Abstract

The Indian sugar industry, second largest in the world, is a key driver of rural development, supporting India’s economic growth. The industry is inherently inclusive supporting over 6 million farmers and their families, along with workers and entrepreneurs of over 550 sugar mills, apart from a host of wholesalers and distributors spread across the country. Contribution of sugarcane to the national GDP is 1.1% which is significant considering that the crop is grown only in 2.57% of the gross cropped area. In India sugar is an essential item of mass consumption, and the domestic demand is around 25 million tonnes per annum. Sugar and jaggery are the cheapest source of energy, supplying around 10% of the daily calorie intake. Sugarcane has been projected as the crop for the future, contributing to the production of not only sugar but also a renewable source of green energy in the form of bioethanol, bioelectricity and many biobased products. The industry produces 350–365 million tons (Mt) cane, 25–27 Mt white sugar and 6–8 Mt jaggery and khandsari every year. Besides, about 2.7 billion litres of alcohol and 5500 MW of power and many chemicals are also produced. The industry is able to export around 3200 MW of power to the grid. The major challenges for sugarcane agriculture is static sugarcane productivity (70 tons/ha) and sugar recovery (10%) at national level. The Indian sugar industry is fully capable of meeting demand of potable alcohol as well as 5% blending in gasoline. Industry is gradually transforming into sugar complexes by producing sugar, bioelectricity, bioethanol, biomanure and chemicals. Emergent businesses like fuel ethanol, raw sugar and structural changes in global market have provided new horizons for the Indian sugar industry. The sector today not only has transformational opportunities that would enable it to continue to service the largest domestic markets but has also emerged as a significant carbon credit and green power producer and has potential to support ethanol blending programme of E10 and beyond. The sugar industry is gearing up to meet the challenges of 2030 through judicious integration of agro-technology, improved management practices, diversification and farmers’ friendly policies. The crop besides providing the food and energy needs of the country also contributes to employment and revenue generation, social development and environmental safety. Because of the manifold benefits from the crop and its wide and varied uses, sugarcane agriculture will remain a major contributor to the sustainable development of sugar industry in India.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Sugar industry, with an annual production capacity of more than 25 million tons, is one of the largest agro-based industries of India. Presently, India contributes 15% towards the global sugar production and 13% towards global sugar consumption. The industry plays a vital role in the rural economy of India and also has high potential source of renewable energy. It supports the livelihood of about 6 million farmers and their dependents and also helps in promoting the diversified ancillary activities. The Industry consists of more than 550 operational sugar mills, which are under different ownership and management structure. India was the fourth largest exporter of sugar in 2015–2016, with a contribution of 4.55% to the global export. Sugarcane occupies around 2.57% of the gross cultivated area in India (~5.0 Mha in 2016–2017), engaging a large mass of human resource in sugar mills, sugarcane fields and other ancillary industries. Approximately 7.5% of the rural population is engaged in sugarcane farming and related activities. Currently, the annual turnover of the sugar industry is around Rs. 90 thousand crores. Sugarcane crop and its products contribute about 1.1% to the national GDP which is significant considering that the crop is grown only in 3% of the gross cropped area. The contribution of sugarcane to the agricultural GDP has steadily increased from about 5% in 1990–1991 to 10% in 2010–2011. During the last two decades, the average annual growth of sugarcane agriculture sector was about 2.6% as against overall growth of 3% in agriculture sector in the country.

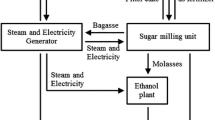

Apart from generating employment for the sugarcane growers, millers and other workers, the Indian sugar industry has been instrumental in accelerating the socio-economic development in villages through mobilizing rural resources. Many sugar factories have established schools, colleges, medical centres and hospitals for the benefit of rural population. This has again led to employment generation in these sectors, increase in income and overall improvement in basic facilities like transport and communication. A large number of sugar factories have diversified into by-product-based industries and have invested in and set up distilleries, organic chemical plants and fertilizer units, thereby promoting a number of subsidiary industries and contributing to economic growth. The Indian sugar industry has evolved into a green industry, self-sufficient in its energy needs and generating surplus exportable power through cogeneration. The crop has also emerged as a multi-product crop, being a source of basic raw material for the production of sugar, ethanol, electricity, paper and boards, besides a host of other ancillary products. The generation of electricity using bagasse has become a standard option for the sugar industry with the green tops and trash of sugarcane serving as important additional raw material for biomass. The use of bagasse as a substitute raw material for wood pulp in paper industry is vital for economic and environmental sustainability. Molasses is an important feedstock for the distilleries, and a large part of the ethanol requirement is met by the distilleries in the country. The ethanol requirement of the country is going up steadily and the crop has come up as an efficient feedstock for bioethanol, to meet the present and future demand for clean and renewable energy source. Thus, the industry has ample scope to evolve in the light of emerging opportunities in the various sectors.

In India, sugar is a prime requirement in every household. Almost 75% of the sugar available is consumed by sugar-based bulk consumers like bakeries, candy makers, sweet makers and soft drink and ice cream manufacturers. Industrial consumption of sugar is growing rapidly particularly from the food processing sector and sugar-based bulk consumers. A rising trend in usage of sugar could be attributed to greater urbanization, rising standard of living and change in food habit. The domestic consumption of sugar accounts for over 95% of sugar production in India, and jaggery and khandsari are mostly consumed by the rural population.

The current sugar production fulfils the domestic requirements with occasional surplus. Though India is the second largest producer of sugar, its export share is marginal due to large domestic demands, which is around 25–26 Mt. The importance of the sugarcane agriculture is that it is able to meet the huge domestic requirement, which otherwise would have necessitated massive imports. Domestic price of sugar in India is lowest among the world. The cost of Indian sugar production is estimated to be in the medium range—higher than Australia and Brazil but lower than that of USA. Extensive efforts are being made to reduce the cost of sugarcane production with improved field and milling technologies.

Indian Sugar Industry: An overview

Sugarcane is cultivated in 5.0 Mha in India (2016–2017 estimates). The mean cane productivity is around 70 t/ha with an average sugar recovery of approximately 10% (Table 1). The main sugar-producing areas of the country are spread over two major zones, the tropical and the subtropical zones (comprising of the southern and northern regions, respectively). The states of Uttar Pradesh, Punjab, Haryana, Uttarakhand and Bihar form the major sugarcane-growing states of the subtropical zone, while Gujarat, Maharashtra, Karnataka, Tamil Nadu and Andhra Pradesh form the major states in the tropical zone. Madhya Pradesh, Chattisgarh, Odisha, Pondicherry, etc., also contribute to the total sugarcane production to some extent. The major sugarcane-growing states, viz. Maharashtra and Uttar Pradesh, constitute approximately 65% of the total area under sugarcane cultivation.

The cane productivity and sugar recovery in the country demand improvement, with the average values much below that in the major sugar-producing countries of the world. The mean cane productivity in the subtropical region is less (~60 t/ha) when compared to that in the tropical region (~80 t/ha), partly due to the adverse climatic conditions in the subtropics. Many a times, sugarcane, an annual crop has to face extremes of climate throughout its life cycle. The extremely favourable climatic conditions that the crop enjoys in the tropical states are responsible to a great extent, for the good crop stand, better cane productivity and sugar recovery in this zone. A rough classification of the various sugarcane-growing states groups the states into different categories based on the average cane productivity and sugar recovery values (Table 2).

The Indian sugar industry is a collage of sugar mills of varying capacities with different ownership and management structures. Beginning from the establishment of the first sugar-manufacturing company by the Dutch in North Bihar in 1840, the industry has come a long way with more than 700 installed sugar factories across the country. The first modern sugar company was set up in 1903 by the British in Uttar Pradesh and Bihar, with a few vacuum pan units. Till 1930s, the sugarcane produced was mainly diverted for the production of Gur and Khandsari sweeteners. The better standard of living of the people and higher incomes led to a gradual increase in demand for white sugar, resulting in a spurt of sugar factories in the country. With the initiation of Five-Year Plans, the 1950s saw an elaborate planning in the industrial sector impacting the Indian sugar industry also. Specific targets for production and consumption were set, and sugarcane and sugar production gained momentum in the country. There had been several regulations or acts for fine-tuning the functioning of this important agro-based industry of the nation. The Essential Commodity Act, 1955, The Sugar (Control) Order Act, 1966, Levy Sugar Supply Control Order, 1979, Sugar Cess Act, 1982, Sugar Developmental Fund Act, 1982, etc., are a few among them. The industry witnessed another landmark development in 2013, in the form of deregulation and other associated reforms as per recommendations of the Rangarajan Committee headed by Dr. C. Rangarajan. The Cabinet Committee on Economic Affairs partially decontrolled the Indian sugar industry with other associated reforms. The panel also favoured a stable external trade policy regime with 5–10% tariff levels, phasing out of cane reservation areas, removing the minimum distance restriction between the mills and doing away with the mandatory jute packing of sugar in the mills. At present, the sugar industry comprises of sugar mills in the government sector, as well as in the private and cooperative sectors, with approximately 48% of the mills in the private sector.

There are 513 operational sugar mills (2015–2016) with a total of 716 installed mills (http://dfpd.nic.in). Out of the installed ones, approximately 46% is in the cooperative sector. The plant size of the mills varies from 2500 to 5000 TCD with many sugar mills expanding to up to 15,000 TCD. The total installed crushing capacity was 329.306 lac tons in 2014–2015, and the utilization capacity was ~86%. During 2015–2016, 230 Mt of sugarcane was procured from farmers by the sugar mills across the country. Besides, there are four sugar refineries in the country in the coastal belt of Kandla, Haldia, Kakkinada and Kutch, which produce refined sugar from imported raw sugar and also from indigenously produced raw sugar. Based on the existing levels of sugarcane availability, crushing capacity and sugar recovery, the country has a potential to produce more than 30 Mt of white sugar, with the tropical and subtropical belts having the potential of around 16 million Mt and 12 million Mt, respectively, for sugar production, every sugar season. The per capita consumption of white sugar in the country is estimated to be around 21 kg during 2015–2016. Another 5 kg/capita per annum sweetener consumption is from Gur/Khandsari products produced in the decentralized sector. The estimated Compounded Annual Growth Rate (CAGR) for domestic consumption of sugar is 2.63% during the last 10 years, which is more than the global average. This is attributable not only to the lower initial base but also to the ever-increasing disposable incomes. As per estimates, the share of bulk consumers in the sugar consumption basket ranges from 60 to 65% and the rest of the consumption is by individual households (Table 3). The decentralized sector which produces 6–8 Mt jaggery and khandsari also provides employment to rural population and has great export potential.

Apart from sugar, sugarcane also supplements the energy sector through biofuel production and cogeneration. Keeping up with the recent paradigm shift, most of the sugar factories have diversified into by-product-based industries and have invested in and set up distilleries, organic chemical plants, paper and particle board factories and cogeneration plants. The green energy production potential of the country by 2030 will be 10,000 MW, which is equivalent to ~50 million carbon credits. A total of 161 sugar mills presently have distilleries attached with the mills. These distilleries have a total capacity of about 2500 million litres per annum. In addition, there are independent distilleries operating on procured molasses making a total of 388 distilleries (STAI 2011). The present ethanol production by sugar mills comes to around 2500 million litres (Nair 2010). The energy demand in India is estimated to grow by 200% or more by 2030. The National Biofuel Policy proposes to scale up the ethanol blending of automobile fuel to 20% by 2017, with ~4400 million litre requirement of bioethanol.

India’s Trade in Sugar

India has been a net exporter of sugar. However, it has been occasional net importer of sugar depending upon demand and supply situation in the country. According to the Directorate General of Commercial Intelligence and Statistics (DGCIS), India’s export of sugar was highest in 2007–2008 and import was on its peak in 2009–2010. Import and export of sugar from 2005–2006 to 2013–2014 are shown in Table 4.

Sugarcane Pricing Policy

With the amendment of the Sugarcane (Control) Order 1966 in 2009 the concept of Statutory Minimum Price (SMP) of sugarcane was replaced with the ‘Fair and Remunerative Price (FRP) of sugarcane for 2009–2010 and subsequent sugar seasons’. The cane price announced by the Central Government is decided on the basis of the recommendations of the Commission for Agricultural Costs and Prices (CACP) after consulting the state governments and associations of sugar industry. Under the FRP system, the farmers are not required to wait for the end of the season or for any announcement of the profits by the sugar mills or the government. The new system also assures the margins on account of profit and risk to farmers irrespective of the fact whether the sugar mills generate profit or not and is not dependent on the performance of any individual sugar mill. In order to ensure that higher sugar recoveries are adequately rewarded and considering variations among sugar mills, the FRP is linked to a basic recovery rate of sugar with a premium payable to farmers for higher recoveries of sugar from sugarcane. There are differences in the cost of production, productivity levels, and also as a result of pressure from farmers’ groups, some states like Uttar Pradesh, Punjab, Haryana, Tamil Nadu and Uttarakhand declare state-specific sugarcane prices called State Advised Prices (SAPs) usually higher than the FRP.

Indian Sugar Industry: A SWOT Analysis

The Indian sugar industry has evolved through many challenges and threats, elevating India to position of the second largest sugar-producing country in the world (Anonymous 2010, 2013). The inherent peculiarities in the system and several other external factors form the basis of the present opportunities for the industry to grow in the face of the challenges and its own weaknesses. These strengths and weaknesses will guide the industry, enabling it to cash in on the opportunities to transform itself in the wake of the paradigm shift, to make the sugarcane cultivation, productive, profitable and sustainable (Anonymous 2013). Let us have a look at the strengths, weaknesses, opportunities and threats that drive the industry to excellence.

Strengths of Indian Sugar Sector

-

1.

Huge domestic consumption base for sugar and other by-products, thereby imparting relative insularity to the Indian sugar industry from global markets. The annual sugar consumption growth, the growing economy, the gap between the sugar consumption at the national and global levels and the estimated increase in population in the coming years point towards a very strong domestic market for its produce, be it sugar, ethanol, cogeneration or other products. This is further ascertained by the National Biofuel Policy which targets 20% blending of automobile fuel by 2020. Thus, there is bound to be an increasing demand for cane, with the domestic supply–demand scenario expected to be favourable for growth.

-

2.

Industry has a well-planned infrastructure in terms of machinery and has lowest process losses, and many factories supply power to state grid and generate biofuel (ethanol) to be blended in petrol. It has highly skilled and motivated work force. The industry is self-reliant in respect of its requirement of power and water.

-

3.

The sector has a potential to make the country to be self-reliant, dealing with the highly sensitive essential commodity of mass consumption. Sugar industry provides direct employment to over 0.5 million workers. It supports the integrated industries (cogeneration, ethanol, chemicals) by providing multiple raw materials.

-

4.

Sugar industry has been a focal point for socio-economic development in the rural areas by way of mobilizing rural resources, generating employment, providing higher income opportunity, and transport and communication facilities.

-

5.

The sugarcane and sugar production capacity is spread over two distinct agro-climatic zones, providing a buffer to the various challenges in these zones, especially the climatic extremes and biotic stresses.

-

6.

The research and development backbone is technically very strong with a well-spread network of research organizations aiding in the enhancement in cane production and productivity. The vast genetic resources available in the country also provide the much needed boost to the sugarcane improvement activities undertaken by the various organizations. The R&D Road Map and Vision 2030/2050 prepared by the national sugarcane research organizations serve as guideline for improving production, productivity and sustainability of sugar industry.

-

7.

A very strong cane management system is in place with the involvement of Information and Communication Technology (ICT). The present-day management system in the field and factory makes use of the GIS-based technologies, computer-based management tools like Sugarcane Information System (SIS), CaneDES for different management aspects including marketing of the produce.

-

8.

It generates replenishable biomass and uses it as fuel without depending on fossil fuel, and on the contrary, it generates additional energy by processing its raw material which is a unique feature of this industry.

-

9.

The Indian sugar industry has most modern milling plants with adequate provision for expansion, and industry has a well-planned infrastructure in terms of machinery and has lowest process losses.

-

10.

Sugarcane farmers are well looked after in terms of new varieties, seed cane and other inputs required for sugarcane crop. Sugarcane farmers are assured for procurement of their cane irrespective of its quality.

Weaknesses

-

1.

Stagnant levels of sugarcane yield and sugar recovery The sugarcane productivity and sugar recovery at the national level have been static for the past few decades. The mean cane productivity has been hovering around 65–70 t/ha, with the average sugar recovery stagnating around 10%. This is far below that in the other sugar-producing countries of the world with similar agro-climatic conditions.

-

2.

High production costs The cost of cultivation of sugarcane is comparatively high, with the costs falling within a range of Rs. 70,000–Rs. 1,80,000 per hectare. This has adversely affected the economic security of the sugarcane growers in the country. The production cost of sugar in India is also high (Rs. 34–37/kg of sugar produced) compared to that in other sugar-producing countries of the world.

-

3.

Small scattered land holdings Approximately 70% of the sugarcane growers in India fall under the small and marginal category, with less than 1.0 ha of land. This poses a great challenge to the application of innovative agro-technologies, including mechanization and also for effective transfer of technology.

-

4.

Huge gaps in implementation Many a times there is a huge gap between the conceptualization and implementation of administrative reforms and also of application of advanced scientific technologies. The accompanying difficulties are compounded by inadequate extension support.

-

5.

Technical deficiencies at the factory level A major chunk of the operational sugar mills have a capacity in the range of 2500–3000 TCD with a few having capacities up to 5000 TCD. Very few mills have been upgraded to 7500–15,000 TCD. The technical upgradation of the sugar mills still needs attention, and the stand-alone sugar mills in the industry also add to the existing woes.

-

6.

Idling capacities Shortage of raw material, i.e. sugarcane, leading to underutilization of the installed capacities is another bane of the industry. Thus, the crushing period is shortened with most of the sugar mills having a crushing period of around 100–120 days in the subtropics and that of 140–160 days in the tropics.

-

7.

Cane payment is based on tonnage not on sucrose which is extracted in the mill and determines the profitability.

-

8.

The state governments also exercise control over supply and distribution of sugarcane as an agricultural crop. The state governments announce SAPs for sugarcane in respect of cane supplied to mills within their boundaries. The SAPs which mills are required to pay are generally substantially higher than the SMP.

Opportunities

-

1.

Vast untapped potential for resource utilization Even though at an enviable second position with respect to sugarcane production at the global level, the mean cane productivity in India is very low compared to that in other countries like Brazil. A lot of scope exists for better utilization of land and other resources, including technological inputs, for improving the cane productivity as well as the sugar recovery. Improved, sustainable and cost-effective technologies can be put to use on a large scale for realizing enhanced productivity and recovery, thereby achieving economic as well as nutritional security.

-

2.

Huge scope for diversification The shift to the concept of “Sugar-Agro-Complexes” and the increasing environmental consciousness have enhanced the demand for green energy and use of clean and green fuels. Cogeneration and also other value-added streams have become significant in the present-day scenario. With the Ethanol Blending Programme of the Government just beginning to take off as per the National Biofuel Policy of the Government and the huge untapped cogeneration potential (50%) of the mills, this area of diversification presents great opportunities for the sector to grow. Biopharming to produce other by-products like bioplastics also is an emerging area, which needs to be exploited by Indian sugar industry.

-

3.

Huge operational capacities and emerging number of upcoming capacities The existing capacities and several newly set-up high-capacity sugar mills offer ample opportunities to enhance the quality of operations keeping up with the growing demand.

-

4.

Niche sugar products Sugarcane agriculture being a labour-intensive sector, with human labour forming a significant workforce, great opportunity emerges, especially in the area of “niche products” like organic sugar, involving the organic cultivation of sugarcane (a human resource-intensive domain). The industry needs to cash in on such peculiarities inherent to the system and should explore other areas also, like the Fair Trade Sugar niche.

Threats

-

1.

Competition from other remunerative crops The huge cane price arrears to farmers and support to other crops may force many of the sugarcane growers to shift to more remunerative crops. This may lead to a permanent replacement of sugarcane by these crops.

-

2.

Climate change and other threats The unpredictable changes in weather during specific stages like ripening, crushing period will adversely affect the cane productivity and sugar recovery. The adverse effects of climate change also are an important threat for sugarcane cultivation.

-

3.

Delicately poised production–consumption situation A shortfall in the supply of sugarcane to the mills will result in underutilization and huge monetary losses to the mills, leading to a stagnation of sugar production. This in turn will lead to a failure to meet the domestic sugar demands. This will be critical to the food security.

-

4.

Poor morale of the sector The uncertainties arising out of the sugar cycle, the resulting financial crisis for the mills, the mounting cane arrears to growers, the underutilization of mill capacities due to shortage of raw materials will invariably lower the morale of the sector as a whole, unless these are tackled with suitable strategies.

Sugar Vision 2030

The Indian sugar industry has been capable of meeting the sugar demand of the nation, the most populated in the world (1.34 billion), with occasional surplus. With a vision for achieving high economic growth, improving cane productivity along with sustainability and contributing to the nation’s food and energy needs, the industry explores all available options to realize this vision, simultaneously meeting the growing domestic demands and enhancing farmer–miller relationships. The industry has a strong backbone of research and development support, with a vast network of research organizations and related establishments, enabling the country to meet the huge domestic requirement, which otherwise would have warranted massive imports.

The consumption of sugar in India has been growing at a steady rate of around 3% potential upside from a demand standpoint. Sugar consumption in the next 5 years is expected to touch 30 Mt due to improved domestic supplies and strong demand, fuelled by a growing population and continued growth in economy. About 60–65% of the sugar demand comes from the bulk consumers such as bakeries, candy, local sweets, and soft drink manufacturers. Most of the khandsari sugar is consumed by local sweets manufacturers; jaggery is mostly consumed in rural areas for household consumption and feed use. The population in the country is set to reach 1.50 billion by 2030 at the present compound growth rate of 1.6% per annum. The projected requirement of sugar for domestic consumption in 2030 is 36 million tonnes (Table 4), which is about 50% higher than the present production. To achieve this target, the sugarcane production should be about 500 Mt from the current 350 Mt for which the production has to be increased by 7–8 Mt annually. The increased production has to be achieved from the existing cane area through improved productivity (>100 tons/ha) and sugar recovery (>11%) since further expansion in cane area is not feasible. In view of the high cost of imports and the strategic importance of food security, India would need to target its production in excess of domestic consumption. The emerging need for energy will require additional ethanol for blending in petrol, and it is presumed that all possible routes of ethanol production, viz. molasses, direct fermentation of cane juice and cellulosic ethanol, will be utilized to meet the demand. Besides, the demand for integrated industries like paper, pulp, energy and other alternative sweeteners also has to be taken into account. According to our estimates, around 600 Mt of sugarcane, 125–140 Mt bagasse and 18–20 Mt molasses will be needed to have exportable surplus of sugar and meet the requirements of integrated industries (Table 5).

The projected sugar requirement for 2020 is 28.50 Mt which the country has achieved in 2006–2007, even though the production could not be sustained in the subsequent years, due to several reasons. This is an indication that, even though the prevailing varieties, agro-technologies and processing technologies are good enough under normal circumstances, to achieve the projected target, renewed efforts need to be in place to overcome the emerging challenges like various biotic and abiotic stresses, climate change leading to variation in rainfall distribution and other related weather parameters so that the pace of growth can be sustained, to meet the projected targets for future.

The government has set up SDF under SDF Act, 1982 for financing ISI. The sugar mills are required to pay for levy of cess, which currently is Rs. 24 per quintal of sugar manufactured to the Consolidated Fund of India. The GoI uses the SDF primarily for advancing loans to facilitate the rehabilitation and modernization of any sugar factory. Fund can also be used to build up and maintain buffer stocks of sugar. The SDF loan is also available to sugar mills for R&D.

Major Constraints in Sugarcane Production

The sugarcane-growing area in India comprises of two distinct zones with a wide array of agro-climatic conditions—the tropical zone and the subtropical zone. The tropical zone accounts for approximately 44% of the area, and the subtropical zone occupies 56% area. The tropical India enjoys very favourable weather conditions for the luxurious growth of the crop, with well-distributed even sunshine all through the year. In the subtropics, the crop experiences pronounced winter, which affects sprouting and growth, and also erratic rainfall, drought and low/high temperatures during late season. Consequently, the productivity in the subtropical regions is relatively low compared to the tropical regions. The average yield in tropical India is about 80 t/ha and about 60 t/ha in subtropical India. At the national level, productivity hovers around 70 t/ha/year. The average sugar recovery in the country is about 10%, with Maharashtra State leading the table with the highest recovery of over 11.3%, mostly due to the ideal climatic conditions for sucrose accumulation prevailing in the state. Despite being the second largest producer of sugar, Indian export share is minimal due to huge domestic demands and occasional fluctuations in sugar production, making it an unstable player in the global sugar market.

Wide Gaps in Cane Productivity

As mentioned before, there is a wide gap in cane productivity between the tropical and the subtropical regions of the country, the former averaging about 80 t/ha and the latter 60 t/ha. This in turn leads to lower cane productivity at the national level. The major factors contributing to the static or low productivity are varietal deterioration, decline in soil productivity and biotic and abiotic stresses, climatic vagaries, etc. Besides, technology adoption remains low in the major sugarcane-growing states, especially in North India. The potential yield and the yield levels achieved at present in the various states/regions also exhibit huge differences, without exception. The experimental maximum yield in sugarcane is 325 t/ha, which is hardly achieved, though individual farmers have reported yields close to this. However, the existing varieties and technologies developed by our research organizations have helped in realizing record yields of 280 t/ha in tropics and 220 t/ha in subtropics at farmer’s field.

Suboptimal Sugar Recovery

In India, the mean sugar recovery percentage from the crop has been far below than that achieved by major sugarcane-based sugar producers with comparable agro-climate, like Brazil and Australia. The sugar recovery in different states has been hovering around 9.5–11.5%, with all India figures of around 10% while the potential is at least 11% in subtropical part and 13% in the tropical part of the country. In some states, cultivation of rejected/denotified varieties by the farmers has invariably led to reduced productivity and low sugar recovery. Rejected varieties occupy a major area (25–40%) in many mills. Some varieties with poor productivity and low sucrose content still occupy a sizeable area in northern states. The climatic aberrations during the ripening and crushing period, like western disturbances, increase in temperature and relative humidity, also bring about a fall in sugar recovery in different parts of the country.

Low Productivity of Ratoon Crop

The ratoon crop occupies a sizable proportion of the total area under cane cultivation, up to 50% of cane area in subtropical states like Uttar Pradesh. The major advantages of ratoons lie in its early maturity, lower cost of cultivation and high sugar recovery during early period of crushing. The productivity of ratoon crop is very low with its contribution to total cane production being around 30%. The yields are reduced due to several factors like use of poor ratooning varieties, inadequate ratoon management practices, poor crop stand, deteriorating soil health.

High Cost of Sugarcane Production

Sugarcane is a labour- and input-intensive long-duration crop. The cost of cultivation of sugarcane has gone up significantly due to the increase in cost of labour and other inputs. Cost of production in different regions varies from Rs. 70,000/ha to Rs. 1,80,000/ha (US$ 1000–2500/ha) depending upon the practices adopted and prevailing cost of inputs and labour. The spiralling cost of fertilizers and other inputs is another major expenditure in sugarcane agriculture. Harvesting operations account for more than 25% of the total cost of production mainly due to high labour cost and labour scarcity. Sugarcane agriculture can be sustained only if profitability can be ensured through reduction of cost of cultivation and improving productivity per unit area. This is possible only through mechanization and adoption of other related cost-effective technological interventions in cane agriculture.

Cyclicality in Cane Production

The cyclicality in sugarcane production has been the bane of Indian sugar sector. The Indian sugar industry lacks the flexibility of the Brazilian sugar industry, where the processing of cane for sugar or alcohol depends on the prevailing market trends with respect to these commodities, ensuring sustained growth and profitability of the industry. The year 2006–2007 witnessed the peak sugar production of 28.2 million tons in the country, with wide swings in the productivity values in subsequent years. With the duration of crushing period getting reduced, underutilization of the existing capacities has been a handicap, which adds to the production costs, apart from raw material costing issues. Thus, the industry ends up being out—placed in the world trade arena. Thus, in the years of surplus production, there is a glut leading to crash of domestic prices. The higher cost structure generally makes Indian exports non-competitive, and the country finds it difficult to export the surplus sugar. This leads to economic crisis for both growers and the mills, resulting in a fall in cane and sugar production in subsequent years. In the year of shortages, the fixed costs affect the balance sheets of the industry. This in turn leads to a delay in payment to farmers for their produce and accumulation of arrears, culminating in the infamous “sugar cycle”. The sugar production in India has fluctuated between 12 and 28 Mt during the last two decades. The central and state governments resort to several corrective measures including better cane prices, subsidies/taxes on export based on the ground situations to overcome the crisis.

Declining Soil Health

The declining soil fertility has been a matter of great concern with the content of soil carbon and other nutrients going down at an alarming rate. Organic C content is <0.3% in many sugarcane-growing regions with deficiencies in micronutrients also being prevalent in many soils. Continued monocropping of sugarcane for several decades has depleted the soil fertility considerably. Productivity of the soil has come down, and soil management concerns like physical, chemical and biological degradation are also becoming increasingly relevant.

Depleting Water Resources

Sugarcane is a water-loving crop, with an estimated average water requirement of 20 megalitres/ha under Indian conditions. The total consumptive use of water varies from 200 to 250 cm for sugarcane during the crop period. A part of this requirement is met through rainfall, and the remaining is through irrigation. With changes in precipitation pattern, the crop faces a water deficit which leads to overexploitation of irrigation resources. The most prevalent irrigation techniques like furrow/flood irrigation have a very low water-use efficiency of about 30–50%. The ground water levels are fast depleting in most parts of the country, and hence, the crop has to compete with the other staple food crops for the limited available water. Continued monocropping has also resulted in depletion of water resources at an alarming rate. Adoption of better water-use efficient irrigation practices like microirrigation and water management technologies are the need of the hour, since water is becoming a limited resource.

A Biotic Stresses and Their Impact on Sugar Productivity

A biotic stresses such as salinity, alkalinity, drought and water-logging affect cane production significantly in many states. Approximately 2.97 lakh ha of cane area is prone to recurrent drought, affecting the crop at one or other stage of growth, bringing down the yields by 30–50%. The losses can be as high as 70% in severe drought conditions. Floods and water-logging are serious problem in eastern UP, Bihar, Orissa, coastal Andhra and Kolhapur area in Maharashtra. Water-logging affects all stages of crop growth and can reduce germination, crop establishment, tillering and growth, resulting in yield reduction. About 7–8 lakh hectares of the total sugarcane-growing area is under saline conditions. Though the crop is moderately tolerant to salinity, the losses are significant.

Diseases and Pests

Sugarcane diseases and pests are major constraints to crop production throughout India, and losses due to disease are estimated to be about 10–15%. Among the diseases, redrot, smut, wilt and sett rot are the important fungal diseases. Bacterial diseases like leaf scald disease (LSD) and ratoon stunting disease (RSD) are found to cause considerable yield loss in certain regions. Viral diseases like mosaic, grassy shoot caused by phytoplasma are prevalent in all the states. However, severity of these diseases is felt in specific situations. Increased incidence of other diseases like yellow leaf disease (YLD), Pokka Boeng is being reported frequently. Incidence of borer complex, Pyrilla, scale insect, whitefly, termite, white grub and mealybugs has also increased. The change in disease and insect dynamics with the changing weather conditions is another challenge in the effective management of diseases and insect pests in this crop.

Impact of Climate Change on Sugarcane

The rise in temperature, increase in atmospheric CO2 concentration, changes in precipitation pattern, soil moisture depletion due to climate change will invariably lead to a decline in sugarcane and sugar production in spite of the comparatively climate change resilient nature of sugarcane crop. Hence, strategies to mitigate these changes need to be in place to ensure productivity, profitability and sustainability of sugarcane cultivation. High temperature is likely to impact plant growth, yield (a yield reduction of ~20–30%), increased weed competition, increased incidence of pests and diseases and most importantly juice sucrose content vis-à-vis recovery. The sucrose losses in standing crop (stand-over) and after harvest (post-harvest) are bound to increase due to high temperature. The industry needs to be aware of the impact of these changes right along the value chain, in order to minimize the losses arising due to climate change. It is also imperative that futuristic research strategies concerning improved cane production, sugar recovery and abiotic and biotic stress management be an inherent part of the R&D activities.

Sugarcane agriculture could be sustained only if profitability can be assured by reducing the cost of cultivation and improving the productivity per unit area. This is possible through new research innovations, mechanization and other technological interventions in cane agriculture. Keeping in mind the food and energy security concerns of the country and the limited cane area, systematic research and development efforts on sugarcane are of utmost importance, especially in subtropical region where cane yield and sugar recovery need to be improved substantially.

Opportunities for Sustainable Development

Sugarcane is the basic raw material for sugar production, while molasses and bagasse which are the by-products of sugar industry form the feedstock for ethanol production and cogeneration, respectively. The demand for sugar, ethanol and electricity is increasing due to growing population and rising per capita income. The increased production has to be achieved from the existing cane area through improved productivity and sugar recovery since further expansion in cane area is not feasible. The various opportunities arising out of the inherent situations need to be cashed upon, to bring about a quantum jump in the cane productivity and sugar recovery, resulting in a economically and environmentally sustainable domestic sugar sector.

Given the projected growth in domestic and international markets, the sector would need to produce at least 600 million Mt of sugarcane by 2030 to meet domestic requirement of sweeteners, bioelectricity and ethanol for E20 blending. Increase in sugar production would be primarily through productivity improvements and enhancement in milling capacity of existing mills. The sector has the potential to improve sugarcane yields to 100–120 t/ha and also to improve the recovery to 11.0–11.5% by 2030. This would enable the sector to produce additional 6.0 million Mt of sugar over and above the domestic requirements. The cane area will remain around 5.0 Mha, and this would also ensure minimal impact on other crops. A higher drawl or greater increase in farm productivity will also enable the target demand to be met, without any substantial increase in cane acreage. Technical upgradation of the existing sugar mills including enhancing the crushing capacities should also be a top priority so that the additional cane can be crushed. In order to improve sugarcane and sugar productivity per unit area, greater investments in research and development with respect to improved cane varieties, seed nurseries, biofertilizers and adoption of improved farm practices will be key imperatives.

To achieve the desired growth in area, productivity and recovery of sugarcane in different agro-ecological zones of the country and to extend appropriate information and technologies to the end users, the following key issues have been identified which are being addressed by our research institutions.

-

Low levels of cane yield and static sugar recovery,

-

High cost of cane cultivation,

-

Decline in factor productivity.

The possible scientific and technical interventions to address these issues are listed in Table 6.

The sugar industry needs to identify its specific priority areas for future research activities and collaborative programmes with the research institutes. The industry should play a greater role in funding research initiatives for cane and work closely with research institutes for setting a focused research agenda. Also, the government’s share of investment in agriculture in the areas of irrigation technologies, pest and disease management, seed and variety development, etc., needs to increase to enhance sugarcane productivity. The government has sponsored Sustainable Development of Sugarcane-Based Cropping System (SUBACS) in 22 states and union territories to help farmers to improve their production and productivity of sugarcane. Similar initiatives should be taken up by the government to enhance the profitability and sustainability of sugarcane agriculture and industry. It is clear from the SWOT analysis that the industry has ample opportunities for growth in the existing situations, and the sector needs to cash in on these using all possible options.

Cyclicality Management Options

The cyclicality in the Indian sugar sector has two components, the natural cyclicality due to climatic variations, biotic and abiotic stresses, etc., and induced cyclicality. Suitable policies by the government and their timely implementation can go a long way in managing the induced cyclicality in the sugar sector. The high sugar and sugarcane prices lead to increase in production at the cost of other crops. The resulting glut in the market and fall in prices impact the ability of mills to pay the farmers, leading to accumulation of arrears to the growers. Mounting arrears lead to a significant fall in cane cultivation in the next year, again resulting in high sugar prices and increased attractiveness of cane. The removal of arrears would also remove induced cyclicality, thereby reducing the incidence of surplus and deficit production phases. Economically, this would translate into reducing the incidence of excess inventory build up in surplus phases and the need for potentially costly imports and government support during deficit phases. Thus, ensuring the alignment between sugarcane and sugar prices would be the major policy imperative for managing cyclicality. The farmer’s monetary profit is impacted by the cane price, farm productivity and the cost of cultivation. The key controllable risks for farmers are the risks related to off-take of cane and non-payment of dues by the mills, and therefore, the farmer–miller relationship can have a significant impact on both these risks. This also ensures sustainability in sugarcane production.

Exploiting the Increasing Domestic Demands

The domestic sugar consumption in the country is estimated to be around 25 Mt (per capita consumption of approximately 21 kg/annum). It is expected that the GDP growth and population growth, the main drivers for consumption, would continue to grow at current rates, with a targeted sugar consumption of approximately 36 million Mt by 2030. There exists a wide gap between the per capita consumption in India and that in other developed countries, leaving much scope for improvement. The greatest challenge for the industry will be to meet this future domestic demand of sugar. Given the high cost of imports and the need for food security, India would need to target its production in excess of domestic consumption. It is imperative that farm and mill efficiency need be improved at all levels to achieve the desired sugar production. Considerable scope exists to augment sugar production in the field through use of improved varieties, better agro-techniques and management practices like plant protection measures. The consumption of sugar in urban areas in some states of Indian union with high GDP and income level (Punjab, Haryana, Maharashtra, Gujarat and Kerala) compare favourably with various developed countries (USA, Switzerland, Netherland, Brazil and Australia). The growth in total sugar consumption in India has been quite impressive and is higher than the average world sugar consumption.

International Trade

International trade is of strategic importance to India as it can help maintain stability in the domestic market during surplus sugar production. Acceptability as a credible exporter will provide the Indian sector an alternate set of markets for diverting surplus sugar production. Similarly, in case of deficits, raw sugar imports could help bridge the supply gap. India has the potential to export to major Indian Ocean markets, due to freight competitiveness with respect to key competitors, Brazil and Thailand. After a few years of fall in sugar prices, the world sugar prices have shown trends of increase and this could potentially make exports more viable for India. However, due to the increasing emergence of destination refineries, key markets are importing greater share of raw sugar, and India’s competitiveness for raw exports is relatively lower as of today. Currently, India’s competitiveness is higher in markets, where share of white sugar imports as percentage of cumulative imports is higher. Moving forward, India would need to build the capability to produce raw sugar and refined sugar of international quality standards, in order to leverage the export opportunity (Anonymous 2007).

India would be able to cash in on this opportunity through productivity improvements and alignment of cane and sugar prices in the domestic market. This will go a long way for a steady cane and sugar production scenario making India a reliable player in the global market. India’s competitiveness can also be increased by enhancing export infrastructure like loading rates and draft in Indian ports. In case of surpluses, exports would enable lower stocks in the domestic market, thus benefiting both mills and farmers through higher sugar realization. India is located close to major sugar-deficient markets. The Indian Ocean countries of Indonesia, Bangladesh, Sri Lanka, Pakistan, Saudi Arabia, UAE and some East African countries are sugar-deficient and can be preferred targets for import due to proximity. Historically, India has exported sugar to the identified deficient countries. India would need to improve its cost structure through productivity and efficiency improvements in the long term. In addition, to export raw sugar, mills would need to make the necessary investments. Currently, India only produces plantation white sugar. Considering that export demand for raw sugar and refined sugar of 45 ICUMSA will increase, India would need to develop the capability to produce these categories of sugar in order to cash on this export opportunity.

Recent developments in the Global Ethanol Market suggest the emergence of ethanol as an internationally traded commodity. Demand growth is robust and is for the first time strongly supported not only by higher oil prices and greater need for energy security, but perhaps more importantly, by global environmental and sustainability concerns. Biofuels, such as ethanol, are central to worldwide efforts to abate greenhouse gases and mitigate climate change. Reports indicate that bioenergy could supply a maximum of slightly more than 30% of total global energy demand. India has much underutilized land and natural resources that could be used to significantly expand liquid biofuel production if oil prices stay high or increase further and become a leading exporter of ethanol like Brazil. The sugar mills need to work on improving and upgrading the necessary infrastructure, along with the necessary R&D efforts so that the industry can meet the future demands (Anonymous 2015a, b and 2016a, b).

Exploiting the Diversification Options

India has evolved as one among the fast-developing economies of the world, with huge demands for resources like electricity, power generation. With an increasing awareness for environmental safety and reduction of GHG emissions, use of alternate energy sources like green/renewable energy and lingocellulosic biofuels has gained preference. This can reduce the GHG emissions to by almost 50% by 2050. Sugarcane, being an excellent source of feedstock for lignocellulosic biofuels/green energy, is a perfect candidate for diversification options like bagasse-based cogeneration, renewable biofuels like bioethanol. The crop is among the highest biomass-producing crops, and the paradigm shift to sugar factories being Agro-Industrial Complexes needs to be taken forward, as an excellent strategy for climate change mitigation. The sugar industry coproducts, viz. bagasse, molasses, pressmud, are vast potential reserves for human and animal consumption as well as for providing renewable energy. Sugarcane and its by-products provide raw material to over 25 industries such as ethanol, pulp and paper, boards, pharmaceuticals and many valuable chemicals, and the commercial potential of these can be tapped with the help of suitable technologies.

Fuel Ethanol

Leading countries including Brazil, USA, EU, Australia, Canada and Japan have their own established fuel ethanol programmes, driven by energy security and environmental concerns. In future, the global fuel ethanol demand is likely to grow exponentially. Ethanol blending up to 20–25% is in place in Brazil, and nearly 30–40% blending is being practised in USA, particularly in the state of California. Global ethanol exports currently at 6.5 billion litres are expected to increase to 50–200 billion litres by 2020. This increase would largely depend on world crude prices and related regulations. India also faces similar environmental concerns along with increasing energy demand and would need to consider developing fuel ethanol programmes with high levels of blending.

The Government of India (GOI) approved the National Policy on Biofuels in 2009. The biofuel policy encourages use of renewable energy resources as alternate fuels to supplement transport fuels (gasoline and diesel for vehicles) and proposes a target of 20% biofuel blending by 2020. Thus, the distillery industry is destined to play a very important and vital role in the nation’s economic and industrial scenario in the near future.

At present, there are about 388 distilleries operating in the country, with a total installed capacity of approximately 6000 million litres of alcohol in a year. However, the licensed capacity is concentrated in three states of Uttar Pradesh, Maharashtra and Tamil Nadu. With the Government of India all set to make blending of motor fuel with ethanol up to 5% mandatory and to raise it to 20% by the year 2020, a substantial increase in the requirement as well as production capacity of ethanol is expected. India therefore needs to exploit the potential of sugarcane as an efficient feedstock for production of ethanol for increasing the total ethanol production and meeting the requirements. Further, increasing the availability of molasses through increase in sugarcane production and sugar mill capacity should be inevitable.

The combined demand for ethanol in India for industrial uses and 20% blending with petrol across the country is estimated to be 10,000 M litres by 2050. The regulatory environment and policy initiatives should facilitate the transition to higher blending programme through necessary changes in the Sugarcane Control Order. Higher levels of blending will also necessitate the mills to have the flexibility to shift from sugar to ethanol, based on market dynamics.

Biobutanol

Presently, sugarcane ethanol is made predominantly from the cane molasses. This current process taps only one-third of the energy sugarcane can offer. The other two-thirds remain locked in the leftover cane fibre (bagasse) and straw. Bioconversion of sugarcane bagasse and cellulosic biomass to ethanol and butanol is another emerging area which requires huge R&D investments. This is particularly important for countries like India, where scope for increasing the production of ethanol from molasses or sugarcane juice is very limited. However, the limitation so far had been the lack of cost-effective technologies to convert bagasse to ethanol. Butanol—a promising next-generation biofuel which packs more energy than ethanol—is an aliphatic saturated alcohol that can be used as a transportation fuel. Butanol has higher octane value than ethanol, can be used in the existing engines and is non-hygroscopic and non-corrosive to engines. Butanol can be produced from sugarcane juice and molasses using bacterial strains. Several improved species of Clostridium, bacteria capable of converting juice and molasses to butanol, have been identified and have been successfully put to us in countries like Japan.

Bioplastics

Ethanol from sugarcane has emerged as an important ingredient to substitute for petroleum in the production of plastic. These so-called bioplastics have the same physical and chemical properties as normal plastic (the most common type is known technically as polyethylene or PET) and maintain full recycling capabilities. The green plastics and polyethylene made from sugarcane bagasse have huge market potential. Each metric ton of bioplastic produced avoids the emission of 2–2.5 metric tons of carbon dioxide on a life cycle basis. Use of bioplastics is still developing, and there is a great potential in India. A number of leading companies have established themselves as major players in this emerging area.

Biohydrocarbons

Biodiesel from sugarcane is one of the most successful examples of biohydrocarbon production, which has great scope in near future. This is being carried out very successfully in Brazil, which has a total annual biodiesel production of approximately 4.5 billion litres using different feedstocks. Farnesene, a chemical compound that can be the basis for a number of renewable chemicals, including aviation fuel is produced from sugarcane. Amyris Biotechnologies, based in California, is one of the pioneers in developing farnesene. Amyris, partnering with its Brazilian subsidiary São Martinho Group, is producing sugarcane-based diesel that has been tested in Brazil. General Electric (GE) and Amyris staged the first-ever sugarcane-based renewable fuel powered flight in 2012. In 2014, the Brazilian airlines GOL became the first in the aviation industry to fly a commercial flight from Florida to Brazil using farnesene.

Power cogeneration

The government policy of promoting cogeneration and renewable resources has given a great boost to the cogeneration in sugar mills. Cogeneration based on bagasse and biomass from sugarcane fields is an environmentally safe and viable option to meet the power requirements of the country. The total exportable power potential in the country is expected to be approximately 10,000 MW by 2030. The current installed capacity is only 5500 MW, and the capacity realization to the extent of 10,000 MW has to be achieved to suitably augment the increasing power requirements. The sector can also generate around 50 million carbon credits through cogeneration. The ethanol production and cogeneration are completely dependent on sugar production as the respective feedstocks are generated as by-products during sugar production. Obviously, the sugarcane production and productivity should increase to utilize the capacity of the mills to the full extent and also to meet the future demands. In this context, development of high-biomass, high-fibre and moderate-sucrose varieties (energy canes) will be of prime importance to the Indian sugar factories. Research priorities should also be fine-tuned to provide the necessary impetus to the cogeneration efforts by sugar mills.

Paper and Pulp Industries

The large-scale exploitation of forest resources for paper manufacturing has been a great concern among the environmentalists, and bagasse pulp is an ideal substitute for paper industry to address this concern. Sugarcane bagasse, which has comparable fibre properties, has been used for paper manufacture in India and Thailand since long. At present sugarcane bagasse accounts for nearly 20% of all paper production in India, China and South America. The paper industry utilizes 10% of the world bagasse production. In India, the Tamil Nadu Newsprint and Papers Ltd, a bagasse-based paper-manufacturing unit, has emerged as the largest among such units in the world and consumes about 1 million tonnes of bagasse every year (www.tnpl.com).

The future of ethanol and green energy is locked in bagasse, and therefore, new and innovative methods are needed to utilize this precious resource. Around 100–125 Mt bagasse would be available by 2030, and 50% of this could be diverted for the commercial production of ethanol/butanol, paper, bioplastics and other industrial products. The following areas will be of much practical and economic significance: (a) development of energy cane (high-biomass/high-fibre/moderate-sugar varieties), (b) energy plantation in mill area as source of fuel, (c) utilization of degraded lands for biomass production, (d) replacement of bagasse with trash or other crop residues as boiler fuel in a phased manner, facilitating the diversion of bagasse for other purposes, (e) suitable microbial consortia for conversion of cellulosic biomass to biofuels, thereby improving the fermentation efficiency, (f) genetic manipulation of the lignin biosynthesis pathway to overcome recalcitrance and enable easy degradation.

The opportunity for using sugarcane as a platform for molecular farming is an attractive proposition, considering its high biomass and ratooning potential. Sugarcane had already been engineered to produce high-value molecules including therapeutics, industrial enzymes, vitamins, vaccines, bioplastics through technologies for expressing the genes of interest in sugarcane and targeting their storage into the vacuoles. This will facilitate easy extraction and purification of the products from the juice. The technology for vacuole targeting has already been perfected in this crop and is being put to use in large scale.

Indian Sugar Industry: Moving Ahead

The Indian sugar industry is all set to surge ahead, cashing in on the ample transformational opportunities available, to become an indispensible player in the global sugar–ethanol/green energy market. The huge demand for sugar and energy in the coming decades and the increasing environmental concerns call for sustainable and profitable ways to enhance sugarcane and sugar production. This will invariably have an impact on the sugarcane-based biofuel and cogeneration scenario and the various ancillary industries. The climate change mitigation also gets interwoven in the sugar and energy canvas, necessitating a fine-tuning of the research and development initiatives to overcome such challenges. Better pricing policies and necessary incentives related to cane and sugar pricing also assume significance, especially with respect to minimizing the effects of cyclicality and better management of downward spiral. The global ethanol market is fast evolving, with 16–20% of the sugar crops being converted into ethanol rather than sugar. India, the second largest producer of sugarcane has tremendous potential to augment its productivity, cashing in on its strengths and converting the weaknesses and threats as opportunities. Productivity and efficiency improvement at the farm and factory level needs to be the top priority so that there is maximum utilization of resources. The interrelationships between sugar, oil and ethanol markets and the subsequent fluctuations need to be important considerations, with the industry acquiring enough flexibility for a demand-driven shift from sugar to ethanol/energy production and vice versa. With a very favourable and booming domestic sugar market, the industry has ample opportunities to evolve and grow in a profitable and sustainable manner.

References

Anonymous. 2007. The Indian sugar industry-sector Roadmap 2017. KPMG Report.

Anonymous. 2010. Global Agricultural Information Network Report No.1033. USDA Foreign Agriculture Service.

Anonymous. 2013. Report of the Working Group on the Sugarcane Production and Sugar Recovery in the country. Government of India. Ministry of Consumer Affairs, Food and Public Distribution. Department of Food and Public Distribution. Directorate of Sugar, New Delhi (India).

Anonymous. 2015a. GAIN Reports IN5050. http://fas.usda.gov.

Anonymous. 2015b. Indian sugar industry-bitter sweetener. CARE Ratings.

Anonymous. 2016a. GAIN Reports IN6057. http://fas.usda.gov.

Anonymous. 2016b. Indian sugar industry-from rags to riches. CARE Ratings.

Nair, N.V. 2010. The challenges and opportunities in sugarcane agriculture. Souvenir STAI, pp. 117–135.

Solomon, S. 2011. The Indian sugar industry: An overview. Sugar Tech 13(4): 255–265.

STAI. 2011. Souvenir. In 10th Joint Convention of The STAI & DSTA, Pune, India. p. 98.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no conflict of interest.

Rights and permissions

About this article

Cite this article

Solomon, S. Sugarcane Production and Development of Sugar Industry in India. Sugar Tech 18, 588–602 (2016). https://doi.org/10.1007/s12355-016-0494-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12355-016-0494-2