Abstract

Globally, governments provide significant tax incentives to business enterprises for research and development (R&D) expenditure to foster innovation. Several fiscal incentives are provided to firms registered under India’s department of scientific and industrial research (DSIR). India provided a super deduction of 200% on R&D expenses in 2011, reduced to 150% in 2016 and 100% in 2020. The study uses firm-level data to test the effectiveness of incentives offered in India and analyze the impact of the rationalization of super deduction. For the study, the difference in difference analysis is done to evaluate the changes in the outcome variables: total, current, and capital R&D expenditures. The treatment group is the firms registered under DSIR. The results show a significant impact of the mix of tax incentives provided on both current and capital expenditures. The super deduction significantly impacted only current expenses and not capital expenditures. The administrative costs under current expenditures are easier to relabel than capital expenditures. The study shows that the overly generous regime incentivized firms to relabel their non-R&D costs as R&D expenses for profiteering. The study supports the move to reduce the super deduction.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Business enterprises' expenditures on Research and Development (R&D) play a critical role in promoting innovation. Joseph Schumpeter described innovation as “Creative Destruction” and identified it as a key to economic growth (Schumpeter 1962). Additionally, Endogenous growth theories have emphasized the significance of innovation and technological advancement for growth. (Lucas 1988; Romer 1990). Recent studies have also shown that innovation promotes firm-level competitiveness (Bacinello et al. 2020; Qiu et al. 2020; Suat and San 2019). A vast literature has shown that innovation increases productivity (Griliches 1958, 1980; Mansfield 1965; Griliches et al. 1984; Mansfield 1984; Mun et al. 1991; Nadiri and Kim 1996; Frantzen 1998; Aghion and Howitt 1998; Klette & Kortum 2002).

Firms' lack of investment in R&D is caused by financial limitations and variations in social and private returns. As a result, governments have been motivated to step in and offer incentives to encourage more R&D investment. (Nelson 1959; Arrow 1962; Aghion and Howitt 1992; Jaffe 1996; Hausmann et al. 2003; Rodrik 2004a, b.)

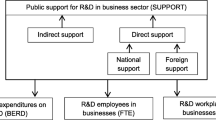

Many countries use R&D tax incentives as policy tools. These incentives can lower the cost of R&D, and are known as input-based incentives. Examples include Tax Deferrals, Allowances, Credits, Concessional Import Tariffs, GST, and Accelerated Depreciation. Other incentives can increase profits earned from R&D, such as Rate Relief, Tax Holidays, and the Patent Box Regime. Several R&D tax incentives in India are available to firms registered under the Department of Scientific & Industrial Research (DSIR). If eligible, firms not registered under DSIR can still claim an income tax deduction on R&D expenses and benefits from the patent box regime and tax holidays. For a summary of tax incentives provided by India and recent changes, see Table 1.

After the pandemic, evaluating the cost of tax incentives is important. The Indian government has made some changes to their policies, which are listed in Table 1. Companies registered under DSIR can receive benefits such as Weighted Tax deduction, Concessional Customs duty, Concessional GST Rate, and Accelerated Depreciation. However, they must fulfill certain requirements such as setting up R&D centers with specific areas and employees, as well as keeping audited accounts of R&D expenditures. One major incentive is the income tax-weighted deduction of 200% on R&D expenditures, also known as the Super deduction. Firms can receive an income tax deduction on R&D expenditures under Sect. 35 of the IT Act, 1961. India has a broader definition of qualifying expenses for exemption compared to other countries, with all current and capital expenses being eligible except for land or building costs. The deduction has changed over time, with it being revised to 150% in 2000–01, 200% in 2010–11, 150% in 2016–17, and finally reduced to 100% from the annual year 2021–22. The study aims to test how effective the incentives provided under DSIR are and evaluate the impact of the rationalization of the Super deduction.

The Super Deduction tax incentive for R&D expenses has the potential downside of encouraging companies to mislabel their non-R&D administrative costs as R&D to take advantage of the 200% tax deduction. This issue has been identified in other countries as well, such as in studies by Mansfield and Switzer (1985), GAO (1989, 2009), Bloom et al. (2019), and Chen et al. (2021). This paper aims to investigate whether Indian firms also engage in this practice of relabelling expenses. While no previous studies have examined this issue in India, this paper fills that gap by providing new evidence on relabelling practices. The quasi-experimental approach of difference-in-difference analysis is used to address potential data endogeneity issues.

The rest of this paper is organized as follows: Sect. 2 provides an overview of the research background and hypothesis development. Section 3 describes the data and methodology. Section 4 presents the findings. Finally, Sect. 5 concludes with some reflections on the implications of our results.

2 Research background and hypothesis development

There are two main types of studies that evaluate the effectiveness of tax incentives: those that measure the impact on individual companies (micro level) and those that measure the impact on a larger scale (macro level). The macro-level studies use overall research and development spending as the dependent variable and examine the effects of tax incentives at the national and state levels. Researchers such as Bloom et al. (2002), Athukorala and Kohpaiboon (2010), McKenzie and Sershun (2010), Moretti and Wilson (2017), and Brown et al. (2017) have conducted studies in this area.

At the micro level, studies have been conducted to evaluate the effects of R&D tax incentives on firms. These studies measure the impact of such incentives on a company's production of new products or processes patents (output additionality) and on its R&D expenditures (input additionality) (Cappelen et al. 2008; Czarnitzki et al. 2011; Colombo et al. 2011, Ivus et al. 2021). The input additionality studies use micro econometric analysis techniques to analyze the impact of R&D tax or generosity of tax on the R&D expenditures of the firm (Berger 1993; Hall and van Reenen 2000; Bloom et al. 2002; Corchuelo and Martinez-Ros 2009; Czarnitzki et al. 2011; Duguet 2010). Some studies have used surveys for R&D data (Oxeraa 2006; Czarnitzki et al. 2011; Cappelen et al. 2012; Lokshin and Mohnen 2012; Lokshin and Mohnen 2013; Mulkay and Mairesse 2013; Guceri 2018) and some studies used annual reports and administered corporate return data for analysis (Yang et al. 2012; Rao 2016; Dechezleprêtre et al. 2016; Guceri and Liu 2019; Agrawal et al. 2020; Chen et al. 2021; Ivus et al. 2021). For this particular study, R&D data from audited annual reports of firms in the country were obtained from the CMIE prowess database.

Several studies have focused on the issue of relabelling expenses (Eisner et al. 1984; Mansfield and Switzer 1985; GAO 1989, 2009; Guceri 2018; Bloom et al. 2019; Chen et al. 2021). The US GAO conducted studies in 1989 and 2009, highlighting concerns over the definition of qualifying expenses and their monitoring. This issue is particularly problematic for developing countries. A recent study by Chen et al. 2021 found that relabelling accounts for 24.2% of reported R&D. It's important to keep in mind that obtaining DSIR certification involves maintaining a separate record of R&D expenses that Statutory Auditors have verified. The firms must also provide information about their projects to renew their certificates periodically. Administrative expenses can only be reclassified as current expenditures to a limited extent. A meta-analysis of microeconomic studies has revealed that R&D tax incentives have a greater impact on current expenditures than capital expenditures (Ladinska et al. 2015). This study aims to determine the effectiveness of R&D tax incentives in stimulating capital and current expenditures while also checking for any signs of reclassification.

One of the main issues with analyzing data is the presence of endogeneity problems, which occur when companies choose to participate in incentive programs on their own. This is also the case in India, where firms self-select and register under DSIR to receive benefits. Due to this concern, several studies use a direct approach to analysis, including Regression Discontinuity, Matching Analysis, or Difference-in-Difference Analysis (Hægeland and Møen 2007; Corchuelo and Martínez-Ros 2009; Yohei 2011; Yang et al. 2012; Bozio et al. 2014; Agrawal et al. 2014; Rao 2016; Dechezleprêtre et al. 2016; Bronzini and Piselli 2016; Guceri 2018; Wang 2018; Ivus et al. 2021). In this study, we use the difference in difference analysis methodology based on a recent survey of incentives in India by Ivus et al. (2021). However, there are two main differences from their study. Firstly, our data covers a longer period, from 2011 to 2021, and focuses on the impact of reducing the super deduction from 200 to 150% on R&D expenditures and patents. Secondly, we test the effects on current and capital expenditures separately, as no previous study has examined the presence of relabelling in India. Our main contribution is to provide evidence of relabelling in the country.

3 Data and methodology

This study primarily utilizes data extracted from two sources: the CMIE prowess database and the DSIR directory of in-house R&D units. The CMIE prowess database contains information on individual companies, gathered from audited annual reports, the Ministry of Company Affairs, and company filings with stock exchanges. This database includes data on the firms' capital, current and total R&D expenditures, and other financial information. The yearly data of firms registered with the DSIR is obtained from the department's annual DSIR directory. Table 2 displays the number of firms registered under DSIR and new recognitions from 2011 to 2021.

In this paper, we examine the R&D spending of companies in two categories: financial and non-financial. The non-financial category comprises firms from various major industries such as manufacturing, mining, electricity, construction, real estate & irrigation, and services. The study collects extensive data from a diverse range of companies operating within these categories. Most of the analyzed companies belong to the Drugs & Pharmaceutical and Computer Software industry groups.

The treatment dummy is the DSIR status of the ith firm in the jth year and is denoted by \({D}_{it}\). The variable takes value one if the firm i is registered with the DSIR in year j; otherwise, the value is zero. This divides the sample into two groups. The treated group is the firms registered under DSIR, and the control group is the group of firms not registered under DSIR. The variable \({C}_{t}\) is the year when the super deduction incentive was available and takes value one for 2011–2016. So, the interaction term \({D}_{it}{C}_{t}\); allows for the difference in the impact of the change in tax incentive on R&D expenditure across two groups.

In this study, we use the variable \({D}_{it}\) to represent the DSIR status of the ith firm in the jth year. This variable takes on a value of one if the firm is registered with DSIR in that year and zero otherwise. Using this variable, we divide our sample into two groups: the treated group, consisting of firms registered under DSIR, and the control group, consisting of firms not registered under DSIR.

Additionally, we use the variable \({C}_{t}\) to represent the year when the super deduction incentive was available. This variable takes on a value of one, from 2011 to 2016. By creating an interaction term between \({D}_{it}{C}_{t}\), we can analyze the difference in the impact of the change in tax incentive on R&D expenditure across the two groups.

The difference-in-difference specification of the model is as follows:

where \({RD}_{it}\) is one of the three measures of ith firm’s R&D intensity in jth year, which is calculated by dividing the R&D expenditures by the firm's sales. The three outcome variables are total R&D intensity, capital R&D intensity, and current R&D intensity. \({\alpha }_{t}\) denotes the time-fixed component in the model. The percentage difference between DSIR registered and non-DSIR firms is (\({e}^{\beta -1})100\). The coefficient \(\gamma \) captures the differential change before 2016 for the treatment group compared to the control group. The percentage treatment effect of the change is (\({e}^{\gamma -1})100\). The \({X}_{it}\) is a vector with a size of K × 1. Various control variables of the vector include Technology Imports, Firm Size, Leverage, importer dummy, exporter dummy, and age (which are listed in Table 3). The vector also includes a constant and \({\epsilon }_{it}\), which represents a stochastic constant term. Table 4 shows the summary statistics of these variables.

4 Findings

Out of the 1244 firms included in the sample, 378 were registered under the DSIR consistently between 2011 and 2021, while 519 were never registered. The status of DSIR registration for all other firms fluctuated over time.Footnote 1 The model estimation results are presented in two sections. The first section analyzes the effects on companies that have been registered under DSIR from 2011 to 2021. In Sect. 4.2, the results are studied after taking into account the variable that changes over time.

4.1 Constant DSIR status

The information presented in this sample is based on data from 378 companies that were registered under DSIR from 2011 to 2021. The model was applied to 6276 observations, with results displayed in Table 5. Column 1 shows the total R&D expenditure intensity, column 2 displays the current R&D expenditure intensity, and column 3 presents the capital R&D expenditure. The variables of interest are the treatment variable \({D}_{it}\) and the interaction variable \({D}_{it}{C}_{t}\).

The data in column (1) indicates that the beta coefficient for variable \({D}_{it}\) is positive (\(\beta \) = 1.417) and the gamma coefficient for variable \({D}_{it}{C}_{t}\) is also positive (\(\gamma \) = 0.286). Both coefficients are highly statistically significant, which means that the average Total R&D expenditure intensity in DSIR-registered firms is 4.1 times higher than in non-registered firms. Additionally, the estimated interaction effect is 1.33, meaning that the treatment effect of super deduction is 33%.

The second column of results shows that the coefficient \(\beta \) for the variable \({D}_{it}\) is 1.396, and the coefficient \(\gamma \) for the variable \({D}_{it}{C}_{t}\) is 0.364. Both coefficients are positive and highly statistically significant, similar to the results for Total R&D expenditures. This means that the average Current R&D expenditure intensity in DSIR-registered firms' treatment groups is 4.03 times greater than the control group of non-registered firms. Additionally, the estimate of the interaction effect is 1.44, indicating that the treatment effect of super deduction is 44%.

Based on the data presented in column (3), it can be observed that the coefficient \(\beta \) is 0.460 for the variable \({D}_{it}\), which is a positive and highly significant value. Meanwhile, the coefficient \(\gamma \) is 0.137 for the variable \({D}_{it}{C}_{t}\), but this value is statistically insignificant. This means that the average capital R&D expenditure intensity in treatment groups of DSIR registered firms is 1.58 times greater than the control group of non-registered firms, as determined by the \({e}^{0.460}\) value. However, the impact of the super deduction treatment on capital R&D expenditures is not significant.

4.2 Time-varying DSIR registration status

Table 6 displays the outcome when the DSIR status, which is the treatment variable, varies over time. The findings in Table 6 are comparable to those in Table 5. The estimates are elevated when the DSIR status is time-varying, but the conclusions are the same. Companies that are registered under DSIR have invested more in research and development (R&D), but the 200% super deduction has only significantly affected current expenses and not capital expenses.

The first column of results indicates that the coefficient \(\beta \) for the variable \({D}_{it}\) is positive, with a value of 1.833. The coefficient \(\gamma \) for the variable \({D}_{it}{C}_{t}\), is also positive, with a value of 0.252. These coefficients are both highly statistically significant. This suggests that the average Total R&D expenditure intensity is 6.25 times greater for treatment groups of DSIR-registered firms compared to the control group of non-registered firms. The estimate for the interaction effect is 1.29, implying that the treatment effect of a 200% super deduction is 29%.

The second column of results shows that the coefficients for the variables \({D}_{it}\) and \({D}_{it}{C}_{t}\) are both positive and highly statistically significant. Specifically, \(\beta \) is 1.826 and \(\gamma \) is 0.325. This indicates that the average Current R&D expenditure intensity in treatment groups of DSIR-registered firms is 6.21 times greater than that of the control group of non-registered firms. The interaction effect estimate is 1.38, meaning that the 200% super deduction treatment effect is 38%.

According to the information in column (3), the \(\beta \) coefficient for variable \({D}_{it}\) is 0.658, which is both positive and highly significant. However, the coefficient for variable \({D}_{it}{C}_{t}\) is \(\gamma \) = 0.042 and statistically insignificant. This means that the average capital R&D expenditure intensity for DSIR-registered firms in treatment groups is 1.93 times greater than that of non-registered control groups. However, the impact of the 200% super deduction treatment on capital R&D expenditures is insignificant.

In this study, the expenses of companies were examined in two categories: financial and non-financial. The model was evaluated for both categories, and the results revealed that non-financial firms had significant impacts while financial firms did not. It is important to note that financial firms made up less than 10% of the sample size. The study also highlighted that non-financial firms play a greater role in the overall research and development expenditure of the economy.

5 Conclusion

This research paper aims to address the topic of relabelling, which has limited literature available. Several governments have changed the R&D tax incentives policy in India from 2011 to 2021. One of the significant changes was the reduction of income tax deductions from 200% in 2022 to 150% in 2016 and eventually to 100% in 2021. This presents an opportunity to examine the effectiveness of the generous deduction and other incentives given to firms registered under DSIR. These firms can avail of several fiscal incentives. The study considers the firms registered under DSIR as the treatment group and uses the difference-in-difference approach to test their effectiveness. The research assesses the changes in R&D expenditure during the period when the Super deduction was available.

The study found that there was a clear difference in the average R&D spending between the companies in the treated group and those in the control group. However, while the super deduction offered was very generous, it only significantly impacted current R&D spending and not capital R&D spending. This lack of impact on capital R&D spending suggests that some companies may have tried to relabel their spending. The increase in Total R&D spending was driven solely by current spending. The super deduction caused an increase of 44% in current spending but had no significant effect on capital R&D spending. This suggests that some companies may have increased their current spending in order to benefit from the tax deduction without increasing their capital spending at a commensurate rate.

The DSIR offers a combination of incentives that effectively increase current and capital R&D expenditures. The fiscal incentives provided by DSIR have resulted in a sixfold increase in current expenditures and almost a two-fold increase in capital expenditures. However, it is important to note that while incentives to encourage R&D expenditures are beneficial, overly generous schemes can lead to abuse of the system. The Super deduction, for example, incentivizes firms to falsely label administrative expenses as R&D expenditures to take advantage of tax deductions without any actual increase in innovation.

Notes

For example, A company named ‘20 Microns Nano Minerals Limited’ was registered under DSIR till 2018 but not afterwards. There were many such companies and therefore model with the time-varying treatment variable (DSIR registration status) is estimated.

References

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60:323–351

Aghion P, Howitt P (1998) A Schumpeterian perspective on growth and competition. In: Coricelli F, Matteo MD, Hahn F (eds) New theories in growth and development. Palgrave Macmillan

Agrawal A, Rosell C, Simcoe T (2020) Tax credits and small firm R&D spending. Am Econ J Econ Pol 12(2):1–21

Agrawal A, Rosell C, Simcoe TS (2014) Do tax credits affect R&D expenditures by small firms? Evidence from Canada, NBER Working Paper 20615

Arrow KJ (1962) Economic welfare and the allocation of resources to invention. The rate and direction of inventive activity. Princeton University Press

Athukorala PC, Kohpaiboon A (2010) Globalization of R&D by US-based multinational enterprises. Res Policy 39(10):1335–1347

Bacinello E, Tontini G, Alberton A (2020) Influence of maturity on corporate social responsibility and sustainable innovation in business performance. Corp Soc Responsib Environ Manag 27(2):749–759

Berger PG (1993) Explicit and implicit tax effects of the R & D tax credit. J Accounting Res 31(2):131–171

Blandinieres F, Steinbrenner D, Weiß B (2020) Which design works? A meta-regression analysis of the impacts of R&D tax incentives. A meta-regression analysis of the impacts of R&D tax incentives, 20-010

Bloom N, Griffith R, Van Reenen J (2002) Do R&D tax credits work? Evidence from a panel of countries 1979–1997. J Public Econ 85(1):1–31. https://doi.org/10.1016/S0047-2727(01)00086-X

Bloom N, Van Reenen J, Williams H (2019) A toolkit of policies to promote innovation. J Econ Perspect 33(3):163–184

Bozio A, Irac D, Py L (2014) Impact of the research tax credit on R&D and innovation: evidence from the 2008 French reform, Banque de France Working Paper 532

Bronzini R, Piselli P (2016) The impact of R&D subsidies on firm innovation. Res Policy 45(2):442–457

Brown JR, Martinsson G, Petersen BC (2017) What promotes R&D? Comparative evidence from around the world. Res Policy 46(2):447–462. https://doi.org/10.1016/j.respol.2016.11.010

Cappelen Å, Raknerud A, Rybalka M (2012) The effects of R&D tax credits on patenting and innovations. Res Policy 41(2):334–345. https://doi.org/10.1016/j.respol.2011.10.001

Chen Z, Liu Z, Suárez Serrato JC, Xu DY (2021) Notching R&D investment with corporate income tax cuts in China. Am Econ Rev 111(7):2065–2100. https://doi.org/10.1257/aer.20191758

Colombo MG, Luca G, Samuele M (2011) R&D subsidies and the performance of high-tech startups. Econ Letters 112(1):97–99

Corchuelo MB, Martínez-Ros E (2009) The effects of fiscal incentives for R&D in Spain, Universidad Carlos III de Madrid Working Paper 09-23

Czarnitzki D, Hanel P, Rosa JM (2011) Evaluating the impact of R&D tax credits on innovation: a micro econometric study on Canadian firms. Res Policy 40(2):217–229. https://doi.org/10.1016/j.respol.2010.09.017

Dechezleprêtre A, Einiö E, Martin R, Nguyen KT, Van Reenen J (2016) Do tax incentives for research increase firm innovation? An RD design for R&D (No. w22405). National Bureau of Economic Research

Duguet E (2010) The effect of the R&D tax credit on the private funding of R&D: An econometric evaluation on French firm level data. Available at SSRN 1592988

Eisner R, Albert SH, Sullivan MA (1984) The new incremental tax credit for R&D: incentive or disincentive? Natl Tax J 37(2):171–183

Frantzen D (1998) R & D, international technical diffusion and total factor productivity. Kyklos 51:489–508

Gao (1989) Tax policy and administration: the research tax credit has stimulated some additional research spending. U.S. Government Accountability Office, Washington

Gao (2009) Tax policy: the research tax credit’s design and administration can be improved. U.S. Government Accountability Office, Washington

Griliches Z (1958) Research costs and social returns: hybrid corn and related innovations. J Polit Econ 76:141–154

Griliches Z (1980) Returns to research and development expenditures in the private sector. New developments in productivity measurement. University of Chicago Press, pp 419–462

Griliches Z, Mairesse J (1984) Productivity and R&D at the firm level. Am Econ Rev 84:66–83

Guceri I (2018) Will the real R&D employees please stand up? Effects of tax breaks on firm-level outcomes. Int Tax Public Financ 25(1):1–63. https://doi.org/10.1007/s10797-017-9438-3

Guceri I, Liu L (2019) Effectiveness of fiscal incentives for R&D: Quasi-experimental evidence. Am Econ J Econ Policy 11(1):266–291

Hægeland T, Møen J (2007) Input additionality in the Norwegian R&D tax credit scheme, Reports 2007/47 Statistics Norway

Hall B, Van Reenen J (2000) How effective are fiscal incentives for R&D? A review of the evidence. Res Policy 29(4–5):449–469

Hausmann R, Rodrik D (2003) Economic development as self-discovery. J Dev Econ 72(2):603–633

Ivus O, Jose M, Sharma R (2021) R&D tax credit and innovation: Evidence from private firms in India. Res Policy 50(1):104128. https://doi.org/10.1016/j.respol.2020.104128

Jaffe A (1996) Economic analysis of research spillovers: implications for the advanced technology program. Econ Anal 1:14

Klette T, Kortum S (2002) Innovating firms and aggregate innovation, NBER Working Paper 8819. National Bureau of Economic Research

Ladinska E, Non M, Straathof B (2015) More R&D with tax incentives? A meta-analysis (No. 309). CPB Netherlands Bureau for Economic Policy Analysis

Boris L, Mohnen P (2012) How effective are level-based R&D tax credits? Evidence from the Netherlands. Appl Econ 44(12):1527–1538

Lokshin B, Mohnen P (2013) Do R&D tax incentives lead to higher wages for R&D workers? Evid Neth Res Policy 42(3):823–830. https://doi.org/10.1016/j.respol.2012.12.004

Lucas R (1988) The mechanics of economic growth. J Monet Econ 22:3–42

Mansfield E (1965) Rates of return from industrial research and development. Am Econ Rev 55(1/2):310–322

Mansfield E (1984) R&D and innovation: some empirical findings. In: Griliches Z (ed) R&D, patents, and productivity. University Press for National Bureau of Economic Research, pp 127–154

Mansfield E, Switzer L (1985) The effects of R&D tax credits and allowances in Canada. Res Policy 14(2):97–107. https://doi.org/10.1016/0048-7333(85)90017-4

McKenzie KJ, Sershun N (2010) Taxation and R&D: an investigation of the push and the pull effects. Can Public Policy 36(3):307–324. https://doi.org/10.3138/cpp.36.3.307

Moretti E, Wilson DJ (2017) The effect of state taxes on the geographical location of top earners: evidence from star scientists. Am Econ Rev 107(7):1858–1903. https://doi.org/10.1257/aer.20150508

Mulkay B, Mairesse J (2013) The R&D tax credit in France: assessment and ex ante evaluation of the 2008 reform. Oxf Econ Pap 65(3):746–766

Mun HW (1991) Korea's total factor productivity, Seoul: Korean Productivity Center. https://doi.org/10.3386/w5506

Nadiri MI, Kim S (1996) International R&D spillovers, trade and productivity in major OECD countries

Nelson RR (1959) The simple economics of basic scientific research. J Polit Econ 67(3):297–306

Oxera (2006) Feasibility study for potential econometric assessment of the impact of R&D tax credits on R&D expenditure, HM Revenue and Customs Research Report 19, Oxford. http://www.innovation-policy.org.uk/compendium/reference/Default.aspx?referenceid=124

Qiu L, Jie X, Wang Y, Zhao M (2020) Green product innovation, green dynamic capability, and competitive advantage: Evidence from Chinese manufacturing enterprises. Corp Soc Responsib Environ Manag 27(1):146–165

Rao N (2016) Do tax credits stimulate R&D spending? The effect of the R&D tax credit in its first decade. J Public Econ 140:1–12. https://doi.org/10.1016/j.jpubeco.2016.05.003

Rodrik D (2004a) Industrial Policy for the Twenty-First Century, CEPR Discussion Paper 4767. Centre for Economic Policy Research

Rodrik D (2004b) Industrial policy for the twenty-first century. Available at SSRN 666808. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=666808

Romer P (1990) Endogenous technological change. J Polit Econ 98:71–102

Schumpeter J (1962) The theory of economic development. Springer

Suat LA, San OT (2019) Corporate environmental management: eco-efficiency and economics benefits among manufacturers certified with EMS14001 in Malaysia. Int J Recent Technol 7(6):873–886

Wang J (2018) Innovation and government intervention: a comparison of singapore and hong kong. Res Policy 47(2):399–412

Yang C-H, Huang C-H, Hou T-T (2012) Tax incentives and R&D activity: firm-level evidence from Taiwan. Res Policy 41(9):1578–1588

Yohei KOBA (2011) Effect of R&D tax credits for small and medium-sized enterprises in Japan: evidence from firm-level data, RIETI Discussion Paper

Funding

No funds, grants, or other support was received.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

I declare that there are no financial and non-financial conflicts of interest.

Human or animal rights

The Research does not involve Human Participants and/or Animals.

Informed consent

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kaushik, A. The effectiveness of research and development tax incentives in India: a quasi-experimental approach. Int J Syst Assur Eng Manag 14, 2329–2336 (2023). https://doi.org/10.1007/s13198-023-02077-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-023-02077-x