Abstract

Energy efficiency (EE) is rapidly growing in many markets today, but its its cost-effectiveness and potential for growth are being hotly debated. These controversies impede public and private investment in efficiency programs, products, and services. As the stakes rise, the debate has heated up and the need grows to clarify the disagreements and disputes. We review the arguments of skeptics and advocates on 10 key questions concerning energy efficiency, attempting to answer three overriding questions: does an EE gap exist, how big is the gap, and how can the gap be shrunk? We tackle 10 areas of contention: the significance of market failures, the efficiency of investment levels, energy intensity as a measure of efficiency, the treatment of naturally occurring EE, the application of discount rates, accounting for transaction costs, treatment of the rebound effect, the practice of EE delivery, the integration of EE into utility business models, and opportunities for EE growth. Research needs in each of these areas are also described. By examining the divergent views of skeptics and advocates and by addressing the limitations of current knowledge, policymakers and stakeholders can make better-informed decisions supported by more defensible analysis.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Modern energy systems face the challenge of providing affordable electricity while also reducing air pollution and greenhouse gas (GHG) emissions. Advocates assert that energy efficiency is one of the least-cost options for addressing this challenge, but skeptics claim that their enthusiasm is ill-founded. Policymakers are trying to balance the urgency for quick climate action with the high upfront capital investment of low-carbon technologies. Energy efficiency is at the center of this debate since there are so many conflicting views about the role it might play and the costs it might require.

Skepticism about the role of energy efficiency lingers in part because of a history of poor policy design and flawed evaluation methods that exclude key costs and benefits, fail to test rival hypotheses, and make heroic assumptions about the persistence of savings. These nettlesome issues have caused some analysts to conclude that engineering estimates exaggerate the size of the “energy efficiency gap” (Gillingham and Palmer 2014). They also argue that engineering calculations fail to account for consumer heterogeneity (Allcott and Greenstone 2012), uncertainty (Hassett and Metcalf 1993), and the potential backlash from the rebound effect (Sorrell et al. 2009). This purported bias in engineering approaches has led some to conclude that there may, in fact, be no energy efficiency gap at all (Jaffe et al. 2004). However, advocates disagree.

To avoid appearing too simplistic, it is important to note that many potential interventions designed to encourage energy efficiency (EE) have their skeptics, but being a skeptic some or even most of the time does not make one a skeptic about all interventions to energy efficiency or about the existence of an EE gap. Objective assessments based on the societal merits of a proposed public policy would not have foregone conclusions; unilateral positions “for” or “against” EE should not prevail. However, the supply chain and socio-political ecosystem supporting incumbent fossil fuels and those supporting less conventional energy options have vested interests in policy outcomes and they utilize their resources to sway the public debate accordingly. As a result, some stakeholders engaged in the public discourse about EE appear on the public record solely as unilateral critics or enthusiasts.

Origins of the debate

Energy efficiency has been a lightning rod in debates about transitioning our energy system to address climate change challenges. It is broadly recognized as a low-cost low-carbon resource, and investment in energy efficiency has been growing for decades. But suggesting that some energy efficiency investments might have “negative costs”—reducing GHG emissions while saving consumers money—is incongruous to the school of neoclassical economics. As markets for energy efficiency expand and evidence grows that energy resources on the customer side of the meter are large and cost-effective, experts continue to disagree about the existence of an energy efficiency gap. Those who believe in the existence of a gap disagree about its size and how to address it.

Free market economists are apt to argue that one will rarely find a $20 bill lying on a busy sidewalk because some passerby would inevitably see the value of the bill as sufficient to justify the time and effort spent stooping down to pick it up. Applying this worldview to energy, many economists and policymakers assume that markets work so well that most cost-effective efficiency investments have already been made. This leads to the claim that further energy efficiency would come at a net cost to society (Taylor and Van Doren 2007)—“the marketplace determines a level of efficiency, and altering this energy efficiency level comes at a cost.” (Makovich 2008).

In a world of rational actors who are utility-maximizing in perfectly competitive markets, government intervention leads to suboptimal outcomes even if such intervention is intended to improve efficiency. “An efficiency investment with a positive return that does not make the cut in a marketplace has a net positive cost,” Makovich (2008) notes, since “it requires giving up something that consumers have revealed they value more.”

National Bureau of Economic Research economists Allcott and Greenstone (2012) conclude that “the empirical magnitudes of the investment inefficiencies [causing the energy efficiency gap] appear to be smaller, indeed substantially smaller, than the massive potential savings calculated in engineering analyses.” If a gap exists, public policy is no way to tackle it, since “the invisible hand of the marketplace is far superior in providing for efficient energy use and conservation than is the dead hand of government planners.” (Taylor 1993).

Advocates have claimed that energy efficiency is cost-effective and indeed might offer “negative costs” for carbon abatement in the long run. As physicist Amory Lovins once put it, the positive savings mean that energy efficiency is not just a free lunch, it is a free lunch you get paid to eat (Bradley 2014).Footnote 1 This view originates from the understanding that significant market failures and barriers impede the uptake of energy efficiency measures. Once the market imperfections and obstacles are removed, energy efficiency will manifest itself as a valuable investment option with high positive returns in capital markets.

This paper scrutinizes these views. We focus mostly on the US experience and dialog about energy efficiency, derived primarily from utility- and government-administered programs. Nevertheless, our conclusions appear to be valid for many industrialized regions of the world. We begin by describing the market failure theory of public policy, including the views of its critics. We then describe the numerous opposing assessments of energy efficiency skeptics and advocates that derive, in part, from their views of just and justifiable policy interventions. A series of 10 contentious issues are examined that derive from three broad questions: does an EE gap exist, how big is the gap, and how can the gap be shrunk? Each of the 10 issues is addressed in turn, presenting pathways forward to improve our understanding, to improve policy, and to guide future research. The paper ends with a set of conclusions and a summary of research needs.

Market failures and public interest rationales for policy interventions

Neoclassical economists generally subscribe to the position that government intervention is legitimate only when markets are flawed. Many of these economists emphasize the economic efficiency of free markets. In competitive markets, prices are assumed to accurately reflect marginal costs; hence, blaming imperfect prices for the slow uptake of low-carbon energy is unwarranted (Taylor and Van Doren 2007). Further, complaints about imperfect prices are seen as overstated (Jaffe et al. 2004). Pareto efficiency is reached when no trades remain that can make any individual better off without making another individual worse off. As a result, the market is the most efficient system of allocating resources. Implicit in this worldview is the acceptance of rational actor theory—consumers have access to complete information, and they base decisions on optimizing personal utility. There is no public policy basis for market interventions. “An efficiency investment with a positive return that does not make the cut in a marketplace has a net positive cost—it requires giving up something that consumers have revealed they value more” (Makovich 2008). As a result, energy efficiency policies and programs are warranted only to the extent that energy markets can be shown to have failures. “Government remedies are most suited to overcoming genuine market failures or government failures.”(U.S. Department of Energy (DOE) and Committee on Climate Change Science and Technology Integration (CCCSTI) 2009). If pesky difficulties bedevil the free and full functioning of energy markets, one can and should implement market-based policy tools to cure them.

Market failure occurs when “prices lie—that is, when the prices of goods and services give false signals about their real value, confounding the communication between consumers and producers.” (Donahue 1989). To identify market failures, it is first necessary to describe the characteristics of a perfect market (see Table 1). Market failures occur when these characteristics do not exist; they are the result of flaws and imperfections in the operation of markets (Brown 2001).

In general, externalities, public goods, monopolies, and information asymmetries are commonly recognized market failures (Weimer and Vining 2011), and in the energy sector they are rampant. Environmental externalities, inefficient pricing of energy, asymmetric and imperfect information, and misplaced incentives have been shown by many to lead to inefficiently low levels of market investment in energy efficiency (Gillingham et al. 2009; Weimer and Vining 2011). Because energy-efficient choices typically involve decisions that trade off initial capital costs against uncertain future savings, the expected energy price has a significant influence on the outcome of the investment analysis. If energy prices are too low to reflect the negative externalities associated with fossil fuel combustion, then investments in energy efficiency are suboptimal. If, instead, “Energy prices are reasonable reflections of total producer costs and consumer demand” as Taylor and Van Doren (2007) contend, then the optimal quantity of energy efficiency may indeed be purchased.

Even if public intervention in markets for energy efficiency can be justified based on the market failure theory of public policy, the theory includes one qualification. While the existence of market failures is a prerequisite for public intervention, it is not a sufficient justification. Feasible, low-cost policies must be available that can eliminate or mitigate these market failures. In these instances, policies can enable markets to operate more efficiently to the benefit of society. In other instances, policies may not be feasible; they may not be politically feasible, they may not fully eliminate the targeted market failure, or they may do so at a cost that exceeds their benefits.

In these cases, it is possible that an alternative obstacle to energy efficiency can be removed or reduced, achieving an outcome similar to what might occur with the elimination of the market failure. Thus, we argue that tackling some market barriers to entry for new competitors and barriers to consumer adoption can be an effective substitute for addressing market failures and that policies that eliminate or mitigate those barriers could replicate the outcome if the market failure were adequately addressed. For example, it is typically difficult to eliminate the principal/agent problem and associated asymmetric information that results from the landlord/tenant relationship that is common in many industrialized countries. In part because this market feature is likely to persist, policymakers in the USA, Japan, the EU, and elsewhere have shrunk the EE gap by promulgating minimum performance standards for equipment and appliances (Brown and Yu 2015).

Here, the caveat is that government intervention in these instances runs the risk of unintended consequences that fail to achieve the desired ends at the lowest cost. Neoclassical economists would argue that the government should not intervene if the target is to reduce some other barrier. “Other types of barriers may be best addressed and resolved by allowing market forces to work.” (U.S. Department of Energy (DOE) and Committee on Climate Change Science and Technology Integration (CCCSTI) 2009).

Market competition combined with the incentive to earn a profit is often sufficient to identify and overcome such barriers, and they tend to do so at the lowest possible cost. But other market barriers exist when making investment decisions under uncertainty, such as values related to future time, risk perception, and technology lock-in (Verbruggen 2012). As a result, we argue that it is valuable to examine both market failures and other barriers to evaluate the best course of action. Any alternative corrective actions should be limited to policies that can be implemented at an acceptable cost, so that economic efficiency can be maximized, as shown in Fig. 1. For example, policies that tackle a market barrier such as reducing the transaction costs of investments in energy efficiency could substitute (at least partially) for fully pricing environmental externalities from fossil fuels.

An earlier version of Fig. 1 was first presented by Jaffe et al. (2004). It sequentially considered (1) market failures for energy efficiency (such as high discount rates), (2) market failures on the supply side (such as environmental externalities), and (3) then the elimination of costly corrective actions—ultimately creating the true social optimum. Our figure includes the additional option of addressing market barriers, if they can be eliminated or reduced at an acceptable cost, and when market failures are persistent.

This line of reasoning is supported by a competing justification for policy intervention, which focuses on the public interest. Scholars have long argued that the ultimate goal of government policies is to ensure the public interest, which reflects the shared interest of the people. Although defining the public interest is a work in progress, the literature has shed light on the core beliefs and values that sustain human society. Studies that have looked at public values have identified a core set of values, including the sustainability of the natural environment, human dignity in terms of having decent jobs, and good health (Jørgensen and Bozeman 2007). Energy efficiency has the ability to protect and realize these public values. By making buildings, businesses, and industries more efficient, policies lead to operating cost savings as well as decreases in air pollutants from burning fossil fuels, improving regional air quality and providing public health benefits (U.S. IAWG 2013; Cox et al. 2013). Additionally, because building construction, renovation, and energy upgrades generally are labor-intensive, energy efficiency policies can create more job opportunities along the entire supply chain. Energy bill savings can be cycled back to the larger economy and induce more indirect job creation (ACEEE 2011; Baer et al. 2015; SEEAction 2015). While EE leads to less energy production with associated job losses, these can be offset by the creation of wealth from energy savings that is spent elsewhere in the economy (Borenstein 2015). There is also evidence that energy efficiency can lead to lower utility rates for all consumers (the “demand reduction induced price effect,” known as DRIPE), stimulating purchases in segments of the economic that are more labor-intensive than energy production and power generation (Baer et al. 2015; SEEAction 2015). The literature on how these job gains and losses compare is sparse due to the complexities and cost of conducting regional input-output life cycle analysis.

The skeptics and the advocates: 10 areas of contention

Since the 1970s’ oil crisis, energy efficiency has grown more than any other single energy resource in North America (Laitner et al. 2012). Similarly, analysis of 11 highly industrialized countries suggests that energy efficiency initiatives have saved more energy than any single supply-side energy resource (IEA 2013). EE is considered by many to be a key option for reducing GHG emissions going forward because it can generate significant energy and non-energy benefits at relatively low cost. As a result, policy discussions increasingly underscore the need to accelerate the deployment of EE measures to capture low-cost energy savings and avoid lost opportunities that occur when long-lived infrastructure is built that locks in outdated equipment. Lock-in is less of an issue for energy efficiency because energy-consuming equipment generally has a shorter lifespan and more rapid stock turnover. At the same time, both supply- and demand-side investments are complicated by the ever evolving technology base and the volatility of energy prices: what makes sense today may not tomorrow—if energy prices rise or fall, a different mix of energy use and capital will be optimal.

Still, there are fundamental disagreements about whether or not an EE gap exists. This disagreement hinges on beliefs about the existence of market flaws and derivative questions about whether or not energy prices reflect costs and whether or not current EE investment levels are efficient.

Experts also disagree over how big the EE gap is, which tends to reflect alternative views about how to measure the potential for economic EE improvements. How should naturally occurring EE be treated, what discount rates should be used, and how should hidden costs be valued?

Finally, there is disagreement over EE policy design and implementation. How hard is it to deliver EE, does the rebound effect eliminate the case for EE, and can EE fit into utility business models?

Each of these three dimensions of the debate has implications for forecasting EE opportunities in the future. Disagreements between the skeptics’ and advocates’ views over these 10 questions are discussed below and are portrayed in the typology of contentious EE issues shown in Fig. 2.

-

Q1. Do prices reflect costs? Many skeptics claim that failures in energy markets are insignificant and energy prices are reasonable reflections of total producer costs and consumer demand. Thus, the hypothesis of low-cost GHG emission reductions from available efficiency gains by “fixing flawed markets does not stand up” (Makovich 2008). They argue that there is no substantive evidence of a misallocation of capital away from energy efficiency due to market flaws: “estimates of un-tapped economical energy-efficiency opportunities are nothing more than fantasy” (Joskow 1995). Inherent to this worldview is the belief that markets will logically work things out on their own: “the market does not fail to deliver energy supply, energy efficiency, or energy security. Private markets automatically perform cost/benefit analyses and ensure that long-run benefits to consumers are maximized.” (Sutherland and Taylor 2002). As one economist put it, “few additional incentives are needed to sell energy-efficient appliances or automobiles because the rewards are real and automatic” (Sioshansi 1994). There is no need to promote energy efficiency because it will occur naturally as markets operate freely. As a result, in many states, industry is allowed to “opt out” of EE programs run by utility companies because of a pervasive belief that “companies have already realized all the cost-effective industrial energy efficiency opportunities that exist” (Shipley and Elliot 2006).

Alternatively, advocates argue that energy prices do not fully reflect the cost of a range of significant negative externalities including climate change and the air and solid waste pollution associated with fossil fuel combustion that have been well documented and are significant (National Research Council 2009); they command a strong rationale for concluding that energy markets are not properly functioning. “An externalityFootnote 2 is any valued impact (positive or negative) resulting from any action (production or consumption) that affects someone who did not fully consent to it through participation in voluntary exchange” (Weimer and Vining 2011). For markets to be competitive, costs and benefits associated with exchanges must be borne solely by the participants of the transaction or internalized in prices so that all assets in the economic system are adequately priced. In addition to the existence of negative externalities, the public goods, monopolies, and information asymmetries associated with energy markets are also failures that permeate energy markets. If energy costs were increased to reflect externalities, if the market were competitive, and if actors were rational, then there would be little need for incentives and other EE policies, as end-user would be more likely to invest in EE.

While it would appear that most economists today who study energy markets acknowledge the external cost of climate change associated with energy use, this does not imply that most economists are efficiency advocates. As illustrated throughout this paper, that would be a false dichotomy since many economists have questioned the existence of an EE gap.

Given the key role that market failures play in justifying market intervention, research is needed to quantify and characterize the role that energy market failures play today. The response of markets to prices also needs more examination. How much would markets be transformed if externalities were addressed? Would the boost in the value of EE in a purely competitive market result in its widespread uptick or only incremental expansion?

-

Q2. Is the current investment level efficient? Skeptics have argued that low levels of investment in energy efficiency simply reflect high opportunity costs for capital; spending money elsewhere appears to be more profitable (Makovich 2008). They focus on competing opportunities for limited capital that might be more rewarding. Because investments in energy efficiency must compete with high opportunity costs, scarce capital is allocated to other options with higher positive returns (Allcott and Greenstone 2012).

Although the opportunity cost argument may have some merit in explaining slow market uptake, formal capital markets are not the sole determinant of investment in energy efficiency. Prosperity of the EE market is affected by the behavior of many players under evolving economic, societal, policy, and technical conditions (IEA 2013). In particular, government interventions can transform markets and behavior, accelerating the deployment of EE measures beyond the level expected by capital markets, as when tax rebates support the purchase of energy-efficient appliances or when low-interest loans are offered. Capital markets do not count the social benefits—so-called positive externalities—of energy efficiency. Some economists argue that external benefits of energy efficiency are insignificant (Allcott and Greenstone 2012), dismissing the evidence from valuation studies of un-priced public goods. Similarly, evaluators often fail to consider the difficult-to-quantify non-energy benefits of energy efficiency such as improved comfort, esthetic enhancements, and better indoor air quality (Stevens et al. 2016; Amann 2006).

Financial markets have started to pay increasing attention to government policies related to climate change mitigation. New financial products and new financing levers and channels are emerging, tailored for energy efficiency in contracts, repayment methods, funding approaches, and business models. In addition to commercial banks, other finance channels and levers are emerging including green investment banks, debt capital markets, green bonds, energy performance contracting, and on-bill financing (IEA 2014).

At the same time, estimating the social benefits of energy efficiency is becoming more feasible thanks to the increasingly standardized and sophisticated valuation techniques that put monetary values on non-market goods and services (NRC 2009). “True-up” calculations for investments should consider the fact that efficiency improvements can avoid social damages from fossil fuel consumption. Adding the avoided damages to the equation, opportunity costs are no longer high for EE investments. Rather, the current investment level is not “efficient” because the market has forgone cheap options for carbon abatement (Geller and Attali 2005).

However, getting the financial incentive right for efficiency investment faces some challenges that merit further investigation and better modeling tools. First, the evaluation of environmental externalities needs to be localized to accurately account for the avoided fuel consumption, emissions, and reliability services. The avoided damages of energy use and production depend on the source of the energy that is avoided and its associated emissions. For example, the avoided environmental damages from energy efficiency will be quite different in coal-intensive Indiana than in California that is more reliant on renewables and natural gas. Estimating avoided emissions is complicated, and better research tools are needed to assist. As a result, the optimal level of efficiency investment varies across local market conditions, which limits the generalizability of valuation studies of specific cases. Second, we still lack experience with market mechanisms and policy designs for internalizing environmental benefits to motivate investment in energy efficiency.

-

Q3. Does energy intensity reflect efficiency? Energy productivity and intensity are common but imperfect indicators of energy efficiency when comparing across cities, states, and countries or over time, because they do not reflect differences in the structure of economies or climate conditions. Still, they are commonly used because they represent the most accessible and easily compiled EE metric. For example, according to the US Energy Information Administration (EIA), both energy and CO2 per dollar of GDP have declined by approximately one third over the past 25 years and are forecast to continue to decline almost in “lockstep” for at least 25 more years; energy use per capita also has declined since 1990, although at a much slower pace, and is forecast to decline by about 10% over the next 25 years (EIA 2016, p. MT-5). Energy efficiency skeptics worry that such figures overstate efficiency gains (Nordhaus et al. 2013), because energy consumption is also affected by population growth, climate, travel patterns, fuel switching, and structural shifts in the economy.

While energy intensity metrics do not perfectly reflect the efficiency of an energy system, they are informative of the input and output energy context of different economies and allow trends to be identified. Due to limited data availability, these simple metrics are often the only measures available, although they can be misleading. For instance, a country that is becoming more service-based and more dependent on imported goods might have declining energy intensity over time, while the energy efficiency of their buildings, manufacturing, and vehicles could be unchanged.

Composite indicators are developed to eliminate the noise in a single energy input versus output indicator, such as the ODEX index measuring incremental efficiency changes (Horowitz and Bertoldi 2015). Decomposition methods are available to isolate the EE effect from activity and structural effects, and experience with them is growing. The activity effect reflects service demand changes due to growing population, climate, transport, and economic activities. The structural effect refers to the change in an economy’s business and industrial composition. With decomposition methods, the real change in an economy’s efficiency level can be measured. The IEA has decomposed the change in total fuel consumption (TFC) of 15 countries from 1990 to 2010. The activity level of these countries grew rapidly at about 1.5% annually. But TFC only grew by 0.5% every year due to significant efficiency gains and small structural changes (IEA 2013). Using the ODEX indicator studying household and manufacturing energy consumption, Horowitz and Bertoldi (2015) find that post-2006 policies enabled EU member states to decrease their energy consumption by 5.6% in 2011.

Research on EE indicators and decomposition has provided useful methods for measuring efficiency improvements. Nevertheless, researchers still need to wrestle with methodological challenges, such as energy quality problems (e.g., the unappealing color rendition and “coldness” of some types of efficient lighting) and partitioning (splitting energy input for processes that provide multiple services or outputs) and aggregation problems (summing up outputs that have different physical units) (see Pérez-Lombard et al. 2013 for a review) to provide non-biased estimations. Another challenge rests in the application of the research, which has proposed a large variety of decomposition methods and indicators. Future studies need a unified efficiency indicator to reduce confusion and simplify application. In particular, which efficiency indicator is most appropriate for the evaluation of policy-driven energy savings?

-

Q4. How should naturally occurring efficiency be counted? Skeptics note that benefits are sometimes double counted when program evaluators and modelers attribute naturally occurring efficiency to policy interventions. Naturally occurring efficiency refers to improvements resulting from technology advancements that are adopted in the market without policy support or intervention. It is also referred to as “autonomous” (Thomas et al. 2012) or “exogenous” energy savings because the savings would have occurred without the EE programs and policies. Often in the past and still sometimes today, program evaluators falsely attribute such effects to policy interventions and include them in estimates of future potential. Energy-saving estimations using pre-post (program) comparisons find it difficult to account for naturally occurring efficiency in the baseline, especially if a matched control group is not used (Thomas et al. 2012). The challenge is to figure out how to go from “gross” savings to “net” savings, those that are attributable to policy interventions. To add yet another level of complexity, if looking at the potential for utility programs to expand energy efficiency, it may be necessary to control for the likely impacts of future government programs such as building codes and appliance standards that may be promulgated in the future. Incorporating such future policy scenarios is challenging and fraught with risk and uncertainty.

Naturally occurring efficiency is part of the “baselining” problem in the evaluation, measurement, and validation (EM&V) of EE programs. Control-treatment comparisons with before and after measurements can correctly treat naturally occurring efficiency as a part of the baseline trend. For example, in the most recent evaluation of the US Weatherization Assistance program, homes weatherized in 2011 were used as a comparison group for the homes weatherized in 2010 (Tonn et al. 2015).

Alternatively, computer-based simulations can use scenario analysis to quantify the naturally occurring efficiency and exclude it from estimations of program-driven efficiency gains. For example, the National Energy Modeling System (the principal US energy modeling tool) includes baseline energy demand projections that account for existing policies and program spending, thereby enabling future policy interventions to be separately assessed (U.S. Energy Information Administration 2015a). California is designing a meter-based efficiency standard, creating standardized calculation of energy savings at the meter.Footnote 3 By comparing consumption pre- and post-EE, this program aims to provide weather normalized energy savings and realization rates using meter data and sophisticated methods to account for naturally occurring efficiency.

As argued by researchers and practitioners, EM&V has to address the uncertainties in calculating energy savings because they are estimated in relation to a counterfactual scenario (the “baseline” or “reference case”). How to deal with the “free rider effect” (Thomas et al. 2012) and which portion of energy savings should be accounted as naturally occurring efficiency are problems that need more research.

-

Q5. How high are discount rates? Analysts often underestimate the discount rates used by consumers and firms to value future streams of energy savings, resulting in an exaggerated size of the EE opportunity (Jaffe et al. 2004). Firm and household discount rates for EE investments are particularly high because of opportunity costs, risks, rational inattention, and illiquidity (that is, the investments cannot be easily sold or exchanged for cash without a substantial loss in value) (Greene 2011). Risks and uncertainty abound when trying new technologies and practices, and their effects are compounded by loss aversion, transaction costs, rational inattention, and the option to wait. Skeptics underscore that this high discounting of future savings undermines the viability of EE markets (Frederick et al. 2002).

Implicit discount rates in practice can be much higher than in theory. One way discount rates are determined is by combining the market interest rate with a time preference premium and some level of uncertainty or risk; with efficient capital markets, discount rates should converge with interest rates. Hausman (1979) theorized that rational actors would equate the present value of energy savings from more efficient technologies with the monetary savings from buying less expensive equipment. His findings on implicit discount rates for efficient air conditioners, however, suggest that sconsumers used discount rates that were much higher than the market interest rate. Subsequent research suggests that future gains receive higher discounting than future losses (Thaler 1991) and that smaller anticipated results receive higher discount rates than larger anticipated results (Benzion et al. 1989).

Discount rate estimates range widely and add to the difficulties of accurately assessing the efficiency gap. Consumers purchasing EE appliances use discount rates of up to 30% (Hausman 1979). The residential demand module of EIA’s National Energy Modeling System uses a 20% discount rate to compute the present value of future operating costs (DOE EIA 2011). It assumes even higher discount rates for EE investments in commercial buildings; for example, approximately half of the consumer choices in lighting and space heating use discount rates greater than 100%, and less than 3% of the population are assumed to use discount rates under 15% (Cox et al. 2013; EIA 2013). Government studies often use a 7% discount rate when assessing private sector investments, consistent with Office of Management and Budget (OMB) guidelines (OMB 2002, 2009). Other assumptions are used in other countries; for example, a declining discount rate is used for long-term projects in France and the UK (Arrow et al. 2013).

Because discount rates are so wide ranging in studies of energy economics, and because they are heterogeneous, it is best practice to do calculations using a range of discount rates. Recognizing the importance of the choice of discount rates, it has become standard practice to evaluate alternative values using sensitivity analysis. Sensitivity analysis of other risk factors, such as projections of the future price of fossil fuels, is also useful (Brown et al. 2014).

Practices that influence risk distribution have significant policy implication to shrink the efficiency gap. Advocates note that benchmarking the energy consumption of houses and commercial buildings can potentially reduce performance uncertainties and information asymmetries in the marketplace; such information programs can thereby lower the discount rates used by buyers and renters to value energy efficiency in the real estate market. Studies have found that providing information can reduce discount rates by up to 22%, by giving consumers greater confidence that their investments will pay off with predictably lower energy costs (Cox et al. 2013).

Research is needed to better understand how future energy savings are discounted by households, commercial building owners, and industrial plant managers in their selection of equipment, goods, and services. Unlike research on consumer choice of fuel economy in the automotive market, the discount rates used in decision-making on building and industrial energy efficiency are much more limited.

-

Q6. How to deal with transaction costs? Program evaluations often overlook “hidden” transaction costs, such as program administration costs and the effort required by participants to find and install new equipment and to process incentive payments such as tax rebates. In neoclassical economics, transaction costs include search and information cost, bargaining cost, and policy enforcement cost. With the increasing demand for program transparency, program administration costs are being tracked more consistently. But the other two costs—of searching for products and information and bargaining and negotiation—are more difficult to quantify and often neglected in program EM&V.

If one looks superficially at the marketplace, then it might appear that EE opportunities abound, but that may be a result of transaction costs that are not currently being counted (Allcott and Greenstone 2012). For example, consumers and firms highly value their time; the effort of searching for the most cost-effective option can be onerous and is often overlooked by advocates of energy efficiency. In addition, risks and uncertainty surround decisions to purchase and implement new technologies and practices, which is compounded by the fact that consumers are generally loss averse (Greene 2011). Skeptics claim that modelers regularly ignore such factors and therefore overestimate the EE gap (Nordhaus et al. 2013). Even recent evaluations have not quantified indirect or soft costs, such as the customers’ cost of investigating energy efficiency investments or waiting at home for a contractor, because these are not reported in the most widely used sources of data on EE programs, including the US Energy Information Administration, Form 861b (Hoffman et al. 2015).

Acknowledging the potential high transaction costs in delivering energy efficiency, policymakers and practitioners have experimented with various program designs aimed at overcoming these costs. Information-based programs, such as the Home Energy Squad in the twin cities of Minneapolis and St. Paul, aim at reducing the cost of searching for efficiency products and information. Home Energy Squad provides energy audit and installation services at a single home visit to save customers time for searching (Brown and Yu 2015). Demonstration, education, and training programs for workforce development of EE professionals can reduce transaction costs as well. As a matter of fact, lessons learned from exemplary EE programs with significant achievements often involve some program design characteristics that help reduce transaction costs in delivering energy efficiency.

Investing in energy efficiency is a complex decision-making process, and program designs need to streamline transaction costs to assist adoption of high-efficiency measures. Information-based programs are typically cost-effective in achieving energy savings (Wang and Brown 2014). However, empirical studies emphasizing efficiency gains from information programs often fail to estimate program costs. For instance, Henryson et al. (2000) present four general information campaigns in Sweden to reduce energy consumption by providing information. The study documented the energy savings from the programs without estimating program costs. Education was found by Fowlie et al. (2015) to be ineffective in weatherization programs for low-income families in the USA (Fowlie et al. 2015), but the National Weatherization Evaluation (Tonn et al. 2015) concluded the opposite. To tackle the issue of high transaction costs and to improve program design, more research and controlled scientific experiments are needed.

-

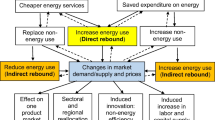

Q7. Is the rebound effect significant? The increase in consumption of energy services that often occurs as efficient technologies are adopted—that is, the “rebound effect”(Greening et al. 2000)—is one of several factors that has fueled skepticism that engineering spreadsheets typically overestimate energy savings. Spreadsheets generally do not model the re-optimization of demand based on price and income changes caused by EE implementation (Borenstein 2015). Thus, for example, when three researchers won the Nobel Prize in Physics for their work on light-emitting diodes (LEDs), the Swedish Academy of Sciences cavalierly noted in their award announcement that “[r]eplacing light bulbs and fluorescent tubes with LEDs will lead to a drastic reduction of electricity requirements for lighting.” This statement triggered a lively debate about the rebound effect.

-

In addition to the direct rebound effect that represents energy service increases with efficiency improvement, indirect rebound effect refers to the induced increases of other consumption (Sorrell and Dimitropoulos 2008; Letschert et al. 2013). The indirect rebound includes increased consumption of other energy services due to price effects, increased consumption of other goods due to income effects, and long-term effects on productivity (Lebot et al. 2004). Indirect rebound can raise more difficulty challenges for policymakers.

Underscoring the magnitude of the rebound effect (allegedly climbing as high as 50% of the savings), Shellenberger and Nordhaus (2014) claimed that more efficient lighting would simply lead to more use of lighting, negating any savings. The TreeHugger blog joined in describing how using wonderful technologies like LEDs causes people to waste energy in new ways.Footnote 4 Debate often conclude with recommendations that expanding the supply of clean electricity resources is what is needed, because efficiency is simply going to lead to more energy consumption.

In response, Goldstein (2014) retorted that good EE policy can deliver the opposite of rebound, where “a little energy efficiency leads to more and more reductions in usage and pollution.” Consider the state of California where vigorous EE policies have been in place for decades, resulting in actual reductions of energy use that are far larger than a simple projection of savings. In addition, policies are available to moderate the rebound effect, for instance by appropriately pricing energy to internalize its various external costs and by better messaging for instance about the intent of financial assistance. Without such messaging, the provision of financial incentives may undermine motivations to engage in conservation efforts by changing the frame from a social to a mo.netary one (Rode et al. 2015). It can provide consumers with a “moral license” to increase their electricity consumption as a “kickback” for consuming energy more efficiently (McCoy and Lyons 2016; Tiefenbeck et al. 2013).

Evidence suggests that the overall goal of energy efficiency—“to use energy more productively and cleanly” (Wagner and Gillingham 2014)—has not been nullified by the rebound effect. In addition, efficiency in many activities—take vacuum cleaning—will not have the same level of takeback because consumers are not likely to want to do more of it—there is little latent demand. More efficient vacuum cleaners will have an income effect, resulting in some combination of more savings and more expenditures. But these expenditures are not likely to be as energy-intensive as vacuum cleaning. As four economists noted in a meta-survey of the topic in Nature, “a vast academic literature shows that rebounds are too small to derail energy-efficiency policies.” (Gillingham et al. 2013). Similarly, Borenstein (2015) concluded that EE investments are unlikely to “backfire”—when rebound more than offsets net savings. On the other hand, rebound could reduce net savings by 10 to 40%. This range is based on a microeconomic analysis of autofuel economy and lighting technologies, using a framework that decomposes rebound into income and substitution effects.

The exact magnitude of the rebound effect remains in contention, and it is probably higher for some energy services such as lighting (where latent demand may exist, especially in developing countries) and lower for other services such as vacuum cleaning (where latent demand is small). Nevertheless, it is clear that good policy can make a difference in driving markets toward efficient choices and conservation.

Models are increasingly accounting for the rebound effect and other various behavioral “wrinkles.” EIA’s National Energy Modeling System is an example, where the rebound effect is assumed to lower the energy savings from efficient electric heat pumps (EIA 2015b). However, modeling assumptions need a stronger research foundation. Research on the rebound effect tends to involve either large-scale econometric studies or small-scale quasi-experiments that lack either control groups or the random assignment of experimental consumers (Sorrell et al. 2009). Quasi-experimental studies with more rigorous research designs and larger samples are needed to examine consumer behavior in-place to understand its impact on energy use (Sorrell et al. 2009). The design of EE policies also can help to constrain the rebound effect, such as imposing caps on energy consumption following efficiency improvements (Lebot et al. 2004).

-

Q8. How hard is it to deliver energy-efficiency? Models do not always reflect how difficult it can be to delivery energy efficiency. Transaction costs of EE deployment are hard to quantify, and programs with high hidden costs are doomed to fail. From the utility’s perspective, the small-scale and dispersed nature of EE projects challenges the aggregation of this resource, making it appear to be difficult to manage and deliver. Effort is required to fill the “pipeline” with EE projects that are investment-ready and creditworthy (MacLean and Purcell 2014). Nevertheless, the small units that comprise this resource enable flexibility: utilities can buy energy efficiency quickly and in variable amounts to meet their needs, subject to ramp-up rates (Brown and Yu 2015). Policy design needs to consider these features of EE technologies and markets.

The pros and cons of different policy instruments are still being hotly debated, and assimilating these instruments into large-scale polycentric systems is still an emerging science. After 40 years of experience with EE policies and programs, one would hope to find a book of recipes for success. But no such cookbook exists. Indeed, many are disappointed with what has been accomplished in light of the hype about how much energy could be saved.

As Fatih Birol, chief economist at the International Energy Agency, put it during the roll-out of a recent World Energy Outlook, “I believe that energy efficiency has been an epic failure by policymakers in almost all countries. Its potential is huge but much of it remains untapped.”(Birol 2012). “[D]oing efficiency is much harder in the real world than it is on an Excel Spreadsheet” (Nordhaus et al. 2013). The problem is that the market failures and obstacles are great, and policy interventions to date have been suboptimal and insufficient.

For those who believe that policy interventions may be needed, “[t]he issue of instrument choice has reached a fever pitch” (Goulder and Parry 2008). Design principles are only now emerging (Stern et al. 2016), and while there are indisputable examples of success (Gillingham et al. 2006; Geller et al. 2006), they are not well documented and not well known. There are lots of catchphrases and clichés about “low-hanging fruit,” but inspirational stories and the details about why they worked are not widely told (Shah 2015). While the pros and cons of different policy instruments are becoming clarified with experience, taking these instruments to the next level by integrating them into self-reinforcing systems is only an emerging science.

On the other hand, policymakers, researchers, and practitioners continue to experiment with innovative policy instruments. General design principles for EE policies are emerging from this experimentation and discussion, including clear goals and theory-based implementation design, stakeholder involvement, ability to adapt, and consistency (Harmelink et al. 2008). Ex post studies are also accumulating knowledge by evaluating the pros and cons of policy instruments (Harmelink et al. 2008; Murphy et al. 2012). In addition, policy packages (i.e., nested and linked policies) are preferred over stand-alone policies that deal with specific markets (IPCC 2014).

But more is needed, and effectively delivering this information to policymakers remains a challenge. The need for further energy behavior research, improvements in experimental energy research designs, and more consistent reporting are called for in the literature (Sorrell et al. 2009). Researchers have also vocalized the need for more multidisciplinary efforts spanning social science, economics, natural sciences, engineering, and planning to successfully address global goals regarding reductions in fossil fuel use (Stern et al. 2016).

-

Q9. Can energy efficiency fit into utility business models? Energy supply resource discussions are heating up with the recent ratification of the Paris Agreement and development of implementation strategies such as the US Environmental Protection Agency’s Clean Power Plan (EIA, 2015a). Energy efficiency is often overlooked in these strategies. For example, in the USA, fewer than 30 states have EE targets (ACEEE 2015), perhaps because policymakers tend to correlate expansion of supply-side resources with economic and employment growth. Private sector investment focuses on building new generation and transmission resources so that systems are not caught short. Energy efficiency is seen as a customer service and not a resource (Joskow and Marron 1993), and efficiency practices are seen as emotional responses to the current tide of green favor and not sober decisions based on an assessment of facts (Brookes 1990).

These views may be motivated by a sense that energy efficiency is not a dependable or predictable energy resource, which is consistent with the fact that utilities across the globe have exhibited a preference for supply-side choices (Vine et al. 2007). In contrast, EE advocates argue that utilities should use least-cost resource planning that considers demand- and supply-side options in a single integrated approach. In some electricity systems, energy service companies (ESCOs) or load aggregators utilize flexible load reduction options to make a profit. With the expanding proportion of renewable energy generation and development of smart grid technologies, targeted and flexible energy efficiency has been identified as an approach to accommodating renewable energies, giving EE investments an additional value stream (Brown et al. 2016).

There is also a growing appreciation that energy demand can be better managed by understanding the types of services that are being sought (thermal comfort, productivity, lighting, mobility, nutrition, entertainment, etc.) and designing more EE technologies and systems to deliver those services. By utilizing best practices associated with the evaluation of investments in new technologies, it is possible to address concerns about reliability. New business models are now able to integrate energy efficiency into utility resource planning, such as performance-based incentives that can produce an extra stream of revenues. This will help inform what role it should play.

Many utilities are still locked into conventional business models that favor resource expansion over energy efficiency. This is driven by the throughput incentive that utility revenue is based on the volume of energy sold. Energy efficiency reduces energy consumption and thus challenges this business model. To encourage utilities to deliver energy efficiency, state governments attempt to use lost-revenue adjustment mechanisms and performance-based incentives to decouple utility revenue from sales. Alternatively, some states contract with third-party organizations rather than utilities to run energy efficiency programs (ACEEE 2015). Such creative decoupling policies can convert energy efficiency into a new revenue stream for utility companies and third parties.

It is still unclear when decoupling is warranted and what the impacts are likely to be. For example, the design of pricing scheme for decoupled utilities must address the question of a reasonable rate of return on investment (Kushler et al. 2006; Lesh 2009; York et al. 2014). Performance incentives always require a valid estimation of the energy savings, which can be tricky due to the choice of baseline. Nevertheless, the society’s increasing demand for efficient and renewable energy resources accents this emerging field of research.

-

Q10. Will opportunities for energy efficiency grow? Controversy swirls over how much energy can be saved with cost-effective investments under current market conditions. Many ex ante studies have estimated the efficiency potential in end-use sectors. These studies often conclude that the potential for energy efficiency is significant, but the diversity of their results undermines confidence in their reliability (Wang and Brown 2014). Allcott and Greenstone (2012), for instance, have concluded that many programs are unable to provide enough energy savings to warrant the investment costs, leading to the conclusion that cost-competitive energy efficiency has already been fully exploited and is largely tapped out. In addition, sluggish growth rates for electricity demand as well as technology innovation in fossil fuel production—such as hydrofracking for shale gas and oil—may lower energy prices and make EE less attractive.

Advocates, on the other hand, emphasize that huge potential exists for future efficiency improvements with advances in science and technology and with the possibility of increasing electrification in all sectors of the economy that could create new value for energy efficiency. One type of advancement focuses on technologies and the other on innovative approaches to encouraging EE.

Technology innovation and advancement happen when knowledge accumulates with experience and experimentation. Building design and operations, manufacturing systems, business supply chains, and the ways they are integrated into communities and regions by physical infrastructures and institutional systems are in a constant state of flux. Breakthroughs in science, engineering, and manufacturing enable the built environment to provide new and improved ways of delivering value to occupants and firms. At the same time, they are consuming less energy per square foot and per value of sales than ever before in most developed nations: a decoupling of economic growth and energy consumption is occurring across the developed world. Much of this progress is due to the use of more EE technologies and practices (IEA 2013; Horowitz and Bertoldi 2015). Looking to the future, more potential for improvement is ready to be adopted, and new opportunities for low-cost energy savings are being invented every day as science and technology advances.

Innovative approaches to delivering EE are also rapidly evolving. But can we count on new approaches going forward or will we be largely stuck with today’s options? (Levinson 2014). EE opportunities have changed in recent years by the introduction of the use of nudges and social norms to encourage energy savings. This is made possible by better data collection and the ability to conduct experiments (Asensio and Delmas 2015), but not necessarily by new EE technologies. Designing the “next generation” of EE programs can exploit the rapidly evolving customer communication gadgets and infrastructure as well as advancements in “smart technologies,” energy automatic management, and information and communication technologies (ICTs) that enable such customer-focused strategies. However, technical innovations themselves often do not deliver revolutionary outcomes because after being pushed or pulled into the marketplace, the market barriers are too powerful. Thus, policy intervention may be needed (Fri 2003). The design of these policies should reflect the rate of technology learning that can be expected.

A significant body of research has examined learning curves for energy supply technologies (Herron and Williams 2013); a similar body of research is needed to understand learning curves for energy end-use technologies, approaches, and policies. The adoption of EE approaches and policies is driven by replication, competition, coercion, and regulatory pressure from peers and higher-level governmental agencies. A literature is emerging on how such forces shape policy adoption and evolution patterns (Deitchman 2017), but more research is needed.

Summary and conclusions

Overall, a growing number of skeptics are vocalizing their concerns about the existence of “low-hanging fruit,” arguing that the energy efficiency opportunity is systematically exaggerated. They underscore many legitimate and important issues for analysts who take short cuts, fail to consider counterfactual evidence, and jump too quickly to conclusions about EE resources. Advocates, in turn, counter by noting that methods are available to address these concerns and that the field has matured significantly. Table 2 summarizes some of this dialog and suggests syntheses that can help disentangle these thorny issues.

The concerns and expectations of EE skeptics and advocates have historically been bipolar, but they appear to be converging as markets and policies for energy efficiency have matured. Clearly, more technology development, policy innovation, program evaluation, and market intelligence are needed so that energy and climate goals can be met at the lowest cost to society.

Skeptics have played an important role in highlighting weaknesses in the design, implementation, and evaluation of EE policies and programs. The success of their messaging can now be measured by the speed that known solutions are adopted. Collisions between skeptics and advocates can ignite new research and new policy designs that improve our understanding of technology, consumer behavior, and interventions in emerging markets for energy efficiency.

Many advocates and skeptics acknowledge the existence of an EE gap, but its size is still difficult to quantify due to varied definitions and methods and the existence of rival hypotheses. With the accumulation of retrospective studies, EM&V methods have grown more sophisticated, as has energy-economic modeling. Alternative policy scenarios can be compared with the business-as-usual forecast to estimate potential energy savings. Examining these EE resources in an integrated planning framework can assess their costs and benefits relative to supply-side alternatives.

The future value of EE depends on growth rates for electricity services, which are a function of competing fuel prices and electrification trends. Opportunities for future efficiency improvement will also be driven by technology advancements, broader consumer acceptance, and better program designs. That being said, research is also required to facilitate the growth of the EE sector. Fields of new research, as suggested by our analysis of the 10 fundamental questions, include (1) localizing the quantification of emission reductions to reflect heterogeneous fuel mixes, which is so important to valuing energy efficiency, (2) addressing energy service quality issues and the role of alternative utility rate designs and business cases, (3) improving the measurement and estimation of efficiency gains from policy, by specifying the counterfactual baseline or naturally occurring efficiency, (4) stronger empirical grounding of transaction costs, discount rates, and rebound effects and how these may be moderated by policy design, and (5) better understanding of consumer acceptance and use of efficiency technologies through stronger energy research designs drawing from expertise across disciplines. Ultimately, new knowledge and research findings need to be applied to improve program design and effectively deliver energy efficiency.

In the end, a more sustainable future requires a balance of investment in energy supply options to meet the growing needs of society and in demand-side options to reduce energy waste. Accumulating experience and knowledge will make EE programs more cost-effective and will make the idea of delivering efficiency to consumers more attractive to decision-makers. The evolving debate between skeptics and advocates will undoubtedly continue to heat up and add value as the stakes rise.

Notes

Amory Lovins, quoted in Robert Bradley, Jr. Capitalism at Work: Business, Government, and Energy (Salem: M&M Scrivener Press, 2009), p. 251.

When externalities are present, two conditions are required: (1) an individual’s utility is affected by other’s activities, and (2) the impact of activities are not fully compensated (Baumol and Oates, 1975).

Open meter is the pilot program implementing EE meter for meter-based savings measurement. http://www.openeemeter.org/

References

ACEEE. (2011). “How Does Energy Efficiency Create Jobs? Fact Sheet.” http://aceee.org/files/pdf/fact-sheet/ee-job-creation.pdf.

Allcott, H., & Greenstone, M. (2012). Is there an energy efficiency gap? Journal of Economic Perspective, 26, 3–28.

Amann, Jennifer Thorne. (2006). Valuation of non-energy benefits to determine cost-effectiveness of whole-house retrofits programs : a literature review. Vol. 20036. Washington D.C.

American Council for an Energy Efficient Economy (ACEEE), (2015). State Energy Efficiency Resources Standards (EERS) (April).

Arrow, K., Cropper, M., Gollier, C., Groom, B., Heal, G., Newell, R., Nordhaus, W., Pindyck, R., Pizer, W., & Portney, P. (2013). Determining benefits and costs for future generations. Science, 341(6144) American Association for the Advancement of Science, 349–350.

Asensio, O. I., & Delmas, M. A. (2015). Nonprice incentives and energy conservation. Proceedings of the National Academy of Sciences, 112(6), E510–E515.

Baer, P., Brown, M. A., & Kim, G. (2015). The job generation impacts of expanding industrial cogeneration. Ecological Economics, 110(2015), 141–153.

Baumol, W. J., & Oates, W. E. (1975). The theory of environmental policy. Englewood Cliffs, N.J: Englewood Cliffs, N.J., Prentice-Hall.

Benzion, U., Rapoport, A., & Yagil, J. (1989). Discount rates inferred from decisions: an experimental study. Management Science, 35(3) INFORMS, 270–284.

Birol, Fatih. (2012). “Chief economist at the International Energy Agency.” http://web.mit.edu/newsoffice/2012/3q-fatih-birol-world-energy-outlook-1127.html.

Borenstein, S. (2015). A microeconomic framework for evaluating energy efficiency rebound and some implications. The Energy Journal, 36(1), 1–21.

Bradley, Robert L. (2014). Capitalism at work: business, government, and energy. M & M Scrivener Press.

Brookes, L. (1990). The greenhouse effect: the fallacies of in the energy efficiency solution. Energy Policy, 18, 199–201.

Brown, M. A. (2001). Market failures and barriers as a basis for clean energy policies. Energy Policy, 29(14), 1197–1207.

Brown, Marilyn A, and Yu Wang. (2015). Green savings: how policies and markets drive energy efficiency: how policies and markets drive energy efficiency. ABC-CLIO.

Brown, M. A., Baer, P., Cox, M., & Kim, J. (2014). Evaluating the risks of alternative energy policies: a case study of industrial energy efficiency. Energy Efficiency, 7(1), 1–22.

Brown, M. A., Johnson, E., Matisoff, D., Staver, B., Beppler, R., & Blackburn, C. (2016). “Impacts of solar power on electricity rates and bills,” Proceedings of the 2016 ACEEE Summer Study on Energy Efficiency in Buildings, Pacific Grove, CA. Washington, DC: American Council for an Energy-Efficient Economy.

Cox, M., Brown, M. A., & Sun, X. (2013). Energy benchmarking of commercial buildings: a low-cost pathway toward urban sustainability. Environmental Research Letters, 8(3), 035018. doi:10.1088/1748-9326/8/3/035018.

Deitchman, B. (2017). Climate and clean energy policy: state institutions and economic implications, Routledge.

DOE EIA. (2011). “Residential demand module of the national energy modeling system model documentation report.” US DOE Energy Information Administration. http://www.eia.gov/FTPROOT/modeldoc/m067 (2011).pdf.

Donahue, John D. (1989). The privatization decision: public ends, private means. Basic Books.

Fowlie, M., Greenstone, M., & Wolfram, C. (2015). Are the non-monetary costs of energy efficiency investments large? Understanding low take-up of a free energy efficiency program. American Economic Review: Papers & Proceedings, 105(5), 201–204. doi:10.1257/aer.p20151011.

Frederick, S., Loewenstein, G., & O’Donoghue, T. (2002). Time discounting and preference : a critical time review. Journal of Economic Literature, 40(2351–401). doi:10.2307/2698382.

Fri, R. W. (2003). The role of knowledge: technological innovation in the energy system. The Energy Journal, 24(4), 51–74 http://www.jstor.org/stable/41323012.

Geller, H., & Attali, S. (2005). The experience with energy efficiency policies and programmes in IEA countries. Paris: Learning from the Critics.

Geller, H., Harrington, P., Rosenfeld, A. H., Tanishima, S., & Unander, F. (2006). Polices for increasing energy efficiency: thirty years of experience in OECD countries. Energy Policy, 34(5), 556–573.

Gillingham, Kenneth, and Karen Palmer. (2014). “Bridging the energy efficiency gap: policy insights from economic theory and empirical evidence.” Review of Environmental Economics and Policy. Oxford University Press, ret021.

Gillingham, K., Newell, R., & Palmer, K. (2006). Energy efficiency policies: a retrospective examination. Annual Review of Environment & Resources, 31(1), 161–192. doi:10.1146/annurev.energy.31.020105.100157.

Gillingham, K., R. Newell, and K. Palmer. (2009). “Energy efficiency economics and policy.” Resources for the Future. http://rff.org/rff/documents/RFF-DP-09-13.pdf.

Gillingham, K., et al. (2013). The rebound effect is overplayed. Nature, 493, 475–476.

Goldstein, David B. (2014). “Efficiency really works!” NRDC. https://www.nrdc.org/experts/david-b-goldstein/efficiency-really-works.

Goulder, L., & Parry, I. W. H. (2008). Instrument choice in environmental policy. Review of Environmental Economics and Policy, 2, 152–174 http://www.rff.org/RFF/Documents/RFF-DP-08-07.pdf.

Greene, D. L. (2011). Uncertainty, loss aversion, and markets for energy efficiency. Energy Economics, 33(4) Elsevier, 608–616.

Greening, L. A., Greene, D. L., & Difiglio, C. (2000). Energy efficiency and consumption—the rebound effect—a survey. Energy Policy, 28(6–7), 389–401.

Harmelink, M., Nilsson, L., & Harmsen, R. (2008). Theory-based policy evaluation of 20 energy efficiency instruments. Energy Efficiency, 1(2), 131–148. doi:10.1007/s12053-008-9007-9.

Hassett, K. A., & Metcalf, G. E. (1993). Energy conservation investment: do consumers discount the future correctly? Energy Policy, 21(6), 710–716.

Hausman, J. A. (1979). Individual discount rates and the purchase and utilization of energy-using durables. The Bell Journal of Economics, 10(1), 33–54.

Henryson, J., Håkansson, T., & Pyrko, J. (2000). Energy efficiency in buildings through information—Swedish perspective. Energy Policy, 28(3), 169–180. doi:10.1016/S0301-4215(00)00004-5.

Herron, Seth and Eric Williams, (2013). “Modeling cascading diffusion of new energy technologies: case study of residential solid oxide fuel cells in the U.S. and internationally” Environmental Science and Technology.

Hoffman, Ian M, Gregory Rybka, Greg Leventis, Charles A Goldman, Lisa Schwartz, Megan Billingsley, and Steven Schiller. (2015). “The total cost of saving electricity through utility customer-funded energy efficiency programs: estimates at the national, state, sector and program level.” Lawrence Berkeley National Laboratory. https://emp.lbl.gov/sites/all/files/total-cost-of-saved-energy.pdf.

Horowitz, M. J., & Bertoldi, P. (2015). A harmonized calculation model for transforming EU bottom-up energy efficiency indicators into empirical estimates of policy impacts. Energy Economics, 51(September), 135–148. doi:10.1016/j.eneco.2015.05.020.

International Energy Agency (IEA). (2013). Energy efficiency market report 2013. Paris: OECD/IEA.

International Energy Agency (IEA). (2014). Energy efficiency market report: market trends and medium-term prospects. Paris, France.

IPCC. (2014). Climate change 2014: mitigation of climate change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge, UK and New York, NY, USA.

Jaffe, A.B., R.G. Newell, and R.N. Stavins. 2004. “Economics of energy efficiency.” Encyclopedia of Energy, Elsevier, Inc.

Jørgensen, T. B., & Bozeman, B. (2007). Public values an inventory. Administration & Society, 39(3) Sage Publications, 354–381.

Joskow, P. (1995). Utility-subsidized energy-efficiency programs. Annual Review of Energy and the Environment, 20, 526–534.

Joskow, P., & Marron, D. (1993). What does a negawatt really cost? Further thoughts and evidence. The Electricity Journal, 6(6), 14–26.

Kushler, Martin, Dan York, and Patti Witte. (2006). “Aligning utility interests with energy efficiency objectives : a review of recent efforts at decoupling and performance incentives” 20036 (October).

Laitner, John A Skip, Steven Nadel, R Neal Elliott, Harvey Sachs, and A Siddiq Khan. (2012). The long-term energy efficiency potential : what the evidence suggests. Washington DC. http://www.aceee.org/sites/default/files/publications/researchreports/e121.pdf.

Lebot, Benoit, Paolo Bertoldi, and Phil Harrington. (2004). “Consumption versus efficiency : have we Designed the right Policies and programmes ? Is energy efficiency enough ? Short discussion on the rebound effect.” In ACEEE Summer Study on Energy Efficiency in Buildings, 206–17.

Lesh, P. G. (2009). Rate impacts and key design elements of gas and electric utility decoupling : a comprehensive review. The Electricity Journal, 22(8), 65–71.

Letschert, V., Desroches, L.-B., Ke, J., & McNeil, M. (2013). Energy efficiency—how far can we raise the bar? Revealing the potential of best available technologies. Energy, 59(September) Elsevier Ltd, 72–82. doi:10.1016/j.energy.2013.06.067.

Levinson, Arik. (2014). “California energy efficiency: lessons for the rest of the world, or not?” Journal of Economic Behavior & Organization, April. http://www.sciencedirect.com/science/article/pii/S016726811400119X.

MacLean, J., & Purcell, D. (2014). Strategies for energy efficiency finance. Montpelier, VT: Regulatory Assistance Project.

Makovich, L. J. (2008). The cost of energy efficiency investments. Cambridge, MA: CERA.

McCoy, D., & Lyons, S. (2016). Unintended outcomes of electricity smart-metering: trading-off consumption and investment behaviour. Energy Efficiency, 1–20.

Murphy, L., Meijer, F., & Visscher, H. (2012). A qualitative evaluation of policy instruments used to improve energy performance of existing private dwellings in the Netherlands. Energy Policy, 45(June), 459–468. doi:10.1016/j.enpol.2012.02.056.

National Research Council (NRC). (2009). “Hidden costs of energy: unpriced consequences of energy production and use.” National Academy Press.

Nordhaus, T., Shellenberger, M., & Jenkins, J. (2013). “Energy efficiency: beware of overpromises.” Breakthrough Institute. http://thebreakthrough.org/index.php/programs/energy-and-climate/the-limits-of-efficiency.

Office of Management and Budget (OMB). (2002). “Guidelines and discount rates for benefit–cost analysis of federal programs.” http://www.whitehouse.gov/sites/default/fi les/omb/assets/a94/a094.pdf.

Office of Management and Budget (OMB). (2009). 2010 Discount Rates for OMB Circular No. A-94. http://www.whitehouse.gov/omb/assets/memoranda_2010/m10-07.pdf.

Pérez-Lombard, L., Ortiz, J., & Velázquez, D. (2013). Revisiting energy efficiency fundamentals. Energy Efficiency, 6(2), 239–254. doi:10.1007/s12053-012-9180-8.

Rode, J., Gómez-Baggethun, E., & Krause, T. (2015). Motivation crowding by economic incentives in conservation policy: a review of the empirical evidence. Ecological Economics, 117, 270–282.

Shah, Jigar V. (2015). “Beyond the cliche: why efficiency needs success stories, not catchphrases.” Greentech Media. http://www.greentechmedia.com/articles/read/beyond-the-cliche-why-efficiency-needs-success-stories-not-catchphrases?utm_source=Daily&utm_medium=Headline&utm_campaign=GTMDaily.

Shellenberger, Michael and Ted Nordhaus. (2014). “The problem with energy efficiency.” The New York Times.

Shipley, A. M., & Neal Elliot, R. (2006). Ripe for the picking: have we exhausted the low-hanging fruit in the industrial sector. Washington DC: American Council for an Energy-Efficient Economy.

Sioshansi, F. P. (1994). Restraining energy demand. Energy Policy, 22(5), 378–392.

Sorrell, S., & Dimitropoulos, J. (2008). The rebound effect: microeconomic definitions, limitations and extensions. Ecological Economics, 65(3), 636–649. doi:10.1016/j.ecolecon.2007.08.013.

Sorrell, S., Dimitropoulos, J., & Sommerville, M. (2009). Empirical estimates of the direct rebound effect: a review. Energy Policy, 37(4), 1356–1371.

State and Local Energy Efficiency Action Network (SEEAction), Dec. 2015, “State approaches to demand reduction induced price effects: examining how energy efficiency can lower prices for all” (https://www4.eere.energy.gov/seeaction/system/files/documents/DRIPE-finalv3_0.pdf).

Stern, Paul C., Kathryn B. Janda, Marilyn A. Brown, Linda Steg, Edward L. Vine, and Loren Lutzenhiser. (2016). “Opportunities and insights for reducing fossil fuel consumption by households and organizations” Nature Energy, May.

Stevens, Noel, Nathan Caron, Christopher Chan and Pam Rathbun. (2016). “Innovative tools for estimating robust non-energy impacts that enhance cost-effectiveness testing and marketing of energy efficiency programs,” Proceedings of the 2016 ACEEE Summer Study on Energy Efficiency in Buildings, Pacific Grove, CA, (Washington, DC: American Council for an Energy-Efficient Economy).

Sutherland, R. J., & Taylor, J. (2002). Time to overhaul federal energy R&D. Policy Analysis, 424, 1–21.

Taylor, J. (1993). Energy conservation and efficiency: the case against coercion. Policy Analysis, 189, 1–13.

Taylor, Jerry, and Peter Van Doren. (2007). “Energy myth five-price signals are insufficient to induce efficient energy investments.” In Energy and American Society – Thirteen Myths, 125–44.

Thaler, Richard H. (1991). “‘Some empirical evidence on dynamic inconsistency.” Quasi Rational Economics 1. Russell Sage Foundation New York, NY, United States: 127–36.

Thomas, S., Boonekamp, P., Vreuls, H., Broc, J.-s., Bosseboeuf, D., Lapillonne, B., & Labanca, N. (2012). How to measure the overall energy savings linked to policies and energy services at the national level? Energy Efficiency, 5(1) Dordrecht: Springer Science & Business Media, 19–35. doi:10.1007/s12053-011-9122-x.

Tiefenbeck, V., Staake, T., Roth, K., & Sachs, O. (2013). For better or for worse? Empirical evidence of moral licensing in a behavioral energy conservation campaign. Energy Policy, 57, 160–171.

Tonn, Bruce, David Carroll, Erin Rose, Beth Hawkins, Scott Pigg, Daniel Bausch, Greg Dalhoff, Michael Blasnik, Joel Eisenberg, and Claire Cowan. (2015). “Weatherization works II—summary of findings from the ARRA period evaluation of the US Department of Energy’s Weatherization Assistance Program.” ORNL/TM-2015/139. Oak Ridge, Tennessee: Oak Ridge National Laboratory. http://weatherization.ornl.gov/RecoveryActpdfs/ORNL_TM-2015_139.pdf.

U.S. Department of Energy (DOE), and Committee on Climate Change Science and Technology Integration (CCCSTI). (2009). “Strategies for the commercialization and deployment of greenhouse gas-intensity reducing technologies and practices.”

U.S. Energy Information Administration (EIA). (2013). Commercial demand module of the national energy modeling system: model documentation 2013 (p. 146). Washington, DC: US Energy Information Administration.

U.S. Energy Information Administration (EIA). (2015a). Analysis of the impacts of the clean power plan. Washington, DC: U.S. Energy Information Administration https://www.eia.gov/analysis/requests/powerplants/cleanplan/pdf/powerplant.pdf.

U.S. Energy Information Administration. (2015b). Analysis of energy efficiency program impacts based on program spending, May 21, http://www.eia.gov/analysis/studies/buildings/efficiencyimpacts/.

U.S. Energy Information Administration. (2016). Annual energy outlook 2016. Washington D.C. Report 0383 (2016).

U.S. IAWG. (2013). “Technical support document: technical update of the social cost of carbon for regulatory impact analysis under Executive Order 12866.” Interagency Working Group on Social Cost of Carbon, United States Government. Washington, DC. http://www.whitehouse.gov/sites/default/files/omb/inforeg/social_cost_of_carbon_for_ria_2013_update.pdf.

Unruh, G. C. (2000). Understanding carbon lock-in. Energy Policy, 28(12) Elsevier, 817–830.

Verbruggen, A. (2012). Financial appraisal of efficiency investments: why the good may be the worst enemy of the best. Energy Efficiency, 5(4), 571–582. doi:10.1007/s12053-012-9149-7.