Abstract

This paper aims to empirically examine the relationship between energy consumption and human capital in Greece, using annual data from 1990 to 2021. Due to the availability of the data, we use the autoregressive distributive lag (ARDL) approach, which is more reliable for studies with small samples. The results indicate that human capital substantially negatively affects energy consumption in the long and short run. When splitting aggregate energy consumption into renewable and non-renewable our findings suggest that human capital stimulates renewable energy consumption and reduces non-renewable energy consumption. Moreover, we find that a higher level of human capital arises from increasing the share of the advanced-educated population, and technological progress reduces non-renewable energy consumption and increases renewable energy consumption. Policymakers in Greece should consider that investing in human capital could be the key for the country to reduce energy consumption and achieve a sustainable growth level by replacing polluting fuels with clean energy sources in the energy mix.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

One of the global issues that researchers and policymakers are increasingly paying attention to is the impact of energy consumption on the environment and economic growth. Concerns about the harmful effects of excessive fossil fuel energy consumption have mainly focused on the current threat of climate change and global warming. The energy transition from non-renewable (pollutants) to renewable (clean) sources is a widely accepted solution to environmental pollution and global warming. The importance of the transition to a renewable energy matrix is formulated in the seventh Sustainable Development Goal (SDG7) and the Paris Agreement. However, the transition must speed up considerably and broaden its scope to achieve SDG 7, align with the goals of the Paris Agreement on global climate change, and implement the 2030 Agenda for Sustainable Development. The energy goal of the European Union (EU) is the reduction of net greenhouse gas emissions by at least 55% by 2030 compared to 1990, by increasing substantially the production of renewable energy sources. In 2022, EU Member States agreed to set a new binding EU-level target, from the current target of 32% to 40% of energy from renewable sources in the overall energy mix by 2030, which is to be updated in 2023 and 2024.

Since environmental sustainability and economic growth have become increasingly important policy concerns in recent years, the link between energy consumption and economic growth is a major issue for the formulation of optimal energy and environmental policies. While energy consumption increases economic growth, the use of fossil energy sources contributes to greenhouse emissions. As a result, researchers have focused attention on the factors that affect energy consumption and economic growth. One potential factor that affects economic growth and energy consumption is human capital. Human capital has long been recognized as a basic contributor to economic growth (Schultz, 1961; Denison, 1962; Lucas, 1988; Barro, 1991; Mankiw et al., 1992; Benhabib & Spiegel, 1994; Barro & Sala-i-Martin, 1995; Sianesi & Van Reenen, 2003; Psacharopoulos & Patrinos, 2004; De la Fuente & Domenech, 2006; Aghion & Howitt, 2009). Human capital boosts labor productivity and thus transitional growth to a higher equilibrium output level (Mankiw et al., 1992). Also, human capital increases the innovative power of an economy, as well as, the knowledge of new technologies, products, and processes that promote sustainable economic growth (Romer, 1990; Jones, 1995; Benhabib & Spiegel, 2005; Vandenbussche et al., 2006, Ang et al., 2011).

Besides economic growth, human capital generates significant fluctuations in energy consumption through different channels (Salim et al., 2017; Yao et al., 2019). Though the energy consumption-economic growth link is far from conclusive within the relevant literature, many empirical findings indicate a positive relationship between them in several countries (Ozturk, 2010; Payne, 2010; Smyth & Narayan, 2015). In this respect, an increase in energy consumption may have been prompted by an increase in income brought about by an improvement in human capital, which is a fundamental input in the production function. Therefore, human capital is a channel that may influence energy consumption indirectly by contributing to economic growth.

Additionally, human capital may directly influence energy consumption. A higher human capital stock means the development of knowledge, skills, competencies, and health embodied in individuals would lead to a better understanding of the importance of environmental and energy sustainability (Gelegenis & Harris, 2014; Kandpal & Broman, 2014). Empirical evidence shows that better-educated individuals are more environmentally aware, buy environment-friendly products, continuously advocate environmental protection, accept strict environmental regulations, and ultimately, consume less energy (Pachauri & Jiang, 2008; Démurger & Fournier, 2011; Lynn, 2011; Li & Lin, 2016; Broadstock et al., 2016, Li & Wang, 2018). There is also evidence that firms with better-educated staff are more energy efficient (Cole et al., 2008; Lan & Munro, 2013; Cagno & Trianni, 2013). In addition, human capital promotes the development of new technologies that are energy efficient and helps a country to reduce energy consumption (Fang & Chang, 2016; Li & Lin, 2016; Lin et al., 2023). Technological progress, resulting from human capital accumulation, is expected to have a positive effect on renewable energy (Awaworyi Churchill et al., 2019; Kostis et al., 2023) and an opposite effect on non-renewable energy consumption (Elliott & Shanshan, 2008; Cagno & Trianni, 2013; Sinha et al., 2020).

This study aims to address several questions regarding the effect of human capital on energy consumption performance and to discuss its policy implications: What is the impact of human capital on energy consumption in the long-run and short-run? How do aspects of different human capital indexes affect energy consumption? Do the results differ depending on the population’s level of education? Can human capital through technological progress promote the transition from non-renewable to renewable energy sources? We answer these questions for the Greek economy over the period 1990–2021. The empirical findings reveal that human capital reduces aggregate energy consumption in the long-run and short-run. Splitting into renewable and non-renewable energy consumption, human capital reduces non-renewable energy consumption and increases renewable energy consumption. The strong robustness of the results is due to the persistence of these relationships using different indexes of human capital. Moreover, we find that the benefits from human capital arise from increasing the share of the advanced-educated working-age population. Also, we find that patents in the energy sector reduce aggregate and non-renewable energy consumption while boosting renewable energy consumption.

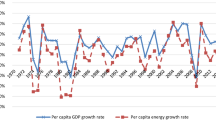

We have chosen Greece as the research subject not only because of its rapid growth in both human capital and energy consumption over the last decades but also because it is one of the most fossil fuel-dependent countries in the European Union. Nevertheless, in the last years, Greece has exhibited a high level of utilizing renewables as energy production from clean sources is growing fast (Eurostat, 2022a). The growth patterns of energy consumption and economic growth in Greece over the examined period are quite similar. Gross Domestic Product (GDP) and energy consumption have expanded rapidly and increased by 68% and 98% in 2007, respectively, compared with 1990. However, after 2008, GDP and energy consumption had a significant fall due to the global financial crisis. Also, the delay in the implementation of the reforms in the sector of renewable energy sources during the economic crisis was addressed by new legal and financial incentives that were the tools of the government’s strategy to support renewable energy technology investments and catch up with the renewable energy targets. In 2016, the Ministry of Energy, in cooperation with the Regulatory Authority for Energy (RAE), adopted Law 4414/2016 as new support for renewable energy resources. In May 2020, Law 4685/2020 concerns the modernization of environmental legislation and the incorporation into Greek legislation of Directives 2018/844 and 2019/692 of the European Parliament and Council. In 2020, Greece exceeded the target set for the participation of RES in the energy mix. According to EurostatFootnote 1, RES penetration increased significantly to 21.7% and has almost tripled compared with 1990.

Also, in Greece, social demand for tertiary education has increased rapidly during the last three decades, and the public educational structures of all levels have been expanded (Pegkas & Tsamadias, 2014). In 2021, 35% of adults (25–64) and 44% of young adults (25–34) have completed tertiary education, compared to just 11% and 17%, respectively, in 1990 (OECD 2022b). The percentages of adults and young adults are close to the EU average (38%, 46%) and the OECD average (41%, 47%). Furthermore, the Hellenic Authority for Higher Education (2020) reports that Greece has the largest number of university students per capita (7.4%) in the European Union (3.8%).

This paper contributes to the empirical literature in several ways. Most of the literature has only considered the connection between aggregate energy consumption and human capital. Therefore, this paper aims to fill this gap in the literature by distinguishing between the effects of human capital on renewable and non-renewable energy consumption. Also, we use different indexes and indicators as proxies of human capital stock and investigate their effects on aggregate, non-renewable, and renewable energy consumption. Moreover, we explicitly consider the effects of different levels of human capital, analyzing separately the impact of higher-educated and less-educated people on aggregate, non-renewable, and renewable energy consumption. Furthermore, we examine the impact of technological progress on aggregate, non-renewable, and renewable energy consumption. Finally, to our knowledge, it is the first study that performs such an analysis of the relationship between human capital and energy consumption in Greece. This facet of the relationship between human capital and energy consumption potentially could not only be critical for addressing gaps in the existing literature but also could serve as a guiding beacon for policy implications and future research.

The rest of the paper is structured as follows: “Literature Review” presents the literature review, while “Methodology” and “Data Set” present the methodology and describe the dataset, respectively. “Econometric Analysis” presents the empirical findings. Finally, “Conclusion and Policy Implications” offers some concluding remarks and possible policy implications.

Literature Review

The literature has extensively examined the issue of energy consumption. Most empirical studies have mainly focused on the relationship between energy consumption (aggregate, renewable and non-renewable) environmental pollution and economic growth (Apergis & Payne, 2010a, Ozturk, 2010; Payne, 2010; Tugcu et al., 2012; Apergis & Payne, 2012; Salim et al., 2014; Smyth & Narayan, 2015; Dogan, 2016; Gozgor et al., 2018; Ntanos et al., 2018; Pegkas, 2020; Caporale et al., 2021; Menegaki, 2021). Most research findings reveal that economic growth is positively associated with energy consumption and environmental pollution. Other studies have investigated the relationships between energy consumption and environmental pollution (Apergis & Payne, 2010b; Shafiei & Salim, 2014; Dogan & Seker, 2016; Inglesi-Lotz & Dogan, 2018; Ahmadi & Frikha, 2023). They conclude that energy consumption from fossil fuel sources is the major contributor to environmental pollution. In contrast, renewable energy sources are the primary solution to the problems associated with environmental pollution and climate change.

In the empirical literature, the effect of human capital on energy consumption has been analyzed at the micro and macro levels. The relevant literature that has focused on the effect of human capital on energy consumption at the micro level suggests that better-educated individuals and households, as well as firms with a greater intensity of human capital, have a better energy performance and consume less energy (Pachauri & Jiang, 2008; Cole et al., 2008; Blackman & Kildegaard, 2010; Démurger & Fournier, 2011; Cagno & Trianni, 2013; Lan & Munro, 2013; Chai & Baudelaire, 2015; Broadstock et al., 2016; He & Reiner, 2016; Khanna et al., 2016; Yang et al., 2017).

Another part of the empirical literature focuses on the macro level. Pablo-Romero and Sánchez-Braza (2015), for a panel set of 38 countries over the period 1995–2007, found significant substitutability between energy consumption and human capital. This result indicates that a higher human capital could be an effective strategy for reducing energy use. Fang and Chang (2016) for 16 Asia-Pacific countries for the 1970–2011 period found the existence of a cointegration relationship between human capital, energy consumption, and economic growth but an insignificant effect of human capital on energy consumption. Salim et al. (2017), for the case of China over the period 1990–2010, found that an improvement in human capital by 1% reduces energy consumption from 0.18 to 0.45%. Akram et al. (2019) investigated the case of India over the period 1990–2010 and found that an improvement in human capital by 1% reduces energy consumption by 1.69%. Shahbaz et al. (2019) found that human capital reduces energy consumption by 0.11% in the USA over the period 1975–2016. Soukiazis et al. (2019) for a panel set of 28 OECD countries over the period 2004–2015 found that tertiary education positively impacts renewable energy consumption in the short and long-run by 0.06% and 0.32%, respectively. Yao et al. (2019) investigated the relationship between human capital and aggregate, renewable, and non-renewable energy consumption for 18 OECD countries over the period 1965–2014. The results suggest that a one standard deviation increase in human capital reduces aggregate and non-renewable energy consumption by 15.36% and 17.33%, respectively, while enhancing renewable energy consumption by 85.54%. Akram et al. (2020) employ data from a panel of 73 countries over the period 1990 to 2014 and found that an increase of human capital by 1% reduces energy consumption by 0.21% for the aggregate sample and the region of countries by a range between 0.85 and 1.81%. Fang and Wolski (2021) investigate the relationship between human capital and energy consumption in China over the period from 1965 to 2014. The results suggest that there is a unidirectional causality running from human capital to energy consumption. Alvarado et al. (2021) for a panel set of 27 developed member countries of the OECD during the period 1980–2015 found that human capital stock reduces non-renewable energy consumption. Jamshid et al. (2022) examined the relationship between education and renewable energy consumption in 5 South Asian countries for the period 1995–2015. The findings reveal that an improvement in human capital by 1% boosts renewable energy consumption by 0.73%. Shahbaz et al. (2022) examine the link between human capital and aggregate, renewable and non-renewable energy consumption in China over the period 1971–2018. The results suggest that an increase in human capital by 1% reduces aggregate and non-renewable energy consumption by 1.05% and 0.89%, respectively, while enhancing renewable energy consumption by 2.18%. Ozcan et al. (2022), for the case of Turkey over the period 1980–2017, found that a 1% improvement in human capital stock increased renewable energy consumption by 2.35%. Also, other studies have considered the heterogeneous effects of different levels of human capital on energy consumption. They confirm that advanced human capital obtained through tertiary education has a different effect on energy consumption than basic human capital obtained through primary and secondary education (Li & Wang, 2018; Yao et al., 2019).

In summary, most studies that have examined the effect of human capital on energy consumption at the macro level have found that human capital has a positive effect on renewable energy consumption. On the other hand, they found a negative relationship between human capital and aggregate energy consumption as well as non-renewable energy consumption. Most studies focus on a sample of many countries, especially OECD countries, while a few studies have examined the case of a single country, especially China. Thus, the literature has failed to examine this issue in the case of a European country and especially a country member of the European Union. Also, most studies do not examine the impact of human capital on renewable and non-renewable energy consumption separately and do not use different proxies for human capital to obtain comparable results.

Methodology

Our model follows that employed in previous empirical studies (see, e.g., Pablo-Romero & Sánchez-Braza, 2015; Li & Lin, 2016; Salim et al., 2017; Yao et al., 2019) where energy consumption is expressed as a function of human capital and a set of controls variables designed to alleviate omitted variable bias:

where the subscript t denotes the year and εt is the error term. EC stands for per capita energy consumption, HC is the human capital stock and X captures the vectors of control variables of energy consumption. As control variables, we use the per capita GDP, the per capita physical capital stock, the energy price index, and the energy patents.

The Autoregressive Distributed Lag (ARDL) bounds technique developed by Pesaran et al. (2001) is utilized to investigate the relationships between the variables in the long and short run. This approach has some advantages compared with other cointegration methods. ARDL produces unbiased long-run estimators that take care of the endogeneity issue and is not sensitive to the size of the sample allowing the estimations for a small sample size. The ARDL method suggests that both the dependent and independent variables are related not only contemporaneously but also across historical (lagged) values. If yt is the dependent variable and x1, …xk are k explanatory variables, a general ARDL (p, q1, … qk) model is given by:

where et is the error term, a0 is a constant term, ψi, and βj,lj are respectively the coefficients associated with lags of yt, and lags of the k regressors of the independent variables xjt, for j = 1…., k.

From the transformation of Eq. (2), we can derive the long-run and short-run relationships between yt and the k regressors (Narayan, 2005). As such, the representation solves for yt in terms of xj,t is:

where c is the short-run coefficient and b is the long-run multiplier of the underlying ARDL model.

To test for cointegration, the bounds test is applied. The null hypothesis of no cointegration is \({H}_{0}: {b}_{0}={b}_{j}=0, \forall j\) against the alternative hypothesis of \({H}_{1}: {b}_{0}\ne {b}_{j}\ne 0\).

In our model, the long-run relationship between variables is expressed in the following equation:

while the short-run interactions between variables are estimated by using the error-correction model and can be formulated as follows:

where ECt is the per capita aggregate energy consumption and for the disaggregate models the per capita non-renewable energy consumption and per capita renewable energy consumption. HCt is the proxy of human capital stock, GDPt is the per capita GDP, CAPt is the per capita physical capital stock, EPIt denotes the energy prices and PATt stands for the energy patents. t and Δ represent the time and the first difference operator, respectively. The data have been transformed into natural logarithms.

Data Set

Our empirical analysis consists of time series for the Greek economy, spanning annual observations for the period 1990 to 2021, due to the data availability. The dependent variables are the aggregate per capita energy consumption (EC), the non-renewable energy consumption (FEC), and the renewable energy consumption (REC), in GWh. All the data on energy consumption was received from the database of Our World in Data (2022). We use three different proxies of human capital stock and investigate their effects on energy consumption. First, the human capital indexFootnote 2 (HCI), based on the combination of the indicators of average years of schooling (based on the databases of Barro-Lee, 2013 and Cohen and Leker, 2014) and returns to education (based on Mincer equation estimates). The data was obtained from the Penn World Table (PWT) version 10.0 (Feenstra et al. 2015) database. Next, the human development index (HDI) measures the average performance in a country in three main dimensions of human development: a long and healthy life proxied by the variable life expectancy at birth, access to knowledge proxied by the average years of schooling and expected years of schooling and a decent standard of living proxied by the variable Gross National Income per capita. Third, we employ the indicator of the average years of schooling (AVE) which is a widely used measure of a country’s stock of human capital. Average years of schooling are the average number of completed years of education of a population aged 25 years and older. The data for HDI and AVE was collected from the Human Development Reports of the United Nations database (2022). Subsequently, we use as a proxy of human capital stock the indicator working-age population 15 years old and over. We separate into the share of the working-age population with advanced education (AHC) and the share of the working-age population without advanced education consisting of the sum of basic and intermediate education levelsFootnote 3 (NAHC). This latter stage of analysis is particularly interesting, as may provide useful findings about how the educational level received by the population affects renewable and non-renewable energy consumption separately. We capture the data from Eurostat’s labor force survey, (2022b). Also, we use per capita GDP at constant 2015 prices (GDP) as a proxy of economic growth. We control for the per capita net physical capital stock (CAP) as physical capital is one of the primary inputs into the production function that influences energy consumption and economic output (Lee & Chien, 2010). Data on per capita GDP and per capita net capital stock sourced from the Ameco database (2022). To proxy energy prices, we employ the energy component of the consumer price index (EPI). Also, as a measure of technological progress, we control the ratio of patents on environment technologies to total patents (PAT). Data on energy prices and patents obtained from OECD (2022a) database indicators. Table 1 provides the descriptive statistics for the variables. We find that renewable energy consumption is more volatile compared to aggregate and non-renewable energy consumption. Human capital variables have stable volatility, except for the share of the working-age population with advanced education. Also, economic growth and capital stock exhibit similar volatility compared to energy consumption.

Figure 1 shows that over the examined period the indexes and indicators of human capital stock have exhibited an increasing trend. Also, a significant increase in the share of the working-age population with advanced education has been observed since the 1990s. On the other hand, the share of the working-age population without advanced education has significantly decreased over the years. Also, renewable energy consumption has steadily increased over the sample period. So, renewable energy consumption and human capital show co-movements, suggesting a positive relationship between them.

Aggregate and non-renewable energy consumption, along with GDP and capital stock, exhibited a steady upward trend until the year 2008, which represents the beginning of the economic crisis. In the following years, they showed a decreasing trend until the last five years that started to grow again. As these variables show a similar trend over time, we expect a positive association between them. Also, the energy price index and patents show a fluctuating trend.

Econometric Analysis

In this section, first, we check for the stationarity of the variables and next, we apply the ARDL bounds test to check for cointegrating relationships among the variables. We then continue with the estimates of the long-run and short-run dynamics.

Unit Root Tests

Initially, we check the stationarity of the data using the Augmented Dickey-Fuller (ADF) (1979, 1981) and Phillips-Perron (1988) tests. We test for the presence of unit roots specify the model first to include intercept and next to include intercept and trend and identify the order of integration for each variable in levels and first differences. The optimal lag length of the regressions is determined by Akaike’s (1974) criterion in the ADF test. Phillip-Perron statistics are obtained by the Bartlett Kernel and the automatic bandwidth parameter approach as suggested by Newey and West (1994).

The null hypothesis is non-stationary for the variables. The results in Table 2 indicate that in levels, the null hypothesis is rejected at the 5% level for the variables EPI and PAT, while for the other variables, the null hypothesis is rejected at the 5% level in the first differences. Therefore, we conclude that the variables EPI and PAT are stationary in levels I(0), while the other variables are stationary in first differences and integrated of order one I(1).

Long-Run and Short-Run Relationships

The ARDL approach is employed to check for cointegration. Because we use annual data for a small sample size, the maximum number of lags in the ARDL was set equal to 2. We use the Akaike information criterion for selecting the optimal lag length. The first stage of the ARDL approach is to conduct the bounds test (F-test) to check for cointegration among the variables. If the F-statistic exceeds the lower and upper critical value bounds, the null hypothesis of no cointegration can be rejected. Once the ARDL bounds test has validated the existence of a cointegrating relationship between the variables we proceed to estimate the long-run coefficients. In the second stage, we estimate the short-run relationship by using the corresponding error correction model. The dynamics of the cointegrated system depend on the size and the statistical significance of the lagged error correction term (ECT) derived from the error correction model. To determine the reliability of the results, we check the model for residual serial correlation using the Breush-Godfrey test, heteroskedasticity using the Breusch-Pagan-Godfrey test and normality using the Jarque-Bera test. In addition, we check for the stability of the parameters of the model using the Cumulative Sum of Recursive Residual (CUSUM) and the Cumulative Sum of Squares of Recursive Residuals (CUSUMSQ) tests (Brown et al., 1975). Finally, to check the robustness of the estimates we employ the Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS) estimators. Like the ARDL approach, these estimators account for specific issues like serial correlation and endogeneity and allow estimations for a small sample size.

Empirical Findings

Aggregate Energy Consumption and Human Capital

The results of the stationarity tests indicate that our model’s variables could be co-integrated. First, we test if the F-statistic exceeds the lower and upper critical bound.

The results of the bounds test reported in Table 3 show that in all the specifications, the value of the F-statistic exceeds the lower and upper critical bound at the 1% level of significance and so the hypothesis that there is no cointegration relationship is rejected. This finding permits us to proceed with estimating the ARDL model.

Table 4 reports the empirical findings. In the long run, we conclude that the human capital proxied by HCI, HDI, and AVE has a significant negative impact on EC. A 1% increase in HCI, HDI, and AVE reduces EC by 1.02%, 2.70%, and 1.37%, respectively. However, our results are controversial when examining the impact of different levels of human capital on EC. There is a significant negative association between energy consumption and human capital through the working-age population with advanced education, while we identify a significant positive association through the working-age population without advanced education. The coefficients of control variables have the expected signs in most specifications. GDP, CAP, and EPI contribute positively to EC, while energy patents have insignificant effects on EC.

In the short run, the findings show that the coefficients of human capital remain negative, confirming the negative impact on EC. Similarly, the results confirm the long-run estimates about the different effects of human capital on EC, depending on the educational level. Also, the results are in the same direction regarding the impact of control variables on EC. The coefficient of the error correction term (ECM) is negative and statistically significant at the 1% level in all the specifications, confirming the established long-run relationship between EC and its determinants. Moreover, the high value of ECM implies the high speed of adjustment from the short-run deviation movements towards the long-run equilibrium path. Also, the ARDL model in all the specifications passes the diagnostic tests related to serial correlation, heteroscedasticity, and normality. Furthermore, the results of the charts of the CUSUM and CUSUM SQ testsFootnote 4 are between the critical bounds at the 5% level, confirming the stability of the model.

To check the robustness of the long-run estimates, we apply the FMOLS and DOLS estimators. Tables 5 and 6 present the results. The findings are consistent with those of the ARDL model, confirming the validity of the estimates. We further note that the coefficient of energy patents is negative and statistically significant using the DOLS estimator, indicating that technological progress reduces the EC.

Non-renewable Energy Consumption and Human Capital

Splitting aggregate energy consumption into non-renewable and renewable counterparts, we first examine the effect of human capital on non-renewable energy consumption. The results of the bounds test presented in Table 7 indicate that in all the specifications, the value of the F-statistic exceeds the lower and upper critical bound at the 1% level of significance and so the null hypothesis that there is no cointegration relationship is rejected. This finding permits us to proceed with estimating the ARDL model.

The results in Table 8 indicate that the human capital proxied by HCI, HDI, and AVE has a significant negative effect on FEC. We found that a 1% increase in HCI, HDI, and AVE reduces FEC by 2.15%, 4.33%, and 2.46%, respectively. Also, there is a significant negative association between energy consumption and human capital through the working-age population with advanced education and a significant positive association through the working-age population without advanced education. The coefficients of control variables have the expected signs in most specifications. GDP, CAP, and EPI contribute positively to FEC, while energy patents have insignificant effects on FEC. In the short run, the findings imply that the coefficients of human capital remain negative. Similarly, the results confirm the long-run estimates about the different effects of human capital on FEC, depending on the educational level. In addition, the effect of control variables on FEC reflected those in the long run. The coefficient of ECM is negative and statistically significant at the 1% level in all specifications, confirming the established long-run relationship between FEC and its determinants. Moreover, the high value of ECM indicates the sizable speed of adjustment of disequilibrium correction for reaching long-run equilibrium steady state position. In most specifications, the coefficient of ECT is greater than one meaning that instead of monotonically converging to the equilibrium path directly, the error correction process fluctuates around the long-run value in a dampening manner. However, once this process is finished, convergence to the equilibrium path is rapid (Narayan & Smyth, 2006). Also, the ARDL model in all the specifications passes the diagnostic tests related to serial correlation, heteroscedasticity, and normality. Furthermore, the results from the CUSUM and the CUSUM SQ tests confirm the stability of the estimates.

To check the robustness of the long-run estimates, we apply the FMOLS and DOLS estimators. The results are presented in Tables 9 and 10. The strong validity of the estimates is confirmed by the fact that the results for each specification are consistent with those in the ARDL model. We also note that the coefficient of energy patents using the DOLS estimator is negative and statistically significant, implying that technological progress reduces the FEC.

Renewable Energy Consumption and Human Capital

Next, we examine the relationship between human capital and renewable energy consumption. The results of the bounds test presented in Table 11 indicate that in all the specifications, the value of the F-statistic exceeds the lower and upper critical bound at the 5% level of significance and the null hypothesis that there is no cointegration relationship is rejected. This finding permits us to proceed with estimating the ARDL model.

Table 12 reports the empirical results. In the long run, human capital proxied by the indexes HCI, HDI, and AVE has a significant positive impact on REC. A 1% increase in HCI, HDI, and AVE increase REC by 9.89%, 15.60%, and 7.96%, respectively. When we examine the effects of the different levels of human capital on REC, our findings are, however, controversial. The working-age population with advanced education has a significant positive association with renewable energy consumption, whereas the working-age population without advanced education has a significant negative one. All the control variables have negligible effects on REC, in contrast to the estimates provided by the EC and FEC models.

In the short run, the findings indicate that the coefficients of human capital remain positive. Similarly, the results confirm the long-run estimates regarding the effects of human capital on REC, based on the educational level. In addition, the coefficients of control variables are insignificant. The established long-run relationship between REC and its determinants is confirmed by the negative and statistically significant coefficient of the ECM in all the specifications. In addition, the high value of ECM implies the high speed of adjustment from the short-run deviation movements towards reaching the long-run equilibrium steady state position. Also, the ARDL model in all the specifications passes the diagnostic tests related to serial correlation, heteroscedasticity, and normality. Furthermore, the results of the CUSUM and the CUSUM SQ tests confirm the stability of the estimates.

The FMOLS and DOLS estimators are applied to validate the robustness of the long-run estimates. Tables 13 and 14 display the results. The strong validity of the estimates is confirmed by the fact that the results for each specification are consistent with those in the ARDL model. We further note that using the DOLS method the coefficient of energy patents in some specifications is positive and statistically significant, indicating that technological progress boosts REC.

Discussion of the Empirical Findings

In this section, we present the overall results, compare them with previous research, and explain their meaning by giving some possible interpretations. The empirical findings provide answers to all the questions that we set as the goal of our paper regarding the relationship between human capital and energy consumption. These findings are specific to the case of Greece. However, they may be useful in a broader context of policy applications in other countries. Specifically, the empirical evidence indicates that in the long-run and short-run, there is a negative relationship between human capital and aggregate energy consumption. When we separate energy consumption into renewable and non-renewable energy consumption, we find that human capital reduces non-renewable energy consumption but increases renewable energy consumption. The strong robustness of the results is due to the persistence of these relationships using different proxies of human capital. Our findings are consistent with the findings of the literature review (Pablo-Romero & Sánchez-Braza, 2015; Salim et al., 2017; Akram et al., 2019; Shahbaz et al., 2019; Soukiazis et al., 2019; Yao et al., 2019; Akram et al., 2020; Jamshid et al., 2022; Shahbaz et al., 2022; Ozcan et al., 2022). Also, we find that HC has a higher size effect in the long-run than the short-run estimates. This finding may suggest that, even though HC rises over time, the energy mix fluctuates little in the short-run and takes a long time to change (Stokey, 2015; Yao et al., 2019; Soukiazis et al., 2019).

Also, we find that aggregate and non-renewable energy consumption decrease, while renewable energy consumption increases when the share of the working-age population with advanced education rises, whereas results are in the opposite direction when the share of the working-age population without advanced education rises. As Lee and Lee (2016) suggest a credible explanation could be that different educational levels reflect different levels of cognitive capacity, thus affecting energy use in different ways. This finding is consistent with the previous studies of Li and Wang (2018) and Yao et al. (2019).

Regarding the results from the control variables in most specifications, we find that the coefficients have the expected sign. GDP and physical capital stock increase aggregate and non-renewable energy consumption, while having insignificant effects on renewable energy consumption. The latter implies that the substitution decision of fossil fuels with renewable energy sources was not interwoven with the economic growth in Greece. The findings are consistent with previous literature research (Apergis & Payne, 2010a, b; Ozturk, 2010; Payne, 2010; Tugcu et al., 2012; Apergis & Payne, 2012; Salim et al., 2014; Smyth & Narayan, 2015; Dogan, 2016; Gozgor et al., 2018; Ntanos et al., 2018; Pegkas, 2020; Caporale et al., 2021; Menegaki, 2021). Also, higher energy prices fail to reduce either aggregate or non-renewable energy consumption. This finding is consistent with the argument that the energy price index is related to macroeconomic trends in the long-run and that energy demand is inelastic in the short-run (Bradley et al., 2015; Salim et al., 2017). In Greece, over the period 1990–2021, the higher energy prices are not related to the reduction of energy consumption, however, soon the countries should reduce their energy consumption to combat rising energy costs. Also, we find that patents in the energy sector reduce aggregate and non-renewable energy consumption while boosting renewable energy consumption. This finding is consistent with the empirical evidence supporting the opinion that human capital contributes to technological progress, enabling switching to more energy-efficient technology, which leads to reduced energy consumption (Elliott & Shanshan, 2008; Cagno & Trianni, 2013; Li & Lin, 2016; Fang & Chang, 2016; Awaworyi Churchill et al., 2019; Sinha et al., 2020; Kostis et al., 2023).

To sum up, our main findings reveal that in the long-run and short-run human capital reduces aggregate energy consumption. Splitting into renewable and non-renewable energy consumption, human capital reduces non-renewable energy consumption and increases renewable energy consumption. Our results are robust to sensitivity tests, considering specific types of energy consumption, alternative methods of measuring human capital stock, and different estimation techniques.

Conclusion and Policy Implications

This paper aims to empirically examine the effect of human capital on energy consumption in Greece over the period 1990 to 2021. It provides new insights into the impact of human capital and technological progress on renewable and non-renewable energy consumption. Our findings suggest that human capital, proxied by different indexes, is likely to decrease aggregate and non-renewable energy consumption and increase renewable energy consumption. Moreover, we find that the benefits from human capital arise from increasing the share of the advanced-educated working-age population. Furthermore, we find that technological progress through energy patents reduces non-renewable energy consumption and increases renewable energy consumption. So, by generating externalities for the reduction of environmental pollution through the switch from fossil fuels to renewable energy sources, human capital could contribute to a cleaner environment. Greece should design an attainable path for the transition from fossil fuels-based to renewable energy sources dedicated to its own economic and institutional structures. This conclusion resonates with the 2030 Agenda for Sustainable Development and the Paris Agreement, which stipulate that countries should plan their emission-cutting efforts through Nationally Determined Contributions (NDCs). In addition to the advantages of environmental pollution and global warming, the renewable energy transition could be the main solution to the rising energy prices and their short-term effects. From a policy perspective, our empirical findings indicate that improvements in human capital, which are mainly driven through advanced education, can be an efficient and less distorted approach to overcoming these obstacles. Investing in human capital, apart from the benefits it provides in promoting economic growth and improving the labor market, can additionally offer a valuable solution to environmental pollution and climate change. Moreover, Greece must increase funding for technological research and development, particularly for energy-saving innovation projects, as patents encourage energy conservation and promote renewable energy. These benefits will be more important for future generations. For future work, we suggest that this analysis should be carried out at the microeconomic level for Greece using data from households and firms. Furthermore, this research issue could be examined for other individual countries or cross-country samples.

Notes

Data is available in the Eurostat dataset: dataset [code: nrg_ind_ren]

For more details on the index see the description in PWT9. Available at: https://www.rug.nl/ggdc/docs/human_capital_in_pwt_90.pdf

Based on the ISCED 2011 classification, basic education (or low education) includes levels 0–2 (less than primary education, primary and lower secondary education). Intermediate education (or medium education) includes levels 3–4 (upper secondary education, post-secondary non-tertiary education). Advanced education (or high education) includes levels 5-8 (short–cycle tertiary education, bachelor’s or equivalent level, master’s or equivalent level, doctoral or equivalent level). Further details are available at: https://ec.europa.eu/eurostat/web/lfs/data/database

The results of the charts are available upon request.

References

Aghion, P., & Howitt, P. (2009). The economics of growth. The MIT Press.

Ahmadi, Z., & Frikha, W. (2023). Consumption-based carbon dioxide emissions and their impact on energy productivity in the G7 countries. Journal of the Knowledge Economy, 14, 3260–3275. https://doi.org/10.1007/s13132-022-00966-3

Akaike, H. (1974). A new look at the statistical model identification. IEEE Transactions on Automatic Control, 19(6), 716–723.

Akram, B., Praveen Jangam, B., & Narayan Rath, B. (2019). Does human capital matter for a reduction in energy consumption in India? International Journal of Energy Sector Management, 13(2), 359–376. https://doi.org/10.1108/IJESM-07-2018-0009

Akram, V., Jangam, B. P., & Rath, B. N. (2020). Examining the linkage between human capital and energy consumption: Cross-country evidence. OPEC Energy Review, 44(1), 3–26.

Alvarado, R., Deng, Q., Tillaguango, B., Mendez, P., Bravo, D., Chamba, J., Alvarado-Lopez, M., & Ahmad, M. (2021). Do economic development and human capital decrease non-renewable energy consumption? Evidence for OECD countries. Energy, 215(B). https://doi.org/10.1016/j.energy.2020.119147

AMECO database. (2022). Available at: https://economy-finance.ec.europa.eu/economic-research-and-databases_en . Accessed July 29, 2022.

Ang, J., Madsen, J., & Islam, M. (2011). The effects of human capital composition on technological convergence. Journal of Macroeconomics, 33(3), 465–476.

Apergis, N., & Payne, J. (2010a). Renewable energy consumption and economic growth: Evidence from a panel of OECD countries. Energy Policy, 38, 656–660.

Apergis, N., & Payne, J. (2010b). The emissions, energy consumption, and growth nexus: Evidence from the common wealth of independent states. Energy Policy, 38(1), 650–655. https://doi.org/10.1016/j.enpol.2009.08.029

Apergis, N., & Payne, J. (2012). Renewable and non-renewable energy consumption growth nexus: Evidence from a panel error correction model. Energy Economics, 34(3), 733–8.

Awaworyi Churchill, S., Inekwe, J., Smyth, R., & Zhang, X. (2019). R&D intensity and carbon emissions in the G7: 1870–2014. Energy Economics, 80, 30–37.

Barro, R. (1991). Economic growth in a cross section of countries. Quarterly Journal of Economics, 106, 407–443.

Barro, R. J., & Lee, J. W. (2013). A new data set of educational attainment in the world, 1950–2010. Journal of Development Economics, 104, 184–198.

Barro, R., & Sala-i-Martin, X. (1995). Economic growth. McGraw-Hill.

Benhabib, J., & Spiegel, M. (1994). The role of human capital in economic development: Evidence from aggregate cross-country data. Journal of Monetary Economics, 34, 143–74.

Benhabib, J., & Spiegel, M. (2005). Human capital and technology diffusion. Handbook of Economic Growth, 1, 935–966. https://doi.org/10.1016/S1574-0684(05)01013-0

Blackman, A., & Kildegaard, A. (2010). Clean technological change in developing country industrial clusters: Mexican leather tanneries. Environmental Economics and Policy Studies, 12(3), 115–132.

Bradley, M. D., Jansen, D. W., & Sinclair, T. M. (2015). How well does “core” inflation capture permanent price changes? Macroeconomic Dynamics, 19(4), 791–815.

Broadstock, D. C., Li, J., & Zhang, D. (2016). Efficiency snakes and energy ladders: A (meta) frontier demand analysis of electricity consumption efficiency in Chinese households. Energy Policy, 91, 383–396.

Brown, R. L., Durbin, J., & Evans, J. (1975). Techniques for testing the constancy of regression relationships over time. Journal of the Royal Statistical Society, Series B, 37, 149–192.

Cagno, E., & Trianni, A. (2013). Exploring drivers for energy efficiency within small-and medium-sized enterprises: First evidences from Italian manufacturing enterprises. Applied Energy, 104, 276–285.

Caporale, G. M., Claudio-Quiroga, G. & Gil-Alana, L. A. (2021). Analysing the relationship between CO2 emissions and GDP in China: A fractional integration and cointegration approach. Journal of Innovation and Entrepreneurship, 10(32). https://doi.org/10.1186/s13731-021-00173-5

Chai, K.-H., & Clément Baudelaire, C. (2015). Understanding the energy efficiency gap in Singapore: A motivation, opportunity, and ability perspective. Journal of Cleaner Production, 100, 224–234. https://doi.org/10.1016/j.jclepro.2015.03.064

Cohen, D., & Leker, L. (2014). Health and education: Another look with the proper data. Mimeo Paris School of Economics.

Cole, M. A., Elliott, R. J. R., & Strobl, E. (2008). The environmental performance of firms: The role of foreign ownership, training, and experience. Ecological Economics, 65(3), 538–546.

De la Fuente, A., & Domenech, R. (2006). Human capital in growth regressions: How much difference does data quality make? Journal of the European Economic Association, 4(1), 1–36. https://doi.org/10.1162/jeea.2006.4.1.1

Démurger, S., & Fournier, M. (2011). Poverty and firewood consumption: A case study of rural households in northern China. China Economic Review, 22(4), 512–523.

Denison, E. F. (1962). The sources of economic growth in the United States and the alternatives before us. Committee for Economic Development.

Dickey, D. A., & Fuller, W. A. (1979). Distributions of the estimators for autoregressive time series with a unit root. Journal of American Statistical Association, 74, 427–431.

Dickey, D. A., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49, 1057–1072.

Dogan, E. (2016). Analyzing the linkage between renewable and non-renewable energy consumption and economic growth by considering structural break in time-series data. Renewable Energy, 99, 1126–1136. https://doi.org/10.1016/j.renene.2016.07.078

Dogan, E., & Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074–1085. https://doi.org/10.1016/j.rser.2016.02.006

Elliott, R. J., & Shanshan, W. (2008). Industrial activity and the environment in China: An industry-level analysis. China Economic Review, 19(3), 393–408.

Eurostat. (2022a). Available at: https://ec.europa.eu/eurostat/web/energy/data. Accessed August 02, 2022.

Eurostat, labor force survey. (2022b). Available at: https://ec.europa.eu/eurostat/web/lfs/data/database . Accessed August 02, 2022.

Fang, Z., & Chang, Y. (2016). Energy, human capital and economic growth in Asia Pacific countries: Evidence from a panel cointegration and causality analysis. Energy Economics, 56, 177–184.

Fang, Z., & Wolski, M. (2021). Human capital, energy and economic growth in China: Evidence from multivariate nonlinear Granger causality tests. Empirical Economics, 60(2), 607–632.

Feenstra, C. R., Inklaar, R., & Timmer, P. M. (2015). The next generation of the Penn World Table. American Economic Review, 105(10), 3150–3182. https://doi.org/10.15141/S5Q94M

Gelegenis, J., & Harris, D. (2014). Undergraduate studies in energy education - A comparative study of Greek and British courses. Renewable Energy, 62, 349–52.

Gozgor, G., Lau, C. K. M., & Lu, Z. (2018). Energy consumption and economic growth: New evidence from the OECD countries. Energy, 153, 27–34.

He, X., & Reiner, D. (2016). Electricity demand and basic needs: Empirical evidence from China’s households. Energy Policy, 90, 212–221.

Hellenic Authority for Higher Education. (2020). Annual Reports, Available at: https://www.ethaae.gr/en/about-hahe/hahe-annual-reports

Human Development Reports of United Nations database. (2022). (http://hdr.undp.org/en/statistics/data/). Accessed on July 1, 2022.

Inglesi-Lotz, R., & Dogan, E. (2018). The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Big 10 electricity generators. Renewable Energy, 123, 36–43.

Jamshid Villanthenkodath, M. A., & Velan, N. (2022). Can educational attainment promote renewable energy consumption? Evidence from heterogeneous panel models. International Journal of Energy Sector Management, 16(6), 1017–1036. https://doi.org/10.1108/IJESM-06-2021-0015

Jones, C. I. (1995). R&D-based models of economic growth. Journal of Political Economy, 103, 759–784.

Kandpal, T. C., & Broman, L. (2014). Renewable energy education: A global status review. Renewable and Sustainable Energy Reviews, 34, 300–324.

Khanna, N. Z., Guo, J., & Zheng, X. (2016). Effects of demand side management on Chinese household electricity consumption: Empirical findings from Chinese household survey. Energy Policy, 95, 113–125.

Kostis, P., Dinçer, H., & Yüksel, S. (2023). Knowledge-based energy investments of European economies and policy recommendations for sustainable development. Journal of the Knowledge Economy, 14, 2630–2662. https://doi.org/10.1007/s13132-022-00972-5

Lan, J., & Munro, A. (2013). Environmental compliance and human capital: Evidence from Chinese industrial firms. Resource and Energy Economics, 35, 534–557.

Lee, C.-C., & Chien, M.-S. (2010). Dynamic modelling of energy consumption, capital stock, and real income in G-7 countries. Energy Economics, 32(3), 564–581.

Lee, J. W., & Lee, H. (2016). Human capital in the long run. Journal of Development Economics, 122, 147–169.

Li, K., & Lin, B. (2016). Impact of energy technology patents in China: Evidence from a panel cointegration and error correction model. Energy Policy, 89, 214–223.

Li, T., & Wang, Y. (2018). Growth channels of human capital: A Chinese panel data study. China Economic Review, 51, 309–322.

Lin, A., Xu, Y., & Shen, H. (2023). Quantitative analysis of human behavior in environmental protection. Journal of the Knowledge Economy, 14, 2982–3009. https://doi.org/10.1007/s13132-022-00977-0

Lucas, E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22, 3–42.

Lynn, P. (2011). When it comes to the environment. Economic and Social Research Council. education affects our actions. ScienceDaily. Retrieved from www.sciencedaily.com/releases/2011/03/110321093843.htm. Accessed 15 Dec 2022.

Mankiw, G., Romer, D., & Weil, D. (1992). A contribution to the empirics of economic growth. Quarterly Journal of Economics, 107, 407–437.

Menegaki, A. (2021). Towards a global energy-sustainable economy nexus; Summing up evidence from recent empirical work. Energies, 14(16), 5074. https://doi.org/10.3390/en14165074

Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from cointegration tests. Applied Economics, 37(17), 1979–1990.

Narayan, P. K., & Smyth, R. (2006). What determines migration flows from low-income to high-income countries? An empirical investigation of Fiji–U.S. migration 1972–2001. Contemporary Economic Policy, 24(2), 332–342. https://doi.org/10.1093/cep/byj019

Newey, W., & West, K. (1994). Automatic lag selection in covariance matrix estimation. Review of Economic Studies, 61, 631–653. https://doi.org/10.2307/2297912

Ntanos, S., Skordoulis, M., & Kyriakopoulos, G. (2018). Renewable energy and economic growth: Evidence from European countries. Sustainability, 10(8), 2626. https://doi.org/10.3390/su10082626

OECD database. (2022a). Available at: https://data.oecd.org. Accessed on August 3, 2022.

OECD. (2022b). Education at a Glance 2022: OECD Indicators. OECD Publishing, Paris. Available at: https://doi.org/10.1787/3197152b-en. Accessed 3 Aug 2022.

Our World in Data database. (2022). https://ourworldindata.org/. Accessed on July 1, 2022.

Ozcan, B., & Danish Temiz, M. (2022). An empirical investigation between renewable energy consumption, globalization and human capital: A dynamic auto-regressive distributive lag simulation. Renewable Energy, 193, 195–203. https://doi.org/10.1016/j.renene.2022.05.016

Ozturk, I. (2010). A literature survey on energy–growth nexus. Energy Policy, 38(1), 340–349.

Pablo-Romero, M. P., & Sánchez-Braza, A. (2015). Productive energy use and economic growth: Energy, physical and human capital relationships. Energy Economics, 49, 420–429.

Pachauri, S., & Jiang, L. (2008). The household energy transition in India and China. Energy Policy, 36(11), 4022–4035.

Payne, J. E. (2010). A survey of the electricity consumption-growth literature. Applied Energy, 87(3), 723–731.

Pegkas, P. (2020). The impact of renewable and non-renewable energy consumption on economic growth: The case of Greece. International Journal of Sustainable Energy, 39(4), 380–395. https://doi.org/10.1080/14786451.2019.1700261

Pegkas, P., & Tsamadias, C. (2014). Does higher education affect economic growth? The case of Greece. International Economic Journal, 28(3), 425–444.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Phillips, P. C., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346.

Psacharopoulos, G., & Patrinos, H. (2004). Returns to investment in education: A further update. Education Economics, 12(2), 111–134.

Romer, P. M. (1990). Endogenous technological change. Journal of Political Economy, 98(5), S71–S102.

Salim, R. A., Hassan, K., & Shafiei, S. (2014). Renewable and non-renewable energy consumption and economic activities: Further evidence from OECD countries. Energy Economics, 44, 350–360.

Salim, R., Yao, Y., & Chen, G. S. (2017). Does human capital matter for energy consumption in China? Energy Economics, 67, 49–59.

Schultz, T. W. (1961). Investment in human capital. The American Economic Review, 51(1), 1–17.

Shafiei, S., & Salim, R. A. (2014). Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: A comparative analysis. Energy Policy, 66, 547–556. https://doi.org/10.1016/j.enpol.2013.10.064

Shahbaz, M., Gozgor, G., & Hammoudeh, S. (2019). Human capital and export diversification as new determinants of energy demand in the United States. Energy Economics, 78, 335–349.

Shahbaz, M., Song, M., Ahmad, S., & Vo, X. V. (2022). Does economic growth stimulate energy consumption? The role of human capital and R&D expenditures in China. Energy Economics, 105, 105662.

Sianesi, B., & Van Reenen, J. (2003). The returns to education: Macroeconomics. Journal of Economic Surveys, 17(2), 157–200.

Sinha, A., Sengupta, T., & Alvarado, R. (2020). Interplay between technological innovation and environmental quality: Formulating the SDG policies for next 11 economies. Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2019.118549

Smyth, R., & Narayan, P. K. (2015). Applied econometrics and implications for energy economics research. Energy Economics, 50, 351–358.

Soukiazis, E., Peoenca, S., & Cerqueira, A. P. (2019). The interconnections between renewable energy, economic development and environmental pollution: A simultaneous equation system approach. The Energy Journal, 40, 1–21.

Stokey, N. (2015). Catching up and falling behind. Journal of Economic Growth, 20, 1–36.

Tugcu, C., Ozturk, I., & Aslan, A. (2012). Renewable and non-renewable energy consumption and economic growth relationship revisited: Evidence from G7 countries. Energy Economics, 34(6), 1942–1950. https://doi.org/10.1016/j.eneco.2012.08.021

Vandenbussche, J., Aghion, P., & Meghir, C. (2006). Growth, distance to frontier and composition of human capital. Journal of Economic Growth, 11(2), 97–127.

Yang, L., Wang, J., & Shi, J. (2017). Can China meet its 2020 economic growth and carbon emissions reduction targets? Journal of Cleaner Production, 142, 993–1001.

Yao, Y., Ivanovski, K., Inekwe, J., & Smyth, R. (2019). Human capital and energy consumption: Evidence from OECD countries. Energy Economics, 84, 104534. https://doi.org/10.1016/j.eneco.2019.104534

Funding

Open access funding provided by HEAL-Link Greece.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Pegkas, P. Energy Consumption and Human Capital: Does Human Capital Stimulate Renewable Energy? The Case of Greece. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-01770-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-01770-x