Abstract

Wealth inequality between the top and bottom deciles has grown over the last 20 years (Piketty and Zucman in Wealth and inheritance in the long run, Centre for Economic Policy Research, London, 2014), as has the racial wealth gap (Shapiro et al. in The roots of the widening racial wealth gap: explaining the black–white economic divide. Institute on Assets and Social Policy, Brandeis University, Waltham, 2013. http://iasp.brandeis.edu/pdfs/Author/shapiro-thomas-m/racialwealthgapbrief.pdf). Within these broad trends of inequality, some families are able to get ahead and grow their wealth, while others are not. Yet we do not understand well the critical variables that increase the likelihood of wealth mobility across the life course—within the same generation. This paper addresses this gap and investigates the following questions: What accounts for intra-generational relative and absolute wealth mobility for families with children in the first decade of the twenty-first century? And how does it differ by race? The paper draws on two longitudinal data sets—the Panel Study of Income Dynamics household survey data matched with neighborhood-level US Census data (1999–2011), and the IASP Leveraging Mobility (LM) study (1998–2011). Applying an integrated mixed methods design, analyses are conducted in three stages: (1) A grounded theory analytic approach of the LM data determines key variables of wealth mobility: homeownership, income, employment characteristics, extended family wealth, negative life events, and neighborhood factors; (2) regression analyses test these indicators for absolute and relative wealth mobility; and (3) recontextualization through further analyses of LM data deepen the regression results by illustrating the pathways of significant wealth mobility predictors. Results reveal that increasing family income, larger family transfers, consistent long-term homeownership, and in some cases white-collar occupations increase the likelihood of upward relative wealth mobility. Negative life events, higher rates of neighborhood poverty, and black race are negatively correlated with the amount of wealth growth. These key drivers of wealth mobility highlight the need for targeted policies that reinforce and expand opportunities for all families to build wealth over the life course.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Contrary to the popular belief that everyone has an equal chance to move up (The Pew Charitable Trusts 2013), research consistently shows that families remain stuck in the bottom and top economic groups in the USA. Income, among the most common measures of economic mobility, captures the ongoing stream of financial resources into the household but misses a critical component of financial well-being. Wealth expands the picture of financial well-being by revealing families’ access to the store of financial resources needed to manage a large reduction or loss in income (McKernan and Ratcliffe 2009) or the capital available to invest in education or real assets like a home. Household wealth is vastly more unequally distributed than income, with a growing gap between those families that hold wealth and those that do not (Piketty and Zucman 2014) and large racial disparities (Shapiro et al. 2014; McKernan et al. 2013; Kochhar et al. 2011; Conley 2009). Emblematic of the wealth gap, some families are able to get ahead and grow their wealth, while others see their wealth decline, often into negative territory.

In the vast body of research on economic mobility, less attention has been paid to the study of wealth mobility between and within generations. The handful of studies on wealth growth and mobility within the same generation focus on past time periods such as the last two decades of the twentieth century (Conley and Glauber 2007), analyze households in general (Conley and Glauber 2007), or focus on either women or men (Jianakoplos and Menchik 1997; Steckel and Krishnan 2006). This study fills a gap by focusing on wealth growth and mobility patterns of families raising children in the twenty-first century, an important area of research for two reasons. First, the wealth of a child’s parents while the child is in the family is a predictor of how well the child does as an adult (Keister 2007). Understanding the dynamics of family wealth mobility when children are living at home reveals policy levers to improve children’s future outcomes. Second and relatedly, parents’ future and retirement economic security depends on the wealth they are able to accumulate during their child-rearing years, impacting how much of a drain they will be on their children’s future financial well-being.

To our best knowledge, no study has examined patterns of intra-generational wealth mobility for parents raising children at the beginning of the twenty-first century, a period marked by unique macro-economic events (two major recessions) and an associated sharp increase in wealth inequality. This integrated mixed method study tests predictors of wealth mobility, identified through qualitative analysis, in multivariate models that combine family-level and neighborhood-level determinants of upward and downward wealth mobility, and recontextualizes the quantitative results. The overarching goal of this research is to depict what accounts for relative and absolute wealth mobility for families with children over the first decade of the twenty-first century and to explore differences by race.

Economic Mobility

Economic mobility has been conceptualized and measured in a number of different ways. The first distinction is whether economic mobility is measured within the same generation (intra-generational mobility), or between two or more different generations (inter-generational mobility). Most mobility studies have focused on inter-generational mobility, studying how children are faring economically compared to their parents. More recently, there has been a new focus on intra-generational mobility, following individuals or families within the same generation.

The second important distinction is whether economic mobility is measured in absolute or relative terms. Absolute measures of economic mobility examine changes in the dollar amount of income or wealth that a family has over time. Relative measures of mobility look at the ranking of the family relative to other families and how that relative placement changes over time.

The third distinction is the measure used to quantify economic mobility. Studies have attempted to use a variety of different indices to represent the economic position of a family or individual. The dominant emphasis in the literature to date has been economic mobility as measured by income or occupation. Increasingly, however, scholars are interested in understanding wealth mobility because of wealth’s unique capacity to be passed from one generation to another; thus, a majority of the research focuses on inter-generational wealth mobility. Strikingly fewer studies examine intra-generational mobility, or wealth mobility over the life course, and none to our knowledge has focused specifically on families with children.

Trends in Wealth Mobility

Research on inter-generational wealth mobility shows some wealth mobility, while at the same time demonstrates that it has become harder to move between wealth quintiles.Footnote 1 Half of Americans have greater wealth holdings than their parents, and over 70 % situated in the bottom wealth quintile surpass their parent’s wealth (The Pew Charitable Trusts 2012). But the rungs of the ladder—the wealth quintiles—are getting further spread apart over time, meaning that it is becoming harder to move from one wealth quintile to another. Median wealth at the lowest quintile has decreased by more than half compared to a generation ago, while at the top of the wealth distribution, median wealth has increased from just under $500,000 to almost $630,000 over the same period (The Pew Charitable Trusts 2012).

As a result of these wealth distribution trends, families tend to be “stuck” in the bottom or top wealth quintiles (The Pew Charitable Trusts 2012), making it especially more difficult to move up the wealth distribution than to hold onto a position at the top of the distribution (Conley and Glauber 2007). The stickiness of one’s placement in the wealth distribution is tied to a legacy of extreme wealth concentration at the very top; since the 1920s, the top 1 % of households have consistently owned an average of at least 30 % of total household sector wealth with great fluctuation over time (Keister and Moller 2000).

Stickiness at the ends of the wealth distribution is seen not only in inter-generational wealth mobility studies, but also in intra-generational wealth mobility (Steckel and Krishnan 2006; Conley and Glauber 2007). Jianakoplos and Menchik (Jianakoplos and Menchik 1997) found that there is remarkable persistence, or stickiness, in the rankings of families at either end of the wealth distribution in the cohort of men they studied over a 15-year period: 62 % of families ranked in the highest quintile in 1966 are also in the same quintile in 1981, and 61 % of families in the bottom quintile remained in that same quintile in 1981. Over half of the families experience some mobility, but mostly to adjacent quintiles. Additionally, black men are slower in moving out of the bottom quintile, and more likely to move down out of the top quintile, than whites.

Race and Wealth Mobility

Research consistently documents stark racial disparities in who is able to get and stay “ahead.” Blacks are not only much more likely to be raised at the bottom of the family income and wealth ladders than are whites, but they also have a harder time exceeding their parents’ family income and wealth than whites (The Pew Charitable Trusts 2012; Conley 2009). Over a generation, whites are twice as likely as blacks to leave the bottom rung, and three-quarters of blacks who resided in families in the bottom wealth quartile as children remain in the bottom half as adults (The Pew Charitable Trusts 2013). By contrast, whites from the bottom quartile had an almost fifty–fifty chance of ending up in the top half of the wealth distribution.

The few studies that examine intra-generational wealth mobility show that black families see substantially less upward wealth mobility, or even financial stability, than white families over their life course. For example, only 24 % of black adults remain in the top wealth quartile as they aged, in contrast to 60 % of white adults who do over their life course (Conley 2009). Blacks are more likely to persist in and move into the bottom deciles (Steckel and Krishnan 2006). Earlier data from the 1960s and 1970s report greater relative wealth mobility among blacks than whites, but less upward wealth mobility for blacks with low wealth status (Jianakoplos and Menchik 1997). A related set of studies seeks to establish the magnitude of wealth accumulated over the life course, documenting the widening of the racial wealth gap over the life course of the same families (McKernan et al. 2013; Shapiro et al. 2013).

Predictors of Wealth Mobility

Identifying and highlighting the “hidden” mechanisms leading to wealth mobility, either inter- or intra-generationally, reveal both the stickiness of financial advantage and disadvantage and how those advantages are transmitted from one generation to the next. These mechanisms are core to understanding how economic inequality is created and perpetuated in American society. Research has examined different predictors of intra-generational wealth mobility, including family structure, private family transfers and inheritance, occupation, income, homeownership, unemployment, divorce, experience of a health event, and entrepreneurship. Variables examined in key wealth mobility studies are listed in Table 1.

Education, white-collar occupation, and income increase the likelihood of upward wealth mobility. In addition, homeownership has a protective effect, reducing the chances of remaining in the bottom decile; conversely, divorce or unemployment increases the chances of moving down (Steckel and Krishnan 2006; Jianakoplos and Menchik 1997). Inheritance or financial transfers have consistently been linked to higher wealth growth and upward wealth mobility (McKernan et al. 2014; Chiteji and Hamilton 2002; Menchik and Jianakoplos 1997).

Evidence shows that children or dependents reduce the incidence of wealth growth and spur downward mobility (Steckel and Krishnan 2006; Keister 2007). When examining the impact of childhood family structure and characteristics on adult wealth accumulation, Keister (2004) finds significantly lower wealth growth for adults raised in families with incomes below the poverty line, with separated or divorced parents, or with extended family in the home. For families above the poverty line, an increase in the number of siblings decreases wealth accumulation, although not for the wealthiest families.

While each of these studies examines a small number of variables, none examines the full range of variables denoting a comprehensive theory of wealth analysis. Importantly, while region and urban/rural variables are included in some models, not one of these studies examines the role of the neighborhood. As Steckel and Krishnan (2006) note, “economists have yet to create a reasonably comprehensive theory of wealth (or income) mobility” and so choose their predictor variables through theories about different aspects of wealth accumulation, prior studies, and “of course, intuition” (p. 202). The lack of theoretically comprehensive analyses of wealth mobility for families with children at the start of the twenty-first century means that we are missing data important to developing relevant contemporary policy. To address some of these shortcomings, this paper seeks to:

-

1.

Document intra-generational wealth trends—accumulation and mobility—for families with children, at a key point in the child’s life—when the child is in the home

-

2.

Begin to develop a comprehensive theory of intra-generational wealth mobility and accumulation

-

3.

Use the comprehensive theory to build a model to predict wealth accumulation and mobility for families with children

-

4.

Examine racial differences in intra-generational wealth mobility and accumulation

Methodology

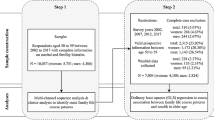

To address these research questions, we follow an integrative mixed methods (IMM) analytical strategy, drawing on two different data sets: the IASP Leveraging Mobility (LM) study, a longitudinal qualitative database, and the Panel Study on Income Dynamics (PSID), a longitudinal national household survey.

Integrative Mixed Methods (IMM) Analysis

Following the approach of an integrative mixed methods (IMM) analysis, the two data sets in this study were developed in parallel to ensure greatest complementarity. Once finalized, our analyses move back and forth between them, with each data set providing insight into the other. The qualitative LM interview database provided the original understanding of the different factors influencing wealth mobility over the course of a 12-year period. We identified and labeled thematic categories by conducting open coding (Strauss and Corbin 1990), discovering and naming emergent categories. We matched these categories with quantitative measures in the PSID, converting qualitative thematic categories into numeric thematic variables (Castro and Coe 2007), and using proxies where we were unable to locate an equivalent variable. The results of the quantitative analyses helped inform the magnitude and significance of the effect of different factors on wealth mobility over time. The final analytic step in IMM analysis, termed “recontextualization,” relates regression model results back to their original qualitative context (Morse 1998). We used the quantitative results to identify the most illuminating case studies of families from the LM data set, and particularly those that would deepen our understanding of the patterns visible in the PSID data. The strength of this fully integrated mixed methods approach is in its capacity to generate “deep structure” conclusions (Castro and Nieri 2008) with greater explanatory power than either a qualitative or quantitative approach alone.

Panel Study on Income Dynamics (PSID)

The PSID has been following a sample of 5000 families and their descendants since 1968. Initially oversampling lower income and black populations, the PSID refreshed its sample in 1997 to better represent changes in the US population. Primarily focused on income and related attitudinal information, the PSID added a wealth data module in 1984. This paper focuses on PSID families who in 1999 were of working age (household heads 25–54 years of age) and had children under age 18 living with them. We follow these families over 12 years until 2011, matching the time frame of the IASP Leveraging Mobility study and its focus on families with children. To understand the relationship between these PSID families and their neighborhood of residence, the PSID family-level survey data are matched with neighborhood-level data from the 2000 US Decennial Census. Census tracts are used as proxies for the neighborhood, following convention in social science research.Footnote 2

PSID Sample Characteristics

Family heads in the PSID sample for this study are 15 % black, close to 40 years old, 54 % with at least a high school degree, and 76 % married (86 % of white family heads, vs 32 % of black heads). Average family income in 1998 was $94,594 (on average $113,130 for white families, significantly higher than the $47,908 average reported by black families), and 38 % of all family heads were employed in white-collar jobs in 1999 (46 % of white heads, vs 19 % of black heads). Seventy-one percent of all families owned their homes in 1999 (81 % of white families, vs just 39 % of black families), and 57 % owned their home through the entire study period (67 % of white families, vs 26 % of black families). As widely documented in prior research, white families received substantially more in financial transfers over the study period, totaling on average $31,938, versus $3708 for black families.

The experience of unforeseen negative life events differs by race. White families experience the loss of a spouse slightly more often (12, vs 10 % for black families) and were also slightly more likely to report the onset of a disability (31, vs 28 % for black families). Unemployment, on the other hand, is more common among black families. Forty-seven percent of black families report unemployment of the family head or wife at some point over the study period, compared to 36 % of white families.

Neighborhood poverty differs greatly between white and black families. Overall, an average of 10 % of families’ neighbors lives below the poverty line. However, for black families, exposure to neighborhood poverty is much higher; on average 18 % of their neighbors live in poverty, compared to just 6 % of the neighbors of white families.

Wealth Mobility

Using the PSID, we conceptualize wealth mobility in two ways: wealth accumulation (absolute positive wealth mobility) and relative wealth mobility. Wealth accumulation is measured as the change in wealth (with home equity) from 1999 to 2011. Relative wealth mobility is measured by assessing families’ respective position in wealth quintiles for 1999 and 2011.

Over the 12-year study period, more than six in ten families (62 %)Footnote 3 experienced positive absolute wealth mobility, accumulating $20,855 at the median ($158,991 at the mean). More white families are able to see their wealth grow (64, vs 52 % of black families), and overall wealth gains were significantly higher for white families ($41,850 at the median, $218,336 at the mean) than for black families ($600 at the median, $2792 at the mean). For white families reporting positive absolute wealth mobility, their median wealth has grown by $483,788 ($133,578 at the mean), compared to a median growth of $27,862 ($76,956 at the mean) for black families. For families who see their wealth shrink, the losses are higher for white families ($64,320 at the median, $260,195 at the mean) compared to black families ($13,500 at the median, $78,120 at the mean).

Not accounting for the starting point (wealth quintile position in 1999), analyses show that close to half of the families (47 %) do not change their relative wealth position between 1999 and 2011. This is true for 51 % of white families, but only 38 % of black families. Black families show a higher percent of upward relative wealth mobility (35, vs 24 % for white families), but also a slightly higher degree of downward relative wealth mobility (27, vs 25 % for white families).

A closer look at the wealth quintile positioning of white and black families with children over the study period confirms what has been termed “stickiness” in prior research. As shown in Figs. 1 and 2, 75 % of white families maintain their status in the highest wealth quintile, in stark contrast to only 19 % of black families who are able to remain in the highest wealth quintile. Another 59 % of black families located in the highest wealth quintile in 1999 find themselves in the fourth quintile 12 years later. At the lower end of the relative wealth distribution, 49 % of black families are stuck in the lowest wealth quintile, as compared to 38 % of white families. Forty percent of black families in the lowest quintile in 1999 are able to move up to the next lowest quintile.

Leveraging Mobility (LM) Study

The IASP Leveraging Mobility (LM) study comprises a unique qualitative data set of in-depth interviews conducted at two points in time, offering a rare look at the financial lives of families and the decisions and trade-offs between financial security and opportunities made during a decade of particular economic volatility. In 1998, the original sample of 180 families was purposefully selected to represent an even proportion of white and black families and an equal split of working-class and middle-class families. At baseline, families have children aged between 3 and 10 years old. At the second wave of 137 interviews, conducted between 2010 and 2012, these children are at the end of their high school career or beyond. The parents are now in the latter half of their working lives, between 40 and 60 years old. The racial breakdown remains the same in the follow-up interviews as in the baseline sample. Families are located in three urban cities in 1998: one on the East Coast, one on the West Coast, and one in the Midwest. At the time of the second interview, the majority lived in the same city or nearby; a few families had moved to other states. The interview data cover information about the children’s educational histories and trajectories, parent’s work histories, family income and expenditures, family wealth and debt, family financial and non-financial assistance, the community or communities where they reside previously and currently, and reflections about their economic security and decisions they have made related to using their assets.

LM Sample Characteristics

For the 137 families interviewed both in 1998 and 2010, the average age in 1998 is 37, and slightly more than half are married at baseline. Over 80 % of families report having completed at least some college in 1998, with small differences in educational attainment by race (83 % of white families, vs 77 % of black families). Just over half of black and white families own their home in 1998. The average income at baseline is $57,823, with black families reporting a higher average income compared to their white counterparts ($63,519 vs $53,419, respectively). Since 1998, black families see a decline in income by nearly $20,000, while white households enjoy an increase of nearly $50,000. Such disparate trends are mirrored in absolute wealth with the magnitude amplified. White families experience a mean increase of nearly half a million dollars in absolute net worth gains. Over that same 12-year period, black households see no gains in net worth; in fact, black families actually see a decline in overall mean net worth of approximately $4000.

Toward a Comprehensive Theory of Wealth Accumulation and Mobility

While the above inequities have been reported for populations other than families raising children, the literature to date does not provide a comprehensive theoretical or empirical grounding for the factors influencing intra-generational wealth mobility. The goal of this mixed method analysis is to provide a basis for developing a more comprehensive theory of intra-generational wealth mobility. Applying grounded theory building in prior analyses (Strauss and Corbin 1990), the following key factors emerge as critical in whether families accumulated wealth, and in some cases changed wealth quintiles, in the LM interviews:

-

(a)

Employment characteristics

-

(b)

Extended family wealth

-

(c)

Negative life events, such as unemployment, onset of a disability, and loss of a spouse

-

(d)

Neighborhood characteristics and housing wealth

This section will briefly describe each of these key factors. More in-depth discussions can be found in a series of reports (Thomas et al. 2014a, b, c; 2013a, b).

Employment Characteristics

LM interviews suggest that the characteristics of employment for earners impacts family wealth mobility. Specifically, families that increased their wealth between 1998 and 2010 have at least one earner who has access to employment with the following characteristics:

-

Comprehensive set of wealth-building benefits: matched defined contribution retirement accounts or traditional pensions (defined benefit plans); health insurance; education credits or investment; severance pay; and disability insurance

-

Flexible schedule: workplace allowed flexibility in work schedule to accommodate the needs of raising children

-

Consistent work: uninterrupted work histories, particularly with the same employer

These characteristics together meant that family earners were able to stay employed with access to the set of wealth-building benefits that could increase their family assets. We call these characteristics “employment capital” due to their importance for building wealth (Thomas et al. 2013a). As previous research demonstrates, black families are concentrated in jobs with little employment capital, undermining their prospects for building wealth (Austin et al. 2011; Thomas et al. 2013a; Henretta 1984; McKernan et al. 2013; Shapiro et al. 2013).

Extended Family Wealth

Interviews with LM families highlight the important ways that extended family wealth, or the “web of wealth,” influences wealth mobility (Thomas et al. 2014b). Families with access to a well-resourced web of wealth receive help in paying for children’s educational costs, including private school, college, test prep, and camps. In some cases, the web of wealth is a regular source of income that prevents downward wealth mobility, while for other families, the web of wealth means upward wealth mobility from a large infusion of cash in the form of inheritance or gifts.

When faced with a drop in or loss of income, families without a well-resourced web of wealth are less able to protect their larger assets (such as a house or car), more likely to take their children out of private schools, and more likely to take on debt. With less access to extended family wealth (Shapiro et al. 2014; McKernan et al. 2014; Chiteji and Hamilton 2006), communities of color are less likely to count on this important ingredient of wealth mobility for themselves and their children.

Negative Life Events

Analyses of the LM study data examine family financial trajectories longitudinally over a period of 12 years, revealing the mechanisms through which negative life events impact wealth. Negative life events both decrease or eliminate income and create a change in life circumstances. Most families face negative life events at some point in their lives; however, the frequency is greater for some families. Black families are more likely to face a range of different negative life events, from unemployment to a health crisis (Weller and Fields 2011; Kim and Lee 2005; Sullivan 2012).

Neighborhoods and Housing Wealth

Housing wealth is determined by the economic trends in the neighborhood, with great fluctuation in home values between neighborhoods. For families that could access homeownership in neighborhoods with higher priced homes and stable home values, building wealth through their home was a real possibility. But purchasing a home in a neighborhood with more volatile and low or even declining housing prices was no guarantee of wealth building through homeownership. Some families see their neighborhood change after their home purchase: for example, going from a stable to a more volatile neighborhood. Race plays a large role in which neighborhoods were stable and which neighborhoods had housing values that were either volatile or declining over time. Building wealth tends to be more likely in predominantly white neighborhoods, while predominantly black or Latino neighborhoods more often see greater home value volatility or declines (Sharkey 2013). In our analyses for this paper, we separate these two variables to explore their independent effects.

Results

Following our integrative mixed methods (IMM) strategy, LM analyses of the key drivers of wealth mobility inform the multivariate models we use to explore the determinants of wealth mobility in the PSID. In addition to proxy measures for each of the key LM factors, we include race as a major variable of interest and control variables for demographic characteristics in the regression models. Table 2 presents descriptive statistics of PSID families with children, by race.

Multivariate regression analyses were conducted in three ways:

-

Model 1: Logistic regression, predicting positive absolute wealth growth from 1999 to 2011

-

Model 2: Ordinary least square regression, predicting the extent of wealth growth for those accumulating wealth from 1999 to 2011

-

Model 3a and 3b: Multi-nominal regression, predicting relative upward, no, or downward wealth mobility from 1999 to 2011

Our empirical models can be summarized in the following equation:

Change in wealth (∆Wealth) is measured in absolute (change in wealth holdings from 1999 to 2011) and relative (change in wealth quintile from 1999 to 2011) terms. For more details on the measurement of all variables, please refer to “Appendix.”

Based on a review of the literature and our qualitative analyses, we expect that wealth accumulation and relative wealth mobility among families raising children from 1999 to 2011 will have a positive relationship with income, white-collar occupation, financial transfers received, and homeownership, and a negative relationship with black race, negative life events, and neighborhood poverty.Footnote 4

Multivariate Analyses: Determinants of Wealth Mobility

Multivariate Model 1: What Variables Predict Whether a Family Sees Any Wealth Accumulation?

Table 3 presents the results of all regression models as discussed above. Logistic regression in Model 1 examines predictors of any wealth growth from 1999 to 2011, regardless of the size of the growth. As expected, income growth, the amount of financial transfers received over the study period, and homeownership in all years of the study period predict a higher likelihood of wealth growth, whereas the experience of any negative life events—a new disability, unemployment, or loss of a spouse—all predicts a lower likelihood of growing wealth. In this analysis, only the demographic controls, black race, white-collar occupation in 1999, and neighborhood poverty did not significantly predict absolute wealth mobility up or down.

Multivariate Model 2: What Predicts the Magnitude of Wealth Growth for Families with Any Wealth Accumulation?

Multivariate linear regression predicts the extent of wealth accumulation only for families who are able to grow their family wealth between 1999 and 2011, using the same predictor variables as in the logistic regression analysis. The outcome measure, wealth with home equity, is transformed into its natural log. This analysis shows that only loss of a spouse and black race of head did not independently predict the extent of wealth growth, albeit the race variable is very close to significance (p = .058). Estimates for all other variables are in the expected direction.

Older, married, more educated, and those in white-collar professions and with higher upward income mobility experience higher wealth growth. In addition, a large financial gift and homeownership pre-1999 and in all the years of the study period add to the amount of wealth accumulation. By contrast, negative life events such as the onset of a disability and facing a period of unemployment predict lower wealth growth. Finally, higher neighborhood poverty has an independent impact on predicting lower wealth growth.

Black race has an independent negative effect on the amount of wealth accumulated; however, it was no longer significant when neighborhood poverty was added to the model.

Multivariate Models 3a and 3b: What are the Variables that Predict Whether a Family Moved Up or Down Relative to Other Families?

The third regression model addresses the likelihood of any upward or downward relative wealth mobility compared with no relative mobility, conducting multi-nominal regression analysis with the same predictor variables as in the above models. Older family heads, and those experiencing the onset of a disability, are significantly less likely to experience relative upward mobility when compared to those who stayed in place. Black families and families who experienced the loss of a spouse or the onset of a disability are more likely to experience downward wealth mobility. Families with upward income mobility, receiving a large financial gift, and who owned their home throughout the entire study period are less likely to move down the wealth ladder. Finally, the extent of poverty experienced in the neighborhood contributes to downward wealth mobility (Table 3).

Qualitative Analyses: Recontextualization

Families raising children in the first decade of the twenty-first century are able to grow their absolute wealth by $20,855 on average. However, not all families followed this trend. More black families lose wealth, and those who are able to build wealth add only $600 at the median, as compared to $41,850 for white families. Relative to other families with children, black families remain stuck in the lowest wealth quintile, while white families grow their position as top wealth holders. These trends will have lasting impacts on the children raised in these families (Keister 2007; Sharkey 2013).

In the following section, we weave together in greater detail the findings from the regression analyses with data from the LM interviews. This analytic process enables us to better understand the mechanisms at play as well as how the intersection of factors we tested independently from each other impact wealth trajectories.

Employment Characteristics

Sharisse Perkins was diagnosed with cancer. She says: “Luckily,… I could take a short-term disability and get my full paycheck, just a huge benefit. But if I didn’t have this job, and I got sick… it’s like you always just worry like one little thing could happen and you would be in deep trouble.”

While income is among the most consistent and largest correlates of wealth building, as Sharisse Perkins’ story illustrates, the quality of employment—what we call “employment capital”—is also critical. Often associated with occupations in which white workers are overrepresented, these positions include a benefits package that protects against negative life events (health insurance, disability insurance, dental insurance, and severance pay), helps wealth building (retirement accounts), and offers work flexibility that allows workers to remain employed as they move through the life course (Rank 2007).

Limited access to employment with flexible schedules hampered some families’ wealth mobility. One in ten of the families in the LM study was unable to find employers to accommodate their family care scheduling needs. Hillary Wooldbridge needed someone to look after her disabled son: “I actually got a job in a nursing home and…I couldn’t stay there…because of his needs…I only did 6 months there…and they wanted me weekends—and weekends was the hardest problems ‘cause I couldn’t leave him home by himself and I wasn’t allowed to take him with me, so…[I had to leave the job].”

To find a job with flexibility, many families take a pay-cut, which results in lower prospects for wealth mobility. Linda Diamond’s son had sickle-cell anemia. In 2010, she was working as a chef at a restaurant making $60,000 a year. A few years before, she had worked at another local restaurant earning $120,000 a year, but had to leave that job. Her employers would not accommodate her need to take care of her son on the occasions when he got sick. Her current job paid less, but offered more flexibility in allowing her to meet her family’s needs.

These examples help illustrate why job characteristics beyond income—employment capital—are so important in wealth mobility. It is not surprising, then, to find our proxy for employment capital—a white-collar occupation in 1999—is a significant predictor of the magnitude of wealth that a family will accumulate.

Extended Family Wealth

The regression analyses underscore the importance of wealth transfers among families for upward wealth mobility and the magnitude of that wealth increase. These wealth transfers serve as a proxy to assess whether a family has access to an affluent extended family network. While extended family wealth does not statistically significantly increase the likelihood that a family with children will move up at least one wealth quintile, it does reduce the likelihood that a family will move down a wealth quintile or more, all other factors held constant, indicating extended family wealth’s protective influence on the relative wealth position of families within the stratification system.

Indeed, the LM interview data provide insight as to how these types of financial transfers operate. For many families we spoke to, extended family wealth benefited them in two ways. First, it stopped wealth loss or downward wealth mobility by preventing families from having to spend down as much of their own assets when they faced a negative life event such as unemployment, divorce, or a health event. Secondly, financial support from parents or aunts and uncles helped families buy their first house, pay for private schools or college for their children, and put away savings for their children’s or their own futures.

The example of the Bzdells showcases the impact of receiving a large inheritance, which shifted their financial status and ensured that a health event did not become a financially derailing event. Nicole and Jessica were in the process of moving to a rural town with their daughter, when Nicole’s mother suddenly died. She left Nicole a large inheritance of $1.2 million, allowing them to purchase their new home outright and providing $40,000 a year in income from a stock portfolio. Jessica could take a part-time job that paid only $20,000, and when Nicole became unable to work due to problems walking, they remained financially secure. As Nicole says, “So we have this cushion now that’s more like … 12 mattresses piled on top of each other.”

Smaller financial transfers also make a difference in wealth mobility. When Joseph Hutcheson was in medical school, he and his wife Suzanne received many small- and medium-sized loans and gifts from their parents. Both sets of parents lent money to cover medical expenses when Suzanne was sick and required hospitalization at a cost of $20,000. When Joseph and Suzanne’s child had to be hospitalized, Joseph’s parents covered the entire $8000 bill. Family support helped them get through medical school without taking on large amounts of loans or dropping out. In addition, financial support for flights home to visit family boosted Suzanne’s psychological well-being, helping her to manage her feelings of home sickness, and receiving monetary gifts during Christmas added to their financial well-being.

These are just some of the ways that family transfers impact how wealth is built. Due to lower-wealth family networks, black families rarely benefit in the same way as whites do from family financial transfers, and if they do receive them, they tend to be of lower value (Shapiro et al. 2014; Thomas et al. 2014b). Ashley Dudley, a black mother interviewed in the LM study, explains: “I have two brothers…the one brother who works…as a bus driver…another brother who is a surveyor for the state, so we’re all working class, we’re all blue collar…I can’t call them up for money because they are just working too…in both families we’re probably the most stable…”

In addition to smaller and less frequent financial transfers, black household wealth growth is often constrained not only by lower rates of receiving financial assistance, but also by higher rates of providing assistance—financial and non-financial—to relatives in need (O’Brien 2012). This is especially true for middle-income black families, whose parents are over four times more likely to be poor than equivalent white families (Nembhard and Chiteji 2006). These differences in extended family wealth sharing explain why we see inheritance impacting absolute wealth growth and relative wealth mobility.

Homeownership

Christine and Langston Mellon and their daughter Marjorie lived in an up-and-coming neighborhood that was showing fast housing value appreciation. Prompted by increasing debt from managing their rental property, they had to sell their house. Shortly after selling the house, they found themselves facing two major negative life events at the same time. Christine was diagnosed with breast cancer, and Langston left his job to pursue self-employment. Luckily their recent home sale netted $387,000, some of which they put into retirement accounts and some into their liquid savings accounts. This extra cushion allowed them to keep their daughter at a local private school while both Langston and Christine were out of work.

As suggested by the story of Christine and Langston, homeownership in certain neighborhoods can provide a fast route to wealth growth and protect certain family members’ social advantages. The regression models suggest that owning a house consistently between 1999 and 2011—a measure of long-term homeownership—increases the likelihood of increasing family wealth between 1999 and 2011, and increases the amount of wealth built by as much as one and a half times. It also has a protective effect: It significantly reduces the likelihood that a family with children experiences downward relative mobility. In Christine and Langston’s case, the wealth built through the fast-paced growth in their home value converted into cash assets protected the family’s financial well-being in the face of a health event and unemployment.

Neighborhoods

Where a family lives has a significant impact on whether they see their wealth increase or decrease and their wealth status relative to other families. While the poverty rate of a neighborhood in which a family with children finds itself located does not significantly predict whether that family will experience upward or downward absolute wealth mobility, it does influence the size of the growth of wealth for families that are upwardly mobile. Families in neighborhoods that are poorer experience less wealth growth than those that are in wealthier neighborhoods.

The contrast between the Mellons and the Andrews families highlights this finding. Rachel and Shawn Andrews are an African American couple who bought their home in the late 1970s for $1500 in a predominantly African American neighborhood. The neighborhood has gone through significant changes. When they first bought, there were many vacant properties and the neighborhood was predominantly African American and lower income. By 2010, those vacant properties were disappearing with increasing racial diversity. By 2010, the property had appreciated to $170,000. While both families see significant percent increases in their property value, the absolute differ greatly.

Neighborhoods also influence wealth mobility acting as a gateway to a range of community institutions and services. School district and neighborhood safety are one of the most frequently mentioned services that neighborhoods provide. When families have to pay extra for either safety or a private school, wealth accumulation and thus mobility are affected. Francesca Boucher, an African American mother, is raising her daughter with minimal support from her ex-husband. Using her personal savings accumulated over 10 years, she purchases a two-bedroom home in a gated community. Safety is a top priority. Francesca wishes she had been able to afford a house in a neighborhood with good public schools so that she does not have to send her daughter to a private school, which has come at a cost for her financially. Describing how she manages financially, she says: “…it’s definitely a trying time. You know, school tuition still has to be paid for her…You just add in the expense of preparing for college. It’s really costly….Yeah. I’m kind of feeling the pinch a little bit.”

Negative Life Events

Negative life events are often linked to a reduction in income. To deal with the resulting economic duress, a family most often draws on saved financial assets to ease material hardship (McKernan and Ratcliffe 2009). We would expect that, after the conclusion of a negative life event, a family would go back to building wealth or persist at a new decreased level of wealth. But the LM data suggest that family financial assets are often not sufficient to manage the crisis, and that families may be vulnerable to a spiral of continuously decreasing assets, especially where they have few assets to start with and cannot rely on extended family wealth.

As well as diverting some savings to lawyers, divorce splits a family’s finances, making each new family more economically fragile and in some cases resulting in downward wealth mobility. Toni Brown, a mother of two living in a Midwest city, sees her wealth plummet into negative territory after her husband left abruptly in 2006. Forced into the workplace by the divorce, Toni is a part-time bus driver and cleaner. In addition to this income, her father moved into help make ends meet.

Bethanie Barrows, another divorcee with two kids, summarizes the financial problem from divorce that leads to slower asset accumulation rates as she talks about what would make her feel more economically secure:

- Bethanie::

If I had the savings that I had before. Like I was very, very good at saving money. Like this amount would go away to savings every week and I can’t even afford to do that anymore, you know, so…

- Interviewer::

What changed?

- Bethanie::

Well, my marriage changed…

Parents with poor health or a disability may be unable to work and find themselves with a reduced income, impacting their wealth-building trajectories. Despite health insurance, health costs accrue. In addition, asset limits in accessing government subsidies may require that the potential recipient spends down any wealth before being able to qualify.

Dyan Powell, a 60-year-old woman living in the suburbs of a Midwest town, raised her two adopted sons on her own. Diagnosed with a chronic progressive illness, she was able to work as a certified public accountant for over 10 years, but in 2007, as her health declined, she had to stop working and began receiving disability payments (SSI), resulting in a significantly diminished income. She described spending down her assets to pay for health insurance for herself and her children, and taking on debt to cover significant out-of-pocket medication costs. She had hoped to be able to work until her children finished college, but her illness made that impossible. Keister’s (2007) research on the impact of lower wealth status during childhood suggests that Dyan’s kids may have a higher risk of accumulating less wealth in their adulthood as a result of the financial impact from their mother’s illness.

LM families frequently experienced unemployment, sometimes resulting in the loss of all household wealth. Both Steve and Christa Barzak lost their jobs during the Great Recession and were unable to make their mortgage payments. They managed to sell their condo in a short sale and split up their family to move in with relatives. Their two daughters and Christa lived with a cousin, and Steve lived with another relative. Their family assets plummeted from nearly $20,000 in 1998 when they were starting out their lives together to $−60,000 in 2010 after they had lost their condo. Steve optimistically reflects, “We’re one step above poverty. But we are one step above.”

Black Wealth Mobility

As this work and prior research shows, wealth accumulation and upward wealth mobility occur more often for white families than for black families. While the regression analyses only found black race as an independent significant predictor of downward relative wealth mobility in the full model, there is evidence in some of the tested models that blacks have a consistent disadvantage in growing wealth. Some of the lack of significance can be explained by the correlations of black race with other independent variables, for example living in a neighborhood with high poverty rates (Massey and Denton 1993; Sharkey 2013; Thomas et al. 2014a). Future analyses will explore in greater detail the relationship between neighborhood, race, and homeownership. For example, subsequent models will test interaction variables between homeownership, race, and neighborhood to specifically see whether homeownership has the same benefits for white families as it does for black families.

Conclusions

This paper provides a first step toward developing a more contemporary and comprehensive theory of intra-generational wealth mobility and wealth accumulation, beginning to explain why unequal wealth mobility patterns persist. While wealth mobility is still within reach for some families, for too many lower-resourced and black families, the American Dream of “rags to riches” remains unattainable. As in prior research, the data for families raising children point toward an entrenched set of households who remain in the top tier of the wealth distribution, despite the challenges presented by two economic recessions coupled with the costs of raising children.

This paper suggests five key policy areas that impact wealth accumulation and wealth mobility. These include: (1) employment characteristics; (2) a family’s access to extended family wealth; (3) unforeseen negative life events; (4) consistent and stable homeownership; and (5) the characteristics of neighborhoods in which families live. A comprehensive “American Dream” policy platform would address each of these areas and find ways to level the playing field so that all families can have the opportunity to accumulate wealth that will provide them and their children with financial well-being, as well as be rewarded for hard work in moving up the wealth distribution.

Notes

Relative economic mobility is typically measured in the movement between quintiles (20 % groups) over time.

Census tracts are designed to be relatively homogeneous units with respect to population characteristics, economic status, and living conditions at the time of establishment; they generally have between 1500 and 8000 people, with an optimum size of 4000 inhabitants. Census tract boundaries normally follow visible features, but may follow governmental unit boundaries and other nonvisible features; they always nest within counties.

All descriptive results are weighted.

We tested the need to use multilevel modeling, due to combining family and neighborhood characteristics. Estimates for the interclass correlation coefficient (Chi square on the group level variance) were lower than .05 and indicate no need for multilevel modeling. In addition, examination of the geographic distribution of families shows that there is little overlap among families residing in the same neighborhood.

References

Austin, A., Hamilton, D., & Darity Jr., W. (2011). Whiter jobs, higher wages: Occupational segregation and the lower wages of black men. EPI briefing paper no. 288. Washington, DC: Economic Policy Institute. Retrieved from http://www.epi.org/publication/whiter_jobs_higher_wages/.

Castro, F. G., & Coe, K. (2007). Traditions and alcohol use: A mixed-methods analysis. Cultural Diversity & Ethnic Minority Psychology, 13(4), 269–284.

Castro, F.G., & Nieri, T. (2008). Culturally-sensitive research: Emerging approaches in theory, measurement and methods for effective research on acculturation, ethnic identity and gender. Paper presented at the Society for Social Work Research, Washington, DC.

Chiteji, N. S., & Hamilton, D. (2002). Family connections and the black–white wealth gap among middle-class families. The Review of Black Political Economy, 301, 8–28.

Chiteji, N. S., & Hamilton, D. (2006). Estimating the effect of race & ethnicity on wealth accumulation & asset-ownership patterns. In J. G. Nembhard & N. Chiteji (Eds.), Wealth accumulation & communities of color in the United States. Ann Arbor, MI: The University of Michigan Press.

Conley, D. (2009). Being black, living in the red: Race, wealth, and social policy in America. Berkeley, CA: University of California Press.

Conley, D., & Glauber, R. (2007). Black–white differences in income and wealth mobility. Paper presented at the Sixth Meeting of the University Working Groups on the Social Dimensions of Inequality.

Conley, D., & Glauber, R. (2008). Wealth mobility and volatility in black and white. Washington, DC: Center for American Progress. Retrieved from https://www.americanprogress.org/issues/economy/report/2008/07/29/4662/wealth-mobility-and-volatility-in-black-and-white/.

Henretta, J. C. (1984). Parental status and child’s home ownership. American Sociological Review, 49(1), 131–140.

Jianakoplos, N. A., & Menchik, P. L. (1997). Wealth mobility. Review of Economics and Statistics, 79(1), 18–31.

Keister, L. A. (2004). Race, family structure, and wealth: The effect of childhood family on adult asset ownership. Sociological Perspectives, 47(2), 161–187.

Keister, L. A. (2007). Upward wealth mobility: Exploring the Roman Catholic advantage. Social Forces, 85(3), 1195–1225.

Keister, L. A., & Moller, S. (2000). Wealth inequality in the United States. Annual Review of Sociology, 26, 63–81.

Kim, H., & Lee, J. (2005). Unequal effects of elders; health problems on wealth depletion across race and ethnicity. Journal of Consumer Affairs, 39(1), 148–172.

Kochhar, R., Fry, R., & Taylor, P. (2011). Wealth gaps rise to record highs between whites, blacks, Hispanics. Washington, DC: Pew Research Center. Retrieved from http://www.pewsocialtrends.org/2011/07/26/wealth-gaps-rise-to-record-highs-between-whites-blacks-hispanics/.

Massey, D., & Denton, N. (1993). American apartheid: Segregation and the making of the underclass. Cambridge: Harvard University Press.

McKernan, S. M., Ratcliffe, C., & Vinopal. (2009). Do assets help families cope with adverse events? Brief 10. Washington, DC: The Urban Insitute. Retrieved from http://www.urban.org/UploadedPDF/411994_help_family_cope.pdf.

McKernan, S. M., Ratcliffe, C., Simms, M., & Zhang, S. (2014). Do racial disparities in private transfers help explain the racial wealth gap? New evidence from longitudinal data. Demography, 51(3), 949–974.

McKernan, S. M., Ratcliffe, C., Steuerle, E., & Zhang, S. (2013). Less than equal: Racial disparities in wealth accumulation. Washington, DC: The Urban Institute. Retrieved from http://www.urban.org/UploadedPDF/412802-Less-Than-Equal-Racial-Disparities-in-Wealth-Accumulation.pdf.

Menchik, P. L., & Jianakoplos, N. A. (1997). Black–white wealth inequality: Is inheritance the reason? Economic Inquiry, 352, 428–442.

Morse, J. M. (1998). Designing funded qualitative research. In N. Denzin & Y. S. Lincoln (Eds.), Strategies of qualitative inquiry (pp. 56–85). Thousand Oaks, CA: Sage Publications.

Nembhard, J., & Chiteji, N. (2006). Wealth accumulation & communities of color in the United States: Current issues. Ann Arbor: University of Michigan Press.

O’Brien, R. L. (2012). Depleting capital: Race, wealth and informal financial assistance. Social Forces, 91(2), 375–395.

Piketty, T., & Zucman, G. (2014). Wealth and inheritance in the long run. London: Centre for Economic Policy Research.

Quadrini, V. (1999). The importance of enterpreneurship for wealth concentration and mobility. Review of Income and Wealth., 45(1), 1–19.

Rank, M. R. (2007). Asset building across the life course. In S. M. Mckernan & M. Sherraden (Eds.), Asset building and low-income families (pp. 67–88). Washington, DC: The Urban Institute Press.

Shapiro, T., Meschede, T., & Osoro, S. (2013). The roots of the widening racial wealth gap: Explaining the black–white economic divide. Waltham, MA: Institue on Assets and Social Policy, Brandeis University. Retrieved from http://iasp.brandeis.edu/pdfs/Author/shapiro-thomas-m/racialwealthgapbrief.pdf.

Shapiro, T., Meschede, T., & Osoro, S. (2014). The widening racial wealth gap: Why wealth is not color blind. In R. Cramer & T. R. W. Shanks (Eds.), The assets perspective: The rise of asset building and its impact on social policy (pp. 99–122). New York: Palgrave Macmillan Publishers.

Sharkey, P. (2013). Stuck in place: Urban neighborhoods and the end of progress toward racial equality. Chicago, IL: The University of Chicago Press.

Steckel, R., & Krishnan, J. (2006). The wealth mobility of men and women during the 1960s and 1970s. Review of Income and Wealth, 52(2), 189–212.

Strauss, A. L., & Corbin, J. M. (1990). Basics of qualitative research: Grounded theory procedures and techniques. Newbury Park, CA: Sage Publications.

Sullivan, L. (2012). A bumpy road: Asset accumulation, unexpected life course events, and later life economic security (Ph.D. in Social Policy). Waltham, MA: Brandeis University. Retrieved from http://gradworks.umi.com/35/62/3562811.html.

The Pew Charitable Trusts. (2012). Pursing the American dream: Economic mobility across generations. Philadelphia, PA: The Pew Charitable Trusts. Retrieved from http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2012/PursuingAmericanDreampdf.pdf.

The Pew Charitable Trusts. (2013). Moving on up: Why do some Americans leave the bottom of the economic ladder, but not others? Issue brief. Philadelphia, PA: The Pew Charitable Trusts. Retrieved from http://www.pewtrusts.org/~/media/Assets/2013/11/01/MovingOnUppdf.pdf.

Thomas, H., Boguslaw, J., Chaganti, S., Atkinson, A., & Shapiro, T. (2013a). Employment capital: How work builds and protects family wealth and security. Leveraging Mobility Series, No. 2. Waltham, MA: Institue on Assets and Social Policy, Brandeis University. Retrieved from http://iasp.brandeis.edu/pdfs/2013/Employment.pdf.

Thomas, H., Boguslaw, J., Chaganti, S., & Shapiro, T. (2014c). Keeping dreams alive: The lane-changer costs of financial disruptions. Leveraging Mobility Series, No. 3. Waltham, MA: Institute on Assets and Social Policy, Brandeis University. Retrieved from https://iasp.brandeis.edu/pdfs/2014/Lane-Changer.pdf.

Thomas, H., Boguslaw, J., Mann, A., & Shapiro, T. (2013b). Leveraging mobility: Building wealth, security and opportunity for family well-being. Leveraging Mobility Series, No. 1. Waltham, MA: Institute on Assets and Social Policy, Brandeis University. Retrieved from https://iasp.brandeis.edu/pdfs/2013/Overview.pdf.

Thomas, H., Meschede, T., Mann, A., Boguslaw, J., & Shapiro, T. (2014b) Web of wealth: Resiliency and opportunity or driver of inequality. Leveraging Mobility Series No. 4. Waltham, MA: Institute on Assets and Social Policy, Brandeis University. Retrieved from http://iasp.brandeis.edu/pdfs/2014/Web.pdf.

Thomas, H., Meschede, T., Mann, A., Stagg, A., & Shapiro, T. (2014a). Location, location, location: The role neighborhoods play in family wealth and well-being. Leveraging Mobility Series, No. 5. Waltham, MA: Institute on Assets and Social Policy, Brandeis University. Retrieved from https://iasp.brandeis.edu/pdfs/2014/Location.pdf.

Weller, C., & Fields, J. (2011). The black and white labor gap in America: Why African Americans struggle to find jobs and remain employed compared to whites, Issue brief. Washington, DC: Center for American Progress. Retrieved from https://www.americanprogress.org/issues/labor/report/2011/07/25/9992/the-black-and-white-labor-gap-in-america/.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Meschede, T., Thomas, H., Mann, A. et al. Wealth Mobility of Families Raising Children in the Twenty-First Century. Race Soc Probl 8, 77–92 (2016). https://doi.org/10.1007/s12552-016-9161-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12552-016-9161-1