Abstract

The paper aims to study the role of technological change in growth through the analysis of the technology spillovers and their transmission channels in five manufacturing industry in Tunisia for the period 1970–2012. Technology plays an important role as a source of growth. However, the understanding of mechanisms by which technology involved in determining business performance differs depending on the industry studied (depending on whether it is high or low technology), the level of human capital, and also the importance of trade and the foreign direct investment. In this perspective, the empirical study is to analyze the relationship between total factor productivity (TFP) (as an indicator of technological progress) and the determinants of technological diffusion. Empirical results suggest that openness to foreign companies and the Trade in Information and Communication Technologies (ICT) had a significant role in the diffusion of technology but the presence of foreign firms has not been a vehicle for technology diffusion for the Tunisian manufacturing sector. This reveals that the diffusion of technology requires certain conditions such as the importance of research and development (R&D) and improving the absorption capacity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The technological changes have an effect on the long-term growth (Solow 1956; Klenow and Rodriguez-Clare 1997). In addition, the differences in technology represent an important determinant of the differences in the total factor productivity (TFP) across countries (Hall and Jones 1999; Romer 1990). Technological diffusion is a key element in upgrading developing countries. Technological change may be seen as a specific feature of the broad concept of “structural change”, seen as different arrangements of productive activity in the economy. As noted by Silva and Teixeira (2008) in their comprehensive survey on the matter, the composition of the economy and its relation with technology change has traditionally been seen as an important factor influencing growth, although with a varying degree of attention over time. Therefore, it would be efficient for developing countries to acquire foreign technology created in the developed countries. In principle, if the innovations are easy to diffusion, a technologically backward country could catch up rapidly by absorbing the most advanced technologies.

The determinants of technological change can be classified into two categories. They can be either exogenous (not dependent on the economic conditions) or endogenous (that meets the economic obligations). Technological change is characterized by three stages: the invention, the innovation, and the diffusion. The first two steps are part of the activity of the research and development (R&D). However, the interaction between the R&D and the diffusion may well determine and describe the process of technological change. Usually, we measure the productivity changes with the growth of the TFP. For advanced nations, the literature (Coccia 2012) shows a positive correlation between R&D intensity (usually measured as a percent of gross domestic product (GDP) or R&D per capita) and various measures of economic growth, including GDP, TFP, and labor productivity. (Coccia 2012) notes that a recent analysis of 65 countries over the 1965–2005 period indicates that a 10 % increase in R&D per capita generates an average increase of about 1.6 % in the long-run TFP. One pertinent issue is to examine the determinants of technological diffusion in the Tunisian manufacturing sector. The literature has been extended into a couple of directions (Coe et al. 2008), the measurement of foreign R&D capital stock to account for the different diffusion channels, the model specification (controlling for additional relevant factors that explain the spillover mechanism), and the econometric techniques used (panel cointegration).

Several empirical studies have focused on the effect of technology and channels of transmission spillovers. Most of these studies found that the new advanced technology can be transferred in the developing countries through the foreign direct investment (FDI). Some empirical research shows that technology transferred through FDI has positive effects on developing countries (Eden et al. 1997; Kokko et al. 1996; Buckley et al. 2002). An analysis of the Chinese firms (Du et al. 2011) found that the foreign presence has a significant impact on the domestic firms through backward and forward (vertical) linkages. In a similar approach (Jordaan 2011), using a cross section finds the evidence of the technology diffusion from the foreign direct investment spillovers. However, it should be noted that knowledge spillovers from the foreign presence may take time to manifest themselves. Other scholars (Todo et al. 2011) found that R&D stock plays a significant role in determining the technological diffusion. However, Suyano et al. (2009) find evidence of technological transfer through competition effects from the foreign presence in the industry using Indonesian firm data for chemical and pharmaceutical industries. Study (Jarkovic and Spatareanu 2011) showed that the spillovers productivity exists through the backward linkage in Romania. They find that the foreign investment and the existence of trade agreements between the host and home country have positive effects on the domestic producers. The literature has also emphasized the importance of the human capital in the process of technological transfer. There many works which consider the learning and the human capital as a source of growth especially in the technological change in a host country. By Nelson and Phelps (1966), the technology diffusion depends on the level of education, Cohen and Levinthal (1989) argue that adoption of technology diffusion depends on the level of the human capital. As well as Engelbrecht (2002) found a positive effect of the human capital in the absorption of the international knowledge spillovers. Kneller (2005) concludes that the effect of technology spillovers varies according to the level of the human capital, the domestic R&D, and the physical distance. Technology spillovers may also take place along the spatial/regional dimension, where knowledge spillovers are geographically localized (Audretsch and Feldman 1996; Jaffe et al. 1993), and there may be geographic boundaries to information flows and knowledge spillovers among the firms in an industry (Krugman 1991).

Section “Determinants of the Technological Diffusion” analyzes the determinants of technology transfer in the Tunisian manufacturing industry. Section “The Empirical Study” analyzes the possible benefits from international technology transfer. Section “Empirical Result and Discussion” presents the empirical results and their discussion. Finally, Section “Conclusion” concludes.

Determinants of the Technological Diffusion

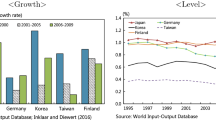

The experience of Asian emerging countries is the best example in terms of technological diffusion. By 2007, China was ranked among the four largest economies in the world in terms of total GDP. In 2008, these economies continued to grow much faster that the world 1.7 % average (see Fig. 1). The growth in these countries was explained largely by the positive effect of technological diffusion through its various channels. However, a various literature surveys on the technological spillovers have identified several channels through which productivity spillovers may occur. In this account, a number of factors, namely, openness to trade, productive specialization, and education (human capital) have been identified by several studies as crucial factors for the adoption and development of technology. Human capital, in particular, acts in two different fronts: directly, as a production factor), and indirectly, by enabling imitation and technological catching up (Castellacci 2008, 2011). To the extent that education backwardness makes difficult the development of more knowledge-intensive sectors and the adoption of new technologies, and since these sectors generally induce a significant growth bonus, relatively low human capital levels may inhibit growth. A study which involved the Portuguese case, showed that human capital is, constitutes one of the most consensual factors underlying the country’s growth difficulties (Veugelers and Mrak 2009; Silva and Teixeira 2011; Lains 2008).

Recently, empirical studies (Seck 2012) show that in effect, the spillover gains associated with an increase in foreign R&D capital available through the FDI channel increase by only 0.0002 point as the FDI stock ratio increase by one percentage point. This result could indicate that a relatively small number of foreign companies are necessary to bring the bulk of foreign technology new to the domestic economy and from which local firms can learn. As FDI keeps increasing, any new foreign activities will not add very much to the existing stock and will more likely bring redundant knowledge or ideas, which the economy has already absorbed and assimilated.

Role of FDI in the Manufacturing Sectors in Tunisia

The manufacturing sector is the main contributor to the growth in Tunisia. There are about 72 % of the foreign firms operating in Tunisia which are totally exporting, generate 1/3 of total exports of Tunisia.

The entry of the foreign owned firms increases the level of competition within the industry as long as the share of their output is sold in the host country.

In addition, we note that the geographical position influences on the attractiveness of the and facilitates the diffusion of the knowledge and the technology which in turn had an impact on the human capital in Tunisia by contact with the multinationals which helps to learn the new practices of the foreign firms to the local firms. According to FIPA,Footnote 1 the accounted for in 2008, 7 % of the (see Fig. 2) and contributed to 23.3 % of the gross fixed capital formation and 38 % of the private investment.

Openness to Trade

The openness is an important factor for explaining the technological diffusion and the technological change. According to (Keller 1997), “Importing a foreign intermediate good [...] Allows a country to capture the R&D or technology-content of the good”. However, the international trade has an impact on the allocation of resources, thus allowing the development of industries and the redeployment of resources from the less efficient sectors to the more efficient sectors this therefore contributes to increased the TFP in particular for the developing countries of the intensive labor, the low level of development, and the strong ability to acquire and attract the human and the physical capital. The export increases the technical efficiency and improves the production process through learning new practices (Greenaway and Kneller 2003). Exposure to international competition may allow firms to learn about the new technologies. Indeed, access to the intermediate inputs and the capital goods through the foreign imports may be associated with the higher growth for the productivity.

The opening of the Tunisian economy and the creation of a free trade area with Europe for the industrial products since 2008 has resulted in a reversal of the positive trend in the TFP. In a zero growth over the period 1980–1990, the TFP has increased steadily to 1.24 % on average in 1990 and 1.38 % for the period 2001–2006 (Banque 2010).

Tunisia has strengthened its integration into the international economy since 1990. The international opening of Tunisia has made the foreign trade and the foreign investment, the two main drivers of the growth. The opening of the economy rate is 107.33 % in 2009Footnote 2 higher than in Turkey (47.66 %) and Morocco (68.08 %). Better integration of the onshore economy will increase the effects of spillovers in terms of the growth and the job creation.

Education Level and Research and Development

The R&D activities play an important role of creating knowledge and promoting learning and absorptive capacity (Aghion and Howitt 1998; Griffith et al. 2004). R&D activities in local universities and research institutions also importantly contribute to a country’s absorptive capacity.

Many countries have spent significant and rising shares of GDP on royalty and licensing fees for foreign technology acquisition. In 2009, the total R&D expenditure in Tunisia is 1.0341 and 1.70198 % in China, in terms of its gross R&D expenditure to GDP ratio. The total R&D expenditure in Tunisia was greater than that of Turkey (0.84902 %) and moving close to the Italy and Brazil (see Fig. 3).

However, the education level is an indicator of the human capital, it can test the absorbency and measures the level of the control and the use of the technologies. This variable can be included in determining the technological change.

In addition, the absorption capacity focuses on how local workers have to develop their skills through FDI inflows undertaken by multinational enterprises (MNEs) who find their direct investment activities in their countries and use economic, financial, and technological incentives considerable. In addition, the measurement of the absorption capacity that determines whether domestic firms benefit from productivity spillovers of FDI must be expressed in the productivity performance of these economies. If the economy shows technological progress means that the economy has transferred the technology from multinationals to domestic firms and developed the capacity of the human capital that can be used to develop a productivity-oriented economy. This is called the driving FDI effect.

Tunisia has in 2010 a comprehensive system of the innovation and the technical support to the firms, it is composed of an upper for Scientific Research and Technology to identify policy options, 15 research centers board (146 laboratories and 638 research units), eight sector technical centers to provide technical support to enterprises, 9 technology parks, a national institute of standards and intellectual property agency to promote the research, the innovation and the creation of firms.

The introduction of new technologies in firms requires the promotion of R&D (R&D). R&D is an important determinant of competitiveness and a necessary condition for the transfer and the technological development, as well, spending on R&D generally reflect the effort of the country in the creation and exploitation of new knowledge and technologies. In this context and in order to encourage companies to invest in R&D, Tunisia has implemented a program upgrade (PMN) which aims to stimulate the R&D. The implementation of this program has helped the firms to integrate technology in their industrial activities. These are large firms that have benefited most from the program upgrade, since 81 % of them have at least an industrial technology against 70 % Footnote 3 for small and medium firms.

The analysis by sector showed that the firms in the mechanical and electrical industries and textile clothing industries are those that provide relatively great importance to the contribution of the technological progress to production with 93 and 90 %, respectively.

In the building materials and glass ceramic industry, there are 58 % of the firms that have R&D activities followed by the chemical industry 54 % and the electrical mechanical industry 48 %. The sectors that have created more new products since joining the program upgrade is the mechanical and the electrical industry (47 %) followed by the chemical industry (19 %) and the building materials and the ceramic glass industry (16 %). Regarding the effort in the innovation and the R&D, the internal R&D expense as a percentage of in Tunisia reached 1.21 % in 2009 against 0.46 % in 2000, it is multiplied by three. This proportion remains below the levels observed in Finland and Korea, however, it is higher than that recorded in Turkey.

New Technologies of Information and Communication

Access to information and communication technologies (ICT) is a necessary condition for the establishment of a knowledge-based economy. If in addition, these technologies are used well, they help to achieve a good performance in terms of the growth and the productivity.

The ICT growth products over the period 2001–2011 have increased exponentially in Tunisia, with a peak of 54 % in 2010. The dynamics of the ICT products is reflected in the structure of the manufacturing trade. Indeed, over the period 2001–2010, the share of these products in exports increased from 4.3 to 11.4 %. This share is even consolidated in 2011, this share attained 13.6 % against 10.6 and 8.6 %, compared to the same period in 2010 and 2009Footnote 4. It is also clear that the change in the structure of the imports reveals the emergence of the products as their share of imports continues to rise, reaching 11.3 % in 2010, compared with 8 % in 2001.

Furthermore, the growth of the exports of the products is growing faster than the imports witch improved the coverage rate. Thus, the rate of coverage of the imports of the goods by the exports almost doubled between 2001 and 2010, 68 % against 37 %, respectivelyFootnote 5.

The Empirical Study

In this study, we try to determine, on the one hand, what are the channels through which technology can be diffused in the manufacturing sector in Tunisia, and in other hand, what is the effect of the diffusion of technology on economic growth?

Data

The data on the stock of capital, labor, and GDP are collected from the institute of the quantitative study data on foreign direct investment in each sector from the database of the agency promoting foreign investment in Tunisia (FIPA). The study will focus on five manufacturing sectors (food industries, building materials and ceramic glass industry, electrical appliances electronic industries chemical, and textile clothing industry). Imports and exports of products by sectorFootnote 6 are from the National Institute of Statistics (INS). Data on investment in R&D from the Ministry of Scientific Research, Technology and Skills Development (MRSTDC).

Methodology

The use of better production techniques and skills in human resources leads to an improvement in factor productivity and hence higher economic growth. So, productivity measures the efficiency with which an economy transforms inputs ‘capital and labor’ in the final product. Where Labor productivity is the GDP per hour worked or employment and capital productivity is GDP per unit of capital. According to Cohen and Levinthal (1989), TFP depends not only on the domestic stock of knowledge but also the stock of foreign knowledge. TFP measures allow an analysis of changes closely linked to the growth, production growth is the result of the growth of inputs and growth in productivity resulting from the use of improved production techniques (technological, organizational) and qualifications of human resources.

Measurement of TFP allows us to see if technological diffusion leads to an acceleration of productivity growth at the sector level. TFP at the sector level is quite heterogeneous; its evolution is determined by both structural and cyclical factors (international situation, external openness, technology investments, etc.). Before addressing the impact of new technologies on TFP in the manufacturing sector, we analyze first how this productivity assessed in previous years.

During the last years, the results recorded an improvement in the contribution of TFP to GDP growth from 26 % during the period 1992–1997 to 45 % during the decade 1997–2006, which translates as the effort on technological progress and improvement of qualification of the workforce. The increase of inputs generates contributions of 30 % for work and 24 % for capital.

In the following, we present some results on the evolution of labor productivity, capital and total productivity at the sectoral level manufacturing sector has a stagnation of the partial labor productivity, hovering around 2.2 % over the period 1987–2007. The international situation has affected the textile and leather clothing that chemistry has affected their productivity (0.7 % for textile clothing leather 2002–2007 and 2.0 % for chemicals). Capital productivity has achieved an average annual increase of 2.7 % over the period 1987 to 2007 with the investment effort in recent years and following a policy of targeting sectors with high added value.

According to the manufacturing sector, electrical engineering industries have been a substantial growth in the productivity of capital, due to the attractiveness and performance of this sector (8.9 % in average annual growth rate between 2002 and 2007), while the textile, clothing, and leather sector has been on the same period a decline in productivity of capital of 1.6 %. TFP chemistry sector grew at a high rate over the period 1987–1995 falling to 4.8 % in 1996–2001 and 1.6 % in 2002–2007. It is also the case of mechanical and electrical industries where TFP growth was 2 and 5.7 %, respectively, for the periods 1987–1995 and 1996–2001, 2002–2007, it grew 7.3 % of TFP. For clothing textile leather, after a growth rate of 4 and 3.2 % recorded in the periods 1987–1995 and 1996–2001, has seen its TFP decreased during the period 2002–2007 to 1.1 %, this decrease is related to the difficulties faced by this sector on the European market.

Measuring the TFP is based on the estimation of a function production. Our estimates are conducted on the basis of sectoral data (firms belonging to the Tunisian manufacturing sector), we used a production function of Cobb-Douglas as follows:

With Y, K, and L are respectively the volume of production sector manufacturing, the stock of capital and number of workers employed in period t. The parameters α and β are elasticities of production capital and labor, respectively, and A is the technical progress or TFP. TFP can be written as follows:

Transforming the above production function into logarithms allows linear estimation, and henceforth small letters will be used for logs. A simple standard estimation equation of the production function then looks as follows:

The residual of this equation is the logarithm of specific TFP.

Model

Firstly, we estimate this model expressed by the following equation (see Table 1):

Where:

-

TFPG: TFP growth in the manufacturing industry,

-

FP: Share of foreign companies in the manufacturing industry as measured by FDI in the manufacturing sector in total FDI,

-

O p e n n e s s: Trade ratio of value added of manufacturing sector,

-

ICT: The sector of ICT output growth in manufacturingFootnote 7, ICT includes variables that measure investments in ICT, four indicators are used: Internet, telephone, mobile and ICT imports. All variables are transformed to logarithmic form. Finally, we introduce an interaction term between FP and ICT import variables to check whether the impact of technological diffusion through FDI channel is strengthened by better ICT infrastructure,

-

L F Footnote 8: Percentage of employed person acquired tertiary education.

The results reported in Table 1 (in columns 2, 3 and 4) show that ICT penetration (Internet and telephone, mobile) has a significant and positive causal link on TFP growth. This is in accordance with (Hassan 2005) finding which highlights that ICT is essential to growth, necessary to develop a country’s productive capacity in all sectors of the economy, and links a country with the global economy and ensures competitiveness. ICT import rate enters significantly positive proving that a high share of ICT import in total services imports stimulates TFP growth, (a 10 % growth of imports of ICT leads to TFP growth of a 0.3 %).

In columns 2, 3, and 4, the impact of the telephone penetration rate on TFP growth appears stronger than that of mobile and Internet penetration rate. This is consistent with the findings of Andrianaivo and Kpodar (2011).

Column 1 shows that FDI may have a positive impact on economic growth in Tunisia depending on the level of ICT diffusion in manufacturing sector. However, countries with high level of ICT diffusion have the potential to attract FDI which is now regarded as a key channel of technology diffusion.

The TFP growth is explained by the level of human capital as a significant relationship between TFP and the labor force as a proxy for human capital. In columns 1 and 2, the negative effect of this variable (LF) is explained by the low level of human capital in the absorption of technologies arising from the inefficiency of the Tunisian educational system.

Trade openness and foreign direct investment (FP) have a significant impact on TFP growth. The positive effect of openness is proving that reducing trade barriers foster technological diffusion. While the negative effect of FP on TFP growth may be due to the lack of investment in hi-tech industries, most of the investments are concentrated on weak industrial sectors such as the textile sector. The foreign presence has not been a vehicle for technology diffusion for the Tunisian manufacturing sector. In column 5, we introduce Internet, mobile and telephone variables in Eq. 4. The results showed the existence of a problem of autocorrelation. To fix this problem, we introduce the lag of the dependent variable (lag TFP).

Technologies Spillovers and its Relationship with the Growth of Tunisian Economy

Foreign direct investment, R&D investment, and exportation and importation are chosen to explain variables, and the model adopted can be expressed as follows:

Where TFP is total factor productivity, i means sector (i = 1…5), and t means period (t = 1990…2012).

-

FDI: foreign direct investment

-

RD: is R&D by sector

-

X: exportation by sector

-

M: importation by sector

We use a panel study based on manufacturing industries in five sector for the period 1970 −2012 where we note:

-

Sector 1 S1: Food industry

-

Sector 2 S2: Industry of building materials ceramic glass

-

Sector 3 S3: Industry of electric and electronic

-

Sector 4 S4: Industry of chemical

-

Sector 5 S5: Industry of textile and clothing chemical.

Empirical Result and Discussion

The fixed effect model results in Table 2 shows that the FDI, exportation, and importation have a significant impact of TFP growth, with estimated values of 0.0815572, 0.2949714, and (-0.3060951), respectively. The R&D (R&D) has positive but insignificant effect on TFP growth (technology diffusion).

In this respect, the econometric result of the analysis has shown that FDI and trade were the most important channels in the diffusion of technology. We have seen the R&D has a insignificant effect on TFP which leads us to conclude that the effect of technology transfer is limited in Tunisia.

This is explained partly by the weakness of FDI in sectors incorporating high technology and low absorption capacity and secondly, offshore companies are export-oriented without a link with local industry. Technology transfer can be beneficial for the development of national technological capabilities. This implies that Tunisia needs to reinforce the investment in R&D.

To control transfers of technologies, it is essential to attract investment and to direct them to the technology intensive sectors and strengthen the development of human capital capable of assimilating all foreign technologies.

Conclusion

This paper explore how a developing country like Tunisia could benefit from technology spillovers and to what extent trade, FDI, and new technologies (ICT) can be a most suitable vehicle for technology diffusion to increase productivity. Since the 1970s, Tunisia has made FDI an important factor in its economic and social development.

Therefore, the trade openness and the introduction of new ICT are seen as a catalyst that is manifested by technological externalities transmitted through international trade. The evidence suggests that the benefits of international technology diffusion depend on the work force and the countrys ability to assimilate and disseminate these technologies developed.

Our results reveal that the interaction term of between FP and ICT penetration is significantly positive which proves that manufacturing sector in Tunisia can benefit from foreign direct investment only once a threshold of ICT development is reached. This implies that Tunisia needs to reinforce ICT infrastructure.

This is explained partly by the weakness of FDI in sectors incorporating high technology and low absorption capacity, and secondly, offshore companies are export-oriented without a link with local industry. Technology transfer can be beneficial for the development of national technological capabilities. To control transfers of technologies, it is essential to attract investment and to direct them to the technology-intensive sectors and strengthen the development of human capital capable of assimilating all foreign technologies.

Notes

Agency promoting foreign investment.

African Development Bank, Report 2012-2013.

From Tunisian Institute of Competitiveness and Quantitative Studies.

From national institute of statistics.

Tunisian Institute of Competitiveness and Quantitative Studies.

We considered the exports and imports of only three sectors for the unavailability of data for other sectors.

Externalities related to ICT are widely spread in the economy that can increase efficiency and productivity rate of technical progress.

W e u s e l a b o r f o r c e a s i n d i c a t o r o f h u m a n c a p i t a l.

References

Aghion, P., & Howitt, P. (1998). Endogenous growth theory. Cambridge: MIT Press.

Andrianaivo, M., & Kpodar, K. (2011). ICT, financial inclusion, and growth evidence from African countries, International Monetary Fund working paper, 1/73.

Audretsch, D., & Feldman, M. (1996). R&D spillovers and the geography of innovation and production. American Economics Review, 86(3), 630–640.

Banque, M. (2010). Revue des politiques de développement vers une croissance tirée par l’innovation, In Rapport nb. 50487-TN.

Buckley, P.J., Clegg, J., & Wang, C. (2002). The impact of inward FDI on the performance of Chinese manufacturing firms. Journal of International Business Studies, 33(4), 637–655.

Castellacci, F. (2008). Technology clubs, technology gaps and growth trajectories. Structural Change and Economic Dynamics, 19(4), 301–314.

Castellacci, F. (2011). Closing the technology gap? Review of Development Economics, 15(1), 180–197.

Coccia, M. (2012). Political economy of R&D to support the modern competitiveness of nations and determinants of economic optimization and inertia. Technovation, 32(6), 370–379.

Coe, D., Helpman, E., & Hoffmaister, A. (2008). International R&D spillover and institutions, IMF Working Paper WP /08/104.

Cohen, W., & Levinthal, D. (1989). Innovation and learning: Two faces of R&D. Economic Journal, 99, 569–596.

Du, L., Harrison, A., & Jefferson, G.H. (2011). Testing for horizontal and vertical spillovers in China, 1998-2007, Journal of Asian Economics.

Eden, L., Levitas, E., & Martinez, R.J. (1997). The production, transfer and spillover of technology: comparing large and small multinational as technology producers. Small Business Economics, 9(1), 53–66.

Engelbrecht, H.J. (2002). Human capital and international knowledge spillovers in TFP growth of a sample of developing countries: an exploration of alternative approaches. Applied Economics, 34(7), 831–841.

Greenaway, D.R., & Kneller, A. (2003). Exporting productivity and agglomeration. European Economic Review, 52(5), 919–939.

Griffith, R., Redding, S., & Reenen, J.V. (2004). Mapping the two faces of R&D: Productivity growth in a panel of OECD industries. The Review of Economics and Statistics, 86(4), 883–895.

Hall, R., & Jones, C. (1999). Why do some countries produce so much more output per worker than others? Quarterly Journal of Economics, 114, 83–116.

Hassan, M.K. (2005). FDI, information technology and economic growth in the mena region. In 10th ERF paper.

Jaffe, A.B., Trajtenberg, M., & Henderson, R. (1993). Geographic localization of knowledge spillovers as evidenced by patent citations. The Quarterly Journal of Economics, 108(3), 577–598.

Jarkovic, B.S., & Spatareanu, M. (2011). Does it matter where you come from? Vertical spillovers from foreign direct investment and the origin of investors. Journal of Development Economics, 96(1), 126–138.

Jordaan, J.A. (2011). FDI, local sourcing and supportive linkages with domestic suppliers: the case of monterey in Mexico. World Development, 39(4), 620–632.

Keller, W. (1997). Trade and transmission of technology, In NBER working paper, No. 6113.

Klenow, P., & Rodriguez-Clare, A. (1997). The neoclassical revival in growth economics: has it gone too far? In B. Bernanke, & J. Rotemberg (Eds.) NBER macroeconomics annual (pp. 73–102). Cambridge: MIT Press.

Kneller, R. (2005). Frontier technology, absorptive capacity and distance. Oxford Bulletin of Economic and statistics, 67(1), 1–23.

Kokko, A., Tansini, R., & Zejan, M. (1996). Local technological capability and productivity spillovers from FDI in the Uruguayan manufacturing sector. Journal of Development Studies, 32(4), 602–611.

Krugman, P. (1991). Increasing returns and economic geography. Journal of Political Economy, 99(3), 483–499.

Lains, P. (2008). The Portuguese Economy in the Irish Mirror, 1960-2004. Open Economies Review, 19, 667–683.

Nelson, R., & Phelps, E. (1966). Foreign direct investment and spillovers of technology. American Economic Review Papers and Proceeding, 56, 69–75.

Romer, P. (1990). Endogenous technological change. Journal of Political Economy, 98(5), 71–102.

Seck, A. (2012). International technology diffusion and economic growth: Explaining the spillover benefits to developing countries. Structural Change and Economic Dynamics, 23, 437–451.

Silva, E.G., & Teixeira, A.A.C. (2011). Does structure influence growth? A panel data econometric assessment of relatively less developed countries, 1979-2003. Industrial and Corporate Change, 20, 457–510.

Silva, E.G., & Teixeira, A.A.C. (2008). Surveying structural change: seminal contributions and a bibliometric account. Structural Change and Economic Dynamics, 19, 273–300.

Solow, R.M. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 65–94.

Suyano, R., Salim, A., & Bloch, H. (2009). Does foreign direct investment lead to productivity Spillovers? Firm level evidence from Indonesia. World Development, 37(12), 1861–1876.

Todo, Y., Zhang, W., & Zhou, L.A. (2011). Inter-industry knowledge spillovers from foreign direct investment in research and development: evidence from china’s: silicon valley. Review of Development Economics, 15(3), 569–585.

Veugelers, R., & Mrak, M. (2009). The knowledge economy and catching up member states of the EU, Knowledge Economists Policy Brief, no.5, The European Commission.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Naanaa, I.D., Sellaouti, F. Technological Diffusion and Growth: Case of the Tunisian Manufacturing Sector. J Knowl Econ 8, 369–383 (2017). https://doi.org/10.1007/s13132-015-0270-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-015-0270-7