Abstract

Background

Promoting substitution of lower priced generics for brand drugs once the market exclusivity period for the latter expires is a key component of the US strategy for achieving value in prescription drugs.

Objective

This study examines the effect of generic competition on drug prices by estimating the effect of entry of generic drugs, following a brand’s loss-of-exclusivity (LOE), on the average price of competing drugs.

Methods

Using the Medicare Part D drug event (PDE) data from 2007 to 2018, we utilize both fixed effects and random effects at the drug level to estimate the relationship of competitors and prices within each drug while controlling for factors across drugs. We follow a drug 24 months and 36 months after first generic entry to examine whether the relationship between number of suppliers and price would change over time. We also test the hypothesis that drugs with more recent LOE might face less competition than those with earlier LOE.

Results

We find that drug prices fall with increasing number of competitors. Prices decline by 20% in markets with about three competitors (the expected price ratio of current generic to pre-generic entry brand average prices is 80%). Prices continue to decline by 80% relative to the pre-generic entry price in markets of ten or more competitors (the expected price ratio is about 30% following 2 years after entry, dropping to 20% following 3 years after entry). We also find that the impact of competition on relative prices is similar for generic drugs first entering the market in either 2007–11 or 2012–15.

Conclusion

Promoting generic entry and maintaining effective provider competition are effective methods for containing drug prices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Drug prices fall with increasing number of competitors. Prices decline by 20% in markets with about three competitors and continue to decline by 80% in markets of ten or more competitors relative to the pre-generic entry price following 3 years after entry. |

The impact of competition on relative prices is similar for generic drugs first entering the market in either 2007–11 or 2012–15. |

Promoting generic entry and maintaining effective provider competition are effective methods for containing drug prices. |

1 Introduction

A critical part of the U.S. strategy for achieving value in prescription drug is the substitution of lower price generics for brand drugs once the market exclusivity period for the latter expires [28, 34]. Generic competition has intensified in the last decade with the expiration of market exclusivity of a large number of branded drugs in 2011 and 2012, creating opportunities for entry and expanded use of lower cost generic drugs [1]. Then, in July 2012, Congress enacted the Generic Drug User Fee Amendments (“GDUFA I”), as part of the Food and Drug Administration Safety and Innovation Act. GDUFA provided additional resources for the US Food and Drug Administration (FDA) to address the backlog of Abbreviated New Drug Applications (“ANDAs”) and expedite its reviews of new ANDA submissions [7]. These developments aided the continuing shift toward the use of generic drugs, whose share of all retail and mail-order -dispensed drugs increased from 36% in 1994 to 75% in 2009 and 90% in 2017 [4, 17]. In clearing a historic backlog of ANDAs, the FDA approved a record number of generics during 2017–19.Footnote 1 These new generic drugs are expected to further moderate the rate of growth in drug spending [28, 29].

However, in recent years, concerns about competition and pricing in the generic industry have arisen. Recent mergers and acquisitions have resulted in consolidation in generic manufacturing. There were 22 mergers and acquisitions in 2014 worth $1.86 billion, in 2015 there were 34 totaling $33.56 billion, and in 2016, there were 42 worth in excess of $44 billion [16]. Therefore, there is concern about whether new generic markets will get the same competitive response as in the past, as well as whether low profit margins will result in an increasing number of noncompetitive generic markets and price spikes [20]. During 2012–15, there were price increases, some very large, for certain generic drugs that are the standard of care for certain diseases [35]. In addition, many of the ANDAs approved by the FDA in recent years have been for subsequent generics—that is, generic versions for markets that already have at least three competitors. There is also concern that such approvals do not have the same price-reducing effect as approval for the first three competitors in the market [23].

In this study, we analyze the effect of generic competition on drug prices to address two of the important questions raised above. First, following a loss of patent exclusivity (LOE) of a brand-name drug, does the price of generic drugs continue to decline with each additional market entrant or level off after the first few entrants? Second, has the price reducing effect of competition in new generic markets declined over time? Addressing these questions has direct policy implications for the FDA of the Department of Health and Human Services (HHS) to affect generic entry and promote competition.

2 Background

There is a considerable amount of literature with varying estimated impacts on the relationship between the number of generic market competitors and prices.Footnote 2

Frank and Salkever (1995) estimate that each entrant reduces the price of a generic product by 5.6–7.2%; thus, moving from the sample mean of about 5–10 competitors would reduce prices by between 28 and 72% [15]. Using IMS data from 1980 through 1991 to study a sample of 32 drugs that lost patent protection during 1984–87, the authors examine the effect of the number of generic sellers (N), the main independent variable obtained from the Orange book, on price, the main dependent variable defined as average revenue per extended unit.Footnote 3

Wiggins and Maness (2004) show that price falls rapidly with entry of a few competitors and price continues to fall even with numerous sellers. For example, price falls about 83% as the number of sellers increase from one to between six and 15, and falls by another 52% as sellers increase from the six to 15 range to more than 40 [36]. Using retail-level pharmacy transaction data for all anti-infective products over the 1984-90 period from the National Prescription Audit of IMS America, the authors estimate the impact on the real price per prescription (dummy for brand name products) of competition. Competition is measured by N (number of sellers), HHI (the Herfindahl index), or 1/(N+1) (the Cournot specification).Footnote 4

Chintan, Hartzema, and Kesselheim (2017) show that the number of manufacturers of the generic drug is strongly associated with the relative price of the generic to the brand-name drug [8]. The relative price decreases to 87% for drugs with one generic competitor, then to 77% with a second manufacturer, and further down to 60% with three manufacturers and 21% with ten or more competitors. The authors examine the relative prices of generic to brand-name drugs using MarketScan commercial claims data during 2008-14.

Berndt, Conti, and Murphy (2017) estimate that the elasticity of price with respect to manufacturer count ranges from − 0.710 to − 0.777 [6]. Assuming an estimated elasticity of -0.75, an increase from two to three manufacturers implies a 30% price decrease.Footnote 5 When adding fixed effects for molecule, the study suggests that increase from two to three manufacturers implies about a 15% price reduction.Footnote 6 The study uses IMS National Sales Perspective data, 2004Q4–2016Q3.

Reiffen and Ward (2005) find a negative relationship between price and the number of firms, and that the marginal effect of an additional firm tends to decline with increasing number of firms [24]. For example, with 11 or more competitors, the generic price is estimated to be 67.5% of the pre-expiry price of the branded drug. Using IMS data on 31 drugs that went off patent in the late 1980s and early 1990s, and subsequently faced competition from generic producers, the average price of a drug is constructed as revenue divided by quantity.Footnote 7 The dependent variable of the price equation is the ratio of the post-patent-expiration generic price for a chemical to the price of the branded version of that chemical during the year prior to patent expiration.Footnote 8

An updated analysis by the (FDA 2019) confirms that greater competition among generic drug makers is associated with lower generic drug prices [14, 21].Footnote 9 Using two different sources for wholesale prices, the FDA shows that generic drug prices after initial generic entry decline with additional competition using both the average manufacturer prices (AMP) reported to the Centers for Medicare and Medicaid Services (CMS) and invoice-based wholesale prices reflecting pharmacy acquisitions from IQVIA’s National Sales Perspective database (NSP).Footnote 10 Based on data for all drug products that had initial generic entry between 2015 and 2017, the results show that for products with a single generic producer, the generic AMP is 39% lower than the brand AMP before generic competition (vs. 31% reduction using invoice prices). With six or more competitors, generic prices using both AMP and invoice prices show price reductions of more than 95% compared to brand prices.

The differences in these results are attributable to factors such as varying samples of drugs studied, differing time periods and the choices made in statistical models. One methodological choice is how to represent the number of generic competitors. The depiction of competition can be categorized into two approaches: (1) using the number of competitors (N) or some variant of N, or (2) using a set of binary variables to describe the number of competitors. The first approach, by using the number of firms as an explanatory variable, assumes that the effect of an increase by 1 in the number of firms is independent of the initial number of firms and that the relationship between the number of suppliers and price is predetermined in the equation. For example, generic price is assumed to vary linearly with N, the number of firms [8, 14, 15]; with N and N2 [10]; or with N and 1/N [36]. The second approach for measuring competition uses a set of binary variables to represent the number of competitors. Unlike using a single number as a dependent variable, this specification would not assume a priori functional form on the effect of additional competitors on price but would allow the marginal effect of an additional firm to vary with the number of firms [24].

While many studies pre-date Medicare Part D, we use the Medicare Part D drug events (PDE) data from 2007 through 2018 to examine all generics entering the Part D markets during 2007–15 and follow the drugs for 24 and 36 months after entry. In addition, we use both approaches adopted in the literature to represent competition and use both fixed and random effects as well as accounting for potential markets size in order to address the potential endogeneity in the relationship between the number of competitors and price.

3 Data and Methods

3.1 Data

To examine the relationship between number of suppliers and price, we use the latest Medicare Part D (PDE) data from 2007 to 2018, hence, complementing most previous work that relies on the IMS national sales data or private payers claims data.Footnote 11 A drug is defined by a combination of molecule (active ingredient), route of administration, and dosage form. The unit of analysis is a drug month (molecule-form-month). We restrict the analysis to single-ingredient drugs with at least 24 to 36 months of generic competition following entry. Therefore, we restrict the data to drugs that had generic entry from 2007 through 2015 as this would allow us to follow a drug that entered in 2015 the full 36 months (ending in 2018) after first generic. We consider an entry to occur in the first month in which a drug has positive sales following at least a quarter of zero sales.

We compute prices of each drug by quantity-weighted averaging ingredient costs across the NDC-levelFootnote 12 to the drug-level, separately for brand and generic as our measure of price is the ingredient cost variable on the Part D data

The baseline price of each drug is the average brand price of the drug during 6 months prior to the first generic entry.Footnote 13 This pre-generic brand price is the baseline against which we compare the trajectory of prices by month following the first generic entry.Footnote 14 We exclude biosimilars and orphan drugs, which have different market and pricing dynamics than typical small molecule drugs, and few orphan drugs have lost patent exclusivity to be meaningful for this analysis. To allow for cross-year comparison, all prices are inflation-adjusted to January 2016 prices using the Consumer Price Index.

3.2 Methods

We specify competition using both the number of suppliers as a continuous variable and as a series of dichotomous variables. Both fixed effects and random effects are applied at the drug level to control for factors across drugs.Footnote 15 Some previous work pointed out that competition was intense for a period after a brand’s loss-of-exclusivity (LOE), but then could wane over time [13]. This study follows a drug 24 months as well as 36 months after first generic entry in order to see whether the relationship between number of suppliers and price would change over time. We also test the hypothesis that drugs with more recent LOE might face less competition than those earlier by breaking our data into two practically equal periods and estimating the competition-price relationship for drugs with first generic entry during 2007–2011 and those with first generic entry during 2012–2015.Footnote 16

The main dependent variable is the generic price ratio relative to the baseline pre-generic-entry brand price. The main independent variable is the number of labelers offering the drug for sale. A labeler can be either a manufacturer or a marketer of a drug. We also examined the number of corporations manufacturing a drug (for the analysis, manufacturers of authorized generics are considered generic manufacturers even if they are the same as the brand manufacturer) as an alternative independent variable, and found the results at the aggregate to be similar in both time frames, 24 months and 36 months, after first generic entry.Footnote 17

The study also controls for expected level of competition and market size in various ways: (1) the number of molecules in a therapeutic groupFootnote 18, (2) market size measured by number of beneficiaries instead of dollarsFootnote 19, and (3) the predicted number of beneficiaries in the absence of the drug going off patent. We also break down the market size into three groups based on the number of beneficiaries in the pre-patent expiration period –bottom 20th percentile, middle 60th percentile, and top 20th percentile- and run a separate regression for each group.Footnote 20

We use both random effects and fixed effects at the molecule-form level to focus on the relationship of competitors and prices within each drug while controlling for factors across drugs.Footnote 21 As the two sets of results are not different, we report the fixed effects results as fixed effects are more restrictive and tend to yield more conservative estimates. The regressions are also clustered at the drug-group level (such as antidepressants) in order to adjust for potential correlation among drugs within the same drug-group.Footnote 22

We also use both approaches commonly found in the literature for depicting the number of competitors, n, the main independent variable: (1) using n or some variant of it, or (2) using a set of binary variables to describe the number of competitors.

The first approach estimates the number of competitors, \({n}_{ift},\) on relative prices, \(\frac{{p}_{ift}}{{P}_{ifu}}\), controlling for the size of the market, \({V}_{ifu}{G}_{cu}^{t-u}\), with fixed effect for the molecule-form. The term \({V}_{ifu}{G}_{cu}^{t-u}\) is a proxy for the current size of the market that should be unaffected by the current prices, because, by construction, we take the pre-patent expiration volume of sales for the drug and apply the pre-patent expiration growth rate for the drug class to project what the current market size would have been in the absence of changes. Note that the (t-u) term is a power so for instance, 3 months after patent expiration we cube the growth rate.

where:

i denotes the molecule, f denote the form, and c denote the therapeutic class the molecule is in.

t denotes the number of months since the beginning of 2007 starting with January 2007 having t=1.

u=u(if) is the month before drug i in form f lost its exclusivity.

Pifu is the standardized price of the branded drug with molecule i and form f in before this drug lost exclusivity.

pift is the standardized price of generics of molecule i in form f and month t.

nift is the number of generic manufacturers/ labelers of molecule i in form f in month t.

Nct is the number of molecules in therapeutic class c in month t.

Viu is the average monthly volume of sales (measured by number of beneficiaries) in the 6 months prior to the patent expiration

Gcu is the geometric average of rct over the 6 months prior to patent expiration, where:

-

rct = Sct/Sc,t−1 .i.e. rct is the growth in the number of beneficiaries taking a drug from class c in month t relative to month t-1

-

Sct is the total number of beneficiaries taking a drug from class c in month t

ϕif is a fixed effect for the molecule-form. This captures all the variables that are not time varying such as drug form, class, year of patent expiration, pre-patent expiry market size, marginal cost as a fraction of price, etc.

The coefficient estimate \(\beta\) in Equation (1) describes the marginal impact of an additional competitor on the relative prices of the drug while controlling for market size, \({V}_{ifu}{G}_{cu}^{t-u},\) and other fixed effects of the drug, ϕif. In controlling for market size, we also break down the market into three groups based on the number of beneficiaries in the pre-patent expiration period –bottom 20th percentile, middle 60th percentile, and top 20th percentile- and run a separate regression for each group.

The second approach, adapted from Reiffen and Ward [24], uses a series of binary variables to capture how many generic manufacturers/labelers there are; the excluded category is one labeler. In other words, \({n}_{ift}\) is represented by nine binary variables, where 1(nift=10) is being used as shorthand for 1(nift≥10) and where the control is when \({n}_{ift}\)=1.

The interpretation of a is the relative generic price when there is one competitor to the branded drug. The other \({\beta }_{k}\) are the reductions in the relative price from a when there are k suppliers. This specification using a series of binary variables to represent different numbers of entries would allow us to estimate a non-linear relationship between number of entries and price reductions.

4 Results

4.1 Descriptive statistics

Our analysis included 299 drugs, marketed by 199 unique labelers, with at least one generic competitor in the 24- then 36-month follow-up period after first generic entry during 2007 to 2015 (the entire study period)

Expecting that the number of generic competitors is highly correlated to the market size within which they would compete—with larger markets drawing more suppliers into them—we categorized markets as small, medium, and large, by the total number of treated beneficiaries in Medicare Part D at the time of initial generic entry into the market. Over half of the drugs in our study are in small markets with fewer than 5000 beneficiaries treated monthly. Nearly all of the markets with ten or more competitors are categorized as “large” with more than 15,000 projected users per month.

Table 1 splits the entire study period in half and displays the data separated for drugs with first generic entry during 2007–2011 and those with first generic entry during 2012–2015. Two key observations can be made with the 36-month follow-up period. First, the 299 total number of drugs with generic entry during the entire 2007–15 period is equally split between those with generic entry during 2007–11 (146) versus during 2012–15 (153). Second, although entrants in the second period (average number of labelers is 4.42) seem to face less competition than those in the earlier period (average number of labelers is 5.15), the difference is not significant.

4.2 Results Based on the Entire Study Period: Number of Suppliers and Relative Prices Following 2 and 3 Years After First Generic Entry

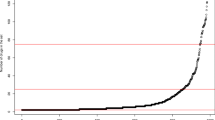

Figure 1 displays the relationship between the number of suppliers and relative prices. We use Equation (2) to predict relative prices for each corresponding number of suppliers, holding all regressors at their mean and setting the fixed effects to zero. The plots show that prices continue to decline with increasing competition, controlling for market size.

Based on data that follow each generic drug for 2 years after first entry, the expected price ratio in markets with approximately three competitors is 80%, implying a 20% decline in prices. In markets of ten or more competitors, the expected price ratio is about 30%, implying a 70% decline in prices relative to the pre-generic entry price (Fig. 1, Panel 1: Following 2 years after entry).

Extending to 3 years after first entry, the expected price ratio declines further. In markets of ten or more competitors, the expected price ratio is less than 20%, implying an 80% or greater decline in prices relative to the pre-generic entry price (Fig. 1, Panel 2: Following 3 years after entry).

4.3 Results Based on the Entire Study Period: Estimated Effect of Competition -Measured by the Number of Competitors in Equation (1)

The relationship between the number of suppliers and generic prices, as characterized in Equation (1) is discussed in this section. Table 2 examines the robustness of the impact on prices of measuring suppliers by either manufacturers or labelers as well as of following a drug for 2 or 3 years after generic entry. The results consistently show that lower drug prices are associated with more generic competition, higher degree of substitutability among the same drug-group (e.g., antidepressant) as represented by the negative effects on prices of the variable “number of molecules in the same drug group”, as well as larger expected market size.

The coefficients of the variable “number of suppliers” suggest that each entry would decrease the generic drug’s relative price by 6 percentage points (suppliers measured by labelers) to 8 percentage points (suppliers measured by manufacturers) in 3 years after generic entry.Footnote 23 The price impacts are all statistically significant. These estimated impacts suggest that generic prices would be expected to be about 50–80% lower than the pre-generic entry branded drug price in a market with approximately ten competitors.

Since the results of using manufacturers or suppliers are qualitatively similar (their coefficients are both negative and significant) and since using labelers would likely yield more conservative estimates, we will be presenting the results based on labelers. We will also present results based on 3 years after first generic entry since the estimated price impact does not differ with following a drug for 2 or 3 years after first generic entry (e.g., the effect of an additional labeler goes from − 0.053 after 2 years to − 0.057 after 3 years following first generic entry).

In addition to controlling for market size on the right-hand-side of the regression equation as shown in Table 2, we alternatively partition the market into three sizes (bottom 20th percentile, top 20th percentile, and the middle 60th percentile of market size) and run three separate estimates for each partition. As the analyses show the impact of competition on prices differs by market size, the study proceeds with analyzing each market size separately.

4.4 Results Based on the Entire Study Period: Estimated Effect of Competition -Measured by a Set of Binary Variables for Each Number of Competitors in Equation (2)

Equation (2) uses a series of binary variables to represent the number generic suppliers with the excluded category being one supplier.

Table 3 shows that prices continue to decrease as the number of competitors increases [18]. Following 3 years after first generic entry, relative prices are about 73% points lower in markets with ten or more suppliers relative to markets with one competitor in the largest market (Table 3). This implies that if the generic-to-brand price ratio is 94% when there is one generic supplier (1–0.057 based on Table 2 for the control group), then the price ratio could be as low as 20% (0.94–0.725) in the top 20th percentile markets with ten or more suppliers.

4.5 Results Based Comparing the Impact of Entry During 2007–11 vs. 2012–15 Periods

In addition to examining the competition-price relationship for drugs with generic entry throughout the whole 2007–15 period, we partition the data into 2 sub-periods, 2007–2011 and 2012–2015, to investigate whether drugs entering more recently could have faced different levels of competition.

The regression results Table 4 confirm that the impact of competition on relative prices are similar for generic drugs first entering the markets in either 2007–11 or 2012–15. Although the magnitude of the estimated impacts tend to be lower for the earlier period (implying that firms could have more incentives to enter the markets thanks to lower expected price reductions due to entry), the 95% confidence intervals for the estimates suggest that the estimated price impacts are not statistically different in the two periods.

5 Concluding Remarks

Showing that generic competition is consistently associated with lower drug prices, this study has key salient features. First, it uses the Medicare Part D drug events (PDE) data from 2007 through 2018, examines all generics entering the Part D markets during 2007–15 follows the drugs for 24 and 36 months after entry, and compares impacts of entry during the 2007–11 versus 2012–15 periods separately. Secondly, the study estimates the impacts with drug fixed effects and drug-group clustering in order to focus on the relationship of competitors and prices within each drug while controlling for factors across drugs and adjusting for correlation among similar drugs within a drug-group. Despite these features, our estimated impacts are also within the ranges found in the literature (see Table 5). We find that prices decline by 20% in markets with approximately three competitors (the expected price ratio of current generic to pre-generic entry brand average prices is 80%). In markets of ten competitors, prices decline 80% relative to the pre-generic entry price (the expected price ratio is about 30% following 2 years after entry, dropping to about 20% following 3 years after entry). Unlike certain studies suggesting that the marginal price reduction diminishes after about four to six entrants, this study supports findings that prices continue to decline with increasing entrants.Footnote 24

We recognize the following developments in the generic drug markets in more recent years as topics for further research. First, our data end in 2018. In order to follow a drug 3 years after first entry, we have to limit to drugs that entered the Part D markets ending in 2015. This ending predates a large influx of generic drugs in more recent years. In fact, new drug launches more than doubled in 2017 from 2016. Forty-two new active substances (NAS) were launched, with 21 for rare diseases and 14 for cancer. Significant shifts in the regulatory process are becoming apparent, as 19 drugs received a breakthrough designation and 18 included patient-reported outcomes as part of their approved label from the FDA [6, 23].Future research with data that can capture generic entry in 2017–18, follow them past 2–3 years in order to capture any exit, and measure competition both on the basis of the number of suppliers but also of the market share of early entrants for each drug would help further our understanding of the impacts of entry and exit on pharmaceutical prices.Footnote 25

Second, the lack of rebates data is a limitation of this research. Although rebates data are considered proprietary and therefore not available to researchers, without data on rebates, the study could not measure the real cost of drugs. On the one hand, this implies that the real effects of generic competition could be less than the effects measured in this study because the brand prices used in the study were artificially high. On the other hand, many generic labelers also pay rebates to pharmacies and wholesalers, hence mitigating the potential overestimating of the effects mentioned above.

In conclusion, the results provide clear evidence to support policies that promote generic entry. In addition, with the results showing that prices continue to decline with increasing number of entrants, efforts to maintain effective provider competition are as or even more important for containing drug prices in the longer run.

Notes

See https://blogs.fda.gov/fdavoice/index.php/2018/02/2017-was-another-record-setting-year-for-generic-drugs/. FDA approved 843 full approvals and 184 tentative approvals in 2017 alone. For 2019, see https://www.fda.gov/drugs/generic-drugs/2019-office-generic-drugs-annual-report.

For this literature review focusing on the U.S. market, we exclude studies using pre-1984 data, the year the Waxman Hatch Act was passed that dramatically changed the landscape of the generic drug industry.

IMS is the precursor of IQVIA. An extended unit is the most basic unit of volume for a product such as capsule or grams.

Real price is in 1982-84 dollars. The HHI (Herfindahl Hirschman index) is computed as the sum of the squared-market-share of each of the 98 chemicals in the data base.

Assuming an elasticity of -0.75, a log change from 2 to 3 manufacturers is equal to 0.4055 log units (ln(3)=1.0986 minus ln(2)=0.6932 equals 0.4055). The price change is therefore -0.75*0.4055=-0.3041 or a 30% price drop.

implying a predicted price increase of -0.75x-0.4955 = 0.3716, or about a 37% price increase

Columns 7 and 13 of Table 5 in Berndt, Ernst R.; Conti, Rena M.; Murphy, Stephen J. (2017).

The price per kilogram is the average revenue for a particular strength and form derived by dividing total generic revenue by the number of kilograms of generic product.

The use the branded price before patent expiration, rather than the contemporaneous branded price, is preferred because the latter is likely to be determined jointly with the generic price. In contrast, the branded price before there is any generic entry is likely to be independent of the number of generic producers in future periods.

An earlier working paper by the Federal Trade Commission (FTC) shows that during the first 24 months of generic entry, the ratio of generic price to branded price declines more slowly in number of manufacturers among drugs that always have less than 5 manufacturers than among drugs that eventually have 5 or more manufacturers [21].

Estimates using AMP show price declines associated with additional generic competition steeper than those based on invoices for pharmacy acquisitions, though most of the difference comes from wholesaler markups.

The PDE contains drug ingredient costs, dispensing fees, and benefit design and payment data that enable CMS to make payments to the plans. It does not have prices net of rebates and discounts paid to payers. Brand prices may be overstated. For example, in 2014, the CMS Office of the Actuary estimates that rebates average 17.5% for brand drugs, varying widely across therapeutic classes.

The Food and Drug Administration (FDA) Drugs identified each drug and reported using a unique, three-segment number called the National Drug Code (NDC). FDA publishes the listed NDC numbers in the NDC Directory (https://www.accessdata.fda.gov/scripts/cder/ndc/index.cfm) which is updated daily (https://www.accessdata.fda.gov/scripts/cder/ndc/index.cfm).

Following the FDA’s approach [11] of using the average brand price of the drug during 3 months prior to the first generic entry, we extend to 6 months to ensure exogeneity of the baseline price given that the brand drug manufacturer might vary its price in anticipation of imminent generic competition.

For sensitivity analyses, we also extend the baseline pre-generic brand price from 6 months to 2 years prior to first generic entry. The results do not differ significantly.

This split at 2012 is important given the finding that generic churning (entry and exit) generally increases until around 2012 then decreases or remains flat thereafter [13].

The labeler identifies the manufacturer or distributor of the drug product (i.e., Pfizer, Allergan (Mylan), Watson, Teva, etc.)

The potential market size for a new generic may depend both on the within molecule substitution from brand to generic and cross molecule substitution within the therapeutic class.

We adjust for market size by classifying drugs according to the number of beneficiaries treated by the brand drug prior to generic entry per month (fewer than 5,000; 5,000 to 15,000; and more than 15,000 beneficiaries).

An important modeling consideration is how to address the potential for endogeneity in the relationship between the number of competitors and price. That is, a biased estimate of the relationship between number of competitors and price might result to the extent unobserved or unmeasured factors affect market entry [21]. Previous studies have used different techniques to account for potential bias including instrumental variables, two stage approaches, fixed effects and exploiting the 180-day period of marketing exclusivity created by provisions of the Hatch Waxman Act. As described below, we examine both fixed and random effects as well as accounting for potential markets size in order to address this issue.

We would argue that the number of competitors is exogenous in this study’s construct, hence, a single reduced form equation is adequate for two reason. First, the current change in price shouldn’t affect the current change in the number of firms in the market since it takes several years of preparatory activities before a generic firm can enter the market. Therefore, if we exclude “late entrants”, which we are doing by limiting the time period to the 2 years or 3 years after 1st generic entry, we should not have a reverse causality problem between prices and number of firms producing the molecule-form.

The drug-group is defined based on the GPI2, Generic Product Identifier classification level 2. More information are available at: https://www.wolterskluwercdi.com/drug-data/gpi/.

The coefficients of the variable “number of suppliers” suggest that each entry would decrease the generic drug’s relative price by 5 percentage points (suppliers measured by labelers) to 7 percentage points (suppliers measured by manufacturers) in 2 years.

Wiggins and Maness (2004), for instance, also found continuing price decline from a few sellers to more than 40 [36].

Future research could also look at the impacts of biosimilars in the US, and generics in other high income countries.

References

Aitken M, Berndt ER, Cutler DM, Kleinrock M, Maini L. Has the era of slow growth for prescription drug spending ended? Health Aff. 2016;35(9):1595–603.

Berndt ER, Mortimer R, Bhattacharjya A, Parece A, Tuttle E. Authorized generic drugs, price competition, and consumers’ welfare. Health Aff. 2007;26(3):790–9. https://doi.org/10.1377/hlthaff.26.3.790.

Berndt ER and Newhouse JP. Pricing and reimbursement in US pharmaceutical markets. National Bureau of Economic Research. 2010; Working Paper 16297 (draft of handbook chapter). Available at: https://www.nber.org/papers/w16297.pdf.

Berndt ER and Murray LA. Brand loyalty, generic entry and price competition in pharmaceuticals in the quarter century after the 1984 Waxman-Hatch Legislation. National Bureau of Economic Research. October 2010; Working Paper 16431. Available at: http://www.nber.org/papers/w16431.

Berndt E, Aitken M. Brand loyalty, generic entry and price competition in pharmaceuticals in the quarter century after the 1984 Waxman-hatch legislation. Int J Econ Bus. 2011;18(2):177–201.

Berndt ER, Conti RM, Murphy SJ. The landscape of us generic prescription drug markets, 2004–2016. National Bureau of Economic Research. 2017; Working Paper 2364. Available at: http://www.nber.org/papers/w23640.

Berndt, ER, Conti RM, Murphy SJ. The generic drug user fee amendments: an economic perspective. National Bureau of Economic Research. 2017; Working Paper No. 23642.

Chintan D, Abraham H, Aaron K. Prices of generic drugs associated with numbers of manufacturers. N Engl J Med. 2017;377:2597–8. https://doi.org/10.1056/NEJMc1711899.

Bond R, Lean D. Sales, promotion and product differentiation in two prescription markets. Washington: Staff Report to the Federal Trade Commission; 1977.

Caves R, Whinston M and Hurwicz M. Patent expiration, entry, and competition in the U.S. pharmaceutical industry. Brookings papers on economic activity: microeconomics. 1991; pp. 1–66. Available at: https://www.brookings.edu/wp-content/uploads/1991/01/1991_bpeamicro_caves.pdf.

Conrad R, Luther R. Generic competition and drug prices: new evidence linking greater generic competition and lower generic drug prices. FDA, Center for Drug Evaluation and Research Report. 2019. Available at: https://www.fda.gov/media/133509/download.

Cook A. How increased competition from generic drugs has affected prices and returns in the pharmaceutical industry. Washington: Congressional Budget Office Study; 1998.

Conti RM, Berndt ER. Four facts concerning competition in U.S. generic prescription drug markets. National Bureau of Economic Research. 2019; Working Paper 26194. Available at: http://www.nber.org/papers/w26194.

Food and Drug Administration. New evidence linking greater generic competition and lower generic drug prices. FDA. 2019. Available at: https://www.fda.gov/about-fda/center-drug-evaluation-and-research-cder/generic-competition-and-drug-prices.

Frank R and Salkever D (1995) Generic entry and the pricing of pharmaceuticals. National bureau of economic research. 1995; Working Paper No. 5306 (Also Reprint No. fr2121) Issued in October 1995. Available at: https://www.nber.org/papers/w5306.pdf.

Gagnon M-A, Karena DV. Merger mania: mergers and acquisitions in the generic drug sector from 1995 to 2016. Globaliz Health. 2017;13:62. https://doi.org/10.1186/s12992-017-0285-x.

IMS Institute for healthcare informatics. Medicine use and spending in the U.S.: A Review of 2015 and Outlook to 2020. 2016.

IQVIA Institute for Human Data Science. Medicine Use and Spending in the U.S., 2017–2022. 2018. Available at https://www.iqvia.com/institute/reports/medicine-use-and-spending-in-the-us-review-of-2017-outlook-to-2022.

IQVIA Institute for Human Data Science. Medicine Use and Spending in the U.S., 2018–2023. 2019. Available at https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/medicine-use-and-spending-in-the-us---a-review-of-2018-outlook-to-2023.pdf?_=1593533824980.

Mozzocchi A and Ashwin AR. Will more generic drug approvals push prices down, or push manufacturers away? Health Forward Blog. Deloitte, January 23, 2020. Available at: https://www2.deloitte.com/us/en/blog/health-care-blog/2020/will-more-generic-drug-approvals-push-prices-down.html.

Olson L and Brett W. The effect of generic drug competition on generic drug prices during the Hatch-Waxman 180-day exclusivity period. Food and Drug Administration. 2013; Working Paper 317. Available at: https://www.ftc.gov/sites/default/files/documents/reports/estimating-effect-entry-generic-drug-prices-using-hatch-waxman-exclusivity/wp317.pdf.

Papke LE, Wooldridge. Panel data methods for fractional response variables with an application to test pass rates. J Econom. 2008;145:121–33.

Pew Charitable Trusts. FDA Approves More Generic Drugs, but Competition Still Lags: FY 2012–17 program achieves mixed results. February 2019. Available at: https://www.pewtrusts.org/-/media/assets/2019/02/fda_approves_more_generic_drugs_but_competition_still_lags.pdf.

Reiffen D, Ward MR. Generic drug industry dynamics. Rev Econ Stat. 2005;87(1):37–49.

Scott M, Fiona M. Entry decisions in the generic pharmaceutical industry. RAND J Econ. 1999;30(3):421–40.

Scott M, Fiona M. Barriers to entry, brand advertising, and generic entry in the U.S. Pharmaceutical Industry. Int J Indust Organiz. 2000;18:1085–104.

Scott M, Fiona M and Boller LT. Enabling competition in pharmaceutical markets. Hutchins Center. 2017; working paper #30.

Sheingold S and Nguyen NX. Impacts of generic competition and benefit management practices on spending for prescription drugs: evidence from medicare’s part D Benefit. Medicare Medicaid Res Rev. 2014; 4(1). Available at: https://www.cms.gov/mmrr/Downloads/MMRR2014_004_01_a01.pdf.

US Department of Health and Human Services. A year of accomplishment. 2017. Available at https://www.hhs.gov/sites/default/files/hhs-end-of-year-accomplishments-2017.pdf.

US Department of Health and Human Services, Office of the Assistant Secretary for Planning and Evaluation (ASPE). Medicare Part B drugs: pricing and incentives. 2016; ASPE Issue Brief. Available at: https://aspe.hhs.gov/system/files/pdf/187581/PartBDrug.pdf.

US Department of Health and Human Services, Office of the Assistant Secretary for Planning and Evaluation (ASPE). Savings available under full generic substitution of multiple source brand drugs in medicare part D. 2018; ASPE Data Point. Available at: https://aspe.hhs.gov/system/files/pdf/259326/DP-Multisource-Brands-in-Part-D.pdf.

US Department of Health and Human Services, Office of the Assistant Secretary for Planning and Evaluation (ASPE). Report to congress: prescription drug pricing report. 2019. Available at: https://aspe.hhs.gov/system/files/pdf/262746/DrugPricingRTC2019.pdf.

US Department of Health and Human Services, Office of the Assistant Secretary for Planning and Evaluation (ASPE). Report to congress: prescription drug pricing. 2020. Available at: https://aspe.hhs.gov/system/files/aspe-files/263451/2020-drug-pricing-report-congress-final.pdf.

US Department of Health and Human Services, Office of the Assistant Secretary for Planning and Evaluation (ASPE). Medicare FFS Part B and international drug prices: a comparison of the top 50 drugs. 2020; ASPE Issue Brief. Available at: https://aspe.hhs.gov/system/files/pdf/264421/Part-B%20Drugs-International-Issue-Brief.pdf.

U.S. Senate Special Committee on Aging. Sudden price spikes in off-patent prescription drugs: the monopoly business model that harms patients, taxpayers, and the U.S. Health Care System. U.S. Government Printing Office. December 2016; Special Report. Available at: www.aging.senate.gov.

Wiggins S and Maness R. Price competition in pharmaceuticals: the case of anti-infectives. Econ Inquiry. 2004; 42: 247–263. Available at: http://www.fgcasal.org/politicafarmaceutica/docs/steven_wiggins_and_robert_maness.pdf

Acknowledgments

Nguyen Xuan Nguyen, Ph.D., Steven H. Sheingold, Ph.D., Wafa Tarazi, Ph.D., and Arielle Bosworth work for the Office of Health Policy in the Office of the Assistant Secretary for Planning and Evaluation, Office of the Secretary, U.S. Department of Health and Human services. There is neither private nor foundation funding for this paper. We are grateful to many colleagues who contributed to this project including, Kenneth Finegold, Ph.D., Amber Jessup, Ph.D., Zeid El-Kilani at ASPE; and Amy Wagner, Bruno Garcia, Edward Sung, Xiao Xiao at Acumen, LLC. We also acknowledge programming support from Acumen, LLC. We kindly thank the reviewers for their valuable comments which significantly improved the paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of Interest/Competing Interests

None.

Funding

None. This is an internal research conducted by the Office of Health Policy in the Office of the Assistant Secretary for Planning and Evaluation, Office of the Secretary, U.S. Department of Health and Human services.

Ethics Approval (Include Appropriate Approvals or Waivers)

Not applicable.

Consent to Participate

Not applicable.

Consent for Publication (from Patients/Participants)

All authors agreed with the content and gave explicit consent to submit the manuscript.

Availability of Data and Material

All data are explained in detail within the manuscript. The Medicare Prescription Drug Events data can be obtained from the Centers for Medicare and Medicaid Services (CMS) via ResDAC with appropriate data use agreements (https://resdac.org/).

Code Availability (Software Application or Custom Code)

Codes used in the analysis will be made available upon request subject to approval by Acumen, LLC.

Authors' Contributions

All authors contributed to the implementation of the research. Nguyen X. Nguyen and Steven H. Sheingold made substantial contributions to the conception or design of the study in consultation with Amy Wagner and colleagues. Nguyen X. Nguyen drafted the report.

Rights and permissions

About this article

Cite this article

Nguyen, N.X., Sheingold, S.H., Tarazi, W. et al. Effect of Competition on Generic Drug Prices. Appl Health Econ Health Policy 20, 243–253 (2022). https://doi.org/10.1007/s40258-021-00705-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40258-021-00705-w