Abstract

Background

An ambitious reform of the early access (EA) process was set up in July 2021 in France, aiming to simplify procedures and accelerate access to innovative drugs.

Objective

This study analyzes the characteristics of oncology drug approvals through the EA process and its impact on real-life data for oncology patients.

Methods

The number and characteristics of EA demands concerning oncology drugs submitted to the National Health Authority (HAS, Haute Autorité de Santé) were reviewed until 31 December 2022. A longitudinal retrospective study on patients treated with an EA oncology drug between 1 January 2019 and 31 December 2022 was also performed using the French nationwide claims database (Systeme National des Données de Santé [SNDS]) to assess the impact of the reform on the number of indications and patients, and the costs.

Results

Among 110 published decisions, the HAS granted 88 (80%) EA indications within 70 days of assessment on average, including 46 (52%) in oncology (67% in solid tumors and 33% in hematological malignancies). Approved indications were mostly supported by randomized phase III trials (67%), whereas refused EA relied more on non-randomized (57%) trials. Overall survival was the primary endpoint of 28% of EA approvals versus none of denied EAs. In the SNDS data, the annual number of patients with cancer treated with an EA drug increased from 3137 patients in 2019 to 18,341 in 2022 (+ 484%), whereas the number of indications rose from 12 to 62, mainly in oncohematology (n = 17), lung (n = 12), digestive (n = 9) and breast cancer (n = 9). Reimbursement costs for EA treatments surged from €42 to €526 million (+ 1159%).

Conclusion

The French EA reform contributed to enabling rapid access to innovations in a wide range of indications for oncology patients. However, the findings highlight ongoing challenges in financial sustainability, warranting continued evaluation and adjustments.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

The early access reform in France has enabled rapid access to innovation, particularly for oncology drugs. |

Approved oncology drugs are mostly supported by high-level evidence studies (phase III trials) with mature overall survival data provided. |

The reform also led to a significant increase in the annual number of patients treated and the reimbursement costs. |

1 Introduction

Cancer is a major public health concern. In 2020, there were 2.7 million new cases in the European Union (EU) countries, leading to 1.3 million deaths [1]. Cancer-related deaths are expected to rise by over 24% by 2035, making it the leading cause of death [2], even with therapeutic innovations.

Drug innovations, as targeted therapies, immunotherapies or chimeric antigen receptor T (CAR-T) cells, have represented a significant breakthrough in the treatment of advanced cancer, significantly improving overall survival (OS) and patient’s quality of life [3, 4]. However, the process of reimbursement and drug pricing has become much more complex and prolonged, taking 503 days on average after European Medicines Agency (EMA) approval in France [5]. Since then, access to medicines in the EU has been accelerated, largely encouraged by the ‘Europe's beating cancer’ plan[6], and various schemes have emerged [7], such as the PRIME (priority medicines) programme for medicines to address unmet needs [8].

Early access programs (EAPs) are designed to provide patients access to medicines before the medicines’ marketing authorization (MA) or during the national reimbursement and pricing process. In 1994, France was a pioneer by implementing an EAP framework called Authorization for Temporary Use (ATU) [9]. However, due to successive modifications over time, the ATU system became increasingly complex with six different pathways [10]. Concomitantly, expenditures related to innovative drugs (including those in the ATU program) continued to rise significantly in France, exhibiting an annual growth rate of 54% between 2019 and 2022. Among these, oncology drugs have seen their costs more than triple over the past 3 years [11].

In July 2021, an ambitious reform of the French early access (EA) system was thus implemented with three main objectives: (1) to simplify and harmonize procedures for EA to innovative drugs; (2) allow patients faster access to drugs; and (3) guarantee financial sustainability for the healthcare system [12]. Two pathways now exist: authorization for early access (AEA), and authorization for compassionate use (ACU). AEA concerns drugs in specific indications, aiming at treating serious, rare or debilitating disease, when all the following criteria are met: (1) in exceptional circumstances; (2) no appropriate treatment exists; (3) treatment cannot be postponed; (4) efficacy and safety of the drug are highly presumed according to clinical trials; and (5) the drug is presumed innovative in regard to a possible clinically meaningful comparator. AEA is applicable both to drugs in ‘pre-MA’ EA (before MA by the EMA) or ‘post-MA’ EA (MA is approved by the EMA but not yet reimbursed/priced) [13]. Conversely, ACU allows, the use of drugs without MA indications in France to treat severe or rare diseases when there is no appropriate treatment available, the patient cannot be enrolled in a clinical trial, and the implementation of treatment cannot be delayed. This applies to drugs not intended for registration or marketing. For example, EA has been granted for therapeutic innovations such as CAR-T-cell therapy and antibody drug conjugates for severe solid tumors and hematologic malignancies. Additionally, compassionate use has been granted for certain drugs already on the market but lacking MA for specific indications, such as dapsone for the treatment of autoimmune bullous dermatosis.

The reform also changes the procedure pathway; whereas ATU was only regulated by the French Medicines Agency (ANSM, Agence nationale de sécurité du médicament et des produits de santé), the National Health Authority (HAS, Haute Autorité de Santé) is now also involved in AEA decisions. The ANSM and HAS are expected to deliver a common decision within 90 days to allow patients prompt access to drugs. Regarding financing for the EA pathway, the drug is provided to hospitals at a price freely fixed by the manufacturer and communicated to the Economic Committee for Healthcare Products (CEPS). However, two types of rebates are applied afterwards: (1) annual rebates based on the net invoiced turnover to hospitals, following a progressive scale set by decree—these rebates can be increased if the manufacturer fails to adhere to the terms of the EA agreement; and (2) ‘unwinding’ rebates based on the final negotiated price with the CEPS.

At the European level, various models of EA to medicines have also emerged. Spain regulates EAPs under Royal Decree 1015/2009, mainly nominal-based but with some cohort-based options such as compassionate use. The UK’s Early Access to Medicines Scheme (EAMS) covers pre-MA drugs for all trial-eligible patients, offered as either nominal- or cohort-based. In Italy, multiple lists oversee EA and off-label use, including Law 648/96, Well-Established Use, and the 5% Fund. While Italy has shown generosity in implementing EAPs, it faces challenges due to mixed approaches combining EA with off-label use. The comparative study of these different EA systems has led researchers to consider the French EA reform as a potential model for harmonizing different European EAPs [7, 13, 14]. However, there is currently insufficient data assessing the impact in terms of drug approvals and number of treated patients in France, and no economic data have been available since the EA reform [7, 15, 16]. This study aims to review the first 18 months of the reform, focusing on oncology (including hematological malignancies) drugs following an AEA decision. The objectives were to analyse the characteristics of oncology drug approvals through the new AEA process and to evaluate the impact of the reform in real-life, in terms of number of indications, number of treated patients, and costs, using the nationwide claims database.

2 Material and Methods

The present study follows a two-step approach. First, it used the HAS data to identify and analyze the characteristics (number, acceptance rate, delay for decision, tumor type, methodological issues of the trial) of the AEA demands related to oncology drugs since the reform (1 July 2021). Second, a longitudinal study using data from the French Nationwide claims reimbursement database (Systeme National des Données de Santé [SNDS]) from 2019 to 2022 was performed to evaluate the impact of the AEA reform in real-life conditions, in terms of number of drugs/indications used, number of patients treated, and reimbursement costs.

2.1 Number and Characteristics of Drug Demands to the Authorization for Early Access (AEA) Pathway

All the AEA demands submitted to the HAS since the reform (1 July 2021) until 31 December 2022 were identified and reviewed. Given that the HAS is now responsible for AEA decisions, all the information regarding the corresponding demands are now available on the HAS website [17], including information regarding the drug, the claimed indication, the eligibility criteria for the AEA program, the pivotal data supporting the demand, the decision (approval/failure) and it reasons, and the submission and decision dates. Note that these dossiers are presented by indication (rather than by drug), as authorization and reimbursement occur on a per-indication basis.

For oncology (solid tumors and hematological malignancies) indications, we collected the drug’s name, therapeutic class (using the WHO Anatomical Therapeutic Chemical classification [18]), the decision, and the time between submission and decision. Data related to the methodology of the main trial supporting the EA demand (phase, design, comparator, primary endpoint, presence of OS data, and OS maturity if provided) were also collected and compared between approval and failure decisions. Combination therapies that submitted two similar demands were counted as a single therapy (n = 4). Three demands for indication renewals with no significant modification were excluded, as well as one demand concerning an antidote (glucarpidase), considering it has no anti-tumor effect. Figure 1 presents a flowchart of the selected demands.

2.2 Real-Word Data on Patients Receiving an Early Access Drug

The second part of our analysis aimed to quantify the impact of the AEA reform in real-life conditions, i.e. the number of drugs (or indications) administered, the number of patients treated by an EAE drug, and their costs in France. To do this, we performed an observational retrospective longitudinal study using the nationwide claims database (SNDS) between 1 January 2019 and 31 December 2022. The SNDS database contains claims data for more than 99% of the French population, covering both hospital and community care and both the public and private sectors [19]. The SNDS uses a unique and anonymous patient identifier, so that individual patients can be followed over their lifetime. Regarding medicines, ATU/AE treatments administered or delivered at hospital are documented into the MEDATU/MEDAPAC database, including information on the drug code (UCD, unite commune de dispensation), the indication code,Footnote 1 the anonymous patient identifier, the month and year of delivery, and the reimbursement cost from the perspective of the French National Health Insurance (in Euros), before discounts are applied. For each indication code identified, the molecule’s name, reimbursement dates under the ATU/EA pathway, therapeutic area, and anatomical location can be retrieved using a Ministry of Health file [10].

All ATU/EA drug deliveries between 1 January 2019 and 31 December 2022 corresponding to solid tumors and hematological malignancy indications were extracted from the MEDATU/MEDAPAC databases. Analysis was restricted to indications included in the AEA pathway (from 1 July 2021 to 31 December 2022) and certain ATU indications (cohort ATU, ‘post-ATU’, indication extension ATU, and direct access post-MA, which later merged to become AEA status, during the period from 1 January 2019 to 30 June 2021), excluding ACU indications. For the selected indications, the number of indications used, number of (prevalent) patients treated, and the costs were calculated monthly and annually, and presented both globally and by tumor localization.

Of note, the sum of the number of patients treated monthly is not equal to the number of patients treated annually, since patients are generally treated over several months.

Statistics were descriptive. Data from the HAS website were collected in Microsoft Excel® (Microsoft Office 2016; Microsoft Corporation, Redmond, WA, USA), whereas analyses from the SNDS data were conducted using SAS® software version 9.4 (SAS Institute, Inc., Cary, NC, USA).

3 Results

3.1 Characteristics of Drugs and Demands Approved Under the AEA Reform

By 31 December 2022, 130 demands for AEA had been submitted by manufacturers to the HAS. Among the 110 decisions published, 54 (49%) concerned oncology indications (67% in solid tumors and 33% in hematological malignancies). Across all therapeutic areas, the HAS has granted 88 (80%) positive access decisions, while the acceptance rate for oncology/hematological malignancy indications is 85%. Oncology drugs that were approved, and their indication, are listed in Online Resource Table 1. Another point is the speed in making decisions, as the HAS and ANSM have rendered them within 70 days on average (range 47–113) and in < 90 days in 87% of cases. Regarding therapeutic classes, 21 (46%) approvals concerned monoclonal antibodies and antibody-drug conjugates, 7 (15%) concerned protein kinase inhibitors (16%), and 6 (13%) concerned CAR-T-cell agents.

The methodological characteristics of the trials supporting the EA decisions are presented on Table 1, according to whether AEA was granted (n = 39) or denied (n = 7). Granted AEAs were mostly supported by phase III trials (67%) that included a randomization (69%), whereas refused AEAs were mainly phase I or II trials (58%), mostly non-comparative (43%). The notion of the comparator is important, as 51% of granted AEAs had a clinically relevant comparator.Footnote 2 However, trials versus placebo or supportive care were also accepted in 18% of cases, in accordance with the HAS methodological guide [21] that accepts them when justified, particularly for rare diseases or when no treatment exists. Regarding the primary (or co-primary) endpoint, these were distributed among OS (28%), progression-free survival (PFS; 28%), overall response rate (ORR, 28%) or another endpoint (23%) for granted demands. OS was also explored as a secondary endpoint in 25 (64%) granted cases. Conversely, primary endpoints were mostly ORR (71%) or other endpoints (29%), but never OS or PFS for denied demands. To date, all demands having mature OS data (41% of cases) in a comparative trial were accepted, meaning that OS data remain a major endpoint, including for the EA process. For the seven denied demands, the HAS considered that an appropriate treatment already existed in the indication (6/7) and/or that the drug was not presumed innovative (5/7).

3.2 Evolution of the Number of Indications, Patients and Cost for AEA Oncology Drugs

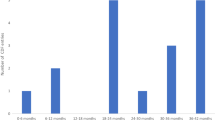

Figure 2 presents the evolution of the number of distinct ATU/EA indications of oncology drugs used in real-world practice from 2019 to 2022, by trimester. It showed that the number of indications strongly increased over the period, ranging from 12 ATU indications (7 for solid cancers and 5 for hematological malignancies) in 2019 to 62 EA indications in 2022, predominantly in hematological malignancies (n = 17), lung cancer (n = 12), digestive cancer (n = 9), and breast cancer (n = 9). This may be explained by multiple extensions of indications (such as CAR-T cells in multiple myeloma or pembrolizumab in four indications [two in breast, one in pancreatic, and one in cervical cancers]), the arrival of new therapeutic classes (two indications for trastuzumab deruxtecan in breast cancer and digestive cancer, or teclistamab), or the pursuit of treatment under EA reform.

Number of distinct ATU/EA indications of oncology drugs used in real-world practice (quarterly month representation) from 2019 to 2022. This figure represents, by trimester, the number of oncology indications in EA, associated with hospital prescriptions, between 2019 and 2022 found in the real-world database of the SNDS. ATU Authorization for Temporary Use, EA early access, SNDS Systeme National des Données de Santé

As a possible consequence, the annual number of patients with cancer who were treated with an AEA drug strongly increased from 3137 patients in 2019 to 18,341 in 2022 (+ 484%). Figure 3 shows the evolution of the number of patients treated by an AEA drug in France, by month and by tumor localization. It reveals that the number of patients treated monthly with an oncology AEA treatment has risen steadily, being multiplied by 20 over the period, from 326 in January 2019 to 6800 in December 2022. It mainly concerned patients treated for breast cancer (from 68 to 2877 patients, + 4131%) or lung cancer (from 84 to 650 patients, + 674%). New localizations have also emerged, such as digestive and urological cancers, with 866 and 619 patients in December 2022, respectively. Hemato-oncology, which represented approximately half of the treated patients in January 2019 (168 patients), saw a sevenfold increase in its number of patients (1251 patients in December 2022) and represents only 18% of patients treated with an EA oncologic drug at the end of the study period.

Number of patients treated by an ATU/AEA oncology drug, per tumor localization and per month. This figure represents the number of patients treated with a molecule for an oncology indication in early access, by tumor location and per month, between 2019 and 2022. The data are derived from the real-world database of the SNDS. AEA authorization for early access, ATU Authorization for Temporary Use, SNDS Systeme National des Données de Santé

Reimbursement costs also increased significantly, from 42 to 526 million between 2019 and 2022 (+ 1159%). In 2022, the higher reimbursement costs concerned treatments for hematological malignancies (€180 million), breast cancer (€159 million), urology (€68 million), and lung cancer (€64 million). Figure 4 shows the evolution of monthly reimbursement costs for AEA drugs in France by tumor localization.

Reimbursement costs for ATU/AEA oncology drugs, per tumor localization and per month. This figure represents the reimbursement costs associated with early access treatments in oncology, by tumor location and per month, between 2019 and 2022. The data are derived from the real-world database of the SNDS. AEA authorization for early access, ATU Authorization for Temporary Use, SNDS Systeme National des Données de Santé

4 Discussion

With 88 indications approved within 18 months, the French EA reform has allowed rapid access to innovations with a high level of evidence and regulatory simplification of the previous EA systems. More than half of approvals concerned oncology indications, predominantly for solid tumors, notably targeted kinase inhibitors and immunotherapy. The same trend was found in the US, where, since 1992, approximately one-quarter of accelerated-approved drugs are precision medicines for treating solid tumors [22]. This trend highlights the fact that specific classes of innovative products dominate the oncology treatment landscape, testifying to the accelerated pace of innovation in this field [23]. With decisions delivered within 70 days on average, ANSM and HAS comply with the regulatory deadline in 87% of cases. This is outstanding as it granted immediate access for AEA drugs to patients. The AEA process is notably quicker than the current drug reimbursement process and the previous ATU evaluation, which required 503 days [5] and 257 days [24], respectively. In addition, approved indications were supported by high-quality methodological studies, with mostly phase III trials including direct comparison, randomization and OS as the primary endpoint in nearly one-third of cases, underlining the continued significance of OS results as a pivotal requirement in the French context. This differs from the US FDA approach for cancer accelerated approvals, which often rely on ORR data from early trials or single-arm trials [25]. It is however in accordance with the French evaluation performed by the HAS for common drug reimbursement, which enhances drugs with substantial clinical benefits supported by methodologically rigorous studies [13]. Previous studies also demonstrated that ATU programs were based on robust approvals characterized by substantial enhancements in clinical benefit and mature OS data, as supported by high ESMO-MCBS and ASCO-VF scores [15].

The large proportion of trials containing mature OS data may be explained by the fact that 62% of demands concern post-MA drugs, where more legitimate final results are to be found. Unlike the FDA’s accelerated approval pathway, the French AEA does not require confirmatory trials to verify the drug’s clinical benefit and obtain definitive approval. Manufacturers are therefore inclined to submit demands containing more mature OS data to comply with HAS requirements. However, as the reform is still recent, it is possible that the trend will change and that drugs with early clinical endpoints such as ORR or PFS will be candidates to obtain an AEA [26,27,28].

Using national medico-administrative databases, our study also unveiled patients benefiting from EA oncology drugs and associated reimbursement costs. We observed a significant rise in the number of patients receiving AEA treatments, with a sixfold increase between 2019 and 2022, accompanied by an increase in costs by tenfold over the period. This growing number of patients and treatment costs appears to be connected to the simultaneous availability of new drugs under EA, as well as new indications for existing drugs now encompassing multiple therapeutic areas, as also noticed in other countries [15, 16, 23]. However, the momentum of increase in the number of indications (Fig. 2) and patients treated (Fig. 5) was already discernible during the ATU period and appears to be continuing since the reform. The EA reform has thus facilitated, but cannot explain, the expansion of innovations in oncology into the market.

Number of patients treated with an EA oncology drug according to their regulatory status (ATU/EA/mixed status) and per month. Of note, the mixed status corresponds to the drugs that were able to directly transition from the ATU status to the EA status at the time of the reform (July 2021). EA early access, ATU Authorization for Temporary Use

However, questions remain regarding the financial aspects and organizational modalities of the reform. The very significant increase in costs may appear worrying, although the reform aimed to control expenditure to ensure health care sustainability. Despite the great increase in the number of indications and patients treated, the trend may be explained by the fact that drug prices are freely fixed by the manufacturer during the AEA period. However, the cost presented in Fig. 4 does not reflect the final expense for the French health system, as the laboratory will pay discounts based on AEA sales and the final drug price negotiated. Consequently, the reform is too recent to estimate the economic burden of AEA on drug expenditures and its impact regarding the sustainability and financing of therapeutic innovations. However, it is essential to closely monitor the impact of the reform and assess whether adjustments are needed to the current system of financing EA, as well as to the mechanism of post-regulatory control through rebates. Questions also linger about the successful and long-time efficacy of the system. As part of the EA agreement, laboratories must provide real-life data on the use, effectiveness, adverse effects and sometimes quality of life to the HAS and ANSM, offering complementary insights to trials. If the usefulness of this data collection is not questioned, challenges regarding the methods, quality, and funding of real-word data collection, which currently rely on hospital teams, are now being raised by French experts [29].

Despite these points of caution, the EA reform in France has allowed fast arrival of a significant number of therapeutic innovations for patients. It concerns innovative medicines for unmet medical needs for serious and sometimes rare cancers, and is supported by high-quality methodology studies with a demonstrated added clinical benefit. The French EA system therefore appears to offer insights for other countries seeking to support and accelerate access to innovations in oncology [7].

Notes

A code provided by the French ministry used to label the drug under the ATU/EA pathway in an authorized indication.

According to the definition of the HAS Transparency Committee’s doctrine, a clinically relevant comparator may be a medicinal product (active substance or placebo, with or without MA), a medical device, a procedure, or any other non-medicinal therapy (or diagnostic method). It plays the same role in the therapeutic strategy as the new medicinal product and is aimed at the same patients [20].

References

European Commission. European Cancer Information System [cited 2023 Jul 31]. https://ecis.jrc.ec.europa.eu/.

International Agency for Research on Cancer. Cancer Tomorrow [cited 2023 Jul 31]. https://gco.iarc.fr/tomorrow/en.

Polkowska M, Ekk-Cierniakowski P, Czepielewska E, Wysoczański W, Matusewicz W, Kozłowska-Wojciechowska M. Survival of melanoma patients treated with novel drugs: retrospective analysis of real-world data. J Cancer Res Clin Oncol. 2017;143:2087–94.

Assié J-B, Corre R, Levra MG, Calvet CY, Gaudin A-F, Grumberg V, et al. Nivolumab treatment in advanced non-small cell lung cancer: real-world long-term outcomes within overall and special populations (the UNIVOC study). Ther Adv Med Oncol. 2020;12:1758835920967237.

Newton M, Stoddart K, Travaglio M, Troein P. EFPIA Patients W.A.I.T. Indicator 2022 Survey.

Europe’s Beating Cancer Plan. European Commission; 2021 [cited 2023 Jan 23]. https://primarysources.brillonline.com/browse/human-rights-documents-online/communication-from-the-commission-to-the-european-parliament-and-the-council;hrdhrd46790058.

Tarantola A, Otto MH, Armeni P, Costa F, Malandrini F, Jommi C. Early access programs for medicines: comparative analysis among France, Italy, Spain, and UK and focus on the Italian case. J Pharm Policy Pract. 2023;16:67.

European Medicines Agency. Support for early access. Amsterdam: European Medicines Agency; 2018 [cited 2023 Aug 1]. https://www.ema.europa.eu/en/human-regulatory/overview/support-early-access.

France’s New Framework for Regulating Off-Label Drug Use | NEJM [cited 2023 Jul 31]. https://doi.org/10.1056/NEJMp1208347.

DGOS; DGS. Autorisation d’accès précoce, autorisation d’accès compassionnel et cadre de prescription compassionnelle. Ministère de la Santé et de la Prévention. 2023 [cited 2023 Aug 3]. https://sante.gouv.fr/soins-et-maladies/medicaments/professionnels-de-sante/autorisation-de-mise-sur-le-marche/article/autorisation-d-acces-precoce-autorisation-d-acces-compassionnel-et-cadre-de.

French National Health Insurance. The proposals of the French National Health Insurance for 2024. 2023 [cited 2023 Jul 31]. https://assurance-maladie.ameli.fr/etudes-et-donnees/2023-rapport-propositions-pour-2024-charges-produits.

Autorisation d’accès précoce, autorisation d’accès compassionnel et cadre de prescription compassionnelle. Ministry of Health and Prevention. 2023 [cited 2023 Jan 10]. https://solidarites-sante.gouv.fr/soins-et-maladies/medicaments/professionnels-de-sante/autorisation-de-mise-sur-le-marche/article/autorisation-d-acces-precoce-autorisation-d-acces-compassionnel-et-cadre-de.

Early access to medicinal products. Haute Autorité de Santé [cited 2023 Feb 2]. https://www.has-sante.fr/jcms/r_1500918/en/early-access-to-medicinal-products.

Martinalbo J, Bowen D, Camarero J, Chapelin M, Démolis P, Foggi P, et al. Early market access of cancer drugs in the EU. Ann Oncol. 2016;27:96–105.

Pham FY-V, Jacquet E, Taleb A, Monard A, Kerouani-Lafaye G, Turcry F, et al. Survival, cost and added therapeutic benefit of drugs granted early access through the French temporary authorization for use program in solid tumors from 2009 to 2019. Int J Cancer. 2022;151:1345–54.

Jacquet E, Kerouani-Lafaye G, Grude F, Goncalves S, Lorence A, Turcry F, et al. Comparative study on anticancer drug access times between FDA, EMA and the French temporary authorisation for use program over 13 years. Eur J Cancer. 2021;149:82–90.

Avis et décisions sur les médicaments. Haute Autorité de Santé [cited 2023 Aug 1]. https://www.has-sante.fr/jcms/p_3281266/fr/avis-et-decisions-sur-les-medicaments.

WHOCC - ATC/DDD Index [cited 2023 Aug 4]. https://www.whocc.no/atc_ddd_index/.

Scailteux L-M, Droitcourt C, Balusson F, Nowak E, Kerbrat S, Dupuy A, et al. French administrative health care database (SNDS): the value of its enrichment. Therapies. 2019;74:215–23.

HAS. Transparency Committee doctrine. 2020.

Early access to medicinal products. Haute Autorité de Santé [cited 2023 Oct 17]. https://www.has-sante.fr/jcms/r_1500918/en/early-access-to-medicinal-products.

Subbiah V, Wirth LJ, Kurzrock R, Pazdur R, Beaver JA, Singh H, et al. Accelerated approvals hit the target in precision oncology. Nat Med. 2022;28:1976–9.

Trends in the approval of cancer therapies by the FDA in the twenty-first century | Nature Reviews Drug Discovery [cited 2023 Jul 27]. https://www.nature.com/articles/s41573-023-00723-4.

LEEM. Bilan économique 2021 des entreprises du médicament—Edition 2022 [cited 2023 Aug 4]. https://www.leem.org/publication/bilan-economique-2021-des-entreprises-du-medicament-edition-2022.

Agrawal S, Arora S, Amiri-Kordestani L, de Claro RA, Fashoyin-Aje L, Gormley N, et al. Use of single-arm trials for US Food and Drug Administration Drug Approval in Oncology, 2002–2021. JAMA Oncol. 2023;9(2):266–72. https://doi.org/10.1001/jamaoncol.2022.5985.

Fashoyin-Aje LA, Mehta GU, Beaver JA, Pazdur R. The on- and off-ramps of oncology accelerated approval. N Engl J Med. 2022;387:1439–42.

Beaver JA, Pazdur R. “Dangling” accelerated approvals in oncology. N Engl J Med. 2021;384: e68.

Mushti SL, Mulkey F, Sridhara R. Evaluation of overall response rate and progression-free survival as potential surrogate endpoints for overall survival in immunotherapy trials. Clin Cancer Res. 2018;24:2268–75.

Renne M, Maquin G, Rosant D, Villiet M, Seron A. Feedback from a university hospital one year after the “simplified” reform of early and expanded access programme: a growing complexity for health professionals. J Pharm Clin. 2022;41:149–57.

Acknowledgements

The authors would like to thank Emilie Nohet and Ilan Moralli for their expertise and assistance in building the study database.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

No external funding was used in the preparation of this manuscript.

Conflict of interest

Tess Martin, Catherine Rioufol, Bertrand Favier, Nicolas Martelli, Isabelle Madelaine, Christos Chouaid and Isabelle Borget declare that they have no conflicts of interest that might be relevant to the contents of this manuscript.

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Availability of data and material

The data that support the findings of this study are available from the Systeme National des Données de Santé (SNDS) but restrictions apply regarding the availability of these data, which were used under license for the current study and are therefore not publicly available. Indeed, under French law and regulations, databases extracted from the SNDS cannot be publicly available.

Code availability

Not applicable.

Author contributions

TM: Conceptualization, data curation, methodology, writing—original draft, writing—reviewing. CR: Conceptualization, methodology, writing—reviewing. BF: Conceptualization, writing—reviewing. NM: Conceptualization, writing—reviewing. IM: Conceptualization, writing—reviewing. CC: Methodology, writing—reviewing. IB: Conceptualization, data curation, methodology, writing—reviewing.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Martin, T., Rioufol, C., Favier, B. et al. Impact of Early Access Reform on Oncology Innovation in France: Approvals, Patients, and Costs. BioDrugs 38, 465–475 (2024). https://doi.org/10.1007/s40259-024-00658-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40259-024-00658-1