Abstract

This study uses a regression discontinuity design to estimate effects of an employment bonus program for long-term unemployed social assistance recipients. The program pays benefit bonuses to persons in the target group for any hours they work in regular employment or subsidized employment schemes. The program pays up to 6 % of post-tax earnings if they enter regular or subsidized employment over a specific two-year period. Our results show that the program has no effects on employment rates, earnings or participation in subsidized employment. The null findings are robust when using RD estimates based on different bandwidths and different window widths around the eligibility threshold and hold for given gender, age, ethnicity and parental status.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

This study considers the effects of a Danish employment bonus program targeting long-term recipients of social assistance.Footnote 1 The social assistance scheme is financed by the Danish Government and is available for unemployed persons who are not eligible for unemployment insurance benefits. Social assistance is means-tested, which implies that social assistance recipients effectively are subjected to a high tax rate on earnings. Employment-contingent bonuses have been applied in many countries to provide an added economic incentive to work and counter the disincentive effects from social assistance systems (OECD 2011).

The Danish employment bonus program, considered in the current study, was designed differently from bonus programs in other countries. This makes it interesting from an evaluation point of view, because it alters some of the mechanisms that may drive a potential effect of the economic bonus. First, by paying bonuses for any hour worked, including subsidized jobs, the program was designed particularly for the long-term unemployed, who may find it hard to gain employment. In contrast, bonus programs in other countries often condition bonus payments on long-term or full-time employment. Second, the Danish program sought to increase awareness of the program by informing unemployed persons about the bonus program at obligatory quarterly meetings with their municipal caseworker. Third, the program paid bonuses automatically and immediately through the income tax system. This may circumvent the problem of low program take-up rates that has been present in other bonus programs, i.e. that the share who claim the bonus when they are eligible is low (Robins and Spiegelman 2001; Decker and O’Leary 1995).

The bonus in the Danish program was 4% of pre-tax earnings with a maximum of USD 90 monthly, or up to 6% of post-tax earnings. Eligibility for the program was based solely on receipt of social assistance for a total of more than 47 weeks in a period prior to the announcement of the program. The construction of the program thus prevented self-selection into the program and allowed the use of a regression-discontinuity design.

Despite the high costs of employment bonus programs, their effects are not well documented. Some of the most well-known evaluations of employment bonus programs are the evaluations of four programs that were tested in the US by means of randomized controlled trials (Woodbury & Spiegelman 1987; Corson et al. 1992; Spiegelman et al. 1992; Decker and O’Leary 1995; Robins and Spiegelman 2001). All four programs were successful in reducing unemployment duration, although in varying degrees, and mostly with modest and temporary effects. The modest effects may, in part, have been a result of low take-up rates of bonuses, which ranged from 12% to 54% (Spiegelman et al. 1992; Decker and O’Leary 1995). The four employment bonus programs from the US differed from the current program by targeting recently laid-off unemployment insurance (UI) claimants and by offering a relatively high bonus that varied between four and nine times the weekly UI benefit level. Additionally, the claimants needed to work for at least four months before being able to claim the bonus.

We are only aware of two employment bonus programs where the effect for the long-term unemployed has been documented. These are the Canadian Self-Sufficiency project (SSP) and a Dutch employment bonus program for long-term social assistance recipients. The findings from these programs are mixed: Whereas the SSP program generated large, but temporary, employment and income effects for the long-term unemployed (Michalopoulos et al. 2002), the Dutch program had no employment effects (van der Klaauw and van Ours 2013). The authors of the last study suggest that the absence of any effect of the bonus could be a result of a program design feature whereby the bonus was paid after each six months in work. We cannot use this explanation for a null finding in our study, because the bonus payments are made each month.

A related strand of literature has examined the impact of employment tax credit schemes, which are also economic bonuses that are contingent on employment. Most evaluations available are from programs in the UK and the US. This literature has, however, not produced impact estimates specifically for the population of long-term unemployed. The UK experience mainly stems from evaluations of the Working Families’ Tax Credit program (Gregg et al. 2009; Francesconi and van der Klaauw 2007; Leigh 2005; Blundell et al. 2005; Brewer et al. 2006; Azmat 2014) that was in operation from 1999 to 2003, and its successor, the Working Tax Credit program (Mulheirn and Pisani 2008). The US experience mainly stems from the Earned Income Tax Credit (Eissa & Liebman 1996; Meyer and Rosenbaum 2001; Eissa et al. 2008; Ellwood 2000; Hotz et al. 2006; Eissa and Hoynes 2004, 2006; Chetty et al. 2013). Both the UK and the US programs are means-tested and provide relatively large bonuses. The programs targeted low-income groups, including low-income workers, and they often specifically targeted single parents. Most of the studies found a positive employment effect of the magnitude of one to eight percentage points.

The current study contributes to the literature by providing new estimates of the impact of an employment bonus program for a target group of long-term unemployed recipients of social assistance. We do so by capturing a causal effect by means of an identification strategy with high internal validity. We also contribute to the literature by providing new knowledge about a program that was designed to alleviate some of the design problems of previous programs.

To preview our findings, our results are in line with the findings in van der Klaauw and van Ours (2013); we find no significant effects of the employment bonus program on employment rates, earnings, subsidized employment, or participation in other active labor market programs. These results also hold for specific subgroups, such as young persons, immigrants and parents. We suggest three potential reasons for the null findings: They may occur because the bonus level is low, because of an inability to respond to the incentive, or because the program was applied in a recession. The findings are important for countries that design bonus programs contingent on employment, and particularly so for countries which are considering programs that target the long-term unemployed specifically.

The paper is structured as follows. We describe the employment bonus program and institutional features of the Danish labor market in the next section. The estimation method is described in Section 3. Section 4 describes the data, while results and conclusions are found in Section 5 and 6.

The Employment Bonus Program

The Danish employment bonus program for the long-term unemployed was introduced by a law passed on 24 May 2012 (Act 473 2012). The program operated for a period of two years, from June 2012 to May 2014. Only persons receiving social assistance on 29 February 2012, and who had been doing so for at least 329 days in the previous year were eligible for the bonus.

The Danish social assistance scheme is a government funded and family-income means-tested income transfer program for unemployed persons who are not covered by unemployment insurance. The money people receive as social assistance corresponds to approximately half the earnings from full-time employment at the average negotiated wage.Footnote 2 Social assistance recipients are only allowed to keep USD 2 per hour worked. The rest of the income they receive from employment will be deducted from their social assistance allowance. This means that they have a limited economic incentive to find work.

Those who qualified for the bonus program were entitled to an additional economic bonus of 4% of the pre-tax earned income, with a maximum corresponding to USD 90 per month. The bonus was tax-free and was not deducted from the social assistance or from any other public income transfers, such as housing benefits or daycare support. When we consider that the average tax rate for social assistance recipients is 30%, this means that the bonus corresponds to up to 5.7% of post-tax earnings.

The employment bonus was awarded for any hour of work in a regular job, in self-employment or in subsidized employment schemes. To increase awareness of the program, the job centers were required to inform the eligible persons at meetings between the unemployed persons and their caseworkers. These meetings are obligatory and, at the time of the program, were required to be held every quarter, as part of the active labor market policy in Denmark (Act 706 2012, §17). Bonus payments were made an integral part of the monthly filing of income tax payments, and the eligible persons therefore automatically received their bonus with their salary payments. An exception to this were self-employed persons, who had to apply for the bonus when filing income statements to the tax authorities.

Figure 1 shows the time frame of the program from qualification period to bonus entitlement period.

Data

We used administrative registry data from Statistics Denmark covering all individuals residing in Denmark. These data are particularly valuable when considering groups such as the long-term unemployed, because sample attrition only occurs due to death or emigration. In our application, sample attrition was only 2%.

We collected information about daily receipt of social assistance, and monthly employment rates from the registry data. Furthermore, we obtained annual background variables on gender, age, region of residence, number of children and marital status, health care use, criminal records and highest attained level of education. The background variables were used for two purposes: 1) To describe the treatment and the control groups, and 2) To add precision to the estimates.

As the employment bonus program was implemented with the aim of influencing the labor supply at the extensive margin, we chose to use regular (i.e. unsubsidized) employment as the primary outcome. We recorded regular employment of persons with any registered taxable earnings or income from self-employment. We also examined the effect on other labor market outcomes to shed light on potential mechanisms of the bonus program; The employment bonus may have affected earnings, either through the intensive margin by altering hours worked per week, or by altering hourly wages, e.g. if it affected reservation wages. As the program provided a bonus for subsidized employment, we included subsidized employment in an alternative definition of employment. Finally, the employment bonus program may have impacted on participation in active labor market programs (ALMP), to the extent that these programs qualified a person for wage subsidy programs or regular employment.

The population consisted of individuals who received social assistance on 29 February 2012, which was one of two eligibility criteria for the bonus program. The other eligibility criterion was receipt of social assistance for at least 329 days within the qualification period. Those who fulfilled this criterion were included in the treatment group, and individuals who received social assistance for fewer days were included in the control group. The main sample was chosen to be individuals who received social assistance within a window of 21 days on each side of the threshold of 329 days (i.e. those who had been on benefits for 308–349 days). The final dataset included 11,109 individuals.

Table 1 reports descriptive statistics for the main sample. The numbers from Table 1 show that the level of employment was equal in the control group and the treatment group over the two years before the qualification period (2009–2010). While 53% of the individuals in the control group had some employment during this period, the same was true for 54% of the individuals in the treatment group, and on average, members of both groups were employed for 16–17 weeks. However, the treatment and the control group differed in other characteristics: the treatment group is generally older and has a larger proportion of women and immigrants.

Table 1 also reports the descriptive statistics for a sample defined by a narrower window of only six days on either side of the eligibility threshold (323–334 days). As expected, in this narrow sample, the differences between the control group and the treatment group are much smaller, and fewer differences are significant. Among persons in the treatment group from the narrow sample, almost a third were first-generation immigrants and only 31% had at least a post-secondary education from Denmark. Therefore, the treatment group were weakly attached to the labor market. This is also witnessed in the reported mean outcomes at the bottom of the table. They show that the persons in the control group and the treatment group are employed for 13–14 weeks, and that they earn approximately DKK 40,000, which corresponds to USD 6000, during the entire two-year entitlement period. There are no significant differences in these outcomes between the persons in the control group and the treatment group.

Methods

We estimate the impact of eligibility for the employment bonus program using a regression-discontinuity (RD) design. We use the number of days of social assistance receipt in the qualification period as the running variable and 329 days as the threshold variable (see for example Lee and Lemieux 2010 for a description of the design and a review of applications). The effect of eligibility for the bonus program is an intent-to-treat (ITT) effect, i.e. irrespective of their knowledge about the program and irrespective of take-up rates.

The ITT approach generates a sharp discontinuity design, and the design identifies a local effect of the employment bonus entitlement at the threshold under one condition: that the conditional mean outcome is continuous at the threshold value of the running variable in the absence of treatment (Hahn et al. 2001).

The assumption of continuity requires that the running variable cannot be manipulated around the threshold in a way that creates discontinuities in pre-treatment variables around the threshold. As emphasized above, manipulation was not possible in the current setting because the threshold was defined by the number of days on social assistance in a year prior to the announcement of the program, and the eligible persons were selected based on this information only. There have not been other changes in the institutional settings governing employment incentives that could generate a discontinuity at the threshold. Nevertheless, we validate the design assumptions by using two standard procedures (Lee and Lemieux 2010; McCrary 2008): 1) By considering the presence of discontinuities in population characteristics and lagged outcomes at the threshold, and 2) By inspection of the density of the running variable near the threshold.

Our preferred estimates are the non-parametric RD estimates obtained as default from the Stata command ‘rdrobust’ (Calonico et al. 2014, 2017). This RD estimator is based on a data-driven mean-squared error (MSE) optimal bandwidth and a triangle-kernel weight. We examine the robustness of the RD estimates when we use different bandwidths, when we apply a bias-correction, when we use different windows around the threshold, and when we include or exclude covariates.

The estimates are local in the sense of being identified for individuals at the threshold only, i.e. for persons who received social assistance for 329 days in the qualification period. The threshold corresponds to unemployment for 90% of a year, which is within the range of commonly applied thresholds of entering long-term unemployment (e.g. Eurostat and Statistics Denmark).

Results

This section presents the RD estimates of the effects of the employment bonus program on employment, earnings, and secondary outcomes relating to participation in active labor market programs. After examining the overall effects, we explore potential effect heterogeneity and provide supplementary analysis of the sensitivity of the estimates and of the validity of the design. We begin with a standard graphical illustration of mean outcomes around the threshold and then proceed to our preferred non-parametric estimates.

Figure 2 depicts the cumulated number of weeks in regular employment over the entire two-year entitlement period across values of the running variable. The threshold is shown with a vertical line between 328 and 329 days on social assistance in the qualification period. The figure shows that the control group to the left of the threshold have been employed for 7–14 weeks during the entire entitlement period, and that the treatment group to the right of the threshold have been employed for 7–11 weeks. The figure also shows a linear fit on each side of the threshold, which shows a tendency towards a decreasing average for those with more days on social assistance, as expected. However, the figure shows no sign of discontinuities at the threshold, and therefore indicates that the bonus program has no effect on cumulated employment in the bonus entitlement period.

The number of weeks in regular employment in the bonus entitlement period, across days on social assistance in the qualification period. Notes: Weeks in regular employment within the bonus entitlement period from 2012:6–2014:5. The running variable is days on social assistance in the qualification period. Each dot represents a mean for persons with a given number of days on social assistance in the qualification period. The polynomial fits are from linear regressions on each side of the threshold in the window with 308–349 days on social assistance

The non-parametric RD estimates of the effect of the bonus program are presented for different labor market outcomes in Table 2. All the outcomes are cumulated over the two-year bonus entitlement period. The results are shown with and without covariates and with and without bias-correction. The first column shows that the RD estimate without bias-correction and no covariates of the effect of the bonus on weeks of regular employment is 0.9 weeks over the two-year period. The bias-corrected estimate is a bit higher, but both estimates are highly insignificant on a conventional 5% level of significance. Adding covariates provides an estimate of 0.58 weeks and reduces the robust standard error, but still leaves the estimate insignificant.

The effect of the employment bonus program on cumulated pre-tax earnings over the two-year entitlement period is DKK 6364 (USD 850) without covariates, slightly higher with bias-correction and about half the size with covariates, but all estimates are also insignificant. The third column includes subsidized employment in the employment definition, but this does not alter the effect of the program. The last column shows the effect on the cumulated number of weeks of participation in active labor market programs, and these effects are also not significant.

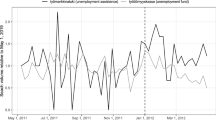

Thus, during the entitlement period, the employment bonus program has no significant effects on four different labor market outcomes. To gauge whether this masks a potential effect in specific sub-periods, we have estimated separate effects for weekly outcomes. It could for example be that there is an effect at the end of the bonus entitlement period, where the treated persons have had more time to respond to the incentive. We have estimated the effects from 2009 to week 39 in 2014, where the data available to us ends. This involves more than 300 estimates before, during and after the qualification and the entitlement periods. These estimates are presented in Fig. 3, which shows that the impact of the employment bonus is not significantly different from zero on a conventional 5% level in any of those weeks.

The effect of the bonus program on weekly regular employment over time – before, during and after the qualification and entitlement periods Notes: RD effects (solid line) estimated on a weekly basis using a non-parametric RD estimate with MSE-optimal bandwidth within a window of 308–349 days. Dotted lines are 95% confidence intervals. The shaded areas are the qualification and the bonus entitlement period, in that order

These results also reveal that the bonus program did not have an impact before the entitlement period, which supports the validity of the design. Finally, the figure tells us that an impact of around 5–10 percentage points at any point in time would suffice for a significant effect. This suggests that even though the RD design is known for being data demanding, this does not seem to be a problem in the current setting.

Effect Heterogeneity

This section presents results for various subgroups with the purpose to explore potential effect heterogeneity. We have estimated effects by gender, age, ethnicity and whether the unemployed persons have any children living at home.Footnote 3 The results for the effects of the bonus program on weeks of regular employment are shown in Table 3, which also includes the overall results for comparison. These estimates are based on the same specification as above.

The effects vary between −0.98 and 4.3 weeks of regular employment for the eight subgroups shown, but none of the effects are significantly different from zero at the 5% level of significance. The smallest effect is found for young people and for unemployed persons with children living at home. The largest effects are found for unemployed persons without children and for unemployed persons older than 30. We also examined whether the effects differed by five administrative regions, which have different labor markets and different levels of income. The results are shown in the appendix (Table 6). Although the effects vary across regions, none are significant. For example, there is no evidence that the employment bonus scheme increased employment in areas with a higher income level and therefore potentially with a higher demand for labor.

Design Validation

We employ two standard validity tests of the RD design (Lee and Lemieux 2010). The first is a test for discontinuities at the threshold in the distribution of pre-determined covariates and lagged outcomes. An example with a lagged outcome was examined above, where it was seen that there was no significant discontinuity in employment prior to the entitlement period. The results for other covariates are summarized in Table 4, and they do not show evidence of any discontinuities either.

The second validation check consists of an inspection of the density of the running variable. If the density showed heaping on either side of the threshold, this would indicate sorting into or out of treatment. We stress that it was not impossible for the unemployed persons to manipulate their own eligibility for the program. Figure 4 shows the density and confirms that there is no evidence of sorting immediately around the threshold. However, there is a peak to the right of the threshold at 335 days on social assistance. This occurs because job changes usually occur on the last or first day of a given month, and the numbers of days on benefit therefore cluster around numbers representing whole months on benefit. Therefore, the peak does not result from manipulation. We further examine the sensitivity of this clustering in the next section.

Robustness Analysis

Even though the RD estimator is only identified locally, we need to use data further away from the threshold, which could result in a bias. We therefore explore how sensitive the results are to the use of non-local data. We do this by varying the width of the window that determines which data are included, and by applying different estimators: local linear models with kernel weights, and parametric 1st and 2nd order polynomial estimators. We avoid higher order polynomials due to the concerns expressed in Gelman and Imbens (2018). Finally, we also examine the results without the persons at the modulus of 335 days on social assistance (see the previous section). As can be seen from Table 5, the effects do vary with specifications, but no economically meaningful nor statistically significant impacts are found, and hence the results are robust.

Discussion

Knowledge about the impact of the economic incentive to work is important when considering intended and unintended outcomes of many welfare and tax reforms. Yet, unfortunately, the empirical literature is relatively silent as to how much a marginal change in the economic incentive to work matters for many groups with a weak attachment to the labor market. A dominant reason for this silence is the difficulty in identifying the causal effect of economic incentives.

The current study contributes to the existing literature on the labor supply responses to economic incentives to work in three ways. Firstly, the study captures the causal effect of the program by applying a design with high internal validity – the regression-discontinuity design. Secondly, the study adds to a particularly sparse literature by considering the effect of an employment bonus program on a population with a weak attachment to the labor market. Finally, the study considers a program with a bonus mechanism which, to the best of our knowledge, has not been evaluated previously: Bonuses are paid for any hour worked in regular or subsidized employment. This unique bonus mechanism is a priori expected to be important, because job entry may be harder for the program’s target group, who have a weak attachment to the labor market.

Our results show that the employment bonus program had no effect for the long-term unemployed persons on their subsequent regular or subsidized employment, earnings, or their participation in active labor market programs. The null findings hold for the entire group of long-term unemployed as well as for sub-groups defined by age, gender, children in the household or country of origin. We find no significant effects on pre-determined outcomes or covariates either, nor do we find significant effects when considering various alternative choices of estimators and sampling windows around the discontinuity threshold.

Our results are at odds with the general findings from literature on employment bonus programs, including the Canadian SSP program for long-term unemployed persons, but in accordance with the findings of a recent study on employment bonuses for the long-term unemployed in the Netherlands. The latter study highlights impatience (hyperbolic discounting) as a potential explanation for their null finding, because of delayed payments of the bonus in the Dutch program (van der Klaauw and van Ours 2013). This cannot be the explanation for the current null finding, as bonuses are paid within a month and simultaneously with regular wage payments. There are a number of possible other explanations for the null finding: 1) The bonus is relatively low and the social assistance level is relatively high, compared to programs evaluated in previous studies; 2) The long-term unemployed persons cannot respond to the incentive because their skill levels and personal characteristics do not match those required by employers; 3) The program period is in a long-term recession, so the demand for low-skilled labor is low. The explanations are not mutually exclusive, but they cannot be separated in the current empirical setting.

In comparison to the current program with a 4% bonus for any hour worked, the Canadian SSP program paid up 20–30% of gross earnings for full-time employment (Michalopoulos et al. 2002). The bonus level in the Dutch bonus program, evaluated in van der Klaauw and van Ours (2013), is closer to the bonus level in the Danish program. The Dutch program paid a maximum bonus between 700 and 900 euros per year for work with a duration of at least six months, corresponding to about 6% of the minimum wage. The actual bonus is therefore somewhat lower. It is therefore likely that the bonus is not sufficiently high in the Danish and the Dutch programs to generate a behavioral effect. We cannot rule out explanation 2) either, particularly because there is reason to believe that the population eligible for the bonus in the current study is worse off than those in both the SSP program and the Dutch program. As an example, almost a third of the population in the current study is composed of immigrants typically from non-western countries, whereas the share of immigrants is only 15% in the Dutch sample and 13.6% in the part of the SSP program targeting the long-term unemployed (Bitler et al. 2008).

In summary, the current study provides reason to be skeptical of policy reforms that rely on large responses to economic incentives for the long-term unemployed, at the very least if the economic incentive is low and applied in a recession.

Notes

In the current Danish context, long-term unemployment is defined as at least 47 weeks of unemployment within a year.

Social assistance during the period corresponds to roughly USD 1570 per month pre-tax for individuals aged 25 with children, and to USD 1180 for individuals aged 25 without children (Act 946 2009). Minimum wage levels are set by collective agreements and vary across industries. The average negotiated minimum wage is approximately USD 18.5 (2012 levels). Full-time employment is 37 h per week and therefore pays approximately USD 2950 at an average hourly minimum wage.

We would have preferred to look at mothers with small children, but the sample was too small for this.

References

Act 946 (2009). Lov om aktiv socialpolitik, LOV 946 af 01/10/2009

Act 473 (2012). Lov om en 2-årig forsøgsordning om jobpræmie til kontanthjælpsmodtagere med langvarig ledighed m.v., LOV 473 af 30/05/2012

Act 706 (2012). Lov om aktiv beskæftigelsesindsats, LOV 726 af 28/06/2012

Azmat G (2014) Evaluating the effectiveness of in-work tax credits. Empir Econ 46:397–425

Bitler MP, Gelbach JB, Hoynes HW (2008) Distributional impacts of the self-sufficiency project. J Public Econ 92:748–765

Blundell R, Brewer M, Shepard A (2005) Evaluating the labour market impact of working families’ tax credit using difference-in-difference, working paper, London, Institute for Fiscal Studies

Brewer M, Duncan A, Shepard A, Suarez MJ (2006) Did working families’ tax credit work? The impact of in-work support on labour supply in Great Britain. Labour Econ 13:699–720

Calonico S, Cattaneo MD, Titiunik R (2014) Robust nonparametric confidence intervals for regression-discontinuity designs. Econometrica 82(6):2295–2326

Calonico S, Cattaneo MD, Farrell MH, Titiunik R (2017) Rdrobust: software for regression-discontinuity designs. Stata J 17(2):372–404

Chetty R, Friedman JN, Saez E (2013) Using differences in knowledge across neighborhoods to uncover the impacts of the EITC on earnings. Am Econ Rev 103:2683–2721

Corson WS, Decker PT, Dunstan S, Kerachsky S (1992) The Pennsylvania reemployment Bonus demonstration: final report, unemployment insurance occasional paper 92–1. U.S. Department of Labor, Employment and Training Administration, Washington, DC

Decker PT, O’Leary CJ (1995) Evaluating pooled evidence from the reemployment Bonus experiments. J Hum Resour 30:534–550

Eissa N, Hoynes HW (2004) Taxes and the labor market participation of married couples: the earned income tax credit. The Journal of Public Economics 88:1931–1958

Eissa N, Hoynes HW (2006) Behavioral responses to taxes: lessons from the EITC on labor supply. Tax Policy and the Economy 20:73–110

Eissa N, Liebman JB (1996) Labor supply response to the earned income tax credit. Q J Econ 111(2):605–637

Eissa N, Kleven HJ, Kreiner CT (2008) Evaluation of four tax reforms in the United States: labor supply and welfare effects for single mothers. J Public Econ 92:795–816

Ellwood DT (2000) The impact of earned income tax credit and social policy reforms on work, marriage, and living arrangements. Natl Tax J 53(4):1063–1106

Francesconi M, van der Klaauw W (2007) The socioeconomic consequences of ‘in-work’ benefit reform for British lone mothers. J Hum Resour 42(1):1–31

Gelman A, Imbens G (2018) Why high-order polynomials should not be used in regression discontinuity designs. J Bus Econ Stat:1–10. https://doi.org/10.1080/07350015.2017.1366909

Gregg P, Harkness S, Smith S (2009) Welfare reform and lone parents in the UK. Econ J 119:F38–F65

Hahn J, Todd P, Van der Klaauw W (2001) Identification and estimation of treatment effects with a regression discontinuity design. Econometrica 69(1):201–209

Hotz VJ, Mullin CH, Scholz JK (2006) Examining the effect of the earned income tax credit on the labor market participation of families on welfare, NBER working paper 11968. National Bureau of Economic Research, Cambridge

Lee DS, Lemieux T (2010) Regression discontinuity designs in economics. J Econ Lit 48(2):281–355

Leigh A (2005) Optimal design of earned income tax credits: Evidence from a British natural experiment, discussion paper no. 488. The Australian National University, Centre for Economic Policy Research, Canberra

McCrary J (2008) Manipulation of the running variable in the regression discontinuity design: a density test. J Econ 142(2):698–714

Meyer BD, Rosenbaum DT (2001) Welfare, the earned income tax credit, and the labor supply of single mothers. Q J Econ 116(3):1063–1114

Michalopoulos C, Tattrie D, Miller C et al (2002) Making work pay. Final report on the self-sufficiency project for long-term welfare recipients. Social Research and Demonstration Corporation (SRDC), Ottawa

Mulheirn I, Pisani M (2008) Working tax credit and labour supply, working paper no. 3. HM Treasury, London

OECD (2011) Taxation and Employment, OECD Tax Policy Studies, No. 21. OECD Publishing, Paris

Robins PK, Spiegelman RG (2001) Reemployment Bonuses in the Unemployment Insurance System: Evidence from Three Field Experiments. W. E. Upjohn Institute for Employment Research, Kalamazoo

Spiegelman RG, O'Leary CJ, Kline KJ (1992) The Washington reemployment Bonus experiment: final report, unemployment insurance occasional paper 92–6. U.S. Department of Labor, Employment and Training Administration, Washington, DC

Van der Klaauw B, van Ours JC (2013) Carrot and stick: how employment bonuses and benefit sanctions affect exit rates from welfare. J Appl Econ 28(2):275–296

Woodbury SA, Spiegelman RG (1987) Bonuses to workers and employers to reduce unemployment: randomized trials in Illinois. Am Econ Rev 77:513–530

Acknowledgements

The study builds on an evaluation conducted for the Danish Agency for Labour Market and Recruitment by the authors while they were both employed at the Danish Institute for Local and Regional Government Research (KORA). All errors and conclusions are the responsibility of the authors alone. The paper has benefited greatly from constructive comments from three anonymous referees, from the editor of the journal and from participants at a seminar the Danish Institute for Local and Regional Government Research and at a research workshop held by the Danish Ministry of Employment.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Arendt, J.N., Kolodziejczyk, C. The Effects of an Employment Bonus for Long-Term Social Assistance Recipients. J Labor Res 40, 412–427 (2019). https://doi.org/10.1007/s12122-019-09290-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12122-019-09290-3