Abstract

The standard of living of persons and households is not only a matter of income, but ultimately depends on the level and quality of their consumption in terms of goods and services purchased. Consumption expenditures can be regarded as the result of decisions based on the demand, preferences and limited economic resources, and are thus manifestations not only of different lifestyles, but also of inequality, affluence and deprivation. But how are different levels and kinds of consumption related to subjective well-being (SWB)? While the relationship between income and SWB has been explored in numerous studies, surprisingly little is known as yet about the association between consumption expenditures and SWB. Referring to theoretical considerations and previous research, this article focuses on the empirical analysis of how and to what extent SWB—in terms of life satisfaction—is affected by the level and structure of consumption expenditures in German households. The analysis is based on the data from the German Socio-Economic Panel Study, which for the first time in 2010 included a module on consumption expenditures. The results of our analysis demonstrate that life satisfaction increases with increasing consumption expenditures, but the findings also suggest that persons in the lowest decile of consumption expenditures turn out to be less unsatisfied with their lives than persons in the lowest income decile. Moreover, our research provides evidence to suggest that low levels of spending resulting from voluntary decisions do not reduce life satisfaction at all. Finally, the paper also points out the ways in which SWB is affected by particular kinds of consumption expenditures. It appears that expenditures on clothing and leisure are drivers of SWB, while expenditures on food and housing—which may be considered more demand driven—do not affect life satisfaction significantly.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The consumption of goods and services constitutes an essential part of human life and is, moreover, considered to be a hallmark of the prevailing lifestyle in the Western world. The material well-being of private households is ultimately defined by the level, kind and quality of their consumption of goods and services, even if it may turn out to be debatable whether or not further growth in material wealth seems to be desirable considering the level of prosperity already achieved. As it thus seems rather obvious to consider consumption as a potential driver of subjective well-being (SWB), the lack of empirical research on the subject is quite striking. In any case, there is ample evidence that consumption can not only be a source of joy, pleasure and satisfaction, but also—if the necessary financial means are lacking—a cause of distress, discontent and absolute or relative deprivation. This article focuses on the role of consumption as a potential driver of SWB compared to other influencing factors, primarily household income. The leading research question will concern how and to what extent SWB is affected by the level and composition of a household’s consumption expenditures.

2 Theoretical background and previous research

As yet, research has rarely addressed the question of whether and how material well-being as measured by the level and structure of private consumption manifests itself in individuals’ SWB levels. The numerous studies focusing on the link between material level of living and SWB are almost exclusively based on the information concerning household income. From a cross-sectional point of view, a rather strong and positive correlation between life satisfaction and household income within and across nations has been observed by a large body of research (see, e.g., Biswas-Diener 2008; Noll and Weick 2010; Stevenson and Wolfers 2013). In other words, at a specific point in time, life satisfaction seems to increase considerably with increasing income, with those at the top of the income distribution being clearly more satisfied with their lives than those at the bottom. According to neoclassical economic theory, a positive association between income and SWB is to be expected first of all, because higher incomes allow for more and better consumption.

Although income is frequently and predominantly used in empirical SWB research as an indicator of people’s level of living, there is ample evidence that current income turns out to be an imperfect measure of material well-being at best, and numerous scholars have argued that consumption expenditures may in fact be a superior measure (Atkinson 1998: 32; Cutler and Katz 1991: 39; Meyer and Sullivan 2006: 2; Slesnick 2001: 122ff.). Previous studies on SWB, which normally used income as a predictor variable, started from the assumption “that current income translates directly into resources for consumption” (MacDonald and Douthitt 1992: 243). Although it is still common practice in empirical research on SWB to use income as a proxy for consumption, sometimes even mistakenly talking about consumption while in fact referring to income (Ahuvia 2002), it is obvious that income and consumption expenditures are far from being identical objects. While current income is undoubtedly a major source of financing consumption expenditures, it would seem not to be the only one. Empirical studies have repeatedly shown, for example, that a significant percentage of households—particularly those in low-income groups—actually spend more than they earn.Footnote 1 This empirical fact shows that consumption expenditures may be financed from sources other than current income, e.g., future income through borrowing, savings, donations. Differences in income and consumption levels may on the other hand also be accounted for by the fact that a household’s total income need not be spent on consumption; some of it may also be saved or donated to others.

If, as pointed out, income and consumption expenditures—although correlated—have to be considered as different issues, it evidently makes sense to look at the relationship between SWB and material level of living, not only in terms of income, but also in terms of expenditures. When it comes to explaining SWB, the latter may even turn out to be the superior measure for two particular reasons:

-

First of all, there is ample agreement in the economic literature that income needs to be spent on goods and services in the first place in order to create utility or to enhance well-being. If it is in fact the case that income affects well-being via consumption, consumption expenditures would turn out to be a more direct and thus possibly superior measure than income.Footnote 2

-

A disadvantage of using income as a proxy for consumption is not only that it may turn out to provide a poor estimate of the actual level of consumption expenditures. Perhaps even more important is the fact that using income obviously does not allow distinctions to be drawn between different kinds of spending, but rather implies that it is only the quantity, and not the content, of the consumer basket that matters. By contrast, using expenditure data usually makes it possible to look at both the size and the content of the basket.

Referring to the relevant economic theory and the previous research on SWB, there would seem, in our view, to be basically three hypotheses concerning how consumption may affect SWB:

First of all, one might assume that it is the absolute level of consumption that matters: The more the better or the more an individual consumes, the higher his/her level of SWB. This hypothesis is based on the neoclassical theory, which implies a direct positive—though not necessarily linear—association between consumption and well-being, as well as the supposition of the “insatiable consumer” (Guillen-Royo 2007: 155). From this perspective, then, “the only meaningful forms of individual satisfaction result from more consumption” (Ackerman 1997: 652).

The second hypothesis puts the emphasis primarily on the quality or composition of consumption: From this point of view, it is not (only) the size of the consumer basket that matters, but rather its content. SWB does not (only) depend on how much, but rather on what kinds of goods and services people consume. Following up on this hypothesis, the challenge for research is then to identify which types of consumption have a greater or lesser effect on SWB, and eventually also answer the question why certain sorts of expenditures may increase people’s happiness. Individuals’ SWB could eventually be enhanced via certain goods and services by reducing material hardship, by increasing prestige or by strengthening social relations (DeLeire and Kalil 2010: 165).

The third hypothesis rests on the assumption that it is not absolute, but relative consumption that matters. Analogously to relative income, the concept of relative consumption refers to the perceived level and quality of one’s own consumption relative to that of significant others, such as colleagues, friends, neighbors or the average citizen, and thus emphasizes the importance of processes of social comparison. According to the relative consumption hypothesis, which is closely linked to Duesenberry’s (1949) theory of consumer behavior and endogenous preferences, one would expect “that those who are able to consume at or above the same level as their peers should be more satisfied than those who cannot” and that “those consumers who are unable to ‘keep up with the Jones’s’ experience dissatisfaction” (MacDonald and Douthitt 1992: 246).

As the “relative consumption hypothesis” raises additional questions, e.g., concerning who the relevant significant others are and how they are to be identified, and also seems to be more demanding in terms of the sort of data required for an appropriate research design, this article will only address hypotheses one and two.

For various reasons, including the lack of appropriate data, there is as yet very little empirical research on how SWB is affected by different levels and kinds of consumption expenditures. One of the first studies addressing the issue empirically was a test of several specific theories of consumption behavior by MacDonald and Douthitt (1992), using data from the local “Wisconsin Basic Needs Study.” Among other, more specific findings related to the theories tested, the authors also find support for the “long standing a priori economic postulate that increased resources lead to higher levels of satisfaction” (MacDonald and Douthitt 1992: 260).

The results of a comparative study on the combined effects of wealth, income and consumption on SWB levels using household panel data from Australia, Britain, Germany, Hungary and the Netherlands showed that in the “countries for which consumption data are available (Britain and Hungary), non-durable consumption expenditures also prove at least as important to happiness as income” (Headey et al. 2004: Abstract). A limitation of this study lies in the incomprehensive consumption expenditure measures used for the two countries—Hungary and Britain—for which consumption data were available at all. While the Hungarian panel employed a rather detailed approach to measuring consumption expenditures,Footnote 3 the consumption measure for Britain used by Headey, Muffels and Wooden is much more limited as it “sums and analyses three expenditures on non-durables: food and groceries, meals out and leisure” (Headey et al. 2004: 7).

“Does consumption buys happiness” is the principal question addressed in a study on older Americans by DeLeire and Kalil (2010), which is based on the nationally representative data from the Health and Retirement Study. This database makes it possible to examine the relationship between various components of consumption expenditures and happiness—as measured by a multi-item life satisfaction index—in much more detail. As the major result of this research, the authors found “that only one component of consumption expenditures is positively related to happiness—leisure consumption” (DeLeire and Kalil 2010: 174).

As part of the “Measuring National Well-being Programme” run by the UK Office for National Statistics, Lewis (2014) has recently published a report on “Income, Expenditure and Personal Well-being,” which presents the results of an analysis based on the data from the “Living Costs and Food Survey,” a sample survey covering ca. 5,500 private households in Great Britain. Among the key results is the finding that the relationship between household expenditure and life satisfaction appears to be somewhat stronger than the relationship between household income and life satisfaction: “The model which included household expenditure was able to explain 12.5 % of the variance in individual life satisfaction compared to 12.1 % for the model with household income” (Lewis 2014: 15). According to the author, “this suggests that household expenditure may be a more accurate predictor” of SWB (Lewis 2014: 15). The results of this study, moreover, “suggest that the well-being of people in non-retired households without children may be more strongly related to household spending than among those in other types of households” (Lewis 2014: 17).

This short overview of research on consumption and SWB does not claim to be comprehensive, but still reveals that—although there are interesting and promising findings—the related research questions have not yet been addressed systematically and that more research is obviously needed.

3 Research design, concepts and data

With a view to the hypotheses mentioned above, this article will address the question of how and to what extent individuals’ SWB is affected by the level and composition of their consumption expenditures as compared to other potential determinants, particularly income. To this end, we will look at the relationship between SWB and household expenditures in different ways and from different angles.

In the first bivariate stage of the analysis, we will explore, from a descriptive perspective, how SWB varies across the consumption expenditure and household income distributions for the total population. In this part of the analysis, special emphasis will also be put on population groups located in the lower parts of the distributions of consumption expenditures and household income. In order to estimate the strength of the relationship between SWB and household expenditures, and to gain more differentiated insights into the nature of this association, multivariate regression techniques will be employed in the following stages of the analysis.

It may be useful to add a few remarks concerning our understanding of the two basic concepts used in the following empirical analysis: SWB on the one hand and consumption and consumption expenditures on the other.

SWB has been characterized as a rather complex and multifaceted construct, covering various components, such as general and specific, and cognitive and affective elements, which have been shown to be interrelated in various ways, but which also seem to be independent from each other to some extent. The cognitive component refers to the cognitive and evaluative processes involved in assessing the individual’s objective life situation, whereas the affective component predominantly expresses affective states, such as emotions and moods (Andrews and McKennell 1980). Our analysis of SWB will have a strong focus on the cognitive dimension and thus make use of life satisfaction, which is generally considered to be an indicator that predominantly measures this dimension of SWB.

According to our understanding, consumption expenditures include all expenditures on goods and services purchased by private households. The levels and structures of consumption expenditures are determined by a range of factors, which relate to each other in complex ways: Among those factors, it is not only the size, structure and social situation of households that are decisive for the different levels and kinds of demand, as well as the financial resources available, but also the personal preferences and lifestyles of household members. At this point, it seems to be appropriate to note that consumption expenditures are not necessarily identical to total consumption. The expenditures of individuals and households over a certain time period frequently differ from their actual consumption over the same period for various reasons. First of all, there is obviously the possibility that goods that have been purchased, such as groceries, books and the like, are never consumed in the strict sense, but only possessed—whether temporarily or for long periods of time. Equally important is perhaps the inverse possibility of consumption without expenditures—at least within the same period—as for example in the case of households which consume housing after having paid off mortgages.Footnote 4 Another example of consumption without expenditures is the consumption of non-market goods and services (home production as well as public goods and services). And last but not least, households may consume stocks of goods bought in previous periods or purchase goods and services to be consumed in future periods. While it thus seems to be important to be aware of the fact that expenditures do not necessarily reflect a household’s total consumption level, expenditures may still be used as the best available proxy of its total consumption.

Worldwide, there are currently only a few databases existing which allow for the empirical examination of the relationship between consumption expenditures and SWB. While the vast majority of the official and research-driven population surveys which include indicators of SWB do not include information about households’ consumption expenditures, surveys which specialize in collecting information about income and expenditures—like the official household budget surveys—usually do not collect information on the SWB of household members. Only recently a small number of research-driven household panel studies, like the American PSID (Charles et al. 2007), the Australian HILDA (Headey et al. 2004) and the German Socio-Economic Panel Study (SOEP) (Marcus et al. 2013)—all of which include SWB indicators—have included measures of consumption expenditures, though without claiming to measure the latter comprehensively. The British Living Costs and Food Survey seems to be one of the first official surveys to include measures of household expenditures along with SWB indicators (Lewis 2014).

The database used for our analyses is the German SOEP,Footnote 5 which in its 2010 round for the first time collected information on consumption expenditures. In contrast to the official “Income and Consumption Survey” (EVS) carried out by the German Statistical Office every 5 years, which collects information on consumption expenditures by making use of the diary method or “shopping basket” approach over a period of 3 months,Footnote 6 the measurement approach employed by the SOEP is comparatively simple. As part of the household questionnaire, SOEP respondents were requested to provide retrospective information on their household’s expenditures (monthly or yearly) in 16 expenditure categories for the year prior to that in which the survey took place. In addition, respondents were also requested to answer questions on the possession of durables—such as cars, washing machines, TV sets, mobile phones—and to provide information on expenditures on such sorts of goods. Information on housing expenditures is being collected regularly in more detail in a different section of the household questionnaire.Footnote 7

A comparison of the SOEP data for 2009 (the reference year) with results from the 2008 EVS reveals various differences (Table 1). Quite striking is first of all the fact that the level of monthly per head consumption expenditure as measured by the SOEP falls on average 533 EUR short of the level recorded in the EVS, while the information on average net household income turns out to be quite similar in both surveys. Without seeking to clarify the reasons behind the considerable difference in the reported consumption expenditure levels in respect of all details at this point, there is a good reason to assume that the comparatively simple and retrospective approach to collecting expenditure data resulted in an underestimation of the total of consumption expenditure by the SOEP. This assumption is inter alia supported by the observation that the expenditure levels reached on the basis of the SOEP data turn out to be lower than those of the EVS in each of the expenditure categories, except housing expenditures, which were collected more extensively, as mentioned above (see Table 1). The difference is particularly pronounced where expenditures on mobility and transportation are concerned, which according to the SOEP amount to only 236 EUR, compared to 400 EUR in the EVS. Only housing expenditures, which are not only collected regularly in each of the SOEP surveys, but are also collected in a more sophisticated and comprehensive way than other types of expenditures, turn out to be slightly higher than the corresponding expenditures in the EVS. On comparison of the various expenditure categories as percentages of the total household budget, the differences are somewhat less pronounced, but still substantial.

Overall, this comparison leads to the conclusion that the data on consumption expenditures as they were collected retrospectively by the SOEP using a rather simple technique may not be sufficient for a detailed analysis of expenditure levels and precise point estimates of budget shares, but may still be used to analyze such relationships as that between consumption expenditures and SWB.

The income variable used in our analysis refers to disposable household income in the year prior to that in which the survey took place and thus covers the same time period as the information on consumption expenditures. The information on disposable household income in the SOEP database results from adding up various sorts of incomes across all the individual household members.Footnote 8

As far as SWB is concerned, the SOEP covers various measures, including life satisfaction, which is going to be used in our analysis. The “life satisfaction” question reads: “How satisfied are you with your life, all things considered?” The answering scale provided to respondents to rate their life satisfaction runs from 0 (completely dissatisfied) to 10 (completely satisfied).

4 Analysis: consumption expenditures and life satisfaction

4.1 Descriptive analysis

In order to explore the bivariate relationship between life satisfaction and consumption expenditures as compared to household income, in the first stage of our analysis, we will consider the manner in which life satisfaction varies across equivalized household expenditure and income deciles.

As Fig. 1 shows, life satisfaction increases considerably with growing income and with increasing expenditures. In both cases, the life satisfaction gap between the poorest and the most well-off deciles turns out to be substantial, but is somewhat larger between the lowest and the highest income deciles (1.3 points on the 0–10 scale) as compared to the lowest and the highest expenditure deciles (0.9 points on the 0–10 scale). From the third decile, the respective life satisfaction levels recorded in relation to income and expenditure do not differ significantly. Obviously, the life satisfaction gap between the respective income and expenditure positions is particularly pronounced in the lowest decile: The poorest 10 % of the population in income terms turns out to be on average less satisfied with their lives (6.3 on the 0–10 scale) than the poorest 10 % in expenditure terms (6.6 on the 0–10 scale). This observation may initially be explained by the fact that household expenditures not only display a smaller variability than household incomes, but also exceed incomes in the lower parts of the distributions. The less unequal distribution of consumption expenditures as compared to household incomes is for example indicated by the observation that average equivalized expenditures in the lowest decile amount to 69 % of the median compared to only 43 % in the case of equivalized income. In other words, the expenditures of the households that are poorest in expenditure terms are less different from the average consumption level than the incomes of the income poor from the median income level. This is accompanied by the fact that in 44 % of the observations, household expenditures in the lowest income decile exceed household incomes, on average by 30 %. Footnote 9

Life satisfaction by deciles of household income and total consumption expenditures. Household net income and consumption expenditures—each equivalized (modified OECD-scale). Database: German Socio-Economic Panel Study (SOEP) 2010; doi:10.5684/soep.v28

A second explanation for the finding that life satisfaction apparently seems to be less impaired by poverty in expenditure terms than by poverty in income terms invokes personal consumption preferences and the assumption that low expenditure levels due to voluntary consumption abstinence will not necessarily reduce subjective well-being. Evidence in support of this assumption is provided by the results of an analysis which compares life satisfaction levels between different low income and expenditure constellations (Table 2) . Interestingly, this analysis shows that persons who belong to the poorest 10 % of the population in both, household income terms and consumption expenditure terms, are even more dissatisfied with their lives (6.0 on the 0–10 scale) than those who fall into the lowest income decile but not the lowest expenditure decile (6.3 on the 0–10 scale). Losses in SWB are thus obviously attenuated if individuals manage to avoid consumption poverty, e.g., by overspending, despite their precarious income situation. At the same time, the findings seem to suggest that even extremely low consumption levels must not necessarily result in pronounced reductions of SWB, if low consumption levels are the outcome of voluntary decisions, potentially reflecting non-materialistic preferences and lifestyles. This view is clearly supported by the finding that persons in the lowest expenditure decile are in fact not—or only very slightly—less satisfied with their lives (6.9 on the 0–10 scale) than the average population (7.0 on the 0–10 scale), as long as they are not income poor at the same time.

4.2 Regression analysis

In order to explore the relationship between SWB and household expenditures more thoroughly, multivariate OLS-regression techniques are used in the following parts of the analysis. To this end, a range of different regression models are employed to assess the explanatory power and effect strength of both total expenditures and specific expenditure categories as compared to income and other potential predictor variables.

The simplest model, which includes only total expenditures or household income as predictor variables,Footnote 10 while controlling for household size as a major determinant of demand, yields an effect size for consumption expenditures (regression coefficient = 0.56; r 2 = 0.04) that is similar to that for household income (regression coefficient = 0.64; r 2 = 0.05) if both variables are put into the regression model separately (Table 3). When both variables are put into the regression model simultaneously, we find that both household expenditures and household incomes have significant effects, but the total variance explained does not increase relative to the model that only includes income (Table 3).

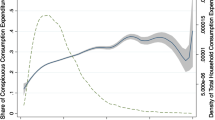

The analysis also shows that life satisfaction does not increase linearly with increasing expenditures, but that gains in life satisfaction rather tend to diminish with increasing consumption levels (Fig. 2). The shape of the relationship is thus similar to that between life satisfaction and household income, which has been repeatedly explained by means of the law of diminishing returns, although the observation is based on cross-sectional data.Footnote 11

Life satisfaction by monthly equivalized consumption expenditures—regression estimates. Database: German Socio-Economic Panel Study (SOEP) 2010; doi:10.5684/soep.v28

The positive association between consumption expenditures and life satisfaction also holds when a number of other potential predictor variables are simultaneously introduced (Table 4). The additional variables entered into the model include age and age squared, living in Eastern Germany, family status, educational achievement, employment status and self-rated health. As previous research had already demonstrated (e.g., Noll and Weick 2010), most of these variables also seem to be related to life satisfaction; some of them—like subjective health, being unemployed, living in Eastern Germany, or living with a partner—even turn out to be strong predictors. As Table 4 clearly shows, the positive effect of total consumption expenditures on life satisfaction turns out to be statistically significant in the multivariate analysis as well. The magnitude of the effect is substantial and again only marginally lower than that of household income.

Overall, the results clearly support the hypothesis that the size of the consumer basket in terms of money spent on various goods and services is positively related to life satisfaction. This observation even holds when household income and a range of additional predictor variables are controlled for at the same time.

The fact that households not only vary in respect of the level of their consumption expenditures, but also in respect of their consumption profiles, raises the question of whether individuals’ SWB may also be influenced by the amount of money spent on different kinds of goods and services. In order to examine whether and to what extent not only the size of the consumer basket, but also its content, matters as a predictor of life satisfaction, in the next stage of the regression analysis total expenditures will be replaced by the amount spent in eleven classes of goods and services: nutrition, clothing, housing and energy, furniture and housing facilities, health, mobility, communication, leisure, education, hotels and restaurants, other. The expenditures on these categories of goods and services are entered into the regression analysis again in logarithmized format for the reasons explained above.

The simplest model, which includes the categorized consumption expenditures as the only independent variables while controlling for household size, explains eight percent of the total variance in life satisfaction (Table 5), which is twice as much as the variance explained by the total expenditures (Table 3). As model 1 in Table 5 reveals, the expenditures on specific goods and services seem to have significant positive or negative effects on SWB. SWB does not seem to be significantly affected, however, by expenditures on nutrition, furniture and housing facilities or expenditures for “other” goods and services. Weak negative effects of lower significance are found for expenditures on housing and energy as well as mobility. Expenditures on leisure goods and activities as well as those on clothing seem to have the strongest positive impact on SWB. While expenditures on education as well as accommodation and restaurants also seem to be positively related to SWB, expenditures relating to health and communication are negatively correlated with SWB according to our results.Footnote 12 Though the negative association with health-related expenditures is in accordance with our expectations, assuming that such expenditures are usually prompted by situations of bad health, the negative relationship with communication expenditures—although rather weak—seems to be more surprising and puzzling. Although there obviously is no clear-cut explanation for this observation as yet, the results of our previous research suggest we should consider communication as a basic need that is similar to nutrition (Noll and Weick 2005: 3). This becomes manifest, for example, in the observation that the proportion of the total expenditure that is spent on communication does not increase with increasing income, but rather decreases, as is the case with expenditures on other basic needs like nutrition and housing.Footnote 13

Our findings concerning the positive effects of expenditures on leisure and clothing seem to be quite plausible and to confirm the results of previous research. As has been mentioned, a recent study on consumption and happiness found only leisure consumption expenditures to be positively related to happiness (DeLeire and Kalil 2010: 174). A positive association between clothing expenditures and SWB was reported by Perez-Truglia (2013) as a result of testing a “conspicuous consumption hypothesis.” This study found that “life satisfaction increases with the ranking of clothing expenditure…, but it does not change with the ranking of food expenditure” (Perez-Truglia 2013: 8). In this article, it is argued that clothing consumption is highly visible and affects SWB via signaling effects, e.g., demonstrating wealth and other status attributes. However, in our view, clothing expenditures seem to be of a more ambiguous nature, since they may include expenditures on both luxury and ordinary clothes, and thus be considered both conspicuous and basic at the same time. Nevertheless, it may well be the case that the positive effect of clothing expenditures on SWB is primarily attributable to luxury or lifestyle goods being purchased and conspicuous consumption, a hypothesis which, however, we cannot test.Footnote 14

Entering household income as an additional predictor variable into the regression model results in only minor changes to the magnitude of the regression coefficients and adds very little in terms of variance explained (Table 5, model 2). The basic pattern of associations also remains more or less unchanged when the whole set of potential predictor variables are entered simultaneously, as in Table 5, model 3, but the variance explained jumps to 29 %. When household income and a number of other predictor variables are controlled for, the effect of the amount spent in some of the expenditure categories on life satisfaction is, as expected, somewhat diminished. In two cases—health-related expenditures and spending on accommodation and restaurants—the effects previously observed turn out to be no longer statistically significant.

The overall results of the regression analysis thus clearly suggest that SWB is not only affected by the size of the consumer basket or the total amount spent, but also by the content of the consumer basket or the amount spent on particular kinds of goods and services.

5 Conclusions

The results of our empirical analysis of the relationship between consumption expenditures and SWB, the first such study carried out in Germany, clearly show that larger consumption expenditures are positively correlated with increasing levels of life satisfaction. The results also reveal that it is not only the quantity of financial resources spent on consumption that matters, but also the kinds of goods and services purchased clearly affect individuals’ SWB in different ways. Among the various kinds of consumption expenditures, those on clothing and leisure prove to be positively related to life satisfaction and thus seem to be drivers of SWB. Unfortunately, as yet the available databases usually do not provide sufficiently fine-grained information on consumption expenditures to allow narrower categories of goods and services to be defined or, for example, luxury from ordinary consumption to be distinguished.

Interestingly, it seems that low levels of consumption expenditures only reduce life satisfaction marginally, if at all, in cases where people voluntarily choose to consume less. This finding, as well as the observation that consumption expenditures frequently exceed incomes in poorer households, may be part of the explanation why being positioned in the lowest part of the expenditure distribution seems to be less harmful to SWB than being positioned in the lowest part of the income distribution. The observation that voluntary consumption abstinence does not significantly reduce SWB may eventually also have implications for policy making, e.g., when it comes to encouraging more sustainable ways of living in our affluent societies.

What are the main conclusions of this analysis for future research on SWB? First of all, the results of the regression analysis demonstrate that—if considered separately—the effect of material well-being in terms of total consumption expenditures on life satisfaction turns out to be of about the same magnitude—indicated by the regression coefficient and the amount of variance explained—as that of material well-being in terms of household income. This finding may be taken to support the view that in order to control for material well-being, it is sufficient to use household income as a proxy, as is currently common practice. However, replacing the total expenditures by the amount spent on various categories of goods and services increases the explanatory power considerably. Using this information almost doubles the amount of variance explained by household income. Moreover, our analysis also provides evidence to suggest that there are differences between the effects of income and consumption across different parts of the respective distributions, which adds to our knowledge about the determinants of SWB and which cannot be taken into account by using income as the only measure of material well-being.

Notes

SWB may, however, also be directly affected by unspent income, e.g., if income as such provides options, security and social prestige, or the prospect of future consumption.

For more details, see (Headey et al. 2004: 9).

More generally, this means that “current-out-of-pocket expenditures may therefore provide an inaccurate picture of the service flow provided by a consumer unit’s stock of consumer durables…, spending on new automobiles is included in expenditures, but the consumption value of the existing stock is not” (Cutler and Katz 1991: 32).

The SOEP is a representative longitudinal study of private households and individuals within households, which is carried out by the German Institute for Economic Research, DIW Berlin. This annual survey currently has a sample size of almost 11,000 households, and around 30,000 persons. For more information on the SOEP, see www.diw.de/en/soep; detailed data documentation information is available at www.diw.de/en/diw_02.c.221180.en/research_data_center_soep.html (accessed October 6, 2014).

For more information on the German Income and Consumption Survey, see Statistisches Bundesamt (2013).

Although the SOEP employed different approaches to collecting housing expenditures, the single-expenditure items were combined to give a total level of housing expenditure according to the taxonomy used in the official Income and Expenditure Survey. Accordingly, expenditures relating to modernization work which increases the financial value of buildings are not considered as consumption, but rather investment. In calculating the housing expenditures of home owners, no “imputed rent” has been taken into account.

For more detailed information, see Becker et al. (2002).

See Noll and Weick (2007) for a more detailed analysis of the issue of “overspending.”

In each of the regression models, both consumption expenditures and household income are treated as logarithmized variables both due to the expected nonlinear relationships and in order to normalize the skewed income and expenditure distributions. Logarithmizing income—and analogously consumption expenditures—as predictors of life satisfaction in regression models seems to represent the current state of the art. See, e.g., Van Praag and Ferrer-I-Carbonell (2008).

Using percentages of the total expenditure rather than the absolute amounts spent in diverse categories of goods and services produced similar results overall. See Noll and Weick (2014: 5).

The observation of a decrease in the proportion of the total expenditure that is spent on nutrition with increasing household income goes back to the studies of the German statistician Ernst Engel in the nineteenth century and is thus also referred to as “Engel's law.”

Available empirical evidence also suggests a positive association between luxury consumption and SWB. See Hudders and Pandelaere (2012).

References

Ackerman F (1997) Consumed in theory: alternative perspectives on the economics of consumption. J Econ Issues 31(3):651–664

Ahuvia AC (2002) Individualism/collectivism and cultures of happiness: a theoretical conjecture on the relationship between consumption, culture and subjective well-being at the national level. J Happiness Stud 3:23–36

Andrews FM, McKennell AC (1980) Measures of self-reported well-being: their affective, cognitive, and other components. Soc Indic Res 8:127–155

Atkinson AB (1998) Poverty in Europe. Blackwell, Oxford

Becker I, Frick J, Grabka MM, Hauser R, Krause P, Wagner GW (2002) A comparison of the main household income surveys for germany: EVS and SOEP. In: Hauser R, Becker I (eds) Reporting on income distribution and poverty. Perspectives from a German and a European point of view. Springer, Heidelberg, pp 55–90

Biswas-Diener R (2008) Material wealth and subjective well-being. In: Eid M, Larsen RJ (eds) The science of subjective well-being. Guilford, New York, pp 307–322

Charles KK, Danziger S, Li G, Schoeni RF (2007) Studying consumption with the panel study of income dynamics: comparisons with the consumer expenditure survey and an application to the intergenerational transmission of well-being. finance and economic discussion series 2007–2016. Divisions of research and statistics and monetary affairs. Federal Reserve Board, Washington, DC

Cutler DM, Katz LF (1991) Macroeconomic performance and the disadvantaged. Brook Pap Econ Act 1(2):1–74

DeLeire T, Kalil A (2010) Does consumption buy happiness? Evidence from the United States. Int Rev Econ 57:163–176

Diener E, Sandvik E, Seidlitz L, Diener M (1993) The relationship between income and subjective well-being: relative or absolute? Soc Indic Res 28:195–223

Duesenberry JS (1949) Income, saving, and the theory of consumer behavior. Harvard University, Cambridge

Easterlin R (2004) Diminishing marginal utility of income? A caveat. University of Southern California, Law and Economics working paper series, No. 5. Los Angeles

Guillen-Royo M (2007) Well-being and consumption: towards a theoretical approach based on human needs satisfaction. In: Bruni L, Porta PL (eds) Handbook on the economics of happiness. Edward Elgar, Cheltenham, pp 151–169

Headey B, Muffels R, Wooden M (2004) Money doesn’t buy happiness… or does it? A reconsideration based on the combined effects of wealth, income and consumption. IZA Discussion Paper No. 1218. Bonn

Hudders L, Pandelaere M (2012) The silver lining of materialism: the impact of luxury consumption on subjective well-being. J Happiness Stud 13:411–437

Lewis J (2014) Income, expenditure and personal well-being, 2011/12. Research report, UK Office for National Statistics. Newport, South Wales (www.ons.gov.uk/ons/dcp171766_365207.pdf; accessed Oct. 6, 2014)

MacDonald M, Douthitt RA (1992) Consumption theories and consumer’s assessments of subjective well-being. J Consum Aff 26(2):243–261

Marcus J, Siegers R, Grabka MM (2013) Preparation of data from the new SOEP consumption module. Editing, imputation, and smoothing. Data documentation 70. Deutsches Institut für Wirtschaftsforschung, Berlin

Meyer B, Sullivan J (2006) Three decades of consumption and income poverty. National poverty center working paper series, No. 06-35. University of Michigan, September 2006 (www.npc.umich.edu/publications/working_papers/; accessed Oct. 6, 2014)

Noll H-H (2007) Household consumption, household incomes and living standards. A review of related recent research activities. GESIS, Mannheim. Published online only (www.gesis.org/fileadmin/upload/institut/wiss_arbeitsbereiche/soz_indikatoren/Publikationen/Household-Expenditures-Research-Report.pdf)

Noll H-H, Weick S (2005) Markante Unterschiede in den Verbrauchsstrukturen verschiedener Einkommens-positionen trotz Konvergenz. Analysen zu Ungleichheit und Strukturwandel des Konsums. Informationsdienst Soziale Indikatoren (ISI) 34:1–5

Noll H-H, Weick S (2007) Einkommensarmut und Konsumarmut—unterschiedliche Perspektiven und Diagnosen. Analysen zum Vergleich der Ungleichheit von Einkommen und Konsumausgaben. Informationsdienst Soziale Indikatoren (ISI) 37:1–6

Noll H-H, Weick S (2010) Subjective well-being in Germany: evolutions, determinants and policy implications. In: Greve B (ed) Happiness and social policy in Europe. Edward Elgar, Cheltenham, pp 70–88

Noll H-H, Weick S (2014) Lebenszufriedenheit steigt mit der Höhe der Konsumausgaben. Analysen zur Struktur von Konsumausgaben und subjektivem Wohlbefinden. Informationsdienst Soziale Indikatoren (ISI) 51:1–6

Perez-Truglia R (2013) A test of the conspicuous–consumption model using subjective well-being data. J Soc Econ 45:146–154

Slesnick DT (2001) Consumption and social welfare. Living standards and their distribution in the United States. Cambridge University Press, Cambridge

Statistisches Bundesamt (2013) Fachserie 15, Heft 7. Wirtschaftsrechnungen. Einkommens- und Verbrauchsstichprobe. Aufgabe, Methode und Durchführung. Wiesbaden

Stevenson B, Wolfers J (2013) Subjective well-being and income: is there any evidence of satiation? Am Econ Rev 103(3):598–604

Van Praag B, Ferrer-I-Carbonell A (2008) Happiness quantified. A satisfaction calculus approach. Revised edition. Oxford University, Oxford

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Noll, HH., Weick, S. Consumption expenditures and subjective well-being: empirical evidence from Germany. Int Rev Econ 62, 101–119 (2015). https://doi.org/10.1007/s12232-014-0219-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12232-014-0219-3

Keywords

- Consumption

- Consumption expenditures

- Household income

- Household expenditures

- Subjective well-being

- Life satisfaction