Abstract

Portfolio optimization generally involves maximizing the expected return of a portfolio while minimizing its risk. However, when considering these 2 conflicting objectives in decision-making contexts, an efficient approach is required to evaluate the solution in the set of efficient frontiers/Pareto optimal solutions. Selecting and managing an investment portfolio are critical for investors. This study proposes an integrated method for portfolio optimization that involves decisions on stock screening, stock selection, and capital allocation. The initial step involves examining the financial data of investment targets. The portfolio is then selected according to the firms’ relative efficiency by using a data envelopment analysis (DEA) model. To determine the allocation of capital to each stock in the constructed portfolio, a multi-objective decision-making (MODM) model is developed. The integrated DEA-MODM approach is applied to Taiwan’s financial market and compared with several benchmarking mutual funds for empirical testing. This comparative study shows that the proposed approach outperforms the Taiwan Excel 50 ETF and 3 other benchmarking mutual funds in numerous quarters of the testing period regarding return rates and Sharpe ratios. Therefore, the proposed integrated DEA-MODM approach can be useful to both investors and researchers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Portfolio selection is a decision-making process that entails selecting and allocating available budgets among various assets to maximize returns, while minimizing risks. To solve this portfolio selection problem, Markowitz (1952) proposed the mean–variance (M–V) model; in which the total return of a portfolio is described using the mean return of selected stocks and the risk is measured according to the variance of the portfolio return. Portfolio selection based on the M–V model reveals how a portfolio exhibits the maximal return for a given level of risk, or the minimal risk for a given level of expected return. The portfolio selection problem can thus be considered a multi-objective decision-making (MODM) problem. Markowitz derived the concept of the efficient frontiers of return and risk. At any point along an efficient frontier, no other point can produce a higher return with less risk. Therefore, investors can select an appropriate point on an efficient frontier according to their preferences.

Within the field of operations research, MODM is based on the belief that a single objective, goal, criterion, or viewpoint is rarely used to make real-world decisions. The main contribution of MODM involves developing appropriate methodologies that can be used to support and assist decision makers in finding a compromised satisfactory solution in resource-constrained situations in which multiple conflicting decision objectives exist and must be considered simultaneously. Because most investors consider both conflicting decision objectives (i.e., return and risk) simultaneously, the framework of MODM is well suited to the complex nature of financial decision-making problems.

As is widely known, a company’s financial statements reveal its business strength and constitute crucial information for investors. Some previous studies on the selection of stock portfolios have been based solely on the mean returns and covariances between these returns (e.g., Chang et al. 2000; Fernández and Gómez 2007). Such studies have developed meta-heuristic methods such as the genetic algorithm, tabu search, simulated annealing, and neural network approaches, to optimize portfolio selection problems and compare the solution efficiency and effectiveness from a computational perspective. Some previous studies have proposed quantitative methods, such as regression and neural networks, using the financial statements of firms as inputs to predict stock prices (Kanas 2001; Graham et al. 2002). These financial statements can be highly correlated to stock price performance. In this study, instead of directly using these financial statements to select investment targets, they serve as the basis for screening stock candidates for further evaluation at later stages by using the data envelopment analysis (DEA) model.

DEA models have been extensively used in performance appraisal in a wide range of applications including financial and non-financial performance measurements. Performance measurements are conducted by evaluating the relative efficiency of numerous decision making units (DMUs). In financial applications of DEA technique, the managerial efficiency of a company or stock can be measured according to its financial data. In other words, some critical financial data of DMUs (stocks) are categorized into separate inputs and outputs in a DEA model to compute their relative efficiencies. In this study, DMUs (stocks) with high efficiency scores were selected to develop the portfolio. Once the target stocks were selected, the next task entailed determining the allocation of capital to each selected stock.

The main purpose of this study is to present an investment evaluation procedure that can help investors in today’s highly uncertain stock market to achieve the decision objective of finding the optimal portfolio. First, unlike some previous studies that have considered only the mean returns and covariances between stock returns, the initial step of our evaluation procedure is to screen relevant stocks and find a group of potential investment targets (candidate stocks) by conducting fundamental analysis. Only stocks that can possibly perform effectively in the long term are eligible to enter the final portfolio. Second, by applying the DEA model, the relative efficiency of each candidate stock is computed and compared. Stocks that are relatively efficient are chosen to develop the final portfolio. Third, an MODM mathematical formulation is developed to determine the allocation of capital to each stock in the final portfolio. The variance of returns does not reflect investor concern; investors are more concerned about the risk of unexpected declines (i.e., the so-called “down-side risk”) than they are about the rise of stock prices. Thus, instead of using the traditional measure of risk, we adopted the down-side risk measure in our MODM mathematical model to be more practical. Moreover, investors may have completely contrasting attitudes toward risk: some investors are risk takers, whereas others are risk avoiders or may be risk neutral. Therefore, it is necessary to develop an investment evaluation method that provides flexibility for users who exhibit contrasting preferences regarding returns and risks. Such flexibility can be achieved by establishing preferred weights in our MODM mathematical model. Finally, the proposed investment evaluation process is applied to Taiwan’s financial market, and compared with several benchmarking mutual funds for empirical testing. Concurrently, the investment performance corresponding to the contrasting risk aversions of users are compared and analyzed.

The remainder of the paper is organized as follows. Section 2 reviews related literature on portfolio selection problems, DEA, and MODM. The proposed methodology and the selection procedure are described in detail in Sect. 3. Section 4 presents the empirical testing of the proposed methodology. Finally, concluding remarks are provided in Sect. 5.

2 Related work

The related work on portfolio selection, MODM, and DEA is described as follows.

2.1 Portfolio selection

First, the Markowitz M–V model for the portfolio selection problem is introduced. Let n be the number of different assets, \( \sigma_{ij } \) be the covariance between returns of asset i and j, \( \mu_{i} \) be the expected return of asset i, and R f be the riskless return rate. The decision variable \( x_{i} \) represents the proportion of capital to be invested in asset i. The M–V model is shown below:

Subject to

The objective function (Eq. 1) is specified to find a portfolio with the minimum variance under the condition that the corresponding expected return must be greater than a pre-specified number (e.g., riskless return rate R f ), as expressed in Eq. (2). Equation (3) constrains the sum of the proportions of capital allocated to all stocks equal to 1. Equation (4) specifies the proportions of capital allocated to each stock, which should be within the range of [0, 1].

In contrast to Markowitz (1952) defining the risk as the covariance among portfolio returns, Sharpe (1963) believed the risk is only related to the level of the linear relation between the expected return of a security and the expected return of a market. Therefore, Sharpe (1971) proposed a linear programming model for solving the portfolio selection problem by using piecewise linear approximation. Konno and Yamazaki (1991) proposed a mean absolute deviation (MAD) model, which is also a linear programming approximation model and the risk is measured as the mean absolute deviation of the difference of the mean and the standard deviation of a security, to solve the portfolio selection problem. They claimed the MAD model is an alternative to the M–V model, preserves the advantage of the M–V model, shortens the computation time of the M–V model, and does not need the covariance matrix. Simaan (1997) evaluated the difference between the MAD model and the M–V model. However, they obtained an oppositive result against the work of Konno and Yamazaki (1991). Readers who are interested in the development of the linear programming for the portfolio selection problem may refer to Mansini et al. (2014) for more detail.

In addition, traditional measures of risk do not accurately reflect investor concern. Investors are actually more concerned about the down-side risk than they are about the rise of stock prices. Hence, Markowitz (1959) proposed two statistics for risk measure: below-mean semi-variance (SVm) and below-target semi-variance (SVt). Nawrocki (1999) reviewed the development and the related issues of measuring the down-side risk, and investigated the applicability of different measurement of the down-side risk in dissimilar scenarios. They concluded that the semi-variance and the lower partial moment are the most commonly used to measure the down-side risk and are the fundamental of the portfolio theory. Models of lower partial moment for measuring risk have been investigated by Bawa (1975), Bawa and Lindenberg (1977), and Fishburn (1977). Therefore, in considering the down-side risk, a more appropriate model, the Markowitz lower partial moment (MLPM) model, was constructed to narrow the gap between conventional models and real-world practices. To generalize the standard M–V model, several constraints, such as the cardinality and bounding constraints, have been added to the model to reflect the reality. The cardinality constraint limits the number of assets allowed in a portfolio, whereas the bounding constraint restricts the amount of money to be invested in each asset. Several heuristic methods have been proposed to solve this generalized yet more complicated model; for example, simulated annealing (Chang et al. 2000), evolutionary algorithms (Chang et al. 2000; Branke et al. 2009), neural networks (Fernández and Gómez 2007), and tabu search (Schaerf 2002).

Several multi-step portfolio selection models have been proposed in the literature either to reduce the portfolio dimensionality or to consider different risk sources. Lozza et al. (2011) proposed an ex post comparison of portfolio selection strategies. This study was divided into three phases. Certain pre-selection approaches were proposed in the first phase, and a few assets that satisfied certain performance criteria were then pre-selected. In the second phase, the dimensionality of the pre-selected assets was reduced, identifying a few common factors through the principle component analysis (PCA) to approximate the asset returns. In the third phase, the asset portfolio was selected by optimizing some performance functionals based on the Markovian hypothesis of portfolio returns. Computational results showed that their proposed strategies give better performance than the traditional approach of maximizing the Sharpe ratio, when applied to forecasted wealth (using Markovianity). In portfolio selection problem, one can limit the total number of assets in the final portfolio or imposing lower and upper bounds to the proportion of capital invested in each product. These constraints have made the problem become NP-Complete-type of problem. Ruiz-Torrubiano and Suárez (2010) proposed hybrid approaches combining several meta-heuristic and pruning heuristics. In their study, pruning heuristics attempt to reduce the dimensionality of the portfolio selection problem by identifying and eliminating from the universe of assets available for investment products that are not likely to appear the optimal portfolio.

As for the portfolio selection problem considering different risk sources, Lozza et al. (2013) presented a method to determine the optimal portfolios in separated steps in which risk from different sources can be cleaned and controlled. They considered price risk and market risk, as these two have more impact than other risk sources. In the first phase, they controlled the price risk of bonds considering 60 optimal funds with a fixed risk measure. Moreover, in addition to the traditional approach, they introduced an immunization in average approach to generate a new risk measure. In the second phase, the market risk was controlled by optimizing a performance measure (Sharpe and Rachev ratios).

2.2 MODM model

The multi-objective decision-making (MODM) model is an appropriate methodology for supporting and assisting decision makers in situations in which multiple conflicting decision factors (e.g., objectives, goals, and criteria) must be considered simultaneously. Hence, the solution of an MODM problem is actually a pursuit of a satisfactory or compromising solution, not an optimal one. The multidimensional nature of financial decisions has already been emphasized by researchers who have noted the necessity to address financial problems in a broader, more realistic context that considers all pertinent factors involved (Zeleny 1982; Zopounidis 1999). Portfolio management, as addressed in the pioneering work of Markowitz (1952), is a typical MODM problem. In addition to the conventional two objectives (i.e., return and risk), Subbu et al. (2005) proposed a model that maximizes the return and minimizes the variance and portfolio value-at-risk (VaR). Ehrgott et al. (2004) formulated a problem with five decision objectives and some non-convex constraints. However, these five constraints are combined into one utility function. Zopounidis et al. (1999) summarized the primary objectives that are considered in portfolio selection problems into three categories: corporal validity objectives, stock acceptability by the investors, and financial objectives. Ogryczak (2000) proposed a multiple criteria linear programming model, which is based on the work of Sharpe (1971) and Konno and Yamazaki (1991), for solving the portfolio selection problem which the preference axioms for choice under risk is taken into account. They employed the weighting approach to combine multiple objectives into a single objective and then used the simplex method or the column generation technique to solve the linear programming model. Steuer and Paul (2003) completed a comprehensive review of MODM to problems and issues in finance.

In financial decision making contexts, decision makers usually establish parameter values, which are stochastic. Abdelaziz et al. (2007) proposed chance-constrained compromise programming (CCCP) by combining the compromise programming from MODM and the chance constrained programming model developed by Charnes and Cooper (1963). CCCP is applied to the Tunisian stock exchange market.

Instead of using the traditional risk measure, an MODM model considering both the expected return maximization and down-side risk minimization was constructed in this study. Solutions of the MODM model were used to determine the allocation of capital to each stock in the constructed portfolio.

2.3 DEA

Data envelopment analysis (DEA) is a non-parametric linear programming technique used to evaluate DMUs when multiple inputs and multiple outputs are involved. The concept of frontier analysis suggested by Farrell (1957) forms the basis of DEA, but Charnes et al. (1978) initiated the recent series of studies on DEA. The objective of DEA is to identify the DMU that produces the largest outputs by consuming the least inputs; such a DMU is considered efficient, with an efficiency score of 1. The efficiency scores are computed by using mathematical programming, which converts multiple input and output measures into a single measure of efficiency that is defined as the ratio of total weighted output to the total weighted input. The weights associated with the inputs and outputs of each DMU are obtained by performing the mathematical formulation so that the relative efficiency score for each DMU can be optimized.

In financial applications of DEA methodology, researchers usually measure the managerial efficiency of a company by using its financial statements. For example, in using certain financial ratios as inputs and outputs, DEA is conducted to evaluate the performance of banks (Yeh 1996) and credit unions (Pille and Paradi 2002). Basso and Funari (2001) used numerical indices proposed in relevant literature and defined mutual fund performance indices by performing DEA to rank a set of mutual funds by accounting for both expected return and risk. In addition, they used empirical data from the Italian financial market to test the proposed DEA performance indices. Edirisinghe and Zhang (2007) developed a generalized DEA model to analyze a firm’s financial statements over time to determine a relative financial strength indicator (RFSI) that is predictive of stock prices. RFSI is determined by maximizing the correlation between the DEA-based score of financial strength and stock market performance. Hsu (2014) considered a variant of the M–V model which the risk is measured by using the below-target semi-variance (SVt). They proposed an integrated procedure using DEA, artificial bee colony (ABC) and genetic programming (GP) for solving the portfolio selection problem. In the first stage, DEA model is used to screen stocks based on their historical financial performance. Then, ABC algorithm is applied to determine the investment proportion of each stock. Finally, GP is used to construct a forecasting model to predict the price of stocks and then used as a basis to decide the transaction rules. DEA has been demonstrated to be an effective method for portfolio selection, and the MODM model provides a compromise for conflicting decision objectives. Therefore, we integrated DEA with the MODM model in this study to allow investors to express their various attitudes toward return and risk.

3 Methodology

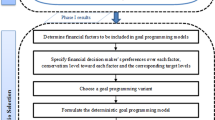

The proposed methodology consists of three stages: stock screening, portfolio selection, and capital allocation. All stocks are screened by performing fundamental analysis to examine their financial strength at the first stage. Stocks passing the examination are treated as candidates for the final portfolio, and are forwarded to the second stage, at which the DEA model is used to measure the relative efficiency of each stock. Stocks with an efficiency score of 1 are selected to form the final portfolio. How to allocate capital to each stock in the developed portfolio is determined by using the MODM model at the final stage. The portfolio is selected and formed every quarter, and the resulting performance of the portfolio is tested in the next quarter.

3.1 Fundamental analysis for stock screening

Because the stock price movement is highly correlated with current and future expected financial performance, fundamental analysis is an effective method for determining which firms are most likely to perform effectively in the long run. For instance, Lev and Thiagarajan (1993) identified a set of financial parameters, for which financial ratios exhibit a strong association with the future return when macroeconomics and firm’s scale were taking into account.

Among the many financial parameters that are used to predict a stock’s future price, the gross profit margin and return on equity (ROE) have been widely used. In addition, the cash flow growth rate is adopted in this study. Therefore, the following three parameters, which were used for stock screening purposes in this study, are described as follows:

-

1.

Gross profit margin is the net income divided by net sales. It measures net income generated by each dollar of sales and is an effective measure of the profitability of a company.

-

2.

ROE is the net income divided by the average common shareholder equity. It measures profitability of stockholders’ investment, and allows investors to see how effectively the money they invested in the firm is being used.

-

3.

Cash flow growth rate is obtained by subtracting the cash flow from Year 1 from the cash flow from Year 2, then dividing that total by the cash flow from Year 1. Cash flow is the driving force that maintains a company’s operations. Positive cash flow indicates the capability of the extension and dividend distribution of a company. Cash flow is critical for the growth and true value of a company.

To effectively filter stocks that do not perform consistently well, the threshold values for gross profit margin, ROE, and the cash flow growth rate are 15, 15, and 5 %, respectively, as established in this study according to the suggestions of experts in the financial market. In addition, these threshold values were obtained by conducting extensive numerical experiments. Low values may diminish the significance of filtering, whereas high values may result in too few candidates for the final portfolio.

Based on these threshold values of three financial parameters, we reserved any stock that satisfied one of the following three criteria as a candidate for the next stage of the DEA process. All of the financial numbers were calculated quarterly.

-

1.

The average gross profit margins of the past 12-month and 3-year periods must be greater than 15 %, whereas the average ROE of the past 12-month and 3-year periods must be greater than 15 %.

-

2.

The average ROE of the past 12-month and 3-year periods must be greater than 15 %, whereas the average cash flow growth rate of the past 12-month and 3-year periods must be greater than 5 %.

-

3.

The average gross profit margins of the past 12-month and 3-year periods must be greater than 15 %, whereas the average cash flow growth rate of the past 12-month and 3-year must be greater than 5 %.

3.2 DEA for constructing final portfolio

At this stage, the stocks screened from the aforementioned three criteria were treated as the candidate for the final portfolio; these candidates are the DMUs for the DEA model. The DMUs are evaluated and ranked based on their relative efficiencies. We used a BCC-output oriented model to measure the efficiency of each DMU. We selected the quarterly down-side risk and β-coefficient, both aimed low, as the input variables. The quarterly return rate and Sharpe ratio, both aimed high, were selected as the output variables for the DEA model. The definitions of these input and output variables are stated as follows.

Input variables:

-

1.

Down-side risk of return rate (\( \sigma_{i} = \sqrt {\frac{1}{T}\mathop \sum \limits_{t = 1}^{T} \left( {Max\left[ {0,\left( {\bar{R}_{i} - R_{t} } \right)} \right]} \right)^{2} } \), where \( \bar{R}_{i} \) is the mean return rate of stock i from time period 1 to T, and \( R_{t} \) is the return rate of time period t);

-

2.

\( \beta_{j} \)-coefficient (\( \beta_{j} = {\text{Cov}}(R_{j} ,R_{m} )/{\text{Var}}(R_{m} ) \), where R j is the return rate of stock j and R m is the return rate of the market); the capital asset pricing model (CAPM) is used to compute individual β-coefficients for each stock.

Output variables:

-

1.

Return rate: the rate of return for each stock is computed quarterly;

-

2.

Sharpe ratio: a measure of the excess return per unit of risk (risk premium) for each stock.

After using the DEA model, stocks with an efficiency score of 1 constitute the final portfolio. The decision of allocating capital to each stock in the portfolio is determined by using the MODM model at the next stage.

3.3 MODM model for capital allocation

A single-objective decision-making problem generally entails seeking the optimal solution. However, when two decision objectives, possibly conflicting, are to be considered simultaneously, solutions that are optimal for both decision objectives may not exist. Hence, we searched for the compromised satisfactory solutions that are the most suitable for decision makers. In the context of portfolio selection, return and risk are the investor’s main concerns. Assume that a portfolio or solution can achieve both return maximization and risk minimization simultaneously; we call this the “positive ideal solution” (PIS). Conversely, assume that a portfolio results in the minimum return and maximum risk; this is called the “negative ideal solution” (NIS). In this research, we extended the model presented by Zeleny (1982) to obtain a compromised solution that most approximates the PIS, and least approximates the NIS.

In the proposed MODM model, investors are allowed to allocate different weights for return and risk objectives, depending on the degree of their risk aversion. Before introducing the MODM model, notations are listed below:

\( f_{1} (x) \): objective function of return rate; \( f_{1}^{*} \) and \( f_{1}^{ - } \) denote the PIS and NIS for the return objective, respectively; \( f_{2} (x) \): objective function of risk; \( f_{2}^{*} \) and \( f_{2}^{ - } \) denote the PIS and NIS for the risk objective, respectively; \( W_{1} \): weight allocated to Decision Objective 1 (return), \( W_{2} \): weight allocated to Decision Objective 2 (risk).

The MODM model can be formulated as follows:

The PIS and NIS of the return and risk objectives are defined by using Eqs. (5) and (6), respectively. The objective function (Eq. 7) expressed as the distance to the PIS of both objectives, is specified as seeking a portfolio which is a compromise solution closest to the PIS. The first term of Eq. (7) measures the distance to the PIS of the return objective, whereas the second term measures the distance to the PIS of the risk objective. Investors can express their preference for return or risk by allocating different weights to these two terms, requiring that the sum of both weights equal to 1 in Eq. (8). Equation (9) demands that the return rate of the selected portfolio must be superior to the riskless return rate. Equation (10) constrains the sum of the proportions of capital allocated to all stocks equal to 1; that is, the entire capital is invested. Equation (11) specifies the proportions of capital allocated to each stock, which should be within the range of [0, 1].

In this study, we focused on the long-term investment performance. Thus, a “buy and hold” trading strategy was adopted, as in Edirisinghe and Zhang (2007) and Ko and Lin (2008). In other words, the stocks in the final portfolio were held unchanged in each investment interval (quarter) during the study period.

The stock trading mechanisms and assumptions used in this study are described as follows:

-

1.

No odd-lot trading was permitted.

-

2.

Subscription and redemption costs required by the investment were not considered.

-

3.

The upper limit of investment capital for each quarter was NT$5 million. If the total capital of the selected portfolio exceeded the upper limit, then an adjustment was made for the stocks with the least deviation to satisfy the budget limit.

-

4.

For each quarter, the price at the end of the first day was set as the buy-in price, whereas the price at the end of the final day was set as the sold-out price.

-

5.

The riskless return rates were set according to the 3-month deposit interest rate of the Bank of Taiwan during our investment period from January 2006 to December 2009.

4 Empirical study

This study proposes a holistic evaluation process of investment. First, the initial step involves screening the stocks and finding a group of potential investment targets (candidate stocks) by performing fundamental analysis. Second, by applying the DEA model, the relative efficiency of each candidate stock is computed and compared; stocks constituting the final portfolio are then selected. Third, the MODM model is developed to determine the capital allocation of each stock in the final portfolio.

This section reports the results of using the proposed method on empirical data from Taiwan’s financial market from January 2006 to December 2009. The top 50 value-weighted stocks in Taiwan’s stock market (also known as the Taiwan 50) were the pool, from which the stocks were screened. The investment portfolio constructed in 2006 Q1 by using the proposed methodology was empirically tested in 2006 Q2. The entire process is systematically illustrated in Sect. 4.2. Performance indices such as the return rate, risk, and Sharpe ratio for various portfolios are listed in Sect. 4.3, and the empirical results are compared with several benchmarking mutual funds in Taiwan’s market.

4.1 Data collection

As mentioned, the target stocks were screened from the pool of the Taiwan 50. These 50 stocks contribute approximately 70 % of the total market values. The proposed methodology was tested on the period from January 2006 to December 2009. As shown in Fig. 1, this study period began with approximately 6,500 points of the TSEC weighted index at 2006 Q1, reaches 9,605 in October 2007, drops significantly to 4,475 in October 2008 because of subprime mortgages, and then gradually recovers in March 2009. Hence, we believe that this study period contained a complete economic cycle and was thus suitable for testing.

A total of 16 investment intervals were in this study. The data were retrieved from the databases of Taiwan Economic Journal (TEJ, http://www.tej.com.tw/twsite/) and the Taiwan Stock Exchange Corporate (TSEC). The data collected included the daily closing price, return rate, and β coefficients of stocks.

The software DEA-Solver was used for measuring the relative efficiency of each selected stock, whereas LINGO was used in the MODM model to generate the recommended portfolio and budget allocation decision.

4.2 An illustrative example

An example is provided to illustrate the proposed process of screening, portfolio construction, and investment capital allocation. Stocks of the Taiwan 50 in 2006 Q1 were used as the selection pool.

4.2.1 Stock screening and portfolio construction

Any stock satisfying at least one of the three specified criteria in Sect. 3.1 was eligible to be a candidate for further DEA processing. After screening the stocks of the Taiwan 50 in 2006 Q1, only 20 were chosen for further selection. All of the companies/stocks are represented by company codes, and the company code of the selected stocks is expressed in bold text in Table 1. Companies corresponding to these codes are also shown on the TSEC Web site. For example, 1301 represents the Formosa Plastics Corporation.

The DEA model (BCC-output oriented) was next applied to compute the relative efficiency scores of these 20 stocks. In the DEA model, the input variables include the quarterly \( \beta \) coefficient and quarterly down-side risk of each stock, whereas the output variables include the average quarterly return rate and Sharpe ratio. The data of inputs and outputs and the corresponding efficiency scores of each DMU/stock are listed in Table 2. Due to some of the original data of the return rates and Sharpe ratio are negative, these two data are normalized because the DEA model requires positive inputs and outputs.

DMUs/target stocks, (1) in which the efficiency scores equal 1, (2) no excess in input, and (3) no shortage in output, were considered efficient relative to other DMUs. Based on the computational results of DEA shown in Table 2, seven stocks were selected from 2006 Q1. They formed the final investment portfolio, including stocks with the codes of 2002, 2308, 2354, 2412, 2498, 2880, and 6505.

4.2.2 Capital allocation

This section describes how to allocate an investment budget to each stock in the final portfolio of 2006 Q1. The MODM model described in Sect. 3.3 was used to determine the capital allocation.

The weights allocated to return and risk objectives actually depend on investor preferences. In this study, nine sets of weights combination; that is, (return: risk) = (1:9), (2:8), (3:7),…, (9,1) were experimented. As expected, the results of six combinations among nine were dominated by three other weight combinations. The allocation decisions of the three non-dominated sets, (1:9), (2:8), and (3:7), are listed in Table 3.

As indicated in Table 3, if the investor seems to be a risk avoider and decides to use a weight combination (1:9), results from using the MODM model would suggest allocating 27.86 % of the capital to the stock with code 2002, 4.55 % to the stock with code 2308, 4.41 % to the stock with code 2354, 37.76 % to the stock with code 2412, 4.07 % to the stock with code 2880, and 15.11 % to the stock with code 6505. Risk avoiders who are more concerned about on risk than return tend to distribute the weights more evenly among stocks (six out of seven). The percentages in each weight combination shown in Table 3 do not necessarily sum up to 100 %, which is because we had a budget limit of NT$5 million per quarter and had only an integral number of shares of stocks to be purchased.

4.2.3 Performance comparison

To test the investment performance of the proposed methodology, the Taiwan Excel 50 ETF (the most representative ETF in Taiwan), a fund that closely tracks the performance of the Taiwan 50 Index, was selected as the benchmark for further comparison. The return rate, risk, and Sharpe ratios were used as comparison criteria. Table 4 presents the results of the proposed methodology and Taiwan Excel 50 ETF. The suggested three sets of weight combinations all significantly outperformed the Taiwan Excel 50 ETF regarding the return rate, risk, and Sharpe ratio. From the return rate perspective, the MODM weight combination (3:7) performed the highest with a return rate of 4.84 %. From the risk perspective, the MODM weight combination (1:9) performed the best, with a risk measure of 0.7165, followed by the 0.9602 of weight combination (2:8), and 1.3802 of weight combination (3:7). The MODM weight combination (2:8) performed the highest regarding the Sharpe ratio (i.e., 2.6117). By using the proposed approach, investors can select different weight allocations according to their preferences regarding return rates and risk.

4.3 Comparison with benchmarking mutual funds

As stated in the previous section, return rate, risk, and Sharpe ratios were used to compare the results of the proposed methodology with several benchmarking mutual funds that are top performers in Taiwan’s mutual fund market (Taiwan’s large-cap equity funds were selected). We required that these funds be listed among the top 10 for their 12-month, 3-year, and 5-year performance levels regarding return rate. The three top performers satisfied the requirement: the Capital Conceptual Fund, HSBC Taiwan Success Fund, and PineBridge Taiwan Giant Fund.

4.3.1 Performance comparison based on quarterly average return rate

Because investors may have contrasting preferences regarding return and risk, we selected three sets of weight combinations to be used in the MODM model; that is, (return: risk) = (9:1) for extreme risk takers; (return: risk) = (1:9) for extreme risk avoiders; and (return: risk) = (5:5) for those who are risk-neutral. These three sets of weight combinations are named “MODM-risk-taker,” “MODM-risk-avoider,” and “MODM-risk-neutral.”

As shown in Table 5, all of the average return rates generated by using the MODM model, regardless of how different the preferences regarding risk were, outperformed those of Taiwan Excel 50 ETF. The MODM-risk-taker and MODM-risk-neutral are the two most favorable of all approaches and funds. The MODM-risk-taker even reached 8.97 % for the average return rates of 16 quarters, which is much more favorable than the 0.99 % of the Taiwan Excel 50 ETF, as well as the other three benchmarking mutual funds. The return rates of the three proposed weight combinations significantly outperformed the three top performers in 2007 Q4 till 2008 Q2, Q2 and Q3 of 2009. Exceptions are 2008 Q3 to 2009 Q1, the financial tsunami period. A reasonable conjecture is that the fund managers had to adjust proactively to the capital allocation of their funds from day to day, and the investment targets of their funds were usually more dispersed during that sensitive period. These promising results demonstrated that using fundamental analysis, combined with the DEA model, can facilitate selecting effectively performing stocks to develop our portfolio.

4.3.2 Performance comparison based on quarterly risk value

Regarding risk, as shown in Table 6, the weight for the MODM-risk-avoider results in the lowest average risk value, 1.2575. This demonstrated its capability of controlling the risk effectively. The weight of MODM-risk-neutral has a slightly more favorable risk value than does the Taiwan Excel 50 ETF, whereas the weight for the MODM-risk-taker is focused more on the return rate, thus producing the largest risk value. As shown in Table 6, except for the weight of the MODM-risk-taker, the weight combinations for both risk avoiders and risk-neutral investors have more favorable control on the risk and performed as effectively as the three top performers did, and they even outperformed the three top performers in some quarters. The weight of the MODM-risk-avoider had the lowest risk value in 11 of 16 quarters during our study period (except 2007 Q2, 2008 Q1, 2008 Q4, 2009 Q2, and 2009 Q3) and outperformed the three benchmarking mutual funds. By contrast, the weight of the MODM-risk-taker produced highly fluctuating results. In 2007 Q1, 2007 Q4, 2008 Q2, and 2009 Q1, the corresponding risk values are almost the lowest; however, in 2006 Q3, Q2 and Q3 of 2007, 2008 Q1, 2008 Q3, Q2, and Q3 of 2009, the corresponding risk values are the highest.

4.3.3 Performance comparison based on quarterly Sharpe ratios

The Sharpe ratio is measured as the excess return obtained per unit of risk. As shown in Table 7, the weight of the MODM-risk-taker results in the most favorable average Sharpe ratio (4.0736), followed by the weight of MODM-risk-neutral (3.9165). These two average Sharpe ratios are significantly more favorable than those of the three benchmarking funds, and far more favorable than the 0.9712 of the Taiwan Excel 50 ETF. As shown in Table 7, except in a few quarters (e.g., 2006 Q3, Q1 and Q4 of 2009), the three weight combinations of the MODM model consistently performed as effectively as the three top performers did during the study period, and generated a higher risk premium than did the three top performers in 2007 Q4, 2008 Q1, 2008 Q2, 2009 Q2, and Q3.

5 Conclusion and recommendation

In this study, we established a holistic portfolio selection procedure that involves stock screening, stock selection, and capital allocation. Some critical financial parameters of firms/stocks were used to screen firms as candidates for the final portfolio. By applying the DEA model, the relative efficiency of each candidate stock was computed and compared. Stocks that are relatively efficient were selected to develop the final portfolio. Finally, an MODM mathematical formulation was developed to determine the allocation of capital to each stock in the final portfolio. Instead of using the traditional measure of risk, we adopted the down-side risk measure in our MODM mathematical model to be more practical. Moreover, we provided flexibility for users exhibiting contrasting preferences regarding returns and risks. This flexibility can be achieved by establishing preferred weights to our MODM mathematical model. The proposed investment evaluation procedure was applied to Taiwan’s financial market and was compared with four benchmarking mutual funds for empirical testing.

The performance levels of the proposed DEA-MODM integrated approach were compared with four benchmarking mutual funds from three perspectives: the return rate, risk, and Sharpe ratios. When the return rate was accounted for, the MODM-risk-taker and MODM-risk-neutral result in the two most favorable of all approaches and benchmarking funds. The MODM-risk-taker even reached 8.97 % for the average return rates of 16 quarters, which is much more favorable than the 0.99 % of the Taiwan Excel 50 ETF. When risk was accounted for, the weight of the MODM-risk-avoider had the lowest risk value in 11 of 16 quarters during our study period (except 2007 Q2, 2008 Q1, 2008 Q4, 2009 Q2, and 2009 Q3), outperformed the three benchmarking mutual funds. When the Sharpe ratio was accounted for, the weight of the MODM-risk-taker resulted in the most favorable average Sharpe ratio, followed by the weight of MODM-risk-neutral. These two average Sharpe ratios are significantly more favorable than those of the three benchmarking funds, and far more favorable than that of the Taiwan Excel 50 ETF.

For future research, as the economic and trade relationship between Taiwan and Mainland China has becomes closer, many new cross-straits businesses have arisen. Therefore, the stock selection pool can accommodate these “China concept stocks” in the evaluation procedure. In addition, other financial parameters may be considered at the stock screening stage of the evaluation procedure.

References

Abdelaziz FB, Aouni B, Fayedh RE (2007) Multi-objective stochastic programming for portfolio selection. Eur J Oper Res 177:1811–1823

Basso A, Funari S (2001) A data envelopment analysis approach to measure the mutual fund performance. Eur J Oper Res 135:477–492

Bawa VS (1975) Optimal rule for ordering uncertain prospects. J Financ Econ 2:95–121

Bawa VS, Lindenberg EB (1977) Capital market equilibrium in a mean-lower partial moment framework. J Financ Econ 5:189–200

Branke J, Scheckenbach B, Stein M, Deb K, Schmeck H (2009) Portfolio optimization with an envelope-based multi-objective evolutionary algorithm. Eur J Oper Res 199:684–693

Chang TJ, Meade N, Beasley J, Sharaiha Y (2000) Heuristics for cardinality constrained portfolio optimization. Comput Oper Res 27:271–302

Charnes A, Cooper WW (1963) Deterministic equivalents for optimizing and satisfying under chance constraints. Oper Res 11:18–39

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision-marking units. Eur J Oper Res 2:429–444

Edirisinghe NCP, Zhang X (2007) Generalized DEA model of fundamental analysis and its application to portfolio optimization. J Bank Finance 31:3311–3335

Ehrgott M, Klamroth K, Schwehm C (2004) An MCDM approach to portfolio optimization. Eur J Oper Res 155:752–770

Farrell MJ (1957) The measurement of productive efficiency. J R Stat Assoc Ser A CXX:253–281

Fernández A, Gómez S (2007) Portfolio selection using neural networks. Comput Oper Res 34:1177–1191

Fishburn PC (1977) Mean-risk analysis with risk associated with below -target returns. Am Econ Rev 67(2):116–126

Graham CM, Cannice MV, Sayre TL (2002) The value-relevance of financial and non-financial information for Internet companies. Thunderbird Int Bus Rev 44:47–70

Hsu CM (2014) An integrated portfolio optimisation procedure based on data envelopment analysis, artificial bee colony algorithm and genetic programming. Int J Syst Sci 45(12):2645–2664

Kanas A (2001) Neural network linear forecasts for stock returns. Int J Financ Econ 6:245–254

Ko PC, Lin PC (2008) Resource allocation neural network in portfolio selection. Expert Syst Appl 35:330–337

Konno H, Yamazaki H (1991) Mean-absolute deviation portfolio optimization model and its application to Tokyo stock market. Manage Sci 37:519–531

Lev B, Thiagarajan SR (1993) Fundamental information analysis. J Account Res 31:190–215

Lozza SO, Angelelli E, Toninelli D (2011) Set-portfolio selection with the use of market stochastic bounds. Emerg Markets Financ Trade 47(5):5–24

Lozza SO, Vitali S, Cassader M (2013) Reward and risk in the fixed income markets. In: Polouček S, Stavárek D (eds) Financial regulation and supervision in the after-crisis period. Proceedings of 14th international conference on finance and banking, pp 329–340

Mansini R, Ogryczak W, Speranza MG (2014) Twenty years of linear programming based portfolio optimization. Eur J Oper Res 234:518–535

Markowitz HM (1952) Portfolio selection. J Financ 7(1):77–91

Markowitz HM (1959) Portfolio selection. Wiley, New York

Nawrocki D (1999) A brief history of downside risk measures. J Invest 8(3):9–25

Ogryczak W (2000) Multiple criteria linear programming model for portfolio selection. Ann Oper Res 97:143–162

Pille P, Paradi JC (2002) Financial performance analysis of Ontario (Canada) Credit Union: an application of DEA in the regulatory environment. Eur J Oper Res 139:339–350

Ruiz-Torrubiano R, Suárez A (2010) Hybrid approaches and dimensionality reduction for portfolio selection with cardinality constraints. IEEE Comput Intell Mag 5(2):92–107

Schaerf A (2002) Local search technique for constrained portfolio selection problems. Comput Econ 20:170–190

Sharpe WF (1963) A simplifies model for portfolio analysis. Manage Sci 9:277–293

Sharpe WF (1971) A linear programming approximation for the general portfolio analysis problem. J Financ Quant Anal 6:1263–1275

Simaan Y (1997) Estimation risk in portfolio selection: the mean variance model versus the mean absolute deviation model. Manage Sci 43:1437–1446

Steuer RE, Paul N (2003) Multiple criteria decision making combined with finance: a categorized bibliographic study. Eur J Oper Res 150(3):496–515

Subbu R, Bonissone P, Eklund N, Bollapragada S, Chalermkraivuth K (2005) Multiobjective financial portfolio design: a hybrid evolutionary approach. In: IEEE congress on evolutionary computation

Yeh QJ (1996) The application of data envelopment analysis in conjunction with financial ratios for bank performance evaluation. J Oper Res Soc 47:980–988

Zeleny M (1982) Multiple criteria decision making. Mc-Graw-Hill, New York

Zopounidis C (1999) Multicriteria decision aid in financial management. Eur J Oper Res 119:404–415

Zopounidis C, Doumpos M, Zanakis S (1999) Stock evaluation using a preference disaggregation methodology. Decis Sci 30:313–336

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, CY., Chiou, CC., Wu, TH. et al. An integrated DEA-MODM methodology for portfolio optimization. Oper Res Int J 15, 115–136 (2015). https://doi.org/10.1007/s12351-014-0164-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-014-0164-7