Abstract

Technological innovation activities are the most effective way to achieve corporate leapfrog development. Based on the Porter effect theory, this paper uses panel data on Chinese manufacturing firms from 2015 to 2018 to construct two-way fixed effects and threshold effects models to explore the impact mechanism of research and development (R&D) investment on corporate total factor productivity (CTFP) under heterogeneous environmental regulations. Baseline regression results indicate that R&D investment significantly promotes CTFP. Meanwhile, we also test the robustness of baseline regression results by replacing the dependent variable, shortening the time windows and adding omitted variables. Moreover, heterogeneity analyses indicate that the contribution of R&D investment to CTFP is more significant in the subgroup regressions of non-SOEs, CEO-dual enterprises and non-heavily polluting enterprises. Economic consequence analysis shows that R&D investment contributes to green innovation performance, financial performance and corporate social responsibility performance by increasing CTFP. Additionally, there is heterogeneity in the moderating effects of market-incentivized environmental regulation (MER), command-and-control environmental regulation (CER) and public participation environmental regulation (PER). MER and PER have moderated mediating effects, but CER does not have a moderated mediating effect. Extended analysis shows that according to the threshold effect test findings, two thresholds exist for MER and one threshold each for PER and CER in the relationship between R&D investment and CTFP. Our findings have important implications in that the government should adopt differentiated environmental regulation policies to support companies in actively carrying out innovation activities, thereby promoting high-quality development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The global economy is currently caught in a predicament of high inflation and low growth. China’s development is essential to the global economic recovery because it is the largest developing nation in the world (Yan et al. 2020). High-quality economic development is the primary task and essential requirement for achieving Chinese-style modern development. The government has implemented an innovation-driven development strategy from the top down to achieve the transformation of economic growth from an extensive to an intensive approach. Research and development (R&D) expenditure is the most essential element of technological innovation activities. As a significant aspect of the market economy, increasing R&D expenditure in companies is beneficial for facilitating green upgrading of manufacturing companies’ industrial structures, thus achieving high-quality development (Huang et al. 2022). Total factor productivity (TFP) is rational resource allocation, and high resource allocation efficiency reflects of high-quality corporate development (Liu and Ling 2022). Therefore, increasing R&D expenditure is conducive to optimizing resource allocation and improving corporate total factor productivity (CTFP).

Technological innovation activities are the key to realizing a national economic transformation and thereby completing leapfrog development. As a result, researchers have conducted in-depth studies of the macro-economic influence of R&D expenditure at the national and societal levels. Studies on R&D investment and human resource management have primarily concentrated on the favourable effect of R&D expenditure on employment expansion, which is more substantial in the manufacturing industry (Shah et al. 2022). Based on the global supply chain perspective, public R&D investment has different impacts on production networks in countries worldwide (Huang et al. 2020). Moreover, from a regional economic growth perspective, R&D expenditure and the degree of urban living quality are correlated (Woo et al. 2017; Erdin and Ozkaya 2020). R&D investments have two effects: they increase local environmental TFP and spill over to neighbouring areas (Wu et al. 2022). In addition, Voutsinas and Tsamadias (2014) find that compared to private R&D investments, public R&D investments have a more favourable effect on regional TFP. It is clear that the economic development of both the country and the region is positively affected by R&D investment. R&D activities are another important strategy for encouraging green upgrading of manufacturing companies’ industrial structures and achieving sustainable development. Therefore, scholars have introduced the economic consequences of R&D investment in micro-firm behaviour. The most focus has been placed on the connection between R&D spending and financial performance (FIP) and green innovation performance (GIP) (Shi and Yang 2022; Wang et al. 2022a, b). Additionally, R&D investment significantly improves firm value and CTFP (Wang et al. 2020). However, due to the lengthy cycle of R&D operations, the positive impact of R&D spending on corporate value needs to catch up. Therefore, this is deemed an investment activity that has the potential to augment the enduring value of corporations (Lee and Choi 2015). According to the external environmental uncertainty perspective, increasing R&D investment can effectively prevent firms from experiencing financial distress and significantly reduce financial risk (Li et al. 2022). Additionally, R&D investment significantly positively affects firms’ cash holdings and IPO underpricing (Baldi and Bodmer 2017; Guo et al. 2021). Hence, R&D expenditure has positive economic consequences at both macro and micro levels.

Environmental regulations are an essential element of governmental social regulations. Because of the negative externalities of environmental pollution, the government, as the maker and implementer of environmental regulations, regulates market activities through macro policies to harmonize of environmental and economic benefits (Han et al. 2017). Based on the Porter effect theory, environmental regulations can induce firms to innovate, which in turn can improve firm performance and TFP through the innovation compensation effect (Mbanyele and Wang 2021; Lv et al. 2023). However, it should be noted that innovation’s compensatory effect is delayed in time, and R&D activities are characterised by long cycles, increased risks and significant capital requirements (Ding et al. 2023). Moreover, due to China’s unique political and economic institutional environment, there are different views on whether companies can achieve quality development when faced with strong environmental regulations. Environmental pollution and corporate financial activities have received the majority of attention in studies on the detrimental economic effects of environmental regulations. Although environmental regulations can stimulate companies to engage in R&D activities, the innovation compensation effect cannot cover regulatory costs, which in turn reduces FIP and market competitiveness (Dechezleprêtre and Sato 2017; Zhou et al. 2020). Moreover, owing to the enforcement of environmental regulatory measures, companies relocate spatially, reducing the advantages of industrial concentration and increasing in environmental problems (Wu et al. 2023). From the circular economy perspective, environmental regulations significantly improve China’s domestic circular economy performance through a catch-up effect but do not have innovation compensation and demonstration effects (Shang et al. 2022). The impact of various environmental regulations on the technological innovation and financial activities of firms are highly diverse (Wang et al. 2022a, b; Chen et al. 2022a, b, c; Bao and Chai 2022).

In conclusion, research has been done on the connection between company performance and R&D spending. CTFP is the leading indicator of the efficiency of production activities per unit of time. There needs to be more research on the economic consequences of the impact of R&D investment and CTFP. In addition, as China’s economy expands and environmental education is integrated, there has been a rise in the strength of market-incentivized environmental regulation (MER) and command-and-control environmental regulation (CER), led by the government, and public participation environmental regulation (PER), carried out by the public. However, at present, scholars have mainly focused on MER, with insufficient attention given to the role of PER and CER. Whether heterogeneous environmental regularity affects the connection between R&D spending and CTFP, and whether there is heterogeneity in the impact mechanisms. These issues are crucial to environmental policy-making and corporate high-quality development and should be explored in depth. In light of those above, this study utilizes panel data of Chinese manufacturing firms listed from 2015 to 2018 to establish a two-way fixed effects model and a panel threshold effect model. Its objective is to investigate the influence mechanism of R&D expenditure on CTFP, along with the threshold effects of heterogeneous environmental regulations, based on R&D investment’s knowledge spillover effects and the incentive effects of environmental regulations.

This paper’s contributions and innovations are as follows. (1) To investigate the process by which R&D expenditure on CTFP impacts, a panel threshold effects model and a two-way fixed effects model are coupled. (2) Robustness tests for main effects are conducted by substituting the dependent variable, including omitted variables and adjusting for time windows. (3) The impact of R&D spending on CTFP may be heterogeneous depending on intrinsic characteristics and the external environment. Therefore, from ownership rights, environmental attributes, and leadership structure perspectives, we study and find that the effect of R&D investment on CTFP is not heterogeneous in all subgroup regressions, further validating that national technological innovation strategy implementation is effective. (4) Studies of economic consequences show that R&D investment contributes to GIP, FIP and corporate social responsibility performance (CSRP) by increasing CTFP. In addition, from the perspective of heterogeneous environmental regulations, we find that there is heterogeneity in the moderating effects of MER and PER on the relationship between R&D investment and CTFP. Further research finds that MER and PER have moderated mediation effects on the economic consequences resulting from the impact of CTFP and R&D expenditure. (5) The results of threshold effect tests show that two thresholds exist for MER and one threshold each for PER and CER in the relationship between R&D investment and CTFP. Our findings have significant ramifications for the government’s efforts to improve the business climate and for businesses’ efforts to achieve sustainable development.

Section “Theoretical analysis and hypothesis formulation” presents the theoretical analyses and hypotheses concerning the direct effect of R&D spending and CTFP, economic consequences, and the moderating and threshold effects of MER, PER and CER. Section “Descriptive data and research method” presents the data and method. Section “Results and discussion” presents the results. Section “Discussion” includes a discussion, and Section “Conclusion" provides the conclusion, implications, limitations and future research directions.

Theoretical analysis and hypothesis formulation

R&D investment and CTFP

The achievement of ‘Made in China 2025’ is the fundamental target of the Chinese government’s innovation-driven development strategy. Technological innovation is an essential catalyst for economic growth at national and regional levels, and a primary means of promoting the transition to green industrial structures (Huang et al. 2022). Technological innovation begins with R&D investment, and high-return investment promotes resource allocation efficiency.

The central and regional governments are the developers and leaders of technological innovation strategies, and the policy implementation has a noteworthy effect on the economy. Numerous studies have examined the connection between R&D spending and TFP using the regional analysis method with spatial dimensions. Taking the Belt and Road countries (B&R) as subjects, Qiu et al. (2021) find that R&D expenditure contributes to TFP in green industries within B&R countries. And the optimization of the institutional environment is conducive to enhancing this positive effect. This fact confirms that China’s major-country diplomacy and innovation-driven development strategies promote the prosperity and stability of countries and regions around the Belt and Road. Moreover, the spatial spillover effect of R&D activities on TFP in Spanish regions is studied by Bengoa et al. (2017). They discover that R&D spending directly contributes to regional TFP and raises it in nearby regions. From the environmental performance perspective, Wu et al. (2022) also find a positive spillover effect of R&D investment using Chinese provinces as a sample. It is crucial to remember that depending on the economic and political climate of the various nations and regions, the effects of R&D expenditure on TFP may change. According to the perspective of nation heterogeneity, Tsamadias et al. (2018) analyse the effect of R&D spending on TFP in European and non-European countries. Additionally, the evidence of the beneficial effect of R&D expenditures on different industries’ total factor productivity is also provided by Edquist and Henrekson (2017) and Salim et al. (2019).

Enterprises are the central subject of a market economy, serving as both implementers and beneficiaries of technological innovation activities that facilitate high-quality corporate development. Using Chinese coastal micro-firms as the study samples, Wang et al. (2020) demonstrate that R&D expenditure significantly positively affects TFP and that there is a U-shaped relationship between them. They also find heterogeneity in this positive relationship due to companies’ internal systems and external environment. According to Global Enterprise Survey (GES) data, increasing R&D investment can reduce production costs, decrease reliance on labour and capital factors, and thus increase TFP (Zhong et al. 2016; Xiao et al. 2021). R&D spending can effectively increase CTFP, but the effects of various R&D funding sources on CTFP vary in intensity. Dai et al. (2022) explore this issue by constructing a spatial panel model. They discover that R&D spending’s knowledge spillover has the most significant effect on CTFP. To promote high-quality development, companies should build R&D cooperation platforms and create a suitable environment for technology exchange to attract more high-tech teams and capital investment. However, Huang et al. (2022) propose a different view. They believe that as most Chinese firms are in a low-quality innovation stage, R&D investment cannot be efficiently converted into productivity. As a result, inefficiency and high costs become the main reasons that inhibit the improvement of the enterprises’ CTFP. In summary, government implements technological innovation-driven strategies from the top down, creating a favourable environment for innovation. In the long run, companies increasing their R&D expenditures are beneficial for achieving high quality and sustainable development. Therefore, we put out the below hypothesis.

H1

R&D investment promotes CTFP.

Economic consequences of the relationship between R&D investment and CTFP

Carrying out technological innovation activities to accelerate green innovation outputs is the most effective way to achieve environmental governance. China is currently going through a crucial transition from low-quality to high-quality innovation. Therefore, the green development strategy of carbon neutrality and carbon peaking proposed by the Chinese central government in 2020 is a guideline for companies to improve their GIP.

Increasing R&D investment can optimize resource allocation, thereby promoting green innovation outputs. Based on a panel vector autoregressive (PVAR) model, Zhang et al. (2022) discover that increasing R&D spending can make innovative outcomes more environmentally friendly. However, the long-cycle characteristic of technological innovation leads to a lag in the process from input to output. The level of technical innovation in the area greatly impacts how well R&D inputs translate into green innovation outputs. The connection between R&D expenditure and GIP has excellent variation, according to Fan and Teo (2022) when regional technological innovation is at different levels by constructing a threshold effect model. Cross-border mergers and acquisitions (M&A) are conducive to combining strong enterprises and sharing advanced technology and quality resources. R&D investment after M&As is beneficial for improving GIP, and there is an S-shaped relationship (Li and Wu 2022). En vironment, social and governance (ESG) as a non-FIP indicator is increasingly taken into account by corporate management. Xu et al. (2020) posit that a prominent positive correlation exists between R&D investment and GIP, and ESG performance is a helpful moderator. Based on studies before, within the framework of China’s green and low-carbon development, enterprises that invest more in R&D are better able to maintain the sustainability of their operations and production. With this in mind, we suggest the below hypothesis.

H2(a)

R&D investment promotes GIP by increasing CTFP.

With increasing awareness of environmental protection among citizens, green production and consumption lifestyles are becoming a common pursuit for them. Following the supply and demand theory, companies can achieve cleaner production, gain a first-mover advantage in the market and expand their market share if they improve the efficiency of their capital investment and output in terms of new processes, new equipment and research and development. Achieving a high rate of return on R&D spending is an essential means of making profits for companies. The reason is that R&D activities are characterized by high risk and high reward, while profitability is the fundamental purpose of business operations. From a financial standpoint, Wang et al. (2022a, b) investigate the mechanism of how R&D spending affects FIP. They find that R&D spending can significantly improve the FIP and that CTFP positively mediats. Technological innovation is the core competitiveness of biotechnology firms, and the intensity of R&D investment determines corporate profitability. Taking pharmaceutical companies as a sample, Michelino (2015) and Nandy (2020) attest to the strong correlation between corporate FIP and R&D expenditure using different FIP indicators. In summary, the essence of trade wars between enterprises or countries is competition for high-tech strength. Businesses can strengthen their core competitiveness by stepping up R&D spending and improving output efficiency. Therefore, we formulate the below hypothesis.

H2(b)

R&D investment promotes FIP by increasing CTFP.

Businesses are responsible for pollution and regulation as the primary agents of the market economy. The beginning of the innovation process, R&D investment, is crucial to environmental management. Therefore, increasing R&D spending demonstrates of actively undertaking corporate social responsibility. Based on signalling theory, companies actively increase their R&D spending to signal their green transformation to the outside world, which is conducive to improving companies’ green reputation. Bae et al. (2022) find that investment in R&D and the CSRP are causally related. CSRP is an intangible asset, and its advertising effects can stimulate firms to increase their R&D spending, improving their brand equity. Small and medium-sized enterprises (SMEs) are important drivers of national economic development. Yu et al. (2020) use SMEs as their sample and find an inverted U-shaped relationship between R&D spending and CSRP of SMEs. Appropriate R&D spending and a fair regional innovation environment are essential for SMEs to fulfil their CSRP. As a comprehensive indicator, CSRP also includes environmental responsibility performance and ethical responsibility performance. Introducing new processes and equipment promotes enterprises to green upgrading of manufacturing companies’ industrial structures, improving their environmental responsibility performance (Kim and Kim 2020). From the green supply chain perspective, companies introduce new technologies and produce green products, which drive upstream and downstream supplPERs and distributors to engage in green innovation activities, improving ethically responsible performance (Shao and Liu 2022). Executives’ attention, a scarce resource, is crucial to the direction of corporate decision-making. Drawing on executives’ emotional intelligence and attention perspectives, Ezzi et al. (2020) conclude that managers who focus more attention on R&D investment will improve CSRP. In summary, this paper proposes the following hypotheses.

H2(c)

R&D investment promotes CSRP by increasing CTFP.

Moderating and threshold effects of environmental regulations

Environmental regulations are an important element of social regulations. Due to the negative externalities of environmental pollution, government departments regulate enterprises’ economic activities by formulating corresponding policies to harmonize environmental protection and economic development (Yu 2017). By the Porter effect theory, environmental regulation may motivate businesses to engage in green innovation initiatives, thereby fostering high-quality corporate development. (Mulaessa and Lin 2021). The moderating effect of environmental regulations has been studied from different perspectives and has been found to be positive to some extent. Based on the perspective of optimizing import trade structure, Gao and Dong (2022) find that environmental regulations have a significant positive impact on the relationship between technological innovation and the complexity of imported technology. The uncertainty and complexity of the external environment increase corporate financial risk. Using OLS and Poisson regression models, Chen et al. (2022a, b, c) find that environmental regulations facilitate the effects of environmental uncertainty on firms’ green technology innovation. Additionally, the moderating impacts of various types of environmental control may vary. Yu et al. (2022) find that both command-and-control and market-incentive environmental regulations promote the positive effects of green innovation on the CSRP of manufacturing SMEs. However, Chen et al. (2022a, b, c) draw different conclusions. They argue that there is heterogeneity in the effect of heterogeneous environmental regulations on the correlation between R&D expenditure and firm performance. Moreover, by constructing a comprehensive index of industry environmental regulations, Yang and Zhao (2023) find a single threshold effect of environmental regulations on the correlation between R&D expenditure and GIP. Chen et al. (2022a, b, c) discovered that environmental regulations positively moderate the correlation between R&D expenditure and firm profitability and that environmental regulations have a threshold effect by constructing a fixed effects model and a panel threshold effect model. Hence, the following hypothesis is suggested.

H3(a)

The moderating effects of heterogeneous environmental regulations are heterogeneous on the relationship between R&D investment and CTFP.

H3(b)

There are threshold effects of heterogeneous environmental regulations on the relationship between R&D investment and CTFP.

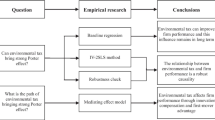

Therefore, following the above theoretical hypotheses, we construct a conceptual model of the impact mechanism of R&D spending and CTFP, as shown in Fig. 1.

Based on these assumptions, a conceptual model of the impact mechanism of R&D expenditure on CTFP is developed, as shown in Fig. 1.

Descriptive data and research method

Sample selection and data sources

To explore the impact mechanism of R&D investment on CTFP under heterogeneous environmental regulatory constraints, this paper uses Chinese listed manufacturing companies in Shanghai A-shares from 2015 to 2018 as the initial sample for the research. We excluded companies with missing data and those whose financial situation is marked as “special treatment” to ensure the reliability of the findings. Eventually, we obtained 964 valid observations for 241 companies. The data used to measure CTFP, FIP, R&D investment, and firm-level control variables are obtained from the China Stock Market & Accounting Research Database (CSMAR). GIP data are from the China Research Data Service (CNRDS) Database. The Hexun.com database provides the data used to determine the CSRP. The data to measure MER are taken from the WIND database and the China Taxation Yearbook. The data for measuring PER and CER are obtained from the National Bureau of Statistics of China (NBS Database) and PKULAW Database (https://www.pkulaw.com), respectively. The macro-level control variables, including economic development, marketization and innovation levels, are obtained from CSMAR Database, the China Market Index Database (https://cmi.ssap.com.cn/) and the China Regional Innovation Capacity Evaluation Report. This paper processes and analyses data using Stata17 and Python3.8 software.

Variable identification and sample description

Dependent variables

This paper takes CTFP as the dependent variable, based on the control function approach, we reMER to the studies of Levinsohn and Petrin (2003) and Lu and Lian (2012) using operating income as total output, net fixed assets as capital input, payment of employee compensation as labour input, and intermediate inputs as the sum of operating costs, selling expenses, administrative expenses and finance costs minus depreciation and amortization and employee compensation, taking the logarithm of continuous variable values plus one. Therefore, the logarithm of the resiheterogeneouss is CTFP.

Furthermore, using CTFP as a mediating variable, we examine the economic consequences of R&D expenditure on the CTFP in terms of GIP, FIP, and CSRP. Among them, the ratio of the number of green inventions independently and jointly applied by enterprises to the total number of green patents plus one in the year is used as an indicator to measure GIP; in addition, return on assets is used to measure FIP. Drawing on the study of Jiang et al. (2022), we use the logarithm of the total CSR score published by Hexun.com plus 1 as the indicator of CSRP.

Independent variables

R&D spending is an essential component of technological innovation activities. To determine the R&D investment intensity of firms, we utilize the logarithm of R&D investment plus one.

Mediating variables

Using CTFP as a mediating variable, this paper explores the economic consequences of the impact of R&D investment and CTFP.

Moderating and threshold variables

Based on the heterogeneity of environmental regulations, this paper classifies environmental regulations into formal and informal. First, following the study of Wang et al. (2022a, b), the ratio of waste discharge fees to the primary business income of industrial enterprises above the scale is used as a measure of MER. Since China implemented an environmental protection tax to replace waste discharge fees in 2018, the sample period of this paper involves data from 2015 to 2018. Therefore, the data for 2015–2017 use the amount of fees paid into the treasury on waste discharge, sourced from the Wind database, and the data for 2018 use the environmental protection tax, sourced from the China Tax Yearbook. Next, referring to the study of Chen et al. (2022a, b, c), we use the entropy method to construct a comprehensive index to measure PER from three aspects: income level, education level, and population density. Among them, the ratio of employees’ average wage in regional urban units to the national average wage is used as an indicator to measure the regional income level; the number of graduates with higher education (including the number of regular students, adult students and web-based students who graduated in regular and short-cycle courses) to the total regional resident population is used as an indicator of the regional education level. The ratio of the regional resident population to the regional area is used as an indicator of population density. Administrative penalties can be an effective tool for the government to fulfil its environmental monitoring function. Therefore, we refer to the study of Yu et al. (2022) and use the logarithm of the number of environmental penalty cases plus one as a measure of CER.

Control variables

Internal factors and the external environment influence CTFP. Therefore, we refer to the study of Mbanyele and Wang (2021) to introduce debt ratio, enterprise size, CEO-dual, independent directors ratio, and type of shareholding at the firm level as control variables. Following the study of Ye and Jiang (2020) and Wu et al. (2022), economic development, marketization, and innovation levels are introduced as control variables at the macro level. Table 1 defines the specific variables in this paper.

Materials and methods

Two-way fixed effects model

First, we explore the direct effect of R&D spending on CTFP by constructing a two-way fixed effects model, as shown in Eq. 1.

Next, we explore the economic consequences of the relationship between R&D spending and CTFP, which means that we have to verify the mediating effect of CTFP. We analyse the economic consequences in terms of GIP, FIP, and CSRP, respectively, as shown in Eqs. (2)-(7).

Finally, the heterogeneous environmental regulations moderating effects models are constructed by adding interaction terms to Eq. (1), as in Eqs. (8)-(10).

where, \({\text{i}}\) represents \({{\text{i}}}^{{\text{th}}}\) firms; \({\text{t}}\) represents \({{\text{t}}}^{{\text{th}}}\) years; \(\mathrm{\alpha }\),\(\upbeta\),\(\upgamma\), \(\updelta\),\(\upzeta\), \(\upeta\),\(\uptheta ,\upkappa ,\uplambda\) and \(\upmu\) represent coefficients; \({\text{Controls}}\) represents the control variables set; Fixed effects represent time and entity fixed effects; and \({\upvarepsilon }_{{\text{it}}}\) represents the residual.

Panel threshold regression model

The effect of R&D investment on CTFP is further examined in the context that MER, PER and CER intensities vary. Therefore, this paper uses MER, PER and CER as threshold variables, performs a threshold effect test using the bootstrap method proposed by Hansen (2000) and estimates the panel threshold effects model using the xthreg command developed by Wang (2015), as in Eqs. (11) and (13).

where, \({\text{i}}\) represents \({{\text{i}}}^{{\text{th}}}\) firms; \({\text{t}}\) represents \({{\text{t}}}^{{\text{th}}}\) years; \({\text{n}}\) represents the number of thresholds; I(·) represents the indicator function; \(\upnu ,\uprho\) and \(\mathrm{\varphi }\) represent coefficients; \(\uptau ,\upupsilon\) and \({\text{o}}\) represent the threshold values; \({\text{Controls}}\) represents the control variables set; and \({\upvarepsilon }_{{\text{it}}}\) represents the residual.

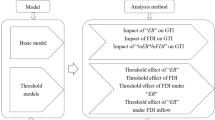

Research design

This paper constructs an integrated model for the impact mechanism of R&D investment on CTFP, as shown in Fig. 2. This research is designed according to the following steps.

Step 1. Data identification. To avoid bias in the results, we use balanced panel data regarding micro-firms and macroeconomic levels.

Step 2. Main effects and their tests. We test the effect of R&D spending on CTFP by constructing a two-fixed effects model. Moreover, numerous tests were also carried out, including the robustness and heterogeneity tests. Results from the baseline regression were confirmed to be reliable.

Step 3. Impact mechanism analysis. This paper investigates the economic effects of the relationship between R&D spending and CTFP concerning GIP, FIP, and CSRP using CTFP as a mediating variable. Furthermore, we find heterogeneity in the moderating effects of MER, PER and CER.

Step 4. Extended analysis. The threshold effects of MER, PER and CER on the correlation between R&D spending and CTFP are examined using a panel threshold effect model.

Step 5. Discussion and conclusion. With the above findings, the following 3 aspects are discussed. (1) The reasons why the impact of R&D expenditure on CTFP is not heterogeneous in subgroup regressions of a shareholding nature. (2) Despite the lagged innovation compensation effect, regulatory costs can still be covered. Technological innovation activities effectively increase CTFP. (3) The reasons for the heterogeneity of the moderating effects of heterogeneous environmental regulation. Finally, we provide constructive recommendations to stakeholders and point out future research directions.

Results and discussion

Baseline regression

To estimate the direct effect of R&D investment on CTFP, this paper stepwise introduces time and entity fixed effects in regression models. Table 2 models (1)-(4) show the results without introducing fixed effects, time-fixed effects, entity-fixed effects and two-way fixed effects, respectively. The results of all models show that R&D spending positively and significantly affects CTFP at the 1% level. H1 is fully supported. Additionally, all models show that firm size significantly and positively affects CTFP at the 1% level. This finding agrees with the theory of financing constraints (Hadlock and Pierce 2010). The larger the company, the lower the intensity of financial constraints, providing sufficient capital for sustainable growth.

Robustness tests

We employed several methods to assess the main effect’s dependability. Table 3 displays the results of robustness tests. In model (1), we draw on the method proposed by Olley and Pakes (1996) for calculating CTFP to regain a measure of CTFP (CTFP_OP). The results indicate that R&D spending significantly promotes the CTFP at the 10% level. As the government implemented the green credit policy and the new environmental tax in 2018, it will somewhat affect the CTFP. Therefore, in the model (2), we set the time window to 2015–2017, and the results show that R&D spending significantly and positively affects CTFP at the 1% level. A long cycle, high costs and high capital requirements characterize R&D activities. The profitability, operational capacity and management governance structure of companies are all key factors affecting the implementation of technological innovation strategies. Therefore, the total asset growth rate, management shareholding ratio and fixed asset turnover ratio are introduced as control variables in the model (3). The result shows that R&D investment also significantly positively affects CTFP at the 1% level. In summary, this paper verified the robustness of baseline regression results by substituting the dependent variable, shortening time windows and adding omitted variables.

Heterogeneity analysis

The impact of R&D spending on CTFP may be heterogeneous due to internal characteristics and the external environment. Hence, this paper analyses whether heterogeneity exists in the main effects from the perspectives of ownership property, leadership structure and environmental attributes. Model (1)-(2) are the results of the subgroup regressions by property of ownership. Model (1) shows that RD expenditure significantly enhances CTFP at the 5% level. Model (2) shows that RD expenditure significantly improves CTFP at the 1% level. Therefore, there is no difference in significance. The Chow test result shows that the p-value is 0.006 and the coefficient between groups is significantly different at the 1% level. Therefore, by comparing the subgroup regression coefficients, we find that the effect of RD expenditure on CTFP is more significant in non-state enterprise (non-SOEs). That is because non-SOEs have more flexible policies and are more innovative. Moreover, this paper uses CEO duality as the criterion to classify the grouped regressions of leadership structure. Models (3)-(4) reveal that R&D expenditure contributes significantly to CTFP at the 1% level, so there is no significant difference. The result of the Chow test shows that the p-value is 0.004 and the coefficients are significantly different between the groups at the 1% level. Therefore, by comparing the subgroup regression coefficients, we find that the effect of R&D expenditure on CTFP is more significant in CEO-dual enterprises. The reason is that CEO-dual enterprises is conducive to stimulate the innovative vitality and improve the innovative efficiency.

We classified the industry into heavily polluting and non-heavily polluting with reference to the study of Ding et al. (2023). Model (5) shows that R&D expenditure contributes significantly to CTFP at the 5% level. Model (6) shows that RD expenditure significantly increases CTFP at the 1% level. Hence, there is no difference in significance. The result of the Chow test shows that the p-value is 0.007 and the coefficients of the two groups are significantly different at the 1% level. Therefore, by comparing the subgroup regression coefficients, we find that the effect of R&D expenditure on CTFP is more significant in non-heavily polluting companies. The reason is that the non-heavily polluting firms have reasonable industrial organisation, easy upgrading, less capital requirement to carry out technological innovation activities and higher innovation efficiency. In summary, the contribution of R&D investment to CTFP is more significant in the subgroup regressions of non-SOEs, CEO heterogeneousity enterprises and non-heavily polluting enterprises (Table 4).

Impact mechanisms

Economic consequences

We use the causal stepwise regression method to test whether R&D investment contributes to corporate GIP, FIP and CSRP by increasing CTFP. Meanwhile, we also use the Process package developed by Igartua and Hayes (2021) and choose the No. 4 model to verify the mediating effect of CTFP by the bootstrap method. If the 95% confidence interval excludes 0, there is mediation; otherwise, there is no mediation.

The test results of the economic consequences of the impact of R&D investment on CTFP are shown in Table 5. Model (1) indicates that R&D spending improves GIP at the 1% level. Model (2) displays that R&D expenditure significantly enhances CTFP at the 1% level. Based on the causal stepwise regression test, it can be directly concluded that the CTFP significantly and positively mediates the impact of R&D spending on GIP. Therefore, H2(a) is fully supported. Model (3) demonstrates that R&D expenditure positively affects FIP at the 1% level. Model (4) demonstrates that CTFP positively improves FIP at the 1% level, and R&D spending positively and insignificantly affects FIP. We can also directly determine that CTFP partially and positively mediates the effect of R&D spending on FIP. Therefore, H2(b) is fully supported. Model (5) shows that R&D expenditure significantly enhances CSRP at the 5% level; model (6) shows that CTFP positively affects CSRP at the 1% level, and R&D spending positively and insignificantly affects CSRP. Therefore, CTFP partially and positively mediates the impact of R&D expenditure on CSRP. The finding fully supports H2(c). Furthermore, after 500 bootstrap samples, none of the confidence intervals contain 0. We also used the Sobel method to verify the mediating effect. The results showed that all findings were significant at the 1% level. Thus, R&D investment contributes to GIP, FIP and CSRP by increasing CTFP.

Moderating effects

This paper explores the heterogeneity of moderating effects of heterogeneous environmental regulations by using MER, PER and CER as moderating variables. Table 6 shows the results of the moderating effect of MER. Control variables, time and entity fixed effects are not introduced in model (1). The result shows that the interaction term between MER and R&D spending significantly and negatively affects CTFP at the 5% level. No control variables are introduced in model (2), but time and entity fixed effects are introduced. The result shows that the interaction term between MER and R&D spending positively affects CTFP but is insignificant. Control variables are introduced in the model (3), but time and entity fixed effects are not introduced. The result shows that the interaction term between MER and R&D spending negatively affects CTFP but is insignificant. Control variables, time and entity fixed effects are introduced in model (4). The result shows that the interaction term between MER and R&D spending positively affects CTFP but is insignificant.

Table 7 shows results for the moderating effects of PER. Control variables, time and entity fixed effects are not introduced in model (1). The results show that the interaction term between PER and R&D spending enhances CTFP at the 1% level. Model (2) does not introduce control variables, but time and entity fixed effects are introduced. The results show that interaction term between PER and R&D spending inhibits CTFP at the 5% level. Control variables are introduced in the model (3), but time and entity fixed effects are not introduced. The result shows that the interaction term between MER and R&D spending improves CTFP but is insignificant. Control variables, time and indiviheterogeneous fixed effects are introduced in the model (4). The results show that interaction term between PER and R&D spending restrains CTFP at the 5% level.

Table 8 shows results for moderating effects of CER. Control variables, time and entity fixed effects are not introduced in model (1). The results show that the interaction term between CER and R&D spending enhances CTFP at the 10% level. Model (2) does not introduce any control variables, but it does introduce time and entity fixed effects. Model (3) introduces control variables, not time and entity fixed effects. The regression results of both models indicate that the interaction term between CER and R&D expenditures dampens CTFP, but it is not statistically significant. Control variables, time and indiviheterogeneous fixed effects are introduced in model (4). The results show that interaction term between CER and R&D spending restrains CTFP at the 5% level. In summary, whether or not control variables, time and entity fixed effects are introduced, the results show a heterogeneous moderating effect of heterogeneous environmental regulations on the relationship between R&D investment and CTFP. Therefore, these findings support H3(a).

Moderated mediating effects

In the previous section, we verified that CTFP and environmental regulation have moderated mediating effects, respectively. Therefore, to further examine whether there is a moderating mediating effect, we use the Process package developed by Igartua and Hayes (2021) and choose the No. 8 model to test the moderating mediating effect of heterogeneous environmental regulations by the bootstrap method. After 5000 bootstrap samples, the test results are shown in Table 9. The confidence intervals do not contain 0, indicating that MER and PER have moderated mediating effects on the economic consequences of the impact of R&D investment on CTFP. However, the test of the moderated mediating effect of CER shows that the confidence interval contains 0, indicating that CER does not have a moderated mediating effect.

Hence, we construct a conceptual model of the moderated mediating effect of heterogeneous environmental regulation, as shown in Fig. 3.

Expanded analysis

Panel threshold effects tests and regression analysis

Before estimating the panel threshold effects model, it is necessary to test for a threshold’s existence and to determine the number of thresholds and the form of the threshold model. In the threshold effect test, we set the number of bootstrap samples to 300, use MER, PER and CER as threshold variables, and obtain the threshold test results, as shown in Table 10. It is assumed that there are three thresholds for each type of environmental regulation, and threshold tests are conducted accordingly. MER has a single threshold of 0.0004 and is significant at the 10% level, a double threshold of 0.0006 is significant at the 5% level. PER has a single threshold of 0.1411, which is significant at the 5% level. CER has a single threshold of 2.2279, which is significant at the 5% level.

Panel threshold regression

Table 11 shows panel threshold regression results. Model (1) shows that when the MER is below 0.0004, R&D investment significantly and positively affects CTFP at the 1% level, with a coefficient of 0.134; when MER is between 0.0004 and 0.0006, R&D investment significantly positively affects CTFP at the 1% level, with a coefficient of 0.114; and when MER is above 0.0006, R&D investment significantly positively affects on CTFP at the 1% level, with a coefficient of 0.146. Therefore, the positive effect of R&D investment on CTFP is most excellent only when MER is above 0.0006. Model (2) shows that when PER is below 0.1411, R&D investment has a significant positive relationship with CTFP at the 1% level, with a coefficient of 0.129; when MER is above 0.1411, R&D investment significantly positively affects CTFP at the 1% level, with a coefficient of 0.124. Therefore, the positive effect of R&D investment on CTFP is greatest when the PER is below 0.1411. Model (3) shows that when CER is below 2.2279, R&D investment has a significant positive relationship with CTFP at the 1% level, with a coefficient of 0.104; when MER is above 2.2279, R&D investment significantly positively affects CTFP at the 1% level, with a coefficient of 0.122. Therefore, the positive effect of R&D investment on CTFP is most excellent when the CER is above 2.2279. In summary, heterogeneous environmental regulations have threshold effects of on the relationship between R&D investment and CTFP. These findings fully support H3(b).

Discussion

This paper combines a two-way fixed effects model with a threshold effects model to explore the impact mechanism of R&D investment on CTFP under heterogeneous environmental regulations. Wevalidate that R&D investment promotes CTFP, and analyse the economic consequences of impact of R&D spending on CTFP. Additionally, based on the transmission mechanism, we test the heterogeneity of the moderating effects of heterogeneous environmental regulations. Our findings have important implications for the government in formulating environmental policies and for enterprises in adjusting their strategic decisions. Based on the above findings, the following issues remain to be discussed.

(1) The effect of R&D expenditure on CTFP is more significant in the non-SOEs subgroup regression. The state ownes SOEs, and their natural political connections give them the advantage of mobilizing more financial and political resources, thus reducing financing costs (Zhao and Jia 2022). Therefore, in general, SOEs can improve their CTFP by conducting technological innovation activities better than non-SOEs. However, this paper reaches a different conclusion. This is because technological innovation strategy is a national development direction set by the central government, and the whole society carries out R&D activities from the top down, creating a favorable innovation atmosphere. Based on the political system with Chinese characteristics, the deepening of combating corruption and building a clean government dictates that local governments must efficiently implement the national general policy and increase subsidies to support R&D activities carried out by enterprises. The national green financial system has also reduced the intensity of financing constraints for non-SOEs to implement R&D activities. Moreover, R&D activities have a lengthy cycle, high expense and high risk. To prevent mismanagement or loss of state-owned assets, the declaration involving major capital projects requires approval not only from the SOE management team but also from higher-level competent administrative units. As a result, the level-by-level approval system for significant decisions leads to less efficient management. Non-SOEs have flexible management and robust policy implementation. Therefore, the positive effect of R&D investment on CTFP is more significant for non-SOEs.

(2) R&D investment contributes to FIP by increasing CTFP. Dechezleprêtre and Sato (2017) believe that the long-cycle, high-risk and high-cost characteristics of R&D investments determine that firms may not improve their FIP in the short term. Due to the high intensity of environmental regulations, to some extent, the innovative compensatory effects may not cover the regulatory and opportunity costs. This paper obtains the opposite conclusion. R&D investment contributes to FIP by increasing CTFP. We believe China’s complete industrial system, with a reasonable division of labour among industries, has greatly reduced production and management costs. Furthermore, China has carried out several comprehensive reforms in the national governance system and government functions, especially in the market supervision departments, to streamline and improve administrative efficiency to create a good business environment for enterprises. A complete industrial system and a good business environment benefitl companies in terms of optimisation of resource allocation and reduction of production and operating costs. Therefore, the innovative compensation effect can cover the cost of regulation to improve corporate competitiveness.

(3) The moderating effect of heterogeneous environmental regulations on the relationship between R&D investment and CTFP is heterogeneous. Ye and Jiang (2020) argue that MER and PER promote the relationship between technological innovation and industrial green growth. However, this paper comes to a different conclusion. We believe that the implementation of national macro-control policies to regulate the operation of the market economy is a manifestation of modernization with Chinese characteristics. Therefore, CER and MER play a robust guiding role in guaranteeing a stable market order and creating a good business environment. Hovewer, the environmental regulatory framework in China has not yet been established, and the supporting policies in this area are not flawless. Therefore, MER has yet to have a significant impact. There are significant economic development disparities among regions in China. However, the government frequently enforces a “one-size-fits-all” policy when imposing environmental penalties and fails to formulate differentiated policies. As a result, CER has a negative moderating effect on the relationship between R&D and CTEF. Furthermore, PER is an advantageous complement to MER. Although there is government policy guidance, the public’s environmental awareness, wage level, and higher education level need to be higher to play a strong monitoring role, instead inhibiting the positive impact of R&D investment on CTFP. We validate that the Porter effect does not apply to Chinese micro firms.

Conclusion

Conclusion and implications

Drawing on the knowledge spillover effect of R&D spending and the incentive effect of environmental regulations, this paper constructs two-way fixed effects and panel threshold effects models using panel data of Chinese manufacturing firms from 2015 to 2018. Meanwhile, the one-period lags of the independent and control variables are applied as instrumental variables to solve the endogeneity issue using GMM and 2SLS. The baseline regression results show that R&D investment significantly promotes CTFP. We obtained findings consistent with Li and Yang (2022). H1 is fully supported. Meanwhile, we also assess the stability of the baseline regression results by substituting the dependent variable, reducing the time window and including omitted variables. Moreover, we verify that the contribution of R&D investment to CTFP is more significant in the subgroup regressions of non-SOEs, CEO-dual enterprises and non-heavily polluting enterprises. The regression results of economic consequences show that R&D investment contributes to GIP, FIP, and CSRP by increasing CTFP. This finding is consistent with that of Shi and Yang (2022) and Wang et al. (2022a, b). H2(a), H2(b) and H2(c) are fully supported. Furthermore, based on the heterogeneous environmental regulation perspective, we obtain the same view as Chen et al. (2022a, b, c). There is heterogeneity in the moderating effects of MER, PER and CER in the correlation between R&D spending and CTFP. H3(a) is fully supported. We also find that MER and PER have moderated mediating effects on the economic consequences of the effects of R&D investment and CTFP. According to the threshold effect test findings, two thresholds exist for MER and one threshold each for PER and CER in the correlation between R&D expenditure and CTFP. These findings entirely supports H3(b). Our findings have important implications for the government to optimize the business environment and for enterprises to achieve sustainable development. Following the findings above, we propose the following constructive suggestions for stakeholders such as enterprises and government departments.

-

1.

The government should continue to deepen the vertical management system of environmental protection authorities and the central environmental protection inspection system and develop differentiated environmental protection policies according to local conditions. China’s unique political system reinforces the power of local governments. The dependency management model of environmental protection weakens the enforcement of environmental regulations by environmental protection departments. Therefore, it is important to weaken the overintervention of local governments in environmental protection departments and continue to deepen the reform of the vertical management system of environmental protection authorities. Meanwhile, the central environmental protection inspection system should be further standardized and legalized to ensure that the laws are in place and violations are punishable, providing legal guarantees for environmental governance. Meanwhile, the intellectual property rights legal system should be improved to create a favorable legal environment for corporate innovation activities. Furthermore, the government should adjust the intensity of environmental regulations according to the economic development level and technological innovation capacity in different regions. It must develop differentiated environmental policies according to local conditions (Mulaessa and Lin 2021). The government ought to augment the quantum of environmental protection and R&D subsidies in underdeveloped regions to aid green upgrading of manufacturing companies’ industrial structures. The green GDP rating mechanism is used as a benchmark for local government governance performance to ensure consistency between local government and corporate performance.

-

2.

Environmental protection departments and civil society should stimulate citizens' enthusiasm for environmental protection and innovation to realize the positive effects of PER. As the governor and supervisor of environmental protection, environmental protection departments assume responsibility for value orientation. Therefore, a sound and transparent government information disclosure system should be established, and the quality of corporate information disclosure should be improved. Additionally, it is essential to improve guidance of environmental protection and innovation policies, give full play to the monitoring mechanism of the media as well as the role of reputation mechanisms, and encourage the public to practice a green lifestyle to raise citizens’ awareness of environmental protection and create a good atmosphere for R&D activities (Chen et al. 2022a, b, c).

-

3.

Enterprises should build R&D platforms, establish the concept of green innovation, and actively undertake corporate social responsibility. R&D activities are the main driver for improving CTFP. Businesses should support clean, efficient processes, energy-saving technologies, and methods for reducing emissions. Meanwhile, taking on social responsibility is one of the purposes of business. Employees are the most critical asset of enterprises. Enterprises should improve their employees’ working environment, the remuneration and welfare system, and the employees’ sense of identity and belonging to corporate values (Shah et al. 2022). Additionally, reputation is an important intangible asset. Companies must not only increase their R&D spending, but also actively improve the social responsibility disclosure quality to convey their positive image to the market, thereby reducing agency costs and easing financing constraints (Salim, et al. 2019). National policy is a guideline for business operations, and companies must adjust their development strategies promptly by government policies on innovation incentives and environmental regulations to achieve high-quality development.

Limitations and future research directions

Future research should focus on the following areas in addition to the aforementioned contributions. As a form of financial support, government subsidies can directly improve corporate financial performance and expand production inputs. Additionally, reputation is a crucial intangible asset for enterprises. Implementating technological innovation activities can enhance a company’s green image in the eyes of the capital market. This, in turn, can increase consumer trust in the brand and investor confidence, leading to larger-scale production. Therefore, our future research will focus on whether R&D investment can improve CTFP by attracting government subsidies and enhancing the company’s green image. Changes in the external economic environment significantly impact enterprise economic behaviour. The government regulates the market economy through macro policies. However, companies, as the main body of the market economy, cannot accurately predict policy changes. Therefore, economic policy uncertainty is also a crucial factor affecting the relationship between R&D investment and CTFP, which is also a future research direction.

Data availability

The data will be available on request by corresponding author.

References

Bae J, Oh H, Kim S (2022) Advertising role of CSR and strategic investment in R&D: evidence from the biohealth industry. J Curr Issues Res Advert 44(1):105–121. https://doi.org/10.1080/10641734.2022.2131655

Baldi G, Bodmer A (2017) R&D investments and Corporate cash holdings. Econ Innov New Technol. https://doi.org/10.1080/10438599.2017.1378191

Bao Q, Chai H (2022) Environmental regulation, financial resource allocation, and regional green technology innovation efficiency. Discrete Dyn Nat Soc 2022:1–11. https://doi.org/10.1155/2022/7415769

Bengoa M, Román VMS, Pérez P (2017) Do R&D activities matter for productivity? A regional spatial approach assessing the role of human and social capital. Econ Model 60:448–461. https://doi.org/10.1016/j.econmod.2016.09.005

Chen W, Chen S, Wu T (2022a) Research of the impact of heterogeneous environmental regulation on the performance of China’s manufacturing enterprises. Front Environ Sci. https://doi.org/10.3389/fenvs.2022.948611

Chen J, Wang X, Shen W, Tan Y, Matac LM, Samad S (2022b) Environmental Uncertainty, environmental regulation and enterprises’ green technological innovation. Int J Environ Res Public Health 19(16):9781. https://doi.org/10.3390/ijerph19169781

Chen M, Shi V, Wei X (2022c) Environmental regulations, R&D intensity, and enterprise profit rate: understanding firm performance in heavy pollution industries. Front Environ Sci. https://doi.org/10.3389/fenvs.2022.1077209

Dai L, Zhang J, Luo S (2022) Effective R&D capital and total factor productivity: evidence using spatial panel data models. Technol Forecast Soc Chang 183:121886. https://doi.org/10.1016/j.techfore.2022.121886

Dechezleprêtre A, Sato M (2017) The impacts of environmental regulations on competitiveness. Rev Environ Econ Policy 11(2):183–206. https://doi.org/10.1093/reep/rex013

Ding X, Xu Z, Petrovskaya MV, Wu K, Ye L, Sun Y, Makarov VM (2023) Exploring the impact mechanism of executives’ environmental attention on corporate green transformation: evidence from the textual analysis of Chinese companies’ management discussion and analysis. Environ Sci Pollut Res 30(31):76640–76659. https://doi.org/10.1007/s11356-023-27725-4

Edquist H, Henrekson M (2017) Do R&D and ICT affect total factor productivity growth differently? Telecommun Policy 41(2):106–119. https://doi.org/10.1016/j.telpol.2016.11.010

Erdin C, Ozkaya G (2020) R&D investments and quality of life in Turkey. Heliyon. https://doi.org/10.1016/j.heliyon.2020.e04006

Ezzi F, Jarboui A, Zouari-Hadiji R (2020) Exploring the relationship between managerial emotional intelligence, R&D and CSR performance: a mediated moderation analysis. J High Technol Manag Res 31(2):100387. https://doi.org/10.1016/j.hitech.2020.100387

Fan J, Teo T (2022) Will China’s R&D investment improve green innovation performance? an empirical study. Environ Sci Pollut Res 29(26):39331–39344. https://doi.org/10.1007/s11356-021-18464-5

Gao X, Dong Z (2022) Technological innovation and the complexity of imported technology: moderating effects based on environmental regulation. Front Environ Sci. https://doi.org/10.3389/fenvs.2022.996867

Guo X, Li K, Yu S, Wei B (2021) Enterprises’ R&D investment, venture capital syndication and IPO underpricing. Sustainability 13(13):7290. https://doi.org/10.3390/su13137290

Hadlock CJ, Pierce JR (2010) New evidence on measuring financial constraints: moving beyond the KZ index. Rev Financ Stud 23(5):1909–1940. https://doi.org/10.1093/rfs/hhq009

Han C, Zhang WG, Feng ZB (2017) How does environmental regulation remove resource misallocation-an analysis of the first obligatory pollution control in china. China Ind Econ 4:115–134. https://doi.org/10.19581/j.cnki.ciejournal.2017.04.007

Hansen BE (2000) Sample splitting and threshold estimation. Econometrica 68(3):575–603. https://doi.org/10.1111/1468-0262.00124

Huang MC, Liou MH, Iwaki Y (2020) The impact of R&D and innovation on global supply Chain transition: GTAP analysis on Japan’s public R&D investment. J Soc Econ Dev 23(S3):447–467. https://doi.org/10.1007/s40847-020-00113-1

Huang H, Qi B, Chen L (2022) Innovation and high-quality development of enterprises—also on the effect of innovation driving the transformation of China’s economic development model. Sustainability 14(14):8440. https://doi.org/10.3390/su14148440

Igartua JJ, Hayes AF (2021) Mediation, moderation, and conditional process analysis: concepts, computations, and some common confusions. Span J Psychol 24:E49. https://doi.org/10.1017/sjp.2021.46

Jiang Y, Qin S, Xu Y (2022) Impact of green credit policy on sustainability performance of high-pollution enterprises. Environ Sci Pollut Res 29:79199–79213. https://doi.org/10.1007/s11356-022-21315-6

Kim SI, Kim KT (2020) The differentiated CSR activities and corporate value. Asian Rev Account 29(1):19–41. https://doi.org/10.1108/ara-05-2020-0067

Lee M, Choi M (2015) Analysis on time-lag effect of research and development investment in the pharmaceutical industry in Korea. Osong Public Health Res Perspect 6(4):241–248. https://doi.org/10.1016/j.phrp.2015.07.001

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–341. https://doi.org/10.1111/1467-937x.00246

Li J, Wu X (2022) The S-shaped relationship between R&D investment and green innovation after cross-border merge and acquisition: evidence from China. Environ Sci Pollut Res 29(36):55039–55057. https://doi.org/10.1007/s11356-022-19739-1

Li X, Yang Y (2022) The relationship between air pollution and company risk-taking: the moderating role of Digital Finance. Front Environ Sci 10:988450. https://doi.org/10.3389/fenvs.2022.988450

Li X, Cheng B, Li Y, Duan J, Tian Y (2022) The relationship between enterprise financial risk and R&D investment under the influence of the COVID-19. Front Public Health. https://doi.org/10.3389/fpubh.2022.910758

Liu Z, Ling Y (2022) Structural transformation, total factor productivity and high-quality development. China Econom 17(1):70–82. https://doi.org/10.19602/j.chinaeconomist.2022.01.06

Lu XD, Lian YJ (2012) Estimation of total factor productivity of industrial enterprises in China:1999–2007. China Econ Q 11(02):179–196. https://doi.org/10.13821/j.cnki.ceq.2012.02.013

Lv K, Zhu S, Liang R, Zhao Y (2023) Environmental regulation, breakthrough technological innovation and total factor productivity of firms–evidence from emission charges of China. Appl Econ. https://doi.org/10.1080/00036846.2023.2175776

Mbanyele W, Wang F (2021) Environmental regulation and technological innovation: evidence from China. Environ Sci Pollut Res 29(9):12890–12910. https://doi.org/10.1007/s11356-021-14975-3

Michelino F, Lamberti E, Cammarano A, Caputo M (2015) Open innovation in the pharmaceutical industry: an empirical analysis on context features, internal R&D, and financial performances. IEEE Trans Eng Manage 62(3):421–435. https://doi.org/10.1109/tem.2015.2437076

Mulaessa N, Lin L (2021) How do proactive environmental strategies affect green innovation? The moderating role of environmental regulations and firm performance. Int J Environ Res Public Health 18(17):9083. https://doi.org/10.3390/ijerph18179083

Nandy M (2020) Is there any impact of R&D on financial performance? Evidence from Indian Pharmaceutical Companies. FIIB Bus Rev 9(4):319–334. https://doi.org/10.1177/2319714520981816

Olley GS, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64(6):1263. https://doi.org/10.2307/2171831

Qiu W, Zhang J, Wu H, Irfan M, Ahmad M (2021) The role of innovation investment and institutional quality on green total factor productivity: evidence from 46 countries along the “Belt and Road.” Environ Sci Pollut Res 29(11):16597–16611. https://doi.org/10.1007/s11356-021-16891-y

Salim R, Hassan K, Rahman S (2019) Impact of R&D expenditures, rainfall and temperature variations in agricultural productivity: empirical evidence from Bangladesh. Appl Econ 52(27):2977–2990. https://doi.org/10.1080/00036846.2019.1697422

Shah IH, Kollydas K, Lee PY, Malki I, Chu C (2022) Does R&D investment drive employment growth? Empirical evidence at industry level from japan. Int J Financ Econ. https://doi.org/10.1002/ijfe.2677

Shang Y, Song M, Zhao X (2022) The development of China’s circular economy: from the perspective of environmental regulation. Waste Manag 149:186–198. https://doi.org/10.1016/j.wasman.2022.05.027

Shao L, Liu Q (2022) Decision-making and the contract of the complementary product supply chain considering consumers’ environmental awareness and government green subsidies. Int J Environ Res Public Health 19(5):3100. https://doi.org/10.3390/ijerph19053100

Shi Y, Yang C (2022) How does multidimensional R&D investment affect green innovation? Evidence from China. Front Psychol. https://doi.org/10.3389/fpsyg.2022.947108

Tsamadias C, Pegkas P, Mamatzakis E, Staikouras C (2018) Does R&D, human capital and FDI matter for TFP in OECD countries? Econ Innov New Technol 28(4):386–406. https://doi.org/10.1080/10438599.2018.1502394

Voutsinas I, Tsamadias C (2014) Does research and development capital affect total factor productivity? Evidence from Greece. Econ Innov New Technol 23(7):631–651. https://doi.org/10.1080/10438599.2013.871169

Wang QY (2015) Fixed-effect panel threshold model using Stata. Stata J 15(1):121–13410

Wang J, Zhang Q, Li Q (2020) R&D investment and total factor productivity: an empirical study of the listed companies in the coastal regions of China. J Coastal Res 106(sp1):13. https://doi.org/10.2112/si106-004.1

Wang X, Fan M, Fan Y, Li Y, Tang X (2022a) R&D investment, financing constraints and corporate financial performance: empirical evidence from China. Front Environ Sci. https://doi.org/10.3389/fenvs.2022.1056672

Wang L, Long Y, Li C (2022b) Research on the impact mechanism of heterogeneous environmental regulation on enterprise green technology innovation. J Environ Manag 322:116127. https://doi.org/10.1016/j.jenvman.2022.116127

Woo Y, Kim E, Lim J (2017) The impact of education and R&D investment on regional economic growth. Sustainability 9(5):676. https://doi.org/10.3390/su9050676

Wu YQ, Li J, Ma JC (2022) The effect of innovation investment on environmental total factor productivity. Math Probl Eng 2022:1–13. https://doi.org/10.1155/2022/3100174

Wu J, Segerson K, Wang C (2023) Is environmental regulation the answer to pollution problems in urbanizing economies? J Environ Econ Manag 117:102754. https://doi.org/10.1016/j.jeem.2022.102754

Xiao Z, Peng H, Pan Z (2021) Innovation, external technological environment and the total factor productivity of enterprises. Account Finance 62(1):3–29. https://doi.org/10.1111/acfi.12779

Xu J, Liu F, Shang Y (2020) R&D investment, ESG performance and green innovation performance: evidence from China. Kybernetes 50(3):737–756. https://doi.org/10.1108/k-12-2019-0793

Yan J, Feng L, Denisov A, Steblyanskaya A, Oosterom J-P (2020) Complexity theory for the modern Chinese economy from an information entropy perspective: modeling of economic efficiency and growth potential. PLoS ONE 15(1):e0227206. https://doi.org/10.1371/journal.pone.0227206

Yang B, Zhao Q (2023) The effects of environmental regulation and environmental protection investment on green technology innovation of enterprises in heavily polluting industries—based on threshold and mediation effect models. Front Environ Sci. https://doi.org/10.3389/fenvs.2023.1167581

Ye HY, Jiang S (2020) The impact of technological innovation on industrial green growth under the constraints of heterogeneous environmental regulations. West Forum Econ Manag 31(4):38–46. https://doi.org/10.12181/jjgl.2020.04.05

Yu X (2017) The mechanism of environmental regulation policy and its practice changes-based on the evolution of environmental regulation policy from 1978 to 2016. Forum Sci Technol China 12:15–31. https://doi.org/10.13580/j.cnki.fstc.2017.12.002

Yu F, Shi Y, Wang T (2020) R&D investment and Chinese manufacturing smes’ corporate social responsibility: the moderating role of regional innovative milieu. J Clean Prod 258:120840. https://doi.org/10.1016/j.jclepro.2020.120840

Yu F, Jiang D, Wang T (2022) The impact of green innovation on manufacturing small and medium enterprises corporate social responsibility fulfillment: the moderating role of regional environmental regulation. Corp Soc Responsib Environ Manag 29(3):712–727. https://doi.org/10.1002/csr.2231

Zhang Y, Chen H, He Z (2022) Environmental regulation, R&D investment, and green technology innovation in China: based on the PVAR model. PLoS ONE. https://doi.org/10.1371/journal.pone.0275498

Zhao X, Jia M (2022) Sincerity or hypocrisy: can green M&A achieve corporate environmental governance? Environ Sci Pollut Res 29(18):27339–27351. https://doi.org/10.1007/s11356-021-17464-9

Zhong QL, Liao GM, Lu ZF (2016) Does R&D investment improve the firm productivity? Based on the instrumental variable analysis of talent introduction policy. J Account Econ 30(5):3–16. https://doi.org/10.16314/j.cnki.31-2074/f.2016.05.001

Zhou B, Wu J, Guo S, Hu M, Wang J (2020) Environmental regulation and financial performance of Chinese listed companies. PLoS ONE. https://doi.org/10.1371/journal.pone.0244083

Acknowledgements

The authors want to thank our editor and reviewers for their valuable comments and advice. The authors also want to acknowledge China Scholarship Council and the contribution of Professor Boris I. Sokolov to this paper.

Funding

This research was funded by the China Scholarship Council (Grant Nos. 202008090357, 202210280044, 202210280022, 202008090178).

Author information

Authors and Affiliations

Contributions

Xiaowei Ding: conceptualization, investigation, methodology, formal analysis, data curation, writing—original draft, and writing—review and editing and corresponding author. Yaqiong Zhang and Yongguang Fu contributed equally to this work: supervision, visualization, validation, and writing—review and editing. Zhenpeng Xu: conceptualization, supervision, and writing—review and editing. All the authors provided critical feedback and helped shape the research, analysis, and manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Editorial responsibility: Maryam Shabani.

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ding, X., Zhang, Y., Fu, Y. et al. R&D investment and corporate total factor productivity under the heterogeneous environmental regulations: evidence from Chinese micro firms. Int. J. Environ. Sci. Technol. (2024). https://doi.org/10.1007/s13762-024-05710-9

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13762-024-05710-9

Keywords

- Environmental regulation constraints

- Research and development investment

- Corporate total factor productivity

- Impact mechanism

- Moderated mediating effect

- Threshold effect