Abstract

Energy saving and emission reduction sometimes mean high cost, so companies do not have enough motivation to always support the related policy. By neglecting the economic cost and the imperfect substitution among input factors, widely used energy efficiency indicators such as “energy intensity” will sometimes lead to uneconomic results. Based on the theory of economic efficiency, “energy economic efficiency” is proposed as a new energy efficiency measurement to integrate cost information. In this paper, we further discuss energy economic efficiency, propose supplementary properties, and measure the efficiency of twelve public thermal power companies during the period of China’s 12th five-year plan. Our results show that (2) the economic efficiency of the twelve public companies decreased slowly. The average economic efficiency was 0.82, and there was approximately 40 billion RMB in potential cost savings in 2015, accounting for 18% of the total cost. (2) The energy economic efficiency of these twelve companies increased by approximately 10% during 2011–2015. (3) The primary mission of most thermal power company is to improve the coal combustion technology. (Christensen 4) When expanding production, the input factors will sometimes be uncoordinated, which will lead to increased costs and decreased energy economic efficiency.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Energy efficiency is not only the topic in technology but also the hot topic in economic, social, and environmental development, which is highly complex, integrated, and systematic. A key component of solving these problems is improving energy efficiency. And energy efficiency can be defined in different situations. When measuring the energy efficiency in energy conversion and production technique, it is always measured by the laws of thermodynamics in physics. And when measuring the effectiveness of a production at industry and region levels, it is always measured by multi-input and multi-output with physical quantity or value quantity using non-parametric frontier approach (Wang et al. 2017). And the energy intensity, which is measured by the energy use per unit of output, is always mentioned in policy goals (NBS 2010). These measurements always focus on one side of the problem. Applying these indexes in reality may not be a smart choice. Sometimes, these indexes show perfect effect and reduce the energy consumption, but they lead to uneconomic results in other ways (Wei and Liao 2010). And these methods also can be applied to estimate the CO2 emission opportunity abatement cost (Wang et al. 2016b). As a part of the economic system, energy is tightly related to other inputs, such as capital and labor, price factor, cost information, and the imperfect substitution among inputs. So when measuring energy, these factors should be considered as much as possible.

The basic and reasonable assumption on companies is the cost minimization. And this is not in conflict with other aims. When making policies, government should consider the profits and cost to motivate the enthusiasms of enterprises in energy saving and environmental protection. Through this way, government could achieve the energy saving and environmental protection goal while the enterprise earning money. Sometimes, there is some conflict between economic development and energy saving. In the agricultural society, we use less energy in the production process, but the level of economic development is relatively low. This situation is not the goal which the modern society desires. So, we should also incorporate the energy saving and environmental protection goal in the development of enterprise, instead of only focusing on a low-carbon goal. For example, Nordhaus’s work, the 2018 Nobel prize in economics, integrates climate change into long-run macroeconomic analysis.

Energy economic efficiency was proposed as a new measurement of energy efficiency, which considers the multi-inputs and the technology constraints, integrates the price information, and aims at the minimum cost to achieve the global optimal solution within the whole economic system (Liao et al. 2016). In this paper, we further discuss energy economic efficiency and propose supplementary properties to perfect the new measurement. We apply this theory to twelve public thermal power companies during the period of China’s 12th five-year plan. The results also verify the theory in practice. We must point out that the energy economic efficiency calculated in this paper only involves the electricity generation part; other parts of the electricity, such as transmission, storage, and management, are not considered.

Literature review

Measuring the efficiency of the electricity industry has long been a hot topic. Taking sulfur dioxide emission, waste water, soot emission, and solid wastes as undesirable outputs and considering both constant returns to scale (CRS) and variable returns to scale (VRS) production functions, Tao and Zhang (2013) measured the environmental efficiency of the electric power industry in 16 cities in the Yangtze River Delta. Bi et al. (2014) calculated the energy efficiency and environmental efficiency of China’s thermal power generation during 2007–2009 and noted the obvious geographic characteristics in different provinces. Using carbon dioxide as the undesirable output, Xie et al. (2014) measured the environmental efficiency of the electric power industry in Brazil, Russia, India, China, and OECD countries using a slack-based measure data envelopment analysis (SBM-DEA). They analyzed the influence of related factors on total factor productivity (TFP) using Tobit model, and results showed that the main driving forces of promoting efficiency are fuel structure change and technological progress. By measuring the efficiency and effectiveness of the electricity generation system in China’s thirty provincial regions during 2006–2010, Wang et al. (2016a) indicated that the reallocation efforts and interregional electricity transmission in China are effective, and a steady increase in electricity generation is needed to improve effectiveness.

While there are many difficulties in acquiring data at the micro level, some works have studied the energy efficiency of the power plant. By analyzing the effect on the 252 fossil fuel power plants in China caused by the size control policy, Zhang et al. (2014) point out that the policy is exactly effective, and private incentives and deregulation are needed to improve the energy environmental performance of state-owned enterprises. Li et al. (2016a) measured the energy efficiency of 67 thermal power plants in China and explained the short-term dynamics among the environmental constraints and five plant-level indicators, including the related variables of coal, oil, water, electricity, and desulfurization systems. Du et al. (2016) pointed out that about 44% of carbon dioxide can be cut by analyzing and investigating the environmental technical efficiency and carbon abatement cost of 648 coal-fueled power plants in China. Other works have studied power plant energy efficiency from the technical perspective. Xu et al. (2016) improved the energy efficiency of power plants by pre-drying coals. Balku (2017) analyzed key parameters that influence efficiency in gas-steam power plants, including air/fuel ratio, gas/steam ratio, compressor pressure ratio, and gas turbines.

Studies about the electricity industry and power plants focus on technology efficiency, environmental performance, and undesirable output. Traditional energy efficiency is based on the analysis of the quantity of energy input. Measuring energy efficiency in terms of cost is more scientific, but studies seldom achieve that.

The cost and benefit study covered many areas. Farrell (1957) provided economic efficiency, technical efficiency, and allocative efficiency under multi-outputs. Christensen (1976) estimates the economies of scale of electric generating firms in the USA. Färe et al. (1985, 1994) provided details in efficiency measurement, and many studies subsequently focused on economic efficiency. And Maloney (2001) analyzed the cost function of USA’s electricity generation. Wang et al. (2013) measured the cost efficiency of China’s thermal power industry, and the results showed that coal price is not the key factor in fluctuating efficiency and incentivizing corporations is needed to improve the management. Li et al. (2016b) calculated the cost efficiency of electric grid utilities in China during 2005–2009 by using SFA-MLE, SFA-Bayes, and StoNED-CNLS model and found the efficiency value to be 0.85–0.92. By investigating cost efficiency and market reform in the OECD electricity sector during 1980–2009, Ajayi et al. (2017) indicated that the electricity market regulatory reform index has a significant influence on efficiency.

The existing research focuses on environmental and emission problems; however, few investigate the energy efficiency of thermal power companies from an economic perspective. By neglecting the price mechanism and imperfect substitution among input factors, current results have some limitations.

Theoretical model for measuring energy efficiency with cost

Following from the basic economic idea of efficiency (Farrell 1957), Liao et al. (2016) proposed the concept of energy economic efficiency and offered mathematical derivations and seven basic properties. Consider the only two input factors, energy (E) and other factor (X), point T is in the production possibility set P, point Q′ is the optimal production point, CC′ is the isoquant, and slope of line AA′ represents the price ratio of two factors. In Fig. 1, energy economic efficiency is defined as Eq. (1), and the two component energy allocative efficiency and the energy utilize efficiency are defined as Eqs. (2) and (3).

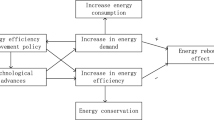

According to the research of Liao et al. (2016), the relationship among economic efficiency, energy economic efficiency, and other input economic efficiency, the explanation of the value, the different results of all special scenario, the comparability, and the sensitivity are discussed diagrammatically and mathematically. But compared with traditional measurements, some essential problems are not fully discussed. In this section, we provide more detailed economic explanations and mathematical derivations. Figure 2. demonstrates the mechanism from the production function to the energy economic efficiency.

In simple terms, energy economic efficiency is the energy cost ratio between the optimal and the real situation. If capital (K), labor (L), and energy (E) are taken as the input factors, we use a linear programming Eq. (4) to calculate the optimal total cost and the cost of each input factor under the optimal situation, and then use Eq. (5) to calculate the energy economic efficiency. In Eq. (5), \( {P}_e\overset{\sim }{E} \) is the energy cost under the optimal situation, and PeE is the energy cost under the real situation.

Compared with other efficiency indictors, the value of the new indictor will be greater than 1 because the energy cost under the optimal situation may be larger than under the real situation, which is \( {P}_e\overset{\sim }{E}>{P}_eE \). Under this situation, more energy inputs and fewer other inputs are needed to reduce the total cost. According to Eq. (6), the absolute value of 1 − ee represents the proportion of energy improvement, and the sign represents the direction of the improvement. The positive sign (ee < 1) means that less energy is needed, and the negative sign (ee > 1) means that more energy is needed. Based on the above discussion, we can determine that the energy economic efficiency values are comparable when they are on the same side of value 1, but not comparable when they are on opposite sides of value 1 without any new definition. For example, 0.9 is better than 0.8, and 1.1 is better than 1.2, but the relationship between 0.9 and 1.1 is still not clear.

As for other input factors, each input factor’s economic efficiency can be easily deduced, for example, capital economic efficiency (ke) for capital (K) and labor economic efficiency (le) for labor (L). Using capital (K), labor (L), and energy (E) as the input factors, and assuming the economic efficiency is Ee, then the relationship among economic efficiency (Ee), capital economic efficiency (ke), labor economic efficiency (le), and energy economic efficiency (e) is shown in Eq. (7). The coefficients of the efficiencies are α, β, and γ. And each coefficient represents the proportion of the related cost in the total cost. The proof is provided in Appendix 1.

If the energy input factor (E) is further divided into (e1, e2, e3, …), the relationship is shown as Eq. (8).

Nevertheless, energy economic efficiency does not meet the property of transitivity. Results under different technological constraints cannot be compared, so we suggest using the same technological constraints when measuring efficiency in different years. In addition, we provide the code in Appendix 4.

We only investigate the electricity generation, excluding the input/output of transmission and distribution due to the two following:

- 1.

Electricity generation and transmission are usually different parts of electricity business since the latter is generally regulated strictly because of its natural monopoly. Power plants are legal entities, which are nominally responsible for their own profits or losses. Since they are many independent thermal power companies, we can easily capture the envelope curve, i.e., the isocost curve, using linear programming (Dorfman et al. 1958).

- 2.

There only two grid corporations in China, located in the south and north without any competition. The grids and generators are different legal entities. And we cannot clarify how many grid capital and labor were used to transport the electricity generated by a specific thermal company. Therefore, we cannot construct the isocost curve. If the data are available, we can reconstruct the isocost curve, and point Q may be different from the formal since the capital and labor measurements are different.

Empirical data

The price of each input factor is the main limitation at the micro-level studies. This paper focuses on thermal power public companies in China during the period of 2011–2015 (China’s 12th five-year plan). After collecting and processing data from 38 companies’ annual fiscal reports, only twelve companies were remained and other companies did not provide direct and indirect information to access the price data. Of these twelve companies, the thermal power business represents, on average, more than 85% of the whole company. These companies’ full names, abbreviations, stock codes, and average total assets in China’s 12th five-year plan are listed in Appendix 2. And Fig. 3 shows the location city and the average total assets of the 12 companies.

According to China’s accounting standards and these annual fiscal reports, the cost of the thermal power companies’ primary business includes fuel fee, depreciation and amortization, employee compensation, maintenance charge, and repair charge. In our study, the total cost of the production includes the cost of capital, the cost of labor cost, and the cost of energy. The cost of capital includes depreciation and amortization, maintenance charge, repair charge, and a part of others. The cost of labor is employee compensation and the cost of energy is the fuel fee.

The measurement of input factors always plays the important part in analyzing of growth and productivity. According to Jorgenson et al. (2016), the input factors include capital (K), labor (L), energy (E), materials (M), and services (S). Because materials (M) and services (S) have little input in this study, we do not consider them. According to the model discussed above, the input data are quantity (Q) and price (P) of input (X), which includes capital (K), labor (L), and energy (E), with the output data (Y) as the production.

The output Y is the quantity of electricity generation in terawatt-hours.

We use coefficient “t” as the thermal power business percent of the whole company. We calculate it as the cost of thermal power divided by the total annual cost for each company. When calculating the quantity of capital (K) and labor (L), the corresponding coefficient t is needed to convert them proportionately.

We use the average fixed assets in a year as capital K’s quantity. And we compute capital K’s price as the fixed asset depreciation divided by the capital K’s quantity. Thus, the total cost of capital is the fixed asset depreciation. We use the number of the company as labor L’s quantity. And we compute labor L’s price as the payroll payable, which includes the salary, pension, and insurance, divided by labor L’s quantity. Thus, the total cost of labor is the whole expenditure on labor.

These power companies mainly use coal for energy, so the quantity of energy (E) is coal usage as measured by ton of coal equivalent, and the price of energy (E) is the price of coal equivalent. Companies seldom provide data directly, so we use the electricity generation and coal consumption rates to compute energy’s (E) quantity and use the total cost of energy and energy’s (E) quantity to compute energy’s (E) price.

Most data information of this model is not the regular item in companies’ annual fiscal reports, and the major data information is calculated using the relevant data we collected one by one. After collecting and processing the data carefully, we obtain a series of panel data that include twelve thermal power public companies during the period of China’s 12th five-year plan (2011–2015), and the processed data can be found in Appendix 4.

Results and discussion

With China’s economy entering the new normal, quality and efficiency problems in energy development have become increasingly prominent. The total amount of electricity generation increased from 4.7 trillion KWh to 5.6 trillion KWh during the period of China’s 12th five-year plan, a 4.4% annual growth rate. However, at the same time, the coal consumption rate decreased by 18 KWh per gram coal equivalent. The average utilization hours of thermal power equipment dropped from 5294 h in 2011 to 4364 h in 2015 (NBS 2017). Based on the energy economic efficiency theory, we compute the economic efficiency, energy economic efficiency, and energy utilize efficiency of these twelve thermal public companies during the 12th five-year plan. The results are shown in Fig. 4 and the details are provided in Appendix 3.

Different efficiency indictors of each company during the 12th Five-Year in China. Note: The full names of these companies are listed in Appendix 2

The cost aspect mainly includes capital, labor, and energy costs. Capital and labor become more and more important. Among these costs, energy is the largest, at an average of 76%; the second most expensive is the capital cost, at an average of 16%; and the smallest is the labor cost, at an average of 8%. Specifically, the HNGJ company has the highest energy cost percentage at 81%, and the NMHD company has the lowest energy cost percentage at 63%. The average energy cost percentage decreased from 82% in 2011 to 67% in 2015 (Fig. 5). Furthermore, the average energy input per unit of power generation decreased from both the quantity and value side. According to the 13th five-year plan for electricity of the people’s republic of China, the net coal consumption rate decreased to 315 g coal equivalent per KWh, shut down about 2.8 MKW small thermal power unit, constructed a series of supercritical generation unit and ultra-supercritical power unit, and improved about 400 MKW energy saving equipment during the time of the 12th five-year plan (NDRC 2017). This lead the transformation from the normal mode to the energy saving and efficiency enhancing mode.

From the economic efficiency aspect, these twelve thermal power public companies’ average economic efficiency was 0.82 during the period of the 12th five-year plan, with approximately 40 billion RMB in potential cost savings in 2015, accounting for 18% of the total cost. Among that, the GDDL company maintained a high economic efficiency, almost at value 1 all the time. The NMHD, HNGJ, and HYDL companies had a large decrease in economic efficiency, and other companies remained steady. In particular, the HYDL company had a significant drop in 2015, caused by its dramatic scaling up. The total assets of the HYDL company rose from 15.4 billion RMB in 2014 to 19.8 billion RMB in 2015, a 29% increase. And the total electricity generation rose from 9.2 TWh in 2014 to 17.3 TWh in 2015, an 88% increase. This rapid growth led to an uncoordinated increase among the inputs of capital, labor, and energy, which reduced economic efficiency. On the other hand, because of the strong association between the inputs of energy and production, the energy economic efficiency of the HYDL company only had a slight drop in 2015.

From the energy economic efficiency aspect, there was a dramatic increase during the period of the 12th five-year plan. Each company’s energy economic efficiency increased, with the average value increasing from 0.74 in 2011 to 0.84 in 2015. In particular, the YNKG company had a dramatic improvement in energy economic efficiency in 2015. This was due to the governance methods in 2014, such as “improving the bidding management of energy, applying the trading mechanism of price and quantity, and so on.” Thus, the energy cost of that company decreased from 1.7 billion RMB in 2014 to 1.4 billion RMB in 2015, a 33% decrease, meaning that the price dropped from 716 RMB/TCE to 550 RMB/TCE, while total electricity generation increased from 8.3 TWh in 2014 to 11.1 TWh in 2015, a 33% increase.

According to Fig. 6, there is no certain relationship between economic efficiency and energy economic efficiency. The companies could be divided into two energy economic efficiency categories: one with a value nearly equal to 1, such as NMHD and GDDL, and the other with a value far lower than 1. Companies could move to the better category by implementing some effective strategies, such as those implemented by the YNKG company.

Conclusions and policy implications

As a primary input factor, energy should be taken into consideration as part of the whole economic system when making decisions. Minimizing the total cost is the producer’s fundamental aim. The strategy of single aim, such as decreasing the energy intensity index, may lead to a local optimal solution. However, the local optimal solution does not always match the global optimal solution, and it may sometimes cause more waste. As a new energy efficiency indicator, energy economic efficiency solved the limitations of a local optimal solution by introducing the price mechanism and considering the whole economic system.

In this paper, we collect and process the quantity and price data of capital, labor, and energy input factors in twelve thermal power public companies during the period of the 12th five-year plan. Based on the new theory and data, we compute the economic efficiency, energy economic efficiency, and other related efficiencies of thermal power generation of these companies. The results show that leading by the policy of energy saving and emission reduction, the energy economic efficiency of the twelve public companies increased in the 12th five-year plan, while the economic efficiency decreased. Moreover, in 2015, these twelve companies had approximately 40 billion RMB in potential cost savings, with approximately 31 billion RMB in energy. And due to high efficiency of these public companies, potential cost savings will be underestimated in some way when applying the results to the whole industry.

The main challenge of China’s thermal power industry is to improve the use of each input factor, especially the energy. Among the 40 billion RMB potential cost savings, about 32 billion RMB (81.5%) is caused by the inefficient use of input factors, which include 21 billion RMB caused by the inefficient use of energy. And another 8 billion RMB (18.5%) potential cost savings is from the unscientific allocation of input factors.

In the next five-year plan, more attention should be paid to energy utilize efficiency, development quality, market rules and regulations, and economic effectiveness, such as the coal combustion technology and the imperfect substitution among energy and other production factors, to decrease total cost. Future policy should combine the energy saving goal and cost saving goal. Concentrating on energy saving or improving energy intensity will cause more waste in the other parts of the economic system. We must emphasize that the final goal is the utility of the whole system; improving energy efficiency is just one tool.

A company’s growth strategy will lead to a huge change in economic efficiency but will have little change in energy economic efficiency. The amount of energy used is strongly associated with production, so energy costs will increase with a fixed coefficient when production increases. While the increase of the capital and labor input factors are limited by their characteristics, in a company growth situation, more attention should be paid to the increase of labor and capital to reduce costs.

References

Ajayi, V., Weyman-Jones, T., & Glass, A. (2017). Cost efficiency and electricity market structure: a case study of OECD countries. Energy Economics, 65, 283–291.

Balku, Ş. (2017). Analysis of combined cycle efficiency by simulation and optimization. Energy Conversion and Management, 148, 174–183.

Bi, G. B., Song, W., Zhou, P., & Liang, L. (2014). Does environmental regulation affect energy efficiency in China's thermal power generation? Empirical evidence from a slacks-based DEA model. Energy Policy, 66, 537–546.

Christensen, L. (1976). Economies of scale in us electric power generation. Journal of Political Economy, 84(4), 655–676.

Dorfman, R., Samuelson, P. A., & Solow, R. M. (1958). Linear programming and economic analysis. Santa Monica: RAND Corporation.

Du, L., Hanley, A., & Zhang, N. (2016). Environmental technical efficiency, technology gap and shadow price of coal-fuelled power plants in China: a parametric meta-frontier analysis. Resource and Energy Economics, 43, 14–32.

Färe, R., Grosskopf, S., & Lovell, C. K. (1985). The measurement of efficiency of production. Springer Science & Business Media, 6.

Färe, R., Grosskopf, S., Norris, M., & Zhang, Z. (1994). Productivity growth, technical progress, and efficiency change in industrialized countries. American Economic Review, 84(1), 66–83.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society. Series A (General), 120(3), 253–290.

Jorgenson, D., Gollop, F. M., & Fraumeni, B. (2016). Productivity and US economic growth. Elsevier, 169.

Li, M. J., Song, C. X., & Tao, W. Q. (2016a). A hybrid model for explaining the short-term dynamics of energy efficiency of China’s thermal power plants. Applied Energy, 169, 738–747.

Li, H. Z., Kopsakangas-Savolainen, M., Xiao, X. Z., Tian, Z. Z., Yang, X. Y., & Wang, J. L. (2016b). Cost efficiency of electric grid utilities in China: A comparison of estimates from SFA–MLE, SFA–Bayes and StoNED–CNLS. Energy Economics, 55, 272–283.

Liao, H., Du, Y. F., Huang, Z., & Wei, Y. M. (2016). Measuring energy economic efficiency: a mathematical programming approach. Applied Energy, 179, 479–487.

Maloney, M. T. (2001). Economies and diseconomies: estimating electricity cost functions. Review of Industrial Organization, 19(2), 165–180.

NBS (National Bureau of Statistics of China) (2010). Handbook of energy statistics. Beijing: China Statistical Press.

NBS (National Bureau of Statistics of China) 2017. China statistical yearbook 2017. Beijing: China Statistical Press.

NDRC (National Development and Reform Commission) (2017). The 13th five-year plan for electricity of the People's Republic of China. https://www.ndrc.gov.cn/fggz/fzzlgh/gjjzxgh/201706/t20170605_1196777.html. Accessed 20 Dec 2017.

Tao, Y., & Zhang, S. (2013). Environmental efficiency of electric power industry in the Yangtze River Delta. Mathematical and Computer Modelling, 58(5), 927–935.

Wang, Y. S., Xie, B. C., Shang, L. F., & Li, W. H. (2013). Measures to improve the performance of China’s thermal power industry in view of cost efficiency. Applied Energy, 112, 1078–1086.

Wang, K., Lee, C. Y., Zhang, J., & Wei, Y. M. (2016a). Operational performance management of the power industry: a distinguishing analysis between effectiveness and efficiency. Annals of Operations Research, 1–25.

Wang, K., Xian, Y., Zhang, J., Li, Y., & Che, L. (2016b). Potential carbon emission abatement cost recovery from carbon emission trading in China: an estimation of industry sector. Journal of Modelling in Management, 11(3), 842–854.

Wang, H., Ang, B. W., Wang, Q. W., & Zhou, P. (2017). Measuring energy performance with sectoral heterogeneity: a non-parametric frontier approach. Energy Economics, 62, 70–78.

Wei, Y. M., & Liao, H. (2010). China energy report (2010): Energy efficiency research. Beijing: Science Press.

Xie, B. C., Shang, L. F., Yang, S. B., & Yi, B. W. (2014). Dynamic environmental efficiency evaluation of electric power industries: evidence from OECD (Organization for Economic Cooperation and Development) and BRIC (Brazil, Russia, India and China) countries. Energy, 74, 147–157.

Xu, C., Xu, G., Zhao, S., Dong, W., Zhou, L., & Yang, Y. (2016). A theoretical investigation of energy efficiency improvement by coal pre-drying in coal fired power plants. Energy Conversion and Management, 122, 580–588.

Zhang, N., Kong, F., Choi, Y., & Zhou, P. (2014). The effect of size-control policy on unified energy and carbon efficiency for Chinese fossil fuel power plants. Energy Policy, 70, 193–200.

Acknowledgments

The authors appreciate the constructive comments from Prof. Paolo Bertoldi and the anonymous reviewers.

Funding

This work is supported by funding from the National Natural Science Foundation of China (Nos. 71521002, 71673026, 71925008, 71950007), Joint Development Program of Beijing Municipal Commission of Education.

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Disclaimer

The views expressed in this paper are solely the authors’ own and do not necessarily reflect the views of the supporting agencies and authors’ affiliations. The authors alone are responsible for any remaining deficiencies.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Appendix

4 The code and data (RAR 14 kb)

Appendices

Appendix 1. The proof

Assuming that:

- Ee:

is economic efficiency;

- ke:

is capital economic efficiency;

- le:

is labor economic efficiency;

- ee:

is energy economic efficiency.

- ck:

is the capital cost under real situation,

- ck∗:

is the capital cost under optimal situation;

- cl:

is the labor cost under real situation,

- cl∗:

is the labor cost under optimal situation;

- ce:

is the energy cost under real situation,

- ce∗:

is the energy cost under optimal situation.

According to the definitions, we have:

So,

Let,

We have,

That is,

Appendix 2. The full names, abbreviations, and stock codes of the 12 companies

No. | Company name | Company code | Assets (billion RMB) | Location |

|---|---|---|---|---|

1 | Huadian Energy Company | HDNY | 23.4 | Harbin |

2 | Huadian Power International | HDGJ | 176.1 | Jinan |

3 | Jilin Electric Power | JDGF | 18.9 | Changchun |

4 | Guodian Changyuan Electric Power | CYDL | 11.6 | Wuhan |

5 | Zhejiang Zheneng Electric Power | ZNDL | 100 | Hangzhou |

6 | Gd Power Development | GDDL | 225.4 | Beijing |

7 | Inner Mongolia Mengdian Huaneng | NMHD | 36.9 | Huhhot |

8 | Datang International Power Generation | DTFD | 282.9 | Beijing |

9 | Hebei Jiantou Energy Investment | JTNY | 20.3 | Shijiazhuang |

10 | Henan Yuneng Holdings | YNKG | 8.8 | Zhengzhou |

11 | Huaneng Power International | HNGJ | 268.7 | Beijing |

12 | Datang Huayin Electric Power | HYDL | 16.6 | Changsha |

Appendix 3. The results

Company code | Year | Economic efficiency | Capital economic efficiency | Labor economic efficiency | Energy economic efficiency | Energy utilize efficiency |

|---|---|---|---|---|---|---|

HDNY | 2011 | 0.75 | 1.57 | 0.38 | 0.68 | 0.88 |

HDNY | 2012 | 0.75 | 1.53 | 0.34 | 0.68 | 0.88 |

HDNY | 2013 | 0.72 | 1.13 | 0.31 | 0.72 | 0.83 |

HDNY | 2014 | 0.73 | 1.06 | 0.35 | 0.74 | 0.82 |

HDNY | 2015 | 0.73 | 1.01 | 0.32 | 0.75 | 0.81 |

HDGJ | 2011 | 0.81 | 1.55 | 0.99 | 0.70 | 0.90 |

HDGJ | 2012 | 0.81 | 1.38 | 0.99 | 0.71 | 0.87 |

HDGJ | 2013 | 0.84 | 1.16 | 1.04 | 0.76 | 0.88 |

HDGJ | 2014 | 0.85 | 1.09 | 1.06 | 0.77 | 0.88 |

HDGJ | 2015 | 0.83 | 0.92 | 0.97 | 0.78 | 0.84 |

JDGF | 2011 | 0.76 | 1.29 | 0.75 | 0.68 | 0.81 |

JDGF | 2012 | 0.76 | 0.86 | 0.75 | 0.74 | 0.77 |

JDGF | 2013 | 0.77 | 0.80 | 0.75 | 0.76 | 0.77 |

JDGF | 2014 | 0.74 | 0.66 | 0.66 | 0.78 | 0.75 |

JDGF | 2015 | 0.70 | 0.54 | 0.58 | 0.84 | 0.76 |

CYDL | 2011 | 0.75 | 1.49 | 0.63 | 0.69 | 0.87 |

CYDL | 2012 | 0.75 | 1.31 | 0.55 | 0.70 | 0.83 |

CYDL | 2013 | 0.78 | 1.46 | 0.68 | 0.70 | 0.87 |

CYDL | 2014 | 0.80 | 1.31 | 0.55 | 0.75 | 0.86 |

CYDL | 2015 | 0.79 | 1.00 | 0.55 | 0.80 | 0.83 |

ZNDL | 2013 | 0.92 | 1.56 | 1.79 | 0.77 | 1.00 |

ZNDL | 2014 | 0.88 | 1.17 | 1.38 | 0.78 | 0.94 |

ZNDL | 2015 | 0.84 | 0.91 | 1.14 | 0.79 | 0.89 |

GDDL | 2011 | 0.99 | 1.21 | 0.84 | 0.96 | 1.00 |

GDDL | 2012 | 0.99 | 1.14 | 0.81 | 0.97 | 1.00 |

GDDL | 2013 | 0.99 | 1.13 | 0.95 | 0.96 | 1.00 |

GDDL | 2014 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

GDDL | 2015 | 0.98 | 0.84 | 0.95 | 1.06 | 1.00 |

NMHD | 2011 | 0.92 | 1.21 | 1.15 | 0.80 | 0.96 |

NMHD | 2012 | 0.88 | 1.03 | 1.12 | 0.79 | 0.90 |

NMHD | 2013 | 0.89 | 0.87 | 0.59 | 0.96 | 0.92 |

NMHD | 2014 | 0.87 | 0.77 | 0.50 | 0.98 | 0.88 |

NMHD | 2015 | 0.78 | 0.61 | 0.43 | 0.98 | 0.80 |

DTFD | 2011 | 0.88 | 1.43 | 1.79 | 0.74 | 0.98 |

DTFD | 2012 | 0.85 | 1.14 | 1.40 | 0.74 | 0.91 |

DTFD | 2013 | 0.86 | 1.04 | 1.35 | 0.75 | 0.91 |

DTFD | 2014 | 0.82 | 0.85 | 1.13 | 0.76 | 0.87 |

DTFD | 2015 | 0.77 | 0.68 | 1.01 | 0.77 | 0.84 |

JTNY | 2011 | 0.79 | 1.64 | 0.62 | 0.70 | 0.91 |

JTNY | 2012 | 0.77 | 1.58 | 0.55 | 0.71 | 0.90 |

JTNY | 2013 | 0.83 | 1.37 | 0.80 | 0.75 | 0.92 |

JTNY | 2014 | 0.84 | 1.19 | 0.87 | 0.76 | 0.88 |

JTNY | 2015 | 0.82 | 0.95 | 0.83 | 0.77 | 0.83 |

YNKG | 2012 | 0.73 | 1.40 | 2.27 | 0.60 | 1.00 |

YNKG | 2013 | 0.85 | 1.15 | 1.87 | 0.74 | 1.00 |

YNKG | 2014 | 0.83 | 1.08 | 1.00 | 0.76 | 0.86 |

YNKG | 2015 | 0.96 | 0.82 | 0.86 | 1.03 | 0.97 |

HNGJ | 2011 | 0.83 | 1.55 | 1.29 | 0.71 | 0.92 |

HNGJ | 2012 | 0.80 | 1.27 | 1.17 | 0.72 | 0.87 |

HNGJ | 2013 | 0.85 | 1.27 | 1.17 | 0.76 | 0.91 |

HNGJ | 2014 | 0.83 | 1.11 | 1.08 | 0.76 | 0.88 |

HNGJ | 2015 | 0.84 | 1.03 | 1.06 | 0.76 | 0.87 |

HYDL | 2011 | 0.82 | 1.85 | 0.63 | 0.73 | 1.00 |

HYDL | 2012 | 0.83 | 1.73 | 0.60 | 0.73 | 0.98 |

HYDL | 2013 | 0.81 | 1.40 | 0.54 | 0.74 | 0.92 |

HYDL | 2014 | 0.77 | 0.91 | 0.54 | 0.78 | 0.84 |

HYDL | 2015 | 0.65 | 0.57 | 0.40 | 0.77 | 0.72 |

Rights and permissions

About this article

Cite this article

Du, YF., Liao, H. & Wei, YM. Integrating cost information in energy efficiency measurement: An empirical study on thermal power companies. Energy Efficiency 13, 697–709 (2020). https://doi.org/10.1007/s12053-020-09849-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-020-09849-5