Abstract

Zoning practice is an important study used to ensure planned sustainability in the urban area and to create the city infrastructure. Until recently, studies on zoning practice have been in the form of method applications to create zoning parcels ready for construction and to provide urban reinforcement areas. Although there are various methods that can be used in the implementation of the zoning plan, the preferred method was the ‘land arrangement (LA) on a determined site’. According to the implementing legislation in Turkey, the arrangement studies are carried out with the ‘equal proportion’ approach. In this application, for the purpose of supplying the urban reinforcement areas stipulated by the plan, up to 45% of each parcel included in the regulation is deducted free of charge under the name of ‘Rearrangement Participation Share (RPS)’; the remaining part is given as zoning parcel. This situation is contrary to the principle of the Turkish Legal System that ‘in land arrangement studies, free deductions are made in return for the increase in the value of the immovable as a result of the zoning plan and its implementation’. Therefore, based on the ‘equivalence’ approach instead of ‘equivalence’ in the free RPS deduction transaction, there is a need for a universal evaluation that ensures the equality of the parcel value before and after the arrangement. In this study, our purpose is to examine the area-value relationship of the zoning parcels allocated to the cadastral parcels with different distribution methods before the arrangement within the scope of land arrangements. In this direction, graphic and vector data were obtained from the relevant public institutions and private offices. In the application of two different value-based methods, ‘factors affecting value’ and ‘market fair values’ were used to determine parcel values. With these values obtained, a zoning application with the content of arrangement was made, and the results of the zoning parcel allocation were examined with the help of regression analysis. The results were tested by comparing the value-based zoning proposal with the still-applied proportionality method. As a result of the application, it was determined that the majority of the parcels allocated in the current proportionality method ‘were given more value than their intrinsic value’.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Effective management of land information is very important for states to be successful in sustainable development policies (Bovkir and Aydinoglu 2018). In Turkey, parcel-scale zoning implementation studies and projects in urban areas are increasing day by day. In particular, the collection of urban plans under a regular and systematic title and the creation of spatial infrastructure have become important in terms of ensuring urban sustainability (Bunyan Unel et al. 2017). For this purpose, it is necessary to know the value of the parcel. Real estate appraisal is the process of ‘estimating the value’ according to the economic, social and technical characteristics of the parcel on the valuation day and the rights and restrictions on it (Yalpir et al. 2014). ‘Real estate valuation’ or ‘real estate development strategies’, which are indispensable in the real estate market, have not been able to reach definitive results in the process of adapting to the developing and changing technology. Accurate determination of real estate values will greatly support the economic development of countries. The use of numerical and correct values in valuation studies will help to reveal the results in a more realistic way, because simple and instant solutions are produced as a result of valuation processes made according to traditional methods (Wang et al. 2015). The need for zoning applications in the land arrangement (LA) method brought this situation back to the agenda. For example, inconsistencies and comparisons between real estate purchase and sale values that directly affect the real estate market; banking transactions, zoning plan implementations, land consolidation, urban transformation works, which are the subject of the pledge of immovables, make a lot of unfair profits from real estate. In particular, value-based changes in land use within the scope of urban area management activities require administrations to take action by paying attention to land characteristics (Zeng and Cleon 2018). If this situation is not taken into account, the existing debates about land use decisions, especially in urban areas used as agricultural land, will always continue, and the land policies for the protection of rural character will be constantly criticized (Arendt Randall 2014; Hawkins 2014; Mohamed 2017); on the other hand, it will remain unclear to whom the value difference resulting from the implementation in planned areas should be given.

In the land arrangement works carried out in Turkey, a free area deduction of up to 45% is made under the name of RPS from each participation parcel that has been implemented. However, just as the current values of the parcels included in the arrangement in the applied method are different from each other, the value of the zoning parcel to be allocated to these parcels after the arrangement is not the same. The old parcels, which have been made regular and usable for construction purposes with zoning plans, will not have the same values in terms of their location, criteria for benefiting from public buildings and distances from urban reinforcement areas. Each cadastral parcel entered into the arrangement has to benefit from the increase in value resulting from zoning practices at the same rate. Therefore, in zoning applications, not equal distribution, but equal value distribution is required (Ertas and Inam 2005; Yildiz et al. 2008; Yilmaz 2016; Yilmaz and Demir 2017). Keeping the values of cadastral parcels equal before arrangement (BA) and after arrangement (AA) should be the aim of a land arrangement based on value equality (Yomralioglu et al. 2007a). In order to ensure such an application, the values of the participation parcels entered into the regulation and the distribution parcels formed after the arrangement should be determined. The distribution process should be carried out by reducing the amount of increase in the value of the zoning parcels to the value of the cadastral parcels. With this approach, zoning practice is carried out in different countries (for example, in Germany), and positive results are obtained (Ulger 2010). Public spaces to be used for the benefit of society are covered by making free deductions from all immovables within the regulation area, within the ‘predictions of the application method used’. As a result of the cut, the remaining total area is given to the owners of the real estate within the arrangement area (Colkesen et al. 2007; Kocoglu 2019).

The implementation of the zoning plan positively changes the existing economic values of the cadastral parcels in the urban area. However, this effect is not experienced at the same rate in all parcels. It is also a fact that the zoning plan implementation methods have some ‘preference’ conditions in themselves, and it is generally recommended to apply the land arrangement method, except for special cases. Although it is known that this method is the most effective method among its technical, economic and sociological elements, it can be said that the real estate owners are sometimes not satisfied with the implementations. This discontent is mainly due to the objections made to the redistribution of the parcels to the owners, especially as a result of the fact that ‘the parcels are not evaluated according to objective and impartial criteria in the land arrangement practices made in accordance with the current regulations and laws’. In addition, it can be said that other problems are ‘not benefiting from the developing and changing technology to the maximum extent, problems in project planning and possible expectations in applications’ (Yildiz et al. 2008).

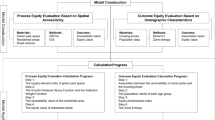

Within the scope of this study, zoning parcels were produced in the ‘proportionateness’ method in accordance with the current zoning legislation in the sample arrangement area. Then, based on the nominal values and Turkish Lira values of the parcels in the regulation area, the values of the parcels were calculated according to the results of the BA and AA, and value maps (Fig. 1) were created in the Geographic Information Systems environment. In addition, the zoning application in the LA method was made on a value-based basis for the parcels that were valuated by BA and AA; a model was produced by making statistical analyses based on the score values of the variables used in the value calculation. In the land arrangement method, the zoning application was made on the basis of the value equality of the cadastral parcels in the field and the zoning parcels formed afterwards.

Material and method

Study area and geographical features

As the study area, an area within the boundaries of the Şehreküstü District of the Demirci District of Manisa Province and shown as the development zone on the plan was chosen as the arrangement area (Fig. 1). The geographical location of the arrangement area, which has an area of approximately 209,000.00 m2, has the coordinates (643.757–644.110) m to the Right and (4.322.799–4.323.220) m of Up. Within the regulation area, there are 1 cadastral island and 21 cadastral parcels of different sizes. In the parcellation plan formed after the implementation, there are 12 zoning islands, 308 zoning parcels and 1 ‘socio-cultural facility area’ reserved for public service (Fig. 2). When the general urbanization structure and zoning plans of the Demirci District are examined, it is observed that the production of zoning parcels or the development areas of the construction are primarily directed due to different factors. Natural factors such as the faulty slope of the topography in the district, the slope of approximately 19% in the land structure and the density of fault lines in this region adversely affected the land production. Such negative effects caused the current real estate values to reach exorbitant values.

Data sets used in the study and their characteristics

According to the zoning implementation legislation in force in Turkey, numerical and verbal data of the cadastral parcels in the arrangement area were needed. The data was obtained from the district municipality, the land registry directorate and the cadastre directorate. In addition to these data, objective data on the factors affecting the real estate value were obtained through field studies. Within the scope of the study, urban reinforcement areas and public institutions located near the site and affecting the real estate value were determined, and the distances of the parcels to the city center, main road, shopping centers, etc. were measured with a GPS device on the walking track and recorded. The ‘Netcad 8.0’ software was used in the processing of the obtained data and the conversion of raster and vector data, and the ‘ArcGIS 10.4’ software was used in the analysis, interpretation and map production stages. In addition, ‘IBM SPSS 24’ software was used in the statistical analysis and interpretation of the obtained data.

Determination of real estate values before and after arrangement

Within the scope of the study, before the values of the parcels in the regulation area were determined, an application was made based on the principle of ‘proportionality’ stipulated by the current zoning implementation legislation. This form of implementation is a zoning implementation method that is still in force in Turkey. Rearrangement Participation Share Ratio, which determines the amount of free deduction to be made in proportion to the area of each cadastral parcel that has been put into practice for the supply of urban reinforcement areas in the regulation area, was calculated as DRSR=0.365172433, and the the Ratio of Governmental Agency Share was calculated as RGAS=0.02158296. Then, the values of the parcels in the field were obtained by using the methods of ‘valuation according to the criteria affecting the value of the parcel’ (nominal) and ‘valuation according to the current real estate market’. In the implementation process, the parceling plan created according to the 1/1000 scaled zoning plan data and the new parcel values were taken as basis. The application was continued over the values of the parcels determined by different methods.

In order to determine the parcel values in the nominal method, first of all, it is necessary to determine the criteria that affect the value of that parcel in an objective way. In order to ensure this situation, the characteristics of the study area should be clearly revealed (Yalpir and Ekiz 2017; Kocoglu 2019). The field where the valuation is carried out should be evaluated as a whole, and the value factors should be determined specific to the site. Otherwise, since many spatial data needs will arise in valuation studies carried out according to classical methods, reliable results will not be produced (Pagourtzi et al. 2003). Within the scope of the study, the criteria affecting the real estate value, the scores and weights of the criteria were calculated. In other words, the values of the participation and distribution parcels within the arrangement area were determined separately by using the effects of the criteria on the value. Different methods can be used in the valuation process. In the application, the nominal valuation method was used due to the fact that it expresses the properties of the real estate more objectively and up-to-date. The weight coefficients determined by Inam (1993) were used in the value calculation. These weight coefficients and the importance of the factors are also explained by survey studies in the literature (Yomralioglu 1993; Bender et al. 2000; Kryvobokov 2005; Nisanci 2005; Yalpir 2007; Cakır and Sesli 2013). According to the nominal valuation method, the factors affecting the value were calculated in two separate stages, before arrangement and after arrengement, specific to the region studied. At this stage, it has been seen that the most important factor in determining the real estate values is the location information. A total of 25 value factors were determined for before arrangement and after arrangement parcels specific to the study region. The local characteristics of the district settlement were effective in the selection of these factors. For example, for a region with no sea nearby, the sea proximity factor is eliminated. Therefore, objective factors should be taken into account when selecting the factors that affect the value (Swango 2016). All available value factors must be taken into account in order to determine objective and comprehensive parcel values. Physical, social, economic and legal characteristics should be considered in determining the factors affecting the parcel value (Yomralioglu and Nisanci 2004; Nisanci 2005; Yomralioglu et al. 2007b; Droj and Droj 2015). In addition, these factors that will affect the real estate value can be evaluated separately for cadastral parcels, for zoning parcels, or as a group. Within the scope of the application:

For cadastral parcels before arrangement (BA); The factors such as environment, topography (slope), exit to the street, availability of public services, parcel shape, distance to highway, available resources, type of land, number of parcel owners, parcel zoning status were taken into consideration.

For zoning parcels after arrangement (AA); Distances to police station, fire station, health centers, city center, harmful areas, education centers, worship centers, highway, shopping center, green areas, railway; exit to the street, location of the parcel in the block, parcel usage area, parcel front, parcel shape, soil type, topography (slope), allowed number of floors and noise factors were taken into consideration.

There will also be value factors that differ from person to person in determining the real estate values. Therefore, it will never be possible to determine the real estate values with a clear expression. Factors affecting the value of the real estate can be increased, for example, security features, neighborhood features, etc. However, considering the socio-economic status of the study area, these factors were not used as a value factor as they would have the same weight on the value. That is, these factors will not make a difference in value. However, approximate values can be predicted by different value factors and valuation methods. The following mathematical model (1) is used in calculating the nominal values of the BA and AA parcels, that is, according to the factors affecting the value, in order to implement the land arrangement (LA) studies with an ‘equivalence’ based method (Yomralioglu 1993).

(i = 1,2,..n), (j = 1,2,.......n),

V : Plot total value,

v : Factor score,

w : Factor weight,

k : Total factor number,

n : Plot number

On the other hand, in another application based on value equality, Turkish Lira (TL) values were obtained for the cadastral parcels regulated and the zoning parcels formed after the arrangement. These values are the current purchase and sale values in the district real estate offices, the real estate declaration values and the current values of the immovables in the municipality archive. By using these TL values provided, TL/m2 unit values of the immovables were determined; TL-indexed valuation approach was applied.

While the valuation processes are carried out specific to the study area, the information of each real estate is evaluated within itself, and the calculation is made in proportion to the shares of the owners. From each cadastral parcel area included in the arrangement, the amount of shares in the official institution area has been deducted, and the valuation has been made over the ‘remaining area’. This calculated value will be the cadastral parcel value to be allocated to the zoning parcel. In the nominal valuation method made with the criteria affecting the value, 10 different factors were used for each parcel of BA, while 15 different value factors were used for each parcel of AA. As a result of the calculations, the total parcel value of BA was calculated as 2,183,437.08 nominal value (NV), while the total value of the zoning parcels with AA was calculated as 2,287,724.21 nominal value (NV). In addition, the parcel values were calculated in TL units, the total parcel value of BA = 2,163,793.72 TL, the total value of the zoning parcels with AA = 6,699,856.77 TL. While the sum of unit values of BA parcels was 1022.00 TL, the sum of unit values of AA parcels was found to be 30,880.00 TL. After the arrangement, with the subdivision plans created within the framework of the standards specified in the regulation, 12 residential zoning blocks and 308 zoning parcels were created. In addition, 11 ‘non-registered immovable’ are included in the zoning plan. Since there will be changes in the attribute information (shape, location, type, etc.) of each cadastral parcel included in the zoning implementation studies, there will be an increase in the value of these parcels.

Calculation of balancing coefficients

While determining the parcel values, the number of value factors affecting that parcel can never be determined exactly. During the valuation, the factors are determined and included in the calculation (Kamau 2010). While determining the parcel values in the appraisal process, the number of criteria affecting the AA parcel value will be higher than the number of criteria affecting the BA parcel value (Gokce and Salali 2014). Therefore, positive changes in the AA attribute information of BA parcels will cause an increase in parcel value. In the distribution phase of the method that accepts the principle of equivalence, the values of the participation parcels and distribution parcels are considered equal. Therefore, an equivalence coefficient must be calculated to equate two different sets of values. The stabilization coefficient ‘z’ is calculated in order to make the BA parcel values equal to the AA parcel values. In order to reduce the AA parcel values to the BA parcel values, this coefficient is multiplied by the AA parcel values to provide value equality.

os : BA total cadastral parcel value

ss : The total value of the zoning parcels produced

Since there are cadastral parcels in the study area and the valuation of these parcels will be more relative than the zoning parcels formed after the regulation, the value of the zoning parcels should be multiplied by the ‘z’ coefficient. In this way, the zoning parcel values will be reduced to the cadastral parcel value, and the values based on distribution will be calculated. Since two different valuation methods were used in the application, the balancing coefficient was calculated separately for both methods. These coefficients are

These calculated coefficients ‘zND’ and ‘zTL’ are multiplied by the ‘total nominal value’ and ‘total TL value’ calculated in the same unit for each parcel after the regulation, and the values based on distribution are calculated (Yomralioglu 1997).

Comparison of allocation methods against cadastre parcels

In the application based on the proportional deduction amount, the application in which the factors affecting the real estate value and nominal values are used, and the application methods in which the TL values of the parcels are used, the values of the zoning parcels allocated against the cadastral parcels were observed during the distribution processes. In line with the calculated values, it was observed that while some parcels were allocated more than their value, some parcels were allocated less than their value. According to the results of the calculations, there has been an increase in the value of the zoning parcels allocated to the cadastral parcels (Tables 1 and 2). In the nominal valuation approach made using the criteria that affect the value, the ‘qNV= 1.047762826’ coefficient was calculated from the relation (AA NV / BA NV = 1) by proportioning the BA parcel values and the AA parcel values. On the other hand, the coefficient of ‘qTL= 3.096347268’ was calculated by using the total TL values of the participation and distribution parcels and by proportioning the BA and AA values to each other in the same way. These determined coefficients have also been the proof of the increase in value throughout the study area. In the whole application, the differences between the theoretical share and allocation values are negative in some cases and positive in other cases. The reason for this situation is that the same value entitlement cannot be provided to the cadastral parcels in the equal-ratio application. Equivalence costs are calculated as over or under value. These calculated values correspond to the amount of value that the participation parcels gained or lost after the arrangement. These differences should be compensated by the issuing institution or the owner.

Results and discussion

Areas subjected to allocation made on the basis of value

The nominal unit values and TL unit values of the BA parcels were calculated in the application area. Then, distribution of two different methods was carried out according to the value of the zoning parcels in which AA was formed. That is, these values used in the distribution phase will be the allocation value of a cadastral parcel participating in the application. Distribution operations should proceed through this logic. The process continued by comparing the cadastral plot values determined before the arrangement with the zoning parcel values formed after the regulation. In other words, without reflecting amount of increase in value after the regulation on the cadastral parcels entered into the regulation, the values of AA development plots will be reduced to the values of cadastral plots with the stabilization coefficient (zND, zTL) (Tables 3 and 4). Likewise, this is the purpose of the ‘equivalence’ based method to be applied. No value loss or gain has been created on the zoning parcels by allocating zoning parcels in line with the value that should be allocated to the cadastral parcels.

Classification of cadastre and zoning parcels according to their values

The factors affecting the value of the immovable property were determined, using the weight and point values of these factors; the unit and total values of all cadastral parcels participating in the arrangement and the zoning parcels formed after the arrangement were calculated. In addition, the unit value and current market value calculation for the same parcels were calculated as TL indexed. In the nominal valuation method made by using the factors affecting the value, the cadastral parcel no. 362 block-5 has the least value and the least unit value. The value of this parcel was calculated as 2120.26 NV and its unit value as 13.62 NV. When the participation rates of the parcels included in the regulation are examined, it is seen that the same parcel has the lowest percentage with the rate of 0.00097%. On the other hand, the real estate with the highest value among the parcels included in the arrangement was the cadastral parcel no. 362 block-1. The nominal value of this parcel was calculated as 417,807.58 NV. The cadastral parcel number 362 block-62 has the highest unit value. The value of this parcel was calculated as 28.01 NV. In the valuation approach applied to the BA parcels and made over the current market TL values, the immovable with the least value is the cadastral parcel no. 362 block-5. The value of this parcel was calculated as 2177.37 TL. The value of the cadastral parcel with the least unit value was calculated as 14.00 TL. Parcels with this value are 362 blocks-5, 6, 7 and 8. The parcel with the lowest rate of participation in the application according to TL values is again the cadastral parcel no. 362 block-5 and has the lowest percentage with a rate of 0.001006%. The cadastral parcel with the highest TL value in the study area is the cadastral parcel, 362 block-1. The value of this parcel was calculated as 403,358.30 TL. In the study, the minimum unit value was calculated as 24.00 TL. Other parcels with this value: 362 blocks-57, 58, 59, 60, 61, 62, 63, 64, 66 and 67 cadastral parcels. When frequency analysis was performed on all cadastral parcels included in the arrangement, it was observed that the parcel values in the study area were different from each other. Frequency analysis was applied separately for both valuation approaches. According to the results of the frequency analysis made according to the nominal valuation approach, the values of the cadastral parcels ranged from 2120.26 NV to 417,807.58 NV. As a result of the analyses made, it has been determined that the reasons for the different values of the cadastral parcels included in the arrangement are ‘the value factors determined for these parcels affect these parcels at different weights and the surface areas of the parcels are different from each other’. The values of 308 zoning parcels of AA were calculated according to two different valuation methods and the results were examined. In the appraisal process made by taking into account the factors affecting the value, the zoning parcel with the least value is the zoning parcel no. 107 block- 9, and the value of this parcel was calculated as 3368.18 NV. The zoning parcel with the least unit value is the zoning parcel no. 107 block-15. The value of this parcel was calculated as NV 31.00. The zoning parcel with the highest value is the zoning parcel no. 108 block-21. The value of this parcel was calculated as 22,236.36 NV (Fig. 3). The zoning parcel with the highest unit value is 101 block-1 zoning parcel, and its value was calculated as 39.65 NV. According to the results of the frequency analysis, the nominal values of the development plots vary between 3368.18NV and 22,236.36 NV.

In the valuation approach applied by using the current market TL values of the zoning parcels formed after the arrangement, the zoning parcel with the least value is the zoning parcel no. 107 block-9, and its value is 9024.54 TL. The parcels with the least unit value are the parcels of the blocks 106 and 107. The values of all parcels on these blocks are determined as 85.00 TL. The zoning parcel with the highest TL value is the zoning parcel no. 108 block-21, and its value is 62,932.50 TL. The zoning parcels with the highest unit value are the parcels on the 109, 110, 111 and 112 blocks. The unit values of the parcels on these blocks are determined as 105.00 TL.

Amounts of deductions resulting from different distribution methods

In order to apply the methods based on value equality and to make distribution in the field, the values of BA and AA parcels must be determined (Ispir 2006). Therefore, within the scope of the study, zoning parcels were produced based on the allocation method according to the parcel. As a result of the distribution process, when an area equivalent to the cadastral parcels was allocated, it was observed that the number of parcels with shares increased. The main reason for this situation is that BA parcel areas are large and these parcels have full shares.

Within the scope of the study, the current zoning application was first applied to the cadastral parcels included in the regulation. Since this application is based on the principle of ‘equal rate’ deductions, 36.5172433% of the area was deducted from each parcel as a free participation fee. After this deduction amount was deducted from the parcel area that entered into the regulation, the distribution process was started. In the application methods made on the basis of ‘equivalence’, on the other hand, BA and AA parcel values were allocated by calculating nominal values and current market TL values. When the applied methods are compared, it has been determined that while the same rate of deduction is made from each parcel in the method based on the ‘equivalence’ principle, ‘the same deduction is not made from each parcel included in the regulation’ in the methods based on the ‘equivalence’ principle (Table 5).

The reason for this situation can be explained as making the participation parcels and distribution parcels equal in value. In other words, this rate will vary according to how much more or how little land is allocated to a cadastral parcel. In the application made on the basis of ‘area’ and ‘value’, it was observed that the amount of allocation for the cadastral parcels included in the regulation was close to each other in some parcels, but quite different in some parcels. The total area difference between the allocation amounts made in the nominal valuation method and the allocation amounts made on the basis of area was −877.49 m2. The difference between the application made using the current market TL values of the parcels and the allocated surface area in the application made based on the area was calculated as −917.05 m2.

In order to allocate AA zoning parcels equal to the value of the parcels, no free deduction should be made from each parcel as a contribution fee. In the study, a deduction was applied according to the allocated zoning parcel value for each cadastral parcel. For this reason, different deduction amounts were applied according to the amount of value increase in each parcel included in the arrangement. In the zoning application made using nominal values, the minimum amount of deduction was 14% in the cadastral parcel no. 362 block-62, and the maximum amount of deduction was 60% in the cadastral parcel no. 362 block-5. The reason for the emergence of this situation is that the cadastral parcel no. 362 block-5 is allocated more land than it deserves, and an area with a value close to the progress payment is allocated to the cadastral parcel no. 362 block-62. In addition, in the zoning application made by using the TL values of the parcels, the minimum deduction was 28% in the cadastral parcel no. 362 block-66, while the maximum deduction was made from the cadastral parcel no. 362 block-6 at the rate of 56%. The difference between the deduction rates in these two different application methods shows that the greater the difference between the distributed parcel value and the cadastral parcel value, the deduction rate will increase in direct proportion. The opposite situation is also true. Equal deductions made from each parcel included in the regulation in zoning applications cannot fully meet the value increase in the zoning parcels after the arrangement. The area of the zoning parcels allocated to the cadastral parcels should be different in order to ensure the parity of the parcel value.

Value analysis of outgoing areas due to the zoning plan

In zoning applications, with the deduction of Rearrangement Participation Share (RPS) and the areas reserved for general services, an area deduction is made at the same rate from each cadastral parcel entered into the arrangement. When the property-zoning plan was examined, it was seen that some parcels entered the general service areas, while some parcels partially entered (Fig. 4). When a ‘value-area comparison’ is made for the areas of cadastral parcels that go to public services, there have been differences in value and area in each cadastral parcel that entered the arrangement. Each cadastral parcel, which is regulated within the application area, is different from the area it gives to public services, regardless of the rearrangement participation share. The emergence of this situation is entirely due to the data of the zoning plan. Since the remaining area is allocated after deducting the rearrangement participation share in the applications made on the basis of the area deduction, it is not seen as a problem that the areas going to public services due to the zoning plan change. However, while the areas going this way are high in some parcels, they are very few in some parcels. These areas vary between 2781.16 m2 and 8.76 m2 on the basis of parcels in the study area. Likewise, when the value equivalents of these areas are calculated, it is seen that while there is a lot of loss in some parcels, this situation is minimized in other parcels.

When the value is compared for the free deduction made from the parcel included in the arrangement and the areas given to the public services due to the location of the parcel in the plan, there is a nominal value difference of 10,594.92 between the two values. In addition, the difference in the TL value of these fields was calculated as 46,322.76 TL. That is, less value fields are interrupted in the iso-ratio method. For example, the value gain of the cadastral parcel no. 362 block-1, which entered into the arrangement, was 5.66%. This parcel benefited from RPS and became a more valuable parcel. However, the depreciation of the cadastral parcel number 362 block-2 next to it was determined as −4.67%, and the deduction without charge was found to be harmful. When these value differences are examined, there is a loss or gain in value between +99.09% and −152.27% (Table 6). Percentage differences were found to be the same in both valuation approaches.

Generating mathematical models with different valuation methods

Academic studies to determine the real estate values by using a mathematical model for zoning practices in the urban area continue to be developed (Yalpir 2018). For this purpose, statistical methods such as ‘hedonic regression model’ or ‘multiple regression analysis’ have been used for a long time (Eckert 2006). Regression analyses are used to determine whether there is a functional relationship between different variables. Especially in real estate valuation, it is one of the classical methods used to determine the degree of importance of the factors affecting the value against each other (Rossini 1998; Isakson 2001; Yalpir et al. 2006, 2014; Morano and Tajani 2013). According to Aydın (2014), ‘the causal relationship between one or more explanatory variables and a respondent variable is called regression analysis’. The formula (3) is used for regression analysis. Studies generally follow the relationship between variables. For example, it can be used to investigate the effect of the criteria affecting the value of a real estate (school, city center, social reinforcement areas, etc.) on the real estate value.

A: Responsive factor

X: Explanatory factors

k: Number of factors

ε: Random error

Multiple regression analyses were conducted in order to examine how much the factors used in determining the value of a parcel explain the parcel unit values according to the nominal valuation method in the study area. Multiple regression analysis is an accepted and widely used method used for this purpose in the literature (Zurada et al. 2011). Within the scope of the study, the parcel values before and after the arrangement were determined by using different numbers of variables. In addition, since the zoning parcel values will differ according to the values of the cadastral parcels, they should be evaluated separately. Therefore, separate mathematical models should be determined for BA and AA. For the cadastral parcels within the scope of the study, the dependent variable was ‘parcel unit value’, and the independent variables were ‘topography, street access, parcel shape, availability of public services, welfare level, distance from the highway, soil type, available resources, parcel zoning status and number of parcel owners’. The soil type variable was excluded from the model due to its high correlation on the land value and contributing 1% to the model, and the model was created with the variables specified in the table. It has been understood that the variable of ‘parcel value’, which is one of the independent variables, explains its variance by 49%, that is, ‘the value of the land is 100% shaped by these factors’. In the study, first of all, the relationship between the factors affecting the value of the cadastral parcels and the unit value was examined, and it was determined that all variables were ‘significant’ at the p<0.01 level. According to this result, the BA cadastral parcel values can be formulated as follows:

‘BA parcel value = parcel area (m2)*( 4.407+(1.015*topography)+(1.001*exit to the Street)+(1.000*parcel shape)+(1.001*presence of public services)+(1.001*prosperity level)+ (1.008*distance to existing highway)+(0.993*available resources)+(1.002*parcel zoning status)+(1.004*parcel ownership number))’.

For the zoning parcels to be produced at the end of the application, the parcel unit values were chosen as the ‘dependent variable’, and all the variables affecting the parcel value after the arrangement were associated as ‘independent variables’. Exit to the street, land use area, distance to the city center, distance to harmful areas, soil type, distance to shopping center, distance to health services, distance to railway, distance to fire station, distance to police station, allowed number of floors and noise variables; since they have the same values in all parcels, they showed a high correlation with the parcel unit value and were not included in the model in the ‘enter’ method. In addition, it was understood that the variables included in the model explained 100% of the variance of the ‘parcel unit value’ variable, that is, ‘the plot value is shaped by 100% of these factors’. In the created mathematical model, the maximum contribution to the unit value was given by the topography variable. Within the scope of the study of the zoning parcels formed after the arrangement, the variables that will form the model with the ‘parcel unit value’ are as follows: distance to worship centers, distance to green areas, location within the island, distance to highway, parcel front, distance to education centers, topography and parcel shape. The relationship between these variables and the parcel unit value was significant at the p<0.01 level. Other factors affecting the value were not included in the model because they were highly correlated with each other. Therefore, the mathematical model for AA parcel values can be formulated as follows:

‘AA parcel value = parcel area(m2)*(21.215+(0.999*block location)+(1.002*parcel front)+(0.997*parcel shape)+(0.990*distance to education centers)+(0.961*to the highway) distance)+(1.003*distance to green areas)+(1.002*topography)+(1.078*distance to worship centers))’.

Integration of the values calculated according to the nominal valuation method into the monetary (TL) values of the immovables is possible with the regression analysis. Using both methods together will help to determine the real estate values with multiple criteria. By this way, more accurate and reliable value determination will be provided. BA parcel values should be evaluated within themselves, and AA parcel values should be evaluated within themselves. Thus, both value factors and current market TL values will be used in determining the values of real estates. For this purpose, unit values calculated using the factors affecting the value will be defined as the independent variable, and TL values of the parcels will be defined as the dependent variable. This method of application will be made separately for BA and AA parcels. Accordingly, regression models based on calculating the TL values of real estates according to the factors affecting the value can be formulated as follows:

‘BA parcel value (TL) = parcel area (m2)*((11.603+0.472*parcel nominal unit value±0.168)’.

For example, before the land arrangement, the nominal unit value of the cadastral parcel no. 362 block-66 was calculated as 20.19 NV. The current unit value of the same parcel is calculated as 24.00 TL. In addition, the land area is 5001.26 m2. When the values are entered according to the created mathematical model, the value of the cadastral parcel no. 362 block-66 will be calculated as 106,530.24 TL.

‘AA parcel value (TL)= parcel area (m2)*((66.264+1.000*parcel nominal unit value±0.227)’.

For example, after the land arrangement, the nominal unit value of the zoning parcel no. 101 block-1 was calculated as 39.65 NV. The current unit value of the same parcel is calculated as 24.00 TL. In addition, the land area is 428.63 m2. When the values are entered according to the mathematical model created, the immovable value of the 101 block-1 development parcel will be calculated as 44,209.33 TL after the land arrangement.

As a result of the multiple regression analysis, there will not be large differences between the values of the variables that define the parcel value in the study area, because the parcels are close to each other in terms of location. If this method is applied to parcels that are far from each other, a difference in variable values is observed. In addition, the rate of defining the parcel value of these variables is shown as a coefficient in multiple regression models. In multiple regression analysis, the correlation values of the criteria that make up the model and the calculation methods of the variables that define the parcel value have taken their place in the literature (Gungor 2019).

Conclusions

It has been determined that the areas of zoning parcels allocated to the cadastral parcels applied during the distribution phase of the ‘zoning application with the content of regulation’ studies, which are both on the basis of proportionality and equivalence, differ. In other words, it has been observed that there is no development parcel area that is equivalent to the value of cadastral parcels. Comparative analyses were made to show that the increase in value after the regulation was not equally reflected to all property owners, in the application based on the current proportionality principle. According to these analyses, it has been observed that each cadastral parcel participating in the implementation is not affected by the arrangement work at the same rate. This situation is against the principle of ‘equality’ legally.

In many land arrangements made in Turkey, it has been concluded that although the Rearrangement Participation Share (RPS) deduction is made specifically for the cadastral parcel, the development parcel is not allocated equal to the intrinsic value of the same parcel, and this injustice will be resolved by determining the unit value of the parcel included in the arrangement as the distribution value. In the method based on value equality, it can be said that the reason for the difference in the parcel values that entered the regulation and that occurred after the regulation is the general service areas included in the plan and allocated to the public free of charge. It has been seen in the study that it would be technically and legally more correct to implement the zoning applications according to the ‘equivalence’ approach based on value equality, compared to the application in the current/applicable ‘equivalence’ approach. It is also clear that this approach will eliminate many problems. The solution of many problems that arise in practice will be possible by the creation of sustainable city plans and the implementation of these plans within the methods based on value equality.

The fact that the real estate valuation model has not been fully established in Turkey also negatively affects the land and land valuation studies in urban area development practices. In this process, the valuation methods of countries that are successful in value-based practice can be applied as a model in Turkey, because the value of a real estate and the factors affecting the value should be the same for all societies (Stelling 2014). It is likely that all these property problems will disappear with the transition of the zoning application process involving land and land arrangement from the ‘area-based’ method to the ‘value-based’ method. In addition, expert personnel and valuation commissions should take part in real estate valuation and zoning implementation studies based on these data, and this should be legalized by laws.

References

Arendt Randall G (2014) Clarifying the conservation subdivision design approach. Planetizen.

Aydın D (2014) Uygulamalı regresyon analizi/ kavramlar ve R hesaplamaları. Nobel Akademik Yayıncılık, Ankara.

Bender A, Din A, Hoesli M, Brocher S (2000) Environmental preferences of homeowners, further evidence using the AHP method. J Prop Invest Financ 18(4):445–455

Bovkir R, Aydinoglu AC (2018) Providing land value information from geographic data infrastructure by using fuzzy logic analysis approach. Land Use Policy 78:46–60

Bunyan Unel F, Yalpir S, Gulnar B (2017) Preference changes depending on age groups of criteria affecting the real estate value. Int J Eng Geosci 2(2):41–51

Cakır P, Sesli AF (2013) Arsa vasıflı taşınmazların değerine etki eden faktörlerin ve bu faktörlerin önem sıralarının belirlenmesi. Harita Teknolojileri Elektronik Dergisi 5(3):1–16

Colkesen I, Sesli FA, Akyol N (2007) Avrupa Birliği’ne uyum sürecinde Türkiye’deki arsa ve arazi düzenlemeleri uygulamaları. TMMOB 11. Turkey Scientific and Technical Chamber of Survey and Cadastre Engineers Conference, 02-06 April 2007, Ankara.

Droj L, Droj G (2015) Usage of location analysis software in the evaluation of commercial real estate properties. Procedia Econ Finance 32:826–832

Eckert J, (2006) Computer-assisted mass appraisal options for transition and developing countries. In: International Studies Program, Working paper 06-43 Andrew Young School of Policy Studies. Georgia State University.

Ertas M, Inam S (2005) Arazi ve arsa düzenlemesi çalışmalarında değer artışına göre katılım payı uygulaması, TMMOB 10. Turkey Scientific and Technical Chamber of Survey and Cadastre Engineers Conference, Ankara-Türkiye

Gokce D, Salali V (2014) Kentsel dönüşümde “eşdeğerlik” ilkesinin önemi. Süleyman Demirel Üniversitesi Fen Bilimleri Enstitüsü Dergisi 18(1):55–65

Gungor R (2019) Kentsel alan düzenleme çalismalarinda değer esasli uygulama. Master Thesis, Konya Technical University, Institute of Science,Konya.

Hawkins CV (2014) Landscape conservation through residential subdivision by laws: explanations for local adoption. Landscape and Urban Planning, 121

Inam, S (1993) Kentsel alan düzenlemelerinde alternatif bir uygulama yöntemi, Selçuk University, Institute of Science, PhD Seminer, Konya.

Isakson HR (2001) Using multiple regression analysis in real estate appraisal. Apprais J 69(4):424–430

Ispir G (2006) İmar uygulamalarında değer farklılıkları ve dağıtım. Master Thesis, K.T.U. Institute of Science,Trabzon.

Kamau GCM J(2010) Computer-assisted analysis of the impact of location on residential property value: a case study of Nairobi, Kenya. The Appraisal Journal, 210.

Kocoglu M (2019) Değer esaslı arsa düzenlemesi modeli ve ülkemizde uygulanabilirliği. Master Thesis, K.T.U. Graduate Education Institute, Konya

Kryvobokov M (2005) Estimating the weights of location attributes with the Analytic Hierarchy Process in Donetsk, Ukraine. Nordic J Surveying Real Estate Res 2(2):5–29

Mohamed R (2017) Why might developers be reluctant to build conservation subdivisions? Insights from spatial regression analysis. Urban Aff Rev 54(6):1170–1190

Morano P, Tajani F (2013) Bare ownership evaluation Hedonic price model vs artificial neural network. Int J Business Intelligence Data Mining 8(4):340–362

Nisanci R (2005) CBS ile nominal değerleme yöntemine dayalı piksel tabanlı kentsel taşınmaz değer haritalarının üretilmesi. PhD Thesis, Karadeniz Teknik University, Institute of Science, Trabzon.

Pagourtzi E, Assimakopoulos V, Hatzichristos T, French N (2003) Practice briefing real estate appraisal: a review of valuation methods. J Prop Invest Financ 21(4)

Rossini P (1998) Improving the results of artificial neural network models for residential valuation. Fourth Annual Pacific-Rim Real Estate Society Conference Perth, Western Australia, 19–21 Jan.

Stelling W (2014) Methods of valuing real estate in Germany. Revista Minelor/Mining Revue 20(3):39–47

Swango D (2016) Land uses and value—resources on corridors, land use regulation and retail leases. Apprais J 3(1):151–162

Ulger NE (2010) Türkiye’de arsa düzenlemeleri ve kentsel dönüşüm. Nobel Yayın Dağıtım, Ankara.

Wang WQ, Dong WH, Liu XD (2015) Real estate appraisal model based on ANN and its application. Int Conf Netw Secur Commun Eng NSCE 2014:413–416

Yalpir S (2007) Bulanık mantık metodolojisi ile taşınmaz değerleme modelinin geliştirilmesi ve uygulaması: Konya örneği. PhD Thesis, Selcuk University, Institute of Science Konya.

Yalpir S (2018) Enhancement of plot valuation with adaptive artificial neural network modeling. Artif Intell Rev 49(3):393–405

Yalpir S, Ekiz M (2017) Eşdeğerlilik esaslı arazi ve arsa düzenlemesinde analitik hiyerarşi prosesinin kullanımı. Ömer Halisdemir Üniversitesi Mühendislik Bilimleri Dergisi 6(1):59–75

Yalpir S, Ozkan G, Tezel G (2006) The investigation of usability of artificial neural networks in the determination of residential real estate prices. The Association for Modeling and Simulation in Enterprises AMSE, Turkey.

Yalpir S, Durduran SS, Unel FB, Yolcu M (2014) Creating a valuation map in GIS through artificial neural network methodology: a case study. Acta Montan Slovaca 19(2):79–89

Yildiz F, Ozkan G, Yalpir S, Yildirim H, Gokmen A, Oztas M (2008) Alan düzenleme ana uygulama esaslarının belirlenmesinde değer eşitliğini esas alan modellerin uygulaması üzerine bir Araştırma. Jeodezi, Jeo-informasyon ve Arazi Yönetimi Dergisi 2(99):1–14

Yilmaz A (2016) İmar uygulaması değerlendirme çatkısının oluşturulması ve değer esaslı uygulama modelinin ülkemize uyarlanması, Yıldız Teknik Universty, Graduate School of Natural and Applied Sciences, PhD Thesis, 355s, İstanbul.

Yilmaz A, Demir H (2017) Değer esaslı imar uygulamaları üzerine soru ve cevaplar. TMMOB 16. Turkey Scientific and Technical Chamber of Survey and Cadastre Engineers Conference, Ankara.

Yomralioglu T (1993) Arsa ve arazi Düzenlemesi için yeni bir uygulama şekli. Harita ve Kadastro Mühendisliği 73:30–43

Yomralioglu T (1997) Eşdeğer ilkesine dayalı arsa ve arazi düzenlemesi modeli. JEFOD-Kentsel Alan Düzenlemelerinde İmar Planı Uygulama Teknikleri, Trabzon-Türkiye, pp 139–152

Yomralioglu T, Nisanci R (2004) Nominal asset land valuation technique by GIS. In FIG Working Week. Athens, Greece. 22-27 May.

Yomralioglu T, Nisanci R, Yildirim V (2007a) An implementation of nominal asset based land readjusment. In FIG Working Week. Hong Kong, China. 13-17 May.

Yomralioglu T, Nisanci R, Uzun B (2007b). Raster tabanlı nominal değerleme yöntemine dayalı arsa-arazi düzenlemesi uygulaması, TMMOB 11. Turkey Scientific and Technical Chamber of Survey and Cadastre Engineers Conference, Ankara.

Zeng Z, Cleon C, B (2018) Factors affecting the adoption of a land information system: an empirical analysis in Liberia. Land Use Policy, 73(1037): 353–362.

Zurada J, Levitan AS, Guan J (2011) A comparison of regression and artificial intelligence methods in a mass appraisal context. J Real Estate Res 33(3):349–387

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author(s) declare that they have no competing interests.

Additional information

Responsible Editor: Amjad Kallel

This study was produced from the master’s thesis, prepared by Ramazan GÜNGÖR and approved by Konya Technical University Graduate Education Institute, on 02.08.2019.

Highlights

• Examining the value-based problems that arise in the implementation of the zoning plan

• Necessity of regulation studies based on value equality in urban areas

• Availability of different valuation methods in zoning applications with arrangement content

Rights and permissions

About this article

Cite this article

Güngör, R., İnam, Ş. Value-based application in urban area design studies. Arab J Geosci 14, 1637 (2021). https://doi.org/10.1007/s12517-021-07980-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12517-021-07980-w