Abstract

Indonesian coal production and consumption are expected to increase within the foreseeable period. The coal production is estimated to reach its peak in 2026 and subsequently will be decreased. Meanwhile the consumption will continually increase. The coal production that is greater than the domestic coal consumption raises a problem of resource allocation in Indonesian energy sector. In this study Indonesian coal resource allocation within the foreseeable period of 2014–2030 is solved using linear programming method. Linear programming optimizes the coal resource allocation by minimizing logistic cost which consist of coal purchasing cost and transportation cost from producer’s transshipment to consumers. The optimization results of resource allocation optimization indicate a change of Indonesian coal suppliers in the domestic market with respect to time to reach the minimum logistic cost. Sensitivity analysis indicates that the pattern of resource allocation will be more affected by coal purchasing cost than transportation cost. Also, the existence of the stock will not change the pattern of resource allocation but will affect the total logistic cost although not significant. Related to domestic market obligation (DMO), stipulation of coal basin priority as supplier of a consumer area with respect to time will ensure the fulfilment of DMO quota for the mining companies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Indonesia depends on fossil fuels such as crude oil, coal, and natural gas as its main energy resources. In early 1990, the energy needs of Indonesia was around 51.9 million tonnes of oil equivalent (MTOE). It comprised 61.1, 6.6, and 29.3% of crude oil, coal, and natural gas, respectively. In 2015, the energy needs has increased to 195.6 MTOE due to rapid economic growth. Fossil fuel still takes place in dominating the domestic demand although the proportion of the respective energy resources is now changed to 37.6, 41.1, and 18.3% [1]. The rest of the demand is fulfilled by renewable energy resources.

Among the three energy resources of fossil fuel, coal has the most rapid consumption growth of approximately 10% per year. Such significant growth may be triggered by the advantages of coal in comparison to other energy resources, i.e. its abundant domestic coal reserves (around 30 million tonnes in 2013), and its bulky solid type make it easy to transport using any kind of mode.

Indonesian coal supply for domestic market is secured enough. The reserve to production ratio (R/P) of coal indicated that it can be utilized for supplying both the domestic and international markets for another 75 years [2]. Despite such abundant coal reserves, the fact that Indonesia is an archipelago country is problematic to transporting the domestic coal supply. Indonesian coal is supplied by two islands, i.e. Sumatra and Kalimantan, both having diverse variations in terms of the coal quality (Fig. 1). The potential foreland coal basins in Kalimantan are Kutai, Tarakan, and Barito basins. The potential continental margin coal basins in Sumatera are Ombilin, Bengkulu, South Sumatera, and Central Sumatera Basins [3]. The coal, of diverse quality, is needed by all the regions in Indonesia, from east to west with the territory length as wide as the length of Europe continent. This raises a problem on resource allocation.

The resources allocation problem is defined as the allocation of limited resources to the end-users in such a way that the maximum overall return is achieved [4]. It typically occurs in non-renewable energy resource. The analysis of the energy resources allocation is carried out during the planning stage of the energy supply. Various methods are available to examine the optimum supply allocation. One of the well-known yet widely used methods is MARKAL (market allocation). MARKAL is a bottom-up, dynamic technique, originally and mostly linear programming model developed by International Energy Agency [5, 6]. Such a model describes supply and demand sides in energy system, and also cover technological aspects to be used to identify the relationship between the macro-economies, energy use, and the impact of energy resources consumption such as carbon emission [6].

With respect to the allocation of energy resources, this study will examine the supply of coal resources in fulfilling the needs of the domestic market until 2030. The assessment covers the aspect of production, consumption, and optimization of the supply allocation. Production is forecasted using Gompertz curve by applying coal basin approach, taking into account its unique geological process which will affect the quality of the coal. For coal commodity, quality is the main determinant of the exploitation rate. Coal consumption will be divided with respect to the consumer area using multi-variable regression linear method. The determinant variable of the coal consumption are regional gross domestic product (GDRP), population, and time. The results of coal production and consumption forecasting until 2030 will be optimized by linear programming method to obtain the optimum condition of coal supply in which lowest logistic cost is achieved.

2 Coal mining in Indonesia: reserves, production and utilization

2.1 Indonesia’s coal reserves

Indonesian coal reserves have continued to increase in the past 10 years. The total coal reserve in 2003 was 6.98 billion tonnes. In 2013, the reserve increased to 30.79 billion tonnes (Fig. 2) [2]. Thus, the average reserve growth is around 16% per year. Kutai Basin has the highest reserve growth, followed by the South Sumatra and Barito basins. The rates of reserve growth of the three coal basins are around 18, 17, and 10%, respectively, indicating that the most intensive exploration activity was conducted in those three coal basins for the past three decades. Furthermore, Kutai, South Sumatra, and Barito basins have the highest coal reserve of around 89% of the total Indonesian coal reserve.

Analysis based on coal quality shows that each coal basin has unique quality distribution. The tectonic process during the coal deposition period determines the quality of coal deposits in each basin. The characteristics of Indonesian coal with respect to the setting of tectonic plates are listed in Table 1 [3].

The Coal basin in Kalimantan is dominated by medium to high calorific value (CV) of coal. Around 87% of Kalimantan coal falls into these categories. High CV coal in Tanjung Formation, Barito Basin, Kalimantan, was formed during the Eocene period. Another Kalimantan high CV coal is explored in the Pinang Dome, Kutai Basin, which was formed by intrusion process during its genesis [7]. About 97% of the reserve of Sumatra coal, however, is dominated by low to medium CV of coal. High CV coal was however still observed in Sumatra, in Ombilin basin and PTBA Anthracite. Ombilin basin was formed during the Eocene period. PTBA Anthracite coal was formed by intrusion process during its genesis. In general, Kalimantan coal has better prospects due to its higher quality coal when compared to Sumatra (Fig. 3) [2].

2.2 Indonesian coal production

Despite such abundant coal reserves, until 1990 Indonesia only produced small amount of coal. Coal was lacking its competitiveness to oil back then. After the oil price booms in 1974 and 1981, there is a tendency to explore coal as a substitute of oil and Indonesia becomes one of the target for coal exploration [8]. Following the success of exploration program of Coal Contract of Work (CCoW) between the GoI and the mining companies in 1979, Indonesia’s coal production has then started to increase. Coal production increased by about 17% per year (Fig. 4) [10] in between 1990 and 2013 and the companies listed in CCoW contributed of more than 60% of total production.

The amount of the coal production is influenced by the amount and quality of the coal reserve in each coal basin. Kutai and Barito basins, the two basins with the highest reserves, contribute around 83% of total coal production. South Sumatera basin, even though has high amount of reserves, only produced 6% of total coal production in 2013. Its contribution is 23% less than the production in Tarakan basin (Fig. 4a), although the total reserves is nearly ten times of Tarakan basin. This indicates that there is another factor which affect the amount of production; the quality of coal reserve.

Coal production, like other non-renewable resources, follows the law of rent by David Riccardo. The law states that producer will prefer to mine high CV coal in advanced than the low CV coal due to higher economic rent [9]. Figure 4b and Table 2 [2, 10] show that around 40% of high CV coal reserves and 10% of the low CV coal reserves have been produced until 2013. Bengkulu, Kutai, Barito, and Tarakan basins have higher priority to mine as they are rich in high CV and medium CV coal. Low CV coal mining has just started in 2004. Within the last 10 years, only less than 1% of low CV coal reserves are mined in Kutai and Tarakan basins.

Indonesian coal production increases significantly within the last 20 year. Such a significant increase is attributed to the comparative advantages of Indonesian coal, i.e.; (1) mining method and strategy, (2) location factor and mode of transportation, and (3) mining production scheme.

2.2.1 Mining method and strategy

Indonesia has many variations of coal deposit. One of the parameters to classify such variations is the sedimentation process and tectonic setting during depositional period. The sedimentation process and tectonic setting during depositional period classify the coal deposits into three categories of geological condition, i.e.; simple, moderate, and complex. The examples of simple geological condition’s coal fields are Bangko Selatan and Muara Tiga Besar (South Sumatera Basin), Senakin Barat (Barito Basin), and Cerenti (Central Sumatera Basin). Meanwhile, the examples of moderate geological conditions coal fields are Senakin (Barito Basin), Loa Janan-Loa Kulu and Petangis (Kutai Basin), Suband and Air Laya (South Sumatera Basin). The last category, coal fields with complex geological condition are found in Warukin Formation (Bario Basin), Sawahluhung (Ombilin Basin), and Bunian Utara (South Sumatera Basin) [11].

Theoretically, the geological condition of the coal field is one of the determinants to decide the mining method [12]. As an example, the underground mine is applicable only for the coal field with simple geological condition. However, Indonesian coal mines are, in practice, mostly open pit mines. In 2013, the production from the open pit mines was accounted of more than 95% of total Indonesian coal production. The open pit method is thought to be the most appropriate method in Indonesia due to low capital investment and high flexibility in mine expansion and coal production [13].

2.2.2 Factor of location and transportation mode

Location and transportation mode are also crucial in coal supply chain. Hauling/barging distance as well as transportation equipment will determine the total production cost of coal mining. Free on Board (FOB) Vessel Cash Cost in 2010 provided comparison of the average coal transportation cost in some countries and Indonesia is listed with the lowest transportation cost compared to other coal producer countries like Australia, USA, South Africa, and Columbia [14]. This becomes one of the comparative advantages of Indonesian coal mine. Lucarelli [8] in his study stated three main reasons why Indonesian coal, especially the Kalimantan coal, is attractive. The three reasons are as follows; easy access to navigable rivers or coastal areas, shorter sailing distance to the export destinations, and higher calorific value coal [8].

2.2.3 Coal mining production scheme

Coal mining in Indonesia has evolved since the enactment of Law No. 1/1967 on foreign direct investment and Law No. 11/1967 on principles of mining in Indonesia. According to Law No. 11/1967, Government of Indonesia (GoI) offered a production scheme called Mining Permit (Kuasa Pertambangan/KP). Such a production scheme is offered only for companies owned by Indonesian citizens. Besides the Mining Permit, as the stipulation of Law No. 1/1966 on foreign direct investment, GoI also offered a production scheme for foreign investor called Contract of Work (Kontrak Karya/KK). The contract of work for coal commodities was then named as Coal Contract of Work (CCoW).

CCoW scheme was made to attract foreign investor to the coal mining industry in Indonesia. In some aspects, CCoW was found to be more attractive than Coal Mining Permit (CMP). Several advantages of CCoW in comparison with CMP are lex specialist and mining concession area. The lex specialist provides legal certainty and exempting CCoW holder from any future changes in Indonesian general law such as taxation law, which may conflict with the law at the time of CCoW implementation [7]. Furthermore CCoW has larger concession area than CMP which provides bigger opportunity for CCoW holder to expand their production scale [7].

2.3 Coal consumption

Indonesian coal is sold in both domestic and export markets. Of the total production, only around 20% is sold in the domestic market. The rest is sold to other countries in Asia, Europe, and America. The domestic coal consumption is generally for power plants, cement plants, industrial processing, etc. Of all the sectors, power plants consume around 65% of coal in the domestic market. The cement industry is generally located in a place close to limestone, the raw material for making cement. Sumatra, Java, South Kalimantan, South Sulawesi, and Nusa Tenggara are the locations of the cement plants in Indonesia. In 2013 there were a total of 63 million tons of cement production which requires 7.2 million tons of coal. Other industries that consume coal are pulp industry in northern Sumatra and the eastern part of Java, metal processing industry in southern Sulawesi, and the textile industry in western Java.

Data of coal consumption per area as plotted in Fig. 5 [10, 15] shows that around 81% of coal is consumed on Java Island (Eastern and Western Java). The island has very high coal demand as it has the highest population density in which the administrative capital and development centers are located.

With respect to time, domestic coal consumption increases. Such an increase is affected by the government policy to substitute an oil based power plant to a coal based power plant. The decision was incorporated into the Blue Print of Indonesian Energy in the President of Indonesia Decree No. 5/2006. Accordingly, the coal portion will be increased gradually in national energy mix. It is targeted to reach 34% in 2025. Starting from 2006 PLN, the Indonesian state electric company, announced a 10,000 MW fast track program to build 33 coal-fired power plant projects. PLN initially targeted completion of its 10,000 MW fast track program by 2010. However, it was delayed due to engineering, procurement, and construction problems as well as financing difficulties. When the new power plants start its commercial operation, Indonesia will need more coal for domestic demand.

2.4 Policy on coal utilization as energy resources

Significant increase in coal production to meet the growing needs of the domestic and export markets urges the Indonesian government to issue and implement policies related to the coal supply, i.e. National Energy Policy and National Coal Policy.

National Energy Policy was established by Indonesian government as stated in Presidential Decree No. 5/2005. It acts as a guide to direct the efforts in achieving energy security of the domestic supply. The target of the National Energy Policy is to achieve energy elasticity of less than 1 in 2025 and to optimize the energy mix by 2025. In the energy mix, the contribution of petroleum in the fulfillment of the national energy will be reduced to below 20%. Meanwhile, the contribution of coal role will be increased to more than 33%. Such a replacement will bring consequences to the national coal supply. National coal production should focus more on the domestic market. Or else, when the coal export is maintained high, coal production shall be increased to anticipate the increasing needs of both the domestic and international markets along with the economic growth. Thus, National Coal Policy is implemented.

National Coal Policy is stated in the Ministerial Decree of the Ministry of Energy and Mineral Resources (MEMR) No. 1128K/2004 dated June 23, 2004 to guarantee the supply and provision of coal for domestic and export markets as well as the domestic growing use of coal. In line with the national coal policy, the Indonesian government has set the rules concerning the security of domestic coal supply, such as Domestic Market Obligation (DMO) and coal price reference.

DMO is the Indonesian government’s policy which aims to ensure the continuity of coal supply in the domestic market. The policy is implemented by the Ministerial Decree of the MEMR No. 34/2009 on the priority of mineral and coal supply for domestic needs by setting up a minimum percentage of coal sales in the domestic market based on the estimated domestic consumption and future production. The quantity of domestic sales for each coal mining company will be determined based on the minimum percentage stated. DMO for period of 2010–2014 is given in Table 3 [10].

The regulation of minimum percentage of coal sales for domestic needs is applied for all the coal mining companies listed in the ministerial decree. The regulation also mentioned that every coal mining company listed is able to export their coal product after fulfilling their DMO quantity. If they cannot fulfill the DMO quantity, there will be warning and/or punishment from the government, i.e. administrative warning, or a production cut to 50% from the future production planning if the written notice by the government is neglected.

Procedures on the mineral and coal price reference is stated in the Ministerial Decree of the MEMR No. 17/2010. The benchmarking of coal price aims to provide a reference value for the coal producer in setting the coal selling price, taking into account the coal quality and international coal price indexes (i.e. New Castle Export Index, New Castle Global Coal Index). Such a reference equates the coal price for the domestic and export markets of the same price (Fig. 6) [1, 10]. Before the application of the coal price reference, domestic coal price was lower than the export price. As a result, the domestic consumers were difficult to get coal supply. This benchmarking system eliminates the tendency of the coal producers to sell coal only to the export market.

3 Allocation of Indonesian coal resources

3.1 Problem on coal resources allocation

In allocating the Indonesian coal resources, one main problem is on how to meet the coal demand in all over regions in Indonesia using the domestic coal production from the coal basins or coalfields. To simplify the allocation problem, a coal transaction model is herein carried out which describes the coal flow from the producers to the consumers. The outline of the coal transaction model is shown in Fig. 7. The coal producers in the model are seven economical coal basins which consist of four basins in Sumatra (Ombilin, Bengkulu, Central Sumatra and South Sumatra) and three basins in Kalimantan (Tarakan, Kutai, and Barito). There are ten main consumers of coal with respect to its location, i.e. Northern Sumatra, Southern Sumatra, Western Java, Eastern Java, Northern Kalimantan, Southern Kalimantan, Northern Sulawesi, Southern Sulawesi, Nusa Tenggara, and Maluku and Papua.

Coal producers produce certain amount of coal with the quality in accordance with the environment of the coal formation. Coal is then distributed in the domestic and the export markets following the market demand. The difference between production and total sales becomes a stock for the manufacturers. This will increase the amount of supply for the basin in the coming period. The supply quantity of coal in a basin is given in Eq. (1).

Note:

-

a \(=\) coal supply in the domestic market

-

P \(=\) coal production

-

X \(=\) exports of coal for the international market

-

S \(=\) coal inventory in mine stockpile

-

t \(=\) time

On the demand side, the consumer will buy coal in accordance with their needs. Domestic consumers are assumed to utilize of both the high and the low CV coal. Overseas consumers, however, generally have requirements with respect to the coal properties. For example, India requires CV of 6300 kcal/kg and low ash coal and Korea requires CV of 5700 kcal/kg [16].

Domestic coal demand is currently around 20% of total production. As a result, the domestic consumers prefer to choose coal with the lowest price. The coal price referred to in the supply chain is defined as the logistic cost. It consists of two components, i.e. coal purchasing cost and transportation cost. Herein, the logistics cost will be the main determinant as an objective function in optimizing the resource allocation pattern from coal producers to consumers in the domestic market, along with other determinant variables such as production, consumption, and stock.

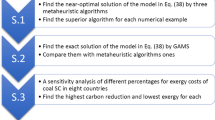

3.2 Model optimization of resource allocation

Problems in optimizing the Indonesian coal resource allocation in the domestic market is represented by coal transaction model. In this study the model will be solved using linear regression method. This method has been widely used for coal allocation cases in the previous studies [17,18,19,20]. Coal from the producers are used to meet the needs of power plants all over Indonesia. This study will optimize the allocation of Indonesian coal supply in the period 2014–2030. The main objective of the optimization process is to minimize the logistic cost. Formulation of the objective function is given in Eq. (2).

Note:

-

c \(=\) logistic cost in USD

-

x \(=\) coal supply quantity in tonnes

-

m \(=\) coal basin/coal field

-

n \(=\) coal consumer

-

i \(=\) 1, 2, \(3,\ldots ,\) m

-

j \(=\) 1, 2, \(3,\ldots ,\) n.

In addition to the objective function, there are other constraints that need to be accommodated in the model, such as;

-

Supply constraint Supply constraint is given to prevent the total coal supply from certain coal basin/coalfield to the consumer not to exceed the supply capacity of such a coal basin/coalfield. Supply capacity is defined in Eq. (3).

$$\begin{aligned} \sum _{j=1}^n x_{t,i,j} \le a_{t,i} \end{aligned}$$(3)Substitution of Eq. (1) into Eq. (2) results in the following supply constraint.

$$\begin{aligned} \sum _{j=1}^n x_{t,i,j} \le P_{t,i} -X_{t,i} -S_{t,i} +S_{t-1,i} \end{aligned}$$(4) -

Demand constraint Demand constraint is given to limit the total coal consumed by the consumer from all producers not to be less than the total coal demand.

$$\begin{aligned} \sum _{i=1}^m x_{t,i,j} \ge b_{t,j} \end{aligned}$$(5) -

Non-negative constraint Non-negative constraint makes sure all the variables of \(x_{i,j} \) to have positive values.

$$\begin{aligned} \sum _{i=1}^m x_{t,i,j} \ge 0 \end{aligned}$$(6)Note:

-

a \(=\) coal production in a coal basin/coalfield in tonnes

-

b \(=\) coal demand in a region in tonnes.

-

-

Coal quality constraint The consumers in the coal transaction model of the domestic market is defined by the region of the coal users, not by type of the industrial coal users. It is assumed that the domestic market will accept all kinds of coal, both the high CV and low CV.

4 Optimization of the Indonesian coal resources allocation

Optimization of the Indonesian coal resource allocation is carried out for the period of 2014–2030. The main components in the coal transaction model, i.e. the determinant variables of production, consumption and logistic cost, will be forecast for the period of time. Necessary assumptions for stock and export sales components of the export market are needed.

4.1 Forecasting the component of coal transaction models

4.1.1 Coal production

There are many methods to forecast the coal production, such as growth curves method (Logistic, Gompertz, and Richard curves) [21,22,23], coal production models by taking into account the interaction between supply and demand [24], and system dynamic model [25]. In this study, Gompertz curve model is carried out to forecast the Indonesian coal production.

Production forecasting by Gompertz curve assumes that the coal resources are subjected to physical limitation. Thus, the production level will start from zero and end at zero. This method also assumes that the influencing factors of coal production, i.e. the availability of reserves, the demand/market, and the development of technology on exploration, mining, and processing, have no significant change throughout the duration of the forecasting period and remain constant with respect to time [23].

The Gompertz curve forecasts the future production based on time series data of the cumulative production of the previous years. The time series data of cumulative production will show a particular growth trend. Such data will then be smoothed into a growth curve as shown in Eq. (7) and iteration procedure is needed to get the constants (k) of the curve equation. From the growth curve, a level of saturation can be obtained.

Note:

-

y(t) : cumulative production in time function t

-

\({\textit{URR}}:\) ultimate recoverable reserves

-

\(k_1,k_2:\) constant

-

\(t-t_0:\) duration of forecast.

Production forecasting is carried out by extrapolating the graph assuming a constant URR and single-peak curve. The curve will reach its maximum point (peak production) when the coal reserve is depleted of around 37% of the total URR [23]. The curve will be asymmetric and skewed to the right.

Equation (7) of Gompertz curve indicates that the cumulative production value of y(t) will only depend on URR value. Thus, the accuracy of URR will determine the accuracy of the coal production forecasting. The URR can be determined through two approaches, i.e. quoted reserves and production history based in reserves [26]. Quoted reserves are estimated based on official data issued by an official institution. Meanwhile URR based on production history is analyzed and determined based on historical data of production such as Hubbert linearization.

This study incorporates URR from the quoted reserve data which is usually greater than the URR derived from the Hubbert Linearization process. The aim to observe the long-term effects of the availability of reserves and the coal production toward the coal resource allocation. URR data from MEMR-GoI in 2013 and production data year 1990–2013 of each coal basin are carried out to forecast the coal production for the period of 2014–2030. The production forecasting results are given in Table 4 and Fig. 8 [27].

4.1.2 Coal consumption

Coal consumption of each consumer regions assigned as \(b_j \) value in the demand constraint of Eq. (5) is herein forecast. There are several methods that can be used to forecast the coal consumption. An example of coal consumption forecasting methods is by foreseeing every sectors of the coal users (electricity, cement, iron and steel, and chemical industry) by taking into account some influencing factors such as the developing trend of the main consumer, per unit of energy consumption, energy saving and technological change [28]. Another method to forecast coal consumption is Auto Regressive Integrated Moving Average (ARIMA) [29]. ARIMA foresees the coal consumption by using independent variable of consumption from the previous year. ARIMA is favorable as it does not involve economic and demographic parameters (population) as independent variables which generally yield fairly large error. Other alternative method is to predict the energy needs using the econometric methods and incorporating energy mix factor to accommodate the proportion of the coal usage by stochastic analysis [30].

In this study, the coal consumption forecasting for each region will be carried out by a multi-variable linear regression method. The dependent variable, in this case the coal consumption, is defined as a linear function of some influencing factors which act as independent variables, i.e. Gross Domestic Regional Product (GDRP), population, and time. The general equation for forecasting of the coal consumption is given in Eq. (8).

Note:

-

Con: Coal consumption

-

GDRP: Gross Domestic Regional Product

-

Pop: Population

-

Time: Time

-

b, c, d: Coefficient.

There are four main steps in forecasting the coal consumption. First step is to determine the coefficient value (constant) for each independent variables of Eq. (8) according to the historical data. Second step is a statistical analysis to check the significance of each independent variable with respect to its effect to the dependent variable. If the independent variable does not significantly affect the dependent variable, it will be withdrawn from Eq. (8). Third step is to estimate the future value for each independent variable. Last but not least, the fourth step is to forecast the coal consumption based on a linear regression function obtained from the first and second steps by incorporating the estimated future value of the independent variables obtained from the third step.

The coal consumption forecasting for each region will be carried out using historical data of independent variables between 2003 and 2013. The results of the multivariable linear regression model for each region of consumers and the estimated amount of consumption are given in Fig. 9 and Table 5.

4.1.3 Logistic cost

Logistic cost is derived from the coal purchasing cost and the transportation cost. Each components of the logistic cost will be forecast using different forecasting method. Purchasing cost is estimated using a trend analysis of the historical data. The transportation cost, on the other hand, will be estimated based on Environmental Protection Agency (EPA) study.

The purchasing cost equals to the mining cost, processing cost and transportation cost of coal to the point of sale in transshipment. These costs are estimated using trend analysis of the historical data of the coal operating cost. The operating cost tends to increase as the reserves decrease. This phenomenon, according to Hotelling (1931), occurs as people or community tend to mine or extract a resource of low operating cost before switching to other resources with higher operating cost [31, 32]. Mineral ores of higher grade will be extracted first as it possess lower processing cost due to lower energy consumption. It will bypass or delay the extraction of the lower grade ores. Similarly in the case of coal, reserves located on or near to the surface will be mined first than those located deeper underground due to lower operating costs. The long-term operating cost may later be descending or increase as function of the grades of the later mined coal reserves as well as the technological development in mining and processing.

Model of the coal mine operating cost is developed by taking into account the assumption that the cost will increase as cumulative production increases. The increase in the operating cost with respect to the cumulative production forms a particularly similar trend to the cumulative availability curve introduced by Tilton and Skinner [33], as long as there is no significant change in the condition of mineable reserves.

The operating cost model is herein developed for every Indonesian economic coal basins. The steps to formulate operating cost model are as follows; (a) determine the operating cost based on the gross profit margin, (b) plotting the historical data of the average operating cost and the cumulative production, (c) trend analysis to smoothing the cumulative availability curve.

Gross profit margin approach is chosen to estimate the operating cost as it enables operating cost data collection of all the Indonesian coal mines. By knowing the profit portion from the gross profit margin, the operating cost is determined as the difference between the revenue and the profit. The revenue earned from the coal sale is a function of the coal quality and benchmark price. The benchmark price used in this study as the basis of estimation is the Asian spot price index applicable for coal with calorific value of 6600 kcal/kg (adb) [1].

After plotting the data of the cumulative production and the estimated operating cost, trend analysis is performed to determine the correlation between the two variables. Figure 10 [34,35,36,37,38,39,40,41,42,43,44] shows the data plotting and the trend analysis of the cumulative production and operating costs in every coal basins. Logarithmic trend is selected as it has identical behavior with the cumulative availability curve of non-renewable resource which has relatively homogeneous mined reserves.

The operating cost model is obtained as a function of the cumulative production. The model may be used to predict the operating cost of the foreseeable future. Results obtained from the coal production forecasting as described in Sect. 4.1.1 will be incorporated as the input of the operating cost model to obtain the estimated operating cost. The results of the estimated operating cost from 2014 to 2040 are plotted in Fig. 11 [45].

The second component of logistic cost is transportation cost. It is calculated as transportation distance between the transshipment ports to the consumer port and multiplied by unit transportation cost. In determining the transportation distance from the transshipment port to consumer port, benchmarking the port locations to represent each coal producer and coal consumer is required. The benchmark ports of producers and consumers as well as the distance of the voyage are listed in Table 6. The voyage distance is then multiplied by the cost of transportation per unit (Eq. (9)) in accordance with the provisions of MEMR-GoI for the barge less than 270 ft long to obtain the transportation cost which in this case is barging cost. Variations of the costs are listed in Table 7.

The transportation cost in future is estimated based on a study conducted by Environmental Protection Agency (EPA) as a reference. It points out that the transportation cost in future may be estimated by applying an escalation factor to the transportation cost of a reference year. The study also evaluates the influencing components of the transportation cost, i.e. fuel, labor, equipment, and productivity. For the foreseeable future, EPA estimates the average escalation factor of the influencing components to be −0.2% per year [46]. But for Indonesia, an escalation factor of −0.2% per year may not be applicable due to its high inflation rate. Therefore in this study a conservative value of 0% escalation factor per year is used.

By summarizing the coal price and the transportation cost, the total logistic cost from producer to consumer can therefore be obtained. Logistic cost is assigned as \(c_{i,j} \) value of the objective function as given in Eq. (2).

4.2 Optimizing coal transaction model

The linear programming problems on coal transaction model as listed in Eqs. (2)–(6) are solved using General Algebraic Modeling System (GAMS). Output of the transaction model is the selling quantities of a specific coal basin to a consumer in the specific location \((x_{i,j})\) which produces the least total logistic cost (Table 8).

Under optimum condition, short term supply of Indonesian coal for the domestic market before 2024 will be fulfilled by four main coal basins of Central Sumatra, South Sumatra, Barito and Tarakan basins. Meanwhile in long term supply, the entire basins except the Ombilin basin will become coal suppliers for the domestic market. High purchasing cost of Ombilin coal is the main reason for its lack of competitiveness.

Conforming to the geographical location of suppliers and the supply areas, consumers on the western part of Indonesia will be supplied by coal basins in Sumatra. Sumatra will be supplied by the Central Sumatra and South Sumatra basins and Western Java will only be supplied by the South Sumatra basin. Other consumer in Eastern parts of Indonesia such as Eastern Java, Kalimantan, Sulawesi, Nusa Tenggara, Maluku and Papua will primarily be supplied by the Barito and Tarakan basins. In the short term supply, Tarakan basin will only contribute a small amount to supply the coal for Northern Sulawesi. Also, there is a possibility of Barito basin to supply coal for Western Java in future due to the high demand which cannot be fulfilled by South Sumatra basin.

In the long term supply, as the coal demand on Sumatra increases, coal will be supplied by Bengkulu basin as well as Central Sumatra and South Sumatra basins whose production are likely to increase. The long term coal supply in eastern part of Indonesia will also change. The main cause is due to the increasing demand in the area which cannot be offset by the coal production of Barito basin as the main supplier. The production of Barito basin production will reach its peak in 2018 and gradually decrease thereafter. The supply will be taken over by the Kutai and Tarakan basins. Due to smaller coal production, Tarakan basin does not contribute as much as Kutai basin and will only supply coal to some part of Eastern Java. The coal supply shortage on the Eastern Indonesia will be filled by the Kutai basin.

5 Sensitivity analysis and policy of domestic market obligation

5.1 Sensitivity analysis

Three influencing components which affect the coal resource allocation are the coal purchasing cost, the transportation cost, and the stock. Sensitivity analysis is herein carried out to such components in the resource transaction model by varying one component while keeping the other two components unchanged.

Effect of coal purchasing cost with respect to the resource allocation is analyzed by increasing the coal purchasing cost of each basins with respect to the initial forecasting. The increase in the purchasing cost will basically reduce the comparative advantage of coal producers which will in turn affect the pattern of resource allocation. When the purchasing cost of Kalimantan coal increases by 10%, there is no significant change in the resource allocation pattern. However, when it increases to 20%, Ombilin and Bengkulu basins begin to contribute in fulfilling the coal demand in Sumatra for both short and long term supply. Similar condition is observed in Sumatra basins that when the purchasing cost increases by 10%, there is no significant change in the resource allocation pattern. But when it increases to 20%, South Sumatra basin will no longer supply coal for the Western Java. The supply for the area will be fulfilled by Barito basin.

The sensitivity analysis of transportation cost in the resource allocation is carried out by changing the escalation factor of the coal transaction model. In Sect. 4.1, the escalation factor is assigned as 0% per year assuming that the transportation cost remains constant until the end of the forecasting period. In this sensitivity analysis, transportation costs will be escalated by 2 and 5% per year. Optimization in coal resource allocation shows almost no significant change in the pattern of resource allocation as the transportation cost increases. This may be due to small contribution of transportation cost which in average is only 12% of the total logistic cost. Thus, coal resource allocation will be affected by the purchasing cost than the transportation cost.

With respect to the stock, sensitivity analysis is performed by assuming each coal basin is able to store stock to a maximum of 10% of the maximum output per year. The existence of stock will reduce the amount of coal sold to the domestic and export market. As a result, the pattern of coal resource allocation does not change but the quantity of sales changes. Quantity of sales of the South Sumatra basin to Western Java reduces by an average of 0.3 million tonnes per year and Barito basin to Western Java increases by an average of 0.32 million tons per year. The presence of stock on the resource allocation slightly increases the total logistic cost. In the coal transaction model without taking into account the stock, total logistics cost between years 2014 and 2030 is USD 297.01 billion, or an average of USD 17.471 billion per year. When the stock of 10% a year is included in the optimization of resource allocation, total logistics cost increases to USD 297.05 billion, or an average of USD 17.473 billion per year.

5.2 Domestic market obligation policy and optimization of coal resource allocation

Implementation of the DMO has faced many problems. One of the problems is the consumer preference to choose producer who offers lowest price. Unfortunately, the chosen producer may not be one of the mining companies listed in Ministerial Decree. The mining companies listed in Ministerial Decree may then have difficulty to get domestic consumers due to their mining technique and mining location which will generate higher selling price.

Problems arising from the application of DMO may be addressed by taking into account the location of coal basins in determining the coal supplier for domestic purposes. Central Sumatra, South Sumatra, and Barito basins shall be prioritized as coal supplier for the short term period. Meanwhile other basins such as Bengkulu, Tarakan, and Kutai basins shall be prioritized for long-term supply. Regulation of the minimum coal price reference in the Ministerial Decree supports the optimization of resource allocation that is suggested to be implemented with the DMO policy. The minimum coal price reference for domestic and export markets which take into account international coal price index may eliminate the reluctance of coal producers to supply the domestic market as the prices of coal in both the domestic and international markets are more or less the same.

6 Conclusion and policy implication

Indonesian coal production and consumption are expected to increase continuously. Coal production forecast by Gompertz curve using coal basin approach results in the peak production of 485 million tonnes which will be reached in 2026. After 2026 Indonesian coal production will be decreased due to the declining production in two main basins; Barito and Kutai basins. The coal consumption estimated by the multi-variable linear regression method on the other hand shows an increasing trend to reach 367 million tons in 2030. The production and consumption forecasting show that the proportion of coal consumption for the domestic market will gradually increase, and accordingly consumption for the export market will decrease.

The total production that is far greater than the consumption allows the consumers to have the privilege to select producer in supplying their demand. Optimization to determine the pattern of the resource allocation is carried out by building a coal transaction model which reflects the coal flow from producers to consumers. Optimization result of linear programming method shows that there will be some changes in the coal suppliers of the domestic market with respect to time to achieve the optimum condition by minimizing the logistic cost. For the short term supply for the domestic market will be fulfilled by Central Sumatra, South Sumatra, Barito, and Tarakan basins. Other basins except the Ombilin basin will be fulfilling the long-term supply. Taking into account the geographical location, Sumatra will be supplied by the Central Sumatra and South Sumatra basins and Western Java will only be supplied by the South Sumatra basin for the short period of time. And for the long term supply, Bengkulu basins will take over the supply. The eastern part of Indonesia will primarily be supplied by the Barito basin and some portion from Tarakan basin for the short term period. After the production in Barito basin reaches its peak in 2018, Kutai and Tarakan basins will take over the supply.

The sensitivity analysis of the coal transaction model shows that the pattern of resource allocation is more affected by the purchasing cost than the transportation cost. The proportion of the transportation cost is 12% of the total logistic cost. It is significantly less than the purchasing cost. The existence of stock will reduce the amount of coal sold to the domestic and export market. As a result, the pattern of coal resource allocation does not change but the quantity of sales changes. The effect of stock on the resource allocation increases the total logistic cost, even though the difference is not significant.

Optimization of the coal supply allocation in the domestic market and the sensitivity of the determinant variables shall be considered in arranging the DMO policies. It can be addressed by taking into account the location of coal basins in determining the coal supplier for domestic use.

References

BP Statistical Review of World Energy (2016). http://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Geological Agency of the Republic of Indonesia: Executive summary: pemutakhiran data dan neraca sumberdaya energy status 2015. Ministry of Energy and Mineral Resources, Republic of Indonesia (2015). http://psdg.bgl.esdm.go.id/Neraca/2015/Executive%20Summary%20Neraca%20Energi%202015.pdf

Koesoemadinata, R.P.: Outline of tertiary coal basin of Indonesia. Ber. Sedimentol. 15, 1–27 (2001)

Mezher, T., Chedid, R., Zahabi, W.: Energy resources allocation using multi-objective goal programming: the case of Lebanon. Appl. Energy 61, 175–192 (1998). doi:10.1016/S0306-2619(98)00043-9

Seebregts, A.J., Goldstein, G.A., Smekens, K.: Energy/environmental modeling with the MARKAL family of models. In: Operation Research Proceedings, pp. 75–82 (2001). doi:10.1007/978-3-642-50282-8_10

Mallah, S., Bansal, N.K.: Allocation of energy resources for power generation in India: business as usual and energy efficiency. Energy Policy 38, 1059–1066 (2010). doi:10.1016/j.enpol.2009.10.058

Stanford, C.E.: Coal resources, production, and use in Indonesia. In: The Coal Handbook: Toward cleaner production–Volume 2: Coal Utilisation. Woodhead Publishing Series in Energy (2013). ISBN:978-1-78242-116-0

Lucarelli, B.: The history and future of Indonesia’s coal industry: impact of politics and regulatory framework on industry structure and performance. Program on Energy and Sustainable Development, Stanford University, USA. Working paper, 93 (2010). http://pesd.fsi.stanford.edu/publications/the_history_and_future_of_indonesias_coal_industry_impact_of_politics_and_regulatory_framework_on_industry_structure_and_performance

Kurz, H.D., Salvadori, N.: On the theory of exhaustible resources: Ricardo vs. Hotelling. The Institute of Social and Economic Research, Osaka University. Discussion Paper No. 756 (2009). doi:10.2139/ssrn.1485282

Petromindo.com in cooperation with Indonesian Coal Mining Association, Indonesian Coal Book 2014/2015

Badan Standardisasi Nasional—Indonesia, Standar Nasional Indonesia: Klasifikasi sumberdaya dan cadangan batubara. Amandemen 1—SNI—13-5014-1998 (1998). http://psdg.geologi.esdm.go.id/kepmen_pp_uu/SNI_13-5104-1998.pdf

Hustrulid, W., Kuchta, M.: Open Pit Mine Planning and Design: Fundamentals, vol. 1. Taylor and Francis Ltd, London (2006)

Kavalov, B., Peteves, S.D.: The future of coal. Directorate General Joint Research Center—European Commission (2007). http://bookshop.europa.eu/sl/the-future-of-coal-pbLDNA22744/downloads/LD-NA-22744-EN-C/LDNA22744ENC_002.pdf;pgid=y8dIS7GUWMdSR0EAlMEUUsWb0000xKhdQjsN;sid=y9SaQlzenx2aEw-kYQkE5T77hreEMBG91aY=?FileName=LDNA22744ENC_002.pdf&SKU=LDNA22744ENC_PDF&CatalogueNumber=LD-NA-22744-EN-C

Belanina, E.: Multimodal coal transportation in Indonesia. Master thesis in Urban, Port, and Transport Economics, Erasmus University Rotterdam (2013). https://thesis.eur.nl/pub/14848/MA-thesis-Belanina-FINAL-report-on-Indonesia.pdf

Petromindo.com in cooperation with Indonesian Coal Mining Association, Indonesian Coal Book 2008/2009

Baruya, P.: Impact of seaborne trade on coal importing countries–Pacific market. IEA Clean Coal Center (2012). ISBN 978-92-9029-522-8. https://www.usea.org/sites/default/files/082012_Impacts%20of%20seaborne%20trade%20on%20coal%20importing%20countries%20-%20Pacific%20market_ccc202.pdf

Lai, J.W., Chen, C.Y.: A cost minimization model for coal import strategy. Energy Policy 24, 1111–1117 (1996). doi:10.1016/S0301-4215(96)00091-2

Liu, C.M., Sherali, H.D.: A coal shipping and blending problem for an electric utility company. Int. J. Manag. Sci.-Omega 28, 433–444 (2000). doi:10.1016/S0305-0483(99)00067-5

Mou, D., Li, Z.: A spatial analysis of China’s coal flow. Energy Policy 48, 358–368 (2012). doi:10.1016/j.enpol.2012.05.034

Zucekaya, A.: Cost minimizing coal logistics for power plants considering transportation constraints. J. Traffic Logist. Eng. 1, 122–127 (2013). doi:10.12720/jtle.1.2.122-127

Patzek, T.W., Croft, G.D.: A global coal production forecast with multi-Hubbert cycle analysis. Energy 35, 3109–3122 (2010). doi:10.1016/j.energy.2010.02.009

Hook, M., Zittel, W., Schindler, J., Aleklett, K.: Global coal production outlooks based on a logistic model. Fuel 89, 3546–3558 (2010). doi:10.1016/j.fuel.2010.06.013

Hook, M., Junchen, L., Oba, N., Snowden, S.: Descriptive and predictive growth curves in energy system analysis. Nat. Resour. Res. 20, 103–116 (2011). doi:10.1007/s11053-011-9139-z

Mohr, S.M., Evans, G.M.: Forecasting coal production until 2100. Fuel 88, 2059–2067 (2009). doi:10.1016/j.fuel.2009.01.032

Yu, S., Wei, Y.: Prediction of China’s coal production-environmental pollution based on a hybrid genetic algorithm-system dynamics model. Energy Policy 42, 521–529 (2012). doi:10.1016/j.enpol.2011.12.018

Ward, J.: Peak phosphorus: quoted reserves vs production history. Published by Energy Bulletin (2008). http://www.resilience.org/stories/2008-08-26/peak-phosphorus-quoted-reserves-vs-production-history

Rosyid, F.A., Adachi, T.: Coal mining in Indonesia: forecasting by the growth curve method. Miner. Econ. 29, 71–85 (2016). doi:10.1007/s13563-016-0091-6

Yan, W., Jingwen, L.: China’s present situation of coal consumption and future coal demand forecast. China Popul. Resour. Environ. 18, 152–155 (2008). doi:10.1016/S1872-583X(09)60009-7

Volkan, S.E., Sertac, A.: ARIMA forecasting of primary energy demand by fuel in Turkey. Energy Policy 35, 1701–1708 (2007). doi:10.1016/j.enpol.2006.05.009

Bo-qian, L., Jiang-hua, L.: Estimating coal production peak and trends of coal imports in China. Energy Policy 38, 512–519 (2010). doi:10.1016/j.enpol.2009.09.042

Livernois, J.R., Uhler, R.S.: Extraction cost and the economics of nonrenewable resources. J. Polit. Econ. 95 (1987). http://www.jstor.org/stable/1831306

Reynolds, D.B.: The mineral economy: how prices and costs can falsely signal decreasing scarcity. Ecol. Econ. 31, 155–166 (1999). doi:10.1016/S0921-8009(99)00098-1

Tilton, J.E., Skinner, B.J.: The meaning of resources. In: McLaren, D.J., Skinner, B.J. (eds.) Resources and World Development, pp. 13–27. Wiley, New York (1987)

Pricewaterhouse Coopers, Mine Indonesia (2007). http://www.pwc.com/id

PT. Adaro Energy, Tbk. 2008–2013. Annual report. http://www.adaro.com/investing/financial-reports/

PT. Bumi Resources, Tbk. 2010–2013. Annual report. http://www.bumiresources.com/index.php?option=com_financialinfo&task=category&id=28&Itemid=52

PT. Baramulti Suksessarana, Tbk. 2012–2013. Annual report. http://www.bssr.co.id/index.php/investor-relations/annual-report

PT. Indika Energy, Tbk. 2009–2013. Annual report. http://www.indikaenergy.co.id/investors/annual-report/

PT. Berau Coal Energy, Tbk. 2010–2013. Annual report. http://www.beraucoalenergy.co.id/investor-relations/annual-report/

PT. Bukit Asam, Tbk. 2006–2013. Annual report. http://www.ptba.co.id/en/investor

PT. Harum Energy, Tbk. 2010–2013. Annual report. http://www.harumenergy.com/en/investor-relations/37/annual-report

PT. Borneo Lumbung Energy & Metal, Tbk. 2011–2013. Annual report. http://borneo.co.id/index.php/investor_relations/annual_reports

PT. Bayan Resources, Tbk. 2010–2013. Annual report. https://www.bayan.com.sg/index.php/en/investor-relations/annual-reports

PT. Indo Tambangraya Megah, Tbk. 2007–2013. Annual report. http://www.itmg.co.id/investor-relation/annual-report

Rosyid, F.A., Adachi, T.: Forecasting on Indonesian coal production and future extraction cost: a tool for formulating policy on coal marketing. Nat. Resour. 7, 677–696 (2016). doi:10.4236/nr.2016.712054

United States Environmental Protection Agency (US-EPA): Documentation for EPA Base Case v.5.13 Using the Integrated Planning Model. US-EPA (2013). https://www.epa.gov/sites/production/files/2015-07/documents/documentation_for_epa_base_case_v.5.13_using_the_integrated_planning_model.pdf

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rosyid, F.A., Adachi, T. Optimization on long term supply allocation of Indonesian coal to domestic market. Energy Syst 9, 385–414 (2018). https://doi.org/10.1007/s12667-017-0229-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12667-017-0229-9