Abstract

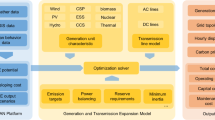

This paper presents a general electricity-CO\(_{2}\) modeling framework that is able to simulate interactions of the energy-only market with different forms of national policy measures. We set up a two sector model where players can invest into various types of generation technologies including renewables, nuclear power and carbon capture, transport, and storage (CCTS). For a detailed representation of CCTS we also include industry players (iron and steel as well as cement), and CO\(_{2}\) transport and CO\(_{2}\) storage including the option for CO\(_{2}\) enhanced oil recovery (CO\(_{2}\)-EOR). The players maximize their expected profits based on variable, fixed and investment costs as well as endogenous prices of electricity, CO\(_{2}\) abatement cost and other incentives, subject to technical and environmental constraints. Demand is inelastic and represented via type hours. The model framework allows for regional disaggregation and features simplified electricity and CO\(_{2}\) pipeline networks. It is balanced via a market clearing for the electricity as well as CO\(_{2}\) market. The equilibrium solution is subject to constraints on CO\(_{2}\) emissions and renewable generation share. We apply the model to a case study of the UK electricity market reform to illustrate the mechanisms and potential results attained from the model.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction: a review of state of the art electricity and CO\(_{2}\) modeling approaches

The need for combating climate change is internationally widely accepted [1] and the role of the electricity sector as a major contributor to global GHG emission reductions is undisputed [2]. However, there exists an international dissent on how to achieve a decarbonization of the sector. Even in the EU, a multitude of approaches exist: Germany has departed on its “Energiewende” path towards a renewable energy based system, with renewable energy sources (RES) already contributing to 30% of electricity production in 2015. At the same time, France still relies on large nuclear capacities; while the United Kingdom (UK) promotes a mixed strategy of renewables, nuclear and carbon capture, transport, and storage (CCTS). The low certificate prices in the European emissions trading system (EU-ETS), at levels below 10 €/tCO\(_{2}\) in 2015—with little hope for a significant rise in the upcoming years [3]—however, give insufficient incentives for most of these low-carbon investments. This endangers achieving the EU climate policy targets for 2030 [4] and puts the global 2 \({^{\circ }}\)C target at risk. Therefore, several countries have started or are about to start backing the EU-ETS with additional national measures. These include different types of feed-in tariffs and market premia, capacity markets (CMs), a minimum CO\(_{2}\) price and emissions performance standards (EPS). Models assessing the future development of a decarbonized electricity market need to adequately incorporate such additional policy measures. In addition, interdependencies between the measures as well as feedbacks with other sectors need to be taken into account.

Different kinds of models are used to assess the impact of policy instruments and their ability to achieve climate change policy objectives. Pfenninger et al. [5] classify models according to the different challenges they address. They differentiate between energy system models for normative scenarios, energy system simulation models for forecasts, power systems and electricity market models for analyzing operational decisions and qualitative and mixed-methods for narrative scenarios. Energy system models such as PRIMES [6], MARKAL [7], EFOM [8] or POLES [9] are able to convey the “big picture” of what is happening in different linked sectors of an energy system. These technology-oriented models focus on the energy conversion system, on the demand-side (e.g. efficiency measures) as well as supply side (e.g. wide range of generation technologies). The advantages of these models are that they cover several sectors, linking them through endogenous fuel substitution. They are mostly solved by optimization or simulation techniques when minimizing system costs or maximizing the overall welfare. Fais et al. [10] integrate different types of RES support schemes such as feed-in tariffs as well as quantity based instruments such as certificate systems in their energy system model Times-D. Their approach can be used to analyze exogenous support scheme but does not establish a link between attaining a specific CO\(_{2}\) target and the level of required RES support, and does not allow analysis of long-term development. Moreover, RES generation is limited exogenously via upper bounds on annual maximum expansion. They assume perfect competition and have limited possibilities to incorporate market power.

Apart from energy system models, there is a large strand of literature that employs a partial equilibrium setting to assess one particular market, e.g. the electricity market. This allows for analyzing non-cooperative firm behavior (e.g. à la Cournot) in more detail by allowing the firms to strategically exploit their influence on the market price with their output decision. Moreover, different risk attitudes and explicit shadow prices can be easily incorporated in these settings. The models have been focusing on considerations of resource adequacy [11], assessing the impact of environmental regulation [12], renewables obligations and portfolio standards see e.g., [13, 14], or congestion management of the transmission network [15].

One technology that is of particular interest for a future decarbonization of the electricity sector is CCTS. The technology comes with a dichotomy: On the one hand, it plays an important role in many of the possible energy system scenarios that are consistent with the EU Energy Roadmap [16]. Accordingly, the scenarios for the newest report from the IPCC [17] estimate a cost increase of 29–297% for reaching the 2\({^{\circ }}\)C target without the CCTS technology.Footnote 1 On the other hand, despite available financial schemes and technology, CCTS has not been implemented on a large scale anywhere in the world. Various authors have addressed this discrepancy with different regional focuses [19,20,21,22]. Gale et al. [23] in addition address this topic in a special issue commemorating the 10th anniversary of the first IPCC [24] special report on CCTS.

Most electricity market models do not put any emphasis on CCTS, and handle the technology like any other conventional generation technology by specifying investment and variable costs and fuel efficiency. For example, Eide et al. [25] apply a stochastic generation expansion model to determine the impact of CO\(_{2}\) EPS on electricity generation investment decisions in the U.S. Their findings show a shift from fossil fuel generation from coal to natural gas rather than incentivizing investment in CCTS. Zhai and Rubin (2013) explored the “tipping point” in natural gas prices for which a coal plant with CCTS becomes economically competitive, as a function of an EPS. Middleton and Eccles [26] calculate the price for CO\(_{2}\) to be in the range of 85–135 US$/tCO\(_{2}\) (65-105 €/tCO\(_{2})\) to incentivize a gas power plant to use CCTS in the USA. This simplified representation of the CCTS technology in these models, however, neglects transportation and storage aspects as well as the possibility of industrial usage of CCTS.

By contrast, if models focus on CCTS infrastructure development, they often neglect how the technology is driven by decisions in the electricity market. A series of studies analyzed the technical potential of CCTS deployment, including possible CO\(_{2}\) pipeline routing [27,28,29,30,31]. The construction of such large-scale new infrastructure networks is highly influenced by public acceptance, especially in densely populated regions such as the European Union [32]. Acceptance issues as well as technical uncertainties can lead to stark increases in costs of CCTS deployment [33]. In the absence of expected technological learning and with persistently low CO\(_{2}\) certificate prices CCTS projects aim at additional income through CO\(_{2}\)-enhanced oil recovery (CO\(_{2}\)-EOR) [34,35,36].

Kjärstad et al. [37] have started to close the gap by combining the techno-economic Chalmers Electricity Investment Model with InfraCCS, a cost optimization tool for bulk CO\(_{2}\) pipelines along with Chalmers databases on power plants and CO\(_{2}\) storage sites. Their approach, however, relies on solving both sectors consecutively starting with the electricity model without any feedback options. They, in addition, do not include CO\(_{2}\) capture from industrial sources. This neglects economies of scale especially with respect to transporting CO\(_{2}\) as well as scarcity effects with respect to CO\(_{2}\) storage. Additional research is needed to include different policy instruments into the modeling frameworks to evaluate the effect of various measures.

With electricity-CO\(_{2}\) (ELCO), the model presented in this paper, we try to close the gap between the different sectoral approached and introduce a comprehensive tool that is suitable for analyzing various climate policy measures in the energy and related sectors.

The remaining paper is structured as follows: The introduction is followed by a detailed description of the ELCO model in Sect. 2. A case study in Sect. 3 applies the ELCO model to the UK electricity market. The main policy measures are adjusted in the model to mimic the UK electricity market reform (EMR) and its long-term effects. Sect. 4 concludes with an outlook of future applications of the ELCO model.

2 Mathematical representation of the ELCO model

The ELCO model mimics the competition of different conventional electricity generation technologies on the electricity market and their interaction with new technologies that are financed via fixed tariffs. Each technology is represented via a stylized player that competes with one another. For a better representation of scarce CO\(_{2}\) storage resources we also include a detailed representation of the complete CCTS value chain. This also includes potential CO\(_{2}\) capture from the steel and cement industry. The different CO\(_{2}\) storage options such as CO\(_{2}\)-EOR, saline aquifers and depleted oil and gas reservoirs compete against one another in the last stage of the CCTS value chain. All players maximize their respective profits subject to their own as well as joint technical and environmental constraints. Other (external) costs as well as further welfare components are not being analyzed. Regional disaggregation takes into account geographical characteristics like availability (especially with respect to maximum potential and conditions for renewables as well as CO\(_{2}\) storage) and specific electricity demand. Time is discretized into representative time slices and years. The time slices are weighted to approximate a representative load duration curve. The players optimize their decision over the entire model horizon (until 2050).

Different policy measures such as a carbon price floor (CPF), an EPS or feed-in tariffs in form of contracts for differences (CfD) are included in the modeling framework. The ELCO model analyzes how these policy instruments will influence the construction of new generation capacities. CfD for newly constructed low-carbon technologies can be derived endogenously using shadow variables of constraints. Assuming perfect competition between the different players, equilibrium is reached when overall system costs are minimized subject to all constraints.

The developed model is able to assess regionally disaggregated investment in electricity generation, generation dispatch and simplified flows as well as CO\(_{2}\) transport, storage, and usage for CO\(_{2}\)-EOR. Incorporating CO\(_{2}\) capture by industrial facilities from the steel, and cement sector enables, on the one hand, the representation of economies of scale along the transport routes while, on the other hand, leading to higher scarcity effects with respect to CO\(_{2}\) storage options.

2.1 Notations of the model

The following tables list the used sets (Table 1), variables (Tables 2 and 3) and parameters (Table 4) of the ELCO model. Parameters are indicated by capital letters, variables by small sized letters and sets are resembled in subscripts. The detailed Karush–Kuhn–Tucker (KKT) conditions of the ELCO model are depicted in the Appendix.

2.2 The electricity sector

The ELCO model represents electricity generation from various technologies. Electricity generation is hereby divided in the two subgroups \(g_{h,n,t,a}\) and g_cfd \(_{h,n,t,aa,a}\). \( g_{h,n,t,a}\) comprise generation from all existing capacities and newly built carbon-intensive capacities from coal, gas OCGT and gas CCGT. g_cfd \(_{h,n,t,aa,a}\), on the other hand, include generation from newly constructed low-carbon generation capacities including PV, wind on/offshore, hydropower, biomass, CCTS coal/gas, and nuclear that are financed via the CfD scheme. The profit function for different technologies share the common component of fix costs FC_G \(_{n,t,a}\) and annualized investment costs INVC_G \(_{n,t,a}\) depending on the investments inv_g \(_{n,t,a}\) (lowest rectangular segment). The variable costs components and revenue differ: for g-type technologies (upper rectangle with upper flat corners) revenue is generated from sales on the electricity market receiving the electricity price mu_e \(_{h,n,a}\). The variable cost function comprise fuel and O&M costs with a linear and a quadratic term (VC_G \(_{n,t,a}\) and INTC_G \(_{t})\). Additionally, CO\(_{2}\) costs are calculated based on the emission factor (EF_EL \(_{t})\), multiplied with the sum of the EU-ETS CO\(_{2}\) certificate price (EUA \(_{a})\) and a carbon price support (CPS \(_{a})\) in case of a carbon floor price for the electricity sector. For g_cfd-type technologies (middle rectangle with rounded corners) revenue is generated from the new CfD scheme. The CfD strike price can be incorporated in two ways: It can either be set exogenously, differentiated by year of construction and technology type. Or the strike price is determined endogenously. In the latter case, it depends on the extent to which generation from the respective technology contributes to achieving the environmental goals (TARGET_CO2 \(_{a}\) and TARGET_RE \(_{a})\) and is incorporated in the dual variables of these constraints (see Sect. 2.2.1). This type also encounters additional variable cost components for possible CO\(_{2}\) infrastructure (transport and storage) which are passed via the dual variable mu_co2 \(_{h,n,a}\) and account for CO\(_{2}\) capture rates CR_G \(_{t}\). The technology specific quadratic cost term is interpreted as integration cost for increasing shares of g_cfd-type generation.

The individual players maximize their profit subject to several constraints. The EPS constraint (2) ensures that generation from newly constructed capacities does not exceed the annual allowed CO\(_{2}\) emissions per GW. The overall emissions are calculated as an annual fuel and site specific sum, allowing for combined accounting of new capacities with and without CCTS. Where the first line gives a theoretical emissions budget, calculated based on the availability of the respective technology (AVAIL \(_{h,n,t})\), the admissible emissions level based on the emission performance standard (EMPS \(_{a})\) and the sum of active installed capacity in year a, for all installation at node n that use the same fuel (e.g., new coal-fired power plants both with and without CCTS count towards the same budget). The second line, gives the actual annual emissions for all installation of the same fuel type at this node based on their emission factor (EF_EL \(_{t})\) and potentially a CO\(_{2}\) capture rate for the technology (CR_G \(_{t})\).

The generation capacity constraints (3) and (4) differ slightly for conventional generation technologies \(g_{h,n,t,a}\) and newly constructed low-carbon technologies g_cfd \(_{h,n,t,aa,a}\), as the calculation of currently available generation capacity differs for the two cases. In the first case current generation (\(g_{h,n,t,a})\) cannot exceed total active installed capacity (\(\sum _{aa\in USE\_EL_{t,a,aa} } {inv\_g_{n,t,aa} } )\) time the respective availability factor (AVAIL \(_{h,n,t})\). For CfD-technologies, the logic is similar, but the generation variable (g_cfd \(_{h,n,t,aa,a})\) also captures the respective installation year.

A diffusion constraint restricts the maximal annual generation (\(\sum _{h,n,aa} TD_h \cdot g\_cfd_{h,n,t,aa,a} )\) depending on generation from the two previous periods multiplied with an empirical diffusion factor (DIFF_G \(_{t})\), plus some initial starting value (START_G \(_{t})\) for new technologies times a weight based on availability factors and the number of nodes where a technology could be installed.

Another constraint limits the overall active installed capacity depending on a technology-specific maximal potential for each node (MAX_INV \(_{n,t})\).

2.2.1 Shared environmental constraints for the electricity sector

All players in the electricity sector have to respect shared environmental constraints: An annual CO\(_{2}\) target guarantees that the emissions from annual dispatch are lower or equal to an exogenously set CO\(_{2}\) reduction path (7).

The target is incorporated in the parameter \(\alpha _{t,a}\), which is calculated according to (8). It corresponds to the marginal contribution of the respective technology to the targeted CO\(_{2}\) intensity for a particular year. This is calculated as the product of a reference CO\(_{2}\) emissions level (REF_CO2) times a percentage target level (CO2_TARGET) divided by total demand. The we subtract the emission factor of the respective technology (EF_EL \(_{t})\), potentially reduced by a capture rate (CR_G \(_{t})\) for CCTS. \(\alpha _{t,a}\) is positive for low-carbon technologies while having negative values for conventional generation.

National renewable targets setting a minimum share of renewable generation can be implemented in an additional renewable constraint. This constraint, however, is deactivated in the scenario analyzed in this paper. Here the target is given as a share of total annual demand which has to be satisfied from renewable sources.

2.3 The electricity transportation utility

The objective function of the electricity transportation utility is shown in the following equation: The sum of variable costs VC_EL_T \(_{n,nn}\) and annualized investment costs INVC_EL_T \(_{n,nn}\) equalize the congestion rent gives as the hourly electricity price (mu_e \(_{h,n,a})\) difference between the two indecent nodes. Electricity flow (el_t \(_{h,n,nn,a})\) is treated as a normal transport commodity ignoring Kirchhoff‘s 2\(^{nd}\) law as network congestion is not the focus of the ELCO model. inv_el_t \(_{n,nn,a}\) gives the electricity grid investment.

The electricity utility maximizes its profits subject to the following line capacity constraint, where line flow (el_t \(_{h,n,nn,a})\) cannot exceed initial capacity (INICAP_EL_T \(_{n,nn})\) plus investment (inv_el_t \(_{n,nn,a})\) in adjacent lines (ADJ_EL \(_{n,nn})\).

2.4 The industry sector

The industry is represented by the two sectors i: Iron and steel as well as cement which are most likely to use CO\(_{2}\) capture as a mitigation option. The objective function of the industry sectors is limited to the abatement costs linked to exogenously given historic CO\(_{2}\) emissions. They include the option of either paying the EUA \(_{a}\) or investing into the CCTS technology with its variable costs VC_CO2 \(_{n,i,a}\), fix costs FC_CO2 \(_{n,i,a}\) and annualized investment costs INVC_CO2 \(_{n,i,a}\). The additional costs for a possible CO\(_{2}\) infrastructure (transport and storage) are passed on from the downstream CO\(_{2}\) sector via the dual variable mu_co2 \(_{h,n,a}\).

The industry sector maximizes its objective function subject to similar constraints as the electricity sector. A diffusion constraint (13) restricts the maximal annual investment depending on previous investments and some initialization capacity (START_CO2 \(_{i})\) multiplied with a diffusion factor (DIFF_CO2 \(_{i})\).

The annual capturing quantity is restricted by the amount of previous investments (14) as well as the overall maximal capturing quantity per node and technology (15).

2.5 The CO\(_{2}\) transportation utility

For the CO\(_{2}\) transportation utility we assume a similar structure as for the electricity transport utility. Again, the sum of variable costs VC_CO2_T \(_{n,nn}\) and annualized investment costs INVC_CO2 \(_{n,nn}\) equalize the difference between the dual prices (mu_co2 \(_{h,n,a})\) between two nodes.

A pipeline capacity constraint restricts CO\(_{2}\) transport:

2.6 The storage sector

Saline aquifers, depleted oil and gas fields (DOGF) and fields with the opportunity for CO\(_{2}\)-EOR are identified as possible storage locations s. The objective function of the storage operator represents the abatement costs linked to the underground storage of CO\(_{2}\). For CO\(_{2}\)-EOR sites it includes the option of returns received from oil sales at oil price OILPRICE \(_{a}\). The storage costs consist of the variable costs VC_CO2 \(_{n,s,a}\), a quadratic cost term INTC_S \(_{t}\), fix costs FC_CO2 \(_{n,s,a}\) and annualized investment costs INVC_CO2 \(_{n,s,a}\). The dual variable mu_co2 \(_{h,n,a}\) is used to pass on the overall storage costs (or in case of CO\(_{2}\)-EOR also possible returns) to the CO\(_{2}\) transport sector.

Storage entities maximize their objective functions subject to a respective diffusion constraint which limits their maximal annual investment based on previous investments and some initiating capacity (START_CO2 \(_{s})\) multiplied with a diffusion factor (DIFF_CO2 \(_{s})\).

Further constraints restrict the annual storage quantities based on prior investments (20) as well as the overall maximal storage quantity per site and technology (MAX_STOR \(_{n,s})\) (21).

2.7 Market clearing conditions across all sectors

Three market clearing conditions connect the different sites (represented as nodes) and sectors in the ELCO model: The first two represent the energy balance, while the third balances CO\(_{2}\) flows. With the introduction of the CfD scheme, the electricity market is fragmented: Technologies not supported by the CfD scheme market their generation to serve residual demand that remains after subtracting supply from CfD supported technologies as shown in (22). This gives the nodal balance as the sum of generation from conventional and CfD-technologies and inflows minus outflows, demand and fixed feed-in from pre-CfD renewables. The free dual variable mu_e \(_{h,n,a}\) of this equation corresponds to the price observed at the electricity wholesale market. By contrast, CfD-technologies do not observe any feedback between their generation and market demand, just like in reality. Therefore, an additional curtailment constraint needs to be introduced (23), that limits total generation to meet the total demand.

The third market clearing is the CO\(_{2}\) flow balance (24) with its free dual variable mu_co2 \(_{h,n,a}\). Here, CO\(_{2}\) flow out of the node plus storage at the node is balanced with CO\(_{2}\)-inflow and captured CO\(_{2}\) from industry and the power sector.

3 Case study: the UK electricity market reform

The UK energy and climate policy used to be subject to a significant dichotomy between its policy targets and reality. Despite of fixed goals on final energy consumption from renewables (15% in 2020) and binding 5-year carbon reduction targets towards an 80% reduction by 2050, the current energy policy framework was lacking instruments to incentivize investments that are necessary to achieve these goals [38]. In addition, up to 20 GW of mostly coal fired generation have exceeded 40 years of age in the year 2015 [39] and are either to be decommissioned or in need of retrofit investments. The upcoming decade therefore becomes vital for a future decarbonized electricity market to prevent stranded investments in carbon intensive power plants. The UK government decided to undertake a major restructuring of its energy policy framework, called EMR [40]. The EMR introduces four main policies to support low-carbon technologies: CfD, carbon floor price (CFP), EPS and a capacity market (CM).

These instruments constitute a major reform to the previous framework of the UK electricity market which was characterized by a high competitiveness and low market concentration [41]. Thus, its effects have been controversially discussed, e.g. by [38, 42]. Some critics question the effect the reform might have on the UK electricity market and in particular on the future of low-carbon technologies. The future generation mix will be mostly determined by the government through long-term contracts with little ability to react quickly to future changes. Major risks include possible welfare losses as well as possible breached climate targets due to stranded investments in carbon intensive power plants (a topic examined by Johnson et al. [43] on a global level). This calls for additional research on low-carbon technologies in the UK. Chalmers et al. [44] summarize the findings of the 2-year UKERC research project on the implementation of CCTS in the UK. To our best knowledge, however, there is no model that evaluates the effects of the UK-EMR on the UK electricity market as well as on the overall CCTS value chain including also the main industrial CO\(_{2}\) emitters.

The following section describes the UK-EMR and the policy measures which are included in the ELCO model.Footnote 2 The used data set and results of this case study are afterwards discussed in the Sects. 3.2 and 3.3. Section 3.4 provides a comparison of case study results to other studies.

3.1 Describing the instruments: contracts for differences, carbon price floor, and emissions performance standard

Contracts for differences (CfD) were tied in the UK Energy Bill in 2013. They consist of a strike price for different low-carbon technologies resembling a fixed feed-in tariff. Generators take part in the normal electricity market but receive top-up payments from the government if the achieved prices are lower than the strike price. The government, on the other hand, receives equivalent payments from the generator if the market price exceeds the strike price. CfD and inherent strike prices are fixed for the duration of the contract. The long-term target of the CfD scheme is to find the most competitive carbon neutral technologies. In the short run, strike price levels are decided on in a technology-specific administrative negotiation process. In the long run, it is envisioned to determine a common strike price via a technology-neutral auction.

The UK government hopes that CfD enhance future investments as feed-in tariffs reduce the risk of market prices and gives incentives for cost reductions. Technologies that are supported through CfD are various kinds of renewables (e.g. on-/offshore wind, PV, tidal, etc.) but also CCTS and nuclear. International dissent exists especially for the latter. Critics argue that a CfD for nuclear energy resembles an illegal subsidy tailored for the newly planned “Hinkley Point” project. The European Commission (EC) regulation requires implementation for an entire technology and accessibility for all possible investors. On the other hand, due to its technology and safety specifics the nuclear sector is only open for a limited number of actors. The EC, however, decided in favour of the project after a formal investigation in October 2014, which might also have an effect on nuclear policies in other countries [45].

The UK introduced a carbon price floor (CPF) of 16 £/tCO\(_{2}\) (around 20 €/tCO\(_{2})\) for electricity generators in 2013 to reduce uncertainty for investors. The CPF consists of the EU-ETS CO\(_{2}\) price and a variable climate change levy on top [carbon price support (CPS)]. Forecasting errors in predicting the price of EU-ETS 2 years ahead can lead to distortions between the targeted and the final CPF. The climate change levy actually already exists since 2001, but the electricity sector used to be exempted from it. In 2013, the levy is expected to generate around £1 bn in the year 2013 [46].

Initially, the CPF was planned to be gradually increasing to reach a target price of 30 £/tCO\(_{2}\) (around 38 €/tCO\(_{2})\) in 2020 and 70 £/tCO\(_{2 }\)(around 88 €/tCO\(_{2})\) in 2030. A constantly rising minimum price should ensure increasing runtimes for low-carbon technologies such as renewables, nuclear and CCTS as fossil based electricity generation becomes more expansive due to their CO\(_{2}\) emissions. The British minister for finance, however, announced in March 2014 that the CPF will be frozen at a level of 18 £/tCO\(_{2}\) (around 23 €/tCO\(_{2})\) until 2019/20 [47]. The reason for this decision was the increasing discrepancy between the CPF and the EU-ETS CO\(_{2}\) emission price, lowering the competitiveness of British firms. It is yet unclear, how the CPF will evolve after 2020; depending probably largely on the effect of the upcoming structural reform of the EU-ETS. The CPS only has an effect on the British electricity sector. Neither is the combustion of natural gas for heating or cooking nor are electricity imports from neighboring countries affected by this instrument. The latter is also the main reason why the CPS has not been implemented in Northern Ireland which is part of the single electricity market in Ireland [38].

Another instrument implemented in the Energy Bill is the CO\(_{2}\) EPS [40]. It limits the maximal annual CO\(_{2}\) emission of newly built or retrofitted electricity units to the ones of an average gas-fired power plant without carbon capture. Plants with higher carbon intensities like coal-fired units either have to reduce their load factor or install capture facilities for parts of their emissions. The EPS for a unit can be calculated by multiplying its capacity with 450 gCO\(_{2}\)/kWh times 7446 h (equivalent to a 0.85 load factor and 8760 h per year). This results in an annual CO\(_{2}\) budget of 3350 tCO\(_{2}\)/MW, restricting a coal-fired unit with emissions of 750 g/kWh to a maximal load factor of 0.5 or 4470 h per year. The goal of this regulation is to foster investment in new gas power plants as well as power plants with capturing units. Power plants with capture units are additionally exempted from EPS for the first 3 years of operation to optimize their production cycles. Special exemptions exist for biomass plants smaller than 50 MW and related to heat production and in the case of temporary energy shortage.

3.2 Data input

Electricity generation capacities as well as data for investment cost, variable cost, fixed cost, availability and life time assumptions are taken from DECC [39, 48]. We assume a linear cost reduction over time for the investment cost according to Schröder et al. [49]; variable and fixed cost remain constant. The costs are independent from power plant location; but availabilities of renewables do vary. Industrial CO\(_{2}\) emissions and their location are taken from studies concentrating on CCTS adoption in the UK industry sector [50, 51]. Capturing costs in the industry sector as well as costs for CO\(_{2}\) storage and CO\(_{2}\)-EOR application are taken from Mendelevitch [34]. The fix costs are included in the variable capturing costs.

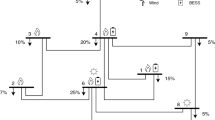

The simplified representation used for this case study consists of three nodes (see Fig. 1). Node 1 and 2 represent the Northern and Southern part of the UK with their power plants and industrial facilities. A third offshore node resembles possible locations for offshore wind parks as well as CO\(_{2}\) storage with and without CO\(_{2}\)-EOR in the North Sea. We assume electricity and CO\(_{2}\) pipeline connections between node 1 and 2 as well as between node 2 and node 3. Moreover, we assume a simplified electricity grid neglecting congestion between nodes in this scenario. In addition, no exchange with the neighboring countries is allowed. CO\(_{2}\) pipelines can endogenously be constructed between adjacent nodes.

The CPF is assumed to remain constant at 18 £/tCO\(_{2}\) (around 23 €/tCO\(_{2})\) until 2020. We assume the CO\(_{2}\) price to increase due to the effects of the structural reform of the EU-ETS. CPF and CO\(_{2}\) price are thus assumed to have the same level from 2030 onwards, rising linearly from €35 in 2030 to €80 in 2050. We include price projections for the strike prices in 2015 and 2020 given by DECC [52]. These technology specific differences will be linearly reduced until 2030. Starting from 2030 all technologies under the CfD will be given the same financial support via an endogenous auctioning system. The EPS is set at a level of 450 g/kWh [40]. An annual CO\(_{2}\) emissions reduction of 1% in the electricity sector is implemented leading to 90% emissions reduction in 2050 compared to 1990, mimicking a CO\(_{2}\) emission reduction path similar to the “gone green” Scenario of National Grid’s Future Energy Scenarios [53]. No specific RES target is set. The discount rate is 5% for all players. The oil price is expected to remain at a level of 65 €/bbl, which is in the rate of the average oil price implied by the World Energy Outlook Current Policies Scenario [54].

The annual load duration curve of UK is approximated by five weighted type hours, assuming a demand reduction of 20% until 2050 (base year 2015). This simplification does not allow for demand shifting nor energy storage in between type hours. CO\(_{2}\) emissions from industrial sources are assumed to decline by 40% until 2050. The lifetime of the existing power plant fleet varies by technology between 25 (most renewables), 40 (gas) and 50 (coal, nuclear, and hydro) years.

3.3 Case study results

This simplified case study was created to show the characteristics and features of the ELCO model. Its results should not be over-interpreted but give an idea of the potential of the model.

The implementation of the various policy measures leads to a diversified electricity portfolio in 2050: with no specific RES target in place, renewables account for 46% of generation, gas (26%), nuclear (15%), and CCTS (13%). The majority of the investments in new renewable capacity happen before 2030. Less favorable regional potentials and technologies such as PV are only used in later periods. The implemented incentive mechanism is comparable to an auctioning system of “uniform pricing” where the last bidder sets the price. The average payments for low-carbon technologies are in the range of 80 to 110 €/MWh but depend strongly on the assumptions for learning curves and technology potentials. Different allocation mechanisms such as “pay as bid” might lower the overall system costs.

The share of coal-fired energy production is sharply reduced from 39% in 2015 to 0% in 2030 due to a phasing-out of the existing capacities (see Fig. 2). New investments in fossil capacities occur for gas-fired CCGT plants, which are built from 2030 onwards. EPS hinders the construction of any new coal-fired power plant without CO\(_{2}\) capture. Sensitivity analysis shows that a change of its current level of 450 g/kWh in the range of 400-500 g/kWh has only little effect: Gas-fired power plants would still be allowed sufficient run-time hours while coal-fired plants remain strongly constrained. The overall capacity of nuclear power plants is slightly reduced over time.Footnote 3 The share of renewables in the system grows continuously from 20% in 2015 to 30% in 2030 and 46% in 2050. Wind off- (41% in 2050) and onshore (25% in 2050) are the main renewable energy sources followed by hydro and biomass (together 27% in 2050).

CO\(_{2}\)-EOR creates additional returns for CCTS deployment through oil sales. These profits trigger investments in CCTS regardless of additional incentives from the energy market. The potential for CO\(_{2}\)-EOR is limited and will be used to its full extent until 2050. The maximum share of CCTS in the electricity mix is 16% in 2045. The combination of assumed ETS and oil price also triggers CCTS deployment in the industry sector from 2020 onwards (see Fig. 3). The industrial CO\(_{2}\) capture rate, contrary to the electricity sector, is constant over all type hours. The storage process requires a constant injection pressure, especially when connected to a CO\(_{2}\)-EOR operation. This shows the need for intermediate CO\(_{2}\) storage to enable a continuous storage procedure and should be more closely examined in further studies. From 2030 onwards, emissions in the industrial sector are captured with the maximum possible capture rate of 90%. The usage of saline aquifers as well as depleted oil and gas fields is not beneficial assuming a CO\(_{2}\) certificate price of 80 €/tCO\(_{2}\) in 2050.

3.4 Comparison of UK showcase results to other studies

Table 5 provides a comparison of key results from the UK show case to findings from other related studies on the electricity and CO\(_{2}\) sector. The different scenarios of Nationalgrid [53] show different visions of the UK electricity sector: The scenarios “gone green” and “slow progression” follow a continuous decarbonization pathway based on the three pillars of RES, nuclear and CCTS. The scenarios “no progression” and “consumer power”, on the other hand, assume less innovation and relatively constant CO\(_{2}\) emissions missing the nation’s climate targets. CCTS is not deployed in the latter two scenarios. By contrast, Kjärstad et al. [37] analyze the entire European electricity sector and take CCTS into account. Results from Nationalgrid [53] as well as from Kjärstad et al. [37], however, only assume CCTS applications in the electricity sector neglecting industrial emissions. Also, the opportunity of additional revenue from CO\(_{2}\)-EOR is not taken into consideration. The CCTS-model of Oei and Mendelevitch [55] includes the industry sector as well as the possibility of CO\(_{2}\)-EOR.

Our model showcase results follow a similar storyline as the “gone green” and “slow progression” scenarios of Nationalgrid [53] for the electricity sector. However, more restrictive assumptions on nuclear technology result in a lower share of nuclear generation. Kjärstad et al. [37] calculate similar shares of RES and nuclear generation, but see twice as high shares for CCTS. More detailed results on the CCTS sector can only be compared to Kjärstad et al. [37] and Oei and Mendelevitch [55]. While the former see CCTS implementation already from 2020 onwards, the latter differentiate between early deployment for CCTS in industry (2020) and late deployment for the electricity sector (2040). This is in line with results obtained in this paper. When comparing our results to Oei and Mendelevitch [55], widening the geographical area from the UK to the entire North-Sea region leads to a lower share of CO\(_{2}\)-EOR storage as also other offshore storage sites near the coastline are being used once all CO\(_{2}\)-EOR potential has been exploited.

4 Conclusion: findings of an integrated electricity-CO\(_{2}\) modeling approach

This paper, we presents a general electricity-CO\(_{2}\) modeling framework (ELCO model). The model captures interactions on the energy-only market and their interrelation with different forms for national policy measures. Additionally, it features a full representation of the carbon capture, transport, and storage (CCTS) chain. Climate policy measures that can be examined include feed-in tariffs, a minimum CO\(_{2}\) price and EPS. For a more comprehensive representation of potential conflict of interest for CO\(_{2}\) storage, the model also includes large point industrial emitters from the iron and steel as well as cement sector that might also invest in carbon capture, increasing scarcity for CO\(_{2}\) storage. Therefore, the modeling framework mimics the typical issues encountered in coal-based electricity systems that are now entering into transition to a low-carbon generation base. The model can be used to examine the effects of different envisioned policy measures and evaluate policy trade-off.

This paper is used to describe the different features and potentials of the ELCO model. Such characteristics can easily be examined with a simplified model, even though its quantitative results should not be over-interpreted. As further development steps we need to test the robustness of the equilibrium results with sensitivity analysis while increasing the regional and time resolution of the model.

The mathematical formulation of the model implies some critical parameter, where the respective choice will have a strong impact on attainable equilibrium results. The deployment of an individual technology will be governed by its relative competitiveness compared to other technologies, but both, maximum nodal potential and the diffusion factor will significantly influence its deployment. Besides, the implemented climate targets (for renewables and for CO\(_{2}\) emissions) drive the results, by providing incentives to invest in RES technologies.

The results of the case study on the UK EMR present a show case of the model framework. It incorporates the unique combination of a fully represented CCTS infrastructure and a detailed representation of the electricity sector in UK. The instruments of the UK EMR, like EPS, CfD and CPF are integrated into the framework. Also we take into account demand variation in type hours, the availability of more and less favorable locations for RES and limits for their annual diffusion. The model is driven by a CO\(_{2}\) target and an optional RES target.

The next steps are to compare the costs of different incentive schemes and to analyze their effects on the deployment of different low-carbon technologies, with a special focus on CCTS with and without the option for CO\(_{2}\)-enhanced oil recovery (CO\(_{2}\)-EOR). The role of industry CCTS needs to be further considered in this context. Additionally, we plan to study the feedback effects between the CfD scheme and the electricity price, and investigate the incentives of the government which acts along the three pillars of energy policy: cost-efficiency, sustainability and security; in a two-level setting. This also includes calculating the system integration costs of low-carbon technologies. A more detailed representation of the electricity transmission system operator (TSO) as market organizer helps doing so by separating financial and physical flows. The TSO is on the one hand responsible to guarantee supply meeting demand at any time and on the other hand reimburses CfD technologies for curtailment. At a later stage, we want to use the model for more realistic case studies to draw conclusions and possible policy recommendations for low-carbon support schemes in the UK as well as in other countries.

Notes

RES and nuclear provide sufficient decarbonization alternatives for the electricity sector. The high cost increase, however, is caused by only limited alternative decarbonization technologies in the industry sector. Negative emissions of large-scale utilization of CCTS with biomass, in addition, compensate for unabatable emissions in other sectors [18].

The specifics of a possible CM in the UK are not clear yet and were therefore not included in this case study.

This is influenced through the diffusion constraint which limits the maximal annual construction, esp. in early periods.

References

World Summit of the Regions.: The Paris Declaration—Opportunity for Bottom-Up Action in Favour of the Low Carbon Economy. Regions of Climate Action, Paris, France (2014)

Leader of the G7.: Leaders’ Declaration G7 Summit, 7– 8 June 2015. Schloss Elmau, Germany, Jun. (2015)

Hu, J., Crijns-Graus, W., Lam, L., Gilbert, A.: Ex-ante evaluation of EU ETS during 2013–2030: EU-internal abatement. Energy Policy 77, 152–163 (2015)

EC.: Questions and answers on the proposed market stability reserve for the EU emissions trading system. European Commission, Brussels, Belgium, Jan. (2014)

Pfenninger, S., Hawkes, A., Keirstead, J.: Energy systems modeling for twenty-first century energy challenges. Renew. Sustain. Energy Rev. 33, 74–86 (2014)

Capros, P., et al.: The PRIMES Energy System Model-reference Manual. Natl. Tech. Univ, Athens (1998)

Fishbone, L.G., Abilock, H.: Markal, a linear-programming model for energy systems analysis: technical description of the bnl version. Int. J. Energy Res. 5(4), 353–375 (1981)

Finon, D.: Scope and limitations of formalized optimization of a national energy system—the EFOM model. Energy Models Eur. Community Energy Policy Spec. Publ. IPC Sci. Technol. Press Ltd. Comm. Eur. Community Bruss. Belg. (1979)

Criqui, P.: International markets and energy prices: the POLES model. In: Lesourd, J.-B., Percebois, J., Valette, F. (Eds.) Models for Energy Policy. Routledge, New York (1996)

Fais, B., Blesl, M., Fahl, U., Voß, A.: Comparing different support schemes for renewable electricity in the scope of an energy systems analysis. Appl. Energy 131, 479–489 (2014)

Ehrenmann, A., Smeers, Y.: Generation capacity expansion in a risky environment: a stochastic equilibrium analysis. Oper. Res. 59(6), 1332–1346 (2011)

Allevi, E., Bonenti, F., Oggioni, G.: Compelementarity Models for Restructured Electricity Markets under Environmental Regulation, Italy, special issue, p 7–27 (2013)

Gürkan, G., Langestraat, R.: Modeling and analysis of renewable energy obligations and technology bandings in the UK electricity market. Energy Policy 70, 85–95 (2014)

Chen, Y., Wang, L.: Renewable portfolio standards in the presence of green consumers and emissions trading. Netw. Spat. Econ. 13(2), 149–181 (2013)

Kunz, F., Zerrahn, A.: Benefits of coordinating congestion management in electricity transmission networks: theory and application to Germany. Util. Policy 35, 34–45 (2015)

EC.: EU Energy, Transport and GHG Emissions Trends to 2050: Reference Scenario 2013. European Commission, Brussels (2013)

IPCC.: Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. IPCC, Geneva (2014)

Kemper, J.: Biomass and carbon dioxide capture and storage: a review. Int. J. Greenh. Gas Control 40, 401–430 (2015)

Groenenberg, H., de Coninck, H.: Effective EU and member state policies for stimulating CCS. Int. J. Greenh. Gas Control 2(4), 653–664 (2008)

von Hirschhausen, C., Herold, J., Oei, P.-Y.: How a ‘low carbon’ innovation can fail—tales from a ‘lost decade’ for carbon capture, transport, and sequestration (CCTS). Econ. Energy Environ Policy 2, 115–123 (2012)

Milligan, B.: Planning for offshore CO\(_{2}\) storage: law and policy in the United Kingdom. Mar. Policy 48, 162–171 (2014)

von Stechow, C., Watson, J., Praetorius, B.: Policy incentives for carbon capture and storage technologies in Europe: a qualitative multi-criteria analysis. Glob. Environ. Change 21(2), 346–357 (2011)

Gale, J., Abanades, J. C., Bachu, S., Jenkins, C.: Special issue commemorating the 10th year anniversary of the publication of the intergovernmental panel on climate change special report on co2 capture and storage. Int. J. Greenh. Gas Control 40, 1–5 (2015)

IPCC.: IPCC Special Report on Carbon Dioxide Capture and Storage. Prepared by Working Group III of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge (2005)

Eide, J., de Sisternes, F.J., Herzog, H.J., Webster, M.D.: CO\(_2\) emission standards and investment in carbon capture. Energy Econ. 45, 53–65 (2014)

Middleton, R.S., Eccles, J.K.: The complex future of CO\(_2\) capture and storage: Variable electricity generation and fossil fuel power. Appl. Energy 108, 66–73 (2013)

Oei, P.-Y., Herold, J., Mendelevitch, R.: Modeling a carbon capture, transport, and storage infrastructure for europe. Environ. Model. Assess. 19, 515–531 (2014)

Morbee, J., Serpa, J., Tzimas, E.: Optimised deployment of a European CO\(_2\) transport network. Int. J. Greenh. Gas Control 7, 48–61 (2012)

Middleton, R.S., Bielicki, J.M.: A scalable infrastructure model for carbon capture and storage: SimCCS. Energy Policy 37(3), 1052–1060 (2009)

Kazmierczak, T., Brandsma, R., Neele, F., Hendriks, C.: Algorithm to create a CCS low-cost pipeline network. Energy Procedia 1(1), 1617–1623 (2008)

Kobos, P.H., Malczynski, L. A., Borns, D. J., McPherson, B. J.: The ‘String of Pearls’: The Integrated Assessment Cost and Source-Sink Model. In: Pittsburgh, PA, USA, Conference Proceedings of the 6th Annual Carbon Capture & Sequestration Conference, May (2007)

Gough, C., OxKeefe, L., Mander, S.: Public perceptions of CO\(_2\) transportation in pipelines. Energy Policy 70, 106–114 (2014)

Knoope, M.M.J., Ramírez, A., Faaij, A.P.C.: The influence of uncertainty in the development of a CO\(_2\) infrastructure network. Appl. Energy 158, 332–347 (2015)

Mendelevitch, R.: The role of CO\(_2\)-EOR for the development of a CCTS infrastructure in the North Sea Region: a techno-economic model and applications. Int. J. Greenh. Gas Control 20, 132–159 (2014)

Kemp, A.G., Kasim, S.: The economics of CO2-EOR cluster developments in the UK Central North Sea. Energy Policy 62, 1344–1355 (2013)

Fleten, S.-E., Lien, K., Ljønes, K., Pagès-Bernaus, A., Aaberg, M.: Value chains for carbon storage and enhanced oil recovery: optimal investment under uncertainty. Energy Syst. 1(4), 457–470 (2010)

Kjärstad, J., Morbee, J., Odenberger, M., Johnsson, F., Tzimas, E.: Modelling large-scale CCS development in Europe linking techno-economic modelling to transport infrastructure. Energy Procedia 37, 2941–2948 (2013)

Pollitt, M.G., Haney, A.B.: Dismantling a competitive electricity sector: the U.K’.s electricity market reform. Electr. J. 26(10), 8–15 (2013)

DECC.: Digest of United Kingdom Energy Statistics 2014. Department of Energy & Climate Change (DECC), London (2014)

The Parliament of Great Britain.: Energy Bill (2013)

DECC.: UK Energy in Brief 2014. Department of Energy & Climate Change (DECC), A National Statistics Publication, London (2014)

Chawla, M., Pollitt, M.: Global trends in electricity transmission system operation: where does the future lie? Electr. J. 26(5), 65–71 (2013)

Johnson, N., Krey, V., McCollum, D., Rao, S., Riahi, K., Rogelj, J.: Stranded on a low-carbon planet: implications of climate policy for the phase-out of coal-based power plants. Technol. Forecast. Soc. Change 90(Part A), 89–102 (2015)

Chalmers, H., et al.: Analysing uncertainties for CCS: from historical analogues to future deployment pathways in the UK. Energy Procedia 37, 7668–7679 (2013)

Černoch, F., Zapletalová, V.: Hinkley point C: a new chance for nuclear power plant construction in central Europe? Energy Policy 83, 165–168 (2015)

Ares, E.: Carbon Price Floor. House of Commons Library, London (2014)

Osborne, G.: Chancellor George Osborne’s Budget 2014 speech, 19th March 2014. London (2014)

DECC.: Electricity Generation Costs. Department of Energy & Climate Change (DECC), London (2013)

Schröder, A., Kunz, F., Meiß, J., Mendelevitch, R., von Hirschhausen, C.: Current and Prospective Costs of Electricity Generation until 2050, vol 68. DIW Data Documentation, Berlin (2013)

Element Energy, P.S.C.E, Imperial College, and University of Sheffield.: Demonstrating CO2 Capture in the UK Cement, Chemicals, Iron and Steel and Oil Refining Sectors by 2025: A Techno-Economic Study. Final Report for DECC and BIS, Cambridge (2014)

Houses of Parliament.: Low Carbon Technologies for Energy-Intensive Industries, vol. 403. Parliamentary Office of Science & Technology, London (2012)

DECC.: Investing in renewable technologies—CfD contract terms and strike prices. Department of Energy & Climate Change (DECC), London (2013)

National Grid.: UK Future Energy Scenarios. National Grid. Warwick, United Kingdom (2016)

International Energy Agency, Ed.: World Energy Outlook 2015. OECD, Paris (2015)

Oei, P.-Y., Mendelevitch, R.: European scenarios of CO\(_2\) infrastructure investment until 2050. Energy. J. 37(3), 171–194 (2016)

Acknowledgements

The first draft of the model was developed during a research stay at the International Institute for Applied System Analysis (IIASA) in Laxenburg, Austria. We want to thank all members of the Energy department and in particular Nils Johnson for numerous fruitful discussions and helpful inputs during these months. Additional thanks goes to our colleagues at DIW Berlin and TU Berlin Claudia Kemfert, Christian von Hirschhausen, Franziska Holz, Daniel Huppmann, and Alexander Zerrahn for their discussions, critiques, and comments. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendix: Karush–Kuhn–Tucker conditions of the ELCO model

Appendix: Karush–Kuhn–Tucker conditions of the ELCO model

1.1 The electricity sector

1.1.1 Shared environmental constraints for the electricity sector

1.2 The electricity transportation utility

1.3 The industry sector

1.4 The CO\(_{2}\) transportation utility

1.5 The CO\(_{2}\) storage sector

1.6 Market clearing conditions across all sectors

Rights and permissions

About this article

Cite this article

Mendelevitch, R., Oei, PY. The impact of policy measures on future power generation portfolio and infrastructure: a combined electricity and CCTS investment and dispatch model (ELCO). Energy Syst 9, 1025–1054 (2018). https://doi.org/10.1007/s12667-017-0242-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12667-017-0242-z