Abstract

To capture more market share, manufacturers have recently set up sales channels on well-known e-commerce platforms, which has greatly changed the business environment. To investigate whether manufacturers should adopt the online dual-channel strategy, we build a Stackelberg game model based on the previous studies and study the optimal decisions and optimal profits of a manufacturer and e-commerce platforms under different strategic backgrounds. Our study shows that, first, the channel selection strategy of the manufacturer is affected by the attributes of the new channel. When consumers of the new channel are very sensitive to the price of the product, the manufacturer should maintain the original single-channel operational strategy; however, when consumers of the new channel are not sensitive to the price of the product, the manufacturer can adopt the strategy of online dual channels. Second, When the price elasticity of the new channel is in a specific range, the implementation of online dual channels will result in a decrease in the manufacturers’ profit but beneficial to the whole supply chain. Therefore, under such conditions, the e-commerce platform should give the manufacturer a certain amount of transfer payment to motivate its implementation of the dual-channel strategy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the twenty-first century, the popularity of the Internet has increased dramatically. The number of internet users in China has reached 989 million, with an internet penetration rate of 70.4 percent by December 2020 (http://www.cnnic.net.cn/hlwfzyj/). In addition, in the past decade, security payment technology and express delivery services have made great progress. Under the comprehensive effect of these factors, online shopping has rapidly attracted many consumers, which is due to its fast and convenient method of consumption. The national e-commerce trading volume reached 34.81 trillion yuan in 2019, an increase of 6.7 percent over the previous year (http://dzsws.mofcom.gov.cn/article/ztxx/ndbg/202007/20200702979478.shtml).

The development of the internet has not only significantly changed people’s consumption patterns but also changed the traditional business model and supply chain model. On the one hand, Tencent, Alibaba, Amazon and other international companies have developed a great deal of online shopping applications, such as Taobao, Tmall, Vipshop and Amazon, which are open to traditional manufacturers and retailers and greatly promote the transformation and upgrading of traditional offline manufacturers and retailers. On the other hand, to occupy more market share, a large number of enterprises have established new channels in various e-commerce platforms. There are great differences in the charging policy of various platforms for merchants. For example, Taobao requires merchants to pay only a certain amount of deposits, while platforms such as JD.com adopt the model of fixed commission and profit extraction.

The form of online dual channels enables the enterprise to contact more consumers than it could before and then gain more market share. However, it also enables more competitors to flow into the market, which intensifies the competition between companies. In addition, the increase in channels means an increase in cost. Researchers and scholars have proposed many effective mechanisms to eliminate or reduce the price competition between dual channels.

However, under what circumstances should an enterprise set up a new channel, and what impact does a new channel have on the profits of the enterprise? These problems urgently need to be solved. At present, there are some studies on the channel selection of manufacturers or retailers, but they mainly focus on the channel selection between offline retail channels and online direct sales channels. There are few studies about online dual channels. However, in practice, many enterprises adopt this mode of operation. Therefore, this paper establishes a model to study the choice of online channels. The main contributions of this study are summarized as follows. First, under the background of the completely online operation of a manufacturer, the optimal strategy of the manufacturer is studied. Through the comparative analysis of the optimal profit of the manufacturer, we find the optimal strategy of the manufacturer in different situations. Second, we solve the optimal decisions of the manufacturer and e-commerce platforms under different channel backgrounds. These results provide a useful reference for the decision-making of enterprises in practice. Finally, we analyse the impact of the attributes of the purely online channel on the optimal decision-making and profit of enterprises. This makes the research conclusion more practical.

The remainder of this paper is organized as follows. We introduce the background of this article in Sect. 1. The literature review presented in Sect. 2. The establishment of the model and the explanation of the related symbols are provided in Sect. 3. In Sect. 4, the equilibrium solutions of a single channel and dual channel are solved, and the optimal solution and optimal profit are analysed. In Sect. 5, the different models are contrastively analysed, and the contract is designed to coordinate the decision of the supply chain. In Sect. 6, numerical analysis is carried out to verify the conclusions. Section 7 concludes the paper. All proofs are outlined in the Appendix.

2 Literature review

The literature that is closely related to this paper focuses on three aspects: the optimal decision of supply chain, and the coordination of supply chain and channel selection of e-commerce supply chain.

2.1 The optimal decision of the supply chain

The optimal decision of supply chain has long been the focus of scholars. A supply chain is a complex entity network, and the behaviour of different enterprises will interact with each other, thus, the decision of supply chain will be affected by many factors. Pu [1] and Zhou [2] studied free riding. Pu pointed out that free riding has an impact on the retailer's sales efforts and then affects the profit of the enterprise. Zhou pointed out that the contract incentive can effectively motivate the retailer to improve the service level when facing free riding and then realize the coordination of the supply chain. The methods of capital constraint relief also have a significant impact on the decision-making of enterprises. Wang [3] analysed the pricing and service decisions of enterprises under different financing modes. Their study found that the supply chain benefited more when other companies in the supply chain shared the cost of financing.

In addition, the operational strategy in the supply chain is one of the focus issues studied by scholars. A single retail channel, a single direct channel and dual channels are common strategies of enterprises, and will have a direct impact on the decision-making and profits of supply chain [4]. Zhu [5] has studied how factors such as supply chain structure (centralized and decentralized), product type (development intensive product or marginal cost intensive product) and competition type (price competition and green competition) affect supply chain decision-making. moreover, some other factors, Similarly, Wang [6] has conducted a comparative analysis of centralized and decentralized decision-making in supply chain and found that the structure of supply chain has a direct impact on the decision-making of supply chain and leads to the highest price decision. Yang [7] conducted a similar study, but came to a different conclusion, which indicates that centralized decision making may lead to lower price decisions. Moreover, such as return strategies [8] and operation costs [9], will also have a significant impact on the optimal decision-making of the supply chain.

Although scholars have conducted detailed studies on the decision-making in the supply chain, they have not reached a consensus or even reached completely opposite conclusions. Therefore, to verify the conclusions of previous studies, this paper explores the influence of supply chain structure and supply chain operation strategy on the optimal decision-making of supply chain through comparative analysis.

2.2 Coordination of supply chain

Although the increase of channels can help enterprises reach more consumers and improve their economic benefits, it will also lead to conflicts between channels [10, 11], which has become one of the most important reasons restricting the development of enterprises at supply chain. To realize the coordination between channels, scholars have designed a variety of coordination mechanisms from different perspectives to effectively realize the coordination between supply chains.

Revenue sharing contract is one of the major ways of coordination. When the supply chain adopts revenue sharing contract, the retailer not only needs to pay the manufacturer the wholesale price of each product purchased, but also needs to pay the manufacturer a certain percentage of the revenue [12]. Revenue sharing contract can make the decision-making of supply chain coordinate with each other [13, 14], which is beneficial to improve the overall efficiency of supply chain and the profit level of enterprises [15]. Chakraborty [16] and Xu [17] made a comparative analysis of centralized and decentralized decision-making in the supply chain and found that the coordination of the supply chain could be realized through revenue sharing contract. Some other contracts have also attracted scholars' attention, such as cost sharing contract [18,19,20,21,22,23], revenue sharing contracts and fixed fee contracts [24] and rebate contracts [25, 26].

In addition to contracts, many other mechanisms can achieve supply chain coordination. Saha [27] studied the recycling strategy of waste products for remanufacturing in a closed-loop supply chain (CLSC) and designed a tripartite discount mechanism to achieve the coordination of the supply chain. Ha [28] studied the manufacturer's equilibrium rebate decision and found that the retailer can induce the manufacturer to provide a rebate through the subsidy strategy, thus realizing the coordination of the supply chain. Qin [29] studied trade credit policy and pointed out that trade credit policy can alleviate the conflict of a dual-channel supply chain composed of a manufacturer and a value-added retailer.

There is a difference between this article and the above literature, since the dual channel studied in the above literature refers to an offline retail channel and an online direct sales channel; Although this paper also involves the conflict and coordination of dual channels, the dual channel in this paper refers to an online channel and an online channel, which is obviously different from previous studies.

2.3 Channel selection of e-commerce supply chain

E-commerce refers to the use of electronic information technology to provide convenient services for enterprises in the supply chain, which will have a significant impact on the decision-making and profits of enterprises in the supply chain [30]. E-commerce involves the whole process of supply chain management, including procurement [31], sales and transportation [32, 33].

Due to the rapid development of e-commerce in the past few decades, competition and cooperation between online and offline channels has become an important issue [34]. E-commerce channel entry will have a significant impact on the profitability and behaviour of manufacturers and retailers in the supply chain. Therefore, a large number of scholars have conducted research on channel selection in the e-commerce supply chain [35]. To study the channel and logistics service selection decisions of offline enterprises, Cao [36] conducted a comparative analysis of enterprises entering and not entering the e-commerce platform. The results show that the channel and logistics service selection strategies of enterprises are influenced by factors such as annual service fees. Khouja [37] studied the manufacturer's channel choice and analysed the optimal decision and profit of the manufacturer under the background of exclusive retail channel, exclusive direct channel and dual channels respectively. Their research results showed that unit transformation cost had a key influence on the manufacturer's channel choice. Wang [9] established a linear demand model to explore the channel selection and pricing strategy in the supply chain and obtained an interesting conclusion, which indicates that only when the operating cost gap between online channel and offline channel is small, dual-channel is the optimal choice for the retailer, otherwise the retailer will only choose the channel with lower cost.

This paper focuses on the issue of channel selection in e-commerce channels as well, but different from other articles: First, in the new business context, manufacturers' choice of online channels is explored, without considering the traditional offline channels; Second, different from other scholars, this paper mainly analyses the impact of price elasticity on the manufacturer's channel selection, rather than the operating cost of the channel; In addition, different from other papers, this paper considers the game between the manufacturer and e-commerce platforms, without involving the retailer.

3 Problem formulation

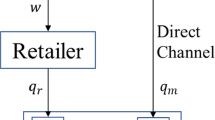

Consider a supply chain that consists of an online manufacturer and two e-commerce platforms. Figure 1 illustrates the dual structure of the manufacturer. The manufacturer, who sells products through online e-commerce platforms, is the leader in the supply chain. To simplify the analysis of the model, we normalize the total cost paid by the manufacturer to 0, which does not have a qualitative impact on the conclusion of the model; this assumption is consistent with that in the studies of Abhishek [38] and Nie [39].

In practice, if a manufacturer sells products on the platform, there are two types of fees:

-

(1)

The fixed fee. Such a fixed fee only guarantees “basic services”, which means that an online shop is allocated to the manufacturer so that sales information can be published and consumers can make a deal with the manufacturer.

-

(2)

The commission. If the manufacturer sells products on the platform, the platform provides sales services. When consumers and the manufacturer complete the product transaction on the platform, the platform charges the manufacturer a certain amount of fees as a commission for providing the sales service.

In the model of this paper, the demand decreases with the increase in the price of a product in its own channel but increases with the increase in the price in another channel. Moreover, the service level provided by the e-commerce platform significantly affects the market demand. Based on previous studies, such as Xu [17], Liu [40] and Chen [41], the cost of service improvement is an increasing and convex function with the service level. In this paper, we assume that the cost of the service improvement by the e-commerce platform can be expressed as a quadratic function of the service level, namely, \({\text{c}}_{s} \left( s \right) = ks^{2} /2\), where the coefficient \({\text{k}}\) is defined as the difficulty degree of service improvement, \({\text{s}}\) is represented as the service level provided by the e-commerce platform.

Furthermore, like many previous researchers, we study a specific linear demand function [42], which is affected by price and service level. The demand function is as follows:

where \(a\) is the potential market size of the product, in addition, we use \(\theta\) to present the market share of channel 1. Parameter \(\beta_{i}\) reflects the sensitivity of the demand of each channel to the change in product price, and the parameter \(\gamma_{i}\) captures the cross-price elasticity of channels. Generally, the demand of channel 1 is more sensitive to the price of channel 1, and likewise for channel 2. Thus, we assume \(\beta_{1} > \gamma_{1}\) and \(\beta_{2} > \gamma_{2}\). Besides, the parameters \(\mu_{1}\) and \(\mu_{2}\) are the coefficients of the service elasticity of \(d_{1}\) and \(d_{2}\).

To complete the model, we impose some additional inequality constraints to guarantee that the model conforms to the actual situation, and the optimal solution of the model exists (Table 1).

Assumption 1

\({\text{k}}_{i} >\max \{ 3\delta \mu_{i}^{2} /\beta_{i} ,\mu_{i}^{2} /\beta_{i} \} \;i = 1,\;2.\) This assumption means that the e-commerce platform's cost in providing service is not very cheap, which is reasonable due to increasing labour costs. A similar assumption was employed by researchers such as Xu [43] and Tsay [44]. Since the input of production factors exhibits diseconomies of scale [45], we ensure that the degree of difficulty in improving the service level is sufficiently large to satisfy the above condition.

Assumption 2

To ensure that the profit functions in the following models are jointly concave on the decision variables and have the maximum value, we need the following assumptions:\(2(k_{i} \beta_{i} - \delta \mu_{i}^{2} ){ - }k_{i} (\gamma_{1} + \gamma_{2} ) > 0\), \((2k_{i} \beta_{i} - \mu_{i}^{2} ){ - }k_{i} (\gamma_{1} + \gamma_{2} )^{2} > 0\), \(2\beta_{i} (2k_{i} \beta_{i} - \mu_{i}^{2} ){ - }k_{i} (\gamma_{1} + \gamma_{2} ) > 0\) and \(4\beta_{1}^{2} - (\gamma_{1} + \gamma_{2} )^{2} > 0\). The following propositions are derived based on such conditions. If the assumptions are not satisfied, the profit functions' concavity cannot be guaranteed. In fact, these assumptions are common in the literature, and similar assumptions can be found in Wang [46].

Assumption 3

In practice, manufacturers need to pay security deposits before undertaking trading activities, which means that the payment of security deposits occurs before the sales cycle. Therefore, for the manufacturer, the security deposit is a sunk cost, which does not affect the decision of the manufacturer, so we normalize the fixed cost to 0.

4 Model solutions and discussion

4.1 Case 1: Only one e-commerce platform

In this section, we consider a single-channel supply chain that consists of an e-commerce platform and an independent manufacturer as the benchmark, and obtain the optimal decision of each party. In our model, the manufacturer and e-commerce platform are perfectly rational, and they make decisions to maximize their own profits. The e-commerce platform and manufacturer follow a Stackelberg game model, in which the manufacturer is in the dominant position, while the e-commerce platform is the follower. The decision-making order is as follows. First, the manufacturer, as the leader, decides the product’s price p; then, the e-commerce platform, as the follower, decides its service level to maximize its own profit with the given price.

In this model, the manufacturer’s profit function is:

The e-commerce platform’s profit function is:

The equilibrium optimal solution is solved by the backward induction method.

Theorem 1

The optimal solution and profit of the manufacturer and the e-commerce platform are as follows:

\(p_{1} = \frac{{ak_{1} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )}},\;s_{1} = \frac{{a\delta \mu_{1}^{2} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )}},\;\pi_{m} = \frac{{a^{2} k_{1} (1 - \delta )}}{{4k_{1} \beta_{1} - 4\delta \mu_{1}^{2} }}\;\pi_{e1} = \frac{{a^{2} k_{1} \delta (2k_{1} \beta_{1} - 3\delta \mu_{1}^{2} )}}{{8(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\)

From Theorem 1, the following propositions can be obtained.

Proposition 1

As indicated in Proposition 1 with the increase in potential market share, the optimal retail price, the optimal service level of the platform and the profit of the platform and the manufacturer also increase. This is consistent with our intuition because an increase in potential market share leads to an increase in the sale volume of the product, which in turn leads to an increase in the profit of the supply chain. Since the profit of e-commerce platform increases, the motivation of e-commerce platform to improve service level will increase, which leads to the increase of service level \(s_{1}^{}\).

Besides, Proposition 1 shows that in a single-channel supply chain, the proportion of the commission is positively correlated with the retail price, the optimal service level and the e-commerce platform’s profit, while the commission ratio has a negative impact on the manufacturer’s benefit. This is because the higher the percentage of the commission is, the higher the operating costs of the manufacturer, which damages the manufacturer’s profit. Therefore, the manufacturer increases the retail price of the product to pursue higher profits. From the perspective of the platform, the higher the commission ratio is, the higher the revenue the platform obtains, and the more willing the e-commerce platform is to improve its service level.

The increase in platform profit comes from two aspects. On the one hand, the increase in the commission ratio directly leads to the increase in revenue. On the other hand, the improvement in service level directly leads to the increase in demand, thus improving the profits of the enterprise. This is consistent with the previous conclusions of Wang [6] and Wang [47], which prove that the optimal retail price, service level and profit of the platform are positively correlated with the commission, while the optimal profit of the manufacturer is negatively correlated with the commission.

Proposition 2

Proposition 2 means that the higher the price elasticity \(\beta_{1}\) is, the lower the retail price and service level of the product are. In addition, the optimal profit of the manufacturer and e-commerce platform are reduced. This is because enterprises should reduce the prices of products with high-price elasticity. Price reduction can greatly increase the sales of the product and ultimately lead to an increase in corporate profits. However, in our model, the sales volume of the product is affected not only by the retail price of the product but also by the service level. When the price decreases, the service level of the e-commerce platform decreases, and the decrease in the service level reduces the sales volume and eventually leads to a decrease in the profits of the manufacturer and the e-commerce platform.

In short, an increase in price elasticity leads to a decrease in the price of the product, which has two opposite effects. First, a decrease in price leads to an increase in demand, which increases the profits of enterprises in the supply chain; second, a decrease in price leads to a decrease in profits. The decrease in the service level also leads to a decrease in sales, which has negative effects on the profits of enterprises. And ultimately the negative effect dominates the positive effect, and therefore, the revenue of the manufacturer and the e-commerce platform eventually decreases.

Proposition 3

As shown in Proposition 3, there is a positive correlation between service demand elasticity \(\mu_{1}\) and the retail price \(p_{1}^{}\), service level \({\text{s}}_{1}^{}\) and the profits of the manufacturer and the platform, while service cost coefficient \(k_{1}\) is negatively correlated with the service demand elasticity \(\mu_{1}\) and the retail price \(p_{1}^{}\), service level \({\text{s}}_{1}^{}\) and the profits of the manufacturer and the platform. These relationships are intuitive. A higher value of \(\mu_{1}\) means a greater impact of the service level on the demand. Therefore, the e-commerce platform actively improves the service level. The improvement in the service level increases the demand and then increases the company’s profit.

In addition, a high-cost coefficient means an increase in cost, and an increase in cost reduces the profit of the enterprise. Then, the decrease in e-commerce platform revenue reduces the platform’s willingness to improve the service level, which leads to a decrease in the service level and the price of products.

4.2 Case 2: Two e-commerce platforms

In this part, we expand the model in Case 1 to involve two e-commerce platforms. In Case 1, we consider the optimal decisions of the manufacturer and e-commerce platform in the case of a single channel. In this part, we consider that on the basis of the original model, the manufacturer actively opens up a new channel to expand the market and improve its profits, which means cooperating with a new e-commerce platform. Figure 1 describes the supply chain structure. In this model, we consider a dual channel supply chain, which consists of a manufacturer and two e-commerce platforms. The decision-making order of the supply chain is as follows. First, the manufacturer, as the leader, decides whether to implement the dual channel strategy. If the dual channel strategy is not implemented, the optimal decision can be solved according to Case 1. If the dual channel strategy is implemented, then in the second step, the manufacturer needs to decide the optimal retail prices \(p_{1}\) and \(p_{2}\) of the two platforms to maximize its profits. Finally, the two e-commerce platforms determine their service levels \(s_{1}\) and \(s_{2}\) based on the retail prices \(p_{1}\) and \(p_{2}\). Figure 2 describes the decision order of the manufacturer and e-commerce platforms in the case of dual channels. In addition, the e-commerce platform mainly determines the proportion of the commission according to the product type. In this paper, the manufacturer sells the same product, so we assume that the commission ratios are the same, that is, \(\delta_{1} { = }\delta_{2} { = }\delta\).

After adopting the dual channel strategy, the profit of the manufacturer is as follows:

The profit functions of platform 1 and platform 2 are as follows:

The equilibrium optimal solution is solved by the backward induction method.

Theorem 2

The optimal decisions of the manufacturer and e-commerce platforms are as follows:

From Theorem 2, the following propositions can be obtained.

Proposition 4

Proposition 4 shows that retail price \({\text{p}}_{1}^{}\) and service level \({\text{s}}_{1}^{}\) are positively correlated with market share θ of channel 1, while retail price \({\text{p}}_{2}^{}\) and service level \({\text{s}}_{2}^{}\) are negatively correlated with market share θ of channel 1. An increase in θ means that the market demand of channel 1 increases, which leads to an increase in the retail price of channel 1. In summary, on the one hand, the market demand of channel 1 increases; on the other hand, the retail price \({\text{p}}_{2}^{}\) also increases, thus bringing higher profits to all enterprises in channel 1, which stimulates platform 1 to improve its service level. However, with an increase in θ, the demand of channel 2 decreases accordingly. Similar to the previous reasons, retail price \({\text{p}}_{2}^{}\) and service level \({\text{s}}_{2}^{}\) decrease.

According to Proposition 4, the higher the proportion of revenue extracted by e-commerce platforms is, the higher the retail price and service level of products will be. An increase in δ means an increase in the cost to the manufacturer, which reduces its earnings. To compensate for the loss, the manufacturer voluntarily raises the retail price. On the other hand, the increase in profit proportion extracted by e-commerce platforms increases their revenue, which makes the e-commerce platform more active in improving the service level. Therefore, both the retail price and service level increase with the increase in δ, which is consistent with the conclusion of a single channel in the previous part.

Proposition 5

Proposition 5 shows that the retail prices \({\text{p}}_{1}^{}\) and \({\text{p}}_{2}^{}\), service level of platform 1 and service level of platform 2 are positively associated with the price elasticity coefficient of platform 1 and platform 2 when the second e-commerce platform is taken into account. This is because as \(\beta_{1}\) increases, all else being equal, the price has a great effect on demand, which leads to a decrease in demand. To increase sales and obtain higher income, the manufacturer actively reduces the price of products, which attracts more consumers to buy products. Low-prices have two effects. First, a low-price lead to higher demand, which increases the income of enterprises; second, a low-price reduces the company’s earnings. Nevertheless, the negative effect dominates the positive effect, and therefore, the revenue of enterprises eventually decreases. Therefore, the willingness of e-commerce platforms to improve their service level decreases, which leads to a decrease in service levels \({\text{s}}_{1}^{}\) and \({\text{s}}_{2}^{}\).

Proposition 6

Through Proposition 6, the increase in cross-price elasticity \(\gamma_{1}\) means that the price of channel 2 has a great impact on the demand of channel 1, so channel 1 obtains a greater demand. Facing a higher demand, the manufacturer increases the price of products to obtain higher profits. In other words, if other conditions remain unchanged, the revenue of both the manufacturer and e-commerce platforms increases. In addition, the increase in e-commerce platform revenue promotes the improvement in its service level, so the service level \({\text{s}}_{1}^{}\) also increases with the increase in \(\gamma_{1}\). Cross-price elasticity \(\gamma_{2}\) is similar to \(\gamma_{1}\), so we omit it.

Proposition 7

Many scholars who have studied the service level in the supply chain, such as Han [48, 49], have reached a similar conclusion; that is, the optimal retail price and the optimal service level in the supply chain are positively correlated with the service elasticity coefficient \(\mu_{i}\). The increase in \(\mu_{1}\) and \(\mu_{2}\) indicates that service levels \({\text{s}}_{1}^{}\) and \({\text{s}}_{2}^{}\) have a highly positive impact on demand. In other words, if \(\mu_{1}\) and \(\mu_{2}\) increase while the retail price and service level remain the same, then the demand for each channel increases. When the demand increases, the price of products from all channels rise due to the manufacturer’s pursuit of profit maximization, which increases the profits of the manufacturer and e-commerce platforms. The increase in e-commerce platform revenue leads to the improvement in service levels \({\text{s}}_{1}^{}\) and \({\text{s}}_{2}^{}\), which is consistent with the impact of the cross-price elasticity coefficient.

Proposition 8

-

(1)

\(\frac{{\partial {\text{p}}_{1}^{} }}{{\partial k_{1} }} < 0\), \(\frac{{\partial {\text{p}}_{2}^{} }}{{\partial {\text{k}}_{1} }} < 0\), \(\frac{{\partial {\text{s}}_{2}^{} }}{{\partial {\text{k}}_{1} }} < 0\), \(\frac{{\partial {\text{p}}_{1}^{} }}{{\partial k_{2} }} < 0\), \(\frac{{\partial {\text{p}}_{2}^{} }}{{\partial {\text{k}}_{2} }} < 0\) and \(\frac{{\partial {\text{s}}_{1}^{} }}{{\partial k_{2} }} < 0\).

-

(2)

If \(\beta_{1} < \frac{{k_{2} (\gamma_{1} + \gamma_{2} )^{2} }}{{4(k_{2} \beta_{2} - \delta \mu_{2}^{2} )}}\) is satisfied, \(\frac{{\partial {\text{s}}_{1}^{} }}{{\partial k_{1} }} > 0\). Otherwise, \(\frac{{\partial {\text{s}}_{1}^{} }}{{\partial k_{1} }} < 0\).

-

(3)

If \(\beta_{2} < \frac{{k_{1} (\gamma_{1} + \gamma_{2} )^{2} }}{{4(k_{1} \beta_{1} - \delta \mu_{1}^{2} )}}\) is satisfied, \(\frac{{\partial {\text{s}}_{2}^{} }}{{\partial k_{2} }} > 0\). Otherwise, \(\frac{{\partial {\text{s}}_{2}^{} }}{{\partial k_{2} }} < 0\).

According to Proposition 8, we can conclude that there is a negative correlation between \({\text{k}}_{1}\) and the optimal decision, which excludes \({\text{s}}_{1}^{}\). There is a negative correlation between \({\text{k}}_{2}\) and the optimal decision, which does not include \({\text{s}}_{2}^{}\).

The increase in \({\text{k}}_{{\text{i}}}\) means the increase in the cost of e-commerce platforms. To maintain its own profits unchanged, the e-commerce platform will reduce the service level, which will force the manufacturer to reduce the price of its products. To ease the channel conflict, the price of products in the other channel will also be reduced accordingly, which will force the other e-commerce platform to reduce its service level.

For e-commerce platforms, service level is affected by their own price elasticity. If the price elasticity \(\beta_{1}\) is less than the threshold, the supply chain relies more on the service level to adjust the market. Therefore, the increase of \({\text{k}}_{i}\) will not reduce the service level. However, when \(\beta_{1}\) exceeds the threshold value, the influence of price on the market increases, so when the service cost increases, the supply chain relies more on the price to adjust with the market.

5 Comparison and analysis

5.1 The optimal solution of centralized decision making

We obtained the optimal solution in the case of a single channel and the optimal solution in the case of a dual channel by using reverse induction in the third and fourth parts. Next, we make a comparative for the two cases.

In the fourth part, we found that the manufacturer and e-commerce platform can achieve their optimal profits when they make decentralized decisions in the context of a single channel. To determine the optimal profit in the case of a single channel, we solve for the optimal profit in the centralized supply chain under the background of a single channel. In the centralized situation, there is a centralized decision maker to determine the optimal price and service level at the same time to achieve the optimal profit of the whole supply chain. Therefore, the profit of the whole supply chain is shown in the following:

Theorem 3

The optimal solution and profit of in single channel as follows:

Corollary 1

\(\pi_{{\text{c}}}^{} > \pi_{{\text{m}}}^{} + \pi_{e1}^{}\).

In the case of centralization, the decision-maker's goal is to maximize the overall profit. However, in the case of decentralization, the decision-making goal of the manufacturer and e-commerce platforms is to maximize their own profit, which leads to a double marginal effect and reduced benefits to the supply chain, which is consistent with the conclusions of Li [50] and Wang [51].

This research conclusion can be explained as follows: in the case of decentralized decision-making, the manufacturer increases the price of products to achieve higher profits, which leads to the reduction of demand. In addition, e-commerce platforms improve their service level. However, the marginal production effect of factors of production is diminishing, so the increase in demand caused by the improvement in service level is less than the negative effect brought by the increase in price. This ultimately leads to a loss of benefit.

Next, we discuss centralized decision-making under the background of dual channels. In the case of centralization, the profit function of dual channels is as follows:

Proposition 9

The optimal solution and profit of supply chain in dual channel are as follows:

To obtain the equilibrium channel strategy, we perform a comparative analysis of the profits of the manufacturer and supply chains under the background of a single channel and dual channels.

5.2 Comparative analysis of profit

To determine whether there is a double marginal effect in the case of dual channels, we compare the optimal profits of centralized decision-making and decentralized decision-making in the case of dual channels. However, due to the complexity of the analytical solution, we use numerical analysis to determine in which case the overall profit of the supply chain is greater.

According to the assumption in the third part of this paper and the practical significance of the parameter, we allow θ to vary in the range of [0,1], assuming \(\delta = 0.1\), \(\beta_{1} = \beta_{2} = 2\), \(\gamma_{1} = \gamma_{2} = 1\), \(\mu_{1} = \mu_{2} = 1.5\), and \(k_{1} = k_{2} = 5\). Figure 3 describes the difference in supply chain profits in the context of centralized decision making and decentralized decision making when \(\theta\) varies in the range of 0 to 1.

According to Fig. 3, we can draw the following conclusions. First, the difference between the total profit in the case of centralization and the total profit in the case of decentralization is always greater than 0. Therefore, there is a double marginal effect in the case of decentralization. Second, the profit difference decreases with the increase in \(\theta\) and then increases with the increase in \(\theta\). Then, we can conclude that in the context of decentralized decision making, the profit is the lowest when the two channels share the whole market fairly equally.

Next, we conduct a comparative analysis of the manufacturers' profits.

In the fourth part, we obtain the optimal prices and the optimal service levels. Then, by substituting them into the profit function, the manufacturer’s maximum profit can be obtained as follows:

Then, to obtain the optimal strategy of the manufacturer, we compare the optimal profit of the manufacturer in the case of a single channel with that in the case of dual channels.

Corollary 2

-

(1)

If \(\beta_{2} >\beta_{2}^{{\text{m}}}\) is satisfied, \(\pi_{m}^{} > \pi_{{\text{m}}}^{}\). otherwise, \(\pi_{m}^{} < \pi_{{\text{m}}}^{}\).

-

(2)

If \(\beta_{2} >\beta_{2}^{{\text{s}}}\) is satisfied, \(\pi_{c}^{} > \pi_{c}^{}\). otherwise, \(\pi_{c}^{} < \pi_{c}^{}.\)where \(\beta_{2}^{m} = \frac{\begin{gathered} k_{1}^{2} \{ k_{2} [4\beta_{1}^{2} (1 - \theta )^{2} - 4\beta_{1} \theta (\theta - 1)(\gamma_{1} + \gamma_{2} ) + \left( {\gamma_{1} + \gamma_{2} } \right)^{2} ] - 4\beta_{1} \delta \left( {\theta^{2} - 1} \right)\mu_{2}^{2} \} \hfill \\ - 4\delta (1 - \theta )k_{1} \mu_{1}^{2} [\delta \mu_{2}^{2} (1 + \theta ) + 2k_{2} \beta_{1} (1 - \theta ) + k_{2} \theta (\gamma_{1} + \gamma_{2} )] + 4\delta^{2} (1 - \theta )^{2} k_{2} \mu_{1}^{4} \hfill \\ \end{gathered} }{{4k_{1} k_{2} (k_{1} \beta_{1} - \delta \mu_{1}^{2} )(1 - \theta^{2} )}}\)

According to Corollary 2, when \(\beta_{2}\) exceeds the threshold value \(\beta_{2}^{{\text{m}}}\), to obtain more sales, the manufacturer will reduce the price of the second channel, which will lead to the decrease of the service level of the second channel. Besides, to mitigation the channel conflict, the price and service level of the first channel will also be reduced, which will bring negative effects to the manufacturer's profits. Finally, the opening of that new channel will lead to the loss of the manufacturer's total profit.

Similarly, when the price elasticity \(\beta_{2}\) exceeds the threshold \(\beta_{2}^{{\text{s}}}\), the profit of the whole supply chain decreases. Thus, for the whole supply chain, the implementation of a single-channel strategy can yield more profits.

From Theorem 2, we can obtain some management enlightenment. Before deciding whether to add new channels, the manufacturer should conduct research on the users of the new e-commerce platform. If the consumers of the new channel are not sensitive to the price, then the manufacturer can implement the channel strategy; however, if the consumers of the new channel are sensitive to the price and exceed a certain threshold value, then the manufacturer's best choice is not to add a new channel.

Corollary 3

-

(1)

If inequality \({ - }1{ + }2\delta <0\), then when \(\theta_{1} <\theta <\theta_{2}\) is satisfied, the threshold values, which were defined in theorem 2, \(\beta_{2}^{{\text{m}}}\) and \(\beta_{2}^{{\text{s}}}\), have the following relationship: \(\beta_{2}^{{\text{s}}} >\beta_{2}^{{\text{m}}}\); otherwise, \(\beta_{2}^{{\text{s}}} <\beta_{2}^{{\text{m}}}\).

-

(2)

If inequality \({ - }1{ + }2\delta >0\) holds, then when \(\theta <\theta_{1}\) or \(\theta >\theta_{2}\) is satisfied, the threshold values, which were defined in theorem 2, \(\beta_{2}^{{\text{m}}}\) and \(\beta_{2}^{{\text{s}}}\) have the following relationship: \(\beta_{2}^{{\text{s}}} >\beta_{2}^{{\text{m}}}\); otherwise, \(\beta_{2}^{{\text{s}}} <\beta_{2}^{{\text{m}}}\).

When

According to Corollary 3, when δ and θ satisfy the above inequalities, the value of is greater than that of . Otherwise, the value of is less than that of . Therefore, according to Theorem 3, we can obtain the equilibrium channel selection strategy of the manufacturer and supply chain, as shown in Corollary 4.

Corollary 4

-

(1)

If \(\beta_{2}^{{\text{s}}} <\beta_{2}^{{\text{m}}}\) holds, then when \(\beta_{2}^{{\text{m}}} <\beta_{2}\), the optimal strategy of manufacturer and supply chain is not to add new channels. When \(\beta_{2}^{{\text{s}}} <\beta_{2} <\beta_{2}^{{\text{m}}}\) is established, the manufacturer implements the dual channel strategy, although this strategy is not optimal for the supply chain. When \(\beta_{2} <\beta_{2}^{{\text{s}}}\), the equilibrium strategy of manufacturer and supply chain is to add new channels.

-

(2)

If \(\beta_{2}^{{\text{m}}} <\beta_{2}^{{\text{s}}}\) is true, then when \(\beta_{2}^{{\text{s}}} <\beta_{2}\), the optimal strategy of the manufacturer and the supply chain is not to add new channels. When \(\beta_{2} <\beta_{2}^{{\text{m}}}\), the equilibrium strategy of the manufacturer and the supply chain is to add new sales channels. However, when \(\beta_{2}^{{\text{m}}} <\beta_{2} <\beta_{2}^{s}\), the manufacturer's equilibrium strategy is not to add new channels, but for the whole supply chain, the development of new channels can bring higher profits.

The equilibrium strategies of the manufacturer and supply chain are as follows:

According to Corollary 4, we can conclude that there are four situations that arise when the manufacturer and the whole supply chain choose their strategies, namely (Dual channel, Dual channel), (Dual channel, Single channel), (Single channel, Single channel) and (Single channel, Dual channel).

Next, we will briefly explain the above four cases.

When \(\beta_{2}^{{\text{s}}} <\beta_{2}^{{\text{m}}}\) is satisfied, the value of \(\beta_{2}\) is divided into three regions, as shown in Fig. 4(1).

In Region I, \(\beta_{2} <\beta_{2}^{{\text{s}}} <\beta_{2}^{{\text{m}}}\), according to the conclusion of Theorem 2, the implementation of a dual channel strategy can increase the profits of the manufacturer and the supply chain. The choice of the manufacturer is to implement the dual channel strategy. In Region II, since \(\beta_{2}^{{\text{s}}} <\beta_{2}\), the implementation of the dual channel reduces the overall profit of the supply chain. Therefore, the optimal choice is not to implement the dual-channel strategy. However, for the manufacturer, the implementation of dual channels can bring more profits, so the manufacturer tends to implement the dual channel strategy. As the manufacturer is the leader, the manufacturer eventually adopts the dual channel strategy, which has a negative effect on the profit of the supply chain. In Region III, after the dual channel strategy is implemented, the profits of the manufacturer and the whole supply chain are reduced, so the manufacturer continues to implement the single channel strategy, which is also beneficial to the supply chain.

When \(\beta_{2}^{{\text{m}}} <\beta_{2}^{{\text{s}}}\) is satisfied, the value of \(\beta_{2}\) is also divided into three regions, as shown in Fig. 4(2).

In Region IV, when \(\beta_{2} <\beta_{2}^{{\text{m}}} <\beta_{2}^{{\text{s}}}\) is satisfied, the implementation of the dual-channel strategy can make the manufacturer and the supply chain obtain more profits, so the manufacturer implements the dual-channel strategy. In Region VI, \(\beta_{2}^{{\text{m}}} <\beta_{2}^{{\text{s}}} <\beta_{2}\); under this background, the implementation of the dual channel strategy not only reduces the profits of the manufacturer but also reduces the profits of the supply chain. Therefore, the single channel strategy is the optimal strategy. In Region V, since \(\beta_{2} <\beta_{2}^{{\text{s}}}\), the implementation of dual channels can bring more profits for the whole supply chain, so the dual channel strategy is better for the supply chain. However, the implementation of the dual channel strategy reduces the profits of the manufacturer, so the manufacturer prefers the single channel strategy.

Therefore, when \(\beta_{2}^{{\text{m}}} <\beta_{2} <\beta_{2}^{{\text{s}}}\), adding a new channel can bring higher profits for the whole supply chain, but it will lead to the decrease of the manufacturers' profits. Thus, e-commerce platforms in the new channel need to provide incentive measures to attract the manufacturer to open up a new channel.

Next, we design a transfer payment contract to support the coordination between the manufacturer and the e-commerce platform. The specific decision-making order is as follows: first, the e-commerce platforms determine their respective service levels to maximize their own profits; second, based on the service levels determined by the e-commerce platforms, the manufacturer determines the optimal retail price; finally, the e-commerce platform in the new channel decides the amount of transfer payment to attract the manufacturer to open up a new channel.

Then, the profit functions of the manufacturer and e-commerce platforms are as follows:

Because the size of the transfer payment is independent of decision variables \(p_{1}\), \(p_{2}\), \(s_{1}\) and \(s_{2}\), the optimal profits of the manufacturer and the e-commerce platforms are as follows:

Only when the following inequalities hold simultaneously can the contract coordinate the whole supply chain effectively.

According to inequalities (12) and (13), we can find that the value range of transfer payments is \([M_{1} ,M_{2} ]\).where

Therefore, when the value of fixed payment falls in the range, the e-commerce platform attracts the manufacturer to open up a new channel through fixed payment. In this context, it is better for the manufacturer and the whole supply chain to open up a new channel.

6 Numerical analysis

In this section, following previous studies He [52], we perform numerical analysis of the above decisions obtained in different models to illustrate the theoretical results and explain some management insights.

6.1 Sensitivity analysis of the optimal decision

To examine the effect of \({\text{a}}\) on the optimal decision, we assume \(\delta = 0.1\), \(\beta_{1} = \beta_{2} = 1\), \(\gamma_{1} = \gamma_{2} = 1\), \(\mu_{1} = \mu_{2} = 1.5\), and \(k_{1} = k_{2} = 5\). Moreover, \({\text{a}}\) and \(\theta\) are independent variables.

The relationship between decision variables and parameters \({\text{a}}\) and \(\theta\) is shown in Fig. 5

Figure 5 demonstrates that the optimal decision is positively related to the potential market demand \({\text{a}}\), and the equilibrium solutions are identical because of our symmetric assumptions on the parameters between the two chains. Besides, \(\theta\) has a significant impact on the equilibrium decision of each channel. Specifically, the increase in \(\theta\) will make the first channel gain more profits, which will make the first channel set a higher price and service level than the second channel, and vice versa.

The impact of the price elasticity on the optimal decision is shown in Fig. 6. In the context of the dual channel strategy, the optimal price (\({\text{p}}_{1}^{d}\), \({\text{p}}_{2}^{{\text{d}}}\), \({\text{p}}_{1}^{dc}\) and \({\text{p}}_{2}^{dc}\)) and the optimal service level (\({\text{s}}_{1}^{d}\), \({\text{s}}_{2}^{{\text{d}}}\), \({\text{s}}_{1}^{dc}\) and \({\text{s}}_{2}^{dc}\)) show a negative correlation with \(\beta_{2}\). However, it is obvious that \(\beta_{2}\) has a greater impact on the decision-making of new channels. Similarly, the optimal price and service level are negatively correlated with \(\beta_{1}\).

From Fig. 7, we can draw the following conclusions. First. in the context of the dual channel strategy, cross-price elasticity has a positive impact on the product price and service level. Furthermore, when the other parameters of the two channels are symmetrical, the optimal price and service level of the two channels are equal.

Through Fig. 8, we can draw the following conclusions. First, in the context of the dual channel strategy, an increase in \(\mu_{2}\) leads to not only an increase in the service level but also an increase in the product price. Second, in the case of centralized decision-making, the manufacturer sets higher product prices, and the e-commerce platform provides a higher service level. Third, the manufacturer and e-commerce platforms are more sensitive to changes in \(\mu_{2}\) when making centralized decisions. The influence of \(\mu_{1}\) on the optimal solution is similar to that of \(\mu_{2}\).The difference is that the change in \(\mu_{1}\) has a positive impact on the optimal decision of a single channel.

Figure 9 prove the relationship between the service cost coefficient and the optimal decision, and the conclusion is similar to the previous conclusion, except for the relationship between the service cost coefficient and its own channel decision in the context of centralized decision-making. Taking \({\text{k}}_{1}\) as an example, when the value of \({\text{k}}_{1}\) is small, the service level of the first channel is significantly higher than the optimal service level of the second channel. However, with the increase in \({\text{k}}_{1}\), \({\text{s}}_{1}^{dc}\) drops sharply, and the service level of the new channel gradually exceeds that of the original channel. The effect of \({\text{k}}_{2}\) is similar to that of \({\text{k}}_{1}\), so we omit it here.

Figure 10 shows that in the context of decentralized decision-making, the optimal price and service level increase with an increase in \(\delta\). However, in the context of centralized decision-making, the optimal decision-making of the manufacturer and e-commerce platforms is not affected by the profit proportion.

Besides, the equilibrium solution under the centralized model is always larger than that under the decentralized decision, which can also be found in Figs. 5, 6, 7, 8 and 9.

6.2 Sensitivity analysis of optimal profit

In this part, we compare the profits of the manufacturer, e-commerce platforms and supply chains under different backgrounds. The settings of the parameters are similar to those in the previous part.

As shown in Fig. 11, When the potential market capacity \({\text{a}}\) increases, the profits of the manufacturer, e-commerce platforms and the whole supply chain, whether centralized or decentralized, increase. However, the change in the original channel's market share \(\theta\) has different effects on the optimal profit. when the original channel's market share \(\theta\) is small, the increase in \(\theta\) leads to the decrease in the profit of the supply chain; only when \(\theta\) is greater than the threshold value (0.5) does the increase in \(\theta\) lead to an increase in the supply chain profits. Besides, the increase in \(\theta\) can have a positive impact on the profit of the first e-commerce platform, but it has a negative impact on the profit of the second e-commerce platform. Therefore, the manufacturer should take measures to ensure a large gap between the market shares of the two channels to obtain greater benefits.

Besides, the profit proportion does not affect the optimal profit under the background of centralized decision-making, while it has an impact on the profits of the manufacturer and e-commerce platforms. When \(\delta\) increases, the profit of the e-commerce platform increases, and the profit of the manufacturer decreases. Currently, the increase in profit is greater than the decrease in profit, leading to an increase in supply chain profit. However, when \(\delta\) exceeds a certain threshold, the decrease in profit exceeds the increase in profit, leading to a decrease in supply chain profit. Therefore, properly increasing the proportion of profits is conducive to increasing supply chain profits.

Figure 12 verifies the conclusion of Theorem 2, which shows that when the value of \(\beta_{2}\) is small, the manufacturer and the supply chain can obtain higher profits by adopting the dual channel strategy; however, when \(\beta_{2}\) exceeds a certain threshold, the manufacturer and the supply chain can obtain higher profits by implementing the single channel strategy. In addition, we can conclude that price elasticity has a negative impact on the profits of enterprises. Especially for the manufacturer and the supply chain, an increase in \(\beta_{{\text{i}}} \left( {{\text{i = }}1,2} \right)\) leads to a significant reduction in profits. The impact of cross-price elasticity \(\gamma_{{\text{i}}}\) on enterprise profit is different from that of price elasticity. In general, the increase in price elasticity \(\gamma_{i} \left( {i = 1,2} \right)\) has a positive impact on the profits of enterprises, except for the profits of the \(j\left( {j = 2 - i} \right)\) platform.

Figure 13 show that service elasticity has little effect on the optimal profit, except in the case of centralized decision-making. In other words, changes in \(\mu_{1}\) and \(\mu_{2}\) can cause only slight changes in the profits of the manufacturer and e-commerce platforms. This is also the case for the service cost coefficients. Therefore, it is unwise for managers to invest many resources to reduce the cost of services and improve profits under the background of decentralized decision-making.

6.3 Analysis of contract coordination

In the following section, we analyse the possibility of the designed contract to provide a reference for the decision-making of enterprises. we reassign the parameters as follows: \({\text{a}} = 10\), \({\text{a}} = 10\), \(\theta = 0.9\), \(\beta_{1} = 2.5\), \(\beta_{2} = 3.5\), \(\gamma_{1} = \gamma_{2} = 1\), \(\mu_{1} = \mu_{2} = 1.5\) and \(k_{1} = k_{2} = 1.5\). Figure 14 show the optimal profit of the enterprise before the implementation of the contract and the feasible range of the contract under the new background, respectively.

According to Fig. 14, we can conclude that with the increase in \(\delta\), the manufacturer's profit decreases, but in the case of a single channel, the manufacturer's profit decreases to a greater extent. Figure 14 shows that the lower bound of the transfer payment \(M_{2}\) accepted by the manufacturer has a downward trend. Thus, when \(\delta\) is too small, there is no possibility of coordination. In this case, the transfer payment provided by the e-commerce platform cannot effectively stimulate the manufacturer. However, when \(\delta\) increases, the possibility of coordination arises. With the increase in \(\delta\), the transfer payment provided by the e-commerce platform gradually increases, which eventually attracts the manufacturer to implement the dual channel strategy. In addition, when \(\delta\) increases and exceeds a certain threshold (0.38), the manufacturer's profit in the dual channel increases, which means that \(M_{1}\) begins to be less than 0. Then, even if the e-commerce platform does not increase the transfer payment, the manufacturer will implement the dual channel strategy.

7 Conclusion

In this paper, we study the manufacturer's channel selection strategy, the manufacturer's optimal price and the determination of the optimal service level of an e-commerce platform. In this paper, the market demand faced by the manufacturer is linear and depends on the price of products determined by the manufacturer and the service level determined by e-commerce platforms. The basic model based on the Stackelberg game is established. To explore the effectiveness of different channel selection strategies, we consider an integrated system controlled by a single decision maker. Then, to maximize the profit of the supply chain, we design a transfer payment contract to support coordination.

Some interesting conclusions are obtained. First, in terms of the channel selection theory, different from the previous research conclusions, neither the single channel strategy nor the dual channel strategy can always be in the dominant position. Therefore, in practice, when the manufacturer decides their channel structure, it needs to carefully analyse the attributes of the new channel and compare it with the original channel. In short, if the consumers of the new sales channel are very sensitive to the price of products, then the manufacturer should not open up the new sales channels; however, if the consumers of the new sales channel are not sensitive to the price of products, the manufacturer should actively open up a new sales channel. Second, in the case of decentralized decision-making, there is a double marginalization effect, whether in the context of a single channel or dual channels, which further proves the previous research on the theory of double margin. Thus, in practice, the manufacturer and e-commerce platforms should cooperate to obtain optimal profits under centralized decision-making and achieve a win–win situation. However, inconsistent with our intuition, although centralized decision-making eliminates dual marginal utility, the price of products under this scenario is higher than that under decentralized decision-making. This is mainly because in the context of centralized decision-making, the level of service provided by the e-commerce platform is higher, which eventually leads to higher product prices. Thus, in the context of centralized decision-making, enterprises can obtain more profits, and consumers can also obtain more benefits. In addition, the contract we design is feasible and can effectively induce the manufacturer to implement the dual channel strategy and achieve a win–win situation between the manufacturer and e-commerce platforms.

Our study has some limitations. First, in this paper, we assume that the manufacturer is the leader of the supply chain. However, in actual transactions, some e-commerce platforms have greater rights and occupy a dominant position. Therefore, in future studies, the manufacturer's channel choice can be analyzed under different power structures. For example, the e-commerce platform is the leader of the supply chain. Second, in our model, the manufacturer faces linear demand, but in reality, enterprises face random market demand. Thus, it would be an interesting extension to study the manufacturer's selection of online channels in the context of random market demand. In addition, there is only one manufacturer and two e-commerce platforms in our model, but there are multiple manufacturers and multiple e-commerce platforms in the real market. Therefore, more interesting conclusions may be drawn if horizontal competition within the supply chain is considered in future studies and more market players are introduced.

References

Pu, X., Gong, L., Han, X.: Consumer free riding: coordinating sales effort in a dual-channel supply chain. Electron. Commer. Res. Appl. 22, 1–12 (2017)

Zhou, Y.-W., Guo, J., Zhou, W.: Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. Int. J. Prod. Econ. 196, 198–210 (2018)

Wang, Y.Y., Yu, Z.Q., Jin, M.Z.: E-commerce supply chains under capital constraints. Electron. Commer. Res. Appl. 35, 14 (2019)

Ding, Q., Dong, C., Pan, Z.: A hierarchical pricing decision process on a dual-channel problem with one manufacturer and one retailer. Int. J. Prod. Econ. 175, 197–212 (2016)

Zhu, W., He, Y.: Green product design in supply chains under competition. Eur. J. Oper. Res. 258(1), 165–180 (2017)

Wang, Y., Yu, Z., Shen, L.: Study on the decision-making and coordination of an e-commerce supply chain with manufacturer fairness concerns. Int. J. Prod. Res. 57(9), 2788–2808 (2018)

Yang, W., Zhang, J., Yan, H.: Impacts of online consumer reviews on a dual-channel supply chain. Omega 101, 102266 (2021)

Li, G., Li, L., Sethi, S.P., et al.: Return strategy and pricing in a dual-channel supply chain. Int. J. Prod. Econ. 215, 153–164 (2019)

Wang, W., Li, G., Cheng, T.C.E.: Channel selection in a supply chain with a multi-channel retailer: The role of channel operating costs. Int. J. Prod. Econ. 173, 54–65 (2016)

Xu, S., Tang, H., Lin, Z., et al.: Pricing and sales-effort analysis of dual-channel supply chain with channel preference, cross-channel return and free riding behavior based on revenue-sharing contract. Int. J. Prod. Econ. 249, 108506 (2022)

Cai, G., Zhang, Z.G., Zhang, M.: Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. Int. J. Prod. Econ. 117(1), 80–96 (2009)

Cachon, G.P., Lariviere, M.A.: Supply chain coordination with revenue-sharing contracts: strengths and limitations. Manage. Sci. 51(1), 30–44 (2005)

Yao, F., Parilina, E., Zaccour, G., et al.: Accounting for consumers’ environmental concern in supply chain contracts. Eur. J. Oper. Res. 301(3), 987–1006 (2022)

Giannoccaro, I., Pontrandolfo, P.: Supply chain coordination by revenue sharing contract. Int. J. Prod. Econ. 92(3), 297 (2004)

Wu, D., Chen, J., Li, P., et al.: Contract coordination of dual channel reverse supply chain considering service level[J]. J. Clean. Prod. 260, 121071 (2020)

Chakraborty, T., Chauhan, S.S., Vidyarthi, N.: Coordination and competition in a common retailer channel: Wholesale price versus revenue-sharing mechanisms. Int. J. Prod. Econ. 166, 103–118 (2015)

Xu, L., Wang, C., Zhao, J.: Decision and coordination in the dual-channel supply chain considering cap-and-trade regulation. J. Clean. Prod. 197, 551–561 (2018)

Chen, J.-Y.: Responsible sourcing and supply chain traceability. International Journal of Production Economics 248, 108462 (2022)

Zhao, C., Wang, D., Younas, A., et al.: Coordination of closed-loop supply chain considering loss-aversion and remanufactured products quality control. Annals Oper. Res. (2022). https://doi.org/10.1007/s10479-022-04619-1

Rathnasiri, S., Ray, P., Vega-Mejía, C.A., et al.: Optimising small-scale electronic commerce supply chain operations: a dynamic cost-sharing contract approach. Annals Oper. Res. (2022). https://doi.org/10.1007/s10479-022-04662-y

Ghosh, D., Shah, J.J.I.J.O.P.E.: Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 164, 319–329 (2015)

Ji, J., Zhang, Z., Yang, L.J.J.O.C.P.: Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J Clean Prod 141, 852–867 (2017)

Qiang, H., Yuyan, W.J.S.: Decision and coordination in a low-carbon e-supply chain considering the manufacturer’s carbon emission reduction behavior. Sustainability 10(5), 1686 (2018)

Zhao, N., Liu, X., Wang, Q., et al.: Information technology-driven operational decisions in a supply chain with random demand disruption and reference effect. Comput. Ind. Eng. 171, 108377 (2022)

Liang, G., Gu, C.: The value of target sales rebate contracts in a supply chain with downstream competition. Int. J. Prod. Econ. 242, 108290 (2021)

Wong, W.K., Qi, J., Leung, S.Y.S.: Coordinating supply chains with sales rebate contracts and vendor-managed inventory. Int. J. Prod. Econ. 120(1), 151–161 (2009)

Saha, S., Sarmah, S.P., Moon, I.: Dual channel closed-loop supply chain coordination with a reward-driven remanufacturing policy. Int. J. Prod. Res. 54(5), 1503–1517 (2015)

Ha, A.Y., Shang, W., Wang, Y.: Manufacturer rebate competition in a supply chain with a common retailer. Prod. Oper. Manag. 26(11), 2122–2136 (2017)

Qin, J., Ren, L., Xia, L., et al.: Pricing strategies for dual-channel supply chains under a trade credit policy. Int. Trans. Oper. Res. 27(5), 2469–2508 (2020)

Pratap, S., Daultani, Y., Dwivedi, A., et al.: Supplier selection and evaluation in e-commerce enterprises: a data envelopment analysis approach. Benchmark. Int. J. 29, 325–341 (2021)

Gunasekaran, A., Mcgaughey, R.E., Ngai, E.W.T., et al.: E-procurement adoption in the Southcoast SMEs. Int. J. Prod. Econ. 122(1), 161–175 (2009)

Zhang, M., Pratap, S., Huang, G.Q., et al.: Optimal collaborative transportation service trading in B2B e-commerce logistics. Int. J. Prod. Res. 55(18), 5485–5501 (2017)

Prajapati, D., Zhou, F., Zhang, M., et al.: Sustainable logistics network design for multi-products delivery operations in B2B e-commerce platform. Sādhanā (2021). https://doi.org/10.1007/s12046-021-01624-1

Che, T., Peng, Z., Lai, F., et al.: Online prejudice and barriers to digital innovation: empirical investigations of Chinese consumers. Inf. Syst. J. 32(3), 630–652 (2021)

Lu, Q.H., Liu, N.: Effects of e-commerce channel entry in a two-echelon supply chain: a comparative analysis of single- and dual-channel distribution systems. Int. J. Prod. Econ. 165, 100–111 (2015)

Cao, K., Xu, Y., Wu, Q., et al.: Optimal channel and logistics service selection strategies in the e-commerce context. Electron. Commerce Res. Appl. 48, 101070 (2021)

Khouja, M., Park, S., Cai, G.: Channel selection and pricing in the presence of retail-captive consumers. Int. J. Prod. Econ. 125(1), 84–95 (2010)

Abhishek, V., Jerath, K., Zhang, Z.J.: Agency selling or reselling? Channel structures in electronic retailing. Manage. Sci. 62(8), 2259–2280 (2016)

Nie, J., Zhong, L., Yan, H., et al.: Retailers’ distribution channel strategies with cross-channel effect in a competitive market. Int. J. Prod. Econ. 213, 32–45 (2019)

Liu, B., Cai, G., Tsay, A.A.: Advertising in asymmetric competing supply chains. Prod. Oper. Manag. 23(11), 1845–1858 (2014)

Chen, J., Liang, L., Yao, D.-Q., et al.: Price and quality decisions in dual-channel supply chains. Eur. J. Oper. Res. 259(3), 935–948 (2017)

Fan, X., Guo, X., Wang, S.: Optimal collection delegation strategies in a retail-/dual-channel supply chain with trade-in programs. Eur. J. Oper. Res. 303(2), 633–649 (2022)

Xu, X., Zhang, W., He, P., et al.: Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega 66, 248–257 (2017)

Tsay, A.A., Agrawal, N.: Channel dynamics under price and service competition. Manuf. Serv. Oper. Manag. 2(4), 372–391 (2000)

Ha, A.Y., Tong, S., Zhang, H.: Sharing demand information in competing supply chains with production diseconomies. Manage. Sci. 57(3), 566–581 (2011)

Wang, Q., Zhao, D., He, L.: Contracting emission reduction for supply chains considering market low-carbon preference. J. Clean. Prod. 120, 72–84 (2016)

Wang, Y.-Y., Li, J.: Research on pricing, service and logistic decision-making of E-supply chain with ‘Free Shipping’ strategy. J. Control Decis. 5(4), 319–337 (2017)

Xin, B., Zhang, L., Xie, L.: Pricing decision of a dual-channel supply chain with different payment, corporate social responsibility and service level. RAIRO Oper. Res. 56(1), 49–75 (2022)

Han, Q., Wang, Y.: Decision and coordination in a low-carbon E-supply chain considering the manufacturer’s carbon emission reduction behavior. Sustainability 10(5), 1686 (2018)

Li, B., Zhu, M., Jiang, Y., et al.: Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 112, 2029–2042 (2016)

Wang, Y., Fan, R., Shen, L., et al.: Decisions and coordination of green e-commerce supply chain considering green manufacturer’s fairness concerns. Int. J. Prod. Res. 58, 7471–8489 (2020)

He, Y., Huang, H., Li, D.: Inventory and pricing decisions for a dual-channel supply chain with deteriorating products. Oper. Res. Int. J. 20(3), 1461–1503 (2018)

Acknowledgements

We would like to sincerely thank the editor and anonymous referees for their helpful suggestions and insightful comments, which have significantly improved the quality of this paper.

Funding

The research is provided by Fundamental Research Funds for the Central Universities (Grant No. 22LZUJBKYDX004), and The Young Doctoral Foundation of Gansu Province (Grant No. 2022QB-010) and Soft Science Special Project of GanSu Basic Research Plan (Grant No. 22JR4ZA043).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

None.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of theorem 1

The profit function of that manufacturer and that e-commerce platform is as follows:

After taking the first-order derivative \(\pi_{e1}^{}\) with respect to \(s\), we have \(\partial \pi_{e1}^{} /\partial s = \delta p_{1} \mu_{1} - k_{1} s_{1}\). Because \(\partial^{2} \pi_{e1}^{} /\partial s_{1}^{2} = - k_{1} < 0\), the profit function is a convex function of service level \(s\), and there is an optimal \(s\) to maximize the platform’s profit. From the first-order condition, the optimal solution can be calculated as follows:

Substituting (16) into Eq. (14), we can find that under the given condition of s, the optimal profit of the manufacturer is as follows:

To maximize the manufacturer’s profit, we have the first-order derivative of the profit function

The second derivative of the profit function with respect to \(p_{1}\) is \(\frac{{\partial^{2} \pi_{m}^{} }}{{\partial P_{1}^{2} }} = 2(1 - \delta )(\frac{{\delta \mu_{1}^{2} }}{{k_{1} }} - \beta_{1} )\). According to the assumption, \({\text{k}}_{1}\) is a sufficiently large number, which is much greater than the other parameters. Therefore, we can judge that \(2(1 - \delta )(\frac{{\delta \mu_{1}^{2} }}{{k_{1} }} - \beta_{1} )\) is less than 0. As a result of \(\frac{{\partial^{2} \pi_{m}^{} }}{{\partial p_{1}^{2} }} < 0\), \(\pi_{m}^{}\) is a concave function of retail price \(p_{1}\). According to \(\partial \pi_{m}^{} /\partial p_{1} = 0\), it can be derived as follows:

When Eq. 18 is substituted into Eq. 16, the optimal service level of the e-commerce platform is

By substituting Eqs. (18) and (19) into (16) and (17), the optimal profit function of the manufacturer and e-commerce platform is shown as follows:

Proof of proposition 1

According to Eqs. (18) and (19), we can see that when \(p_{1}^{} = \frac{{a{\text{k}}_{1} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )}}\) and \({\text{s}}_{1}^{} = \frac{{a\delta \mu_{1}^{2} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )}}\), the manufacturer and the e-commerce platform can achieve optimal profits. Their optimal profits are as follows:

It is apparent \(\frac{{\partial p_{1}^{} }}{{\partial {\text{a}}}} = \frac{{{\text{k}}_{1} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )}}\), \(\frac{{\partial {\text{s}}_{1}^{} }}{\partial a} = \frac{{\delta \mu_{1}^{2} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )}}\), \(\frac{{\partial \pi_{e1}^{} }}{{\partial {\text{a}}}} = \frac{{ak_{1} \delta (2k_{1} \beta_{1} - 3\delta \mu_{1}^{2} )}}{{4(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\) and \(\frac{{\partial \pi_{{\text{m}}}^{} }}{{\partial {\text{a}}}} = \frac{{ak_{1} (1 - \delta )}}{{2k_{1} \beta_{1} - 2\delta \mu_{1}^{2} }}\).So when \(2k_{1} \beta_{1} - 3\delta \mu_{1}^{2} > 0\), that is, \(k_{1} \beta_{1} > \frac{{3\delta \mu_{1}^{2} }}{2}\) is satisfied, we can get \(\frac{{\partial p_{1}^{} }}{{\partial {\text{a}}}} > 0\), \(\frac{{\partial {\text{s}}_{1}^{} }}{\partial a} > 0\), \(\frac{{\partial \Pi_{{\text{m}}}^{} }}{{\partial {\text{a}}}} > 0\) and \(\frac{{\partial \Pi_{e1}^{} }}{{\partial {\text{a}}}} > 0\).

Similarly, we can get \(\frac{{\partial p_{1}^{} }}{\partial \delta } = \frac{{{\text{ak}}_{1} \mu_{1}^{2} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\), \(\frac{{\partial {\text{s}}_{1}^{} }}{\partial \delta } = \frac{{{\text{a}}k_{1} \beta_{1} \mu_{1} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\), \(\frac{{\partial \pi_{{\text{m}}}^{} }}{\partial \delta } = \frac{{ - a^{2} k_{1} (k_{1} \beta_{1} - \mu_{1}^{2} )}}{{4(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\) and \(\frac{{\partial \pi_{e1}^{} }}{\partial \delta } = \frac{{a^{2} k_{1}^{2} \beta_{1} (k_{1} \beta_{1} - 2\delta \mu_{1}^{2} )}}{{4(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{3} }}\). So when \(k_{1} \beta_{1} - \mu_{1}^{2} > 0\) and \(k_{1} \beta_{1} - \delta \mu_{1}^{2} > 0\) is satisfied, we can get \(\frac{{\partial p_{1}^{} }}{\partial \delta } > 0\), \(\frac{{\partial {\text{s}}_{1}^{} }}{\partial \delta } > 0\), \(\frac{{\partial \pi_{{\text{m}}}^{} }}{\partial \delta } < 0\) and \(\frac{{\partial \pi_{e1}^{} }}{\partial \delta } > 0\). Therefore, the conclusion of proposition 1 is proved.

Proof of proposition 2

After taking the first-order derivative of \(p_{1}^{}\), \({\text{s}}_{1}^{}\), \(\pi_{m}^{}\) and \(\pi_{e1}^{}\) with respect to \(\beta_{1}\), we can derive that \(\frac{{\partial p_{1}^{} }}{{\partial \beta_{1} }} = { - }\frac{{{\text{ak}}_{1}^{2} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\), \(\frac{{\partial {\text{s}}_{1}^{} }}{{\partial \beta_{1} }} = { - }\frac{{{\text{a}}\delta k_{1} \mu_{1} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\), \(\frac{{\partial \pi_{{\text{m}}}^{} }}{{\partial \beta_{1} }} = - \frac{{a^{2} k_{1}^{2} (1 - \delta )}}{{4(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\) and \(\frac{{\partial \pi_{e1}^{} }}{{\partial \beta_{1} }} = { - }\frac{{a^{2} k_{1}^{2} \delta (k_{1} \beta_{1} - 2\delta \mu_{1}^{2} )}}{{4(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{3} }}\). So when \(k_{1} \beta_{1} - 2\delta \mu_{1}^{2} > 0\) and \(k_{1} \beta_{1} - \delta \mu_{1}^{2} > 0\) is satisfied, we can obtain \(\frac{{\partial p_{1}^{} }}{{\partial \beta_{1} }} < 0\), \(\frac{{\partial {\text{s}}_{1}^{} }}{{\partial \beta_{1} }} < 0\), \(\frac{{\partial \pi_{{\text{m}}}^{} }}{{\partial \beta_{1} }} < 0\) and \(\frac{{\partial \pi_{e1}^{} }}{{\partial \beta_{1} }} < 0\). Therefore, the conclusion of proposition 2 is proved.

Proof of proposition 3

After taking the first-order derivative of \(p_{1}^{}\), \({\text{s}}_{1}^{}\), \(\pi_{m}^{}\) and \(\pi_{e1}^{}\) with respect to \(\mu_{1}\), we can derive that \(\frac{{\partial p_{1}^{} }}{{\partial \mu_{1} }} = \frac{{{\text{a}}\delta {\text{k}}_{1} \mu_{1} }}{{(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\), \(\frac{{\partial {\text{s}}_{1}^{} }}{{\partial \mu_{1} }} = \frac{{{\text{a}}\delta (k_{1} \beta_{1} { + }\delta \mu_{1}^{2} )}}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\), \(\frac{{\partial \pi_{e1}^{} }}{{\partial \mu_{1} }} = \frac{{a^{2} \delta^{2} k_{1} \mu_{1} (k_{1} \beta_{1} - 3\delta \mu_{1}^{2} )}}{{4(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{3} }}\) and \(\frac{{\partial \pi_{{\text{m}}}^{} }}{{\partial \mu_{1} }} = \frac{{a^{2} \delta k_{1} \mu_{1} (1 - \delta )}}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\); Similarly, we can get \(\frac{{\partial p_{1}^{} }}{{\partial {\text{k}}_{1} }} = - \frac{{{\text{a}}\delta \mu_{1}^{2} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\), \(\frac{{\partial {\text{s}}_{1}^{} }}{{\partial k_{1} }} = - \frac{{{\text{a}}\delta \beta_{1} \mu_{1} }}{{2(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\), \(\frac{{\partial \pi_{{\text{m}}}^{} }}{{\partial k_{1} }} = - \frac{{a^{2} \delta \mu_{1}^{2} (1 - \delta )}}{{4(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{2} }}\) and \(\frac{{\partial \pi_{e1}^{} }}{{\partial \mu_{1} }} = { - }\frac{{a^{2} \delta^{2} \mu_{1}^{2} (k_{1} \beta_{1} - 3\delta \mu_{1}^{2} )}}{{8(k_{1} \beta_{1} - \delta \mu_{1}^{2} )^{3} }}\).

So when \(k_{1} \beta_{1} - 3\delta \mu_{1}^{2} > 0\) and \(k_{1} \beta_{1} - \delta \mu_{1}^{2} > 0\) is satisfied, we can obtain \(\frac{{\partial p_{1}^{} }}{{\partial \mu_{1} }} > 0\), \(\frac{{\partial {\text{s}}_{1}^{} }}{{\partial \mu_{1} }} > 0\), \(\frac{{\partial \pi_{{\text{m}}}^{} }}{{\partial \mu_{1} }} > 0\), \(\frac{{\partial \pi_{e1}^{} }}{{\partial \mu_{1} }} > 0\), \(\frac{{\partial p_{1}^{} }}{{\partial {\text{k}}_{1} }} < 0\), \(\frac{{\partial {\text{s}}_{1}^{} }}{{\partial {\text{k}}_{1} }} < 0\), \(\frac{{\partial \pi_{{\text{m}}}^{} }}{{\partial {\text{k}}_{1} }} < 0\) and \(\frac{{\partial \pi_{e1}^{} }}{{\partial {\text{k}}_{1} }} < 0\).

Therefore, the conclusion of proposition 3 is proved.

Proof of theorem 2

After adopting the dual channel strategy, the profit of the manufacturer is as follows:

The profit functions of platform 1 and platform 2 are as follows:

In the third stage, platform 1 and platform 2 need to determine the optimal service \(s_{1}\) and \(s_{2}\) based on the manufacturer’s given retail prices \(p_{1}\) and \(p_{2}\) to maximize their own revenue.

Since \(\frac{{\partial^{2} \pi_{{{\text{e1}}}}^{} }}{{\partial s_{1}^{2} }} = - k_{1} < 0\), \(\frac{{\partial^{2} \pi_{{{\text{e2}}}}^{} }}{{\partial s_{2}^{2} }} = - k_{2} < 0\), there are optimal service levels \(s_{1}\) and \(s_{2}\) so that platform 1 and platform 2 can maximize their respective revenue. The first-order derivatives of \(\pi_{{{\text{e1}}}}^{}\) to \(s_{1}\) and \(\pi_{{{\text{e2}}}}^{}\) to \(s_{2}\) are as follows:

Therefore, let the first derivative order be equal to zero, and the optimal service level is shown as follows:

Substituting Eqs. (26) and (27) into the manufacturer’s profit function, we can obtain

It can be obtain from Eq. (28) that the Hessian matrix of the manufacturer's profit function with respect to \({\text{p}}_{1}\) and \({\text{p}}_{2}\) is as follows:

So we know that when \(k_{1} \beta_{1} - \delta \mu_{1}^{2} > 0\) and \(4(k_{1} \beta_{1} - \delta \mu_{1}^{2} )(k_{2} \beta_{2} - \delta \mu_{2}^{2} ) - k_{1} k_{2} (\gamma_{1} + \gamma_{2} )^{2} > 0\) are satisfied. we obtain the following inequality:

According to the assumption mentioned above, the Hessian matrix of \(\pi_{{\text{m}}}^{}\) with respect to \(p_{1}\) and \({\text{p}}_{2}\) is negative definite, so when its first derivative is equal to zero, the optimal \(p_{1}\) and \({\text{p}}_{2}\) can be obtained.

When retail prices (29) and (30) are brought into the optimal service level (26) and (27), the services of the platforms can be obtained as follows:

Proof of proposition 4

The following equation can be obtained by calculating the first derivative of \({\text{p}}_{1}^{}\), \({\text{p}}_{2}^{}\), \({\text{s}}_{1}^{}\) and \({\text{s}}_{2}^{}\) to \(\theta\) respectively: