Abstract

This research aims to determine and appreciate the role of control of corruption combined with environmental entrepreneurship on CO2 emission quality. To attain this objective, the researchers developed a model to examine the relationship between environmental entrepreneurship and environmental degradation, taking into account the effects of corruption and financial market development in the long and short run. This study was performed for 15 countries in the Middle East and North African region between 2000 and 2019 by adopting a PMG-ARDL approach. Findings show that (i) real income significantly increases carbon dioxide emissions, while environmental entrepreneurship decreases pollution; (ii) control of corruption can improve environmental quality by influencing environmental entrepreneurship and carbon dioxide emission relationship; and (iii) financial development does not affect the environmental entrepreneurship and carbon dioxide relationship. The conclusion highlights the critical role of controlling corruption to achieve environmental sustainability in the Middle East and North Africa (MENA) region through the adoption of environmental entrepreneurship. The empirical investigation provides captivating findings concerning the environmental sustainability process, which has important policy implications.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The invasive issue of environmental degradation (ED) has been increasingly gaining global attention, emerging as a significant worldwide problem that urgently necessitates immediate intervention to halt its detrimental impacts (Kartal, 2022). Environmental degradation can be comprehensively defined as the deterioration of the environment through the massive use of vital resources such as air, water, and soil destroying ecosystems (Ajide et al., 2024; Ogboru & Anga, 2015)

Over the years, a great number of research endeavors have been dedicated to the quest of identifying factors that can limit this rampant degradation (Apergis and Payne, 2009). Among these factors, trade openness (Basarir and Arman, 2014), financial development, entrepreneurial activity (Schaltegger and Wagner, 2011), institutional quality, and corruption (Damania et al., 2003) can be cited. Previous literature confirms that entrepreneurship and anti-corruption are the most common factors that can increase environmental quality. At the same time, it is admitted that entrepreneurial activity, which enhances economic growth and can create social and environmental profits, depends on reducing corruption as one of the determinants of institutional quality and requires rules and regulations (Ragmoun, 2020a; Ragmoun, 2020b). This confirms that these factors are interdependent and affect environmental quality separately. However, it is notable that the intricate interplay between these aspects has been explored separately in the majority of studies (Dean & McMullen, 2007; Li et al., 2018; Odnolko et al., 2022; Philip et al., 2023; Sekrafi & Sghaier, 2018a, 2018b) with only a limited number of research that associated these two approaches. Their combined effect on environmental degradation is still unexplored until this time especially when considering environmental entrepreneurship.

Entrepreneurs making considerable efforts to make environmental development and adopt such orientation as their main business strategy are called sustainable entrepreneurs who adopt a sustainable entrepreneurship process (Schaltegger and Wagner, 2011). Such entrepreneurs develop sustainable and new methods to provide products and services, reducing environmental degradation and consequently improving life quality (York and Venkataraman, 2010). The association between eco-entrepreneurship and sustainable development was widely debated in the literature (Sinatti, 2019), and many recent studies concentrated on the impact of entrepreneurship on EQ, but the majority of results are still inconclusive and in many times contradictory. Three main approaches can be identified. The first consider it negative and conclude that entrepreneurial activity deteriorates EQ (Riti and Shu, 2016). The second considers entrepreneurship as a critical determinant of environmental quality (York and Venkataraman, 2010), and such activity can protect the environment. The third and last approach sustains that such a positive effect needs preconditions like green innovations and institutional quality (Youssef et al., 2018).

The proposed research belongs to the third approach and supposes that controlling corruption is essential to stimulate the effect of entrepreneurial activity, especially sustainable entrepreneurship, on environmental quality. Starting a business according to the entrepreneurial activity requirements has to meet government regulations. In this state, corruption as a form of deregulation requires attention due to its effect on entrepreneurial activity and environmental quality. Previous studies, in this line of idea, supported that corruption causes environmental degradation (Cui et al., 2021) in two ways: by reducing investments and disturbing economic activities while delimiting resource uses (Usman, 2022; Wang et al., 2020) or by delimiting the application of environmental regulations to impact negatively the environment (Pei et al., 2021). This impact constitutes one of the most recurrent topics in the theoretical and empirical studies, but how to reduce its effect or the definition of some directives is still very limited due to the high costs of the control of corruption. This research constitutes one of the primary empirical investigations trying to identify and measure the combined effect of sustainable entrepreneurship and the control of corruption on EQ. The general idea adopted here supposes that a sustainable entrepreneur will impose some specific regulations or rules about the environment which can reduce corruption by providing new conditions stimulating sustainable development, promoting economic growth, and reducing eventual deregulations.

The main objective of this paper is to deal profoundly with the complementarity and significance of environmental degradation, entrepreneurship, and anti-corruption and the potential synergistic effect that can be generated by their intersection. This research is particularly focused on the context of the Middle East and North Africa (MENA) region. This region has shown a profound and consistent concern for environmental quality and protection, which made it a suitable and representative case for our study. It is noteworthy that the MENA region has been actively involved in relentless efforts towards environmental protection.

By undertaking this research, we aim to fill an empirical research gap by employing the pooled mean group autoregressive distributed lag (PMG ARDL) model. This approach will enrich the existing literature, proposing a practical, tested, and implementable solution for preserving environmental quality by reducing and preventing environmental degradation.

The integrative approach of entrepreneurship and anti-corruption to delimit environmental degradation can provide a holistic and comprehensive approach to tackling this phenomenon.

This paper is expected to provide new insights into studies on ED, enriching the discourse and providing a fresh perspective on the issue. Its major contribution, however, lies in its empirical and tested solution for preserving environmental quality, which could potentially serve as a critical pathway for limiting environmental degradation. Thus, this research not only elucidates the significance of entrepreneurship and anti-corruption in mitigating environmental degradation but also provides a concrete, practical solution that can be implemented to achieve this objective.

Concretely, this research tries to test this effect for 15 MENA countries between 2000 and 2019. The selected sample included differentiated income levels of development to cover a variety of situations in the MENA region, which is more and more concerned with developing an entrepreneurship process to stimulate economic development while considering environmental constraints for sustainability. In this context, our research will provide three capital contributions. First, it combines entrepreneurship activity with environmental standards and demonstrates that environmental sustainability in MENA is positively affected by human capital, trade openness, and long-term GDP growth. This study considers various factors that affect and indirectly affect environmental quality to define a critical pathway and integrative approach for a sustainable environment. Second, it confirms the EKC model in the MENA region to examine and appreciate the contribution of entrepreneurship, especially environmental, to a sustainable environment. Third, it is evident that while entrepreneurship is now discussed as a critical channel for fostering and developing sustainability, much uncertainty still exists in dealing with the conditions needed to generate sustainable products and services. This research contributes by incorporating environmental entrepreneurship as an explorative process of renewable energy and confirms its ability to be a conditional variable to achieve sustainability under specific conditions and proportional to a temporal approach (long term).

The following research is structured in three parts. The first is mainly theoretical to define a hypothesis based on the conceptual framework. The second part details the methodological approach and main tests. The last part presents a discussion of different results and conclusions.

Literature review

As detailed below, this research presents an exhaustive approach to different factors of environmental degradation while insisting on the combined effect of environmental entrepreneurship and the control of corruption. Contrary to the existing literature, the effect of control of corruption is not considered as direct on environmental degradation but a variable with an indirect effect. The research supposes that the effect of environmental entrepreneurship is amplified by controlling corruption. Trade openness (TO) and financial development (FD) are also considered, and their impact is tested to compare the corresponding effect of each variable in this case.

In this part, different relationships are discussed and detailed according to previous studies in the same field of research to define the hypothesis while defining each variable. All five main variables are used: environmental entrepreneurship, corruption, environmental degradation, TO, and FD.

ED and EE

Environmental entrepreneurship is a form of entrepreneurship that generates green innovations for a clean environment while considering economic goals (Antolin-Lopez et al., 2019; Dean & McMullen, 2007; Mohapatra et al., 2024; Wei et al., 2023). Based on this definition, it can be confirmed that environmental entrepreneurship positively and significantly affects environmental quality, but how this effect can be managed has not been extensively analyzed, and correspondent empirical work is still limited.

Environmental entrepreneurship is considered a good predictor for achieving sustainable development goals (Chen et al., 2022). The entrepreneurial mindset has been re-oriented for environmental sustainability by shifting new approaches to entrepreneurial activities and their environmental consequences (Gu & Zheng, 2021).

Environmental entrepreneurship has become a hot topic for researchers and practitioners due to its ability to delimit climate change, especially global warming (Sun et al., 2020). The development of new businesses that can support the achievement of the Sustainable Development Goals is an important task, and nowadays, it is a real and urgent need of the hour. Entrepreneurs, transmitters of entrepreneurship, are called to lead their businesses towards a new entrepreneurial path based on adopting clean, green technologies to reduce environmental damage without hindering economic development (Wei & Ullah, 2022).

As a deduction, interest has shifted to a new vision of entrepreneurial orientation centered on the environment, which will allow, at the same time, solving environmentally degrading problems and attaining sustainable green economic development (Ali et al., 2024; Manigandan et al., 2024; Reynolds, 2018). Consequently, the importance of environmental entrepreneurship has increased, allowing the conservation of nature and resources and solving many other environmental problems.

To this extent, studies on environmental entrepreneurship are increasingly concerned, and there is consensus that creating an environmental entrepreneurship process has critical opportunities that contribute to improving EQ and sustainable economic growth (Udeagha & Ngepah, 2023; York et al., 2016). Without entrepreneurial activities, economic growth declines. Entrepreneurship is essential, yet it is crucial to remember that the associated activities should not harm the environment or escalate energy demand.

According to Sun et al. (2020), the complementarity between environmental entrepreneurship and a sustainable environment exists in both the short and long time under the condition that environmental entrepreneurs are encouraged to promote environmentally sustainable activities. Following this view, efficient and prudent use of resources must be defined to generate a synergetic effect between environmental policies/regulations and environmental entrepreneurship to reduce environmental difficulties (Akinyemi & Adejumo, 2018; Adedoyin et al., 2021).

Proportionally, several previous researchers emphasized that institutional theory is massively adopted in entrepreneurship research and has increased significantly due to the importance of institutions for entrepreneurial activity (Meek et al., 2010). According to this approach, institutions determine the environmental orientation of entrepreneurial activity because it explains entrepreneurial behavior and is an orientation degree for environmental ventures (Meek et al., 2010).

-

H1. Environmental entrepreneurship negatively affects environmental degradation

ED and anti-corruption

Corruption is assimilated to an abuse of power oriented to personal gain (Ganda, 2020; Usman, 2022), which can take different forms. The majority of previous studies suggest that corruption impacts environmental quality (Usman, 2022; Wang et al., 2020) and aggravates CO2 emissions contributing, in this way, to environmental degradation (Ozturk et al., 2019; Sekrafi & Sghaier, 2018a, 2018b). However, this effect seems more limited for countries with high-income levels (Ragmoun, 2023). This point allows us to support an indirect effect of corruption via financial development. On the other hand, this corruption is considered an obstacle to economic growth (Aidt, 2009). Increasing economic development is crucial to curb corruption as it stimulates environmental quality. However, corruption negatively affects human and financial development by depleting resources (Ragmoun, 2023). This paradoxical situation confirms the interdependence between environmental quality, environmental entrepreneurship, and corruption.

Bardi and Hfaiedh (2021) found that with good and effective government policies, consumers are able and predisposed to pay for a healthy environment. They added that the effect of corruption on EQ is not admitted, and it can vary according to groups and countries, as well as indicators used to appreciate this effect. As can be seen, the effect and interdependence between environmental entrepreneurship and environmental quality via corruption exist, but there is no consensus about its value or conditions.

-

H2. Anti-corruption affects the interrelationship between environmental entrepreneurship and environmental quality

Environmental degradation (ED) and financial development (FD)

Some previous studies supported that Financial Development (FD) could stimulate environmental investments (Alam et al., 2013; Allayannis et al., 2012) by encouraging and developing environmentally friendly behaviors (Sinha et al., 2020).

Geyer-Klingeberg et al. (2019) demonstrated that financial development generates and encourages technological advancement, which reduces pollutant emissions. This effect is considered negative by other researchers who argue that FD encourages expenditures in industrial projects and facilitates the entrance of heavy industries, increasing energy usage and pollution (Sharif et al., 2019). Recent research explained that this effect exists, but it is nonlinear (Jia et al., 2021; Sharma et al., 2021; Zerbib, 2019).

As can be seen, the impact of FD on EQ is not well treated and is still not fixed. Considering that development positively impacts environmental quality in both the long and short term, regulations and policies need to be defined, respected, and updated, as argued by Bahoo et al. (2022). While it is challenging to halt financial development efforts, regulating them can be done to ensure they become “environmentally friendly.”

-

H3. Anti-corruption affects the interrelationship between FD and EQ

ED and TO

The effect of TO on environmental degradation has previously been studied by many studies with mixed results. Three main approaches could be extracted: TO is harmful (Yu et al., 2019), TO is good for environmental quality (Bernard & Mandal, 2016), and there is no effect between TO.

Bernard and Mandal (2016), who supported a significant and positive impact of TO on environmental quality, associated some additional factors as a condition, such as political factors. Ling et al. (2020) confirm the same positive effect for a long period. Gasimli et al. (2019) argue that TO can stimulate environmental quality if it is associated with energy and urbanization.

Le et al. (2016) used a panel cointegration approach to study this effect and conclude that it is positive if associated with economic growth. Zhang et al. (2017) indicated a negative impact of trade openness on CO2 emission contrary to energy consumption and GDP, which positively affects CO2 emission.

This integrative approach was also adopted by Ertugrul et al. (2016), who supported the same positive effect in the long-run time if some factors are considered. Njindan et al. (2017) support that this effect depends on time: it is positive for a long time and negative for a short time.

Lastly, Sun et al. (2019) and Bahoo et al. (2023) conclude that this effect can be negative and positive depending on income level.

This brief analysis permits us to conclude that the effect of TO on environmental quality exists and to be positive, an integrative approach with additional factors is recommended. In this state, corruption was added. The general idea supposes that respecting rules and policies can delimit the effect of TO and reorient it to eco-activity. Also, the PMG-ARDL approach adopted in this state allows us to consider the long and short time simultaneously. This approach was not used previously.

-

H4. Anti-corruption affects the interrelationship between trade openness and environmental quality

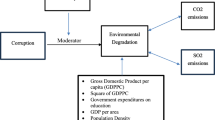

This research is the first to entertain an exhaustive approach to the impact of entrepreneurial entrepreneurship on environmental quality, one of the most important pillars of sustainable development goals. It considers the direct effect in the long and short term to provide a critical pathway to improve environmental quality via predetermined factors and entrepreneurial entrepreneurship. The institutional approach adopted here constitutes one of the major contributions that can help dress recommendations to stimulate environmental entrepreneurship orientation and sustainable development (Fig. 1).

Data and methods

In this study, the author aimed to explore how environmental entrepreneurship affects CO2 emissions and verify whether this effect depends on controlling corruption and financial market development levels in MENA countries over a long and short time. The Pesaran, Shin, and Smith (PSS) estimation method (1996), commonly known as the PMG-ARDL model, is a popular method used in econometrics for estimating long-run relationships among variables in a dynamic panel data setting. It combines the autoregressive distributed lag (ARDL) model with the panel cointegration approach. According to our research objective, this method seems to be the most appropriate due to the nature of the variables used and the nature of the supposed relationships during the time. Table 1 details the data sources for every variable, as well as the measures adopted. The research period covers 2000 to 2019.

Inspired by Sun et al. (2020), the primary equation is as follows:

The final variable used to explain gas emissions is human capital (HD), defined by the human development index, which has been shown to reduce gas emissions in some countries (Dauda et al., 2021). β1, β2, β3, β4, and β5 refer to all explanatory variables: (i) indicates countries, (t) shows time, ε is the residual term, and Ln denotes the natural logarithm operator.

The author introduced institutional quality, especially corruption, based on the research objective. As supported by AkhbAri and Nejati (2019), a decrease in the corruption level causes a decrease in the CO2 emissions level:

where CORR is the variable that measures the control of the corruption index and varies between 0 (higher level) and 100 (low level); regarding CO2 emissions, a high level of corruption appears to increase gas emissions and reduce sustainable development (Hao et al., 2021).

To validate the Kuznets environmental curve, the author adds GDP to the square of (GDP)2. The equation is estimated as follows:

The study examined cross-sectional dependence (CD) before applying the pooled mean group-autoregressive distributed lag (PMG-ARDL) approach. Non-stationarity tests were applied from the first to the third test generation to overcome CD problems. Such issues need to be properly addressed and handled to avoid erroneous results, stationarity bias, cointegration, and size bias (Khan et al., 2022; Khan & Ullah, 2019). Pearson’s (2007) CD test was used to confirm that there were no issues with cross-sectional dependence. Once the CD value was calculated, the panel data unit root approach was chosen as the second-generation approach to remove cross-sectional dependence.

\({\overset{\frown }{\rho}}_{ij}\) refers to different error correlations and N the cross-sectional dimensions and T the time, respectively. Three different unit root tests were used in this study: Pesaran’s cross-sectional augmented Dickey-Fuller (CADF), panel unit root tests under cross-sectional dependence (Breitung & Das, 2005) and Pesaran and Shin (CIPS) tests, which are cross-sectionally augmented Im. Accordingly, the variables are treated according to a regression equation that considers common factors (human capital, trade openness, corruption, GDP, entrepreneurship and financial development):

where αi = − ρiγiθ is a deterministic term, P is the lag order, θt is a common factor between individuals, and \(\overline{y_t}=\left(1/N\right)\sum \limits_{i=1}^N{y}_{i,t}\) is the individual average:

H0 means that the presence of a unit root is rejected if the test value is lower than the critical value specified by Pesaran (2007). The cointegration test for the panel proposed by Westerlund (2007) is based on the following error-correction model:

when t = 1…… T and i = 1……… N, dt is a deterministic component. If d = 0, then the deterministic term is absent; if d = 1, Δyit is generated by a constant; and if then dt = (1, t)′, Δyit is generated by a constant and a trend. The basic equation is as follows:

with \({\lambda}_i^{\prime }={\alpha}_i{\beta}^{\prime }\).

α i denotes the speed of adjustment

The absence of a cointegration relationship is shown as : H0 : αi = 0

H1 is based on the hypothesis of heterogeneity. H1 : αi ≺ 0

Indeed, the two statistics do not require the homogeneity of the term αi. Panel test assumes that they are all equal (i):

for all (i): H1 : αi = α ≺ 0

Construction of the “group-mean test”

The first step was to estimate the basis equation. The second was to appreciate the following augmented regression:

\({\overset{\frown }{\alpha}}_i(1)={\overset{\frown }{\omega}}_{ui}/{\overset{\frown }{\omega}}_{ui}\) where \({\overset{\frown }{\omega}}_{ui}\) and \({\overset{\frown }{\omega}}_{yi}\) are the long-term variances of \({\overset{\frown }{u}}_{i,t}\) and Δyi, t. The final statistics « group-mean test » is

Construction of the “Panel test statistic”

The construction of “Panel test statistic” is performed on three levels:

-

The first level was to calculate the error term: the difference between \({\tilde{y}}_{it-1}\) and yit − 1.

-

The second level is to regress \(\varDelta {\tilde{y}}_{it}\) on \({\tilde{y}}_{it-1}\) to obtain \(\overset{\frown }{\alpha }\), which takes the following form:

$$\overset{\frown }{\alpha }={\left(\sum_{i=1}^N\sum_{t=2}^T{{\tilde{y}}^2}_{it-1}\right)}^{-1}\left(\sum_{i=1}^N\sum_{t=2}^T\frac{1}{{\overset{\frown }{\alpha}}_i(1)}{\tilde{y}}_{it-1}\varDelta {\tilde{y}}_{it}\right)$$

The standard deviation of \(\overset{\frown }{\alpha }\) can be written as follows:

\({\overset{\frown }{S}}_N^2=1/N\sum_{i=1}^N{\overset{\frown }{\sigma}}_i/{\overset{\frown }{\alpha}}_i(1)\); \({\overset{\frown }{\sigma}}_i\) is the standard deviation obtained from basic regression.

-

The third level is to calculate this panel equation :

$${P}_{\tau }=\frac{\overset{\frown }{\alpha }}{SE\left(\overset{\frown }{\alpha}\right)};{P}_{\alpha }=\overset{\frown }{\alpha }T$$

when N, T → ∞, the statistics follow a normal distribution where the mean is 0

Estimation method

An extension was made by Pesaran et al. (1999), who proposed the pooled group mean estimator.

This estimator allows for the homogeneity of the long-run coefficients, the heterogeneity of the coefficients of the short-run parameters, and the variances of the error term.

For Eq. 3, the specific model for PMG is given above:

with

θ i shows the error correction terms. If it is negative and significant, a long-term relationship between variables exists, γ∗′i, j interprets parameters in the short run, and β′ indicates the eventual association in the long-run between CO2 emissions and exploratory variables.

Results

CD test

Table 2 shows that H0 can be rejected for all variables used in this study. Therefore, it is imperative to consider this dependence between the groups in the subsequent course of this analysis.

Unit root test result

Tables 3 and 4 show that all variables have unit roots at levels. After the first difference, all variables appear stationary at the significance levels of 1%, 5%, and 10%. From this, it can be concluded that all series are integrated in order between the country groups (I(1)).

Panel cointegration test

These results are only given for Eqs. (1) and (2), which include all variables in this analysis.

Westerlund’s (2007) cointegration was performed to assess the long-run interdependence. According to the Gτ, Gα, Pτ, and Pα test statistics, H0 is rejected at different levels of significance. The robust p value, as shown in Table 5, provides clear evidence for the cointegration of Eqs. 1 and 2.

PMG estimation results

Table 6 shows PMG estimates between variables (the short and long run). The long-run coefficient value confirms that human capital and TO significantly and positively affect pollution. Based on Eq. 3, each 1% increase in TO and HC means 0.063% and 0.467% increase in CO2 emissions, respectively. This result is supported by Oh and Bhuyan (2018).

FD only has a significant and negative impact on CO2 emissions in Eq. 2, and every 1% increase in the FD implies 0.12% decrease in CO2 emissions. This result shows that FD improves EQ in the MENA region, as demonstrated by Aluko and Obalade (2020) and Shen et al. (2021). According to the estimation results of Eq. 3, the effects of GDP per capita on CO2 emissions are mixed as supported by Beşer and Beşer (2017) and Aslam et al. (2021).

Our three specifications show that EE has a negative effect on CO2 emissions in the MENA region, which confirms that such entrepreneurial activity could be an effective solution to increase EQ in the MENA region and promote better sustainable development in the short and long term. Companies operating in the MENA region need to take private initiatives to bring clean or renewable energy to the market to participate in the transformation process of the economy and develop environmentally related services and products that could promote sustainable economic growth while reducing carbon emissions (Al-Shetwi, 2022; Xu et al., 2022).

The control of corruption negatively affects the CO2 emissions. This result suggests that some MENA countries have reached a level of corruption control that can reduce their carbon emissions. A 1% increase in the anti-corruption index would lead to a 0.417% reduction in CO2 emissions. In the last part of this research, the researcher tested the effect of the interaction between environmental entrepreneurship, control of corruption, and financial development on CO2 emissions. The author tries to determine whether the effect of environmental entrepreneurship on CO2 emissions depends on the anti-corruption level and FD in the MENA region. To achieve this, estimation of the following long-term relationship is necessary: the first relies on the interaction effect of environmental entrepreneurship and corruption control (Eq. 4), and the second is contingent on financial development (Eq. 5):

Based on Eqs. 4 and 5, the results show that the interaction variable Ln(CORR) × Ln(EE) negatively affects CO2 emissions. This finding indicates that the impact of EE depends on the corruption control level in the MENA region. With a high level of control of corruption, environmental entrepreneurship can have a greater effect on reducing CO2 emissions.

This result constitutes our main contribution because it associates researchers who supported the negative effect of environmental entrepreneurship on environment degradation (Dean & McMullen, 2007; Masjud, 2020; Philip et al., 2023) as well as studies related to the effect of the control of corruption and its effect on environmental quality (Chen et al., 2018; Usman et al., 2021). The results of Eq. 5 are consistent with previous studies which demonstrated that FD is important for the development of EE, but this importance seems to be limited compared with the effect of control of corruption.

To reinforce this result, the marginal effects of environmental entrepreneurship on CO2 emissions are calculated as follows:

Based on the results in Table 7, the threshold effect can be calculated and it is estimated to be around 10.7, suggesting that countries with control of the corruption index that exceeds 10.7 can benefit more from environmental entrepreneurship to reduce CO2 emissions.

In addition, findings confirm the marginal effect of EE remains negative in all countries. The most important effect is observed in UAE and Qatar. Contrary to the impact of the combined effect of FD and EE, this effect seems to be not statistically significant. This confirms that financial markets in MENA countries are still not sufficiently developed to finance and support environment-related entrepreneurial activities. However, this objective can be approached progressively by controlling corruption. Fig. 2 illustrates the marginal effects of environmental entrepreneurship.

Discussion

The research study concludes that the interaction effect of EE and anti-corruption on environmental degradation is more important than their separated effects in the Middle East and North Africa (MENA) region. Our results suggest a positive effect of both human capital and trade openness (TO) on the levels of pollution. This is consistent with Bernard and Mandal (2016). On the other hand, financial development (FD) demonstrates a conspicuously negative influence on CO2 emissions which is in line with Zerbib (2019), Sharma et al. (2021), and Jia et al. (2021), effectively improving EQ across the region. The impacts of GDP per capita on CO2 emissions, however, proved to be somewhat inconsistent, with varying effects observed across the region as supported by Lantz and Feng (2006). Moreover, environmental entrepreneurship (EE) showed a negative correlation with CO2 emissions, thus implying its potential to significantly improve EQ, particularly when combined with effective mechanisms of corruption control according to our results.

This means that enhancing human capital and advocating more open trade policies might inadvertently cause an increase in pollution levels. This revelation raises serious concerns about the need for sustainable development strategies. It is indeed paramount to strike a delicate balance between enhancing human capital, promoting trade openness, and controlling pollution levels. This implies that the MENA nations must consider the environmental impacts of their growth strategies, ensuring that their efforts towards human and economic development do not come at the cost of environmental degradation.

Another key finding from the research relates to the role of FD in influencing CO2 emissions. It is observed that FD has a significant and negative impact on CO2 emissions, and this is online with many previous researchers (Sun & Razzaq, 2022). This suggests that the process of financial growth may contribute to the improvement of EQ. This positive correlation could be attributed to the fact that financial development often involves the implementation of more efficient and advanced technologies, which are likely to be less polluting. This finding underscores the necessity for financial institutions and policy-makers to consider the environmental implications of their decisions, particularly in terms of their potential to affect CO2 emissions.

The study also highlights the important role of EE in influencing CO2 emissions in the MENA region. It is found that EE has a negative effect on CO2 emissions, implying its potential effectiveness as a solution for enhancing EQ. However, it is also noted that the impact of EE strongly depends on the level of corruption control in place. With rigorous corruption control measures, environmental entrepreneurship can have a more substantial and beneficial effect in reducing CO2 emissions. This suggests that the MENA nations need to foster a culture of environmental entrepreneurship, while also ensuring stringent corruption control measures to manage and reduce CO2 emissions effectively.

The research study enriches and combines different previous studies by indicating an interdependent effect between EE and anti-corruption measures on EQ, even though the influence of GDP per capita remains mixed. This suggests that addressing environmental degradation requires a multi-pronged approach. Specifically, it is important to foster environmental entrepreneurship, while also simultaneously curbing corruption. This approach presents a novel and potentially effective way to address environmental degradation. It emphasizes the importance of synergies between environmental entrepreneurship and anti-corruption measures in managing CO2 emissions and improving overall environmental quality. This finding provides a new perspective on the importance of corruption control in environmental management, highlighting the need for comprehensive, integrated solutions to address environmental challenges in the MENA region.

Conclusion

This study measures and explores the conditions under which environmental entrepreneurship can achieve environmentally sustainable growth in the MENA. More specifically, the study has tried to clarify and better understand the critical and central roles of environmental entrepreneurship in stimulating sustainable future environmental development in the MENA region and whether this impact can depend on corruption control and financial development.

Using the PMG-ARDL panel approach and considering CO2 emissions as a measure of sustainable environmental development, the author developed a model to examine the relationship between environmental entrepreneurship and sustainable environmental development, taking into account the effects of corruption and financial market development in the long and short run in 16 selected MENA countries over the period 2000–2019.

Policy implications

Our empirical investigation provides captivating findings concerning the environmental sustainability process, which has important policy implications.

First, it is found that environmental entrepreneurship could be an effective solution to reduce CO2 emissions for the MENA region and improve sustainable development, where this contribution is much higher with lower corruption and higher financial development. This means that improved laws and governance to reduce corruption are needed in MENA countries to achieve environmental sustainability. Setting up more intentions for financial development and human capital can also increase sustainability through environmental entrepreneurship. Second, the author assessed the existence of a relationship between GDP and CO2 emissions. This means that in the short term, financial development, trade openness, and human capital increase the level of CO2; however, in the long term, thanks to environmental entrepreneurship, this impact is reversed. Thus, the environmental sustainability of such an entrepreneurial process depends on how resources (human and financial ) are invested. Overall, it seems evident that while environmental entrepreneurship is now discussed as a determinant channel for fostering environmental sustainability, substantial uncertainty related to the conditions required to move towards environmentally sustainable services and products still exists. This research enriches studies in this direction; however, additional research is still needed in this emerging field. Several questions persist, mainly four hot topics related to policy perspective: What characterizes the environmental sustainability generated by entrepreneurship development? How does this differ from the ordinary entrepreneurship process? What drives environmental entrepreneurship’s sustainable orientation? Can networks and artificial intelligence contribute to sustainable environmental entrepreneurship?

Research limitations

Despite the implications and insights provided by this study, it has some limitations. This study analyzes only the direct interrelationships that influence the relationship between environmental entrepreneurship and environmental sustainability as the principal determinant. Environmental entrepreneurship is a complex process that requires several stages. Future studies should extend the research framework adopted here by integrating mediating and moderating factors.

Data availability

Will be shared if requested.

References

Adedoyin, F. F., Ozturk, I., Agboola, M. O., Agboola, P. O., & Bekun, F. V. (2021). The implications of renewable and non-renewable energy generating in Sub-Saharan Africa: The role of economic policy uncertainties. Energy Policy, 150, 112115.

Aidt, T. S. (2009). Corruption, institutions, and economic development. Oxford Review of Economic Policy, 25(2), 271–291.

Ajide, F. M., Soyemi, K. A., & Oladipupo, S. A. (2024). Business climate and environmental degradation: evidence from Africa. Environment, Development and Sustainability, 26(2), 4753–4779.

Akhbari, R., & Nejati, M. (2019). The effect of corruption on carbon emissions in developed and developing countries: empirical investigation of a claim. Heliyon, 5(9). https://doi.org/10.1016/j.heliyon.2019.e02516

Akinyemi, F. O., & Adejumo, O. O. (2018). Government policies and entrepreneurship phases in emerging economies: Nigeria and South Africa. Journal of Global Entrepreneurship Research, 8, 35. https://doi.org/10.1186/s40497-018-0131-5

Alam, A., & Bhowmick, B. (2013). Examining the domains of entrepreneurial ecosystem framework—a bibliometric analysis. Journal of Global Entrepreneurship Research, 13, 16. https://doi.org/10.1007/s40497-023-00358-0

Ali, E. B., Shayanmehr, S., Radmehr, R., Bayitse, R., & Agbozo, E. (2024). Investigating environmental quality among G20 nations: the impacts of environmental goods and low-carbon technologies in mitigating environmental degradation. Geoscience Frontiers, 15(1), 101695.

Allayannis, G., Lel, U., & Miller, D. P. (2012). The use of foreign currency derivatives. corporate governance, and firm value around the world. Journal of International Economics, 87, 65–79.

Al-Shetwi, A. (2022). Sustainable development of renewable energy integrated power sector: trends, environmental impacts, and recent challenges. The Science of the Total Environment, 822, 153645.

Aluko, O. A., & Obalade, A. A. (2020). Financial development and environmental quality in sub-Saharan Africa: is there a technology effect? Science of The Total Environment, 747, 141–515. https://doi.org/10.1016/j.scitotenv.2020.141515

Antolin-Lopez, R., Martinez-del-Rio, J., & Cespedes-Lorente, J. J. (2019). Environmental entrepreneurship as a multi-component and dynamic construct: duality of goals, environmental agency, and environmental value creation. Business Ethics: A European Review, 28(4), 407–422.

Apergis, N., & Payne, J. E. (2009). The emissions, energy consumption, and growth nexus: evidence from the commonwealth of independent states. Energy Policy, 38(1), 650–655.

Aslam, B., Hu, J., Shahab, S., Ahmad, A., Saleem, M., Shah, S. S., & Hassan, M. (2021). The nexus of industrialization, GDP per capita and CO2 emission in China. Environmental Technology & Innovation, 23, 101674.

Bahoo, S., Ilan, A., & Josanco, F. (2022). Corruption, foreign aid, and international trade. Thunderbird International Business Review, 64(2), 139–167.

Bahoo, S., Ilan, A., Josanco, F., & Marco, C. (2023). Corruption, formal institutions, and foreign direct investment: the case of OECD countries in Africa. Thunderbird International Business Review, 65(5), 461–483.

Bardi, W., & Hfaiedh, M. A. (2021). Causal interaction between FDI, corruption and environmental quality in the MENA Region. Economies, 9(14). https://doi.org/10.3390/economies9010014

Basarir, A., & Arman, H. (2014). The effects of economic growth on environment: an application of environmental Kuznets curve in United Arab Emirates. TOJSAT, 4(1), 53–59.

Bernard, J., & Mandal, S. K. (2016). The impact of trade openness on environmental quality: an empirical analysis of emerging and developing economies. WIT Transactions on Ecology and the Environment, 203, 195–208.

Beşer, M. K., & Beşer, B. H. (2017). The relationship between energy consumption, CO2 emissions and GDP per capita: a revisit of the evidence from Turkey. Alphanumeric Journal, 5, 353–368.

Breitung, J., & Das, S. (2005). Panel unit root tests under cross-sectional dependence. Statistica Neerlandica, 59(4), 414–433. https://doi.org/10.1111/J.1467-9574.2005.00299.X

Chen, C., Junjian, G., & Luo, R. (2022). Corporate innovation and RandD expenditure disclosures. Technological Forecasting and Social Change, 174, 121230.

Chen, H., Hao, Y., Li, J., & Xiaojie, S. (2018). The impact of environmental regulation, shadow economy, and corruption on environmental quality: theory and empirical evidence from China. Journal of Cleaner Production, 195, 200–214.

Cui, Y., Wei, Z., Xue, Q., & Sohail, S. (2021). Educational attainment and environmental Kuznets curve in China: an aggregate and disaggregate analysis. Environmental Science and Pollution Research, 29(30), 45612–45622.

Damania, R., Fredriksson, P. G., & List, J. A. (2003). Trade liberalization, corruption, and environmental policy formation: theory and evidence. Journal of Environmental Economics and Management, 46(3), 490–512.

Dauda, L., Long, X., Mensah, C. N., Salman, M., Boamah, K. B., Ampon-Wireko, S., & Kofi Dogbe, C. S. (2021). Innovation, trade openness and CO2 emissions in selected countries in Africa. Journal of Cleaner Production, 281, 125143. https://doi.org/10.1016/j.jclepro.2020.125143

Dean, T. J., & McMullen, J. S. (2007). Toward a theory of sustainable entrepreneurship: Reducing environmental degradation through entrepreneurial action. Journal of Business Venturing, 22, 50–76.

Ertugrul, M., Cetin, F. S., & Dogan, E. (2016). The impact of trade openness on global carbon dioxide emissions: evidence from the top ten emitters among developing countries. Ecological Indicators, 67, 543–555.

Ganda, F. (2020). The influence of corruption on environmental sustainability in the developing economies of Southern Africa. Heliyon, 6, e04387.

Gasimli, O., Haq, I. U., Naradda Gamage, S. K., Shihadeh, F., Rajapakshe, P. S. K., & Shafiq, M. (2019). Energy, trade, urbanization and environmental degradation nexus in Sri Lanka: bounds testing approach. Energies, 12(9), 1655.

Geyer-Klingeberg, J., Hang, M., & Rathgeber, A. W. (2019). What drives financial hedging? A meta-regression analysis of corporate hedging determinants. International Revue of Financial Anal., 61, 203–221.

Gu, W., & Zheng, X. (2021). An empirical study on the impact of sustainable entrepreneurship: based on the environmental Kuznets model. Journal of Business Research, 123, 613–624.

Hao, Y., Gai, Z., Yan, G., Wu, H., & Irfan, M. (2021). The spatial spillover effect and nonlinear relationship analysis between environmental decentralization, government corruption and air pollution: Evidence from China. Science of The Total Environment, 763, 144183.

Jia, L., Sun, H., Zhou, Q., Zhao, L., & Wu, W. (2021). Pilot-scale two-stage constructed wetlands based on novel solid carbon for rural wastewater treatment in southern China: enhanced nitrogen removal and mechanism. Journal of Environmental Management, 292, 112750.

Kartal, M. T., Kılıç Depren, S., Ayhan, F., & Depren, Ö. (2022). Impact of renewable and fossil fuel energy consumption on environmental degradation: evidence from USA by nonlinearapproaches. International Journal of Sustainable Development & World Ecology, 29(8), 738–755.

Khan, D., & Ullah, A. (2019). Testing the relationship between globalization and carbon dioxide emissions in Pakistan: does environmental Kuznets curve exist? Environment Science Pollution Ressources, 26, 15194–15208.

Khan, H., Weili, L., & Khan, I. (2022). Environmental innovation, trade openness and quality institutions: an integrated investigation about environmental sustainability. Environment, Development and Sustainability, 24, 3832–3862. https://doi.org/10.1007/s10668-021-01590-y

Lantz, V., & Feng, Q. (2006). Assessing income, population, and technology impacts on CO2 emissions in Canada: where's the EKC? Ecological Economics, 57, 229–238.

Le, T. H., Chang, Y., & Park, D. (2016). Trade openness and environmental quality: international evidence. Energy Policy, 92, 45–55.

Li, B., Hao, Y., & Chang, C. P. (2018). Does an anticorruption campaign deteriorate environmental quality? Evidence from China”. Energy & Environment, 29(1), 67–94.

Ling, T. Y., Ab-Rahim, R., & Mohd-Kamal, K. A. (2020). Trade openness and environmental degradation in asean-5 countries. International Journal of Academic Research in Business and Social Sciences, 10(2), 691–707.

Manigandan, P., Alam, M. S., Murshed, M., Ozturk, I., Altuntas, S., & Alam, M. M. (2024). Promoting sustainable economic growth through natural resources management, green innovations, environmental policy deployment, and financial development: fresh evidence from India. Resources Policy, 90, 104681.

Masjud, Y. I. (2020). Ecopreneurship as a solution to environmental problems: Implications for university entrepreneurship education. Journal of Environmental Science and Sustainable Development, 3, 97–113.

Meek, W. R., Pacheco, D. F., & York, J. G. (2010). The impact of social norms on entrepreneurial action: evidence from the environmental entrepreneurship context. Journal of Business Venturing, 25(5), 493–509.

Mohapatra, S., Roy, S., Upadhyay, A., & Kumar, A. (2024). Circular value creation through environmental entrepreneurship initiatives: A case-based exploration. Business Strategy and the Environment, 1–21. https://doi.org/10.1002/bse.3682

Njindan Iyke, B., & Odhiambo, N. M. (2017). Inflationary thresholds, financial development and economic growth: New evidence from two West African countries. Global Economy Journal, 17(2), 20160042.

Odnolko, I., Hladii, O., Bondarchuk, O., Zhadan, Y., & Leonidova, O. (2022). Anti-corruption reform as a component of the sustainable development strategy and its impact on a safe environment. Cuestiones Políticas, 40(75), 232–242.

Ogboru, I., and Anga, R. A. (2015). Environmental degradation and sustainable economic development in Nigeria: a theoretical approach

Oh, K. Y., & Bhuyan, M. I. (2018). Trade openness and CO 2 emissions: evidence of Bangladesh. Asian Journal of Atmospheric Environment (AJAE), 12(1), 30–36.

Ozturk, I., Al-Mulali, U., & Solarin, S. A. (2019). The control of corruption and energy efficiency relationship: an empirical note. Environmental Science and Pollution Research, 26, 17277–17283.

Pearson, C. E. (2007). Combined cross-sectional prospective study to identify barriers to adherence of pancreatic enzyme use in patients with cystic fibrosis (Doctoral dissertation, University of Southampton).

Pei, J., Sturm, B., & Yu, A. (2021). Are exporters more environmentally friendly? A re-appraisal that uses China’s micro-data. The World Economy, 44(5), 1402–1427.

Pesaran, H., Shin, Y., & Smith, R. J. (1996). Testing for the existence of a long-run relationship. In DAE Working Papers Amalgamated Series 9622. University of Cambridge.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics, 22(2), 265–312. https://doi.org/10.1002/jae.951

Pesaran, M. H., Shin, Y., & Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association, 94(446), 621–634. https://doi.org/10.1080/01621459.1999.10474156

Philip, L. D., Emir, F., & Alola, A. A. (2023). The asymmetric nexus of entrepreneurship and environmental quality in a developing economy. International Journal of Environmental Science Technology, 19, 7625–7636. https://doi.org/10.1007/s13762-021-03670-y

Ragmoun, W. (2020a). A spatio-temporal analysis of human capital, economic and institutional quality as determinants of international formal entrepreneurship. European Journal of International Management, 1(1), 1–25.

Ragmoun, W. (2020b). Institutional quality, unemployment, economic growth, and entrepreneurial activity in developed countries: a dynamic and sustainable. Review of International Business and Strategy, 33(3), 345–370.

Ragmoun, W. (2023). Ecological footprint, natural resource rent, and industrial production in MENA region: Empirical evidence using the SDM model. Heliyon, 9(9), 1–23.

Reynolds, O. (2018). Examining the legitimation strategies of sustainability-oriented entrepreneurs. Journal of Accounting and Organizational Change, 7, 346–379.

Riti, J. S., & Shu, Y. (2016). Renewable energy, energy efficiency, and eco-friendly environment (RE 5) in Nigeria. Energy, Sustainability and Society, 6, 1–16.

Schaltegger, S., & Wagner, M. (2011). Sustainable entrepreneurship and sustainability innovation: categories and interactions. Business Strategy and the Environment, 20(4), 222–237.

Sekrafi, H., & Sghaier, A. (2018a). Examining the relationship between corruption, economic growth, environmental degradation, and energy consumption: a panel analysis in MENA region. Journal of the Knowledge Economy, 9, 963–979.

Sekrafi, H., & Sghaier, A. (2018b). The effect of corruption on carbon dioxide emissions and energy consumption in Tunisia. PSU Research Review, 2, 81–95.

Sharif, A., Afshan, S., & Qureshi, M. A. (2019). Idolization and ramification between globalization and ecological footprints: evidence from the quantile-on-quantile approach. Environmental Science and Pollution Research, 26, 11191–11211.

Sharma, R., Shahbaz, M., Sinha, A., & Vo, X. V. (2021). Examining the temporal impact of stock market development on carbon intensity: evidence from South Asian countries. Journal of Environmental Management, 297, 113248.

Shen, J., Qi, Z., Lisong, X., Shuoshuo, T., & Peng, W. (2021). Future CO2 emission trends and radical decarbonization path of iron and steel industry in China. Journal of Cleaner Production, 326, 129354. https://doi.org/10.1016/j.jclepro.2021.129354

Sinatti, G. (2019). Return migration, entrepreneurship and development: Contrasting the economic growth perspective of Senegal’s diaspora policy through amigrant-centred approach. African Studies, 78(4), 609–623.

Sinha, A., Shah, M. I., Sengupta, T., & Jiao, Z. (2020). Analyzing technology-emissions association in Top-10 polluted MENA countries: how to ascertain sustainable development by quantile modeling approach. Journal of Environmental Management, 267, 110602.

Sun, G., Tariq, M. H., & Mohsin, M. (2019). Evaluating the environmental effects of economic openness: evidence from SAARC countries. Environmental Science and Pollution Research, 26(24), 24542–24551.

Sun, H., Samuel, C. A., Amissah, J. C. K., Taghizadeh-Hesary, F., & Mensah, I. A. (2020). Non-linear nexus between CO2 emissions and economic growth: a comparison of OECD and BandR countries. Energy, 212, 118637.

Sun, Y., & Razzaq, A. (2022). Composite fiscal decentralisation and green innovation: imperative strategy for institutional reforms and sustainable development in OECD countries. Sustainable Development, 30(5), 944–957.

Udeagha, M. C., & Ngepah, N. (2023). The drivers of environmental sustainability in BRICS economies: do green finance and fintech matter? World Development Sustainability, 3, 100096.

Usman, O. (2022). Modeling the economic and social issues related to environmental quality in nigeria: the role of economic growth and internal conflict. Environmental Science and Pollution Research, 29, 39209–39227.

Usman, O., Iorember, P. T., Ozturk, I., & Bekun, F. V. (2021). Examining the interaction effect of control of corruption and income level on environmental quality in Africa. Sustainability, 14, 11391.

Wang, S., Zhao, D., & Chen, H. (2020). Government corruption, resource misallocation, and ecological efficiency. Energy Economics, 85, 104573.

Wei, L., & Ullah, S. (2022). International tourism, digital infrastructure, and CO2 emissions: fresh evidence from panel quantile regression approach. Environment Science Pollution Ressources, 29, 36273–36280.

Wei, X., Ren, H., Ullah, S., & Bozkurt, C. (2023). Does environmental entrepreneurship play a role in sustainable green development? Evidence from emerging Asian economies. Economic research-Ekonomska istraživanja, 36, 73–85.

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69, 709–748.

Xu, Z., Peng, J., Qiu, S., Liu, Y., Dong, J., & Zhang, H. (2022). Responses of spatial relationships between ecosystem services and the Sustainable Development Goals to urbanization. Science of The Total Environment, 850, 157868.

York, J. G., O'Neil, I., & Sarasvathy, S. D. (2016). Exploring environmental entrepreneurship: identity coupling, venture goals, and stakeholder incentives. Journal of Management Studies, 53(5), 695–737.

York, J. G., & Venkataraman, S. (2010). The entrepreneur–environment nexus: Uncertainty, innovation, and allocation. Journal of Business Venturing, 25(5), 449–463.

Youssef, C., Bizet, F., Bastien, R., Legland, D., Bogeat-Triboulot, M. B., & Hummel, I. (2018). Quantitative dissection of variations in root growth rate: a matter of cell proliferation or of cellexpansion? Journal of Experimental Botany, 69(21), 5157–5168.

Yu, D., Nataliia, S., Yoo, J., & Hwang, Y. S. (2019). Does trade openness convey a positive impact for the environmental quality? Evidence from a panel of CIS countries. Eurasian Geography and Economics, 60(3), 333–356.

Zerbib, O. D. (2019). The effect of pro-environmental preferences on bond prices: evidence from green bonds. Journal of Banking and Finance, 98, 39–60.

Zhang, Q., Jiang, X., Tong, D., et al. (2017). Transboundary health impacts of transported global air pollution and international trade. Nature, 543(7647), 705–709.

Code availability

Not applicable.

Author information

Authors and Affiliations

Contributions

The author read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval (include appropriate approvals or waivers)

Not applicable.

Consent to participate (include appropriate statements)

Not applicable.

Consent for publication (include appropriate statements)

Not applicable.

Competing interests

The authors declare no competing interests.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ragmoun, W. The impact of environmental entrepreneurship and anti-corruption on environmental degradation. J Glob Entrepr Res 14, 17 (2024). https://doi.org/10.1007/s40497-024-00389-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40497-024-00389-1