Abstract

The main objective of this study is to examine the long-run relationship between export upgrading and economic growth for 51 countries over the period of 1984–2015. For this purpose, a panel cointegration framework that allows to control for parameters heterogeneity, cross-sectional dependence, and nonstationarity has been deployed. Furthermore, three homogenous subpanels have been considered based on the income level of the sample countries (high-, middle-, and low-income subpanels). Empirical results from panel cointegration tests yield evidence of a long-run relationship between export upgrading, economic growth, FDI, human capital, and trade openness. Moreover, based on the common correlated effects mean group (CCEMG) technique, the results indicate that export upgrading has a positive and significant effect on economic growth for the global, high-income, and middle-income panels, while this effect is insignificant for the low-income country panel. The causality analysis indicates the existence of a feedback effect between export complexity and economic growth for the global panel as well as for the high- and middle-income country groups in the long-run. For low-income countries, however, there is no causal relationship between these two variables, and this finding holds both in the short run and in the long run.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A nascent strand of the economic literature has emphasized the role of export upgrading as one of the major drivers of growth and economic development. Several recent researches have provided empirical evidence that countries with a more sophisticated (complex) export basket grow faster than those with a less sophisticated (complex) export basket (Hausmann et al., 2007; Hidalgo et al., 2007; Hidalgo and Hausmann, 2009; Santos-Paulino, 2011; Jarreau and Poncet, 2012; Felipe et al., 2012; Felipe et al., 2012; Poncet and De Waldemar, 2013;; Ferrarini and Scaramozzino, 2016; Zhu and Li, 2017; Lin et al.; 2017). In other words, what matters to countries’ economic growth is not purely how much they export, but what they export (Rodrik, 2006). The reason is that countries that export commodities with a relatively high technological content should be more likely to benefit from positive externalities that help their economies growing faster (Sheridan, 2014).

Although the aforementioned studies have provided valuable insights into whether and how export upgrading may affect growth, they suffer from the limitations inherent in standard cross-country and panel regressions. One of the commonly criticisms of the standard panel estimators is the implicit assumption of a cross-sectional independence among panel units. This is because the traditional procedures for estimation of pooled models, such as the fixed effects, instrumental variables, and generalized method-of-moments (GMM) estimators proposed, by among others, Arellano and Bond (1991), Ahn and Schmidt (1995), Arellano and Bover (1995), and Blundell and Bond (1998) typically assume that the disturbances of error terms are cross-sectionally independent. This assumption, however, might be too restrictive, in particular in the analysis of macroeconomic or financial data that have strong inter-economy linkages (Urbain and Westerlund, 2006). Interdependency applies in the relation between exports and growth among others. In fact, cross-section dependence among countries is unavoidable due to, for instance, market integration processes, globalization of economic activity, offshoring processes, or because of the presence of common shocks like oil price shocks (Banerjee and Carrion-i-Silvestre, 2014). Since the assumption of cross-sectional independence is difficult to satisfy in a panel data, neglecting it may lead to substantial bias and size distortions (see for instance, O'Connell, 1998; Nauges and Thomas, 2003; Pesaran, 2006; Sarafidis and Robertson, 2009; Sarafidis et al., 2009; Ahn et al., 2013; Robertson and Sarafidis, 2015). Conventional estimation techniques may thus be spurious and lead to misleading conclusions.

As observed by Lee (2011), a methodological problem with the homogeneous panel approach used in the majority of studies examining the export sophistication-growth nexus is ignoring the substantial degree of heterogeneity in the growth experience of countries. That is to say, the effects on growth have been assumed to be identical across countries, i.e., parameter homogeneity. However, recent research emphasizes that the impact of trade on growth varies considerably across countries (see inter alia, Foster, 2008; Dufrénot et al., 2010; Lee, 2011). In particular, Lee (2011) finds that fast-growing countries tend to gain more from international trade than countries with relatively low growth. Heterogeneity across countries is likely to arise as a result of differences in economic conditions or social-cultural backgrounds (Chou, 2013). Now, it is well recognized that when applied to testing growth effects, standard techniques can produce inconsistent and potentially misleading estimates of the model parameters, since growth models typically exhibit substantial cross-sectional heterogeneity (Pesaran and Smith, 1995; Lee et al., 1997; Pedroni, 2007; Eberhardt and Teal, 2011).

A further problem with previous studies is ignoring the integration properties of the data, although it is well documented in the literature that most macroeconomic variables are potentially nonstationary (see, Pedroni 2007; Eberhardt and Teal, 2012. When variables are not stationary, averaging data cannot solve the problem of unit roots in the data as the data-generating process remains unchanged (Kim and Lin, 2017). Furthermore, while averaging obviously causes information loss, especially when the data are highly persistent, it remains unclear whether averaging over fixed-length intervals effectively eliminates business cyclical fluctuations (see, Loayza and Ranciere, 2006; Herzer and Vollmer, 2012; Huang et al., 2015; Kim and Lin, 2017, among others).

In this paper, we undertake the heterogeneous panel framework with cross-sectional dependence recently developed by Pesaran (2006) as an alternative approach to overcome the abovementioned problems. This methodology has many advantages. First, it allows to take into account both cross-section dependence and cross-country heterogeneity. Second, it is useful to deal with the problems of omitted variables, endogenous regressors, and measurement error (Pesaran, 2006; Pedroni, 2007; Bai, 2009; Kapetanios et al., 2011). Third, it allows for more robust estimates by utilizing variation between countries as well as variation over time.

The main purpose of this paper is to provide new empirical evidence on the relationship between export upgrading and economic growth, by applying panel cointegration and causality tests on a heterogeneous panel of 51 countries over the period 1984–2015. Specifically, after examining the existence of cross-sectional dependence, we use the second generation panel unit root test (Pesaran, 2007), the panel cointegration test proposed by Westerlund (2007), and the Common Correlated Effects Mean Group (CCEMG) estimates suggested by Pesaran (2006) to estimate the long-run relationship between export sophistication and economic growth. A panel vector error-correction model is subsequently estimated to test the direction of causality (Pesaran et al., 1999).

Accordingly, our article differs from the previous literature and makes at least three contributions. First, unlike previous studies which assume a unidirectional causal relationship from export upgrading to economic growth, we analyze the Granger causal relationship between the variables within a panel error-correction model framework. Rich countries are expected to export more sophisticated capital- and technology-intensive products (Schott, 2008). The evidence of reverse causality is, therefore, rather strong. Second, our study makes a methodological contribution. To the best of our knowledge, the current paper is the first attempt to employ the Pesaran (2006) CCEMG approach to examine the export sophistication-economic growth nexus. With this approach, we can control for parameters heterogeneity, cross-sectional dependence, and nonstationarity. Finally, previous studies have not looked at the impact of export upgrading to economic growth in countries with different levels of income. We fill this gap by splitting the sample into different groups of countries based on the levels of income, and offer new insights from heterogeneous panels. Indeed, recent theoretical and empirical work shows that export upgrading may affect economic growth in different ways in rich versus poor countries (see, Felipe et al., 2012; Sheridan, 2014).

The remainder of the paper is organized as follows. Section 2 briefly reviews the literature on the importance of export upgrading for economic growth. Section 3 describes the measurement methods of export upgrading. Section 4 presents the dataset and econometric model used in our analysis. Section 5 presents our empirical methodology and discusses our results. Section 6 concludes.

Literature Review

Ever since the pioneering contributions of Kuznets and Murphy (1966), Kaldor (1967), and Chenery and Taylor (1968), it has been recognized that economic development is a process of structural transformation of the productive structure, whereby resources were shifted from activities of lower productivity into activities of higher productivity. In this line of thought, it has been acknowledged that different activities play different roles in the economy because they are subject to various degrees of returns to scale, their outputs have different income elasticities of demand, and because their market structures are different (Felipe et al., 2012). These ideas have been revived recently by Hidalgo et al. (2007) and Hidalgo and Hausmann (2009), who explain economic development as a process of learning how to produce (and export) more complex products (Felipe et al., 2014). According to Hidalgo and Hausmann’s theory of capabilities, a country’s capacity to grow depends on its capacity to accumulate the capabilities that are required to produce diverse and more sophisticated/complex goods. Therefore, differences in income across countries can be explained by differences in countries’ ability to upgrade their production and diversify into complex goods (McMillan and Rodrik, 2011). As Fosu (1996) argues, one reason for the differing impact of manufacturing and primary exports on economic growth is that primary exports are usually raw and unprocessed whereas manufactured goods are more technologically intensive, and therefore more likely to create positive spillovers.

Empirical evidence on the positive role played by export upgrading in promoting economic growth is provided by several authors. For example, Hausmann et al. (2007) analyzed the benefits of export sophistication for economic growth both empirically and theoretically. Using a panel data set for 40 countries over the period 1992–2003, the authors found that export sophistication leads to faster economic growth. Santos-Paulino (2011) applied a standard augmented aggregate production function to determine the relationship between export upgrading and economic growth. His sample included 74 developed and developing countries and the data spanned from 1992 to 2004. Three variables were used to proxy export upgrading, namely inter-industry specialization index, Herfindahl-Hirschmann export concentration, and Hausmann et al.’s (2007) measure of export sophistication. Using these variables, he found a positive effect of both export specialization and export sophistication on growth.

Jarreau and Poncet (2012) investigated the effects of export sophistication on regional economic growth for a panel of 30 Chinese provinces over the period 1997–2009. Cross-sectional estimation results revealed a positive and significant effect of export sophistication on regional economic performance in China. This implies that regions specializing in more sophisticated goods subsequently grow faster. Similar results were found by Poncet and De Waldemar (2013) who examined the relationship between output structure and economic development at city level. Using the new indicator of complexity of Hidalgo and Hausmann (2009), the empirical evidence suggests that regions specializing in more complex goods subsequently grow faster.

Jimenez and Razmi (2013) examined the impact of manufacturing exports destined for industrialized countries on real GDP per capita growth of some Asian developing countries using both ordinary least squares (OLS) and GMM techniques. They found a robust, positive, and statistically significant effect of the share of high technology-intensive goods in aggregate exports on output growth.

Sheridan (2014) explored the relationship between disaggregated exports and economic growth for a sample of 92 countries over the period1970–2009. Using OLS and fixed effects (FE) estimation techniques, the author showed that increasing manufacturing exports is important for a sustainable economic growth. To accomplish the above results, he also carried out regression tree analysis and found that this positive relationship only holds once a threshold level of development is reached. In a more recent study, Ferrarini and Scaramozzino (2016) analyzed the impact of production complexity and its adaptability on the level of output and on its rate of growth within an endogenous growth model. They showed that increased complexity has an ambiguous effect on the output level, but positively affects economic growth by enhancing human capital training. To test empirically these theoretical models, the authors utilized a panel data Correlated Random Effects (CRE) framework for a sample of 89 countries, and the empirical evidence supports the predictions of their theoretical model.

Zhu and Li (2017) presented further evidence that complexity matters for economic growth. They estimated a standard growth model using data on 126 countries for the period 1995 to 2010. Export complexity was found to be positively correlated with GDP per capita growth rate. Furthermore, their results also demonstrate that a good interaction between human capital and complexity affects growth positively. Likewise, Teixeira and Queirós (2016), using a panel data set for 30 countries over the period 1960–2011, found that the interaction between human capital and structural change (proxied by the share of high-tech/high knowledge-intensive industries in total employment) impacts significantly on economic growth.

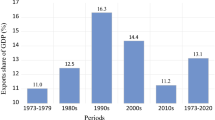

In a multi-country study, Albeaik et al. (2017) employed the pooled OLS, random effects, and fixed effects models to examine the relationship between export complexity and economic growth for a panel dataset covering 121 countries over the period 1973–2013. Using an improved Economic Complexity Index (called ECI+), the empirical evidence suggests that countries specializing in more complex goods subsequently grow faster.

Stojkoski and Kocarev (2017) examined the link between complexity and economic growth in 16 countries of Southeastern and Central Europe using both ordinary least squares (OLS) and GMM techniques. Their empirical results indicate that economic complexity has a significant and positive long-run impact on economic growth. While using panel data for a sample of 147 countries over the period 1979–2011, Gala et al. (2018) conclude that export complexity is important to explain convergence and divergence among countries.

In a more recent research, Güneri (2019) investigated the relationship between export complexity and economic growth by using a panel data of 81 countries over 1981–2015 period, using the system GMM estimator. The results based on averaged data show that export complexity has a positive and significant effect on economic growth. A Similar positive effect of export complexity sophistication on growth was observed by Shimbov et al. (2019) for Western Balkan countries. Further insight is offered by Mealy et al. (2019) who demonstrated by employing the spectral clustering algorithm that the economic complexity index is significantly and positively associated with GDP per capita and economic growth.

Measuring Export Upgrading

In this paper, following Felipe et al. (2012), Poncet and De Waldemar (2013), and Zhu and Li (2017), among others, the level of export upgrading is proxied by the export complexity index. Several measures of export complexity (or sophistication) have been proposed in the literature. Rodrik (2006) and Hausmann et al. (2007) suggest an export sophistication index,Footnote 1 called PRODY, which is a weighted average of exporting countries’ per capita incomes, where the weights are each exporting country’s comparative advantage in the product. The productivity level associated with a country’s exports, denoted by EXPY, is then computed as a weighted average of all exported products’ PRODY for that country. Algebraically:

wherexjl is the value of country j’s export of commodity l, Xj the total value of country j’s exports, and Yj the per capita income of country j, measured as the real GDP per capita in PPP.

A major drawback of the most widely used export sophistication EXPY measure is that it is computed by comparison to the income level of countries with similar export structures, giving rise to a circular issue that “rich countries export rich country products”(Hidalgo, 2009). Another weakness of this measure is that is sensitive to the size of the country under investigation (Kumakura, 2007) and the choice of product nomenclature (Yao, 2009). To overcome these caveats, Hidalgo and Hausmann (2009) propose an innovative measure of export complexity that is based solely on information about the network structure of countries and the products they export. They identify complex products as those requiring a wide set of diverse and exclusive capabilities. Complex goods, therefore, are less ubiquitous—not easily reproducible everywhere—and are expected to be produced by a few countries endowed with numerous and exclusive capabilities (Maggioni et al., 2016).

Hidalgo and Hausmann (2009) develop the so-called method of reflections that iteratively combines relevant information on products’ ubiquity and countries’ diversification gathered from the world trade network to provide a refined measure of product complexity. Roughly, two components of complexity are the starting point of this method: Product’s ubiquity as the number of countries that export the product with revealed comparative advantage (RCA), and product diversification as the number of products that a country exports with RCA. Ubiquity and diversification are the simplest proxies for complexity of a product and a country, respectively; they are computed as follows:

Ubiquity:

Diversification:

where j denotes the country, l the product, and Mjl=1 if country j exports product l with revealed comparative advantage (RCA)Footnote 2 and Mjl=0. otherwise.

Then, by making use of the method of reflections, Hidalgo and Hausmann (2009) derive a refinement of the complexity measures in Eqs. (3) and (4):

where n stands for the number of iterations. Equations (5) and (6) are iterated until no additional information can be retrieved from the previous iteration, that is when the relative rankings of the values estimated using (5) and (6) in two subsequent iterations, n and n+1, are the same.Footnote 3 For each country (j), as Hidalgo and Hausmann (2009) note, Kj, n’s even-numbered iterations (Kj, 0,Kj, 2,Kj, 4,…) measure the level of export diversification, while Kj, n’s odd-numbered iterations (Kj, 1,Kj, 3,Kj, 5,…) measure the level of export ubiquity. On the other hand, for each product (l), Kl, n’s even-numbered iterations (Kl, 0,Kl, 2,Kl, 4,…) measure the level of export ubiquity, while Kl, n’s odd-numbered iterations (Kl, 1,Kl, 3,Kl, 5,…) measure the level of diversification of the countries that export product.

Substituting (5) into (6), we obtain

where

The ECI is then computed following Hidalgo and Hausmann (2009) as:

Here, Kjrefers to the eigenvector of \( {\overset{\sim }{M}}_{jj\prime } \) associated with the second largest eigenvalue. <> denotes an average and stdev is the standard deviation (Hausmann et al., 2014; Hartmann et al., 2017).

From an empirical point of view, using ECI as a measure of export upgrading has at least three key advantages in comparison to other measures of export upgrading. First, it may reflect numerous product technological capabilities, such as technological diversification, the need for specific investments, or higher human capital content (Maggioni et al., 2016). Second, it circumvents the circularity issue whereby rich countries export rich-country goods (Lectard and Rougier, 2018). Third, as noted by Hidalgo and Hausmann (2009), it captures information about the complexity of the set of capabilities available within a country.

Model Specification and Data

Model

In this study, we examine the effects of export upgrading on economic growth within a panel framework that takes into account three relevant features in the data: nonstationarity, cross-sectional dependence, and parameter heterogeneity. Specifically, we consider the following linear heterogeneous panel regression model:

where i=1, …, N denotes a country index and t=1, …, T denotes the time period. Y is the level of a country’s economic growth, measured by the natural logarithm of the real GDP per capita in constant 2005 US dollars. EXPU is the export upgrading indicator measured by the Hidalgo and Hausmann (2009) economic complexity index (ECI). Xit is a set of control variables including, in line with Poncet and De Waldemar (2013), the ratio of investment to GDP (INVR), the share of population enrolled in secondary schooling (HC), the openness rate measured as the share of imports and exports in GDP (OPEN), and the foreign direct investment inflows over GDP (FDI). αi is a country-specific intercept, dt is a time dummy, and εit is the composite error term.

Data Sources and Descriptive Statistics

We use data for a panel of 51 countries over the period 1984–2015. Countries are split into three subpanels based on the World Bank’s income classification: high-income (23 countries), middle-income (17), and low-income (11). Data on per capita GDP, investment, trade openness, school enrollment, and foreign direct investment inflows as a percentage of GDP come from the World Bank’s World Development Indicators database. The economic complexity index is from the MIT’s Observatory of Economic Complexity.Footnote 4 The descriptive statistics and pairwise correlations between our main variables of interest for the subpanels countries and also for the global panel are shown in Appendix A. As regards our measure of export upgrading, the mean of export complexity index is the highest for the high-income countries, followed by middle- and low-income countries. It is also noted that the middle-income countries are more volatile in export complexity; its relative standard deviation is 2.136, which is the highest when compared to other subpanels’ countries relative standard deviation.

Econometric Methodology and Empirical Results

The main objective of this paper is to test whether there is a long-run relationship and dynamic causal between export upgrading and economic growth. The testing procedure involves the following steps: (i) we examine the existence of cross-sectional dependency across the countries; (ii) Once it is established that the panel is subject to a significant degree of residual cross-section dependence, a “second generation” panel unit root test developed by Pesaran (2007) that is robust to such dependence is conducted to check the integration order of the time series variables; (iii) if the time series are integrated of the same order, panel cointegration tests are then employed to identify the existence of a long-run relationship. Both Pedroni’s (2004) residual-based tests and Westerlund’s (2007) error-correction-based tests are employed for this purpose; (iv) Once it is confirmed that the variables are cointegrated, the long-run estimates are obtainedby using the Common Correlated Effects Mean Group (CCEMG) estimator of Pesaran (2006), and finally, (v) a panel vector error-correction model is estimated in order to infer the Granger causal relationship between the series.

Cross-sectional Dependence Tests

The first step in the analysis is to test the existence of cross-sectional dependence across countries. To this end, we use the semi-parametric test proposed by Frees (1995, 2004) and the parametric testing procedure suggested by Pesaran (2004). These two tests are especially attractive and show better power properties when the number of cross sections is higher than the number of time series in the panel. Besides, Frees’s and Pesaran’s tests can be used with both balanced and unbalanced panels and are robust to parameter heterogeneity and/or structural breaks.

Pesaran (2004) proposed a cross-section dependency test (hereafter, CD) that does not require an a priori specification of a connection or spatial matrix and is applicable to a wide range of panel data models. In the CD test, the null hypothesis of no-cross-section dependence is H0:Cov(εit,εjt)=0 for all t, and i≠j is tested against the alternative hypothesis of cross-section dependence H1: Cov(εit,εjt)≠0 for at least one pair of i≠j. In order to test the null hypothesis, Pesaran (2004) developed the CD statistic as follows:

where \( {\hat{\rho}}_{ij} \)is the sample estimate of the pairwise correlation of the residuals from the OLS estimation of Eq. (1) for each i. Specifically,

and \( {\hat{\varepsilon}}_{it} \)is the OLS estimate of εitin Eq. (10). Under the null hypothesis of no cross-sectional dependence with T→∞ and then N→∞ in any order, the CD test has an asymptotic normal standard distribution. Although it has zero mean for fixed T and N and is robust to parameter heterogeneity and structural breaks in the slope coefficients and error variance, the CD test has low power when the factor loadings have zero mean in the cross-sectional dimension (Sarafidis et al., 2009).

Frees (1995, 2004) proposed a statistic (hereafter, \( {R}_{AVE}^2\ \Big) \)that is not subject to this weakness. The statistic is based on the sum of the squared correlation and is defined as follows:

where \( {\hat{r}}_{ij} \) is the estimated Spearman’s rank coefficient. According to Frees (1995, 2004), this test statistic follows a joint distribution of two independent chi-square variables, i.e.,

where

In Eq. (15) \( {\chi}_{1,T-1}^2 \) and \( {\chi}_{2,T\left(T-3\right)/2}^2 \)are independent chi-square random variables with 1−T and T(T−3)/2degrees of freedom, respectively, and a(T)=4(T+2)/(5(T−1)2(T+1)) and b(T)=2(5T+6)/(5T(T−1)(T+1)). The null hypothesis is rejected if:

\( {R}_{AVE}^2>{\left(T-1\right)}^{-1}+{Q}_q/N, \) where Qqis the appropriate quintile of the Q distribution.

The results from cross-section dependency tests reported in Table 1 strongly reject the null hypothesis of no cross-sectional dependence across the countries at the 1% significance level for the whole sample as well as across all three sub-samples. This result underlines the importance of taking into consideration cross-section dependence when analyzing export upgrading-growth nexus.

Panel Unit Root Tests

As preliminary analysis suggests the presence of cross-sectional dependence among the countries in the panel, we decided to apply the Pesaran's (2007) cross-sectional augmented panel unit root test(hereafter, CIPS) which—in contrast to conventional panel unit-root tests—allows for cross-sectional dependence. In the CIPS test, contemporaneous correlation is accounted for by augmenting the standard augmented Dickey–Fuller (ADF) regression equations with the cross-section average of lagged levels and first differences of the individual series as follows:

where qit denotes the series under consideration (Y, ECI, INVR, HC, OPEN, or FDI), \( {\overline{q}}_t={N}^{-1}\sum \limits_{i=1}^N{q}_{it} \) is the cross-sectional mean of qit,\( \Delta {\overline{q}}_t={N}^{-1}\sum \limits_{i=1}^N{\overline{q}}_{it} \), p is lag order of the model, ∆ is the first-difference operator, γ is a constant term that captures the country-specific effects, t is a time trend, and eitis a white-noise disturbance with a variance of σ2.

In Eq. (16), the CIPS test assumes that the null hypothesis is given by H0:φi=0 for all i, whereas the alternative hypothesis is given by H1: φi<0 and assumes that qit is stationary. The CIPS test statistic developed by Pesaran (2007) can be expressed as follows:

where ti(N,T) is the t statistic of φi in Eq. (16).

Results of the CIPS unit root test are reported in Table 2. They indicate that all variables are nonstationary in levels and stationary in their first differences at the 1% significance level for high-, middle-, and low-income subpanels as well as for the whole panel block. This implies that all variables are integrated of order one, i.e., I (1).

Panel Cointegration Tests

Having established the presence of unit roots in the panel time series and that they are I (1), the next step would be to examine whether a long-run equilibrium relationship exists among the variables. For this purpose, we perform the standard panel cointegration tests proposed by Pedroni (1999, 2004). Because these tests do not allow for cross-section dependence, we also implement the error-correction-based cointegration tests developed by Westerlund (2007).

Pedroni (1999, 2004) proposed seven test statistics, which can be classified into two categories. The first category, referred to as panel cointegration statistics, is based on the within-dimension approach. . It includes the panel-ν statistic (Zv), panel rho-statistic (Zρ), panel PP-statistic (ZPP), and panel ADF-statistic (ZADF). These statistics pool the autoregressive coefficients across different countries for the unit root tests on the estimated residuals taking into account common time factors and heterogeneity across countries. The second category, referred to as group-mean panel cointegration tests, is based on the between-dimension approach which includes three statistics: group rho-statistic (\( {\overline{Z}}_{\rho } \)), group PP-statistic (\( {\overline{Z}}_{PP} \)), and group ADF-statistic (\( {\overline{Z}}_{ADF} \)).These statistics are based on averages of the individual autoregressive coefficients associated with the unit root tests of the residuals for each country.

The seven test statistics of Pedroni (1999, 2004) are based on the estimated residuals derived from the following regression equation:

For all of the seven tests, the null hypothesis is the absence of cointegration (H0: ρi=1; ∀ i). The alternative hypothesis for between-dimension statistics is H1:ρi˂ 1,∀ i. While the alternative hypothesis for within dimension statistics is H1:ρi=ρ˂ 1,∀I, where ρi is the autoregressive term of the residuals given by:

Westerlund's (2007) test is also constructed on the same approach as the Pedroni (1999, 2004) test but is based on structural rather than residual dynamics, so that it does not impose any common factor restrictions. Interestingly, the test allows for dependence both within and between the cross-sectional units, and shows good small-sample properties and high power relative to residual-based panel cointegration tests. Furthermore, this bootstrap test is based on the sieve-sampling scheme, and has the advantage of significantly reducing the distortions resulting from the use of the asymptotic normal distribution. The joint null hypothesis is that all cross-sections in the panel are cointegrated. Hence, if the null is not rejected, one can assume that there is a cointegrating relationship between the variables, which is needed to derive an estimate of the parameters of the long-run model.

The proposed test of Westerlund (2007) is based on an error-correction framework:

where d denotes the deterministic components, Z is the vector of explanatory variables (export upgrading, openness rate, foreign direct investment inflows over GDP, the share of investment in GDP, and the share of population enrolled in secondary schooling), p denotes the lag order, and α is the error-correction parameter.

Westerlund (2007) proposed four test statistics, two of which are based on the assumption that the autoregressive parameter is constant for all units and are known as panel cointegration statistics (Pa, Pt) and the other two statistics are based on the assumption that the autoregressive parameters vary from unit to unit, and are denoted as group-mean cointegration statistics (Ga, Gt). The four statistics follow a standard normal distribution.

The Ga and Gt statistics test H0:αi=0;∀i versus H1: αi<0 for at least one of the series, i. The rejection of the null hypothesis can be taken as genuine evidence of cointegration of at least one of the cross-sectional units. The two group-mean tests are given by:

where \( SE\left({\hat{\alpha}}_i\right) \) is the conventional standard error of \( {\hat{\alpha}}_{i.} \)

By contrast, the Pa and Pt statistics test H0:αi=0;∀i versus H1: αi=α<0;∀i. Hence, the rejection of the null hypothesis can be considered as more accurate evidence of cointegration for the panel as a whole. The two panel tests can be calculated by:

Table 3 displays the results of the Pedroni (1999, 2004)panel cointegration tests. The test results show that most statistics are statistically significant, and therefore, the null hypothesis of no cointegration can be rejected, suggesting that the variables are cointegrated in all subgroups of countries and the full sample.

The results from the Westerlund (2007) panel cointegration tests are reported in Table 4. As it can be seen, the null hypothesis of no cointegration is rejected in most cases, providing an additional support for the presence of cointegrating relationship between variables.

Therefore, overall evidence from the Pedroni (1999, 2004) and Westerlund (2007) tests for cointegration indicate that there is a long-run relationship between export upgrading, economic growth, FDI, human capital, and trade openness in the four panels of high-, middle-, and low-income countries as well the full-sample panel.

Panel Cointegration Regressions

Several estimation methods have been proposed in the literature to estimate the cointegrating vectors, like pooled mean group (PMG) (Pesaran et al., 1999), fully modified OLS (FMOLS) (Pedroni, 2000, 2001), and dynamic OLS (DOLS) (Kao and Chiang, 2001). However, it is established that these standard estimation procedures can lead to inconsistent estimates and incorrect inference in the presence of cross-sectional dependence. (see, Phillips and Sul, 2003; Kapetanios et al., 2011). In this regard, the common correlated effects mean group (CCEMG) estimator proposed by Pesaran (2006) seems to be an appropriate econometric method. As suggested by Holly et al. (2010), CCEMG estimator is consistent under heterogeneity and cross-sectional dependence. Besides, it is also shown to hold under a variety of situations, such as weak cross-sectional dependence in the errors, unit roots in the factors and possible contemporaneous dependence of the observed regressors with the unobserved factor factors (Kapetanios and Pesaran, 2007; Chudik et al., 2011; Pesaran and Tosetti, 2011), and can be extended to the case of heterogeneous dynamic panel data models with weakly exogenous regressors (Chudik and Pesaran, 2015).

The CCEMG procedure accounts for the existence of unobserved common factors across countries by augmenting Eq. (18) with cross-sectional averages of all variables as additional regressors. That is,

where, \( \overline{Y_t}=\frac{1}{N}\sum \limits_{i=1}^N{Y}_{it} \),\( {\overline{EXPU}}_t=\frac{1}{N}\sum \limits_{i=1}^N{EXPU}_{it,}\overline{INVR_t}=\frac{1}{N}\sum \limits_{i=1}^N{INVR}_{it},{\overline{HC}}_t=\frac{1}{N}\sum \limits_{i=1}^N{HC}_{it},{\overline{OPEN}}_t=\frac{1}{N}\sum \limits_{i=1}^N{OPEN}_{it\kern0.5em } \)and \( {\overline{FDI}}_t=\frac{1}{N}\sum \limits_{i=1}^N{FDI}_{it} \).

The common correlated effects (CCE) estimator for the ith country’s slope coefficient Bi=(β,γ,μ,ρ,δ)′, proposed by Pesaran (2006) and extended by Kapetanios et al. (2011) and Pesaran and Tosetti (2011) is,

where Zi=(Zi1,Zi2,…,ZiT)′,zit=(EXPUit,INVRit,HCit,OPENit,FDIit)′,Yi=(Yi1,Yi2,…,YiT)′,\( D={I}_T-H{\left(\overline{H}\prime \overline{H}\right)}^{-1}\overline{H} \), \( \overline{H}=\left({h}_1,{h}_2,\dots, {h}_T\right)^{\prime } \),\( {h}_t=\left(1,\overline{{\mathrm{Y}}_t},\overline{EXPU},\overline{INVR_t},{\overline{HC}}_t,{\overline{OPEN}}_t,{\overline{FDI}}_t\right) \).

The CCEMG estimator is the average of the individual CCE estimators\( {\hat{\ B}}_{CCE,i} \):

Panels A–D of Table 5 report the results of the CCEMG estimates for the whole sample as well as for the three sub-samples, i.e., high-, middle-, and low-income countries.

For the full sample, the results in panel A indicate that export complexity has a positive and significant effect on economic growth at least at 10% significance level. Furthermore, the magnitude of the coefficient suggests that a 10% increase in export complexity index raises GDP per capita by 0.4 percentage points in the long run on average. This implies that countries with a more complex export basket tend to grow faster than countries with a less complex export basket. This result is consistent with the findings of Poncet and De Waldemar (2013) and Ferrarini and Scaramozzino (2016).

For the subpanel of high-income countries, the results in panel B show that the coefficient estimate on export complexity remains positive and significant at least at the 10% level, with a larger magnitude than that found in the full-sample model. This result is in line with the finding of Gozgor and Can (2016), but contradictory to those of Hausmann et al. (2007). In fact, the latter authors find that in high-income countries, there is no significant relationship between export sophistication and growth, whereas in middle- and low-income countries they find that this relationship is positive and strongly significant.

In the middle-income subsample, we find that export complexity has a positive and statistically significant effect on economic growth as a 10% increase in export complexity index raises GDP per capita by 0.7 percentage points in the long run on average. This result is in line with the findings of Shimbov et al. (2019) for the Western Balkan countries. For the subpanel of low-income countries, however, the effect of export complexity on economic growth appears to be negative but insignificant. Our results relating to low-income panel are similar to Grancay et al. (2015), who find a negative impact of export sophistication on economic growth for nonresource-based low-income countries.Footnote 5

What our results indicate is that export complexity alone is not enough to foster economic growth in low-income countries. This negative effect could be channeled through the distributional effects of vertical specialization trade or through the skilled-bias technical change. As shown by Ferrarini and Scaramozzino (2016), growth benefits from increased complexity depend on the potential trade-off between the gains from specialization and the O-ring effects. Other possible explanation of this result is that the positive growth externalities from complex exports are conditional on the trade regime (Wang and Wei, 2010; Jarreau and Poncet, 2012; Poncet and De Waldemar, 2013) and the sector that dominates the economy (Aditya and Acharyya, 2013). Furthermore, our results tally with Teixeira and Queirós (2016), who provide empirical evidence suggesting that structural change can slow economic growth due to the huge mismatch between structural change processes and available skills of countries’ workforces.

Regarding the control variables, we find that the share of investment in GDP has a significantly positive effect on growth in most specifications, which is consistent with both the theoretical and empirical growth literature (see e.g., Khan and Reinhart, 1990; Podrecca and Carmeci, 2001; Madsen, 2002; Milbourne et al., 2003). Similarly, economic growth is also affected positively and significantly by FDI inflows as a 1% increase in foreign direct investment raises the economic growth for the global panel by around 0.01% on average. This result is consistent with the findings of Anwar and Nguyen (2010). On the other hand, the coefficient of the schooling variable, the proxy for human capital stock, is ambiguous in sign and insignificant in most cases. This finding may be surprising in light of the importance attached to human capital in endogenous growth models and the regressions results (Barro, 1991; Mankiw et al., 1992; Bassanini and Scarpetta, 2002; and Sala-i-Martin et al., 2004). However, it is consistent with those of Ben Habib and Spiegel (1994), Islam (1995), Barro (2001), Henderson (2010), Delgado et al. (2014), Acemoglu et al. (2014), and Madsen et al. (2015), who either found a negative or insignificant relationship between human capital and growth.Footnote 6

Panel Granger causality tests

Given the variables are cointegrated, a panel-based VECM (Pesaran et al., 1999) is estimated to perform Granger causality tests. This panel followed by the two step procedure of Engle and Granger (1987) is employed to account for the long-run and short-run dynamic linkages. The first step estimates the long-run parameters in Eq. (18) in order to obtain the residuals corresponding to the deviation from equilibrium. The second step estimates the parameters related to the short-run adjustment. The resulting equations are used in conjunction with panel Granger causality testing:

where Δ is the first-difference operator; φj, i, t (j=1,2,3,4,5,6) means the fixed country effect; k (k=1,…,m) is the optimal lag length determined by the Schwarz Information Criterion; λjis the adjustment coefficient; εj, i, t is the serially uncorrelated error term with mean zero; and ECTt−1 is the estimated lagged error-correction term derived from the long-run cointegrating relationship. With respect to Eq. (23), short-run causality is tested by the statistical significance of the partial F-statistics associated with the respective first differenced lagged independent variables. Long-run causality is determined by the statistical significance of the respective ECTs using a t-test.

The results of Granger causality between export upgrading, economic growth, and other control variables are reported in Tables 6, 7, 8, and 9. For the global panel (Table 6), the short-run dynamics suggests a bidirectional causal relationship (feedback effect) between export complexity and trade openness, and same inference is drawn between the share of investment and trade openness. The bidirectional causality also exists between human capital and foreign direct investment. In addition, it was found that there is unidirectional causality running from export complexity and trade openness to economic growth and from the share of investment to export complexity. Regarding the long-run causality, the coefficient of lagged error-correction term (ECTt−1) is found to be negative and statistically significant at least at the 10% level in all regressions. This suggests that there is long-run relationship among the variables and provides evidence of an error-correction mechanism that drives the variables back to their long-run equilibrium.

In the case of the high-income country panel (Table 7), bidirectional causality between the share of investment and economic growth has been identified. There is also evidence of short-run Granger causality running from the share of investment and human capital to trade openness, from export complexity to economic growth, from the share of investment to export complexity, and from foreign direct investment to human capital. In the long run, the statistically significant estimate of ECTt−1 with a negative sign supports the long-run relationship among the variables.

For the middle-income country panel, the results reported in Table 8 indicate the existence of bidirectional short-run causality between the share of investment and trade openness and the same is true between human capital and foreign direct investment. The evidence also suggests a unidirectional Granger causality running from export complexity and trade openness to economic growth, and from the share of investment and trade openness to export complexity. In addition, the long-run results indicate that there is a bidirectional Granger causality among the running variables.

As regards the low-income country panel, our results in Table 9 show that economic growth, human capital, and trade openness Granger cause foreign direct investment in the short run. The findings reveal also the existence of a short-run unidirectional Granger causality running from foreign direct investment to the share of investment and from export complexity to trade openness. With respect to the long-run causality, the results indicate the existence of bidirectional long-run causality between human capital, foreign direct investment, and economic growth.

Conclusion

The main objective of this study was to examine the long-run and causal relationships between export upgrading and economic growth for 51 high-, middle-, and low-income countries over the period of 1984–2015. For this purpose, a panel cointegration framework that allows to control for parameters heterogeneity, cross-sectional dependence, and nonstationarity has been deployed. Furthermore, three homogenous subpanels have been considered based on the income level of the sample countries (high-, middle-, and low-income subpanels).

The results of the cross-sectional dependence and panel unit root tests suggest that all the variables are cross-sectionally dependent and are I(1). Besides, the cointegration tests yield evidence of a long-run relationship between export upgrading, economic growth, FDI, human capital, and trade openness.

The panel CCEMG results indicate that export upgrading has a positive and significant effect on economic growth for the global, high-income, and middle-income panels, while this effect is insignificant for the low-income country panel. The causality analysis indicates the existence of a feedback effect between export complexity and economic growth for the global panel as well as for the high- and middle-income country groups in the long-run. For low-income countries, however, there is no causal relationship between these two variables, and this finding holds both in the short-run and in the long-run. This finding may stem from the fact that poor countries have low endowments in physical and human capital and do not have the required skills to develop a more complex production structure. The benefits from engaging in a process of export sophistication, at an early stage of development, are marginal or even negative. Striving to move towards more specialization and complexity would boost human capital accumulation, help building new skills and capabilities, and foster economic growth. Felipe et al. (2012) point out that the accumulation of capabilities in developing and poor countries is generally hindered by information and coordination externalities that may give rise to market failures and inadequate action by the private sector. Cadot et al. (2011) also argue that in the case of countries that are not endowed with sufficient capabilities to produce more sophisticated goods, no industrial policy will make them successful exporters. On the other hand, rich countries are relatively well endowed with more advanced productive capabilities (human and physical capital, the legal system, institutions, etc.) that allow them to exploit all the benefits from engaging in a process of export sophistication and mitigate its adverse effects (Saafi and Nouira, 2018).

We concluded that economic specialization alone is not enough to spur economic growth in developing and poor countries because growth benefits from increased complexity will most likely be outweighed by the negative O-ring effects, i.e., the costs of production failure caused by increased complexity in those countries. Increasing export complexity for its own sake, therefore, may be counter-productive. Strong incentives and sound policy instruments will be needed to develop the right set of capabilities enables developing and emerging countries to move up the value chain and break into fast-growing markets for knowledge- and innovation-based products and services (Fortunato and Razo, 2014). These should include, among others, fostering the accumulation of skills and knowledge, improving the productive capacity, and making knowledge-related investments (Barkhordari et al., 2018). Further, some scholars argue that technology upgrading is highly dependent on whether countries use global value chains and international R&D networks as levers, linkages, and mechanisms of learning (for example, Radosevic and Stancova, 2018).

While the evidence reported here is important, it remains purely empirical and should be seen as a starting point for further analysis in this area. In future research, it would be valuable to develop a comprehensive theoretical and analytical framework that could accommodate the findings reported in the current paper. We further acknowledge that in this study, we do not identify all the possible factors that drive the relationship between export upgrading and economic growth. Therefore, it would be worthwhile to investigate the circumstances under which export upgrading is growth-enhancing. That is to say, to what extent the effects of export upgrading are contingent on the level of financial and institutional development, the capital and human stock, the degree of trade openness, and sound macroeconomic policies, etc.

Notes

A very similar measure of product sophistication is developed by Lall et al. (2006).

The index of RCA is defined following Balassa (1964) as the ratio of the export share of a given commodity in the country’s export basket to the same share at the worldwide level. The algebraic expression is given by:

$$ {RCA}_{jl}=\frac{\raisebox{1ex}{${x}_{jl}$}\!\left/ \!\raisebox{-1ex}{${X}_j$}\right.}{\sum \limits_j\left(\raisebox{1ex}{${x}_{jl}$}\!\left/ \!\raisebox{-1ex}{${X}_j$}\right.\right)} $$Available at atlas.media.mit.edu.

However, it is worth noting that other studies have shown contradictory findings. Lin et al. (2017), for instance, report a positive and significant effect of export sophistication on economic growth for the Sub Saharan countries. This discrepancy, as discussed in Gozgor and Can (2016), may be due to the different countries’ samples, different dataset, and different econometric estimation techniques.

References

Acemoglu, D., Francisco, A. G., & Robinson, J. R. (2014). Institutions, human capital, and development. Annu. Rev. Econ., 6(1), 875–912.

Aditya, A., & Acharyya, R. (2013). Export diversification, composition, and economic growth: evidence from cross-country analysis. The Journal of International Trade & Economic Development, 22(7), 959–992.

Ahn, S. C., Young, H. L., & Schmidt, P. (2013). Panel data models with multiple time-varying individual effects. Journal of Econometrics, 174(1), 1–14.

Ahn, S. C., & Schmidt, P. (1995). Efficient estimation of models for dynamic panel data." Journal of Econometrics, 68(1), 5–27.

Albeaik, S., Kaltenberg, M., Alsaleh, M., & Hidalgo, C. A. (2017). Improving the economic complexity index. ArXiv e-prints.

Anwar, S., & Nguyen, L. P. (2010). Foreign direct investment and economic growth in Vietnam. Asia Pacific Business Review, 16, 83–202.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277–297.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51.

Bai, J. (2009). Panel data models with interactive fixed effects. Econometrica, 77(4), 1229–1279.

Balassa, B. (1964). The purchasing-power parity doctrine: a reappraisal. Journal of Political Economy, 72(6), 584–596.

Banerjee, A., & Carrion-i-Silvestre, J. L. (2014). Testing for panel cointegration using common correlated effects estimators. In In discussion paper, 15–02: Department of Economics. Birmingham: University of.

Barkhordari, S., Fattahi, M., & Azimi, N. A. (2018). The impact of knowledge-based economy on growth performance: Evidence from MENA Countries. Journal of the Knowledge Economy, 10(3), 1168–1182. https://doi.org/10.1007/s13132-018-0522-4.

Barro, R. J. (1991). Economic growth in a cross section of countries. The Quarterly Journal of Economics, 106(2), 407–443.

Barro, R. J. (2001). Human capital and growth. The American Economic Review, 91(2), 12–17.

Bassanini, A., & Scarpetta, S. (2002). Does human capital matter for growth in OECD countries? A pooled mean-group approach. Economics Letters, 74(3), 399–405.

Benhabib, J., & Spiegel, M. M. (1994). The role of human capital in economic development evidence from aggregate cross-country data. Journal of Monetary Economics, 34(2), 143–173.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143.

Cadot, O., Carrère, C., & Strauss-Kahn, V. (2011). Export diversification: what’s behind the hump? Review of Economics and Statistics, 93(2), 590–605.

Chenery, H. B., & Taylor, L. (1968). Development patterns: among countries and over time. The Review of Economics and Statistics, 50(4), 391–416.

Chou, M. C. H. (2013). Does tourism development promote economic growth in transition countries? A panel data analysis. Economic Modelling, 33, 226–232.

Chudik, A., & Pesaran, M. H. (2015). Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. Journal of Econometrics, 188(2), 393–420.

Chudik, A., Pesaran, M. H., & Tosetti, E. (2011). Weak and strong cross-section dependence and estimation of large panels. The Econometrics Journal, 14(1), C45–C90.

De la Fuente, A., & Doménech, R. (2006). Human capital in growth regressions: how much difference does data quality make? Journal of the European Economic Association, 4(1), 1–36.

Delgado, M. S., Henderson, D. J., & Parmeter, C. F. (2014). Does education matter for economic growth? Oxford Bulletin of Economics and Statistics, 76(3), 334–359.

Dufrenot, G., Mignon, V., & Tsangarides, C. (2010). The trade-growth nexus in the developing countries: a quantile regression approach. Review of World Economics, 146(4), 731–761.

Eberhardt, M., & Teal, F. (2011). Econometrics for grumblers: a new look at the literature on cross-country growth empirics. Journal of Economic Surveys, 25(1), 109–155.

Eberhardt, M., & Teal, F. (2012). No mangoes in the tundra: spatial heterogeneity in agricultural productivity analysis. Oxford Bulletin of Economics and Statistics, 75(6), 914–939.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: representation, estimation,and testing. Econometrica, 55, 251–276.

Felipe, J., Kumar, U., & Abdon, A. (2012). Using capabilities to project growth, 2010–2030. Journal of the Japanese and International Economies, 26(1), 153–166.

Felipe, J., Kumar, U., & Abdon, A. (2014). How rich countries became rich and why poor countries remain poor: it’s the economic structure… duh! Japan and the World Economy, 29, 46–58.

Felipe, J., Kumar, U., Abdon, A., & Bacate, M. (2012). Product complexity and economic development. Structural Change and Economic Dynamics, 23(1), 36–68.

Ferrarini, B., & Scaramozzino, P. (2016). Production complexity, adaptability and economic growth. Structural Change and Economic Dynamics, 37, 52–61.

Fortunato, P., & Razo, C. (2014). Export sophistication, growth and the middle-income trap. In J. M. Salazar-Xirinachs, I. Nübler, & R. Kozul-Wright (Eds.), Transforming Economies: Making Industrial Policy Work for Growth, Jobs and Development. Geneva: International Labour Office.

Foster, N. (2008). The impact of trade liberalisation on economic growth: evidence from a quantile regression analysis. Kyklos, 61(4), 543–567.

Fosu, A. K. (1996). Primary exports and economic growth in developing countries. The World Economy, 19(4), 465–475.

Frees, E. W. (1995). Assessing cross-sectional correlation in panel data. Journal of Econometrics, 69(2), 393–414.

Frees, E. W. (2004). Longitudinal and panel data: analysis and applications in the social sciences. Cambridge: Cambridge University Press.

Gala, P., Rocha, I., & Magacho, G. (2018). The structuralist revenge: economic complexity as an important dimension to evaluate growth and development. Brazilian Journal of Political Economy, 38, 2(151), 219–236.

Gozgor, G., & Can, M. (2016). Effects of the product diversification of exports on income at different stages of economic development. Eurasian Business Review, 6(2), 215–235.

Grancay, M., Grancay, N., & Dudas, T. (2015). What you export matters: does it really? Contemporary Economics, 9(2), 233–244.

Güneri, B. (2019). Economic complexity and economic performance, Ph.D. Dissertation, Hacettepe University Graduate School of Social Sciences.

Hartmann, D., Guevarda, M. R., Jara-Figueroa, C., Aristaran, M., & Hidalgo, C. A. (2017). Linking economic complexity, institutions, and income inequality. World Development, 93, 75–93.

Hausmann, R., Hidalgo, C. A., Bustos, S., Coscia, M., Chung, S., Jimenez, J., Simoes, A., & Yıldırım, M. A. (2014). The atlas of economic complexity: mapping paths to prosperity. MIT Press.

Hausmann, R., Hwang, J., & Rodrik, R. (2007). What you export matters. Journal of Economic Growth, 12(1), 1–25.

Henderson, D. J. (2010). A test for multimodality of regression derivatives with application to nonparametric growth regressions. Journal of Applied Econometrics, 25(3), 458–480.

Herzer, D., & Vollmer, S. (2012). Inequality and growth: evidence from panel cointegration. The Journal of Economic Inequality, 10(4), 489–503.

Hidalgo, C. A. (2009). The dynamics of economic complexity and the product space over a 42 year period. Center for International Development Working Paper, 189.

Hidalgo, C. A., & Hausmann, R. (2009). The building blocks of economic complexity. proceedings of the national academy of sciences, 106(26), 10570-10575.

Hidalgo, C. A., Klinger, B., Barabási, A. L., & Hausmann, R. (2007). The product space conditions the development of nations. Science, 317(5837), 482–487.

Holly, S., Pesaran, M. H., & Yamagata, T. (2010). A spatio-temporal model of house prices in the USA. Journal of Econometrics, 158(1), 160–173.

Islam, N. (1995). Growth empirics: a panel data approach. The Quarterly Journal of Economics, 110(4), 1127–1170.

Jarreau, J., & Poncet, S. (2012). Export sophistication and economic growth: evidence from China. Journal of Development Economics, 97(2), 281–292.

Jimenez, G. H., & Razmi, A. (2013). Can Asia sustain an export-led growth strategy in the aftermath of the global crisis? Exploring a neglected aspect. Journal of Asian Economics, 29, 45–61.

Kaldor, N. (1967). Strategic factors in economic development, New York State School of Industrial and Labour Relations. Ithaca NY: Cornell University.

Kao, C., & Chiang, M. H. (2001). On the estimation and inference of a cointegrated regression in panel data. In B. H. Baltagi, T. B. Fomby, & R. C. Hill (Eds.), Nonstationary Panels, Panel Cointegration, and Dynamic Panels (Advances in Econometrics, Volume 15) (pp. 179–222). Emerald Group Publishing Limited.

Kapetanios, G., & Pesaran, M. H. (2007). Alternative approaches to estimation and inference in large multifactor panels: small sample results with an application to modelling of asset returns. In G. Phillips & E. Tzavalis (Eds.), The refinement of econometric estimation and test procedures: finite sample and asymptotic analysis (pp. 282–318). Cambridge: Cambridge University Press.

Kapetanios, G., Pesaran, M. H., & Yamagata, T. (2011). Panels with non-stationary multifactor error structures. Journal of Econometrics, 160(2), 326–348.

Khan, M. S., & Reinhart, C. M. (1990). Private investment and economic growth in developing countries. World Development, 18(1), 19–27.

Kim, D. H., & Lin, S. H. (2017). Natural resources and economic development: new panel evidence. Environmental and Resource Economics, 66(2), 363–391.

Krueger, A. B., & Lindahl, M. (2001). Education for growth: why and for whom? Journal of Economic Literature, 39(4), 1101–1136.

Kumakura, M. (2007). What’s so special about China’s exports? A comment. China & World Economy, 15(5), 18–37.

Kuznets, S., & Murphy, J. T. (1966). Modern economic growth: rate, structure, and spread. Vol. 2: Yale University Press New Haven.

Lall, S., Weiss, J., & Zhang, J. (2006). The “sophistication” of exports: a new trade measure. World Development, 34(2), 222–237.

Lectard, P., & Rougier, E. (2018). Can developing countries gain from defying comparative advantage? Distance to comparative advantage, export diversification and sophistication, and the dynamics of specialization. World Development, 102, 90–110.

Lee, J. (2011). Export specialization and economic growth around the world. Economic Systems, 35(1), 45–63.

Lee, K., Pesaran, M. H., & Smith, R. (1997). Growth and convergence in a multi-country empirical stochastic Solow model. Journal of Applied Econometrics, 12(4), 357–392.

Lin, F., Weldemicael, E. O., & Wang, X. (2017). Export sophistication increases income in sub-Saharan Africa: evidence from 1981–2000. Empirical Economics, 52(4), 1–23.

Loayza, N. V., & Ranciere, R. (2006). Financial development, financial fragility, and growth. Journal of Money, Credit and Banking, 38(4), 1051–1076.

Madsen, J. (2002). The causality between investment and economic growth. Economics Letters, 74(2), 157–163.

Madsen, J., Raschky, P. A., & Skali, A. (2015). Does democracy drive income in the world, 1500–2000? European Economic Review, 78, 175–195.

Maggioni, D., Lo Turco, A., & Gallegati, M. (2016). Does product complexity matter for firms’ output volatility? Journal of Development Economics, 121, 94–109.

Mankiw, N. G., Romer, D., & Weil, D. N. (1992). A contribution to the empirics of economic growth. The Quarterly Journal of Economics, 107(2), 407–437.

McMillan, M. S, & Rodrik, D. (2011). Globalization, structural change and productivity growth. National Bureau of Economic Research.

Mealy, P., Farmer, J. D., & Teytelboym, A. (2019), Interpreting economic complexity, Science Advances, 5, eaau1705.

Milbourne, R., Otto, G., & Voss, G. (2003). Public investment and economic growth. Applied Economics, 35, 527–540.

Nauges, C., & Thomas, A. (2003). Consistent estimation of dynamic panel data models with time-varying individual effects. Annales d'Economie et Statistique, 53–75.

O'Connell, P. G. J. (1998). The overvaluation of purchasing power parity. Journal of International Economics, 44(1), 1–19.

Pedroni, P. (1999). Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics, 61(1), 653–670.

Pedroni, P. (2000). Fully modified OLS for heterogeneous cointegrated panels. In B. H. Baltagi (Ed.), Nonstationary Panels, Panel Cointegration and Dynamic Panels, 15 (pp. 93–130). Amsterdam: Elsevier.

Pedroni, P. (2001). Purchasing power parity tests in cointegrated panels. Review of Economics and Statistics, 83(4), 727–731.

Pedroni, P. (2004). Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory, 20(03), 597–625.

Pedroni, P. (2007). Social capital, barriers to production and capital shares: implications for the importance of parameter heterogeneity from a nonstationary panel approach. Journal of Applied Econometrics, 22(2), 429–451.

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica, 74(4), 967–1012.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics, 22(2), 265–312.

Pesaran, M. H., Shin, Y., & Smith, R. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association, 94(446), 621–634.

Pesaran, M. H., & Smith, R. (1995). Estimating long-run relationships from dynamic heterogeneous panels. Journal of Econometrics, 68(1), 79–113.

Pesaran, M. H., & Tosetti, E. (2011). Large panels with common factors and spatial correlation. Journal of Econometrics, 161(2), 182–202.

Pesaran, M. H. (2004). General diagnostic tests for cross section dependence in panels. CESifo Working Paper.

Phillips, P. C. B., & Sul, D. (2003). Dynamic panel estimation and homogeneity testing under cross section dependence. The Econometrics Journal, 6(1), 217–259.

Podrecca, E., & Carmeci, G. (2001). Fixed investment and economic growth: new results on causality. Applied Economics, 33(2), 177–182.

Poncet, S., & de Waldemar, F. S. (2013). Export upgrading and growth: the prerequisite of domestic embeddedness. World Development, 51, 104–118.

Radosevic, S., & Stancova, K. C. (2018). Internationalising smart specialisation: assessment and issues in the case of EU new member states. Journal of the Knowledge Economy, 9, 263–293. https://doi.org/10.1007/s13132-015-0339-3.

Robertson, D., & Sarafidis, V. (2015). IV estimation of panels with factor residuals. Journal of Econometrics, 185(2), 526–541.

Rodrik, D. (2006). What's so special about China’s exports? China & World Economy, 14(5), 1–19.

Saafi, S., & Nouira, R. (2018). Re-examining the relationship between export upgrading and economic growth: is there a threshold effect? The Economic and Social Review, 49(4), 437–454.

Sala-i-Martin, X., Doppelhofer, G., & Miller, R. (2004). Determinants of long-term growth: a Bayesian averaging of classical estimates (BACE) approach. American Economic Review, 94(4), 813–835.

Santos-Paulino, A. U. (2011). Trade specialization, export productivity and growth in Brazil, China, India, South Africa, and a cross section of countries. Economic Change and Restructuring, 44(1–2), 75–97.

Sarafidis, V., & Robertson, D. (2009). On the impact of error cross-sectional dependence in short dynamic panel estimation. The Econometrics Journal, 12(1), 62–81.

Sarafidis, V., Yamagata, T., & Robertson, D. (2009). A test of cross section dependence for a linear dynamic panel model with regressors. Journal of Econometrics, 148(2), 149–161.

Schott, P. K. (2008). The relative sophistication of Chinese exports. Economic Policy, 23(53), 5–49.

Sheridan, B. J. (2014). Manufacturing exports and growth: when is a developing country ready to transition from primary exports to manufacturing exports? Journal of Macroeconomics, 42, 1–13.

Shimbov, B., Alguacil, M., & Suárez, C. (2019). Export structure upgrading and economic growth in the Western Balkan countries. Emerging Markets Finance and Trade, 55(10), 2185–2210. https://doi.org/10.1080/1540496X.2018.1563538.

Stojkoski, V., & Kocarev, L. (2017). The relationship between growth and economic complexity: evidence from Southeastern and Central Europe. MPRA Paper No. 7783, Munich Personal RePEc Archive.

Teixeira, A. A. C., & Queirós, A. S. S. (2016). Economic growth, human capital and structural change: a dynamic panel data analysis. Research Policy, 45(8), 1636–1648.

Urbain, J-P., & Westerlund, J. (2006). Spurious regression in nonstationary panels with cross-unit cointegration: METEOR, Maastricht research school of Economics of TEchnology and ORganizations.

Wang, Z., & Wei, S. J. (2010). What accounts for the rising sophistication of China’s exports? In China’s growing role in world trade, 63–104. University of Chicago Press.

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69(6), 709–748.

Yao, S. (2009). Why are Chinese exports not so special? China & World Economy, 17(1), 47–65.

Zhu, S., & Li, R. (2017). Economic complexity, human capital and economic growth: empirical research based on cross-country panel data. Applied Economics, 49(38), 3815–3828.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Summary statistics and correlation matrix

Summary statistics and correlation matrix

Mean | S.D. | R.S.D | Min | Max | (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|---|---|---|---|---|

All countries | |||||||||||

(1) Y | 8.2716 | 1.5761 | 0.190 | 4.9924 | 11.143 | 1.000 | |||||

(2) ECI | 0.1454 | 1.0284 | 7.082 | −2.7825 | 2.7188 | 0.7998*** | 1.000 | ||||

(3) FDI | 2.8518 | 5.0668 | 1.776 | −12.208 | 88.0963 | 0.1120 | 0.056** | 1.000 | |||

(4) HC | 70.5677 | 33.7305 | 0.477 | 3.058 | 165.5813 | 0.7741*** | 0.346** | 0.139** | 1.000 | ||

(5) INVR | 0.2882 | 1.0223 | 3.548 | 0.0023 | 21.6421 | −0.0385 | −0.059 | −0.018 | −0.067 | 1.000 | |

(6) OPEN | 0.7337 | 0.4693 | 0.639 | 0.06175 | 2.9480 | 0.012 | 0.090 | 0.175 | 0.167 | 0.097*** | 1.000 |

High-income countries | |||||||||||

(1) Y | 10.0875 | 0.693 | 0.068 | 8.0325 | 11.1432 | 1.000 | |||||

(2) ECI | 1.1748 | 0.7479 | 0.636 | −0.7433 | 2.7188 | 0.5564*** | 1.000 | ||||

(3) FDI | 3.5622 | 6.6536 | 0.867 | −9.2012 | 88.096 | 0.1005*** | −0.068* | 1.000 | |||

(4) HC | 101.1926 | 24.6734 | 0.243 | 8.5286 | 165.5813 | 0.2220*** | −0.075* | 0.100** | 1.000 | ||

(5) INVR | 0.2194 | 0.04798 | 0.218 | 0.0927 | 0.5622 | 0.5452*** | 0.209*** | 0.036*** | 0.143*** | 1.000 | |

(6) OPEN | 0.7973 | 0.4193 | 0.525 | 0.1255 | 2.0908 | 0.2116*** | 0.119*** | 0.326*** | 0.222*** | 0.251*** | 1.000 |

Middle-income countries | |||||||||||

(1) Y | 7.5227 | 0.8001 | 0.106 | 0.4260 | 9.0834 | 1.000 | |||||

(2) ECI | −0.309 | 0.6690 | −2.136 | −2.7825 | 1.2903 | 0.427*** | 1.000 | ||||

(3) FDI | 2.3734 | 3.647 | 1.536 | −0.7668 | −2.2084 | 0.082 | 0.053 | 1.000 | |||

(4) HC | 59.3646 | 23.1526 | 0.390 | 12.2382 | 110.7636 | 0.518*** | 0.488*** | 0.159*** | 1.000 | ||

(5) INVR | 0.3381 | 1.3369 | 3.954 | 0.0026 | 21.042 | −0.023 | −0.064** | −0.025 | −0.091 | 1.000 | |

(6) OPEN | 0.7905 | 0.5075 | 0.641 | 0.6175 | 2.9480 | 0.173*** | 0.159*** | −0.103* | −0.221 | 0.104 | 1.000 |

Low-income countries | |||||||||||

(1) Y | 5.7208 | 0.2899 | 0.050 | 4.9724 | 6.3607 | 1.000 | |||||

(2) ECI | −1.0453 | 0.4541 | −0.343 | −2.5551 | 1.1560 | 0.152 | 1.000 | ||||

(3) FDI | 3.4149 | 5.582 | 1.634 | −0.7668 | 43.3288 | 45.2899 | −0.024 | 1.000 | |||

(4) HC | 17.0769 | 10.5154 | 0.615 | 3.0583 | 46.0794 | 0.566 | −0.030** | 0.338*** | 1.000 | ||

(5) INVR | 0.2170 | 0.772 | 3.554 | 0.0969 | 0.5602 | 0.465* | 0.036 | 0.196*** | 0.297 | 1.000 | |

(6) OPEN | 0.4582 | 0.1653 | 0.360 | 0.2186 | 0.8327 | 0.084 | 0.440 | 0.397 | 0.052*** | −0.05 | 1.000 |

Rights and permissions

About this article

Cite this article

Chrid, N., Saafi, S. & Chakroun, M. Export Upgrading and Economic Growth: a Panel Cointegration and Causality Analysis. J Knowl Econ 12, 811–841 (2021). https://doi.org/10.1007/s13132-020-00640-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-020-00640-6

Keywords

- Export upgrading

- Economic growth

- Panel cointegration

- Cross-sectional dependence

- Common correlated effects mean group (CCEMG) technique