Abstract

The aim of the supply chain is to integrate environmental aspects with energy efficiency consumption. This study considers an integrated two-echelon green supply chain with carbon emission from production, warehousing, transporting, deterioration of items, as well as disposing waste. The deterioration rate is controlled by utilizing preservation technology investment. Also, for the fast-growing business, the suppliers offer credit period to the retailer, and the same credit period is offered by retailer to end customers, which works as an influential strategy for attracting new customers and has a positive impact on sales. The whole model is studied in an inflationary environment. The discussed model was solved analytically and obtained the optimal solution in a quasi-closed form solution; and simultaneously optimizes the optimal time and preservation technology cost in a two-echelon supply chain model considering controllable deterioration, waste, and carbon emission. To illustrate the present study, a numerical analysis and a sensitivity analysis have been presented. The convexity is obtained analytically as well as graphically. The objective is to minimize total cost and to reduce total carbon emissions. The analysis of the proposed model shows that the optimal results are quite realistic and can be applied to minimize total cost and reduce total carbon emission of supply chain integration.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

For more than three decades, integration and collaboration among supply chain members have shown great potential in supply chain management. Many researchers are inspired by global awareness of environmental sustainability to determine how demands placed on the environment can be met without reducing its capacity to allow humans to live well now and in the future. Sustainability primarily focuses on economic, social, and environmental growth, which are informally referred to as people, profit and planet respectively. Eco-product design, sustainable construction, process improvement, and lean operations etc., are all part of this scope (Walker et al. [1]). Many researchers have incorporated carbon emissions into inventory management. Jauhari et al. [2] combined fixed and variable emission costs, in which fixed emission costs include forward and reverse transportation of defective products between vendor and buyer, and variable emission costs depend on delivery size. Low carbon supply chain management (Daryanto and Wee [3]) is not harmful to the environment. The most important aspect of becoming eco-friendly is sustainability. Because the entire world is polluted with toxic amounts of carbon emissions, making it sustainable can be a wise decision. Recently, Lu et al. [4] studied emission from two-stage supply chain. Their model considers carbon emissions from transport and warehousing of products. This research includes carbon emission costs with carbon emission regulation in the total integrated cost. The above study also considers carbon tax regulation.

One of the key factors that should not be neglected is deterioration, as inventory flow is reduced due to the combination of demand and deterioration. Deterioration is generally defined as evaporation, obsolescence, decay, spoilage, damage, dryness, and other processes that reduce the quality and quantity of a product (Rau et al. [5]). One of the assumptions in traditional inventory models was that items retained their physical characteristics well while being stored, but this is not always true for all items. As a result, investment in preservation technology is essential for controlling item deterioration, reducing economic losses, improving customer service, and increasing market competition. Following this discovery, many researchers worked on inventory models for deteriorating items using preservation technology (Mishra et al. [6]). Food waste at retailers occurs from deterioration, and not only from product expiration (Beullens and Ghiami [7]).

An inventory model is based on the belief that as soon as the supplier receives the producer's goods, he must pay for the goods. However, in today's scenario, it is very common to observe that the producer will allocate a specific time interval for paying the total price of items that the producer owes to the suppliers for the goods, known as the trade credit period (TCP). In most cases, interest is not charged if the money is returned within the time specified by the producer. There are two advantages to the producer's trade-credit period.

-

1.

This price reduction policy for green products attracts new customers.

-

2.

It should result in a decrease in sales because it takes time to profit from this delay period more frequently, and some customers will pay faster.

In today’s competitive environment, TCP performs as policy for an increasing number of customers. They may offer TCP (Ho [8]; Shah et al. [9]) or be involved in the strategic coordination of supply chain.

1.1 Contribution of the study

From literature survey and Table 1, it is clearly seen that no research has been done by combining the following factors at the same time: two-echelon inventory model with (1) controllable deterioration (2) inflation (3) trade credit period (4) carbon emission (production process, warehousing, transporting, storing, waste activities). Therefore, our objective is to merge these factors combinedly to make more realistic model. This model determines optimal time, preservation technology cost and total cost. In order to obtain the optimal policy, we used quasi-closed form to help the producer and supplier to evaluate optimal replenishment decision under minimizing the total cost. Further, mathematical software Mathematica is used for numerical and sensitive analysis.

The contribution of this paper and previous study is summarized in Table 1. Apart from introduction, this paper is divided into 9 Sections. Previous related studies are narrated in Sect. 2. Assumption and notations are given in Sect. 3. The description of mathematical model is given in Sect. 4. To obtain optimal solution of the proposed model a solution procedure is provided in Sect. 5. To show the effectiveness and availability of the proposed model, a numerical analysis and sensitivity analysis have been conducted in Sects. 6 and 7 respectively. The results and managerial insights are combinedly given in Sect. 8. Finally, the paper ends with some concluding remarks and possible future extensions of this work in Sect. 9. The flowchart of this study is presented in Fig. 1.

2 Literature review

In this section, the detailed information of previous research which is also useful for this study is presented. This section is divided into 6 sub sections based on the following specific areas such inventory models, inventory model inventory model with deterioration, inventory model with controllable deterioration, inventory model with inflation, inventory model with trade credit and inventory model with carbon emission.

2.1 Inventory model

He et al. [10] examined selling opportunities of manufacturer in production inventory model of a deteriorating items in different markets. They explored the production management strategies and found that they are important to improve a firm’s profitability. In business practice, it is seen that the huge stock of one product has a negative impact on other products. To deal with such situation, an EOQ model for homogeneous products was examined by Sana [11]. They considered the displayed stock space is limited and the demand of items is dependent on displayed stock level. Rau et al. [12] proposed a deteriorating item inventory model with shortage due to supplier in an integrated supply chain model. Another observable issue is freshness of items as freshness declines with time results decrease in demand at the same price. The freshness of items may increase or decrease the sale of items. Therefore, an inventory model for deteriorating items has been studied by Banrjee and Agarwal [13] in which demand is initially dependent on price and later it depends on freshness. Rabta [14] formulated an inventory model for a product in circular economy. They assumed that the demand, price and costs depend on the circularity level of the products. They optimized optimal circularity level and order quantity simultaneously.

2.2 Inventory model with deterioration

Many researchers worked on integrated inventory model for deteriorating items. Sarkar [15] solved a production inventory problem for deteriorating items in a two-echelon supply chain network design. They considered three types of probabilistic deterioration function to calculated associated cost. They obtained the optimal number of deliveries with integers, minimum cost, lot size for three different models. Ghiami and Williams [16] studied a single producer multi-buyer integrated inventory model for a deteriorating item with finite production rate. Chan et al. [17] proposed an integrated inventory model for exponentially deteriorating items considering single-vendor single-buyer. They optimized how production rate affects the total cost by taking it as a decision variable. Moubed et al. [18] studied a closed-loop supply chain including a manufacturer and a distributing centre that are producing and distributing one type of deteriorating item to consumers. The deteriorating items are collected from distribution centre and made available by the producer. The effect of three strategies: bargaining, better warehousing and changed collection rules are simulated using dynamic system.

2.3 Inventory model with controllable deterioration

A dynamic pricing inventory decision making model of deteriorating items having stochastic demand and promotional effort has been discussed by Soni and Chauhan [19]. They utilized preservation investment in their model. Maihami et al. [20] presented an inventory control model for supply chain of deteriorating items. They adopted probabilistic demand and deterioration, and compared integrated and non-integrated policy. They also studied the impact of the compensation policy in the supply chain coordination. The deterioration rate of perishable items can be reduced by using preservation technology. A multistage inventory problem for deteriorating items considering manufacturer’s raw materials and finished products on collaborative preservation investment has been studied by Chang et al. [21]. Yu et al. [22] analysed an inventory optimization problem consisting perishable products under carbon emission. Recently, Yadav et al. [23] presented a sustainable supply chain model having two manufacturer and a common retailer. They identified the optimal value of production rate, order quantity, number of shipment and preservation investment. they reduced 20% wastage of quantity by using preservation technology and proved that preservation technology’s benefits are more useful for the product’s safety and quality issues.

2.4 Inventory model with inflation

For long term businesses the effect of inflation cannot be ignored in supply chain management. Two-warehouse inventory system of deteriorating items with exponential demand under inflation and partial backordering has been provided by Bansal and Ahalawat [24]. Singh and Sharma [25] considered integrated inventory model in which raw materials are purchased by manufacturer from supplier. After this manufacturer produces finished goods and delivers them to a buyer. They considered that the production rate is dependent on demand rate whereas the demand rate is time dependent. To make their model more realistic, the effect of inflation on all costs has been considered. Tiwari et al. [26] investigated a two-warehouse inventory model for deteriorating items. They studied the effect of inflation on the optimal model. This model allows shortages and partial backlogging. Recently, Hemapriya and Uthayakumar [27] discussed the effect of inflation and ordering cost reduction depending on lead time and lead time reduction on the single-vendor single-buyer integrated production inventory model.

2.5 Inventory model with trade credit period

Trade credits are useful to improve the cash flow of businesses as well as improve relationship with vendor. Chung et al. [28] investigated a new integrated three-echelon supply chain model with non-instantaneous deterioration. In their model the supplier offers permissible delay period to the retailer and simultaneously the retailer provides maximal trade credit period to end customers to encourage sale and business profit. In the same year, Das et al. [29] demonstrated two integrated inventory models considering impact of discrete TCP on the purchased quantity and manufacturer collects raw-material with free transportation cost offered by supplier. They identified an optimal transportation cycles and optimal business cycles. In today’s scenario, different forms of TC policy are available to encourage retailer to buy larger quantities. An order quantity dependent trade credit period in supply chain model has been examined by Ouyang et al. [30]. Krugon and Nagaraju [31] developed two echelon inventory model with nonlinear price dependent demand. In their model producer delivered single item to the retailer and to encourage customers, a credit period is provided to the retailer by the manufacturer. They evaluated cycle time, retailer’s replenishment quantity, number of shipment and total cost. Ding et al. [32] investigated two-echelon supply chain network design with credit period. They optimized TC terms and safety stock level simultaneously. Mahota and Mahato [33] presented an inventory model with expiration date and dynamic demand under trade credit.

2.6 Inventory model with carbon emission

Environmental impacts of supply chain are considerable research areas. With the increasing awareness of climate change, researchers are now incorporating eco-friendly considerations into supply chain decision models. Wahab et al. [34] coordinated and integrated two-level international supply chain considering imperfect items and environmental impact. An integrating simulation model has been examined by Fichtinger et al. [35] considering warehouse-related greenhouse gas emission. They obtained that supply lead time, reorder quantities, and storage items all have substantial impact on total costs and emission. Tiwari et al. [36] examined an integrated inventory model to control environmental impact. They assumed transporting, storing/keeping deteriorating items, warehousing can create carbon emission and also minimized both total relevant cost, and carbon emission cost. Again, Tiwari et al. [37] established a green inventory problem for non-instantaneous deteriorating items under different conditions of delay in payments. They minimized carbon emission and maximized profit. The supply chain system involving vendor, buyer and freight forwarding company considering environment issues has been developed by Wangsa et al. [38]. In the same year, Mishra et al. [39] studied a carbon cap and tax regulated greener inventory problem for a buyer using a linear and non-linear price dependent demand. They controlled deterioration of greenhouse farm by using preservation investment. Also, identified that linear price dependent demand can give maximum profit. Latha et al. [40] developed joint economic lot size inventory model which consist of single-vendor and single-buyer and combinedly working on ordering cost reduction investment, back-order price discount and reduction on lead time by adopting geometric shipment policy. Giri and Ray [41] examined a sustainable supply chain considering a supplier and a manufacturer with emission sensitive demand under cap-and trade policy.

3 Notations and assumptions

In the development of the multi-echelon sustainable inventory model the below given notations and assumptions are utilized:

4 Notations

The mathematical representation of the notation is given in Table 2.

4.1 Assumptions

-

1.

The demand rate (D) is known, constant, and a single type of item is considered.

-

2.

The production rate (P) of manufacturer is known, constant, and greater than the demand rate.

-

3.

The deterioration rate (\(\theta_{0}\)) of the items is constant.

-

4.

The preservation technology investment is used to reduce the deterioration rate of items.

-

5.

Let \(m(\xi ) = 1 - e^{ - \lambda \xi }\) where \(\xi\) is an investment in preservation technology and “\(\lambda\)” is a factor representing the percentage increase in \(m(\xi )\). \(m(\xi ) = 1 - e^{ - \lambda \xi }\) is a function that is continuous, concave, and twice differential with respect to preservation investment \(\xi\), at \(m(0) = 0\) and \(\mathop {\lim }\limits_{\xi \to \infty } m(\xi ) = 1\). Here \(m^{\prime}(\xi ) = \lambda e^{ - \lambda \xi }\) and \(m^{\prime\prime}(\xi ) = - \lambda^{2} e^{ - \lambda \xi } < 0\).

-

6.

The transportation of items from one place to another place in “n” deliveries is done by truck.

-

7.

Logistic activities, production process, warehousing of unsold items, storing deterioration items, disposal of waste can create carbon emissions.

-

8.

A shortage is not allowed.

5 Model description

5.1 Vendor’s inventory model

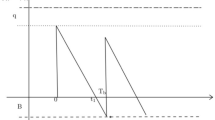

Figure 2 shows the producer’s model for deteriorating products when shortages are not allowed. At time \(t = 0\), the manufacturing process starts and the quantity is zero. Production reaches its maximum level \(Q_{m}\) at time \(t = t_{1}\) at a constant rate of production P, demand rate D, and deterioration rate \(\theta_{0}\). From that point, inventory starts to decline due to customer demand and deterioration. The inventory becomes zero at time t = T.

[See Appendix 1 for mathematical development].

Manufacturer total average cost consists of setup cost, production cost, preservation technology cost, solid waste disposal cost, holding cost, deterioration cost, and transportation cost, therefore

In which.

5.1.1 Production cost

The production cost considers both traditional production cost (\(C_{p}\)) and carbon emission cost (\(C_{pe}\)) associated with business from manufacturing a product or providing services. Therefore, production cost with the effect of inflation and carbon emission cost can be calculated as follows:

where \(C_{pe} = e_{p} E_{e} T_{X}\) is carbon emission cost produced by energy usage for the machining and handling operations in production.

5.1.2 Holding cost

Figure 2 shows that the inventory is carrying in the interval [0, \(t_{1}\)] to [\(t_{1}\), T]. The producer’s holding cost is sum of two costs; traditional carrying cost (\(C_{hm}\)) and carbon emission cost (\(C_{hme}\)) due to consumption. Therefore, the total holding cost per unit time with the effect of inflation can be formulated as

where \(C_{hme} = w_{me} E_{e} T_{X}\) is carbon emission cost generated by inventory warehousing activities.

5.1.3 Deterioration cost

From Fig. 2 it is seen that the deterioration of items happens during time [0, t1] to [t1, T]. Therefore, the total deterioration cost with the effect of inflation and carbon emission cost can be determined as

where \(C_{dme} = d_{me} T_{X}\) is carbon emission cost from deterioration of items.

5.1.4 Preservation technology cost

The preservation technology is applied to preserve the products from deterioration. Therefore, the preservation technology cost can be calculated as

5.1.5 Waste disposal cost

At the end of each production cycle, a certain amount of waste is produced and being disposed. Further, the cost of waste disposal activities directly affects the price of the products and consumer’s demand. Therefore, the waste disposal cost includes the fixed cost for disposing waste items in the form of garbage/ solid waste and the variable costs of solid waste emission.

where \(C_{we} = wE_{mw} T_{X}\) is variable carbon emission cost generated from solid waste disposing.

5.1.6 Transportation cost

The producer’s logistic cost consists of fixed transportation cost, variable transportation cost, and carbon emission cost. The variable transportation cost depends on distance of product delivery, fuel consumption by vehicle, the additional fuel consumption per ton of payload, weight of product, delivered quantity, and fuel price. The carbon emission cost depends on the delivery distance, delivered quantity, and standard vehicle emission cost for product delivery \((e_{1} ,e_{2} ).\)

where \(e_{1} = F_{e} T_{X} {\text{ and }}e_{2} = F_{e} T_{X}\) is carbon emission cost from vehicle.

Hence,

The total carbon emission of the producer is

5.2 Supplier’s inventory model

The supplier’s inventory behaviour with time is represented in Fig. 3. Initially the inventory level is Qs and it starts declining due to the effect of deterioration rate and demand rate. Here, the producer supplies the inventory to the supplier in n different shipments.

Supplier’s total average cost is sum of ordering cost, holding cost, deterioration cost and preservation technology cost, therefore

In which.

5.2.1 Ordering cost

5.2.2 Holding cost

The holding cost includes warehousing costs and handling cost that remains unsold. Figure 3 shows that inventory or stock is carrying in the interval [0, v]. Therefore, the total holding cost per cycle with the effect of inflation and carbon emission cost can be formulated as

where \(C_{hse} = w_{se} E_{e} T_{X}\) is carbon emission cost generated by inventory warehousing activities.

5.2.3 Deterioration cost

From Fig. 3 it is seen that the deterioration of items happens during time [0, v]. Therefore, the total deterioration cost with the effect of inflation and carbon emission can be determined as

where \(C_{dse} = D_{se} T_{X}\) is carbon emission cost from deterioration of products.

5.2.4 Preservation technology cost

Hence,

Total carbon emission of the supplier is

Now based on the permissible delay period allowed to supplier three cases arises:

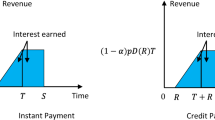

Case I: When \(N_{s} \le M_{s} \le v + N_{s}\).

In this case, the TCP offered by the supplier to his customers is much lower than the TCP proposed by the producer to the supplier. Following receipt of the revenue, the supplier earns interest on the average sales revenue over the time period \((M_{s} - N_{s} )\). The finances are arranged so that the payment to the producer is made on time \(M_{s}\). Figure 4 (4.1) depicts it.

Interest earned for items can be expressed as:

Interest payable for items can be expressed as:

Total cost TCs1 for the supplier.

\(TC_{s1} = TC_{s} + IP_{s1} - IE_{s1}\) [See Appendix 3].

Case II: When \(N_{s} \le v + N_{s} \le M_{s}\).

In this case, TCP offered by the producer to the supplier is more than the cycle length of the supplier and the TCP provided by the supplier to his customers, and the supplier earns interest on the received average sales revenue during \((N_{s} ,v + N_{s} )\) and on total sales revenue for \((M_{s} - (v + N_{s} ))\), but there is no interest payable by the supplier. Figure 4 (4.2) depicts it.

Interest earned for items can be expressed as:

Total cost TCs2 for the supplier.

\(TC_{s2} = TC_{s} - IE_{s2}\) [See Appendix 4].

Case III: When \(M_{s} \le N_{s} \le v + N_{s}\).

In this case, TCP offered by the supplier to his customers is greater than the period provided by the producer to the supplier, and the supplier has no interest, but pays interest on the full order of products for a time \((N_{s} - M_{s} )\) and average product held during the cycle “v”. Figure 4 (4.3) depicts it.

Total cost TCs3 for the supplier.

\(TC_{s3} = TC_{s} + IP_{s3}\) [See Appendix 5].

5.3 Integrated cost function for two- echelon supply chain

Finally, the joint total cost for integrated system is sum of producer’s total cost and supplier’s total cost in various cases, and can be developed as:

The detailed expression of \(TIC_{1} (t_{1} ,\xi )\), \(TIC_{2} (t_{1} ,\xi )\) and \(TIC_{3} (t_{1} ,\xi )\) are given in Appendix 6, 7, and 8, respectively.

5.4 Total carbon emission of the integrated system

\(TE = TE_{m} + TE_{s}\) [See Appendix 9].

6 Solution procedure

The integrated total cost in each case is function of two variables \(t_{1}\) and \(\xi\). The objective of this model is to minimise total cost where \(t_{1} > 0\) and \(\xi > 0\). To minimise total cost function with respect to cycle time \(t_{1}\) and preservation technology cost \(\xi\), the necessary conditions are \(\frac{\partial TIC}{{\partial t_{1} }} = 0\) and \(\frac{\partial TIC}{{\partial \xi }} = 0\).

To determine the optimal value of the decision variables, the convexity of total cost function should satisfy. As total cost function is non-linear, we prove the convexity of \(TIC(t_{1} ,\xi )\) empirically in Appendix 10.

7 Numerical analysis

The proposed model can be illustrated using the numerical example from Daryanto et al. [42] and Shah et al. [9] with some modification.

Using above numerical values of inventory parameters, an optimum solution for the proposed model is presented in Table 3.

From above Table 3, it is clear that minimum total cost of the proposed model is obtained from Case 3 (\(M_{s} \le N_{s} \le v + N_{s}\)). Therefore, the optimal value of \(t_{1} * = 2.7163weeks\), preservation technology cost ξ* = 33.288$, minimum total cost TIC3* = 34450.6$ and total carbon emission \(TE = 82.6tonCO_{2} /time\). All these results are obtained by adopting mathematical software Mathematica 11.3. Convexity for different cases of trade credit is shown in Figs. 5, 6 and 7.

Now, we validate our numerical through sufficient condition which is

and \(\left( {\frac{{\partial^{2} TIC}}{{\partial t_{1}^{2} }}} \right)\left( {\frac{{\partial^{2} TIC}}{{\partial \xi^{2} }}} \right) - \left( {\frac{{\partial^{2} TIC}}{{\partial t_{1} \partial \xi }}} \right)^{2} = 49756.55 > 0 \,\).

Therefore, the optimum solution is unique.

8 Sensitivity analysis

To get more insight in terms of total cost function, a sensitivity analysis is performed by changing the value of one parameter by \(\pm 10\%\) and \(\pm 20\%\). Results are shown in Table 4. For the analysis, we calculate the percentage change in the total cost with the following equation:

9 Result and discussion

The following results can be identified from the sensitivity analysis.

-

1.

If the production rate \(P\) and production cost \({C}_{p}\) increase, then total cost and preservation technology cost both will increase, while the production time decreases. As a result, manufacturers must consider flexible manufacturing in order to make better supply chain decisions.

-

2.

It is cleared from Table 4 that an increasing demand rate \(D\) of products leads to the increase of \({t}_{1}\), \(\xi\) and \({TIC}_{3}\). It expresses that when the demand rate increases the cycle time will also increase, and as a result, the organization is more likely to order more products. A high demand rate indicates that the product is of high quality, promoting the organisation to increase preservation investment in order to reduce deterioration rate.

-

3.

When the deterioration rate \({\theta }_{0}\) increases then critical time and total cost both are increasing and preservation technology cost is constant.

-

4.

If the setup cost \({A}_{m}\) increases, then critical time and preservation cost both remain fixed, while total cost is slightly increasing.

-

5.

The change in parameter (\(\lambda\)) decrease both total cost and preservation technology cost at constant time.

-

6.

The change in inflation rate r decreases total cost and increases time at constant preservation technology cost. Therefore, keeping the inflation rate into consideration is a good strategy for a realistic model as well as to reduce the total cost.

-

7.

The change in warehouse energy consumption (\({w}_{me}\), \({w}_{se}\)), emission from deterioration (\({d}_{me}\), \({d}_{se}\)), weight of solid waste disposal (w), and fixed transportation cost (\(C_{T}\)) have a significant effect on total cost. These parameters are related to carbon emissions from energy consumption, waste disposal and transportation. Therefore, these parameters need to be carefully controlled to promote sustainable system when modelling, in order to reduce total cost as well carbon emission cost.

-

8.

The variable transportation cost (\(C_{t}\)), delivery distance (d), consumption of fuel (\(c_{1} ,c_{2}\)), and vehicle’s emission (\(F_{e}\)) are significant to total cost while other decision variables \(t_{1}\) and \(\xi\) remain constant. These variables are related to transportation cost. As a result, in order to maintain lower transportation cost, these parameters must be carefully controlled within a supply chain.

-

9.

The total integrated cost is sensitive to the change in supplier’s ordering cost (\(A_{s}\)), holding cost (\(C_{hm} ,C_{hs}\)), and deterioration cost (\(C_{dm}\)). Therefore, reduction of these costs must be needed to reduce the inventory cost.

-

10.

If the interest paid rate (\(I_{p}\)) increases then the total integrated cost decreases while other decision variables \(t_{1}\) and \(\xi\) remain same.

9.1 Managerial insights

-

The supply chain can benefit from making decisions to advance inventory management by taking the cost of carbon emissions into account. The production rate highly affects the total cost. As a result, when modelling, decision maker needs to choose flexible manufacturing. Sensitivity analysis has revealed that as production rate increases, so does the total integrated cost of this model.

-

On the other hand, investment in preservation technology also helps to reduce deterioration rate.

-

By taking into account carbon emissions, waste disposal cost along with transportation cost, the supply chain manager can help the decision maker for making ecological system. The outcome provides a supply chain manager with managerial insight into controlling carbon emission costs.

-

Further, when interest paid rate (\(I_{p}\)) increases then total integrated cost decreases. Hence, trade credit policy encourage customer to buy quantities in bulk and minimizes total cost at the same time.

10 Conclusion

In this study, we proposed an integrated two-echelon green supply chain inventory model by extending recent studies on low carbon supply chain and inventory models. The proposed model incorporates the effect of environmental carbon emission cost, preservation technology investment, inflation, and trade credit period. Production activities, warehousing, keeping deteriorating items, waste disposal, and transportation can create carbon emissions. A mathematical model integrates a single producer and single supplier to optimize preservation investment and optimal time for minimizing the joint total economic cost and environmental carbon emission. The present model shows advantage of coordination and integration among producer and supplier in reducing environmental carbon emission. This model is based on the inventory management theory; and examined how all optimal decision variables and the supply chain’s total cost are affected by critical parameters. Using numerical example, we have shown that out of all cases based on trade credit the total integrated cost is minimum when \(M_{s} \le N_{s} \le v + N_{s}\). From sensitivity analysis it is obtained that the decision-maker/supply chain manager should give more attention for reducing production cost, setup cost, ordering cost and deteriorating cost.

For future one can extend this model by using probabilistic demand such as market trended price-sensitive demand, advertisement dependent demand, credit linked demand etc. Carbon tariff system such as carbon cap or a cap-and-trade system can be other possible extension. Also, this work can be extended by considering back ordering policy.

References

Walker, H., Seuring, S., Sarkis, J., Klassen, R.: Sustainable operations management: recent trends and future directions. Int. J. Oper. Prod. Manag. (2014). https://doi.org/10.1108/IJOPM-12-2013-0557

Jauhari, W.A., Pamuji, A.S., Rosyidi, C.N.: Cooperative inventory model for vendor-buyer system with unequal-sized shipment, defective items and carbon emission costs. Int. J. Logist. Syst. Manag. 19(2), 163–186 (2014)

Daryanto, Y., Wee, H.M.: Sustainable economic production quantity models: an approach toward a cleaner production. J. Adv. Manag. Sci 6(4), 206–212 (2018)

Lu, C.J., Lee, T.S., Gu, M., Yang, C.T.: A multistage sustainable production-inventory model with carbon emission reduction and price-dependent demand under stackelberg game. Appl. Sci. 10, 4878 (2020). https://doi.org/10.3390/app10144878

Rau, H., Wu, M.Y., Wee, H.M.: Integrated inventory model for deteriorating items under a multi-echelon supply chain environment. Int. J. Prod. Econ. 86(2), 155–168 (2003)

Mishra, U., Wu, J.Z., Tsao, Y.C., Tseng, M.L.: Sustainable inventory system with controllable non-instantaneous deterioration and environmental emission rates. J. Clean. Prod. 244, 118807 (2020)

Beullens, P., Ghiami, Y.: Waste reduction in the supply chain of a deteriorating food items-impact of supply chain structure on retailer performance. Eur. J. Oper. Res. (2021). https://doi.org/10.1016/j.ejor.2021.09.015

Ho, C.H.: The optimal integrated inventory policy with price-and-credit-linked demand under two-level trade credit. Comput. Ind. Eng. 60(1), 117–126 (2011)

Shah, N.H., Pate, D.G., Shah, D.B.: Optimal pricing and ordering policies for inventory system with two-level trade credits under price-sensitive trended demand. Int. J. Appl. Comput. Math. 1, 101–110 (2015)

He, Y., Wang, S.Y., Lai, K.K.: An optimal production inventory model for deteriorating items with multiple market demand. Eur. J. Oper. Res. 203(3), 593–600 (2010)

Sana, S.S.: An EOQ model of homogeneous products while demand is salesmen’s initiatives and stock sensitive. Comput. Math. Appl. 62(2), 577–587 (2014)

Rau, H., Wu, M.Y., Wee, H.M.: Deteriorating item inventory model with shortage due to supplier in an integrated supply chain. Int. J. Syst. Sci. 35(5), 293–303 (2004)

Banrjee, S., Agarwal, S.: Inventory model for deteriorating items with freshness and price dependent demand: optimal discounting and ordering policies. Appl. Math. Model. 52, 53–64 (2017)

Rabta, B.: An economic order quantity inventory model for a product with a circular economy indicator. Comput. Ind. Eng. 140, 106215 (2019). https://doi.org/10.1016/j.cie.2019.106215

Sarkar, B.: A production-inventory model with probabilistic deterioration in two-echelon supply chain management. Appl. Math. Model. 37(5), 3138–3151 (2013)

Ghiami, Y., Williams, T.: A two-echelon production inventory model for deteriorating items with multiple buyers. Int. J. Prod. Econ. 159, 233–240 (2015)

Chan, C.K., Wong, W.H., Langevin, A., Lee, Y.C.E.: An integrated production-inventory model for deteriorating items with consideration of optimal production rate and deterioration during delivery. Int. J. Prod. Econ. (2017). https://doi.org/10.1016/j.ijpe.2017.04.001

Moubed, M., Boroumandzad, Y., Nadizadeh, A.: A dynamic model for deteriorating products in a closed-loop supply chain. Simul. Model. Pract. Theory 108(2), 102269 (2021). https://doi.org/10.1016/j.simpat.2021.102269

Soni, H.N., Chauhan, A.D.: Joint pricing, inventory, and preservation decision for deteriorating items with stochastic demand and promotional efforts. J. Ind. Eng. Int. 14, 831–843 (2018)

Maihami, R., Govindan, K., Fattahi, M.: The inventory and pricing decisions in a three-echelon supply chain of deteriorating items under probabilistic environment. Transp. Res. E Logist. Transp. Rev. 131, 118–138 (2019)

Chang, C.C., Lu, C.J., Yang, C.T.: Multistage supply chain production-inventory model with collaborative preservation technology investment. Sci. Iran. (2020). https://doi.org/10.24200/SCI.2020.53357.3200

Yu, C., Qu, Z., Archibald, T.W., Luan, Z.: An inventory model of a deteriorating product considering carbon emissions. J. Clean. Prod. 148(3), 106694 (2020). https://doi.org/10.1016/j.cie.2020.106694

Yadav, D., Kumari, R., Kumar, N., Sarkar, B.: Reduction of waste and carbon emission through the selection of items with cross-price elasticity of demand to form a sustainable supply chain with preservation technology. J. Clean. Prod. 297(23), 126298 (2021). https://doi.org/10.1016/j.jclepro.2021.126298

Bansal, K.K., Ahalawat, N.: Integrated inventory models for decaying items with exponential demand under inflation. Int. J. Soft Comput. Eng. 2(3), 578–587 (2012)

Singh, S.R., Sharma, S.: An integrated model with variable production and demand rate under inflation. Proced. Technol. 10, 381–391 (2013). https://doi.org/10.1016/j.protcy.2013.12.374

Tiwari, S., Barrón, L.E.C., Khanna, A., Jaggi, C.K.: Impact of trade credit and inflation on retailer’s ordering policies for non-instantaneous deteriorating items in a two-warehouse environment. Int. J. Prod. Econ. 176, 154–169 (2016). https://doi.org/10.1016/j.ijpe.2016.03.016

Hempriya, S., Uthaykumar, R.: Inflation and time value of money in a vendor-buyer inventory system with transportation cost and ordering cost reduction. J. Control Decis. 8(2), 98–105 (2021)

Chung, K.J., Barrón, L.E.C., Ting, P.S.: An inventory model with non-instantaneous receipt and exponentially deteriorating items for an integrated three-layer supply chain system under two-levels of trade credit. Int. J. Prod. Econ. 155, 310–317 (2014)

Das, B.C., Das, B., Mondal, S.K.: Optimal transportation and business cycles in an integrated production-inventory model with a discrete credit period. Transp. Res. E Logist. Transp. Rev. 68, 1–13 (2014)

Ouyang, L.Y., Ho, C.H., Su, C.H., Yang, C.T.: An integrated inventory model with capacity constraints and order-size dependent trade credit. Comput. Ind. Eng. (2015). https://doi.org/10.1016/j.cie.2014.12.035

Krugon, S., Nagaraju, D.: Optimality of cycle time and inventory decisions in a two-echelon inventory system with non-linear price dependent demand under credit period. Mater. Today Proc. 5(5), 12499–12508 (2018)

Ding, Y., Jiang, Y., Zhou, Z.: Two-echelon supply chain network design with trade credit. Comput. Oper. Res. 131, 105270 (2021). https://doi.org/10.1016/j.cor.2021.105270

Mahato, C., Mahato, G.C.: Optimal inventory policies for deteriorating items with expiration date and dynamic demand under two-level trade credit. Opsearch (2021). https://doi.org/10.1007/s12597-021-00507-7

Wahab, M.I.M., Mamun, S.M.H., Ongkunaruk, P.: EOQ models for a coordinated two-level international supply chain considering imperfect items and environmental impact. Int. J. Prod. Econ. 134(1), 151–158 (2011)

Fichtinger, J., Ries, J.M., Grosse, E.H., Baker, P.: Assessing the environmental impacts of integrated inventory and warehouse management. Int. J. Prod. Econ. (2015). https://doi.org/10.1016/j.ijpe.2015.06.025

Tiwari, S., Daryanto, Y., Wee, H.M.: Sustainable inventory management with deteriorating and imperfect quality items considering carbon emission. J. Clean. Prod. 192, 281–292 (2018)

Tiwari, S., Ahmed, W., Sarkar, B.: Sustainable ordering policies for non-instantaneous deteriorating items under carbon emission and multi-trade credit policies. J. Clean. Prod. 240, 118183 (2019). https://doi.org/10.1016/j.clepro.2019.118183

Wangsa, I.D., Tiwari, S., Wee, H.M., Reong, S.: A sustainable vendor-buyer inventory system considering transportation, loading and unloading activities. J. Clean. Prod. 271, 122120 (2020). https://doi.org/10.1016/j.clepro.2020.122120

Mishra, U., Wu, J.Z., Sarkar, B.: optimum sustainable inventory management with backorder and deterioration under controllable carbon emission. J. Clean. Prod. 279, 123699 (2020). https://doi.org/10.1016/j.clepro.2020.123699

Latha, K.F.M., Kumar, M.G., Uttayakumar, R.: Two echelon economic lot sizing problems with geometric shipment policy backorder price discount and optimal investment to reduce ordering cost. Opsearch 58, 1133–1163 (2021). https://doi.org/10.1007/s12597-021-00515-7

Giri, B.C., Ray, I.: Optimal sustainability investment and pricing decisions in a two-echelon supply chain emissions sensitive demand under cap-and-trade policy. Opsearch (2022). https://doi.org/10.1007/s12597-021-00569-7

Daryanto, Y., Wee, H.M., Astanti, R.D.: Three-echelon supply chain model considering carbon emission and item deterioration. Transp. Res. E Logist. Transp. Rev. 122, 368–383 (2019)

Acknowledgements

The authors express their gratitude to the Chief-editor and the anonymous reviewers for their comments and valuable suggestions to improve this paper.

Funding

During this research no funding was received.

Author information

Authors and Affiliations

Contributions

NH, SRS and NP conceived and worked together to achieve this work. The mathematical idea, methodology and writing of the paper is done by NP; NH and SRS. both supervised the work. Finally, all the authors have read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no competing interest.

Ethics approval and consent to participate

This article does not contain any studies with human participants or animals performed by any of the authors.

Consent for publication

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Let \(I_{m1} (t)\) is inventory level of deteriorating items at any time \(t(0 \le t \le t_{1} )\) and \(I_{m2} (t)\) is inventory level of deteriorating items at any time \(t(t_{1} \le t \le T)\). The behaviour of inventory over time is represented by following differential equations;

Figure 1 satisfies the boundary conditions which are

Solving Eqs. (1.1) and (1.2) with the help of Eq. (1.3), we have the inventory level of deteriorating items at any time t as follows

At time t = t1 the maximum inventory level

Appendix 2

Suppose \(I_{s} (t)\) is the inventory level of the supplier which received from producer. The differential function of the inventory level at any time “t” oner the period \([0,v]\) is

Boundary conditions are specified for this model

Analytic solution of the differential equations

Appendix 3

Appendix 4

Appendix 5

Appendix 6

Appendix 7

Appendix 8

Appendix 9

Appendix 10

For the function to be convex, the following sufficient conditions must be satisfied:

and one or both

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Handa, N., Singh, S.R. & Punetha, N. Impact of carbon emission in two-echelon supply chain inventory decision with controllable deterioration and two-level trade-credit period. OPSEARCH 59, 1555–1586 (2022). https://doi.org/10.1007/s12597-022-00599-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12597-022-00599-9