Abstract

This paper aims at identifying the factors that influence the design of the accounting information system in the Tunisian small and medium industries (SMIs) through the characteristics of information, accounting management tools, and degree of formalism. The accounting information system is considered to be a key factor of competitiveness of companies. It provides managers with the relevant accounting information to help them with the decision making. Through a set of structural and behavioral factors, we tried to improve the understanding of the accounting information system in the developing countries, using Tunisia as an example. Based on a technical questionnaire, a total of 221 Tunisian companies operating exclusively in the industrial sector were studied. By using the PLS structural equation modeling, we showed that the design of accounting information system is influenced by several factors of contingency. When we looked at structural contingency, we found a positive and significant effect of the firm’s size on the degree of formalism. In addition, a positive and significant effect of the organizational structure on the characteristics of the accounting information systems was shown. Furthermore, the examination of the behavioral contingency showed that the manager’s profile affects in part the use of accounting management tools. In conclusion, our study extends the accounting information system literature and helps managers to have a framework to enhance the performance of their industries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

During these last years, a growing attention has been paid to the research on the accounting information system (AIS) in small and medium enterprises (SMEs) (Affes and Chabchoub 2007; Ben Hamadi et al. 2014; Bonache et al. 2015; Chapellier et al. 2013; Condor 2012; Davila 2005).

The accounting information system is one of the privileged themes in the field of research in management sciences (Merchant and Van der Stede 2011). However, the majority of studies which have mainly focused on large organizations compared to smaller enterprises (Condor 2012) have been undertaken on developed countries.

This lack of interest in the SMEs is due, in part, to the prejudice that companies produce rudimentary accounting information. However, SMEs are prominent in the economies of several countries especially in the developing ones, such as Tunisia, where they contribute to the growth of the economy through a high employment capacity, which provides wealth for the country.

Indeed, SMEs are in the center of the Tunisian economic system (Ben Hamadi et al. 2014 ; Kossaï and Piget 2014). Despite their dominant economic position, the SMEs suffer from several barriers to their development, such as difficulties to get funding from banks and the problem of information assymetry and transparency caused both by their generally familiar character coupled with a little formal management mode and a restrictive normative accounting framework. The lack of professional management tools restrains growth and even causes the crisis of firms (Greiner 1972).

Nevertheless, to overcome some of the constraints, we propose that the Tunisian SMEs should build a relevant accounting information system to better meet the needs of managers, if they want to continue playing a major role in the economy, and strengthen their competitiveness and credibility with all their external partners. Therefore, SMEs have a greater need of accounting data and must have an adequate accounting information system in order to meet its challenges.

In the absence of accounting transparency in these firms and the few empirical studies (Chapellier and Ben Hamadi 2012), we found that the study of accounting information system of the Tunisian SMIs is legitimate and relevant, particularly in a context characterized by a high competition and globalization.

This field of research presents an innovative and extensive character in the way that the accounting information system constitutes a subject of controversy mostly because of the absence of a universal definition and in the presence of mixed and contradictory results (Chapellier et al. 2013). Despite the increasing number of literature on AIS, a sound theoretical foundation is still missing, which is also true for the concept of accounting information system itself.

On this subject, most studies of accounting information system use the theory of structural contingency (Abdel Kader and Luther 2008; Al-Omri and Drury 2007; Chenhall 2003; Gerdin 2005; Jänkälä 2007; Reid and Smith 2000). This theory suggests that different contingency factors influence the structure of the company. However, other studies explain that this approach is insufficient because it neglects the influence of the actors on their management (Affes and Chabchoub 2007 ; Chapellier 1994 ; Germain 2000; Lavigne 1999; Santin and Van Caillie 2008). For a better understanding of the accounting information system, we are going beyond the scope of the theory of structural contingency by integrating behavioral contingency factors.

The purpose of this research is structured around the following questions: What is the effect of structural and behavioral variables? The aim of this paper is to identify the factors that influence the design of the accounting information system in the Tunisian SMIs through the characteristics of information, accounting management tools, and degree of formalism.

An empirical study was conducted by adopting a technical questionnaire among Tunisian companies operating exclusively in the industrial sector. Using the method of partial least squares path modeling, the results showed that the design of accounting information system is influenced by several factors of contingency.

The examination of structural contingency showed that there is a positive and significant effect of the firm’s size on the degree of formalism. Besides, a positive and significant effect of the organizational structure on the characteristics of the accounting information systems was observed. Furthermore, investigating the behavioral contingency showed that the manager’s profile affects in part the use of accounting management tools.

This research contributes to the debate on the design of the accounting information system of SMEs in developing countries, like Tunisia, as most of previous studies focused on the developed countries.

Few studies have examined the accounting information system in the Tunisian context and, to our knowledge, there is no research involving all of these factors in the same study to explain the design of the accounting information system through the following dimensions: characteristics of information (scope, timeliness, aggregation), accounting management tools (traditional, modern, related to export), and degree of formalism.

Our study extends the accounting information system literature and can enrich the reflections and analyses of professional accountants in shedding light on the AIS. In addition, this work can assist managers and leaders to have a frame of reference and ameliorate their ability to understand and design a satisfactory accounting information system for their needs and then help them to improve the performance of their industries and ensure their survival. Moreover, it can be useful to the Tunisian regulatory organism to develop new laws to enhance the accounting information system of companies.

This paper is structured as follows: Section 1 includes the theoretical framework and hypotheses. Section 2 shows materials and methods. In section 3, the results are presented. Section 4 contains the research discussion. Finally, the research implications and limitations as well as the future prospects are presented in the conclusion.

Theoretical Framework and Hypotheses

The Accounting Information System in the Tunisian SMI

The study of the accounting information system is one of the privileged themes in the field of research in management control and in management in general (Merchant and Van der Stede 2011). It is a vital tool in the organization which provides the necessary information used by professionals for effective decision making, planning, and control functions that ensure the competitiveness of the organizations (Saganuwan et al. 2013).

The accounting information system could be considered as a logical intersection between accounting and information systems (Manteghi and Jahromi 2012). Other researchers distinguished separately the three words that constitute the expression of accounting information system (system, information, and accounting) (Sori 2009; Soudani 2012). Chapellier et al. (2013) defined the accounting information system as an organized structure of means and actors to produce accounting data (mandatory and optional, historical, and forecast) used by SME managers to run their business.

For our study, we define the accounting information system design through the broad characteristics of information (scope, timeliness, aggregation), accounting management tools, and the degree of formalism.

Information Characteristics

Soudani (2012) states that the accounting information system design can be defined in terms of information characteristics. To define this concept, we refer to the study of Chenhall and Morris (1986) who consider information in terms of scope, timeliness, and aggregation, that continue to be used by researchers like Hammad et al. (2013), Ramli and Iskandar (2014). The scope of an information system is to provide information, which focuses on external, non-financial and future-oriented information, to the manager. Timeliness refers to the frequency and speed of reporting. Aggregation information implies the use of analytical or decision models and a combination of temporal and functional summation.

Management Accounting Tools

The management accounting tools used are inspired by the work of Baines and Langfield-Smith (2003), Berland and De Rongé (2013), Chenhall and Langfield-Smith (1998), Nobre (2001), Vallerand et al. (2008). For the current study, we distinguish the traditional management tools (namely cost accounting, complete cost price, direct cost price, analysis of budget variances, operational dashboard), the modern management tools (like activity-based costing, benchmarking, value chain analysis, product life cycle analysis, main product profitability analysis, the main customer’s profitability analysis), and the export management tools (namely analysis of the profitability of the foreign markets, analysis of the profitability of the foreign customers, and analysis of the logistic expenses caused by exports).

Degree of Formalism

To measure the degree of formalism, we adopted the work of Hage and Aiken (1969), Gordon and Narayanan (1984) and Kalika (1987) that explains the degree of formalism of the accounting information system by the existence of written rules and procedures that comply with procedures by employees, monitoring, penalties, and rewards.

Contingency Theory

In this research, we mobilize the contingency theory which, despite the attributed criticisms, is always appropriate in the field of management. In fact, some research showed the potential influence of the structural and behavioral contingency factors on the accounting information system. Examples of these factors are the size (Ben Hamadi et al. 2014; Chapellier et al. 2013), the age of the firm (Ben Hamadi et al. 2014; Davila 2005; Lassoued and Abdelmoula 2006), the organizational structure (Hammad et al. 2013; Sisaye and Birnberg 2010), the uncertainty of environment (Chapellier et al. 2013; Hammad et al. 2013), the profile of manager (Ben Hamadi et al. 2014; Ngongang 2007), and the export (Chapellier et al. 2013; Chapellier and Mohammed 2010).

Contingency Factors

Export

The Tunisian market is very competitive and narrow (Boubakri et al. 2013; Zghidi and Zaiem 2011). Thus, Tunisian SMIs have an interest in getting into new , and to do so, export is one of the commonly used strategies adopted. So, faced with this challenge to be competitive, we believe that SMEs need to have a relevant accounting information system. Chapellier and Mohammed (2010) spotted a significant relationship between the variable export and the complexity of the accounting information system. Besides, Davila et al. (2012) showed that the effective management of foreign activities needs sophisticated management control systems that can respond to local differences while benefiting from the advantages of global opportunities. In fact, exporting SMEs must establish more formal and sophisticated accounting information systems, which give effective accounting information in order to conquer new foreign markets. This led us to formulate the following hypotheses:

-

H1.1: The more a firm exports, the more its AIS is formalized.

-

H1.2: The more a firm exports, the more its sophisticated management tools are used.

Size of the Firm

The size of the firm appears to be an explanatory variable of design accounting information system in a SMI. It is considered a key factor in the structural contingency that explains and justifies the use of management control tools in SMI (Ben Hamadi et al. 2011; Chapellier and Ben Hamadi 2012; Ngongang 2013). The more a company grows, the more its accounting information system becomes complex (Ben Hamadi et al. 2011; Chapellier and Ben Hamadi 2012). Davila (2005) revealed that size is expected to be associated with the formalization of the result control. Larger firms tend to make greater use of more formal administrative controls, as opposed to informal procedures. Indeed, leaders can manage their business informally without the use of formal management tools, up to a certain point, but beyond that, the increasing size and complexity of the business will be difficult to manage; hence, the necessity of formalism. Merchant (1981) emphasized that the larger the business is, the more likely it prefers formal rather than informal management information systems. Additionally, Merchant (1984) considered that the size was positively related to the degree of formality in the use of a budgeting system.

Large firms have resources that enable them to adopt more sophisticated management accounting practices than small firms (Abdel-Kader and Luther 2008). Besides, Haldma and Lääts (2002) argue that the sophistication level of cost accounting and budgeting systems tends to increase in line with a firm’s size. Therefore, if the size of the company increases, there is more diversification, complication, sophistication of management tools, and formalization of the accounting information system. Accordingly, we tested the two underlying hypotheses:

-

H2.1: The more the size of the firm increases, the more its sophisticated management tools are used.

-

H2.2: The more the size of the firm increases, the more its AIS is formalized.

Age of Firm

Little research has focused on the relationship between the age of the firm and its accounting practices (Bonache et al. 2015). In this context, one of the asked questions is the difference between the accounting practices of the older organizations and those of the younger ones. The study of Davila (2005) showed the relevance of the age on the management control systems. Actually, the results indicated that low age is associated with a dominance of rather informal control systems, while high age leads to rather formalized and mechanistic management control systems. For several authors, age evolving into more bureaucratic forms is often associated with the growth of the organization. Mintzberg (1982) explains that as the age of the firm increases, its behavior becomes formalized. The model of growth phases of Greiner (1972) revealed that the emergence of the management control systems will intervene after a number of years. During the first phase, the entrepreneurial organization is characterized by informal ties, whereas in the second phase, it is characterized by a more formalized and standardized structure. However, Holmes and Nicholls (1989) showed that the acquisition or the preparation of a relatively detailed level of accounting information decreases as the firm’s age increases. They explained that in the early years of the company’s existence, the manager is requesting information because it is a learning situation but that over time, this demand will fall before stabilizing. Therefore, we side with Mintzberg in his statements and hypothesize that:

-

H3: The older the firm is, the more its AIS is formalized.

Organizational Structure

One of the more common operationalisations of structure in the management accounting literature is the mechanistic/organic continuum (Burns and Stalker 1961; Chenhall 2003 ; Christ and Burritt 2013).

Burns and Stalker (1961) advocate that organizational efficiency and effectiveness would be best served by what they termed a mechanistic structure when the environmental conditions are stable. However, when the environmental conditions are uncertain or in a state of flux, an organic structure would produce superior results. Given the context of our study, we adopted the organic structure. Choe (1998) argues that organic structures have higher information processing capabilities and more interdependence among sub-units.

Previous studies have demonstrated the relationship between organizational structure and the characteristics of the accounting information system (Chang et al. 2003; Chenhall and Morris 1986; Chia 1995; Choe 1998; Hammad et al. 2013). Choe (1998) stipulated that when the organizational structure is organic, the scope of timely and aggregated information associated with a high user’s participation has a positive impact on the management accounting system performance. Similarly, Chang et al. (2003) and Chia (1995) reached the same conclusions by examining the effects of the interactions between the characteristics of the management control systems and the level of decentralization on the performance of the managers. High degree of decentralization supports a high information processing capability, as more managers require more sophisticated information in making decisions. Indeed, the AIS should correct the defects of the organic structure (Otley 1980), which has less control over the managers. In fact, the managers need to aggregate information to control and coordinate the activities of the interdependent units (Gul 1991). Generally, extended information is also sought in decentralized organizations to deal with the variety of decisions (Chenhall and Morris 1986). The results found by Chenhall and Morris (1986) show that in a decentralized organizations, the scope and aggregate information are perceived useful by managers. Therefore, an SMI with an organic organizational structure needs more information. As a consequence, the following hypothesis is put forward:

-

H4: The more organic the organizational structure is, the more the characteristics of information (scope, timeliness, and aggregation) are used.

Uncertainty of the Environment

The environment is a dominant contextual variable which is at the basis of contingency-based research. Perhaps the most widely researched aspect of the environment is uncertainty (Chenhall 2003). In fact, uncertainty of the environment makes managerial planning and control more difficult because of the unpredictability of future events (Burns and Stalker 1961; Chenhall and Morris 1986; Lawrence and Lorsch 1967).

SMEs operating in a dynamic and uncertain environment have an accounting information system more complex than SMEs operating in a simple and stable environment. Indeed, as environmental uncertainty increases, decision-makers seek more extensive and detailed accounting information for planning and control (Hammad et al. 2013). Merchant and Van der Stede (2011) advocate that uncertainty has powerful effects on the management control system. Indeed, when uncertainty increases, the need to collect information also increases (Daft and Macintosh 1981; Daft and Lengel 1986). Chenhall and Morris (1986), Chia (1995) and Chong and Chong (1997) believe that the increase of perceived uncertainty of the environment leads to a high recourse of firms to external and non-financial information. Several authors (Chenhall and Morris 1986; Gordon and Narayanan 1984) showed that perceived uncertainty of the environment can be diminished if managers provide information on a wider scope. Post and Epstein (1977) argue that their effective management is linked to the availability of adequate and timely information. On the other hand, Mintzberg (1973) found that managers were concerned not only by obtaining accurate and complete information, but also by having it quickly. Therefore, if the environment is uncertain and dynamic, managers need to have a useful broad scope, timely and aggregated information for the decision making process. Hence, our hypothesis is as follows:

-

H5: The more uncertain the environmental is, the more the characteristics of information (scope, timeliness, and aggregation) are used.

Profile of the Manager

The manager of a SME has a very strong influence on its management system (Lefebvre 1991) when she/he tends to personify the company (Coupal 1994). Actually, she/he is the most dominant actor (Affes and Chabchoub 2007). Her/his profile is identified like a balance sheet, a photo at a given moment when it is often explained by the personality, the training, the professional experience, and the membership in social networks (Bernard 2010). To study the profile of the manager, we should consider her/his age, experience, and training.

Davila (2005) found that the entrepreneur’s age is relevant to explain the accounting information system. Some researchers found that the degree of using accounting data decreases as the leaders’age increases (Begon 1990).

Regarding the relationship between the manager’s experience and her/his accounting practices, some authors found no relationship between the degree of data production and the user’s experience (Reix 1984), while others revealed an inverse relationship (Chapellier 1994; Affes and Chabchoub 2007). For the latter, this relationship is explained by a double logic. First, the least experienced leaders are often the most trained, and secondly, the decision-makers in a learning situation would be applicants for volume. Therefore, more information decreases and then stabilizes. In fact, inexperienced leaders attempt to overcome their lack of experience by developing a more complex accounting data system (Affes and Chabchoub 2007). Others argue that the production levels increase with experience (Nelson 1987). They explain that experienced decision makers are usually more capable of modeling sophisticated problems.

Regarding the type of training, the manager would also be a predictor of accounting practices (Chapellier 1994; Chapellier and Mohammed 2010). These authors explain that a leader who has a training accountant type or manager would be more likely to use accounting data.

A great number of studies underlined that highly educated leaders have, in general, more complex accounting data (Lacombe-Saboly 1994; Lavigne 2002). Moreover, more trained individuals tolerate a higher level of abstraction and have a greater ability to integrate larger amounts of information (Chapellier 2011). Thus, in the light of the foregoing, the following hypotheses can be stated:

-

H6.1: The younger the manager is, the more sophisticated the used management tools are.

-

H6.2: he more experienced the manager is, the more sophisticated the used management tools are.

-

H6.3: The more trained the manager is, the more sophisticated the used management tools are.

Therefore, our conceptual model can be presented as follows (Figure 1).

Materials and Methods

Sample and Data Collection

The selected sample applied in this research consists of all the Tunisian industrial companies. During the study period, there are 5731Footnote 1 companies, 47% of which are totally exporting. This shows the importance of exports in the Tunisian economy, particularly, in the industrial sector. Our empirical study focuses mainly on the Tunisian companies operating exclusively in the industrial sector.

A technical questionnaire is used. The data were collected through the administration of a questionnaireFootnote 2 to SMIs. We conducted a pre-test questionnaire toward three researchers, in the same field of us, and five managers, in order to ensure understanding and clarity of the questions and adopted in the Tunisian context before submitting it to the final sample. After that, the questionnaire was handed to the senior managers attached to the accounting department of the headquarters; then a few days later, after being completed, it was retrieved at the proposal of the manager.

Our sample was selected from the register of firms published in the website of the Tunisian Agency for the Promotion of Industry and Innovation (API). For reasons of practicability, security, and respect, the allowed time to this research; our sample is located mainly in the region of Sfax, where dwell the researcher, because this study was realized in critical period after the Revolution when the country was in disorder and not easy to move and to access to information.

Chapellier and Ben Hamadi (2012) showed the lack of accounting transparency in Tunisian SMEs. Actually, the absence of investigation culture of investigation made it difficult for most managers to answer especially accounting related questions filed in their boxes. We noticed the same in a previous survey where respondents were reluctant to accounting issues, and sometimes they did not agree to meet, although, the research was purely academic. For increasing the response rate, we also relied on our knowledge network to collect information.

A similar study of Stepniewski et al. (2008), in the Tunisian context, is based on the collection of data on the administration of a questionnaire by direct interviews with a convenient sample of Tunisian SME managers. For Sekaran (2003), convenience sampling is a sampling technique where subjects are selected because of their convenient accessibility and proximity to the researcher. This technique involves collecting information from members of the population who are conveniently available to provide information. The subjects were selected just because they were easier to asses and willing to participate in this research. This sampling technique is fast, inexpensive, and easy; besides, the subjects are available.

We conducted a representative sample test through ANOVA statistical test. We found that the geographical distribution of the sample firms does not affect their answers.

The survey was launched at the beginning of August 2012 and ended at the begining of October 2012. Three hundred questionnaires were distributed, 226 were filled in, and five dropped out for incomplete responses and a large number of missing answers. To increase the response rate, we conducted telephone reminders to those involved, and we have proposed to grant the summary results of the study. In the end, our sample consisted of 221 industrial companies with a response rate of 73.67%.

(74.1%) of the respondents are employees–executives with (45.7%) aged between 30 and 40 years (52.3%), managers primarily attached to the accounting department, and (51.8%) senior managers who have a basic accounting education (62.4%) which can be explained by the theme of the subject related to accounting, and (16.7%) have a technical education. However, only 5.4% of the respondents are not well trained, but have some experience. Regarding the respondents’ experience, the survey showed us that (43.9%) of the respondents had been in their positions for more than 10 years with (43.4%) of whom had always worked for their current companies, while (35.3%) had previously worked in other companies.

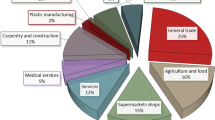

On the other hand, our survey covered (29%) of the various industrial sectors, such as the mechanical and metallurgical industries with (16.3%), the food industries (12.7%), and the textile and clothing industries (11.3%). Regarding the size of firm, (34.8%) of the companies employ between 20 and 50 people. As for the firm’s age, the survey showed that 35.3% are between 10 and 25 years old. Our study sample consists of 72.9% exporting and 27.1% non-exporting firms companies (Table 1).

Measurement of Research Variables

The variables of this research are measured using different items formulated as questions from previous works or a set of questions suited to the constructed study (Table 2).

Characteristics of Information

The characteristics of information are measured using an instrument developed by Chenhall and Morris (1986) and used by Hammad et al. (2013) and Ramli and Iskander (2014).

The measures of the information characteristics, such as the scope (focusing on external, nonfinancial and future-oriented information), timeliness (referring to the frequency and speed of reporting), and aggregation (referring to the use of analytical or decision models, information aggregated by time period, and information aggregated by functional area) were calculated on a five-point scale ranging from “never” to “always” regarding the respondents’ frequency use of information in the company. The Cronbach alpha statistics, which gave 0.813 for broad scope, 0.733 for timeliness, and 0.844 for aggregation, indicated a satisfactory internal reliability of the information scales (Table 3).

Accounting Management Tools

The accounting management tools are measured using an instrument developed by Baines and Langfield-Smith (2003), Chenhall and Langfield-Smith (1998). Respondents are asked to indicate the frequency of management tools used in their business. All the items of traditional management accounting (namely cost accounting, complete cost price, direct cost price, analysis of budget variances, and operational dashboard), modern management accounting (like activity-based costing, benchmarking, value chain analysis, product life cycle analysis, main product profitability analysis, main customer’s profitability analysis), and management accounting connected to export (foreign markets profitability the analysis, analysis of the profitability of the foreign customers ,and analysis of the logistic expenses caused by the export) were measured on a five-point Likert-type scale varying between “never present” and “always present”. The Cronbach alpha statistics of 0.843 for MTT, 0.869 for MTM, and 0.925 for MTE indicated a satisfactory internal reliability (Table 3).

Degree of Formalism

The degree of formalism is measured using an instrument developed by Hage and Aiken (1969), Gordon and Narayanan (1984) and Kalika (1987). The instrument measures the degree of formalism by focusing on five questions, namely the written rules and procedures, the employees’ conformity to the established procedures, problem solving following the rules and procedures, the penalties if the procedures are not followed, and the financial rewards when all the procedures are correctly applied. The respondents were asked to indicate frequency on a five-point scale ranging from “Never” to “Always”. The Cronbach alpha coefficient was 0.830, which is beyond the lower limit of acceptability of 0.70 (Nunnaly 1978) (Table 3).

Organic Organizational Structure

The instrument for measuring the organic organizational structure was developed by Gordon and Narayanan (1984), where items are measured on a Likert scale of 5 points varying between “No delegation” to “Complete delegation”. Six questions are used to measure the degree of the authority delegated to the appropriate managers for decision-making concerning the development of new products or services, the hiring and firing of managerial personnel, the selection of large investments, the budget allocation pricing, and export decisions. The internal reliability of the 6-item scale was 0.878 according to the Cronbach alpha statistic (Table 3).

Uncertainty of the Environment

The instrument used to measure the environment uncertainty is adopted from Govindarajan (1984) and has been used by Boujelbene and Affes (2015). The respondents were asked to indicate on a five-point Likert-type scale varying between “much easier to predict” and “much harder to predict”, concerning the manufacturing technology, the competitors’ actions, the market demand, the product design and attributes, the raw material availability, the raw material price, and government regulation. Following a factor analysis, two factors were identified: the ENV1 factor, which is related to the availability of raw materials, the commodity prices, and the government regulations; and the ENV2 factor, which is associated with the market demand in terms of quantity and quality. The Cronbach alpha statistics of 0.759 for the ENV1 and 0.746 for the ENV2 indicated a satisfactory internal reliability of the scale (Table 3).

Impact of Exports on the Accounting Information System

The instrument measures the impact of the exports on the accounting by focusing on the questions constructed for this study, namely the use of an accounting and financial software, the use of a commercial management and administrative software, the Internal operating procedures adopted in business, the profile of the recruited staff, the profitability of business taken globally, the profitability of the exported products, the labor cost, the accuracy and the volume of the accounting information to be produced, the frequency of the accounting information to be produced, the level of workers’ motivation skills, the complexity of the business organization, and the requirement level of external controllers (tax authorities, auditors, customs).

On the other hand, the respondents were asked to assess the impact of the exports on a five-point Likert-type scale varying between “not at all important” and “essen-tial”. The Cronbach alpha statistics showed an internal reliability of 0.969 of this measure (Table 3).

Model

A partial least squares (PLS) analysis was used to test the research model and hypotheses.

The PLS is a component-based structural equation modeling technique that simultaneously tests the psychometric properties of the scales used to measure the constructs (measurement model) and examine the strength of the relationships between the constructs (structural model). For this study, the PLS is suitable for the causal-predictive analysis of complex relationships with multiple independent and dependent variables. The used sample size is relatively small (Hair et al. 2014) and does not require multivariate normal data (Chin 1998).

Measurement Model

The measurement model in the PLS is assessed in terms of indicator reliability, internal consistency reliability, convergent validity, and discriminant validity (Hair et al. 2014).

The internal consistency reliability of each construct is evaluated using the Cronbach’s alpha and the composite reliability. The Cronbach’s alphas for the constructs presented in Table 3 ranges from 0.733 to 0.969. These values are beyond the recommended threshold of 0.7 (Nunnally 1978). The internal consistency of each construct is also assessed based on its composite reliability. As shown in Table 3, the composite reliability exceeds 0.84 for all the latent variables, which is greater than the critical value of 0.7, indicating a satisfactory reliability of the constructs in the model (Hair et al. 2014).

To check the convergent validity, Table 3 shows the AVE for each construct is above 0.5, which indicates that the latent factors can explain at least 50% of the measured variance (Hair et al. 2014). Therefore, convergent validity may be considered as satisfactory.

Concerning the discriminant validity, Table 4 shows that each of the square roots of the AVEs (diagonal) is higher than the correlation of that construct with the other constructs (Fornell and Larcker 1981). This indicates that all the measures have a satisfactory discriminant validity.

Overall, the results obtained by the PLS measurement model indicate that each construct shows a satisfactory internal consistency reliability, a convergent validity, and a discriminant validity, which helps make an interpretation of the structural model.

Structural Model

The PLS is used to analyze the structural model and test the proposed hypotheses. It produces standardized β-statistics for each path coefficient. These coefficients might be biased in the presence of high levels of collinearity among the predictor constructs (Lisi 2016). Therefore, collinearity diagnostics were assessed as a preliminary test of the structural model (Hair et al. 2014). For this reason, we checked the presence of multicollinearity among variables by calculating the tolerance and variance inflation factor (VIF) in SPSS. Table 5 shows that the resulting VIF values are between 1.004 and 3.286, which is lower than 5, and the tolerance values range between 0.304 and 0.996, which is higher than 0.2. Therefore, it is possible to conclude that collinearity does not represent a threat to the robustness of the study results.

A bootstrapping (5000 samples) is used to evaluate the statistical significance of each path coefficient (Hair et al. 2014). As the objective of the PLS is to maximize rather than fit the explained, the overall incidence of the significant relationships between the constructs and the explained variance of the dependent variables (i.e., the R2 measures) is used to evaluate the PLS model instead of the goodness-of-fit measures (Chin 1998).

Results

Before presenting the results of the explanatory analysis, we introduced the descriptive analysis. Table 6 provides a descriptive statistics which gives a concise overview of the collected data. It presents the position of features and main dispersion of our study. It helps us assess the absence of outliers in our sample.

On the one hand, Table 7 shows that some of the correlation matrix coefficients obtained from the responses of 221 managers are quite high; however, no collinearity was detected (Table 5). On the other hand, an endogeneity examination using the Hausman test was made to make sure that the results are not due to the presence of extraneous variables. The findings showed the absence of the biais of endogeneity.

After the estimation of the model, SmartPLS provides the outer loadings and/or outer weights for the measurement models, the path coefficients for the structural model relationships, and the R2 values of the latent endogenous variables (Hair et al. 2014).

It was found that all the outer loadings are well above the critical value of 0.70 (Hair et al. 2014). Then, an examination of the outer loadings was made as our model includes only reflectively measured constructs. The only exception is one indicator of timeliness (infodo2) and of modern management accounting (og9) with an outer loading, respectively, of 0.689 and 0.694. However, the t statistics are respectively significant with 5.549 and 11.925.

Figure 2 shows the results of structural model test. The R2 shows that the research model explains 16.2% of the variance in the degree of formalism, 16.5% of the variance in the scope, 6.1% of the variance in timeliness, 6.1% of the variance in aggregation, 20.6% of the variance in traditional management tools, 10.1% of the variance in modern management tools, and 35% of the variance in management tools related to exports.

The results of the structural model (Table 8) showed that the export variable is measured by three dimensions, two of which, the IMPEX and the MEXP, have a significant effect on the degree of formalism. The IMPEX variable interprets the impact of exports on the accounting software, financial management, accuracy, volume, and frequency of the accounting information to occur, the operating procedures, the complexity and profitability of activity, exported products, and the personal profile. This variable has a positive and significant effect on the degree of formalism with (t = 2.361; p = 0.018). It can be deduced that the greater the exports impact on the accounting software, on profitability, the higher formalism there will be.

As for the variable MEXP variable, which is a binary variable (0: no export; 1: export), the results of structural equations showed that it has a positive and significant effect on the degree of formalism with (t = 2.148; p = 0.032). This result shows that exports have a significant impact on formalism, whereas the INTEX has no significant effect on the degree of formalism. This can be explained by the fact that even with minimal export operations, there is always a procedure to follow.

Therefore, it can be said that the export variable has partially an effect on the degree of formalism in the Tunisian SMIs; hypothesis H1.1 is partially supported.

Beside validating the relationship between exports and the accounting management tools, the results showed that the MEXP variable has a relationship with MTT (cost accounting, full cost accounting, direct cost calculation, analysis of budget variances, and scoreboard) (t = 1.663; p = 0.096Footnote 3) and MTE (the analysis of the profitability of foreign markets, analysis of the profitability of foreign customers, and analysis of logistics costs caused by export) (t = 2.310; p = 0.021). However, the MEXP has no significant effect with MTM (benchmarking analysis, analysis of the value chain, life cycle analysis of the product, profitability analysis of the principal product, and profitability analysis of the principal client) (t = 1.544; p = 0.123).

Regarding the IMPEX variable, it has a positive and significant effect with MTT (t = 2.663; p = 0.008), MTM (t = 2.495; p = 0.013), and MTE (t = 2.926; p = 0.003); therefore, hypothesis H1.2 is partially supported.

On the other hand, the size of firm has a positive and significant effect on the use of the accounting tools with the traditional management tools (t = 3.533; p = 0.000) and management tools related to export (t = 1.693; p = 0.090Footnote 4), but has no effect on the use of the modern management tools (t = 0.725; p = 0.469). Consequently, hypothesis H2.1 is partially supported.

Moreover, the size of the firm has a positive and significant effect on the degree of formalism (t = 3.223; p = 0.001). Therefore, hypothesis H2.2 is supported.

Besides, the age of the firm does not have a significant effect on the degree of formalism (t = 0.070; p = 0.944). Subsequently, hypothesis H3 is not supported. Table 7 shows the absence of a significant correlation between the firm’s age and the degree of formalism. Greiner’s model, as well as the empirical results by Davila (2005) and by Bonache et al. (2015), explain this by the existence of a non-linear relation between these two variables.

Concerning the organic organizational structure, it was found that it has a positive and significant effect on all the following sophisticated characteristics of the AIS: scope (t = 4.312; p = 0.000), timeliness (t = 2.199; p = 0.028), and aggregation (t = 3.148; p = 0.002). Thus, hypothesis H4 is supported.

Regarding the environment uncertainty, two analysis factors were identified, the ENV1, which is related to the availability of raw materials, commodity prices, and government regulations, do not affect the characteristics of the AIS. However, the ENV2, which is associated with the market demand in terms of quantity and quality, has a positive and significant effect only on the scope (t = 2.874; p = 0.004) and timeliness (t = 1.719; p = 0.086). In this way, it can be said that the environmental uncertainty contextual factor has a partial impact on the characteristics of the accounting information system. Consequently, hypothesis H5 is partially supported.

The results about the manager’s profile showed that the age of the manager does not have a significant effect on the use of the accounting management tools. Therefore, hypothesis H6.1 is not supported.

Similarly, experience does not have a significant effect on the used management tools, and subsequently, hypothesis H6.2 is not supported.

However, the variable training has a positive and significant effect on the MTT (t = 2.073; p = 0.038) but no effect on the MTM and MTE. As a result, hypothesis H6.3 is partially supported.

Discussion

Based on the findings about exports, the dimension the IMPEX (namely the impact on the accounting software, on financial management, accuracy, volume, and frequency of the expected accounting information, the operating procedures, the complexity and profitability of activities, exported products, and the personal profile) has a positive and significant effect on the degree of formalism. In fact, it can be deduced that the greater the impact that exports have, the higher formalism will be. However, the dimension, the INTEX, has no impact on the degree of formalism. This can be explained by the fact that even with minimal export operations, there is always a procedure to follow.

To validate the relationship between exports and accounting management tools, the results showed that the MEXP variable has a positive relationship with the MTT (cost accounting, full cost accounting, direct cost calculation, analysis of budget variances, and scoreboard) and the MTE (the analysis of the profitability of foreign markets, analysis of the profitability of foreign customers, and analysis of the logistics costs caused by export), but it has no significant relationship with the MTM (benchmarking analysis, analysis of the value chain, life cycle analysis of the product, profitability analysis of the principal product, and profitability analysis of the principal client).

In fact, the IMPEX variable was found to have a positive and significant relationship with the MTT, MTM, and MTE.

This work emphasizes that the firm’s size has an effect only on the use of the accounting tools among the traditional and the export-related management tools. Consequently, the relationship between the size and the management tools is partially supported. This result does not confirm the expectation that more sophisticated management accounting tools are likely to be implemented by larger companies (e.g. Abdel-Kader and Luther 2008; Haldma and Lääts 2002).

In fact, this can be explained by the specific nature of the business activity, either it is complex or not, as well as by the managers’need to use the management tools. Additionally, the use of sophisticated management cannot necessarily answer the managers’needs who can be satisfied even with the use of basic and simple management tools.

In the Tunisian context, Lassoued and Abdelmoula (2006) showed that the use of accounting data by managers increases with the size of the company, confirming the results of Bajan-Banaszak (1993), Chapellier (1994) and Lavigne (2002).

It was found that the size of the firm has a positive and significant effect on the degree of formalism. Therefore, this can be explained by the fact that the greater the company’s size, the higher formalism in the SMI will be, which helps overcome the control problems. Therefore, managers need more formal management to run their businesses easier especially when the company becomes large.

Additionally, the age of the firm was found to have no impact on the degree of formalism. Thus, the necessity to have a certain degree of formalism in the SMI is not related to the contextual factor. This result converges with the study of Chapellier (1994) that tested the relationship between the firm’s age and the complexity of the accounting information systems on a sample of 113 French SMEs, but found no connection between these two variables. These results are quite consistent with those found by Affes and Chabchoub (2007), Ben Hamadi et al. (2011) and Ngongang (2007, 2013). Articles by Davila (2005) and Bonache et al. (2015) showed that the size effect on the relation between the firm’s age and complexity is really small and contingent.

As for the organic organizational structure, it was found to have a positive and significant effect on all the sophisticated characteristics of the AIS; scope, timeliness, and aggregation.

This indicates that managers require the use of broad-scope information, which is external, non-financial, and future-oriented. Moreover, they need more timely information in terms of frequency and speed of reporting. Actually, managers are more likely to use aggregated information in various forms, such as by time period, functional areas, or decision models. In fact, the use of the characteristics of the broad scope, timeliness, and aggregation, characteristics of the AIS would be useful for the decision making process.

We can say that such information is necessary for executives to better manage their decisions. This converges, in part, with the recent work of Hammad et al. (2013) who found a positive relationship only with the timeliness and aggregation. However, Chenhall and Morris (1986) showed that decentralization has strictly an impact on aggregation.

Regarding the environment uncertainty, two analysis factors can be identified; the ENV1, which is related to the availability of raw materials, commodity prices, and government regulations, does not affect the characteristics of the AIS. However, the ENV2, which is associated to market demand in quantity and quality, has a positive and significant relationship with the scope and timeliness but no significant effect on aggregation. This result is in line with the study of Chenhall and Morris (1986), who found that environment uncertainty is significantly associated with the scope and timeliness, but not with aggregation.

On their part, Hammed et al. (2013) discerned a negative significant relationship with the environment uncertainty as well as with the types of information scope, timeliness, and aggregation. On the other hand, Chapellier et al. (2013) showed that when the environment is uncertain, most the SMEs have a complex accounting information system.

Therefore, it can be deduced that the environment uncertainty is greater in firms where managers have a greater need to gather additional information to reduce and control environmental uncertainty. This result was also supported by Boujelbene and Affes (2015) in the Tunisian context. In this way, it can be said that managers facing uncertainty should be provided with information to enhance their decisions.

The results about the manager’s profile revealed that the manager’s age does not explain the effect on the use of accounting management tools.

Similarly, experience was found to have no significant effect on the used management tools. This result is in line with the work of Lassoued and Abdelmoula (2006), Ngongang (2007), Ben Hamadi and Chapellier (2010), Ben Hamadi et al. (2011), Chapellier and Mohammed (2010) and Chapellier et al. (2013).

However, the training variable was found to have a significant and positive effect on the MTT but no effect on the MTM and MTE. On the other hand, Lassoued and Abdelmoula (2006) showed that the leader’s training level is significantly related to the degree of use of accounting data without clearly determining the direction of the relationship. Therefore, it can be deduced that if a manager is trained in management, she/he will have more traditional management tools (as the cost accounting, the complete cost price, the direct cost price, the analysis of budget variances, the operational dashboard), the same modern management tools (like the ABC, the benchmarking, the value chain analysis, the product life cycle analysis), as well as management tools related to exports (like analysis of the foreign market profitability, the analysis of the foreign customers’profitability).

Conclusion

The purpose of this paper is to identify the structural and behavioral factors that influence the design of the accounting information system in the Tunisian SMIs through the characteristics of information, accounting management tools, and degree of formalism. For this purpose, the data were collected using a questionnaire administered to 221Tunisian companies operating exclusively in the industrial sector. The results showed that the design of accounting information system is influenced by several factors, using the methods of partial least squares with SmartPLS software.

This work contributes, in theory, to the debate on the design of accounting information system in SMEs in the developing countries, such as Tunisia. The choice of Tunisia is explained by the lack of studies on the accounting information system in developing countries since the majority of previous studies were carried out in the developed countries.

Methodologically, the partial least squares path modeling was used to test the conceptual model. Despite their complexity, these methods present several advantages compared to conventional statistical approaches, such as multiple regression analysis. In addition, they help construct and test the validity and reliability of latent constructs developed from a combination of items (measurement scales). These methods are also used when sample size is small; the data are non normally distributed, or when complex models with many indicators and model relationships are estimated.

On the managerial level, this study can enrich the reflections and analyses of professional accountants in shedding light on the AIS and help them to improve their businesses. It can be also useful in relation to the Tunisian regulatory organism to develop new laws to improve the accounting information system of companies. Furthermore, to focus on companies that have an exclusively local market, new laws were developed to improve the AIS and the analytical system. However, as any scientific work, this research has limitations. At the theoretical level, there is a limited number of variables that prove to be crucial in explaining the accounting information system.

However, the ones that were discarded could contribute by their integration, to increase the explanatory power of the proposed model. Therefore, it would be interesting to incorporate in future research other variables that were not included in this research for practicability reasons.

Notes

The database has been used is of the Tunisian Agency for the Promotion of Industry and Innovation (API) (www.tunisieindustrie.nat.tn) to identify this population of 5731 companies.

The questionnaire has been mailed by the same interviewer. There are no difference between earlier and late interview to reveal biases.

Significance level of 10%

Significance level of 10%

References

Abdel Kader, M., & Luther, R. (2008). The impact of firm characteristics on management accounting practices: a UK based empirical analysis. Br Account Rev, 40(1), 2–27.

Affes, H., & Chabchoub, A. (2007). Le système d’information comptable : les déterminants de ses caractéristiques et son impact sur la performance financière des PME en Tunisie. La Revue des Sciences de Gestion, Direction et Gestion, 224-225, 59–68.

Al-Omri, M., & Drury, C. (2007). A survey of factors influencing the choice of product costing systems in UK organizations. Manag Account Res, 18(4), 399–424.

Baines, A., & Langfield-Smith, K. (2003). Antecedents to management accounting change: a structural equation approach. Acc Organ Soc, 28(7–8), 675–698.

Bajan-Banaszak, G. (1993). L’expert-comptable et le conseil en gestion, Revue Française de Comptabilité, n° 249, 95–101.

Ben Hamadi, Z.,& Chapellier, P. (2010). Le système de données comptables des dirigeants de PME tunisiennes: Facteurs de contingence et impact sur la performance financière. Management International.

Ben Hamadi, Z., Bonache, A.B., Chapellier, P. & Mohammed, A. (2011). Les déterminants de la complexité des systèmes de données comptables des dirigeants de petites et moyennes entreprises : Une méta-analyse sur données individuelles, Hal.archives ouvertes.fr/docs/00/64/65/18/PDF/Ben_Hamadi.pdf.

Ben Hamadi, Z., Chapellier, P. & Villeseque-Dubus, F. (2014). Innovations budgétaires en PME : l’influence du secteur d’activité et du profil du dirigeant, Innovations, p 223–252.

Begon, G. (1990). Le système d’information de synthèse dans les PME : Un marché. Mémoire d’expertise comptable, 98 p. + annexes.

Berland, N., & De Rongé, Y. (2013). Contrôle de gestion. France: Pearson Education.

Bernard, O. (2010). Système de contrôle de gestion et trajectoire du propriétaire-dirigeant de petite entreprise : Le secteur de l’agencement d’intérieur dans le Grand-Est. Thèse de Doctorat en sciences de gestion, Université Paris-Est - Marne la Vallée.

Bonache, A. B., Chapellier, P., Ben Hamadi, Z., & Mohammed, A. (2015). Les déterminants de la complexité des systèmes d’information comptables des dirigeants de PME : contingences culturelles et endogénéité. Manag Int, 19(3), 148–168.

Boubakri, W. B., Zghidi, A. B. Y., & Zaiem, I. (2013). The effect of export stimuli on export performance: the case of the Tunisian industrial firms. International Review of Management and Business Research, 2(1), 155–167.

Boujelbene, M. A., & Affes, H. (2015). Impact of environmental uncertainty on the relationship between budgetary participation and managerial performance and job satisfaction: some Tunisian evidence. International Journal of Accounting and Finance, 5(1), 27–47.

Burns, T. E., & Stalker, G. M. (1961). The management of innovation. University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship.

Chang, R. D., Chang, Y. W., & Paper, D. (2003). The effect of task uncertainty, decentralization and AIS characteristics on the performance of AIS: an empirical case in Taiwan. Information and Management, 40(4), 691–703.

Chapellier, P. (1994). Comptabilités et systèmes d’information du dirigeant de PME : essai d’observation et d’interprétation des pratiques. Doctorat en sciences de gestion, Montpellier: Université de Montpellier II.

Chapellier, P. (2011). Vers un modèle de gestion hybride pour le dirigeant de PME : Une étude de la triangulation entre système d’information formel, recours à l’expert et mètis du dirigeant. Habilitation à Diriger des Recherches – Université de Nice Sophia Antipolis.

Chapellier, P., & Ben Hamadi, Z. (2012). Le système de données comptables des dirigeants de PME tunisiennes: complexité et déterminants. Manag Int, 16(4), 151–167.

Chapellier, P. & Mohammed, A. (2010). Les pratiques comptables des dirigeants de PME Syriennes dans un contexte de libéralisation de l’économie. 31ème Congrès de l’Association Francophone de Comptabilité (AFC), Nice.

Chapellier, P., Mohammed, A., & Teller, R. (2013). Le système d’information comptable des dirigeants de PME syriennes : complexité et contingences. Management & Avenir, 65(7), 48. doi:10.3917/mav.065.0048.

Chenhall, R. H. (2003). Management control systems design within organisational context: findings from contingency-based research and directions for the future. Accounting, Organisation and Society, 28, 127–168. doi:10.1108/18347641011023270.

Chenhall, R. H., & Morris, D. (1986). The impact of structure, environment, and interdependence on the perceived usefulness of management accounting systems. Account Rev, 61(1), 16–35.

Chenhall, R. H., & Langfield-Smith, K. (1998). The relationship between strategic priorities, management techniques and management accounting: an empirical investigation using a systems approach. Acc Organ Soc, 23(3), 243–264.

Chia, Y. M. (1995). Decentralization, management accounting systems (MAS) information characteristics and their interaction effects on managerial performance: a Singapore study. Journal of Business Finance & Accounting, 22(6), 811–830.

Chin, W. W. (1998). The partial least squares approach to structural equation modeling. In G. A. Marcoulides (Ed.), Modern methods for business research (pp. 295–336). Mahwah, NJ: Lawrence Erlbaum Associates, Publisher.

Choe, J. M. (1998). The effects of user participation on the design of accounting information systems. Information and Management, 34(3), 185–198.

Chong, V. K., & Chong, K. M. (1997). Strategic choices, environmental uncertainty and SBU performance: a note on the intervening role of management accounting systems. Account Bus Res, 27(4), 268–276.

Christ, L. K. & Burritt, R. L. (2013). Environmental management accounting: the significance of contingent variables for adoption. J Clean Prod, 41, 163–173 (online). Available: http://elsevier.com/locate/jelepro.

Condor, R. (2012). Le contrôle de gestion dans les PME : une approche par la taille et le cycle de vie. Revue internationale P.M.E. Economie et gestion de la petite et moyenne entreprise, 25(2), 77–97.

Coupal, M. (1994). Les PME, copie conforme de son fondateur. Revue Organisation, 3(1), 39–44.

Daft, R. L., & Lengel, R. H. (1986). Organizational information requirements, media richness and structural design. Manag Sci, 32(5), 554–571.

Daft, R. L., & Macintosh, N. B. (1981). A tentative exploration into the amount and equivocality of information processing in organizational work units. Adm Sci Q, 26, 207–224.

Davila, T. (2005). An exploratory study on the emergence of management control systems: formalizing human resources in small growing firms. Acc Organ Soc, 30(3), 223–248.

Davila, A., Epstein, M.J. & Manzoni, J.F.(2012). Performance Measurement and Management Control: Global Issues.Emerald Books, Studies in Managerial and financial accounting, 25.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. J Mark Res, 48, 39–50.

Gerdin, J. (2005). Management accounting system design in manufacturing departments: an empirical investigation using a multiple contingencies approach. Accounting, Organization and Society, 30(2), 99–126.

Germain, C. (2000). Contrôle organisationnel et contrôle de gestion : la place des tableaux de bord dans le système de contrôle des petites et moyennes entreprises. Thèse de doctorat en sciences de gestion, Bordeaux, Université Montesquieu- Bordeaux IV.

Gordon, L. A., & Narayanan, V. K. (1984). Management accounting systems, perceived environment uncertainty and organization structure: an empirical investigation. Accounting Organizations and Society, 9(1), 33–47.

Govindarajan, V. (1984). Appropriateness of accounting data in performance evaluation: an empirical examination of environmental uncertainty as an intervening variable. Acc Organ Soc, 9(2), 125–135.

Greiner, L. E. (1972). Evolution and revolution as organizations grow. Harv Bus Rev, 76(3), 3–11.

Gul, F. A. (1991). The effects of management accounting systems and environmental uncertainty on small business managers’ performance. Account Bus Res, 22(85), 57–61.

Hage, J., & Aiken, M. (1969). Routine technology, social structure, and organization goals. Adm Sci Q, 14(3), 366–376.

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2014). A primer on partial least squares structural equation modeling (PLS-SEM). Thousand Oaks, CA: Sage ISBN 9781452217444.

Haldma, T., & Lääts, K. (2002). Contingencies influencing the management accounting practices of Estonian manufacturing companies. Manag Account Res, 13(4), 379–400.

Hammad, S. A., Jusoh, R., & Ghozali, I. (2013). Decentralization, perceived environmental uncertainty, managerial performance and management accounting system information in Egyptian hospital. Int J Account Inf Manag, 21(4), 314–330.

Holmes, S., & Nicholls, D. (1989). Modelling the accounting information requirement of small business. Account Bus Res, 19(74), 143–150.

Jänkälä, S. (2007). Management control systems (MCS) in the small business context : Linking effects of contextual factors with MCS and financial performance of small firms. http://herkules.oulu.fi/isbn9789514285288.

Kalika, M. (1987). Structures d’entreprises, réalités, déterminants, performances. Economica

Kossaï, M., & Piget, P. (2014). Adoption of information and communication technology and firm profitability: empirical evidence from Tunisian SMEs. The Journal of High Technology Management Research, 25(1), 9–20.

Lacombe-Saboly, M. (1994). Les déterminants de la qualité des produits comptables des entreprises : Le rôle du dirigeant. Thèse de Sciences de Gestion, Université de Poitiers.

Lassoued, K. & Abdelmoula, I. (2006). Les déterminants des systèmes d’information comptables dans les PME: une recherche empirique dans le contexte tunisien. 27ème Congrès de l’Association Francophone de Comptabilité (AFC), Tunis.

Lavigne, B. (1999). Contribution à l’étude de la genèse des états financiers des PME. Thèse de Sciences de Gestion - Université Paris Dauphine.

Lavigne B. (2002). Contribution à l’étude de la genèse des états financiers des PME, Comptabilité, Contrôle, Audit, Tome 8, Vol. 1, mai, 25–44.

Lawrence, P. R., & Lorsch, J. W. (1967). Differentiation and integration in complex organizations. Adm Sci Q, 12(1), 1–47.

Lefebvre, E. (1991). Profil distinctif des dirigeants de PME innovatrices. Revue internationale PME, 4(3), 7–26.

Lisi, I. E. (2016). Determinants and performance effects of social performance measurement systems. J Bus Ethics, 38, 1–27. doi:10.1007/s10551-016-3287-3.

Manteghi, N., & Jahromi, S. K. (2012). Designing accounting information system using SSADM1 case study: south fars power generation management company (SFPGMC). Procedia Technology, 1, 308–312.

Merchant, K. A. (1981). The design of the corporate budgeting system: influences on managerial behavior and performance. Account Rev, 4, 813–829.

Merchant, K. A. (1984). Influences on departmental budgeting: an empirical examination of a contingency model. Acc Organ Soc, 9(3), 291–307.

Merchant, K. A., & Van der Stede, W. A. (2011). Management control systems: performance measurement, evaluation and incentives. Harlow, UK: Prentice Hall.

Mintzberg, H. (1973). The nature of managerial work. New York: Harper & Row.

Mintzberg, H. (1982). Structure et dynamique des organisations. Paris: Les Editions d’Organisation.

Nelson, G. W. (1987). Information needs of female entrepreneurs. J Small Bus Manag, 25, 38–44.

Ngongang, D. (2007). Analyse des facteurs déterminants du système d’information comptable et des pratiques comptables des PME tchadiennes. La Revue des Sciences de Gestion, Direction et Gestion, 224-225, 49–57.

Ngongang, D. (2010). Analyse de la pratique des coûts dans les PMI camerounaises. Revue Libanaise de Gestion et d’Économie, 3(5), 92–114.

Ngongang, D. (2013). Système d’information comptable et contrôle de gestion dans les entreprises camerounaises. La Revue Gestion et Organisation, 5(2), 113–120.

Nobre, T. (2001). Méthodes et outils de contrôle de gestion dans les PME. Finance –Contrôle– Stratégie, 4(2), 119–148.

Nunnally, J. C. (1978). Psychometric theory (2nd ed). New York: McGraw-Hill.

Otley, D. (1980). The contingency theory and management accounting: achievement and prognosis. Acc Organ Soc, 5(4), 413–428.

Post, J., & Epstein, M. J. (1977). Information systems for societal reporting. Acad Manag Rev, 2(1), 81–87.

Ramli, I., & Iskandar, D. (2014). Control authority, business strategy, and the characteristics of management accounting information systems. Procedia - Social and Behavioral Sciences, 164, 384–390.

Reid, G. C., & Smith, J. A. (2000). The impact of contingencies on management accounting system development. Manag Account Res, 11(4), 427–450.

Reix, R. (1984). Quelques facteurs affectant l’utilisation d’informations de caractère comptable. Actes du congrès de l’Association Française de Comptabilité, Nice.

Saganuwan, M. U., Ismail, W. K. W., & Ahmad, U. N. U. (2013). Technostress: mediating accounting information system performance. Information Management and Business Review, 5(6), 270–277.

Santin, S. & Van Caillie, D. (2008). Le design du système de contrôle de gestion des PME : Une quête de stabilité adaptative. 29ème Congrès annuel de l’Association Francophone de Comptabilité, Paris.

Sekaran, U. (2003). Research methods for business—a skill building approach (4th ed.). USA: John Wiley and Sons, Inc..

Sisaye, S., & Birnberg, J. (2010). Extent and scope of diffusion and adoption of process innovations in management accounting systems. Int J Account Inf Manag, 18(2), 118–139.

Sori, Z. M. (2009). Accounting information systems (AIS) and knowledge management: a case study. American Journal of Scientific Research, 4, 36–44.

Soudani, S. N. (2012). The usefulness of an accounting information system for effective organizational performance. International Journal of Economics and Finance, 4(5), 136–145.

Stepniewski, J., Souid, S. & Azzabi, L. (2008). La relation facteurs de contingence, complexité du système d’information comptable et performance financière. www.scribd.com/doc/51654351/La-relation-facteurs-de-contingence. Accessed 06/11/2010.

Vallerand, J., Morrill, J. & Berthelot, S. (2008). Positionnement de la PME manufacturière canadienne face aux outils de gestion enseignés dans les programmes de formation universitaire en administration. 9ème Congrès International Francophone sur l’Entrepreneuriatet les PME, Louvain-la-neuve.

Zghidi, A.B.Y. & Zaiem, I. (2011). Stratégie d’adaptation du produit et performance à l’export : Effets du secteur d’activité et des caractéristiques internes de l’entreprise. 20ème Conférence d’AIMS, Nantes.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ghorbel, J. A Study of Contingency Factors of Accounting Information System Design in Tunisian SMIs. J Knowl Econ 10, 74–103 (2019). https://doi.org/10.1007/s13132-016-0439-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-016-0439-8