Abstract

Background and Objective

It is unclear whether private insurance benefit designs align with the most widely used ex-US definition of value, the incremental cost-effectiveness ratio (ICER). A large Pacific Northwest private insurance plan explicitly implemented a tiered formulary based on cost-effectiveness estimates of individual drugs in 2010, resulting in cost savings to the plan without negatively affecting patient health service utilization. Given the pressures of rising costs, we investigate whether employer-based private health insurance plans have adopted value-based cost-sharing approaches that are in line with cost-effectiveness estimates.

Methods

At the drug level, we identified five drug tier designations (0–4) that are tied to increasing ICER ranges in a large claims dataset from 2010 to 2013. We used a random effects model to evaluate whether out-of-pocket (OOP) cost levels and trends were associated with drug value designation, controlling for generic status and list price, and whether the associations varied by insurance plan type and insurance market concentration, as measured by the Herfindahl-Hirschman Index (HHI). We also estimated the weighted mean cost effectiveness of the drug claims in the sample by year and generic status using the formulary’s cost-effectiveness value ranges.

Results

The 2010 volume weighted mean OOP cost for a 30-day supply of drugs in tiers 0 through 4 were $US6.87, $US22.62, $US62.22, $US57.36, and $US59.85, respectively (2013 US dollars). OOP costs for cost-saving and preventive drugs (tier 0) decreased 5% annually from 2010 to 2013 (p < 0.01); OOP costs for drugs costing under $US10,000/quality-adjusted life-year (QALY) (tier 1) decreased 4.5% annually (p < 0.01) and OOP costs for drugs costing over $US50,000/QALY (tier 3) and $US150,000/QALY (tier 4) decreased by 2.4% and 2.2%, respectively (p < 0.01 and p = 0.046). OOP costs for drugs valued between $US10,000 and $US50,000/QALY did not change significantly (p = 0.31). Average ICER estimates increased for generic drugs and did not change for brand name drugs.

Conclusion

OOP costs for prescription drugs are decreasing across value levels, with OOP costs for higher-value drugs generally decreasing at a faster rate than lower-value drugs. The relationship between cost sharing and value remains tenuous, however, particularly at higher ICER levels, likely reflecting the persistence of traditional formulary structures and increasing use of generic drugs over brand name drugs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Cost sharing for pharmaceuticals was generally not related to value in private insurance formularies beyond $US10,000 per quality-adjusted life-year (QALY). |

Average cost-sharing amounts decreased for all drugs from 2010 to 2013, and at a higher rate for high-value drugs than for low-value drugs. |

There is space in drug formularies to encourage use of higher-value drug options and, similarly, to discourage use of lower-value drug options, particularly for drugs valued above $US10,000 per QALY. |

1 Introduction

While prescription drug expenditure rates fluctuate depending on new products and patent expirations, experts project per capita drug spending in the USA will grow between 4 and 6% annually through to 2024 [1]. Stakeholders have advanced multiple models to obtain greater value on drug spending, including indication-based pricing and outcomes-based arrangements, while new technologies are subject to budget impact analysis before their uptake [2,3,4]. Because approximately half of Americans have private insurance, private insurance companies have significant potential to influence drug demand and costs [5]. Value-based insurance design (VBID), where insurance schemes align patient cost sharing with the value of services, is one payer-based strategy to improve medication adherence without increasing total health costs [6].

There appears to be some enthusiasm for VBID among private and public payers, with various plans being suggested or implemented [7,8,9,10,11,12]. One particular payer, Premera Blue Cross of Mountlake Terrace, Washington, USA, implemented a design known as the value-based formulary (VBF) that used cost-effectiveness analysis (CEA) to determine cost sharing [13]. Co-payments for drugs with a low (high) incremental cost-effectiveness ratio (ICER) and high (low) value were lowered (increased) accordingly. Several studies analyzed Premera Blue Cross’s transition from a cost-based to value-based insurance formulary in 2010, the only private insurance company to explicitly transition their formulary [13,14,15]. They found that their value-based tiering decreased spending on medication per member per month compared with non-VBF tiering, and that medication utilization, health services utilization, and non-medication expenditures did not change [15]. Evidence from programs applying VBID to specific drugs (but not full formularies) is optimistic but not conclusive about the exact benefits of shifting to value-based decision-making in private plans [6].

Beyond those explicitly aligning formulary placement with value evidence, it is unknown to what degree commercial plans at large are using value evidence in decision-making. One study found that two case study formularies were only partially aligned with cost-effectiveness evidence [16]. More recently, a study found that drugs exclusion lists in large pharmacy benefit managers were not significantly associated with value evidence [17]. Further, there is little published evidence of programs using VBID to discourage use of low-value services and drugs by increasing cost sharing, although existing studies show this strategy could be cost saving [14, 18]. In addition, most studies of VBID focus on a narrow portion of medications used to treat chronic conditions, such as cardiovascular disease, diabetes mellitus, or asthma, for which generic alternatives are available [6, 19]. There is a gap in the literature regarding formulary-wide alignment with value evidence, and whether cost sharing is being used to drive behavior around both high-value and low-value drugs.

Insurance plans that implement a type of VBID must be clear about which elements of value they are using. CEA is the most widely accepted metric for determining the value of drugs globally, often combined with other aspects of value such as availability of alternative treatments, novelty, and disease severity. CEA is generally a good measure for assessing changes in value trends in benefit design because it can be used across health conditions and has a broad base of data available for many common drugs [20, 21]. In a recent interview regarding value assessment frameworks, private insurance representatives claimed most insurers do not have formal policies regarding the use of CEA research. While private insurers are under pressure to cover a majority of drugs regardless of value evidence, CEA may inform formulary placement if alternatives exist [22].

To understand the extent to which private insurance companies are aligning (implicitly or otherwise) formulary cost sharing with evidence of drug value, and factors influencing that shift, we analyzed the out-of-pocket (OOP) costs for medication fills from 2010 to 2013 using a large commercial claims database and drug-specific cost-effectiveness value designations. If private insurance companies were using cost-effectiveness evidence in formulary placement decisions, we would expect an increasing gap in the nominal amount of cost sharing between high and low levels of drug value as measured by cost effectiveness. To our knowledge, this is the first empirical study in a large sample of commercial health plans to evaluate whether OOP costs in the USA are aligned with cost-effectiveness estimates. Secondarily, we use our dataset to evaluate the overall cost effectiveness of drug usage over this period, i.e., whether the utilization weighted average cost effectiveness of drugs has changed over the study timeframe.

2 Methods

To answer our research questions, we ran a retrospective prescription claims analysis on drug-specific cost-sharing levels and drug-specific value designations over a period of 4 years.

2.1 Data

We used data from three sources. First, we obtained pharmacy claims data from IBM® MarketScan® Commercial Database (IBM Corporation, Somers, NY, USA). This dataset contains claims-level data from over 115 million unique patients with employer-based private health insurance, including information on co-payments, deductible amounts, drug code, therapeutic class, prescription drug payment, plan type, and location. Second, we obtained a dataset that contained drug-specific value designations from the 2010 VBF of a large insurer in the Pacific Northwest as described in Sects. 2.2 and 2.3. This drug-specific dataset was applied to claims data collapsed to the drug-year level, with unique drugs defined by unique combinations of dosage form, active ingredient, and generic status. Finally, we added data from the American Medical Association on private insurance market concentration at the metropolitan statistical area (MSA) level [23].

2.2 Tier Definitions

Each drug in Premera Blue Cross’ 2010 VBF is categorized into one of five ordinal tiers based on their cost effectiveness, with each tier representing a cost-effectiveness range (Table 1). The tiers range from 0 to 4, with 0 being the highest value and 4 being the lowest. There are two sets of tier definitions with corresponding cost-effectiveness ranges to separate typical drugs and special case drugs; the special case drug category was created to allow for additional considerations for drugs with established clinically meaningful benefits, such as ethical issues, rarity, or unmet clinical needs. Premera Blue Cross collected cost-effectiveness values for each drug from the published literature, the Tufts CEA registry, Cochrane reviews, manufacturer models, and health technology assessment (HTA) organization reports, using the societal perspective when available [13]. ‘Tier’, as defined by Premera Blue Cross, is used in this study as a proxy for value level and the terms are used interchangeably throughout.

2.3 Collapsed Claims Data at Drug-Year Level

We constructed a drug-year-level dataset that had four observations for each unique drug representing the four first quarters of the years 2010–2013. Since we sought to understand how plans set cost sharing for each unique drug over time, we dropped claims outside of the first quarter of each year since these were likely to be affected if individuals exceeded their OOP maximum payments (which is more likely to occur at the end of the year).

To calculate the mean OOP cost for each drug-year, we added all OOP costs (co-payments, co-insurance, and deductible charges) for each prescription drug claim and standardized them to a 30-day supply, dropping all observations less than zero. Generic status was defined as a categorical variable with four options: brand name (with or without an available generic), multisource generic, single-source generic, and other (which included over-the-counter drugs and those no longer available). The mean average wholesale price (AWP) was the average of a drug’s AWP over all claims during the first quarter of each year standardized to a 30-day supply. Plan payment was the average amount the insurance company paid for a drug, excluding patient OOP costs, in each quarter 1, standardized to a 30-day supply. We then collapsed the dataset, taking the average variable value for each unique drug and year combination.

2.4 Regression Analysis

We ran a random effects model with robust standard errors clustered on drug ID (i) at the year (j) level (Eq. 1):

The outcome variable (Yij) was the natural log of the mean OOP cost, interpreted as percentage change over time. The explanatory variables of interest were year, value designation (i.e., tier) as a categorical variable with tier 0 as the reference group, and the interaction of year and value designation. Additional vectors of covariates (\(\beta X)\) included the 2010 generic status of each drug, logged AWP, and logged average plan payment. These control variables were added as generic status and drug price could potentially affect cost-sharing amounts and obscure the relationship of interest.

We repeated the same analysis using four additional models to check the robustness of our results: an ordinary least squares (OLS) model with a log link and standard errors clustered on drug ID; a population average model with an unstructured correlation matrix; a population average model with an autoregressive order correlation matrix with a lag of 1; a fixed effects model; and a random effects model (available in the “Appendix”).

2.5 Association of Organizational and Regional Market Characteristics on Value Trends

We next ran Eq. (1) on two additional datasets, data collapsed by plan type and data collapsed by MSA, to understand factors associated with the relationship of cost sharing and value over time. For insurance plan type, each line of data was a unique combination of drug, year, and plan type. Plan type categories included health maintenance organizations (HMOs), preferred provider organizations (PPOs), point of service plans (POS; both with and without capitation), high-deductible health plans (HDHPs), and other (basic/major medical, comprehensive, exclusive provider organization). Because the level of insurance market competition may also have bearing on a payer’s ability to set formulary prices, we considered market competition as an associated factor. We collapsed the data so each observation was a unique combination of drug, year, and MSA, and linked the claims data to MSA-level market concentration. Market concentration was measured via 2013 Herfindahl-Hirschman Index (HHI), which measures market competition amongst firms in a similar sector, for 388 MSAs as defined by the US Office of Management and Budget. We used the HHI numbers for 2013 for all 4 years in question because other studies have found that the HHI for insurance markets by MSA did not change significantly over that time period [24]. We categorized each MSA into three categories based on the US Department of Justice antitrust thresholds: unconcentrated markets had an HHI of 1500 or less, moderately concentrated markets had an HHI between 1500 and 2500, and markets with an HHI above 2500 were considered highly concentrated [25].

2.6 Estimated Average Drug Value

We conducted additional analyses to estimate the alignment of actual prescription drug utilization volume with CEA-based value estimates to evaluate the overall ‘value’ of prescription drugs used by this population. Premera Blue Cross assigns drugs to co-payment tiers based on ICER ranges. We estimated low, midpoint, and high ICER values for each drug based on the range of its assigned tier to calculate an average cost-effective estimate for all drugs in the sample weighted by their relative use (Table 1). Cost-saving drugs were assumed to have an ICER of $US0 per quality-adjusted life-year (QALY) to avoid problems of interpreting negative ICERs and to err on conservative valuation (all values are given in 2013 US dollars). Because we cannot parse out which drugs in tier 0 are cost saving and which are preventive, drugs in tier 0 were assumed to have a range of ICERs between $US0 and $US10,000 per QALY, the same as tier 1. While preventive medications may have a range of cost-effectiveness ratios depending on factors such as the population targeted, the placement of a drug in a tier with zero cost sharing indicates it has high value for the plan and therefore a low ICER. The upper bound of $US10,000 is a conservative estimate based on the next highest tier. We assumed the maximum CEA ratio for the drugs in tier 4, whose definition includes all drugs with an ICER above $US150,000 per QALY, would be $US1,000,000 per QALY as most drugs do not exceed this amount [26].

To get yearly average ICER estimates, we multiplied the drug-specific ICER estimate (low, midpoint, or high value of the cost-effectiveness range) by the drug-specific total days’ supply of medication for all quarters over the entire observation period divided by total days’ supply for all drugs over the same period and summed across all drugs. To test significance, we ran three linear regressions with low, middle, and high ICER estimates as the outcome variable; quarter and generic status were the predictors of interest, weighted by the number of claims in each quarter.

2.7 Software and Data Permissions

MarketScan® data manipulation was done with SAS® version 9.3 software (SAS Institute, Cary, NC, USA). Value designation data by drug provided from Premera Blue Cross of Washington. Regression analyses were performed with STATA® version 14 (StataCorp LP, College Station, TX, USA).

3 Results

3.1 Descriptive Statistics

We mapped 1720–1896 unique drugs (depending on year), as defined by dosage form, active ingredient, and generic status from the Premera Blue Cross VBF to a major commercial claims database. Of these drugs, about 50% were multisource generic and 40% were brand name. Of the drugs identified, 57% were in tiers 0 and 1 (preventative, cost saving, or had a cost-effectiveness ratio under $US10,000 per QALY). Tier value overwhelmingly aligned with generic status: 98% of generic drugs were in tier 0 or 1 while 90% of brand name drugs were in tiers 2–4, and the percentage of drug claims for generics increased over time (72–82% in 2010 to 2013, respectively). By number of claims, most prescriptions were for high-value (tiers 0 and 1) and generic drugs.

The average OOP costs by drug ranged from $US6.87 to $US62.22, while the average plan payments by drug ranged from $US18.19 to $US286.17 (each standardized to a 30-day prescription). The mean percentage cost sharing, weighted by number of claims, ranged from 27 to 56% among the value tiers.

There was a general trend in increasing OOP costs and total plan payment when comparing tier 0 with tier 1 and tiers 2–4 (Table 2). Tiers 2–4 had similar plan payment amounts and OOP costs. Percentage cost sharing, weighted by number of claims, clustered in two groups with an average 55% cost sharing for tiers 0–1 and 28% for tiers 2–4.

Most of our claims data were from PPO (67%) and HMO (14%) insurance plans. HMO insurance plans had universally lower OOP costs but similar or higher total mean plan payment costs. Most claims also came from highly concentrated insurance markets (> 70%). Unconcentrated markets had slightly lower plan payment costs but similar OOP costs per pharmacy claim compared with moderately and highly concentrated insurance markets.

3.2 Regression Results

We found similar results across all models, which suggests robustness of the results. We report the random effects model results as it accounted for repeated observations in our panel dataset and allowed greater estimation efficiency, with an overall r2 = 0.736 and ρ = 0.847. (The full regression output is shown in the “Appendix”.)

In the base year of 2010, OOP costs for tiers 1–4 were 52%, 76%, 91%, and 78% higher than the reference group (tier 0), respectively (Table 3). OOP costs for drugs in tiers 0 and 1 decreased over the study timeframe by about 5% per year (p < 0.001) and were not statistically different from one another. OOP costs for tiers 3 and 4 decreased by about 2.4% and 2.2% per year (p = 0.007 and 0.011, respectively) and were not statistically different from one another. OOP costs did not change significantly for tier 2 (p = 0.312).

These trends were slightly more pronounced with PPO insurance plans, which comprise 67% of the data, and slightly less pronounced in HMO plans, which comprised 16% of the data. In PPOs, OOP costs decreased by about 6% per year for tiers 0 and 1 (p < 0.001) and by about 2% per year for tiers 2–4 (p = 0.006, 0.00, and 0.06, respectively). The tiers within these two groups were not significantly distinct from each other, but the groups were (p < 0.001). OOP costs were not clearly delineated between tiers 2 and 4 in any insurance plan type. HDHPs generally had the most variability and growth in OOP costs, while HMOs were the only plan type to have no significant change in patient costs over the timeframe in three of the five drug value categories.

At all levels of market concentration, OOP costs for higher-value drugs decreased at a faster rate than lower-value drugs, although the trend was more pronounced in unconcentrated markets. In unconcentrated markets, OOP costs decreased by 8.5% per year for tier 0 drugs (p = 0.016), while the same drugs in moderately and highly concentrated markets decreased by around 5% annually (p < 0.001). OOP costs for tier 1 drugs decreased by around 4% annually (p < 0.001) in highly concentrated markets, while changes in OOP costs for tiers 2–4 (lower-value drugs) were small.

3.3 Estimated Average Drug Value Model Results

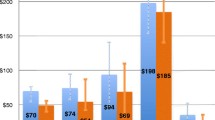

Generic status acts as a confounder in estimating the average weighted ICER of drug claims between 2010 and 2013. Before splitting the data by generic status, it appears that the weighted average ICER for drug claims were decreasing over time, regardless of low, middle, or high estimates. When stratified by generic status, the weighted average ICER for drug claims increases over time in both generic and brand name drugs by between $US210 and $US550 per year (p < 0.001) (Table 4). The average estimated ICER for brand name drugs was on average between $US40,000 and $US180,000 higher than for generics (p < 0.001). Examining the percentage of claims each year by tier and generic status shows an increase in claims for drugs in tiers 0 and 1 (22–25% and 52–59%, respectively) and an increase in generic drug use over the time period (72–82%).

4 Discussion

4.1 Value Versus Generic Status

In this study, we explored the extent to which commercial insurance plans aligned with, and shifted to, value-based cost sharing for prescription drugs. We applied drug-specific ICER estimates from one payer to observed drug-specific OOP costs from a large commercial claims dataset to infer benefit design over this period. The results provide evidence that most plans in 2010 already aligned value-based cost sharing to some extent, with lower average OOP drug costs for higher-value drugs. Results also suggest that OOP costs were decreasing over the timeframe in two trajectories: OOP drug costs for higher-value drugs (in tiers 0 and 1, costing up to $US10,000/QALY) decreased faster than OOP costs for lower-value drugs (tiers 2–4, costing over $US10,000/QALY). This trend was particularly clear for PPO insurance plans, which comprised about 70% of the claims data.

One explanation for this trend may be that commercial formulary decisions consider generic status more than explicit value. Generic drugs were overwhelmingly in tiers 0–1 and brand name drugs in tiers 2–4 in our sample. Despite a wide range of cost-effectiveness values (from $US10,000 to over $US150,000 per QALY), tiers 2–4 were not statistically significantly different in cost sharing compared with each other either at baseline or over time. This is supported by the large literature base that has shown the longstanding endeavor of US payers to increase use of generic medications [27]. Indeed, a recent paper puts the generic utilization rate in the USA (i.e., the proportion of prescription drug volume ascribed to generics) to be the highest among ten high-income developed countries [28].

Our average ICER estimates weighted by drug-specific utilization also underscore the importance of generic versus brand name status. Table 4 and Fig. 1 show that there is an overall trend of decreasing average ICERs over time. However, when stratifying brand–generic status, this trend seems to largely disappear except for the high estimate trend for branded drugs in 2010. Over this period, we observe increasing proportion of generic utilization in our sample (Fig. 1). These data suggest that commercial plans and their insured population have been moving towards value over time, as evaluated by OOP costs and total utilization, respectively. However, such movement appears to be driven by brand–generic status rather than by cost-effectiveness evidence.

This is an important distinction because there is likely a limit to substantial future gains from continuing to pursue increased generic utilization. In fact, more recent data show that although there are continued increases in unbranded generic drug utilization in the USA, the proportion of total drug spending attributed to branded drugs has been increasing simultaneously, especially with the rising spending on branded specialty drugs [27]. These results also provide evidence that insurance plans may be decreasing cost sharing for high-value drugs, but are not increasing cost share of low-value drugs as an offset (an issue that not many studies have addressed) [6]. Our results also reflect the fact that over half (56%) of all private insurance formularies have three or fewer tiers, allowing for less nuance in cost sharing between drugs relative to Premera Blue Cross’s five-tier formulary [29].

Another potential reason for the similarity in cost sharing for drugs valued over $US10,000 per QALY may be because Premera Blue Cross’s value designations do not necessarily reflect negotiated drug prices for the commercial insurance payers in our sample. We include a plan payment variable in the model, but this does not account for confidential rebates paid by manufacturers to health plans; their absence potentially means that plan costs are not accurately captured. Hence, to the degree that Premera Blue Cross’s negotiated plan costs for drugs differ from the observed plan costs in our dataset, there will be misclassification of plan–drug-specific value.

4.2 Influence of Plan Type and Market Competition

Analysis results stratified by plan type revealed significant differences between HMOs and the four other plan types. HMO plans showed no significant change in patient costs over the timeframe for any value designation compared to significant changes in all other plan types, as well as the lowest mark-ups for brand name and single-source generics, and the biggest discounts on multisource generics. The constant term for HMOs is not higher than the other plans, indicating the trends were not due to differences in initial cost-sharing levels. HMOs may have other levers to influence healthcare use other than cost sharing. For example, staff model HMOs may have a stronger influence on physician prescribing behavior that affects utilization, reducing the need for demand price levers. Further, because of stronger utilization management, they also may be able to negotiate better prices, reducing the need for high cost sharing.

The association between market competition and drug cost sharing is complex. The model indicates that there was lower cost sharing in competitive markets in 2010, but that patient costs increased faster in competitive markets, catching up to cost-sharing levels of monopolies and monopsonies. Further research may illuminate differences in shifts toward VBID by geographic region rather than by insurance market concentration.

4.3 Limitations

Our analysis should be interpreted with the acknowledgement of several limitations. Firstly, our data are based on a large, non-random cross-section of employer-based private health insurance enrollees, and therefore cannot be generalized to the entire US population or publicly sponsored health insurance programs. Secondly, the data are constrained to the years 2010–2013 to avoid confounding effects from the Affordable Care Act (ACA); however, there still may have been some anticipatory pricing changes such as early adoption of HDHPs in our timeframe as the deadline to implement ACA policies approached. The ACA specifically influenced cost sharing for high-value drugs, as insurance companies were required to provide many preventive services without cost sharing [9]. Other policies enacted during that time may also have influenced our results; future work should consider payer adoption of value as influenced by the implementation of the ACA and other policies.

There were also limitations to our value designations. Premera Blue Cross’s 2010 VBF was based on public literature but may have taken into account their firms’ specific negotiated rates. Because the value designations are Premera Blue Cross-specific, these figures will not correspond exactly to the range of privately negotiate drug prices that most commercial health insurers and pharmacy benefit managers use. Negotiated prices or rebates are not evenly distributed across the database either, as rebates for branded drugs are likely to be more substantial. Although we did our best to control for the total amount paid for each drug claim, there is no way to perfectly align overarching value designation with each firm-specific value. An additional limitation is that the value data are from 2010, and it is possible that there were changes over the 4-year period in drug price or effectiveness evidence. This limitation is less of a concern given the short timeframe of the study.

Lastly, our estimation of average weighted value for drugs over time did not factor in the additional formulary categories for special case drugs, which were given more generous ICER ranges. Using these higher ranges would have resulted in even higher estimated ICERs; however, their influence is likely to be minimal given the small proportion of drug volume for which these specialty drugs account.

5 Conclusion

Private payers have considerable potential to influence the use of prescription drugs. Our analysis suggests that payers appear to be designing cost sharing to align with value. However, this movement appears to be through the mechanism of brand–generic status rather than finer cost-effectiveness estimates. There may be potential gains from applying a cost-effectiveness approach to informing cost sharing for branded medications.

References

Cox C, Kamal R. Recent trends in prescription drug spending, and what to look out for in coming years. Kaiser Family Foundation: Peterson-Kaiser Health System Tracker. 2015. https://www.healthsystemtracker.org/brief/recent-trends-in-prescription-drug-spending-and-what-to-look-out-for-in-coming-years/. Accessed 30 Sept 2018.

Brown JD, Sheer R, Pasquale M, Sudharshan L, Axelsen K, Subedi P, et al. Payer and pharmaceutical manufacturer considerations for outcomes-based agreements in the United States. Value Health. 2018;21(1):33–40.

Yeung K, Li M, Carlson JJ. Using performance-based risk-sharing arrangements to address uncertainty in indication-based pricing. J Manag Care Spec Pharm. 2017;23(10):1010–5.

Mauskopf JA, Sullivan SD, Annemans L, Caro J, Mullins CD, Nuijten M, et al. Principles of good practice for budget impact analysis: report of the ISPOR Task Force on good research practices—budget impact analysis. Value Health. 2007;10(5):336–47.

Neumann PJ, Cohen JT. Measuring the value of prescription drugs. N Engl J Med. 2015;373(27):2595–7.

Agarwal R, Gupta A, Fendrick AM. Value-based insurance design improves medication adherence without an increase in total health care spending. Health Aff (Millwood). 2018;37(7):1057–64.

Choudhry NK, Rosenthal MB, Milstein A. Assessing the evidence for value-based insurance design. Health Aff (Millwood). 2010;29(11):1988–94.

Analytics CHE. Current and new approaches to making drugs more affordable CVS caremark. 2018. https://cvshealth.com/sites/default/files/cvs-health-current-and-new-approaches-to-making-drugs-more-affordable.pdf. Accessed 30 Sept 2018.

Patient protection and Affordable Care Act. Public Law. 2010;111(48):759–62.

Congress US. National defense authorization act for fiscal year 2016. Sec HR. 2015;4909:2943.

Fendrick MA. Government funding bill expands MA V-BID model test to all 50 states [press release]. Center for value-based insurance design. 2018. http://vbidcenter.org/chronic-care-act-funding-bill/. Accessed 30 Sept 2018.

Centers for Medicare & Medicaid Services. Medicare advantage value-based insurance design model. 2018. https://innovation.cms.gov/initiatives/vbid/. Accessed 30 Sept 2018.

Sullivan SD, Yeung K, Vogeler C, Ramsey SD, Wong E, Murphy CO, et al. Design, implementation, and first-year outcomes of a value-based drug formulary. J Manag Care Spec Pharm. 2015;21(4):269–75.

Yeung K, Basu A, Hansen RN, Watkins JB, Sullivan SD. Impact of a value-based formulary on medication utilization, health services utilization, and expenditures. Med Care. 2017;55(2):191–8.

Yeung K, Basu A, Hansen RN, Sullivan SD. Price elasticities of pharmaceuticals in a value based-formulary setting. Health Econ. 2018;27(11):1788–804.

Neumann PJ, Lin P, Greenberg D, Berger M, Teutsch S, Mansley E, et al. Do drug formulary policies reflect evidence of value? Am J Manag Care. 2006;12(1):30–6.

Cohen JP, Khoury CE, Milne CP, Peters SM. Rising drug costs drives the growth of pharmacy benefit managers exclusion lists: are exclusion decisions value-based? Health Serv Res. 2018;53:2758–69.

Gruber J, Maclean JC, Wright BJ, Wilkinson ES, Volpp K. The impact of increased cost-sharing on utilization of low value services: evidence from the State of Oregon. Working paper 22875. Cambridge: National Bureau of Economic Research; 2016.

Campbell JD, Belozeroff V, Whittington MD, Rubin RJ, Raggi P, Briggs AH. prices for common cardiovascular drugs in the US are not consistently aligned with value. Health Aff (Millwood). 2018;37(8):1298–305.

Marseille E, Larson B, Kazi DS, Kahn JG, Rosen S. Thresholds for the cost–effectiveness of interventions: alternative approaches. Bull World Health Organ. 2014;93:118–24.

Sanders GD, Neumann PJ, Basu A, Brock DW, Feeny D, Krahn M, et al. Recommendations for conduct, methodological practices, and reporting of cost-effectiveness analyses: second panel on cost-effectiveness in health and medicine. JAMA. 2016;316(10):1093–103.

Solow B, Pezalla EJ. ISPOR’s initiative on US value assessment frameworks: the use of cost-effectiveness research in decision making among US insurers. Value Health. 2018;21(2):166–8.

Emmons D, Guardado J, Kane C. Competition in health insurance: a comprehensive study of U.S. markets. Chicago; American Medical Association; 2015.

Fulton BD. Health care market concentration trends in the United States: evidence and policy responses. Health Aff (Millwood). 2017;36(9):1530–8.

US Department of Justice. Herfindahl-Hirschman Index. 2018. https://www.justice.gov/atr/herfindahl-hirschman-index. Accessed 27 Sept 2018.

Center for the Evaluation of Value and Risk in Health. The cost-effectiveness analysis (CEA) registry. http://www.cearegistry.org. Accessed 27 Sept 2018.

Aitken M, Kleinrock M, Lyle J, Caskey L. Medicine use and shifting costs of healthcare: a review of the use of medicines in the United States in 2013. Parsippany: IMS Institute for Healthcare Informatics; 2014.

Papanicolas I, Woskie LR, Jha AK. Health care spending in the United States and other high-income countries. JAMA. 2018;319(10):1024–39.

Claxton G, Rae M, Long M, Damico A, Whitmore H, Foster G. Health benefits in 2017: stable coverage, workers faced considerable variation in costs. Health Aff (Millwood). 2017;36(10):1838–47.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Elizabeth Brouwer, Kai Yeung, and Anirban Basu report no conflicts of interest.

Funding

The authors report no income related to this project.

Author contributions

Elizabeth Brouwer was the lead on developing the methods, as well as constructing the dataset from MarketScan® Database, running the analyses, and writing the manuscript. Kai Yeung initially developed the idea, provided the drug-specific value data, consulted on methods, and contributed to editing and writing the manuscript. Anirban Basu helped develop the methods and edit the manuscript.

Data Availability

The data that support the findings of this study are available from the IBM MarketScan® Database but restrictions apply to the availability of these data, which were used under the license for the current study and so are not publicly available. Data are available from the corresponding author upon reasonable request and with permission of Truvan Analytics.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Brouwer, E.D., Basu, A. & Yeung, K. Adoption of Cost Effectiveness-Driven Value-Based Formularies in Private Health Insurance from 2010 to 2013. PharmacoEconomics 37, 1287–1300 (2019). https://doi.org/10.1007/s40273-019-00821-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40273-019-00821-5