Abstract

Energy efficiency networks have received increasing attention over the last few years, not only from national governments (Austria, China, Germany, Sweden, and Switzerland) but also from utilities, consulting engineers, chambers of commerce, and city councils. This paper examines the factors that contribute to the success of such networks by drawing on unique data from two pilot projects involving 34 energy efficiency networks in Germany. The objective is to explain why the companies participating in such networks are much faster at reducing their energy costs than the average in similar businesses. Possible explanations for the success of energy efficiency networks include the following: (1) energy audits make profitable potentials visible; (2) the joint network targets for efficiency and emissions increase the motivation of energy managers, decision-makers, and other staff members; (3) the meetings and site visits of the network participants act like an intensive training course to increase the knowledge of efficient solutions, change decision routines, and lead to trust among the participants; and (4) network participation reduces transaction costs. In our data, we find support for the first, the third, and the fourth explanations, i.e. the audits make profitable potentials visible and networks function as a training course to increase knowledge. And, from the point of view of participants, transaction costs are reduced. The impact of network goals, on the other hand, appears to have both up- and downsides. We conclude that there is the need for further research in order to capture these mechanisms in more detail.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Realising cost-effective energy savings could help to meet half of Europe’s 2050 goal for reducing greenhouse gas emissions (Wesselink et al. 2010). In this context, energy efficiency networks have received increasing attention over the last few years, not only from national governments (Austria, China, Denmark, Germany, Sweden, and Switzerland) but also from utilities, consulting engineers, chambers of commerce, and city councils (Paramonova and Thollander 2016; Jochem et al. 2016). These networks are intended to promote economically viable energy efficiency improvements. An energy efficiency network usually consists of a group of organisations, often between eight and 15, mostly companies, but sometimes also public institutions and other types of organisations. Typically, members of a network are from either the same local area or the same line of business. The networks are established for a defined period of time, usually a minimum of 2, but generally for 3 to 4 years.Footnote 1 Network activities combine activities around energy efficiency on the individual and the group level. On the individual level, they consist of conducting an energy audit (or drawing on the outcome of an existing one), identifying the most promising measures, which are then implemented, and monitoring their success. On the group level, this is accompanied by continuous exchanges between network participants to facilitate energy efficiency improvements. Important roles within the networks include the network operator, network moderator, and consulting engineers. Network operators organise the administrative and financial issues, e.g. the distribution of costs or fulfilling the requirements due to governmental support of the networks. Typical organisations which act as administrators include industry associations or (local) energy companies. Network moderators are responsible for the organisational part as well as the development of the network itself, i.e. they are the central point of contact within the network, organise meetings and external expertise for the topics of interest to the network participants. Finally, consulting engineers, who also conduct the initial audits if needed, provide the expertise concerning energy efficiency topics.

The concept of Learning Energy Efficiency Networks (LEEN) was first implemented in Switzerland and transferred to Germany in 2002 and has undergone continuous refinement since then and diffused to other countries (cp. Jochem et al. (2016) for a more detailed description of the development). From 2008 to 2014, the German government, namely the Ministry for Environmental Affairs, financially supported a pilot project to set up 30 LEEN across Germany (“30-Pilot Networks” project). This is the main source for the empirical data used in this paper. The LEEN concept targets companies which spend at least €0.5 million each year on energy to make sure that participation is cost-effective. The implementation of the 30-Pilot Networks project was coordinated by the Fraunhofer ISI (2016), an applied research institute. This coordination, the development of standards and procedures as well as the necessary documents by Fraunhofer ISI together with several project partners, was funded by the German government. In addition, one third of the actual costs of running a network were funded (up to a max. €80,000–120,000 per network depending on the number of companies per network), e.g. for meetings and presentations by external experts including the initial audits.Footnote 2 The initial audits and the reporting on the audits in these networks were designed to comply with ISO 50001, which was published in 2011. While following ISO 50001 is voluntary in Germany, doing so qualifies energy-intensive companies for exemption from certain energy taxes (Rohde et al. 2015). In addition, the initial audit also complies with the obligations from the national implementation of Article 8 of the European Energy Efficiency Directive (EED), introduced in 2015, which requires larger enterprises to conduct an energy audit every 4 years (Rohde et al. 2015). However, since this regulation was only introduced after the 30-Pilot Network project was completed, it did not influence the data analysed in this paper. There is also an adapted concept for smaller companies with lower energy costs called Mari:e (“Mari:e – mach’s richtig: energieeffizient”, i.e. “do it right: be energy efficient”, project lifetime from 2013 to 2016).Footnote 3 In this paper, we also draw on data from all four Mari:e networks that have been established. The initiation of the Mari:e networks was coordinated by STREKS, a German foundation. The work of STREKS was again funded by the German government, while the costs of the initial audit for the participating companies were supported under a programme of the German KfW-Bank, which specialises in distributing public funding and sponsored loans and ran a programme supporting energy audits. The KfW-programme was in place until 2014.

These successful pilot projects were followed by two further initiatives in Germany to promote energy efficiency networks. Firstly, the German government and 20 industrial associations agreed on a target of 500 energy efficiency networks until 2020 following an adapted minimum standard regarding network structure and performance. Secondly, and supporting this initiative, the German Ministry for the Environment initiated a project to extend the more extensive LEEN concept to 100 networks in Germany by 2017. Based on the findings from the 30-Pilot Networks project, it is expected that 75 PJ of primary energy can be saved and greenhouse gas emissions can be reduced by 5 million tonnes by 2020 (BMWi 2014).

Generally, it is assumed that companies constantly improve their energy efficiency level independent of any external intervention, e.g. due to the replacement of old equipment and acquiring new technologies. Such autonomous progress is usually assumed to add up to 1% energy efficiency improvement per year (cp. Worrell et al. (2009) and Jochem et al. (2010)). Earlier work on the LEEN networks (Bradke et al. 2015) indicates that companies participating in such networks progress about twice as fast. Thus, energy efficiency networks seem to be a successful way to encourage energy efficiency improvements in companies. However, so far, there has been little research on how and why efficiency networks are successful.

To explore the possible answers to these questions, we summarise the research on factors hindering the realisation of profitable efficiency potentials, outline the findings of earlier publications on efficiency networks, and then discuss the underlying processes that might contribute to network success. Building on this background information, empirical data drawn mainly from the 30-Pilot Networks project are analysed to explore whether they confirm the assumptions about the underlying processes. However, the nature of this study is explorative and not intended to test hypotheses.

Processes contributing to the success of energy efficiency networks

This section starts with a very brief description of the obstacles hindering the realisation of profitable energy efficiency potentials as these have been intensively explored in the literature. This is followed by a summary of the literature on LEEN so far and concludes with assumptions about the processes contributing to the success of LEEN.

Barriers to energy efficiency in industry

The literature on barriers to energy efficiency looks at the so-called energy efficiency gap (e.g. Jaffe and Stavins (1994) and Brown 2001)), i.e. why cost-effective energy efficiency measures are not always put into practice. A barrier is usually defined as “a mechanism that inhibits a decision or behaviour that appears to be both energy efficient and economically efficient” (Sorrell et al. 2004). The widely cited classification of barriers suggested by Sorrell et al. (2004) distinguishes six categories of barriers, which can be summarised as follows:

-

Risks: Risks are negative consequences associated with the introduction of energy efficiency measures, e.g. unintended changes to product quality or the stability of the production process.

-

Imperfect information: Imperfect information is incomplete, preliminary, or uncertain information that impedes a decision-maker from making a well-informed decision.

-

Hidden costs: Hidden costs are reductions in utility or effort that are not fully accounted for in techno-economic considerations, e.g. overhead or transaction costs.

-

Access to capital: Access to capital describes a situation where companies do not have the financial means to invest in otherwise cost-effective measures, e.g. due to other priorities or limited credit lines.

-

Split incentives: Split incentives describe a situation where the incentives of implementing energy efficiency measures do not appropriately encourage all the involved actors, e.g. when expenditures for investments and the resulting energy savings are accounted for in different departments.

-

Bounded rationality: Bounded rationality describes constraints that impede rational decisions, e.g. decision-makers’ lack of time or focus on more prestigious projects.

Various studies have suggested extensions of the conceptual foundations, e.g. by stressing the drivers of or motivators for energy efficiency (e.g. Thollander et al. (2013), Cagno and Trianni (2013), and Meath et al. (2016)), by considering the dynamics and interconnections among barriers (e.g. Chai and Yeo (2012) and Cagno et al. (2013)), by stressing the social and cultural dimensions of barriers (e.g. Palm (2009) and Bell et al. (2014)), or by addressing other contextual factors (e.g. Cooremans (2012) and Langlois-Bertrand et al. (2015)). There are also indications that certain organisational characteristics can affect the relevance of particular barriers, e.g. the size or sector of an organisation (Trianni and Cagno 2012).

Despite a general consensus on the relevance of barriers, it remains difficult to pinpoint the overarching relevance of individual barriers in empirical studies. This is probably due to different taxonomical approaches and heterogeneous industrial segments as well as the usually overlapping and often elusive nature of barriers. Sorrell et al. (2011) attempted to identify indications for the relevance of each barrier according to the previously mentioned categories. Their findings suggest that barriers related to imperfect information, access to capital, and bounded rationality are particularly relevant.

Earlier research on energy efficiency networks

The development of energy efficiency networks has been closely monitored by research institutes. For example, the pilot project for 30 LEEN included an extensive evaluation process, which produced a rich amount of data from several sources that served as the basis for several papers (e.g. Köwener et al. (2011), Jochem et al. (2010), Köwener et al. (2014), and Wohlfarth et al. (2017)—see below for more details). Research from other countries has also contributed to this literature (e.g. Paramonova et al. (2014), Paramonova and Thollander (2016), and Nakova (2007)).

Earlier research described the approach of energy efficiency networks and their influence on increasing energy efficiency in companies. Several publications presented updated figures on the energy efficiency targets agreed between companies (2% per year on average, see Köwener et al. (2011), similarly Jochem et al. (2010)). A more recent publication by Köwener et al. (2014) highlighted that the pilot phase for LEEN identified 7000 measures, of which 3600 were profitable (i.e. with an internal rate of return > 12%). Based on the same data, Rohde et al. (2015) examined the structure of the identified measures and concluded that a major share (~ 85%) requires investments below €50,000 and that the average payback time for profitable measures is between 2.2 years (for compressed air systems) and 4.3 years (for air conditioning). Paramonova et al. (2014) also underlined the positive impacts of energy efficiency networks beyond those a stand-alone energy audit can achieve based on data from eight Swedish networks.

Some authors, e.g. Köwener et al. (2014) or Jochem and Gruber (2007), have already identified mechanisms that make the network approach successful, e.g. the structured process of an energy efficiency network that includes an energy review in each company, regular meetings, and yearly monitoring. However, they have not related these mechanisms to data from the networks.

Wohlfarth et al. (2016) relate the network approach to the literature on barriers. They identified information deficits as a relevant barrier for companies and demonstrated empirically that energy efficiency networks could overcome this barrier. Furthermore, they identified financial barriers as the most prevalent. They also found that the number of implemented measures is related to company size. Motivational issues are more prevalent in bigger companies and in those with higher energy costs / belonging to an energy-intensive industry. Financial barriers are more prevalent in companies that are part of another corporation and if decisions depend on the amount of expenses. Another paper by Wohlfarth et al. (2017) based on survey data showed that network participants were mainly motivated by the need for practical knowledge and specific information resulting from the participation in networks; the majority of surveyed participants stated that network participation resulted in the implementation of measures that would not have been realised otherwise. Similarly, based on a number of interviews with network coordinators and participants in Sweden, Paramonova and Thollander (2016) report that respondents are convinced that network participation helped them to reduce energy costs and set up performance indicators. Several of them observed enhanced employee motivation regarding energy issues as an outcome of participation. Some companies found it difficult to provide the resources needed for network activities over a longer period. Companies identified mutual learning and the exchange of experience as relevant drivers of network success. Especially this last block of studies provides some first indications about the socio-technical process underlying energy efficiency networks, which is the focus of this paper.

Assumptions about the working mechanisms of energy efficiency networks

In this paper, we want to explore in more detail the mechanisms that make efficiency networks effective, i.e. what processes and mechanisms are triggered or supported by the networks that lead to the additional improvements in energy efficiency? As outlined above, Köwener et al. (2014) or Jochem and Gruber (2007) indicated which mechanisms could be relevant, while Wohlfarth et al. (2017) draw on the literature concerning barriers to efficiency improvements and relate this to network activities. The innovative angle of this paper is that we aim to take a closer look at the mechanisms themselves by developing assumptions and then exploring these assumptions empirically based on data from the two pilot projects.

The main idea regarding the working mechanisms of efficiency networks is that these networks are social constructs (cp. Jochem and Gruber (2007), who look at networks from a social relations perspective). They trigger progress in energy efficiency on an individual (energy managers, decision-makers) and group level (the organisation, i.e. the company or institution, as a whole, across the network participants) and thereby reduce the perceived barriers that hindered the organisation from realising relevant profitable potentials (cp. Wohlfarth et al. (2016)). In the following, we present four assumptions about the working mechanisms of energy efficiency networks.

First of all, we assume that the networks act as an agenda setter, i.e. energy efficiency becomes a topic of organisational decision-making through the participation in the network. Although the relevance of this step has been recognised in the literature, knowledge about it is limited (cp. Hutzschenreuter and Kleindienst (2006) and Cooremans (2012)). Agenda setting is the precondition for decision-making about specific issues. In addition to agenda setting, the initial energy audits make profitable potentials visible—to the individual as well as the group. This is likely to help reduce the problems related to barriers such as imperfect information and bounded rationality.

Secondly, while agenda setting leads to awareness of profitable efficiency potentials, actually initiating measures and putting them into practice needs further motivation. It is assumed that this motivation grows from the joint network targets on efficiency and emissions. Literature on organisational goal setting (e.g. Locke and Latham (2002)) has shown that (common) goals are a powerful means to sustain motivation for actions. It is likely that they also address barriers like split incentives.

Thirdly, we assume that the regular meetings and site visits to network participants act like an intensive training course that sustains motivation and also increases the knowledge about efficient solutions (cp. Paramonova and Thollander (2016)). This increase of knowledge is likely to have effects on several of the barriers outlined above. It obviously reduces information deficits (cp. Wohlfarth et al. (2017)), but also reduces the perceived risk of measures as, within networks, participants are able to profit from the experiences of other network members. Again, it is likely to help reduce bounded rationality by focusing attention and adding facts to the knowledge used as the basis for decision-making.

Fourth, we expect networks to reduce the transaction costs related to implementing energy efficiency measures. Transaction costs cover all the resources that need to be invested due to an exchange of goods or services (Richter and Furubotn 2003), i.e. the costs for searching and analysing relevant information and for negotiations and decision-making processes as well as for control and realisation. Energy efficiency measures are also accompanied by these kinds of transaction costs, but it is assumed that they are lower for companies participating in networks for the following reasons: Network participants exchange experiences and also engage in bilateral consultation, so the transaction costs for gathering and evaluating information should be lower for them. Similarly, the effort for negotiation and decision-making can be reduced by building on the experience of other network participants. Transaction costs can exert major influence on the decision process concerning investments, but there are hardly any empirical studies of this issue to date (Mai and Jochem 2017; Mai et al. 2014).

In the next section, we analyse the empirical data to see if it supports our four assumptions.

Methods

This paper draws on empirical data from the two LEEN pilot projects, the 30-Pilot Networks project and Mari:e. The 30-Pilot Networks project was intended to initiate and manage 30 LEEN and was accompanied by a parallel evaluation process. This evaluation process had two main goals: one, to continuously improve network management by providing feedback, and two, to accumulate data for scientific analysis. Both pilot projects focused on local and regional networks. This implies that companies from different lines of business were involved. As a result, the networks tended to focus more on cross-cutting issues that affected all the participants like lighting or waste heat utilisation and less on efficiency potentials in the companies’ individual production processes.

The main sources of data are the following: (i) the lists of measures identified in the initial audits; (ii) the annual monitoring data; (iii) three surveys of the participating companies (after network initiation, after completing the audit, at the end of the network phase); (iv) the interview series with the main network actors, i.e. network initiator, consulting engineer, and network moderator; and (v) additional survey of a sub-sample of participating countries from the 30-Pilot Networks on transaction costs. The 30-Pilot Network process provided data for (i) to (v), while four networks from Mari:e provided additional data for (i) and (ii). The data will be described in more detail in this section after outlining the network design applied in the LEEN pilot and in Mari:e.

The network design for LEEN and Mari:e

Both network approaches started with an energy audit to obtain a detailed evaluation of the status quo and, more importantly, to identify potentially profitable energy efficiency measures. These audits are extensive and include a structured data collection by the participating company prior to a field visit from an engineer who supports each network as a consultant. If an audit had already been conducted before the company joined the network, its outcome can be adapted and complemented where necessary to comply with LEEN standards. LEEN audit standards emphasise that the audit is done by an external consultant with resources of around ten working days to guarantee high-quality standards. Based on the audit’s findings, each participating company defines an individual quantitative goal regarding efficiency. Starting at the same time, the participants attend regular meetings (3–4 per year), which usually take place at the site of one of the network participants. A site tour focusing on energy efficiency is part of the standard agenda at these meetings as well as discussions about specific topics that are supported by input from external experts. Each company’s progress is monitored on an annual basis as is the network’s success as a whole in terms of energy savings and CO2 emission reductions. The LEEN concept includes a training programme for the consulting engineer and the network moderator, who support and organise the network processes and provide technical tools for the energy audit and other network components. The network activities including the audit and the work of the consulting engineer and the moderator are funded by contributions from the participating companies. It is assumed that the money saved through the identified and implemented energy efficiency measures will exceed these contributions. Additionally, public funding may reduce the participants’ contributions as was the case in the 30-Pilot Networks project.

Energy audit and monitoring data

Various quantitative technical data were collected during the 30-Pilot Networks and the Mari:e projects. Consulting engineers and network moderators used standardised tools for the initial energy audits and the annual monitoring within these projects. The energy efficiency, CO2 saving potential, and the profitability of the proposed measures can be analysed based on the energy audit reports of 400 companies (360 from the 30-Pilot Networks, 40 from Mari:e) (Table 1). Overall, companies from a broad variety of industries participated in both types of networks. The biggest subgroup with ca. 10% comprised companies from the food sector. Other industries included mechanical engineering, metal products, chemicals and plastics, beverages, and health care.

The monitoring methodology was changed to a bottom-up approach during the 30-Pilot Networks project (Ott and Jochem 2012), so that monitoring results are only available for roughly 260 companies. As explained in more detail by Köwener et al. (2014), this approach takes into consideration the sum of all measures realised between the base year and the year of analysis, expressed in energy units per year. This indicator only lists measures that are documented as energy efficiency measures by the organisation. As the effect of the measure is normally only determined once, certain effects are adjusted in the calculation, e.g. heating degree-day values or changes in production. In order to capture all the changes, the impact of each measure is calculated for the analysed year. The bottom-up approach identifies the sum for both the energy efficiency improvement and the CO2 emission reduction. Currently, the LEEN management system defines an annual monitoring process for all companies based on final energy and primary energy. As mentioned earlier in this paper, both the energy audits and the monitoring process conform to DIN EN ISO 50001.

Monitoring is intended to provide evidence of the effects realised by the measures. It is a way to track the progress made towards the individual energy efficiency targets and the jointly agreed network target. The base year of this target is the year when the network was launched. During the network’s lifetime of 3 to 4 years, the individual targets of all companies are aggregated, monitored yearly, and compared to the agreed network target to track the progress made.

Questionnaires and interviews

The social scientific part of the evaluation process documented the expectations about and the satisfaction or dissatisfaction of all the actors involved with the different network elements and processes. These actors include the network participants, i.e. the companies, but also other network actors such as the network initiators, consulting engineers, and network moderators.

Due to the large number of more than 300 companies participating in the 30 networks, a standardised approach applying a written survey was chosen. This survey was conducted in three waves—wave 1 in the first year of the network including mainly questions about network initiation, motivation for participation, and expectations regarding the network. The second wave was conducted after a network had completed the energy audit phase and focused on experiences with the audit. The third and last wave was conducted towards the end of the network and covered the types of measures taken, barriers encountered, the decision-making process in the organisation, interaction with certain political measures, and network ratings. Of the 360 companies participating in the networks, 304 responded to the first survey, 281 to the second, and 213 to the third. While it is normal in longitudinal studies for the number of respondents to decrease across survey waves, the relatively low number of completed questionnaires in the final round here was partly due to the high level of network activities during the final period of the network process. Questionnaires were provided in the form of Word files that could be filled in on a computer, or printed out and completed as a paper and pencil version. The questionnaires received back from the companies were checked for quality and data were then entered into an SPSS file for further analysis. For this paper, we only used data from the second and third survey waves and applied descriptive statistics as well as a multivariate linear regression model to analyse them.

Interviews were conducted with the other network actors in order to protocol their experiences and collect their feedback on possible improvements and encountered difficulties. These interviews followed a guideline to ensure comparability and most of them lasted between 30 and 40 min. Interviews were recorded and later transcribed. Each network has an initiator, an engineer, and a moderator. However, the number of interviews in each category does not equal 30, because, for example, two bigger engineering consultancies were engaged in several pilot networks with small groups of engineers. In other cases, several freelance engineers shared the network activities of a single network between them. Also, some of the moderators were responsible for more than one network. Thus, in the end, 30 initiators of networks were interviewed, some of whom were also active as network moderators. Twenty-nine interviews were conducted with consulting engineers, who covered all 30 networks. There were interviews with 26 moderators, who covered all the networks from the pilot project. Software was used to code all three interview series in order to draw conclusions and identify relevant results. Codes were developed based on the interview guideline and then refined as needed, e.g. by breaking down questions that led to answers covering many aspects into sub-codes, or by adding codes for additional topics. The analysis uses a thematic approach, i.e. identifying themes and patterns, and not a quantitative approach, e.g. counting the frequency of certain codes. In the following, original quotes from the interviews (shown in italics) will be used to illustrate selected findings.

Finally, an additional survey was conducted of companies participating in the 30-Pilot Networks project. As this survey was extensive, only a sub-sample was invited to take part (100 companies), of which 79 participated. This survey focused on the transaction costs of an energy efficiency measure and tried to explore this issue in detail. The survey is described in Mai et al. (2014) and Mai and Jochem (2017).

The following figure gives an overview of the network life cycle and the data sources (Fig. 1).

Results

This section is structured using the four assumptions outlined above and combines findings from the sources described in the “Methods” section. It starts with data illustrating the networks’ success and updating the figures presented in earlier publications (Köwener et al. 2011; Jochem et al. 2010; Köwener et al. 2014).

As outlined above, the joint efforts resulted in an annual energy efficiency improvement that is higher than the assumed average of German industry (Bradke et al. 2015). Evaluating the data from the submitted monitoring reports from 30-Pilot Networks as well as from the four networks of the Mari:e project shows an average increase in energy efficiency of 2.0% per year and a reduction in CO2 emissions of 2.3% per year. This observation is based on the average 3-year participation in a network per company. The data also allowed us to look at the network’s progress, which was assessed in terms of the total final energy savings and corresponding reductions of CO2 emissions per network. Subsequently, the annual progress of the networks was estimated in a similar manner based on the duration of each network, providing the range of achieved annual energy savings (Fig. 2). The achieved energy savings range from 0.3 to 4.3% per year and per network, while the median corresponds to 1.7%. The achieved CO2 emission reduction displays a similar wide range (from 0.2 to 5.9% with a median of 2.1% per year and per network).

These values are based on the weighted average values of the energy efficiency increase and CO2 reduction as a percentage of the total final energy consumption and total CO2 emissions per network. Our colleagues (Köwener et al. 2014) defined the method that we apply in our study as well: The weighted average reveals the sum of the absolute amount of saved energy of all network companies related to the total energy consumption of the whole network. The contribution of small companies to the network target is limited if large companies participate as well. This explains why some networks achieve relatively “small” energy savings and CO2 reductions as seen in Fig. 2.

Audits make profitable potentials visible

To show how audits make profitable efficiency potentials visible, we draw on (1) data from an evaluation of the energy audit phase that covers the reports of the companies participating in either 30-Pilot Networks or Mari:e, (2) findings from the second survey wave, (3) the interviews with consulting engineers. The evaluation focuses on the regional and local energy efficiency networks and does not include other network types (e.g. sectoral, intra-corporate or in-house networks). These results reflect the energy and CO2 saving potentials identified during the energy audit. The energy audit report received by the participating companies includes an overview of all the identified measures in terms of savings and profitability. Compared to an earlier evaluation of the 30-Pilot Networks published by Köwener et al. (2014), which provided similar results, our analysis is based on a broader sample and identified more than 8000 potential measures, i.e. on average about 20 per organisation (cp. Table 1 above). Of this number, about 3900 measures were classified as profitable, meaning that their internal rate of return is higher than 12%.Footnote 4 Ten profitable measures were identified on average for each organisation, with an energy-saving potential of about 2500 MWh and a CO2 reduction potential of approximately 900 tons per year (see Table 2).

The identified measures were categorised into several relevant technology areas (see Table 2). One should take into consideration that the average total additional investment (as shown in Table 1) does not reflect the total investment sum for the specific technology/measure, but the additional investment sum for a more efficient measure. For example, it captures additional costs for highly insulated windows in comparison to standard ones.

In addition, the same data set of energy efficiency measures was categorised using a detailed cluster system (Leinweber 2014). Selected results in Table 3 show the three most frequently suggested technical subcategories for selected technology areas. The breakdown into this detailed cluster system gives us insights into which kinds of measure turn out to be highly profitable at a relatively small additional investment. This evaluation indicates that, according to the initial energy audit estimations, often rather “trivial” measures of optimisation, adjustment and switching off lights in the production area are highly profitable and thus have low risk (Table 3). This can be observed especially in the technology area of compressed air, where all three subcategories have an average internal rate of return (IRR) of well over 40%, while optimisation measures concerning the adjustment and control of equipment are the most profitable. Furthermore, we see an indication that introducing energy management systems in companies turns out to be profitable, resulting in a fairly high energy-saving potential (465 MWh on average).

We also look at the network participants’ perception of the energy audit, drawing on the evaluation data from the 30-Pilot Networks. The second questionnaire featured questions asking for evaluations of several aspects regarding the energy audit. Of the 267 respondents answering the question asking for an overall evaluation of the energy audit on a 5-point scale, 71 rated it with 5 points as very good, and 149 rated it with 4 points, i.e. 82% gave a positive evaluation. Thirty-nine rated it with 3 points and were therefore neutral or undecided; and eight respondents chose 2 points and a negative evaluation. These results show that, overall, participants had a positive perception of the energy audit.

To learn more about the factors influencing the overall evaluation of the energy audit, the variable was regressed on several ratings of single aspects of the energy audit. These single aspects included 15 items, of which five were identified as relevant by a stepwise linear regression model (Table 3).

Overall, 55.6% of the variance in the overall evaluation of the energy audit is explained by the independent variables that remained in the final equation. The most important influencing factor as indicated by the highest β-value is that the report is comprehensive/detailed. From the perspective of the surveyed companies, other relevant factors included the identification of new aspects, sufficient audit length, and the perception that the received advice is competent and comprehensive. Overall, these factors can be interpreted as aspects that contribute to the audit making profitable potentials visible and therefore of value to the participants.

The effects of the energy audit were also addressed within the interviews with the consulting engineers. The consulting engineers agree that the main effect of the energy audit is to get the relevant member of the participating company involved in the topic of energy efficiency and engaged in looking at the relevant data, e.g. the respective facilities and machinery, the current energy demand, and the factors influencing this demand. According to the statements of the consulting engineers, one of the audit’s effects is that it gives a more general perspective and directs attention as illustrated by the following exemplary quote:

They [the participating companies] often no longer see what is under their noses, or have any new ideas. It is useful if someone from outside comes and points out the main issues regarding possible measures, state of technology etc. That’s the main task of the energy audit.

Motivation from joint network targets

In order to analyse whether the joint network targets enhance the motivation to engage in energy efficiency, we draw again on the interviews with the consulting engineers and complement this by findings from the second survey wave and the interviews with the moderators.

It turns out that a few comments of the engineers refer directly to the motivational effects of the joint network targets. Some point out that they had the impression that the targets are less important, especially as they have no effect if they are not reached:

It was good to have defined goals! However, I did not have the impression that it was important what these were exactly, when to reach them or how the effort was shared within the network. Maybe this was too abstract. The specific measures were always exciting topics of interest, but whether they contributed to the network target and how feasible that target is did not seem so relevant.

Many networks did not have problems with defining a network target (nearly 50% of the surveyed companies agreed with a respective statement in the second survey wave), but if problems arose (reported by 32% of the surveyed companies), this led to unsettledness in the network as pointed out in the interviews by the consulting engineers:

If there is a participant who is very cautious about this and then makes a critical statement, this influences the whole group. However, in reality, it depends on the group.

Another difficulty that emerged was that the network timeframe repeatedly turned out to be too short to reach (ambitious) targets, as many companies needed a relatively long time, e.g. to settle investments. This is suggested by comments that were added by survey participants as well as by statements during the moderator interviews.

Overall, there is little support from the evaluation data for the assumption that network targets are an important factor contributing to network success.

Intensive training

To explore whether network participation increases knowledge, we analysed the third survey wave as well as the moderator interviews.

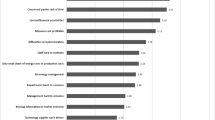

In the third wave of the survey, participants were asked to rate (1) the topics treated in the network meetings, (2) the exchange of experience in these meetings, and (3) the site visits offered as part of the meetings. All three aspects were rated very positively, with site visits rated the highest (cp. Figure 3).

Furthermore, 59% of the respondents reported that they are in contact with other network members outside the network meetings. Analysing an open question about the content of these discussions shows that they mainly concern specific technologies, with lighting being a significant topic as well as experiences with certain measures.

Participants were also asked whether their expectations from the network phase were fulfilled (cp. Figure 4). Aspects like identifying new ideas to reduce energy consumption and the exchange with other companies were ranked very positively.

Ratings of fulfilled evaluations by participating organisation in third survey wave. 1 = not fulfilled; 5 = perfectly fulfilled. Sample size for this evaluation 90–207 respondents. Respondents could also choose that they did not share this expectation; such answers are counted as missing for this figure.

This finding is also supported by the moderator interviews, which indicate that the informal exchanges between network participants helped them a lot in making decisions:

[The direct exchange about experiences] is the most important measure. (…) If I [as a participating organisation] talk about topics within the network and if my network friend has already done it and is convinced about it, then it is not a sales event, but then he persuades me as a peer.

Network participation reduces transaction costs

The results in this section are based on an analysis of the data from the additional survey on transaction costs with 78 participants. Transaction costs per measure were found to vary between 0.3 and 423% of the investment. The median is 10.4%. They mainly consist of information costs and decision costs. The analysis shows that taking transaction costs into account decreases the cost-effectiveness of a measure but rarely renders it unprofitable. The annual energy cost savings and their profitability are usually too high for such an outcome. The capital value decreases by an average of 4% if transaction costs are included, and the internal interest rate by 15%. The amortization period increases by 0.25 to 2.6 years on average. Furthermore, transaction costs are negatively correlated with the costs for the investment, the energy consumption, and the turnover of the company as well influenced by the type and the technology of the investment.

However, these figures do not indicate to what extent transaction costs are positively or negatively influenced by network participation. Therefore, the additional survey also asked about participants’ perceptions. It turns out that 55 companies (71%) agree with the statement that transaction costs are reduced by the exchange of experiences during network meetings.

Discussion and conclusion

Energy efficiency networks are an increasingly important instrument to help organisations reduce their energy demand. In Germany, the federal government wants to establish 500 such networks. Some research has already been published on these networks and their success in improving energy efficiency has not been questioned so far. However, there has been relatively little research into how and why they work. This paper is a first explorative attempt to close this gap.

We draw on data from a pilot project in Germany, which initiated and successfully managed 30 networks and included the collection of a rich data set on technical parameters (from energy audits and annual monitoring of measures taken), and social science approaches (three survey waves with the participating companies; interviews series with network initiators, consulting engineers, network moderators; additional survey on transaction costs), as well as additional technical data from the Mari:e project.

We make four assumptions about why networks are successful: (1) audits make profitable potentials visible; (2) the joint network targets on efficiency and emissions increase the motivation of energy managers, decision-makers, and other staff members; (3) the meetings and site visits of the network participants act like an intensive training course to increase the knowledge of efficient solutions, change decision routines, and lead to trust among the participants; and (4) network participation reduces transaction costs.

The available data was then analysed to see whether it supported our four assumptions. It is important to note that this study is not a test of scientific hypotheses, but tries to identify which of these assumptions is worth investigating further in future research.

We find some support for the assumption that energy audits make profitable potentials visible. First of all, the technical data clearly show that relevant profitable potentials and corresponding measures could be identified in all participating companies, with an average of ten measures per organisation—which is a higher number than in other programmes (cp. Fleiter et al. (2014)). Secondly, this interpretation of visibility is supported by findings from the survey as well as the interviews. Thus, we assume that the visibility of profitable potentials is an important effect of the networks that should be explored further, e.g. by relating visibility to success indicators. It is important to note that identified potentials are not identical with realised potentials and never will be. Making them visible is a necessary first step to providing companies with a list of starting points that are worth pursuing. Overall, it is not realistic that all of the identified measures will be realised in the end, especially not within the lifetime of the network. Some have a longer implementation time and some do not make sense in the long run due to other restructuring processes within the company, etc. Additionally, the monitoring results also show that companies sometimes engage in measures that were not part of the original list identified in the audit.

We also expected that the joint network goals would act as strong motivators. However, we found little support for this assumption and even some indications that difficulties in defining the goals counteracted their intended impact. As these were not unusual across the networks, it is possible that the network moderators and consulting engineers might not have focused enough on emphasising the goals during the network process in the pilot projects. This may be the reason why the goals could not fully develop their motivational potential. In any case, our data did not support our assumption. This does not mean that network goals are not important, but that our evaluation approach was not able to document it.

Regarding the third assumption, we find some support from the evaluation data that network participation resembles a training course in energy issues by increasing and confirming knowledge and thereby reducing the risks associated with energy efficiency decisions. Finally, the assumption about network participants benefitting from the reduction of transaction costs is also supported by the survey data. It is important to note that, in our paper, transaction costs are restricted to those for implementing a measure and network participants were positive that these are reduced by network participation. This issue is closely related to our other assumptions, e.g. networks act as an intensive training course. It should also be pointed out that network participation may lead to additional transaction costs which are not taken into account by our respondents but which should be considered when designing policy measures to enhance energy efficiency: Establishing and managing networks also results in additional costs on a societal level but to look into these is beyond the scope of this paper.

To further develop the network concept, it is important to identify the most relevant network elements and how these can be optimised for maximum impact. For example, what kind of initial audit is a necessary precondition for success? What is most important about the network meetings—technical input or informal exchange or the combination of both? A more thorough investigation of these topics could also contribute to defining minimum standards for efficiency networks.

Notes

However, they may also run for much longer depending on political framework conditions, e.g. in Switzerland, companies commit themselves to 10-year targets as part of CO2 legislation.

See http://www.30pilot-netzwerke.de/archiv/nw-de/downloads/Foerderbekanntmachung-.pdf_%3b for the details (in German), last accessed 12/11/2017.

For a detailed comparison of the concepts in German, see https://www.energie-effizienz-netzwerke.de/een-wAssets/docs/Vergleich-LEEN-und-Marie.pdf, last accessed 17/03/2017.

An internal rate of return of 12% was determined as the profitability limit in both pilot projects, meaning that all measures with an IRR above 12% were considered profitable by the organisations and suggested for implementation.

References

Bell, M., Carrington, G., Lawson, R., & Stephenson, J. (2014). Socio-technical barriers to the use of energy-efficient timber drying technology in New Zealand. In: Energy Policy, 67, 747–755.

Bradke, H., Jochem, E., Mielicke, U., Ott, V., Mai, M., Köwener D., Idrissova, F., Weissenbach, K., Bauer, J., Meier, N., Hack, M., Diemer, R., Feihl, M., Bergmann, K., Berger, R., Ernst, C., Kubin, K. (2015): Lernende Energieeffizienz- und Klimaschutz-Netzwerke. 30 Pilot-Netzwerke und Entwicklung von Investitionsberechnungshilfen. Abschlussbericht an das Bundesministerium für Umwelt, Naturschutz, Bau und Reaktorsicherheit und an den Projektträger Jülich. Karlsruhe, Pfedelbach, Stuttgart, Berlin, Fraunhofer ISI, 2015.

Brown, M. A. (2001). Market failures and barriers as a basis for clean energy policies. In: Energy Policy, 29, 1197–1207.

BMWi (Bundesministerium für Wirtschaft und Technologie) (2014): Mehr aus Energie machen. Ein gutes Stück Arbeit. Nationaler Aktionsplan Energieeffizienz. Berlin: BMWi. https://www.bmwi.de/Redaktion/DE/Publikationen/Energie/nationaler-aktionsplan-energieeffizienznape.pdf?__blob=publicationFile&v=6. Accessed: 29/12/2017.

Cagno, E., & Trianni, A. (2013). Exploring drivers for energy efficiency within small- and medium-sized enterprises: first evidences from Italian manufacturing enterprises. In: Applied Energy, 104, 276–285.

Cagno, E., Worrell, E., Trianni, A., & Pugliese, G. (2013). A novel approach for barriers to industrial energy efficiency. In: Renewable and Sustainable Energy Reviews, 19, 290–308.

Chai, K.-H., & Yeo, C. (2012). Overcoming energy efficiency barriers through systems approach—a conceptual framework. In: Energy Policy, 46, 460–472.

Cooremans, C. (2012). Investment in energy efficiency: do the characteristics of investments matter? In: Energy Efficiency, 5, 497–518.

Fleiter, T., Hirzel, S., Ostrander, B., Schleich, J., Schlomann, B., Mai, M., Gruber, E., Holländer, E., Roser, A., Gerspacher, A. (2014). Evaluation des Förderprogramms “Energieberatung im Mittelstand”. Schlussbericht, im Auftrag des Bundesministeriums für Wirtschaft und Energie, Karlsruhe, Fraunhofer ISI, Dezember 2014.

Fraunhofer ISI (2016) (ed.): Vergleich des LEEN-Netzwerkmanagementsystems für größere und kleinere Unternehmen/Standorte. Online: https://www.energie-effizienz-netzwerke.de/een-wAssets/docs/Vergleich-LEEN-und-Marie.pdf. Accessed: 13/04/2016.

Hutzschenreuter, T., & Kleindienst, I. (2006). Strategy-process research: what have we learned and what is still to be explored. Journal of Management, 32, 673–720.

Jaffe, A. B., & Stavins, R. N. (1994). The energy-efficiency gap. What does it mean? In: Energy Policy, 22(10), 804–810.

Jochem, E., & Gruber, E. (2007). Local learning-networks on energy efficiency in industry—successful initiative in Germany. Applied Energy, 2007(84), 806–816.

Jochem, E., Mai, M., Ott, V. (2010): Energieeffizienznetzwerke – beschleunigte Emissionsminderungen in der mittelständischen Wirtschaft. In: Zeitschrift für Energiewirtschaft, 34, 21–28.

Jochem, E., Gerspacher, A., Eberle, A., Mai, M., Mielicke, U. (2016). Energy efficiency networks—a group energy management system as a business model? In: eceee Industrial Summer Study 2016. Proceedings: Industrial Efficiency 2016, Going beyond energy efficiency to deliver savings, competitiveness and a circular economy, pp. 641–650. Berlin.

Köwener, D., Jochem, E., Mielicke, U. (2011). Energy efficiency networks for companies—concept, achievements and prospects. In: eceee Summer Study 2011. Proceedings: Summer Study 2011, The Foundation of a Low-Carbon Society, pp. 725–733. Belambra Presqu’île de Giens.

Köwener, D., Nabitz, L., Mielicke, U., & Idrissova, F. (2014). Learning energy efficiency networks for companies—saving potentials, realisation and dissemination (pp. 91–100). Arnhem, Netherlands: ECEEE Summer Study Proceedings.

Langlois-Bertrand, S., Benhaddadi, M., Jegen, M., & Pineau, P.-O. (2015). Political-institutional barriers to energy efficiency. In: Energy Strategy Reviews, 8, 30–38.

Leinweber, L., (2014): Clustering von Energieeffizienz-Maßnahmen aus der Monitoringphase im Projekt “30 Pilot-Netzwerke”, Bachelor thesis, Hochschule Karlsruhe, 2014.

Locke, E. A., & Latham, G. P. (2002). Building a practically useful theory of goal setting and task motivation: a 35-year-odyssey. American Psychologist, 57(9), 705–717. https://doi.org/10.1037/0003-066X.57.9.705.

Mai, M., Jochem, E. (2017). Vermindern Energieeffizienz-Netzwerke auch die Transaktionskosten von Energieeffizienz-Investitionen?. Wien, Österreich: 10. Internationale Energiewirtschaftstagung an der TU Wien, IEWT 2017. https://eeg.tuwien.ac.at/eeg.tuwien.ac.at_pages/events/iewt/iewt2017/html/files/fullpapers/201_Mai_fullpaper_2017-02-14_08-48.pdf. Accessed 29/12/2017.

Mai, M., Gebhardt, T., Wahl, F., Dann, J., & Jochem, E. (2014). Transaktionskosten bei Energieeffizienz-Investitionen in Unternehmen. Eine empirische Untersuchung in Energieeffizienz-Netzwerken Deutschlands. Zeitschrift für Energiewirtschaft, 38(4), 269–279. https://doi.org/10.1007/s12398-014-0141-0.

Meath, C., Linnenluecke, M., & Griffiths, A. (2016). Barriers and motivators to the adoption of energy savings measures for small- and medium-sized enterprises (SMEs): the case of the ClimateSmart Business Cluster program. In: Journal of Cleaner Production, 112, 3597–3604.

Nakova, K. (2007). Energy efficiency networks in Eastern Europe and capacity building for urban sustainability: the experience of two municipal networks. Indoor Built Environment, 16(3), 248–254.

Ott, V., Jochem, E. (2012). Monitoring – reine regelmäßige Reflexion auf dem Zielpfad. In: UmweltWirtschaftsForum (uwf), 20(2012) 1, 75–84.

Palm, J. (2009). Placing barriers to industrial energy efficiency in a social context: a discussion of lifestyle categorisation. In: Energy Efficiency, 2, 263–270.

Paramonova, S., Backlund, S., & Thollander, P. (2014). Swedish energy networks among industrial SMEs (pp. 619–628). Arnhem, Netherlands: ECEEE Summer Study Proceedings.

Paramonova, S., & Thollander, P. (2016). Energy-efficiency networks for SMEs: learning from the Swedish experience. Renewable and Sustainable Energy Reviews., 65(2016), 295–307. https://doi.org/10.1016/j.rser.2016.06.088.

Richter, R., & Furubotn, E. G. (2003). Neue Institutionenökonomik: Eine Einführung und kritische Würdigung. Tübingen: Mohr Siebeck.

Rohde, C., Mielicke, U., Nabitz, L., Köwener, D. (2015). Learning energy efficiency networks—evidence based experiences from Germany. In: Proceedings ACEEE Summer Study on Energy Efficiency in Industry, p. 1–12. New York.

Sorrell, S., Mallet, A., Nye, S. (2011). Barriers to industrial energy efficiency: a literature review. United Nations Industrial Development Organisation. Development Policy, Statistics and Research Branch Working Paper 10/2011. Wien: United Nations Industrial Development Organization.

Sorrell, S., O'Malley, E., Schleich, J., & Scott, S. (2004). The economics of energy efficiency: barriers to cost-effective investment. Cheltenham: Elgar.

Thollander, P., Backlund, S., Trianni, A., & Cagno, E. (2013). Beyond barriers—a case study on driving forces for improved energy efficiency in the foundry industries in Finland, France, Germany, Italy, Poland, Spain, and Sweden. Applied Energy, 111, 636–643. https://doi.org/10.1016/j.apenergy.2013.05.036.

Trianni, A., & Cagno, E. (2012). Dealing with barriers to energy efficiency and SMEs: some empirical evidences. In: Energy, 37, 494–504.

Wesselink, B., Harmsen, R., Eichhammer, W. et al. (2010). Energy savings 2020. How to triple the impact of energy energy saving policies in Europe. European climate foundation (ECF) and the Regulatory assistance project (RAP). http://www.roadmap2050.eu/attachments/files/EnergySavings2020-FullReport.pdf. Accessed: 13.04.2016.

Wohlfarth, K., Eichhammer, W., Schlomann, B., & Mielicke, U. (2016). Learning networks as an enabler for informed decisions to target energy-efficiency potentials in companies. In: Journal of cleaner production, 163, 118–127.

Wohlfarth, K., Schlomann, B., Eichhammer, W., & Worrel, E. (2017). Chances for changes—tailoring energy efficiency measures to target groups. In: eceee Industrial Summer Study 2016. Proceedings: Industrial efficiency 2016, going beyond energy efficiency to deliver savings, competitiveness and a circular economy, pp. 137-149. Berlin.

Worrell, E., Bernstein, L., Roy, J., Price, L., & Harnisch, J. (2009). Industrial energy efficiency and climate change mitigation. Energy Efficiency., 2(2), 109–123. https://doi.org/10.1007/s12053-008-9032-8.

Funding

The pilot phase of the energy efficiency networks complying with the LEEN standard as well as the work on this paper were funded by the Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (grant nos. 03KS0036 and 03KE000361A).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Rights and permissions

About this article

Cite this article

Dütschke, E., Hirzel, S., Idrissova, F. et al. Energy efficiency networks—what are the processes that make them work?. Energy Efficiency 11, 1177–1192 (2018). https://doi.org/10.1007/s12053-017-9606-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-017-9606-4