Abstract

This study investigates the contribution of public investment to economic growth in Cameroon from 1977 to 2015. It uses the Autoregressive Distributed Lag cointegration (ARDL) approach to estimate a modified version of the production function. The estimates indicate that real gross domestic product, labor force, public investment and private investment are cointegrated. Also based on the estimates, public and private investments have positive and significant effects on real gross domestic product in both the short-run and the long-run. The estimates further show that labor force has a significant long-run relationship with real gross domestic product but found no evidence of a significant short-run relationship. The error correction term is negative and significant suggesting that any deviations of real GDP growth from the long-term value would be corrected subsequently.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Cameroon economy resurged after an unprecedented decline between 1986 and 1994. The economic meltdown led to cutbacks in government revenue and expenditures including public investment. Real growth was rekindled in 1995 when the franc CFA was devalued and the government of Cameroon implemented medium term economic recovery programs since 1997. The policies were designed to achieve and maintain a high rate of economic growth that would raise per capita income and reduce the level of poverty in the country. The programs were also intended to stabilize the economy and consolidate public finances while strengthening the role of the private sector. The optimistic economic situation and the prospects for future growth as envisioned in the development program of the country could face setbacks as the country’s infrastructure is dire and public investment in infrastructure is low compared to Cameroon’s middle-income peers (Dominguez-Torres and Foster 2011). The government of Cameroon has recently embarked on large-scale infrastructure development and appears to be committed to real investment climate reforms as this is critical for long-term real growth and private sector development.

The study uses time series data to investigate the role of public investment in the long-term economic growth in Cameroon. It uses a simplified production function that incorporates both private and public investments as inputs in the production function. The study employs the Autoregressive Distributive Lag bound testing procedure proposed by Pesaran and Shin (1999), and Pesaran et al. (2001). Unlike the Johansen and Juselius (1990) conventional method of cointegration, the ARDL procedure is a more statistically significant approach in small samples like the current study. The rest of the paper is structured as follows: Section 2 presents a brief overview of investment and growth performance of the Cameroon economy. Section 3 presents a brief review of related literature. Section 4 proposes the empirical model used for the analysis and discusses the sources of data. The empirical analysis and the conclusion of the study are provided in Sections 5 and 6 respectively.

2 Investment and growth performance of Cameroon

Cameroon implemented a series of economic development plans starting from 1961 with the first Five Year Development Plan aimed at promoting social and economic development. The development strategy led to the expansion of public sector investment and provided incentives for private sector investment. It also contributed to the expansion of public sector investment. The fourth development plan (1976–1981), which was indeed the last to be implemented, led to the creation of many public-sector enterprises that were highly mismanaged and grossly inefficient (Ghura 1997; Amin 2002). Despite the challenges encountered in executing the development plans, public and private investments expanded rapidly between 1970 and 1985 and Cameroon experienced high GDP growth (Subramanian 1994; Ghura 1997; Amin 2002). Cameroon’s average real growth reached 7% between 1975 and 1985 and was mainly attributed to the agriculture and petroleum booms of the 1970s and early 1980s. The increase in public expenditure on state-owned enterprises and on infrastructure tended to be unproductive as the government created many loss-making public enterprises and initiated infrastructure projects that were unsustainable. These projects encountered problems with management and technology transfer and as such, a large amount of capital was unproductive and wasted (Ghura 1997; Amin 1998).

Cameroon’s economic growth slowed down following a severe economic crisis that began in 1986. At the beginning of the crisis, government officials were quick to attribute the meltdown exclusively to deterioration in the terms of trade and the fall in commodity prices in the world markets. But macroeconomic and structural imbalances contributed significantly to the unprecedented decline in the growth rate of Cameroon’s real gross domestic product in the second half of the 1980s. The excessive state intervention in the economy and poor allocation of public resources including expenditures, especially on infrastructure and on unsustainable projects resulted in excess spending. Excess spending in turn contributed to severe fiscal deficits and in the accumulation of internal and external debts. In addition, public investments by inefficient state-owned enterprises in agriculture, transportation, banking and financial services crowded out private investments, thus hindering expansion in private investment and economic growth. Initially, the government implemented internal adjustment measures to correct both budget and trade imbalances. Unfortunately, these programs failed to achieve their objectives; and in 1988 Cameroon agreed to implement stabilization programs backed by the International Monetary Fund and a structural adjustment program supported and promoted by the World Bank. The expenditure switching policies strongly promoted by these institutions resulted in cutbacks in public expenditures including investment spending. Domestic saving and investments plummeted with investment flooring to less than 14% of GDP in 1992 (Amin 1998). Efforts to make the government more efficient constrained it to either restructure most of the government-run loss-making enterprises by opening to private capital or to privatize and in most cases liquidate them.

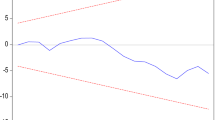

Figure 1 below depicts the evolution of Cameroon’s real GDP growth, public and private investments as a percentage of GDP from 1977 to 2014. Regardless of the evidence that show significant spikes due to the volatility of GDP growth during the 1980s and early 1990s, Cameroon’s growth performance in the second half of the 1970s to the mid-1980s was outstanding. The average Real GDP growth over this period was 7% and such growth was spectacular compared with those of most Sub-Saharan African countries. The high growth performance led to a growth in both government’s recurrent and capital investment expenditures. A large amount of the increase in public investments was devoted to large and wasteful projects that were later abandoned (Ghura 1997; Amin 2002). Public investment declined as output growth plummeted until the mid-1990s when it sluggishly rose again. The rise in public investment followed the improvement in real GDP growth, which began during the mid-1990s together with government’s commitment to developing infrastructure. Thus, Cameroon has doubled the public investment/ GDP ratio to more than 4% since 2010 and the momentum seems to be building up for more expansion in infrastructural investments particularly in electricity and transport sectors.

Cameroon: Real GDP Growth, Public and Private Investments as Percentage of GDP, 1977–2015. Source: Constructed from World Development Indicators and World Bank Data, 2016

Macroeconomic and institutional reforms implemented in 1988 had little impact as the imbalances widened and Cameroon’s exports remained less competitive relative to those of her major trading partners partly due to the overvaluation of the local currency - the CFA franc. The CFA franc was consequently devalued in 1994 and Cameroon equally implemented medium-term economic recovery programs, which to some extent, contributed to restoring economic growth. Cameroon has experienced steady but slow economic growth averaging 3.5% between 1995 and 2010 and a growth rate hovering around 4 to 5% since 2010 (World Development Indicators, 2016). The Cameroon government has now acknowledged the extent to which investment in infrastructure is essential to the long-term development of the country and has launched a ten-year development plan that prioritizes infrastructure development. Yet this venture may be counter-productive if the country does not improve its institutions and governance, which tend to be a hindrance to successful implementations of public investment projects.

Cameroon’s gross public investments peaked in 1986 (see Fig. 1), stagnated between 1994 and 2004, and then increased again. Despite the increase, public investment spending in Cameroon continued to fall below the Sub-Saharan African average and that of regional peers highlighting the severity of the deficiency. The lack of adequate infrastructure in the country remains a key obstacle to doing business in Cameroon (Samaké et al. 2013; IMF 2014). Between 2002 and 2011, Cameroon’s average public investment-to-GDP ratio was only 3.5% compared to 10% the Central African Monetary and Economic Community (CEMAC) where Cameroon is a member and 7% in Sub-Sahara Africa. The overall qualityFootnote 1 of Cameroon’s infrastructure is low compared to that of other Sub-Sahara African countries and the country ranks 128 out of 148 countries across the world (IMF 2014).

Overwhelming evidence from the literature (Aschauer 1989; Barro 1990; Afonso and St. Aubyn 2008) suggests public investment is a key driver of economic growth and development. Cameroon’s ability to achieve growth and development largely depends on the ability of the country to raise the quality of its infrastructure especially roads and power supply. This is achievable with increases in public investment despite the revenue challenges that the country is facing as oil resources are fast depleting. Ensuring that there is transparency in the public procurement process is crucial in attracting the private sector participation in infrastructure projects. Public investment in infrastructure and the social sector is critical for growth and overall economic performance but can crowd-in private capital (Aschauer 1989; Barro 1990; IMF 2014). Unfortunately, less than half of Cameroon’s public investment is translated into productive capital because of inefficiency in the implementation of public investment projects and poor governance (Samaké et al. 2013; IMF 2014).

Empirical evidence on the contribution of public capital to economic growth upholds the fact that the actual accumulation of productive capital from public investment spending, especially in low and middle-income countries, is often overstated because of inefficiencies in the implementation of public investment (Gupta et al. 2011). Addressing the problem of inefficiencies in the implementation of investment budget is expected to improve the effectiveness of Cameroon government budgetary allocations for investment and execution and consequently enhance economic growth.

3 Literature review

There exist to date two opposing views on the impact of public investment on economic growth. The first view is that public investment spending contributes positively to economic growth. Authors sharing this opinion argue that public investment on economic infrastructure facilitates the implementation of investment plans by private agents, generates positive externalities and eliminates communication and transportation bottlenecks (Aschauer 1989; Barro 1990; Afonso and St. Aubyn 2008). The authors also argue that public investment in infrastructures such as airports, sewage systems, education, and roads may create favorable conditions for private investments, thus raising the productivity of private sector investment. These authors also agree that public investments generate positive externalities and crowd-in private investments.

Aschauer (1989) has shown in a study of the relationship between aggregate productivity and government spending variables in the United States that nonmilitary spending in core infrastructure of streets, highways, airports, mass transit, sewers, and water systems play an important role in stimulating private investment among other things. He also found that public provision of infrastructure capital had an overall crowding-in effect on private investment, and that public and private investments were complementary. The complementarity between private and public investment could be attributed to the fact that private investment enhances future growth of real income; thus, supporting the fact that effective public policy has a permanent effect on real output. Erenburg (1993) has also found a positive correlation between the public provision of infrastructure and private investment. As private investment activity enhances future growth of real income, these statistical results seem to imply that public investment has a permanent effect on real output.

Khan and Reinhart (1990) warned that in the situation where public investments crowd-in private investment, any reduction of public investment would slow down economic growth. Calderon and Serven (2010) have provided estimated evidence that African countries could boost annual economic growth by about 1.5 if infrastructure deficits are cut by half compared to other regions. Thus, protecting public investments from discretionary cuts and prioritizing infrastructure spending will restore economic growth in low income infrastructure deficient countries such as Cameroon. Ramireez (2009), investigated whether public investment spending on economic infrastructure enhances economic growth and labor productivity in Argentina. The study estimated a dynamic labor productivity function for the period 1960–2005 that include public and private investment as well as labor force as arguments and sought to determine their impact on economic growth. His study found a significant impact of public investment on the rate of labor productivity growth.

The second view on the impact of public investment on output growth is that public investments can divert resources from critical uses or even crowd out private investments. An increase in public investment may require an increase in taxes or government demand for funds in capital markets to finance the investments, which might increase interest rates (Aschauer 1989; Afonso and St. Aubyn 2008). A rise in interest rates would reduce the amount of savings available for private investors, leading to a decrease in the expected return on private capital and this could likely crowd-out private investments. Devarajan et al. (1996) have provided evidence that a shift of public capital from current government expenditures to capital expenditures holding the overall government spending constant would lower economic growth if public capital share was initially too high. This fact is supported by Canning and Pedroni (2008) who suggest this would happen if the gain from infrastructure is outweighed by the diversion of resources from other uses.

Ashipala and Haimbodi (2003) examined the relationship between public investment and economic growth in South Africa, Botswana and Namibia using vector error correction model (VECM) methodology. The study did not find any impact of public investment on growth. However, private investment was found to have a long run impact on growth in South Africa and Namibia. The findings by Ashipala and Haimbodi confirm earlier studies, particularly those by Devarajan et al. (1996); and Barro (1990). Devarajan et al. (1996) found an inverse relationship between public investment and growth in a sample of developing countries over the period 1970–1990, suggesting that government may have been misallocating expenditures in favor of capital expenditures rather than outlays on sectors such as infrastructure.

Warner (2014) examined the impact of public investment spurts on the economic growth in low income countries. His study found a positive but rather weak relationship between public investment spending and growth in the short term and no significant impact in the long term. However, he noted the prevalence of problems with public investments that would compromise efficiency, including incentives to proceed with project if the actors are to benefit rather than whether such projects are socially worth implementing, poor choice of projects due to lack of information for effective appraisals, lack of safeguards against self-serving analysts, and lack of economic analysis. The concerns raised by Warner (2014) regarding the efficacy of public investment were upheld earlier by Keefer and Knack (2007) who show evidence that suggests that public investment is higher in countries with limited political checks and balances and is generally prone to rent-seeking.

A few studies of public capital and economic growth in Cameroon (Ghura 1997; Amin 1998; Dominguez-Torres and Foster 2011) have provided consistent evidence of the role of public investment on the country’s economic growth. In a Working Paper of the International Monetary Fund, Ghura (1997) performed an empirical investigation of factors that contributed to economic growth in Cameroon during 1963–1996 using the endogenous growth model. The results show that the aggregate production function exhibits increasing returns to scale and that the impact of private investment on economic growth is positive, significant and robust. His results also found that increases in government investment contributed to economic growth, but was less robust compared to the impact of private investment. However, these results were obtained during the crisis and adjustment era characterized by severe cuts in government investments due to the fall in government revenue and because of the stabilization policies put in place to address the crisis. Even so, the long run effects were not examined.

Amin (1998) investigates the relationship between public and private investment in Cameroon and found that public investment crowds out private investments thus upholding earlier findings that government investments were carried out in sectors that compete or do not enhance the efficiency of the private sector such as infrastructure spending. Tchouassi and Ngangue (2014) obtained similar results in their study of fourteen African countries including Cameroon using panel data from 1980 to 2010. Dominguez-Torres and Foster (2011) in a study on Cameroon’s infrastructure found that Cameroon will need to invest an additional $350 million each year for about 15 years to reach the infrastructure level of middle- income African countries. The authors further found that the country will gain about $586 million annually from any potential gain in infrastructure related services. If this gain were sustained for 15 years, the growth in per capita income or the potential gain in economic growth will reach 3.3%. While this sounds less realistic for Cameroon, particularly because of poor investment management experiences, the surge in public investments in recent years demonstrates government’s commitment to reaching its long-term development plan (IMF 2014).

In a more recent study Samaké et al. (2013), assess the implications of public investment on growth and fiscal sustainability in Cameroon, and reached the conclusion that Cameroon’s public investment contributes less to the accumulation of public capital. The authors suggested that due to implementation problems, public investment budgets were not fully and properly executed and this is attributed to low administrative capacity and poor governance. The consequence of the low efficiency of public investment is the lack of adequate infrastructure - a key obstacle to Cameroon economic growth. Samaké et al. (2013) also suggested that increasing the size of public allocations for investments and the effectiveness of such investments could increase economic growth. This viewpoint has been supported in the IMF Cameroon country report (2014). Per this report, inadequate infrastructure is the most potential challenge to economic growth in the country. While studies have investigated the link between private and public investment and Cameroon’s dismal economic growth, none of the studies have investigated the long-run effects of public investment on Cameroon’s economic growth. It is important to know the long-run growth effects of public investment, more so as the Cameroon government’s long-term development vision for the country has been the subject of heated debate. By 2035, Cameroon aims to be a democratic emerging country united in its diversity.

The study examines the impact of public investment on social and economic infrastructure in Cameroon and leans towards the viewpoint that public investment spending in Cameroon if well implemented, can contribute positively to economic growth.

4 Theoretical framework

Several studies on the contribution of public and private investments to economic growth have extensively used variations of the neoclassical growth model. This study follows the same approach to examine the relationship between public investment and economic growth in Cameroon. Following the lead of Aschauer (1989) and Albala-Bertrand and Mamatzakis (2001), the study incorporates public investment and a set of other variables that affect output. We use a modified neoclassical production function of the following form:

where RGDP is a measure of real output level, LAB is the labor force, GINV is public investment, PINV is private investment, and t is the time index. The above production function satisfies the inada conditions which guarantee the stability of the economic growth path. The function is decreasing in x and strictly concave in each input such that:

Equation (1) can be re-written as a Cobb-Douglas production function as used in Aschauer (1989), Albala-Bertrand and Mamatzakis 2001; Fullerton et al. (2013) as follows:

where A is the efficiency parameter which measures the overall effectiveness with which labor force, public investment, and private investment are utilized. The production function specified above is assumed to exhibit increasing returns so that the percentage change in all the three variables will lead to a more than proportionate change in RGDP. This contrasts sharply with that held by Aschauer (1989), which assumed a production function characterized by constant returns to scale.

An estimable version of the model is obtained through the log transformation of the eq. (2) and is expressed as follows:

where β s is the elasticity of the RGDP function with respect to each of the arguments, with s = 1, 2, and 3. ε is the random error term. The coefficient β s is assumed to be positive.

4.1 The autoregressive distributed lag cointegration approach

As mentioned previously, this study investigates the short-run and the long-run relationship between economic growth, public investment and other relevant control variables. Although relatively recent, the ARDL cointegration techniques have been found to offer useful insights into this relationship. The ARDL model is a standard least squares regression that includes the lags of both the dependent and the independent variables (Pesaran and Shin 1999). The ARDL procedure became prominent recently through the works of Pesaran and Shin (1999) and Pesaran et al. (2001). The dependent variable and the independent variables are not only contemporeously related but also, they are related across their historical lagged values. The reason for such two step-relationship is explained by the dynamic nature of macroeconomic variables, that is, the time needed for a macroeconomic variable to produce all the effect on another macroeconomic variable.

The ARDL model has several advantages over the Johansen and Juselius (1990) cointegration. First, unlike the ARDL models, the Johansen and Juselius cointegration does not perform well with small samples. Second, the ARDL approach does not restrict the variables in the regression to be integrated of the same order. Thus, the ARDL approach can be applied when the variables are a mixture of integrated order of zero I (0) and one I (1) (Pesaran et al. 2001). Third, the ARDL procedure estimates the long-run relationship using a single reduced form equation unlike the Johansen approach which allows for a system of equations. Finally, since many choices need to be made in the traditional Johansen approach to cointegration including the choice of the number of endogenous and exogenous variables, the empirical results are sensitive to the choices and the method adopted (Pesaran and Shin 1999).

Following Pesaran and Shin (1999), and Pesaran et al. (2001), the ARDL can be written in the following generic form:

where the symbol Δ is the difference operator, the parameters δ 1 , δ 2 , δ 3 , and δ 4 represent long-run multipliers; and α 1i , α 2i , α 3i , and α 4i are short-run dynamic coefficients of the ARDL model. DUM 1 and DUM 2 are dummy variables that are included to account for structural breaks in the data. To determine whether there exist a cointegrating relationship among RGDP, LAB, GINV and PINV, we test the null hypothesis, H 0 : δ 1 = δ 2 = δ 3 = δ 4 = 0 against the alternate, H 0 : δ 1 ≠ δ 2 ≠ δ 3 ≠ δ 4 ≠ 0 by conducting a non-standard F-testFootnote 2 using the variables in levels. The ARDL procedure requires the Granger causality test to determine the short-run and the long-run relationship among the variables of the model. The test is conducted using the following equation:

where, λ measures the speed of adjustment and the ECT is the residuals from the estimation of eq. (4). The error correction term can lead to a better understanding of the nature of non-stationarity among the series and can also improve long-term forecasting.

The dependent variable is RGDP (the log real GDP) and is constructed using constant 2010 U.S. dollars real GDP data from the 2016 World Development Indicators (WDI) of the World Bank. The explanatory variable of interest is public investment. Public investment (GINV) consists of government spending on social and economic infrastructure (e.g. education, energy, transport network and public works). The data used to construct this variable are from the World Bank National Accounts Data, the OECG National Account data and from DataMarket.com website. As in most studies, data on active labor force (LAB) is used as a proxy for labor force participation.Footnote 3 This study uses active labor force data to control for the impact of labor on economic growth. Labor force consists of people of age 15 and older who are eligible to work based on the International Labor Organization definition of economically active population. The data is from the 2016 World Development indicators. Private investments consist of gross outlays by the private sector and private nonprofit agencies. Data on private investment (PINV) are from the 2016 World Development Indicators.

5 Empirical results

5.1 Unit root test

Before estimating the ARDL models, the dynamic properties of the time series need to be determined. This is necessary because macroeconomic time series data used in this study like most macroeconomic time series are more likely to exhibit a time trend (i.e. non-stationary) that may render the estimations spurious. According to Eagle and Granger (1987), running ordinary least squares regressions on non-stationary time series data will yield spurious regression results in which there will appear a significant relationship between variables that are unrelated. The null hypothesis is that the variable under investigation has unit roots. This hypothesis is tested against the alternative hypothesis that it does not using the Augmented-Dickey-Fuller (ADF) test, (Dickey and Fuller 1981). Testing the existence of unit roots can be performed using various versions of the following regression.

where, Yt is the relevant time series, α is a constant, t is a linear deterministic time trend, λ is the coefficient on the time trend, δ and β are parameters to be estimated and ε is the residual error term which are to be white noise. The test is performed separately for each level variable as well as for its difference with the aim of establishing the order of integration under the assumption of a stochastic trend. Typically, the unit root tests test the null hypothesis H 0 : δ = 0 against the one-sided alternative H 0 : δ < 0. The results of the Augmented-Dickey-Fuller test with a lag lengthFootnote 4 that was automatically obtained from the Schwarz information criterion (SIC) are presented in Table 1. The results suggest that the null hypothesis of a unit root in the time series cannot be rejected at 5% level of significance in levels for all variables.

The test is also performed for the first differences of the variables reported in columns 4 and 5 of Table 1. The null hypothesis of a unit root is rejected for all the time series at 5% level of significance. These results are consistent with the hypothesis that the individual time series are individually integrated of order one or I (1). Since the data appears to be stationary after first difference, no further tests are performed.

The presence of structural breaks if ignored, may significantly reduce the power of the traditional ADF test reported in Table 1 when the stationary alternative is true. In the presence of structural breaks, it is possible to erroneously conclude that a unit root exists in the relevant series when it does not. To circumvent this problem, Zivot and Andrews (2002), developed an algorithm that considers each data point as a possible break date and run a regression for every possible break date following a logical order. During the period running from 1977 to 2015, structural breaks occurred in Cameroon’s macroeconomic data during the period of economic crisis from 1986 to 1994. Table 2 reports the Zivot-Andrews one-break unit and the endogenously determined one-time break date for each of the series of the model and Fig. 2 shows the plot for the breakpoint of RGDP.

Apart from the RGDP which is stationary at levels, the estimates reported in Table 2 are consistent with those reported in Table 1. The results show that the null hypothesis of structural breaks in both levels and first difference cannot be rejected at 5% level of significance. The Zivot-Andrew test endogenously determines the break-date for each of the series. These break-dates coincide with the period of severe economic crisis which began in 1986 and ended in 1994.

5.2 Autoregressive distributed lag estimations

Having determined that the variables are all integrated of order one I (1), we apply the ARDL bound testing procedure to test for the evidence of cointegration among the variables RGDP, LAB, GINV and PINV. The Akaike Information Criterion was used to automatically select a maximum lag of 5 for both the dependent variable and the regressors. The procedure evaluated 200 models of which the model with the lowest AIC was selected from the best 20 of the ARDL models. The resulting ARDL (3, 4, 4, 5) model have 3 lags of RGDP, 4 lags of LAB, 5 lags of GINV and 4 lags of PINV (see Appendix 4). Table 3 shows the critical values of the Bound test provided by Narayan (2004). The two sets of critical values presented are respectively I(0) and I(1), where the set I(0) refers to the lower bound critical values and set I(1) referring to upper bound critical values.

The calculated F-statistic of 7.682 is greater than the upper and the lower bounds critical values at 1% level of significance using restricted intercept and no trend. The results imply that we can reject the null hypothesis of no long-run relationship in favor of a cointegration relationship between real GDP, labor force, public investment, and private investment.

Table 4 provides the estimates of the long-run coefficients based on normalizing RGDP. The dependent variable is the natural logarithm of real gross domestic product (RGDP) while all the regressors are also in natural logarithm so that the estimated coefficients are interpreted as long-run elasticities. The results reveal that in the long-run, public investment (GINV) has a strong and significant effect on RGDP and a 1 % increase in public investment leads to a 0.175% increase in RGDP. Also, as expected, labor force has a significant long-run relationship with real GDP and a 1 % increase in the former will lead to a 0.462% increase in the latter. Furthermore, as expected, private investment has a significant and positive long-run relationship impact on real GDP growth. A 1 % increase in private investment will increase RGDP by 0.135%. Based on the long-run estimated long-run coefficients, improving the dire state of Cameroon’s infrastructure and removing other obstacles to doing business in the country can contribute to the long-run growth of RGDP.

The estimations shown in Table 5 reveal that the error correction term is negative and significant, implying that there exists a long-run relationship between the variables of the model. Model A does not include breakpoints while Model B includes dummy variables for 1987 breakpoint and 1991 and 1992 breakpoints respectively. The speed of convergence to the equilibrium state per period as indicated by the coefficient of the error correction term is 45.4% in model A and 44% in model B. In addition, 45.4 and 44% percent of the deviation of the variables from their long run equilibrium in the two models will be corrected within a year. The highly significant ECT term is further evidence of a stable long-run relationship (Bannerjee et al. 1998). The estimates indicate that LAB is not a significant determinant of RGDP although its lags are significant at 5% and 1% respectively. The estimates also reveal that GINV has a strong and significant short-run effect on RGDP and a 1 % increase in this variable in Model A will have a 0.063% increase in RGDP while a 1 % increase in GINV will cause RGDP in Model B to increase by 0.047%. Private investment also has a significant short-run effect on RGDP and a 1 % increase in PINV in Model A will cause RGDP to increase by 0.041% and a 1 % increase of this variable in Model B will lead to a 0.051% increase in RGDP. The Cameroon economy experienced a severe economic decline between 1986 and 1994 and the structural breaks obtained from the Zivot-Andrew one-unit root test suggested that the null hypothesis of no structural breaks was rejected for the economic crisis years of 1987, 1991 and 1992. The coefficient for DUM2 for 1991 and 1992 has the expected negative sign and is significant at 5%. The overall results suggest that public investment has a positive and significant effect on real GDP growth. The other variables except for labor force are statistically significant both with and without the dummy variables.

5.3 Diagnostic and stability tests

The results of the residual diagnostics test for normality, serial correlation and heteroskedasticity for the ARDL model are reported in Table 6. The results of residual diagnostics include the normality test based on the Jacque-Bera statistic, the Breusch-Godfrey Serial Correlation LM Test, and the heteroskedasticity test. The normality test results show that the error is normally distributed. Also, the p-value associated with the serial correlation LM test is greater than 5% implying that we reject the null hypothesis serial correlation. The results of the diagnostic tests show that the model estimates are consistent and acceptable. In addition, the adjusted R-squared reported in Table 5 indicates that about 93% of the variation in RGDP is explained by the regression.

Testing for the presence of parameter stability is a requirement for a well specified and performed ARDL model (Pesaran and Pesaran 1997). Thus, evaluating the regression equation to see whether it is stable or not is critical for time series data because of the uncertainty of when a structural break might occur. Consequently, we applied the cumulative sum (CUSUM) and the cumulative sum of squares (CUSUMQ) to recursive residuals estimated from the ARDL model (Figs. 3 and 4 respectively). The plots of CUSUM and CUSUM square residuals are within the 5% critical boundaries as suggested by Bahmani-Oskooee and Wing (2002) thus confirming that the long-run coefficients of the model under study are stable. These results are consistent with the estimated coefficient of the ARDL model.

The ARDL model has an autoregressive structure and should be dynamically stable. The inverse roots of the characteristic equation associated with the ARDL (3, 4, 4, 5) model are presented in Appendix 5. The inverse roots lie inside the unit circle confirming the dynamic stability of the ARDL model.

5.4 Discussion of results

The coefficient of the error correction shows how quickly the variables will return to equilibrium in the dynamic model and the coefficient should have a negative sign and should be statistically significant. Table 5 shows that in model A and B, the coefficients of the error correction term are equal to (−0.454) and (−0.440) respectively implying that deviations from long-term equilibrium are corrected in both models by 45.4% and 44% respectively. The coefficient of labor is positive and significant in the estimated long-run model but not in the short-run. Also, as expected, GINV has a positive and significant effect on RGDP in both the short-run and the long-run implying a strong causal relationship between public investment and real GDP growth. Private investment (PINV) has the expected positive sign and is significant in both the long-run and the short-run model estimates. In addition, the lagged value ΔPINV (−3) has a strong positive and significant short-run effect on RGDP indicating that the effect of private investment on RGDP is strongly influenced by previous investment outlays.

The estimated results are consistent with the conclusion reached by Nazmi and Ramirez (1997) that public and private investment have an identical impact on economic growth. This study finds that the effect of private investment in Cameroon is slightly lower than that of public investment on the growth process in Cameroon. Despite the strong and robust relationship between public investment and real output growth, inefficiencies in the execution of public investment projects as well as poor governance (Gauthier and Zeufack 2011) tend to limit the effectiveness of government investment projects. Gupta et al. (2011) have also noted that public investments are not fully translated into productive capital assets despite the positive impact of government investment on economic growth. This is further supported by findings by Tabova and Baker (2011) that investment failed to spur growth in FCFA countries due to the lack of strong institutions and good governance. The results are also not consistent with findings by Khan and Reinhart (1990) that private investment has a larger impact on economic growth than public investment. The findings suggest that cuts in government investments or inefficiency in implementing government investment programs can undermine economic growth since these play a key role on output growth. However, the strong positive effect of public investment on RGDP is consistent with results from an earlier study on public investment and economic growth in Cameroon, Ghura (1997), which finds that increases in government investment expenditures have a positive impact on economic growth in Cameroon. More so, as we find in this study, the positive long-run impact is very significant.

Several studies have examined the relationship between public investment and economic growth using various methodologies with mixed conclusions. The current study circumvents the problem associated with the application of the Johansen and Juselius cointegration method on estimations with few observations (38 observations) by using Autoregressive Distributed Lag methodology. This study also suggests the crucial role of previous investments especially private sector investments on the performance of the Cameroon economy which has not been addressed in previous studies on the effects of investments and economic growth.

6 Conclusion

This paper analyzed the long-run and the short-run relationship between public investment and real output in Cameroon during the period 1977–2015. The ARDL cointegration estimation results suggest that real GDP growth (RGDP), labor (LAB), private investment (PINV), and public investment (GINV), have a long run equilibrium relationship. Although structural breaks were found in all the variables based on the Zivot-Andrews one break unit root test, only RGDP is stationary in levels. CUSUM and CUSUMSQ confirmed the constancy of the regression relationship over the period under study and the estimated model also passed the diagnostic tests. The results from the error correction model suggest that there is a positive and significant relationship between GINV and RGDP and between PINV and RGDP. Hence increases in the levels of each of these variables would positively affect the RGDP growth. The results from the estimated equation show an error term with the expected negative sign which is also statistically significant at 5%. The positive and significant relationships between GINV and RGDP and between PINV and RGDP are consistent with results from previous studies which find positive effects of public and private investments on output growth as highlighted in the literature (Aschauer 1989; Barro 1990; Afonso and St. Aubyn 2008) and confirmed in this study.

From a policy standpoint, this study suggests that the government of Cameroon should step up public investments in infrastructure, transport, communication and education including other relevant sectors to boost private sector investments activities and the overall performance of the economy. This can be achieved through the design and implementation of investment plans and institutional reforms aimed at enhancing the effectiveness of public investment spending. Equally important is the need to focus on the proper and efficient execution of the government projects and this must be stressed because studies have shown great inefficiency in public institutions and poor implementation of public investment projects. Approved investment budgets tend not to be properly and fully spent, and thus do not fully contribute to growth and development as they should. Cameroon’s oil resources are dwindling; all other resources could be mobilized from various sectors to help increase investment in infrastructure capital. These investments which generate positive externality effects are likely to create a more productive private sector. A thriving private sector would enhance the productivity of the economy. Thus, public investment in the relevant sectors is likely to crowd in private investment and promote economic growth. Although Cameroon on average lags Sub-Sahara African countries on infrastructure development, poor infrastructure is also a key obstacle to economic development in several countries in the region. Boosting infrastructure spending in the region and improving the implementation of government investment projects while reducing administrative bottlenecks and poor governance would revive the growth potentials of the continent. This is important as our study demonstrate the strong positive impact of current, previous and long-term investments on economic performance.

Notes

The overall quality of infrastructure is based on the yearly Global Competitive Report by the World Economic Forum surveys business leaders in their respective countries (IMF 2015). Thus, the quality of infrastructure is an index used in ranking countries based on the quality of ports, roads, air transport, electricity, and telecommunication infrastructure.

The absence of reliable data on labor force participation in Cameroon is problematic especially as the rate of unemployment is quite high.

The maximum lag of 9 was determined based on the suggestion by Ng and Perron (1995) which sets an upper bound P max for P. Following this approach, the absolute value of the t-statistic for testing the significance of the last lagged difference should be greater than 1.6 so that P is set to be equal to Pmax. If this not the case, the procedure consists of reducing lag length by one and of repeating the process.

References

Afonso A, St. Aubyn M (2008) Macroeconomic Rates of Public and Private Investment: Crowding-in and Crowding-out Effects. School of Economics and Management. Technical University of Lisbon. Working Paper No. 06/2008/DE/UECE

Albala-Bertrand JM, Mamatzakis EC (2001) Is public infrastructure productive? Evidence from Chile. Appl Econ Lett 8:195–198. https://doi.org/10.1080/13504850150504595

Amin A (1998) Cameroon’s Fiscal policy and economic growth AERC Research Paper No. 85. Nairobi

Amin A (2002) An examination of the sources of economic growth in Cameroon. AERC Research Paper No. 116. Nairobi

Aschauer D (1989) Is public expenditure productive? J Monet Econ 23:127–2000. https://doi.org/10.1016/0304-3932(89)90047-0

Ashipala J, Haimbodi N (2003) The impact of public investment on economic growth in Namibia. NEPRU Working Paper No. 88

Bahmani-Oskooee M, Wing NGRC (2002) Long-run demand for money in Hong Kong: an application of the ARDL model. Int J Bus Econ 1(2):147–155

Bannerjee A, Dolado J, Mestre R (1998) Error-correction mechanism tests for cointegration in the single equation framework. J Time Ser Anal 19:267–283 http://www.tandfonline.com/doi/abs/10.1080/07350015.1992.10509905

Barro RJ (1990) Government spending in a simple model of endogenous growth. J Polit Econ 98:103–125 http://nrs.harvard.edu/urn-3:HUL.InstRepos:3451296

Calderon C, Serven L (2010) Infrastructure and economic development in sub-Saharan Africa. J Afr Econ 19:i13–i87. https://doi.org/10.1093/jae/ejp022

Canning D, Pedroni P (2008) Infrastructure, long-run economic growth and causality tests for Cointegrated panels. Manch Sch 76(5):504–527. https://doi.org/10.1111/j.1467-9957.2008.01073.x

Devarajan S, Swaroop V, Zou H (1996) The composition of public expenditure and economic growth. J Monet Econ 37:313–344. https://doi.org/10.1016/S0304-3932(96)90039-2

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometric Soc 49(4):1057–1072. https://doi.org/10.2307/1912517

Dominguez-Torres C, Foster V (2011) Cameroon’s Infrastructure : a continental perspective. Policy Research working paper; no. WPS 5697. World Bank. © World Bank. https://openknowledge.worldbank.org/handle/10986/3461 License : Creative Commons Attribution CC BY 3.0

Eagle RF, Granger CWJ (1987) Cointegration and error correction: representation, estimation and testing. Econometrica 55(2):251–276. https://doi.org/10.2307/1913236

Erenburg SJ (1993) The real effects of public investment on private investment. Appl Econ 25:831–837. https://doi.org/10.1080/00036849300000137

Fullerton TM, Monzon AG, Walke AG (2013) Physical infrastructure and economic growth in El Paso. Econ Dev Q 27(4):363–373. https://doi.org/10.1177/0891242413489168

Gauthier B, Zeufack A (2011) Governance and oil revenues in Cameroon. In: Collier P, Venables AJ (eds) Plundered nations? Successes and failures in natural resource extraction. Palgrave Macmillan, New York, pp 27–78

Ghura D (1997) Private investment and endogenous growth: evidence from Cameroon. IMF Working Papers, 97(165)

Gupta S, Kanpur A, Papageorgiou C, Wane A (2011) Efficiency-adjusted public capital and growth. IMF Working Paper No. 217. International Monetary Fund, Washington D.C

International Monetary Fund. (2014). Cameroon: selected issues, IMF Country Report No. 213. Washington, D.C.

International Monetary Fund. (2015). Cameroon: selected issues, IMF country report no. 15/332. Washington, D.C.

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on Cointegration with applications to the demand for money. Oxf Bull Econ Stat 52:169–210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Keefer PF, Knack S (2007) Boondoggles, rent-seeking and political checks and balances: public investment under unaccountable governments. Rev Econ Stat 89:566–572

Khan MS, Reinhart CM (1990) Private investment and economic growth in developing countries. World Dev 18(1):19–27. https://doi.org/10.1016/0305-750X(90)90100-C

Narayan PK, (2004) Reformulating critical values for the bounds f-statistics approach to cointegration: an application to the tourism demand model for Fiji. Monash University, Clayton, Victoria

Nazmi N, Ramirez MD (1997) Public and private investment and economic growth in Mexico. Contemp Econ Policy 15(1):65–75. https://doi.org/10.1111/j.1465-7287.1997.tb00455.x

Ng S, Perron P (1995) Unit Root Tests in ARMA Models with Data-Dependent Methods for the Selection of the Truncation Lag. J Am Stat Assoc 90(429):268–281

Pesaran MH, Pesaran B (1997) Working with Microfit 4.0: Interactive econometric analysis;[Windows version]. Oxford University press

Pesaran MH, Shin Y (1999) An autoregressive distributed lag-Modelling approaches to Cointegration analysis. Econometrics and economic theory in the 20th century: the Ragnar Frisch centennial symposium. Strom S.-Cambridge University Press, Cambridge

Pesaran MH, Shin Y, Smith R (2001) Bounds testing approaches to the analysis of level relationship. J Appl Econ 16(3):289–326. https://doi.org/10.1002/jae.616

Ramireez MD (2009). Does public investment enhance labor productivity growth in Argentina? A Cointegration analysis. Economics Department Working Paper No. 57, Yale University

Samaké I, Muthoora P S, Versailles B (2013) Fiscal sustainability, public investment, and growth in natural resource-rich, low-income countries: the case of Cameroon. IMF Working Papers, 13(144)

Subramanian S (1994) The oil boom and after: structural adjustment in Cameroon. Cornell Food and Nutrition Policy Program, Ithaca

Tabova A, Baker C (2011) Determinants of non-oil growth in the FRA-zone oil producing countries: how do they differ? IMF Working Paper-African Department, Washington DC

Tchouassi G, Ngangue N (2014) Private and public Investment in Africa: a time-series cross-country analysis. Int J Econ Financ 6(5):264–273. https://doi.org/10.5539/ijef.v6n5p264

Warner A (2014) Public investment as an engine of growth. IMF Working Papers, 14(148)

World Bank (2016) World Development Indicators 2016. Washington, DC. © World Bank. https://openknowledge.worldbank.org/handle/10986/23969 License: CC BY 3.0 IGO.

Zivot E, Andrews WK (2002) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 20(1):25–44. https://doi.org/10.1198/073500102753410372

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Appendix 2

Appendix 3

Appendix 4

Appendix 5

Rights and permissions

About this article

Cite this article

Ntembe, A., Amin, A.A. & Tawah, R. Analysis of public investments and economic growth in Cameroon. J Econ Finan 42, 591–614 (2018). https://doi.org/10.1007/s12197-017-9411-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-017-9411-0

Keywords

- Cameroon

- Public investment

- Autoregressive Distributed Lag

- Error correction

- Infrastructure

- Economic growth