Abstract

The Aerospace Industry (AI) is considered strategic in Mexico due to the opportunities it offers Mexican business communities to insert themselves into a global value chain of high competitive standards. Due to its production specificities, it needs to develop a chain of suppliers that may lead to externalities or intentional knowledge transfer and the creation of networks with local economies and business co-locations. This paper aims to investigate patterns of co-location of firms and establishments around the AI across Mexico. The analysis applies spatial statistical techniques to detect spatial agglomerations of different industrial sectors related to the AI. The findings include a detailed description of the spatial distribution of AI co-location patterns in terms of industrial branch and firm size. Results indicate that the AI industry is mainly spatially co-located by itself and by industries in the electronics, machinery and equipment sectors. Our findings could potentially provide input to policy makers in terms of clustering and public policies according to regionally productive vocations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The Aerospace Industry (AI) in Mexico has attracted the interest of scholars and public policy makers because of the opportunity it offers Mexican business communities to improve their competitive advantage over those belonging to its supplier chain, which is internationally recognized for having high quality standards (Casalet et al. 2011). National and local governments consider the AI as strategic due to its potential contribution to technological progress through its development of high value-added productive processes and because of its high probability of knowledge spillover through its links with local economies (Lublinski 2003; Beaudry 2001). It may also influence the ability of local firms to make manufacturing more efficient and to develop activities with a higher degree of specialization, which is essential for host developing economies that hope to benefit in the long run from foreign direct investment (FDI) (Humphrey and Schmitz 2002; Keesing and Lall 1992; Piore and Ruiz Durán 1998; Schmitz and Knorringa 2000; UNCTAD 2011).

A firm’s location is important and has implications not only for the firm, but also for the region in which it is located (Bunyaratavej et al. 2008). A suitable location can reduce transportation costs and provide better accessibility. Proximity to other firms could involve the sharing of similar cultural and institutional goals and promote technological transfer (Humphrey and Schmitz 2002; Williamson 1979; Batheld et al. 2004). Co-location of diverse productive sectors around the AI is a characteristic of mature aerospace clusters usually composed of metallurgy, machinery and equipment, electronics, automotive and materials manufacturers (Chu et al. 2010).

Company size affects the flexibility of the supply chain (Martínez and Pérez 2005). In this regard, clusters of industries – for example, automotive, aerospace, and electronics – are typically anchored to an assembly company that operates as the leader and is characterized by its technological and design capabilities (Giuliani et al. 2005). Specifically, larger aerospace clusters, such as one in Montreal, are comprised of one or several Original Equipment Manufacturers (OEMs) surrounded by several small and medium enterprises (SMEs) that supply components and parts and are located at different tiers in the supply chain (Niosi and Zhegu 2005). In this context, it is interesting to identify the structure of the different AI clusters in Mexico and differentiate business co-location based not only on industry, but also on the size of the economic unit involved.

This study investigates co-location patterns of establishments around the AI based on their geographical location. Specifically, our study exploits geo-referenced data of economic units belonging to this sector. Given the characteristics of this data, each observation presents an attribute that allows its categorization in terms of the industrial sector and firm size. Our aim is to answer the following research questions: To what extent do firms in different industrial sectors tend to be spatially co-located around Aerospace Industry firms? If they do, are those sectors showing higher chances of being spatially co-located? And finally, what specific industries may be more susceptible to the effects of inter-sectorial upgrading due to their proximity to the aerospace industry?

To meet our research objectives, we use a spatial statistics measure called Co-location Quotient (CLQ) (Leslie and Kronenfeld 2011) from which it is possible to explore proximity patterns between two particular industrial branches that might differ in terms of location and employment size. The results obtained allow us to look at the co-location directionality of each pair of industrial industries that consequently are visually displayed in a fairly similar network diagram.

Our contribution to the extant literature is threefold. First, this appears to be the first study that combines the use of geocoded information with the application of spatial statistics techniques in the context of a relevant industrial sector in Mexico such as the AI. Second, we provide a new way to display the results via a network diagram, which in turn facilitates the visualization and description of the findings. Third, the analysis of co-location differentiated by company size is a novel way to identify the specific structure – not only by industry, but also by the size of the economic unit – of aerospace clusters located in Mexico.

A Brief History of the Aerospace Industry in Mexico

The presence of this industry in Mexico dates back to before the Second World War (Jiménez 2013), although the installation of the first foreign firms occurred at the time of the “import substitution model”, an economic policy that advocates replacing foreign imports with domestic production to enhance the vertical integration of the economy (Alarcon and Mckinley 1992). In the 1960s, companies such as Rockwell Collins and Light Switch arrived in Baja California (Carrillo and Hualde 2013). Others dedicated to the maintenance of parts and the manufacture of aircraft parts were installed in Querétaro (Villavicencio et al. 2013), and in 1999 the design centers of General Electric (GE) and the Sonora Smith West (Contreras and Bracamonte 2013) were also located in the state. By 2000, and according to the Ministry of Economy (SE), 20 companies in Mexico were together exporting approximately USD $150 million worth of aircraft parts.

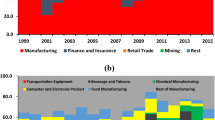

Due to the characteristics of the sector and its contribution to Mexican employment, investment and exports, in 2003 the Secretaría de Economía (SE) announced the interest of the federal government in developing the AI sector by attracting leading international companies (Secretaría de Economía (SE) 2013). The main interest was to foster industrial clusters capable of promoting the competitiveness of the national business and of local universities and public research centers (Casalet et al. 2011). As of 2013, the AI consists of approximately 259 firms that provide more than 34,000 jobs in 18 entities, mainly in central and northern Mexico (ProMéxico 2013a, b). Five of these States stand out as constituting 76 % of the sector’s total number of firms: Baja California, Sonora, Querétaro, Chihuahua and Nuevo León. Official records have identified them as the most important “regions” for the Mexican AI, whose capabilities, specificity and existing industrial niches enable them to develop strategies that orient their potential productive vocations, see Fig. 1.

Theoretical Justification

By building on the New Economic Geography (NEG), it is possible to understand the firm’s location choice and the structure it acquires. Agglomeration economies are considered as the main scenario where social and technological innovations develop, mainly through the establishment of business linkages (Fujita and Thisse 1996). These agglomerations are suitable spaces to promote spillovers given that they facilitate information exchange between firms and intensify communication and information transfer based on personal contact between the diverse actors involved in the process (Marshall 1920; Batheld et al. 2004). These benefits can increase when agglomerations include actors with international affiliations, given that the information and skills they acquire tend to disperse within the agglomeration. Once they become integrated into firms in related sectors, they influence the ability of these firms to generate information and execute effective labor divisions (Batheld et al. 2004).

The externalities originated through the process, either technological (spillovers) or pecuniary, are key determinants for explaining business linkages at different geographical distances. These, in turn, allow for the integration of firms from AI-related sectors, which implies a horizontal movement toward a new sector that requires the implementation of productive activities not previously carried out. It involves a process of technological transfer executed beforehand and customer-supplier links between and among businesses, resulting in a horizontal upgrading of the firms involved. Once integrated into the industry, these firms may upgrade their products, processes or functions (Humphrey and Schmitz 2000). In this context, some argue that, once they adapt new production technologies, firms may evolve to undertake more complex activities related to the manufacture of parts and sub-assembly for the aerospace industry. This may eventually lead to the abandonment of basic activities such as tooling or tool machining (Esposito and Passaro 1997).

Horizontal upgrading might also involve the development of suppliers through a cooperative relationship established between client and supplier within a given GVC. Its purpose is to generate permanent improvements in the suppliers’ performance while at the same time strengthening the competitive advantage of clients (Hahn et al. 1990; Krause 1997, 1999; Vickery et al. 2003). For this reason, it can be considered a long-term competitive strategy (Giunipero 1990; Monczka et al. 1993; Hartley and Choi 1996; Goffin et al. 2006) that benefits multinational corporations by reducing their production costs and delivery times for certain products, thus rendering them more competitive. (Dyer 1996; Li et al. 2007; Blalock and Gertler 2008), Not only that: local businesses can also benefit, assuming there is a transference and integration of technological development into their productive capacities, in addition to different agents that may become involved in the process (such as universities, research centers and industrial associations) (Padilla-Pérez 2008).

In this context, the role of some local and federal policies has been relevant in the promotion of aerospace spatial clustering within the country. According to Casalet (2013) these policies have involved: a) the attraction of world-leading firms in the sector, b) implementation of fiscal incentives, and c) promotion of locating anchor firms within industrial parks. Therefore, this paper acknowledges the increasing interest in the AI sector, focusing on the spatial distribution of those firms that belong to it.

Methods and Data Description

In recent years, an increasing number of empirical studies, including those of Duranton and Overman (REStud, 2002), Ellison and Glaeser (JPE, 1997), Mori and Smith (2011), and Billings and Johnson (2014), have been devoted to describing industrial agglomeration patterns using point-based firm-level data.

Although widely used, some characteristics of the Ellison and Glaeser (1997) (E-G) index prevent us from applying it to the present analysis. First, the calculation involves shares of a particular industry in a determined area, the share of total employment in that area, and the sizes of the plants comprising that industry. Given that the data used in the analysis does not contain information about the exact number of employees but, rather, a range of employees, the replication of such an index is difficult. Furthermore, the E-G index uses geographical units, such as states or counties, as the distance criteria or scale upon which to measure industrial agglomeration. It is now well understood that such an index is affected by the underlying spatial zoning system, i.e., the shape, size and relative position of spatial units. This has been labeled Modifiable Areal Unit Problems (MAUP) in the regional science literature (Barlet et al. 2013; 338).

Another approach to describing industrial location patterns helps overcome discreteness, as it considers space as continuous. A well-known index proposed by Duranton and Overman (2002) consists of taking the density distribution of bilateral distances between all pairs of plants in a given industry. The test involves localization of industries based on whether the density distribution of bilateral distances is close to the density distribution that would be expected if plants were randomly allocated in space. In a somewhat similar setting, Marcon and Puech (2003) also develop an index aimed at assessing spatial localization of point patterns. While the core strength of these two continuous measurements are independent of the spatial unit size choice, the practical implementation may involve computationally intensive procedures (Kominers 2008; pp. 8). Although we recognize the importance of developing these types of measurements, this area is left for further research.

We emphasize that the main interest of this study is not in exploring agglomeration patterns per se, but instead, co-location patterns of industries in relation to the aerospace industry. The method used here, the CLQ statistic, is consistent with our objectives because it allows the exploration of proximity patterns between two particular industrial branches that might differ in terms of their location and employment size. It is particularly useful for two reasons. First, while a symmetric representation of the results is obtained – meaning that for every pair of categories (industries), the corresponding CLQ is calculated through a nxn matrix – the off-diagonal results of such a matrix might not be symmetric. In other words, while industry A might be co-located to B, the inverse is not necessarily true. Second, we take advantage of this directionality of each pair of industries, and consequently the relation between them is visually displayed in a fairly similar network diagram. This facilitates the exposition of the findings, given that exploring co-location patterns by firm size is a crucial component of the present analysis.

The CLQ is specifically defined with respect to two categories (for example, types A and B) and provides a measure of the degree to which one categorical subset is spatially dependent on another. That is to say, CLQ A- >B measures the degree to which type A events are spatially co-located by type B events. It is calculated as the ratio between the points being observed in comparison with the expected points belonging to a specific type, between the set of closest neighboring points of another type.

The CLQ has its roots in the classical location quotient used by geographers and economists to assess the degree of specialization of a region based on specific industries (Blair 1995; Stimson et al. 2006). It is especially useful when performing population analysis with geo-referenced data that, in turn, can be grouped in different categories with the following characteristics: (a) information is nominal, so that other measures, such as cross-variogram (Vallejos 2008), are not applicable; (b) analysis is based on specific and not polygonal information, as established in the join count statistical (Cliff and Ord 1981); and (c) when the analysis is centered on one population and not on the comparison between two of them, as formulated in the null cross-k-function (Cressie 1991) hypothesis.

The CLQ formal representation is based on a given population P, where each individual is categorized or grouped in one of the k-categories part of an X set, assuming AεX and BεX denote potential categories that belong to X. CLQ A->B is defined as the ratio observed between the expected proportions of type B events, between A′s closest neighbors.

Where N denotes the size of the total population; NA corresponds to the population size of category A; N′B denotes the size of population B (if A ≠ B); and C A_B denotes the recount of type A points whose nearest neighbor is a type B point. A CLQA->B numerator is the proportion of type B points between A′s closest neighbors (meaning the observed proportion), while the denominator is the proportion of type B points that could be the closest neighbor of type A events (meaning, the expected proportion).

Semantically, CLQ A->B denotes the spatial co-location that A exerts on B, or alternatively, the degree to which B co-locates A. For example, a CLQ A->B close to 2 would indicate that A is twice as likely to have B as its closest neighbor as what might be expected if the location of data in space were randomly distributed. It should be clarified that the co-location expressed by CLQ A->B is unidirectional, since it depends on its relationship to its closest neighboring points. In other words, in the case of observations where A′s nearest neighbor is B, but B′s nearest neighbor is not A, then CA_B > CB_A; and therefore, CLQA->B > CLQB->A, logically expressing that A is more co-located to B than B to A. In a case where the same category or group is analyzed, CLQ is interpreted in a similar way, so that a CLQA->A =0.67 would indicate that the expectation would be that A is two-thirds as likely to be its own nearest neighbor, given the proportion of A with respect to the analyzed data. In this case, co-location is bi-directional (see Leslie and Kronenfeld 2011, p. 313).

This study uses spatially referenced data available at a firm level obtained from the National Statistical Directory of Economic Units (DENUE in Spanish) prepared by the National Institute of Statistics and Geography (INEGI in Spanish). This database contains more than 4 million economic units (or establishments) located throughout Mexico from the following sectors: manufacturing, trade and services, mining, electricity, water and gas, construction, transportation and storage and financial services.

This source of information includes geographic coordinates (latitude and longitude) for each economic unit, as well as an identifier by entity, municipality and basic geo-statistical area (AGEB). With regard to other attributes, it is also possible to obtain the number of employees based on the following strata: 0–5, 6–10, 11–30, 31–50, 51–100, 101–250 and 251 or more, and the type of economic and industrial activity, based on the North American Industrial Classification System (NAICS) for 2007. As it relates to the present study, the NAICS Code is particularly important because it enables the identification of the industrial branch where establishments belong, given a 4-digit NAICS code.

Results

The analysis first considers 47 NAICS industry codes where the selection was made considering two different sources of information: a) the list of companies in the Matrix of Capabilities, Products and Processes published by ProMéxico (2013a, b), and b) the industry codes that maintain linkages as aerospace industry suppliers (NAICS code: 3364) in the Input–Output Mexican table (2008). (See Table 4 of the Appendix for a full description of each of the NAICS codes considered.)

From the first source (Matrix of Capabilities, Products and Processes) a list of 259 companies is identified which, according to ProMéxico (2013a, b), constitute the Mexican aerospace industry. In order to gather information on their industry classification through NAICS codes, a matching process from the (DENUE) was undertaken. In doing this, it was possible to identify 46 NAICS codes belonging to 259 companies which constitute the Mexican aerospace industry and the associated information that comes from the DENUE. From the second source of information (Input–Output table), it was possible to identify 14 industries that maintain a supplier relationship with the aerospace sector. The final data set is made up of 47 NAICS codes, as only one (NAICS 4811) was identified in the second but not the first of the sources above described. (See Table 1 for the full list of NAICS codes.) As noted, the wholesale of raw materials for industry (NAICS code: 4342) is of the utmost importance (20 % of units observed), followed by metal structures and products, blacksmith manufacturing (NAICS code: 3323) and the repair and maintenance of electronic equipment and precision equipment (NAICS code: 8112). These three industries together account for almost 50 % of all observations presented in Table 1.

The next step consists of applying the CLQ to identify industries that show co-location patterns with respect to the AI. This test was done for the 47 industries previously identified. In the process, 19 industries (NAICS codes) showed significant colocation patterns, that is, they tend not to be randomly located around the AI. In Table 2 we show the results obtained for each NAICS code, in descending order of the estimated CLQ. Note that it shows all CLQ results with significance,Footnote 1 regardless of whether or not they exhibit an estimate greater than the unit. The findings indicate that firms belonging to the AI (NAICS code: 3364) tend to be co-located with themselves, and are mostly related to the production of manufacturing parts.Footnote 2 This, in turn, supports the argument that aerospace clusters are often formed by one or several anchor firms surrounded by small and medium-sized firms that supply components and specialized parts (Niosi and Zhegu 2005). The second industry or NAICS code with the greatest CLQ corresponds to internal combustion engines, turbines and transmissions manufacturing (NAICS code: 3336). The rest of the significant CLQ results with a CLQ > 1 corresponds to the following NAICS codes: 3339, 3329, 3344, 3327, 3315, 3262, and 3321.

In order to analyze the co-location of establishments not only belonging to the aerospace industry but also to the industries in the entire dataset, the CLQ is estimated once more and a co-location matrix is generated; see Table 3. As expected, each industry exhibits the strongest co-location index with itself. Among these, machinery and equipment for manufacturing industries (NAICS code: 3332), aerospace equipment manufacturing (NAICS code: 3364), scheduled air transport services (NAICS code: 4811), computer systems design and related services (NAICS code: 5415) and business management services (NAICS code: 5611) are the industries exhibiting the highest-co-location patterns.

Note that aerospace equipment manufacturing is co-located with three different industries: machinery and equipment for manufacturing industries, except metalworking (NAICS code: 3332), internal combustion engines, turbines, transmissions manufacturing (NAICS code: 3336) and with nonferrous metals industries, except aluminum (NAICS code: 3314). Business management services (NAICS code: 5611) is only co-located with scheduled air transport (NAICS code: 5611). Machinery and equipment for manufacturing industries manufacturing, except metalworking (NAICS code: 3332) tend to co-locate with industries of nonferrous metals, except aluminum (NAICS code: 3314) and rubber products manufacturing (NAICS code: 3262).

One of the features of the CLQ statistic is that it is possible to obtain uni- or bi- directional spatial co-location patterns. Figure 2 depicts the relationships detected in the above table, where the thickness of the lines shows the strength of the relationship and arrows show the direction (unidirectional or bidirectional). For example, other fabricated metal products manufacturing (NAICS code: 3329) is co-located unidirectionally with services computer systems design and related services (NAICS code: 5415); and scheduled air transport (NAICS code: 4811) is co-located bidirectionally with business management services (NAICS code: 5611).

We can also observe that aerospace equipment manufacturing (NAICS code: 3364) is co-located with more general industries like internal combustion engines, turbines, transmissions manufacturing (NAICS code: 3336), machinery and equipment for manufacturing industries manufacturing, except metalworking (NAICS code: 3332) and industries of nonferrous metals, except aluminum (NAICS code: 3314), which are bi-directionally co-located. As expected, the first two show a greater relationship with the aerospace industry, but all of them are co-located at the same time with the commercial sector (NAICS code: 4352), which, as we expect, maintains a relationship with almost all the industries in the diagram.

Figure 3 displays results this time by establishment size, where numerical markers have been added to each NAICS industry to differentiate establishment-size groups:

-

a)

micro (0–10 employees): 3364-1,

-

b)

small (11–100 employees) : 3364-2,

-

c)

medium (101–250 employees) : 3364-3,

-

d)

large (251 or more employees): 3364-4,

On the one hand, the figure shows that large-size AI establishments tend to co-locate only with themselves, i.e., not with other size groups of the AI. On the other hand, micro, small and medium enterprises in the AI industry show co-location patterns not only with themselves, but also with other group size establishments in the same industry.

Note that micro enterprises in the AI exhibit the greatest number of other industrial branches with which they tend to be co-located (approximately 13 industrial branches), while small size establishments co-locate with seven, medium size with five, and large size with only four industrial branches. From the same figure it is possible to identify those industries with which AI establishments tend to be co-located individually; that is, in the case of small businesses in the AI they are most likely to be co-located with small, medium and large establishments in the internal combustion engines, turbines, transmissions manufacturing industry (codes: 3336-2, -3, -4). Medium size establishments in the AI, however, are co-located with establishments of the same size in the boilers, tanks and metal containers manufacturing industry (code: 3324-3). Large establishments in the AI, on the other hand, tend to co-locate as neighbors to microenterprises in the electronics manufacturing industry (code: 3344-1).

Final Discussion

The identification of the aerospace cluster’s composition is useful for understanding its location and its relationship to the regional economy. Utilizing the CLQ method, we aimed to provide a better description of the aerospace sector in several aspects, such as its industry composition, industry linkages, and spatial organization. Conclusions can be drawn as follows. First, on the basis of the identification results, it can be concluded that the aerospace industry cluster in Mexico is generally composed of five subgroups: the aerospace industry; metal manufacturing and product manufacturing; the machinery and equipment industry; the electronics industry; and services.

Second, the network of intra-cluster linkages are mainly represented by the links between and among the aerospace industry and other manufacturing sectors like internal combustion engines, turbines and transmissions with a bidirectional co-location. Machinery and equipment, and industries of nonferrous metals are both unidirectional. This means the aerospace industry is especially co-located with these industries. Therefore, the present analysis suggests that the first three industries would potentially obtain upgrading benefits through their relationship with the aerospace industry, while the rest of them (those industries indirectly linked to the aerospace industry) could obtain technological externalities or spillovers more indirectly.

By comparing the results obtained for the aerospace industry in Mexico with the industrial composition of the sector detected for China and the United States conducted by Chu et al. (2010), you can mostly find matches. As compared to China, the Mexican AI industrial composition is very similar, with the exception of the ship and floating devices industry. Regarding the USA, the detected industrial composition is comprised of 38 industries, which largely coincide with those found in the present study, except those relating to communications equipment, agriculture, construction and mining machinery, architectural and structural metal products, basic chemicals, non-apparel textile products, food products, wood products, and HVAC and refrigeration equipment. In general, we can see that this industry is accompanied by the sectors of mechanical engineering, engine manufacturers, parts manufacturers, electrical engineering, cabin manufacturers, support services and maintenance and repairs (Beaudry 2001).

The information obtained from the present analysis therefore points to the likelihood of a productive sector being found non-randomly as the closest neighbor to the AI by identifying patterns of co-location, which facilitates understanding of the industrial configuration of the country’s main aerospace agglomeration. These may have arisen due to transportation costs and the availability of human capital, enabling the creation of vertical links between the different actors in the productive sectors identified as their closest neighbors. The benefits to be derived from industrial co-location are related to the exchange of information, which creates a common knowledge base that may perpetuate. These benefits are significant, not only in the private sphere, but also for local economic development; hence their importance and implications for the development of public policy actions. In the aerospace sector, in particular, the co-location of various productive sectors is a feature that signals the maturity level of aeronautical clusters, and therefore the probability of agglomeration economies emerging and bringing benefits to the regional economy.

As we described, upgrading effects may occur in different ways (horizontal, product, process or functional), but, regardless of this, they require certain conditions to occur, such as geographic proximity or clustering between firms; infrastructure; emergence of large firms within the cluster; intellectual and industrial property rights; reliable staff turnover; knowledge generated internally by firms; institutions with knowledge acquired from outside the cluster; public and private funding; international links; and links between the different co-located firms (Humphrey and Schmitz 2002).

This analysis therefore provides input for the design of a clustering policy. However, to deepen the analysis, it should be complemented with an analysis of economic links in the industry (at the national and state levels) by studying the Input–Output Matrix in order to understand the degree of economic integration of the various branches in the industry’s production chain. In addition, to broaden understanding of the sector, there is a need for a qualitative analysis to comprehend the dynamics of the industry and the feasibility of domestic producers becoming integrated into this supply chain.

Public policy efforts would advocate the emergence and maintenance of industrial clusters in the regional economy and, at the same time, the appearance of links between enterprises from complementary sectors to facilitate interchange or knowledge and technology transfer through channels such as joint ventures, coproduction partnerships, training, etc. The identification of the aerospace cluster’s composition also provides input to develop and design regional-sectorial innovation ecosystems as a regional industrial policy to promote the competitiveness of the regional aerospace industry in Mexico (Cooke 2008).

Finally, it also noted that the aerospace cluster’s spatial evolution in Mexico is mainly related to regional product capabilities. The more developed these are, the greater the number of links that the aerospace industry will be able to establish with the regional economy.

The identification of the aerospace industry composition and location is important in pursuing regional policies to promote related variety and principles of smart specialization and forming regional advantages that incorporate the ideas of embeddedness, relatedness, and connectivity (Cooke 2008; McCann and Ortega-Argilés 2013; Boschma 2014). Regional industrial policies or innovation policies that stimulate public and private investment in high technology and knowledge-intensive spinoffs would be recommended in the co-location patterns identified. Too, mechanisms for facilitating networking among workers and company owners could enable integration within knowledge networks to foster extra-regional linkages in the form of localized knowledge networks (Boschma and Iammarino 2009).

Notes

Significance obtained from Monte Carlo simulations, see Leslie and Kronefeld (2011, pp. 317)

As mentioned above, DENUE’s information enables us to gather information relating to firm size. The data suggests a significant presence of micro enterprises (79 %) while aerospace industry (NAICS code: 3364) is dominated by medium-sized enterprises (43 %), that is to say, almost half of the industry is composed of companies which have from 51 to 250 employees.

References

Alarcon, D., & Mckinley, T. (1992). The restructuring projects of Brazil and Mexico. Latin American Perspectives, 19(2), 72–87.

Barlet, M., Briant, A., & Crusson, L. (2013). Location patterns of service industries in France: a distance-based approach. Regional Science and Urban Economics, 43(2), 338–351.

Batheld, H., Malmberg, A., & Maskell, P. (2004). Clusters and knowledge: local buzz, global pipelines and the process of knowledge creation. Progress in Human Geography, 28(1), 31–56. doi:10.1191/0309132504ph469oa.

Beaudry, C. (2001). Entry, growth and patenting in industrial clusters: a study of the aerospace industry in the uk. International Journal of the Economics of Business, 8(3), 405–436.

Billings, S. B., & Johnson, E. B. (2014). Agglomeration within an urban area. Mimeo: University of North Carolina Charlotte.

Blair, J. (1995). Local economic development: analysis and practice. London: Sage.

Blalock, G., & Gertler, P. (2008). Welfare gains from foreign direct investment through technology transfer to local suppliers. Journal of International Economics, 74(2), 402–421. doi:10.1016/j.jinteco.2007.05.011.

Boschma, R. (2014). Constructing regional advantage and smart specialisation: comparison of two European policy concepts. Scienze Regionali 51–68. doi:10.3280/SCRE2014-001004.

Boschma, R., & Iammarino, S. (2009). Related variety, trade linkages, and regional growth in Italy. Economic Geography, 85(3), 289–311.

Bunyaratavej, K., Hahn, E., & Doh, J. (2008). Multinational investment and host country development: location efficiencies for services offshoring. Journal of World Business, 43(2), 227–242. doi:10.1016/j.jwb.2007.11.001.

Carrillo, J., & Hualde, A. (2013). ¿Una maquiladora diferente? competencias laborales profesionales en la industria aeroespacial en Baja California. In M. Casalet (Ed.), La industria aeroespacial: Complejidad productiva e institucional (pp. 163–197). México: FLACSO.

Casalet, M. (2013). Actores y redes públicas y privadas en el desarrollo del sector aeroespacial internacional y nacional: el cluster de Querétaro, una oportunidad regional. In M. Casalet (Ed.), La industria aeroespacial: complejidad productiva e institucional (pp. 93–134). México: FLACSO.

Casalet, M., Buenrostro, E., Stezano, F., Oliver, R., Abelenda, L. (2011). Evolución y complejidad en el desarrollo de encadenamientos productivos en México. Los desafíos de la construcción del cluster aeroespacial en Querétaro. Comisión Económica para América Latina y el Caribe (CEPAL).

Chu, B., Zhang, H., & Jin, F. (2010). Identification and comparison of aircraft industry clusters in China and United States. Chinese Geographical Science, 20(5), 471–480. doi:10.1007/s11769-010-0421-5.

Cliff, A., & Ord, J. (1981). Spatial processes: models and application. London: Pion.

Contreras, O., & Bracamonte, A. (2013). Capacidades de manufactura global en regiones emergentes. La industria aeroespacial en Sonora. In M. Casalet (Ed.), La industria aeroespacial: complejidad productiva e institucional (pp. 199–223). México: FLACSO.

Cooke, P. (2008). Regional innovation systems: origin of the species. International Journal of Technological Learning, Innovation and Development, 1(3), 393–409.

Cressie, N. (1991). Statistics for spatial data. New York: Wiley.

Duranton, G., & Overman, H. (2002). Testing for localization using micro-geographic data. The Review of Economic Studies, 72(4), 1077–1106.

Dyer, J. (1996). Specialized supplier networks as a source of competitive advantage: evidence from the auto industry. Strategic Management Journal, 17, 271–292. doi:10.1002/(SICI)1097-0266(199604)17:4.

Ellison, G., & Glaeser, E. (1997). Geographic concentration in U.S. manufacturing industries: a dartboard approach. Journal of Political Economy, 105(5), 889–927.

Esposito, E., & Passaro, R. (1997). Material requirement planning and the supply chain at Alenia aircraft. European Journal of Purchasing and Supply Management, 3(1), 43–51. doi:10.1016/S0969-7012(96)00004-4.

Fujita, M., & Thisse, J. (1996). Economics of agglomeration. Journal of the Japanese and International Economies, 10(21), 339–378.

Giuliani, E., Pietrobelli, C., & Rabellotti, R. (2005). Upgrading in global value chains: lessons from Latin American clusters. World Development, 33(4), 549–573.

Giunipero, L. (1990). Motivating and monitoring JIT supplier performance. Journal of Purchasing and Material Management, 26(3), 19–25. doi:10.1016/j.jom.2003.12.007.

Goffin, K., Lemke, F., & Szwejczewski, M. (2006). An exploratory study of ‘close’ supplier-manufacturer relationships. Journal of Operations Management, 24, 189–209. doi:10.1016/j.jom.2005.05.003.

Hahn, C., Watts, C., & Kim, K. (1990). Supplier development program: a conceptual model. International Journal of Purchasing and Materials Management, 26(2), 2–7.

Hartley, J., & Choi, T. (1996). Supplier development: customers as a catalyst of process change. Business Horizons, 39(4), 37–44.

Humphrey, J., & Schmitz, H. (2000). Governance and upgrading: linking industrial cluster and global value chain research (IDS Working Paper 120). Brighton: IDS.

Humphrey, J., & Schmitz, H. (2002). How does insertion in global value chains affect upgrading in industrial clusters? Regional Studies, 36, 1017–1027.

Jiménez, A. (2013). México, Fábrica de aviones. Suplementos Corporativos, M.M.G. Communications, Inc. http://www.aviaciononline.com/2010/02/08/mexico-fabrica-de-aviones/.

Keesing, D., & Lall, S. (1992). Marketing manufactured exports from developing countries: learning sequences and public support. In G. Helleiner (Ed.), Trade policy, industrialization and development: new perspectives. Oxford: Clarendon.

Kominers, S.D. (2008) Measuring agglomeration. Harvard Urban and Social Economics Seminar. http://www.scottkom.com/articles/measure_agglomeration.pdf.

Krause, D. (1997). Supplier development: current practices and outcomes. International Journal of Purchasing and Materials Management, 33(2), 12–19. doi:10.1111/j.1745-493X.1997.tb00287.x.

Krause, D. (1999). The antecedents of buying firms’ efforts to improve suppliers. Journal of Operations Management, 17(2), 205–224. doi:10.1016/S0272-6963(98)00038-2.

Leslie, T., & Kronenfeld, B. (2011). The colocation quotient: a new measure of spatial association between categorical subsets of points. Geographical Analysis, 43, 306–326. doi:10.1111/j.1538-4632.2011.00821.x.

Li, W., Humphreys, P., Yeung, A., & Cheng, T. (2007). The impact of specific supplier development efforts on buyer competitive advantage: an empirical model. International Journal of Production Economics, 106, 230–247. doi:10.1016/j.ijpe.2006.06.005.

Lublinski, A. E. (2003). Does geographic proximity matter? evidence from clustered and non-clustered aeronautic firms in Germany. Regional Studies, 37(5), 453–467. doi:10.1080/0034340032000089031.

Marcon, E., & Puech, F. (2003). Evaluating the geographic concentration of industries using distance-based methods. Journal of Economic Geography, 3(4), 409–428.

Marshall, A. (1920). Principles of economics (8th ed.). London: Macmillan.

Martínez, A., & Pérez, M. (2005). Supply chain flexibility and firm performance: a conceptual model and empirical study in the automotive industry. International Journal of Operations & Production Management, 25(7), 681–700.

McCann, P., Ortega-Argilés, R. (2013). Smart specialization, regional growth and applications to European Union cohesion policy. Regional Studies 1–12.

Monczka, R., Trent, R., & Callahan, T. (1993). Supply base strategies to maximize supplier performance. International Journal of Physical Distribution and Logistics Management, 23(4), 42–54. doi:10.1108/09600039310041509.

Mori, T., & Smith, T. E. (2011). An industrial agglomeration approach to central place and city size regularities. Journal of Regional Science, 51(4), 694–731.

Niosi, J., & Zhegu, M. (2005). Aerospace clusters: local or global knowledge spillovers? Industry and Innovation, 12(1), 1–25. doi:10.1080/1366271042000339049.

Padilla-Pérez, R. (2008). A regional approach to study technology transfer through foreign direct investment: the electronics industry in two Mexican regions. Research Policy, 37, 849–860. doi:10.1016/j.respol.2008.03.003.

Piore, M., & Ruiz Durán, C. (1998). Innovation cases into the Mexican maquila. In J. Humphrey & M. Piore (Eds.), Learning, liberalization and economic adjustment (pp. 191–241). Tokyo: Mitsuhiro Kagami, Institute of Developing Economies.

ProMéxico (2013a) Matrix of capabilities, products and processes. http://www.promexico.gob.mx/work/models/promexico/Resource/114/1/images/Mapa_Aeroespacial_2012_web%281%29.pdf.

ProMéxico (2013b) Plan nacional de vuelo. Industria aeroespacial Mexicana. Mapa de ruta. http://www.promexico.gob.mx/work/models/promexico/Resource/114/1/images/MRT-Aeroespacial-esp-2013.pdf.

Schmitz, H., & Knorringa, P. (2000). Learning from global buyers. Journal of Development Studies, 37(2), 177–205.

Secretaría de Economía (SE) (2013) Reglas de operación del fondo de apoyo para la micro, pequeña y mediana empresa (Fondo PYME) para el< ejercicio fiscal 2013. Diario Oficial de la Federación.

Stimson, R., Stough, R., Roberts, B. (2006). Regional economic development: analysis and planning strategy. Springer.

UNCTAD. (2011). Foreign direct investment, the transfer and diffusion of technology, and sustainable development. Geneva: United Nations.

Vallejos, R. (2008). Assessing the association between two spatial or temporal sequences. Journal of Applied Statistics, 35, 1323–1343.

Vickery, S., Jayaram, J., Droge, C., & Calantone, R. (2003). The effects of an integrative supply chain strategy on customer service and financial performance: an analysis of direct versus indirect relationships. Journal of Operations Management, 21(5), 523–539. doi:10.1016/j.jom.2003.02.002.

Villavicencio, D., Hernández, J., & Souza, L. (2013). Capacidades y oportunidades para el desarrollo de la industria aeronáutica en Querétaro. In M. Casalet (Ed.), La industria aeroespacial: complejidad productiva e institucional. México: FLACSO.

Williamson, O. (1979). Transaction-cost economics: the governance of contractual relations. Journal of Law and Economics, 22(2), 233–261.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Statement of Human Rights

This article does not contain any studies with human participants performed by any of the authors.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Flores, M., Villarreal, A. & Flores, S. Spatial Co-location Patterns of Aerospace Industry Firms in Mexico. Appl. Spatial Analysis 10, 233–251 (2017). https://doi.org/10.1007/s12061-015-9180-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12061-015-9180-0