Abstract

This article assesses the path of environmental degradation under the environmental Kuznets curve framework in Nordic European countries using data spanning the period 2005–2019 and employing the ordinary least squares techniques. The findings reveal evidence of a U-shaped structure; meaning, economic growth during the study period under the Norden “Green Deal and Action Plans” impulse remains on a pathway in which environmental quality is not yet improved. Further, there is no leveraging effect that changes the U-shaped structure into and inverted U-shaped. However, Nordic countries are characterized by the existence of the Pollution Halo Effect. Indeed, foreign direct investment inflows lead to increase use of advanced technologies and improved management practices. These results are robust to the use of different techniques such as alternative dependent variables, addition of control variables in response of the likely attrition bias, test of non-belonging to Eurozone features, and quantile analysis. As policy implications, Nordic European countries should amplify environmental management practices and policies to achieve low carbon footprint production or consumption in their economies, as well as pursue on a long-term basis, initiatives for a Green Nordic label, and energy efficiency as settled in the Norden Environmental Action Plan.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Combating climate change and environmental degradation has been a priority for the developed and developing world (Apergis et al., 2023). This is because climate change imposes an existential threat on the globe while already presenting sizeable economic costs to countries through its negative effects on health outcomes (Neira et al., 2014), increase of forest fires (Flannigan et al., 2000; Michetti & Pinar, 2019; Seidl et al., 2017), and decrease of agricultural returns (Lobell et al., 2011; Ray et al., 2019), among others. Sparking from the initial Kuznets’ curve (Kuznets, 1955), an extensive body of literature has emerged in this area. The environmental Kuznets curve (EKC) posits an inverted-U relationship between pollution and economic development. Kuznets’ name was apparently attached to the curve by Grossman and Kruegger’s (1991, 1993, 1995) seminal works which noted his resemblance to Kuznets’s inverted-U relationship between income inequality and development (Dasgupta et al., 2002).

With these recent environmental concerns described above and the related challenges, there has been an increase in global action to mitigate the consequence of environmental degradation and climate change. As underlined by Apergis et al. (2023), the 26th United Nations (UN) Climate Change Conference of the Parties (COP26), held in Glasgow in 2021, has addressed these environmental issues and urged countries to act to secure global net zero emission by 2050; the Global Energy Review report of International Energy Agency (IEA, 2021) estimated that carbon emissions increased by almost 5% in 2021. In the same strand, achievements in terms of environmental quality and economic expansion targets are determinant in the European Environmental Agency Countries (EEA-32). Given that Nordic European countries are all members of that organization, it could be interesting to evaluate the effects of their agenda achievement carried on through their “Green Deal” initiative and their Environmental Action Plans. This agenda represents the main environmental strategy of Nordic countries.

Indeed, in 2019, the Nordic communityFootnote 1 (Denmark, Finland, Iceland, Sweden, and Norway) have built a cooperation with the aim of making the Nordic European Region the most sustainable, competitive, and integrated in the world by 2030 through 15 indicators (Nordic Statistic database, 2022). Prior to this, a Nordic Environmental Plan was put in place for the period 2013–2018 as well as 2021–2024 as part of an effort to maintain a strong Nordic community that promotes inclusive green development, environmental values, and Nordic cooperation in a strong Europe. In this stream, environmental values also refer to initiatives and actions that could help to control climate change and air pollution. This can be realized by achieving targets in mitigating GHG in the Arctic region, protecting biological diversity, and controlling chemical’s negative impacts on human health. A key point is to discuss at length the environmental challenges facing by the Nordic countries, such as the urgent need for a new and binding international climate agreement (Norden, 2012, p.4).

Overall, the Nordic countries place great importance on regular monitoring and tracking of changes in environmental conditions, as well as on assessing the evolution of changes or degradation in well-being. They also promote the importance of valuable ecosystem services in improving well-being through natural capital. By strengthening social and environmental education to ensure that “Nordic society as a whole is aware of the vital importance of ecosystem services,” the Nordic countries are taking an important step (Norden, 2012, p.5).

All these efforts of the Nordic countries communities are a demonstration of Nordic countries’ environmental leadership in the EEA-32 as well as in international environmental conventions. Secondly, the ambition to actively play a key role in green achievements such as strong inclusive green development with sustainable production capacity building, sustainable consumption pattern, and resource efficiency provides a field of investigation and questioning whether the increase in income is linear or non-linear with environmental quality in this specific region.

Within the theoretical underpinning of the economic tools applied to the evaluation of how greenness or not could be the economic growth path (1), environmental performance (2), and environmental externalities theory (3), the main objective and importance of this study is to assess whether the efforts made and popularized by the Nordic countries through the different Norden Environmental Action Plans have passed or not a sustained environmental inflection point within the EKC framework. From an initial standard polluting economy, the area after the inflection point describes a green growth economy pathway. Therefore, the study analyzes whether the EKC hypothesis is verified in the Nordic European countries. Moreover, the “Green Deal” is continuously implemented in the Nordic countries. Currently, the “Climate and Environmental Action Plan for Nordens hus 2022–2024” which presents Vision 2030 states that the Nordic Region will become the most sustainable and integrated region in the world by 2030, with the initiative divided into three strategic priority areas: A green Nordic Region, a competitive Nordic Region, and a socially sustainable Nordic Region.

Justification for EKC Framework

The EKC framework describes characteristics of pollution emissions, environmental quality, or environmental improvements (Stern, 2017), in relation to changes in economic growth. Therefore, as established and widely discussed byFootnote 2 Data and De (2021), Fakher (2019), Marinas et al. (2018), Xepapadeas (2005), Dasgupta et al. (2002), Panayotou (1993, 1995, 1997), and the World Bank (1992), the early stages of economic growth show an increase in pollutant emissions associated with a degradation in environmental quality. However, after a certain level of per capita income, there is a reversal of this environmental degradation trajectory, establishing an inverted U-shaped configuration between environmental quality and economic growth. In the present study, as methodological orientation, the environmental quality is captured through CO2 emissions and Ecofootprint. This selection has been done among many other indicators available in the literature where under the prerequisite of data availability, environmental quality could be also proxied by indicators such as adjusted net savings, environmental fragility, level of nitrous oxide or methane emissions, air quality, biodiversity, degree of environmental sustainability, or environmental performance (Boleti et al., 2020; Shahbaz & Sinha, 2018).

According to Shahbaz and Sinha (2018), the inverted-U pattern is generally valid in transitional, emerging, and developed countries, while developing countries with low elasticity of high environmental quality may exhibit a U-shaped pattern. Unfortunately, with respect to the literature, the EKC hypothesis appears to be inconclusive on this previous conclusion, because results may vary according to the modeling strategies, indicators used, sample length or specification, and data. As results, U-shaped structure could also be verified in developing or developed countries, as well as in low-, medium-, and high-income economies. As an illustration, Raihan (2023) investigated with DOLS estimation method how different factors such as urbanization, industrialization, tourism, renewable energy consumption, economic growth, agricultural productivity, and forest area can affect environmental quality through carbon emission. While urbanization, economic growth, tourism, and industrialization contribute to the increase of CO2 emissions, renewable energy consumption, agricultural production, and forest area lead to its decrease.

The EKC hypothesis has been widely studied in European countries, but the approach in this study has received little attention and represents a gap that needs to be filled in the literature. In fact, the aim is to conduct an investigation of the EKC hypothesis in two main parts: First, the assessment is made in the initial sample in which five Nordic European countries are combined. Second, the panel sample is further divided into two sub-groups by making a clear distinction between Nordic European countries which are using Euro currency and Nordic European countries that are not members of the Eurozone system. The reason for this distinction is that the Nordic countries are considered to form a national bloc (Schewe, 2015) among European countries on the one hand, and they seem to have some green specificity.

On the other hand, as Sääksjärvi (2020) points out, they are considered to have a more private sector–oriented environmental governance, and they seem to influence the environmental policy processes of the European Union as analyzed by Panke (2010). With this distinction between countries, the aforementioned inconclusive and scattered results of the EKC surveys are further confirmed in the literature regarding the Nordic countries. While some of them are characterized by an inverted U-shaped relationship, other Nordic countries show a U-shaped (Kar, 2021) or N-shaped structure.

In view of the above, the Nordic countries—within the framework of the different Norden Environmental Action Plans up to the current one (2021–2024), the European Union Environmental Convention, Agenda such as the Eco-Innovation Action Plan, agreements and policies strategies such as the EU Low Carbon Roadmap 2050—are making deep structural changes to achieve and strengthen eco-development in order to establish a relationship between environmental quality and economic growth. It is therefore assumed in this study that green innovation as well as the knowledge process induced by the stronger green technological development reflects a specific economic transformation of European countries, which could be interpreted as an increase in economic complexity (Hausmann & Hidalgo, 2011; Hausmann et al., 2007, 2011; Hidalgo & Hausmann, 2009). This indicator has the ability to explain and predict structural transformation outcomes deriving from economic expansion to abatements obtain in the intensity of pollution emissions level and income inequality (Hausmann et al., 2014). In this context, Grossman and Krueger’s (1995) theoretical EKC framework that helps to investigate the relationship between economic growth and the environmental quality can be considered theoretical underpinning of this article.

Hypotheses and Contributions of the Study

Thorough the related hypothesis, five objectives are tested in this paper, and they could be summarized as follows: First, using the initial econometric model which is inspired by Panayotou et al. (2000) and Tchapchet-Tchouto (2023), the paper investigates whether the EKC structure is valid in the sample (Hypothesis 1). Second, the attention is focused on whether economic complexity can have a strong leveraging effect to transform a U-shaped structure into an inverted U-shaped structure in Nordic European countries (Hypothesis 2). Third, given that this concern has received little attention with recent data, it must be addressed in a context where economic complexity is endowed with sustainability and technological innovation skills (Hypothesis 3) and is capable of playing a decisive role. In fact, this is to take into account the fact that Nordic countries are always promoting low carbon emission goods consumption and production strategies, as well as efficient energy use. Fourth, given the configuration of the sample, the study assumes and takes up the advantage provided by the currency heterogeneity feature (Hypothesis 4) among Nordic countries economies. This feature offers here the possibility of an alternative investigation for robustness purposes. Indeed, the currency criterion easily allows us to capture if the non-belonging to the Eurozone could be a source of heterogeneity. Fifth, we test the Pollution Halo Effect (PHE) by interpreting the relationship between the FDI and CO2 emissions. Sixth, within the quantile analysis (Koenker & Bassett, 1978) that is used as robustness check approach, the study also investigates whether heterogeneity among countries can be explained through a threshold effect (Hypothesis 5).

Thus, the strategy described through these previous objectives represents a novelty in the literature that examines the EKC hypothesis in the Nordic European countries. To shed light on the outcomes of Nordic environmental improvements characterized by the predominance of the “Green Deal” and the Norden Environmental Action Plan objectives, the study outlines empirical investigations to enrich the literature with appropriate clarifications. As main contributions of this study, the first strand of the results strongly suggests that the EKC structure is not valid in the Nordic countries where a U-shaped relationship between environmental quality indicators and economic growth is found to be robust. Furthermore, the second strand of the results shows that the leveraging effect of the economic complexity that consists to check whether accounting for economic sophistication through Economic Complexity Index (ECI) features could change the U-shaped structure into an inverted U-shaped is not valid in the Nordic countries.

For robustness checks, additional control variables strategy could be useful to check for a likely omitted variables bias. These variables are used for testing the forest resource curse hypothesis, openness to merchandise trade scenario, and the spillover effect of incoming investment flows that account for the PHE hypothesis. Therefore, the third strand of the results evidence the existence of the PHE as it is found that FDI inflows lead to increase use of advance technologies and improved management practices in these economies. Other important aspects of the economic structure are taken into consideration through the addition of population growth, outgoing investment flows, price fluctuation scenario that reflected by inflation, tax applied on goods and services for fiscal features, electricity infrastructure, and diversification of the economy with the development of the service sector. Then, ecological footprint as an alternative dependent variable is also tested with the same estimation method. In addition, robustness is concluded with quantile analysis estimations that account for countries’ threshold effects.

This study contributes to a number of research areas. As such, firstly, the contributions made here are filling a gap within the literature and are contributing to the debate on the investigation of the EKC hypothesis in the Nordic area that usually acts to influence the environmental policies and decisions in the European Union as well as in the European Environmental Agency countries. Secondly, given that the technological innovation skills do not have the expected leveraging effect in the Nordic countries, this study thus contributes in the sense of technological assessment by documenting the Pollution Halo Effect characterized in these economies through the usage of high standards of technological capabilities compatible with economic sophistication features that can allow to expect a different outcome in the future. Thirdly, the initiatives in this article differ from the previous studies in line with the EKC hypothesis investigation in the Nordic countries, in the sense that it documents a strong relationship between economic performance—through the usage of Gross National Income per capita—and environmental quality (1); in addition, by testing for the first time the ECI’s leveraging effect in this context (2), by taking into account among Nordic countries, the criterion of non-belonging to the Eurozone that can be capture through four Nordic countries (3). Fourthly, different estimation techniques through alternative dependent variable, control variables, and quantile estimation method provide insights for supporting the robustness of the findings and policy implications.

Indeed, the study suggests that in the perspective to achieve EU Low Carbon Roadmap 2050, Nordic European countries should continue to act for sustainable structural transformation. This describes a path where high value of environmental quality associates to low values of carbon emissions will be related to high standards of income per capita and less inequality.

The remainder of the paper observed the following organization: the “Related Literature” section deals with the related literature, the “Data Sources and Statistics Measurements” section presents data sources and describes the statistics measurements, and the “Presentation of the Methodological Framework” section presents the model, estimation strategy, and results, including robustness checks and discussion. The last section concludes and draws some policy recommendations as well as future research directions.

Related Literature

The EKC framework assumes the existence of an inverted U-shaped relationship between environmental quality and country’s per capita income. This idea has attracted increasing interest (Caviglia-Harris et al., 2009). It is frequent that ongoing environmental degradation is used to be observed in wealthier countries although they are generally engaged with different policies and strategies in international agreement objectives that aim at mitigating greenhouse gases (GHG) and pollutions targets issues. Specific driver can cause environmental degradation affecting advanced and emerging economies with different intensity and severity (Cavlovic et al., 2000). This will be investigated in the two groups of countries with different institutional characteristics, but belonging to the same whole sample. Thus, the most important factors that fueling economic growth and environmental quality or degradation are essential to address a more appropriate response to environmental issues.

If theoretical studies have emphasized with a certain consensus about the analytical properties around the relationship between economic growth path and its environmental footprint closed to production activities and consumption behavior,Footnote 3 this does not seem to be the case for empirical works with a discrepancy in results mostly based on the nature of the energy usedFootnote 4 (renewable versus non-renewable). Instead of human factor’s impact on the environment (IPATFootnote 5) analysis framework,Footnote 6 the EKC hypothesis has predominantly became with time a core framework for the debate concerning environmental quality and growth.

The following literature review is mainly focusing first on studies in relation directly to Nordic European countries globally or in a single-country analysis approach (1), before tackling the ones that could indirectly concern Nordic economies through their link with Europe or OECD otherwise (2).

In the five Nordic countries, Urban and Nordensvärd (2018) have studied the low carbon energy transition comparative analysis with energy use per capita, total and per capita carbon emissions as proxy of environmental quality over the period 1960–2015. Overall, mitigate results are found with the evidence of EKC hypothesis which is mostly verified in Denmark, often in Sweden and Iceland, less in Finland, and never in Norway. With data of heterogeneous panels spanning from 1981 to 2018, Kar (2021) studied the CO2 emissions and economic growth nexus in the five Nordic countries by using the augmented mean group (AMG) estimation method, when energy consumption and financial development matter. The EKC hypothesis is found to be valid in Denmark and Iceland, while it is invalid elsewhere. With a different approach, Tapsin and Yazici (2014) investigated the same relation with data over the period 1960–2010, using means of panel data analysis. There is no evidence of EKC structure. However, they highlighted evidence of an N-shaped structure between economic growth and environmental quality proxied by carbon emissions. Using an autoregressive distributed lag (ARDL) cointegration approach with quadratic and cubic equation functions, Baek (2015) investigated the EKC hypothesis with CO2 emissions in the Arctic region. The five Nordic countries of this present study are represented in the seven Arctic countries selected by Baek (2015). While considering the role of energy consumption, the study is conducted in the period 1960–2010. In this study, findings show that Arctic countries are characterized by a U-shaped structure, while energy consumption exacerbates the environmental quality. A significant role of economic growth in the ability to mitigate CO2 emissions is established by the results in Iceland unlike other Arctic countries.

In a single-country analysis approach, Pakrooh and Brännlund (2021) focused on Sweden by deeping with a similar ARDL to test for the EKC structure with data spanning 1990 to 2019. Their findings show that the EKC hypothesis is valid from the 1996 turning point. In this context, the sectoral approach provides the scope to underline the importance of effective fossil-related policies to be initiated in the service sector which is highly under the influence of transportation activities. Always in Sweden, Bese (2018) outlined that EKC hypothesis is not confirmed with ARDL bound causality tests over the period 1960–2014. Shahbaz et al. (2017) studied Sweden economy with data on the timeframe 1850–2008 and Friedman multivariate adaptive regression splines (MARS), threshold cointegration estimation methods. EKC hypothesis is found to be valid with a turning point in 1967, and a non-linear cointegration is characterized between economic growth and carbon emissions. Thus, with two different estimation method and timeframe data, results are inconclusive in Sweden. With the same estimation method, Zambrano-Monserrate et al. (2016) performed a similar study in Iceland where an inverted U-shaped is characterized with data spanning 1960–2010 and consideration in addition of trade liberalization.

The second strand of the literature review below extends this analysis to the contributions indirectly related to Nordic countries. The indirect link here is captured through the lense of the belonging to the European area or OECD alternatively.

In a global country investigation streamline, Neagu and Teodoru (2019) used fully modified ordinary least square (FMOLS) and dynamics ordinary least squares (DOLS) with data from 1995 to 2016 to evaluate if production quality can positively influence damages on the environment among 25 European countries. Both groups of authors disaggregated their sample countries by level of development, and they found that there is a positive effect of the production quality through the economic complexity process only for low- and medium-income development level countries. Knowing that economic sophistication indicator is based on countries’ exportation features, studies such as Mania (2020) and Apergis et al. (2018) have examined the relationship between exports and carbon emissions under EKC hypothesis in 19 developed (high-income) countries.Footnote 7 They stand to verify whether a diversification in productive structure yields to an increase in exports and how this leads to lower CO2 emissions. As OECD is concerned, Churchill et al. (2018) studied the EKC hypothesis in a group of 20 countries with data spanning the period 1870–2014. Concerning the EKC structure, their results show some heterogeneous figures. Indeed, evidence of EKC structure was found only in nine countries with different specificities: indeed, an inverted U-shaped was found in five countries, whereas an inverted N-shaped in one country and finally N-shaped in three countries.

Fakher and Inglesi-Lotz (2022) have studied the role of renewable, non-renewable energy consumption on the environmental quality in OECD and Organization in Petroleum Exporting Countries (OPEC) on the period 2000 to 2019. Using continuously update fully modified and bias-corrected inverted N-shaped is found in OPEC countries, whereas inverted U-shaped is characterized in OECD countries. The main variables tested in the study are showing that non-renewable energy consumption is significantly detrimental to the environmental quality, while renewable energy consumption is improving environmental quality. The approach of this study is similar to that of Fakher, Ahmed, Acheampong et al. (2022) and Fakher, Ahmed, Alvarado et al. (2022) which mainly focused also in OPEC countries on the role of six environmental indicators that describe environmental quality. Using AMG, Driscoll and Kraay, and Prais-Winsten estimation techniques, Nathaniel et al. (2023) showed the negative effect of international tourism, economic growth, and population on environmental quality. Technological innovation, foreign direct investment, and renewal energy participate to the decrease of CO2 emissions.

Also related to the European context, in a single-country analysis approach, Can and Gozgor (2017) investigated with DOLS the existence of EKC in France while taking into account economic complexity and energy consumption, with data spanning from 1964 to 2014. Results established that a negative relationship between economic complexity and environmental degradation and they have also introduced economic sophistication as a differentiating element of production volume.

In sum, it is noticed that many types of variables have been used to approximate the environmental quality, with findings generally inconclusive concerning the EKC hypothesis in European countries in general as well as in Nordic countries especially. Among all the literature, few studies have investigated in Europe the effects of taking into account the structural change through economic complexity while investigating around the EKC hypothesis, and to the best of our knowledge, no study is using the currency zone criteria to apply in sub-group samples for this concern. The discrepancy with the studies of Mania (2020) and Apergis et al. (2018) comes from the fact that they have essentially focused on how exportations are affecting environmental quality and how diversification in productive component could lead to an upward trajectory of exportations. Moreover, the leveraging effect of economic complexity hypothesized and extensively investigated in this study has not yet been tested in Nordic European context. Therefore, this present study sheds light on these issues by starting at an aggregate level with the whole sample of Nordic European countries where economic complexity is tested. The criterion of currency zone is introduced only after the sample disaggregation. This study also differs with the existent literature because it is not focusing on financial development (Fakher Ahmed, Acheampong et al., 2022; Fakher, Ahmed, Alvarado et al., 2022) and renewable or non-renewable energy (Fakher & Inglesi-Lotz, 2022; Nathaniel et al., 2023). However, all these studies are sharing the same framework of environmental Kuznets curve.

Literature review on Nordic countries shows that although there seems to be a consensus on two countries (Denmark and Iceland) in which the EKC hypothesis is often verified, except Norway, the situation of the other countries is unclear. Furthermore, studies that considered Nordic countries as a whole like in the approach of this paper have received very little attention as seen in the literature. For the few existing ones on the issue, their finding concludes in favor of the non-validity of the inverted U-shaped in the Nordic countries. Nevertheless, while looking after the economic complexity effect in the sample as well as the non-Euro currency Nordic countries sub-sample, the outcome of taking into account the effect behind the non-belonging criterion to the Eurozone is also considered.

All the aforementioned discrepancies set us apart from the existing literature. Since Nordic countries are analyzed as a whole sample, the approach here is similar to that of Tapsin and Yazici (2014).

Data Sources and Statistics Measurements

Data Sources

This study employs macroeconomics variables data on a sample of five Nordic European countriesFootnote 8 obtained from the World Development Indicator (WDI) of the World Bank database. The time scope of the data is 2005–2019 with the determinant driver for the cross-country sample and study period established according to the criterion of data availability, mainly the Economic Complexity Index on the period, without missing values in the series of many key variables. Regarding the fact that among the selected countries, the main economies in terms of GDP and economic leadership in the Nordic region are included in the sample of this study; the absence of little components of Nordic area could not generate a statistical analysis selection bias in this study. While Table 1 presents the Nordic countries descriptive statistics, Table 2 presents the matrix of correlation of Nordic countries.

Dataset 1: Dependent and Independent Variables

Carbon emissions available in metric tons per capita are the dependent variable, and Ecofootprint index is used as alternative dependent variable in robustness check. The interest variable is Gross Nation Income (GNI) per capita considered in logarithm form, which is considered in purchasing power parities in current international dollars to reflect the income level of each country. It is used as a measure of economic growth because data of the alternative variable (GDP per capita) which is usually used with this topic were not totally available on the timeframe for all countries. National investment, foreign direct investment inflows and outflows, and trade openness variables are used as a percentage of GDP.

Dataset 2: Sets of Control Variables

Popgrowth is the annual population growth rate for a year expressed as a percentage. Electrickwh in kWh per capita provided in logarithm measures the electric power consumption produced. Taxgoodservrev is the taxes on goods and services as a percentage of revenue, while forestrentgdp and servicevagdp are, respectively, forest rents that allow us to hypothesized a forest resource curse scenario and value added in service as a percentage of GDP that allow to consider the scenario of specialization of Nordic countries economies or diversification with others activities. The consumer price index reflects the annual percentage change in the cost to the average consumer of acquiring a basket of goods and services described by the inflation.

Dataset 3: Economic Sophistication Data

A third group of variables is defined as control variable designed by Economic Complexity Index (ECI) that plays a key role in the estimation’s process. This variable is obtained from the Atlas OEC database. It is used to demonstrate the effect of economic complexity regarding the baseline result scenario, and as in Hausmann et al. (2007), this variable is likely to be closely related to economic sophistication.

Descriptive Statistics Measurements of Nordic Countries

In the benchmark analysis except ecological footprint and economic complexity in Nordic countries and taxes on goods and services, the set of variables is available. On average, carbon emission indicator is set at a maximum of 12.726 with a mean of 3.265 in Nordic countries, while ecological footprint is set at a mean of 6.541 with a maximum of 8.423.

Variables characteristics from descriptive statistics show that there is a broader dispersion between countries or a great heterogeneity among countries of the panel. There are countries that emit more than others, since their level of emission is far above the mean. Therefore, pollution control efforts will be important (resp. low) in countries with a higher (resp. lower) level of carbon emissions than in countries with low (resp. high) level of carbon emission. Based on these specificities, environmental policy schemes through environmental taxes could present a discrepancy in their implementation.

Production structure can offer a second length of interpretation. All the countries of the panel in the Nordic countries have a positive level of economic complexity that also indicates their capacity of exporting sophisticated product abroad (also see Trade statistics). They are characterized by a good level of income per capita in average, a high level of taxation of goods and services (up to 40.409), a mean of inflation around the average of European countries, and an important contribution of service sector in the value added with an average of 60.12. FDI inflow level indicates that some countries are attractive to foreign direct investment, others are not, and are also characterized by important capital outflows. Electricity consumption is in line with production level, proxy by Gross National Income per capita. Thus, these statistics describe the economic dynamism of Nordic economies countries.

Based on the data presented above in this section, empirical analyses are assessed with the methodological framework described below.

Presentation of the Methodological Framework

Estimation Strategy

In this study, the relationship between carbon emissions and economic growth is suggested, with a different specification of economic growth. The approach here differs from the others in the literature because Gross National Income (GNI) per capita is used instead of other measure of economic growth as Gross Domestic Product (GDP) per capita, for example. Following the literature review and given the previous approaches of Panayotou et al. (2000) and Tchapchet-Tchouto (2023), the first equation is used to test the basic EKC hypothesis as follows:

Then, economic complexity term is introduced and that gives this second regression equation:

In these equations, the subset t is a time variable, \({CO2}_{i,t}\) is the carbon emission level per capita, and \({\alpha }_{0}\) is the scale parameter. \({ECI}_{i,t}\) is the Economic Complexity Index in each country, with the idea that this variable can be a significant determinant of CO2 emissions. \({X}_{k,t}\) is a vector of control variables defined in Dataset 2, subsection “Data Sources.” \({\alpha }_{1}, {\alpha }_{2},\) and \({\delta }_{3}\) are the coefficients of Gross National Income and Gross National Income Square and Economic Complexity Index, and \({\delta }_{k}\) is a vector of the coefficients of the control variables which will be determined.

EKC Structure Hypotheses

\({\alpha }_{1} \mathrm{and }{\alpha }_{2}\) Are expected to be positive and negative, respectively, to validate an environmental Kuznets curve (EKC) in European economies countries, \({u}_{i}\) is an unobserved country-specific effect, \({v}_{t}\) is a time-specific effect, and \({\varepsilon }_{it}\) is the error term. Besides, \({\delta }_{3}\) < 0 will be required for the country to benefit from reductions in environmental degradation as economic complexity increases.

Economic structure is describing by the explanatory variables that are investment, trade, and foreign direct investment inflows. Concerning explanatory variables, except national investment, it is expected in this study that an increase in foreign direct investment inflows and merchandise trade leads to an increase in carbon emissions and therefore a degradation of the environmental quality. Among control variables, it is expected from this study that the level of population will exacerbate the environmental quality and the effect of the tax on good will not harm the environmental quality.

Empirical Results

In this section, the presentation of the results is organized in three parts. While the first part is dealing with baseline empirical results of the whole sample, the second part is focusing on the analysis from the strategy that consists in testing the non-Eurozone Nordic countries belonging sub-sample. Finally, taking into account the currency zone features, the third part is dealing with the effects of this characteristic.

The Effects of Economic Growth on Carbon Emissions

The baseline empirical results are presented in Table 3, columns (1) to (5). The findings are highlighting the effects of Gross National Income per capita and selected explanatory variables on carbon emissions. First of all, the rationale behind the sign of the coefficient obtained through the results is showing evidence of the fact that Nordic countries are characterized by a U-shaped structure.

Consistent U-Shaped Structure in Nordic Countries Without ECI Leveraging Effect

At this stage, the significance of the results is analyzed. Table 3 shows in columns (1) to (12) in the whole sample of the Nordic countries, a significant result for the independent variables Gross National Income per capita (GNIpc) and Square of National Income per capita (GNISQ). While columns (1) to (5), (7), (8), (10), and (11) show results that are significant at 5%, columns (6), (9), and (12) disclose significance at 1% level. Results here include the first sensitivity test with control variables. The interpretation of EKC hypothesis in the results is based on the coefficient signs. Here, GNIpc is associated with a consistent negative coefficient, while GNISQ coefficient is confirmed to be positive even in the sensitivity analysis. These results indicate that in the whole sample, Nordic countries are basically characterized by a U-shaped relationship between carbon emissions which is a proxy of environmental quality and economic growth.

Furthermore, to capture the issue of omitted variables, a first sensitivity test is performed by adding more control variables in the baseline estimations (see Table 3 columns (6) to (11)). As also shown in Table 3, sensitivity test with economic complexity variable, used as additional explanatory variable, is introduced in column (12), and the effects from the baseline results scenario are also checked.

In the second part of the empirical results, the objective is to investigate if the non-belonging to a currency zone such as “Euro Currency Zone” could be the source of heterogeneity in the initial results. Therefore, the study focuses on the strategy that consists in the verification of the validity or not of the EKC hypothesis in the non-Eurozone Nordic countries sub-group. The reason that justifies the focus on the non-Eurozone instead of the Eurozone or both areas is mainly based on that Finland is the only Nordic country to adopt Euro currency. This has conducted to the impossibility to use the panel data only for a single country. The EKC hypothesis is then tested in a sub-group of four Nordic countries.

Therefore, Eqs. 1 and 2 are re-estimated in the sub-sample of non-Euro currency countries, and Table 4 presents the results. As in the previous approach, testing the model with ECI variable following Eq. 2 is to investigate if there is any change or not from the U-shaped structure hypothesis (see the columns in each table with ECI in Table 4).

U-Shaped Structure in Nordic Non-Euro Currency Countries

Given the results in Table 4, a conclusion can be made with evidence of non-EKC structure in this sub-sample of Nordic countries. In fact, for Nordic non-Euro currency countries, results in columns 1 to 11 from Table 4 above provide the combination of signs affecting GNI and GNISQ that confirm the U-shape structure but only column (1) presents a significant result with 1% level of significance. Similarly, results depicting the U-shaped structure in Table 4 are found with a 1% level of significance in column (5), 5% level in columns (2), (4), (7), and (12), and 10% in column (6).

At all, in both the whole sample and non-Euro currency countries, adding control variables including ECI confirms these findings. In fact, both columns 12 (Table 3 and 4) show that there is no evidence of leveraging effect of ECI.

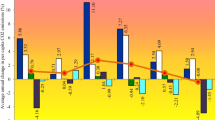

Figure 1 shows that the non-Euro currency Nordic sub-groups of countries are presenting a U-shaped structure and the slope of the line representing the relation between CO2 emissions and economic growth in Euro currency countries is more slanted to the right than in non-Euro currency countries. This could be an indication to the fact that pollution control efforts in Euro currency Nordic countries seem to have a much more effective results comparing to the non-Euro currency countries. High values of income per capita are much related to low values of carbon emission in Euro currency Nordic countries. Even the slope tend to be negative on non-Euro currency Nordic countries, the improvement of environmental quality in terms of CO2 emissions level average is very slow, regarding the slope of the line.

The other interpretation that can be extracted from this graph is that even the trends are showing that Nordic sub-group countries are converging in general in a stage where the improvement of the environmental quality is related to the increase of income per capita. The Nordic countries did not yet reach the turning point that leads to the inverted U-shaped which characterized the EKC structure.

After this result mainly based on the additional control including ECI that has been estimated in the whole sample as well as in the non-Eurozone sub-sample, a step forward will consist in sensitivity analysis by looking after the estimation results while using an alternative method of robustness in view to assess how robust the results of this research are. It consists in a selection of an alternative measurement of environmental quality as presented below in the next section, followed by results and discussions.

Further Robustness Check

This section focuses on another method of robustness check. Then, proceeding with ecological footprint (Ecofootprint) being used as an alternative dependent variable. It represents a valuable proxy of carbon emissions and thus of environmental quality. Results of the estimations that have been performed by using both equations in the sub-group of non-Euro currency Nordic countries are presented in Table 5. Figure 2 shows and confirms in non-Euro currency Nordic countries the initial shape of the slope obtained previously in baseline results. In fact, the results show here for non-Euro currency Nordic countries, the confirmation of the observation that has been previously established in Fig. 1.

At this stage, this study explores the results presented in Table 5. Indeed, in Table 5, except columns (2), (11), and (12) where the findings indicated 5% level of significance, U-shaped structure is found with 1% level of significance in the other columns in the non-Euro Nordic countries. The results are robust and consistent with additional variables, including when ECI is taking into account under Eq. (2).

Quantile Analysis in Nordic Countries

The approach here consists in a non-parametric test by using quantile analysis in the whole sample of Nordic countries. The aim is to investigate if the U-shaped is confirmed by this method of estimation or not. So, this method is a robustness check of the baseline results to the extreme or the threshold values of the dependent variable (CO2 emissions used as proxy of the environmental quality). Moreover, it allows us to outline if the panel of the Nordic countries is characterized by the existence of any heterogeneity on the fractions of the dependent variable (conditional mean or other quantiles). While OLS is looking for conditional means of the dependent variable across values of the independent variables, following Koenker and Bassett (1978), quantile regression estimates the conditional median or other quantile of the dependent variable across the value of the independent variables. It is used to explain more useful predictive relationships between variables in case there is a weak or partial relationship between the means of such variables. This method is used in robustness because the study investigates the case whereas the conditions of linear regression such as homoscedasticity, normality, linearity, or independence could not be met. Therefore, using all the previous control variables, four fractions of the dependent variable have been studied with this estimation technique.Footnote 9

Table 6 presents the estimation results by quantile where GNI and GNISQ per capita in column (1) provide the sign that confirms the U-shaped structure in the first quantile (0.25) considered low-income Nordic countries; however, the result obtained is not significant. The findings also confirm the initial U-shape structure with 1% level of significance within quantiles (0.50) and (0.90), and 5% in quantile 0.75. Figures 3 and 4 in the “Appendix” section present the dependent variable in each quantile as well as the coefficient for each regressor by quantile.(Table 7)

Discussion

Following these results, it can be concluded that the first hypothesis that aims to investigate whether the EKC structure is valid in the Nordic countries is not verified. In response to the second hypothesis, economic complexity does not have the expected leveraging effect that can transform a U-shaped structure into an inverted U-shaped structure, even it is endowed with sustainability skills according to the third hypothesis. Regarding the fourth hypothesis, once countries are disaggregated regarding the currency criterion, there is also no leveraging effect in each sub-group of Nordic countries. Finally, quantile analysis provides a scope to characterize threshold heterogeneity among Nordic countries due to the difference of the magnitude of the effects obtained from each country’s threshold (Hypothesis 5).

Most of other works that deals with Nordic European countries have adopted a single-country modeling approach. Meanwhile, this study does not perform estimations of each single country separately in the approach of this article. It differs from the previous studies because the currency criterion is used in the subdivision of each sub-group and the effect of economic complexity is tested. The findings also differ from the recent studies that tend to highlight the predominance of individual country’s heterogeneity when investigating EKC structure with CO2 total emissions in some countries such as Denmark, Iceland, and Sweden (Urban & Nordensvärd, 2018). There is also a difference in results with Kar (2021) and Bese (2018) who investigated the EKC structure with CO2 emissions per capita in Denmark, Iceland, Finland, and Sweden, but the inverted U-shaped has been found only in Denmark and Iceland. Meanwhile, these authors also find no evidence of EKC hypothesis existence in the other countries of the Nordic region as in this paper. The findings in this study are in the same streamline with the results established by Baek (2015).

On another length, the findings here differ from those of Tapsin and Yazici (2014) and partially Churchill et al. (2018) that established the evidence of an N-shaped showing that income growth increases environmental degradation until a threshold point, following by a decline of the CO2 emission. However, after a certain point, a further increase of the income leads to an increase of environmental degradation. Churchill et al. (2018) also characterized the existence of an inverted U-shaped, as well as an inverted N-shaped in OECD countries that strongly diverge with the results of this study. According to energy used, U-shaped structure has been found in Finland, Iceland, Sweden, and Norway by Urban and Nordensvärd (2018) as in the approach adopted here which differs by the use of CO2 emissions, but inverted U-shaped is characterized in Denmark by these previous authors.

Conclusion

Within the context of “the Green Deal” and the Norden Environmental Action Plans, this study empirically investigates the validity of the EKC hypothesis in Nordic European countries using carbon dioxide emissions per capita (and ecological footprint considered alternative measure of the dependent variable for robustness checks). Covering the five countries of the Nordic European region, the data spans the period 2005–2019. The results show the evidence of a consistent U-shaped structure in the Nordic countries within the different estimation methods.

Indeed, the results are robust to additional control variables (1). This includes economic complexity scenario that is used to simulate the effects of a sustained structural change. Structural change here could be defined as the proficiency of Nordic countries in low carbon emission goods production, obtained under efficient energy used in the production process. The finding of this study is also robust non-Euro currency Nordic countries sub-sample (2). As the main conclusion regarding one of the important objectives of this study, there is no leveraging effect of the economic complexity that could modify the U-shaped into an inverted U-shaped neither in Nordic countries (3) nor in the sub-sample constitutes by non-Euro currency countries that are belonging to the Nordic region (4). Therefore, the present study concludes that the non-Euro currency criterion is not a source of heterogeneity at this stage.

With quantile analysis, there is a differentiated effect between each quantile, characterized by the existence of a threshold heterogeneity (5). Though it was found from data analysis that high values of income per capita are progressively much related to low values of carbon emission in Nordic countries, a conclusion can be made regarding empirical results that Nordic countries are not yet at the turning point level that leads to the inverted U-shaped structure (4). However, given that from the results, it is evident to conclude that FDI inflows are improving management practices and increasing use of advanced technologies in Nordic economies and the study characterizes the existence of the PHE in the Nordic European countries.

Some policy implications arise from these findings: First, Nordic economies need to continuously develop low carbon footprint production and consumption model such as environmental standard targets from the “Green Deal” and Norden Environmental Action Plans. Second, they need to pursue on a long-term basis, initiatives to converge to a Green Nordic label, energy efficiency while adapting sustained consumption behaviors given under economic cycle constraints.Footnote 10 Third, to support green production, compensation mechanisms through subsidies to the production sector, for example, can be used.

The main caveat of this study could be associated to the timeframe of the study. Unfortunately, this is directly related to the data unavailability. Therefore, with time, once data will become available, this will offer the possibility as one future research direction, to investigate if the efforts popularized throughout the “Green Deal” and the Norden Environmental Action Plans have pushed the Nordic European economies after the inverted U-shaped inflection or turning point. Furthermore, taking environmental taxFootnote 11 into consideration can provide the perspective to test how environmental policy designs with this tool in Nordic countries can influence the level of GHG generated by industrial activities, transportation sector, or energy production, among others.

Availability of Data and Materials

The datasets used and analyzed during the current study are available from the corresponding author and could be shared on reasonable request. Economic Complexity Index can be found in the Atlas OEC database accessible from: https://oec.world/en/rankings/eci/hs6/hs96?tab=table.

Notes

This Nordic community also involves the Faroe Islands, Greenland, and Aland.

Particularly in the literature that deals with European countries: Data and De (2021), Ma et al. (2021), Xu et al. (2020), Ali et al. (2020), Alsayed and Kun Sek (2013) for renewable energy; Jozwik et al. (2021), Topolewski (2021), Dogan et al., (2020), Balcilar et al. (2020), Li et al. (2020), Destek et al. (2016), Bozkurt and Okumus (2019), Al Mulali et al. (2015), Figuero and Pastén (2009), and Suri and Chapman (1998), Richmond and Kaufmann (2006a, b), Shahbaz et al. (2017), Ansari et al. (2020), Altıntas and Kassouri (2020), and Chen (2016) for non-renewable energy.

Environmental impact (I), population (P), affluence (A), and technology (T).

Austria, Belgium, Canada, Denmark, Finland, France, Germany, Italy, Japan, The Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, the UK, USA, and Uruguay.

Denmark, Iceland, Norway, and Sweden (non-Eurozone Nordic country members) and Finland (Eurozone Nordic country member).

Tchapchet-Tchouto et al. (2022).

Abbreviations

- AMG:

-

Augmented Mean Group

- CO2:

-

Carbon Dioxide

- COP26:

-

26Th United Nations (UN) Climate Change Conference of the Parties

- DOLS:

-

Dynamics Ordinary Least Squares

- ECI:

-

Economic Complexity Index

- EcoFP:

-

Ecological Footprint

- EKC:

-

Environmental Kuznets Curve

- EURC:

-

Euro Currency

- FDI:

-

Foreign Direct Investment

- FMOLS:

-

Fully Modified Ordinary Least Squares

- GDP:

-

Gross Domestic Product

- GHG:

-

Greenhouse Gases

- GNI:

-

Gross National Income

- GNIpc:

-

Gross National Income per Capita

- GNISQ:

-

Gross National Income Square

- IEA:

-

International Energy Agency

- IPAT:

-

Impact, Population, Affluence, Technology

- NEURC:

-

Non-Euro Currency

- OEC:

-

The Observatory of Economic Complexity

- OECD:

-

Organisation for Economic Co-operation and Development

- OPEC:

-

Organization in Petroleum Exporting Countries

- PHE:

-

Pollution Halo Effect

- UN :

-

United Nations

- WDI:

-

World Development Indicators

References

Al Mulali, U., Weng Wai, C., Sheau-Ting, L., & Mohammed, A. H. (2015). Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecological Indicators, 48, 315–323.

Ali, M., Raza, S. A., & Khamis, B. (2020). Environmental degradation, economic growth, and energy innovation: Evidence from European countries. Environmental Science and Pollution Resources, 27, 28306–28315.

Alsayed, A. R. M., & Kun Sek, S. (2013). Environmental Kuznets Curve : Evidence from developed and developing economies. Applied Mathematical Sciences, 7(21), 1081–1092. https://doi.org/10.12988/ams.2013.13098

Altıntas, H., & Kassouri, Y. (2020). Is the environmental Kuznets curve in Europe related to the per-capita ecological footprint or CO2 emissions? Ecological Indicators, 113, 106187.

Andersson, J. J. (2019). Carbon taxes and CO2 emissions: Sweden as a case study. American Economic Journal: Economic Policy, 11(4), 1–30.

Ansari, M. A., Haider, S., & Khan, N. (2020). Environmental Kuznets curve revisited: An analysis using ecological and material footprint. Ecological Indicators, 115, 106416.

Apergis, N., & Can, & M., Gozgor, G., Lau, C.K.M. (2018). Effects of exports concentration on CO2 emissions in developed countries : An empirical analysis. Environmental Science and Pollution Resources International, 25(14), 14106–14116.

Apergis, N., Pinar, M., & Unlu, E. (2023). How do foreign direct investment flows affect carbon emissions in BRICS countries? Revisiting the pollution haven hypothesis using bilateral FDI flows from OECD to BRICS countries. Environmental Science and Pollution Resources, 30(6), 14680–14692.

Baek, J. (2015). Environmental Kuznets curve for CO2 emissions: The case of Arctic countries. Energy Economics, 50, 13–17.

Balcilar, M., Ozdemir, Z. A., & Tunçsiper, B. (2020). On the nexus among carbon dioxide emissions, energy consumption and economic growth in G-7 countries: New insights from the historical decomposition approach. Environment, Development and Sustainability, 22(8), 8097–8134.

Bese, E. (2018). Environmental Kuznets curve (EKC): Evidence from Sweden. SMART Journal, 4(14), 1093–1099.

Bimonte, S., & Stabile, A. (2017). EKC and the income elasticity hypothesis land for housing or land for future? Ecological Indicators, 73, 800–808.

Boleti, E., Garas, A., Kyriakou, A., & Lapatinas, A. (2020). Economic complexity and environmental performance: Evidence from a world sample. Environmental Modeling and Assessment, 26, 251–270.

Bozkurt, C., & Okumuş, İ. (2019). Environmental Kuznets curve hypothesis in selected EU countries: Kyoto effect. Balkans Journal of Emerging Trends in Social Sciences, 2, 134–139. https://doi.org/10.31410/Balkans.JETSS.2019.2.2.134-139

Can, M., & Gozgor, G. (2017). The impact of economic complexity on carbon emissions : Evidence from France. Environmental Science and Pollution Research, 24, 16364–16370. https://doi.org/10.1007/s11356-017-9219-7

Caviglia-Harris, J. L., Chambers, D., & Kahn, J. R. (2009). Taking the ‘U’ out of Kuznets: A comprehensive analysis of the EKC and environmental degradation. Ecological Economics, 68, 1149–1159.

Cavlovic, T. A., Baker, K. H., Berrens, R. P., & Gawanda, K. (2000). A meta-analysis of environmental Kuznets curve studies. Agricultural and Resource Economics Review, 29, 1–11.

Chen, W.-J. (2016). Is the Green Solow Model valid for CO2 emissions in the European Union? Environmental and Resource Economics. https://doi.org/10.1007/s10640-015-9975-0

Churchill, S. A., Inekwe, J., Ivanovski, K., Smyth, R. (2018). The environmental Kuznets curve in the OECD: 1870–2014. Energy Economics, 75(C), 389–399.

Cole, M. A. (2007). Corruption, income and the environment: An empirical analysis. Ecological Economics, 62(34), 637–647.

Cole, M., & Neumayer, E. (2004). Examining the impact of demographic factors on air pollution. in Population and Environment, 26(1).

Dasgupta, S., Laplante, B., Wang, H., & Wheeler, D. (2002). Confronting the environmental Kuznets curve. Journal of Economic Perspectives, 16, 147–168.

Data, S., & De, T. (2021). Linkage between energy use, pollution, and economic growth—A cross-country analysis, Economics Environmental Sustainability and Economy.

Destek, M. A., Balli, E., & Manga, M. (2016). The relationship between CO2 emission, energy consumption urbanization and trade openess for selected CEECs. Research in World Economy, 7(1), 52–58.

Dinda, S. (2004). Environmental Kuznets curve hypothesis: A survey. Ecological Economics, 49, 431–455.

Dogan, E., Altinoz, B., Madaleno, M., & Taskin, D. (2020). The impact of renewable energy consumption to economic growth: A replication and extension of Inglesi-Lotz (2016). Energy Economics. https://doi.org/10.1016/j.eneco.2020.104866

Fakher, H.-A. (2019). Investigating the determinant factors of experimental quality (based on ecological carbon footprint index). Environmental Science and Pollution Research, 26, 10276–10291.

Fakher, H. A., & Inglesi-Lotz, R. (2022). Revisiting environmental Kuznets curve: an investigation of renewable and non-renewable energy consumption role. Environmental Science and Pollution Research, 29, 1–19. https://doi.org/10.1007/s11356-022-21776-9

Fakher, H.-A., Ahmed, Z., Acheampong, A. O., & Nathaniel, P. S. (2022). Renewable energy, non renewable energy, and environmental quality newus : An investigation of the N-shaped environmental Kuznets curve based on six environmental indicators. Energy. https://doi.org/10.1016/j.energy.2022.125660

Fakher, H.-A., Ahmed, Z., Alvarado, R., & Murshed, M. (2022). Exploring renewable energy, financial development, environmental quality and economic growth nexus: New evidence from composite indices for environmental quality and financial development. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-022-20709-w

Figuero, B., & Pasten, C. R. (2009). Country specific environmental Kuznets curves : A random coefficient approach applied to high income countries. Estudios De Economia, 36(1), 5–32.

Flannigan, M. D., Stocks, B. J., & Wotton, B. M. (2000). Climate change and forest fires. Sci Total Environment, 262(3), 221–229.

Galeotti, M., Lanza, A., & Pauli, F. (2006). Reassessing the environmental Kuznets curve for CO2 emissions : A robustness exercise. Ecological Economics, 57(1), 152–163.

Grossman, G. M., & Kruegger, A. B. (1991). Environmental impact of a North American Free Trade Agreement, Working Paper 3941, National Bureau of Economic Research, Cambridge, MA.

Grossman, G. M., & Krueger, A. B. (1993). Environmental impacts of a North American Free Trade Agreement. In Garber, P., Editor, The U.S.-Mexico Free Trade Agreement, p. 165–177. MIT Press, Cambridge, MA.

Grossman, G. M., & Krueger, A. B. (1995). Economic growth and the environment. The Quarterly Journal of Economics, 110(2), 353–377.

Hausmann, R., & Hidalgo, C. (2011). The network of structure of economic output. Journal of Economic Growth, 16, 309–342.

Hausmann, R., Hwang, J., & Rodik, D. (2007). What you export matters. Journal of Economic Growth, 12(1), 1–25.

Hausmann, R., Hidalgo, C. A., Bustos, S., Coscia, M., Chung, S., Jimenez, J., Simoez, A., & Yildirim, M. (2011). The atlas of economic complexity, Hollis (N.H), Puritan Press.

Hausmann, R., Hidalgo, C. A., Bustos, S., Coscia, M., Simoes, A., & Yildirim, M. A. (2014). The atlas of economic complexity: Mapping paths to prosperity. MIT Press.

Hidalgo, C. A., & Hausmann, R. (2009). The building blocks of economic complexity. Proceedings of the National Academy of Sciences of the United States of America, 106(25), 10570–10575.

IEA. (2021). Global energy review 2021, Assessing the effects of economic recoveries on global energy demand and CO2 emissions in 2021. Paris: International Energy Agency. Accessible at: www.iea.org/reports/global-energy-review-2021. Accessed on 25 July 2023.

John, A., & Pecchenino, R. (1994). An overlapping generations model of growth and the environment. The Economic Journal, 104, 1393–1410.

John, A., Pecchenino, R., Schimmlpfennig, D., & Schreft, S. (1995). Short-lived agents and the long-lived environment. Journal of Public Economics, 58, 127–141.

Jozwik, B., Gavryshkiv, A. V., Kyophilavong, P., & Kyophilavong, L. (2021). Revisiting the environmental Kuznets curve hypothesis: A case of Central Europe. Energies, 14(12). https://doi.org/10.3390/en14123415

Kar, A. (2021). Testing environmental Kuznets curve for CO2 emission in Nordic countries. International Journal of Environmental Studies.

Kocherginsky, X., He, X., & Mu, Y. (2005). Practical confidence intervals for regression quantiles. Journal of Computational and Graphical Statistics, 14, 41–55.

Koenker, R. (2005). Quantile regression. Cambridge University Press.

Koenker, R., & Jr Bassett, G. (1978). Regression quantiles. Econometrica: Journal of the Econometric Society, 30–50.

Kuznets, S. (1955). Economic growth and income equality. American Economic Review, 45(1), 1–28.

Li, K., Hu, E., Xu, C., Musah, M., Kong, Y., Mensah, I. A., Zu, J., Jiang, W., & Su, Y. (2020). A heterogeneous analysis of the nexus between energy consumption, economic growth and carbon emissions: Evidence from the Group of Twenty (G20) countries. Energy Exploration & Exploitation, 39(3), 815–837. https://doi.org/10.1177/0144598720980198

Lin, B., & Li, X. (2011). The effect of carbon tax on per capita CO2 emissions. Energy Policy, 39(9), 5137–5146.

Lobell, D. B., Schlenker, W., & Costa-Roberts, J. (2011). Climate trends and global crop production since 1980. Science, 333(6042), 616–620.

Ma, X., Ahmed, N., & Oei, P. Y. (2021). Environmental Kuznets curve in France and Germany; Role of renewable and non-renewable energy. Renewable Energy, 172(S), 88–99.

Mania, E. (2020). Exports diversification and CO2 emissions : An augmented environmental Kuznets curve. Journal of International Development, 32(2), 165–185.

Marinas, M.-C., Dinu, M., Socol, A.-G., & Socol, C. (2018). Renewable energy consumption and economic growth. Causality relationship in Central and Eastern European countries. PLOS ONE. https://doi.org/10.1371/journal.pone.0202951

Michetti, M., & Pinar, M. (2019). Forest fires across Italian regions and implication for climate change: A panel data analysis. Environment and Resources Economics, 72(1), 207–246.

Nathaniel, S. P., Solomon, C. J., Ajide, K. B., Ahmed, Z., & Fakher, H.-A. (2023). Striving towards carbon neutrality in emerging markets: The combined influence of international tourism and eco-friendly technology. International Journal of Sustainable Development and World Ecology. https://doi.org/10.1080/13504509.2023.2195831

Neagu, O., & Teodoru, M. C. (2019). The relationship between economic complexity, energy consumption structure and greenhouse gas emissions: Heterogeneous panel evidence from the EU countries. Sustainability, 11(2).

Neira, M., Campbell-Lendrum, D., Maiero, M., Dora, C., & Bustreo, F. (2014). Health and climate change: The end of the beginning? Lancet 384(9960), 2085–2086.

Norden (2012). Environmental Action Plan 2009–2012, Nordic Council of Minister, accessible at : http://norden.diva-portal.org/smash/get/diva2:702779/FULLTEXT01.pdf, accessed on 06 june, 2022.

Nordic Statistic database, (2022). accessible at www.nordicstatistics.org. Accessed on 03 May 2022.

Pakrooh, P., & Brännlund, R. (2021). Examining the environmental Kuznets curve in Sweden to assess the nexus of economic sectors. Pollution, 7(3), 585–606. https://doi.org/10.22059/poll.2021.319566.1024

Panayotou, T. (1993). Empirical tests and policy analysis of environmental degradation at different stages of economic development. Working Paper number 238, Technology and Employment Programme, International Labour Office, Geneva.

Panayotou, T. (1995). Environmental degradation at different stages of economic development, in Ahmed, I., Doeleman, J.A., Eds, Beyond Rio : The Environmental Crisis and Sustainable Livelihoods in the Third World, ILO Studies Series, St Martin’s Press, New York.

Panayotou, T. (1997). Demystifying the environmental Kuznets curve: Turning a black box into a policy tool. Environment and Development Economics, 2, 465–485.

Panayotou, T., Peterson, A., & Sachs, J. (2000). Is the environmental Kuznets curve driven by structural change? What extended time series may imply for developing countries, CAER II Discussion Paper number. 80. https://doi.org/10.7916/D8CV4QJF

Panke, D. (2010). Small states in the European Union: Coping with structural disadvantages (1st ed.). Ashgate Publishing Limited.

Raihan, A. (2023). Toward sustainable and green development in Chile: Dynamic influence of carbon emission reduction variables. Innovation and Green Development, 2, 100038.

Ray, D. K., West, P. C., Clark, M., Gerber, J. S., Prishchepov, A. V., & Chatterjee, S. (2019). Climate change has likely already affected global food production. PLoS ONE 14(5). https://doi.org/10.1371/journal.pone.021714

Richmond, A. K., & Kaufmann, R. K. (2006a). Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecological Economics, 56(2), 176–189.

Richmond, A. K., & Kaufmann, R. K. (2006b). Energy prices and turning points: The relationship between income and energy use/carbon emissions. The Energy Journal, 27(4), 157–180.

Sääksjärvi, S. C. (2020). Positioning the Nordic Countries in European Union Environmental Policy. The Journal of Environmental and Development. https://doi.org/10.1177/1070496520933324

Schewe, T. (2015). Monetary policy regimes and the Nordic model. Buskerud and Vestfold University College.

Seidl, R., Thom, D., & Kautz, M. (2017). Forest disturbances under climate change. Natural Climate Change, 7, 395–402. https://doi.org/10.1038/nclimate3303

Selden, T. M., & Song, D. (1994). Environmental quality and development: Is there a Kuznets curve for air pollution emissions? Journal of Environmental Economics and Management, 27, 147–162.

Shafik, N., & Bandyopadhyay, S. (1992). Economic growth and environmental quality: Time series and cross section evidence. Policy Research Working Paper number WPS904, The World Bank, Washington, DC, USA.

Shahbaz, M., & Sinha, A. (2018). Environmental Kuznets curve for CO2 emissions : A literature Survey. Journal of Economic Studies, 46(2).

Shahbaz, M., Shafiullah, M., Papavassiliou, V. G., & Hammoudeh, S. (2017). The CO2-growth nexus revisited: A nonparametric analysis for the G7 economies over nearly two centuries. Energy Economics, 65, 183–193.

Stern, D. I. (1998). Progress on the environmental Kuznets curve? Environment and Development Economics, 3, 173–196.

Stern, D. I. (2004). The rise and fall of the environmental Kuznets curve. World Development, 32(8), 1419–1439.

Stern, D. I. (2017). The environmental Kuznets curve after 25 years. Journal of Bioeconomics, 19, 7–28.

Suri, V., & Chapman, D. (1998). Economic growth, trade and energy: Implications for the environmental Kuznets curve. Ecological Economics, 25(2), 195–208. https://doi.org/10.1016/S0921-8009(97)00180-8

Tapsin, G., & Yazici, C. (2014). Testing the environmental Kuznets curve hypothesis for Nordic countries. European Journal of Economics, Finance and Administrative Sciences, 67.

Tarr, G. (2010). Small sample performance of quantile regression confidence intervals. Journal of Statistical Computation & Simulation, 82(1), 81–94.

Tchapchet-Tchouto, J. E. (2023). Testing the economic growth path “green resilience” under natural resources constraint in Asia-Pacific economies, Journal of Environmental Assessment Policy and Management, 25(2). https://doi.org/10.1142/S1464333223500102

Topolewski, L. (2021). Relationship between energy consumption and economic growth in European countries: Evidence from dynamic panel data analysis, Energies, 14(12). https://doi.org/10.3390/en14123565

Tchapchet-Tchouto, J.-E., Duthil, G., Savard, L., & Ngo Ngueda, R. D. (2022). Pollution abatement strategy and the dichotomy of “Green” versus “non-green” products: A new analytical insight. Journal of the Knowledge Economy. https://doi.org/10.1007/s13132-022-00929-8

Urban, F., & Nordensvärd, J. (2018). Low Carbon Energy Transition in the Nordic Countries: Evidence from the Environmental Kuznets Curve: Energies, 9, 1–17.

World Bank. (1992). World Development Report 1992. Oxford University Press.

Xepapadeas, A. (2005), Economic growth and the environment. Chapter 23 in Handbook of Environmental Economics, 3, 1219–1271.

Xu, X. L., Huang, G. H., Liu, L. R., Guan, Y. R., Zhai, M. Y., & Li, Y. P. (2020). Revealing dynamic impacts of socioeconomic factors on air pollution changes in Guangdong Province, China. The Science of The Total Environment, 699(9), 134178. https://doi.org/10.1016/j.scitotenv.2019.134178

Zambrano-Monserrate, M. A., Trocolly-Quiroz, A., & Paccheto-Borja, M. J. (2016). Testing the environmental Kuznets curve hypothesis in Iceland: 1960–2010. Revista De Economia Del Rosario, 19(1), 5–28. https://doi.org/10.12804/revistas.urosario.edu.co/economia/a.5239

Acknowledgements

The authors are indebted to the editor and anonymous referees for their valuable comments that have enabled to improve the quality of this article. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Tchapchet-Tchouto, JE., Duthil, G., Meyet Tchouapi, R. et al. The Environmental Kuznets Curve Under Norden “Green Deal” and Action Plans in Nordic European Countries. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-01744-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-01744-z

Keywords

- Norden Environmental Action Plan

- Economic Complexity

- Ecological Footprint

- Carbon Emissions

- Nordic European Countries

- Environmental Kuznets Curve