Abstract

The literature on the relationship between innovation, financial development, and economic growth has attracted growing interest in recent years; however, some authors have investigated this relationship using mainly Granger causality test and focusing specially on European countries. This paper examines the causal relationship between innovation, financial development, and economic growth using panel VAR approach for 27 OECD countries over the period 2001–2016. This methodology has allowed us to analyze the three-way linkages between innovation, financial development, and economic growth. Most importantly, the findings revealed that there is a unidirectional causality from economic growth to financial development. The neutrality hypothesis is confirmed from financial development to economic growth as well as between innovation and economic growth and between financial development and innovation. The paper concludes that further regulation of financial systems and the quality of funding are important ingredients to foster economic development. The paper also concludes that the relationship between innovation and economic growth is complex and country-specific characteristics can play an important role in fostering innovation and productivity. Finally, the paper concludes that governments can play an important role in developing a legislative framework favoring the development of innovation financing through the patent guarantee deposit.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The link between innovation, financial development, and growth has recently attracted increasing interest in the scientific community to better understand the complex dynamics that govern the underlying structure of the contemporary economy. Several authors show that innovation and financial development are essential variables for ensuring economic growth and the competitive advantage of countries. We can categorize past studies in this field into three strands, but empirical evidence remains mostly controversial and ambiguous. The first strand focuses on the link between innovation and economic growth. Many studies find a strong empirical relationship between innovation and economic growth (Howells 2005; Sinha 2008; Hassan and Tucci 2010; Fan 2011; Cetin 2013; Maradana et al. 2017; Pradhan et al. 2018). The second of research examined the relationship between financial development and economic growth. The role of financial development in economic growth has been considered as one of the fundamental principles of the economy (Levine 1997; Rajan and Zingales 1998). These studies show that the development of economic activity will increase the need for financial services, thus improving the financial system (Dimitris and Efthymios 2004; Fung 2009; Pradhan et al. 2018). The third strand of research examined the relationship between innovation and financial development. This literature postulates that the financial system fosters innovation by providing essential financial services. The works of Hsu et al. (2014), Pradhan et al. (2016), and Pradhan et al. (2018) confirm the hypothesis that financial development drives innovation at the country level. Despite the volume of work, the effects of innovation and financial development on economic growth are still at the heart of the economic debate. The financial crisis of 2008 has shown how much these sectors of the economy are interdependent and that a cross-examination is needed to analyze this interdependence (Dosi et al. 2016). However, little is known about the specificities of the links between finance, innovation, and economic growth, and the main works have often studied these themes separately, while they are strongly intertwined in macroeconomic functioning (Dutraive 2016). Previous work on these themes suffers from two major limitations. First, many previous empirical studies of these relationships are based on cross-sectional data, which cannot properly address country-specific problems. Second, much of the previous work is largely derived from a bidirectional causal analysis and may therefore suffer from bias of the omission of variables. In these studies, the Granger causality test was widely used to identify causality in a bidirectional setting on chronological or panel data. One of the main reasons for the lack of consensus is that the Granger causality test in a two-variable setting may be biased (Stern 1993). However, it was clear that the results obtained by performing a bidirectional causality test may be invalid due to the omission of an important variable that may affect the two variables included in the causality model (Omri et al. 2014; Le and Tran-Nam 2018).

This study therefore attempts to fill this gap by examining the causal link between financial development, innovation, and economic growth using a multivariate panel approach, known as the panel vector autoregression model (PVAR), proposed by Love and Zicchino (2006) to examine the relationship for a panel consisting of 27 OECD countries. Multivariate models incorporate other variables to ensure robust results that can alter the statistical relationship established in a two-variable setting (Bartleet and Gounder 2010). The study attempts to answer two critical questions. Does financial development (economic growth), which stems from economic growth (financial development), contribute to fostering innovation in the OECD country? Which sector leads to the process of improving innovation capacity—the financial sector or the real sector?

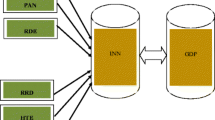

The main contribution of this study is twofold. First, this paper used panel VAR approach (PVAR) to study the three-way linkages between innovation, financial development, and economic growth for a panel consitsing of 27 OECD countries. However, to the best of our knowledge, none of the empirical studies has focused on investigating the three-way linkages between innovation, financial development, and growth using the panel VAR procedure. The main contribution of this procedure is that it combines the classical approach of VAR models with the approach of panel data. The use of panel data addresses issues related to data availability and increases the number of data by including country information (Boubtane 2018). This methodology also has the advantage of involving several endogenous variables explained by their delayed values and will allow us to analyze both the impact of (Abdouli and Hammami 2017) innovation (INN) and financial development (FD) on the economic growth, (Abrigo and Love 2016) economic growth and financial development (FD) on innovation (INN), and (Acemoglu and Robinson 2006) economic growth and innovation (INN) on financial development (FD), using the System GMM estimator developed by Blundell and Bond (1998). The latter makes it possible to control the problem of endogeneity and makes the results coherent and robust (Acheampong 2018). In this paper, forecast error variance decomposition (FEVD) and impulse response functions (IRF) are used to predict the impact of a positive shock of economic growth on innovation (INN) and financial development (FD) in the short and long term. Second, and following the work of Omri et al. (2014) and Abdouli and Hammami (2017), the form of growth was applied to all variables. As a result, all the variables are stationary, which allows us to avoid the problem of cointegration. In this sense, the approach adopted in this study is to estimate short-run and not estimating the long-run one, given the characteristics of our growth form modeling.

The paper is organized as follows. “Literature Review” section presents a brief description of the literature. “Data and Methodology” section describes the econometric modeling approach and describes the data used. “The Estimation of the VAR Model for Each Country” section discusses the empirical results of the VAR model for each country. “The Estimation of the VAR Model for All Countries” section presents the empirical results for all countries. “Conclusion and Policy Implications” section presents the conclusions and offer some policy implications.

Literature Review

Innovation and Economic Growth

Recent researches on the sources of economic growth have demonstrated the significant role of innovation and a considerable portion of the developed economies such as OECD countries can be associated to the process and volume of innovations of such economies. Since the seminal work of Schumpeter (1934), literature specifies that innovation and new technology have emerged as one of the primary driving force of economic growth (Solow 1956; Griliches and Mairesse 1984; Romer 1990; Grossman and Helpman 1994; Aghion et al. 2005; Aghion and Howitt 2009). Innovation is considered as one of the key drivers of the economic growth, and innovative activity underpins economic productivity and growth. Rosenberg (2004) emphasizes that long-run economic growth depends on the creation and fostering of an environment that encourages and creates the incentives for innovation and application of new technologies, such as intellectual property (IP) rights (Chu 2010; Hu and Png 2013). Technological change and all the factors that favor the emergence of new knowledge are at the root of economic development (Atun et al. 2007; Aghion and Howitt 2009). Hence, at the macroeconomic level, growth is manifested by the diffusion of innovation in economic activity, which enables a dynamic process of accumulation of physical, human, and technical capital (Belze and Gauthier 2000). This process contributes to the growth of labor productivity and total factor productivity (TFP) and thereby accelerates economic growth (Crépon et al. 1998).

At empirical level, Goel and Ram (1994) found an evidence, from a sample of 52 countries, that innovation has a positive impact on economic growth. Similarly, Lebel (2008) concluded that innovation contributes significantly to economic growth using a panel consisting of 103 countries. Ulku (2004) investigates the relationship between economic growth, R&D expenditures, and innovation for 20 OECD countries and 10 non-member countries and provides evidence that innovations have a positive impact on GDP/capita, both for developed and emerging economies. In the recent years, several researchers have increasingly paid attention to investigate the link between innovation and economic growth (Andergassen et al. 2009; Hassan and Tucci 2010; Wu 2010; Fan 2011; Pece et al. 2015; Bae and Yoo 2015; Santacreu 2015; Bilas et al. 2016; Maradana et al. 2017; Pradhan et al. 2018; Avila-Lopez et al. 2019; Maradana et al. 2019). The works of Wu et al. (2010) and Pradhan et al. (2018), using the Granger causality test, find a positive and significant relationship between innovation and economic growth. In contrast, Bilas et al. (2016) find a negative relationship between innovation and economic growth using Granger causality for 28 European countries over the period 2003–2013. On the other hand, the studies by Birdsall and Rhee (1993) for OECD countries and Samimi and Alerasoul (2009) for developing countries conclude that there is no causal link between innovation and economic growth. Recently, Kacprzyk and Doryń (2017) have found no significant impact of innovation measured by R&D activities on growth in EU-15 countries. In other cases, it is the economic growth that can also increase the level of innovation in the development process (Maradana et al. 2017). To this sense, some authors found a unidirectional causality from economic growth to innovation activities (Sinha 2008; Howells 2005). However, other studies found a bidirectional causality between innovation and economic growth (Yu-Ming et al. 2007; Guloglu and Tekin 2012; Cetin 2013; Pradhan et al. 2016). Cetin (2013) examines the causal relationship between R&D expenditure and economic growth in 9 European countries using Granger causality test. The results indicate that R&D expenditure cause GDP in the cases of Finland, France and Spain and there is bidirectional causality in Finland and France. Maradana et al. (2017, 2019) found the presence of both unidirectional and bidirectional causality between innovation and per capita economic growth using a Granger causality test for 19 European countries over the period 1989–2014.

Financial Development and Economic Growth

A number of researches have focused on the finance-growth nexus and stressed the role of a well-developed financial system for the economy helping to reduce friction and provide information on investment opportunities (Acemoglu and Zilibotti 1997; Levine 1997). For instance, a well-developed financial market reduces information cost thereby leading to better capital allocation (Greenwood and Jovanovic 1990) and also reduces the cost of corporate governance (Bencivenga and Smith 1993). Also, developed financial intermediaries boost the technological innovation through rewards to the entrepreneurs (King and Levine 1993). Levine (1997) states that financial systems assist in trading, diversification, and risk amelioration, apart from facilitating transactions of goods and services. Further, Das and Guha-Khasnobis (2008) state that the allocation of credit through financial system can be used to finance working capital requirements and investment in fixed capital that can help to enhance productivity in the real sector.

Several empirical studies have agreed that financial sector development has positive effect on growth (King and Levine 1993; Levine et al. 2000; Saci et al. 2009; Beck et al. 2000; Christopoulos and Tsionas 2004; Wu et al. 2010; Leitao 2010; Azman-Saini et al. 2010; Hassan et al. 2011; Uddin et al. 2013; Nazlioglu et al. 2014; Herwartz and Walle 2014; Pradhan et al. 2016; Durusu-Ciftci et al. 2017; Shahbaz et al. 2017; Guru and Yadav 2019). Levine et al. (2000) using GMM technique found that the exogenous component of financial intermediary development is positively associated with economic growth. Beck et al. (2000) concluded that financial intermediaries exert a large positive impact on the total factor productivity growth, which feeds through to overall GDP growth. Saci et al. (2009) found that stock market development indicators have positive significant effect on growth. However, it was found that in the presence of stock market development indicators, banking sector development negatively influenced economic growth. Leitao (2010) found a positive correlation of financial development with economic growth for 27 European Union Countries between 1980 and 2006.

Wu et al. (2010) using a panel data set composed of 13 countries in European Union over the period of 1976–2005 found a long-run equilibrium relationship among banking development, stock market development, and economic development, and stock market capitalization and liquidity have positive long-run effects on economic development. Also, the authors found that financial depth may have a negative long-run effect on real output, but improving risk diversification and information services of commercial banks results in stable economic development. Herwartz and Walle (2014) using annual data for 73 economies spanning the period 1975–2011 concluded that the impact of finance on economic development is generally stronger in high-income economies than in low-income economies. In more recent studies, Shahbaz et al. (2017) found that financial development increases economic activity in China and India using annual data over the period 1970–2013. Asteriou and Spanos (2019) found that before the financial crisis financial development promoted economic growth, while after the crisis it hindered economic activity using a panel dataset of 26 European Union countries over the period 1990–2016. Durusu-Ciftci et al. (2017) show that debt from credit markets and equity from stock markets are two long-run determinants of GDP per capita for a panel of 40 countries over the period 1989–2011. The panel data analyses reveal that both channels have positive long-run effects on steady-state level of GDP per capita, and the contribution of the credit markets is substantially greater.

On the other hand, Luintel and Khan (1999) found bidirectional causality between financial development and economic growth for a sample of ten economies. Similarly, Wolde-Rufael (2009) found bidirectional causality between economic growth and each of the financial development variables. Dritsakis and Adamopoulos (2004) found bidirectional causality between financial development and economic growth. Pradhan et al. (2017) found a unidirectional causality from banking sector development to economic growth and a bidirectional causality between stock market development and economic growth, and insurance sector development and economic growth in ASEAN region for the period of 1991–2011.

However, another pool of studies both in the case of developed and developing countries have found weak relationship between financial development and economic growth (Narayan and Narayan 2013; Bhanumurthy and Singh 2013; Grassa and Gazdar 2014; Pradhan et al. 2014; Menyah et al. 2014; Ductor and Grechyna 2015; Samargandi et al. 2015). Bhanumurthy and Singh (2013) did not find a long-run equilibrium relationship between bank branches and state domestic product for India. Finally, Menyah et al. (2014) found financial development to have no causal association with economic growth. Pradhan et al. (2014) argue that there is no causal link between the two variables, supporting a hypothesis of neutrality. Samargandi et al. (2015) show that countries reach a threshold from which financial development no longer contributes to economic growth.

Financial Development and Innovation

A number of researches provide support for Schumpeter’s (1912) argument that banks encourage innovative activities (King and Levine 1993; Levine 1997; Rajan and Zingales 1998; Allen and Gale 1999; Morales 2003; Cabral and Mata 2003; Aghion et al. 2005; Hyytinen and Toivanen 2005; Acemoglu and Robinson 2006; Zang and Kim 2007). These authors find that banks promote technological innovation by allocating resources to entrepreneurs with the most promising new opportunities, such as new products and production methods. This suggests that by altering the resource allocation process, financial sector of a country exerts positive influences on innovation-related activity by providing essential financial services (such as information acquisition and risk management), which lowers transaction costs, reducing risk and thus facilitating investment in innovative entrepreneurial activity in the long run (Levine 1997).

Zang and Kim (2007) hypothesize that a well-developed financial sector reduces agency costs, allowing for a larger flow of funds to the research sector, thus increasing the rate of innovation. The authors conclude that a well-developed financial sector is an important determinant of growth in the number of application for invention patents in these countries and thus constitutes an engine of growth. Rajan and Zingales (1998) argue that industries that are more dependent on external finance grow relatively faster in countries that are more financially developed. Innovation-based growth model of Aghion et al. (2005) shows that financial development plays a vital role in creating and sustaining innovation-based economies. Financial development reduces the cost of screening and monitoring activities, which subsequently diminishes agency problems and hence inspires firms to engage in innovation-related activities. Hyytinen and Toivanen (2005) shows that financial market imperfections constrain growth and hold back innovative activities of firms in Finland and indicate that public policy plays an important role in alleviating financial market imperfections.

At the empirical level, Morck and Nakamura (1999) suggest that credit markets discourage firms from investing in innovative projects because they have an inherent propensity for low-risk investments. Hsu et al. (2014) find evidence that the development of the credit market discourages innovation in the industries most dependent on external financing and in industries that are the most technology intensive. On the other hand, Ang (2011) provides evidence that financial development is important in alleviating market frictions, and hence in promoting knowledge-based activities. Barbosa and Faria (2011) found that credit market regulation is an important determinant of innovation production and contend that financial development promotes innovative activities by improving information sharing and thereby facilitating access to credit for firms, especially technology-based start-up firms. Maskus et al. (2012) found that domestic financial development as measured by private credit by deposit money banks, stock market capitalization, and private bond market capitalization have significant positive impact on R&D intensity. More recently, Hsu et al. (2014) find evidence that the development of the credit market discourages innovation in the industries most dependent on external financing and in industries that are the most technology intensive. Pradhan et al. (2016) found that development of the financial sector and enhanced innovative capacity in the Eurozone contribute to long-term economic growth. Ho et al. (2018) show that banking market deepening is associated with increased innovation only when political institutions are sufficiently democratic using panel data from 74 countries over the period 1970–2010.

Data and Methodology

The analysis was performed over the period 2001–2016 for 27 OECD countries. The choice of countries and the period was limited by the availability of data. We use the annual data sourced from the World Bank’s development indicators and the OECD database.

The variables are economic growth measured by GDP per capita (2010 constant US $), gross fixed capital formation per capita (2010 constant US $) as a proxy for capital stock, the share of total trade (% of GDP) as proxy for indicator of openness of trade, the share of net inflows of foreign direct investment (% of GDP) as a proxy for foreign direct investment, the consumer price index (in annual percentage) as a proxy for inflation, and the share of higher education graduates (% of the population aged between 25 and 34 years) as a proxy for human capital. The share of domestic credit to the private sector (% of GDP) is a proxy for financial development. In this study, it is assumed that there are large differences in the quality of domestic financial systems across countries, suggesting that financial system can be viewed as an endowment. As shown in Table 1, there is wide cross-country variation in the ratio of domestic credit to private sector to GDP. Countries with well-functioning financial systems should tend to specialize in financially intensive goods. We would like measure of how countries’ financial sector improves the firm’s ability to fulfill their need for external finance. Therefore, our measure of financial development is the ratio of domestic credit to private sector to GDP (domestic credit) which refers to financial resources provided to the private sector, such as loans and trade credits. It is assumed to better channel the domestic financial savings to domestic private sector. This variable not only indicates the level of domestic investment but also measures the level of development of the financial institutions. Ideally, a higher value of domestic credit to private sector indicates that the credit provided will lead to economic growth.

Despite the growing number of scientific studies on innovation, the literature has not established the existence of a single indicator measuring innovation. Several studies (Hsu et al. 2014; Pradhan et al. 2018) measure innovation through R&D expenditures, number of patent applications, number of citations, training expenses, and so on. Several authors stress the disadvantages of these proxies (Thomson 2009; Moser 2013). In order to overcome this problem, some researchers consider that innovation is considered as an approximation of productivity growth. In this sense, Jorgenson (2011) finds that innovation generates higher output growth superior to the capital and labor inputs, and which results in multifactor productivity growth. This proposition has been validated in an empirical study by Hall (2011a). The author shows that innovation has a positive and significant effect on factor productivity growth. Thus, productivity growth could be a reasonable measure of successful innovation for all (or almost all) types of the economy and at multiple levels of aggregation (firms, sectors, regions) (Hall 2011b). Similarly, Fazlıoğlu et al. (2019) find strong evidence of the impact of innovation on business productivity through different types of innovation (product, process, and organizational). The idea was later extended by Kostis et al. (2018) who claim that the best proxy to measure innovation is that which reflects the success of production. The authors draw on empirical and theoretical work by Jones (2002), Hall (2011b), and Iwaisako and Futagami (2013) to use labor productivity per hour as a proxy for innovation measurement. In this study, we agree with this proposition and we consider the growth rate of labor productivity per hour as a proxy for innovation. Table 1 shows the descriptive statistics of the variables used in our estimation.

The extended Cobb-Douglas production framework helps us to explore the three-way link between the three endogenous variables: innovation, financial development, and economic growth using panel VAR model based on the System GMM estimator developed by Blundell and Bond (1998). It is therefore interesting to examine the relationships between the three variables by considering them in one modeling framework. Based on this interaction, this modeling can help policymakers develop sound economic policies to support economic development.

To this end, we use a Cobb-Douglas production function in which gross domestic product (GDP) depends on capital and labor. Specifically, we consider the following Cobb-Douglas extended production function:

Where Y is the real GDP, A total factor productivity, K the capital stock, L the labor force, ε the error term, and α and β are the elasticities of production with respect to labor and capital.

We further assume that the production function has constant returns to scale, or α + β = 1.

In our model, technology is determined endogenously through innovation and financial development and as part of the Cobb-Douglas production function (Ho et al. 2009; Shahbaz and Lean 2012). Therefore, we have

with θ being the invariant constant over time and FD and INN respectively refer to financial development and innovation.

Substituting Eq. (2) in Eq. (1), we will have

After dividing Eq. (3) by L, we have

Then, the production function in Eq. (4) is transformed into linear-Log function as follows:

We suppose that log (θ) = a so the new equation will be as follows:

We write Eq. (6) in a growth form with a time series specification, as follows:

where the subscript i represents the country (i = 1,.., N) (N = 27 in our study) and t represents the time period (t = 1,.., T), and g(Y) represents real output, g(INN) innovation, g(FD) financial development, and g(K) capital stock, and ε is the error term.

In this study, we will estimate three panel VAR models; each model consisting of three equations:

with g(Y) represents real output, g(INN) innovation, g(FD) financial development, g(K), g(OPEN), g(HC), g(INF), and g(FDI) are the instrumental variables for the three equations. The subscript i represents the country (i = 1, 2 ...N), and t represents the period (t = 1, 2 ...T).

The number of Lags of the variables g(Y), g(INN) and g(FD) are determined by k, and i and t represent country and time.

In the equations above, Eq. (8) examines the impact of innovation (INN), financial development (FD), and capital stock (K) on economic growth (Lebel 2008; Shahbaz and Lean 2012). Eq. (9) postulates that economic growth, financial development, trade openness (OPEN), and human capital (HC) have a significant impact on innovation (Acemoglu and Robinson 2006; Papalia et al. 2011; Pradhan et al. 2018). Finally, Eq. (10) assumes that innovation, economic growth, inflation (INF), and foreign direct investment (FDI) have an impact on financial development (Druck et al. 2007; Lee and Chang 2009).

The Estimation of the VAR Model for Each Country

Unit Root Test Results

In this section, we examine the relationship between economic growth, innovation, and financial development for each country using time series data. The choice of a time series analysis is a significant improvement over the existing studies on this issue. In fact, economic, monetary, and industrial policies can vary from one country to another. Moreover, this analysis is very relevant in that it allows us to take into account the heterogeneity of countries and to identify the key information for each country.

Before analyzing the causality relations, we first employ the unit root test to check the stationary for each series. Based on the characteristics of time series data, we select either the level or the first difference series in the estimation of a vector autoregression (VAR) model for the causality test. In this model, all variables are transformed in a growth form. It can be seen that these transformed variables are stationary in level and integrated of order zero, I (0).

The VAR Model

In our VAR (p) model, we select the multivariables GDP, INN, and FD to account for their interactions with their p-lag variables. The optimal lag order k of VAR system is selected by the Akaike information criterion (AIC). Toda and Yamamoto (1995) find that the optimal order of integration for economic series is at most 2. However, the study by Dolado and Lütkepohl (1996) showed that the optimal number of lag equal to 1 has better properties. In this study, optimal lag order = 1 is used to construct the augmented VAR model for each country.

The results in Tables 2, 3, 4 enable us to draw the following conclusions regarding the interactions between economic growth, innovation, and financial development, according to estimation of the VAR model. Beginning with Table 2 which contains the estimated results about Eq. (8), the findings revealed that economic growth lagged by one period promotes economic growth at 1%, 5%, and 10% level for all countries except for Denmark, Japan, and Sweden. An increase in the initial economic growth by 1% causes the increase of the economic growth by 0.309%, 0.251%, and 0.609% for Spain, USA, and Turkey respectively. An increase in the initial economic growth by 5% increases the economic growth of 0.353%, 0.380%, 0.262%, 0.229%, and 0.455% for Greece, Hungary, Poland, UK, and Switzerland respectively. An increase in the initial economic growth of 10% increases the economic growth by 0.337% for Czech Republic. However, an increase in the initial economic growth of 1% and 5% decreases the economic growth by 0.221%, 0.434%, and 0.390% respectively for Denmark, Japan, and Sweden.

On the other hand, innovation lagged by one period has a positive significant impact on economic growth for Spain, Norway, UK, and Sweden and a negative and significant impact for Turkey. The magnitude implies that the increase by 1%, 5%, and 10% of innovation increases economic growth of 0.581%, 0.303%, 0.63%, and 0.445% respectively for UK, Norway, Sweden, and Spain. The results are in line with those found by Wu et al. (2010), Cetin (2013), and Pradhan et al. (2018). On the other hand, the increase of innovation decreases economic growth by 0.405% for Turkey. The results also confirm those found by Bilas et al. (2016).

Financial development lagged by one period has a positive significant impact on economic growth for 4 out of 27 countries in the sample. An increase by 1% and 5% of financial development increases economic growth by 0.308%, 0.692%, 0.118%, and 0.060%, respectively, for Finland, Switzerland, Australia, and Denmark. The results are in line with those found by King and Levine (1993), Rajan and Zingales (1998), Shan and Jianhong (2006), and Pradhan et al. (2016, 2018). For two countries, the results show a negative impact. Economic growth is negatively impacted by increased financial development, with a 5% increase in financial development leading to a decrease by 0.145% and 0.047% of economic growth, respectively, for Chile and Czech Republic. These results are in line with those found by Gregorio and Guidotti (1995) and Ben Naceur and Ghazouani (2007).

On the other hand, the capital stock coefficient is positive and significant for 26 out of 27 countries. The capital stock has a positive significant impact on GDP per capita at the 1% and 5% level. These results are in line with those found by Hamdi et al. (2014). The capital stock has no effect on GDP per capita for Korea.

The empirical results pertaining to Eq. (9) are presented in Table 3. It appears that GDP per capita lagged by one period has a positive significant impact on innovation at 1% and 5% level for Chile, Greece, Mexico, and the Czech Republic. We can say that a 1% increase in GDP per capita leads to an increase of innovation by 0.809%, 0.575%, 0.743%, and 0.696% respectively. These results are in line with those found by Howells (2005). For Denmark, Spain, USA, Italy, Netherlands, and Sweden, the impact is negative at the 1% and 5% level. It has no significant positive impact for the remainder countries.

On the other hand, financial development lagged by one period has a positive and significant impact on innovation for the USA, Iceland, Portugal, and Switzerland. We can say that 1% and 5% increase in financial development causes the increase of innovation by 0.076%, 0.101%, 0.509%, and 0.050% for USA, Portugal, Switzerland, and Iceland respectively. This seems to be consistent with the results achieved by Morales (2003), Acemoglu and Robinson (2006), Barbosa and Faria (2011), and Maskus et al. (2012). However, for Ireland, Luxembourg, and Turkey, the results show a negative impact. For the remainder countries, there is no positive significant impact of financial development on innovation, which is similar to the results of Morck and Nakamura (1999) and Hsu et al. (2014).

The human capital variable has a positive significant impact on innovation for 3 out of 27 countries. It has a positive impact for France and Italy at 1% and 5% level. This implies that 1% increase in human capital causes the increases of innovation by 0.327% for France and that 5% increase in human capital causes the increases of innovation by 0.046% for Italy. These results are in line with those that highlight the positive effect of human capital on country’s innovation capability (Romer 1990; Barro and Lee 2001). Several empirical studies show that human capital has an indirect impact on innovation through increasing the level of technology used, thereby increasing productivity (Coe et al. 2009; Papalia et al. 2011).

Finally, the trade openness variable has a positive significant impact on innovation at 1% and 5% level for Germany, Finland, France, Germany, Hungary, Italy, Japan Mexico, Netherlands, Portugal, Czech Republic, and Turkey. These results are in line with those found by Schiff and Wang (2006) and Vogel and Wagner (2009). A negative impact is found for Spain, Iceland, Norway, and Switzerland. For Belgium, Australia, Denmark, Chile, Luxembourg, Poland, UK, Sweden, and Switzerland; there is no positive significant impact of trade openness on innovation.

The empirical results pertaining to Eq. (9) are presented in Table 4. The findings revealed that GDP per capita lagged by one period has a positive significant impact on financial development for Germany, Czech Republic, Denmark, Finland, Luxembourg, Portugal, Czech Republic, UK, and Sweden at 1%, 5%, and 10% level. This implies that 1% increase in economic growth lagged by one period increases financial development by 1.581% for Denmark, 1.162% for Finland, 1.167% for Portugal, 5.071% for Czech Republic, 2.821% for the UK, and 1.020% for Sweden. We can say that 5% increase in economic growth lagged by one period increases financial development by 0.810% for Germany and 1.874% for Luxembourg. These results are in line with those found by Dimitris and Efthymios (2004). However, GDP per capita lagged by one period has a negative impact on financial development for Spain and Turkey at the 1% and 10% level.

On the other hand, innovation lagged by one period has a positive and significant impact on financial development for Belgium, Iceland, and Turkey at 1% and 5% level. We can say that 5% increase in innovation lagged by one period increases financial development by 2.11% for Belgium and 0.396% for Iceland and 1% increase in innovation lagged by one period increases financial development by 1.783% for Turkey. On the other hand, financial development is negatively impacted by innovation lagged by one period at 1% and 5% level for Korea, Spain, and Czech Republic as the increase in innovation decreases financial development by 2.90%, 5.914%, and 6.248% respectively.

The inflation variable has a negative impact on financial development in most countries at 1%, 5%, and 10% level. We can say that 1% increase in inflation decreases financial development by 2.29% for Germany, 1.95% for Australia, and 0.505% for Turkey; hence, a 5% increase in inflation decreases financial development by 1.771% for Spain, 1.201% for Sweden, and 1.073% for Switzerland. These results are in line with those found by Druck et al. (2007) using a panel consiting of 120 countries.

Finally, the variable of foreign direct investment has a negative impact on financial development for 4 out of 27 countries at the 5% and 10% level. We can say that 10% increase of FDI decreases financial development by 0.009% for Belgium, 0.002% for Korea, and 0.0014% for Switzerland. On the other hand, a 5% increase of FDI increases financial development by 0.003%, 0.001%, and 0.0014% for France, Japan, and Switzerland respectively; hence, a 1% increase of FDI increases financial development by 0.013% for the UK. These results are in line with those achieved by Lee and Chang (2009) who found bidirectional causality between FDI and financial development using a panel consiting of 37 countries.

The Estimation of the VAR Model for All Countries

Cross-sectional Dependency Test

The general assumption in the panel data econometrics is that the data used are cross-sectional independent and so this assumption should be tested. Cross-section units can be either cross-sectionally independent or cross-sectionally dependent (that can be attributed to macroeconomic or economic policy change shocks) (Pesaran and Tosetti 2011; Banerjee and Carrion-i-Silvestre 2017). There are various tests in the literature, including Breusch and Pagan (1980) and Pesaran’s (2004) CD tests. Pesaran CD test has the advantage compared with another tests including the high power for small samples and the applicable in balanced and unbalanced panel data (Pesaran 2007; Samadi 2019).

In our study, we apply the CD test of Pesaran (2004) to test for cross-sectional dependence. The test was performed by the Stata module xtcdf, proposed by Wursten (2017). Table 5 reports the test statistics and the corresponding p value. The null hypothesis of the CD test is that the cross-section units are cross-sectionally independent. The results of the CD test illustrate the existence of cross-sectional independency between variables.

Panel Unit Root Test

The appropriate unit root tests in panel data are determined based on the results of cross-sectional dependence/independence tests. If there is a cross-sectional dependence on the panel data, Pesaran’s CIPS unit root test (2007) or cross-section augmented Dickey-Fuller (CADF) test should be used, and if there is cross-sectional independence, the Im-Pesaran-Shin (IPS) unit root test and Levin-Lin-Chu (LLC) unit root test should be used (Breitung and Pesaran 2005). In this study, Levin et al. (2002) and Im et al. (2003) panel unit root tests are used, to verify the stationarity of the variables used in our model. Table 6 shows the results of the unit root panel tests for the levels variables in the model. The standardized t statistics are reported, along with the corresponding significance levels (in brackets). It can be seen that all variables are statistically significant under the LLC and IPS tests. Therefore, unit root tests indicate that all variables are integrated of order zero, I (0).

Determination of the Optimal Lag for the Three Models

The estimated VAR model requires determining the optimal lag number (p). The number of lag k of each VAR model is determined by applying the Schwarz criterion (SC) and the Akaike information criterion (AIC). From the results given in Tables 8, 9, and 10 in the AppendixFootnote 1, the optimal lag (p) equals 1 because it minimizes Schwarz and Akaike functions.

Results of Panel VAR Model

The estimated results for global panel for the three models are presented in Table 6. All variables in the VAR model are transformed into a growth form.

The estimated results of model 1 show that GDP per capita in the preceding period as well as the capital stock increases GDP per capita at 1% level. This implies that a 1% increase in capital stock increases economic growth by 0.167%.

The estimated results of model 2 show that trade openness and the level of human capital increases innovation at 1% and 10% level. This implies that a 1% increase in trade openness increases innovation by 0.059% and that a 10% increase in human capital causes an increase in innovation by 0.001%. This is consistent with the results found by Barro and Lee (2001) and Papalia et al. (2011).

The estimated results of model 3 show that GDP per capital lagged by one period has a positive significant impact on financial development at the 1% level. This implies that 1% increase in GDP per capita increases financial development by 0.531%. This is consistent with the results found by Fung (2009).

Forecast Error Variance Decomposition

This section presents the forecast ger variance decomposition (FEVD)Footnote 2 at the panel level as a whole. In our model, a shock on economic growth explains 0.39% of the variation of innovation and 0.09% of the variation of financial development for the next 10 years. These results suggest that a positive shock to economic growth has a minor influence on innovation in the long run and an insignificant or minor impact in the short run and long run on financial development. These results are obvious and consistent with the causality tests, as GDP does not cause financial development and innovation.

Impulse Response Analysis

In this section, the impulse response functions (IRF) and the 95% confidence interval band that was generated based on 200 Monte Carlo simulationsFootnote 3 are presented. The stability graphFootnote 4 shows that the PVAR satisfies the stability conditions. The VAR model is stable if the entire associated matrix is strictly less than one (Abrigo and Love 2016). Thus, the VAR model is stable if all the eigenvalues lie in the unit circle. From the roots of the companion matrix, the global and regional eigenvalues are in the unit circle, suggesting that the PVAR model is stable and that the results are good for forecasts and policy recommendations.

According to Abrigo and Love (2016), stability implies that the panel VAR is invertible and presents an infinite order vector moving average, providing a known interpretation of the estimated IRF and forecast error variance decompositions. The orthogonalization of VAR residuals makes it possible to study the response of innovation, financial development and trade openness to a shock on economic growth.

Figure 1 illustrates the global impulse response (IRF) functions of innovation and financial development to a shock of economic growth. Figure 1 shows that a positive shock to economic growth initially increases financial development and then declines in the long run. While a positive shock on economic growth hinders innovation and then stabilizes in the long run.

Conclusion and Policy Implications

This present study examined the three-way linkage between innovation, financial development, and economic growth using a Cobb-Douglas production function. While the literature on the causal relationship between innovation, financial development, and growth has attracted growing interest in recent years, no study has examined the three-way relationship using the panel VAR procedure. The objective of this study is to fill this gap by examining the causal relationships between the three variables for 27 OECD countries over the period 2001–2016.

In sum, empirical results for individual or collective countries can be summarized as follows. First, with respect to the causal relationship between innovation, financial development, and economic growth for individual countries, our results support the evidence that (Abdouli and Hammami 2017) there is a unidirectional hypothesis of innovation to economic growth for Spain, Norway, UK, Sweden, and Turkey. (Abrigo and Love 2016) For Australia, Chile, Denmark, Finland, Czech Republic, and Switzerland, there is a unidirectional causality of financial development to economic growth. (Acemoglu and Robinson 2006) In addition, for Chile, Denmark, Spain, USA, Greece, Italy, Mexico, Netherlands, Czech Republic, and Sweden, there is a unidirectional causality of economic growth to innovation. (Acemoglu and Zilibotti 1997) There is also a unidirectional causality from financial development to innovation for Ireland, Iceland, Luxembourg, Sweden, Switzerland, and Turkey. (Acheampong 2018) For Denmark, Czech Republic, Finland, Germany, Luxembourg, Portugal, Spain, Sweden, Turkey, and the UK, the findings revealed a unidirectional causality of economic growth to financial development. (Aghion and Howitt 2009) A unidirectional causality is also found from innovation to financial development for Belgium, Spain, Korea, Iceland, Czech Republic, and Turkey.

Therefore, the findings also confirm the hypothesis of neutrality for the link between innovation and economic growth for Germany, Australia, Belgium, Chile, Korea, Denmark, USA, Finland, France, Greece, Hungary, Ireland, Iceland, Italy, Japan, Luxembourg, Mexico, Netherlands, Poland, Portugal, Czech Republic, and Switzerland. The neutrality hypothesis for the link between financial development and economic growth is also confirmed for the UK, Sweden, and Turkey. This implies that there is no effect on economic growth, which in turn, does not affect innovation and financial development.

Moreover, the results support the presence of bidirectional causality between innovation and economic growth for Spain and Sweden. This supports the presence of the feedback hypothesis for these two countries. There is also bidirectional causality between financial development and economic growth for Denmark, Finland, and the Czech Republic and bidirectional causality between innovation and financial development for Iceland and Turkey.

In addition, the results for the global panel model show a unidirectional causality from economic growth to financial development. On the other hand, the neutrality hypothesis is confirmed by our results from financial development to economic growth. These results are in line with those found by some economists (Cecchetti and Kharroubi 2012; Arcand et al. 2015; Law and Singh 2014) who mention that there is a threshold from which further expansion of the financial sector has no effect on economic activity. This requires an efficient allocation of financial resources. Hence, the leaders of OECD countries should further regulate their financial systems and strengthen the quality of funding rather than focusing on an effort to develop the financial sector to foster economic development. These measures provide a sound banking system that builds trust of savers so that financial resources can be efficiently mobilized to increase the productivity of the economy. Therefore, the banking system should be simplified and bank charges should be reduced, making banking more accessible. Similarly, banking products should be diversified so that non-banking financial corporations and non-financial institutions can enter the banking sector (Pradhan et al. 2017).

The findings also confirm the neutrality hypothesis between innovation and economic growth. These results are in line with those found by Birdsall and Rhee (1993) and Kacprzyk and Doryń (2017) who found no causal relationship between innovation and economic growth in the case of OECD countries and European countries respectively. Similarly, Bilas et al. (2016) found a negative relationship between innovation and economic growth for 28 European countries over the period 2003–2013. The results may indicate that the relationship between innovation and economic growth is more complex and can be justified as follows. First, the heterogeneity of OECD countries that can influence the results is an important issue that can reflect differences in culture and most importantly institutions (Guellec and Van Pottelsberghe de la Potterie 2004). In fact, the OECD includes countries with low R&D intensity (Chile, Mexico, Turkey, Hungary, for example) and economies with relatively high R&D expenditures (Finland, UK, Japan, Denmark, USA, Germany, for example). Therefore, setting common goals and increasing R&D expenses, without taking country-specific characteristics into account, may not be sufficient as a policy guideline (Kacprzyk and Doryń 2017; Cunningham 2018). Second, with regard to public R&D spending, they are mainly aimed at generating basic knowledge that is later has no impact on business funded R&D and therefore has no impact on private sector capability to create technological innovations (Guellec and Van Pottelsberghe de la Potterie 2003). Furthermore, much of the government-funded R&D is for public missions such as healthcare or education, which do not directly affect productivity (Guellec and Van Pottelsberghe de la Potterie 2001). It is therefore quite possible that there is no direct link between public R&D and growth and that government-funded R&D spending may not be effective to increase productivity (Guellec and Van Pottelsberghe de la Potterie 2001; OECD 2007).

Taking into account all previous developments, our study suggests that economic growth and development strategies may vary from one member state to another and that they should take into account the country’s specific contexts and development challenges (Cunningham 2018). Thus, OECD countries must go beyond simply defining common objectives for innovation policy. However, innovation should not only be at the center of economic policies, but a coordinated and coherent approach involving all countries is needed to foster innovation and improve its economic impact. Also, governments should support relations between research institutes, industries, and universities, increase the intensity of R&D spending, and apply more effective R&D policies. In addition, strengthening patent protection across countries may raise the issue of establishing a unitary patent system in OECD countries comparable to the ongoing process of expanding the protection of intellectual property rights in the EU as suggested by Kacprzyk and Doryń (2017).

The neutrality hypothesis is also confirmed between financial development and innovation. These results are consistent with the results obtained by Morck and Nakamura (1999) and Hsu et al. (2014). These studies claim that innovation incorporates a higher degree of risk and uncertainty. Thus, the financing of innovation is hampered by problems of moral hazard and adverse selection. These frictions lead to credit rationing, higher capital costs, and inefficient levels of innovation. To overcome this problem, Mann (2018) finds that intangible guarantees can have significant economic value. Nevertheless, the clarification of legal uncertainties has led to important conclusions about financing and innovation. This can be a useful focus for policy makers interested in stimulating innovation and economic growth. They can develop a legislative framework favoring the development of innovation financing through the patent guarantee deposit. This funding mechanism potentially offers a channel for innovation financing that does not depend on fluctuations in the availability of venture capital or market conditions for IPOs and can address market failure in bank financing for R&D and innovation activities.

Notes

See Appendix: Tables A1, A2, and A3: Determination of the optimal lag for the three models.

See the appendix for the variance decomposition table.

The standard deviations of the impulse response functions were calculated, and Monte Carlo simulations were used to generate confidence intervals following Love and Zicchino (2006). The decomposition of the forecast error variance was also estimated over a 10-year period.

See the appendix for the stability graph.

References

Abdouli, M., & Hammami, S. (2017). Investigating the causality links between environmental quality, foreign direct investment and economic growth in MENA countries. International Business Review, 26(2), 264–278.

Abrigo, M., & Love, I. (2016). Estimation of panel vector autoregression in Stata: a package of programs”, University of Hawaii Working Paper No. 16-2, University of Hawaii, Manoa.

Acemoglu, D., & Robinson, J. (2006). De facto political power and institutional persistence. American Economic Review, 96(2), 325–330.

Acemoglu, D., & Zilibotti, F. (1997). Was prometheus unbound by chance? Risk, diversification, and growth. Journal of Political Economy, 105(4), 709–751.

Acheampong, A. O. (2018). Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Economics, 74, 677–692.

Aghion, P., & Howitt, P. (2009). The Economics of Growth. Cambridge: MIT Press.

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: an inverted-U relationship. The Quarterly Journal of Economics, 120(2), 701–728.

Allen, F., & Gale, D. (1999). Innovations in financial services, relationships, and risk sharing. Management Science, 45(9), 1239–1253.

Andergassen, R., Ricottilli, M., & Nardini, F. (2009). Innovation and growth through local and global interaction. Journal of Economic Dynamics and Control, 33(10), 1779–1795.

Ang, J. B. (2011). Financial development, liberalization and technological deepening. European Economic Review, 55(5), 688–701.

Arcand, J. L., Berkes, E., & Panizza, U. (2015). Too much Finance? Journal of Economic Growth, 20(2), 105–148.

Asteriou, D., & Spanos, K. (2019). The relationship between financial development and economic growth during the recent crisis : Evidence from the EU. Finance Research Letters, 28(C), 238–245.

Atun, R. A., Harvey, I., & Wild, J. (2007). Innovation, patents and economic growth. International Journal of Innovation Management, 11(2), 279–297.

Avila-Lopez, L. A., Lyu, C., & Lopez-Leyva, S. (2019). Innovation and growth: evidence from Latin American countries. Journal of Applied Economics, 22(1), 278–303.

Azman-Saini, W. N. W., Law, S. H., & Ahmad, A. H. (2010). FDI and economic growth new evidence on the role of financial markets. Economics Letters, 107(2), 211–213.

Bae, S. H., & Yoo, K. (2015). Economic modelling of innovation in the creative industries and its implications. Technological Forecasting and Social Change, 96, 101–110.

Banerjee, A., & Carrion-i-Silvestre, J. L. (2017). Testing for panel cointegration using common correlated effects estimators. Journal of Time Series Analysis, 38(4), 610–636.

Barbosa, N., & Faria, A. (2011). Innovation across Europe: How important are institutional differences? Research Policy, 49(9), 1157–1169.

Barro, R., & Lee, J. W. (2001). International data on educational attainment. Oxford Economic Papers, 53(3), 541–563.

Bartleet, M., & Gounder, R. (2010). Energy consumption and economic growth in New Zealand: results of trivariate and multivariate models. Energy Policy, 38(7), 3508–3517.

Beck, T., Levine, R., & Loayza, N. (2000). Finance and the sources of growth. Journal of Financial Economics, 58(1–2), 261–300.

Belze, L., & Gauthier, O. (2000). Innovation et croissance économique: rôle et enjeux du financement des PME. Revue Internationale P.M.E, 13(1), 65–86.

Ben Naceur, S., & Ghazouani, S. (2007). Stock markets, banks, and economic growth: empirical evidence from the MENA region. Research in International Business and Finance, 21(2), 297–315.

Bencivenga, V. R., & Smith, B. D. (1993). Some consequences of credit rationing in an endogenous growth model. Journal of Economic Dynamics and Control, 17(1–2), 97–122.

Bhanumurthy, N. R., & Singh, P. (2013). Financial sector development and economic growth in Indian states. International Journal of Economic Policy in Emerging Economies, 6(1), 47–63.

Bilas, V., Bosnjak, M., & Cizmic, T. (2016). Relationship between Research and Development and Economic Growth in the EU Countries. 13th International Scientific Conference on Economic and Social Development, 14-16 April, Barcelona.

Birdsall, N., & Rhee, C. (1993). Does research and development contribute to economic growth in developing countries? Policy Research Working Paper, n°1221. Washington, D.C. USA: The World Bank.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143.

Boubtane, E. (2018). Schengen trente ans après. Quels impacts économiques des flux migratoires ?, in F. Dubet, Politiques des frontières, La Découverte, coll. « Recherches », Paris.

Breitung, J., and Pesaran, M. H. (2005). Unit Roots and Cointegration in Panels, Cambridge Working Papers in Economics 0535, Faculty of Economics, University of Cambridge, London.

Breusch, T. S., & Pagan, A. R. (1980). The Lagrange multiplier test and its applications to model specification in econometrics. Review of Economic Studies, 47(1), 239–253.

Cabral, L., & Mata, J. (2003). On the evolution of the firm size distribution: facts and theory. American Economic Review, 93(4), 1075–1090.

Cecchetti, S. G., & Kharroubi, E. (2012). Reassessing the impact of finance on growth. BIS Working Papers, n° 381. Bank for International Settlements.

Cetin, M. (2013). The hypothesis of innovation-based economic growth: a causal relationship. International Journal of Economic and Administrative Studies, 6(11), 1–16.

Christopoulos, D., & Tsionas, E. (2004). Financial development and economic growth: evidence from panel unit root and cointegration tests. Journal of Development Economics, 73(1), 55–74.

Chu, A. C. (2010). Effects of patent policy on income and consumption inequality in a R&D growth model. Southern Economic Journal, 77(2), 336–350.

Coe, D. T., Helpman, E., & Hoffmaister, A. (2009). International R&D spillovers and institutions. European Economic Review, 53(7), 723–741.

Crépon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation and productivity: an econometric analysis at the firm level. Journal Economics of Innovation and New Technology, 7(2), 115–185.

Cunningham, B. (2018). Gale Researcher Guide for: The Challenge of Development. Farmington Hill: Cengage Learning-Gale.

Das, P. K., & Guha-Khasnobis, B. (2008). Finance and growth an empirical assessment of the Indian economy. In B. Guha-Khasnobis & G. Mavrotas (Eds.), Financial Development, institutions, growth and Poverty Reduction (pp. 120–140). New York, NY: Palgrave Macmillan.

Dimitris, K. C., & Efthymios, G. T. (2004). Financial development and economic growth: evidence from panel unit root and co-integration tests. Journal of Development Economics, 73(1), 55–74.

Dolado, J. J., & Lütkepohl, H. (1996). Making Wald tests work for cointegrated VAR systems. Econometric Reviews, 15(4), 369–386.

Dosi, G., Revest, V., & Sapio, A. (2016). Financial regimes, financialization patterns and industrial performances: preliminary remarks. Revue d’Economie Industrielle, 2(145), 63–96.

Dritsakis, N., & Adamopoulos, A. (2004). Financial development and economic growth in Greece: an empirical investigation with Granger causality analysis. International Economic Journal, 18(4), 547–559.

Druck, P. F., Plekhanov, A., & Dehesa, M. (2007). Relative price stability, creditor rights, and financial deepening. Working Paper, n°07/139. Washington, USA: International Monetary Fund.

Ductor, L., & Grechyna, D. (2015). Financial development, real sector output, and economic growth. International Review of Economics and Finance, 37(C), 393–405.

Durusu-Ciftci, D., Ispir, M. S., & Yetkiner, H. (2017). Financial development and economic growth : some theory and more evidence. Journal of Policy Modeling, 39(2), 290–306.

Dutraive, N. (2016). Introduction. Industrie, finance, innovation et gouvernance dans la crise : vers un changement structurel? Revue d’Economie Industrielle, 2(154), 13–32.

Fan, P. (2011). Innovation capacity and economic development: China and India. Economic Change and Restructuring, 44(1–2), 49–73.

Fazlıoğlu, B., Başak, D., & Yereli, A. B. (2019). The effect of innovation on productivity: evidence from Turkish manufacturing firms. Industry & Innovation, 26(4), 439–460.

Fung, M. K. (2009). Financial development and economic growth: convergence or divergence? Journal of International Money and Finance, 28(1), 56–67.

Goel, R. K., & Ram, R. (1994). Research and development expenditures and economic growth: a cross-country study. Economic Development and Cultural Change, 42(2), 403–411.

Grassa, R., & Gazdar, K. (2014). Financial development and economic growth in GCC countries. International Journal of Social Economics, 41(6), 493–514.

Greenwood, J., & Jovanovic, B. (1990). Financial development, growth, and the distribution of income. The Journal of Political Economy, 98(5), 1076–1107.

Gregorio, J. D., & Guidotti, P. E. (1995). Financial development and economic growth. World Development, 123(3), 433–448.

Griliches, Z., & Mairesse, J. (1984). Productivity and R&D at the firm level. In Z. Griliches (Ed.), R&D, patents and productivity (pp. 339–374). Chicago: University of Chicago Press.

Grossman, G. M., & Helpman, E. (1994). Endogenous innovation in the theory of growth. The Journal of Economic Perspectives, 8(1), 23–44.

Guellec, D., & Van Pottelsberghe de la Potterie, B. (2001). R&D and productivity growth : panel data analysis of 16 OECD countries. OECD science, technology and industry working papers n°3. Paris: OECD Publishing.

Guellec, D., & Van Pottelsberghe de la Potterie, B. (2003). The impact of public R&D expenditure on business R&D. Economics of Innovation and New Technology, 12(3), 225–243.

Guellec, D., & Van Pottelsberghe de la Potterie, B. (2004). From R&D to productivity growth : Do the institutional settings and the source of funds of R&D matter? Oxford Bulletin of Economics and Statistics, 66(3), 353–378.

Guloglu, B., & Tekin, R. B. (2012). A panel causality analysis of the relationship among research and development, innovation, and economic growth in high-income OECD countries. Eurasian Economic Review, 2(1), 32–47.

Guru, B., & Yadav, I. (2019). Financial development and economic growth: panel evidence from BRICS. Journal of Economics, Finance and Administrative Science, 24(47), 113–126.

Hall, B. H. (2011a). Innovation and productivity. Nordic Economic Policy Review, 2, 167–204.

Hall, B. H. (2011b). Using productivity growth as an innovation indicator. Report for the High-Level Panel on Measuring Innovation. DG Research, European Commission: Brussels.

Hamdi, H., Sbia, R., & Shahbaz, M. (2014). The nexus between electricity consumption and economic growth in Bahrain. Economic Modeling, 38, 227–237.

Hassan, I., & Tucci, C. L. (2010). The innovation-economic growth nexus: global evidence. Research Policy, 39(10), 1264–1276.

Hassan, M., Sanchez, B., & Yu, J. (2011). Financial development and economic growth: new evidence from panel data. The Quarterly Review of Economics and Finance, 51(1), 88–104.

Herwartz, H., & Walle, Y. M. (2014). Determinants of the link between financial and economic development: evidence from a functional coefficient model. Economic Modelling, 37(C), 417–427.

Ho, Y. P., Wong, P. K., & Toh, M. H. (2009). The impact of R&D on the Singapore economy: an empirical evaluation. The Singapore Economic Review, 54(1), 1–20.

Ho, C., Huang, S., Shi, H., & Wu, J. (2018). Financial deepening and innovation: the role of political institutions. World Development, 109(C), 1–13.

Howells, J. (2005). Innovation and regional economic development: a matter of perspective? Research Policy, 34(8), 1220–1234.

Hsu, P. H., Tian, X., & Xu, Y. (2014). Financial development and innovation: cross-country evidence. Journal of Financial Economics, 112(1), 116–135.

Hu, A., & Png, I. (2013). Patent rights and economic growth: evidence from cross-country panels of manufacturing industries. Oxford Economic Papers, 65(3), 675–698.

Hyytinen, A., & Toivanen, O. (2005). Do financial constraints hold back innovation and growth ? Evidence on the role of public policy. Research Policy, 34(9), 1385–1403.

Im, K., Pesaran, H., & Shin, Y. (2003). Testing for Unit Roots in Heterogeneous Panels. Journal of Econometrics, 115(1), 53–74.

Iwaisako, T., & Futagami, K. (2013). Patent protection, capital accumulation, and economic growth. Economic Theory, 52(2), 631–668.

Jones, C. I. (2002). Introduction to economic growth. New York: Norton.

Jorgenson, W. D. (2011). Innovation and productivity growth. American Journal of Agricultural Economics, 93(2), 276–296.

Kacprzyk, A., & Doryń, W. (2017). Innovation and economic growth in old and new member states of the European Union. Economic Research, 30(1), 1724–1742.

King, R. G., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics, 108(3), 717–737.

Kostis, P. C., Kafka, K. I., & Petrakis, P. E. (2018). Cultural change and innovation performance. Journal of Business Research, 88, 306–313.

Law, S. H., & Singh, N. (2014). Does too much finance harm economic growth? Journal of Banking & Finance, 41, 36–44.

Le, T. H., & Tran-Nam, B. (2018). Trade liberalization, financial modernization and economic development: an empirical study of selected Asia–Pacific countries. Research in Economics, 72(2), 343–355.

Lebel, P. (2008). The role of creative innovation in economic growth: some international comparisons. Journal of Asian Economics, 19(4), 334–347.

Lee, C. C., & Chang, C. P. (2009). FDI, financial development, and economic growth: international evidence. Journal of Applied Economics, 12(2), 249–271.

Leitao, N. C. (2010). Financial development and economic growth: a panel data approach. Theoretical and Applied Economics, 10(551), 15–24.

Levine, P. (1997). Financial development and economic growth: views and agenda. Journal of Economic Literature, 35(2), 688–726.

Levine, R., Loayza, N., & Beck, T. (2000). Financial intermediation and growth: causality and causes. Journal of Monetary Economics, 46(1), 31–77.

Levin, A., Lin, C. F., & Chu, C. S. J. (2002). Unit root test in panel data : asymptotic and finite sample properties. Journal of Econometrics, 108(1), 1–24.

Love, I., & Zicchino, L. (2006). Financial development and dynamic investment behavior: evidence from panel VAR. The Quarterly Review of Economics and Finance, 46(2), 192–210.

Luintel, K. B., & Khan, M. (1999). A quantitative reassessment of the finance-growth nexus: evidence from a multivariate VAR. Journal of Development Economics, 60(2), 381–405.

Mann, W. (2018). Creditor rights and innovation: evidence from patent collateral. Journal of Financial Economics, 130(1), 25–47.

Maradana, R. P., Pradhan, R. P., Dash, S., Gaurav, K., Jayakumar, M., & Chatterje, D. (2017). Does innovation promote economic growth? Evidence from European countries. Journal of Innovation and Entrepreneurship, 6(1), 1–23.

Maradana, R. P., Pradhan, R. P., Danish, S., Kunal, B. Z., Manju, G., Ajoy, J., & Sarangi, K. (2019). Innovation and economic growth in European economic area countries: the granger causality approach. IIMB Management Review, Available online 3. https://doi.org/10.1016/j.iimb.2019.03.002.

Maskus, K. E., Neumann, R., & Seidel, T. (2012). How national and international financial development affect industrial R&D. European Economic Review, 56(1), 72–83.

Menyah, K., Nazlioglu, S., & Wolde-Rufael, Y. (2014). Financial development, trade openness and economic growth in African countries: new insights from a panel causality approach. Economic Modelling, 37(C), 386–394.

Morales, M. F. (2003). Financial intermediation in a model of growth through creative destruction. Macroeconomic Dynamics, 7(3), 363–393.

Morck, R., & Nakamura, M. (1999). Banks and corporate control in Japan. Journal of Finance, 54(1), 319–339.

Moser, P. (2013). Patents and innovation: evidence from economic history. Journal of Economic perspectives, 27(1), 23–44.

Narayan, P. K., & Narayan, S. (2013). The short run relationship between the financial systems and economic growth: new evidence from regional panels. International Review of Financial Analysis, 29, 70–78.

Nazlioglu, S., Menyah, K., & Wolde-Rufael, Y. (2014). Financial development, trade openness and economic growth in African countries: new insights from a panel causality approach. Economic Modelling, 37(1), 386–394.

OECD. (2007). Innovation and growth: rationale for an innovation strategy. Paris: OECD.

Omri, A., Nguyen, D. K., & Rault, C. (2014). Causal interactions between CO2 emissions, FDI, and economic growth: evidence from dynamic simultaneous-equation models. Economic Modelling, 42, 382–389.

Papalia, R. B., Bertarelli, S., & Filippucci, C. (2011). Human capital, technological spillovers and development across OECD countries. Working Papers, n°15. Bologna: AlmaLaurea Inter-University Consortium.

Pece, A. M., Simona, O. E. O., & Salisteanu, F. (2015). Innovation and economic growth: an empirical analysis for CEE countries. Procedia Economics and Finance, 26, 461–467.

Pesaran, M. H. (2004). General diagnostic tests for cross section dependence in panels. University of Cambridge, Faculty of Economics, Cambridge Working Papers in Economics No. 0435.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross section dependence. Journal of Applied Econometrics, 22(2), 265–312.

Pesaran, M. H., & Tosetti, E. (2011). Large panels with common factors and spatial correlation. Journal of Econometrics, 161(2), 182–202.

Pradhan, R. P., Arvin, M. B., Hall, J. H., & Bahmanic, S. (2014). Causal nexus between economic growth, banking sector development, stock market development and other macroeconomic variables: the case of ASEAN countries. Review of Financial Economics, 23(4), 155–173.

Pradhan, R. P., Arvin, M. B., Hall, J. H., & Nair, M. (2016). Innovation, financial development and economic growth in Eurozone countries. Applied Economics Letters, 23(16), 1141–1144.

Pradhan, R. P., Arvin, M. B., Bahmani, S., Hall, J. H., & Norman, N. R. (2017). Finance and growth: evidence from the ARF countries. The Quarterly Review of Economics and Finance, 66(C), 136–148.

Pradhan, R. P., Arvinb, B. M., & Bahmanic, S. (2018). Are innovation and financial development causative factors in economic growth? Evidence from a panel granger causality test. Technological Forecasting and Social Change, 132, 130–142.

Rajan, R. G., & Zingales, L. (1998). Financial dependence and growth. American Economic Review, 88(3), 559–586.

Romer, P. M. (1990). Endogenous technological change. Journal of Political Economy, 98(5), S71–S102.

Rosenberg, N. (2004). Innovation and economic growth. Paris: OECD.

Saci, K., Giorgioni, G., & Holden, K. (2009). Does financial development affect growth ? Applied Economics, 41(13), 1701–1707.

Samadi, A. (2019). Institutions and entrepreneurship: unidirectional or bidirectional causality? Journal of Global Entrepreneurship Research, 9(3), 1–16.

Samargandi, N., Fidrmuc, J., & Ghosh, S. (2015). Is the relationship between financial development and economic growth monotonic? Evidence from a sample of middle-income countries. World Development, 68(1), 66–81.

Samimi, A. J., & Alerasoul, S. M. (2009). R&D and economic growth: new evidence from some developing countries. Australian Journal of Basic and Applied Sciences, 3(4), 3464–3469.

Santacreu, A. M. (2015). Innovation, diffusion, and trade: theory and measurement. Journal of Monetary Economics, 75(C), 1–20.

Schiff, M., & Wang, Y. (2006). North-south and south-south trade-related technology diffusion: an industry-level analysis. Canadian Journal of Economics, 39(3), 831–844.

Schumpeter, J. A. (1912). The Theory of Economic Development, tenth printing 2004. New Brunswick: Transaction Publishers.

Schumpeter, J. A. (1934). The theory of economic development: an inquiry into profits, capital, credit, interest and the business cycle. Cambridge: Harvard University Press.

Shahbaz, M., & Lean, H. H. (2012). Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy, 40, 473–479.

Shahbaz, M., Van Hong, T. H., Kumar M., & Roubaud, D. (2017). Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. MPRA Paper, n°76527, University Library of Munich, Munich.

Shan, J., & Jianhong, Q. (2006). Does financial development ‘lead’ economic growth? The case of China. Annals of Economics and Finance, 7(1), 197–216.

Sinha, D. (2008). Patents, innovations and economic growth in Japan and South Korea: evidence from individual country and panel data. Applied Econometrics and International Development, 8(1), 181–188.

Solow, R. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70, 65–94.

Stern, D. I. (1993). Energy and economic growth in the USA, a multivariate approach. Energy Economics, 15(2), 137–150.

Thomson, R. (2009). Structures of change in the mechanical age: technological innovation in the United States, 1790–1865. Baltimore: John Hopkins Universiry Press.

Toda, H. Y., & Yamamoto, T. (1995). Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics, 66(1–2), 225–250.

Uddin, G. S., Sjö, B., & Shahbaz, M. (2013). The causal nexus between financial development and economic growth in Kenya. Economic Modelling, 35(C), 701–707.

Ulku, H. (2004). R&D, Innovation, and Economic Growth: An Empirical Analysis. IMF Working Paper, International Monetary Fund, 2004(185), 2–35.

Vogel, A., & Wagner, J. (2009). Higher productivity in importing German manufacturing firms: self-selection, learning from importing, or both? Review of World Economics, 145(4), 641–665.

Wolde-Rufael, Y. (2009). Re-examining the financial development and economic growth nexus in Kenya. Economic Modelling, 26(6), 1140–1146.

Wu, Y. (2010). Innovation and Economic Growth in China, Economics Discussion/Working Papers 10-10, The University of Western Australia, Department of Economics.

Wu, J. L., Han, H., & Cheng, S. Y. (2010). The dynamic impacts of financial institutions on economic growth: evidence from the European Union. Journal of Macroeconomics, 32(3), 879–891.

Wursten, J. (2017). XTCDF : Stata module to perform Pesaran’s CD-test for cross-sectional dependence in panel context, Statistical Software Components S458385. Boston College Department of Economics.

Yu-Ming, W., Li, Z., & Jianxia, L. (2007). Cointegration and Causality between R&D Expenditure and Economic Growth in China: 1953‐2004. International Conference on Public Administration (3rd ICPA), Sichuan, China.

Zang, H., & Kim, Y. C. (2007). Does financial development precede growth? Robinson and Lucas might be right. Applied Economics Letters, 14(1), 15–19.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix. Table 8, 9, and 10. Determination of the optimal lag for the three models

Appendix. Table 8, 9, and 10. Determination of the optimal lag for the three models

Rights and permissions

About this article

Cite this article

Mtar, K., Belazreg, W. Causal Nexus Between Innovation, Financial Development, and Economic Growth: the Case of OECD Countries. J Knowl Econ 12, 310–341 (2021). https://doi.org/10.1007/s13132-020-00628-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-020-00628-2