Abstract

We investigate the causes of increases in economic freedom by examining a cross section of countries from 1990 to 2010 and examining factors that have previously been associated with increases in freedom alongside other factors which have been found to be important for growth. We find that higher initial GNI per capita is associated with larger subsequent increases in economic freedom and countries are less likely to improve their freedom the higher their initial level of freedom, energy exports, and ethnolinguistic fractionalization. When we test subsamples, we find that little explains changes in freedom in countries with high levels of initial freedom, initially high incomes, and that did not receive foreign aid.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Empirical evidence has mounted that economic freedom leads to a number of improved societal outcomes (Hall and Lawson 2014; Hall et al. 2015). For example, economic freedom has been shown to lead to higher incomes (Easton and Walker 1997), economic growth (Gwartney et al. 1997; Cebula 2011), a significantly positive effect on overall wellbeing (Gehring 2013) and longevity (Grubel 1998). Although many studies have been done on the consequences of economic freedom, comparatively fewer studies have been done on the causes of changes in economic freedom. We examine a cross section of countries over the last 20 years to see what factors were correlated with increases and decreases in economic freedom.

Economic freedom could be affected by numerous factors. Financial crisis may impact economic freedom by breaking existing political equilibria (Pitlik and Wirth 2003; Young and Bologna 2015). Natural resource endowment, specifically oil, has also been theorized to hinder the development of institutions consistent with economic freedom (Campbell and Snyder 2012). The impact of foreign aid has also been examined extensively (Powell and Ryan 2006; Vasquez 1998; Heckelman and Knack 2008).

A significant body of scholarship has considered how the role of legal origins (Glaeser and Shleifer 2002; La Porta et al. 2008), the ability to constrain the executive function of government (Glaeser et al. 2004), and ethnolinguistic fractionalization (Easterly and Levine 1997) have impacted subsequent economic development. Given the importance of economic freedom for economic development, perhaps some of these factors influence subsequent development via their impact on economic freedom.

This paper contributes to the literature on a few significant margins. First, we merge the literature that has examined factors influence economic freedom with some of the literature considering how other factors influence economic outcomes by examining whether these other factors also impact economic freedom and thus might impact growth through their impact on economic freedom.

We also separately test countries which have made the largest increases in economic freedom from 1990 to 2010 to determine whether these factors impact countries that make large improvements differently. Perhaps causes of large systematic changes in economic freedom are different from those that are more mundane. Intuitively, maybe crises break political equilibria in a way that allows for large changes in economic freedom, but not in a way that significantly impacts smaller changes in economic freedom.

Similarly, we sort countries by their initial levels of economic freedom to examine whether different factors are responsible for increasing freedom in already relatively free countries compared to the factors that are important for increasing freedom in relatively unfree countries. Intuitively, perhaps the factors that lead to institutional change in a country like the USA are fundamentally different than factors that lead to institutional change in an unfree country like Zimbabwe.

Following the same method, we separately test countries which have received foreign aid and which have not received foreign aid to see whether our factors impact countries who receive foreign aid differently than countries which do not receive foreign aid. We also test countries with one standard deviation above mean value for their initial (1990) GNI per capital value and level of ethnolinguistic fractionalization to test whether our variables affect countries with comparatively higher income and more diversity differently.

2 Literature review

Less developed countries which possess an abundance of natural resources demanded by other nations could be afforded “easy riches” (Sachs and Warner 1999; Sala-i-Martin and Subramanian 2013) which can prolong poor institutional quality. As a consequence, this poor institutional quality stifles economic freedom. Isham et al. (2005) found a statistically significant negative relationship between natural resource endowment, the rule of law, political stability, government effectiveness, and property rights security for developing countries. Busse and Groning (2013) similarly found natural resource exports were associated with an increase in corruption and a negative impact on bureaucratic quality. It is important to note there is no a priori reason for an abundance of resources to necessarily complement intrusive governments or poor institutional quality. It is plausible that countries with stable institutions and secure property rights will not be affected by resource endowment in a similar manor as countries with institutions inimical to economic freedom. For instance, Campbell and Snyder (2012) found natural resources themselves do not enable governments to hamper economic growth. Rather, the “resource curse” is prevalent when the endowment of resources affects governmental functions which affect economic freedom. Similarly, Cebula and Mixon (2014) noted that economic freedom and high regulatory quality were necessary to provide an environment which supports the effective use of energy and sustainable energy infrastructure.

The existing literature on the impact of crises on institutions is mixed. Crises can motivate governments to implement liberalized policies which increase economic freedom out of political necessity (Lal 1987). When referring to fiscal and inflationary crises specifically, the severity and longevity of the crises is critical in determining whether changes in political equilibria will allow for liberalized reforms. Pitlik and Wirth (2003) found deep fiscal and inflationary crises were significantly correlated with policy reform in favor of liberalization and economic freedom. Young and Bologna (2015) found inflationary crises have historically reduced the amount of government spending as a percentage of GDP (improving economic freedom); however, they were unable to conclude the scope of government policies was significantly affected by periods of crisis. The authors also found countries which frequently endure crisis periods possessed weaker legal systems and less ability to secure property rights. This indicates crisis periods may not always elicit liberalizing policies, and it is possible that crises could lead to increases in governmental scope and size (Higgs 1987).

There is a large body of literature examining the relationship between foreign aid, institutional quality, and economic freedom. Bauer long contended that foreign aid “politicized” economic life and undermined reliance on markets (1991). If aid is continually given to governments which do not adopt growth-enabling reforms (many of which are consistent with economic freedom), there is little incentive for these governments to adopt pro-growth-enabling reforms (Williamson 2010; Coyne and Ryan 2009; Easterly 2003, 2006; Bauer 2000). Instead of incentivizing productive actions to enhance growth and development, aid can undermine political and economic institutions, including democracy (Djankov et al. 2008), property rights, trade openness (Young and Sheehan 2014), and may encourage rent seeking (Hodler 2007; Easterly 2001) Vasquez (1998) found coordinated programs which exchange aid in anticipation of developmental progress have often result in static or decreasing amounts of economic freedom. Powell and Ryan (2006) examined how aid flow impacted aid in five- and ten-year periods between 1970 and 2000 and found evidence in some specifications that more aid was associated with decreased freedom and no relationship in other specifications. Similarly, Heckelman and Knack (2009) studied the relationship between aid and changes in economic freedom from 1990 to 2000 and found aid was associated with decreases in economic freedom.

Despite evidence of aid’s failure to increase economic freedom, recent literature notes that donor efforts to influence liberalization policy has improved overtime (Heckelman and Knack 2008; Koeberle 2003). As noted by Heckelman and Knack (2008), “The limited (or even adverse) effects of donors’ country programs on economic and political reform do not necessarily imply that they deserve no credit for substantial advances by developing countries in recent decades.” Burnside and Dollar (2000) found aid may be more effective if distributed conditional on good policy. These good policies could result in both higher institutional quality and increases in economic freedom which are positively associated with growth and prosperity (Cebula and Clark 2012).

A country’s legal origins may negatively or positively affect institutional and governmental quality. Hayek (1960) argued in favor of the Common law tradition over Civil law believing Common law contained less restrictions on economic liberty. Nambi and Rajhi (2013) using an endogenous growth model highlight the restrictions placed on financial development when a countries’ legal system is ineffective in securing contracts. According to Glaeser and Shleifer (2002), a Civil Law legal origin, “is especially vulnerable to abuse by a bad government” (p. 1224) as a result of its centralized enforcement where, “Common law, with its decentralization of adjudication, is less vulnerable to politicization” (p. 1224). Common law legal origins have been associated with a stronger ability to secure property rights (Mahoney 2001). Alternatively, Civil Law-based legal systems have been associated with institutions detrimental to economic freedom including a weaker ability to secure property rights, higher regulation (La Porta et al. 1999), governmental ownership of the banking industryFootnote 1 (La Porta et al. 2002), a stronger likeliness to conscript (Mulligan and Shleifer 2005), and less effectiveness in constraining the executive branch of government (Glaeser et al. 2004).

The literature shows a country’s legal origin effects on critical institutions which can affect the ability of the amount of economic freedom to change. Comparatively, less analysis has been done on the impact of legal origins to changes in economic freedom. Nattinger and Hall (2012) found a negative relationship between state-level economic freedom and US states which were originally settled by countries with civil law legal origin.

Diversity could make institutional transition and policy implementation more difficult (Alesina and Drazen 1991). A country’s ethnolinguistic fractionalization can serve as a proxy to divergence in political ideology which processes implications for the performance and role of government Glaeser et al. (2004). Easterly et al. (2003) found measures of “social cohesion” including ethnolinguistic fractionalization, “endogenously determine institutional quality” (p. 103). This institutional quality could impact the ability for economic freedom to change. For example, Easterly and Levine (1997) found ethnolinguistic fractionalization in Sub-Saharan African countries was associated with political instability, low levels of infrastructure and schooling, weak financial markets, and governmental deficit. Ethnolinguistic fractionalization has also been empirically associated with higher corruption (Ali and Isse 2003) larger sizes of government, and less freedom to exchange with foreign nations (Heckelman and Knack 2008).

3 Data

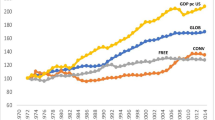

We examine the change in economic freedom over the years 1990–2010 from a sample of 97 countries.Footnote 2 The Economic Freedom of the World Annual Report is used to measure the degree of economic freedom in each country. The index measures the degree of freedom over 5 areas: size of government, legal system and property rights, sound money, freedom to trade internationally, and regulation, which are comprised of a total of 42 variables. Each variable is ranked from 1 to 10 with larger numbers indicating higher levels of economic freedom. The index contains economic freedom scores over 5-year periods from 1990 to 2000 and yearly scores from 2001 to 2010. Aid%GNI represents the foreign aid received as a percentage of total GNI over the 20-year time interval. We obtained annual aid, GNI and GNI per capita data from the World Bank World Development Indicators. When data were unavailable, we calculated our total Aid to GNI to include only years when both figures were available.

EnergyExports is a binary variable which takes the value of one if a country’s net export of energy as a percentage of energy use exceeds a Z-score of 0.94 (one standard deviation). We calculated the Z-scores based on the sample of those countries which were net energy exporters. Countries which are net importers of energy are given a score of zero. Annual World Bank energy imports data are measured as a percentage of energy use less production of oil equivalents where negative values indicate the country is a net exporter of energy.

DeepCrisisI represents a deep inflationary crisis. MediumCrisisI represents a medium inflationary crisis. DeepCrisisG represents a deep growth crisis. MediumCrisisG represents a medium growth crisis. All crisis variables are binary and take a value of 1 if the country experienced a crisis. We use Pitlik and Wirth’s (2003) scoring system to measure economic crises. The system places growth and inflationary crises into the categories no crisis, medium crisis, and deep crisis. A number score is given each year. For growth crises, positive growth rates are given a score of 0. Growth rates between 0 and −1 % are given a score of 1. Any growth rate below −1 % is given a 2. Inflation rates are given a 0 score if the rate is below 10 %. It receives a score of 1 if the rate is between 10 and 40 %. If the rate is between 40 and 100 %, the score is 2, and if the rate is above 100 %, the score is 3. The scores for inflation and growth are then summed over 5-year periods. For growth, if the total 5-year score is above 5, it is considered a deep crisis. Scores between 3 and 5 are considered medium crises. Similarly, any 5-year score above 10 points is considered a deep inflationary crisis and if the score is between 10 and 2 it will be considered a medium inflationary crisis. For our empirical analysis, we use a dummy variable if a crisis has occurred at any time over our 20-year interval. Data on inflation and growth percentage were obtained from the International Monetary Fund.

ExecConstraint estimates the level of restraint on the executive branches of governments. We obtained data on the executive constraint of each country from the Polity IV database. This system rates executive constraint on a scale from 1 to 8 with higher values indicating that people having stronger control over their government’s executive branch. According to Glasier et al. (2004), this measure serves as a proxy to consistency of electoral experiences where fluctuations in scores are likely due to political instability. The index for executive constraint does not offer a value if there is a period of transition or an interregnum (both domestic and foreign). In our country sample, Kuwait, Cote d’Ivoire, and Burundi faced periods of foreign interregnums. Burundi, the Democratic Republic of the Congo, Cote d’Ivoire, Fiji, Ghana, Guinea Bissau, Haiti, Madagascar Mali, Nigeria, Peru, South Africa all faced periods of transition. Sierra Leone misses values for a domestic interregnum over the years 2000–2004. We address the data availability problem by using the method of Glaeser et al. (2004) where we took the standard deviation of each of the countries’ executive constraint score in 5-year increments. This allows for multiple observation points that account for changes in political stability. The standard deviation was calculated using fewer observations when required. The standard deviations were normalized between 0 and 1.

EthnoFraction represents the ethnolinguistic fractionalization score for the given country and remains constant for each country over the relevant time period. We obtain our information on ethnolinguistic fractionalization from La Porta et al. (1999) who followed the method of Easterly and Levine (1997). These authors obtained their measurement by averaging the probabilities that (1) two randomly selected people for a given country will belong to the same ethnolinguistic group; (2) the probability that two randomly selected people in a given country speak different languages; (3) the probability that two randomly selected people do not speak the same language; (4) the percentage of a country’s population who do not speak the official language; (5) the percentage of a countries’ population which does not speak the most commonly spoken language. This variable is measured as a fraction with values between 0 and 1. Values closer to 1 represent higher levels of ethnolinguistic fractionalization.

LegalOrg tests for common, civil, German, and Scandinavian legal origins with the socialist legal origin as the default. We follow the categorization of legal origins from La Porta et al. (2008). The legal origins of countries were taken from the CIA World Factbook which breaks down the legal origins of each country into the categories of Common Law, Civil Law, Customary Law, European Union Law, French Law, International Law, Islamic Law, Napoleonic Code, Religious Law, Roman Law, Roman-Dutch Law, Spanish Law, and United States Law. The majority of these are defined as a form of Civil Law. We follow the designated legal origin used by La Porta et al. (2008) when the World Factbook considers a country to have a mixed legal structure.

InitialSchool represents the primary school enrollment ratio for the year 1990. Primary school enrollment is used to see whether a more literate population is more likely to cause increases in freedom. We use the Gross Enrollment Ratio as a measure of primary school enrollment. The ratio considers all enrolled students, regardless of age, over the total population within the primary education population.

Log Initial GNI/Capita represents the logarithm of the gross national income per capita for each country in the year 1990 to examine whether wealthier countries are more likely to increase their freedom. Population represents a countries’ average population over the years 1990–2010. We control for it to examine whether a large population makes it harder to build winning coalitions to change policy. Table 1 contains descriptive statistics.Footnote 3

4 Model and empirical results

This model used to examine the underlying causes of economic freedom follows a similar structure used by Powell and Ryan (2006), Hall (2015), and Heckelman and Knack (2009):

where X = InitialSchool; ExecConstraint; Log InitialGNI/Capita; Population; EthnoFraction; Legalorg;

Following Powell and Ryan (2006), Heckelman and Knack (2009), and Nattinger and Hall (2012), ordinary least squared methods were used to obtain our results. Our dependent variable, ∆EF, represents the total change in economic freedom from 1990 to 2010. The InitialEF is each country’s freedom score in 1990 is used to control for the initial level of economic freedom. We begin by regressing factors that have previously been shown to impact economic freedom: aid, resources, and various crises. We then separately test for variables found in the growth literature including: 1990 level of gross primarily school enrollment, executive constraint, logarithm of the initial GNI per capita, population, ethnolinguistic fractionalization, and legal origin.

The results in Table 2 show, as expected, a highly significant negative relationship between initial level of economic freedom and subsequent improvements in economic freedom. Increases in economic freedom become more difficult to achieve the freer a country already is. Higher energy exportation was consistently related to smaller improvements in economic freedom which is consistent with resource curse hypothesis discussed earlier. An energy-exporting country whose exports as a percentage of energy use is 1 standard deviation above the average for an energy-exporting country was associated with between a 0.6 and 1.15 point smaller increase in economic freedom. Consistent with the prior literature, aid received as a percentage of GNI was found in some regressions to be statistically significantly and negatively related to changes in economic freedom and insignificant in others. Unlike the findings of Pitlik and Wirth (2003), but similar to Young and Bologna (2015) we did not find a consistent statistically significant positive relationship between crises and changes in economic freedom. When we did find statically significant relationships, they indicated that economic crises tended to limit increases in economic freedom. The occurrence of a medium growth crisis and medium inflationary crisis was associated with smaller increases in economic freedom in some specifications.

Our results, when combining factors that have been shown to be an important cause of economic freedom in prior studies into regressions together, are generally consistent with the existing literature. Next, we turn to our contribution of combining these together and then individually including new factors that have been important for levels of development but have not been used to explain levels of economic freedom.

Our two most significant findings in these areas that once other factors that influence economic freedom are controlled for ethnolinguistic fractionalization and initial GDP per capita both influence a country’s subsequent increase in economic freedom. Greater ethnolinguistic fractionalization tends to make increases in economic freedom smaller. A one standard deviation increase in economic linguistic fractionalization is associated with a 0.25 smaller subsequent increase in economic freedom. In the growth literature, higher initial incomes would usually predict slower economic growth via convergence (Solow 1956). We find that this effect maybe somewhat offset because, once initial levels of freedom are controlled for, higher incomes still are associated with higher subsequent increases in economic freedom. A one standard deviation in initial per capita incomes was associated with a 0.5 subsequent increase in economic freedom.

In the cases of initial levels of schooling, executive constraints, population size, and legal origins, we do not find statistically significant impacts on a country’s improvement in economic freedom once the other factors that influence economic freedom are taken into account. This does not amount to rejecting prior studies that have found these factors to be important for growth. It merely indicates that to the extent that they are important for growth, it does not appear that their importance stems from any impact they have on changes in a country’s freedom.

Based on our results in Table 2, we truncate our model to only include variables that were statistically significant in explaining economic freedom, when considering other treatments. Our new model is:

We used this model to test a subsample of countries which have made the largest increases in economic freedom to see whether relatively larger changes come about differently than small changes. We ran one regression with the 50 % of countries that made the largest increases in economic freedom and another regression with only the top 33 % of countries making the largest improvements in economic freedom. These regression results are reported in Table 3.

In the 50 % of countries that made the largest increases in economic freedom, we again found that higher initial levels of economic freedom make additional increases in economic freedom more difficult. Energy exportation was similarly shown to have a negative relationship with changes in economic freedom where a 1 standard deviation increase in the Z-score taken from the sample of energy-exporting countries is associated with approximately a 1.2 smaller increase in economic freedom (slightly over a standard deviation). The estimated coefficient values for both initial economic freedom and energy exportation were comparatively larger for countries which have made larger changes. The logarithm of the initial GNI per capita positively impacted changes in economic freedom for both of our largest changes in economic freedom subsamples. We also found a positive and statistically significant correlation between aid and freedom for those countries that made the largest improvements in economic freedom. This need not be interpreted as inconsistent with prior literature and the negative coefficients we found when examining the whole sample. It is conceivable that aid may make positive reforms unlikely in most cases as governments receive rents that they can use to maintain the existing equilibrium or further repress freedom but that in a smaller number of cases where a government desires to make large reforms, including slashing taxes, the aid loosens the budget constraint and allows for larger reforms. Finally, a medium inflationary crisis was associate with smaller increases in economic freedom among countries in the highest 1/3rd of improvers of economic freedom.

We next examined whether the factors that caused already relatively free countries to increase freedom differed from the factors that caused less free countries to improve. Intuitively, perhaps the factors that might influence changes in a place like Zimbabwe (ranked last in the index) are different from those that would cause a country like Hong Kong (ranked 1st) to improve their freedom. To do this, we broke our sample into the top 33 % and top 50 % of countries by their beginning (1990) freedom score and the bottom 33 and 50 % in initial freedom score.

In our regressions (not reported in the tables) using the highest 33 and 50 % initial economic freedom scores, the only consistent statistically significant relationship was a negative relationship between initial economic freedom and changes in economic freedom. For countries with lower initial economic freedom scores, we found a consistent negative relationship between energy exportation and changes in economic freedom. The log of the initial GNI per Capita was positively associated with changes in economic freedom for the 33 and 50 % of countries with the lowest initial levels of freedom. Ethnolinguistic fractionalization was also found to have a negative relationship with changes in economic freedom for the countries with the lowest initial economic freedom levels. We also found that the occurrence of a medium inflationary crisis was associated with a smaller increase in economic freedom for the lowest 33 %. These findings indicate that most of the general results are driven by countries who begin with low levels of freedom. For countries that begin with a high level of freedom, there is little that is statistically associated with subsequent improvements in freedom.

To increase our understanding of the causal relations the variables used in our truncated model, we used subsamples of countries which received aid, did not receive aid, whose energy exports were not a standard deviation above the Z-score taken from the sample of energy-exporting countries, whose ethnolinguistic fractionalization exceeded 63 % (a standard deviation above the sample mean), and whose logarithm of initial GNI per capita exceeded 4.19 (a standard deviation above the sample mean). This approach allows us to test whether the factors in our model affect countries which received aid, did not receive aid, or have comparatively higher levels of wealth and diversity differently. The results of our regressions separating countries which received aid and did not receive aid are reported in Table 4. Our regressions examining subsamples of countries whose energy exports were not a standard deviation above the Z-score taken from the sample of energy exporting countries, whose ethnolinguistic fractionalization exceeded 63 % and whose logarithm of initial GNI per capita exceeded 4.19 are presented in Table 5.

In countries that did not receive aid, only the initial level of economic freedom was a significant predictor of subsequent increases in freedom. In contrast, in aid-receiving countries high energy exports and ethnolinguistic fractionalization were again negatively associated with subsequent improvements in economic freedom and initial per capita incomes were positively associated with improvements. We suspect that this is because countries that receive aid are likely to be those who are already struggling with poverty associated (caused?) with their fractionalization and fights over rents from resources.

In Table 5, we report regressions where we separately examined countries with high initial levels of wealth, high levels of energy exports, and high levels of ethnolinguistic fractionalization. In each case, we continued to find a negative relationship between change in economic freedom and initial level of economic freedom. In our regression examining high initial wealth countries, we found that energy exports were positively, rather than negatively associated with subsequent increases in economic freedom. Similarly, we found that ethnolinguistic fractionalization was no longer significant. We also found that once a country already had a high income, initial levels of income were now negatively rather than positively associated with subsequent increases in economic freedom. We suspect that once a country has already achieved a high level of income it has been able to overcome any problems associated with fractionalization and that rather than a resource curse, a higher level of energy exports creates an alternative source of revenue that allows taxes to be kept lower (and freedom higher) so that differences in these factors between already wealthy countries are fundamentally different than between those in the entire sample.

When we examined only countries without high energy exports (were less than one standard deviation above the country sample mean), the signs and significance were consistent with our general results. Medium growth crises, which were occasionally significant in our general results, were also significant here. In countries where the linguistic fractionalization exceeded 63 %, our results were also largely consistent with our general findings. Thus, these subsamples were not significantly different than the entire sample.

In addition to using a 20-year interval to look for the change in economic freedom, we also tested our equations with 10-, 5-, and 3-year time intervals. These regressions did not offer additional explanatory power and generally had less statistical and economic significance. This is not surprising as other recent work has found that changes in freedom are long-run phenomena that require longer time periods of analysis for the variables of interest to have an effect (Clark et al. 2015; O’Reilly and Powell 2015; Young and Bologna 2015).Footnote 4

5 Conclusion

Although much research has been done studying the consequences of adopting institutions of economic freedom, comparatively little research has been done on the causes of the adoption of the institutions of economic freedom themselves. This paper addresses this gap by combining many of the previously examined factors and adds to this other variables associated with economic growth which could impact growth via their effect on economic freedom.

Our results are largely consistent with the existing literature on factors that are associated with greater increases in freedom. We find higher initial levels of economic freedom, and energy exports are associated with smaller subsequent improvements in economic freedom and that, depending on specification, sometimes greater foreign aid or inflationary and growth crises can be associated with smaller improvements in freedom.

When we add in many factors that have been shown to be important for growth, we find that ethnolinguistic fractionalization is generally associated with smaller subsequent improvements in economic freedom and higher initial incomes are associated with larger improvements in economic freedom. Other factors, such as schooling, executive constraints, population size, and legal origins, may be important for growth, but we do not find that their importance comes through the effect that they have on improvements in economic freedom.

When examining a subset of countries that made the largest improvement in economic freedom, we find most of our variables retained their sign and significance. The most significant change was that the sign on aid, which had been consistently negative, turned positive. This might be an indication that while aid can be a drag that politicizes economic life and decreases freedom in general, that it allows a relaxed budget constraint that allows for larger increases in economic freedom for the minority of countries that desire to make major reforms. More research in this area is needed.

When we split the sample between countries that were high or low in their initial level of freedom, we find that very little (only initial freedom levels) is associated with subsequent changes in economic freedom in countries that already have high levels of economic freedom. The results for countries with low initial levels of freedom are consistent with our general results. The path of reform might be much more idiosyncratic in countries that have already achieved high levels of freedom.

We find a similar pattern when we split the sample by those countries which received aid and those that didn’t. Our general results hold for countries receiving aid. But for countries that do not receive aid, all factors except initial levels of freedom lose their significance. This is likely because there is a high overlap between countries with high initial levels of freedom and not receiving aid (higher than average 1990 levels of economic freedom and not receiving aid were positively perfectly correlated).

When we separate our sample by those countries that have high initial income levels, not high energy exports, and high levels of ethnolinguistic fractionalization we continue to consistently find that initial levels of freedom are negatively associated with subsequent improvements. In countries with high initial levels of wealth, energy exports change sign and ethnolinguistic fractionalization loses its significance. We suspect that once a country has already achieved a high level of income it has been able to overcome any problems associated with fractionalization and that rather than a resource curse, a higher level of energy exports creates an alternative source of revenue that allows taxes to be kept lower. In countries without high level of energy exports and with high levels of fractionalization, we find results that are consistent with our general findings.

A final word of caution is in order. This study has all of the benefits, and drawbacks, of a cross-country empirical study. The process of institutional changes is complex and imperfectly understood. Changes in economic freedom, in some cases, could be driven by factors, such as changes in ideas, individual leadership, or historical accidents, that are absent from our study. There also could be individual cases where factors that we find statistically insignificant overall, were significant in specific n = 1 cases. Better understanding of the forces that lead to changes in freedom will require much future research using multiple methodologies.

Notes

La Porta et al. (2008) found this relationship also hold holds for Scandinavian and German based legal systems.

The countries used in our sample are: Albania, Algeria, Argentina, Australia, Austria, Bahrain, Bangladesh, Belgium, Benin, Bolivia, Botswana, Brazil, Bulgaria, Cameroon, Canada, Chile, China, Colombia, Democratic Republic of the Congo, Republic of the Congo, Costa Rica, Cote d’Ivoire, Cyprus, Denmark, Dominican Republic, Ecuador, Egypt, El Salvador, Finland, France, Gabon, Germany, Ghana, Greece, Guatemala, Honduras, Hong Kong, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, Jordan, Kenya, South Korea, Luxembourg, Madagascar, Malaysia, Mexico, Morocco, Namibia, Nepal, Netherlands, New Zealand, Nicaragua, Niger, Nigeria, Norway, Oman, Pakistan, Panama, Paraguay, Peru, The Philippines, Poland, Portugal, Romania, Senegal, Singapore, South Africa, Spain, Sri Lanka, Sweden, Switzerland, Syria, Tanzania, Togo, Trinidad & Tobago, Tunisia, Turkey, United Arab Emirates, United Kingdom, United States, Uruguay, Venezuela, Zambia, and Zimbabwe. Due to unavailable data we omitted the countries Bahrain, Oman, Kuwait, Iran, and Democratic Republic of the Congo when we tested for ethnolinguistic fractionalization. We omitted Iceland, South Korea, Cyprus, Malta, Benin, Hong Kong, and Democratic Republic of the Congo due to data unavailability for executive constraint. We omitted Haiti, Kuwait, and Jamaica when we tested for the logarithm of the initial GNI per capita.

We also used a correlation matrix to test the relationship between our independent variables. The correlation between the Initial level of economic freedom and logarithm of Initial GNI per capita was 0.74. The correlation between deep inflationary and growth crises variables was 0.72. The correlation between Aid and the logarithm of initial GNI per capita was −0.6. The correlation between Medium Growth Crises and initial economic freedom was −0.53. All other correlations between variables were less than 0.5.

We also tested the effect of religious affiliation on the change in economic freedom by using binary variables to represent if the majority of a nation’s population considered themselves Christians, Muslims, or Buddhists We found that religious affiliation did not provide significant explanatory power.

References

Alesina A, Drazen A (1991) Why are stabilizations delayed? Am Econ Rev 81:1170–1188

Ali A, Isse H (2003) Determinants of economic corruption: a cross-country comparison. Cato J 22:449–466

Bauer PT (1991) The development frontier. Harvard University Press, Cambridge

Bauer PT (2000) From subsistence to exchange and other essays. Princeton University Press, Princeton

Burnside C, Dollar D (2000) Aid, Policies and Growth. Am Econ Rev 90:847–868

Busse M, Groning S (2013) the resource curse revisited: governance and natural resources. Public Choice 154:1–20

Campbell N, Snyder T (2012) Economic growth, economic freedom, and the resource curse. J Priv Enterp 28:23–46

Cebula R (2011) Economic growth, ten forms of economic freedom, and political stability: an empirical study using panel data, 2003–2007. J Priv Enterp 26:61–81

Cebula R, Clark JR (2012) Lessons from the experience of OECD nations on macroeconomic growth and economic freedom. Int Rev Econ 59:231–243

Cebula R, Mixon F (2014) The roles of economic freedom and regulatory quality in creating a favorable environment for investment in energy R&D, infrastructure, and capacity. Am J Econ Sociol 73:299–324

Clark JR, Lawson R, Nowrasteh A, Powell B, Murphy R (2015) Does immigration impact institutions? Public Choice 163:321–335

Coyne C, Ryan M (2009) With friends like these, who needs enemies? Aiding the world’s worst dictators. Indep Rev 14:26–44

Djankov S, Montalvo J, Reynal-Querol M (2008) The curse of aid. J Econ Growth 13:169–194

Easterly W (2001) The elusive quest for growth economists’ adventures and misadventures in the tropics. MIT Press, Cambridge

Easterly W (2003) Can foreign aid buy growth? J Econ Perspect 17:23–44

Easterly W (2006) The white man’s burden: why the west’s efforts to aid the rest have done so much ill and so little good. Penguin Press, New York

Easterly W, Levine R (1997) Africa’s growth tragedy: policies and ethnic divisions. Quart J Econ 112:1203–1250

Easterly W, Ritzen J, Woolcock M (2003) Social cohesion, institutions, and growth. Econ Polit 18:103–120

Easton S, Walker A (1997) Income, growth, and economic freedom. Am Econ Rev 87:328–332

Gehring K (2013) Who benefits from economic freedom? Unraveling the effect of economic freedom on subjective well-being. World Dev 50:74–90

Glaeser E, Shleifer A (2002) Legal origins. Quart J Econ 117:1193–1229

Glaeser E, La Porta R, Lopez-De-Silanes F, Shleifer A (2004) Do institutions cause growth? J Econ Growth 9:271–303

Grubel H (1998) Economic freedom and human welfare: some empirical findings. Cato J 18:287–304

Gwartney J, Lawson R, Holcombe R (1997) Economic freedom and the environment for economic growth. J Inst Theor Econ 155:643–663

Hall J (2015) Institutional convergence: exit or voice? Working paper. http://www.be.wvu.edu/phd_economics/pdf/15-40.pdf

Hall J, Lawson R (2014) Economic freedom of the world: an accounting of the literature. Contemp Econ Policy 32:1–19

Hall J, Stansel D, Tarabar D (2015) Economic freedom studies at the state level: a survey. Working paper. http://be.wvu.edu/phd_economics/pdf/15-07.pdf

Hayek F (1960) The constitution of liberty. University of Chicago Press, Chicago

Heckelman J, Knack S (2008) Foreign aid and market-liberalizing reform. Economica 75:524–548

Heckelman J, Knack S (2009) Aid, economic freedom, and growth. Contemp Econ Policy 27:46–53

Higgs R (1987) Crisis and Leviathan critical episodes in the growth of American government. Oxford University Press, Oxford

Hodler R (2007) Rent seeking and aid effectiveness. Int Tax Public Financ 14:525–541

Isham J, Woolcock M, Pritchett L, Busby G (2005) The varieties of resource experience: natural resource export structures and the political economy of economic growth. World Bank Econ Rev 19:141–174

Koeberle S (2003) Should policy-based lending still involve conditionality? World Bank Res Obs 18:249–273

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny R (1999) The quality of government. J Law Econ Organ 15:222–279

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny R (2002) Investor protection and corporate valuation. J Financ 57:1147–1170

La Porta R, Lopez-de-Silanes F, Shleifer A (2008) The economic consequences of legal origins. J Econ Lit 46:285–332

Lal D (1987) The political economy of economic liberalization. World Bank Econ Rev 1:273–299

Mahoney P (2001) The common law and economic growth: Hayek might be right. J Legal Stud 30(2):503–525

Mulligan C, Shleifer A (2005) Conscription as regulation. Am Law Econ Rev 7:85–111

Nambi M, Rajhi T (2013) Banking, contract enforcement, and economic growth. Int Rev Econ 60:83–100

Nattinger M, Hall J (2012) Legal origins and state economic freedom. J Econ Econ Educ Res 13:25–32

O’Reilly C, Powell B (2015) War and the growth of government. Eur J Polit Econ 40:31–41

Pitlik H, Wirth S (2003) Do crises promote the extent of economic liberalization? An empirical test. Eur J Polit Econ 19:565–581

Powell B, Ryan M (2006) Does development aid lead to economic freedom? J Priv Enterp 21:1–21

Sachs J, Warner A (1999) The big rush, natural resource booms and growth. J Dev Econ 59:43–76

Sala-i-Martin X, Subramanian A (2013) Addressing the natural resource curse: an illustration from Nigeria. J Afr Econ 22:570–615

Solow R (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Vasquez I (1998) Official assistance, economic freedom, and policy change: is foreign aid like champagne? Cato J 18:275–286

Williamson C (2010) Exploring the failure of foreign aid: the role of incentives and information. Rev Aust Econ 23:17–33

Young A, Sheehan K (2014) Foreign aid, institutional quality, and growth. Eur J Polit Econ 36:195–208

Young AT, Bologna J (2015) Crises and government: some empirical evidence. Contemp Econ Policy 34(2):234–249. doi:10.1111/coep.12154

Acknowledgments

We thank Audrey Redford, Kathleen Sheehan, and the participants at the Free Market Institute’s seminar series for helpful comments on earlier drafts and the John Templeton Foundation for financial support.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Funding

This study was funded by the John Templeton Foundation ($10,000).

Rights and permissions

About this article

Cite this article

March, R.J., Lyford, C. & Powell, B. Causes and barriers to increases in economic freedom. Int Rev Econ 64, 87–103 (2017). https://doi.org/10.1007/s12232-016-0263-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12232-016-0263-2