Abstract

Purpose

A template to prepare a business case for Process Analytical Technology (PAT) and Continuous Manufacturing (CM) projects is presented in this study. Business cases are necessary tools used in different organizations to present new projects for management evaluation. As new ways of working under PAT and CM constitute a significant investment of capital, time, personnel, and other resources, a solid business case will facilitate the organization, presentation, and justification of these innovative strategies to management for their evaluation. The authors understand that this is the first study that considers the implementation of PAT in a specific manufacturing facility, including potential tax benefits associated with the manufacturing location.

Methods

A financial analysis template was used to develop a business case for an innovative stream sampler for pharmaceutical powder blends. The business case financial model included the capital investment and associated costs for implementing this powder sampler. The case study modeled three different potential tax benefits modalities. The definition of the financial model parameters, assumptions, and constraints are followed by the recommendations of pharmaceutical industry leaders and tax advisors.

Results

The financial model provided the evaluation of the listed relevant costs and benefits. The analysis evidenced a significant influence of tax incentives on the economic evaluation. As a result, the financial model estimated a net present value (NPV) range of $420,957 to $578,896, an internal rate of return (IRR) with a minimal of 65% and a maximum of 89%, and a return of investment (ROI) of 82 to 133% for the proposed PAT investment. The most significant benefits representing additional savings between $14,157 and $234,157 per year were presented applying the tax incentives.

Conclusion

The PAT Business Case template facilitates evaluating different scenarios, costs, and benefits for a proposed project. Each company may adopt the business case model according to its cost structure and manufacturing processes. The tax benefits contribute further to this case study, especially the super deduction, followed by the R&D tax credit. Furthermore, the tax incentives effects can be evaluated by entering the input data without an additional step in the business case template.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Process Analytical Technology (PAT) implementation is a key element in improving drug manufacturing processes. PAT is a systems approach “for designing, analyzing, and controlling manufacturing through timely measurements (i.e., during processing) of critical quality and performance attributes of raw and in-process materials and processes, with the goal of ensuring final product quality” [1]. The expectation is that PAT will support innovation and efficiency in pharmaceutical process development, manufacturing, and quality assurance. However, the implementation of PAT requires a significant investment; and constitutes a capital project [2].

The improvement of manufacturing through PAT requires the approval of new investments to monitor or control a process or work with the information obtained. PAT projects require careful evaluation because their outcomes will directly impact the organization’s profitability [3]. Scientists can justify PAT implementation through a business case, which is the most used tool to justify a capital investment [4, 5]. The business case is an instrument that describes the problem, cost, benefits, possible solutions, facts, and data required to make a decision [6, 7]. The cost/benefit model is the most critical component of the business case to make capital investment decisions, as companies will select and invest in projects that maximize profitability. The profitability of PAT projects will be compared to other proposed projects as companies evaluate possible investments.

Currently, there is a need to provide new powder sampling systems as alternatives to sample thieves. There are numerous examples of the problems associated with sampling of static powder beds by a sample thief [8,9,10,11,12]. This study presents a series of business case scenarios using a newly developed stream sampler based on the principles of the “Theory of Sampling” [13]. The Fundamental Sampling Principle states that all the material or batch must have the same probability of being sampled and that the material is not affected by the sampling process [13]. The stream sampler allows for the non-destructive analysis of powders flowing within the sampler through a sapphire window using spectroscopic techniques such as near infrared (NIR) or Raman spectroscopy.

The PAT literature focuses on scientific and technical considerations, with minimal discussion of fundamental financial aspects [18,19,20,21]. However, several articles discuss the economic analysis for PAT applications [2, 14,15,16]. The economic feasibility of the PAT implementation based on a production strategy for three products of a specific pharmaceutical company was evaluated in 2006 [16]. This research observed significant savings in quality control (QC) testing, increased process efficiency, and improved process performance. The cost-efficiencies generated through the combination of PAT and Lean Manufacturing could generate savings by improving process capability and supply chain management [14]. The economic impact of the PAT implementation in the identification of raw materials in the manufacturing of pharmaceutical products was analyzed [15]. This study highlighted PAT’s benefits by identifying the raw materials at the warehouse without sending the samples to the QC laboratory. Previous studies have shown that process understanding is increased through PAT, providing valuable information for a real-time release testing (RTRT) strategy [17]. Process understanding may also facilitate product approval and help a company reach the market quickly and increase its sales. The larger pharmaceutical companies now have PAT groups that provide information that contributes to new products approval. The value of PAT in product approval and development is clear, and the cost/benefits of in-line monitoring and RTRT were discussed by a BioPhorum committee [18].

The authors are not aware of any studies considering the costs associated with PAT implementation within the quality system of the manufacturing site subject of this technology transfer, including the effects of the tax credit incentives for that specific region or country. The financial models obtained in the studies related to the economic analysis of PAT depend on the cost structure and expectations of each company. Economic analysis related to the PAT for monitoring and control of blend uniformity may have been developed within companies but not shared or discussed with the PAT community.

For the first time, this article presents the application of a business case template, considering the manufacturing site subject of the PAT technology transfer. This study takes into consideration the costs of changes in plant procedures that are necessary for PAT implementation. The template also calculates the effect of tax incentives on the net present value (NPV), internal rate of return (IRR), and return on investment (ROI) of the proposed PAT investment. The business case template provides the financial evaluation of a new stream sampler currently under development and the financial assessment of acquiring supporting instrumentation, including a near-infrared or Raman spectrometer or the implementation of continuous manufacturing. The template could be used to evaluate many other PAT or continuous manufacturing investments and is not limited to the stream sampler in this case study. The business case template presented in this study will be available as a tool for advancing PAT and CM within the pharmaceutical industry.

Materials and Methods

Stream Sampler

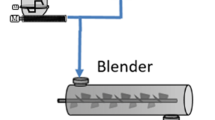

The stream sampler consists of a powder inlet, a sapphire window, a powder collection port, and the powder exit. The flow area within the sampler is consistent with the spot size of the spectroscopic equipment used ensuring all the material has equal opportunity of being analyzed [19]. Figure 1 shows the applications of the stream sampler when determining drug concentrations in a manufacturing process or in its development phase. The stream sampler can be used to analyze powder mixtures in a continuous or batch process. In both scenarios, the sampler could be placed before a tablet press for real-time monitoring of drug concentration through near-infrared or Raman spectroscopic measurements. The real-time drug concentration results obtained from the NIR or Raman spectra could be provided to a feed forward control system to accept or reject tablets at the tablet press. The stream sampler would eliminate the use of a sample thief, which requires an interruption of the manufacturing process and possible powder segregation [8].

The stream sampler also has a sample collection port to remove a cross-section of the material flow area without interrupting the powder flow. These samples can be subject to analysis by a reference method such as high-performance liquid chromatography (HPLC). This feature could be useful for companies that are developing new processes as shown in Fig. 1. After the sample collection port, the material completely exits the stream sampler ensuring new material is continuously analyzed. Once the material exits the sampler, it can continue to next process step as shown in Fig. 1. The sample collection port was designed for use during process development or validation.

Business Case Excel Template

The business case discussed in this study considers the use of the sampler for real-time monitoring. The template works as a user-friendly calculator where the user enters the data in a source data section. This section feeds the subsequent parts of the template (Capital Investment, Operational Cost, and Benefits Computations). The cost/benefit model consists of fourteen sections described in Table 1.

Economic Evaluation Methods

The economic evaluation methods used in the business case model correspond to net present value (NPV), internal rate of return (IRR), and return on investment (ROI).

The NPV allows evaluating the profitability of an investment or project; it is calculated given a discount rate i, and net cash flow CFj, at the year j, using Eq. 1 [20]:

The NPV represents the sum of the equivalency of the expected cash flows at the present time. The interest rate that causes a discounted breakeven point by making this sum equal to zero is called the internal rate of return (IRR). This is shown in Eq. 2 [16]:

The ROI is a profitability metric that compares the accumulated net of total of benefits (profit) obtained, Pj, and all expenses, Ej, with the capital investment made. The ROI evaluates the investment performance or efficiency, as shown in Eq. 3 [21]:

Tax Incentives and PAT

The investment alternatives must consider the impact of taxes and tax incentives to obtain better estimates of the cash flows and the economic evaluation methods. Most governments, especially developing countries, have implemented tax incentives to promote foreign investment and stimulate economic development in their country. These initiatives offer more favorable tax treatment to specific economic activities [22]. Taxes and tax incentives can affect the profitability of the investment, reducing or increasing the return of investment, respectively. PAT implementation could be a research and development (R&D) activity conducted at the manufacturing site which qualifies for tax credits.

Case Study

Design of Analysis

Table 2 describes the case study inputs for the pharmaceutical manufacturing site evaluated in this study. The operation city for the manufacturing plant corresponds to Mayagüez, Puerto Rico. The site size is 1000 employees, roughly the standard size of the manufacturing companies of solid oral dosing drugs established in Puerto Rico [23]. The yearly revenue billing of this manufacturing site is over $1 billion and corresponds to the sales of products in the USA, including Puerto Rico. The Puerto Rico branch of this company has a finished good inventory estimated at $869,842, representing 37% of total company inventory. This inventory data and revenue came from a similar manufacturing site in the island and its name is being protected due to a confidentiality agreement.

The contribution to the government is defined by a percentage based on the municipality over the real property (PAT equipment cost). This contribution has a 75% tax exemption according to the 2062.02 section of the Puerto Rico incentive code. This tax exemption is explained in detail in Table 5.

The minimum attractive rate of return (MARR) was 30% for this case study, but lower MARR values can still be attractive to management in projects of high-volume production. The MARR corresponds to the minimum profit a company expects to make from an investment, considering the investment risks. Thus, a MARR of 30% corresponds to an acceptable investment. Higher values for the MARR are used by companies short of capital or at industries where volatile prices increase the risk of poor returns for projects, as in the petroleum industry [20]. The MARR allows the managers to compare and evaluate investment alternatives with the same risk level.

The labor cost input related to the production line, and process quality monitoring included the salaries of a quality specialist, an operator, and an inspector position. The cost per hour for each position defined in this case study is roughly the standard salary of the manufacturing companies established in Puerto Rico. The salary for a quality specialist and an inspector was estimated at $40 per hour, while the operator salary corresponds to $16 per hour.

The sampling process in a manufacturing company implies a unit sample cost, which in this case study is equal to $100. This cost includes the material used cost, consumable cost, inspection holding times, and labor cost of the QC laboratory personnel.

Table 3 shows the cost associated with the stream sampler, its installation, and production line setup. The case study will consider an investment in one stream sampler, estimated around $70,000, and one spectrometer capable of doing real-time analysis, which costs approximately $150,000. The estimated installation and maintenance costs are 5% of the equipment cost and include transportation and equipment adaptation to the line by the supplier. The maintenance cost includes the labor cost of the maintenance personnel, spare parts, and holding times. The monitoring process using the stream sampler is in-line, which implies changes in the manufacturing line. The changes considered in this case study corresponds to changes in the quality management system (QMS), given the sampler is not an invasive equipment. This cost was included in the heading other capital costs (refers to Table 7).

The implementation of the stream sampler and NIR spectrometer will require equipment utilization and data management training. The estimated supplier training cost is $150 per hour for data management training. The training cost will be recurrent as an operational cost when the PAT implementation is completed and will be realized by the company personnel that the supplier trained.

The real-time monitoring of drug concentration in blends also requires developing a calibration model, which implies the preparation of blends at several concentrations, typically five concentrations. The case study assumed a formula for a direct compression process for 10% w/w of an over the counter (OTC) drug. The material cost employed for building all chemometrics models corresponds to 10 kg of active pharmaceutical ingredient (API) and 75 kg of excipient [24]. The API cost is equal to $148 per kilogram, given it corresponds to a popular OTC of common use. This cost could vary according to the API specialty reaching a sale price of $2520 per kilogram [25] The excipient cost corresponds to $17 per kilogram, for a total material cost employed for building chemometrics models of $2755. Preparation of the calibration model requires one chemometrician. The chemometrician standard salary of the manufacturing companies in Puerto Rico is equal to $58 per hour.

Multivariate data analysis (MVDA) tools are often installed when PAT equipment is installed to aid data collection and data analysis. These MVDA tools included equipment (Laptop) estimated at $2000 and software (Licenses MVDA) with a cost of $8000.

The work-in-progress (WIP) inspection allows monitoring the product through its processing [26]. The WIP is a term that specifies the partially finished products awaiting completion. The WIP inspection consists of inserting a sampling thief, removing powder, and placing it in vials for sending them to QC laboratory. Procedures for storing, cleaning, and training of personnel in the proper use of the sample thief are required. However, this inspection implies holding times by interrupting the manufacturing process when the sampling thief is used. The implementation of the stream sampler implies a 100% cost reduction of the WIP inspection cost. The stream sampler allows the collection of samples without interrupting the flow of the WIP. PAT equipment allows identifying the critical quality and performance attributes of WIP without sending the samples to the QC laboratory.

PAT implementation generates many benefits. PAT reduces the labor of the QC laboratory personnel since measurements are made during production [1, 14]. This reduction was estimated at 90% of the labor cost of QC laboratory. The improvement in production yield is another benefit, resulting from the minimizing product losses due to nonconformance. A reduction of 90% was estimated based on nonconforming batch reduction as the prevention of rejected products helps the production yield. This improvement is achieved through the process understanding that is gained in PAT, and ensuing control strategies to allow process adjustments to assure product quality. Besides, savings of 50% on inventory carrying cost may result from the decrease of inventory hold-ups and reduction in batch release time related to QC delays [4, 16, 27]. Table 4 describes the expected stream sampler benefits defined as savings, corresponding to a percentage reduction applied to the operational cost.

Tax Incentives

The template takes into consideration tax incentives for investments. For this case study, the current tax incentives laws of Puerto Rico, which have offered tax incentives for more than 50 years, were used [23]. China, Singapore, India, Ireland, and other sites also offer attractive tax incentives for pharmaceutical manufacturing. The tax benefits can be substantial and an important incentive for investment in PAT and advanced manufacturing in any country. The template could be applied using the tax incentives laws of other manufacturing sites, given the template structure. The template may also be used without considering tax benefits.

Scenarios Considering Tax Incentives

The template structure may be used to evaluate different scenarios according to the tax incentives that the pharmaceutical company could apply. This study considers incentives established by the Government of Puerto Rico to promote activities that generate sustainable economic development on the island. The list of the pharmaceutical industry’s incentives resulted from the literature review, feedback from tax advisors, and interviews with leaders of the Department of Economic Development and Commerce (DEDC) of Puerto Rico. Currently (as of 2020), tax incentives are governed by the Puerto Rico Incentive Code, Act 60 established in 2019 [28]. The analysis of different scenarios is essential for pharmaceutical companies because it allows evaluating the best and efficient way to use the tax credit incentives. Besides, the tax incentives help to reach the project’s purpose of saving money, making it more attractive for managers. This case study includes three different tax credit scenarios. Table 5 provides a summary of the tax benefits taken into consideration in each scenario:

Scenario I: Depreciation and Tax Benefits

The depreciation method used corresponds to the Modified Accelerated Cost Recovery System (MACRS) because it allows for more significant accelerated depreciation over a given time. Alternatively, the business case template allows using the straight-Line depreciation method according to the financial guidelines of the company. For the stream sampler, the useful life used to calculate the depreciation corresponds to 5 years. This useful life is established in asset types classification for MACRS in Publication 946 by the Department of Treasure of the United States [29].

Scenario II: Depreciation, Tax Benefits, and R&D Credit

This scenario corresponds to an extension of Scenario I but with differences in the tax incentives used. Scenario II considers the benefits for the pharmaceutical companies associated with research and development activities. The tax credit related to this benefit affects the depreciation base, reducing it by 50%. The depreciation base corresponds to the equipment cost, which in this case study is equal to $220,000. Therefore, the base amount for depreciation calculations will be $110,000.

Scenario III: Tax Benefits and Super-deduction Without R&D Credit

The third scenario considers the tax incentive of the super-deduction currently (as of year 2020) available in Puerto Rico. This tax incentives corresponds to the 100% Exemption for Investment in Buildings, Structures, Machinery and Equipment. The super-deduction base corresponds in this case study to the total equipment cost, which is equal to $220,000. The tax incentive of super-deduction does not consider depreciation cost. The super-deduction and the depreciation are mutually exclusive.

Assumptions and Constraints

The following assumptions were defined for the case study according to the results obtained in meetings with pharmaceutical experts and the Puerto Rico Incentive Code [28]. The assumptions and constraints are shown in Table 6.

Results and Discussion

All the scenarios considered a base structure related to the capital investment, operational cost, and benefits associated with the PAT implementation. The study period, defined to evaluate the cost-effectiveness of the project, corresponds to 7 years, based on current business practice documented in the literature for similar applications [15, 16]. According to previous studies, the PAT implementation could reach a break-even point after as little as 6 years [16]. The useful life of the stream sampler should be longer than the 7 years of the study period. The depreciable life is defined by the depreciation method; MACRS establishes a 5-year depreciation period for this kind of equipment. The following results correspond to the outputs of the business case template:

Capital Investment Cost

According to the inputs used in the source data section, the total capital required for implementing the stream sampler corresponds to $330,827. Table 7 provides a list of the cost items. The PAT equipment cost group corresponds to the cost associated directly with the equipment and the activities required for its operation. The qualification, validation, approval cost corresponds to the development of protocols and their execution to determine whether the equipment meets the specifications of its intended purposes and requirements related to product quality. PAT equipment must be qualified and calibrated before being utilized. This qualification and calibration cost corresponds to the salary and expenses associated with one Pharmaceutical Validation Specialist who performs the instrument qualification in 40 h per week, during twelve workweeks. Training in equipment utilization and data management is required to use the equipment and the data obtained correctly. The PAT equipment training cost was estimated at $3756, which corresponds to supplier cost and the man-hours of two operators, considering that the supplier would provide the initial training for the sampler. The PAT Equipment Data Management training cost was estimated at $2656. This corresponds to a supplier cost of $150 per hour, 8 h per day, during two workdays, offered for two employees (operator).

The other costs included in the capital investment correspond to the additional requirements and changes in the production line. The stream sampler in this case study requires a calibration model to calculate the drug concentration with the near-infrared spectra obtained. The PAT implementation requires the development of chemometric models. This development requires the preparation of blends at several concentrations, spectral acquisition, and calculation of the calibration model. The time required for these activities was estimated at 24, 8, and 16 h per week, respectively, for twelve workweeks. Major pharmaceutical companies now have personnel focused on PAT and with expertise in chemometrics. Three employees are required to complete the three activities. The material employed for building chemometrics models in the first activity has a cost equal to $2755. Spectral data analysis with chemometrics requires MVDA software [16]. The MVDA capability requires equipment (Laptop), software (Licenses MVDA), and the labor cost of one chemometrician 40 h per week, for three workweeks.

PAT technology implementation requires activities related to the company’s quality system [1]. The quality systems that require changes include the Quality Management System (QMC) and Change Control System. The cost associated with these activities was calculated according to two specific activities: prepare and review documents and training of two employees (quality specialists). These activities require 10 and 6 h respectively, in 1 week.

Operational Cost Associated with PAT

After its implementation, the costs associated with PAT correspond to the maintenance cost, PAT equipment training cost, and PAT equipment data management training cost. These costs are in addition to the current costs required for the tablet production line operation and they are recurrent costs (overhead cost). The implementation of new equipment at the production line implies yearly maintenance after its first operation year. The literature review provided an estimate of cost for maintenance. The maintenance cost was estimated at $3500, which corresponds to the 5% equipment cost (stream sampler). The stream sampler operation can be done by the pharmaceutical process operator, therefore there is no additional cost incurred. The cost of training at PAT equipment and PAT Equipment Data Management, was estimated at $256 per year for each. These costs correspond to the man-hours of two employees (operators) per training, 8 h per day, during one workday. These employees received the training from the supplier. The total operational cost calculated with the inputs used at the source data section corresponds to $4012 per year.

This estimate does not include losses related to testing inaccuracy or “false negatives” that may occur in the early stages of the PAT implementation. However, this application is focused on real-time determination of drug concentration of a pharmaceutical blend, a PAT application that has been widely studied where the occurrence of false negatives is less likely [30,31,32]. False negatives are often related to sampling errors which would be reduced with the stream sampler [33, 34]. The false negatives may also be related to lack of understanding of real-time results. Companies that move from off-line methods to real-time methods will see process variation that was never observed since it was not measured. False negatives could be an excellent subject of future studies, but is outside the scope of this study.

Benefits Associated to PAT Equipment Operation

The total savings per year using the stream sampler was estimated as $381,753 (refers to Table 8). The 57% of total benefits, equal to $217,461, correspond to the effect of the reduction of inventory levels. The decrease of inventory hold-ups and the reduction in release time related to QC delays could help reduce inventory levels [4, 16, 27]. An efficient manufacturing process could help to prevent significant inventory hold-ups and avoid stock-out risks. The evaluation considers only a single product at a single manufacturing site. The reduction of inventory costs would be much greater if PAT is applied throughout to all processes done at the company.

The savings of in-process control (IPC) laboratory costs would be 100% of the sampling and testing cost (WIP inspection cost). The stream sampler allows real-time process monitoring without interrupting the flow of the WIP at the batch production line. The cost reduction consisted of the avoidance of IPC laboratory activities with the in-line tests [14, 16, 27, 35]. It would no longer be necessary to pull samples from a blender with a sample thief and bring them to the laboratory for analysis.

The WIP inspection cost was estimated for a worst-case scenario. This inspection corresponds to two inspection types using a sample thief: characterization and validation. Each type of inspection requires two employees (inspector) per shift for sample collection. Three shifts were estimated for the production operation in this case study. A total of 4 h per shift per week were required for each inspection type, for a total of 384 man-hours per shift per year per inspection type. The analysis of three batches in characterization inspection was estimated. Equally, the analysis of three batches was estimated for validation inspection. Forty samples per batch were estimated for each inspection type. The sample cost corresponds to $100. This cost is totally reduced with the stream sampler use, representing savings equal to $107,160 per year, 28% of the total savings. The benefits per year when implementing the stream sampler are shown in Table 8 and represented graphically in Fig. 2. Figure 2 shows that the main benefits are related to lower inventory levels, followed by the IPC laboratory costs. The line in Fig. 2 emphasizes the cumulative percentage of each benefit of the total savings by PAT operation.

The implementation of PAT using the stream sampler allows for the prevention of non-conforming products accounting for an increase in production yield. The estimated benefit accounted for by the increase in production yield was $54,540 per year. The prevention of product rejection can be attributed to PAT implementation and increased process understanding [1, 14]. The continuous and frequent blend evaluation through the stream sampler/PAT system facilitates taking real-time corrective actions, contributing to prevention and risk management throughout the product manufacturing lifecycle [36, 37].

PAT also reduces the cost associated with quality cost labor for investigations of process deviations. Any out-of-specification result obtained from a sample thief, a genuine blend homogeneity failure, sampling, or testing error requires an investigation. The implementation of the stream sampler and PAT system reduces the probability of having a sampling and testing error, resulting in a reduction of the frequency of investigation events [16, 38]. The estimated benefit of reduced investigations was a 90% reduction of investigation events per year, accounting for a saving of $2,592 in this case study.

The real-time monitoring of the blending process through the stream sampler in combination with NIR or Raman spectroscopy also adds a significant advantage in terms of the immediate detection of a variation in the drug concentration in the blends. Thousands of measurements would be available for a continuous process, providing information that could be used for process improvement [32]. In contrast, the sample thief, and the off-line determination of drug concentration in blends by a QC laboratory occurs after a batch blending process is completed.

The stream sampler facilitates the statistical evaluation of the blend uniformity data [39]. The sampler with the spectroscopic technique and chemometrics permits multiple determinations of drug concentration in the flowing blends where all parts of the blend now have the same opportunity of being selected and the material is not affected by the sampling process. Compared to the thief sampling, which uses pre-defined sample locations and affects the material, the stream sampler increases the aleatory nature of the samples, making it possible to perform variographic analysis and characterize the process variance and materials heterogeneity. Variographic analysis provides an estimate of the sampling and analytical errors and makes it possible to differentiate between them and the variation related to the heterogeneity of the powder blends [19, 39]. This can be very beneficial in the development of a process. The benefits could also include the faster transfer of a new product from research and development to manufacturing. No company wants to delay the approval of a new product due to a sampling problem typically observed by using a sample thief. R&D groups wish to have all the technology necessary to bring products to market faster, and manufacturing units want to implement them successfully in the shortest possible time.

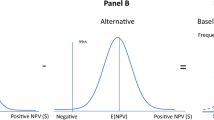

Benefits Associated to Tax Incentives

The results of tax benefits are divided by scenario according to the case study assumptions. Figure 3 shows the benefits per year associated to tax incentives by scenario. Even though the financial analysis results of the three scenarios evaluated are favorable from NPV, IRR, and ROI perspectives, the super deduction scenario showed maximization potential for benefits. An NPV value that is significantly positive, in this case above the level of capital investment, provides the basis of favorability by which a company should consider this technology. In addition, deduction and tax scenarios, which are location-specific, add to the financial favorability. The first scenario considers the most common situation in which the depreciation method is applied with tax incentives and is favorable with a total tax benefit of $14,157. The most significant tax benefits came from the third scenario with the super deduction, $234,157, followed by the second scenario related to Puerto Rico’s R&D Tax Credit with a total of $96,864. The tax benefits are location specific as they consider government tax and research incentive programs as the PR R&D credit code in this case. These tax benefits must be requested, they are not automatic, and the companies must also meet requirements to apply for them. These requirements are contained at the Incentive Code, Act 60 established in 2019 [28].

Results by Scenario

Table 9 provides the results for the economic evaluation methods by scenario. All the scenarios are favorable for implementing the stream sampler/PAT system for what we understand is a typical pharmaceutical manufacturing operation. Although it has the lowest economical metrics, the first scenario has a positive impact with a NPV positive of $420,957. A positive NPV implies that this project will generate benefits: the higher the NPV value, the greater the project’s profitability. An IRR of 65%, a ROI of 82%, and a payback period of less than 2 years for the first scenario make it financially attractive. For the second scenario, the metrics are more favorable than the first scenario, with a NPV of $526,753, an IRR of 78%, a ROI above 100%, and a payback period of 1.5 years. The third scenario is the most attractive of the three possible options with an NPV of $578,896, an IRR equal to 89%, an ROI of 133%, and a payback period of 1.3 years.

The IRR must be compared with the MARR to evaluate if the stream sampler implementation is profitable [20]. The implementation of the stream sampler is a profitable project because the IRR is higher than the chosen MARR of the case study (30%). IRR allows measuring the growth rate that is expected from the project. The higher the IRR, the more profitable the project would be, and this case study obtained an IRR that is over three times the MARR [15].

The ROI compares the initial investment versus the benefits obtained by the project. A positive and high ROI reflects that the stream sampler implementation is profitable, in this case, based on the first-year return. Hence, the stream sampler becomes more desirable for a company because its returns are higher than the invested resources.

A relatively short payback period makes the project more attractive because the time needed to recover the capital investment is brief. In any of the studied scenarios, the investment recovery occurs in less than 2 years.

Conclusions

The costs and benefits associated with the stream sampler are also applicable to many other projects involving PAT, continuous manufacturing, and emerging technologies. The stream sampler has been used as example of a PAT investment to further investigate the costs and benefits associated with its implementation in manufacturing. The authors are certain that this study will catalyze much needed progress in evaluating the costs and benefits of introducing new technologies in pharmaceutical manufacturing.

The reduction in inventory levels and decrease of IPC laboratory activities are positive effects of the implementation of the stream sampler and monitoring with NIR or Raman spectroscopy. Besides, the stream sampler implementation could be a very profitable investment project, with a rate of return between 65 and 89% and a payback period between 1.3 and 2 years approximately. The return on investment may represent a difference between 82 and 133% versus the capital investment for this project which is economically attractive.

The tax benefits contribute further to this case study, especially the super deduction, followed by the R&D tax credit. The case study evidenced the ease of using this business case model, including analyzing and reviewing the results. This business case template allows evaluation in real-time of any change generated during the project’s analysis and its effect on the project’s economic evaluation methods. Furthermore, the tax incentives effects can be evaluated by entering the input data without an additional step in the template.

As future work, we need to consider evaluating the sampler/PAT system implementation in manufacturing lines associated with other types of products. Likewise, we should consider the evaluation of PAT implementation in medical device production and the food industry. The economic impact that PAT implementation shall consider is the exploration these kinds of industries and the benefits associated with sustainability, testing simplification, and quality system requirements.

Data availability

All data is available as supplementary material of this article.

References

U.S. Department of Health and Human Services FDA. Guidance for Industry - PAT A Framework for Innovative Pharmaceutical Development, Manufacturing, and Quality Assurance. 2004;1–19.

Fontalvo-Lascano MA, Méndez-Piñero MI, Romañach RJ. Development of a business case model for process analytical technology implementation in the pharmaceutical industry. Proceedings of the 5th NA International Conference on Industrial Engineering and Operations Management. Detroit, Michigan: IEOM Society International. 2020;1144–52.

Qaid WAA, Finaev VI, Tychinsky AV. Algorithmization of the process of preparation of capital investment project. Mediterr J Soc Sci. 2015;6(2):354.

Maes I, Van Liedekerke B. The need for a broader perspective if process analytical technology implementation is to be successful in the pharmaceutical sector. J Pharm Innov. 2006;1(1):19–21.

Kourti T, Davis B. The business benefits of quality by design (QbD). Pharm Eng. 2012;32(4):1–10.

Stratton M. Business case development guideline. Crystal Ball User Conference. 2004;1–24.

Aithal S. An effective method of developing business case studies based on company analysis. Economics Educator: Courses. 2017.

Muzzio FJ, Robinson P, Wightman C, Brone D. Sampling practices in powder blending. Int J Pharm. 1997;155(2):153–78. https://doi.org/10.1016/s0378-5173(97)04865-5.

Berman J, Schoeneman A, Shelton JT. Unit dose sampling: a tale of two thieves. Drug Dev Ind Pharm. 1996;22(11):1121–32. https://doi.org/10.3109/03639049609065948.

Esbensen KH, Román-Ospino AD, Sanchez A, Romañach RJ. Adequacy and verifiability of pharmaceutical mixtures and dose units by variographic analysis (Theory of Sampling) – A call for a regulatory paradigm shift. Int J Pharm. 2016;499(1–2):156–74. https://doi.org/10.1016/j.ijpharm.2015.12.038.

U.S. Department of Health and Human Services FDA. ANDA's: Blend Uniformity Analysis; Withdrawal of Draft Guidance. 2002.

Prescott JK, Garcia TP. A solid dosage and blend content uniformity troubleshooting diagram. Pharm Technol. 2001;25(3):68–88.

Esbensen KH. Introduction to the theory and practice of sampling. Chichester, West Sussex PO18 0HY, UK: IMP Open. 2020.

Cogdill RP, Knight TP, Anderson CA, Drennen JK. The financial returns on investments in process analytical technology and lean manufacturing: benchmarks and case sudy. J Pharm Innov. 2007;2(1):38–50. https://doi.org/10.1007/s12247-007-9007-x.

Freeman SC, Gujral B, Rufino D. Building a business case for PAT. Pharma Manufacturing. 2007.

Valþórsson H. PAT implementation in pharmaceutical manufacturing and its economical impact. University of Basel. 2006.

Markl D, Warman M, Dumarey M, Bergman E-L, Folestad S, Shi Z, et al. Review of real-time release testing of pharmaceutical tablets: State-of-the art, challenges and future perspective. Int J Pharm. 2020;582:119353. https://doi.org/10.1016/j.ijpharm.2020.119353.

BioPhorum. In-line monitoring/real-time release testing in biopharmaceutical processes prioritization and cost-benefit analysis. 2020;45.

Sierra-Vega NO, Romañach RJ, Méndez R. Real-time quantification of low-dose cohesive formulations within a sampling interface for flowing powders. Int J Pharm. 2020;588: 119726. https://doi.org/10.1016/j.ijpharm.2020.119726.

Newman DG, Eschenbach TG, Lavelle JP, Lewis N. Engineering economic analysis. 14 ed. Oxford University Press. 2020.

Zamfir M, Manea MD, Ionescu L. Return on investment – indicator for measuring the profitability of invested capital. Valahian Journal of Economic Studies. 2017;7(2):79–86. https://doi.org/10.1515/vjes-2016-0010.

Klemm A, Van Parys S. Empirical evidence on the effects of tax incentives. Int Tax Public Financ. 2012;19(3):393–423. https://doi.org/10.1007/s10797-011-9194-8.

Jones Lang LaSalle (JLL). Life Sciences Manufacturing Report Puerto Rico. Invest Puerto Rico. 2020;36

Sierra-Vega NO, Román-Ospino A, Scicolone J, Muzzio FJ, Romañach RJ, Méndez R. Assessment of blend uniformity in a continuous tablet manufacturing process. Int J Pharm. 2019;560:322–33. https://doi.org/10.1016/j.ijpharm.2019.01.073.

Hill AM, Barber MJ, Gotham D. Estimated costs of production and potential prices for the WHO Essential Medicines List. BMJ Glob Health. 2018;3(1):e000571. https://doi.org/10.1136/bmjgh-2017-000571.

Hopp WJ, Spearman ML. Factory physics. Waveland Press. 2011.

Harrington TS, Alinaghian L, Srai JS. Making the business case for continuous manufacturing in the Pharmaceutical Industry. Proceedings of the 25th Annual Production and Operations Management Society (POMS) Conference, Atlanta GA. 2014.

Puerto Rico House of Representatives. Act 60. Puerto Rico Incentives Code. San Juan, Puerto Rico. 2019.

U. S. Internal Revenue Service (IRS). How To depreciate property. In: Treasury US Dot, editor. 2015.

Corredor C, Lozano R, Bu X, McCann R, Dougherty J, Stevens T, et al. Analytical method quality by design for an on-line near-infrared method to monitor blend potency and uniformity. J Pharm Innov. 2015;10(1):47–55. https://doi.org/10.1007/s12247-014-9205-2.

Sierra-Vega NO, Romañach RJ, Méndez R. Feed frame: The last processing step before the tablet compaction in pharmaceutical manufacturing. Int J Pharm. 2019;572: 118728. https://doi.org/10.1016/j.ijpharm.2019.118728.

Vargas JM, Nielsen S, Cárdenas V, Gonzalez A, Aymat EY, Almodovar E, et al. Process analytical technology in continuous manufacturing of a commercial pharmaceutical product. Int J Pharm. 2018;538(1–2):167–78. https://doi.org/10.1016/j.ijpharm.2018.01.003.

Green RL, Thurau G, Pixley NC, Mateos A, Reed RA, Higgins JP. In-line monitoring of moisture content in fluid bed dryers using near-IR spectroscopy with consideration of sampling effects on method accuracy. Anal Chem. 2005;77(14):4515–22. https://doi.org/10.1021/ac050272q.

Romañach R, Joubert Castro A, Esbensen K. What are sampling errors what can we do about them? Part 1. Spectrosc Eur. 2021;33(2):7.

Guenard R, Thurau G. Implementation of process analytical technologies. Process Analytical Technology. John Wiley & Sons, Ltd. 2010;17–36.

Moran F, Sullivan C, Keener K, Cullen P. Facilitating smart HACCP strategies with process analytical technology. Curr Opin Food Sci. 2017;17:94–9. https://doi.org/10.1016/j.cofs.2017.11.003.

Esmonde-White KA, Cuellar M, Uerpmann C, Lenain B, Lewis IR. Raman spectroscopy as a process analytical technology for pharmaceutical manufacturing and bioprocessing. Anal Bioanal Chem. 2017;409(3):637–49. https://doi.org/10.1007/s00216-016-9824-1.

Murphy T, O'Mahony N, Panduru K, Riordan D, Walsh J. Pharmaceutical manufacturing and the quality by design (QBD), process analytical technology (PAT) approach. 27th Irish Signals and Systems Conference (ISSC): IEEE. 2016;1–7.

Sánchez-Paternina A, Sierra-Vega NO, Cárdenas V, Méndez R, Esbensen KH, Romañach RJ. Variographic analysis: a new methodology for quality assurance of pharmaceutical blending processes. Comput Chem Eng. 2019;124:109–23. https://doi.org/10.1016/j.compchemeng.2019.02.010.

Acknowledgements

This study was financially supported by the U.S. Economic Development Administration (EDA) (Investment No.: 01-79-14889). The authors would like to thank several pharmaceutical industry leaders, CPA María de los Ángeles Rivera, tax advisor at Kevane Grant Thornton company, and Víctor Merced Amalbert, chief business development of the Department of Economic Development and Commerce (DEDC) of Puerto Rico, who provided valuable insights for the development of the business case.

Funding

This research is funded by Economic Development Administration, Award Number: (01–70-14889).

Author information

Authors and Affiliations

Contributions

MAF-L: Coordinated this research and carried out all experiments, data analysis, and drafted the manuscript. BBA-H: Drafted the manuscript, prepared figures, and data analysis. CC: Aided in manuscript revisions and establishing theoretical data needed. EJS: Aided in manuscript revisions and establishing theoretical data needed. MIMP: Coordination of the research, helped establish methods for data analysis, and aided in the conception of the study. RJR: Conceived this study and participated in coordinating the research.

Corresponding author

Ethics declarations

Consent for Publication

All the authors mentioned in the manuscript have agreed for authorship, read, and approved the manuscript and given consent for submission and subsequent publication of the manuscript.

Conflict of Interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Fontalvo-Lascano, M.A., Alvarado-Hernández, B.B., Conde, C. et al. Development and Application of a Business Case Model for a Stream Sampler in the Pharmaceutical Industry. J Pharm Innov 18, 182–194 (2023). https://doi.org/10.1007/s12247-022-09634-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12247-022-09634-0