Abstract

The purpose of this research is twofold: First, it aims to clarify the public subsidy effect on Small–Medium Enterprises’ (SMEs’) R&D expenditures by contrasting total R&D investments and net R&D investments excluding the amount of public funding. The second aim is to determine whether government subsidies induce firms to nonlinearly invest their own funds in R&D. To control for potential selection bias, we estimate the policy effect through matching techniques and a dose–response function with a generalized propensity score, using panel data that link the 2015 through 2019 waves of the South Korean Survey on the Technology of SMEs. We were not able to reject the hypothesis that uses a linear effect of public subsidies on SMEs’ R&D investments, suggesting a complementary effect on total R&D expenditures and a partial crowding-out effect for the net R&D case without a specific minimum threshold or a saturation point. Further investigation of a possible heterogeneous effect based on a subsample shows a U-shaped relationship, with a minimum threshold in the manufacturing industry. Our findings imply that public financial support for SMEs in South Korea has not completely prevented market failure beyond a certain level of public intervention. Importantly, the absolute amount of direct public support for individual SMEs should be increased in order to efficiently promote R&D spending in the manufacturing sector.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Small–medium enterprises (SMEs) are considered an important driver of national economic growth due to the impact of innovation. However, it is common knowledge that market failures result in lower private R&D spending due to information asymmetry in capital markets and limited access to innovation results (Arrow, 1962). Specifically, SMEs are likely to experience financial constraints since external investors might be reluctant to fund owing to a lack of technological knowledge regarding an inventor’s innovation projects (Meuleman & Maeseneire, 2012). Therefore, innovation policies for SMEs, which primarily suffer from resource shortages, are a central topic for policy makers in developed, developing, and emerging countries (Bellucci et al., 2019; Cin et al., 2017; Radicic & Pugh, 2017). According to OECD (2017), in 2015, South Korea ranked fourth, after Russia, Hungary, and the USA, in terms of the ratio of the country’s public subsidies for business R&D to its GDP. Public subsidies for SMEs’ R&D activities in Korea amounted to about 3 billion Korean won in 2017 (Kim & Jeong, 2019), for which it ranked second among the OECD countries (Lee, 2018).

As a government commits significant resources to stimulate private R&D and innovation, increased attention is also paid to the evidence-based effectiveness of its policy interventions. Although abundant studies have assessed the impact of policy interventions on private R&D expenditures, there is no clear consensus regarding the resulting policy impact (Cunningham et al., 2016, 78). A recent meta-analysis that synthesizes empirical studies reports a positive but small effect (Dimos & Pugh, 2016).

One important stream regarding subsidy impacts on private R&D investments that has been neglected is the amount of public funding received by firms (Cerulli, 2010; Zúñiga‐Vicente et al., 2014). Thus, it is essential to clarify the impact of innovation policy in terms of whether it promotes additional R&D outlays beyond the level of public support.

The literature has also begun to discuss whether the policy impact is potentially nonlinear. Most previous studies assume a linear relationship between subsidies and private R&D activities, and many studies ignore differences in the amount of the subsidies and consider only whether firms are subsidized (Zúñiga‐Vicente et al., 2014). According to Becker (2015), who conducted a systematic review of the empirical evidence, the policy impact might vary depending on the level of the subsidy, resulting in an inverted U-shaped or S-shaped relationship. This is in line with previous claims that a minimal subsidy amount is necessary for influencing a firm’s R&D (Aschhoff, 2009) and that a firm’s R&D activities are expected to be inelastic beyond a certain level of its resources, depending on the size and scope of the business (Zúñiga‐Vicente et al., 2014). In addition, recent empirical studies seem to provide a rationale for examining a potential nonlinearity since there is evidence that firms receiving a higher level of public financial support with both subsidies and tax breaks show a lower investment effect than firms that receive only subsidies (Dumont, 2017; Marino et al., 2016).

To our knowledge, only a few studies have considered potential nonlinear relationships (i.e., Dai & Cheng, 2015). It is worthwhile to examine the optimal level of potential public subsidies to justify the role of policy interventions with respect to private R&D. Our study addresses this research gap by employing both a linear and a nonlinear model that incorporate the results of applying matching methods to SMEs. We highlight that the result when the amount of public funding is subtracted from the total R&D investment contradicts Dai and Cheng’s results for nonlinear relationships between policy and R&D investments. The findings provide useful information for innovation policies insofar as they show a lack of evidence for potential nonlinear policy impacts, and they also contribute to the growing knowledge of the effectiveness of subsidy policies for private R&D expenditures with respect to a continuous variable for the level of public support.

The remainder of this paper is organized as follows. The “Literature Review” section reviews the related literature. The “Research Method” section describes our research method, and the “Data and Variables” section provides an overview of innovation policies for SMEs in South Korea, our data, and the variables. The “Results” section presents our empirical results, and the “Conclusion and Policy Implication” section discusses our findings and their implications.

Literature Review

Examination of the effect of subsidy policies on beneficiaries’ R&D investments, specifically, their input additionality, originated from a theoretical perspective on market failure (Arrow, 1962; Nelson, 1958). Knowledge generated through R&D activities is regarded as a public good, characterized by nonrivalry and nonexclusiveness. Therefore, reliance on private R&D investments is less than socially optimal, as firms cannot fully own the benefits of their R&D activities. The uncertainties of R&D results and information asymmetries between investors and those who perform the R&D are also crucial factors that impede private funding for R&D, which provides the theoretical rationale for public support. Public financial support such as subsidies can reduce market failure by lowering private R&D costs and thereby increasing the marginal profits from R&D projects.

From an analytical perspective, the effects of public subsidies on firm innovation activities are generally divided into three types: input, output, and behavior. Our paper focuses on the first of these, which refers to the R&D investment. A considerable amount of empirical research has been conducted in this area. The seminal work by David et al. (2000) synthesizes previous research and emphasizes that controlling for selection bias and endogeneity is critical to estimating unbiased policy effects. Indeed, an important perspective in the debate over public intervention is that the selection process for government funding is not random. Public institutions are likely to choose companies that are known to be competent or projects that have a high probability of R&D success regardless of subsidy support in order to avoid policy failures. Strategies for selecting only winners are inherent in the recipient selection process, which creates potential selection-bias issues with respect to estimating policy effectiveness (Cerulli, 2010; David et al., 2000). Parametric regression techniques such as selection models, instrumental estimation, and nonparametric matching methods are widely applied to control for these issues (Cerulli, 2010). Several review papers have tried to find a clear conclusion regarding the subsidy effect on private R&D investment (i.e., Becker, 2015; Zúñiga‐Vicente et al., 2014). However, these papers note that the policy effect on private R&D outlays is rather inconclusive. Recently, Dimos and Pugh (2016) conducted a meta-analysis based on 52 empirical studies published between 2000 and 2013 and found a positive but small effect.

One important research direction that the extant literature tends to overlook is to consider the actual amounts of subsidies and the firm’s R&D activities (Zúñiga‐Vicente et al., 2014). According to Dimos and Pugh (2016), based on the result of meta-regression analyses, a binary policy variable does not lead to overestimation of the treatment effect. However, the authors clearly pinpoint that an additionality effect can be confirmed when the level of R&D investment excluding the amount of public funds, that is, the net R&D expenditure, is higher than a counterfactual condition. They report that only 17 out of 52 studies had used a continuous policy variable. Regarding the present paper’s research interest, several studies have tried to clarify the relationship between public subsidies and R&D investments with a focus on SMEs. Although a crowding-out effect has also been found (Romero-Jordán et al., 2014), the large majority of these papers report a positive role of public funding (Bellucci et al., 2019; Cin et al., 2017; Czarnitzki & Delanote, 2015; Hottenrott & Lopes-Bento, 2014; Mariani & Mealli, 2018). However, it is important to note that these studies either consider a binary subsidy variable or regard private R&D investments without excluding the amount of public funds, even when the research uses a continuous level of public subsidies.

An additional issue related to the effect of policy on private innovation that is receiving growing attention but remains underexplored is the possible nonlinearity of this effect. Most extant research assumes that the relationship between policy intervention and private R&D is linear. However, a recent paper by Becker (2015) that conducts a broad review of the effect of public policy on private R&D investments points out the potential for nonlinearity. To the best of our knowledge, this thread of studies is still in an early stage. Using data for 17 OECD countries, Guellec and Potterie (2003), who are the first researchers to investigate nonlinearity, find that the public subsidy effect on business R&D has an inverted U-shape. They identify the threshold level of subsidies for which the signs of policy effectiveness are negative as 20% of the total private R&D investment. Görg and Strobl (2007) also find a reverse U-shaped relationship using plant-level data for Ireland. Using firm-level data for China, Dai and Cheng (2015) report an S-shaped relationship for the public subsidy impact on a firm’s net R&D investment excluding the amount of subsidies, which suggests that there is an optimal level of public subsidies. Other recent papers also consider a nonlinear approach to clarify the effect of public financial support including Cerulli et al. (2020), Hottenrott and Lawson (2017), and Nilsen et al. (2020), although these studies do not address questions about the private R&D investment but instead use dose–response models to demonstrate the effect of public policy on firm innovation performance.

Our study departs from previous research insofar as it considers a continuous policy variable, total or net R&D outlays, and a potential nonlinear relationship between public subsidies and private R&D investments, with a focus on SMEs in South Korea.

Research Method

This paper uses matching methods in order to control for a potential selection bias. As noted earlier, several econometric methods have been developed to consider the possibility of selection bias. We regard matching techniques as appropriate for data set that we used in this study and for achieving our research purpose. First, we use propensity score matching (hereafter PSM), which was proposed by Rosenbaum and Rubin (1983). PSM allows us to identify a matching group for subsidized SMEs and to estimate a linear positive or negative policy effect. Second, we use the generalized propensity score method (hereafter GPS) and a dose–response function to estimate the causal effect of public subsidies on SMEs’ R&D investments based on different treatment levels. GPS was initially proposed by Hirano and Imbens (2004) as an extension of PSM which considers the treatment to have a discrete status. The processing variables in GPS are continuous rather than discontinuous. A properly estimated GPS is crucial for guaranteeing nonsignificant statistical differences among the pretreatment covariates at each level of public subsidies. This means that firms at different levels of the treatment need to be identical based on predefined factors that are used for the GPS estimation and can only differ in their subsidy allocations. The dose–response function is then defined as the response of firms’ private R&D investments to specific levels of public subsidies. In the following subsection, we outline our assumptions and describe our implementations of PSM and the average dose–response function in greater detail.

Propensity Score Matching

PSM is widely used for analysis of the effects of innovation policies (Cerulli, 2010; David et al., 2000). This method basically estimates the average effect by comparing the actual outcomes when a firm receives public aid to counterfactual outcomes for the same firm. Since counterfactual outcomes are not observable, matching establishes these by considering firms equivalent in terms of characteristics other than funding status. Each supported firm is matched with the closest nonsupported firm based on a propensity score. In this paper, PSM is implemented as one-to-one nearest neighbor matching that allows replacement with a caliper restriction. To guarantee the matching quality, the mean difference of a covariate between the treatment group and the control group is checked. This ensures that only twin firms are matched.

The average treatment effect is estimated as follows:

where Y1 and Y0 denote the value of an outcome variable (Y) in the presence and absence of treatment, respectively, and D indicates the status of the treatment, with D = 1 indicating treatment and D = 0 indicating nontreatment. In Eq. 1, E(Y1|D = 1) can be calculated, but E(Y0|D = 1) is not observable. To address this, E(Y0|D = 1) needs to be replaced by reference to the proper counterfactual firm that is not supported. These firms can be selected based on the propensity score, P(D = 1|X). Firms that are not supported have the same probability of being treated given the set of covariates X, which are supposed to simultaneously influence the treatment and the outcome. Using the propensity score, the estimated ATT can be written as Eq. 2:

The matching method is based on two identifying assumptions, given in Eqs. 3 and 4. The first is the conditional independence assumption, unconfoundedness or selection on observables, which indicates that the outcomes Y1 and Y0 are independent of the treatment status D, conditional on the observed covariates X (Imbens, 2004):

The second is the overlap or common support condition, which is that the estimated propensity scores have values between 0 and 1. This implies that both supported and nonsupported firms have a positive probability of either receiving the treatment or not receiving it:

Generalized Propensity Score Matching

Basic Framework

Let a sample of firms be indexed by i = 1, …, N, and let Yi(t) denote the potential outcome for individual firm i ∈ I under a given treatment level t ∈ T, where T = [t0, t1] is a continuous set of treatment values. We use Y to represent SMEs’ net R&D investments and T to represent public subsidies, as described in the next section. For each individual firm i, there is a vector of pretreatment covariates Xi and the level of the treatment the firm receives, ti, and the potential outcome corresponding to the level of treatment actually received, Yi = Yi(ti), is observed. Our purpose is to estimate the average dose–response function μ(t) = E[Yi(t)]. For simplicity, we omit the subscript i in the subsequent section.

Assumptions

In order to implement the GPS, Hirano and Imbens (2004) introduce the assumption of weak unconfoundedness, which ensures the random allocation of different levels of public subsidies, conditional on the observed pretreatment covariates:

The covariates X should include variables that determine the public’s choice of subsidized firms. The dose–response function can be calculated by estimating average outcomes in subpopulations that are divided by pretreatment covariates and different levels of treatment. Let r(t, x) be the conditional density of the treatment given the covariates:

The GPS is then defined as R = r(T, X). The GPS has a balancing property similar to the standard propensity score matching. The probability that t = T is independent of the covariates X within strata with the same value of r(t, X):

Both the weak unconfoundedness assumption and the balancing property suggest that the assignment to the treatment level is unconfounded given the GPS. Let fT be the conditional probability of receiving T. Then, for each t:

This result allows estimation of the dose–response function by applying the GPS to remove any selection bias associated with a difference in covariates.

Practical Implementation

According to Hirano and Imbens (2004), there are two steps for removing bias using the GPS. In the first step, the conditional expectation of the outcome is estimated as a function of two scalar variables, the treatment level T and the GPS R:

The regression function β(t, r) does not have a causal interpretation.

In the second step, the conditional expectation for the GPS at a specific level of treatment is averaged to estimate the dose–response function:

In addition, Hirano and Imbens (2004) include the following stages for practical implementation of the GPS method. In the first stage, a normal distribution is employed to model the conditional distribution of the treatment T given the covariates X i:

If the normal or lognormal distribution model is statistically confirmed, the estimated GPS can be obtained after estimating (β0, β1, σ2) by ordinary least squares. Then the GPS is modelled as:

However, our treatment variable does not meet the normality condition. To solve this case, a generalized linear model (GLM) can be employed as an alternative technique for estimating the GPS (Bia & Mattei, 2008). The GLM approach allows for flexible distribution assumptions regarding public subsidies and also allows for a potential wide range of nonnormal distributions. These properties can be formalized as shown below. Specifically, this paper incorporates a gamma distribution with a log link function:

Equation 13 states that the distribution of the treatment variable belongs to the exponential family, where a(θ) represents the distribution function in the exponential family and the parameters ϕ and θ are associated with certain exponential family distributions. Equation 14 specifies that a transformation of the mean g{•} is linearly related to explanatory variables contained in X, where g{•} denotes the link function.

In cases where the GLM is used, the GPS can be obtained by the following equation (Guardabascio & Ventura, 2014):

After obtaining the GPS, the expectation of the outcome variable E(Y|T, R) conditional on the treatment levels and the estimated GPS is estimated. A quadratic or cubic approximation of the treatment variable and the GPS is included in the model to allow for a nonlinear specification, as follows:

Finally, the dose–response function is obtained by estimating the average potential outcome at different levels of the treatment variable:

Data and Variables

Data

The empirical analyses rely on a panel dataset that was constructed by linking the data from the South Korean Survey on Technology of SMEs (STS) for the years between 2015 and 2019 to characterize firms’ pretreatment status and to distinguish the timing of the treatment and the SMEs’ subsequent activity. The STS, which provides single-year cross sections of data at the firm level, is conducted by the South Korea Ministry of SMEs and Startups, which collects data related to firms’ R&D and innovation activities via mail and face-to-face interviews. The survey’s structure and questions are largely similar to those of the “Korea Innovation Survey,” which is based on the OECD Oslo Manual. The information collected in the survey has an advantage over data from other related sources insofar as it provides the specific amount of public funding within SMEs’ total spending for R&D activities. Moreover, this information is used as preliminary data for discussing and developing policy directions for SME R&D and innovations (Ministry of SMEs and Startups, 2018). This survey has also been widely used by researchers to analyze themes involving SMEs’ R&D activities and related innovation issues because of its representation of the SMEs in South Korea (Kang & Park, 2018; Shin & Kim, 2020). We begin with an initial sample (unbalanced panel) of 17,500 observations since the survey for each year comprises a sample of 3500. We selected 302 firms (413 observations) that participated in the survey for three consecutive years. Our sample covers the R&D-active SMEs with more than 10 employees in the Korea Standard Industrial Classification (KSIC) 10–34 (manufacturing industry) and 58, 62, 63, 70, 72, and 73 (knowledge-intensive businesses) during the period 2014–2018.

Outcome Variable

As a measure of the outcome variable, we used each firm’s R&D outlay in time T + 1, capturing a time difference from the period in which SMEs receive public aid. We constructed two outcome variables: the total R&D investment (TORD) and the net R&D investment (NERD), calculated as the total R&D amount minus the amount of public subsidies. The latter outcome is regarded as more appropriate for demonstrating a complementary or substitution effect, because the existence of subsidies within a firm’s total R&D investment turns out to be a confounding element (Cerulli, 2010). We use a logged value for the total R&D investment to mitigate the skewness of the distribution, and we apply a cube root transformation for the net R&D investment, due to the negative value of the variable.

Treatment Variable

The treatment variable is subsidies, measured by the total amount of public subsidies a firm received in time T. This variable was entered in logarithmic form in our model since the distribution is skewed. It is important to know the subsidy amount in order to demonstrate whether subsidies promote or substitute for private expenditures (David et al., 2000).

Matching Variables

We considered a range of matching variables based on prior literature. Every matching variable represents a firm’s status in time T-1, capturing a pretreatment status. A proper matching variable needs to reflect decisions made about both the selection of recipients and the outcome of policy support, such as the R&D investment in this study. First, we included the log of the total sales to measure firm sizes, as it is well documented that larger firms are more likely to innovate (Czarnitzki & Delanote, 2015). Second, firms that export their products are usually confronted with fierce global competition, but exporting can also expand market opportunities (Ralph & Pope, 2002). Active firms in foreign markets are more likely to apply for subsidies, and policymakers are inclined to provide support for those export companies (Clausen, 2009; Hottenrott & Lopes-Bento, 2014). We therefore use the ratio of exports to total sales to measure a firm’s export activity. Third, we include R&D intensity as measured by the ratio of R&D personnel to overall employees, to indicate firms’ research activity efforts and their accumulation of internal R&D knowledge (Caloghirou et al., 2004; Veugelers, 1997). This represents the well-known concept of absorptive capacity, which refers to a firm’s ability to recognize the value of new, external information, assimilate it, and apply it for commercial purposes, a capacity that is crucial for innovation (Cohen & Levinthal, 1990). Fourth, a high degree of novelty, indicating the newness of an innovation, increases a firm’s probability of being subsidized (Cantner & Kösters, 2012; Szücs, 2018). Firms’ higher R&D investments have been shown to be associated with greater degrees of innovation novelty (Amara et al., 2008; Plechero & Chaminade, 2016). We use a dummy variable to capture the novelty of an innovation by coding the value as 1 if a firm declares its technological innovation as a world or domestic first, and 0 otherwise (Cozzarin, 2006). Fifth, we include a previous subsidy dummy variable to represent the persistence of being granted subsidies (González & Pazó, 2008; Herrera & Sánchez-González, 2013). Thus, firms in different lagged subgroups can have an identical status for their subsidies in the previous year. Sixth, we consider a firm’s age, which represents the firm’s evolutionary aspects such as private growth and survival in a certain industry (Huergo & Jaumandreu, 2004). Seventh, previous experience in successful R&D endeavors plays a critical role when a firm applies for subsidies, since governments usually follow the strategy of picking winners (Czarnitzki & Lopes-Bento, 2014). Therefore, we include a firm’s total number of formal appropriations by summing the number of the firm’s patents, utility models, designs, and trademarks. Finally, we consider innovation opportunities and sources as an unobserved heterogeneity across industry sectors by adopting the OECD taxonomy at the 2-digit level. We apply binary variables in five categories based on the KSIC, which was established in accordance with the International Standard Industrial Classification (Table 1).

Results

Descriptive Statistics

Table 2 describes the research variables and their descriptive statistics. As shown in Table 3, subsidized and nonsubsidized firms differed significantly in their characteristics. Specifically, the factors firm size, R&D intensity, novel innovation, and previous subsidization influence a firm’s use of financial support. Correlations between the research variables are provided in the Appendix. As can be seen, except for industry variables, the maximum value of the coefficient is 0.399 between size and R&D intensity.

Identification of Matching Group

This study further identified a matching group of recipient firms for the analyses in order to minimize any potential selection bias. Importantly, GPS matching, which we applied to test for a possible nonlinear relationship between public funding and SMEs’ R&D investments, basically considers every research sample for the analyses. Using propensity score matching that considers the binary status of being subsidized (Rosenbaum & Rubin, 1983), we dropped nonrecipient firms that do not meet the condition of having a propensity score within a 0.05 caliper restriction (i.e., Czarnitzki & Delanote, 2015). As a result, 407 observations (298 firms) were finally selected after samples were excluded. Table 4 shows the results of probit regressions for obtaining propensity scores using public R&D subsidies (SUB) as a dependent variable. The matching variables SIZE and NOV are positively associated with a firm’s self-selection for being funded. The characteristics of the raw data used in this study might have affected this result, as the survey was only conducted for R&D-active SMEs.

Results of Propensity Score Matching (Test for a Linear Relationship)

We conducted PSM based on the binary funding status variable to analyze the policy effect. Specifically, we matched firms through one-on-one matching with a 0.05 caliper restriction. Regarding the quality of the matching, the characteristics of recipient and counterfactual groups resulting from a t-test are reported in Table 5. We were able to guarantee that every matching variable between supported and unsupported groups did not differ significantly after the matching, which indicates that the matching was successful. Therefore, we can conclude that the selection bias should be minimal. Table 6 shows the estimated results for the PSM model. Interestingly, the opposite result is found, based on the characteristics of the outcome variable. As can be seen, the coefficient of the total R&D investment is significant and positive at the 5% significance level, indicating an additionality effect of public support. In contrast, the coefficient of the net R&D investment is significantly negative at the 1% significance level, suggesting a partial crowding-out effect. These results indicate that public funding seems to stimulate SMEs’ R&D activities overall, although SMEs partially substitute public aid for their own additional investments. We further analyzed the policy effect based on various subsamples to better understand the role of public funding, as the subsidy effect on R&D investment might vary depending on the heterogeneous characteristics of firms, such as their industry sectors or R&D capacities. First, we considered the industry sector. We divided the research sample into two groups: a manufacturing sector and a knowledge-intensive sector. We estimated the PSM model for only the manufacturing sector, since the small sample size (n = 75) for knowledge-intensive businesses prevented us from conducting an exclusive analysis. For the same reason, we could not subdivide the research sample into subsamples of high-tech, medium-tech, and low-tech industries.Footnote 1 Second, we further estimated the PSM model based on firms with a high absorptive capacity. The literature explains that strategic R&D investments are strongly associated with a firm’s absorptive capacity (i.e., Grünfeld, 2003; Nieto & Quevedo, 2005), and the effectiveness of public programs can also be affected by a firm’s absorptive capacity (Becker et al., 2013). We divided the research sample into two groups based on whether the firm had a formal independent R&D institute. Unfortunately, only the results from the sample with R&D institutes can be presented, since approximately 15% of the sample with no R&D institutes are subsidized. The estimated results are reported in Table 7. The results are overall consistent with the full sample case, except for the total R&D investment of the high absorptive capacity sample, where the coefficient is positive but statistically insignificant. In sum, the empirical results from the PSM model suggest that public funding promotes SMEs’ investment in R&D activities; however, firms substitute public aid for their own R&D spending.

Results of Generalized Propensity Score Matching (Test for a Nonlinear Relationship)

In this study, we used GPS matching to examine a potential nonlinear relationship between public subsidies and SMEs’ R&D investments.

GPS Estimation

In order to estimate the GPS, which is the conditional distribution of the treatment subsidies in our case, the given covariates needed to be modeled. Following Guardabascio and Ventura (2014), we applied the GLM, since the log-transformed subsidy variable does not follow a normal distribution. Specifically, we incorporated a gamma distribution with a log link function to estimate the results. We obtained the estimation of the GPS based on Eq. 15, using the estimated coefficients from the GLM. Table 8 shows the estimation of the GPS. As can be seen, the covariates can explain a firm’s subsidization.

Balancing Property

To check whether the estimated GPS is reasonable, we implemented the balancing property test by comparing the means of the covariates at three different subsidy levels. The intervals are defined as [0, 0], (0, 186], and (186, 1844], reflecting the distribution of the subsidy amount in million won. The first interval includes 79.1% of the total sample, and the second and third intervals account for 11.8% and 9.1%, respectively. We calculated the difference for each covariate by comparing the value at one interval with the values at the other two intervals. We estimated the GPS at the median level of the treatment within each group to obtain the values. In addition, we separated the GPS into three quantiles, and within each quantile, we obtained the differences by comparing the means of the covariates in that quantile with those that are not in that quantile. We calculated the results of the balancing property test that are given in Table 9 by dividing the results before and after controlling for the propensity score. The results suggest that the GPS improves the balance: The balancing property is satisfied at the 1% significance level based on a standard two-sided t-test. This suggests that the GPSs are well defined, which enables our model to estimate the dose–response function. Although three t-statistics remain greater than the absolute value 1.96, we believe that the GPS adjustment largely eliminates differences. It is important to note that recent research using GPS matching emphasizes a mitigation of differences in the pretreatment covariates (i.e., Dai et al., 2020; Kancs & Siliverstovs, 2016; Li et al., 2019).

Main Result

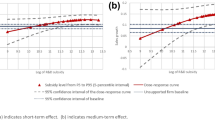

Table 10 describes the estimated GPS-adjusted dose–response function with 100 bootstrap replications, which was the main aim of our paper. Approximations from both the quadratic equation (model 1) and the cubic equation (model 2) are provided. The estimated coefficients have no direct meaning, but they provide an interpretation of whether the covariates introduce any bias (Hirano & Imbens, 2004). The results show that the GPS method is adequate for ruling out any potential bias induced by the covariates. Thus, the variation in the level of a firm’s R&D investment can be explained as a causal effect of the variation in the level of public subsidies. The main results for the dependent variables are graphically provided in Figs. 1 and 2. The result from the quadratic estimation clearly shows U-shaped relationships. The total R&D investment responses to the levels of the treatment decrease until around 3.06 (21.3 million won) and the net R&D investment responses decrease until around 4.02 (55.9 million won), with each response increasing after those points. This implies that there is a minimum threshold for promoting SMEs’ R&D investments and a steadily increasing effect of public subsidies with a higher intensity of the treatment beyond the threshold. The result of the quadratic GPS matching model indicates a similar pattern for both total and net R&D investments; however, there is a notable difference in the 95% confidence bounds. In the case of model 1B, the upper and lower 95% confidence bounds diverge after the minimum threshold point, in contrast to Model 1A, where they remain constant. Therefore, we cautiously consider that our results confirm the U-shaped relationship only for model 1A. However, in the case of model 1B, a decreasing effect corresponding to increased treatment levels without a turning point seems to be more plausible. The results from the cubic estimation indicate some interesting points. According to the estimated result from model 2A, the response of an SME’s total R&D investment to subsidies decreases until the amount of public funding exceeds 2.31 (10.1 million won), and then it turns positive, but the SME’s total R&D investment again begins to decline when public funding exceeds 6.89 (988.6 million won). This suggests that a minimum threshold and a saturation point may exist for the relationship between an SME’s total R&D investment and public aid. However, our result cannot clearly demonstrate the existence of a saturation point, since the 95% confidence bounds for model 2A diverge widely beyond the estimated saturation point. Moreover, the estimated value for the minimum threshold has no practical meaning based on the distribution of the SUB variable. Therefore, we cautiously confirm that a linear positive impact rather than a U-shaped relationship to the levels of subsidization is more plausible for SMEs’ total R&D investment. The result for model 2B shows that the coefficients for the SUB variable of both the quadratic and the cubic form are statistically insignificant (Table 10), persuasively implying a linear negative effect with increased levels of public funding.

Heterogeneous Effect (Subsample Analyses)

A nonlinearity of the subsidy effect on R&D investment might vary depending on firms’ heterogeneous characteristics. Therefore, similar to the PSM model, we further estimated the dose–response functions based on two subsamples: SMEs in the manufacturing sector and those with a high absorptive capacity. The estimation results for the dose–response function and the balancing property test are reported in the Appendix. Figures 3, 4, and 5 provide graphical results. As can be seen, the pattern of SMEs’ response to public financial aid is highly consistent with the overall case of the total sample analyses. It is important to note that the U-shaped relationship between public support and SMEs’ R&D investment seems to be confirmed for the case of net R&D investments based on the manufacturing sector subsample. The graph illustrates a steadily decreasing net R&D investment response to levels of financial support above 4.61 (100.6 million won), which then turns into an increasing response. This result indicates that a certain value of public financial support rather than a certain minimum threshold is required to stimulate SMEs’ net R&D investment in the manufacturing industry. The other results from the GPS matching model for the subsample analyses cannot clearly confirm the existence of a minimum threshold or a saturation point due to the practically nonmeaningful value of the estimated subsidy level, given the statistical insignificance of the SUB variable (Tables 11, 12, 13, 14 and 15).

Discussion and Implications

This study investigated the impact of public subsidies on SMEs R&D outlays, focusing on a net volume of additional private investment and a potential nonlinearity of policy impact. We employed the standard PSM and GPS matching technique to overcome a selection-bias issue. As empirical results, we find that a crowding-out effect can be rejected only for total R&D investments. This well supports the existing strand of literature. In the case of net R&D investments, our empirical analyses confirm a partial crowding-out effect, indicating that public funding partially lowers SMEs’ own R&D outlays. Results from subsample analyses are shown to be consistent with the overall case of the full sample. Moreover, we cannot reject the null hypothesis regarding a nonlinear relationship with a clarified minimum threshold and saturation point. Our findings show a positive relationship for the total R&D investment and a negative relationship for the net R&D investment, which are largely consistent with the PSM results. One notable exception is the result of a subsample analysis of the manufacturing sector, regardless of whether the R&D investment is total or net, which indicates a U-shaped relationship with a minimum threshold. This implies that the policy effect varies depending on the level of the subsidies, and notably, there is no decreasing effect based on the overall level of support. A related perspective can be found in a study by Dai and Cheng (2015), who points out that the absence of a saturation point for the subsidy effect might indicate that the examined data lie within a particular interval of support. Thus, we postulate that the amounts of subsidies provided in South Korea have not yet reached the maximal optimal level in the manufacturing sector. In sum, we conclude that the subsidy effect on SMEs’ R&D investments in South Korea is linear rather than nonlinear; admittedly direct financial support fails to play a role in stimulating SMEs’ own additional R&D outlays beyond the amount of public funding the firm has received.

Several implications can be drawn from our findings. First, we contribute to the literature on policy effectiveness regarding a continuous level of public aids. Previous studies have noted that information about subsidy amounts might be useful for evaluating additionality effects (David et al., 2000; Zúñiga‐Vicente et al., 2014), as would consideration of private firms’ net R&D expenditures, excluding the amount of subsidies they have received (Becker, 2015; Cerulli, 2010). We have incorporated these points in examining the additionality effects for SMEs to arrive at our empirical results, which clearly support the positive role of public subsidies in promoting SMEs’ total R&D activities, although it turns out that a negative impact prevails for net R&D investments. We believe that incorporating the amount of subsidies is more informative for corroborating additionality effects beyond committed public financing. In this regard, it is worth noting that the substantial resources that the South Korean government has dedicated to SMEs’ R&D have only partially served to overcome market failures.

Second, we find a nonlinear policy effect, i.e., a U-shaped relationship with a certain minimum threshold, for the manufacturing sector, unlike the general case with partial crowding-out effects. This supports the argument that a larger amount of public subsidies for individual SMEs in the manufacturing sector is desirable for more efficiently stimulating SMEs’ R&D activity. The government of South Korea has recently emphasized the importance of strengthening the competitiveness of both high-tech and traditional manufacturing sectors. Moreover, the government has announced that its policy direction for SMEs would be shifted from “a short term and a small volume for many” to “an extended term and a large volume, but bounded based on growth stage or capacities” (Union of Related Ministries 2019). From the policy maker’s view, our findings provide a rationale for committing larger volume to support individual SME in a manufacturing sector. Along with this point, our findings implicate R&D subsidies for manufacturing sectors should be weighted more on the intensity of support such as a size of provided resource per SME than the extensiveness such as the number of beneficiaries.

Third, our findings emphasize that, as an external factor, public subsidies in general are an important determinant of private innovation. This also contributes to the strategic management literature, as financial resources obtained from external sources could be a precursor to a firm’s R&D and innovation activities, as noted by Chapman et al. (2018).

This paper also has several limitations, along with the implications and contributions mentioned above. First, we use firms’ R&D expenditures as an outcome variable regardless of the specific purpose. Some studies have emphasized that R&D is not a homogenous activity and that a market failure is more likely to occur for a firm’s research activity than for its development activities (Barge-Gil & López, 2014; Clausen, 2009). Future studies can clarify policy effects with respect to the nature of the R&D. Second, forms of financial support other than subsidies, such as tax breaks, should also be considered for estimating the amount of support a firm has received, since subsidies and tax breaks are both typical tools that are used to stimulate business R&D in OECD countries. Some studies have pointed out that the policy effect might be overestimated unless a policy mix that includes the interaction among policy tools is taken into account (Castellacci & Lie, 2015; Dumont, 2017). Unfortunately, the data used for this study only contain information about subsidies; thus, further studies can disentangle the issue of financial intensity with respect to various public tools. Third, policy effects might be heterogeneous, depending on the characteristics of different companies. Due to the size of our sample, we could not investigate the impact of subsidies by various features such as having a technological domain or a progression of firm business. For example, young innovative SMEs in a fast-growing sector may be of special interest from the policymakers’ point of view.

Concluding Remarks

The South Korean government continues to implement an aggressive subsidy policy to encourage private R&D and innovation activities. From a view of evidence-based policy making, increased corporate R&D investments compared to the amount of financial supports are important for confirming the effectiveness of policy programs. Previous studies have shown that the effects of subsidies for SMEs are mainly positive; however, these studies largely consider the total R&D investment without excluding the amount of public funding, and they may overlook the potential nonlinearity of the effects. Therefore, this paper focuses on investigating the effectiveness of subsidies for SMEs, while considering the aforementioned points. Our approach presents the first empirical evidence regarding the questions of an additionality effect beyond public funding and a nonlinearity effect for South Korea’s SME subsidy scheme to the best of our knowledge. Overall, public subsidies seem to induce SMEs to invest more in R&D, however, they fail to stimulate SMEs’ investments beyond a level of policy support. As for investigating the potential nonlinearity of policy impact, we find a linear relationship. The only exception is a U-shaped relationship with a minimum threshold for the case of manufacturing sectors. Our intention in this paper was to contribute to the growing body of knowledge on the effect of public subsidies on SMEs’ R&D expenditures.

Notes

We have to admit this as a limitation of our study. Within each treatment group, 21% of the industries are high- and medium–high tech and 17% are medium–low and low tech.

References

Amara, N., Landry, R., Becheikh, N., & Ouimet, M. (2008). Learning and novelty of innovation in established manufacturing SMEs. Technovation, 28(7), 450–463.

Arrow, K. (1962). Economic welfare and the allocation of resources for invention. The Rate and Direction of Inventive Activity: Economic and Social Factors, 609–626, Princeton University Press.

Aschhoff, B. (2009). The effect of subsidies on R&D investment and success–Do subsidy history and size matter?. ZEW-Centre for European Economic Research Discussion Paper, 09-032.

Barge-Gil, A., & López, A. (2014). R&D determinants: Accounting for the differences between research and development. Research Policy, 43(9), 1634–1648.

Becker, S. O., Egger, P. H., & Von Ehrlich, M. (2013). Absorptive capacity and the growth and investment effects of regional transfers: A regression discontinuity design with heterogeneous treatment effects. American Economic Journal: Economic Policy, 5(4), 29–77.

Becker, B. (2015). Public R&D policies and private R&D investment: A survey of the empirical evidence. Journal of Economic Surveys, 29(5), 917–942.

Bellucci, A., Pennacchio, L., & Zazzaro, A. (2019). Public R&D subsidies: Collaborative versus individual place-based programs for SMEs. Small Business Economics, 52(1), 213–240.

Bia, M., & Mattei, A. (2008). A Stata package for the estimation of the dose-response function through adjustment for the generalized propensity score. The Stata Journal, 8(3), 354–373.

Caloghirou, Y., Kastelli, I., & Tsakanikas, A. (2004). Internal capabilities and external knowledge sources: Complements or substitutes for innovative performance? Technovation, 24(1), 29–39.

Clausen, T. H. (2009). Do subsidies have positive impacts on R&D and innovation activities at the firm level? Structural Change and Economic Dynamics, 20(4), 239–253.

Cantner, U., & Kösters, S. (2012). Picking the winner? Empirical evidence on the targeting of R&D subsidies to start-ups. Small Business Economics, 39(4), 921–936.

Castellacci, F., & Lie, C. M. (2015). Do the effects of R&D tax credits vary across industries? A Meta-Regression Analysis. Research Policy, 44(4), 819–832.

Cerulli, G. (2010). Modelling and measuring the effect of public subsidies on business R&D: A critical review of the econometric literature. Economic Record, 86(274), 421–449.

Cerulli, G., Corsino, M., Gabriele, R., & Giunta, A. (2020). A dose–response evaluation of a regional R&D subsidies policy. Economics of Innovation and New Technology, 1–18.

Chapman, G., Lucena, A., & Afcha, S. (2018). R&D subsidies & external collaborative breadth: Differential gains and the role of collaboration experience. Research Policy, 47(3), 623–636.

Cin, B. C., Kim, Y. J., & Vonortas, N. S. (2017). The impact of public R&D subsidy on small firm productivity: Evidence from Korean SMEs Small Business Economics 48 2 345 360

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 128–152.

Cozzarin, B. P. (2006). Are world-first innovations conditional on economic performance? Technovation, 26(9), 1017–1028.

Cunningham, P., Gök, A., & Larédo, P. (2016). The impact of direct support to R & D and innovation in firms. Edward Elgar Publishing.

Czarnitzki, D., & Delanote, J. (2015). R&D policies for young SMEs: Input and output effects Small Business Economics 45 3 465 485

Czarnitzki, D., & Lopes-Bento, C. (2014). Innovation subsidies: Does the funding source matter for innovation intensity and performance? Empirical evidence from Germany. Industry and Innovation, 21(5), 380–409.

Dai, X., & Cheng, L. (2015). The effect of public subsidies on corporate R&D investment: An application of the generalized propensity score. Technological Forecasting and Social Change, 90, 410–419.

Dai, X., Guo, Y., & Wang, L. (2020). Composition of R&D expenditures and firm performance. Technology Analysis & Strategic Management, 32(6), 739–752.

David, P. A., Hall, B. H., & Toole, A. A. (2000). Is public R&D a complement or substitute for private R&D? A review of the econometric evidence. Research Policy, 29(4–5), 497–529.

Dimos, C., & Pugh, G. (2016). The effectiveness of R&D subsidies: A meta-regression analysis of the evaluation literature. Research Policy, 45(4), 797–815.

Dumont, M. (2017). Assessing the policy mix of public support to business R&D. Research Policy, 46(10), 1851–1862.

González, X., & Pazó, C. (2008). Do public subsidies stimulate private R&D spending? Research Policy, 37(3), 371–389.

Görg, H., & Strobl, E. (2007). The effect of R&D subsidies on private R&D. Economica, 74(294), 215–234.

Grünfeld, L. A. (2003). Meet me halfway but don’t rush: Absorptive capacity and strategic R&D investment revisited. International Journal of Industrial Organization, 21(8), 1091–1109.

Guardabascio, B., & Ventura, M. (2014). Estimating the dose–response function through a generalized linear model approach. The Stata Journal, 14(1), 141–158.

Guellec, D., & Van Pottelsberghe De La Potterie, B. (2003). The impact of public R&D expenditure on business R&D. Economics of Innovation and New Technology, 12(3), 225–243.

Herrera, L., & Sanchez-Gonzalez, G. (2013). Firm size and innovation policy. International Small Business Journal, 31(2), 137–155.

Hirano, K., & Imbens, G. W. (2004). The propensity score with continuous treatments. Applied Bayesian Modeling and Causal Inference from Incomplete-Data Perspectives, 226164, 73–84.

Hottenrott, H., & Lawson, C. (2017). Fishing for complementarities: Research grants and research productivity. International Journal of Industrial Organization, 51, 1–38.

Hottenrott, H., & Lopes-Bento, C. (2014). (International) R&D collaboration and SMEs: The effectiveness of targeted public R&D support schemes. Research Policy, 43(6), 1055–1066.

Huergo, E., & Jaumandreu, J. (2004). How does probability of innovation change with firm age? Small Business Economics, 22(3–4), 193–207.

Imbens, G. W. (2004). Nonparametric estimation of average treatment effects under exogeneity: A review. Review of Economics and Statistics, 86(1), 4–29.

Kancs, A., & Siliverstovs, B. (2016). R&D and nonlinear productivity growth. Research Policy, 45(3), 634–646.

Kang, S., & Park, S. (2018). A relationship between innovation capability and performance: Differences in firm development stages. Asia-Pacific Journal of Business Venturing and Entrepreneurship., 13(2), 91–100.

Kim, S. W., & Jeong, H. J. (2019). A comparison between R&D support system of S.Korea and U.S. STEPI Insight, 231, 1-32.

Lee, S. H. (2018). The SMEs R&D policy impacts and directions. KDI Focus, 89.

Li, Y., Palma, M. A., Hall, C. R., Khachatryan, H., & Capps, O., Jr. (2019). Measuring the effects of advertising on green industry sales: A generalized propensity score approach. Applied Economics, 51(12), 1303–1318.

Mariani, M., & Mealli, F. (2018). The effects of R&D subsidies to small and medium-sized enterprises. Evidence from a regional program. Italian Economic Journal, 4(2), 249–281.

Marino, M., Lhuillery, S., Parrotta, P., & Sala, D. (2016). Additionality or crowding-out? An overall evaluation of public R&D subsidy on private R&D expenditure. Research Policy, 45(9), 1715–1730.

Ministry of SMEs and Startups. (2018). Survey on Technology of SMEs.

Meuleman, M., & De Maeseneire, W. (2012). Do R&D subsidies affect SMEs’ access to external financing? Research Policy, 41(3), 580–591.

Nelson, R. R. (1958). The simple economics of basic scientific research. Journal of Political Economy, 67(3), 297–306.

Nieto, M., & Quevedo, P. (2005). Absorptive capacity, technological opportunity, knowledge spillovers, and innovative effort. Technovation, 25(10), 1141–1157.

Nilsen, Ø. A., Raknerud, A., & Iancu, D. C. (2020). Public R&D support and firm performance: A multivariate dose-response analysis. Research Policy, 49(7), 104067.

OECD. (2017). OECD Science, Technology and Industry Scoreboard 2017

Plechero, M., & Chaminade, C. (2016). Spatial distribution of innovation networks, technological competencies and degree of novelty in emerging economy firms. European Planning Studies, 24(6), 1056–1078.

Radicic, D., & Pugh, G. (2017). R&D programmes, policy mix, and the ‘european paradox’: Evidence from European SMEs. Science and Public Policy, 44(4), 497–512.

Pope, R. A. (2002). Why small firms export: Another look. Journal of Small Business Management, 40(1), 17–26.

Romero-Jordán, D., Delgado-Rodríguez, M. J., Alvarez-Ayuso, I., & de Lucas-Santos, S. (2014). Assessment of the public tools used to promote R&D investment in Spanish SMEs. Small Business Economics, 43(4), 959–976.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55.

Shin, I., & Kim, H. S. (2020). An Empirical Analysis of R&D Cooperation Effect on Firm Performance of Biotechnology SMEs. Innovation Studies, 15(2), 25–55.

Szücs, F. (2018). Research subsidies, industry–university cooperation and innovation. Research Policy, 47(7), 1256–1266.

Union of Related Ministries. (2019). The way to innovate a support system of SMEs R&D.

Veugelers, R. (1997). Internal R & D expenditures and external technology sourcing. Research Policy, 26(3), 303–315.

Zúñiga-Vicente, J. Á., Alonso-Borrego, C., Forcadell, F. J., & Galán, J. I. (2014). Assessing the effect of public subsidies on firm R&D investment: A survey. Journal of Economic Surveys, 28(1), 36–67.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Kiman, K., Jongmin, Y. Linear or Nonlinear? Investigation an Affect of Public Subsidies on SMEs R&D Investment. J Knowl Econ 13, 2519–2546 (2022). https://doi.org/10.1007/s13132-021-00823-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-021-00823-9