Abstract

Although trade liberalization may increase a country’s welfare, its specific effect on a country’s fishing industry has not been well studied. By decomposing the effect of international trade into four parts, i.e., scale-technique effects (ST), the indirect trade-induced composition effect (IC), the indirect effect of trade intensity through income (ITC), and the direct effect of trade intensity (DTC), this study empirically investigates the effect of trade openness on country-level fisheries production. To take into account the endogeneity of trade openness and income, we adopt the instrumental variable approach. We find that a rise in trade openness reduces fisheries catch on average. In particular, the long-run effect is large. This result implies that future production is affected by current overfishing through stock dynamics. Our decomposed elasticities indicate that the ST and ITC dominate in the trade elasticity of fisheries catch. While ST implies that overfishing would be affected by trade, ITC may either establish an “overfishing haven”, similar to a “pollution haven” in the environmental literature, or production shift of fisheries to countries with lax regulation to pass stringent regulation, which is more likely to occur in high-income countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Fish are some of the most traded food commodities in the world [1]. The trade of fisheries products has expanded in recent decades as advances in distribution and information technologies have unified the global seafood market. The share of total fisheries production which was exported was 25% in 1976, and 36% in 2014 [2]. Although the total trade in fisheries products has increased, the impact of this trade on fisheries production at country level has not yet been investigated.

In this paper, we analyze the relationship between international trade and domestic fisheries production. Our model takes into account the decomposed effects of international trade, and treats trade and income as endogenous. The result shows that trade openness may reduce fisheries production through indirect effects.

International trade may affect domestic fisheries and their catches positively or negatively depending on various factors. Basic economic theory states that when fishing is less profitable, labor and capital assets will be reallocated to other sectors and thus the catch will reduce. This reduction allows for fisheries resources to recover given their renewable nature [3]. Based on this prediction, an increase in the trade intensity for importing countries could lead to a reduction in the price of fisheries products and thus the resource of the importing country may recover as a result of decreased fishing pressure. Theoretical literature on trade and renewable resources supports this prediction. In the Ricardian trade model in Brander and Taylor [4], the country in which the autarky price is higher than the world price would export the manufactured good (the other good) and import natural resources, hence the resource stock will recover. In reality, however, the composition of target species may be changed due to the change in prices induced by trade. This may result in the collapse of ecosystems and reduce fisheries production. Furthermore, the trade-induced reduction in prices can also increase pressure on fishing in developing countries because fishermen in these countries may increase their fishing effort to ensure their fundamental income under low prices. This may occur due to low marginal costs and lack of alternative sectors for the reallocation of labor and capital. The effect of international trade on fisheries resources is, therefore, still indeterminate.

As trade liberalization agreements are increasing worldwide, it is important to explore possible counter strategies to mitigate their adverse effects on fisheries and associated industries. Despite this, there are a limited number of empirical studies on trade openness and fisheries production.

Theoretical models on international trade and natural resources have focused on development. Brander and Taylor [4,5,6] developed the most influential model, a Ricardian one with a single manufacturing good and a single natural resource. An important insight from this model is that the determinant of comparative advantage is not only at the scale of factor endowments, but also the biology of the renewable resource stock and management policy. While the model has been extended to incorporate various factors, the key insight of the model about the effects of opening up trade is that trade liberalization may cause a reduction in a resource’s production in the long term due to over-exploitation. Countries with a comparative advantage in resource stocks export the natural resource and initially gain from trade, but the increased fishing pressure may lead to the collapse of the stock and reduction in the productivity of that resource sector.

While the theoretical model shows the effects of international trade on natural resources (i.e., fisheries), there is little empirical evidence showing these effects. Eggert and Greaker [7] discuss some empirical cases in developing countries, where fish are a net export, and claim that trade liberalization in such countries would lead to a reduction in welfare and stocks because of a lack of resource management. Nielsen [8] describes the effect of trade liberalization in the case of East Baltic cod and concludes that trade negatively affects the welfare in the supplier country. Although these studies use specific cases to show the effects of trade on natural resources, what is missing is a comprehensive study that empirically analyzes the effect of international trade on the production of natural resources. Asche et al. [9] describes the trade flow between developed and developing countries, yet the causal effect of trade liberalization is not disentangled from other effects. In this study, we empirically estimate the effect of trade openness on country-level fishery catch (landings) and look into the general consequence of trade liberalization at a global scale.

This study does not consider the relative status of fisheries resources (i.e., depleting resources), a complex mixture of various time series including abundance, spatial distribution, and fishing efforts. Instead, this study focuses on the time series of fish production to capture the effect of trade openness on domestic fish production and its time-varying characteristics.

Materials and methods

Materials

This study used catch data from the SEA AROUND US project (http://www.seaaroundus.org/). Per capita income [gross domestic product (GDP) per capita], the capital–labor ratio, investment per worker, and population are taken from the Extended Penn World Table 3.0. Trade openness (as a percentage of GDP) was obtained from the World Development Indicators Online. Data on school attainment (years) are from the education dataset in Barro and Lee [10]. We obtained data on bilateral trade flows from the IFS Direction of Trade CD-ROM. Data on distances between the country pairs in question (physical distance), land area and dummy variables indicating linguistic links, common borders, and landlocked status are from the Central Intelligence Agency World Factbook website. We obtained the above data from 1964 to 2006. The descriptive statistics are shown in Table 1.

Catch–trade model

This study takes into account the endogeneity of trade intensity and income to estimate the effect of international trade on a country-level fisheries catch. We modified the model developed by Managi et al. [11] and Tsurumi and Managi [12]. First of all, catch is modeled by the following equation:

where H it denotes the total fish catch (volume) of country i in year t, and S is GDP per capita. GDP per capita is assumed to be quadratic to capture the scale-technique effect. K/L denotes a country’s capital–labor ratio; RK/L denotes a country’s relative capital–labor ratio; RS is relative GDP per capita. These relative variables are defined relative to the world average for each year. T is defined as the ratio of aggregate exports and imports to GDP, called the “trade intensity ratio,” which is considered a proxy for trade openness. ɛ 1 is an error term and consists of an individual country effect η 1, a time-specific effect λ 1, and a random disturbance ν 1.

There could be various trade measures. While other measures such as tariff or explicit transportation costs could be used, the measure for an empirical analysis should have a wide cross-country coverage and a time-series variation. Trade intensity ratio can be calculated easily from widely available import and export data. In addition, the trade intensity increases as the trade friction decreases, as stated in Antweiler et al. [13]. For these reasons, we adopt the trade intensity ratio as the trade openness measure.

To model income, this study applies the following equation:

where P is the population; Inv is investment per worker; Sch is school attendance years and used as a proxy for human capital investment; and ɛ 2 is an error term and consists of an individual country effect η 2, a time-specific effect λ 2, and random disturbance ν 2.

Endogeneity

A main issue in the estimation is the endogeneity of explanatory variables. Trade intensity and fisheries production can be endogenous because, for example, the fisheries catch may represent important export goods in some countries, and the performance of the fishing industry affects trade intensity. Similarly, income may be correlated with unobserved factors that affect fisheries production. These endogeneities may cause serious biases in the parameter estimates if they are not dealt with. This study treats trade and income as endogenous, as in Frankel and Rose [14], and applies instrumental variables (IV) for trade openness by the following equation:

where Trade ij is bilateral trade flows from country i to country j, GDP i is the gross domestic product of country i, Dis ij is the distance between country i and country j, P j is the population of country j, Lan ij is a common language dummy that takes a value of 1 if two countries have the same language and 0 otherwise, Bor ij is a common border dummy that takes a value of 1 if countries i and j share a border and 0 otherwise, Area is the land area of a country, and Landlocked is a dummy variable that takes a value of 1 if one country is landlocked, 2 if both countries are landlocked, and 0 otherwise, and ɛ 3 is an error term. These geographical characteristics are considered as exogenous because they affect the bi-lateral relationships with trade partners, but are unlikely to affect the domestic fisheries catch. Note that this study does not include landlocked countries data in the catch data [Eq. (1)]. To estimate Eq. (3), we use ordinary least squares.

Table 2 shows estimations from Eq. (1), which confirm the results in the literature. We construct the instrumental variables for openness as follows. First, a first-stage regression of the gravity equation is computed. Next, we take the exponential of the fitted values of bilateral trade and sum across bilateral trading partners as follows:

The fitted openness variable is added as an additional instrumental variable for the generalized method of moments (GMM).

Trade elasticities

This study decomposes the terms in Eq. (1) into two components as follows. One is the scale-technique effect (ST it ) and another is the composition effect (C it )

These terms are assumed to be the effects of income and production on the fisheries catch, and we expect to estimate the scale-technique effect from this [11]. This effect is consistent with the environmental Kuznets curve hypothesis [15, 16]. The amount of fish caught is not only considered environmental damage, there is also an analogy and it is described largely in terms of the dominance of scale effects at low income levels and the dominance of technique effects at high levels of income.

The composition effect is expressed as follows:

A country’s comparative advantage is a major factor influencing the composition effects. This study takes into account the factor endowment, stringency of environmental regulations, and trade openness as factors affecting the comparative advantage, as in both Antweiler et al. [13] and Managi et al. [11]. A capital-abundant country will specialize in capital-intensive production, whereas a labor-abundant country has a comparative advantage in labor-intensive goods. This effect is captured by the terms with K/L, RK/L and RS. In addition, a comparative advantage of a capital abundant country may be weakened by relatively more stringent regulation, which is often implemented in high-income countries. To capture this effect, we include the term (K/L)S.

Furthermore, a rise in trade openness promotes an increase in the production of capital-intensive goods in countries with a comparative advantage in these goods and a fall in the production of capital-intensive goods in countries with a comparative advantage in labor-intensive goods. This shift in production may affect the countries’ fisheries catches. To reflect this effect, we include the (RK/L)T and (RK/L)2 T terms.

Conversely, a rise in trade openness may move the production of fisheries catch from countries with more stringent environmental regulations (high-income countries) to countries with less stringent environmental regulation (lower income countries). This effect is called the “environmental regulation effect” and is captured by the terms with RS.

The first part of Eq. (6) is interpreted as the indirect effect of trade, and the second part with trade intensity T it is the direct effect of trade. The first part is called the “indirect trade-induced composition effect” (IC it ), which reflects the indirect effect of a trade-induced change in income on fisheries production, and the latter is the “direct trade-induced composition effect” (TC it ). IC it and TC it are expressed as follows:

Here, our main interest is to quantify the decomposed effect of trade intensity. We accordingly consider the effect of a 1% increase in trade intensity.

σ SST corresponds to short-term trade elasticity, driven by the scale-technique effect through trade-induced changes in income; the superscript S refers to the short-term effects. σ SIC is the short-term trade elasticity caused by the indirect composition effect through trade-induced changes in the income. The latter two terms in Eq. (9) are the effects of an increase in trade intensity in Eq. (8) which are decomposed into two parts: the indirect effect of trade intensity through changes in income, and the direct effect of trade intensity. These two effects are defined as the indirect effect of trade intensity through income in the composition effect (ITC) and the direct effect of trade intensity in the composition effect (DTC), and denoted as σ SITC and σ SDTC , respectively. Here, we call these measures “elasticities,” because they are percent point changes in catch relative to 1 % change in trade intensity. The percent point change in a catch is defined as the change relative to the average catch, \(\bar{H}\), in the data. It is noteworthy that we use the short-term trade elasticity of income, which is calculated from Eq. (2) as \(\frac{{\partial S_{it} }}{{\partial T_{it} }} = \beta_{2}\). Using the short-term trade elasticity and Eqs. (5), (7) and (8), we obtain the expressions of the decomposed short-term elasticities:

The total short-term trade-induced composition effect, σ S C , is calculated as:

Similarly, we define the long-term trade elasticities, σ LST ,\(\sigma_{\text{IC}}^{L}\),\(\sigma_{\text{ITC}}^{L}\), and \(\sigma_{\text{DTC}}^{L}\) by considering the effects of the lagged term, H it-1, which is calculated from Eq. (1) as 1/(1 − α 1), and the long-term trade elasticity of income, which is calculated from Eq. (2) as β 2/(1 − β 1). Accordingly, the long-term overall trade openness elasticity of fisheries production, σ L T , is defined as follows:

In the same manner as the short-term decomposed elasticities, the long-term decomposed trade elasticities are expressed as follows:

The total long-term trade-induced composition effect, σ L C , is calculated as

The actual calculation of elasticities is based on the parameter estimates and the sample averages of the variables.

Estimation

Following Managi et al. [11], we use a difference GMM proposed by Arellano and Bond [17] to estimate Eqs. (1) and (2), which are estimated separately. Arellano and Bond derived a consistent GMM estimator for the parameters of a linear dynamic panel-data model. This estimator is designed for datasets with many panels and few periods, and requires that there be no autocorrelation in the idiosyncratic errors. Estimators are constructed by first-differencing to remove the panel-level effects and using instruments to form moment conditions. The moment conditions are formed from the first-difference errors and instruments. Lagged levels of the dependent variable, the predetermined variables, and the endogenous variables are used to form GMM-type instruments [17]. We construct instruments for the lagged dependent variable from the second and third lags of the dependent variable. These lags of dependent variables are uncorrelated with the composite-error process [18]. The resulting estimations were carried out using the -xtabond- command in Stata 14, which imposes all necessary moment conditions when using the Arellano and Bond model.

Results

We fitted the model to the data to conform as much as possible with Managi et al. [11] and Tsurumi and Managi [12]. Tables 3 and 4 report the estimation results of the catch and income models, respectively. We use differenced GMM for Tables 3 and 4. The Sargan test result indicates that our instruments are not invalid. Additionally, the result of Cragg-Donald Wald F-statistic shows that there is no weak instrument issue. Table 5 shows the short- and long-term decomposed trade intensity elasticities calculated from the estimates and sample averages of the variables in the data. These elasticities are computed by adopting the parameter estimates from Tables 3 and 4.

Table 4 shows the main estimates of this study. The lagged catch term is statistically significant with a positive sign. This implies that the explanatory variables, such as trade openness and income, dynamically influence the catch. These results verify that the adjustment process, given the explanatory variables, such as trade openness, are different in the short term and long term. Accordingly, it is meaningful to calculate the trade intensity elasticities of the fish catch in the short and long term differently.

The signs of GDP per capita were negative on the first order and positive on the quadratic term. This variable is intended to capture the scale and technique effects, as discussed in the Materials and methods section. This result is different from that in environmental quality [11, 13, 14] or deforestation literature [12], in which the sign of the first-order term is positive, and the quadratic term is negative. In this study, the signs are opposite. We need to be careful when interpreting the results, as they may indicate the fisheries resource stock, unlike other industry-related natural resources and environmental factors.

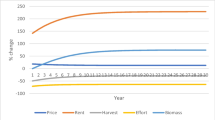

Unlike environmental quality or forestation, fisheries production does not simply increase as the scale of the economy increases. The estimates of α 2 and α 3 suggest that, initially, the catch decreases as GDP per capita increases, but then the catch increases once its value surpasses $19,244, as shown in Fig. 1a. There are a few possible explanations for this curve. First, the per capita income approximates the development level in a country. Accordingly, this is a proxy for the strictness of resource use and the techniques used to catch fish. The decreasing part of the curve indicates that pressure on fish due to development in catch technology exceeds the positive effect of resource management. In the increasing part of the curve, fisheries resource management and technological development have a synergetic effect on the fisheries catch. In addition, the scale effect also plays a role in fisheries production, i.e., fisheries production increases as the economy expands. Furthermore, the increase in per capita income may induce a preference shift, which leads to more consumption of seafood instead of other types of meat as a source of protein (e.g., Eq. [19]). Such effects of scale, technique, stringency of management, and income effect on preferences cannot be decomposed given the dataset.

The trade elasticity of catch driven by the scale-technique effect, σ ST, is negative both in the short and long term, as shown in Table 5. At the average level of income, the effects of overfishing dominate the effects of technique. In the long term, this negative effect increases due to the long-term income elasticity of trade (β 1) and the persistence of catch (α 1). The greater magnitude of long-term negative elasticity supports the possibility of overfishing caused by the scale effect. This is because the low level of the resource stock causes a reduction in current catch. The low stock level is triggered by the overfishing in the previous periods.

The sign for the estimated coefficient of the capital-labor ratio (K/L) is positive and for the squared term, (K/L)2, is negative (Fig. 1b). In the range of the low capital-labor ratio, the fishery catch tends to increase as the capital-labor ratio of a country increases. This is reasonable since the capitalized country tends to have more capital-intensive fisheries (e.g., larger vessels/engine powers). The fisheries catch, however, falls as the capita-labor ratio increases to more than $112,545 per worker, indicating that the fishing industry is not a capital-intensive industry relative to other industries. When a country is sufficiently capitalized, the production of other highly capitalized industries rises and fisheries production decreases because the country has a greater comparative advantage in capital-intensive goods.

The interaction term (K/L) × S, captures two effects: the reduced comparative advantage of the fishing industry due to strict regulation (e.g., conservation approach to protect fisheries resources), and the reinforcement of comparative advantage due to technological development. The statistically insignificant and small absolute value of the estimate of α 6 indicates that these two effects offset each other. Accordingly, the short-term and long-term trade elasticities driven by the indirect composition effect through trade-induced changes in income (σ SIC and σ LIC ) are as small as zero.

The direct effect of trade openness is measured through the interaction of trade intensity with relative capital-labor ratio and relative income, as shown in Eq. (8). The relationship between the effect on catch and the capita-labor ratio based on the estimates suggest that the direct effect of trade intensity tends to be negative as countries are capitalized relative to rest of the world. This could be because capitalized countries tend to have a comparative advantage in other capital-intensive industries other than the fishing industry.

Managi et al. [11] explain that countries with a relatively high per capita income are under stringent environmental regulations, and thus the production of capital intensive goods decreases. This effect is called the “environmental regulation effect.” In the estimating equation, this effect is captured by the terms with relative income (RS). Our estimates show that trade openness increases fisheries production for low relative-income countries, but decrease it for the countries with a relative income which is more than twice the world average (Fig. 1d). This implies that stringent regulation or resource management, which tends to take place in relatively wealthy countries, weakens the comparative advantage of fisheries, and thus fisheries production decreases. Instead, fisheries products can be exported from the countries with lenient regulations where there tends to be a low relative income, as if these countries were “overfishing havens.” Such a shift is often discussed in the environment and trade literature and these countries are also called “pollution havens” [20,21,22,23].

While such a shift is common in environmental quality, the mechanism behind the relationship between fisheries and trade may be different. Although the fisheries production shifts from a country with stringent regulations to one with permissive regulations, the high production level in the lax regulation country may be sustainable only in the short term due to the resource stock effect. Resources in countries with lax regulations are potentially, or actually, overfished due to unregulated fishing pressures, and the resource stock level could decrease. Accordingly, the resulting catch is low. Although such a resource stock effect is not directly captured in our estimation, the result of long-term trade elasticity is consistent with this interpretation. The indirect effect of trade intensity through changes in income, σ SITC , is negative. That is, a rise in the trade openness increases a country’s income, and it leads to higher regulation as a result. In the long term, the sign of the elasticity, σ LITC , is still negative, and the magnitude is greater. This can be a composite effect of strengthening regulations due to a rise in relative income and the loss of productivity in fisheries due to reduced stocks as a result of overfishing.

The direct effects of trade intensity, σ DTC, are small relative to those of σ ITC in both the short and long term. The effect of trade intensity is positive for countries with a low relative capital-labor ratio, but becomes negative for countries with a relative capital-labor ratio of more than 1 (Fig. 1c). This is because the fishing industry is at a comparative disadvantage. The threshold is near one, implying that the effect switches from positive to negative on a world average. Accordingly, the direct effect of trade intensity is near zero on average.

The overall effects of trade intensity on fisheries production is negative in both the short and long term. However, the magnitude of trade elasticity is large in the long term, while it is significantly small in the short term. In both the short and long term, the scale-technique effect and indirect effect of trade openness through income change dominate. On average, the increase in trade openness results in a long-term reduction in the fisheries catch. This result supports the theoretical prediction made by Brander and Taylor [4,5,6], that long-term fisheries production may be decreased due to a drop in the productivity of fisheries caused by overexploitation.

Discussion

In this study, we analyzed the impact of trade openness on national-level fisheries production using comprehensive data on fisheries catches and treating trade and income as endogenous. Our results show that an increase in trade openness reduces country-level fisheries catches on average, which is consistent with the fact that the global fish catch is decreasing [24] while international trade expands.

The short- and long-term elasticities show that the negative impact of trade liberalization is small in the short term, but becomes large in the long term. The large catch in some countries caused by trade intensification reduces the catch in the long term through a decrease in the renewability of stocks of the resource. There are strong correlations between resource stock status and fisheries catches at a global level [25]. The main impacts are due to the scale-technique effect (ST) and the indirect effect of trade intensification through income change (ITC). For a country like Japan, which explicitly states that one of its focal fishery policies is to generate employment, the long-term effects of free trade are problematic for the achievement of this goal. This is an urgent issue since the global trend is to liberalize trade and promote free trade, e.g., the number of regional free trade agreements is increasing [26]. Participating in a global market may be beneficial to a country’s whole economy, but an appropriate resource management policy, considering its impact through comparative advantages, should be implemented. As we discussed in the Results section, we are unable give a detail interpretation of the scale-technique effect with the model we built and the data we have.

The issue of most concern raised in this study is the prospect of an overfishing haven effect that can be boosted by trade liberalization. If resource stocks are independent of countries, the resource stock of the countries with lax regulation will collapse, and they may thus suffer from decreased societal welfare, as predicted by Brander and Taylor (“mild overuse case” [5]). This is problematic because fisheries trade may worsen the North–South divide through a shift in fisheries production. Namely, the difference in development between industrialized countries and developing countries widens because lax regulation is often implemented in developing countries. Moreover, if the resource stock is shared among two or more countries, the impact is not only on countries with lax regulations, but also on the other countries involved. Overfishing in countries with lax regulation affects resource dynamics. Hence, the fisheries productivity of countries with stringent regulations drops if they catch a shared stock, as analyzed theoretically by Rus [27] and Takarada et al. [28].

In the context of an overfishing haven, the regulation in countries without comparative advantages may have a spillover effect on the excess fishing capacity of countries with a comparative advantage. One of the resource management measures used to reduce excess fishing capacity is a fishing capacity reduction program (e.g., buybacks). Governments buyback excess fishing vessels to reduce fishing pressure on their resource. These excess vessels and gear are often transferred to countries with limited fishing capital. As countries obtain comparative advantages, this process can accelerate a shift from fishing capital to a new overfishing haven. To prevent such a vicious cycle, countries with comparative advantages should regulate their fishery imports to only those from certified sustainable fisheries, such as those regulated by the Marine Stewardship Council.

Our approach is limited by the fact that the effects of stock dynamics and resource management regulation cannot be differentiated. In the environmental damage literature, the scale effect simply increases the damage, while the technique and management effects decrease the damage. In fisheries production, the scale effect may increase the catch because it increases the capacity of fishing effort, but the catch may also decrease because the resource stock deteriorates due to overfishing. In addition, management regulation may directly decrease production, but it may also increase it in the long term because the resource stock may recover.

This study focuses on fisheries production by aggregating the production of all fish stocks and trade openness, therefore it does not consider the resource dynamics of individual fish stocks. Costello et al. [24] projected future fisheries production under various management scenarios by combining a basic logistic surplus production model with fish species-specific parameters from the global database (i.e., FishBase) and a profit model. Our study does not explicitly model the resource dynamics of individual fish stocks, but uses the estimation equation that was first proposed by Antweiler [13] for air pollution and applied to other environmental subjects such as forestry [12, 14] and water resources [28]. As the theoretical literature on resource and trade shows that the resource stock status and dynamics significantly affect the outcome of the international trade of natural resource goods, the integration of the bioeconomic models and trade models is necessary in future studies.

Lastly, this study does not discuss the comprehensive regulation of fisheries production and resource management measures. This study approximates the degree of regulation on fisheries production from the level of income (GDP per capita) because such regulation is often rigorous in countries with comparative advantages. Regulations on fisheries production can be categorized into: (1) input control (e.g., a limit on days at sea, fishing capacity); and (2) output control (e.g., a limit on total amount of catch). These controls work in countries without a comparative advantage due to their cost. Without sufficient data on each state’s regulations for fisheries production, we simply approximate the effects of regulation on GDP per capita, a method adopted in other studies [11, 13]. By including proxy indicators of the objectives of an individual state’s fishery policy, extension of this study in the future may identify the effects of regulations on fisheries production and their interaction with trade openness.

References

Sumaila UR, Tipping A, Bellmann C (2016) Oceans, fisheries and the trade system. Mar Policy 69:171–172

Food and Agriculture Organisation (2014) The state of world fisheries and aquaculture. Food and Agriculture Organisation, Rome

Sumaila UR, Khan A, Watson R et al (2007) The World Trade Organization and global fisheries sustainability. Fish Res 88:1–3

Brander JA, Taylor MS (1997) International trade and open-access renewable resources: the small open economy case. Can J Econ 30(3):526–552

Brander JA, Taylor MS (1997) International trade between consumer and conservationist countries. Resour Energy Econ 19(4):267–297

Brander JA, Taylor MS (1998) Open access renewable resources: trade and trade policy in a two-country model. J Int Econ 44(2):181–209

Eggert H and Greaker M (2009) Effects of global fisheries on developing countries possibilities for income and threat of depletion. Working papers in economics, report 393. University of Gothenburg, Göteborg

Nielsen M (2009) Modelling fish trade liberalisation: does fish trade liberalisation result in welfare gains or losses? Mar Policy 33(1):1–7

Asche F, Bellemare MF, Roheim C, Smith MD, Tveteras S (2015) Fair enough? food security and the international trade of seafood. World Dev 67:151–160

Barro R, Lee JW (2013) A new data set of educational attainment in the world, 1950–2010. J Dev Econ 104:184–198

Managi S, Hibiki A, Tsurumi T (2009) Does trade openness improve environmental quality? J Environ Econ Manage 58(3):346–363

Tsurumi T, Managi S (2014) The effect of trade openness on deforestation: empirical analysis for 142 countries. Environ Econ Policy Stud 16(4):305–324

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev USA 91(4):877–908

Frankel JA, Rose AK (2005) Is trade good or bad for the environment? sorting out the causality. Rev Econ Stat 87(1):85–91

Selden TM, Song D (1994) Environmental quality and development: is there a Kuznets curve for air pollution emissions? J Environ Econ Manage 27(2):147–162

Cole MA, Elliott RJR (2003) Determining the trade-environment composition effect: the role of capital, labor and environmental regulations. J Environ Econ Manage 46(3):363–383

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Baum CF (2006) An introduction to modern econometrics using stata. Stata, College Station

Gallet CA (2010) The income elasticity of meat: a meta-analysis. Aust J Agric Resour Econ 54(4):477–490

Pethig R (1976) Pollution, welfare, and environmental policy in the theory of comparative advantage. J Environ Econ Manage 2(3):160–169

Chichilnisky G (1994) North–South trade and the global environment. Am Econ Rev 84(4):851–874

Copeland BR, Taylor MS (1994) North–South trade and the environment. Q J Econ 109(3):755–787

Copeland BR, Taylor MS (1999) Trade, spatial separation, and the environment. J Int Econ 47(1):137–168

Worm B, Barbier EB, Beaumont N et al (2006) Impacts of biodiversity loss on ocean ecosystem services. Science 314(5800):787–790

Costello C, Ovando D, Clavelle T et al (2016) Global fishery futures under contrasting management regimes. Proc Natl Acad Sci USA 113(18):5125–5219

WTO (2017) Regional trade agreements https://www.wto.org/english/tratop_e/region_e/regfac_e.htm. Accessed 21 July 2017

Rus HA (2012) Transboundary marine resources and trading neighbours. Environ Resour Econ 53(2):159–184

Takarada Y, Dong W, Ogawa T (2013) Shared renewable resources: gains from trade and trade policy. Rev Int Econ 21(5):1032–1047

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Abe, K., Ishimura, G., Tsurumi, T. et al. Does trade openness reduce a domestic fisheries catch?. Fish Sci 83, 897–906 (2017). https://doi.org/10.1007/s12562-017-1130-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12562-017-1130-0