Abstract

The Irish economic boom resulted in a substantial increase in car-ownership and commuting. These trends were particularly noticeable in the Greater Dublin Area (GDA), with an unprecedented increase in employment levels and private car registrations. While employment dropped by an overall 6 % during the recent economic recession, the already increasing process of suburbanisation around Irish main cities continued. The commuting belt around Dublin extended beyond the GDA with a substantial number of individuals commuting long distances. The aim of this paper is to examine the impact of both monetary and non-monetary commuting costs on the distribution of employment income in Ireland. The Census of Population is the only nationwide source of information on commuting patterns in Ireland. However, this data set does not include information on individual income. In contrast, SMILE (Simulation Model for the Irish Local Economy) contains employment income data for each individual in Ireland. Using data from the Census of Population of Ireland, discrete choice models of commuting mode choice are estimated for three sub-samples of the Irish population based on residential and employment location and the subjective value of travel time (SVTT) is calculated. The SVTT is then combined with the SMILE data to produce a geo-referenced, attribute rich dataset containing commuting, income, demographic and socio-economic data. Results show that the monetary and non-monetary costs of commuting are highest among those living and working in the GDA.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Increasing commuting distances has been negatively associated with the growing patterns of suburbanisation experienced in developed economies (Lyons and Chatterjee 2008; Sultana and Weber 2007). Commuting is a mechanism to balance the geographical mismatch between the supply and the demand for labour. According to the traditional urban economic theory, residential location is the result of the trade-off between commuting costs and housing costs (Alonso 1964; Mills 1972; Muth 1969). Households decide to locate their residence further from work and have greater commuting costs in exchange for lower housing costs. In contrast to this model, search theory assumes that labour and housing markets are not perfectly competitive and that workers cannot fully minimise their commuting costs (Rouwendal 2004; Van Ommeren et al. 1999; Van Ommeren and Rietveld 2007). According to search theory, increasing commuting distances are the outcome of a job search process where longer commutes have been traded for higher wage rates (Sandow and Westin 2010). Contemporary workforce specialisation gives rise to labour markets offering few potential jobs within ‘reasonable’ distance, and therefore give rise to so-called ‘thin labour markets’ (Manning 2003; Sandow and Westin 2010). Therefore, the impact of the labour market on commuting behaviour relates to workers’ skills and occupations, with a direct relationship between high education levels and increased mobility and commuting distances (Eliasson et al. 2003; Gruber 2010; Hazans 2004; Prashker et al. 2008; Sandow 2008; Van Ham 2001).

This research is concerned with the impact of commuting behaviour on the spatial distribution of employment income in Ireland. Evidence suggests that increased employment in professional and managerial posts in the Greater Dublin Area (GDA) and other Irish cities has led to higher salaries in these areas (Morrissey and O’Donoghue 2011). At the same time, levels of commuting have increased across the country, particularly in the GDA (Vega and Reynolds-Feighan 2009; Commins and Nolan 2011). Total commuting costs, being the sum of monetary and time costs, can be quite substantial. For a worker with an eight-hour working day and a one-way commute of half an hour, the total commuting costs are estimated to be about 10 % of the daily wage (Rouwendal and van Ommeren 2007). About 70 % of these costs are due to time costs and about 30 % due to monetary costs (Rouwendal and van Ommeren 2007; Small and Verhoef 1992).

While travel distance and the subsequent cost burden on individuals have been of interest to transport researchers for some time (Jara-Díaz 2000), much of this research has focused on quantifying the cost of commuting across different locations and socio-economic groups (Hazans 2004). With the exception of Hazans (2004) work on commuting patterns in Estonia, Latvia and Lithuania, where commuting was shown to substantially reduce wage differentials between capital cities and rural areas, as well as between capital cities and other cities, little research has sought to account for the cost of commuting on employment income. This lack of research is not due to lack of policy interest in this area, but rather to address such a question a variety of microdata containing both commuting and income data is required (Lovelace et al. 2014).

The aim of this paper is to examine the impact of both monetary and non-monetary commuting costs on the distribution of employment income in Ireland. The Census of Population of Ireland is the only nationwide source of information on commuting patterns in the country. However, this data set does not include information on individual income. In contrast, SMILE (Simulation Model for the Irish Local Economy) contains employment income data for each individual in Ireland. The paper combines both methodologies to present a unique dataset for Ireland that allows to obtain the spatial distribution of the impact of commuting on employment income at the electoral district (ED) level.

Linking spatial microsimulation models to exogenous models provides a powerful tool for examining a wider range of policy questions (Smith et al. 2006; Morrissey et al. 2008; Van Leeuwen 2010; Tomintz et al. 2013). Spatial microsimulation is a means of synthetically creating large-scale micro-datasets at different geographical scales. The development and application of spatial microsimulation models offers considerable scope and potential to analyse the individual composition of an area so that specific policies may be directed to areas with the greatest need for that policy (Birkin and Clarke 2012). To date a number of techniques have been developed to produce spatial microsimulation models, including Iterative Proportional Fitting (IPF), deterministic reweighting (Ballas et al. 2005), combinational optimisation (Voas and Williamson 2001) and GREGWT (Lymer et al. 2008). Each of these methods results in the synthesis of spatial microdata by combining small area census data with survey data. In other words, the models simulate virtual populations to match real aggregate data (Birkin and Clarke 2012; Tanton 2014).

Using data from the 2011 Census of Population of Ireland, discrete choice models of commuting mode choice are estimated for three sub-samples of the Irish population based on residential and employment location. The subjective value of travel time (SVTT) is then calculated for each of these areas. This value of travel time is then combined with the SMILE data to produce a unique geo-referenced, attribute rich dataset containing commuting, income, demographic and socio-economic data. Such a dataset currently does not exist for Ireland. However, linking data created by a spatial microsimulation model within a travel to work framework provides the necessary data to examine the relative impact of commuting on the spatial distribution of employment income at the small area level in Ireland. Results from this research also extend previous research on commuting in Ireland (Commins and Nolan 2010, 2011).

The paper is structured as follows: the next section provides a detail account of the spatial microsimulation methodology and data used in the paper. Section 3 provides a theoretical introduction to the value of travel time and the modelling framework, followed by data and estimation results. Section 4 shows the results obtained from linking the travel demand model and the SVTT with the spatial microsimulation model. Section 5 includes the discussion of the results.

Spatial Microsimulation: Data and Methods

In order to model the impact of commuting travel times on employment income, spatially referenced micro-data is required. Small Area Population Statistics (SAPS) data contains census information disaggregated to the electoral division level. Electoral Divisions (EDs) are the smallest legally defined administrative areas in Ireland. There are 3440 EDs with a mean population of 1346 (S.D = 2197), ranging from 73 to 36,057 individuals. Based on the SAPS dataset, the Place of Work School Census of Anonymised Records (POWSCAR) dataset for 2011 is geographically referenced (ED level) commuting dataset for Ireland. For the first time, POWSCAR 2011 contains detailed commuting data for the entire population both adults and children. All workers resident in Ireland on Census night were coded to their place of work and all Irish resident students from the age of 5 and upwards were coded to their place of school/college. The commuting data contained in POWSCAR includes residential ED location; work ED Location, distance to work, travel time to work and mode choice. However, similar to SAPS, POWSCAR does not contain income information. In contrast, household survey data such as the Survey of Income and Living Conditions (SILC) contains income and employment information at the individual and household level.

The SILC is a nationally representative survey that began in 2003 and replaced the Living in Ireland Survey, which ended in 2001. The sampling frame used for the SILC is the Irish Register of Electors. The dataset contains a variety of demographic and socio-economic characteristics, including income, employment and household composition statistics. However, while the SILC dataset contains employee and income data at the micro level this data is only available at a coarse spatial scale – the NUTS2 regional variable, which contains two regions, the Border, Midlands and West region and the South East region). As such, any analysis using the SILC survey is constrained to the national level. Furthermore, the SILC dataset does not contain commuting data. Using a matching algorithm to link the data in the SILC with the small area level SAPS and POWSCAR data, a much richer dataset would be obtained that would allow an examination of the variations in the value of commuting travel times relative to disposable income across the Irish regions and spatial microsimulation techniques can be used to accomplish this.

SMILE was developed by the Rural Economy Development Programme (REDP), Teagasc and the School of Geography, University of Leeds (Ballas et al. 2006; Morrissey et al. 2008). The first version of SMILE, referred to as SMILE2002 for the purpose of this paper, was based on 2002 Census of Population data and the Living in Ireland Survey (2001) and used a combinational optimisation algorithm, simulated annealing (Morrissey et al. 2008). However, although simulated annealing allows to model both individual and household processes, the algorithm requires significant computational intensity due to the degree to which new household combinations are tested for an improvement in fit during the simulation (Farrell et al. 2012; Hynes et al. 2009). As a result, to create SMILE 2006 and SMILE 2011 and match the Small Area Population Statistics (SAPS, 2011), SILC (2010) and POWSCAR (2011) datasets, a more computationally efficient method known as quota sampling (QS) was developed by Farrell et al. 2012).

QS requires both the spatially referenced aggregate data and micro level datasets outlined above. Similar to the process of SA (Morrissey et al. 2008) survey data are reweighted according to key constraining totals, or ‘quotas’, for each local area. For both SMILE 2006 and 2011, these quotas are provided by the SAPS dataset. Five matching constraints were used in developing SMILE 2011; these include the number of individuals in each ED, the number of households in each ED, the number of individuals in each household, a tabulated age, sex variable and education level. In SMILE, the unit of analysis consists of individuals grouped into households while the constraints can be either at the individual or household level. One of the key goals of the QS method is to achieve computational efficiency. To achieve this efficiency the QS process is apportioned into a number of iterations based on an ordered repeated sampling procedure (Farrell et al. 2012).

In practice, the implementation of QS raises a number of issues (Morrissey et al. 2014; Farrell et al. 2012). These issues include a bias towards sampling smaller households, an inability to adequately simulate certain demographic groups due to disparities between survey and census data distributions and difficulties in allocating the final few households due to the increasingly restrictive nature of quota counts as the simulation progresses. To overcome these issues an ordered constraint procedure where groups that are difficult to allocate, particularly large households and households containing children, are selected first (Farrell et al. 2012). Following this step, the sampling procedure admits under-represented groups. Finally, to overcome prohibitively restrictive quota counts, a process similar to the swapping of households in simulated annealing is required (see Morrissey et al. 2008). This is achieved by removing each constraint one by one until the quota is met. Constraints are removed in reverse order of the degree to which they influence household income (Farrell et al. 2012). This is determined by pre-synthesis regression analysis (Edwards and Tanton 2012). This design minimises subjectivity, whereby the broadening of constraints is only introduced when absolutely necessary and in a manner, which ensures that, variables that explain the greatest level of variability are retained to the greatest extent. Generally all quotas are filled and this stage is skipped. As noted by Farrell et al. (2012) ordering the constraints in such a manner may cause validation issues to arise, in that the distribution for larger households or under-represented groups may be less robust. However, any modelling method that aims to simplify real-world complexity will have issues. To decrease these issues, validation of the QS output is an integral component of the model’s construction.

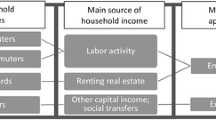

Calibration

The computation cost of QS and other methods of generating small area data limit the number of constraints one can use (Morrissey and O’Donoghue 2011; Farrell et al. 2012). However the spatial heterogeneity of the simulated data depends upon achieving the correct multivariate relationship with non-constraining variables, as well as the constraining variables. The need to optimise computational efficiency, whilst ensuring the spatial heterogeneity of the simulated dataset means that a calibration mechanism must be used (Morrissey et al. 2013; Morrissey and O’Donoghue 2011). The purpose of the calibration procedure is to align the small area level data within SMILE with exogenous data on labour force participation and income. The procedure operates in two stages. The first stage estimates a set of equations (logistic or multinomial) determining the presence of an income based on labour force participation. The second step involves predicting the level of income for individual using logged income regression models. A full description and application of the calibration method in terms of labour force and income distributions and socio-economic characteristics and health service utilisation is provided by Morrissey and O’Donoghue (2011) and Morrissey et al. (2013), respectively.

Using a probabilistic alignment technique the spatial distribution of unconstrained labour market characteristics are calibrated against their original SAPS totals. Once the correct distribution of these variables has been established, the level of income is calibrated according to external county level national accounts data (CSO, 2011). Definitional differences between micro level and national accounts data prohibit calibrating income in absolute terms, as scaling average income by source to the national accounts total can affect the distributional properties of the data. Thus, the calibration procedure is augmented in a step-wise fashion to ensure average county income-by-income source (i.e. market income, social welfare income, capital income, etc.) corresponds to county level national accounts. This allows the same distribution properties of the underlying income data to be largely maintained (Morrissey et al. 2014).

Finally, the newly calibrated data must be validated to ensure that the alignment process was successful and that the newly calibrated micro level income data represents the exogenous income totals. The newly calibrated data was validated using an external, out-of-sample validation technique (Caldwell 1996). Out-of-sample validation involves comparing the synthetically created microdata with new, external data. From a spatial perspective, the income data was validated against the county income estimates at the county level, while the weighted SILC was used to validate income estimates at the regional level. Table 1 presents the result of the income validation at the county level. Examining the real CSO income estimates and the simulated estimates on can see that although definitional issues arise when linking micro and macro level data, the simulated income data is very close to CSO data, with an average percentage difference of less than 1 %. Sligo showed the lowest percentage difference between the simulated and CSO data, with a 0.01 % difference. The simulated data for both Offaly, Monaghan and Meath had the highest difference, 4.24 %, 3.91 % and 3.27 % respectively. It is however important to note that comparing the rank distributions between the CSO and simulated data that Meath maintains its distribution rank (6 CSO, 6 simulated data). The difference between the CSO and simulated data for Monaghan is however larger (23 CSO, 18 simulated). Thus, the SMILE alignment procedure still over estimates the average income in County Monaghan. Overall, with regard to the difference in rank between the CSO and simulated data, it was found that the cross county distribution of income was mostly maintained with Dublin having the highest income per person and Donegal the lowest.

Travel to Work Model

Since the economic theory of the valuation of time was first introduced in the 1960s, the subject of time allocation has been explored from different perspectives. Becker (1965) was the first to introduce the cost of time in the traditional theory of choice, with the idea of a value attached to the time assigned to particular activities. Under Becker’s (1965) theory, individual satisfaction came from final goods, with market goods and time for preparation and consumption as necessary inputs. Soon after Becker’s (1965) paper, this theory was re-formulated by Johnson (1966) and later by Oort (1969) to incorporate work time and travel time into the basic utility function. Their research showed that including work time within the utility function led to a value of time equal to the wage rate plus the subjective value of work, which is the ratio between the marginal utility of work and the marginal utility of income (Jara-Díaz 2000).

The daily trip to work is ubiquitious, yet its characteristics vary from person to person and place to place (Lovelace et al. 2014). An individual must choose between a set of discrete alternatives (transport modes), given the choices that are available to them. Following research by Train and McFadden (1978), the analysis of travel behaviour has been increasingly based on disaggregated data within discrete choice models. Discrete choice models may be used to estimate the probability of an individual decision-maker choosing particular alternative from a set of alternatives, as a function of the attributes of the choice and the demographic and socio-economic characteristics of the individual (Commins and Nolan 2011). Similar to the original research by Becker (1965), these models are grounded in consumer utility theory whereby the individual chooses among alternatives with the aim of maximising personal utility depending on G, the volume of goods and services they can buy, L, the amount of ‘leisure’ time they have, and T the amount of time they have to spend travelling. Travel can occur by different modes i, involving different costs and travel times. Since total money and time budgets are fixed, travel costs and times impact on the amount of other goods and the amount of leisure time available. The problem can be set out as an utility maximisation problem follows:

where M is the total money budget available, c i is the cost of travel associated with mode i, Ti* is the minimum travel time by mode i and T is the total time available. The three Lagrangean multipliers associated with each of the restrictions to the problem above, λ, μ, ψ 1 , …, ψ M ≥ 0, can be interpreted as follows: λ is the marginal utility of income or money (the shadow price of relaxing the budget constraint), μ is the marginal utility of time in terms of relaxing the total time constraint, and ψ i is the marginal utility due to relaxing the minimum travel time of mode I (Bates 1987). After carrying out a first order approximation of the direct utility, Bates (1987) obtains the following formulation:

where the cost parameter coincides with the negative of the marginal utility of income (βc = − λ) and the travel time parameter for mode i is equal to the negative of the marginal utility of relaxing the minimum travel time of model I \( \left({\upbeta}_{{\mathrm{T}}_{\mathrm{i}}}=-{\uppsi}_{\mathrm{i}}\right) \). This formulation justifies the introduction of travel time and travel cost as explanatory variables of modal choice. Also, given that these parameters can be interpreted as marginal utilities, the marginal rate of substitution between time and money corresponds to the \( {\beta}_{T_i}/{\beta}_c \) ratio. This can be interpreted as the marginal propensity to pay to save travel time by a given mode, which is what is generally known as the subjective value of travel time (SVTT), (Mackie and Nelthorp 2001).

Data

The data used in this paper for the travel to work model comes from the Place of Work Census of Anonymised Records (POWSCAR) from the 2011 Census of Population of Ireland. Due to the substantial difference in population density and public transport provision, the model is estimated for 3 sub-regions: (i) Greater Dublin Area – Dublin County Borough, Fingal, South Dublin, Dun-Laoghaire-Rathdown, Kildare, Meath, Wicklow and Louth, (ii) Other Provincial Cities – Cork, Limerick, Galway and Waterford and (iii) Other Towns and Rural Areas. Table 2 shows the commuting patterns of the three sub-regions.

The sample excludes those working from home and those with a mobile place of employment. To ease the computational burden, a 10 % random sample is used to estimate the models. Each observation contains socio-economic information such as age, gender, household type, housing tenure, marital status, education level, socio-economic group and industrial group, as well as the land use characteristics of the electoral districts for the origin-destination journey to work, travel time, distance and main mode of transport. All variables are self-reported.

In this application, an individual chooses between two modes of travel to work: (1) Motorcycle, Car Driver or Car Passenger and (2) Bus or Train. Mode availability is taken into account in the estimation process and the probabilities are computed accordingly. The attributes of the alternatives and the characteristics of the decision maker included are those typically used for modelling travel mode choice. While (self-reported) travel times for the chosen modes of travel to work are available in the data, the travel times for the non-chosen modes are not. The method employed by De Palma and Rochat (2000) is used to estimate the travel times for the non-chosen alternatives in the data set. A comprehensive analysis of the alternative formulations for generating a travel time variable for Ireland was carried out in Commins and Nolan (2010), where De Palma and Rochat’s (2000) approach was found to be the most robust method in this regard. Travel cost information is constructed as a basic measure of cost per kilometre using information on 2006 public transport fares and the overall cost of driving a car (including insurance, tax, depreciation and fuel costs) from the National Transport Authority of Ireland. In addition to the alternative-specific variables, a number of socio-economic variables are used for the analysis. These include the gender, age, education level, socio-economic group, the nature of residential occupancy and the residential and employment location. Variable definitions are presented in Table 3.

Estimation Results

The results of the discrete choice model for the three regions under analysis are shown in Table 4. Version 1.8 of Bierlaire Optimization Toolbox for General Extreme Value Model Estimation (BIOGEME) was used to estimate the model (Bierlaire 2003, 2009). BIOGEME is a freeware package designed for the development of research in the context of discrete choice models in general, and of Generalized Extreme Value models in particular (McFadden, 1978).

Overall, the results are consistent with those previously reported in previous studies by Commins and Nolan (2010, 2011) for the same study area. The probability of driving to work is significantly lower for those with third-level qualifications living in the GDA. This is consistent with previous results for the same region (see Commins and Nolan 2011 for details). A possible explanation may have to do with the potential environmental awareness of those with higher levels of education who may prefer to use public transport alternatives. However, this is not the case in other provincial cities and towns and rural areas, where the opposite pattern is observed. This may respond to the well-documented lack of public transport options outside the capital city (Rau and Vega 2012).

In terms of the land use dummy variable for the GDA model, those working in Dublin City are less likely to use their private car to commute to their workplace. In the case of the GDA, age is a significant predictor of the choice of mode of travel. Older individuals are more likely to use the car in comparison with those aged 15–34. As expected, high car ownership in the household is a strong predictor of the level of car use across the entire country. Those living in the so-called “commuter counties” of Meath, Kildare, Wicklow and Louth are significantly more likely to travel to work by car.

Being female is associated with an increase probability of travelling by public transport in all areas, but the estimates are non-significant outside the GDA. When compared with those who own their residential property, individuals in rented accommodation have an increased probability of travelling by public transport.

With regard to the socio-economic group, individuals classified as manual-skilled, semi-skilled and unskilled are more likely to use a private car in the GDA and Other Towns and Rural Areas than the reference category. This contrasts with the estimates obtained for non-manual workers when compared with those in the top socio-economic group in each of the three regions, who are less likely to use their private car.

The alternative-specific estimates for travel time and travel cost are highly significant in all sub-regions. A generic specification is presented in the paper. According to the theoretical framework presented in Section 2, it is expected that the estimates for the travel time and travel cost variables present a negative sign. The subjective value of travel time (SVTT) in Euros per hour is shown in Table 5.

In the GDA, the SVTT for commuting is €10/h. The largest SVTT is obtained for other provincial cities, while the SVTT for commuters in Other Towns and Rural Areas is substantially lower. A possible explanation for this result is that those areas included under other provincial cities are primarily comprised of urban and sub-urban districts, possibly subject to heavy traffic congestion due to limited public transport options and in some cases, longer commuting distance. Overall, the values obtained from the analysis are in line with those used by the Department of Transport Common Appraisal Framework (DTTAS 2016).

Combining the Travel Demand Model with SMILE

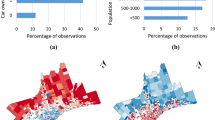

Once the travel demand model has been estimated using the POWSCAR dataset, the estimates are merged with the employment income data produced by SMILE to obtain the spatial distribution of the impact of commuting relative to employment income at the ED level. It is important to note that employment income refers to income derived from employee or self-employed based work in its gross form. Using small area level referenced microdata extends the previous research on commuting in Ireland outlined above (Commins and Nolan 2010, 2011; Nolan 2010). Figures 1a and b show the spatial distribution of the average monetary travel cost and travel time at the electoral district level for Ireland. While the average travel cost does not show clear spatial patterns, there are strong urban effects in the average travel time, which is notably higher around main urban areas and it is particularly evident in the case of the GDA. Figure 2 shows the standard deviation from the mean difference between average travel cost and travel time. Results show that electoral districts with a significant difference between both travel indicators are found across Dublin’s commuting districts and along the main transport corridors into the capital, which tend to be subject to high congestion levels.

The data presented in this paper shows the consequences of the Irish economic boom, which resulted in a substantial increase in car-ownership and commuting (Brady and O’Mahony 2011). These trends were particularly noticeable in the GDA, which saw an increase in employment by 48.9 % and private car registrations by over 60 % over the period 1996–2006 (Brady and O’Mahony 2011). Research by Morgenroth (2002) found that during this period, the commuting belt around Dublin extended beyond the GDA and that a substantial number of individuals commuted long distances. While there was a decrease in levels of commuting in 2011 as a result of the economic downturn, the effects of the recent economic boom are still visible. Within this context, Fig. 3 provides the net travel cost (NTC) at the small area level for Ireland. This measure takes into account for each ED the monetary cost per kilometre as well as the monetary cost per minute of commuting. The commuter counties within the GDA - Meath, Kildare, Wicklow and Louth - show the highest net travel cost in the country (€8205 - €13,227). Figure 3 also shows the spatial distribution of net travel costs of other Irish cities, with particularly high levels found around the hinterlands of Galway and Cork. Meredith and van Egeraat (2013) note that Galway (12 %) and Cork (20 %) have seen the highest increase in employment between 2001 and 2006, which may partially explain the high levels in net travel costs. Rural areas in the West, North West and South West have the lowest net travel costs. However, these regions are characterised by high farming rates, particularly in comparison to the East of the country.

Figure 4 presents the net travel cost relative to employment income at the ED level. The cost of commuting as a percentage of income shows a clear spatial pattern across the GDA and the suburban areas of Galway, Cork, Limerick and Waterford. However, Dublin City shows a relatively low net travel cost as a percentage of income when compared to its commuter hinterland and other Irish cities. The highest percentage is found across the GDA, particularly to the West and North of Dublin City, with costs between 29 % and 33 % of employment income. This would indicate that whilst the employment profile of employees in the GDA is predominately professional (Morrissey and O’Donoghue 2011), commuting costs represent a high share of employment income. Outside the GDA there is a clear spatial pattern in the relative cost of commuting.

An additional objective of this paper is to establish if lesser commuting costs impact positively on employment income relative to high commuting areas. Table 6 presents the average income rank, the net commuting cost as a percentage of income and the average income rank once commuting costs have been taken into account for each county in Ireland. Suburban areas of Dublin – Dun Laoghaire, Fingal and South Dublin – rank at the top in terms of income as well as counties along Dublin’s commuter belt such as Wicklow and Kildare. Table 6 shows that both Meath and Kildare experience the largest impact of commuting relative to employment income followed by Wicklow and the Dublin City suburbs. Once commuting costs are accounted for, commuters in County Kildare move from having the 9th highest income to having the 15th highest. Commuters in County Meath, moving from the 21st highest income position to the 28th, also experience a large impact. The results reflect the high cost of commuting for individuals living in the commuting counties around Dublin.

The counties that experience the highest increase are those that are outside of the main commuting zones, with commuters in Longford and Offaly, rising 5 income positions, while commuters in a number of counties, including Tipperary North, Roscommon and Monaghan all increasing income positions. The results presented here illustrate how spatial microsimulation modelling can be used to address previously unanswered research questions, the spatial economic impact of commuting relative to income at the micro level.

Discussion

During the Irish economic boom years or the so-called Celtic Tiger period, which took place from the mid-1990s to the mid-2000s, Ireland experienced an unprecedented rise in commuting distances within extended local labour market areas. These new commuting patterns, driven by a dispersed settlement structure and an uncontrolled property bubble that had developed over the previous five years (Fitzgerald 2014), resulted in an increasingly uneven spatial distribution of commuting costs across Irish regions. Simultaneously, increased employment in professional and managerial posts in the GDA and other Irish cities led to higher salaries in these regions (Morrissey and O’Donoghue 2011). This paper is concerned with the overall net effect of these developments, where higher salaries in urban areas were accepted in exchange for increased levels of commuting and urban sprawl, in particular within the GDA. This research sheds light on the impact that dispersed commuting and settlement patterns had on the spatial distribution of employment income across Ireland. To examine this, data from a spatial microsimulation model was combined with a standard travel demand model and the estimated subjective values of travel time (SVTT).

The economic crisis that hit Ireland in 2008, together with the policy developments that followed, namely the severe fiscal adjustment, have further emphasised these regional disparities. Results from this research show that while there is a relatively better provision of transport infrastructure in the GDA than in the rest of the country, the net cost of commuting in this region is significantly higher. This is particularly evident in the case of the commuter counties adjacent to Dublin City, which also present some of the highest levels of average income in the country. Overlying these results are longer-term development processes driven by complex patterns of residential and employment location and the subsequent need for longer commuting distances, which are only likely to be improved by the implementation of effective spatial planning policies.

Conclusion

Linking spatial microsimulation models to exogenous models provides a powerful tool for examining a wider range of policy questions (Smith et al. 2006; Morrissey et al. 2008; Van Leeuwen 2010). The aim of this paper is to examine the impact of both monetary and non-monetary commuting costs on the distribution of employment income in Ireland. The lack of information on individual income within the Census of Population of Ireland, which is the only nationwide source of information on commuting patterns in Ireland, sets the rationale for the methodology presented in this paper. The paper combines a spatial microsimulation model (SMILE) with a standard travel demand model for commuting choices to present a unique dataset for Ireland that allows to obtain the spatial distribution of the impact of commuting on employment income at the electoral district (ED) level.

Increased employment in professional and managerial posts in the GDA and other Irish cities led to higher salaries in these areas (Morrissey and O’Donoghue 2011). At the same time, levels of commuting increased across the country, particularly in the GDA (Vega and Reynolds-Feighan 2009; Commins and Nolan 2011). This was accompanied by significant investments in transport infrastructure, which have primarily focused on public transport improvements in the GDA and the development of the inter-urban motorway network (Vega and Reynolds-Feighan 2012). Incorporating data from a spatial microsimulation model within a travel demand model, it was found that while there is a relatively better provision of transport infrastructure in the GDA than in the rest of the country, the net cost of commuting in this region is significantly higher. This is particularly evident in the case of the commuter counties adjacent to Dublin City, which also present some of the highest levels of average income in the country. This paper shows that in the case of the GDA, higher income levels do not compensate for the cost commuting in these areas, which results in a relative drop in the county level income ranking. Further analysis found that other Irish cities show high net commuting costs as a percentage of income, in particular Galway City and its commuter hinterland. In contrast, the relative impact of commuting on employment income is significantly lower outside the primary commuting belts, particularly smaller towns and rural areas.

In conclusion, it is obvious that sophisticated tools are required to understand the complex dynamics that underlie labour markets and their impacts at the local and individual level. Less obvious however, is the need for sophisticated micro data detailing the residential and employment location for each employee, along with their demographic, socio-economic, labour force participation, income, resource usage, etc., profile. Combining the data created by a spatial microsimulation model within a travel demand model allows for a novel analysis of the impact of commuting on employment income at the small area level in Ireland. Understanding these impacts has implications for transport policy and transport infrastructure prioritisation at the national and regional level. The type of analysis presented in this paper and the uneven spatial distribution of the impact of commuting on employment income provide policy makers with additional tools for design and implementation of future transport infrastructure investment strategies.

References

Alonso, W. (1964). Location and land use. Toward a general theory of land rent. Cambridge: Harvard Univiversity Press.

Ballas, D., Clarke, G., Dorling, D., Eyre, H., Thomas, B., & Rossiter, D. (2005). SimBritain: a spatial microsimulation approach to population dynamics. Population, Space and Place, 11(1), 13–34.

Ballas, D., Clarke, G., & Wiemers, E. (2006). Spatial microsimulation for rural policy analysis in Ireland: The implications of CAP reforms for the national spatial strategy. Journal of Rural Studies, 22(3), 367–378.

Bates, J. (1987). Measuring travel time values with a discrete choice model: a note. The Economic Journal, 97, 493–498.

Becker, G. (1965). A Theory of the allocation of time. The Economic Journal, 75, 493–517.

Bierlaire, M. (2003). BIOGEME: a free package for the estimation of discrete choice models. In Swiss Transport Research Conference (No. TRANSP-OR-CONF-2006-048).

Bierlaire, M. (2009). Estimation of discrete choice models with BIOGEME 1.8. Transport and Mobility Laboratory, École Polytechnique Fédérale de Lausanne (EPFL): Lausanne.

Birkin, M., & Clarke, G. (2012). The enhancement of spatial microsimulation models using geodemographics. Annals of Regional Science, 49(2), 515–532.

Brady, J., & O’Mahony, M. (2011). Travel to work in Dublin. The potential Impacts of Electric Vehicles on Climate Change and Urban Air Quality. Transportation Research Part D: Transport and Environment, 16(2), 188–193.

Caldwell, S. (1996). Health, wealth, pensions and life paths: The CORSIM dynamic microsimulation model. Contributions to Economic Analysis, 232, 505–522.

Commins, N., & Nolan, A. (2010). Car ownership and mode of transport to work in Ireland. The Economic and Social Review, 41(1), 43–75.

Commins, N., & Nolan, A. (2011). The determinants of mode of transport to work in the. Greater Dublin Area Transport Policy, 18(1), 259–268.

CSO (Central Statistics Office) (2011). National Accounts 2011. Dublin: Central Statistics Office.

De Palma, A., & Rochat, D. (2000). Mode choices for trips to work in Geneva: an empirical analysis. Journal of Transport Geography, 8(1), 43–51.

DTTAS (2016). Department of Transport, Tourism and Sport Common Appraisal Framework for Transport Projects and Programmes, Dublin.

Edwards, K. L., & Tanton, R. (2012). Validation of spatial microsimulation models. In Spatial Microsimulation: A Reference Guide for Users (pp. 249–258). Springer Netherlands.

Eliasson, K., Lindgren, U., & Westerlund, O. (2003). Geographical labour mobility: migration or commuting? Regional Studies, 37(8), 827–837.

Farrell, N., Morrissey, K., & O’Donoghue, C. (2012). Creating a spatial microsimulation model of the irish local economy. In R. Tanton & E. Edwards (Eds.), Spatial microsimulation: a reference guide for users (pp. 200–217). London: Springer.

Fitzgerald, J. (2014). Ireland’s recovery from crisis. In CESifo Forum. Ifo Institute for Economic Research at the University of Munich, 15(2), 8–13.

Gruber, S. (2010). To migrate or to commute? Review of Economic Analysis, 2(1), 110–134.

Hazans, M. (2004). Does commuting reduce wage disparities? Growth and Change, 35, 360–390.

Hynes S, Morrissey K, O’Donoghue C, Clarke G. (2009) A spatial microsimulation analysis of methane emissions from irish agriculture. Ecological Complexity, 6 (2). pp. 135–146.

Jara-Díaz, S. (2000). Allocation and valuation of travel time savings. In D. A. Hensher & K. Button (Eds.), Transport modelling, handbooks in transport (pp. 304–319). Oxford: Pergamon Press.

Johnson, M. (1966). Travel time and the price of leisure. Western Economics Journal, 4, 135–145.

Lovelace, R., Ballas, D., & Watson, M. (2014). A spatial microsimulation approach for the analysis of commuter patterns: from individual to regional levels. Journal of Transport Geography, 34, 282–296.

Lymer, S., Brown, L., Yap, M., & Harding, A. (2008). Regional disability estimates for New South Wales in 2001 using spatial microsimulation. Applied Spatial Analysis and Policy, 1(2), 99–116.

Lyons, G., & Chatterjee, K. (2008). A human perspective on the daily commute: costs, benefits and trade-offs. Transport Reviews, 28(2), 181–198.

Mackie, P., & Nelthorp, J. (2001). Cost–benefit analysis in transport. In K. Button & D. Hensher (Eds.), Handbook of transport systems and traffic control (pp. 143–174). Oxford: Elsevier.

Manning, A. (2003). The real thin theory: monopsony in modern labour markets. Labour Economics, 10(2), 105–131.

McFadden, D. (1978). Modeling the choice of residential location. Transportation Research Record 673, pp. 72–77.

Meredith, D., & Van Egeraat, C. (2013). Revisiting the National Spatial Strategy ten years on. Administration, 60(3), 3–9.

Mills, E. S. (1972). Studies in the structure of the urban economy. John Hopkins Press: Baltimore.

Morgenroth, E. L. (2002). Commuting in Ireland: an analysis of inter-county commuting flows. Dublin: Economic and Social Research Institute.

Morrissey, K., & O’Donoghue, C. (2011). The spatial distribution of labour force participation and market earning at the sub-national level in Ireland. Review of Economic Analysis, 2, 80–101.

Morrissey, K., Clarke, G., Ballas, D., Hynes, S., & O’Donoghue, C. (2008). Analysing Access to GP Services in Rural Ireland using micro-level Analysis. Area, 40(3), 354–364.

Morrissey, K., O’Donoghue, C., Clarke, G., & Li, J. (2013). Using simulated data to examine the determinats of acute hospital demand at the small area level. Geographical Analysis, 45(1), 49–76.

Morrissey, K., O’Donoghue, C., & Farrell, N. (2014). The local impact of the marine sector in Ireland: a spatial microsimulation analysis. Spatial Economic Analysis, 9(1), 31–50.

Muth, R. F. (1969). Cities and housing; the spatial pattern of urban residential land use. University of Chicago Press: Chicago

Nolan, A. (2010). A dynamic analysis of household car ownership. Transportation research part A: policy and practice, 44(6), 446–455.

Oort, C. (1969). The evaluation of traveling time. Journal of Transport Economics and Policy, 1, 279–286.

Prashker, J., Shiftan, Y., & Hershkovitch-Sarusi, P. (2008). Residential choice location, gender and the commute trip to work in Tel Aviv. Journal of Transport Geography, 16(5), 332–341.

Rau, H., & Vega, A. (2012). Spatial (im) mobility and accessibility in Ireland: Implications for transport policy. Growth and Change, 43(4), 667–696.

Rouwendal, J. (2004). Search theory and commuting behavior. Growth and Change, 35(3), 391–418.

Rouwendal J, van Ommeren J. (2007). Recruitment in a Monopsonistic Labour Market: Will Travel Costs be reimbursed?, Tinbergen Institute Discussion Paper, TI 2007-044/3.

Sandow, E. (2008). Commuting behaviour in sparsely populated areas: evidence from northern Sweden. Journal of Transport Geography, 16(1), 14–27.

Sandow, E., & Westin, K. (2010). The persevering commuter–Duration of long-distance commuting. Transportation Research Part A: Policy and Practice, 44(6), 433–445.

Small, K. A., & Verhoef, E. (1992). Urban transport economics. Harwood: Chur.

Smith, D., Clarke G., P., Ransley, J., & Cade, J. (2006). Food access and health: a microsimulation framework for analysis. Studies in Regional Science, 35(4), 909–927.

Sultana, S., & Weber, J. (2007). Journey-to-work patterns in the age of sprawl: evidence from two midsize Southern Metropolitan areas*. The Professional Geographer, 59(2), 193–208.

Tanton, R. (2014). A review of spatial microsimulation methods. International Journal of Microsimulation, 7(1), 4–25.

Tomintz, M. N., Clarke, G. P., Rigby, J. E., & Green, J. M. (2013). Optimising the location of antenatal classes. Midwifery, 29(1), 33–43.

Train, K., & McFadden, D. (1978). The goods/leisure tradeoff and disaggregate work trip mode choice models. Transportation Research, 12, 349–353.

Van Ham, M. (2001). Workplace mobility and occupational achievement. International Journal of Population Geography, 7(4), 295–306.

Van Leeuwen, E. S. (2010). The effects of future retail developments on the local economy: combining micro and macro approaches. Papers in Regional Science, 89(4), 691–710.

Van Ommeren, J., & Rietveld, P. (2007). Compensation for commuting in imperfect urban markets. Papers in Regional Science, 86(2), 241–259.

Van Ommeren, J., Rietveld, P., & Nijkamp, P. (1999). Impacts of employed spouses on job-moving behavior. International Regional Science Review, 22(1), 54–68.

Vega, A, Reynolds-Feighan, A (2009) A methodological framework for the study of residential location and travel-to-work mode choice under central and suburban employment destination patterns. Transportation Research Part A-Policy and Practice 43, 401–419.

Vega A, Reynolds-Feighan A (2012) Evaluating network centrality measures in air transport accessibility analysis: a case study for Ireland. UCD School of Economics Working Paper Series, University College Dublin.

Voas D and Williamson P (2001) Evaluating goodness-of-fit measures for synthetic microdata. Journal of Geographical and Environmental Modelling, l(2),177–200.

Westin, K., & Sandow, E. (2010). People’s preferences for commuting in sparsely populated areas: The case of Sweden. Journal of Transport and Land Use, 2(3).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vega, A., Kilgarriff, P., O’Donoghue, C. et al. The Spatial Impact of Commuting on Income: a Spatial Microsimulation Approach. Appl. Spatial Analysis 10, 475–495 (2017). https://doi.org/10.1007/s12061-016-9202-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12061-016-9202-6