Abstract

This study examines how the perceptions of fairness in tax regimes influence tax morale. We empirically demonstrate the importance of the perception of fairness in shaping tax morale and the subsequent attitudes by examining data on approximately 7300 taxpayers by the National Survey of Tax and Benefit of South Korea. To estimate the tax moral inherent in taxpayers, we adopt the framed and hypothetical tax evasion question method. We find that taxpayers are more likely to pay taxes if they perceive the tax system as fair in terms of vertical, horizontal, exchange, and distributive fairness, while procedural fairness is not statistically significant. Our results also indicate that the peer effect and trust in government have an essential positive correlation with tax morale.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

From the traditional economic perspective, harsh penalties discourage tax evasion (Allingham and Sandmo 1972; Chander and Louis 1998; Oladele et al. 2019). However, many studies report evidence that people continue to pay taxes even when they have the opportunity to evade them (Alm et al. 1992; Mikesell and Liucija, 2007). This result implies that the notion that only strong enforcement can prevent tax evasion may not be valid.

We consider taxpayers not just as potential criminals but as potential clients (Cyan et al. 2016; Torgler 2003a, 2003b; Rodriguez-Justicia and Theilen 2018). As potential clients, taxpayers are likely to pay taxes if the tax system and society are fair. Many studies report that fairness value crucially affects taxpayers’ willingness to pay (Torgler 2002; Finocchiaro and Ilde 2014; Moser et al. 1995; Fortin et al. 2007; Dijke and Peter, 2010; Verboon and Sjoerd 2009; Kim 2002).

Although prior studies revealed a close positive relationship between fairness and tax morale, this study aimed to obtain more robust results from the following perspectives. First, we estimate people’s tax morale by using a sophisticated framed questionnaire in which taxpayers’ psychological distance to tax evasion decreases. In the World Value Survey (WVS), the following statement is designed neutrally to estimate people's tax morale: “Cheating on taxes if you have a chance”. Although these neutral questions have no bias themselves, people can act differently from their responses even if they provide honest responses. Respondents say no to cheating taxes because it sounds very bad. However, keeping some cash may not equate to cheating taxes in this respondent’s mind.

Second, we observe the effects of multiple fairness factors on tax morale in consistent circumstance. Most previous studies have focused on a single fairness factor in tax morale in diverse data sets or using natural experiment like policy change (e.g., Murphy and Tom 2008; Lindsay 2016). Although there are consistent results on the impact of single fairness under various conditions, it is important to examine whether several types of fairness have consistent results under consistent conditions. Moreover, singular fairness factor might presents statistical problems, such as the omitted variable bias, which could reduce the credibility of the findings. Therefore, considering multiple types of fairness will strengthen the results found between tax morale and fairness.

Third, we conduct a study on the relationship between fairness and tax morale for Korean taxpayers belonging to completely different backgrounds from participants from WEIRD (western educated industrialized rich democratic) countries. Most tax compliance experiments, both in the laboratory and in the field, use subjects and taxpayers from WEIRD countries, such as Torgler (2016) for field experiments and Alm and Antoine (2020) for laboratory experiments. Henrich et al. (2010) comment extensively on the use of WEIRD countries’ participants in experiments. Tax morale and tax compliance are influenced by the culture and the institutions of taxpayers' country of origin (Alm et al. 1995; Alm and Benno, 2006; Mickiewicz et al. 2019). South Korea has a very different ethnic, cultural, and historical composition from that of WEIRD countries. It is worth exploring if the effect of fairness on tax morale results is consistent with previous studies, even those using samples from completely different backgrounds.

The current study employs approximately 7300 representative taxpayers from the South Korean National Survey of Tax and Benefits (NaSTaB) in 2016. We use a framed tax evasion question that asked “How much cash income without documentation should the shopkeeper report to the National Tax Service? (See Sect. 4.1.1 for a more detailed scenario of this question).” We compare the distribution of tax morale from the framed questioning (NaSTaB) to the neutral tax evasion question (WVS). Around 22% of taxpayers respond to the lowest tax morale for the framed question in the NaSTaB, but only a few individuals show the lowest tax morale (2%) in the WVS neutral questioning case. In the case of the highest morale, WVS (61%) was about twice as high as that of NasTaB (34%).

Based on the tax morale estimated from the framed question, we consider the relationship between multiple aspects of fairness and tax morale, including vertical fairness, exchange fairness, horizontal fairness, distributive fairness, and procedural fairness. The outcomes are consistent with those of previous studies; namely that multiple fairness factor analysis provides favorable conditions for the robustness of results. Furthermore, we look at whether these implications can be observed equally in groups with various social characteristics. We find that although we cannot obtain strong statistical evidence, we can still say that tax fairness is influential in most different socio-economic groups. However, in the case of procedure fairness, an inconsistent impact was observed for each group.

The rest of this paper is organized as follows: Sect. 2 provides a brief literature review about tax morale and fairness. Section 3 shows the hypotheses about fairness and tax morale. Section 4 explains our empirical approach. Section 5 discusses the empirical results. It also provides checks for the validity of findings. Section 6 gives our conclusions.

2 Related literature

The importance of fairness is manifested in several ways. Adams (1965) considered participants’ actual responses to unfairness to indicate that participants may quietly seek to reduce inequity by adjusting their inputs or contributions to the exchange relationship between them and the government. Trivers (1971) also discussed the importance of fairness in tax morale. He observed that fairness strongly impacts moral emotions, such as guilt, trust, dislike, gratitude, and moralistic aggression. Kirchler (2007) suggested that taxpayers’ knowledge of tax law, their attitudes toward the government and taxation, fairness, and motivational tendencies to comply, among others, are psychological determinants shaping tax behavior. Murphy and Tom (2008) found that people would be more inclined to cooperate with authorities if authorities treated them fairly.

Our study considers five tax fairness factors: vertical, exchange, horizontal, distributive, and procedural fairness. Table 1 shows a comprehensive overview in the literature of fairness and tax morale. Vertical fairness is considered to be important for tax morale. Based on the context of the Tax Reform Act of 1986, Kinsey and Harold (1993) found that vertical fairness positively relates to tax morale. Torgler (2002), through experimental data, found that vertical fairness factors significantly influence tax evasion. Finocchiaro and Ilde (2014) analyzed responses from 120 students with different backgrounds in Italy to observe a positive relationship between inequity and tax evasion. Their analysis found that the perception of vertical unfairness decreased tax compliance.

About exchange fairness, Kim (2002) designed an experiment involving 46 master of business administration’s (MBA) students. He found that taxpayers who thought they were not getting a fair return from the government for their taxes reported less income than taxpayers who perceived equity in their exchange with the government. While Torgler (2002) found that though vertical fairness significantly affected tax evasion, the effect of exchange fairness was not as clear.

Considering horizontal fairness, Moser et al. (1995) used experimental data and found that perceptions about horizontal inequity affected subjects’ reporting decisions. Fortin et al. (2007) also used experimental data and found that perceived unfair taxation might increase tax evasion.

Distributive fairness is also an essential factor for tax morale. Verboon and Sjoerd (2009) found that distributive fairness positively affected tax compliance attitudes with relatively low personal norms. Wenzel (2003) discussed the relationship between fairness and tax compliance based on the literature involving the distinctions between socio-psychological, distributive, procedural, and retributive justice.

Procedural fairness has also been discussed in some studies. Extensive surveys of the Australian tax system (Hartner et al. 2008) revealed that tax compliance increased when people felt that tax authorities treated them with procedural fairness. Dijke and Peter (2010) conducted two studies on 60 undergraduate psychology students from the Open University of the Netherlands and 567 workers. They concluded that procedural fairness could enhance tax compliance when the people trusted the authorities. Gobena and Marius (2016) analyzed responses from 231 small and large business owners and/or their accounts in the Ethiopian capital. They observed a positive relationship between procedural justice and voluntary tax compliance.

The relationship between fairness and tax morale is also reflected in the analysis of different data types. Kirchler (2007) developed a whole subsection on fairness and mentioned a mix of experimental and empirical works. Typical experimental studies mainly include Spicer and Lee (1980) and Alm et al. (1992). Roberts and Peggy (1994) and Van Dijke and Peter (2010) provide good examples of empirical analysis. Regardless of the experiment or empirical research methods, the results show that fairness plays an important role in reducing tax evasion.

Overall, our study focuses on various perceptions about fairness and their effects on tax morale. Although previous studies revealed that taxpayers might seek to offset their distress in inequitable relationships with tax evasion (Torgler 2002), their perceptions about fairness also influenced tax morale. For example, Cummings et al. (2009) suggested that individuals’ perceptions about their government significantly impact tax compliance.

3 Hypotheses: Fairness and tax morale

Numerous survey studies have presented a positive relationship between fairness and tax morale with a neutral tax morale question (Kinsey and Harold 1993; Wenzel 2002; Verboon and Sjoerd, 2009), but how about using a framed tax morale question? Many empirical evidence reports that a person's behavior may vary depending on frames. For instance, Mazar et al. (2008) indicated that cheating increased when potential cheaters were offered the opportunity to earn tokens rather than coins. Something comparable happens with the studies of Jacquemet et al. (2019) or Jacquemet et al. (2020), and they found that when the dishonest behavior was less easily identifiable, cheating increased. However, for Barr and Danila (2009), framing did not affect bribe acceptance, as the issue of artificiality may be of particular importance in bribery experiments. Therefore, even previous researches show positive relationship between fairness and tax morale, which will change depending on how the estimate tax morale question is framed on the questionnaire.

Hypothesis 1

Tax fairness factors have positive effects on framed tax morale.

The second hypothesis is regarding the relationship of various fairnesses in socio-economic backgrounds. We analyze different education levels, employment types, ages and income separately. Taxpayers with a high level of education may not be much affected by tax fairness factors because their tax morale should be higher than taxpayers with a low level of education (Rodriguez-Justicia and Theilen 2018). Meanwhile, except for small business owners (Verboon and Sjoerd 2009), we also want to know what kind of connection exists between fairness and tax morale among other types of employment, such as wage earner, temporary employee, self-employed, and homemaker. Meanwhile, according to Cyan et al. (2016), age positively affects attitudes toward tax compliance. We also conduct an analysis according to household income level.

Hypothesis 2

Regardless of the socio-economic background, tax morale will be higher when tax regimes achieve certain fairness values.

4 Empirical approach

4.1 Data

The data used in this study were derived from the NaSTaB, as administered by the South Korea Institute of Public Finance. NaSTaB panel surveys have been conducted in 15 cities and provinces across the country. The panels conduct in-person interviews. With individual consent, the organization strives to improve the accuracy of income tax return information by collecting year-end tax returns of wages and salaried income, and the total income tax returns by the respondents. The original sample included 5634 households; family members aged 15 and above, who had lived with their family for more than six months were included. To reduce fear of being audited in government, according to Article 33 of the Statistics Law, security is guaranteed, and the surveyor signs and submits to the respondents to ensure that the survey and the submitted income documents are not used for any other purpose beyond statistical purposes.

Our study applied the data of 2016 because the tax consciousness factors of interest to the study were captured in that year. The consciousness data involved approximately 7300 taxpayers. Table 7 (see Appendix A) summarizes the main variables, including the dependent and explanatory variables. Table 8 (see Appendix A) presents the correlation matrix of each tax fairness factor.

4.1.1 Dependent variable

We construct a framed and hypothetical scenario to estimate the intrinsic motivation for tax. The scenario is as follows:

Mr. C operates a tteokbokki (spicy stir-fried rice cakes) shop.Footnote 1 The previous year’s total sales were 80 million Korean won. Of these, 60 million Korean won came from sales through credit cards, check cards, and cash receipts. A further 20 million won were cash sales but without any supporting documents. Mr. C will, thus, report the 60 million Korean won in sales to the National Tax Service.

The tax morale question in our study was presented as follows:

How much cash income without documentation (out of a total of 20 million South Korean won) should the shopkeeper report to the National Tax Service?

Respondents were asked to assess this issue on an 11-point scale, ranging from 1 (no need to report cash) to 11 (report all the cash). In this study, responses of 1 and 2 were grouped with a value of 1; 3 and 4 with a value of 2; 5, 6, and 7, with a value of 3; 8 and 9 with a value of 4; and 10 and 11 with a value of 5. Taxpayers’ morale was defined as lowest if the respondent answered 1 and 2, while the highest tax morale included taxpayers who answered 10 and 11.

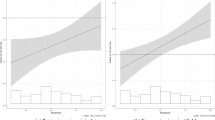

We compare the distribution of tax morale displayed by the framed tax evasion question (NaSTaB) and neutral tax evasion question (WVS). To compare with WVS, NaSTaB’s 10 and 11 scales are merged. As shown in Fig. 1, around 22% of taxpayers responded to the lowest tax morale to the general question in NaSTaB, but only a few individuals showed the lowest tax morale (2%) in WVS.

Tax morale between a framed tax morale question and a neutral tax morale question. Question on tax morale in NaSTaB is “How much cash income without documentation should the shopkeeper report to the National Tax Service?”. World Value Survey question on tax morale in wave 6 is: “Cheating on taxes if you have a chance (10-point scale)”

4.1.2 Explanatory variables

The main explanatory variable, tax fairness, is separated into five categories: vertical, exchange, horizontal, distributive, and procedural fairness. Our study defines tax fairness factors in line with the definitions in studies by Wenzel (2003) and Hofmann et al. (2008).

We address vertical fairness concerns according to Wenzel’s (2003) study. The tax burdens for certain social strata differed relative to others, with the following question: “Do you think you pay higher or lower taxes as per your financial ability?” Following Wenzel’s (2003) and Kinsey and Harold (1993) interpretations, this question refers to the fair distribution of tax burdens across different income levels. Horizontal fairness concerns the burden of taxes for taxpayers relative to other taxpayers within a given social stratum (Wenzel 2003). This study uses the same definition of horizontal fairness, with the following question: “Do you think you are paying higher taxes compared with taxpayers with a financial ability similar to yours?” Lindsay (2016) also defined horizontal equity as the concept that taxpayers positioned identically relative to their tax base should pay equal tax. This study also noted—consistent with the question that if individuals had the same income under a particular income tax regime, they should owe the same amount of tax. Exchange fairness relates to the taxpayer’s tax burden and the government’s provision of public goods (Hofmann et al. 2008). Given this description, this study presented the following exchange fairness question: “Do you think you receive higher or lower government benefits, compared with the taxes you paid?” Procedural fairness involves the tax collection processes and allocation of resources (Hofmann et al. 2008). This study investigated perceptions on procedural fairness through the following question: “Do you think that the Korean tax system adequately reflects the differences in income levels and fairly distributes the tax burden between income groups?” According to Wenzel (2003), distributive fairness refers to the fairness of resource allocation or distribution outcomes. Thus, we presented the following question: “Do you think the government is using its tax revenue fairly?”.

In addition to the five main explanatory factors, we include the independent variables of “income disparity” and “peer effect” as the “indirect fairness” factors. “Income disparity” denotes taxpayers’ perception about the differences in income between different strata. When they applied the laboratory experimental data Engel et al. (2020) found that tax morale dropped if income was known to be heterogeneous. “Peer effect” reflects Erzo et al. (2014) work, wherein taxes are paid depending on other individuals’ views or behaviors. The following question interrogated peer effect: “In your opinion, to what extent does the ‘trust that other people are reporting and paying tax honestly and accurately’ affect your honest tax reporting and payments?”.

To control other psychological factors, we set up two representative variables based on the slippery slope theory. According to the slippery slope theory, tax authorities’ power and citizens’ trust are both important determinants of tax compliance intentions (Batrancea et al. 2019; Kastlunger et al. 2013; Kirchler et al. 2008). In our paper, trust in government is assessed by the question: “Do you think Korean customs offices are doing their best to alleviate taxpayers’ inconveniences related to filing and paying taxes?” Finally, the perceived punishment level, which can reflect the government’s power, was teased out by the question: “What do you think is the level of punishment for tax evaders in South Korea?” Table 7 in Appendix A displays the detailed questions regarding these explanatory variables.

This study adds common characteristics for individuals as control variables: age, gender, education, employment dummies, household income, employment type, and religion. Education is segmented into three levels: below middle school, a high school graduate, college graduate or higher. This study also included 14 employment dummies: managers; experts in different fields such as clerks; service personnel; salespersons; agricultural workers, forest workers, fishery workers; technicians; device operators; machine manipulators and assembly personnel; labor service personnel; military personnel; house workers; the unemployed; and students. We also controll for the employment type, such as full-time staff, part-time staff, self-employed, and homemakers. We have three representative religion dummies (Protestant, Catholic, and Buddhism) in South Korea (Kim 2021).

4.2 Empirical model

We use the ordered probit model to account for the ranking of information (five-point scale) for the dependent variable. The models are.

where \(y_i^*\) is a latent variable representing the level of tax morale from taxpayer i. Further, x is a vector of explanatory variables and \({\varepsilon_i}\) is an error term.

The five categories for tax morale \({y^*}\) are much lower (S = 1), lower (S = 2), medium (S = 3), higher (S = 4), and much higher (S = 5).

This study’s regression primarily included fairness variables and other control variables and is estimated with the following equation:

where “Direct fairness” indicates vertical, exchange, horizontal, distributive, and procedural fairness. “Indirect fairness” implies the following variables: income disparity and peer effects, OPF stands for “other psychological factors,” including trust in government and the subjective punishment level for the taxpayer i. Further, CL is a vector of control variables: age, gender, education, employment dummies, household income, employment type, and religion. \({\varepsilon_i}\) is an error term.

5 Results

5.1 Main result

We check the first hypothesis by examining the relationship between framed tax morale and diverse tax fairness factors. In Table 2, specification 1 to 5 indicates that every tax fairness exhibits a significant and positive relationship with tax morale. Meanwhile, we find that the effects of vertical and horizontal fairness factors are significantly higher than other fairness factors. The results suggest that individuals have higher tax morale if they perceived the tax system and tax burdens as fair. However, procedural fairness is statistically not significant in the last specification. Our empirical results are consistent with the previous research (Kinsey and Harold, 1993; Alm et al. 1993; Finocchiaro and Ilde 2014). Considering these results, we accept Hypothesis 1 that different fairness factors positively correlate with framed tax morale.

Indirect fairness and other psychological factors such as “income disparity” show negative effect and indicate that taxpayers pay fewer taxes voluntarily when they feel unfair income distribution in society. However, it is statistically not significant. The factors such as “peer effect” and “trust in government” positively affect higher tax morale. Although the “punishment level” reveals a negative relationship with tax morale, we can suppose that taxpayers with higher tax morale will consider that the punishment is lower. This might be explained by retributive justice, in which the high tax morale group considers that the punishment level is not a sufficiently high deterrent.

5.2 Heterogeneous checks

To confirm that fairness has a positive effect on tax morale regardless of the taxpayer's socio-economic background, we have seen how the effects of fairness differ according to education, employment type, age, and income. Table 3 reports the results by education level. Regardless different coefficients in each group, fairness factors positively affect tax morale nevertheless different education background. However, procedural fainress negatively affects college graduate or higher education group.

The results according to the employment type are reported in Table 4. Column 1 shows the effect of multiple fairness factors and tax morale among wage earners. Both vertical and distributive fairness factors have a positive and significant effect with tax morale, a similar trend for the self-employed taxpayers in column 3. While in column 2, only the exchange fairness factor has a positive impact with tax morale for the temporary employees. Overall, vertical fairness has an essential, significant impact on the main taxpayers, namely wage earners and self-employed workers. However, exchange fairness seems more important for temporary employees and homemakers.

Table 5 shows the marginal effects of fairness factors and framed tax morale according to different age stages. Column 1 indicates that for the 17 to 35 years old taxpayers, procedural fairness has a negative impact with framed tax morale. While in column 2, for the 36 to 50 years old taxpayers, vertical and distributive fairness factors show a significant and positive impact with tax morale. Similar to the case of 51 to 65 years old taxpayers. While for the taxpayers who are more than 66 years old, horizontal, distributive, and procedural fairness factors have important implications for tax morale.

Table 6 presents the marginal effects of the fairness factors and framed tax morale according to different income levels. Column 1 shows that for the lowest income (0–25%), vertical and distributive fairness has a positive impact on framed tax morale. In column 2, for the low- and middle-income (25–50%) taxpayers, exchange and horizontal fairness factors show a significant and positive impact on tax morale. For the middle- and high-income taxpayers (50–75%), although the fairness factors are not significant, all show a positive impact on framed tax morale. For the highest income group, vertical and distributive fairness increases tax morale, but the procedural fairness factor shows a negative effect on framed tax morale.

Considering these results, we cannot fully accept Hypothesis 2 because of inconsistent impact of factors on each group and a lack of strong statistical evidence. For example, procedural fairness has a positive and significant effect on tax morale in the below middle school and more than 66 years old groups. However, procedural fairness presents negative impact on tax morale in college graduate or higher and 17–35 years old groups.

Although Hypothesis 2 cannot be perfectly accepted, we can still say that tax morale is positively affected by fairness because in most groups, it shows that perception of fairness displayed positive effects, consistent to the main results.

5.3 Robustness checks

To check the robustness of our main results, we conducted following alternative estimations which are reported in Appendix B. First, to test whether the results were sensitive to our dependent variable tax morale categorization, we use the questionnaire’s original 11-point scale in Table 9. Second, to test the sensitivity of our results concerning the analysis model and the scaling of tax morale, we used OLS to estimate the relationship between tax fairness and the 11-point scale-dependent variable in Table 10. Consequently, although we used a different econometric model and different tax morale categorizations, we found that our main results did not change.

6 Conclusions

This study investigated the role of perceptions on fairness in shaping tax morale. The current study used a framed hypothetical tax evasion question to measure the tax moral inherent in taxpayers. As a result, it showed a very different distribution compared to previous studies using neutral questions. This is a meaningful finding for future studies and framed and hypothetical tax evasion questions could help in measuring actual tax evasion situations. Further, we employed a large and representative sample size of taxpayers from an in-person survey. To improve the analysis of single fairness from the past, this study used multiple fairness factors to analyze the correlation between perceptions on fairness and tax morale.

One major finding from our statistical analysis is that taxpayers are more willing to pay taxes, if they perceive the system as fair. The results do not change by using different estimation models and different tax morale categorizations. Second, to confirm the positive effect of fairness on tax morale, regardless of the taxpayer's socio-economic background, we showed how the effects of fairness differ according to education, employment type, age, and income group. The third empirical finding is that the relationship between indirect fairness and tax morale is complicated. Specific examples are required for certain analyses. For instance, the “peer effect” and “trust in government” have an essential positive correlation with tax morale, while the level of punishment and income disparity negatively correlate with tax morale. These factors might provide compelling topics for future research.

Tax fairness may significantly encourage citizens’ tax morale, as well as social law. Policymakers will find compliance easier to realize through social law that considers the positive role of fairness and perceptions about fairness in tax regimes.

Notes

For a more detailed explanation, the tteokbokki (spicy stir-fried rice cakes) is one of the most popular Korean street foods; tteokbokki shops are common in Korea and can be found nearly everywhere. After deducting a series of expenses—such as rental fees, labor, and material costs—80 million South Korean won (approximately 73,000 dollars) is an ordinary sales figure in South Korea in 2016.

References

Adams JS (1965) Inequity in social exchange. In: Berkowitz L (ed) Advances in experimental social psychology, 2nd edn. Academic Press, pp 267–99

Allingham MG, Sandmo A (1972) Income tax evasion: a theoretical analysis. In: James S (ed) Taxation: critical perspectives on the world economy, 3rd edn. Routledge, pp 323–338

Alm J, Antoine M (2020) 40 years of tax evasion games: a meta-analysis. Exp Econ. https://doi.org/10.1007/s10683-020-09679-3

Alm J, Benno T (2006) Culture differences and tax morale in the United States and in Europe. J Econ Psychol 27:224–246

Alm J, Gary HM, Schulze WD (1992) Why do people pay taxes? J Public Econ 48:21–38

Alm J, Betty RJ, Michael M (1993) Fiscal exchange, collective decision institutions, and tax compliance. J Econ Behav Organ 22(3):285–303

Alm J, Isabel S, Ana D (1995) Economic and noneconomic factors in tax compliance. KYKLOS-BERNE- 48:3–3

Barr A, Danila S (2009) The effects of externalities and framing on bribery in a petty corruption experiment. Exp Econ 12:488–503

Batrancea L, Anca N, Jerome O, Christoph K, Erich K, Erik H, Avi W et al (2019) Trust and power as determinants of tax compliance across 44 nations. J Econ Psychol 74:102191

Chander P, Louis LW (1998) A General characterization of optimal income tax enforcement. Rev Econ Stud 65:165–183

Cummings RG, Jorge M, Michael M, Benno T (2009) Tax morale affects tax compliance: evidence from surveys and an artefactual field experiment. J Econ Behav Organ 70:447–457

Cyan MR, Antonios MK, Jorge M (2016) The Determinants of tax morale in Pakistan. J Asian Finance Econ Bus 47(December):23–34

Dijke M, Peter V (2010) Trust in Authorities as a boundary condition to procedural fairness effects on tax compliance. J Econ Psychol 31:80–91

Engel C, Luigi M, Azzurra M (2020) Tax morale and fairness in conflict an experiment. J Econ Psychol 81(December):102314

Erzo FP, Lutterman FP, Monica S (2014) Tax Morale. J Econ Perspect 28:149–168

Finocchiaro CM, Ilde R (2014) Tax compliance under horizontal and vertical equity conditions: an experimental approach. Int Tax Public Finan 21:560–577

Fortin B, Guy L, Marie-Claire V (2007) Tax evasion and social interactions. J Public Econ 91:2089–2112

Gobena LB, Marius V (2016) Power, justice, and trust: a moderated mediation analysis of tax compliance among Ethiopian business owners. J Public Econ 52:24–37

Hartner M, Silvia R, Erich K, Alfred S (2008) Procedural fairness and tax compliance. Econ Anal Policy 38:137–152

Henrich J, Steven JH, Ara N (2010) Most people are Not WEIRD. Nature 466:29–29

Hofmann E, Erik H, Erich K (2008) Preconditions of voluntary tax compliance: knowledge and evaluation of taxation, norms, fairness, and motivation to cooperate. Zeitschrift Fur Psychologie 216(4):209–217

Jacquemet N, Luchini S, Rosaz J, Shogren JF (2019) Truth telling under oath. Manage Sci 65:426–438

Jacquemet N, Luchini S, Malézieux A, and Shogren JF (2020) “Who’ll stop lying under oath? Empirical Evidence From Tax Evasion Games. Eur Econ Rev 124(103369):103369

Kastlunger B, Edoardo L, Erich K, Alfred S (2013) Powerful authorities and trusting citizens: the slippery slope framework and tax compliance in Italy. J Econ Psychol 34(February):36–45

Kim CK (2002) Does fairness matter in tax reporting behavior? J Econ Psychol 23:771–785

Kim Y (2021) Politics, religion, and tax incentives for charitable giving in South Korea. KER 37:141–155

Kinsey KA, Harold GG (1993) Did the Tax Reform Act of 1986 improve compliance? Three studies of pre- and post-TRA compliance attitudes. Law & Policy 15:293–325

Kirchler E (2007) The economic psychology of tax behaviour. Cambridge University Press

Kirchler E, Erik H, Ingrid W (2008) Enforced versus voluntary tax compliance: the ‘slippery slope’ framework. J Econ Psychol 29:210–225

Lindsay IK (2016) Tax fairness by convention: a defense of horizontal equity. Fla Tax Rev 19:79

Mazar N, On A, Dan A (2008) The dishonesty of honest people: a theory of self-concept maintenance. J Mark Res 45:633–644

Mickiewicz T, Anna R, Arnis S (2019) To pay or not to pay? Business owners’ tax morale: testing a neo-institutional framework in a transition environment. J Bus Ethics 157:75–93

Mikesell JL, Liucija B (2007) The tax compliance puzzle: evidence from theory and practice. Int J Public Adm 30:1045–1081

Moser DV, John HE, Chung KK (1995) The effects of horizontal and exchange inequity on tax reporting decisions. Account Rev 70:619–634

Murphy K, Tom T (2008) Procedural justice and compliance behaviour: the mediating role of emotions. J Appl Soc Psychol 38:652–668

Oladele R, Foluso OA, Ahmodu AO, Yusuff SA, Alade M (2019) Tax enforcement tools and tax compliance in Ondo State. Nigeria Acad J Interdiscip 8:27

Roberts ML, Peggy AH (1994) Progressive taxation, fairness, and compliance. Law & Policy 16:27–48

Rodriguez-Justicia D, Theilen B (2018) Education and tax morale. J Econ Psychol 64:18–48

Spicer MW, Lee AB (1980) Fiscal inequity and tax evasion: an experimental approach. Natl Tax J 33:171–175

Torgler B (2003b) Tax morale, rule-governed behaviour and trust. Const Political Econ 14:119–140

Torgler B (2016) Tax compliance and data: what is available and what is needed. Aust Econ Rev 49:352–364

Torgler B (2002) Vertical and exchange equity in a tax morale experiment. Citeseer. https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.200.5116&rep=rep1&type=pdf

Torgler B (2003a) Tax morale and institutions. https://doi.org/10.2139/ssrn.663686

Trivers RL (1971) The evolution of reciprocal altruism. Q Rev Biol 46:35–57

Verboon P, Sjoerd G (2009) The role of fairness in tax compliance. Neth J Psychol 65:136–145

Wenzel M (2002) The impact of outcome orientation and justice concerns on tax compliance: the role of taxpayers’ identity. J Appl Soc Psychol 87:629–645

Wenzel M (2003) Tax compliance and the psychology of justice: mapping the field. W: V. Braithwaite (red.), taxing democracy: understanding tax avoidance and evasion (s. 41--69).Ashgate, Aldershot.

Acknowledgements

We thank the anonymous reviewers for their valuable remarks. The datasets generated during the current study are available in the National Survey of Tax and Benefit repository, https://www.kipf.re.kr/panel/.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Appendix B

Rights and permissions

About this article

Cite this article

Kim, Y., Wan, H. The effect of fairness on tax morale in South Korea: a framed question approach. Int Rev Econ 69, 103–123 (2022). https://doi.org/10.1007/s12232-022-00387-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12232-022-00387-3