Abstract

Using syndicated loan data, the paper finds that loan spreads have increased and have remained elevated post-2009. Regressions, controlling for currency fixed effects, loan types, loan sizes, number of participating banks, tenors, confirm the higher spreads post-2009. Further analysis reveals that the average number of banks per syndication rose for developed economies but fell for emerging economies. This is explained by the higher market shares of non-Japanese Asian banks in developing economies post-crisis, but with lower syndication intensity. Consistent with the capital shock hypothesis, Western and Japanese banks intensify the degree of syndication post-crisis, but other Asian banks do not. The lower syndication intensity of suggests that market efficiency has declined for developing economies. Syndication should be further encouraged to reduce spreads.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the financial crisis of late 2000s, there have been many changes to the banking sector globally. Firstly, many crisis-affected Western banks have pulled back from their earlier expansions. This can be attributed to a variety of reasons, such as the need to deleverage and repair balance sheets, slower global growth, and possibly tighter regulatory regimes. On the last point, the Basel framework requires banks to hold more capital (“regulatory capital”) against their assets. This has also raised the cost of capital.

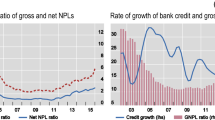

The key motivation of this paper stems from the following observation. Since the financial crisis in 2008/2009, the Interbank Offered Rate (or reference rate) has dropped sharply following the actions by central banks. It remained under 1% for much of the decade, and has only started to climb in 2016 to above 1% (see Fig. 1).

However, in the syndicated bank loan market, the lending spreads over this reference rate spiked in 2009 and have remained elevated, at around 3 percentage points (or 300 basis points, bps) over the reference rate (see Fig. 2). In short, borrowing costs were not as low as what the reference rate suggested, and could rise further when interest rates normalize. There is a large body of academic research into interest rate setting by central banks but relatively little on spreads. This paper thus studies the syndicated bank lending market, with an emphasis on pre- and post-crisis comparison.

The syndicated bank loan market is important for the following reasons. Globally, close to US$5 trillion a year of bank loans are conducted through syndication (Thomson Reuters 2015); it is a large global market for credit in other words. Many corporates rely on syndicated bank loans to fund new investment projects, as not many companies have the capacity for independent fund raising. In developing economies, where bond markets tend to be less developed, loans become a primary source of corporate or project funding (see Gadanecz 2004, for an overview of the market). Many sub-national governments also rely on this market for funding.

For those in the development community, the health of the syndicated loan market (especially in developing economies) is also linked to the “billions to trillions” agenda. Multinational Financing Institutions such as the World Bank have long stressed that funding from them alone would not be able to overcome the shortfall in development finance. Hence, there has been an emphasis to mobilize private sector funding into development projects, including infrastructure. The syndicated loan market is one such avenue, where private finance can be mobilized. The International Finance Corporation (IFC) of the World Bank Group is particularly active in syndication, given their emphasis on private sector development.

Banks have always played an important role in maturity transformation. Many banks also have the capacity to operate across borders, structure and syndicate loans, conduct due diligence, check on credit history etc. These are functions which are important for finance to flow. In the case of syndicated loans where many banks participate in financing, borrowers would have stronger incentives to ensure that they continue to maintain good credit records. Arguably, banks are better-placed than other investors, such as pension or sovereign funds, to operate in this space. Syndicated bank financing for development (e.g., power, transport, oil and gas, water) is thus important in this context.

1.1 Literature review: why do banks syndicate?

There is ample literature on banking. Nevertheless, research into the syndication market is relatively thin by comparison. Primarily, syndication enables originating banks or lead lenders to reduce exposure to borrower-related risks by sharing a part of the loans across the syndicates (Simons 1993). The lead bank (or lead banks) would usually require other participating banks to pay an upfront fee. Non-lead banks participating in the syndicate are then able to lend to borrowers they would not normally have access to. Broadly, this is known as the diversification motive, for both the lead and participating banks.

Large and complex projects would typically require some form of syndication, to overcome constraints such as capital, country or sector, or single borrower risk limits within each bank. Syndication can thus help expand credit availability, often across borders. In addition, participating banks would usually have covenants that enable them to sell their portion to other financiers during the course of the loan, without affecting the borrower or other lenders in the syndicate. Syndication thus offers considerable flexibility for bankers to adjust their portfolios. Syndication also provides diversification for the borrowers, by allowing them to build up relationships with a larger pool of bankers.

However, syndication also means the lead bank giving up a share of the loan profits, and perhaps more importantly, sharing customer relationships with other banks (which could reduce future profits). This runs counter to the diversification motive for the lead bank. There is also an information asymmetry problem between the lead bank and other participating banks. As mentioned, the lead bank collects an upfront fee from participating banks, while participating banks share the downsides should the loan go sour. There are thus both adverse selection and moral hazard at work. These factors will lead to lower syndication.

The literature on syndicated loans has thus focused on the drivers for syndication, and the tradeoffs faced (Simons 1993; Dennis and Mullineaux 2000; Ivashina and Scharfstein 2010; Godlewski and Weill 2008). Providing a clear illustration of such tradeoffs, Ivashina and Scharfstein (2010) find that syndication is counter-cyclical – banks have greater incentive to keep a larger share of the loan to themselves in favorable economic conditions (that is, less syndication), and they syndicate more when they are faced with shocks to bank capital.

This paper builds on earlier literature by examining how the syndication market has changed pre- and post-crisis, given the large shock that had occurred in 2008/2009. The key result is that interest rate spreads have risen significantly post-crisis, and have remained elevated, despite the low policy rate environment. The paper also documents the rise of large non-Japanese Asian banks in the global syndication market (especially in developing economies). Post-crisis, Western and Japanese banks increased their diversification effort and syndicated more loans with each other. This is not observed for other Asian banks, despite the increase in their respective market share. The paper thus provides empirical evidence that supports the capital shock hypothesis, which is in line with earlier research.

The rest of the paper is as follows. Section 2 provides a description of the data used for the study, including a discussion on data limitations. Section 3 provides the regression equation, results and robustness checks. Section 4 provides further discussions and implications, and Section 5 concludes.

2 Data

The study makes use of the extensive database on loans in Thomson Reuters. There are altogether around 265,000 data points covering all sectors, across the sample period 1990–2016. Each data point contains basic information such as the year in which the deal occurred, name of the borrower, the borrower’s economic sector, the country of operation, the lenders (including lead bank(s) and other bank(s) in the syndication). Each complete data point would also contain information on the terms of borrowing – the amount, the currency, the reference interest rate, and the spread above this reference interest rate. However, not all samples hold complete data, and the treatment for this will be discussed later.

For this study, the period before 2009 is labelled as pre-crisis, while 2009 and onwards is labelled as post-crisis. The choice of labelling is motivated by the spike seen in 2009 (see Fig. 2). Note that the labelling of pre- and post-crisis is mainly descriptive to aid the flow of discussion. As to be seen later, year dummies (i.e., year fixed effects) are used in the regressions, as opposed to just pre- and post-crisis. The regression results are thus not dependent this labelling choice.

2.1 Reference rates and spreads

The most common reference rate is the London Interbank Offered Rate, or LIBOR (almost half of all samples). The other reference rates are Euribor, Tokyo LIBOR (TIBOR), Singapore and Hong Kong IBORs, but these have relatively small shares in the market compared to LIBOR.

Adding to the reference rates is the recorded spread. The assumption here is that the reference rate reflects the banks’ financing costs, for example, if they need to borrow from or lend to the interbank market. The price of the loans made to companies is the spread (in basis points, or bps) above this reference rate. The spread is the key variable that will be studied in this paper. The spread, together with the reference rate, become the borrowing cost.

Furthermore, the loans can be made in floating or fixed terms. A fixed term loan will carry a fixed interest rate for the tenor of the loan. A floating loan will rise or fall with the change of reference rates (keeping spread constant). With the floating loans, interest rate risks are borne by the borrower. For fixed term loan, interest risks are borne by the lenders. Unsurprisingly, spreads will be higher for fixed term loans.

A large majority of the samples are floating term loans. This implies that as the reference rate moves up, borrowing costs will rise. Fixed rate loans are relatively rare pre-crisis (less than 1% of samples). Post-crisis however, fixed term loans became around 30% of samples. The intuition here is that with the very low reference rates post-crisis, more borrowers chose to lock in more expensive fixed term loans and not bear interest rate risks. The change in composition could be one of the reasons why observed spreads have increased. But as the regressions later will show, compositional changes to more fixed term loans cannot explain to the full extent the spike in spreads post-crisis.

Note that around 50% of the data did not have a spread recorded (i.e., missing variable). The paper does not make any attempts to correct for this, and samples with missing data are omitted from the regression. The key part of this paper is the regression of the spreads on various explanatory variables. The fact that 50% of the data did not record a spread still leaves the research with a large dataset to work with (more than 138,000 data points). There is also no reason to suspect that the incomplete data is due to the dependent variables.Footnote 1

2.2 Principal sum and tranches

Each data point is a standalone deal, or part of a larger deal. For standalone deals, the “Principal sum” would be equal to the “Proceeds”, as there is only a single tranche of loan. However, for some large sized deals, each data point can be part of a larger deal. For example, the principal sum – which is the size of the whole deal – could be $1 billion but broken into several tranches of proceeds, for example $300 m, $300 m, and $400 m. In such cases, it would be recorded as 3 separate data points, as each tranche could come in at different times, under different market conditions, maturities etc.Footnote 2 But all three data points will record the same principal sum. The usefulness of this feature is that the number of tranches would correlate with the size of the loans (hence becoming a useful instrument), but should not otherwise directly influence the spreads.

2.3 Years to maturity

The start date of the loan – called the closing date – is recorded for each data point, together with the maturity date.Footnote 3 This makes it possible for the years to maturity or tenor for each loan to be computed.

2.4 Number of banks

The most interesting aspect of the dataset is perhaps the record of the banks participating in each deal. Banks either participate as a bookrunner, or mandated arranger. The bookrunner is the bank(s) leading the deal, or lead bank(s), while mandated arrangers are other banks participating in the syndication. From the dataset, one is unfortunately unable to tell how much funding each bank in the syndicate is providing to the deal (i.e., no information on loan shares). However, it is possible to count the total number of banks in each deal (bookrunners and mandated arrangers) and record this as a variable. It is also possible to perform name searches and find the banks that are syndicating together. This will be part of the analysis, to be described later.

2.5 Deal size and instrumental variables

A natural question is whether the size of the deal, or principal sum, has any effect on spreads. However, one would also expect the spread of the loan to also affect how much the borrower wishes to take on. In other words, there would be endogeneity between spread and principal sum. A simple way would be to use a 2-stage least square regression to deal with this. In the first stage, sector and country fixed effects, the number of tranches, loan ratings by Standard and Poor’s (S&P) are used to instrument for principal sum. This will be described more fully in the regression section.Footnote 4

2.6 Data limitations

While the paper has a large dataset to work with, there are also data limitations. As mentioned, around half of the sample points have some missing data, and these samples are omitted in the analysis.

The dataset does not capture important loan characteristics that would affect spreads. For example, the type and strength of the collaterals – usually important in pricing the spreads of the loans – are not recorded. Similarly, the financial strength and the credit history of the borrower would also influence spreads, but are also not recorded in the data.

Nevertheless, the key focus of this paper is how underlying spreads have evolved over time. On the assumption that the missing information does not systematically vary over time (such as if the nature and strength of the collaterals are on average similar across the years), the missing information would affect the regression fit but not have a material impact on the regression coefficients.

2.7 Preliminary results

The syndication market is highly cyclical (see Fig. 3). Total loan size has recovered to around pre-crisis levels, but has not grown past that level. However, as mentioned, spreads have risen markedly post-crisis. Before 2009, average spreads over reference rates hovered at around 200 bps. There was a sharp spike in spreads in 2009. And spreads remained elevated at around 300 bps, or around 100 bps above pre-crisis levels, for the 7 years after the crisis. The first order implication here is that borrowing cost has not been as low as policy rates would suggest. The causes and implications of this will be further examined in the regression analysis below.

The next question is whether tenor has changed post-crisis? This question arises because there have been concerns that the higher regulatory capital required for long term loans has made banks more reluctant to commit to long tenors. The short answer is no. Average tenors tend to be pro-cyclical – i.e., loan tenors are longer for deals closed in better general economic conditions, and vice versa. As can be seen from the graph below, average tenors shortened considerably during the financial crisis, but reverted to roughly what is the average of 5–6 years.Footnote 5 Interestingly, tenors are slightly longer on average in developing economies (see Fig. 4).

The one aspect that has changed significantly post-crisis is the number of banks participating in syndication. For developed economies, there was on average slightly more than 2 banks in each syndication pre-crisis, and this figure increased to 3 after 2010. The step jump can be seen in Fig. 5. However, there is a noticeable decline in the average number of participating banks for developing economies, from the peak of an average of 3.5 banks per deal pre-crisis, to 2.5 banks post-crisis (see Fig. 5). This will be explored in greater details in subsequent sections.

3 Regression

The main part of this study is to understand the structure of spreads, and to ascertain the magnitude of the underlying spread changes. A regression estimate is necessary to remove the effects of spreads that are due to known factors, e.g., tenor changes, number of participating banks, or changes in sector, country and floating or fixed compositions etc. The following equation is estimated in the regression

Where

- rn,:

-

is the recorded spread (in bps) of the data point;

- ci, cj, yt:

-

are the country, loan currency types and year fixed effects respectively;

- ytm n :

-

is the year to maturity, or tenor;

- P n :

-

is the principle sum, or size of the deal (in logs);

- bankcount n :

-

is the number of banks in the syndicate;

- T n :

-

is the coupon type (floating or fixed), using an indicator;

- S n :

-

is the borrower status (Government, JV., Private, Public, Sub-national);

- ε n :

-

is the error term

The objective of the regression is to estimate the coefficients for underlying spreads (βt) over time, controlled for other factors. The regression also estimates coefficients for important variables such as deal size, tenor, and the number of participating banks in the syndicate etc.

3.1 2-stage least squares

Given the endogeneity of deal size (Pn) and spreads (rn), deal size will be instrumented for with the following – sector and country fixed effects, number of tranches in the deal, and the S&P rating. The model is thus over-identified. The full regression is carried out using IVREGRESS in STATA (with 2SLS and VCE(robust) specifications). The coefficient estimates are presented in Table 1.

The coefficients on year fixed effects, which is key to seeing how underlying spreads have evolved over time, are not presented in the table above but in Fig. 6 below to aid visualization. It will show that even after accounting for the various factors such as loan size, number of participating banks etc., there remains a sizeable spike in the spreads post-2009.

The test for weak instruments is reported in Table 2, with the null hypothesis for weak instruments rejected.

Furthermore, the paper performs a Hausman Test to highlight the effect of endogeneity (see Table 3). From this test, the estimated coefficients differ significantly between IV and non-IV regressions, especially for the loan size variable, or principal sum (Pn). The non-IV estimate in fact shows that larger loans result in lower spreads, which is of the wrong sign. The IV estimate for the number of participating banks (bankcount) is also significantly larger, highlighting the importance of more syndicating banks in reducing the spreads.

In the regression estimates presented above, the S&P rating is used as an instrument to account for the endogeneity of deal size (Pn). Naturally, there would be concerns around whether S&P ratings directly affected the spread of the loan. This will make it an invalid instrument.

For robustness checks, two separate regressions are performed – one with S&P rating included as a control variable (and not as an instrument). The coefficient estimates are presented in Table 4 below. The next regression further removes both S&P ratings and sector fixed effects as instruments (and incorporated these as control variables). The estimates are presented in Table 5. In both instances, the goodness of fit is reduced, but the signs of the key coefficients remained unchanged and the magnitudes remained approximately the same. The robustness checks thus provide further confidence.Footnote 6

3.2 Five key results

First, deal size affects spreads. A log point (10 times) increase in deal size increases spreads by around 50–62 bps. Most of the studies dealing with loan size in fact recorded a negative relationship between loan size and spreads (Kleimeier and Megginson 2000; Ivashina and Scharfstein 2010). This is counter-intuitive.

A larger-sized loan would expose the lender to higher single borrower risk, or bump up against sector or country risks. It also ties up more of the bank’s capital. It is thus unlikely that larger loans result in lower spreads. Hence, the negative coefficients observed in previous studies could be due to the lack of treatment for endogeneity. Indeed, if the above regression is run without instrumental variables, a negative coefficient for principal sum would been returned as seen in the Hausman Test. The use of instrumental variables in this paper corrects for this.

Second, an additional participating bank in a deal lowers spread by 22–24 bps on average. This affirms the benefits of diversification described in the literature. This is an important point, and points towards policies to encourage syndication and to overcome the information asymmetry that reduces the intensity of syndication.

Third, tenor has only a small positive impact on spreads. An additional year adds less than 5 bps to spreads. However, this could be due to the fact that a large majority of the loans are below 12 years (with average of around 5–6 years).

Fourth, fixed rate loans attract a higher spread, of around 115–169 bps. Post-crisis, more loans were done in fixed terms. It is likely that borrowers took advantage of generally low interest rates to lock in higher, but fixed rates. This explains (in a small part) the rise in observed average spreads. Nonetheless, this does not fully account for the rise in spreads, as seen by the year fixed effects in the regressions. This leads to the next point.

Fifth, and importantly, the regression results show that spreads have indeed increased significantly post-crisis, and have remained high. The above variables in the regression can explain part of the increase in spread only. The year fixed effects in the regression (βt) shows that underlying spreads spiked up in 2009/10 to 300 bps. It has hovered around 200–250 bps in the seven years post-crisis, higher than the 100–150 bps observed pre-crisis.Footnote 7

4 Discussion and implications

4.1 Higher spreads and secular stagnation

Consider the “secular stagnation” hypothesis (Summers 2014). One of the symptoms is the low demand for debt-financed investment, and low equilibrium interest rate. The hypothesis implies that low final demand (through an exogenous shock) leads to a lack of borrowing; the causality runs from low final demand to low loan demand, and low interest rates.

This paper does not make a definitive statement on the secular stagnation hypothesis, but shows that borrowing costs might not have fallen as much as policy rates would suggest. Clearly, spreads have increased post-crisis, even after accounting for various factors. This suggests that something has changed in the banking sector globally. High spreads could have contributed to the lack of investment recovery. If spreads do not come down, this would imply even higher borrowing costs as reference rates rise.

4.2 Differences between non-bank and bank borrowers

Interestingly, the average spreads for bank borrowers have also increased (see Fig. 7), but not to the extent of the regression estimates seen in Fig. 2. After the initial spike in 2009, spreads for bank borrowers returned to (only) around 50–60 bps higher than pre-crisis period. It is not clear why spreads for bank borrowers have not increased by as much, but consider the following. Suppose that banks have better financing options compared to non-bank companies – that is, banks are better able to access other sources of funds, including their own funds. This would imply greater “competition” in lending to bank borrowers, and explain the lower spreads faced by bank borrowers.

In turn, this would also imply that the borrowing costs faced by banks would be a more accurate measure of the increase in cost of capital post-crisis, and the observed increase in spreads (above what is seen for bank borrowers) is due to some other factors. The rise in spreads is an area that warrants more research.

4.3 Higher average number of syndicators pre-crisis

From the data, the average number of banks per syndication pre-crisis is higher in developing economies, compared to developed economies (see Fig. 5). This supports the diversification hypothesis – that is, banks syndicate together to diversify risks and gain new customers. The diversification motive is stronger for lending in riskier developing economies, which explains why the average banks per syndication is higher pre-crisis.

The interesting change came post-crisis. Two key observations from the data can be made. First, the average number of syndicating banks increased for developed economies. This lends support to the capital shock hypothesis. Post-crisis, banks syndicate more to overcome capital constraints, or because borrowers have become riskier. This implies a stronger diversification motive, and hence the higher number of participating banks per syndicated loan.

4.4 Lower syndication intensity in developing economies post-crisis

The second and more interesting observation is that the average number of banks per syndication in developing economies decreased post-crisis. How is this still consistent with the capital shock hypothesis? The data show that some Western banks cut back their lending exposure to developing economies post-crisis (ABN, Citibank). On the other hand, a few banks, mainly from Asia, gained larger market shares post-crisis (see Table 6).

With the changes in market shares in developing economies, syndication patterns also shifted. This can be seen with a simple exercise. For every deal, a “1” (indicator variable) is marked for Bank A if it is a participant, and a “0” is marked otherwise. This is then repeated for all major banks, and across the dataset. If Bank A and Bank B are participants in deal X, it would be a “1” for these two banks, and “0” for all others.

It is then possible to correlate the times banks appear with each other. The correlation matrix will show how often banks appear with one another in the same transaction. If Bank A and Bank B have a correlation closer to 1, it will imply that both banks often appeared together in the same transactions; a correlation closer to −1 will imply that both banks often enter into different deals (exclusive of each another). The correlations therefore provide the intensity of syndication. Banks that are syndicating loans with many other banks will see more positive correlations.

A comparison of the pre- and post-crisis heatmaps shows up some important differences (see Annex, Table 7). Post-crisis, Western banks increased the intensity of their syndication in developing economies. They collaborate a lot more with each other, as seen by the darker post-crisis heatmap. Banks like BNP, Barclays, Citibank have continued to operate in developing economies but with a higher level of syndication intensity. Similarly, Japanese banks have also increased their level of collaboration with each other, and with other banks.

On the other hand, the rising Asian banks (Bank of China, ICBC, Korean Development Bank, Bank of Taiwan) in the market have lower syndication intensity compared to Western or Japanese banks.Footnote 8 This gives stronger evidence in support of the capital shock hypothesis. Western banks, facing capital shocks, have had to syndicate a lot more, even when faced with the same conditions (and needs for diversification) in developing markets.

As discussed in the introduction, the level of syndication is determined by the tradeoff between the diversification motive (more syndication) against information asymmetry (less syndication). With the increased market shares of Asian banks in developing economies, and lower syndication intensity, one could posit that market efficiency could have fallen.

4.5 Fixed cost?

Finally, it is important to consider an alternative, and more benign, explanation for the high post-crisis spreads – namely the need for banks to maintain a certain margin to cover fixed cost for the deals. When interest rates are so low (as they have been post-crisis), banks charge a higher spread to cover the non-funding related costs of syndicated deals (e.g., front office expenses like carry and commission, back office expenses like due diligence). When interest rates are high, banks generate enough income through loans (in syndicated deals or in other loan segments) to cover these expenses, thereby allowing them to reduce spreads on syndicated deals. If this is the explanation, one would expect spreads to come down once the interest rate starts reverting to post-crisis levels, resulting in a smaller rise in borrowing cost. At this point, it is hard to tell if fixed cost is indeed a key explanation.

5 Conclusion

The paper observes that post-crisis, lending spreads on syndicated bank loans have increased and have remained elevated. Though the syndication market is not the only source of funding for companies, it is a large market, and points to the fact that borrowing costs have not been nearly as low as headline interest rates would suggest. This provides some contrary evidence to the secular stagnation hypothesis, and suggests that the lack of investment recovery post-crisis could be in part explained by higher than expected borrowing costs.

Furthermore, a detailed examination of syndication patterns points to two facts. The first is that some Asian banks have gained market shares in the developing economies, providing more credit but with less syndication intensity. Capital-affected Western banks (and Japanese banks) on the other hand have increased their syndication intensity.

Going forward, the big question is what will happen to the spreads when interest rates start rising. Have bank capital or operating costs been permanently shifted upwards post-crisis, bringing about permanently higher spreads – which will cause borrowing costs to rise further when reference rates rise? Or would capital shocks that hit Western banks recede with more time, bringing spreads down, thereby offsetting the effects of rate rise. These are the key questions that this research can only provide part answers to. Given that this would have direct impact on borrowing costs, it would be important to continue assessing the spread changes in the syndication market as interest rates normalize in the years ahead.

Finally, the paper provides evidence that supports the capital shock hypothesis, which explains why Western banks seek greater diversification and increase their syndication activity post-crisis. This is not observed in non-Japanese Asian banks, which now have a larger share of the market. Due to information asymmetry, one can posit that there is inefficiency in the syndication market. Arguably, market efficiency has decreased in the developing economies with lower syndication. As syndication (with the benefits of increased diversification) reduces loan spreads, it should be more actively encouraged by policy makers.

Notes

Suppose the missing data on spreads (truncation) is from below – i.e., spreads below a certain level are not recorded – or from above (spreads above a certain level are not recorded) – the resulting estimates from the regressions would then be interpreted as the lower bound given the attenuation effect.

Because of these reasons, collapsing all tranches into a single transaction would result in loss of information.

In the industry, a loan is said to have achieve financial closing when all the funding parties are in place, with the loan being made available for the borrower to draw on.

The ratings for some syndicated loan is also recorded (for Standard and Poor’s, and/or Moody’s, and/or Fitch). But for most data points, no ratings were recorded, and a default of “CCC+” is set. As most large loans will come with a rating, the presence of the rating itself becomes a good predictor on the size of loans.

The distribution of the tenor also matters. A large majority of the loans, around 95%, have tenors of 12 years or less. A check on pre- and post-2009 data does not reveal any significant shortening of loan tenors, except during a few crisis-hit years.

Returning to the issue of unobserved variables discussed under data limitations, it is useful to note that the rating agency S&P would typically incorporate information such as borrower’s strength, credit history, and collaterals before assigning a rating. Using S&P ratings as an independent variable here (instead of instrument) would have absorbed the effects of some of these unobserved variables. The fact that the regression estimates here have not changed much from the main regression therefore also offers some comfort.

In addition, the paper also performed separate regressions as follow (a) developed economies pre-crisis (b) developed economies post-crisis (c) developing economies pre-crisis and (d) developing economies post-crisis. The key results of positive coefficient for principal sum and negative coefficient for bankcount continue to hold in these separate regressions. These can be provided upon request.

The paper also tested the same correlations by removing China borrowers. The same result holds, and this shows that the result here (i.e., the lack of syndication amongst Chinese banks) is not due to their operations in their domestic market, but a more general phenomenon.

References

Dennis S, Mullineaux D (2000) Syndicated loans. J Financ Intermed 9:404–426

Gadanecz, Blaise (2004), The syndicated loan market: structure development and implications. Bank of International Settlement Quarterly Review December 2004

Godlewski CJ, Weill L (2008) Syndicated loans in emerging markets. Emerg Mark Rev 9:206–219

Ivashina V, Scharfstein D (2010) Loan syndication and credit cycle. Am Econ Rev Pap Proc 100:57–61

Kleimeier S, Megginson WL (2000) Are project finance loans different from other syndicated credits. J Appl Corp Financ 13(1):75–87

Thomson Reuters, 2015, Global Syndicated Loans Review

Simons (1993), Why do banks syndicate loans?. New England Economic Review

Summers LH (2014) U.S. economic prospects: secular stagnation, hysteresis, and the zero lower bound. Bus Econ 49:65–73

Acknowledgements

I am grateful to the discussions and views provided by colleagues at the Bank, as well as the comments and suggestions from the referees. The views expressed in this paper are the author’s and do not necessarily reflect the views and policies of the Bank.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Thia, J.P. Bank lending – what has changed post crisis?. J Econ Finan 43, 256–272 (2019). https://doi.org/10.1007/s12197-018-9441-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-018-9441-2