Abstract

Protection of patents is a double-edged sword—while it encourages innovation it causes deadweight loss due to monopolistic production of patented products. The current approach to minimizing the deadweight loss is a compromised one—providing weak patent protection in order to strike a balance between the positive and negative effects of patent rights. Through a scrutiny of the purpose and mechanism of patent protection, this paper suggests a new design for the patent system. This new design aims to stimulate innovation directly while minimizing deadweight loss.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Despite many patent law reforms undertaken worldwide, the effectiveness of the modern patent system has been cast in doubt due to many problems associated with the system, including poor patent quality, low usage of patent technology, patent trolls, and most notably, the impediment of incremental innovations, or innovation based on prior innovations. These problems have triggered hot debates on the patent system. While most people believe that the patent system is still workable after reforms, some think the system is either unnecessary or broken and beyond repair.

Ordover (1991) argued that appropriately structured patent law and antitrust rules can ensure both the incentives for investment in research and development (R&D) and the diffusing of research results through licensing and other means. Thurow (1997) demonstrated the impact on the system of intellectual property rights, including the patent system, the fundamental shifts in technology and in the economic landscape, such as the decline in public knowledge, the emergence of information technology, and the globalization of the economy. He claimed that squeezing today’s innovations into yesterday’s intellectual property system simply does not work and suggested some basic principles for building a new system. Merges (1999) listed the problems related to business concept patents and recommended the US government to adopt a patent opposition system. Bessen and Meurer (2008) detailed the problems in implementing the patent laws and supported their claims be marshaling of empirical data. Their book also provided detailed suggestions for patent reform, including the ones they think are not politically feasible in the near future. Boldrin and Levine (2013) contend that the patent system is unnecessary because market pressure is the main driver of innovations and, although they agree about the positive impact of the patent system, they think the system should be abolished because the pressure of political economy will corrupt any effort for successful patent reform.

The negative impact of patent laws on incremental innovations came to the attention of Scotchmer (1991) and Gallini (2002). Scotchmer (1991) identified the cumulative nature of research as the reason that patent law may hinder innovation. Gallini (2002) suggested that, in the case of sequential research, an enhanced ability to enforce patents may impede, rather than promote, innovation. The underlying reason is that the downstream inventor has to obtain patent permission from the upstream inventor in order to produce or sell his/her downstream invention.

To address this problem, Scotchmer (1991) considered it necessary not only to reward early (junior) innovators fully for the technological foundation they provide to later (senior) innovators, but also to reward adequately later innovators for their improvements to existing innovation, as well as for the new products they develop. Scotchmer considered the “nature” system of property rights unable to solve this problem. She called for prior agreements among research firms, such as forming joint research ventures. Green and Scotchmer (1995) argued further that, due to the difficulties associated with dividing profit, patent lives need to be long enough so that one can assume that the whole sequence of innovations occurs in a single innovation firm.

The above-mentioned problems associated with the patent system are largely due to the exclusive nature of patent rights. While the monopoly right of patents encourages innovation, it causes social welfare loss because it restricts production and thus limits consumption of patented products. The common solution to the double-edged sword of patent protection is a balanced approach, which advocates a moderate level of patent protection in order to strike a balance between the positive and the negative effects of patent rights. In other words, there exist optimal patent length and patent breadth which maximize the net social benefit. However, this balanced approach is a compromised one: a stronger protection gives more incentives to innovate but necessitates more deadweight loss, while a weaker protection reduces both. The purpose of this paper is to present a new approach to patent system reform so as to stimulate innovation directly while minimizing deadweight loss.

It is necessary to put a caveat here. This paper does not intend either to address all issues related to the patent system or provide a detailed plan for patent reform. Rather, the purpose of the paper is to provide a new design which will dramatically transform the patent system. To some readers, this purpose seems narrow because it does not take care of the reality of the enforcement of patent laws around the world. However, the author has two justifications. One is that it is impossible to address in one paper all or even the majority of the issues related to the patent system because of the complexity of the topic. This complexity is well demonstrated in the patent debate. The other justification is that, although all aspects and any details of patent laws are important, it is arguable that the principle of, and approach to, patent reform is of the highest priority. Using an analogy of building a house, the construction work is of course crucial to the quality of the final product, but a well-thought out, scientific, and user-friendly design is the pre-condition.

The remainder of this paper is organized as follows. Section 2 illustrates and analyses common misunderstandings on the patent system. The analysis leads to abandoning the balanced approach in patent system design. Section 3 investigates the source of undesirable patent monopoly power and suggests the reforms needed in order to establish a new patent system capable of providing maximum protection for innovation while limiting the negative impact of patent monopoly. Based on logical reasoning on the changes proposed to be made to the current patent system, Section 4 envisions the expected impact of the new patent system. Section 5 concludes.

Misunderstandings Regarding the Patent System

The double-edged-sword nature of the patent system has triggered tremendous debate from both proponents and opponents. While the debate has highlighted the problems in the current patent laws, it has also exposed a number of misunderstandings regarding the patent system. These misunderstandings need to be rectified in order to design a new patent system. To start with, it is useful to highlight the two features of innovation/invention, which are the key to our discussion.

One feature of innovation is the high possibility of failure or high risk to investment in innovation. Innovation by definition involves the creation of something new, so inventors step into uncharted territory. As a result, many successful innovations come only after numerous failed experiments. Although statistics on innovation failure/success are difficult to obtain, it is widely accepted that a high percentage of investment for research and development is not successful. There are two types of innovations: product innovation and production innovation. The goal of the former is to invent new products while the effort of the latter is to improve production efficiency. Compared with production innovations, product innovation has a much higher risk of failure because it normally involves much larger (or more radical) changes and there is much less information available to product investors.

The other feature of innovation is its large positive externality resulting from innovation imitation. Innovation requires hard and intelligent work, takes a long time, and requires a great deal of money. Imitating an innovation is, however, fairly easy. For example, software that takes several years and costs millions of dollars to develop may take only a few minutes to copy. Compared with production innovation, product innovation is much more vulnerable to imitation. Because production innovations are applied to production procedures or machinery, imitating these innovations requires knowledge about the production environment. Imitating a new product does not, however, require this knowledge. The vulnerability of product innovation to imitation means that the positive externality of product innovation is enormous.

-

(1)

Is the patent system dispensable?

The main purpose of a patent system is to stimulate invention or innovation. Some opponents to the patent system argue that a patent system is totally unnecessary because there are other ways to stimulate innovation such as public innovation center, government subsidy (or prize money), and the first mover advantage incentive in market competition. It is claimed that, unlike the patent system, the other ways of stimulating innovation will not cause a loss of social welfare. We will examine the different ways of stimulating innovation in turn.

The traditional response to positive externalities is public produce or subsidizing private produce, for example, the national security system and the road system. However, in the case of innovation, these solutions do not seem efficient. The public innovation institution solution is criticized as breaking the economic link between the innovation and its use—it is evident that public research is shown to be insensitive to technological requirements in the marketplace (Nelson 1990; Block 1991). On the other hand, subsidized private innovation suffers from the difficulty of monitoring and the high cost of administration. These solutions are even more inefficient in considering the high risk, and large externality, of innovation.

Figure 1 is drawn in a way to reflect the features of innovation activity. Due to the high possibility of innovation failure, innovation activities are very costly. This means that the marginal cost of innovation is very high or, to be more precise, the initial marginal cost (from innovation failure to success) is very high. MC in Fig. 1 shows the marginal cost of innovation while MC’ shows a firm’s marginal cost after being offset by government subsidies. On the other hand, social return to innovation is enormous due to the large positive externality of innovation, while the private return to the innovator is very low due to the low cost and easiness of innovation imitation. MR in Fig. 1 is the marginal return to the inventor and SMR is the social marginal return (they depart considerably due to the high externality of innovation).

Without a policy to stimulate innovation, the high level of MC and the low level of MR for the innovation firm necessitates that only a very small number of innovations occur at point A. The public innovation institute solution means that the government will produce innovation according to the marginal cost MC and the social marginal return SMR, so a higher innovation output can be achieved at point B. However, it requires the government to pay the very high innovation cost of MC and this will lead to a large social burden. In the case of the subsidized private produce solution, government will pay a great deal of subsidy (MC-MC’) so the firm’s marginal cost shifts from MC to MC’. Despite the much lower marginal cost curve MC’, the innovation output increases only very mildly at point C due to the large divergence between private and social return to innovation. Considering that there are numerous innovations the government has to support and that not all innovations will have market success, the government spending in stimulating innovation will be massive.

The mechanism and the performance of the patent system are quite different. Theoretically, if the spillover effect is eliminated by “perfect” patent protection (i.e., patent laws are perfectly monitored and enforced without a time limit), the social marginal revenue curve SMR becomes the firm’s marginal revenue curve, i.e., MR shift to SMR. With MC as the firm’s marginal cost curve, the best outcome at point B is achieved without any increase in government spending. In comparing the three ways of stimulating innovation, the patent system is the most effective and efficient. However, the patent system has the drawback of limiting the application of patent technology. The social welfare loss due to this drawback will be discussed later, but here we can provide an overall statement that, considering the high chance of innovation failure and all the costs of successful and numerous failed innovations, the social welfare loss due to patent monopoly should be well below the cost of government produce or government subsidy.

The effectiveness of the patent system can also be viewed from the perspective of property rights. Like the intellectual property rights protected by copyright laws, innovation is the intellectual property of inventors. The efficiency of a clearly defined property right is well explained by Coase (1960) and the necessity for privatizing the property right of an invention was demonstrated by Kitch’s prospect theory (Kitch 1977). According to Coase’s Theorem, clearly defined property rights and obligations, combined with bargaining and negotiations between the parties concerned, can often ensure a more efficient allocation of resources than government intervention or the provision of public goods. If an innovation is legally defined as the intellectual property of the inventor, then others have to pay for using it. As a result, the social return and private return equalizes and the problem of underinvestment of innovation is solved.

From the above discussion, the benefit of a patent system—encouraging innovation—is very clear, at least in theory. However, some people argue that, in modern days, there is no need for a patent system in order to stimulate innovation because the first mover advantage forces firms to innovate.

The argument is based on oligopolistic competition. It is argued that, while the perfectly competitive market and monopoly market do not provide any incentive to invention,Footnote 1 firms facing oligopolistic competition have to innovate just to maintain their market position. As such, the oligopolistic market can generate enough innovations so the patent system is not necessary (e.g., Scherer 1970; Needham 1975; Manfield 1986; Levin et al. 1987; Baumol 2002; Pretnar 2003). It is also argued that many factors in an imperfect market economy have provided sufficient inducement to innovation, such as the lead time advantage, the learning curve, reputation, product differentiation, and transaction cost (Dasgupta and Stiglitz 1988; Moir 2008; Schacht and Thomas 2005).

If innovation is so attractive to firms and the market economy can provide sufficient innovation incentives, or “innovation pressure” in the terminology of Pretnar (2003), the patent system is indeed unnecessary. However, this argument overlooks an important feature of innovation—innovation investment is of high risk (or of high sunk cost).

In fact, being innovative or not, is a dilemma for firms. On the one hand any non-innovating firm will be faced with considerable erosion (Baumol 2002), or will die eventually (Freeman and Soete 1997). On the other hand, the high possibility of innovation failure may incur a loss for the innovating firm, and this may lead to its early death. The decision on being innovative or not, to some degree, is the choice between dying slowly and dying quickly but with some slim hope of thriving if the innovation is successful. Given the risk aversion nature of human beings, it is more likely that the firm will choose the option of dying slowly unless it is facing the immediate pressure of dying soon—a new firm with little market share or an old firm facing a sharp decrease in sales.

It is evident that the market pressure in oligopoly competition does help induce innovation, but the question needing to be answered is: can market pressure induce enough innovation for the economy? Although we may take pride in the number of innovations we are enjoying or likely to enjoy, e.g., Internet, iphone, driverless transportation, drone-delivered parcels, and space travel, the repeated occurrence of economic recessions suggests that the speed of innovation is insufficient.

The link between economic recession and innovation can be briefly explained as follows. The feature of economic recessions in modern time is tumbling sales and excess production capacity. Neoclassical economists claim that an economic recession is caused by partial gluts or mismatches between supply and demand, in other words, they claim that some products are greatly demanded by consumers but the producers have failed to find them and/or failed to produce them. However, the long durations of large economic recessions indicate that the products of high demand suggested by neoclassical economists do not exist or have not been invented yet. If these products in high demand do exist and if we can trust the intelligence of the producers, the instinct of chasing profit will propel the producers to discover and produce the products in high demand. As such, the economic recessions will be short-lived. By this reasoning, inadequate invention is the cause of economic recessions, so effective ways are necessary to encourage innovation in order to avoid economic recessions.

-

(2)

Is the balanced approach a valid one for designing the patent system?

The heart of the current patent system design is the balanced approach. The approach initiated by Nordhaus (1967) was based on an economic model which showed that there exists a finite optimal patent length. Gallini (1992) confirms that there is an optimal patent length for both cases: with or without imitation activity. Horowitz and Lai (1996) also claim an optimal patent length both for stimulating innovation and for increasing social welfare. However, Gilbert and Shapiro (1990) concluded that the optimal patent length should be infinite because there is a constant trade-off between the rewards to the patentee and the deadweight loss when the length of patent is increased. Ginarte and Park (1997) and Qian (2007) presented some empirical evidence showing that there may exist an inverted U-shape relationship between the strength of patent right and innovation activity.

As many economists agree, due to the limitations in empirical economic data, the accuracy and reliability of empirical research in economics is questionable and thus clear and convincing empirical results are rare (Gollin 2008; Moschini 2010). Since the next subsection is devoted to discussing the empirical research on the patent system, here the author focuses only on the theoretic studies and aims to show that the optimal patent length claimed in the previous studies may be not applicable to the reality due to the assumptions used in their models.

The model of Horowitz and Lai (1996) shows that the size of innovation is positively related to patent length while the innovation frequency is negatively related to patent length. This finding necessitates an inverted U-shaped relationship between patent length and innovation rate and between patent length and social welfare. However, the negative impact of patent length on innovation frequency is directly from the pricing rule designed in Horowitz and Lai (1996): the innovator sets a price premium to such an extent that he/she can capture the entire market. When the patent expires, he/she has no quality advantage (patented products are assumed to have higher quality than the non-infringing imitations) and thus has no way to capture the entire market. Thus, the innovator will innovate a new product to capture the entire market only at the time when the patent expires. As such, the longer patent length, the less frequent the innovator will innovate, and vice versa. There is no such pricing rule in reality and thus the innovation pattern in Horowitz and Lai (1996) is not necessarily realistic. As a result, the claimed inverted U-shaped curve is not applicable to the real world.

To obtain the optimal patent length, most models (e.g., Nordhaus 1967; Gallini 1992) use the procedure of minimizing deadweight loss subject to a fixed return to the patentee. The constrained optimization procedure is a valid one and is widely used in many economics problems, such as the conditions for optimal production and optimal consumption. However, this procedure must be operated under the condition of choices under certainty and this is not the case for innovation activity. Investment on an invention is at high risk of invention failure and thus the investment is associated with high uncertainty. Because of this high uncertainty, both the cost of and return to an invention is unknown until they are realized, so there is no way to set an optimal patent duration based on the unknown cost and return. One may think estimated cost and return can be used to set an optimal patent duration, but the projections on cost and return to innovation are frequently proven to be remarkably different from the realized return. For example, the value of the invention of the supersonic airplane “Concord” was vastly overestimated while the value of Google and Facebook was tremendously underestimated. Since the invention cost and return cannot be estimated in a reliable way, any attempt to set an optimal patent duration based on the estimated cost and return will be either not feasible or unreliable. Since the constrained optimization is not applicable to the case of innovation due to the uncertainty involved, the models of choice under certainty are invalid, so do their conclusions from the models.

There is another common argument for a time limit on patent rights: the return to R&D investment (or research cost) is decreasing as R&D investment increases, so a limited patent protection can induce the optimal investment on research or on an invention. It is true that, at the aggregate level, return to R&D investment may be decreasing, but the return to R&D investment for each invention varies remarkably and does not follow the rule of decreasing return. Many inventions end in failure, so there is no return to R&D investment. Some inventions costing huge sums of money might have very low returns, but other inventions are quite the opposite. Since the return from an invention is more directly linked to the risk of failure rather than the level of R&D investment on the invention, it is not possible to have an optimal level of R&D investment. Thus, it is impossible to set an optimal patent length based on a non-existent optimal R&D level.

Patent protection has two dimensions, length and breadth, so a number of researchers have set out to identify the trade-off between patent length and breadth. Klemperer (1990) suggested: when patent breadth is wide, the minimum patent length is optimal; when the patent breadth is narrow, an infinite patent length is optimal. Gilbert and Shapiro (1990) indicated that the optimal patent length is infinite while the optimal patent breadth should be adjusted to the reward for innovation. Gallini (1992) claimed that the optimal patent policy consists of broad patents with patent lengths adjusted to achieving the desired reward for the patentee. Denicolo (1996) concluded that, generally, the less efficient the competition in the product market, the more likely it is that broad and short patents are socially optimal.

Similar to the case of studies on patent length, the conclusions of the above studies are closely related to their definition of patent breadth and the assumptions used in their models. Klemperer (1990) defined patent breadth as the distance between the patented product and the products in a product space that competing firms can sell without infringing the patent. He obtained the optimal patent breadth and length by minimizing the social cost per dollar of profit to the patentee (or the ratio of social cost to the patentee’s profit). Since the fixed total return to the patentee is expressed as the integral over the patent life of the profit flow while the profit flow is expressed as a function of patent breadth, the trade-off between patent breadth and patent length is implicitly expressed in this assumption. Gilbert and Shapiro (1990) defined patent breadth as the flow rate of profit available to the patentee, and assumed social welfare (W) becomes increasingly costly as patent breadth increases (W′ < 0 and W″ < 0), so it is not surprising that their conclusion is in favor of long but narrow patents. Gallini (1992) defined patent breadth as the flow of profits earned by the innovator and linked patent length and breadth to imitation costs. Since a long patent duration encourages imitation and a wide patent breadth will increase imitation costs and thus deter imitation, it is natural that Gallini’s study is in favor of broad and short-lived patent protection. Denicolo (1996) made different assumptions about the behavior of social cost of patents under different scenarios and, accordingly, reached different conclusions.

To sum up, although the previous studies on optimal patent protection make a worthwhile contribution to this issue, their conclusions differ greatly and even contradict each other due to the different assumptions and approaches adopted. To avoid the complications in previous studies, the author intends to prove that there is no optimal patent length by using the least number of assumptions and by confining the analysis to the basic case of patent protection.

In this basic case, the patentee acts as a monopoly during the patent length. The benefit of patent protection is the stimulus to future innovations while the social cost of patent protection is the deadweight loss due to reduced production of patented products. Because the profit obtained by the patent monopoly will stimulate all innovators to engage in innovation activity, it is reasonable to assume that the number of future innovation is positively related to the profit obtained by the patent monopoly. To find the optimal patent duration, we compare the social benefit of patent protection (the incentive to stimulate invention) with the social cost of patent monopoly power.

Figure 2 illustrates the production and pricing strategy of a monopoly, as well as the social cost of patent monopoly and the incentives of patent protection. With a marginal cost MC (assuming a constant MC for simplification) and facing a demand curve DD’, a competitive firm will produce optimally at point C when supply equals demand, i.e., the firm will produce quantity QC and accept the market price PC. If the firm is a monopoly of the product, e.g., a monopoly protected by patent rights, the firm can maximize profit by producing at point A where marginal cost equals marginal revenue. As a result, the monopoly produces less (QM < QC) and charges a higher price (PM > PC).

For a patent monopoly, the price difference (PM-PC) can be viewed as a return on the patent, i.e., patent rent per unit of output, so the line PMB or MC0 can be viewed as the firm’s marginal cost inclusive of patent rent. Compared with production under a perfect competition scenario at point C, the monopoly achieves a super profit (i.e., patent rent) of area PMBAPC but leads to a social cost or deadweight loss—the area of ABC—due to reduced production and consumption. The super profit PMBAPC obtained by the patent holder can be viewed as an incentive to invent. Assuming the impact factor of PMBAPC on future invention is i, the social benefit of patent protection is i* PMBAPC. An optimal patent duration should maximize the net social benefit, namely i* PMBAPC − ABC. In relation to patent duration, we need to consider this net social benefit for each year.

First, we consider a simplified case: the demand curve is unchanged for each year. In this case, the net social benefit is the same for each year and the optimal patent duration will be at the two extreme ends: if i* PMBAPC − ABC > 0, the net social benefit is positive for each year, so the optimal patent duration is infinity; if i*PMBAPC − ABC < 0, the net social benefit is negative for each year, so the optimal patent duration is zero, i.e., abolishing the patent law. For a more general case, we can let all future values be discounted to the present value by a discount rate, but the conclusion will not change because the present values of these two parts will change by the same degree over time.

In the case of the linear demand curve shown in Fig. 2, the MR curve will always pass through the midpoint of any horizontal segment below the demand curve DD’, i.e., PCA = AC, or QC = 2QM, so PMBAPC = 2*ABC. The ratio of the social benefit to the social cost of the invention can be calculated as: R = i*PMBAPC / ABC = 2i. As a result, optimal patent duration can be set based on the impact factor i: if i = 1/2, then R = 1, the patent system has no impact on net social welfare for each year, so any length of patent duration has the same result. If i > 1/2, then R > 1. The patent system has a positive social impact for each year, so an infinite patent duration is desirable. If i < 1/2, R < 1, the patent system has a negative social impact for each year, so a zero patent duration should be set, i.e., the item should not be patented.

Second, we consider the case of the demand curve changing over time. Since the variation of the demand curve is unpredictable, there is no general rule to determine the optimal patent duration for any changes in the demand curve. However, we can consider a simplified likely case: where the demand curve is linear, demand for the patent product will reduce over time because of market saturation, and the demand curve will tend to become flatter in the long run (i.e., more elastic). Figure 3 demonstrates this case.

In Fig. 3, MC is the firm’s marginal cost curve and Pc is the price in a perfect competitive market. The demand curve and the marginal revenue curve for year 1 are D1 and MR1, respectively. For year 2, they are D2 and MR2. The monopoly output and price charged for year 1 are QM1 and PM1, respectively, for year 2 they are QM2 and PM2. Because the demand curves are linear here, it is easy to verify that the marginal curve passes through the midpoint of the horizontal axis, i.e., OE = EF. The geometry rule necessitates that PcA = AC, PcA2 = A2C2, so the area of PM1BAPC is twice as much as the area of ABC, and the area of PM2B2A2PC is twice as much as the area of A2B2C2. As such, the ratio of social benefit to social cost is the same in year 1 and in year 2 because: R1 = i* PM1BAPC/ABC = 2i, R2 = i* PM2 B2A2PC/A2B2C2 = 2i. Consequently, we reach the same conclusion as in the case where the demand curve does not change over time.

One can change the assumption on how the demand curve varies over time, but the ratio of social benefit to social cost is the same for each year as long as the demand curve is linear. For the non-linear demand curve, the analysis becomes more complicated, but it can be shown that the social benefit and social cost go in the same direction and change by a similar degree.

-

(3)

Is the empirical evidence on the patent system reliable?

The empirical evidence on the impact of the patent system is mixed and this leads to two camps of economists and practitioners, i.e., supporters and opponents of the patent system. Generally speaking, focusing on empirical evidence is reasonable because every theory needs to be examined by facts. However, the empirical evidence in social science is very complex due to the data problem. Most data in social science are time series data or even aggregated macro data. These data are affected by a large number of factors (including unknown factors), so they are totally different from scientific data based on experiments conducted under the same condition. As a result, we need to be very careful in interpreting or believing empirical results in social science.

Substantial empirical research based on survey data shows that the proportion of patented innovations induced by the patent system is low, the percentage of patent renewal is small, and the usage of patent information is not encouraging (e.g., Scherer et al. 1959; Manfield 1986; Levin et al. 1987; Cohen et al. 2000). However, Taylor and Silberson (1973) indicate that the survey data from the pharmaceutical and fine chemicals industries show that, without the patent system, about 65% of innovation will not occur in these industries while patent-induced innovation is 8% for all industries. Kanwar and Evanson (2001) find that higher patent protection leads to higher research and development spending as a fraction of GDP. Jaffe (2000), Lerner (2002), and Boldrin and Levine (2008) examined many empirical studies and found that the link between patent protection and the number of innovations is weak.

Since most empirical studies indicate that the patent system is ineffective in stimulating innovation, should we believe the majority of results and consequently abolish the patent system? We should not overreact because the results from the empirical studies are only indicative due to the data issue.

First, it is hard to find data on the number of innovations in an economy, so some studies use the number of patents as proxy while some studies use the amount of R&D. These proxies do not necessarily have high correlation with the number of innovations. On the other hand, although the purpose of these empirical studies is to assess the impact of the patent system, the variable used to represent the patent system is to reflect the policy changes made to the patent laws. As a result, it is the impact of these changes, rather than the impact of the patent system, that is indicated by the studies. Patent protection strength indexes are constructed and used by some empirical researchers (e.g., Ginarte and Park 1997; Qian 2007). These highly aggregated indexes may indicate the overall power of a patent system, but they are not necessarily indicators of a better patent system. For example, the wider patent breadth and scope lead to a higher patent protection indexes, but the exaggerated patent breadth and scope indicate a bad patent system.

Secondly, the time series data (e.g., the amount of R&D each year) may be affected by numerous factors (including unknown factors), so it is impossible for the researchers to claim that the results are definitely caused by the patent system. In natural science, a research has a powerful tool—doing experiments—to eliminate the complexity caused by numerous factors, so he/she can draw a reliable conclusion on causality. A researcher in social science has no such luxury, so social science research suffers from complexity caused by data. Although a number of complex data analysis methods are developed in social science, no method is creditably successful in dealing with the interaction among numerous variables as well as the problem of missing important variables.

Thirdly, the poor results from the survey data may result from the shortcomings of the “current” patent system, not from the principle of the patent system. For example, the reasons for low usage of patent information, as recognized by many researchers, are largely the shortcomings in the patent registration process such as the incomprehensible legalistic language (Mandeville et al. 1982), the obscurity of patent titles (Murphy 2002), the ineffective patent classification (Desrochers 1998), and the low novelty and inventiveness criteria for issuing patents (Lunney 2001; Jaffe and Lerner 2004).

Because of the complication and limitations in data, one should not put too much faith in empirical results derived from these data. On the contrary, if the logic is well grounded and straightforward, one should believe the logic because it is supported by evidence in our life time. For example, our experience and economic theory tell us that printing more money will lead to inflation. However, if we regress money supply with CPI, we may find money and CPI are not correlated well or even are negatively correlated due to many other contributing factors. In this case, it is more reliable to believe our commonsense. When it comes to the effectiveness of the patent system, one can be sure that patent protection must have a positive impact on encouraging invention because the system gives the inventor high reward. This logic is correct and thus believable. The non-supportive results, on the other hand, must result from convolution of data and thus is not reliable.

We also need to apply careful logical reasoning even for well-documented facts. Based on the survey of R&D managers by Cohen et al. (2000), Boldrin and Levine (2013) claimed market pressure (or first mover advantage) is the main driver of innovation because more than 50% of managers think lead time is important to earning a return on innovation and less than 35% of managers (excluding the pharmaceutical and medical instruments industry) indicate that having patents is important. This claim is invalid because the survey did not indicate that lead time is more important than the perspective of filing a patent. Even if the survey does say so, the conclusion that first mover advantage is the main driver of innovation is still invalid, because what the survey shows is the opinion of R&D managers who, as the representatives of the producers, largely rely on production to earn a return. If anyone had surveyed inventors like Thomas Edison, one can imagine that the answer must be that the patent is the main driver of invention.

The other example is the phenomenon of the industry life cycle: new industries tend to be more innovative and have fewer patents while old industries tend to be less innovative and file more patent litigation. This phenomenon is used by Boldrin and Levine (2013) to claim: the first mover advantage is the driver for new industry and the patent is used by old industry to inhibit innovation. These claims also need to be examined by careful logical reasoning.

It is true new industries tend to be more innovative but file fewer patents, but this does not mean that new industries are not encouraged by patent protection or the perspective of patent protection. New industries also value and need patent protection and that is the reason that new industries also file patent applications. A new industry files fewer patents not because it does not care about patents but because it has fewer patents to file and/or has less time and less resources to file patent—it is busy in getting products into the market. In a way, a new industry acts like an innovative producer. On the other hand, old industries are indeed less innovative and tend to seek rent out of their patents. However, this fact does not indicate that patents only work for the less innovative old industries. Meanwhile, the first mover advantage also applies to the old industry and this is evident by the fact that the old industry also tries to be innovative (e.g., Microsoft has also tried different innovations in doing business), but the industry simply runs out of ideas or goes in the wrong direction and thus fails in innovation. Recall that many innovations are unsuccessful no matter if the industries are new or old. The old industry story is one of many unsuccessful innovations. From this point of view, an old industry is like a depleted innovator who tried and failed so has to use the patent to earn a living.

In short, both first mover advantage and patent protection work for both new and old industries. The different outcomes for these two industries are due to the fact that the new industry plays a role of a successful innovative producer while the old industry acts as a representative of unsuccessful innovators. Since innovation is a risky game, it is normal to have both successful and unsuccessful firms in an economy. In other words, without the effort of numerous successful and unsuccessful firms, no one can know which firm or which innovation will have market success, so it makes no sense to pick up the successful firms (e.g., the new industry) and lay blame on unsuccessful firms (e.g., the old industry).

-

(4)

Is the political economy of the patent system bankrupting the system?

It is a general consensus among both proponents and opponents of the patent system that an optimal patent system can serve to encourage innovation and that the current patent system has many problems and thus can be improved substantially. However, Landes and Posner (2004) and Scherer (2009) raise the issue of the political economy of the patent system and cast doubt on patent reform. Boldrin and Levine (2013) even claim that the patent system should be abolished because political-economy pressure makes it impossible to accomplish the required patent reform. Their proposition of political economy of the patent system has some elements of truth but does not depict the whole picture.

There are two central arguments concerning the political economy of the patent system. One is that the patent system is designed and operated by interest groups while consumers (i.e., the public) are excluded. The other is that, since patenting is a technical subject, the interests of voters are not well represented and this causes regulatory capture—the regulators act in the interests of the regulated, instead of the broader public. We discuss these two arguments in turn.

For the first argument, it is true that interest groups may have heavy influences on patent system design and administration, but this is not unique to the patent system. Like any other laws, patent law is enacted by the Parliament, operated by the Government and arbitrated by Courts. Other laws and regulations are also subject to lobbies by interest groups. In essence, the political economy of the patent system is the political economy of any other laws and regulations. We cannot abolish all laws and regulations because of lobbies by interest groups. This also applies to the patent system.

The argument that the political economy of the patent system excludes consumers or the public is a misunderstanding. When we use a graph (e.g., Fig. 2) to demonstrate the impact of patent monopoly, we included the loss to consumer surplus as part of social welfare loss. Here the consumer means the public who are the final users of the patented products, while the producer is a firm who has invented and exclusively produced the patent products. In the patent system, however, the producer (patent owner) is the person or entity, namely the inventor or innovator, who has invented and filed the patent, while the consumer (user of patents) is the person or entity who needs a patent permission to produce the patented product, i.e., the manufacturer or producer. Both the patent owner (the inventor) and the patent user (the producer) are included in the design of the patent system and can be presented in courts (i.e., patent user as defendant and patent owner as litigator). The interest of the consumer as the final user or the public is directly related to the patent users through the market price of patented products and thus indirectly represented in the courts by the patent users or the defendant. This system is the same as any other law or court system, for example, it is unnecessary for the broader public to be represented in a criminal court or a civil court.

The second argument that the patent system is highly technical is indeed an issue predominant in the patent system. The highly technical nature of the patent system may impose some challenges in operating the system, especially when the system is not mature or standardized, but this should not be a vital problem for the system. As explained previously, it is not the public, but the representatives of the patent owner, the representatives of the patent user, and the judge (or the jury) who are involved in the patent system. It is reasonable to believe that there will be qualified personnel who can understand the technicalities in the patent to fill these roles. Even the public can understand the technicalities by experience, by education, or by learning from mistakes. Broadly speaking, although more specialty is embedded in the patent system, the technical nature is a common factor in specialized courts such as property rights, intellectual property rights, military, and marriage, so it is not unique to the patent system.

In short, it is unrealistic to assume that the patent system is designed by impartial legislators and administrated by a benevolent government, so the political economy of the patent system has a valid point. Albeit having some specialty, the political economy of the patent system, is essentially the same as the political economy of any other laws and regulations. The dynamics of different players in the patent system (i.e., the parliament, the patent office, and the representatives of the patent owner and of the patent user) can overcome the political economy problem, so it is an overreaction to advocate abolishing the patent system. Nevertheless, the approach of the political economy of the patent system highlights the issues in the patent system. These issues can be solved through a thorough reform of the patent system.

Reforms Required in Order to Build a New Patent System

Based on the discussion in Section 2, the balanced approach is shown to be baseless. Thus, imposing limitations on patent duration and breadth will not solve the problems caused by patent monopoly power; on the contrary, it will limit the net benefit to society. An optimal patent system needs a totally different approach. In this section, we will investigate the source of undesirable patent monopoly power and propose the necessary reforms to transform the current patent system to an optimal one.

The fundamental function of a patent system is to allow inventors to profit from their inventions by prohibiting others from producing patented products. Traditionally, inventors will profit by producing and selling the exclusive products they have invented, so inventors are rewarded through their engagement in production activity. However, this type of reward system is suitable only for the underdeveloped period in history, during which both invention and production are relatively simpler, take less time, and require less specialty.

In modern times, both inventing and producing patent goods may take a long time and require substantial capital, knowledge, and effort. Moreover, managing the production process may not be the strength of the patentee, whose strength is more likely on the invention of new products. As a result, the patent system provides various types of patent transactions such as transfer of patent right, assignment of patent right, exclusive patent licensing, and non-exclusive patent licensing. These transactions are consistent with the definition of patent right in the current patent system; however, not all these transactions are beneficial to the society.

The transfer of patent right involves a change of patent ownership, so the monopoly power of the patent will be transferred but will not be amplified. Non-exclusive patent licensing does not involve any change of monopoly power of the patent. These two transactions will not lead to more social cost because the monopoly power does not increase. However, it is a different story when it comes to the other two types of patent transactions.

Assignment of a patent right enables the monopolistic patent rights to be transferred to many people other than the patent holder, so the monopoly power is magnified but, in the meantime, the benefit to inventors is very limited. Although the assignment of a patent right brings some revenue to the patent holder currently, the patent right signed out reduces the chance for the patent holder to profit through the granting of patent licenses in the future. Exclusive licensing does not transfer the monopoly power of the patent right, but this practice enables the licensees to have monopoly power in producing patent products in different regions, so the patent monopoly power is also magnified. This practice also limits the benefit to the patent holders: they are unable to grant any licenses in the regions where exclusive licenses have been granted. In short, the magnified patent monopoly in both cases (i.e., assignment of patent right and exclusive patent licensing) necessitates magnified deadweight loss (or social cost) but has no significant positive impact on stimulating invention, so in both cases the magnified patent monopoly is undesirable.

The undesirable amplification of monopoly power in the above two patent transactions stems directly from the broad definition of patent right in the current patent system, so a new patent system must start with a redefinition of “patent right.” Several other changes to current patent laws are also necessary. These are now discussed in turn.

-

(1)

Redefining patent right.

Current patent laws grant patentees the exclusive right to implement their innovations. For example, in the USA, patent rights is defined as the rights granted to inventors by the federal government, pursuant to its power under Article I, Section 8, Clause 8, of the U.S. Constitution, that permit them to exclude others from making, using, or selling an invention for a definite, or restricted, period of time. This broad definition is subject to interpretation and can lead to abuse of patent monopoly. Under this patent rights definition, patentees are able to grant all kinds of licenses and sign all sorts of agreements, or even refuse without any reason to grant a license. Moreover, this definition rewards invention through granting exclusive production so it is the role as the producer that is rewarded, rather than through the role as the inventor. For example, some inventors do end up being rewarded very highly, such as the creators of Microsoft, Apple, and Google, but their rewards come from their roles in producing new products rather than through their roles as inventors. The implication of this rewarding mechanism is that, in order to maximize the benefit of an invention, the inventor has to become a producer or a manager.

To prevent the abuse of patent monopoly power and to reward invention directly, patent right should be redefined as “the right to exclude others from commercially producing an invention without obtaining non-exclusive permits from the patent holder.” In other words, patent right is the exclusive right of patentees to grant non-exclusive licenses for commercial production of the patented products. This definition has two fundamental implications.

First, the definition separates the role of innovator from the role of producer. Under the new definition of patent rights proposed here, innovation is rewarded directly through the right to grant patent licenses, rather than indirectly through producing patented products. Separating the two activities of invention and production allows the innovation/research department to be an independent, self-financed entity and thus leads to the more efficient use of specialized human capital. For example, Bill Gates would not have become the previous CEO of Microsoft and would have been available to work on more innovations.

The separation of innovation and production into distinct companies may also help to solve the problem of sequential innovation, a problem that concerns many economists and practitioners alike. Based on the current definition of patent right, even with a research exemption, a downstream invention cannot proceed without a patent permission obtained from the upstream inventor because the patent invention is clearly for commercial purpose and thus is not qualified for research exemption. The obligation of obtaining a patent permit also binds the downstream invention to the upstream invention so the downstream inventor cannot sell his/her invention separately. Scotchmer (1991) suggested a prior agreement between upstream and downstream inventors to divide the receipts from selling the patent licenses to producers, but this suggestion is neither practical nor efficient because of the high cost of negotiation between inventors when market information about the patent licenses is very limited.

However, if the new definition of patent right is in place, the downstream inventor does not need to obtain a license from any upstream patentee because the downstream inventor does not need to commercially produce the products patented by the upstream inventor. Instead, it is the production firms that need to obtain patent licenses from all inventors involved in the new products. In this way, the rewards to upstream and downstream inventors are determined by the negotiation between inventors and producers, or by the market value of their inventions. The prior agreement between upstream and downstream inventors as suggested by Scotchmer (1991) becomes unnecessary.

A second and more fundamental implication of the proposed new definition of patent right is that it will lay the foundation for an efficient patent market. The current definition of patent right is broad and production-focused, so the patent right is not a specific marketable product. The broad definition also leads to complexity and high cost of patent transaction, which hinders the formation of an efficient patent market. Without an efficient market to channel research funds into innovation activities, the speed of innovation is low and, consequently, the scarcity of new products imposes a tight constraint on economic growth. The proposed new definition presents a clearly identified product—the non-exclusive patent license. This product has a distinct value, which can be determined by the market, and is transferrable. Thus, the new definition provides a base for a functioning patent market. A functioning patent market will play a crucial role in stimulating innovation.

-

(2)

Standardizing patent transactions.

Under current patent laws, a patent transaction is implemented by an unregulated contract. Given the open-ended nature of these contracts, many inappropriate contents may be included and thus lead to various abuses of patent monopoly, such as the excessive price of patent licenses and the tie-in problem, which refers to the practice where the patent holder inserts some clauses in a licensing contract so as to extend their monopoly power, for example, requiring the licensee to purchase the goods nominated by the patentee. In order to avoid these problems, the new patent law needs: (a) to forbid any assignment of patent right and any exclusive patent license, and (b) to simplify and standardize patent licensing.

It may be argued that patent laws should not ban the granting of exclusive licenses, because this imposes constraints on the way the patentees to cash in their inventions. However, this is a common misperception. Normally it is the producer that desires an exclusive license because the producer likes the monopoly power of setting the price for the patented product. So, the exclusive patent license actually is in favor of the licensees. On the other hand, the exclusive license actually imposes great constraint on the patentee. After granting an exclusive license, the value of the patent will decrease substantially because the patentee is no longer able to grant another license in the same region. If exclusive licensing is banned, licensees are no longer able to seek an exclusive license. This means the patentee has unlimited opportunities to grant licenses later and thus the patentee has the potential to make more profit.

Banning exclusive licenses can also reduce the patent license price (a non-exclusive license will be much cheaper than an exclusive license) and thus the prices of patented products due to more competition in producing patented products. The reduced patent license price will not affect the income of the patentee negatively because an increased number of non-exclusive patent licenses can be granted. On the contrary, it may increase the patentee’s income because the patentee can set the patent license price according to market demand so as to maximize his/her profit. The reduced prices of new products, thanks to the reduced license fee and increased competition in production, will also benefit consumers greatly.

The most important impact of forbidding exclusive licenses is that it will lead to a thicker patent market which will improve market efficiency. The thicker patent market results from the improved accessibility of the patent market due to the reduced complexity in patent transaction and from the increased number of buyers of non-exclusive patent licenses. Buyers’ willingness to pay will reveal the true market value of the patent license, which in turn reveals the value of the patent. Through changes in the price of the patent license and in the value of the patent, the market will reward inventors based on the market value of their work, and thus encourage further innovation at a degree which is most beneficial to the economy.

Under this new patent system, patent licensing would be very simple. Even a statement “I grant xxx the right to use the method/technology in patent No. xxx” would be sufficient. The simplicity of patent licensing would avoid all sorts of problems in current patent practice including tie-ins. This kind of problem can be avoided by standardizing the license agreement, allowing contents only related to patent rights such as permission for the use of patent technology in return for a royalty or annual fee.

In reality, in order to implement the patented technology, the licensee may require technical assistance from the patentee. However, this kind of cooperation or supporting agreement does not involve the right to use the patented technology, so it can and should be included in a separate agreement. The advantage of a separate agreement regarding production cooperation is that any attempt to extend patent monopolistic power will be delinked from patent licensing and thus will eventually fail.

It may be argued that the separation of agreements will have little effect on reigning in patent monopoly power because most patent licensees do need technical support in producing the patent products. The key to this argument is that, although the patentee may be a good candidate for providing technical support, he/she is not the only one who can do so, i.e., he/she does not have monopoly power on this. An expert or even a person trained in the area would have enough knowledge to provide technical support. The separation of the agreement may, on one hand, remove the extended monopoly power from the patentee and, on the other hand, foster a new technical service industry.

The simplicity of patent licensing would also greatly reduce the transaction costs and information asymmetry and thus improve market efficiency. The high transaction cost and information asymmetry are features of current patent transactions. By and large, the high transaction cost is due to the complexity of current patent licensing and the extended monopoly power of the patentees. The separation of the patent licensing agreement and the technical support agreement can remove the source of information asymmetry in the patent licensing agreement. It can also overcome the information asymmetry problem in the technical support agreement by allowing for more technical support service providers other than the patentee for the licensee to choose.

-

(3)

Prolonging the duration of patent rights infinitely and abolishing the compulsory license rule.

Due to concerns regarding the negative effects of patent monopoly, current patent laws grant only temporary patent rights. The durations of patent right vary from country to country and depend on different kinds of inventions, but these durations have been harmonized through the introduction of the Unified Patent. Currently, the maximum patent duration is generally 20 years, with medical patents being 5 years longer. The duration for an innovation patent or petty patent is about 6 years.

As demonstrated in Section 2, an optimal finite duration of patent protection exists only in some rare cases where social cost associated with patent monopoly grows faster than its social benefit and, generally speaking, an infinite length of patent protection will maximize the social benefit of the patent system. With the exclusive license being banned under the new patent system, the social cost of patent protection would be reduced substantially, as the deadweight loss in producing patented products would be eliminated because the production of patented products becomes competitive. Consequently, the concern about the negative effects of the patent system is unwarranted and the limit on patent duration should be removed. It is also worth noting that, even though the patent law may provide an infinite patent duration, the effective life of a patent is limited. As the patented technology is outdated or the patented product has been phased out of the market, the patent loses its value and disappears naturally.

Limit in patent right duration should be removed also because it is a major obstacle to a functioning patent market. Limited duration means that the property right of a patent is temporary only. When the patent is close to its maturity, the patent value approaches zero, so the temporary property right significantly reduces incentives to innovate, and imposes a great distortion on the patent market. It is an open secret that many companies are exploiting the expired patents and are waiting to exploit the nearly expired patents. The removal of limit on patent duration can help to form a thicker, less-distorted, and thus more effective, patent market.

An extreme case of limited patent duration is the compulsory license rule. Although this rule is rarely used in reality, it exerts potential pressure on patentees in their pricing of patent licenses. As Reid (1993, p. 132) realized, “There have been relatively few compulsory license applications in recent decades… nevertheless they have probably wielded an influence wider than might have been expected from the paucity of the case law. The background threat of a compulsory license application is a potent lever in the hands of a person applying to a patentee for a voluntary license on reasonable terms.” In this regard, it is still worthwhile to discuss the compulsory license rule here.

The compulsory license rule has been adopted by many countries to address abuses of patent rights. For example, while Article 48(3) of Patents Act 1977 in UK lists different kinds of abuse of patent monopoly, Article 48(1) stipulates:

At any time after the expiry of 3 years, or of such other period as may be prescribed, from the date of the grant of the patent, any person may apply to the comptroller on one or more of the grounds specified in subsection (3) below: (a) For a license under the patent, (b) For an entry to be made in the register to the effect that licenses under the patent are to be available as of right, or (c) Where the applicant is a government department, for the grant to any person specified in the application of a license under the patent.

This rule is unnecessary under the proposed new patent system because abuse of patent rights can be avoided in other ways. For example, the tie-in problem can be fixed by standardizing patent licensing, while the excess prices of patent rights and patent burying can be solved by a functioning patent market. Even so, some may argue that the compulsory license rule is still required to safeguard the implementation of some very important patents such as generic invention patents and patents on pharmaceutical and pollution control equipment. This caution is understandable, but the problem should be solved using methods that will not hinder the patent market, such as government involvement in production of certain goods after the government has purchased the relevant patent licenses. If less protection is provided for these extremely important innovations by employing the compulsory license rule, the public may gain some benefit in the short run, by having cheaper patent licenses and thus cheaper prices for new products. However, the public will be worse off in the long run, as fewer innovations of this type will be made in the future.

The compulsory license rule is not only unnecessary but also very harmful. It wrongly imposes the task of implementing and diffusing patent technology on inventors. This distracts the energy of inventors from continuing invention activity into the implementing of the invention, a job more appropriately suited to the entrepreneur. More importantly, the extremely short period of time stipulated by the compulsory license rule greatly disadvantages inventors in the negotiation of patent license prices. If a patent right does not command a fair price due to the pressure of limited time, further innovation activity becomes unattractive. As a result, inventors or potential inventors will try to find a more attractive career.

Tandon (1982) argued that, if the government is able to provide an optimal price for patent licenses, the compulsory license rule is of no harm. The problem with this argument is that nobody can detect the optimal price except the market. If the “optimal price” designated by the government is only a fraction of the market price for the patent, this compulsory license rule will greatly discourage invention. In considering its damaging effects on the patent system, the compulsory license rule should therefore be abolished.

-

(4)

Improving the quality of patent and widening the patent protection scope

Due to a large increase in patent application numbers and a lack of resources in the patent office in the USA, many patents were approved even if they were not essentially innovative, for example, Amazon’s “one click” patent. These kinds of patents are of low quality, or “low height” as termed by Foster and Breitwieser (2012). A non-innovative patent has a negative impact because it imposes a social cost (patent monopoly power) without any social benefit (i.e., no effect on stimulating invention). Another example of low quality patents is inappropriate patent breadth. The optimal breadth of patent protection should be the one that matches the true breadth of the patent innovation. It is the responsibility of the patentee to make sure in their application that the claimed breadth of their patent is the same as the true breadth of their innovation. However, there is a tendency for patent applicants to exaggerate the patent breadth of an innovation so that some of the claimed breadth is not a true innovation. The exaggerated part of patent breadth also imposes a social cost (patent monopoly power) without any social benefit, so it entails net social cost and is undesirable.

The key factors leading to a low quality patent are a lack of resources and the low quality of patent officers. The latter can be addressed by proper training, and the former can be solved by increasing the patent application fee and the patent maintenance cost. Lack of understanding on the significance of approving a patent may also be a contributing factor. A high quality patent has a great positive impact on invention and on the economy while a low quality patent has a great negative impact on the economy but has little impact on invention. However, this difference is blurred in the current patent system. With a new definition of patent right and an infinite patent duration, the impact of approving a patent will become more noticeable. Nevertheless, in order to prevent granting low quality patents, the decision of the patent office needs to be challengeable in the court system.

For historical and practical reasons, current patent laws only protect practical inventions. Since the function of a fundamental discovery is mainly to contribute to humanity’s knowledge or ideas base, it is impractical to grant a patent right. Legal scholars unanimously claim that knowledge and ideas are not patentable (Pretnar 2003). Currently neither patent laws nor copyright laws protect scientific discoveries and theoretical breakthroughs, so theoretical and fundamental research is severely underfunded. It heavily depends on government funding because few private companies are interested in it. However, scientific discoveries and theoretical breakthroughs are the foundation of practical inventions and have widespread indirect influence on the economy. It is possible and desirable to impose a fundamental-research tax on patent applications or on patent trading transactions. This could be one of many ways to protect the source of the invention, and thus to guarantee an injection of adequate innovations into the economy.

-

(5)

Enhancing international coordination in patent protection.

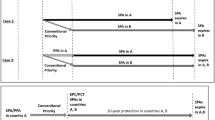

Due to globalization, a patent innovation can easily cross national boundaries, but the patent law of one country can protect only the benefit of inventors within that country and become powerless beyond its boundaries. It is arguable that the country thoroughly revising its patent law first will enjoy an enriched pool of innovations and thus stimulate its economic growth the most. However, producers in this country will initially be unfairly disadvantaged, because countries without a strict patent law will be able to utilize these innovations at reduced cost, or even obtain them free. To protect the benefit of inventors on a global scale, and to give all companies an equal footing in producing patented products, it is highly desirable to enhance international coordination in revision and implementation of patent laws.

The development of the patent system provides an example of good international coordination. For example, the agreement on trade-related aspects of intellectual property rights (TRIPS) was incorporated into the charter of the World Trade Organization (WTO) in 1994 and this resulted in uniform patent standards throughout the membership of the WTO. This experience can be utilized in the globalization of the new patent law so as to stimulate global innovation and thus boost world economy.

Expected Impact of the New Patent System

The proposed reform in the previous section would lead to a new patent system. It can be expected that the new patent system would not only have profound influence on innovation activity and on economic growth, but will also bring dramatic changes in social structure.

-

(1)

Stimulating invention activity to the greatest extent

Invention is to create something totally new, so inventors are stepping into uncharted territory. The high rate of invention failure necessitates a high risk of innovation investment. Consequently, the high risk needs to be balanced by high return in order to encourage invention activity and innovation investment. The current patent system provides some encouragement, but the balanced approach limits the return to patent holders and thus weakens encouragement.

The suggested new patent system removes the impediments on patent protection and gives inventors the maximum amount of reward. Extending the patent duration infinitely and abolishing the compulsory license rule are obviously beneficial to inventors. Some reforms may seem at odds with inventors but actually are for their benefit. For example, forbidding both an exclusive license and a patent assignment seem to limit the way for inventors to profit from their inventions, but this practice actually prevents licensees from bargaining for exclusive licenses and patent assignments. By this practice, inventors may lose some revenue in the short run but they will gain much more in the long run because the patent market (or potential patent demand) is protected. In short, the new patent system makes sure that only the patent holders can enjoy monopoly power over the natural life of their patents so the patent holders can maximized their profit from patent licensing. The maximum amount of benefit to patent holders will stimulate invention activity to the greatest degree.

-

(2)

Minimizing net social cost

While rewarding inventors greatly, the new patent system can also minimize the net social cost of patent monopoly. This is achieved in many ways. First, extending patent duration infinitely does increase the social cost of patent monopoly but, as explained previously, the increase in social cost is outweighed by the much greater increase in social benefit—the inventions stimulated patent protection. As a result, the net social benefit increases, in other words, the net social cost decreases.

Secondly, forbidding exclusive licensing and patent assignment is another source of net social cost minimization. This practice can avoid the amplification of patent monopoly power and can stimulate more invention activity by increasing the long-term benefit to inventors. This leads to a decrease in the social cost and an increase in social benefit, so the net social cost decreases greatly.

Thirdly, the standardization of patent licensing practice will reduce substantially the high transaction cost in the current patent practice. The separation of the patent licensing agreement and the technical support agreement will also reduce the information asymmetry problem and improve efficiency.

Last but not least, increasing the patent quality due to proper resourcing and training will also minimize the net social cost. A low quality patent like the “one click” patent has a large social cost on producing goods and services but has no social benefit because it will not stimulate true invention. As a result, preventing a low quality patent is a large saving in the net social cost.

-

(3)

Facilitating the formation of an effective patent market

The major obstacles to an effective patent market are limited patent duration and complicated patent transactions. The former necessitates a limited patent life which is a great distortion to the patent market. The latter leads to high transaction costs and thus makes the patent market inefficient.

The proposed new patent system overcomes the two obstacles and will lead to a thicker, simpler and less-distorted market. As discussed in the previous section, prolonging the patent duration infinitely will remove the distortion and help to form a sustainable patent market; forbidding the assignment of patents as well as exclusive patent licensing will reduce the price of patent right, foster more demands, and thus form a thicker patent market; standardizing patent licensing agreements will reduce the patent transaction cost; separating patent license agreements and technical support agreements will prevent the extension of patent monopoly power to patent technical support services and thus reduce the information asymmetry problem. Once the obstacles on the patent market are removed, the patent market is expected to become efficient and effective. An efficient patent market will play a vital role in efficiently channeling funds into invention activities.

-

(4)

Promoting faster and smoother economic growth.

It is common wisdom that economic growth is often interrupted by economic recessions. The cause of economic recession is contentious. Keynesian economists blame deficiency of effective demand, which causes over production in the economy (i.e., general gluts). Classical economists think economic recession is caused by a mismatch between demand and supply (partial gluts). The long durations of large economic recessions (e.g., 4 years for the Great Depression starting from 1929 and 2 years for the Global Financial Crisis occurred in 2008) indicate that the mismatch theory is implausible. If there are products which are in high demand (or undersupply), producers would be able to find the mismatch and rebalance supply and demand fairly quickly and thus the economy would be back on its footing very soon. However, the reality shows otherwise.

With the new patent system, invention will be greatly encouraged. Thus, invention shortage can be avoided and producers can always find and produce new products which have high market demand. Consequently, an economic recession will not occur. Putting it differently, the new patent system will foster an efficient patent market. With an efficient patent market channeling funds to invention activity and an efficient capital market channeling funds to production activity, the synergy of these two markets can balance invention activity and production activity. If invention activity is not enough, the return rate of innovation activity will be higher than that of production activity, so more funds will flow into invention activity, and vice versa. As the two markets can coordinate effectively the innovation and production activities, a smoother and faster economic growth is guaranteed by market mechanism.

-

(5)

Resulting in dramatic societal change

Experience tells us that new products have market potential and old products tend to cause market saturation. If there are enough new products in an economy, a developed economy has sufficient resources (e.g., capital and labor) and technology to satisfy the demand, so the economy will keep growing. Based the previous reasoning, the re-occurring economic recessions must imply that inventions or new products are scarce in a modern economy and they become the key factors for economic growth: only new products have growing market demand which can support economic growth.