Abstract

The world witnessed unprecedented growth of digitalisation, especially the rise of digital banking with a more robust ecosystem. Salient discussions are widely done by consumers, marketing society, e-commerce, banking and fintech industries, regulators and literature experts. This research critically evaluates the evolution of the retail consumer behaviour model arising from digitalisation with an in-depth study of variables closely associated with consumer behaviour in the Singapore market. The research philosophy used in the current study is Critical Realism based on ontology. Descriptive research is used in the present study to examine the situation as it exists in the current state of the effects of digitalisation on consumers. The study is a cross-section analysis with a deductive approach. Data is collected through a web-based questionnaire with a sample size of 200, selected using a non-probabilistic convenience sampling method. Various statistical analysis tools, including Descriptive Analysis, ANOVA (Analysis of Variance), Pearson’s correlation coefficient test and inferential statistics tools like a simple linear regression test, were applied and presented. Hypotheses related to perceived risks, perceived values, and various attributes, namely social groups, intention, attitude and emotion correlation with digital consumer purchase behaviour, are also studied and tested. The findings highlight that perceived risk, perceived values and emotion elements positively impact digital consumer behaviour. Notwithstanding that, it is pivotal to point out that these independent variables are not correlated with the rationale of consumers. Recommendations suggested providing deeper insights into measures for consumer protection against the threats of digitalisation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The purpose of this research study is to examine the influence of digitalisation on consumer behaviour in Singapore context and evaluate digitalisation-driven transformations through a comprehensive literature review and detailed data analysis to propose viable recommendations for future progressions. There are key transformations explored through recent consumer behavioural studies and significant future development will be based on interpretations and progressive work carried out on digitalisation. Digitalisation describes the continuous convergence of both real and cyber world which is regarded as the primary driver of innovation across main sectors of the economy. Both operational and functional areas benefit from digitalisation which pose great impact on existing work environment (Reichstein et al. 2019; Rangaswamy et al. 2022). Emerging technologies have resulted in high digital demand and sophisticated level of customers worldwide. The year 2020 undoubtedly has brought a number of extraordinary challenges for the banking, retail and technology sectors as digital revolution continues to fast track and accelerates. Digital banking is no longer optional today (Gray et al. 2020; Rangaswamy et al. 2023). Rightly, Movassagh et al. (2021) and Periyasamy et al. (2023) indicated that the main aim of the entities is to maximize the information used for diagnosis and prediction. Similarly, Jain et al. (2019) also highlighted that it is an ongoing challenge for companies to arrive at the right policies and study the associated risks. Digitalisation and changes in regulatory landscape as well as the emergence of fintech companies have influenced customers’ attitude, behaviour and expectations due to digitalisation’ omnipresence (Swacha-Lech 2017).

Consumers in this contemporary age now have lesser concerns over the physical location of their service providers but heightened expectations on quality, speed, simplicity and efficiency. For example, customers who actively seek credit generally require timely end-to-end processes, minimal transaction fees and flexible terms and conditions. However, that is inevitably accompanied with increased risk of sub-optimal decisions at consumers’ disadvantage as a result of quick financial decisioning through web-based lending or via smartphone application in the absence of adequate consumer protection (Bouyon and Ayoub 2018).

1.1 Background of the study

It is also recognised that research investigations of consumer behaviour as well as the evolution of decision-making process have become an integral part of literature today. Thus, research work in this research has helped to present an extensive literature review on the evaluation of challenges and impact of digitalisation on consumers in Singapore including any latest trends and emerging themes. For example, to determine whether consumers’ attitude on products and services is strongly associated with digital confidence in short-term as compared to long-term. It is also critical to analyse the core theories and models established in the field of consumer behaviour and decision-making. Through the findings of an external report of Deutsche bank (Forest and Rose 2015), one is able to note that digitalisation impact is limitless and transformative especially where the financial sector is concerned. It extends beyond cost-saving benefit from technology innovation perspective. In the financial services industry, digital revolution is transforming how customers access products/services. New digital technologies are re-shaping the value proposition of existing financial services (PwC 2016). There is a growing need for consumers to be cautious to make a clear distinction between established financial institutions/fintech companies and smaller market entrants before entering into decisions on retail online shopping and banking transactions.

Whilst e-commerce, big data and artificial intelligence trends have led to substantial productivity, disruptions to existing social norms must not be ignored (OECD 2018). One has to always recognise that technology is not a perfect solution which result in negative implications (Johnson et al. 2008). For example, information flow has raised emerging issues around privacy (Brusoni and Vaccaro 2017). The existing problem of digitalisation not being fully optimised by customers and its consequences are neither fully addressed nor effectively mitigated. This research study examines the adequacy and effectiveness of measures developed to protect consumers from the threats of digitalisation as highlighted under one of the research objectives.

1.2 Problem statement

With digitalisation, firms seek renewal of business models to remain competitive (Zott and Amit 2011) and pursue integration of new product solutions into the design of business models. However, there is a problem to be addressed where digital optimisation has not been fully achieved as consumer behaviour model continues to face the challenges of digitalisation. The present research study based on Singapore market provides insightful views into the development of a theoretical framework for better protected environment against risks. The aim of the study is to critically examine whether the benefits exceed costs of digitalisation including key challenges and impact of digitalisation from a consumer perspective focusing on retail and financial services. The research problem of consumers’ digital sub-optimisation leads to the following objectives:

-

(i)

To assess the variables that are strongly associated with the rational and attitude of digital consumers.

-

(ii)

To evaluate the trends and maturity level of consumers in digital banking transitioning from the conventional financial services model.

-

(iii)

To examine the adequacy and effectiveness of measures that protect consumers from the threats of digitalisation.

Following are the research questions that are studied in the present research.

-

(i)

How the customers of retail business and financial services benefit or are affected by digitalisation at an optimal/sub-optimal level for rational decision-making?

-

(ii)

How are consumer trends and maturity level impacted by digital transformation in financial services?

-

(iii)

What are the measures implemented to protect consumers from the challenges of digitalisation in retail and financial services?

Comprehensively, the above introduction section presents research questions and objectives based on the research problems. Further, in the next section, a thorough literature review on the related subject matter, including the variables influencing the rationale and attitude of digital consumers, trends and maturity of consumers transitioning from conventional financial services to digital banking, adequacy and effectiveness of consumer protection from digitalisation threats, effects of digital transformation on long-term customer needs, etc is presented. It also leads to the research gap analysis conceptual framework and hypotheses tested in this study. It is followed by a section about the methods and methodology chosen to conduct the study. Subsequently, sections related to results, discussion, conclusion, and implications are presented. Furthermore, research limitations, future research and development are also discussed.

2 Literature review

With heightened expectations on digital customer experiences and regulatory focus, a critique of the existing theoretical frameworks performed has identified key themes on the relationships amongst variable factors and the impact of digitalisation on consumer behaviour, including gaps to be addressed in current research. Traditional models of consumer purchasing behaviour has placed emphasis on economic importance focusing on the concept of benefits versus cost minimisation. Hence, one is arguably able to have predictive power on consumer behaviour using economic indicators. For example, consumers’ purchasing ability and price of competitive products. On the other hand, contemporary studies have developed models of consumer purchasing behaviour such as Howard-Sheth model (1989) which utilises the concept of stimulus-response to argue on consumers preferred or choice behaviour over a period of time.

2.1 Variables influencing the rational and attitude of digital consumers

2.1.1 Technology desired but should be combined with human interaction

Moorhouse et al. (2017) studied the prevalence of United Kingdom (UK) consumer empowerment from the effects of digitalisation. Whilst it was observed that retailers have increasingly integrated technologies to attract new/existing markets (example: integration of self-service technologies elevated by up-to-date payment solutions/digital wallets), there were lessons learnt from technology failures that adversely affect customer satisfaction. A combined busines model of human interaction and technology for personalised customer experience is thus desired (Balconi et al. 2017). The research also highlighted the growth of emergent digital technologies for immersive brand and product experiences (Scholz and Smith 2016) to meet consumer demands for increased quality. Notwithstanding, the study did not analyse in depth the impact and ways to overcome the challenges of integrating technological innovations in which social engagement and human interaction are important independent variables to be studied in establishing the proposed conceptual framework.

2.1.2 Consumers’ digital confidence, social and emotion factors are key

Tunn et al., (2020) developed the framework of consumer digital confidence in terms of how it affects customers’ attitude toward short-term product-service systems (“PSS”). A mixed-methods study was applied (Schoonenboom and Johnson 2017). Hypothesis test found that consumers’ digital confidence hugely influenced on their attitude towards short-term PSS compared to long-term PSS. The study recommended that sustainability potential of digital PSS in design phase along with infrastructure cost (versus benefits) should be assessed. Nonetheless, the test on the effects of digital confidence (Sussan et al. 2016) on consumers’ attitude in longer term including impact of digitalisation on business models (Bouwman et al. 2018) were inadequately explored and would be addressed in current research.

Zolkepli et al. (2020) examined the role of mobile application (“apps”) digital usage in shaping consumer behaviour. The study refers to Sheth’s propositions to explore the perceived consumption values on mobile apps behaviour and investigates the impact of rating and cost on consumer behaviour. Questionnaires were collected with nine hypotheses examined. The structural equation modelling led four significant factors (functional, social, emotional and conditional values), which found to accurately predict the effect of perceived apps values on mobile consumer behaviour. The current research incorporates similar variables except for functional and conditional values as these are specific to usage of mobile apps. Although findings were country specific (Malaysia), the cultural element affecting consumption values would not differ to Singapore’s demographic profile for present research purpose. Nevertheless, readiness and inclusiveness are value-factors suggested for future studies.

2.2 Trends and maturity of consumers transitioning from conventional financial services to digital banking (“DB”) model

2.2.1 National support towards digital trend

Singapore has one of the highest digital coverages globally. The Infocomm and Media Development Authority gathered that 98% have access to the internet (Infocomm Media Development Authority 2019). Further in March 2020, Singapore had introduced the national digital literacy programme for students across all levels (Ng et al. 2021). That was a push to the upward trend for young generation to be digitally capable to meet accelerated growth in digital space and any threats underway.

2.2.2 Digital disruption trend led to higher customer satisfaction

Vives (2019) advocated that digital disruption in financial sector is driven by demand from changes in consumer expectations and supply factors such as Internet Application Programming Interfaces (“APIs”), cloud computing, smartphones, digital currencies and blockchain technology. API model have resulted higher service improvements particularly more rapid payments and facilitate unbundling of services. It is a standard established for data sharing in open banking applications that enable third-party access to consumers’ bank data (subject to their prior consent) and a fundamental tool of digital disruption. Such data sharing capability not only gives market solutions to overcome switching cost pressure for customers but also raise competition to help them with a choice to compare product/service offers (OECD 2018). However, that inevitably translate into concerns around protection of customer data privacy, which will be dealt in current research.

2.2.3 Lack of in-depth analysis on variables that impact consumer digital uptake

Mbama and Ezepue (2018) evaluated the conceptual model of variable factors (which include perceived value, perceived risk, functional and service quality, innovation and customer engagement) that determine UK customer experience in DB. Example, the impact of perceived security risk of mobile banking on digital uptake from the hypothesis explored (Jun and Palacios 2016). The research helped to fill the gap in the understanding of customer perceptions of relationships amongst DB, client experience and banks’ financial performance (Mbama and Ezepue 2018), which have been inadequately explored in past literature. Multi-varied factor analysis and structural equation modelling were used to test the hypotheses on the relationships of the studied factors. It was concluded that a significant relationship between customer experience and satisfaction related to financial performance existed. Nevertheless, customer experience factors which have the closest relationship with customers’ DB utilisation are not fully determined in this UK study. Similar study was conducted to understand the Jordanian consumer’s online purchase intentions and integrated trust. Results inducted that there needs a significant amount of further empirical research in this area to fully understand consumers’ online purchase intention especially in the context of expectancy, perceived trust and price value (Singh et al 2017).

That presented an opportunity for perceived risks and value, intention and attitude variable factors to be examined deeply in the present research. In this context, the following hypotheses of the study will be tested,

Null Hypothesis 1a

Perceived risks are not significantly correlated with digital consumer purchase behaviour.

Null Hypothesis 1b

Perceived values are not significantly correlated with digital consumer purchase behaviour.

2.3 Adequacy and effectiveness of consumer protection from digitalisation threats

2.3.1 Inadequate coverage of emerging digital risks in regulations

Swacha-Lech (2017) attempted to deal with the problem of banks’ challenges in view of rising customers’ expectations mainly on convenience, simplicity and speed, in this present technological environment. In particular, the adequacy of proper regulations (external environment) and the conservative attitude of regulators to implement innovations were being raised. Regulators need to be more attentive to new areas of risks related to appropriate functioning of digitalisation and its extent of vulnerability to external attacks including risks of new business models (example: peer-to-peer lending) involving consumers/investors’ protection and financial stability. Undoubtedly, these emerging areas have not been well addressed in existing legislations due to their specific nature. The resolution to that has not been sufficiently covered and is to be examined in present research for development of the proposed theoretical framework.

Wewege, et al. (2020) found that digital banking strongly relied on infrastructure competencies for data sharing, connectivity and standardisation of APIs. Even though these activities are conducted within regulatory framework of data protection to ensure privacy compliance, the problem on effectiveness of banks/fintech companies in risk mitigation needs to be examined in the present research. The study also note that fundamental growth drivers of DB transformation depend on data driven Artificial Intelligence (“AI”) to meet changing customer behavioral trends and their online banking requirement. Nonetheless, there is lack of regulatory framework to support fintech(s) to defend against cyber threats. Lastly, it is worth noting that consumer maturity level in the transition from conventional to DB model, is debatable. For instance, cashless payments have experienced growth in recent years but such activities are still largely executed in cash through conventional-based branch banking despite digital banks may offer higher interest rates.

2.3.2 Regulators’ broad-based approach ineffective to manage specific digital risks

Van Loo (2017) of Boston school of law argued that there has been a call for increased consumer protection in digital environment. In conjunction with that, Pei (2018) conducted a study on Singapore’s approach in the development and regulation of fintech which had observed that regulators have been challenged to ensure a level-playing field in digital economy. However, the research did not provide insights on solutions for an effective regulatory approach to address specific risk impact by sub-categories. Example, digital payments pose the risk of authentication/ identity whilst peer-to-peer lending platforms/crowdfunding create implications on consumer protection/fraud risk. Although regulators advocated a risk-based approach to oversight industry digital growth, the study did not propose solutions to address risks effectively.

Many recent studies are confined to digital sectors focusing on improvements to consumption processes. That has raised questions on the lack of a digital humanities approach to resolve agile needs (Ryynänen and Hyyryläinen, 2018). Firms should have proper ability to forecast consumption potential, consumer reactions and market impact, and build future capabilities to embed digital humanities approach in predictive modelling. To address the gap, the present research has sought to examine the influence of identified variables on consumer behaviour incorporating the element of digital humanities factor which is motivated by both the existing theory on hierarchy of needs and integrated factors on consumer choices.

2.4 Effects of digital transformation on long-term customer needs

Value creation occurs in end-to-end consumer decision process (Sweeney and Soutar 2001) along customer interactions (Lemon and Verhoef 2016; Puccinelli et al. 2009). Digital transformation empowers value creation to fulfil customer needs. In the study conducted by Reinartz et al. (2019), the sources of value creation identified were:

Automation—activities that operate without active human intervention (Vamos 2009) to offer real-time information and responses, simplify or eliminate routine processes for consumers.

Individualisation—customisation tailored to customers needs (Riecken 2000) where digital data is combined with other customer data (Van Bommel et al. 2014) but must be properly managed to ensure privacy compliance (Van Doorn & Hoekstra 2013; Martin & Murphy 2017).

Ambience embeddedness—integration of processes, products, and communications into customer routines. Digital technologies create ambience embeddedness by connecting customer data for seamless interactions. For example, Amazon's integrated voice-based interactions (Kharpal 2017).

Interaction–virtual/physical relations including the nature of the interaction. Digital technologies enhance traditional interactions or create new ones in consumer decisioning (Ramaswamy and Ozcan 2018).

Transparency and control–activities that provide quality information and product use. Digitalisations simplify customer access and retrieval of product information. Example, access to customers for tracking of product functionalities (Verhoef et al. 2017).

Additionally, the evolution of consumer behaviour model in digital transformation has driven a study on Singapore consumers in e-commerce (Choon and Chetan 2015) where it was noted that customers were attracted to digitalisation for its convenience, accessibility and lower pricing. Key concerns were on product quality, security risk and product delivery charges, which reflects the current research problem of digitalisation not fully optimised. Country economic attractiveness is another determining factor for digitalisation success. Example, Singapore’s global standing compared to Vietnam (Cameron et al. 2019).

While technological advancements led to omni-channel retailing (Piotrowicz and Cuthbertson, 2016) and enhanced digital payments (Taylor 2016), there were digital technology issues (Moorhouse et al. 2017) that impacted consumer satisfaction (Johnson et al. 2008), which relates to the problem on sub-optimal use of digitalisation in the present research study. Consumer behaviour has also been negatively influenced due to biased online reviews (Yarrow 2014). Lastly, it is key to recognise that leading industry trends in digitalisation [example: ability to design a competitive offer that meets customers’ expectations on quality, simplicity and speed with a high degree of assurance on transaction security (Swacha-Lech 2017) reflects the research objective for more appropriate digital solutions. The trends of millennial generation in embedding deep customer centric focus (Swacha-Lech 2017) are also increasingly important for faster and better solutions (example: streamlined product application processes). Clients now demand high standards of digital experience where customer centricity is a main priority (PwC 2016).

Present research seeks to evaluate the variables that are strongly associated with the rational and attitude of digital consumers by way of null hypothesis test to confirm the correlation between independent variables (perceived risks and values, social groups, intention, attitude and emotion) and dependent variable (digital consumer purchase behaviour). A comprehensive data analysis is carried out using statistical approaches to evaluate and validate the variables which are critical that affect the relationship between digitalisation and consumer purchase behaviour directly. This research effort also aims to evaluate the level of transition and maturity including any major trends of consumers from the conventional financial services model to digital banking phase as outlined under one of the research objectives. In this context, the following hypotheses of the study will be tested,

Null Hypothesis 2

Social groups are not significantly correlated with digital consumer purchase behaviour

Null Hypothesis 3

Intention is not significantly correlated with digital consumer purchase behaviour.

Null Hypothesis 4

Attitude is not significantly correlated with digital consumer purchase behaviour.

Null Hypothesis 5

Emotion is not significantly correlated with digital consumer purchase behaviour.

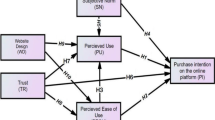

2.5 Research gap and conceptual framework

The literature review summarises the significance of customer behaviour in digital transformation and highlights the gap of a deficient focus on variable factors that impact consumer rational behaviour. The present study has instilled deeper insights into the relationships and influences of the variables on perceived risks and values, social groups, intention, attitude, emotion, social engagement and human interaction, as these have not been researched adequately in the past. The aim is to propose a coherent conceptual framework (Fig. 1) which supports the notion of consumer behaviour is not perfectly rational in digital environment being influenced by independent variables and motivated by existing hierarchy of human needs (Maslow 1970); and integrated social, psychological and cultural factors on consumer choices (Howard and Sheth 1989).

3 Methods and methodology

Given the phenomenon of probable individual and societal impact, it is imperative to have a sound understanding and critical evaluation of its drivers, positive and negative outcomes wherein the developments and trends within digitalisation require a coherent and elaborate research in this report to discuss the benefits in the different applied digitised fields while mitigating the risks it entails. Critical realism seeks to explore causative structures for what are experienced and observed, which brings illumination to this research topic recognising the complexity involved filtered through the lens of discussion on the sets of concepts that display their properties and relations between them. Thus, critical realism based on ontology, is applied in this present research to evaluate the previous studies on the nature of reality around the events that took place in consumer digitalisation (Saunders and Lewis 2012) to guide the development of the theoretical construct of digital consumer behaviour.

Descriptive research is used in the present study to examine the situation as it exists in current state on the effects of digitalisation over consumers. The approach involves identification of attributes of the digital phenomenon and exploring the correlation between retail and financial services on consumer behaviour in digitalisation. To conduct the descriptive research, developmental design (exploring how characteristics change over time involving cross-sectional study to compare consumers of retail and financial services) and survey research (capturing digital phenomena at the moment through representative sampling data with open/close-ended and category questions to collect and analyse data from respondents) are adopted (Williams 2011).

This research is based on deductive approach, aimed at testing of existing theories with the ability to adapt and respond in view of changes. The evaluation on variables identified under the proposed conceptual framework has been conducted using a web-based questionnaire (mono method) in order to test the hypotheses and answer to the research questions designed. Content validity questionnaire designed was validated with senior banking industry professionals. Construct validity was done based on the discussion with the Statistician. The questionnaire was amended based on the comments from the experts. Reliability tests was conducted using Cronbach Alpha method. The results indicated the score of 0.81, which shows that high reliability. Taherdoost (2016) indicated that the coefficient Cronbach α between 0.7 and 0.9 has high reliability. A non-probabilistic convenience sampling method across different age groups for a meaningful representation of digital active users has been applied. The population of the study is 5.81 million internet users, or 96.9% of Singapore’s total population. (Sue 2023). Three hundred respondents were reached out with the questionnaire to respond online, and 204 responses were received, with a response rate of 68%. After discarding four incomplete questionnaire forms, 200 responses were used for the study. Though the sample size of 200 is not representative of the entire population, the rationale for choosing 200 as the sample size is for statistical purposes, as it is an acceptable large sample.

4 Results and discussion

The analysis of descriptive statistics is detailed as follows which have deep linkage to the research objective on the evaluation of demographic variables that are strongly associated with the rational and attitude of digital consumers.

Table 1 depicts that “female” respondents stood at 57.5% (n = 115) compared to male respondents at 42.5% (n = 85). Overall, the outcome can still be considered as quite a balanced representation of views between male and female for the benefit of this research work. That is also consistent with the general worldwide growing agenda on increasing recognition of females in professional leadership roles making significant economic and social contributions.

Table 2 shows that 25.5% (n = 51) of the respondents is between 40 and 49 years of age forming the largest group. Ranked second is the age group of 30–39 years at 21.0% (n = 42). This indicates that the survey has attract a large number of middle age and above or matured users who actively perform online transactions via e-commerce or digital banking platform for personal as well as family needs. Nevertheless, it is important not to overlook that the younger millennial generation that also forms about 20% of the surveyed population where this group of respondents are technology savvy users.

Table 3 above portrays that a significant percentage of respondents is bachelor’s degree holders at 39.0% (n = 78) while the second largest group is A-level/diploma holders at 36.0% (n = 72). These two categories of digital consumers on a combined basis provides a majority of 75%. The result suggests that academic qualification is not a barrier in digital usage as everyone is able to benefit from technological advancement which has led to simplicity and convenience for everyone.

Table 4 reflects that half (49.0%) of the survey population is married (n = 98) whilst many (n = 79) are also single (39.5%). Digital usage is widely spread across the population in every country whether single or married.

Table 5 shows that more than half (60.5% or n = 121) of respondents are full-time employed followed by students (15.5% or n = 31). An interesting observation is that non-income earning users are increasingly given financial independence to make online purchases. The young generation is notably a large segment of the market.

Table 6 indicates that a large proportion (n = 48 or 24.0%) consists of highest earning income group of S$90,000 or higher. It is also notable that 20% of the respondents fall under the lowest income category of S$30,000. This observation shows that digital use is not strongly correlated to income but dependent upon individual preferences or perceived risks/values.

Through the survey questionnaire completed, it was visible that majority of consumers (43.3% or n = 71) maintained a neutral position towards whether online shopping or banking websites are properly secured in protection of customers’ interest against the risks of cyber-crime. This finding is aligned with the literature review that the retail and financial services industry is facing continuous challenge to ensure adequate protection against the threats of digitalisation.

4.1 ANOVA test

ANOVA, known as “Analysis of Variance”, is a statistical test that has been applied to analyse the difference between the means of more than two groups for this research study. The analysis is as below:

Null Hypothesis 1a

Perceived risks are not significantly correlated with digital consumer purchase behaviour.

Table 7 illustrates that the level of significance is clearly lower than 0.05 which shows that the perceived risk factor (example: whether shopping platforms are properly secured to protect consumer interests against the risks of cyber-crime) is closely correlated to consumer purchase behaviour and directly affected by digitalisation.

Null Hypothesis 1b

Perceived values are not significantly correlated with digital consumer purchase behaviour.

Table 8 illustrates that the level of significance is clearly lower than 0.05 which reflects that the perceived value factor (example: whether products/services purchased via online are often influenced by perceived benefit) is closely correlated to consumer purchase behaviour and directly impacted by digitalisation.

Null Hypothesis 2

Social groups are not significantly correlated with digital consumer purchase behaviour.

Table 9 illustrates that the level of significance for social group factor is clearly lower than 0.05. Thus, denoting that social trends or group beliefs is strongly associated with consumer purchase behaviour and directly impacted by digitalisation.

Null Hypothesis 3

Intention is not significantly correlated with digital consumer purchase behaviour.

Table 10 illustrates that the level of significance for customers’ intention factor is factor is clearly lower than 0.05. Hence, representing that consumers’ objective is closely correlated to consumer purchase behaviour and directly impacted by digitalisation.

Null Hypothesis 4

Attitude is not significantly correlated with digital consumer purchase behaviour.

Table 11 illustrates that the level of significance for consumers’ attitude factor is 0.06 which is slightly higher than 0.05. Thus, indicating that customers’ intention for making a purchase do not necessarily affect consumer purchase behaviour where digitalisation is concerned.

Null Hypothesis 5

Emotion is not significantly correlated with digital consumer purchase behaviour.

Table 12 illustrates that the level of significance for consumers’ emotional factor is clearly lower than 0.05 which shows that customers’ preferences or feelings is closely correlated to consumer purchase behaviour and directly affected by digitalisation.

4.2 Pearson’s correlation test

Pearson’s correlation coefficient test is applied to measure the statistical relationship between two continuous variables in this research study. The analysis in Table 13 noted that correlation is significant between independent variables (perceived risk & value, social trends, customers’ intention and emotion factor) and dependent variable (customer purchase behaviour) where digitalisation is concerned.

4.2.1 Inferential statistics

Simple linear regression test is applied and is presented in Table 14.

As such, the descriptive statistics prove that age and gender amongst others are binding factors for digitalisation that have altered consumer purchase behaviour over time. The ANOVA test concluded that null hypotheses of H1 (perceived risk and value), H2 (social groups), H3 (intention) and H5 (emotion) were rejected as p-value was less than significance level. Thus, perceived risk & value, social groups, intention and emotion factors are critical, which directly affect the relationship between digitalisation and consumer purchase behaviour. Similarly, the findings noted from Pearson’s correlation coefficient test were aligned with test of ANOVA. Simple linear regression test was also used where it is noted that the significance value of perceived risk, self-intention, social trends or group beliefs and customer attitude of digitalisation was significant.

5 Conclusions

Overall, this research work has set the right direction to develop the basis for future studies in terms of the scope of digitalisation to support the expansion of Singapore’ digital economy. Unlike developing countries, Singapore is faced with less extraordinary changing patterns of consumer behaviour from the impact of digitalisation. With the research philosophy used in the current study as critical realism based on ontology, descriptive research examined the situation as it exists in the current state of the effects of digitalisation on consumers. As a cross-section analysis with a deductive approach, data was collected through a web-based questionnaire with a sample size of 200, selected using a non-probabilistic convenience sampling method. The survey questionnaire answers obtained were meaningful for the research data analysis. Some participants being clearly more knowledgeable than others gave responses after a more detailed consideration as expected. Representative data points were gathered where selected sample was rational and sufficiently logical in contributing to valid findings that drawn objective and appropriate conclusions which influence consumer behaviour arising from digitalisation. The results of this research work have offered important constructs about the relationships between digitalisation and consumer behaviour. The study has presented adequate evidence that perceived risk & value, social groups, intention and emotion factors are critical which have direct impact on the relationships between digitalisation and consumer purchase behaviour.

This research has filled the gap of the required literature on the study of implications of digitalisation as fewer of such studies have been conducted previously. A more thorough understanding of consumer purchasing behaviour was derived from the research as well as the cultural and societal impact on digitlisation. There is a remarkable positive growth in digital usage within the country in an optimal status notwithsanding of demographic challenges in age, qualification or income distribution. That clearly shows an increased sign of deeper appreciation of the benefits of digitalisation to consumers of retail and financial services sector. Organisations and consumers on an ongoing basis are stepping up focus on demographic factors to identify greater insights into market direction to further explore the potential of any untapped consumer segments. A well balanced focus wil help to determine changes in key factors that drive the purchasing behaviour of digital consumers.

This research has examined theories of consumer behaviour and decision-making, highlighting salient aspects that are applicable to digital impact in financial services and retail sector for continual adaption. Based on literature review as well as research data analysis, coherent conceptual framework is developed, which supports the notion of consumer behaviour is not perfectly rational in digital environment being influenced by independent variables [perceived risk & value, social groups, intention and emotion factors] and motivated by existing theory/models [Maslow hierarchy of human needs; Howard-Sheth’ model of integrated social, psychological and cultural factors on consumer choices; and Engel-Kollat-Blackwell’ model that combines multiple aspects that influence consumer decision-making]. An important element of the framework developed is the recognition that processes interact with each other closely as opposed to consumers merely following a linear progression through stages.

The final component of this research work is the outcome of consumers’ decision not only in purchase but also in post-decision evaluation that will lead to further societal and collective benefits of digitalisation. It must also be noted that the existing models established for consumer-decision making are not well calibrated for the analysis of impact on financial services in particular to digital banking. Hence, the new conceptual framework proposed as above is a constructive response to the call for an improved consumer behaviour model of financial services in digital banking. However, it must be remembered that many digital platforms are still restricted to focused sectors only which are merely aimed to improve consumption processes or to resolve identified practical issues but not a sustainable approach.

While it is known that consumer adopted digital platforms have proved to be functional, the focus has to evolve from services offering perspective. Therefore, the challenge is to develop new and innovative applications that raises questions as to how the digital humanities approach is able to solve agile development cases effectively, as prompt utilisation requires high expertise from various fields. Research focus on consumption practices within digital platforms that are often conducted successfully will not provide the right solution until the humanities element is sufficiently considered in future research studies.

6 Implications

An extended coverage of portfolio of products and services demographically to capture wider perceptions and views in developing the revised strategy is recommended. This is important as digital banking continues to expand the range of products/services offering not only for retail customers but also for the non-retail sector that encompasses the underserved small and medium companies. Regulatory and policy makers should put in more concerted efforts to identify continual improvements in strengthening the mechanisms for protection of customers’ interests against the risks of digitalisation (example: cybercrime). As evidenced in the survey questionnaire completion, 43 percent of respondents maintained a neutral stance over this area of concern which demonstrates that the issue has not been effectively mitigated till now. Digital inclusion takes more than making programmes available. While Singapore’s digital inclusion efforts thus far are laudable, the tremendous mobilisation in response to COVID-19 displays to the country that true digital inclusion requires coordinated commitment from multiple ministries and ground efforts (Ng et al. 2021). Xueqin et al. (2022) studied on the technology-dependent shopping and contactless technologies. It was highlighted the COVID-19 pandemic has led to a rapid surge of digitalisation in shopping activities. Beyond technical knowledge, it also demands intimate social knowledge about digitally excluded communities and business knowledge to involve companies in corporate digital responsibility. A similar study was conducted by Umit et al. (2021) that studied the consumer's perceptions, attitudes and behavioural intentions towards drone delivery of online orders and it has aligned to the results of the present study. A universal approach will cost more than targeted approaches because of broader coverage. Progressive and redistributive efforts need to press on so that gaps in devices, internet and knowledge are continually plugged for national digital inclusion amongst all consumers from different walks of life.

7 Research limitations, future research and development

Although the critical aspects of the research objectives have been effectively addressed, the research study on the impact of digitalisation over consumer behaviour is limited to demographics of Singapore population. Notwithstanding the geographical limitation, Singapore is a representative market in the region as the country plays a significant role in the region as a leading technology and financial services hub. There are also constraints faced in terms of time and cost factor as this is self-sponsored research. Contact methods have been restricted due to recent heightened measures implemented due increased number of COVID-19 cases reported across the region. Hence, targeted and focused interviews that were initially planned for to cross-validate any subjective responses from the survey questionnaire exercise could not be carried out in view of the abovementioned circumstances.

A larger sample size representation from different parts of the country to yield better results is a valid argument to improve the quality of future research data. It is recommended that if further research is conducted, the sample size can feasibly increase to around 300 participants, instead of 200 obtained in the current research. Statistical tests in the future can choose to use a different dependent variable of digitalisation as compared to the current research that only tested on consumer behaviour. It is recommended that further research to utilise other developed existing models and new variables to determine wider reaching impact of digitalisation as well as to build more efficient and effective strategies for the advantage of consumers through processes that are mutually beneficial.

Data availability statement

The authors confirms that all data generated or analysed during this study are included in this published article.

References

Balconi M, Natale MR, Benabdallah N, Crivelli D (2017) New business models: the agents and inter-agents in a neuroscientific domain. Neuropsychol Trends 21:53–63

Bommel Van E, Edelman D, and Ungerman K (2014). Digitising the consumer decision journey. McKinsey & Company. Retrieved from https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/digitizing-the-consumer-decision-journey

Bouwman H, Nikou S, Molina-Castillo FJ, De Reuver M (2018) The impact of digitalisation on business models. Digital Policy, Regul Gov J 20(2):105–124

Bouyon S, Ayoub J (2018) Consumer credit, digitalisation and behavioural economics: are new protection rules needed? (No. 13831). Centre for European Policy Studies

Brodsky L, and Oakes L (2017). Data sharing and open banking. McKinsey & Company.

Brusoni S, Vaccaro A (2017) Ethics, technology and organizational innovation. J Bus Ethics 143(2):223–226. https://doi.org/10.1007/s10551-016-3061-6

Cameron A, Pham TH, Atherton J, Nguyen DH, Nguyen TP, Tran ST, Nguyen TN, Trinh HY and Hajkowicz S (2019). Vietnam’s future digital economy–towards 2030 and 2045: Brisbane: CSIRO Summary Report.

Choon YS, Chetan S (2015) An exploration into the factors driving consumers in singapore towards or away from the adoption of online shopping. Global Business Manag Res J 7(1):60–73

Court D, Elzinga D, Mulder S, and Vetvik OJ (2009). The consumer decision journey. McKinsey Quarterly.

Forest H and Rose D (2015). Delighting customers and democratising finance: digitalisation and the future of commercial banking. Deutsche Bank Global Transaction Banking.

Gray J, Addison G, Matheson E (2020) Digital banking maturity 2020. Deloitte, UK

Howard JA, Sheth JN (1989) The theory of buyer behaviour. Wilcy, New York, pp 33–34

Infocomm Media Development Authority (2019) Annual survey on infocomm usage in households and by individuals for 2019

Jain R, Alzubi J, Jain N, Joshi P (2019) Assessing risk in life insurance using ensemble learning. J Intell Fuzzy Syst 37:1–12. https://doi.org/10.3233/JIFS-190078

Johnson DS, Bardhi F, Dunn DT (2008) Understanding how technology paradoxes affect customer satisfaction with self-service technology: the role of performance ambiguity and trust in technology. Psychol Market J 25(5):416–443. https://doi.org/10.1002/mar.20218

Jun M, Palacios S (2016) Examining the key dimensions of mobile banking service quality: an exploratory study. Int J Bank Market 34(3):307–326. https://doi.org/10.1108/IJBM-01-2015-0015

Jung KC, Santhanam P, Wray P, Shubhankar S, Vandensteen J (2020) The rise of digital banking in Southeast Asia. Boston Consulting Group, Singapore

Kharpal A (2017). Amazon's Alexa stole the show at CES in a bid to become the internet of things operating system. CNBC. Retrieved from https://www.cnbc.com/2017/01/06/ces-2017-amazon-alexa-stole-the-show-a-bid-to-become-the-iot-operating-system.html. Accessed 14 December 2022.

Kollat DT, Engel JF, Blackwell RD (1970) Current problems in consumer behaviour research. J Market Res. https://doi.org/10.2307/3150290

Lemon KN, Verhoef PC (2016) Understanding customer experience throughout the customer journey. J Mark 80(6):69–96. https://doi.org/10.1509/jm.15.0420

Lindh C, Nordman E, Hanell S, Safari A, Hadjikhani A (2020) Digitalisation and international online sale: antecedents of purchase intent. J Int Consum Mark 32(4):324–335. https://doi.org/10.1080/08961530.2019.1707143

Martin KD, Murphy PE (2017) The role of data privacy in marketing. J Acad Mark Sci 45(2):135–155. https://doi.org/10.1007/s11747-016-0495-4

Maslow AH (1970) Motivation and personality, 2nd edn. Harper & Row, New York

Mbama CI, Ezepue PO (2018) Digital banking, customer experience and bank financial performance: UK customers’ perceptions. Int J Bank Market 36(2):230–255. https://doi.org/10.1108/IJBM-11-2016-0181

Moorhouse N, Tom Dieck MC, Jung T (2017) Technological innovations transforming the consumer retail experience: a review of literature. Manchester Metropolitan University, UK

Movassagh AA, Alzubi J, Gheisari M, Rahimi M, Mohan S, Abbasi A, Nabipour N (2021) Artificial neural networks training algorithm integrating invasive weed optimization with differential evolutionary model. J Ambient Intell Humaniz Comput. https://doi.org/10.1007/s12652-020-02623-6

Ng YH, Lim SS, Ang N, Lim D, Soh G, Pakianathan P, Ang B (2021) From digital exclusion to universal digital access in Singapore. National University of Singapore, Singapore

OECD (2018) Implications of the digital transformation for the business sector, OECD conference, 8th-9th November 2018, London. OECD, France, pp 1–9

Pei SF (2018) Singapore approach to develop and regulate FinTech. Lee Kong Chian School of Business, Singapore Management University, Singapore

Periyasamy G, Rangaswamy E, Srinivasan UR (2023) A study on impact of ageing population on Singapore healthcare systems using machine learning algorithms. World Rev Entrep, Manag Sustain Dev 19(1–2):47–70. https://doi.org/10.1504/WREMSD.2023.127243

Piotrowicz W, Cuthbertson R (2016) Introduction to the special issue information technology in retail: toward omnichannel retailing. Int J Electron Commer 18(4):5–15. https://doi.org/10.2753/JEC1086-4415180400

Puccinelli NM, Goodstein RC, Grewal D, Price R, Raghubir P, Stewart D (2009) Customer experience management in retailing: understanding the buying process. J Retail 85(1):15–30. https://doi.org/10.1016/j.jretai.2008.11.003

PwC. (2016). Blurred lines: how fintech is shaping financial services. Global FinTech report. Retrieved from http://www.pwc.com/gx/en/advisory-services/FinTech/pwc-fintech-globalreport.pdf. Accessed 14 December 2022.

Ramaswamy V, Ozcan K (2018) Offerings as digitalised interactive platforms: a conceptual framework and implications. J Mark 82(4):19–31. https://doi.org/10.1509/jm.15.0365

Rangaswamy E, Nawaz N, Changzhuang Z (2022) The impact of digital technology on changing consumer behaviors with special reference to the home furnishing sector in Singapore. Humanit Soc Sci Commun 9(1):83. https://doi.org/10.1057/s41599-022-01102-x

Rangaswamy E, Nadipilli N, Nawaz N (2023) A comparative study of traditional bank A and digital bank B from an organizational innovation perspective. In: Alareeni B, Hamdan A (eds) Innovation of businesses, and digitalization during Covid-19 Pandemic. ICBT 2021. Lecture Notes in Networks and Systems, vol 488. Springer, Cham. https://doi.org/10.1007/978-3-031-08090-6_21

Reichstein C, Harting R, Neumaier P (2019) Understanding the potential value of digitization for business–quantitative research results of european experts. University of Applied Sciences, Germany

Reinartz W, Wiegand N, Imschloss M (2019) The impact of digital transformation on the retailing value chain. Int J Res Mark 36(3):350–366. https://doi.org/10.1016/j.ijresmar.2018.12.002

Riecken D (2000) Personalised views of personalisation. Commun ACM 43(8):26–28

Ryynänen TT, Hyyryläinen TT (2018) Digitalisation of consumption and digital humanities: development trajectories and challenges for the future, DHN18.

Saunders M, and Lewis P (2012). Chapter 5: choosing your research design. In Doing research in business and management (2nd ed., pp. 104–136). UK: Pearson.

Scholz J, Smith AN (2016) Augmented reality: designing immersive experiences that maximize consumer engagement. Bus Horiz 59(2):149–161

Schoonenboom J, Johnson RB (2017) How to construct a mixed methods research design. KZfSS J 69(2):107–131. https://doi.org/10.1007/s11577-017-0454-1

Singh A, Alryalat MAA, Alzubi JA, Sarma HKD (2017) Understanding Jordanian consumers’ online purchase intentions: integrating trust to the UTAUT2 framework. Int J Appl Eng Res 12(20):10258–10268

Sue H (2023). Social media statistics in Singapore [Updated 2023]. Retrieved from https://www.meltwater.com/en/blog/social-media-statistics-singapore

Sussan F, Autio E, Kosturik J (2016). Leveraging ICTs for better lives: the introduction of an index on digital life. Paper presented at CPRLATAM Conference, Mexico.

Swacha-Lech M (2017) The main challenges facing the retail banking industry in the era of digitalisation. J Insur Financ Markets Consum Prot 26(4/2017):94–116

Sweeney JC, Soutar GN (2001) Consumer perceived value: the development of a multiple item scale. J Retail 77(2):203–220. https://doi.org/10.1016/S0022-4359(01)00041-0

Taherdoost H (2016) Sampling methods in research methodology; how to choose a sampling technique for research. Int J Acad Res Manag 5:18–27. https://doi.org/10.2139/ssrn.3205035

Taisto R, and Tapani H (2018) Proceedings of the digital humanities in the nordic countries, 3rd Conference, Helsinki, Finland, 7–9th March 2018.

Taylor E (2016) Mobile payment technologies in retail: a review of potential benefits and risks. Int J Retail Distrib Manag 44(2):159–177. https://doi.org/10.1108/IJRDM-05-2015-0065

Tunn VSC, Van Den Hende EA, Bocken NMP, Schoormans JPL (2020) Digitalised product-service systems: effects on consumers’ attitudes and experiences. Resour Conserv Recycl J. https://doi.org/10.1016/j.resconrec.2020.105045

Vamos T (2009). Social, organisational, and individual impacts of automation. In Springer Handbook of Automation (pp. 71–92). Germany: Springer Science & Business Media. https://doi.org/10.1007/978-3-540-78831-7_5

Van Loo R (2017) Rise of the digital regulator. Duke Law J 66:1267–1328

Van Doorn J, Hoekstra JC (2013) Customisation of online advertising: the role of intrusiveness. Mark Lett J 24(4):339–351. https://doi.org/10.1007/s11002-012-9222-1

Verhoef PC, Stephen AT, Kannan PK, Luo X, Vibhanshu A, Andrews M, Zhang Y (2017) Consumer connectivity in a complex, technology-enabled, and mobile-oriented world with smart products. J Interact Mark 40(4):1–8. https://doi.org/10.1016/j.intmar.2017.06.001

Vives X (2019) Digital disruption in banking. Ann Rev Financ Econ 11:243–272

Wang X, Wong YD, Chen T, Yuen KF (2022) An investigation of technology-dependent shopping in the pandemic era: Integrating response efficacy and identity expressiveness into the theory of planned behavior. J Bus Res 142:1053–1067. https://doi.org/10.1016/j.jbusres.2022.01.042

Wewege L, Lee J, Thomsett M (2020) Disruptions and digital banking trends. J Appl Finance Bank 10(6):1–2

Williams C (2011) Research methods. J Bus Econ Res 5(3):65–71

Yaprak U, Kılıç F, Okumuş A (2021) Is the Covid-19 pandemic strong enough to change the online order delivery methods? Changes in the relationship between attitude and behaviour towards order delivery by drone. Technol Forecast Soc Change. https://doi.org/10.1016/j.techfore.2021.120829

Yarrow K (2014) Decoding the new consumer mind: how and why we shop and buy. Jossey-Bass, A Wiley Brand, San Francisco, CA

Zolkepli I, Mukhiar S, Tan CF (2020) Mobile consumer behaviour on apps usage: the effects of perceived values, rating, and cost. J Mark Commun. https://doi.org/10.1080/13527266.2020.1749108

Zott C, Amit R, Massa L (2011) The business model: recent developments and future research. J Manag 37(4):1019–1042. https://doi.org/10.1177/0149206311406265

Funding

The authors did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Contributions

Conceptualization: [ER,WS], Methodology: [ER,WS], Formal analysis and investigation: [ER,WS,GJ], Writing—original draft preparation: [ER,WS]; Writing—review and editing: [ER,WS,GJ]. Each named author has substantially contributed to conducting the underlying research and drafting this manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no competing interests to declare that are relevant to the content of this article.

Human and animal rights

This article does not contain any studies with human or animal subjects performed by any of the authors.

Consent to participate

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rangaswamy, E., Yong, W.S. & Joy, G.V. The evaluation of challenges and impact of digitalisation on consumers in Singapore. Int J Syst Assur Eng Manag 15, 1704–1716 (2024). https://doi.org/10.1007/s13198-023-02023-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-023-02023-x