Abstract

Accelerating the cultivation and development of the residential rental property (hereafter, rental property) market is an indispensable part of improving China’s housing market system, and the rationality of rental prices has become the focus of social attention in this development process. Drawing on geospatial big data, such as rental data collected from 5i5j and Points of Interest (POI) facilities in Hangzhou, this paper examines spatial distribution characteristics of rental property and associated rents in Hangzhou using GIS spatial analysis and employs a spatial multilevel model to investigate the determinants of such rents. The results indicate that the spatial distribution and kernel density distribution of rental property and associated rents in Hangzhou are alike, being characterized by a similar center-edge structure. Furthermore, considering the positive spatial autocorrelation of rents in Hangzhou, three spatial proxy variables are filtered out through eigenvector spatial filtering analysis to reduce the spatial autocorrelation problem. In addition, the spatial multilevel model witnesses the best goodness-of-fit when compared with the traditional ordinary last squares (OLS) and multilevel models. The results of the spatial multilevel model show that residential rents in Hangzhou are affected by both individual-level and street-level factors. At the individual level, building characteristics such as house area, number of bedrooms, decoration grade, story, and age are the major determinants. At the street level, distance to cultural and sports facilities is negatively associated with rents, while distance to bus stations, 3A hospitals (three first-class hospitals), and commercial complexes is positively associated with them. Comparing the impact intensity of various distance variables, distance to city center and public transit has the largest impact on rents in Hangzhou, followed by distance to educational, medical, and living facilities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The rented residential market is an indispensable part of the housing market system around the world. However, according to the 2020 China population census, the national home-ownership rate in China has reached 80.29%, which is much higher than that in other developed countries (Goodman & Mayer, 2018; Voigtländer, 2009) and indicates a shortage in the rental housing supply in China. To solve the problem of inadequate residential rental property (hereafter, rental property) in China, particularly in big cities, central and local governments have attached great importance to coordinating development between rental and owner-occupied housing in recent years. As the 2020 China population census yearbook shows, the national floating population reached 375.82 million, an increase of 69.73% over 2010, of which the inter-provincial floating population accounted for 124.84 million. Moreover, the floating population in China mainly migrates to economically developed areas, including urban agglomerations and metropolitan areas (Chen et al., 2021), thereby bringing much demand for rental property and leading to higher rents in China’s big cities. Since rents play an important role in affecting tenants’ housing pressure and quality of life (Shamsuddin & Campbell, 2022), understanding the spatial distribution of such rents in Chinese cities and their determinants is particularly necessary for policy-makers and urban planners to sustain the steady and sound development of the rented residential market in China.

A large number of studies has been conducted to identify the factors affecting house prices or rents at different spatial scales. From a macroscopic perspective, house prices and rents at the national or regional scale are mainly determined by the fundamentals of urban socioeconomic and housing supply. Previous studies have found that levels of economic development and household income (Kuroki, 2019; Wang et al., 2022), rate of migration and urbanization (Saiz, 2007; Wang et al., 2017), industrial structure (Landis et al., 2002), and quality of the living environment (Zhan et al., 2021) are all positively associated with house prices and rents. Other studies have examined the relationship between financial factors, such as loan interest rates and monetary policy, and housing value and found that loose monetary policy is beneficial in increasing house prices and rents (Duan et al., 2021; Huang et al., 2015). With the growing attention to environmental quality, a vast literature has investigated the role of urban environment factors in determining house prices and rents and found that better air quality tends to increase both (Ou et al., 2022; Zhang et al., 2021). Other studies have found that the quality of urban amenities can also be capitalized into house prices and rents (Huang et al., 2015; Liu et al., 2021).

From a microscopic perspective, hedonic pricing theory insists that the price of property is not determined by the commodity itself, but the attributes or characteristics attached to it (Rosen, 1974). Following this theory, the determinants of house prices and rents at the intra-city level are mainly building, location, and neighborhood characteristics. In terms of building characteristics, extensive studies have found that interior factors such as house area, number of bedrooms, story, degree of decoration, and age are important influences on house prices and rents (Li et al., 2019; Mathur, 2022). With respect to location characteristics, distance to city center (Shen et al., 2021; Wen et al., 2015) and proximity to public transport (Jun & Kim, 2017)are found to be predictors of house prices and rents. As regards neighborhood characteristics, the role of neighborhood amenities, such as proximity to schools, hospitals, and urban green spaces, has been widely discussed in the literature, and houses with convenient, accessible, or high-quality urban amenities tend to be positively associated with higher house prices and rents (Glaesener & Caruso, 2015; Hu et al., 2019b; Wen et al., 2015). A small subset of studies has found that, in addition to the neighborhood’s physical environment, its social environment, such as crime rate and socioeconomic status, is also related to house prices and rents (Ihlanfeldt & Mayock, 2010; Myers, 2004; Wang et al., 2021).

On the whole, most existing hedonic price model studies at the micro level have focused on the factors influencing house prices. Empirical evidence on the determinants of rents remains lacking, particularly in developing countries such as China. Due to disparity in access to public services, homeowners and tenants tend to have different housing choice preferences for urban amenities and building characteristics, further affecting people’s willingness to pay house prices and rents (Cui et al., 2018). Some emerging studies have provided evidence of differences in the determinants affecting house prices and rents. For instance, Liu et al. (2018) took Chengdu in China as a case study and found that haze has a different degree of impact intensity on house sale and rental prices. Cui et al. (2018) used house purchase and rent transaction data in 2017 in Beijing and showed that homeowners prefer a higher-quality living environment, while renters are more concerned with proximity to an employment center and public transit convenience.

In terms of research methods, various extended hedonic price models have been utilized to examine the determinants of house prices and rents. Among them, the ordinary least squares (OLS) regression model is the most widely utilized approach due to its easy interpretation and estimation (Schläpfer et al., 2015); however, it fails to consider the spatial dependence of property prices, which may lead to a biased parameter estimation. To solve potential spatial autocorrelation problems, an increasing number of studies has extended the traditional hedonic price model using the OLS approach to spatial hedonic price models using the spatial error model, spatial lag model, and geographically weighted regression model (Cohen & Coughlin, 2008; Sohn et al., 2020; Wen et al., 2018). In addition, the eigenvector spatial filtering model (SFM) is a typical spatial regression method used to solve spatial autocorrelation problems in observations and has been widely used in urban and regional studies (Griffith et al., 2019; Tiefelsdorf & Griffith, 2007), but its application in identifying the determinants of house prices and rents is still very limited (McCord et al., 2019). Other than spatial spillover effect, house prices and rents within the same neighborhood or spatial unit are generally more alike than those from different neighborhoods or spatial units, showing a typical cluster effect (Chasco & Gallo, 2013). Considering data hierarchy structure in housing prices and rents data, extensive work has used the multilevel hedonic price model as an alternative, as it can better deal with nested data and examine the contextual effects of higher-level spatial units (Glaesener & Caruso, 2015). However, the ordinary multilevel model has also been criticized for neglecting the contextual effects from nearby neighborhoods due to the potential role of nearby neighborhoods’ environment in determining local housing prices and rents (Hu et al., 2019a). To fill the gaps in the existing research methods, the spatial multilevel model, which considers both the clustering effects of data hierarchical structure and neighborhood spatial spillover effects for the observations, has been increasingly recognized as an alternative approach for exploring the determinants of house prices and rents (Dong et al., 2019; Hu et al., 2019a). However, studies on the determinants of rents using the spatial multilevel hedonic price model are still very limited, particularly in China’s metropolitan areas, where there is great demand for rental property.

During the past decade, driven by the rapid growth of the permanent resident population in Hangzhou and soaring house prices, the development of rental property in Hangzhou has also witnessed a rapid increase. Moreover, Hangzhou, which was selected as one of the first 12 pilot cities for rental property development in 2017, serves as a demonstration and policy experience for the development of China’s rental property market. Against this backdrop, taking Hangzhou as our study case and drawing on rental data obtained from the 5i5j website, this study examined the spatial distribution characteristics of rental properties and associated rents in Hangzhou and employed a spatial multilevel model to explore the determinants of rents, with the aim of providing insight into demand for rental properties to inform the development of the rental property market in China. More specifically, this study attempts to: (1) explore the spatial distribution characteristics of rental properties and associated rents in Hangzhou; (2) investigate whether there are both spatial spillover effects and contextual effects of rents in Hangzhou; and (3) reveal the determinants of rents in Hangzhou using the spatial multilevel model and compare goodness-of-fit among the different hedonic price models.

Materials and Methods

Research Framework

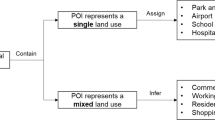

Following the research framework of the hedonic price model proposed by Rosen (1974), this study selected 16 explanatory variables related to residential rents in Hangzhou from the dimensions of building, location, and neighborhood characteristics. Considering the fact that a large number of rent observations in Hangzhou had similar location and neighborhood characteristics, it was considered inappropriate to use the traditional OLS regression model to eliminate intra-group differences for the rents sample, and multilevel hedonic models were more favored in a large number of studies. To ensure the independence of samples, a suitable model should consider the contextual effect of the hierarchical structure on rental data and the spatial spillover effect on rents from nearby neighborhood characteristics. Following insights from previous studies(Hu et al., 2019a; Kim & Kim, 2019), this study employs a spatial multilevel model approach which combines the eigenvector SFM and the traditional multilevel model to construct an analytical framework to identify the determinants of rents in Hangzhou (Fig. 1).

Data Sources

The data used in our study include rental data and urban facility POI data. Of these, rental data were collected from rental property listings in Hangzhou on the 5i5j online rental platform (https://hz.5i5j.com/) in December 2020. The obtained data include monthly rents, latitude and longitude coordinates, house area, story, and other building characteristics. In terms of spatial distribution, rental properties in Hangzhou are mainly concentrated in the central urban areas (e.g., Shangcheng District, Xiacheng District, Jianggan District, Gongshu District, Xihu District, and Binjiang District) and several suburban municipal districts, such as Yuhang District and Xiaoshan District. Moreover, as there is relatively little information on rental properties in other districts in Hangzhou, we selected the above eight urban districts as our study area, which includes 13,719 samples of rental properties within 100 streets or towns in the Hangzhou metropolitan area.

The data for the explanatory variables, such as urban location and facilities data, were obtained from government websites in Hangzhou and the Amap Company. The data consisted of a total of 7399 spatial point elements, involving city centers and various types of urban facilities (e.g., public transit and educational, medical, and living facilities). Of these, accessibility to city centers and public transit are classified as location characteristic variables, while accessibility to urban facilities is classified as a neighborhood characteristic variable. Spatial point elements for the city centers and urban facilities were all geocoded by geographic location coordinates piker API in the Amap Company and transformed into the WGS1984 geographic coordinate system. Lastly, a geospatial database regarding rents and their determinants in Hangzhou was constructed. In this study, accessibility to city centers and various types of urban facilities were calculated using the shortest distance method by ArcGIS 10.8 software. Table 1 shows the descriptive statistics of the variables used in the study.

Research Methods

The spatial multilevel model can combine the advantages of both the traditional multilevel and spatial econometric models (e.g., eigenvector SFM or spatial lag model) (Dong et al., 2015; Park & Kim, 2014), which integrate both contextual effects on rents from local streets and spatial spillover effects from nearby streets. The specific formula of the spatial multilevel model is as follows:

where the spatial multilevel model can be divided into two parts, namely fixed effects and random effects. Of these, fixed effects are established through multilevel model equations, while random effects address spatial autocorrelation in the observations. \(\mathrm{Ln}{R}_{ij}\) represents the natural logarithm of housing rents for property i on street j, where i and j represent the number of the individual’s rental property and street, respectively. \({\upgamma }_{00}\) represents the mean value of rents among all the streets; \({\upgamma }_{01}\) represents the estimated coefficients of the street-level explanatory variables \({\mathrm{Z}}_{\mathrm{j}}\); \({\upgamma }_{10}\) represents the estimated coefficients of the individual-level explanatory variables; \({X}_{ij}\) are the control variables for the street-level variables \({\mathrm{Z}}_{\mathrm{j}}\); \({\mathrm{r}}_{\mathrm{ij}}\) represents the error term at the individual level; and \({\upmu }_{0\mathrm{j}}\) and \({\upmu }_{1\mathrm{j}}\) are the street-level error term and coefficients of the explanatory variables. The spatial proxy variable is introduced into the multilevel model by using the eigenvector spatial filtering technique. The formula is as follows:

where the linear combination of eigenvectors \(\mathrm{E\gamma }\) is introduced into the multilevel model as a spatial proxy variable to separate the spatial signal from the random effects of spatial autocorrelation witnessed at the street level, leaving only the white noise \({\mu }_{0j}^{^{\prime}}+{\mu }_{1j}^{^{\prime}}{X}_{ij}\). The regression results produced by the above-mentioned filtering process are unbiased, thereby improving the explanatory power of the model.

To compare model fit across different regression models, we took Akaike Information Criterion (AIC) as a measure. Generally, a smaller AIC value indicates a better model fit. The eigenvector SFM was run by R 4.2.0 software, and the parameter estimation of all other regression models was implemented by Stata 15.0 software.

Results and Discussion

Spatial Distribution of Rental Properties and Rents

Figure 2a is a kernel density distribution for rental properties in Hangzhou. As shown, the spatial distribution of such properties in Hangzhou is characterized by central agglomeration and low density in the suburban areas. More specifically, many streets located in the urban central areas, such as Wenhui Street, Shangtang Street, and Caihe Street, witness the highest kernel density of rental properties, while streets in the suburban areas, such as Yuhang Street and Yunhe Street, show the lowest kernel density of rental properties.

Figure 2b shows the spatial distribution characteristics of the street-level average rents in Hangzhou, which present a spatial structure characteristic of “center-periphery.” In other words, the spatial distribution of rents in Hangzhou decreases from the inner city to the outer city. More specifically, streets with higher rents are mainly distributed in the central urban areas, including Wulin Street, Qingbo Street, and Xintang Street, whose monthly rents all exceed 90.41 yuan/m2. In contrast, streets with lower rents include Yuhang Street, Xianlin Street, and Yunhe Street, where the monthly rent is less than 47.12 yuan/m2. Comparing Fig. 2a and b, it can be seen that the spatial distribution of higher value for rental properties is somewhat similar to that of the corresponding rents in Hangzhou, and both show a certain degree of center-edge spatial structure. This result aligns with many previous research findings highlighting that the higher rents are witnessed around the city center(Chen et al., 2016; Tomal, 2020). The most likely explanation for this is that that the city center in Hangzhou is characterized by the more demand for rental market and much better neighborhood environment.

Spatial Proxy Variable Extraction

To explore the spatial spillover effect of rents in Hangzhou, the spatial statistical analysis tool in the ArcGIS 10.8 software was utilized to measure global spatial autocorrelation characteristics of street-level rents. The analysis shows that the global Moran’s I index of rents in Hangzhou is 0.404, passing the significance test at the 1% level, indicating that there is a significant positive spatial correlation of rents at street level in Hangzhou. Therefore, our study should consider the spatial dependence of rents in Hangzhou when discussing the determinants affecting such rents.

Our study employs a new spatial hedonic price model, named the SFM, to deal with the spatial dependence of rents. The core principle of the SFM is to filter out the spatial spillover effect in the residuals by adding the extracted spatial proxy variables, which is conducive to keeping the basic formula of the ordinary multilevel model and expanding the original model into a spatial multilevel model. In this study, street-level rents were used as the dependent variable in the SFM, and street-level explanatory variables, such as distance to Wulin Square, civic center, bus station, subway station, and elementary school, were used as independent variables to filter eigenvectors. The final modeling result using SFM extracted three eigenvectors, which are also denoted as spatial proxy variables.

Figure 3 shows the spatial distribution of the three spatial proxy variables extracted by SFM, all of which show a positive spatial autocorrelation pattern. The high-value areas of the first two spatial proxy variables (Sf1 and Sf2), illustrated in Fig. 3a and b, show a spatial clustering in the central urban areas, while the high-value areas of the third spatial proxy variable (Sf3), mapped in Fig. 3c, is relatively scattered in the suburban areas. The results of the global spatial autocorrelation analysis for the three spatial proxy variables show that the global Moran’s I index was 0.468 (P < 0.01), 0.152 (P < 0.01), and 0.026 (P = 0.160), respectively, indicating that the first two spatial proxy variables have a significant positive spatial correlation, while the last one has no significant spatial autocorrelation, and that these three filtered spatial proxy variables can effectively reduce the spatial autocorrelation of street-level rents in Hangzhou.

Modeling the Determinants of Rents in Hangzhou

Comparison of Benchmark Model Results

To examine whether contextual effects exist for street-level rents, we adopt a multilevel hedonic price approach to explore the determinants of rents in Hangzhou. Before running the multilevel model, we ran a null model to determine whether using such an approach would be appropriate. The results of the null model show that the variances of rents in Hangzhou at the individual and street level are 0.086 and 0.098, respectively, and the calculated intra-group correlation coefficient (ICC) is 53.4%, indicating that street-level factors can explain 53.4% of the total variance of rents in Hangzhou, which is much larger than the recommended standard of 5.9% to use a multilevel model (Cohen, 1988). Therefore, adopting a multilevel hedonic price model approach was necessary in our study, considering the hierarchical structure of rental data in Hangzhou.

Table 2 shows the regression results in the benchmark models for the determinants of rents in Hangzhou. Models 1–3 in Table 2 are the regression results for the OLS model, multilevel model, and SFM, respectively. The results of the three models in Table 2 all show that rents in Hangzhou are determined by both individual-level and street-level factors, and the multilevel model outperforms the spatial filtering and OLS models in terms of goodness-of-fit, with AIC values of -72.757, 648.404, and 788.218, respectively.

Spatial Multilevel Model Results

Considering that both contextual and spatial spillover effects impact rents in Hangzhou, this study utilized the spatial multilevel model, which combines the multilevel and spatial econometric models, to investigate the determinants of such rents. The spatial multilevel model results show that its AIC value is -75.505, which is also smaller than the AIC value of the other benchmark models, as presented in Table 2, indicating that the spatial multilevel model has a better goodness-of-fit than other regression models. Therefore, this study focuses on the results analysis of the spatial multilevel model listed in Table 3.

(1) Individual-Level Variables

In terms of individual-level variables, building characteristics such as house area, number of bedrooms, decoration grade, floor level, and age all have a significant relationship with rents in Hangzhou, having passed the significance test at a 1% level. Of these, number of bedrooms and decoration grade are found to be positively associated with rents in Hangzhou, with regression coefficients of 0.017 and 0.106, respectively. That is to say, for every 1% increase in the number of bedrooms and decoration grade, rents can increase by 0.017% and 0.106%, respectively. This finding aligns with previous research (Cui et al., 2018), which found that properties with more bedrooms and a higher decoration grade sold or rented for higher values.

House area, floor level, and age are found to have a significant negative relationship with rents in Hangzhou. Of these, the regression coefficient of house area on rents is -0.003, indicating that a larger house area tends to reduce rent per unit area. This finding conforms with the results of previous research (Cui et al., 2018; Tomal, 2020), which can be explained by the fact that there is a marginally decreasing relationship between housing consumption utility for renters and living area; hence, a larger house area is likely to reduce rent per unit area. The effect coefficient of floor level on rents is -0.010, indicating that the rent for higher-story properties is obviously lower than that for lower-story ones. This is contrary to some previous findings (Tomal, 2020; Yang et al., 2020), but concurs with the results of other studies (Wen et al., 2015). A possible reason is that many old rental properties remain in the central areas in Hangzhou which lack elevators or basic public-service facilities, thereby decreasing higher-story rents. House age is negatively associated with rents in Hangzhou, with a regression coefficient of -0.008, indicating that rents tend to be lower in older properties, as is consistent with earlier work (Tomal, 2020; Wen et al., 2018).

(2) Street-Level Variables

In terms of street-level variables, both location and neighborhood characteristics are found to have a significant association with rents in Hangzhou. As regards location characteristics, distance to Wulin Square and the civic center are both found to be negatively associated with such rents. For every 1% increase in distance to Wulin Square and the civic center, rents increase by 0.216% and 0.151%, respectively, indicating that higher accessibility to city centers can cause rents to increase. This finding can be attributed to the fact that urban dwellers living in the central area of Hangzhou generally have more employment opportunities, better urban public services, and shorter commuting times, leading to a greater demand for rental property and higher rents. Compared with the regression coefficients for distance to the city center, the magnitude of the regression coefficient for distance to Wulin Square is much larger than that for the distance to the civic center, indicating that distance to Wulin Square, considered to be the old city center, plays a more important role in determining rents in Hangzhou.

As regards access to public transit, distance to a subway station is negatively associated with rents in Hangzhou, with a regression coefficient of -0.033, suggesting that rents decrease by 0.033% for every 1% increase in distance to a subway station from the rental property, everything else equal. This finding implies that a shortened distance to a subway station for rental properties induces higher rents, and access to a subway station plays an important role in affecting rents in Hangzhou. Contrarily, the distance to a bus station is positively associated with rents in Hangzhou, with a regression coefficient of 0.092. That is, for every 1% increase in the distance to a bus station, rents increase by 0.092%, assuming all other factors constant. Although previous research findings found a positive correlation between public transit and house prices or rents (Yang et al., 2020), a possible explanation for the depressing effect of distance to bus station on rents in Hangzhou is that potential negative externalities, such as traffic congestion and noise, frequently accompany proximity to bus stations, and the operational efficiency and service quality of buses still need to improve to meet the demand of many tenants.

With regard to neighborhood characteristics, urban facilities such as educational, medical, and living facilities are all found to have a significant association with rents in Hangzhou. As regards educational facilities, distance to primary school and university are both significantly negatively associated with such rents. Every 1% increase in the distance to a primary school and university can decrease rents by 6.0% and 2.5%, respectively, indicating that proximity to these educational resources is beneficial for increasing rents in Hangzhou, which is in line with most previous findings (He, 2017; Wen et al., 2018). As regards medical facilities, distance to a 3A hospital has a significant positive relationship with rents in Hangzhou, with a regression coefficient of 0.016, indicating that proximity to a 3A hospital unexpectedly lowers rents in Hangzhou. Although previous studies have found a mixed or nonlinear relationship between hospitals and house prices or rents (Tomal, 2020; Yuan et al., 2018), our findings support a negative association between proximity to a 3A hospital and rents in Hangzhou. This may be explained by the fact that the potential traffic congestion, noise, and solid waste surrounding 3A hospitals would lower the quality of the living environment for nearby urban dwellers.

In terms of living facilities, distance to cultural and sports facilities has a significant negative impact on rents in Hangzhou, with a regression coefficient of -0.022, indicating that better accessibility to cultural and sports facilities is conducive to increasing such rents. Distance to a commercial complex has a significant positive impact on rents, with a regression coefficient of 0.016, indicating that accessibility to a commercial complex has a negative effect on rents in Hangzhou. This finding contradicts previous findings which insisted on the value-added effect of business districts (Jang & Kang, 2015; Pope & Pope, 2015). This finding may be due to the limited consumption capacity of the tenant group and the fact that the locations of some new-built commercial complexes in suburban areas are likely to decrease shopping demand from tenants, leading to a negative association between access to a commercial complex and rents in Hangzhou.

Comparison of Impact Intensity of Distance Variables on Rents

Figure 4 compares the impact intensity of distance variables related to location characteristics and neighborhood characteristics on rents in Hangzhou. As shown, distance to a bus station, 3A hospital, and commercial complex are all significantly and positively associated with such rents. Conversely, distance to Wulin Square, the civic center, and a subway station, primary school, university, cultural and sports facility, and commercial complex are negatively associated with such rents. The findings further verify the robustness of our modelling analysis results and suggest that distance variables associated with location and neighborhood characteristics are crucial factors affecting rents in Hangzhou. Moreover, despite being significant in the OLS and SFMs, several explanatory variables in the multilevel model and spatial multilevel model, such as distance to a community hospital and an urban park, have no significant association with rents in Hangzhou. This finding indicates that accessibility to a community hospital and an urban park is not a crucial predictor of rents in Hangzhou when considering the nested characteristic of housing rent data.

Comparing the impact intensity of the estimated coefficients in the different hedonic price models, location variables such as distance to Wulin Square and a civic center, subway station, and bus station witness the largest impact, indicating that location characteristics are the most important factors influencing rents in Hangzhou. This result is consistent with that of previous studies in the Chinese context(Chen et al., 2016; Liu et al., 2022). Furthermore, in line with most previous findings(Li et al., 2019; Wen et al., 2018), neighborhood characteristics such as distance to a primary school, university, and cultural and sports facility also see higher impact coefficients, indicating these neighborhood characteristics have relatively strong effects on rents in Hangzhou. Lastly, distance to a 3A hospital and commercial complex see the smallest impact intensity and significantly positive correlation with rents in Hangzhou, inconsistent with findings documented in Shenzhen(Hu et al., 2019b).

Conclusions

Drawing on rental data in Hangzhou collected from the website 5i5j, this paper utilized GIS spatial analysis to examine the spatial distribution characteristics of rental properties and rents in Hangzhou. It further employed the spatial multilevel model to investigate the determinants of rents in Hangzhou. This study draws the following conclusions.

First, the spatial distribution pattern and kernel density distribution of rental property and rents in Hangzhou are very similar, as both show a spatial structure of a “center-edge” pattern. Of the two, the kernel density distribution of rental property listings in Hangzhou presents a spatial distribution characteristic of central-area agglomeration. The kernel density of rental property listings is higher in central urban areas and lower in suburban areas. In terms of rents, the spatial gradient of rents in Hangzhou also shows a decreasing trend from the city center to the periphery.

Second, the average street-level rent in Hangzhou witnesses a significant positive spatial correlation with the global Moran’s I index of 0.404, indicating that there is a significant spatial spillover effect on rents in Hangzhou at the street level. To address the spatial dependence in rents, three spatial proxy variables were filtered out through an eigenvector spatial filtering approach, their corresponding Moran’s I index being 0.468, 0.152, and 0.026, respectively, indicating that these three can effectively address the spatial autocorrelation problem of rents in Hangzhou.

Third, the spatial multilevel model outperforms other hedonic price models in explaining the determinants of rents in Hangzhou. More specifically, the AIC values in the spatial multilevel model, multilevel model, SFM, and OLS model are -75.505, -72.757, 648.404, and 788.218, respectively, indicating that the spatial multilevel model, which considers both the hierarchical data characteristics and contextual effects, has the best goodness-of-fit.

Fourth, the results of the spatial multilevel model show that building, location, and neighborhood characteristics are all potential predictors influencing rents in Hangzhou. At the individual level, building characteristics such as house area, number of bedrooms, decoration grade, story, and age are significantly associated with rents in Hangzhou. At the street level, location characteristics such as distance to Wulin Square, the civic center, and a subway station have a significant and negative relationship with rents in Hangzhou, while distance to a bus station has a significant and positive association with such rents. With regard to neighborhood characteristics, distance to a primary school, university, and cultural and sports facility are found to have a significantly negative association with rents in Hangzhou, while distance to a 3A hospital and commercial complex are reported to have a significant and positive association with such rents.

Last, comparing the impact intensity of various distance variables at the street level, distance to Wulin Square, the civic center, and public transportation facilities have the greatest impact on rents in Hangzhou, followed by distance to a primary school, cultural and sports facility, 3A hospital, and commercial complex.

Our contributions to the existing literature include the following aspects. First, this study enriches hedonic price model studies on the determinants affecting rents from a perspective of the rental property market. Second, this study provides crucial theoretical and methodological contributions to reveal spatial distribution characteristics and determinants of rents in a Chinese metropolis. Theoretically, our study builds a new analytical framework of the determinants of rents in Hangzhou considering both spatial dependence at the street level and hierarchical structure characteristics of rental data, and differentiating traditional building, location, and neighborhood characteristics into different hierarchical factors. The research results can provide scientific evidence for promoting the reasonable pricing and stable and healthy development of rental property in domestic metropolises. Methodologically, our study employed a spatial multilevel model to identify the determinants affecting rents and showed the best model goodness-of-fit, providing a method reference for modelling the determinants of rents in other metropolises worldwide.

Some limitations in this study should be noted. First, it only considered the rents included in the rental data for ordinary residences in Hangzhou published by the website 5i5j and may have neglected the rental information published by other rental property websites as well as for institutions such as long-term rental apartments. Additionally, the impact of COVID-19 on the rental market has also not been well considered. Future research should combine long-term rental apartments in the rental property data of Hangzhou and the official monitoring data of rents provided by the governments’ rental property platform information system to reveal spatial patterns and the determinants of different types of rental property’s rent value. Second, due to data availability, neighborhood effect factors considered at the street level remain limited. Factors such as street socioeconomic status, crime rate, employment opportunities, and other formal rental property supply could also affect rents in Hangzhou. Future research can incorporate more neighborhood-level factors, such as socioeconomic status and security, to examine neighborhood contextual effects on rents. Last, compared with spatial multilevel model employed in other studies (Dong & Harris, 2015; Dong et al., 2020), this study has only considered spatial autocorrelation effects on rents at the neighborhood level. Future studies should continue to expand the spatial multilevel model, dealing with spatial autocorrelation effects of rents in Hangzhou at both property scale and neighborhood scale.

Our findings have at least three policy implications: First, government and planning bureau in Hangzhou should reasonably plan the spatial location of rental housing. Since access to urban CBD has a more important impact on rents in Hangzhou, rents nearby the urban centers are generally higher. Thus, government should strengthen the supply of affordable rental housing near the urban centers or provide more rent subsidies for local tenants. Second, government agencies in Hangzhou should strengthen the construction of public service facilities around rental housing. It is found that the accessibility of public service facilities such as subway stations, primary schools, universities and cultural and sports facilities can be capitalized into rents in Hangzhou. Therefore, strengthening the construction of supporting public service facilities around rental houses is conducive to improving the overall rents. Third, government departments in Hangzhou should pay attention to the coordinated construction of neighborhood environment. As the spatial multilevel model results showed that the local neighborhood environment may have a spatial spillover effect on the rents in the nearby neighborhoods, so it is essential to strengthen the coordinated construction of the neighborhood environment across different neighborhoods, which is conducive to realizing the value of the neighborhood environment to a greater extent.

Data Availability

Rental properties data were collected from rental property listings in Hangzhou on the 5i5j online rental platform (https://hz.5i5j.com/) in December 2020.

References

Chasco, C., & Gallo, J. L. (2013). The impact of objective and subjective measures of air quality and noise on house prices: A multilevel approach for downtown Madrid. Economic Geography, 89, 127–148.

Chen, L., Xi, M., Jin, W., & Hu, Y. (2021). Spatial pattern of long-term residence in the urban floating population of China and its influencing factors. Chinese Geographical Science, 31, 342–358.

Chen, Y. M., Liu, X. P., Li, X., Liu, Y. L., & Xu, X. C. (2016). Mapping the fine-scale spatial pattern of housing rent in the metropolitan area by using online rental listings and ensemble learning. Applied Geography, 75, 200–212.

Cohen, J. (1988). Statistical Power Analysis for the Behavioral Sciences. Technometrics, 31, 499–500.

Cohen, J. P., & Coughlin, C. C. (2008). Spatial hedonic models of airport noise, proximity, and housing prices. J Regional Sci, 48, 859–878.

Cui, N., Gu, H., Shen, T., & Feng, C. (2018). The impact of micro-level influencing factors on home value: A housing price-rent comparison. Sustainability-Basel, 10, 4343.

Dong, G., Harris, R., Jones, K., & Yu, J. (2015). Multilevel modelling with spatial interaction effects with application to an emerging land market in Beijing, China. PLoS ONE, 10, e0130761.

Dong, G., Wolf, L., Alexiou, A., & Arribas-Bel, D. (2019). Inferring neighbourhood quality with property transaction records by using a locally adaptive spatial multi-level model. Computers, Environment and Urban Systems, 73, 118–125.

Dong, G. P., & Harris, R. (2015). Spatial Autoregressive Models for Geographically Hierarchical Data Structures. Geographical Analysis, 47, 173–191.

Dong, G. P., Ma, J., Lee, D. C., Chen, M. X., Pryce, G., & Chen, Y. (2020). Developing a Locally Adaptive Spatial Multilevel Logistic Model to Analyze Ecological Effects on Health Using Individual Census Records. Annals of the American Association of Geographers, 110, 739–757.

Duan, J., Tian, G., Yang, L., & Zhou, T. (2021). Addressing the macroeconomic and hedonic determinants of housing prices in Beijing Metropolitan Area, China. Habitat International, 113, 102374.

Glaesener, M.-L., & Caruso, G. (2015). Neighborhood green and services diversity effects on land prices: Evidence from a multilevel hedonic analysis in Luxembourg. Landscape and Urban Planning, 143, 100–111.

Goodman, L. S., & Mayer, C. (2018). Homeownership and the American Dream. Journal of Economic Perspectives, 32, 31–58.

Griffith, D., Chun, Y., & Li, B. (2019). Spatial regression analysis using eigenvector spatial filtering. Academic Press.

He, S. Y. (2017). A hierarchical estimation of school quality capitalisation in house prices in Orange County, California. Urban Studies, 54, 3337–3359.

Hu, L., Chun, Y., & Griffith, D. A. (2019a). A multilevel eigenvector spatial filtering model of house prices: A case study of house sales in Fairfax County, Virginia. ISPRS International Journal of Geo-Information, 8, 508.

Hu, L., He, S., Han, Z., Xiao, H., Su, S., Weng, M., & Cai, Z. (2019b). Monitoring housing rental prices based on social media: An integrated approach of machine-learning algorithms and hedonic modeling to inform equitable housing policies. Land Use Policy, 82, 657–673.

Huang, D. J., Leung, C. K., & Qu, B. (2015). Do bank loans and local amenities explain Chinese urban house prices? China Economic Review, 34, 19–38.

Ihlanfeldt, K., & Mayock, T. (2010). Panel data estimates of the effects of different types of crime on housing prices. Regional Science and Urban Economics, 40, 161–172.

Jang, M., & Kang, C.-D. (2015). Retail accessibility and proximity effects on housing prices in Seoul, Korea: A retail type and housing submarket approach. Habitat International, 49, 516–528.

Jun, M.-J., & Kim, H.-J. (2017). Measuring the effect of greenbelt proximity on apartment rents in Seoul. Cities, 62, 10–22.

Kim, S., & Kim, Y. (2019). Spatially filtered multilevel analysis on spatial determinants for malaria occurrence in Korea. International Journal of Environmental Research and Public Health, 16, 1250.

Kuroki, M. (2019). Imbalanced sex ratios and housing prices in the US. Growth and Change, 50, 1441–1459.

Landis, J. D., Elmer, V., & Zook, M. (2002). New economy housing markets: Fast and furious—but different? Housing Policy Debate, 13, 233–274.

Li, H., Wei, Y. D., & Wu, Y. (2019). Analyzing the private rental housing market in Shanghai with open data. Land Use Policy, 85, 271–284.

Liu, G., Zhao, J., Wu, H., & Zhuang, T. (2022). Spatial Pattern of the Determinants for the Private Housing Rental Prices in Highly Dense Populated Chinese Cities—Case of Chongqing. Land, 11, 2299.

Liu, R. Q., Yu, C., Liu, C. M., Jiang, J., & Xu, J. (2018). Impacts of Haze on Housing Prices: An Empirical Analysis Based on Data from Chengdu (China). International Journal of Environmental Research and Public Health, 15, 1161.

Liu, X., Jiang, C., Wang, F., & Yao, S. (2021). The impact of high-speed railway on urban housing prices in China: A network accessibility perspective. Transportation Research Part A: Policy and Practice, 152, 84–99.

Mathur, S. (2022). Non-linear and weakly monotonic relationship between school quality and house prices. Land Use Policy, 113, 105922.

McCord, M. J., McCord, J., Davis, P. T., Haran, M., & Bidanset, P. (2019). House price estimation using an eigenvector spatial filtering approach. International Journal of Housing Markets and Analysis, 13, 845–867.

Myers, C. K. (2004). Discrimination and neighborhood effects: Understanding racial differentials in US housing prices. Journal of Urban Economics, 56, 279–302.

Ou, Y., Zheng, S., & Nam, K.-M. (2022). Impacts of air pollution on urban housing prices in China. Journal of Housing and the Built Environment, 37, 423–441.

Park, Y. M., & Kim, Y. (2014). A spatially filtered multilevel model to account for spatial dependency: Application to self-rated health status in South Korea. International Journal of Health Geographics, 13, 1–10.

Pope, D. G., & Pope, J. C. (2015). When Walmart comes to town: Always low housing prices? Always? Journal of Urban Economics, 87, 1–13.

Rosen, S. (1974). Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. Journal of Political Economy, 82, 34–55.

Saiz, A. (2007). Immigration and housing rents in American cities. Journal of Urban Economics, 61, 345–371.

Schläpfer, F., Waltert, F., Segura, L., & Kienast, F. (2015). Valuation of landscape amenities: A hedonic pricing analysis of housing rents in urban, suburban and periurban Switzerland. Landscape and Urban Planning, 141, 24–40.

Shamsuddin, S., & Campbell, C. (2022). Housing cost burden, material hardship, and well-being. Housing Policy Debate, 32, 413–432.

Shen, H., Li, L., Zhu, H., Liu, Y., & Luo, Z. (2021). Exploring a Pricing Model for Urban Rental Houses from a Geographical Perspective. Land, 11, 4.

Sohn, W., Kim, H. W., Kim, J.-H., & Li, M.-H. (2020). The capitalized amenity of green infrastructure in single-family housing values: An application of the spatial hedonic pricing method. Urban Forestry & Urban Greening, 49, 126643.

Tiefelsdorf, M., & Griffith, D. A. (2007). Semiparametric filtering of spatial autocorrelation: The eigenvector approach. Environment and Planning A, 39, 1193–1221.

Tomal, M. (2020). Modelling housing rents using spatial autoregressive geographically weighted regression: A case study in Cracow, Poland. ISPRS International Journal of Geo-Information, 9, 346.

Voigtländer, M. (2009). Why is the German homeownership rate so low? Housing Studies, 24, 355–372.

Wang, X.-R., Hui, E.C.-M., & Sun, J.-X. (2017). Population migration, urbanization and housing prices: Evidence from the cities in China. Habitat International, 66, 49–56.

Wang, Y., Wu, K., Jin, L., Huang, G., Zhang, Y., Su, Y., Zhang, H.o., Qin, J., (2021). Identifying the Spatial Heterogeneity in the Effects of the Social Environment on Housing Rents in Guangzhou, China. Applied Spatial Analysis and Policy, 14, 849-877.

Wang, Y., Wu, K., Zhao, Y., Wang, C., & Zhang, H. O. (2022). Examining the Effects of the Built Environment on Housing Rents in the Pearl River Delta of China. Applied Spatial Analysis and Policy, 15, 289–313.

Wen, H., Xiao, Y., Hui, E. C., & Zhang, L. (2018). Education quality, accessibility, and housing price: Does spatial heterogeneity exist in education capitalization? Habitat International, 78, 68–82.

Wen, H., Zhang, Y., & Zhang, L. (2015). Assessing amenity effects of urban landscapes on housing price in Hangzhou, China. Urban Forestry & Urban Greening, 14, 1017–1026.

Yang, L., Chu, X., Gou, Z., Yang, H., Lu, Y., & Huang, W. (2020). Accessibility and proximity effects of bus rapid transit on housing prices: Heterogeneity across price quantiles and space. Journal of Transport Geography, 88, 102850.

Yuan, F., Wu, J. W., Wei, Y. D., & Wang, L. (2018). Policy change, amenity, and spatiotemporal dynamics of housing prices in Nanjing, China. Land Use Policy, 75, 225–236.

Zhan, D., Kwan, M.-P., Zhang, W., Xie, C., & Zhang, J. (2021). Impact of the Quality of Urban Settlements on Housing Prices in China. Journal of Urban Planning and Development, 147, 05021044.

Zhang, H., Chen, J., & Wang, Z. (2021). Spatial heterogeneity in spillover effect of air pollution on housing prices: Evidence from China. Cities, 113, 103145.

Funding

This work was supported by the National Natural Science Foundation of China (42001120), Fundamental Research Funds for the Provincial Universities of Zhejiang (GB202103004).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhan, D., Xie, C., Zhang, J. et al. Investigating the Determinants of Housing Rents in Hangzhou, China: A Spatial Multilevel Model Approach. Appl. Spatial Analysis 16, 1707–1727 (2023). https://doi.org/10.1007/s12061-023-09530-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12061-023-09530-1