Abstract

This study aims to construct and validate a conceptual model for assessing online brand experience (OBE) in the rapidly evolving Indian neobanking sector. By leveraging a conceptual framework, our study investigates how personalised services, service quality, and digital interface design influence customer loyalty, satisfaction, and advocacy. Our study uses partial least squares structural equation modelling (PLS-SEM) and examines survey data from 421 participants. The study further evaluates how constructs such as personalisation (PER), service quality (SEQ), functional quality (FUQ), and perceived aesthetics (PAE) influence OBE and their subsequent effects on customer loyalty (CUL), satisfaction (CUS), and Net Promoter Score (NPS). The results indicate that customisation plays an important role in shaping OBE with service and functional quality. This study identifies areas for further study within the Neobanking and OBE Literature. Further, this study observes that strong customer loyalty does not correlate with advocacy, suggesting a relationship between loyalty and the NPS. Our study findings offer valuable insights into neobanks by emphasising the importance of banking services and quality enhancements in enriching OBE and nurturing loyalty in the neo-banking sector.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The neobanks are projected to reach a market size of US$9.24 trillion by 2027, experiencing a growth rate of 18.15% from 2023 to 2027 (Statista 2021). Neobanks, fully digital banks without any physical branches, are reshaping customer expectations and experiences by offering enhanced convenience, personalised services, and advanced technological features (Tiwari 2023). Analysts expect India’s neobanks to witness a compound growth rate (CAGR) of 50.5% over the next 3 years (Kapoor and Bfsi 2022). The country’s rapid digital transformation, extensive smartphone penetration, and a young, tech-savvy population eager for convenient and innovative financial solutions have fueled this rise in India’s neobanks (Kumar et al. 2023). However, this rapid growth has created a set of challenges: consumers express dissatisfaction in terms of customer service (Majorel 2022; NewsDirect 2022), and they concern themselves with the security and privacy of their financial transactions (Roy and Prabhakaran 2022), inconsistent user experiences, and the challenges in navigating digital platforms contribute toward customer reluctance (Sardar and Anjaria 2023).

Digital interactions substantially impact OBE (Abu-Snoubar et al. 2022). Prior research has shown that brand reputation improves a company’s capacity to establish persistent connections with consumers (Tsai and Lu 2023). To differentiate themselves and retain a competitive edge in the market, businesses integrate online experiential marketing techniques (Sakib 2022; Budiati et al. 2021), as researchers have identified emotional and affective responses during bank service as critical determinants of customer behaviour, underscoring the need for a deeper understanding of customer emotions in service experiences (Calvo-Porral and Lévy-Mangin 2020). Previous studies have examined the effects of OBE on customer satisfaction and behavioural intentions (Baek et al. 2020), satisfaction and loyalty (Quan et al. 2020), online brand trust and repurchase intentions (Syahputra et al. 2022), and brand familiarity and customer satisfaction (Jiang et al. 2020) across different industries and contexts. Nevertheless, research in the context of OBE in banking is scarce, presenting significant opportunities for future investigation (Zhu and Park 2022).

Amidst the increasing standardisation, lack of customisation, and shift towards digitisation in the banking industry, it is crucial to foster customer relationships (Babarinde et al. 2020; Aniqoh et al. 2022). While previous studies have extensively examined customer experience in Internet Banking (Manoharan et al. 2021), Online Banking (Khan et al. 2019), and Mobile Banking (van Klyton et al. 2021), there is a dearth of literature specifically focusing on online brand experience (OBE). Researchers have explored the impact of OBE on brand loyalty (Marliawati and Cahyaningdyah 2020). Prior studies in banking have researched customer brand engagement (Khan et al. 2016), Consumption Values (Fathima et al. 2022), Customer Experience, Bank Image, and Trust (Verma and Kaur 2023), artificial intelligence in consumers’ brand preferences (Ho and Chow 2023), Brand Commitment (Erobathriek et al. 2023), and mobile applications (Khan 2023). However, the impact of cognitive, affective, and behavioural factors on neobanks’ OBE remains unresearched. Brand reputation has emerged as a significant notion of the capacity to impact consumer behaviour (Choi and Burnham 2020). An increasing amount of research on OBE exists; however, a lack of conceptual frameworks to explore how humans interact with technological entities remains (Dodds et al. 2022; Choudhury 2022; Festerling et al. 2022). Hence, this study proposes the following research question.

-

To understand the CAB factors that impact OBE for neobanks and the likelihood of customers recommending the bank to others.

-

To understand the impact of OBE and the mediating factors of customer loyalty and satisfaction in recommending neobanks to others.

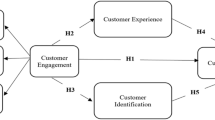

This study is proposed to address the research question by building a conceptual model based on Gartner’s (1994) cognitive-affective-behavioural (CAB) theory to study online brand experience, which plays a crucial role in shaping customer perceptions and behaviours (Rather et al. 2022). Our study integrates cognitive factors such as Functional Quality (FUQ), Information Quality (IQU), and personalisation (PER); affective factors such as perceived aesthetics (PAE) and perceived usability (PUS); and behavioural factors such as Service Quality (SEQ) and Customer Service and Support (CSS). Further study integrates Customer Loyalty (CL) and Customer Satisfaction (CUS) to analyse the impact on the Net Promoter score.

This study makes three distinct contributions to the topic of online brand experience and neobanking. First, it enhances the online brand experience domain, increasing the attention given to online brand experience as a new research area, indicating its growing significance in the virtual marketplace (Quan et al. 2020). This study contributes to previous studies on OBE, which primarily focused on online brand communities (Wong and Hung 2022), hotels (Purohit et al. 2023), web sites (Fathima et al. 2022), online destination brands (Li et al. 2022), and Scales for Measuring OBE (Xie et al. 2023). The results of our study show that online consumer interactions within neobanking are further enhanced by integrating cognitive, emotional, and behavioural factors.

Second, our study builds on previous studies and literature on cognitive-affective-behavioural (CAB) studies (Eagly and Chaiken 1993). Our study contributes to the literature by studying it in the context of Indian neobanks, which has not been researched earlier. This study builds on the model suggested by Chauhan et al. (2022) through a detailed literature review on digital banking. This study differs from previous research on the usage of the CAB model, which predominantly focuses on smartphone brands (Wong et al. 2019), mobile wallet adoption (Lacap 2022), social networking (Chih et al. 2020), YouTube advertisements (Mahmoud and Abdelbaki 2019), and content sharing (Hsiao 2020). By integrating the cognitive, affective, and behavioural aspects, this study enhances the understanding of online customer and brand interactions within neobanking.

Additionally, our study addresses the research gaps in previous research by further exploring the cognitive and affective factors shaping customer behaviour in the banking sector (Raza et al. 2019), where there is a need for interplay between affective orientation, cognitive load, and brand story style in influencing bank preferences (Kao and Wu 2019). Understanding the affective and cognitive factors that hinder banking relationships emphasises the importance of trust and cognitive factors in banking interactions, thus indicating a gap in understanding these factors in the context of customer behaviour (Cuesta González et al. 2022).

2 Literature review and conceptual framework

2.1 Online brand experience

Researchers suggest that brand experience (BE) is a sensory, emotional, cognitive, and behavioural response prompted by brand-related stimuli, which include components such as design, identity, packaging, communication, and surroundings (Brakus et al. 2009). Customers’ behaviour may be considerably impacted by behavioural and economics (BE), with both positive and negative effects. Mostafa and Kasamani (2020) and Shukla and Shamurailatpam (2022) investigate the notion of behavioural economics (BE) in the physical world, whereas Sadek and Mehelmi (2020) investigate it in the digital sphere. Electronic market platforms that allow users to make purchases online have emerged as a result of advancements in information and communication technology (ICT) (Ha and Perks 2005; Lee and Jeong 2014; Morgan-Thomas and Veloutsou 2013). The emotional, attitudinal, and evaluative reactions that consumers generate as a consequence of their interactions with enterprises on the Internet are referred to as online brand experiences (OBE) (Khan et al. 2016).

According to research, BE received via websites is favourable engagement (such as participating in events, using online communities, and perceiving the value for money, variety, and originality of visual representations, among others) with a specific website" (Ha and Perks 2005). Rahman and Mannan (2018) and Sadek and Mehelmi (2020) performed studies that revealed the impact of OBE on consumer behaviour, notably purchase intent, loyalty, and trust. The OBE is linked to emotional commitment, brand relationships, and brand engagement, all of which help build brand loyalty (Khan et al. 2019). Previous studies have reflected a strong connection between the quality of OBE and trust building as well as the development of customer relationships (Bravo et al. 2019; Yasin et al. 2019). Banks moving from traditional to digital platforms have increased their focus on studies on the overall user experience (Timokhina et al. 2021). Firms must understand and manage OBE to successfully position their brands (Rafif et al. 2022). Recent studies highlight the importance of the Online Brand Experience (OBE) as a crucial branding tactic (Sadek and Mehelmi 2020). Based on the literature review in Table 1, there is a scarcity of research exploring the impact of OBE on the quality of relationships, specifically in terms of cognitive, affective, and behavioural factors.

2.2 Cognitive-affective-behavioural (CAB) framework

For the perception and explanation of human behaviour, Gartner (1994) proposed cognitive-affective-behavioural (CAB) theory. The impact of CAB factors on a customer’s choice to accept a new technology has long been studied in innovation and marketing research. Cognitive techniques for technology adoption share the view that the user’s desire to embrace technology is the result of the user’s logical appraisal of numerous facts about the technology and environment of usage. Rose et al. (2012) investigated the association between website navigation, search, and functionality and cognitive processing. Information quality is assessed using the perceived dependability and trustworthiness of the source supplying information, which is considered a cognitive factor. Emotional and affective responses followed. The marketing literature has thoroughly studied the role of affection in consumer behaviour through hedonic consumption (Holbrook and Hirschman 1982), experiential marketing (Brakus et al. 2009), and sensory marketing (Krishna 2011). Consequently, customers make both logical and emotional decisions (Brakus et al. 2009). Positive emotions are reactions to desirable outcomes that consumers want to achieve (Martínez et al., 2022; Johnson and Stewart 2005), such as pleasure and enjoyment, in addition to meeting task-related goals. Customers’ emotional states may, therefore, be influenced by aesthetic enjoyment and excitement (Brakus et al. 2009). Websites with high aesthetic characteristics aim to provide customers with a pleasant buying experience (Chang et al. 2014). Customisation allows websites or apps to adjust services according to consumers’ needs. Personalisation pleasure adds to positive emotional states (Shukla and Shamurailatpam 2022). Various variables have a significant impact on technology uptake. Furthermore, research indicates that an individual’s self-assurance in using technology influences their ability to navigate new technical settings.

This study proposes a conceptual model that focuses on the neobanking industry in India. The determinant for this study is evaluated based on previous studies and taken while creating this model to focus on customer brand experience in the banking sector (Kapoor and Bfsi 2022). This study integrates personalisation (PER), which is identified as a crucial factor in the banking sector because of its ability to significantly improve customer engagement and loyalty via tailored services (Mogaji et al. 2021). The study also includes Service Quality (SEQ) which recognises its impact on customer satisfaction as a measure in the absence of face-to-face contact at a bank (Kaabachi et al. 2019). FUQ is added to the effectiveness of digital platform ecosystems, which directly affects customer satisfaction (Zhu and Chen 2012). CUL is a mediator factor in the banking business, as it has a strong connection with profitability and word of mouth (Rust et al. 1999). IQU is revealed by its function in building confidence and trust, which are essential factors in financial decision-making (Herington and Weaven 2009). Integrating PUS and Aesthetics (PAE) enables the measurement of user friendliness and visual attractiveness. All of these influences have a significant impact on the competence of users to continue using interfaces (Shobeiri et al. 2014). The NPS is used as a metric to evaluate individual advocacy, which plays a crucial role in brand growth within a competitive market such as India (Mogaji et al. 2021). This model seeks to analyse the many aspects that influence customer perceptions and behaviours in the ever-changing field of Indian neobanking.

This study presents a paradigm that establishes a connection between the importance of Online Brand Experience (OBE) in neobanking and hitherto uninvestigated domains, such as branding and product management. The impact of OBEs on consumer happiness and experience, although extensively studied, is significant. This study presents a paradigm (see Fig. 1) that offers a viewpoint for understanding the impact of customer-centric neobanks. This study primarily focuses on analysing the necessary conditions and outcomes of brand experience in the banking industry (Ashrafpour et al. 2021). Additionally, it highlights the insufficient research on the relationship between customer experience and loyalty in the banking sector (Chauhan et al. 2022).

The main objective of this study is to increase the understanding of the services and factors that influence neobank customer brand experience. It focuses on users interested in banking. Using this method, neobanking brands and product managers can improve their market position and brand equity by enhancing customer experiences and aligning offerings with consumer preferences. The model considers the emotional and behavioural aspects of customers’ interactions with a neobanking brand, providing an analytical framework. This research advances our understanding of the quality of neobanking services, brand loyalty, and digital customer behaviour. Implementing this approach will improve the practical understanding of the stakeholders involved in banking, ultimately benefiting the industry.

3 Hypotheses

3.1 Functional quality (FUQ)

Functional quality (FUQ) is how well and consistently services and systems work to satisfy the demands and expectations of online banking customers. According to a study by Mbama et al. (2018), Alfarizi (2023), and Narteh (2018), the quality of digital banking services significantly influences consumer happiness and loyalty. Higher functional quality ensures smoother transactions and more reliable services, which reduces user frustration and enhances overall satisfaction with the brand experience (Tumewah et al. 2020; Narteh 2018; Krasonikolakis et al. 2020). This argument is supported by service quality literature, which consistently links system functionality with user satisfaction and perceived value. Hence, we propose the following hypotheses.

H1

FUQ affects OBE in the neobanks.

3.2 Information quality (IQU)

Information quality (IQU) refers to the accuracy, comprehensiveness, consistency, and up-to-date data provided to clients. Accurate, timely, and relevant information is crucial in the banking sector, where decisions are information-sensitive. For banking purposes, such as data, transaction records, account statements, and other relevant information, information must be accurate and reliable (Koya et al. 2021; Kumalasari et al. 2022). The level of client satisfaction with banking services is closely tied to the quality of the information provided (Deswanto 2020). High information quality increases trust and confidence in the platform, thereby enhancing users’ overall brand experience. This relationship is grounded in information systems research which demonstrates that superior information quality leads to improved user engagement and satisfaction. Hence, we propose the following hypotheses.

H2

IQU affects the OBE of neobanks.

3.3 Personalisation (PER)

Personalisation (PER) in banks involves leveraging consumer data and technology to tailor banking services and interactions, based on each client’s preferences and needs. The use of intelligence (AI) has greatly enhanced banking by enabling banks to offer personalised and customised digital experiences to consumers (Ayadurai and Joneidy 2021). According to Sati and Sharma (2023), personalisation plays a role in shaping client perceptions and satisfaction in the banking industry. Other significant aspects of service quality include content relevance, user-friendly interfaces, access to information resources, and customisable options. This finding is consistent with marketing theories on consumer behaviour, which suggest that personalised interactions increase consumer engagement and loyalty by meeting individual needs more effectively. Consequently, we propose the following hypothesis:

H3

PER affects neobanks’ OBE.

3.4 Perceived aesthetics (PAE)

Perceived aesthetics (PAE) refers to the inference and judgment of the visual appeal, design, and overall attractiveness of digital banking interfaces and platforms. According to Islam et al. (2020), the significance of appealing and user-friendly banking websites is emphasised by the concept of perceived aesthetics in banking, as it creates a positive impression of usability among users. Moosa et al. (2021) explored banking. They found that design aesthetics have a favourable impact on consumers’ confidence in the system, as well as their inclination to use mobile banking services. Well-designed interfaces that are visually appealing and intuitive can significantly enhance user satisfaction and contribute to a positive online brand experience, as supported by aesthetics and usability literature. Hence, we propose the following hypothesis:

H4

PAE affects the OBE in the neobanks.

3.5 Perceived usability (PUS)

Perceived usability (PUS) is employed to describe customers’ perceptions of a bank’s platforms regarding their quality of user-friendliness and ease of use during interaction with the bank. Research indicates that when customers perceive banking services to be easy to use, they are more likely to embrace and utilise them frequently (Chauhan et al. 2022; Gichuhi 2020). The perceived ease of use of banking systems plays a role in building customer trust and promoting adoption rates for Internet-only banks (Kaabachi et al. 2019). High usability reduces barriers to engagement, facilitating a smoother customer journey and a more positive brand experience. This hypothesis is grounded in usability studies, which show that user-friendly systems lead to higher satisfaction and a better overall user experience. Therefore, we propose the following hypothesis:

H5

PUS affects the OBE in the neobanks.

3.6 Service quality (SEQ)

Service quality (SEQ) in banking affects customers’ intentions to use digital banking services. This study emphasises that factors such as employee expertise, understanding, prompt resolution of problems, added advantages, and responsiveness contribute significantly to banking service quality (Koya et al. 2021). Service quality aspects such as ease of use, effectiveness, privacy/security, reliability, convenience, functional quality, and digital banking innovations have been identified as drivers of customer satisfaction and loyalty in the realm of banking (Zouari and Abdelhedi 2021). High service quality ensures that customer needs are met effectively, which enhances the perceived value of the brand and strengthens the brand experience. This is supported by extensive literature on service quality and customer satisfaction. Hence, we propose the following hypothesis:

H6

SEQ will affect the online brand experience in neobanks.

3.7 Customer service and support (CSS)

Customer service and support (CSS) are the deciding factors in whether a consumer is satisfied and loyal. Customers can handle financial matter’s by using electronic or digital infrastructure (Sampurna and Miranti 2022). Customers’ concerns about security and privacy affect the uptake of online banking, underscoring the significance of reliability and safety in online payment systems (Kantika et al. 2022). When it comes to digital banking, customer care and support play a crucial role in determining the client’s experience, happiness, and loyalty. Digital transformation, trust, security, and service quality are major determinants of consumer happiness and the uptake of online banking. Understanding and resolving consumer demands and concerns will be crucial for digital banks to maintain their success as the industry continues to change. This hypothesis is grounded in the service management literature, which suggests that timely and effective support contributes to a positive perception of a brand, thereby improving the overall brand experience. Hence, our study proposes the following hypothesis:

H7

Customer Service and Support will affect neobanks’ OBE.

3.8 Online brand experience (OBE)

Online brand experience (OBE) revolves around users’ perceptions and interactions with a bank’s brand while using digital platforms, such as websites and mobile apps. Yasin et al. (2019) studied the implication of OBE in improving customer interactions and engagement in the financial industry. Prathomo and Magetsari (2018) propose that further studies should prioritise enhancing the banking experience to promote customer engagement with the brands of banks. A positive online brand experience fosters customer loyalty as it satisfies and exceeds customer expectations, leading to repeated engagement. This relationship is supported by theories of customer engagement and loyalty, which suggest that positive experiences lead to emotional attachment to and commitment to a brand. Given these observations, we propose the following hypothesis:

H8a

OBE affect neobanks CUL.

H8b

OBE affects the neobanks to CUS.

H8c

OBE affects NPS of neobanks.

3.9 Customer loyalty (CUL)

Customer loyalty (CUL) is an inclination toward consumers engaged in a business and is influenced by positive previous experiences and overall satisfaction (Oliver 1999). This factor is important in the computation of the Net Promoter Score (NPS), a metric used to assess customer loyalty and the inclination to endorse a company’s products or services (Reichheld 2003). The NPS framework categorises participants into three groups based on their likelihood of recommending a company: promoters, passives, and critics. Loyal customers, sometimes referred to as advocates, contribute to the improvement of NPS rankings. Through enjoyable encounters, people can function as brand ambassadors, leading to the acquisition of repeat businesses and consumers through recommendations (Keiningham et al. 2020). Emphasising the development of loyal customers may have advantageous outcomes for a company’s Net Promoter Score (NPS). Customer loyalty, typically a result of continued satisfaction and positive experiences, should theoretically increase the likelihood of customers acting as promoters. However, this hypothesis tests the strength and directness of that relationship within the neobanking context, exploring whether loyalty alone is sufficient to drive recommendation behaviours. Therefore, we propose the following hypothesis:

H9

CUL affects NPS in neobanks.

3.10 Customer satisfaction (CUS)

Customer satisfaction (CUS) assesses the level of satisfaction, pleasure, and fulfilment that an individual experiences with a service. The CUS is crucial for the ongoing survival and prosperity of digital banks in today’s fiercely competitive conditions (Khatoon et al. 2020; Duc 2022; Pritjahjono et al. 2023). It is complicated to connect to cutting-edge electronic banking, the success of the organisation, and customer intention. Research undertaken by Chiguvi (2023), Wiharso et al. (2022), and Pritjahjono et al. (2023) suggest that the quality of digital banking platforms, user experience, and ongoing development are factors that might significantly impact customer satisfaction with digital banking services. Customer satisfaction is expected to have a direct impact on Net Promoter Scores because satisfied customers are more likely to recommend the bank to their peers. This hypothesis is rooted in empirical studies that have consistently demonstrated a strong link between customer satisfaction and propensity to engage in positive word-of-mouth. Therefore, we propose the following hypothesis:

H10

CUS affects NPS in neobanks.

4 Research methodology

Convenience sampling provides advantages in terms of ease and efficiency, particularly when focusing on a group such as users of digital banking. This method allowed for survey responder availability and willingness to participate. This is particularly beneficial in studies or situations where time and resources are limited, as highlighted by Bryman and Bell (2015). Convenience sampling was used in this study owing to its cost-effectiveness and practicality (RahiSamar and Ngah 2020). Similar banking studies have used convenience sampling methods (Hussein et al. 2022).

Empirical data were collected using a structured survey instrument designed with care and precision to ensure validity and reliability (Bryman and Bell 2015). A test survey was administered beforehand to check for gaps, accessibility, and readability and to ensure accuracy in the final questionnaire. All questions were written in English, so two professors looked them over to ensure that they made sense and had the proper language and organisation. The proposed corrections were made and the final survey was sent to selected respondents from each sampling stratum to provide input to the questionnaire. By integrating the comments, we enhanced the survey by making the questions clearer and more succinct. Through our survey, it was suggested that each responder chose their primary financial institution from the list of banking institutions with which they have had recent transactions or interactions, which would help to fill out the questionnaire based on their personal experiences.

Our study used the G-Power or inverse square root approach to calculate the minimal sample size as suggested by Kock and Hadaya (2016), as its relevance and significance in banking studies allow researchers to select an appropriate sample size for their studies, proving study conclusions statistically valid and reliable. The G-Power software was used with a significance level of 5% and a minimum path coefficient of 0.2 which yielded a minimum sample size of 155. The survey was open for 4 months (June to September 2023) and was disseminated via personalised Emails, Web Chats (survey links were sent through Chats), and LinkedIn (survey links were sent through LinkedIn Chats and Posts). Previous banking studies have employed Likert-scale scales ranging from 1 to 5. The use of a 5-point Likert scale in banking studies is primarily attributed to its ability to efficiently capture the intensity of respondents’ attitudes and opinions with a balanced range of options, facilitating easier analysis and interpretation (Aslam and Jawaid 2022; Basheer et al. 2022). We collected 421 valid responses across the Delhi NCR region which was considerably greater than the number reported in previous studies (Akhtar et al. 2019), with a 98% response rate (Hussein et al. 2022). The choice of Delhi NCR as the research site in various studies is strategic because of its complex socio-economic landscape and diverse population, making it an ideal setting for examining varied phenomena and underscoring the value of Delhi NCR’s dynamic market environment in generating insights applicable to broader urban settings (Khan et al. 2022).

5 Results

5.1 Demographic details

Based on the customer profile demographic data, our study was conducted, and the results are shown in Table 1.

5.2 Measurement model

Smart PLS is preferred when data do not strictly adhere to multivariate normality, which is a common issue in practical research scenarios. This variance-based SEM tool (Smart PLS) is advantageous for its robustness against non-normal data and its ability to handle smaller sample sizes effectively compared with AMOS, which is a covariance-based SEM tool (Sakaria et al. 2023).

This study used a hypothesised framework and a multi-item reflective construct (Table 2) to ascertain the final output model and its associated features. According to Hair et al. (2010), all results of the factor loadings of the indicators were found to be statistically significant, indicating that they met the requirement of being greater than 0.70. We assessed the model credibility using reliability (CR) and average variance extracted (AVE). Cronbach’s alpha (CA) was used to measure component dependability, according to Hoffmann and Birnbrich (2012), to preserve homogeneity. We found components with consistency > 0.70 (Table 3). The composite reliability (CR) and Cronbach’s alpha (CA) values exceeded 0.70. Our study examined the factor loadings and average variance retrieved to prove convergent validity. Bagozzi and Yi (1988) state that AVE must surpass 0.5 for convergent validity. Tables 4 and 5 show that the construction met or exceeded the standards. We employed the Fornell–Larcker criteria given by Fornell and Larcker (1981) to evaluate validity by comparing the concept variances to their common variances. The model required all constructs to have root levels greater than their inter-correlations. Table 2 shows how we used this strategy to ensure accuracy.

Non-response and Common method bias is a bias in the survey when the proportion of respondents dramatically differs from those who were invited but chose not to participate (Tellis and Chandrasekaran 2010). Regarding survey methods, non-response bias limits the generalisability of the study (Michie and Marteau 1999). According to Ruhl (2004), it is essential to address this issue. The t-test revealed no significant changes. As data are gathered, a common method bias can occur (Podsakoff et al. 2012). The single-factor Harman test evaluates respondents for common method bias (Podsakoff and Organ 1986) and finds no significant changes.

5.3 Structural model

As a continuation of the studied model, we also evaluated the output for structural analysis. Multicollinearity was evaluated using variance inflation factor (VIF) values acquired via the PLS approach. To verify the structural model, we calculated R2, f2, and Q2 values (Tables 5 and 6). The goodness of fit of the model was evaluated using the standardised root mean square residual (SRMR), which is a criterion for PLS-SEM models. An SRMR value of 0.064 was reached, which is a good fit for the model because it is below the threshold of 0.08 based on the guidelines by Henseler et al. (2014). Furthermore, the VIF did not exceed five for either the outer model items (ranging from 1.000 to 3.221) or the inner model pathways (ranging from 1.000 to 3.573), indicating that multicollinearity is not a problem, and the validity of the model has been confirmed (Hair et al, 2014). Our study reflected an F2 value greater than 0.35, indicative of a large effect size, signifying a strong influence of the predictor on the outcome. F-square (effect size) values greater than 1 can be justified in financial studies, especially in contexts involving complex relationships and significant predictor effects. Such values indicate a strong practical significance of predictors in the models, which is particularly relevant in the financial sector (Asni and Agustia 2021). The Q2 coefficient, which was used to determine the level of predictability of the model, was calculated by applying the blindfolding technique, a resampling procedure in the software for PLS. The Q2 value for such a construct as behavioural intention (BIU) was 0.241 which is greater than the threshold of 0.01, implying that the model can predict more than the minimum amount of variance. The effect size interpretation of Hair et al. (2014) suggests that Q2, in this case, indicates a medium effect on the endogenous variable (Fig. 2).

6 Findings and discussion

Hypothesis analysis using PLS-SEM helps identify the specific issues that affect the online brand experience of neobanks and thus their influence on customer loyalty, satisfaction, and Net Promoter Score (NPS). The positive and significant path coefficients (0.125, t = 3.199) in H1 demonstrate that functional quality has a positive impact on OBE in the neobanks. This finding emphasises the role of functional aspects, including app functionality and feature sets, in creating positive online experiences. A path coefficient of 0.088 and a t-value of 3.162 for H2 show a positive effect of information quality on OBE; that is, information that is accurate, timely, and relevant is the key to such an improvement in user experiences. H3 strongly supports that personalisation significantly improves OBE with a substantial path coefficient of 0.486 and a t-value of 16.024. This highlights the importance of personalised customer experience for neobank clients. The support of H4, with a path coefficient of 0.095 and a t-value of 2.261, highlights the role of aesthetics in the online environment that positively influences user perception. H5 reveals that usability positively affects OBE (path coefficient = 0.081, t = 2.601), underlining the importance of user-friendly interfaces in banking apps. H6 is supported (path coefficient = 0.120, t = 3.098), showing that high service quality affects OBE positively, which is essential for customer satisfaction.

Moreover, H7, with a beta value of 0.152 and a t-value of 3.569, is essential as it underscores the importance of effective customer service and support in improving online brand experience. The strong positive impact of online brand experience on customer loyalty, satisfaction, and NPS is indicated by H8a, H8b, and H8c, with very high t-values, emphasising the critical role of OBE in driving these outcomes. H9 was not supported (path coefficient = − 0.156, t = 2.082), indicating that greater loyalty does not necessarily translate into a higher NPS, meaning that other factors could moderate or attenuate this relationship in the context of neobanks. While a t-value greater than 1.96 is a general criterion for statistical significance, the rejection of hypothesis H9 is justified by additional considerations such as adjusted significance thresholds, practical significance, effect size, and model-specific adjustments. The primary reason for the rejection of H9 is not merely the T value but also the direction and magnitude of the path coefficient. In hypothesis H9 (CUL → NPS), the path coefficient is negative (− 0.156), indicating an inverse relationship between Customer Loyalty and Net Promoter Score. A result might be statistically significant (t-value > 1.96) but not practically significant. Therefore, hypothesis rejection also considers the practical implications of the findings (Martinez 2022). Supporting H10, a direct relationship (path coefficient = 0.633, t = 6.56) is established, which means that customer satisfaction significantly affects the NPS. This supports the argument that NPS is a crucial performance metric for neobanks.

For our study to answer research question 1, the results confirm that several CAB factors have a significant effect on OBE. Moreover, all of these constructs, that is, Functional Quality (FUQ), Information Quality (IQU), personalisation (PER), perceived aesthetics (PAE), Perceived Usability (PUS), Service Quality (SEQ), and Customer Service and Support (CSS) have positive effects on OBE which is supported by their significant path coefficients. The general improvement in the online brand experience through different dimensions indicates that when neobanks manage all these factors well, the customer experience is substantially enhanced which makes customers likely to recommend the bank to others. For Research Question 2, the analysis features the mediating effect of customer loyalty and satisfaction on the link between OBE and customer recommendations. The findings reveal a very powerful and positive effect of OBE on both customer loyalty and satisfaction (with highly significant t-values), which are important for increasing the Net Promoter Score (NPS). Similarly, even though customer loyalty tends to promote NPS, it was observed not to have a positive impact on NPS against all odds. However, this also implies that loyalty itself does not lead to higher recommendations unless loyal customers are satisfied or other relevant factors are in place. This fine understanding gives neobanks very important insights into concentrating their strategies not only on loyalty but also on ensuring high customer satisfaction to raise their referrals.

In assessing the neobanking sector, the roles of Customer Loyalty (CUL) and Customer Satisfaction (CUS) are instrumental as mediating variables in the relationship between Online Brand Experience (OBE) and Net Promoter Score (NPS). Empirical evidence suggests that while OBE significantly elevates both CUL and CUS, the translation of these enhancements into NPS is primarily mediated through customer satisfaction rather than loyalty. This finding implies that customer loyalty, while valuable, does not directly correlate with a higher NPS, highlighting that satisfaction is a more critical mediator that effectively translates positive brand experiences into customer recommendations. Such insights are pivotal for neobanks, indicating that strategic initiatives should focus not only on cultivating loyalty but also on ensuring elevated levels of customer satisfaction to optimise the likelihood of customers promoting the bank to their peers. This understanding underscores the importance of designing customer experiences that not only engage but also satisfy, thereby fostering advocacy and enhancing the NPS.

7 Theoretical contribution

Our study contributes theoretically by analysing previous results and proving new correlations that will increase academics’ comprehension of a methodical approach to the OBE. We enhanced this theoretical work by learning more about OBCE. Further generalisation was also added to the OBE relationships. First, based on the study results, we enhance the online brand experience domain, increasing the attention given to online brand experience as a new research area, indicating its growing significance in the virtual marketplace (Quan et al. 2020). This study contributes to the literature on OBE. The results of our study build on comprehensive online consumer interactions within neobanking which is further enhanced by integrating cognitive, emotional, and behavioural factors.

Second, our study builds on previous studies and literature on cognitive-affective-behavioural (CAB) studies (Eagly and Chaiken 1993). Our study contributes to the literature by studying it in the context of Indian neobanks, which has not been researched earlier. This study builds on the model suggested by Chauhan et al. (2022) through a detailed literature review on digital banking. By integrating the cognitive, affective, and behavioural aspects, this study enhances the understanding of online customer and brand interactions within neobanking. Additionally, our study addresses the research gaps in previous research by further exploring the cognitive and affective factors shaping customer behaviour in the banking sector (Raza et al. 2019), where there is a need for interplay between affective orientation, cognitive load, and brand story style in influencing bank preferences (Kao and Wu 2019). Understanding the affective and cognitive factors that hinder banking relationships emphasises the importance of trust and cognitive factors in banking interactions, thus indicating a gap in understanding these factors in the context of customer behaviour (Cuesta González et al. 2022).

8 Managerial contribution

The implications of the study’s results for management in the neobanking industry in India are manifold, with one specific focus on optimising the Online Brand Experience (OBE) to increase consumer advocacy, loyalty, and satisfaction (as measured by the Net Promoter Score). Managers can interpret and respond to the critical variables studied as follows. Personalisation has a significant impact on OBE and needs to prioritise the development of a more individualised banking experience. This may entail the utilisation of consumer data to provide tailored product recommendations, financial guidance, or user interfaces. The objective of personalisation strategies is to foster a sense of recognition and appreciation for the customer as a unique individual. This has the potential to significantly enhance customer engagement and loyalty. Given the correlation between OBE and functional quality, neobanks must prioritise the smooth functioning of their platforms. Managers are responsible for guaranteeing that their IT infrastructure is resilient, experiencing minimal periods of inactivity, and providing cutting-edge capabilities that not only satisfy but surpass customer anticipations.

Service quality and consumer support are vital to the OBE. Managers should allocate resources for the training of customer service teams to guarantee prompt, efficient, and compassionate reactions to customer concerns and enquiries. Incorporating customer feedback into service enhancements can also contribute to maintaining superior service quality standards. High-quality, accurate, timely, and relevant information contributes to the OBE. Managers should ensure that all customer-facing information, whether on the website, mobile apps, or through customer service channels, is clear and useful. This can involve maintaining an informative blog, sending regular financial tips, and providing clear information on products and services. The results highlight the importance of aesthetics and usability in OBE. Managers should focus on the user interface and experience design of digital platforms, ensuring that they are not only visually appealing but also intuitive and easy to navigate. This can lead to higher user satisfaction and a better overall brand experience.

OBE’s influence of OBE on customer loyalty and satisfaction underscores the need for managers to focus on creating positive experiences at every touch point. Loyal and satisfied customers are more likely to continue using the service and may become brand advocates. Although customer loyalty does not show a strong direct correlation with NPS, customer satisfaction does so. Thus, managers should concentrate on converting satisfied customers into promoters by incentivising referrals and sharing positive experiences. They should also explore why loyal customers may not promote banks, and develop strategies to address these barriers.

9 Limitations and future studies

This study had certain limitations that should be noted. The use of the convenience sample approach raises issues regarding the generalisability of the results to the full community of neobank users, as it may not adequately reflect the variety seen in larger demographics. Furthermore, it is worth noting that although the cross-sectional design of the study provides valuable insights at a particular point in time, it does not account for the temporal aspect required to assess alterations in consumer perceptions and behaviours over prolonged durations. Given the time constraints of this study, it is possible that it did not fully capture the changing dynamics of customer brand interactions in the emerging neobanking sector. Since Indian neobanks are under scrutiny, this raises questions about whether these findings can be applied to legal environments in other countries. To overcome these limitations, future research could use designs to track changes over time using ranked sampling for a more representative sample and expand the scope to include comparative analyses across various countries or regions. By adopting this approach, we can gain an understanding of all the factors involved and develop a universal view of the global neobanking landscape. Further investigation could also explore how technological advancements and evolving consumer preferences impact brand experiences. These insights would provide information about where neobanking services might be headed and how customer interaction methods may evolve in the future.

10 Conclusion

This study has significantly advanced our understanding of the Online Brand Experience (OBE) in the Indian neobanking sector through a comprehensive study of how cognitive, affective, and behavioural factors influence customer perceptions and behaviours. Our findings demonstrate the substantial impact of functional quality, information quality, personalisation, perceived aesthetics, perceived usability, service quality, and customer service and support on enhancing OBE. These elements collectively contribute to improving customer loyalty and satisfaction, which are crucial for increasing the Net Promoter Score (NPS).

The research confirmed that, while all tested constructs positively affect OBE, the most profound influence arises from personalisation, indicating that custom-tailored experiences are particularly significant in the digital banking environment. This highlights the importance of investing in advanced data analytics and AI technologies to offer personalised services that meet individual customer needs and preferences. Interestingly, our study also revealed that, while OBE strongly predicts customer loyalty and satisfaction, customer loyalty does not directly correlate with a higher NPS. This suggests that satisfaction plays a more critical role in influencing whether customers would recommend the bank to others. Thus, neobanks need to focus not only on loyal customers but also on ensuring that they are satisfied and willing to act as brand advocates.

References

Abu-Snoubar TK, Aldowkat I, Al-Shboul Y, Atiyat MA, Al-Hyari HS (2022) The attitudes of Jordanian english language and literature undergraduate students toward open-book exams. Front Educ. https://doi.org/10.3389/feduc.2022.1050587

Akhtar S, Irfan M, Sarwar A, Asma, Rashid QU (2019) Factors influencing individuals’ intention to adopt mobile banking in China and Pakistan: the moderating role of cultural values. J Public Aff. https://doi.org/10.1002/pa.1884

Alfarizi M (2023) Interaction of customer satisfaction and retention of digital services: PLS evidence from Indonesian Sharia banking. Int J Islamic Econ Finance. https://doi.org/10.18196/ijief.v6i1.16824

Aniqoh NAFA, Nihayah AZ, Amalia F (2022) The role of digital banking industry towards consumer behavior during the COVID 19. J Digital Mark Halal Ind 4(2):75–88. https://doi.org/10.21580/jdmhi.2022.4.2.13378

Ashrafpour N, Esfahlan HN, Aali S, Taghizadeh H (2021) The prerequisites and consequences of customers’ online experience regarding the moderating role of brand congruity: evidence from an Iranian bank. J Islamic Mark 13(10):2144–2172. https://doi.org/10.1108/jima-09-2020-0277

Aslam W, Jawaid ST (2022) Green banking adoption practices: improving environmental, financial, and operational performance. Int J Ethics Syst 39(4):820–840. https://doi.org/10.1108/ijoes-06-2022-0125

Asni N, Agustia D (2021) The mediating role of financial performance in the relationship between green innovation and firm value: evidence from ASEAN countries. Eur J Innov Manag 25(5):1328–1347. https://doi.org/10.1108/ejim-11-2020-0459

Ayadurai C, Joneidy S (2021) Artificial intelligence and bank soundness: a done deal?—Part 1. IntechOpen eBooks. https://doi.org/10.5772/intechopen.95539.

Babarınde GF, Gidigbi MO, Ndaghu JT, Abdulmajeed I (2020) Digital finance and the future of nigerian banking system: a review. Nile J Bus Econ 6(16):24–35. https://doi.org/10.20321/nilejbe.v6i16.02

Baek E, Choo HJ, Wei X, Yoon SY (2020) Understanding the virtual tours of retail stores: how can store brand experience promote visit intentions? Int J Retail Distrib Manag 48(7):649–666. https://doi.org/10.1108/ijrdm-09-2019-0294

Bagozzi RP, Yi Y (1988) On the evaluation of structural equation models. J Acad Mark Sci 16(1):74–94. https://doi.org/10.1007/bf02723327

Basheer MF, Hameed WU, Zarooni MIMAA, Raoof R, Sattar J (2022) Role of corporate social responsibility, management practices, organizational behavior in social equity with mediating role of women empowerment: a study of the Islamic banking sector of South Punjab. Front Psychol. https://doi.org/10.3389/fpsyg.2022.926169

Beldad AD, Hegner SM (2017) Expanding the technology acceptance model with the inclusion of trust, social influence, and health valuation to determine the predictors of german users’ Willingness to Continue using a Fitness App: A Structural Equation Modeling Approach. Inter J Human–Computer Interact 34(9):882–893. https://www.tandfonline.com/doi/full/10.1080/10447318.2017.1403220

Brakus JJ, Schmitt BH, Zarantonello L (2009) Brand experience: what is it? How is it measured? Does it affect loyalty? J Mark 73(3):52–68. https://doi.org/10.1509/jmkg.73.3.52

Bravo R, Martínez E, Pina JM (2019) Effects of customer perceptions in multichannel retail banking. Int J Bank Mark 37(5):1253–1274. https://doi.org/10.1108/ijbm-07-2018-0170

Bryman and Bell (2015) https://www.scirp.org/(S(351jmbntvnsjt1aadkozje))/reference/referencespapers.aspx?referenceid=2525658

Budiati Y, Untoro W, Wahyudi L, Harsono M (2021) The mediating effect of strategy on entrepreneurial orientation and performance. J Res Mark Entrep 24(1):1–22. https://doi.org/10.1108/jrme-05-2020-0048

Calvo-Porral C, Lévy-Mangín J-P (2020) An emotion-based segmentation of bank service customers. Int J Bank Mark 38(7):1441–1463. https://doi.org/10.1108/ijbm-05-2020-0285

Chang K, Kuo N-T, Hsu C, Cheng Y-S (2014) The impact of website quality and perceived trust on customer purchase intention in the hotel sector: website brand and perceived value as moderators. Int J Innov Manag Technol. https://doi.org/10.7763/ijimt.2014.v5.523

Chauhan S, Akhtar A, Gupta A (2022) Customer experience in digital banking: a review and future research directions. Int J Qual Serv Sci 14(2):311–348. https://doi.org/10.1108/ijqss-02-2021-0027

Chiguvi D (2023) Analysis of the effectiveness of e-customer service platforms on customer satisfaction at ABSA, Botswana. Int J Res Bus Soc Sci 12(1):57–71. https://doi.org/10.20525/ijrbs.v12i1.2283

Chih W, Hsu L-C, Ortiz J (2020) The antecedents and consequences of the perceived positive eWOM review credibility. Ind Manag Data Syst 120(6):1217–1243. https://doi.org/10.1108/imds-10-2019-0573

Choi L, Burnham TA (2020) Brand reputation and customer voluntary sharing behavior: the intervening roles of self-expressive brand perceptions and status seeking. J Prod Brand Manag 30(4):565–578. https://doi.org/10.1108/jpbm-12-2019-2670

Choudhury A (2022) Toward an ecologically valid conceptual framework for the use of artificial intelligence in clinical settings: need for systems thinking, accountability, decision-making, trust, and patient safety considerations in safeguarding the technology and clinicians. JMIR Hum Factors 9(2):e35421. https://doi.org/10.2196/35421

de la Cuesta-González M, Fernandez-Olit B, Orenes-Casanova I, Paredes-Gazquez J (2022) Affective and cognitive factors that hinder the banking relationships of economically vulnerable consumers. Int J Bank Mark 40(7):1337–1363. https://doi.org/10.1108/ijbm-10-2021-0491

Deswanto V (2020) Satisfaction of using mobile banking in islamic banks: TTF and information quality perspective. IEEE. https://doi.org/10.4108/eai.26-3-2019.2290688

Dodds S, Russell-Bennett R, Chen T, Oertzen A-S, Salvador-Carulla L, Hung YY (2022) Blended human-technology service realities in healthcare. J Serv Theory Pract 32(1):75–99. https://doi.org/10.1108/jstp-12-2020-0285

Duc PM (2022) Customer satisfaction in digital banking sector in Vietnam: a meta-case approach. Telos 24(3):819–836. https://doi.org/10.36390/telos243.22

Eagly and Chaiken (1993) https://psycnet.apa.org/record/1992-98849-000

Erobathriek A, Pangaribuan CH, Princes E (2023) Social media marketing activities to tie-in brand commitment: a brand experience mediation. IEEE. https://doi.org/10.1109/icimtech59029.2023.10278053

Fathima A, Khan A, Alam AS (2022) Relationship of the theory of consumption values and flow with online brand experience: a study of young consumers. J Int Commer 22(4):509–537. https://doi.org/10.1080/15332861.2022.2109876

Festerling J, Siraj I, Malmberg L (2022) Exploring children’s exposure to voice assistants and their ontological conceptualizations of life and technology. AI Soc. https://doi.org/10.1007/s00146-022-01555-3

Fornell C, Larcker DF (1981) Evaluating structural equation models with unobservable variables and measurement error. J Mark Res 18(1):39. https://doi.org/10.2307/3151312

Gartner WC (1994) Image formation process. J Travel Tour Mark 2(2–3):191–216. https://doi.org/10.1300/j073v02n02_12

Gichuhi RKPGD (2020) Influence of technology usability on digital banking adoption by customers of selected commercial banks in Nakuru Town, Kenya. Editon Consort J Econ Dev Stud 1(1):28–39. https://doi.org/10.51317/ecjeds.v1i1.68

Ha H, Perks H (2005) Effects of consumer perceptions of brand experience on the web: brand familiarity, satisfaction and brand trust. J Consum Behav 4(6):438–452. https://doi.org/10.1002/cb.29

Hair JF, Sarstedt M, Hopkins L, Kuppelwieser VG (2014) Partial least squares structural equation modeling (PLS-SEM). Eur Bus Rev 26(2):106–121. https://doi.org/10.1108/ebr-10-2013-0128

Hair et al. (2010) https://www.scirp.org/reference/ReferencesPapers?ReferenceID=1841396

Hamzah ZL, Alwi SFS, Othman N (2014) Designing corporate brand experience in an online context: a qualitative insight. J Bus Res 67(11):2299–2310. https://doi.org/10.1016/j.jbusres.2014.06.018

Henseler J, Ringle CM, Sarstedt M (2014) A new criterion for assessing discriminant validity in variance-based structural equation modeling. J Acad Mark Sci 43(1):115–135. https://doi.org/10.1007/s11747-014-0403-8

Herington CA, Weaven S (2009) E-retailing by banks: e-service quality and its importance to customer satisfaction. Eur J Mark 43(9/10):1220–1231. https://doi.org/10.1108/03090560910976456

Ho SPS, Chow MYC (2023) The role of artificial intelligence in consumers’ brand preference for retail banks in Hong Kong. J Financ Serv Mark. https://doi.org/10.1057/s41264-022-00207-3

Hoffmann AOI, Birnbrich C (2012) The impact of fraud prevention on bank-customer relationships. Int J Bank Mark 30(5):390–407. https://doi.org/10.1108/02652321211247435

Holbrook MB, Hirschman EC (1982) The experiential aspects of consumption: consumer fantasies, feelings, and fun. J Consumer Res 9(2):132. https://doi.org/10.1086/208906

Hsiao C (2020) Understanding content sharing on the internet: test of a cognitive-affective-conative model. Online Inf Rev 44(7):1289–1306. https://doi.org/10.1108/oir-11-2019-0350

Huang Y, Lyu J, Xue X, Peng K (2020) Cognitive basis for the development of aesthetic preference: Findings from symmetry preference. PLoS ONE 15(10):e0239973. https://doi.org/10.1371/journal.pone.0239973

Hussein AS, Sumiati S, Hapsari R, Bakar JA (2022) Bank 4.0 experiential quality and customer loyalty: a serial mediating role of customer trust and engagement. TQM J 35(7):1706–1721. https://doi.org/10.1108/tqm-11-2021-0344

Islam JU, Shahid S, Rasool A, Rahman Z, Khan I, Rather RA (2020) Impact of website attributes on customer engagement in banking: a solicitation of stimulus-organism-response theory. Int J Bank Mark 38(6):1279–1303. https://doi.org/10.1108/ijbm-12-2019-0460

Jiang W, Lin Z, Liu X, Xiao S, Li Y (2020) The interaction effects of online reviews, brand, and price on consumer hotel booking decision making. J Travel Res 60(4):846–859. https://doi.org/10.1177/0047287520912330

Johnson AR, Stewart DW (2005) A reappraisal of the role of emotion in consumer behaviour. In: Review of marketing research, pp 3–34. https://doi.org/10.1108/s1548-6435(2004)0000001005

Kaabachi S, Mrad SB, Fiedler A (2019) The moderating effect of e-bank structure on French consumers’ trust. Int J Bank Mark 38(2):501–528. https://doi.org/10.1108/ijbm-04-2019-0119

Kantika K, Kurniasari F, Mulyono M (2022) The factors affecting digital bank services adoption using trust as mediating variable. J Bus Manag Rev 3(10):690–704. https://doi.org/10.47153/jbmr310.4882022

Kao DT, Wu P-H (2019) The impact of affective orientation on bank preference as moderated by cognitive load and brand story style. Int J Bank Mark 37(5):1334–1349. https://doi.org/10.1108/ijbm-09-2018-0238

Kapoor S, Bfsi E (2022) Millennials to drive accelerated growth for Neobanks in India: Report, ETBFSI.com. https://bfsi.economictimes.indiatimes.com/news/banking/millennials-to-drive-accelerated-growth-for-neobanks-in-india-report/93194520

Keiningham TL et al (2020) Customer experience driven business model innovation. J Bus Res 116:431–440. https://doi.org/10.1016/j.jbusres.2019.08.003

Keisidou E, Sarigiannidis L, Maditinos DI, Thalassinos EI (2013) Customer satisfaction, loyalty and financial performance: A holistic approach of the Greek banking sector. Int J Bank Mark 31(4):259–288. https://doi.org/10.1108/IJBM-11-2012-0114

Khan I (2023) Customer engagement outcomes in mobile applications: Self-congruence as a moderator. J Retail Consum Serv 75:103497. https://doi.org/10.1016/j.jretconser.2023.103497

Khan I, Rahman Z, Fatma M (2016) The role of customer brand engagement and brand experience in online banking. Int J Bank Mark 34(7):1025–1041. https://doi.org/10.1108/ijbm-07-2015-0110

Khan I, Hollebeek LD, Fatma M, Islam JU, Rahman Z (2019) Brand engagement and experience in online services. J Serv Mark J Serv Mark 34(2):163–175. https://doi.org/10.1108/jsm-03-2019-0106

Khan MA, Vivek, Minhaj SM, Saifi MA, Alam S, Hasan A (2022) Impact of store design and atmosphere on shoppers’ purchase decisions: an empirical study with special reference to Delhi-NCR. Sustainability 15(1):95. https://doi.org/10.3390/su15010095

Khatoon S, Zhou X, Hussain H (2020) The mediating effect of customer satisfaction on the relationship between electronic banking service quality and customer purchase intention: evidence from the Qatar banking sector. SAGE Open 10(2):215824402093588. https://doi.org/10.1177/2158244020935887

Kock N, Hadaya P (2016) Minimum sample size estimation in PLS-SEM: the inverse square root and gamma-exponential methods. ISJ Inf Syst J 28(1):227–261. https://doi.org/10.1111/isj.12131

Koya K, Consultants VM, Jones DR (2021) A path of roses and financial literacy: exploring the usability of UK’s digital banking services to improve younger adult adoption. IEEE. https://doi.org/10.1145/3449365.3449369

Krasonikolakis I, Tsarbopoulos M, Eng T (2020) Are incumbent banks bygones in the face of digital transformation? J Gen Manag 46(1):60–69. https://doi.org/10.1177/0306307020937883

Krishna A (2011) An integrative review of sensory marketing: engaging the senses to affect perception, judgment and behavior. J Consum Psychol 22(3):332–351. https://doi.org/10.1016/j.jcps.2011.08.003

Kulkarni N (2022) Brand usability- as one of the elements of halo effect in case of online banking industry. IEEE. https://doi.org/10.1109/iihc55949.2022.10060589

Kumalasari RAD, Permanasari KI, Karismariyanti M, Munandar DR (2022) Mobile Banking: system quality, information quality, service quality, customer satisfaction and loyalty. J Ad’ministrare 9(1):141. https://doi.org/10.26858/ja.v9i1.33951

Kumar R, Singh R, Kumar K, Khan S, Corvello V (2023) How does perceived risk and trust affect mobile banking adoption? Empirical evidence from India. Sustainability 15(5):4053. https://doi.org/10.3390/su15054053

Lacap JPG (2022) Exploring mobile wallet adoption in the Philippines: a partial least squares path modelling approach. Int Halal Sci Technol Conf 15(1):14–23. https://doi.org/10.31098/ihsatec.v15i1.590

Lee S, Jeong M-Y (2014) Enhancing online brand experiences: an application of congruity theory. Int J Hosp Manag 40:49–58. https://doi.org/10.1016/j.ijhm.2014.03.008

Li Z, Zhang D, Zhang Q, Liu X (2022) Constructing online destination brand experience and bilateral behavioral intentions: a sensory conduction perspective. Curr Issue Tour 26(20):3364–3380. https://doi.org/10.1080/13683500.2022.2122782

Liu et al (2020) Effects of information quality on information adoption on social media review platforms: moderating role of perceived risk. Data Sci Manage 1(1):13–22. https://doi.org/10.1016/j.dsm.2021.02.004

Loureiro SMC, Sarmento EM (2018) Enhancing brand equity through emotions and experience: the banking sector. Int J Bank Mark 36(5):868–883. https://doi.org/10.1108/ijbm-03-2017-0061

Mahmoud AE, Abdelbaki OF (2019) Behavioral intentions and cognitive-affective effects of exposure to YouTube advertisements among college students. Al-MağAllah Al-ʿilm Iyyaẗ Li-BuḥŪṮ Al-ʿilāQāT Al-ʿāMaẗ Wa Al-IʿlāN 2019(18):1–21. https://doi.org/10.21608/sjocs.2019.147764.

Majorel (2022) Teleperformance. https://www.majorel.com/how-we-can-help/customer-experience-cx-for-fintechs-neobanks-solution/

Manoharan S, Katuk N, Hassan S, Ahmad R (2021) To click or not to click the link: the factors influencing internet banking users’ intention in responding to phishing emails. Inf Comput Secur 30(1):37–62. https://doi.org/10.1108/ics-04-2021-0046

Marliawati A, Cahyaningdyah D (2020) Impacts the brand of experience and brand image on brand loyalty: mediators brand of trust. Deleted J 9(2):140–151. https://doi.org/10.15294/maj.v9i2.36945

Martínez CV, Antonetti P, Crisafulli B (2022) Emotions and consumers’ adoption of innovations: an integrative review and research agenda. Technol Forecast Soc Change 179:121609. https://doi.org/10.1016/j.techfore.2022.121609

Mbama CI, Ezepue PO, Alboul L, Beer M (2018) Digital banking, customer experience and financial performance. J Res Interact Mark 12(4):432–451. https://doi.org/10.1108/jrim-01-2018-0026

Michie S, Marteau TM (1999) Non-response bias in prospective studies of patients and health care professionals. Int J Soc Res Methodol 2(3):203–212. https://doi.org/10.1080/136455799295014

Mogaji E, Adeola O, Hinson RE, Nguyen NP, Nwoba AC, Soetan TO (2021) Marketing bank services to financially vulnerable customers: evidence from an emerging economy. Int J Bank Mark 39(3):402–428. https://doi.org/10.1108/ijbm-07-2020-0379

Moosa HAA, Mousa M, Chaouali W, Hammami SM, McKnight H, Danks NP (2021) Using humanness and design aesthetics to choose the ‘best’ type of trust: a study of mobile banking in France. Int J Retail Distrib Manag 50(2):251–275. https://doi.org/10.1108/ijrdm-04-2021-0159

Morgan-Thomas A, Veloutsou C (2013) Beyond technology acceptance: brand relationships and online brand experience. J Bus Res 66(1):21–27. https://doi.org/10.1016/j.jbusres.2011.07.019

Mostafa RB, Kasamani T (2020) Brand experience and brand loyalty: is it a matter of emotions? Asia Pac J Mark Logist 33(4):1033–1051. https://doi.org/10.1108/apjml-11-2019-0669

Narteh B (2018) Service quality and customer satisfaction in Ghanaian retail banks: the moderating role of price. Int J Bank Mark 36(1):68–88. https://doi.org/10.1108/ijbm-08-2016-0118

NewsDirect (2022) News Direct. https://newsdirect.com/news/us-banking-industry-challenges-galore-as-customer-experience-cx-issues-are-demanding-attention-849421520

Octavia R, Rahmawati A, Shafitranata S (2023) The effect of consumer brand engagement on online brand experience and its consequences on banking apps service. J Econ Bus Account Vent 26(1):1. https://doi.org/10.14414/jebav.v26i1.3461

Oliver RL (1999) Whence consumer loyalty? J Mark 63:33. https://doi.org/10.2307/1252099

Ong KS, Nguyen B, Alwi SFS (2017) Consumer-based virtual brand personality (CBVBP), customer satisfaction and brand loyalty in the online banking industry. Int J Bank Mark 35(3):370–390. https://doi.org/10.1108/ijbm-04-2016-0054

Podsakoff PM, Organ DW (1986) Self-reports in organizational research: problems and prospects. J Manag 12(4):531–544. https://doi.org/10.1177/014920638601200408

Podsakoff PM, MacKenzie SB, Podsakoff NP (2012) Sources of method bias in social science research and recommendations on how to control it. Annu Rev Psychol 63(1):539–569. https://doi.org/10.1146/annurev-psych-120710-100452

Prathomo and Magetsari NA (2018) Available: https://journal.unnes.ac.id/nju/index.php/jdm/article/view/15192

Pritjahjono P, Jahroh S, Saptono IT (2023) The effect of customer loyalty in digital banking services: role satisfaction factor, customer experience and EWOM. Indones J Bus Entrep. https://doi.org/10.17358/ijbe.9.1.129

Purohit S, Hollebeek LD, Das M, Sigurðsson V (2023) The effect of customers’ brand experience on brand evangelism: the case of luxury hotels. Tour Manag Perspect 46:101092. https://doi.org/10.1016/j.tmp.2023.101092

Quan NH, Khanh NT, Nhung DTH, Ngân NTK, Phong LT (2020) The influence of website brand equity, e-brand experience on e-loyalty: the mediating role of e-satisfaction. Manag Sci Lett. https://doi.org/10.5267/j.msl.2019.8.015

Rafif et al (2022). https://www.emerald.com/insight/content/doi/10.1108/IJSMS-03-2017-0018/full/html

Rahi S, Ghani MA, Ngah AH (2020) Factors propelling the adoption of internet banking: the role of e-customer service website design brand image and customer satisfaction. Int J Bus Inf Syst 33(4):549. https://doi.org/10.1504/ijbis.2020.105870

Rahman MS, Mannan M (2018) Consumer online purchase behavior of local fashion clothing brands. J Fash Mark Manag 22(3):404–419. https://doi.org/10.1108/jfmm-11-2017-0118

Rather RA, Hollebeek LD, Vo-Thanh T, Ramkissoon H, Leppiman A, Smith DL (2022) Shaping customer brand loyalty during the pandemic: the role of brand credibility, value congruence, experience, identification, and engagement. J Consum Behav 21(5):1175–1189. https://doi.org/10.1002/cb.2070

Raza SA, Shah N, Ali M (2019) Acceptance of mobile banking in Islamic banks: evidence from modified UTAUT model. J Islamic Mark 10(1):357–376. https://doi.org/10.1108/jima-04-2017-0038

Reichheld FF (2023) The one number you need to grow. https://www.nashc.net/wp-content/uploads/2014/10/the-one-number-you-need-to-know.pdf

Rose S, Clark M, Samouel P, Hair N (2012) Online customer experience in e-retailing: an empirical model of antecedents and outcomes. J Retail 88(2):308–322. https://doi.org/10.1016/j.jretai.2012.03.001

Roy NC, Prabhakaran S (2022) Internal-led cyber frauds in Indian banks: an effective machine learning–based defense system to fraud detection, prioritization and prevention. Aslib J Inf Manag 75(2):246–296. https://doi.org/10.1108/ajim-11-2021-0339

Ruhl K (2004) Qualitative research practice: a guide for social science students and researchers. https://www.ssoar.info/ssoar/handle/document/5028

Rust RT, Inman JJ, Jia J, Zahorik AJ (1999) What you don’t know about Customer-PErceived quality: the role of customer expectation distributions. Mark Sci 18(1):77–92. https://doi.org/10.1287/mksc.18.1.77

Sadek H, Mehelmi HE (2020) Customer brand engagement impact on brand satisfaction, loyalty, and trust in the online context Egyptian banking sector. J Bus Retail Manag Res. https://doi.org/10.24052/jbrmr/v14is03/art-033

Safeer AA, Le TT (2023) Transforming customers into evangelists: influence of online brand experience on relationship quality and brand evangelism in the banking industry. Asia Pac J Mark Logist 35(12):2947–2964. https://doi.org/10.1108/apjml-12-2022-1018

Sakaria D, Maat SM, Matore MEEM (2023) Examining the optimal choice of SEM statistical software packages for Sustainable mathematics education: a systematic review. Sustainability 15(4):3209. https://doi.org/10.3390/su15043209

Sakib SMN (2022) The role of experience in the digital age and its purpose in the value creation process. IEEE. https://doi.org/10.31219/osf.io/vh7gz

Sampurna PA, Miranti T (2022) The effect of service quality, banking digitalization, and customer relationship management (CRM) on customer loyalty. J Maksipreneur Manaj Kop Dan Entrepr 12(1):303. https://doi.org/10.30588/jmp.v12i1.1138

Sánchez et al (2009) Testing a hierarchical and integrated model of quality in the service sector: functional, relational, and tangible dimensions. Total Qual Manag Business Excellence 20(11):1173–1188. https://doi.org/10.1080/14783360903247577

Sardar S, Anjaria K (2023) The future of banking: how neo banks are changing the industry. Int J Manag Public Policy Res 2(2):32–41. https://doi.org/10.55829/ijmpr.v2i2.153

Sati M, Sharma N (2023) Understanding customer satisfaction in Indian banking industry using Kano’s model. IEEE. https://doi.org/10.4108/eai.16-12-2022.2326202

Shobeiri S, Mazaheri E, Laroche M (2014) Improving customer website involvement through experiential marketing. Serv Ind J 34(11):885–900. https://doi.org/10.1080/02642069.2014.915953

Shukla P, Shamurailatpam SD (2022) Conceptualizing the use of artificial intelligence in customer relationship management and quality of services, In: Advances in marketing, customer relationship management, and e-services book series, pp 177–201. https://doi.org/10.4018/978-1-7998-7959-6.ch012

Statista (2021) Neobanking—Worldwide | Statista market forecast, Statista. https://www.statista.com/outlook/dmo/fintech/neobanking/worldwide

Syahputra ZE, Adam M, Putra TRI (2022) The effect of consumer experience and brand trust on e-market place repurchase intention and its impact on consumer loyalty: case study after tokopedia merger become goto. Int J Sci Manag Res 05(12):84–96. https://doi.org/10.37502/ijsmr.2022.51207

Tellis GJ, Chandrasekaran D (2010) Extent and impact of response biases in cross-national survey research. Int J Res Mark 27(4):329–341. https://doi.org/10.1016/j.ijresmar.2010.08.003

Tiwari P (2023) Effect of innovation practices of banks on customer loyalty: an SEM-ANN approach. Benchmarking 30(10):4536–4568. https://doi.org/10.1108/bij-06-2022-0392

Tsai J, Lu T (2023) Is brand reputation a banner for social marketing? A social enterprise product consumption perspective. Psychol Mark 40(10):2041–2059. https://doi.org/10.1002/mar.21870

Tumewah E, Kurniawan Y (2020) The effect of M-Banking service quality and customer perceived value to satisfaction and loyalty of Bank XYZ customers. Int J Manag Humanit 4(6):132–138. https://doi.org/10.35940/ijmh.f0634.024620

Tимoxинa ГC et al (2021) Digital customer experience mapping in Russian premium banking. Economies 9(3):108. https://doi.org/10.3390/economies9030108

Van Klyton A, Mesías JFT, Castaño-Muñoz W (2021) Innovation resistance and mobile banking in rural Colombia. J Rural Stud 81:269–280. https://doi.org/10.1016/j.jrurstud.2020.10.035

Verma N, Kaur M (2023) Examining the relationship among customer experience, bank image, and trust: a multichannel banking perspective. J Glob Mark 36(2):141–164. https://doi.org/10.1080/08911762.2023.2188508

Wiharso G, Basudani WA, Simamora VT, Mulyadi H (2022) Digital banking: assessing customer satisfaction through product quality. Dinasti Int J Econ Finance Account 3(4):412–418. https://doi.org/10.38035/dijefa.v3i4.1436

Wong A, Hung YY (2022) Love the star, love the team? The spillover effect of athlete sub brand to team brand advocacy in online brand communities. J Prod Brand Manag 32(2):343–359. https://doi.org/10.1108/jpbm-01-2022-3824

Wong KH, Chang HH, Yeh CH (2019) The effects of consumption values and relational benefits on smartphone brand switching behavior. Inf Technol People 32(1):217–243. https://doi.org/10.1108/itp-02-2018-0064

Xie Y, Zhou R, Wang X, Tan B-C (2023) Digital marketing: develop the scales for measuring brand experience in the digital economy. Lect Notes Comput Sci. https://doi.org/10.1007/978-3-031-48060-7_42

Yasin MM, Porcu L, Liébana-Cabanillas F (2019) The Effect of brand experience on customers’ engagement behavior within the context of online brand communities: the impact on intention to forward online company-generated Content. Sustainability 11(17):4649. https://doi.org/10.3390/su11174649

Yasin MM, Liébana-Cabanillas F, Porcu L, Kayed RN (2020) The role of customer online brand experience in customers’ intention to forward online company-generated content: the case of the Islamic online banking sector in Palestine. J Retail Consum Serv 52:101902. https://doi.org/10.1016/j.jretconser.2019.101902

Zhu Y, Chen H (2012) Service fairness and customer satisfaction in internet banking. Internet Res 22(4):482–498. https://doi.org/10.1108/10662241211251006

Zhu T, Park SK (2022) Encouraging brand evangelism through failure attribution and recovery justice: the moderating role of emotional attachment. Front Psychol. https://doi.org/10.3389/fpsyg.2022.877446

Zouari G, Abdelhedi M (2021) Customer satisfaction in the digital era: evidence from Islamic banking. J Innov Entrep. https://doi.org/10.1186/s13731-021-00151-x

Funding

The authors did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflicts of interest relevant to the content of this article. This research did not receive any specific grants from funding agencies in the public, commercial, or not-for-profit sectors.

Informed consent

Not applicable as this study did not involve human participants.

Research involving human and animal participants

This research did not involve any human participants or animals. Therefore, no approval was obtained from the ethics committee. This study strictly adhered to the principles outlined in the Declaration of Helsinki.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1

Appendix 1

Construct | Items | Survey questionnaire |

|---|---|---|

Functional Quality (FUQ) Sánchez et al. (2009) | FUQ1 | The neobank’s app/website always provides the banking services I need |

FUQ2 | Transactions through the neobank are processed without any errors | |

FUQ3 | The neobanking services are available whenever I need them | |

Information Quality (IQU) | IQU1 | The information provided by the neobank is always accurate |

IQU2 | The neobank’s app/website provides information that is just sufficient for my banking needs | |

IQU3 | The information available on the neobank’s platforms is always current and up-to-date | |

Personalisation (PER) Kumar et al. (2023) | PER1 | The neobank offers personalized banking products and services that suit my needs |

PER2 | I receive personalized financial advice that is relevant to my financial situation | |

PER3 | The neobank’s app/website personalizes my experience based on my past interactions | |

Perceived Aesthetics (PAE) Huang et al. (2020) | PAE1 | The design of the neobank’s app/website is visually appealing to me |

PAE2 | The visual design of the neobank’s interface makes it stand out compared to other banks | |

PAE3 | The aesthetic aspects of the neobank’s app/website make it pleasant to use | |

Perceived Usability (PUS) Parasuraman, Zeithaml and Malhotra (2005) | PUS1 | I find the neobank’s app/website easy to use |

PUS2 | I can complete my banking tasks quickly using the neobank’s app/website | |

PUS3 | Learning to operate the neobank’s app/website was easy for me | |

Service Quality (SEQ) Zeithaml (1988) | SEQ1 | The customer support from the neobank promptly addresses and resolves my issues |

SEQ2 | I am satisfied with the level of competence of the neobank’s customer service team | |

SEQ3 | The neobank consistently meets my expectations in terms of service quality | |

Customer Service and Support (CSS) Zeithaml, Berry, & Parasuraman, 1993 | CSS1 | When I have a problem, the neobank’s customer service is supportive and helpful |

CSS2 | The customer service team of the neobank is always accessible when I need them | |

CSS3 | The neobank’s customer support provides clear and understandable information to my inquiries | |

Online Brand Experience (OBE) Morgan-Thomas and Veloutsou (2013) | OBE1 | The web page layout of the neobank is appealing |

OBE2 | The content on the neobank website is always up-to-date | |