Abstract

Electrical energy storage (EES) constitutes a potential candidate capable of regulating the power generation to match the loads via time-shifting. Optimally planned, EES facilities can meet the increasing requirement of reserves to manage the variability and uncertainty of renewable energy sources (RES) whilst improving the system operation efficiency and economics. In this work, the impact of intermittent RES on total production cost (TPC) is evaluated in the presence and absence of storage, using annual data regarding the non-interconnected power system of the island of Cyprus. Performing weekly simulations for the entire year of 2017, TPC is computed by solving the unit commitment based on a constrained Lagrange Relaxation method. Seven selected EES technologies are modeled and evaluated via a life-cycle cost analysis, based on the most realistic technical and cost data found in the literature. The results derived from the uncertainty analysis performed, show that zinc-air (Zn-air) battery offers the highest net present value (NPV). Lead-acid (Pb-acid) and sodium-sulfur (Na-S) are considered viable solutions in terms of mean NPV and investment risk. Lithium-ion (Li-ion) battery exhibits a particularly expensive choice. Dominated by its increased capital cost which still governs its overall cost performance Li-ion achieves a negative mean NPV far below zero. However, to strengthen the benefits derived from EES integration, further research and development is needed improving the performance and costs of storage. The uncertainty governing the majority of EES technologies, in turn, will be reduced, increasing their participation and RES contribution in autonomous power system operations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Day-ahead scheduling of electricity generation is a crucial and challenging optimization problem in current power systems. Variability and uncertainty in net load caused by increasing penetration of renewable generation (RG) have motivated the study of alternative approaches that increase flexibility without affecting the stable operation of conventional power plants [1]. Besides achieving minimum total production cost, the generation schedule must satisfy a large set of different technical and operational constraints.

In contrast to the large interconnected power systems, the integration of intermittent RG in autonomous island grids is subject to security and reliability limitations. As a result, operating reserves (both spinning and non-spinning) are required to cover the uncertainty caused by forecast errors, whereas sufficient ramping capability is necessary to address the variability issues which often occur at high time resolutions (e.g., minute-to-minute) [2]. Spinning reserves represent the on-line capacity synchronized to the grid and ready to meet electric demand within 10 min while non-spinning is the off-line generation capacity that can be ramped to capacity and synchronized to the grid within 10 min and can maintain that output for at least 2 h.

Due to the isolation, small area and remoteness, electricity supply for people inhabited in more than 50 thousand islands on the earth, mainly rely on imported fossil fuels the price of which is 3–4 times higher than that in the mainland. On the other hand, for most islands the sunlight is sufficient for generating abundant electricity from PV in summer while in winter wind power can be the main contributor to electricity supply [3]. Consequently, it is crucial for a solution to be examined, in order to facilitate a shift towards decarbonization without degrading the continuity and quality of power supply in islands but reducing the exposure of such weak economies to varying fuel prices or shortages [4].

Electrical energy storage (EES) constitutes a potential candidate capable of regulating the power generation to match the loads via time-shifting. EES may favor some technologies from being applied in contingency reserves, based on two main requirements namely, the time of response and storage duration. First, the rapid response needed to provide a large fraction of both primary and secondary reserves favors the flywheels, electrochemical and electromagnetic storage technologies. The second requirement invites the storage system to retain the energy stored for several days and operate as a complement or substitute when needed instead of increasing/decreasing its output to continuously maintain the generation-demand balance. This excludes flywheels and electromagnetic storage (both capacitive and conductive) from participating because of their increased daily parasitic losses expressed by their self-discharge rate [5]. Within the wide variety of electrochemical storage systems, Nickel-based technologies are also excluded because of memory effect aspects [6].

Based on the previously described concept, the performance of battery-based energy storage facilities applied in an island’s power system is investigated. The considered technologies include lead-acid (Pb-acid), zinc-air (Zn-air), sodium-sulfur (Na-S), lithium-ion (Li-ion) batteries and vanadium-redox (VRB), zinc-bromine (Zn-Br) and polysulfide-bromide (PSB) flow batteries. The spinning reserve requirements (power rating and energy capacity) derives after strongly restricted unit commitment (UC) optimization solved via a novel Lagrange Relaxation method, based on real data of both generation and demand. Each EES system is subjected to life-cycle cost analysis distinguishing their power-related and capacity-related costs. Once optimally planned, the systems are analysed and compared through an uncertainty analysis concerning the most recent technological variations in development status and cost metrics in research.

The remaining of the paper is organized as follows. In Sect. 2 the methodology adopted for simulation purposes is presented and explained in detail. The main characteristics of the study case island system along with the description of the EES configurations to be simulated are provided in Sect. 3. In Sect. 4, the weekly and annual simulation results are presented, evaluated and discussed, while the conclusions are drawn in Sect. 5.

2 Methodology

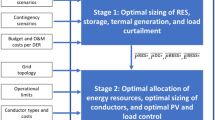

Aiming at minimizing the spinning reserve requirements, our investigation is focused on a methodology performed in four steps; (1) the robust formulation for the UC problem considering both operational and technical constraints; (2) the proposed method for UC optimization subject to the complex constraints; (3) the determination of EES optimal size; and (4) the life-cycle cost analysis of the examined EES models.

2.1 UC problem formulation

The total production cost (TPC) of a power system consisting of traditional thermal units is mainly the cost of fuel (CF) [7, 8], start-up (CSU) and shut-down (CSD) costs [9,10,11], maintenance cost (CM) [12], emission cost (CE) [13], and cost of energy not served (CENS) [14]. By denoting the number of generating units with N and the number of periods with T, a formulation for the UC problem is as follows:

The decision variable Uti , represents the on–off states of generating units, taking the value “1” if the ith unit is on-line at the particular time t or “0” if the unit is off-line according to \( U_{i}^{t} \in \left\{ {1,0} \right\} \). Pti is the production level of each unit at that period. The thermal fuel cost Fi(Pti ) is expressed by a second order (quadratic) function as follows:

where ai, bi and ci are positive fuel cost coefficients derived from the specific fuel cost and heat rate curve of each generating unit. Maintenance costs comprise both fixed and variable values. Costs that do not change as a function of plant output are expressed via fixed costs (CfM) (e.g., per kW-month), whereas variable costs (CvM) are associated with the maintenance costs that change as a function of energy output (e.g., per unit of MWh). The variable maintenance cost is formulated by the next equation.

CBM and CIM components represent the base and incremental maintenance cost for each generator, respectively. The formulation of the start-up cost is presented in Eq. (11). Start-up cost is warmth-dependent, corresponding to the hot, warm or cold condition of each generating unit, defined by the time that the unit has been off-loaded until start up. Hence, it can be approximated by a small value known as hot start-up cost (HSU) if the unit was only turned off recently or a “cold-start” value (CSU):

where ti,cold is the cold start time of the ith unit and MDi is the minimum down time of the ith unit which is explained below.

Shut-down cost is usually a constant or at least time-independent value for each thermal unit, and thus it is usually excluded from the objective function. Contrariwise, it could be described as a function of power output by making use of the incremental shut-down cost (ki) via the following equation:

Finally, since the conventional thermal units assumed for generation are coal-fired, a quadratic function can be considered for the emission curve as follows:

where αci, βci and γci are the CO2 emission coefficients of unit i.

While the objective (1) is the sum of total production cost in all periods, Uti and Pti are used to model various operational constraints. Constraint (2) ensures that the sum of the power produced from all committed units meets the net load demand \( P_{netD}^{t} \) along with transmission loss \( (P_{loss}^{t}) \) at each time-interval, considering the contribution of renewable generation \( (P_{RG}^{t}) \) normally treated as negative load so that \( P_{netD}^{t} = P_{D}^{t} - P_{RG}^{t} \). Constraint (3) guarantees that the power margins cover the spinning reserve requirements SRt based on the maximum ramping capacity (Pti,max-cap ) of each unit. The maximum and minimum rated power forcing the generating units to operate within their boundaries are represented by constraint (4). Considering the time a unit has started-up (tu) or shut-down (td), the satisfaction of predefined minimum up (MUi) and down (MDi) times before a change in state occurs is constraint by (5) and (6), respectively. The last constraints (7) and (8), represent the ramp-up (RUi) and ramp-down (RDi) rate restrictions between consecutive periods.

Further constraints may include the unit status restrictions and plant crew constraints. Unit status may restrict a unit in three possible states namely, the must-run, must-out and run at a fixed-MW output [8]. The number of units that can simultaneously start-up is restricted by the plant crew constraints depending on the number of operators available or the maximum water availability for feeding multiple boilers [7].

2.2 UC proposed solution

In contrast to economic dispatch (ED) where it is assumed that all units are already connected to the system, UC assumes that the generating units are available and appropriate subsets must be selected to provide the minimum operating cost. While integer variables are involved, UC is more difficult to solve mathematically constituting a more complex procedure which considers the ED as a subproblem to the solution.

Based on a dual optimization approach, Lagrange Relaxation solution becomes advantageous over dynamic programming-based approaches where all generating units are examined in the same time interval. This disturbs the coupling constraints since an action to one unit affects what will happen on the others. Through the dual optimization procedure, the UC problem solves by “relaxing” (or temporarily ignoring) the coupling constraints as if they did not exist, so that other primal constraints can easily be added to the problem.

The method starts by defining the fundamental constraints and the objective function.

Minimize:

subject to loading constraints,

and unit constraints.

Adding the constraint function (15) to the objective (14) after multiplying the first by an undetermined multiplier λ, we obtain Lagrange Function shown in Eq. (17):

The first derivative gives the necessary condition for the existence of a minimum cost. When the Lagrangian is rewritten as:

it is observed that the second term is constant and can be neglected to reach the form of Eq. (19):

The goal of separating the units has been achieved and the term inside the outer brackets can now be solved separately for each generating unit. The minimum of the final function for each unit over all time periods is found by the first derivative and makes sense only when \( U_{i}^{t} = 1 \). The necessary condition for the existence of a minimum cost of operation for the thermal power system is that all the unit incremental cost rates must be equal to the undetermined value λt over all time periods according to:

To incorporate the thermal constraints of minimum and maximum power output of each generating unit, the following conditions must be qualified:

Finally, since the objective is to minimize \( \left[ {F_{i} \left( {P_{i}^{t} } \right) - \lambda^{t} P_{i}^{t} } \right] \) at each stage and as this value goes to 0 only when \( U_{i}^{t} = 0 \), the only way to get a lower value is to achieve:

While the solution is given for each generating unit independently, the remaining constraints can easily be integrated. The dimensionality problems affecting dynamic programming have been avoided and a way remains to be found adjusting λt values for the coupling constraints of load balance, spinning reserve, etc. Such an example is presented by Eq. (23):

The function q(λ) represents the Lagrangian Function and its derivative results in:

To avoid oscillations the values of α must be distinguished according to derivative’s sign so that:

A measure of the closeness to the solution is referred to as relative duality gap (RDG) and is given by the following equation.

J* represents the total cost (for the N generating units during the T time periods) estimated by the relaxed λ while q* is the total cost given by the corrected λ values used in ED. In some cases, the process may fall into oscillations due to unnecessary commitments and de-commitments of identical units. This is reflected as overload or underload conditions violating the power balance constraints. To deal with such a sensitivity problem, the identical units j can be grouped to form a composite cost function and an alternative process is utilized to optimally define the active unit number (\( \eta_{i}^{t} \)) of each group i based on the following mathematical statements [15]:

Instead of performing calculations in three-dimensional matrices, a recently proposed method recommends the commitment of identical units in two further stages regarding the dual and primal problem for grouped (i) and individually included (j) generating units [16]. The contribution of each generating group is reformulated, by making use of dual variable constraints. To overcome oscillations and achieve the convergence, such variables are needed to detect which group was last-up, to set the time duration that each distinguished (un-grouped) unit has been on-line or off-line at the end of interval t, and to identify if the unit was started-up at the beginning of this interval. The dual and relaxed problems are alternatively resolved until the optimal Lagrange multiplier vector is found iteratively.

2.3 Optimal EES sizing

The role of the proposed EES facility is to store and provide energy, in order to replace the deficit of spinning reserves. Aiming to evaluate the improvement achieved by the application of EES, two case-studies are investigated with weekly simulations carried out for the entire duration of a year. In the first case, the optimal UC schedules along with the total production costs are evaluated based on non-zero spinning reserve requirements (SR ≠ 0) and model (1)–(8). The procedure is repeated in the second case where the application of EES adequately replaces the spinning reserve margins. Sitting fully charged and ready to be brought online when called upon, the EES facility makes the system capable of handling net-load dynamic changes ensuring the operation reliability. Thus, the second case considers zero spinning reserve requirements (SR = 0) from thermal power plants.

To adequately replace SR requirements the optimal size (both rated power and energy capacity) considers the worst-case scenario. Therefore, the rated power (\( P_{rated}^{*} \)) can be defined according to the maximum difference between spinning reserve margin without storage and power margin from committed units when storage was applied to eliminate it, as follows:

On the other hand, energy capacity (\( E_{cap}^{*} \)) is determined by the highest requirement to provide power for hs hours, as defined by Eqs. (27) and (28).

Performing weekly simulations for a whole year, the annual profitable return (APR) can be computed according to Eq. (33):

2.4 Life-cycle cost analysis of EES

The selected EES facilities are modeled considering both the investment and operation costs. Power-related costs concern the power conversion system (PCS) and balance of plant (BOP) while energy storage medium (ESM) involves the energy-related costs. As a result, the initial project cost (IPC) can be expressed as a function of rated power (\( P_{rated}^{*} \)) and energy capacity (\( E_{cap}^{*} \)) based on the following equation:

To meet the requirements of the intended application in terms of output (useful) energy, CESM must be oversized to take into consideration the ac-to-ac conversion losses, the maximum permitted capacity and parasitic losses. Hence, IPC is rewritten as a function of the round-trip efficiency (η), depth of discharge (DoD), self-discharge rate (SDR) and storage duration (hs):

Operation and maintenance (O&M) cost accounts for both fixed O&M values (CfO&M) expressed per kW-year and variable O&M values (CvO&M) which represent the operational costs that change as a function of annual discharged energy (Edis) [12]. The total O&M cost (CO&M) is calculated through the use of Eq. (36):

For each individual technology k selected to participate, the life-cycle cost (LCC) (during the span of the EES facility’s useful lifetime) can be computed as the present value of the system by Eq. (37). The net present value (NPV) for each EES facility k is finally achieved by Eq. (38):

where N is the examined lifespan in years and iR the discount rate.

3 Case study system

A medium-sized energy system is selected with a peak demand of 1108 MW and a load factor of 53% which constitutes a representative example of an island’s autonomous, non-interconnected power system. This is the system of Cyprus powered by three thermal power plants consisting of a total of twenty generating units whose main technical and economic characteristics are listed in Table 1, as well as by domestic renewable resources including biomass, solar PV and wind. According to the Cyprus Energy Regulatory Authority (CERA), during the year from 31 December 2016 to 31 December 2017 the installed capacity for thermal, wind, PV and biomass generating units was 1278 MW, 157.5 MW, 112.2 MW and 9.81 MW, respectively [17].

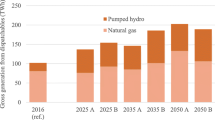

To assess the impact of EES on system operation, both weekly and yearly simulation results are required. The necessary data obtained from CERA regard the half-hourly power demand during the year of 2017 along with the real-time generation from renewable energy sources (RES). Two case studies are carried out to evaluate the profitable return derived by the application of EES. The first case assumes a spinning reserve requirement accounting for 6% of the total power demand and 100% of the variable renewable energy sources (VRES). Offering a monthly-constant power output, biomass is considered as a firm import, whereas VRES refers to wind and PV generation for each time interval of the year. By the application of EES in the second case, the spinning reserve requirements become zero and the optimization procedure is repeated recording the total production cost.

The variation in load demand for the whole year of 2017 and weekly representative profiles for summer, winter and spring is provided in Figs. 1 and 2, respectively. Based on a single bus model we assume that the demand is satisfied as soon as the total production is approximately equal to the total consumption and spinning reserve requirements are qualified.

Annual electricity demand variation during the entire year of 2017 [17]

Weekly profile of seasonal electricity demand of the year 2017 [17]

4 Results

The optimal scheduling of generating units to meet the net load demand is solved over a short-term horizon of 336 half-hours to let ramp-rate limitations be involved. Completing the second’s case 52-week optimization process, the APR achieved was rated at €55,839,700 according to Eq. (33). Undoubtedly, SR provides a high influence on the TPC. Forcing the utilities to over-schedule and individual units to operate partially-loaded, leads to increased start-up costs, inefficient and uneconomic dispatch.

The contribution of RES during the weak which comprises the worst-case scenario is presented in Fig. 3. The high variability of the net load cannot be satisfactorily absorbed by the week power system (due to ramp-up and -down limitations), requiring faster-response and expensive gas turbine generation to take place. The resulted UC programs for the worst case-study derived from the two case-studies are depicted in Fig. 4. By making use of Eqs. (29, 30) and (31, 32) the optimal size of EES system was determined in terms of power rating and energy capacity to 143.94 MW and 498.94 MWh, respectively.

Net load demand vs. RES contribution for the week comprising the worst-case scenario (23 April 2017) [17]

All necessary information regarding the different EES technologies selected is listed in Table 2. The ac-to-ac conversion efficiency assumed to be 90% including both transformers and converters, while we considered zero transmission losses (placement of devices near thermal generation units) [18]. The examined lifetime (N) was set at 10 years in order to avoid any replacements based on the lifetime of the main components comprise each EES facility [19]. Since the costs relating to fixed O&M and variable O&M were unavailable for Zn-air battery and PSB flow battery, the maximum values based on the rest of technologies were assumed. The main characteristics affecting the life-cycle cost analysis performed are enclosed in Table 3.

Finally, in order to include the uncertainties due to the large technological variations between system types, we performed uncertainty analyses considering the variation range between all input parameters. Table 4 lists the calculated results while their graphic representation is shown in Fig. 5. The median value indicates the NPV for averaged values for all inputs to decide whether investing in a technology is feasible. Min/max range refer to the extremities between low performance/high costs and high performance/low costs. The middle range results from the individual variation from highest to lowest values for both performance characteristics and cost metrics, deviating around the median. Min/max range shows the risk and increases by increasing IPC while the middle range indicates the degree of dependence of each technology on their initial investment.

Although VRB, Zn-Br and PSB flow batteries possess a high maximum NPV of greater than 300 M€, they are dominated by their capital cost since the lower and upper bounds coincide with minimum and maximum values. In addition, their median value revolves around zero. Pb-acid and Na-S batteries exhibit almost only positive NPV ranges with acceptable investment risk while the highest-performance and lowest-cost is offered by Zn-air devices. Zn-air also provides the lowest investment risk much below Li-ion, providing the highest potential in long-term contingency reserve applications. Finally, Li-ion provides the highest uncertainty and lowest median value, much below zero.

5 Conclusions

In this work, a methodology for the optimal planning of EES facilities involved in contingency-reserve applications has been presented. Based on a single-bus model the thermal generation of the power system of Cyprus has been optimally scheduled for the year 2017 without and with EES facilities. The UC optimization problem was conducted via a novel Lagrange Relaxation method with constraints and considering the impact of RES. Our proposed approach successfully dealt with identical generating units found in isolated power systems, enabling the realistic determination of the optimal EES size based on actual data. Pb-acid, Zn-air, Na-S, Li-ion, VRB, Zn-Br and PSB batteries were selected to replace the deficit in spinning reserves and subjected to uncertainty analysis. The formulation of storage was properly addressed relying on an innovative model. The model developed takes into account not only the ac-to-ac efficiency but also other losses including the depth of discharge and self-discharge rate of each technology. In addition, it distinguishes the power-related and capacity-related cost components leading to more substantial outcomes.

The derived simulation results showed that improvements exist in profitable return credits when EES was integrated. The findings of our extensive evaluation are summarized as follows: (1) TPC is strongly affected by RES uncertainty and variability allowing different storage technologies to take place and enhance flexibility. (2) The optimal size of the proposed EES facility was determined to 143.94 MW/498.94MWh based on the worst-case scenario. (3) The uncertainty analysis performed on NPV, indicates that Zn-air offers the greatest potential in terms of performance and investment risk. (4) Pb-acid and Na-S battery systems constitute feasible investments whereas Li-ion stands out of preferences since it possesses a negative mean value and is dominated by its still high capital cost.

Abbreviations

- APR :

-

Annual profitable return

- C BM :

-

Base maintenance cost

- C BOP :

-

Balance of plant cost

- C E :

-

Emission cost

- C ENS :

-

Cost of energy not served

- C ESM :

-

Cost of energy storage medium

- C F :

-

Fuel cost

- C fO&M :

-

Fixed operation and maintenance cost

- C IM :

-

Incremental maintenance cost

- C M :

-

Maintenance cost

- C O&M :

-

Annual operation and maintenance cost

- C PCS :

-

Cost of power conversion system

- C SD :

-

Shut-down cost

- C SU :

-

Start-up cost

- CSU :

-

Cold start-up cost

- C vO&M :

-

Variable operation and maintenance cost

- DoD :

-

Depth of discharge

- E cap :

-

Energy capacity

- E d-y :

-

Total discharging energy per year

- h s :

-

Storage duration

- HSU :

-

Hot start-up cost

- i R :

-

Discount rate

- IPC :

-

Initial project cost

- J* :

-

Total relaxed cost

- λ :

-

Lagrange multiplier

- LCC :

-

Life-cycle cost of storage

- MD i :

-

Minimum down time of unit i

- MU i :

-

Minimum up time of unit i

- N :

-

Examined lifespan

- NPV :

-

Net present value

- η :

-

Round-trip efficiency

- η t i :

-

Active unit number of group j in period t

- η t imαχ :

-

Maximum unit number of group j in period t

- η t imin :

-

Minimum unit number of group j in period t

- P t i :

-

Power output of unit i at time t

- P imin :

-

Minimum operating limit of unit i

- P imax :

-

Maximum operating limit of unit i

- P loss :

-

Transmission loss

- P netD :

-

Net load demand

- P rated :

-

Rated power

- P RES :

-

Renewable generation

- P solar :

-

Solar generation

- P wind :

-

Wind generation

- q* :

-

Total cost corrected by ED

- RDG :

-

Relative duality gap

- RD i :

-

Ramp-down rate of unit i

- RU i :

-

Ramp-up rate of unit i

- SDR :

-

Self-discharge rate

- SR t :

-

Spinning reserve requirements at time t

- τ i :

-

Thermal time constant of unit i

- T i :

-

Duration of continuously OFF of unit i

- t i,cold :

-

Cold start time of unit i

- TPC :

-

Total production cost

- t d :

-

Down time

- t u :

-

Up time

- U t i :

-

Status of unit i at time t

References

Mahmutogullari, A.I., Ahmed, S., Cavus, O., Akturk, M.S.: The value of multi-stage stochastic programming in risk-averse unit commitment under uncertainty. IEEE Transact. Power Syst. (2019)

Kwon, H., Park, J.K., Kim, D., Yi, J., Park, H.: A flexible ramping capacity model for generation scheduling with high levels of wind energy penetration. Energies 9, 12 (2016)

Kuang, Y., et al.: A review of renewable energy utilization in islands. Renew. Sustain. Energy Rev. 59, 504–513 (2016)

Shirley, R., Kammen, D.: Renewable energy sector development in the Caribbean: current trends and lessons from history. Energy Policy 57, 244–252 (2013)

Nikolaidis, P., Poullikkas, A.: A comparative review of electrical energy storage systems for better sustainability. J. Power Technol. 97(3), 220–245 (2017)

Nikolaidis, P., Poullikkas, A.: Cost metrics of electrical energy storage technologies in potential power system operations. Sustain. Energy Technol. Assess. 25, 43–59 (2018)

Sheble, G.B., Member, S.: Unit commitment literature synopsis. Power Syst. IEEE Trans. 9, 1 (1994)

Padhy, N.P.: Unit commitment—a bibliographical survey. IEEE Trans. Power Syst. 19(2), 1196–1205 (2004)

Krishna, P.V.R., Sao, S.: Price based unit commitment problem under deregulation. Int. J. Sci. Eng. Technol. 184(1), 177–184 (2012)

Xie, Y.G., Chiang, H.D.: A novel solution methodology for solving large-scale thermal unit commitment problems. Electr. Power Compon. Syst. 38(14), 1615–1634 (2010)

Patra, S., Goswami, S.K., Goswami, B.: Differential evolution algorithm for solving unit commitment with ramp constraints. Electr. Power Compon. Syst. 36(8), 771–787 (2008)

Obi, M., Jensen, S.M., Ferris, J.B., Bass, R.B.: Calculation of levelized costs of electricity for various electrical energy storage systems. Renew. Sustain. Energy Rev. 67, 908–920 (2017)

Zhang, X., Xie, J., Zhu, Z., Zheng, J., Qiang, H., Rong, H.: Smart grid cost-emission unit commitment via co-evolutionary agents. Energies 9(10), 834 (2016)

Suazo-martínez, C., Pereira-bonvallet, E., Palma-behnke, R.: A simulation framework for optimal energy storage sizing. Energies 7(5), 3033–3055 (2014)

Feng, X., Liao, Y.: Electric power components and systems a new lagrangian multiplier update approach for lagrangian relaxation based unit commitment. Electr. Power Compon. Syst. 34, 5008 (2017)

Nikolaidis, P., Chatzis, S., Poullikkas, A.: Renewable energy integration through optimal unit commitment and electricity storage in weak power networks. Int. J. Sustain. Energy 37(10), 1–17 (2018)

CERA: Annual Report of Cyprus Energy Regulatory Authority. CERA, pp. 1–102 (2017). http://www.cera.org.cy

Dufo-lópez, R., Bernal-agustín, J.L.: Techno-economic analysis of grid-connected battery storage. Energy Convers. Manag. 91, 394–404 (2015)

Spanias, C.A., Nikolaidis, P.N., Lestas, I.: Techno-economic analysis of the potential conversion of the outdated moni power plant to a large scale research facility. In: 5th International Conference on Renewable Energy Sources and Energy Efficiency, pp. 208–220 (2016)

Nikolaidis, P., Chatzis, S., Poullikkas, A.: Life cycle cost analysis of electricity storage facilities in flexible power systems. Int. J. Sustain. Energy 13, 1–21 (2019)

Liu, Q., Wang, Y., Dai, L., Yao, J.: Scalable fabrication of nanoporous carbon fiber films as bifunctional catalytic electrodes for flexible Zn-air batteries. Adv. Mater. 1000, 3000–3006 (2016)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nikolaidis, P., Chatzis, S. & Poullikkas, A. Optimal planning of electricity storage to minimize operating reserve requirements in an isolated island grid. Energy Syst 11, 1157–1174 (2020). https://doi.org/10.1007/s12667-019-00355-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12667-019-00355-x