Abstract

Circular initiatives in the supply chain (SC) address collaboration between SC management and the circular economy (CE). Sustainable circular supply chains (SCSC) allow firms to grow without causing the extraction of virgin resources and other environmental damage. They do this by returning waste materials to the manufacturing cycle instead of using new resources. As a result, those industries that tend to restructure their SCs on CE principles can gain economic, social, and environmental benefits. However, the rates of SCSC use are still low mainly because major risks are perceived to be associated with it, making decision-making difficult. The present paper develops a new decision-making methodology in order to address the multi-criteria decision-making (MCDM) problem. It uses a step-wise weight assessment ratio analysis (SWARA) and a combined compromise solution (CoCoSo) methodology on q-rung orthopair fuzzy sets (q-ROFSs). The SWARA in this method produces estimates of the weighting values of the SCSC risks in the manufacturing industry. CoCoSo ranks the firms working in the manufacturing sector according to the SCSC risks. Then, to demonstrate the performance quality of the proposed method, a computational study of the SCSC risks of a selection of appropriate firms in the manufacturing sector is outlined in the q-ROFSs environment. Comparative and sensitivity analyses were conducted in order to assess the efficiency of the developed approach. The results of the analysis confirmed the competence of the proposed approach in performing the tasks defined. Finally, the outcomes of the study show that the design for circularity with a weight value of 0.0352 is the main sustainable circular supply chain risk in manufacturing companies and the company-I with the overall compromise degree 2.0584 is the best company over different sustainable circular supply chain risks.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Many companies and organizations wish to have “supply chains (SCs)” that are completely sustainable from economic, social, and environmental perspectives (Ethirajan et al. 2021; Méndez-Picazo et al. 2021). Therefore in recent years, many policymakers, researchers, and practitioners have shifted the focus of their thinking towards the adoption of sustainable strategy practices in SC (Ansari et al. 2020). These moves have been reinforced by a growing awareness of how many industrial activities have caused the depletion and degradation of the natural resources of natural ecosystems (Govindan and Hasanagic 2018). Therefore, this is a must for all decision-makers to actively consider the environmental issues across businesses’ SC operations (Alkhuzaim et al. 2021; Ferasso et al. 2020). The recently developed concept of the “circular economy (CE)” encourages companies to adopt a circular model of operation and production (De Angelis et al. 2018). However, ‘financial fear’-the belief that circular products might negatively impact their primary sales-has made most companies hesitant to offer circular products. This phenomenon is known as cannibalization (Linder and Williander 2017; van Loon and Van Wassenhove 2018). There is also the risk of cannibalization in CE processes once a novel product made by a new remanufacturing technique is offered (Hazen et al. 2017; Saidani et al. 2020).

CE provides closed-loop systems (Contreras-Lisperguer et al. 2021; Lonca et al. 2020; Velvizhi et al. 2020) through which the residual resources and components are used to the maximum extent possible (Bridgens et al. 2019; Jain et al. 2018). Many previous studies have assessed CE on the basis of theoretical and systemic approaches, but numerous industries are now attempting real-world explorations of the potential conditions for applying CE to their processes (Batista et al. 2018; Ferasso et al. 2020). CE has been demonstrated to be worthwhile working on, at least because of the obvious depletion of natural resources and the generation of tremendous volumes of waste across the globe. As a result, it is now of critical importance to implement CE in all SC contexts. In the context of SC, circular initiatives essentially deal with the collaborations that may take place between SC management and CE (Singhal et al. 2020; Farooque et al. 2019). As implied by the term, a “sustainable circular supply chain (SCSC)” ends the problem of a company’s socio-economic development depending on the environmental damage caused by the extraction of resources (Ethirajan et al. 2021).

SCSC addresses the issues around how to return waste to the production cycle when producing new products instead of simply throwing them away (Genovese et al. 2017). Nasir et al. (2017) examined the implementation of SCSC for insulation materials using waste as raw materials. They found that the emission of carbon dioxide could be decreased by 60%. The concept of reverse logistics assesses the end-of-life of products and components (Julianelli et al. 2020). SCSC has managed, by adopting eco-friendly concepts and offering numerous environmental and financial benefits, to attract the attention of some of the biggest companies, e.g., Unilever, Renault, and Google (De Angelis et al. 2018; Dey et al. 2020a; Hernandez 2019). The adoption of new concepts in an SC can be associated with some risks and disruptions, and those companies that seek to ensure a smooth transition tend to focus on risk analysis and related activities (Geissdoerfer et al. 2018; Moktadir et al. 2018).

The adoption of CE in SC is an increasingly common part of firms’ approaches to sustainability (Lahane et al. 2020). SCSC seeks to integrate the philosophy of CE into SCs activities (Farooque et al. 2019; De Angelis et al. 2018) and is thus a great alternative solution to the conventional linear SC ‘take-make-dispose-of’ business models. The conventional SC converts natural resources into new products and delivers them, ultimately, to the final customers. This process generally ends with dumping the product into landfills, which produces a huge volume of waste and much environmental damage (Singhal et al. 2020; Farooque et al. 2019). Conversely, the SCSC-based on the concept of CE concentrates on the regeneration and restoration of end-of-life products. SCSC uses the 6Rs principle (reuse, recycling, reduction, redesign, repair, and remanufacturing) to create a closed-loop system that minimizes resource inputs, waste, carbon emissions, and pollution throughout the process (Geissdoerfer et al. 2018; Bressanelli et al. 2020).

To identify the above-noted risks and their effects, the present study considers numerous case studies and approaches, assesses them, and finally proposes an effective strategy for risk moderation. Financial risks arise because of the potential for lower product sales and retailer procurement sharing. This, in turn, has an indirect impact on the inventory processes, which also may result in operational risks (Bressanelli et al. 2020; Hussain and Malik 2020). In addition, operational risks can be caused by natural calamities that affect the supply of raw materials and the delivery of the products to customers, which can negatively impact the firm’s reputation (Rosa et al. 2019; Prieto-Sandoval et al. 2018).

About the implementation of SCSC, many studies have attempted to identify the most critical drivers/enablers/critical success factors (Bag and Pretorius 2020) and the key obstacles (Agyemang et al. 2019; Vermunt et al. 2019). The implementation of the principles of CE along different business operations may involve several challenges (Ethirajan et al. 2021; Mangla et al. 2018). Unfortunately, only one recent study by Ethirajan et al. (2021) has assessed the overall sustainability dimensions (i.e., economic, social, and environmental) of the SCSC risks. There is, therefore, a large gap in the literature, and much work remains to be done on understanding the risks.

Because of factors such as the absence of adequate information, time complexity, and the uncertainty of human thinking, “decision-makers (DMs)” generally fail to provide accurate outcomes in real-world MCDM problems. Yager (2017) originated the idea of “q-rung orthopair fuzzy sets (q-ROFSs)”, which are also referred to as “belongingness degree (BD)” and “non-belongingness degree (ND)” with the condition that the sum of the qth power of BD and ND is ≤ 1, where q ≥ 1. The assessment region of the q-ROFSs is broader than the regions of PFSs and IFSs based on the different parameter q (q ≥ 1) values (Yager 2017; Peng and Liu 2019; Mishra and Rani 2021b). Therefore, the q-ROFS is recognized as a more flexible and applicable way of handling conditions with higher levels of uncertainty. In recent years, many researchers have focused on solving the problems in the q-ROFSs environment. Darko and Liang (2020) examined some Hamacher aggregation operators and discussed how they could be applied to real applications on q-ROFSs, Krishankumar et al. (2021) produced a decision-making framework on q-ROFSs to solve the problem of choosing renewable energy resources, and Rani and Mishra (2020a) used an extended version of the “weighted aggregated sum product assessment (WASPAS)” method to evaluate fuel technologies on the q-ROFSs setting.

Generally, during a “multi-criteria decision-making (MCDM)” process, the criteria weights are given high importance by DMs. Several studies have described the criteria weights as objective and subjective weights (Kersuliene et al. 2010). Kersuliene et al. (2010) proposed the “step-wise weight assessment ratio analysis (SWARA)” method to compute the weight of criteria. The computational work of SWARA is simpler than in “analytic hierarchy process (AHP)” and “best–worst method (BWM)”. SWARA requires fewer pairwise comparisons than AHP and offers high consistency. SWARA (Rezaei 2015) is more understandable than BWM, involves less computational complexity, and does not necessitate solving complex linear objective functions. In recent years, “vIsekriterijumska optimizacija I kompromisno resenje (VIKOR)” and SWARA were integrated by Rani and Mishra (2020c) in order to assess eco-industrial thermal power plants on “single-valued neutrosophic sets (SVNSs)” and to select an optimal solar panel on PFSs. Mishra et al. (2020) integrated SWARA with “complex proportional assessment (COPRAS)” to evaluate bioenergy production procedures with IFSs. Rani et al. (2020a) combined COPRAS and SWARA to assess the sustainable supplier for “hesitant fuzzy sets (HFSs)”. The SWARA- “additive ratio assessment (ARAS)” model was employed by Rani et al. (2020b) to assess the methods already introduced in the relevant literature to treat healthcare waste.

In another recent study, Yazdani et al. (2019b) proposed the “combined compromise solution (CoCoSo)” model, an innovative MCDM method incorporating the aggregated compromise solution with a variety of aggregation strategies to obtain a compromise solution. CoCoSo has also been found highly stable and reliable in terms of ranking the available alternatives: removing or adding alternatives exerts less influence on the overall priority outcomes than with VIKOR, “technique for order preference by similarity to ideal solution (TOPSIS)”, and other MCDM models (Yazdani et al. 2019a). The CoCoSo and “criteria importance through intercriteria correlation (CRITIC)” methods were developed in the study of (Tapas Kumar et al. 2019) in order to select “battery-operated electric vehicles (BEVs)”. Rani and Mishra (2020b) examined a new SVN-CoCoSo methodology to assess “waste from electrical and electronic equipment (WEEE)” recycling partners. Mishra and Rani (2021a) hybridized CoCoSo and CRITIC on SVNSs to select the optimal “sustainable third-party reverse logistic provider (S3PRLP)”. A hybrid approach was discussed by Mishra et al. (2021a) using CoCoSo and discrimination measures on HFSs to find an effective solution to the problem of S3PRLP assessment. Liu et al. (2021) discussed and prioritized the medical waste treat technologies under the “Pythagorean fuzzy sets (PFSs)” with the similarity measure-based CoCoSo method.

Accordingly, the current paper focuses on the context of q-ROFSs. SWARA is also a popular method in different scientific domains, used to estimate the subjective criteria weights or significance degree of attributes. SWARA is a policy-based method working on weighting criteria, considering their priority (He et al. 2021; Yang et al. 2021). Policymakers can organize this priority considering the descriptive future scenarios, strategic plans, and current regulations. However, the literature consists of very few studies focusing upon the use of SWARA for q-ROFSs. Therefore, this methodology offers a q-ROF-SWARA-CoCoSo model using SWARA and CoCoSo in the q-ROFSs environment. The CoCoSo makes available a simple computation process with exact and dependable results that could analyze and evaluate the SCSC risks in the manufacturing industry in the q-ROFSs environment. As a result, the current study makes the following contributions:

-

Identifies the related risks of SCSC in the manufacturing industry; this study is conducted a survey framework using a recent literature review and expert interviews.

-

Presents a comprehensive framework to evaluate and analyze sustainable circular supply chain risks in the manufacturing industry using a new decision-making approach.

-

Proposes a novel decision-making model using q-ROF-SWARA-CoCoSo to rank the companies and analyze the SCSC risks in the manufacturing industry.

-

Uses the SWARA procedure to assess the sustainable circular supply chain risks in the manufacturing industry.

-

Uses the CoCoSo approach to prioritize the companies in the manufacturing sector by analyzing the key sustainable circular supply chain risks.

-

Compares and validates the proposed q-ROF-SWARA-CoCoSo approach using other extant decision-making frameworks.

The rest of the paper is structured in the following sections. Section 2 presented the literature review and related works of sustainable circular supply chain risks in the manufacturing industry. Section 3 provided the proposed q-ROF-SWARA-CoCoSo approach and the basic concept of q-ROFSs. Section 4 presented the results of the study, the case study, sensitivity investigation, and comparative study. Finally, Sect. 5 discussed the conclusion of the study.

2 Literature review

The majority of scholars agree that the only way to have sustainable development in the manufacturing sector is to switch from the linear model to a CE model in manufacturing (Geissdoerfer et al. 2018; Su et al. 2013). The current rate of population growth and increasing consumption rates are the key parameters in growing the global demand for food, to be satisfied by agricultural activities. Natural resources are the basis for both food production and a range of other services. We need also remember that economic and social sustainability describes the capacity of a firm to operate profitably while also being sustainable (Dabbous and Tarhini, 2021; Tiago et al. 2021).

In addition, in order to encourage CE principles in SCs, changes in governmental policies are required on the regulation and taxation of imported used products. Developing and formulating an appropriately structured framework and establishing new laws and guidelines can help to support the acceptance and implementation of SCSC (Lahane et al. 2020). The CE effectively develops social and economic factors by using natural resources and ecosystems in effective ways by considering innovative ideas in materials, components, and product reusability (Lewandowski 2016). It inspires the development of novel circular business plans and remanufacturing techniques to support reverse logistics, long-term business performance, and robust supplier partnerships for green-public procurements (Perey et al. 2018). As a result, manufacturing organizations attempt to form well-structured networks supporting circularity in their SCs. To mitigate financial sourcing and constraint-related risks, company management teams need to provide a range of strategies, e.g., establishing financial resource capacities and forming a contingency plan to effectively adopt SCSC in their businesses (Bag and Pretorius 2020). An appropriate way of facilitating the implementation of SCSC is the allocation of funds to the firms willing to implement circularity practices (Tura et al. 2019). Rizos et al. (2016) that governments must introduce strict laws and effective policies in order to promote or improve SCSC practices. If SCSC is to be implemented successfully, companies need to develop appropriate management policies in order to minimize risks linked with regulation and legality (De Angelis et al. 2018). Firms risk legal actions when adopting SCSC if uncertainties exist concerning company laws, policies, activities, inaction, services, and products (Prajapati et al. 2019).

Recently, policymakers, businesses, and scholars have focused more on CE as a means of enhancing SC operational efficiency (Dev et al. 2020; Khan et al. 2020), and the development of automation and reverse logistics practices are encouraging manufacturing companies to adopt CE into their existing SCs (Yadav et al. 2020). In numerous European countries, regulations and policies have been established, directing firms toward adopting and using SCSC in their manufacturing units (Huybrechts et al. 2018). Although SCSC is still in its infancy in many developing countries (Lahane et al. 2020), the sustainable nature and the ecological and economic benefits of SCSC have been attractive to several key companies, such as Google, Unilever, Renault (Dey et al. 2020b).

To alleviate the risks related to SCSC, there is a need to identify proactive solutions. Several scholars have proposed using diverse and situation-specific solutions to manage most of the SCSC risks effectively. According to Govindan and Hasanagic (2018), several driving factors of CE strongly impact SC-related activities. Therefore, CE’s driving factors could be thought of as an approach for the efficient use of SCSC. Some scholars have referred to these driving factors as facilitating factors, critical success factors, enablers, and indicators (Agyemang et al. 2019; Rajput and Singh 2019). Several firms have offered sustainable programs for mitigating different risks in SC. In a company, the rationale behind CE could be applied to a variety of departments, e.g., procurement, information systems, and manufacturing (Ansari and Kant 2017), so firms need to restructure their SC network with sustainable growth in mind (Bassi and Dias 2020; Yadav et al. 2020). In addition, CE helps firms identify and reduce the risks involved in this restructuring. Recently, the literature has highlighted the significance of risk analysis, but it does not explain how a firm could use such capabilities to realize corporate sustainability.

In the same way, compliance or integrity risks result in the misalignment between internal policies and industrial regulations and laws and material loss, financial forfeiture, and legal penalties (Castillo et al. 2018; Giannakis and Papadopoulos 2016). Likewise, ineffective decisions can have destructive impacts on a company’s strategic, financial, compliance, and operational aspects (Sarafan et al. 2019; Wijethilake and Lama 2019). To effectively manage the potential risks of adopting SCSC, managers and SC practitioners should be ready to take proactive measures to mitigate such risks. To this end, they must be capable of identifying, prioritizing, and analyzing all probable risks.

According to Perey et al. (2018), using a properly structured reverse logistics network can affect the SCSC’s operational activities and performance. As a result, in recent years, many companies have attempted to form a network that enables circularity in their SCs (Yadav et al. 2020). The use of innovative IT systems to track end-of-life products by companies will enhance product return rates (Prajapati et al. 2019). The adoption of SCSC could be well accelerated by the engagement of all stakeholders, e.g., customers, suppliers, supply chain members, and employees (Ansari and Kant 2017). Holding seminars and awareness programs and educating the stakeholders regarding all aspects of SCSC activities and sustainable benefits could significantly reduce different risks related to the demand, supply, and social aspects of SCs (Cardoso de Oliveira et al. 2019). Customers also have the responsibility to protect the environment; this contribution could be reinforced by giving incentives and rewards (Moktadir et al. 2018). Consumers’ interest in purchasing and using circular products should be well supported and promoted through the development of proper standards, the establishment of assurance policies, and the provision of inspection certifications for recycled/remanufactured products (Ansari and Kant 2017).

This literature review has used various keywords, e.g., CE’s risks, SCSC management, SC risk management, risk analytical tools, sustainable risk drivers, etc. It demonstrates that the literature currently lacks research on risk: a significant gap. One important work is by Ethirajan et al. (2021), who conducted several analyses on SCSC risks in the manufacturing sector using a grey DEMATEL decision-making approach. They showed that a transparent process is the major risk, and branding is the least-important risk that are taken into consideration when adopting circular initiatives in SC operations. Their findings also revealed that there is a need for proper strategy measures in future research to lessen the adverse impacts of these risks. The knowledge developed from the green/sustainable SC can be extended to SCSC to a certain degree, but further research is needed into the risk assessment specific to SCSC (Dubey et al. 2015). This paper addresses this gap in the literature. It identifies the following risks for SCSC: marketing strategies, public policy, institutional risks, controlled cash-flow, natural disaster, safety measures, design for circularity, political and security risks, specified machine, transparent process, design risk, partnership risks, inventory control risks, information control risks, risky emergency control risks, competing risk, material quality, standards, cargo thefts, workers’ coordination, procurement costs risk, distribution risk, biological and environmental risks, market forecast risks, bullwhip effect risks, processing environment, material delay, information and communication technology, social responsibilities, report governing risk, product service life, return on investment and product quality risk.

3 Research methodology

In this section, first, we discuss the basic idea of q-ROFSs. Next, we propose an integrated q-ROF-SWARA-CoCoSo methodology.

3.1 Preliminaries

The current section shows the basic idea of the q-ROFSs.

Definition 1 (Yager 2017 )

Let \(\Xi = \left\{ {z_{1} ,z_{2} ,...,z_{n} } \right\}\) be a finite discourse set. A q-ROFS ‘M’ in \(\Xi\) is described as follows:

where \(\mu_{M}\) and \(\nu_{M}\) imply the BD and ND of \(z_{i} \, \in \,\Xi ,\) respectively, \(\mu_{M} \, \in \,\left[ {0,\,1} \right],\)\(\nu_{M}\, \in \,\left[ {0,\,1} \right],\)\(0\, \le \,\left( {\mu_{M} \left( {z_{i} } \right)} \right)^{q} \, + \,\left( {\nu_{M} \left( {z_{i} } \right)} \right)^{q} \, \le \,1,\) with \(q\, \ge \,1.\) The indeterminacy degree is defined as \(\pi_{M} \left( {z_{i} } \right) = \,\sqrt[q]{{1 - \left( {\mu_{M} \left( {z_{i} } \right)} \right)^{q} \, - \left( {\nu_{M} \left( {z_{i} } \right)} \right)^{q} }},\,\,\forall \,z_{i} \, \in \,\Xi .\). The Orthopair \(\left( {\mu_{M} \left( {z_{i} } \right),\,\nu_{M} \left( {z_{i} } \right)} \right)\) is referred to as the “q-rung orthopair fuzzy number (q-ROFN)” and is denoted by \(\varphi = \,\left( {\mu_{\varphi } ,\,\nu_{\varphi } } \right).\)

Definition 2 (Liu and Wang 2018 )

Let q-ROFNs \(\varphi = \,\left( {\mu_{\varphi } ,\,\nu_{\varphi } } \right),\)\(\varphi_{1} = \,\left( {\mu_{{\varphi_{1} }} ,\,\nu_{{\varphi_{1} }} } \right)\) and \(\varphi_{2} = \,\left( {\mu_{{\varphi_{2} }} ,\,\nu_{{\varphi_{2} }} } \right)\) be q-ROFNs, then the operations can be given by.

Definition 3 (Liu and Wang, 2018 )

Let \(\varphi = \,\left( {\mu_{\varphi } ,\,\nu_{\varphi } } \right)\) be a q-ROFN. The score and accuracy values are defined by \({\mathbb{S}}\left( \varphi \right) = \mu_{\varphi }^{q} - \nu_{\varphi }^{q}\) and \(\hbar \left( \varphi \right) = \mu_{\varphi }^{q} + \nu_{\varphi }^{q}\) respectively wherein \({\mathbb{S}}\left( \varphi \right) \in \left[ { - 1,\,1} \right]\) and \(\hbar \left( \varphi \right) \in \left[ {0,1} \right]\).

Definition 4

Let \(\varphi = \,\left( {\mu_{\varphi } ,\,\nu_{\varphi } } \right)\) be a q-ROFN. Then normalised score and uncertainty values are given by

For any two q-ROFNs \(\varphi_{1} \, = \,\left( {\mu_{{\varphi_{1} }} ,\,\nu_{{\varphi_{1} }} } \right)\) and \(\varphi_{2} \, = \,\left( {\mu_{{\varphi_{2} }} ,\,\nu_{{\varphi_{2} }} } \right),\)

-

(i)

If \({\mathbb{S}}^{*} \left( {\varphi_{1} } \right) > {\mathbb{S}}^{*} \left( {\varphi_{2} } \right),\) then \(\varphi_{1} > \varphi_{2} ,\)

-

(ii)

If \({\mathbb{S}}^{*} \left( {\varphi_{1} } \right) = {\mathbb{S}}^{*} \left( {\varphi_{2} } \right),\) then

-

(a)

if \(\hbar^{^\circ } \left( {\varphi_{1} } \right) > \hbar^{^\circ } \left( {\varphi_{2} } \right),\) then \(\varphi_{1} < \varphi_{2} ;\)

-

(b)

if \(\hbar^{^\circ } \left( {\varphi_{1} } \right) = \hbar^{^\circ } \left( {\varphi_{2} } \right),\) then \(\varphi_{1} = \varphi_{2} .\)

-

(a)

Definition 5 (Liu et al. 2019 )

Let \(\varphi_{1} \, = \,\left( {\mu_{{\varphi_{1} }} ,\,\nu_{{\varphi_{1} }} } \right)\) and \(\varphi_{2} \, = \,\left( {\mu_{{\varphi_{2} }} ,\,\nu_{{\varphi_{2} }} } \right)\) be q-ROFNs. Now, the distance between \(\varphi_{1} \,\) and \(\varphi_{2} \,\) is described by

3.2 Proposed q-ROF-SWARA-CoCoSo approach

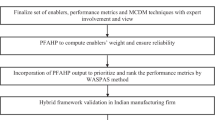

The CoCoSo was pioneered by Yazdani et al. (2020) to address the MCDM problems effectively. It works based on the “simple additive weighting (SAW)” and “weighted product measure (WPM)” models. In order to extend the application range of this method in the present paper, an innovative q-ROF-SWARA-CoCoSo method is proposed with the use of SWARA to describe those MCDM problems that suffer from high ambiguity and complexity. In the following, the detailed process of the proposed q-ROF-SWARA-CoCoSo framework is elaborated (see Fig. 1).

Step 1: Generate a “linguistic decision matrix (LDM)”.

A set of \(\ell\) “decision-makers (DMs)” \(A = \left\{ {A_{1} ,A_{2} ,...,A_{\ell } } \right\}\) determine the sets of \(m\) options \(X\, = \,\left\{ {X_{1} ,\,X_{2} ,\,...,\,X_{m} } \right\}\) and \(n\) criteria \(P\, = \,\left\{ {P_{1} ,\,P_{2} ,\,...,\,P_{n} } \right\}\) respectively. Due to the imprecision of human observance, lack of data, and imprecise knowledge about the options, the DMs allocate the “linguistic decision-matrix (LDM)” to evaluate their judgment on option Xi over a criterion Pj. Assume that \({\mathbb{Z}}^{\left( k \right)} = \left( {\xi_{ij}^{\left( k \right)} } \right)_{m\, \times \,n} ,\,\,\,i\, = 1,\,2,\,...,\,m,\,j\, = 1,\,2,\,...,n\) is the suggested LDM by DMs, where \(\xi_{ij}^{\left( k \right)}\) refer to the evaluation of an option Xi over a criterion Pj in the form of “linguistic values (LVs)” given by kth DM.

Step 2: Compute the weights of DMs.

To determine the DMs’ weights, firstly, the importance degrees of the DMs are assumed as LVs and then articulated by q-ROFNs. To compute the kth DM, let \(A_{k} \, = \,\left( {\mu_{k} ,\,\nu_{k} ,\,\pi_{k} } \right)\) be the q-ROFN. Now, the expert weight is obtained by

Step 3: Obtain the “aggregated q-rung orthopair decision-matrix (A-q-ROF-DM)”.

To create an A-q-ROF-DM, the “q-ROF weighted averaging (q-ROFWA)” operator is used and then \({\text{A}} = \left( {\xi_{ij} } \right)_{m\, \times \,n} ,\) where

Step 4: Computation of criteria weights.

The procedure of the SWARA model for computing the criteria weights is given by.

Step 4.1: Assess the crisp values. The q-ROF-score value \({\mathbb{S}}^{*} \left( {\xi_{kj} } \right)\) is estimated by Eq. (1).

Step 4.2: Prioritise the criteria. The prioritisation of the attributes is done based on the DE’s priorities from the most to the least significant attributes.

Step 4.3: Evaluate the comparative significance of the mean value. The significance degree is estimated from the second place attribute, and the subsequent comparative significance is calculated by comparing attribute \(s_{j}\) with attribute \(s_{j - 1} .\)

Step 4.4: Calculate the comparative coefficient \(\kappa_{j}\) as follows:

where \(\sigma_{j}\) symbolises the significance degree.

Step 4.5: Compute the weights. The recalculated weight \(\rho_{j}\) is given by

Step 4.6: Compute the normalised weight. The attribute weights are normalised as

Step 5: Construct the “normalised A-q-ROF-DM (NA-q-ROF-DM)”.

The NA-q-ROF-DM \({\mathbb{R}} = \left[ {\varsigma_{ij} } \right]_{m\, \times \,n}\) is found from \({\rm A} = \left( {\xi_{ij} } \right)_{m\, \times \,n}\) and is discussed as

Step 6: Assess the “weighted sum measure (WSM)” and “weighted product measure (WSM)”.

The WSM \({\mathbb{C}}_{i}^{(1)}\) and WPM \({\mathbb{C}}_{i}^{(2)}\) values for each alternative are estimated as

Step 7: Estimate the relative weights or “balanced compromise degree (BCD)” of the options.

The appraisal values are given in order to evaluate the options’ relative scores, which are discussed as follows:

Here \(\vartheta\) is the strategy mechanism coefficient, and \(\vartheta \in \left[ {0,1} \right].\) Generally, we take \(\vartheta = 0.5.\)

Step 8: Estimate the “overall compromise degree (OCD)”.

The OCD \(\beta_{i}\) is computed for each alternative as

The priority of alternatives by increasing degrees of the overall compromise indexes (OCDs) \(\beta_{i} .\)

4 Results

4.1 Case study

At this step, an expert survey is performed to validate the identified risk factors. To begin with, the experts who are capable of validating the identified SCSC risk factors in the manufacturing industry are judiciously chosen. Several experts working in the manufacturing industry who had experience with field surveys were invited to determine the probable risk factors. A questionnaire was developed using an inclusive survey approach and designed based on the extant literature. The interviewees were selected experts with special knowledge of the risk factors important to the stakeholders in the leather industry. In total, 32 risks were identified. They were marketing strategies, public policy, institutional risks, controlled cash-flow, natural disaster, safety measures, design for circularity, political and security risks, specified machine, transparent process, design risks, partnership risks, inventory control risks, information control risks, emergency control risks, competition risk, material quality, standards, cargo thefts, workers’ coordination, procurement costs risk, distribution risk, biological and environmental risks, market forecast risks, bullwhip effect risks, processing environment, material delay, information and communication technology, social responsibilities, report governing risk, product service life, return on investment and product quality risk. In the next stage, to evaluate the selected risks in the manufacturing sector, a decision team of three DEs from selected manufacturing companies is created within the case enterprise. Each team comprises one environmental manager, one SC manager, and one supervisor from the production and manufacturing section. All the DMs have more than 15 years of experience with SC procedures. The following steps provide the performance degrees of options and SCSC risks.

Step 1–2: Assume that the DMs’ weights are specified in form of q-ROFNs, presented by {(0.85, 0.50, 0.6390), (0.70, 0.65, 0.7258), (0.75, 0.60, 0.7128)}. Now, Table 1 designates the LVs of DMs to evaluate the options over related criteria. Table 2 presents the LDM \({\mathbb{Z}}^{\left( k \right)} = \left( {\xi_{ij}^{\left( k \right)} } \right)_{m\, \times \,n} ,\,k = 1,2,3\). The important degrees provided by DMs are in terms of LDM. Now, the weight \(\lambda_{k} :k=1,2,3\) of DMs are evaluated by employing Eq. (3) and given as {\(\varpi_{1}\) = 0.4058, \(\varpi_{2}\) = 0.2712, \(\varpi_{3}\) = 0.3230}.

Step 3: Using Eq. (4) to create an A-q-ROF-DM \({\text{A}} = \left( {\xi_{ij} } \right)_{m\, \times \,n}\) for options over various SCSC risks. It is depicted in Table 3.

Step 4: To estimate the weight of SCSC risks with the help of SWARA. DMs play a vital role in evaluating and calculating the weights (see Table 4). Each DM is expected to choose the importance of each risk. Using Eqs. (5)–(8), all SCSC risk factors’ weights are given in Table 5, in the \(w_{j}\) column.

\(w_{j} =\) (0.0321, 0.0308, 0.0276, 0.0307, 0.0263, 0.0352, 0.0323, 0.0312, 0.0289, 0.0331, 0.0293, 0.0289, 0.0319, 0.0325, 0.0315, 0.0298, 0.0306, 0.0300, 0.0288, 0.0332, 0.0324, 0.0343, 0.0292, 0.0317, 0.0311, 0.0290, 0.0317, 0.0311, 0.0340, 0.0330, 0.0338, 0.0339).

Here, Fig. 2 discusses the weights of diverse, sustainable circular supply chain risks relative to the goal. Design for circularity (s6) with a weight value of 0.0352 is the principal sustainable circular supply chain risk in manufacturing companies. The next four in order of importance are: Biological and environmental risks (s22) with a weight value of 0.0343, Report governing risk (s29) with weight 0.0340, Product quality risk (s32) with the weight of 0.0339, and Return on investment (s31) with the weight of 0.0338. Several others were considered crucial sustainable circular supply chain risks.

Step 5: Since all risk factors values are beneficial thus, there is no need to obtain NA-ROF-DM.

Steps 6–8: From Eqs. (9) and (10), the WPM and WSM degrees are estimated for diverse companies over different sustainable circular supply chain risks. Using Eqs. (11)–(14), the outcomes of the q-ROF-SWARA-CoCoSo method are computed and are shown in Table 6. The preference ranking of companies with different sustainable circular supply chain risks is \(C_{1} \, \succ \,C_{2} \, \succ \,C_{3} \,,\) and thus, the company-I (C1) is the best company over different sustainable circular supply chain risks.

4.2 Comparative study

The result of the q-ROF-SWARA-CoCoSo method was compared with the results of the different approaches. To demonstrate the efficacy and the unique advantages of the introduced method, the “q-ROF-WASPAS” (Rani and Mishra 2020a) are employed to tackle the same problem. The procedure of the q-ROF-WASPAS model is given by.

Steps 1–6: Analogous to the above-mentioned approach.

Step 7: Compute the WASPAS degree of each alternative as

where \(\lambda\) symbolises the strategy coefficient and \(\lambda \in \left[ {0,\,\,1} \right].\)

Step 8: Prioritise the options based on score degrees of \(\alpha_{i} .\)

Steps 5–8: Applying Eqs. (11), (12), and (15) to estimate all the measures. Their q-ROF-score values were obtained and are depicted in Table 7. Therefore, the company’s prioritization is assessed as \(C_{1} \succ C_{2} \succ C_{3}\) and C1, i.e., company-I, is the most desirable option. The outcomes are slightly different with introduced and extant methods. So far, the q-ROF-SWARA-CoCoSo approach is more resilient and stable than the “q-ROF-WASPAS” approaches and thus has wider applicability.

The q-ROF-SWARA-CoCoSo method was more robust than the methods mentioned above, with a broader range of applicability. In the following, the most important benefits of q-ROF-SWARA-CoCoSo are presented (See also Fig. 3):

-

The q-ROFSs can reflect more objectively the DE’s hesitancy than the other classical extensions of FS. The q-ROF-SWARA-CoCoSo, therefore, offers a more flexible method for expressing the uncertainty in assessing the SCSC risks.

-

SWARA assesses the criteria weights, which is applicable to assessing the SCSC risks in the manufacturing sector. This adds greater reliability, efficiency, and sensibility to q-ROF-SWARA-CoCoSo.

-

The q-ROF-SWARA-CoCoSo has the capacity of processing the available information more appropriately and with considering various perspectives, e.g., the benefit and non-benefit attributes.

In the following, we present the limitations of the introduced MCDM methodology:

-

In the developed q-ROF-SWARA-CoCoSo method, all criteria are considered to be dependent on each other. However, in realistic circumstances, there are interrelationships among the criteria.

-

A subjective weighting procedure is applied to obtain the significance weight value of SCSC risks that enlightens the views of DMs concerning the relative importance of SCSC risks.

-

As SCSC issues become increasingly serious, more dimensions of sustainability should be considered in the assessment of risks of SCSC in the manufacturing industry.

4.3 Sensitivity investigation

A sensitivity analysis was also performed to examine how the developed method executes the tasks defined. The analysis of the effects of the results of the q-ROF-SWARA-CoCoSo model was discussed, and the effects of altering the parameter ϑ on the organisations’ rankings. Figure 4 displays the analysis of the impacts of the value of the coefficient ϑ (\(0 \le \vartheta \le 1\)) upon the values of the most important risks of SCSC. It also shows the utility degrees of the firms. For each firm, the overall compromise indices were measured considering different values of the parameter ϑ. The obtained results graphically displayed in Fig. 4 indicate that the firms’ options under different SCSC risks are dependent upon and sensitive to various parameter ϑ values. Thus, under various values of ϑ, the stability of q-ROF-SWARA-CoCoSo was confirmed. As shown in Fig. 4 and Table 8, option C1 obtained the first position in the ranking, while C3 was ranked the last one.

According to the results presented in Fig. 4 and Table 8, the changes to parameter ϑ in the interval [0, 1] have a slight impact on the change in the values of the main SCSC risks. Therefore q-ROF-SWARA-CoCoSo does not depend on any bias, and the obtained outcomes in the current study are steady.

5 Conclusions

The development of technology led to many benefits and, on the other hand, the production of lots of waste and polluting substances. Sustainability attempts to encompass all environmental, social, and economic aspects of a business’s activities. More specifically, adopting sustainability in manufacturing companies is extremely important for both governments and industries. The present paper has emphasized the significance of understanding the sustainability of SCSC. If sustainability is to be achieved, all industries must take note of the potential risk factors and threats inherent in every business context. For that reason, the current paper proposed an innovative MCDM method using q-ROFSs to analyze, rank, and evaluate the SCSC risks for firms working in the manufacturing sector. It introduces an extended decision-making framework with the SWARA and CoCoSo approaches on q-ROFSs called the “q-ROF-SWARA-CoCoSo” to evaluate manufacturing companies’ sustainable circular supply chain risks. In computing with the SWARA tool the weight of the risks in each sustainable circular supply chain, the characteristics of the DMs were crucial. Each DM was asked to choose the degree of importance of each risk factor in several sustainable circular supply chains relative to their goals. The CoCoSo framework was used to compute the preference order. In order to validate the results, a comparison was conducted using the q-ROF-WASPAS, q-ROF-WPM, and q-ROF-WSM frameworks.

In the future, business companies will need to adopt sustainable strategies in their SCs because the growth rates of consumption and production activities have resulted in the excessive use of existing natural resources. Governments, especially those of developing countries, must establish strict policies supporting the adoption of SCSC management. In addition, policymakers are expected to consider more economic incentives to promote the use of circular products and services and increase companies’ interest in using a circular culture in their business settings.

Moreover, circular SC will increasingly be a critical element in firms’ attempts to build sustainable images. First, policymakers need to arrange for sustainable awareness programs for all stakeholders who could make substantial contributions to improving circular practices in firms. Then, policymakers could use circular SC to attain a wide range of sustainable objectives, e.g., generating financial progress, creating job opportunities, and reducing adverse environmental effects. As a result, policymakers can significantly contribute to setting the stage for the transition from a traditional linear economy model into a CE model and providing incentives for adopting circular business models. The final ranked solutions could be used by government officials when developing effective support strategies for firms and their stakeholders: this, in turn, could improve the nation’s economic status.

In addition, the current research has considerable theoretical and practical implications. It makes a substantial theoretical contribution to the literature by analysing the risk factors associated with SCSC around sustainability. From the managerial perspective, it makes a strong contribution to understanding the real problems in the field. Our findings can aid practitioners in understanding the risk factors involved in SCSC and help policymakers develop the strategies required—pro-active, active, and reactive risk moderation—to address effectively the risks that SCSC poses. The findings could also help plan effective treatment plant facilities and appropriate facilities for solid waste disposal in the manufacturing sector. They could also guide the improvement of the relationships among the SCSC industry owners and workers. So, in these ways, the present study can aid in accelerating risk alleviation in the context of SCSC. The major contributions of the current research could be elaborated in two phases. First, the present paper determined the potential risk factors for sustainable SCSC in the context of a developing economy, which had been rarely inspected before. This is the first research into the risk factors related to SCSC in a sustainability context. Then, the data collected from the experts and practitioners of various case companies revealed valuable outcomes that could contribute significantly to studies that are to be conducted in the future on sustainability.

Change history

10 February 2024

This article has been retracted. Please see the Retraction Notice for more detail: https://doi.org/10.1007/s12063-024-00449-5

References

Agyemang M, Kusi-Sarpong S, Khan SA, Mani V, Rehman ST, Kusi-Sarpong H (2019) Drivers and barriers to circular economy implementation. Manag Decis 57(4):971–994. https://doi.org/10.1108/MD-11-2018-1178

Alkhuzaim L, Zhu Q, Sarkis J (2021) Evaluating emergy analysis at the nexus of circular economy and sustainable supply chain management. Sustainable Production and Consumption 25:413–424. https://doi.org/10.1016/j.spc.2020.11.022

Ansari ZN, Kant R (2017) Exploring the Framework Development Status for Sustainability in Supply Chain Management: a Systematic Literature Synthesis and Future Research Directions. Bus Strateg Environ 26(7):873–892. https://doi.org/10.1002/bse.1945

Ansari ZN, Kant R, Shankar R (2020) Evaluation and ranking of solutions to mitigate sustainable remanufacturing supply chain risks: a hybrid fuzzy SWARA-fuzzy COPRAS framework approach. Int J Sustain Eng 13(6):473–494. https://doi.org/10.1080/19397038.2020.1758973

Bag S, Pretorius JHC (2020) Relationships between industry 4.0, sustainable manufacturing and circular economy: proposal of a research framework. Int J Organ Anal ahead-of-print (ahead-of-print). https://doi.org/10.1108/IJOA-04-2020-2120

Bassi F, Dias JG (2020) Sustainable development of small- and medium-sized enterprises in the European Union: A taxonomy of circular economy practices. Bus Strateg Environ 29(6):2528–2541. https://doi.org/10.1002/bse.2518

Batista L, Bourlakis M, Liu Y, Smart P, Sohal A (2018) Supply chain operations for a circular economy. Prod Plan Control 29(6):419–424. https://doi.org/10.1080/09537287.2018.1449267

Bressanelli G, Saccani N, Pigosso DCA, Perona M (2020) Circular Economy in the WEEE industry: a systematic literature review and a research agenda. Sustain Prod Consum 23:174–188. https://doi.org/10.1016/j.spc.2020.05.007

Bridgens B, Hobson K, Lilley D, Lee J, Scott JL, Wilson GT (2019) Closing the Loop on E-waste: A Multidisciplinary Perspective. 23(1):169-181. https://doi.org/10.1111/jiec.12645

Cardoso de Oliveira MC, Machado MC, Chiappetta Jabbour CJ, de Sousa L, Jabbour AB (2019) Paving the way for the circular economy and more sustainable supply chains. Manag Environ Qual An Int J 30(5):1095–1113. https://doi.org/10.1108/MEQ-01-2019-0005

Castillo VE, Mollenkopf DA, Bell JE, Bozdogan H (2018) Supply chain integrity: a key to sustainable supply chain management. 39(1):38-56. https://doi.org/10.1111/jbl.12176

Contreras-Lisperguer R, Muñoz-Cerón E, Aguilera J, de la Casa J (2021) A set of principles for applying Circular Economy to the PV industry: Modeling a closed-loop material cycle system for crystalline photovoltaic panels. Sustain Prod Consu 28:164–179. https://doi.org/10.1016/j.spc.2021.03.033

Dabbous A, Tarhini A (2021) Does sharing economy promote sustainable economic development and energy efficiency? Evidence from OECD countries. J Innov Knowl 6(1):58–68. https://doi.org/10.1016/j.jik.2020.11.001

Darko AP, Liang D (2020) Some q-rung orthopair fuzzy Hamacher aggregation operators and their application to multiple attribute group decision making with modified EDAS method. Eng Appl Artif Intell 87:103259. https://doi.org/10.1016/j.engappai.2019.103259

De Angelis R, Howard M, Miemczyk J (2018) Supply chain management and the circular economy: towards the circular supply chain. Prod Plan Control 29(6):425–437. https://doi.org/10.1080/09537287.2018.1449244

Dev NK, Shankar R, Qaiser FH (2020) Industry 4.0 and circular economy: Operational excellence for sustainable reverse supply chain performance. Resour Conserv Recycl 153:104583. https://doi.org/10.1016/j.resconrec.2019.104583

Dey PK, Malesios C, De D, Budhwar P, Chowdhury S, Cheffi W (2020a) Circular economy to enhance sustainability of small and medium-sized enterprises. 29(6):2145-2169. https://doi.org/10.1002/bse.2492

Dey PK, Malesios C, De D, Budhwar P, Chowdhury S, Cheffi W (2020b) Circular economy to enhance sustainability of small and medium-sized enterprises. Bus Strateg Environ 29(6):2145–2169. https://doi.org/10.1002/bse.2492

Dubey R, Gunasekaran A, Samar Ali S (2015) Exploring the relationship between leadership, operational practices, institutional pressures and environmental performance: A framework for green supply chain. Int J Prod Econ 160:120–132. https://doi.org/10.1016/j.ijpe.2014.10.001

Ethirajan M, Arasu MT, Kandasamy J, KEK V, Nadeem SP, Kumar A (2021) Analysing the risks of adopting circular economy initiatives in manufacturing supply chains. Bus Strateg Environ 30(1):204–236. https://doi.org/10.1002/bse.2617

Farooque M, Zhang A, Thürer M, Qu T, Huisingh D (2019) Circular supply chain management: a definition and structured literature review. J Clean Prod 228:882–900. https://doi.org/10.1016/j.jclepro.2019.04.303

Ferasso M, Beliaeva T, Kraus S, Clauss T, Ribeiro-Soriano D (2020) Circular economy business models: the state of research and avenues ahead 29(8):3006-3024. https://doi.org/10.1002/bse.2554

Geissdoerfer M, Morioka SN, de Carvalho MM, Evans S (2018) Business models and supply chains for the circular economy. J Clean Prod 190:712–721. https://doi.org/10.1016/j.jclepro.2018.04.159

Genovese A, Acquaye AA, Figueroa A, Koh SCL (2017) Sustainable supply chain management and the transition towards a circular economy: evidence and some applications. Omega 66:344–357. https://doi.org/10.1016/j.omega.2015.05.015

Giannakis M, Papadopoulos T (2016) Supply chain sustainability: a risk management approach. Int J Prod Econ 171:455–470. https://doi.org/10.1016/j.ijpe.2015.06.032

Govindan K, Hasanagic M (2018) A systematic review on drivers, barriers, and practices towards circular economy: a supply chain perspective. Int J Prod Res 56(1–2):278–311. https://doi.org/10.1080/00207543.2017.1402141

Hazen BT, Mollenkopf DA, Wang Y (2017) Remanufacturing for the circular economy: an examination of consumer switching behavior. Bus Strateg Environ 26(4):451–464. https://doi.org/10.1002/bse.1929

He J, Huang Z, Mishra AR, Alrasheedi M (2021) Developing a new framework for conceptualizing the emerging sustainable community-based tourism using an extended interval-valued Pythagorean fuzzy SWARA-MULTIMOORA. Technol Forecast Soc Chang 171:120955. https://doi.org/10.1016/j.techfore.2021.120955

Hernandez RJ (2019) Sustainable product-service systems and circular economies. 11(19):5383

Hussain M, Malik M (2020) Organizational enablers for circular economy in the context of sustainable supply chain management. J Clean Prod 256:120375. https://doi.org/10.1016/j.jclepro.2020.120375

Huybrechts D, Derden A, Van den Abeele L, Vander Aa S, Smets T (2018) Best available techniques and the value chain perspective. J Clean Prod 174:847–856. https://doi.org/10.1016/j.jclepro.2017.10.346

Jain S, Jain NK, Metri B (2018) Strategic framework towards measuring a circular supply chain management. Benchmarking: An Int J 25(8):3238–3252. https://doi.org/10.1108/BIJ-11-2017-0304

Julianelli V, Caiado RGG, Scavarda LF, Cruz SPdMF (2020) Interplay between reverse logistics and circular economy: critical success factors-based taxonomy and framework. Resour Conserv Recycl 158:104784. https://doi.org/10.1016/j.resconrec.2020.104784

Kersuliene V, Zavadskas EK, Turskis Z (2010) Selection of rational dispute resolution method by applying new step-wise weight assessment ratio analysis (SWARA). J Bus Econ Manag 11(2):243–258. https://doi.org/10.3846/jbem.2010.12

Khan O, Daddi T, Iraldo F (2020) Microfoundations of dynamic capabilities: insights from circular economy business cases. 29(3):1479-1493. https://doi.org/10.1002/bse.2447

Krishankumar R, Nimmagadda SS, Rani P, Mishra AR, Ravichandran KS, Gandomi AH (2021) Solving renewable energy source selection problems using a q-rung orthopair fuzzy-based integrated decision-making approach. J Clean Prod 279:123329. https://doi.org/10.1016/j.jclepro.2020.123329

Lahane S, Kant R, Shankar R (2020) Circular supply chain management: a state-of-art review and future opportunities. J Clean Prod 258:120859. https://doi.org/10.1016/j.jclepro.2020.120859

Lewandowski M (2016) Designing the business models for circular economy—towards the conceptual framework 8(1):43

Linder M, Williander M (2017) Circular business model innovation: inherent uncertainties 26(2):182-196. https://doi.org/10.1002/bse.1906

Liu D, Chen X, Peng D (2019) Some cosine similarity measures and distance measures between q-rung orthopair fuzzy sets. Int J Intell Syst 34(7):1572–1587. https://doi.org/10.1002/int.22108

Liu P, Wang P (2018) Some q-Rung Orthopair Fuzzy Aggregation Operators and their Applications to Multiple-Attribute Decision Making. Int J Intell Syst 33(2):259–280. https://doi.org/10.1002/int.21927

Liu P, Rani P, Mishra AR (2021) A novel Pythagorean fuzzy combined compromise solution framework for the assessment of medical waste treatment technology. J Clean Prod 292:120047. https://doi.org/10.1016/j.jclepro.2021.126047

Lonca G, Lesage P, Majeau-Bettez G, Bernard S, Margni M (2020) Assessing scaling effects of circular economy strategies: A case study on plastic bottle closed-loop recycling in the USA PET market. Resour Conserv Recycl 162:105013. https://doi.org/10.1016/j.resconrec.2020.105013

Mangla SK, Luthra S, Mishra N, Singh A, Rana NP, Dora M, Dwivedi Y (2018) Barriers to effective circular supply chain management in a developing country context. Prod Plan Control 29(6):551–569. https://doi.org/10.1080/09537287.2018.1449265

Méndez-Picazo M, Galindo-Martín M, Castaño-Martínez M (2021) Effects of sociocultural and economic factors on social entrepreneurship and sustainable development. J Innov Knowl 6(2):69–77. https://doi.org/10.1016/j.jik.2020.06.001

Mishra AR, Rani P (2021a) Assessment of sustainable third party reverse logistic provider using the single-valued neutrosophic combined compromise Solution framework. Cleaner and Responsible Consumption 2:100011. https://doi.org/10.1016/j.clrc.2021.100011

Mishra AR, Rani P (2021b) A q-rung orthopair fuzzy ARAS method based on entropy and discrimination measures: an application of sustainable recycling partner selection. J Ambient Intell Humaniz Comput. https://doi.org/10.1007/s12652-021-03549-3

Mishra AR, Rani P, Krishankumar R, Zavadskas EK, Cavallaro F, Ravichandran KS (2021) A hesitant fuzzy combined compromise solution framework-based on discrimination measure for ranking sustainable third-party reverse logistic providers. Sustainability 13(4). https://doi.org/10.3390/su13042064

Mishra AR, Rani P, Pandey K, Mardani A, Streimikis J, Streimikiene D, Alrasheedi M (2020) Novel multi-criteria intuitionistic fuzzy SWARA–COPRAS approach for sustainability evaluation of the bioenergy production process 12(10):4155

Moktadir MA, Rahman T, Rahman MH, Ali SM, Paul SK (2018) Drivers to sustainable manufacturing practices and circular economy: a perspective of leather industries in Bangladesh. J Clean Prod 174:1366–1380. https://doi.org/10.1016/j.jclepro.2017.11.063

Nasir MHA, Genovese A, Acquaye AA, Koh SCL, Yamoah F (2017) Comparing linear and circular supply chains: a case study from the construction industry. Int J Prod Econ 183:443–457. https://doi.org/10.1016/j.ijpe.2016.06.008

Peng X, Liu L (2019) Information measures for q-rung orthopair fuzzy sets. Int J Intell Syst 34(8):1795–1834. https://doi.org/10.1002/int.22115

Perey R, Benn S, Agarwal R, Edwards M (2018) The place of waste: changing business value for the circular economy 27(5):631-642. https://doi.org/10.1002/bse.2068

Prajapati H, Kant R, Shankar R (2019) Bequeath life to death: state-of-art review on reverse logistics. J Clean Prod 211:503–520. https://doi.org/10.1016/j.jclepro.2018.11.187

Prieto-Sandoval V, Ormazabal M, Jaca C, Viles E (2018) Key elements in assessing circular economy implementation in small and medium-sized enterprises 27(8):1525-1534. https://doi.org/10.1002/bse.2210

Rajput S, Singh SP (2019) Connecting circular economy and industry 4.0. Int J Inf Manage 49:98–113. https://doi.org/10.1016/j.ijinfomgt.2019.03.002

Rani P, Mishra AR (2020a) Multi-criteria weighted aggregated sum product assessment framework for fuel technology selection using q-rung orthopair fuzzy sets. Sustain Prod Consum 24:90–104. https://doi.org/10.1016/j.spc.2020.06.015

Rani P, Mishra AR (2020b) Novel single-valued neutrosophic combined compromise solution approach for sustainable waste electrical and electronics equipment recycling partner selection. IEEE Trans Eng Manag 1–15. https://doi.org/10.1109/TEM.2020.3033121

Rani P, Mishra AR (2020c) Single-valued neutrosophic SWARA-VIKOR framework for performance assessment of eco-industrial thermal power plants. ICSES Transactions on Neural and Fuzzy Computing 3(1):1–9

Rani P, Mishra AR, Krishankumar R, Mardani A, Cavallaro F, Ravichandran KS, Balasubramanian K (2020a) Hesitant fuzzy SWARA-complex proportional assessment approach for sustainable supplier selection (HF-SWARA-COPRAS). Symmetry 12(7). https://doi.org/10.3390/sym12071152

Rani P, Mishra AR, Krishankumar R, Ravichandran KS, Gandomi AH (2020b) A new pythagorean fuzzy based decision framework for assessing healthcare waste treatment. IEEE Trans Eng Manag 1–15. https://doi.org/10.1109/TEM.2020.3023707

Rezaei J (2015) Best-worst multi-criteria decision-making method. Omega 53:49–57. https://doi.org/10.1016/j.omega.2014.11.009

Rizos V, Behrens A, Van der Gaast W, Hofman E, Ioannou A, Kafyeke T, Flamos A, Rinaldi R, Papadelis S, Hirschnitz-Garbers M, Topi C (2016) Implementation of circular economy business models by small and medium-sized enterprises (smes): barriers and enablers 8(11):1212

Rosa P, Sassanelli C, Terzi S (2019) Towards circular business models: a systematic literature review on classification frameworks and archetypes. J Clean Prod 236:117696. https://doi.org/10.1016/j.jclepro.2019.117696

Saidani M, Yannou B, Leroy Y, Cluzel F (2020) Dismantling, remanufacturing and recovering heavy vehicles in a circular economy—technico-economic and organisational lessons learnt from an industrial pilot study. Resour Conserv Recycl 156:104684. https://doi.org/10.1016/j.resconrec.2020.104684

Sarafan M, Squire B, Brandon-Jones E (2019) A behavioural view of supply chain risk management. In: Zsidisin GA, Henke M (eds) Revisiting Supply Chain Risk. Springer International Publishing, Cham 233–247. https://doi.org/10.1007/978-3-030-03813-7_14

Singhal D, Tripathy S, Jena SK (2020) Remanufacturing for the circular economy: study and evaluation of critical factors. Resour Conserv Recycl 156:104681. https://doi.org/10.1016/j.resconrec.2020.104681

Su B, Heshmati A, Geng Y, Yu X (2013) A review of the circular economy in China: moving from rhetoric to implementation. J Clean Prod 42:215–227. https://doi.org/10.1016/j.jclepro.2012.11.020

Tapas Kumar B, Željko S, Prasenjit C, Morteza Y (2019) An integrated methodology for evaluation of electric vehicles under sustainable automotive environment. In: Prasenjit C, Morteza Y, Shankar C, Dilbagh P, Siddhartha B (eds) Advanced Multi-Criteria Decision Making for Addressing Complex Sustainability Issues. IGI Global, Hershey, PA, USA 41–62. https://doi.org/10.4018/978-1-5225-8579-4.ch003

Tiago F, Gil A, Stemberger S, Borges-Tiago T (2021) Digital sustainability communication in tourism. J Innov Knowl 6(1):27–34. https://doi.org/10.1016/j.jik.2019.12.002

Tura N, Hanski J, Ahola T, Ståhle M, Piiparinen S, Valkokari P (2019) Unlocking circular business: a framework of barriers and drivers. J Clean Prod 212:90–98. https://doi.org/10.1016/j.jclepro.2018.11.202

van Loon P, Van Wassenhove LN (2018) Assessing the economic and environmental impact of remanufacturing: a decision support tool for OEM suppliers. Int J Prod Res 56(4):1662–1674. https://doi.org/10.1080/00207543.2017.1367107

Velvizhi G, Shanthakumar S, Das B, Pugazhendhi A, Priya TS, Ashok B, Nanthagopal K, Vignesh R, Karthick C (2020) Biodegradable and non-biodegradable fraction of municipal solid waste for multifaceted applications through a closed loop integrated refinery platform: Paving a path towards circular economy. Sci Total Environ 731:138049. https://doi.org/10.1016/j.scitotenv.2020.138049

Vermunt DA, Negro SO, Verweij PA, Kuppens DV, Hekkert MP (2019) Exploring barriers to implementing different circular business models. J Clean Prod 222:891–902. https://doi.org/10.1016/j.jclepro.2019.03.052

Wijethilake C, Lama T (2019) Sustainability core values and sustainability risk management: Moderating effects of top management commitment and stakeholder pressure. 28(1):143-154.https://doi.org/10.1002/bse.2245

Yadav G, Luthra S, Jakhar SK, Mangla SK, Rai DP (2020) A framework to overcome sustainable supply chain challenges through solution measures of industry 40 and circular economy: An automotive case. J Clean Prod 254:120112. https://doi.org/10.1016/j.jclepro.2020.120112

Yager RR (2017) Generalized Orthopair Fuzzy Sets. IEEE Trans Fuzzy Syst 25(5):1222–1230. https://doi.org/10.1109/TFUZZ.2016.2604005

Yang K, Duan T, Feng J, Mishra AR (2021) Internet of things challenges of sustainable supply chain management in the manufacturing sector using an integrated q-Rung Orthopair Fuzzy-CRITIC-VIKOR method. J Enterp Inf Manag. https://doi.org/10.1108/JEIM-06-2021-0261

Yazdani M, Tavana M, Pamučar D, Chatterjee P (2020) A rough based multi-criteria evaluation method for healthcare waste disposal location decisions. Comput Ind Eng 143:106394. https://doi.org/10.1016/j.cie.2020.106394

Yazdani M, Wen Z, Liao H, Banaitis A, Turskis Z (2019a) A grey combined compromise solution (CoCoSo-G) method for supplier selection in construction management. J Civ Eng Manag 25(8):858–874

Yazdani M, Zarate P, Kazimieras Zavadskas E, Turskis Z (2019b) A combined compromise solution (CoCoSo) method for multi-criteria decision-making problems. Manag Decis 57(9):2501–2519. https://doi.org/10.1108/MD-05-2017-0458

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article has been retracted. Please see the retraction notice for more detail:https://doi.org/10.1007/s12063-024-00449-5

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bai, L., Garcia, F.J.S. & Mishra, A.R. RETRACTED ARTICLE: Adoption of the sustainable circular supply chain under disruptions risk in manufacturing industry using an integrated fuzzy decision-making approach. Oper Manag Res 15, 743–759 (2022). https://doi.org/10.1007/s12063-022-00267-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12063-022-00267-7