Abstract

The paper aims at explaining why large-scale energy-intensive industries—here the German iron and steel industry—had a period of slow uptake of major energy-efficient technologies from the mid 1990s to mid 2000s (Arens and Worrell, 2014) and why from the mid 2000s onwards these technologies are increasingly implemented again. We analyze the underlying factors and investment/innovation behavior of individual firms in the German iron and steel industry to better understand barriers and drivers for technological change. The paper gives insights on the decision-making process on energy efficiency in firms and helps to understand how policy affects decision-making. We use a mixed method approach. First, we analyze the diffusion of three energy-efficient technologies (EET) for primary steelmaking from their introduction until today (top-pressure recovery turbine (TRT), basic oxygen furnace gas recovery (BOFGR), and pulverized coal injection (PCI)). We derive the uptake of these technologies both at the national level and at the level of the individual firm. Second, we analyze the impact of drivers and barriers on the decision-making process of individual firms whether or not they want to implement these technologies. Economics and access to capital are the foremost barriers to the uptake of an EET. If the expected payback period exceeds a certain value or if the company lacks capital, investments in EET seem not to happen. But even if an EET is economically viable and the company has access to capital, investments in EET might not be realized. Policy-induced prices might have strengthened the recent diffusion of TRT. We found indications that in a limited number of cases, policy intervention was a driving factor. Technical risks and imperfect information are only marginal factors in our cases. Site-specific factors seem to be important, as site-specific factors shape the economics of the selected EET.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Energy efficiency is regarded as a major means to reduce carbon dioxide emissions until the energy systems has been transformed to a sustainable system based on renewable energy carriers. However, e.g., Hirst and Brown (1990) found an untapped potential to improve energy efficiency although these measures were identified to be cost-effective. The energy efficiency gap thus describes the difference between the potential to implement energy-efficient technologies and the actual adoption of these technologies (Brunke et al. 2014).

Arens et al. (2012) analyzed the development of the energy intensity of selected processes of the steel industry in Germany between 1991 and 2007. Although the analysis covered a period of 17 years, energy efficiency improvements were surprisingly low.

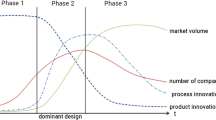

Arens and Worrell (2014) analyzed the diffusion of key energy-efficient technologies (EETs) in the German steel industry to better understand the slow improvement rates. Technologies were introduced in two phases, i.e., in the earlier phase (around 1960) technologies diffused continuously and were completely implemented after about 30 years. However, technologies introduced during the second phase (around 1980) did not diffuse completely and further potential remains. The technologies diffused strongly in the initial phase but then, 10–15 years after their introduction, no further implementation took place. Only recently, adoption has increased again.

Drivers and barriers

Energy-efficient technologies (EETs) can be regarded as a particular case of innovations (Fleiter et al. 2012a). There is a wide range of literature on the diffusion of innovations. Rogers (2003) describes the s-shaped diffusion process. He categorized the adopters as innovators (those that take up innovative technologies first), early adopters (those that take up a technology when proven), and those that implement it once the technology is more widespread (i.e., early majority, late majority, and laggards). This process of uptake may partly explain the energy efficiency gap, which is defined as the difference between the economic viable level of energy efficiency and the actual level (e.g. Brunke et al. 2014; Backlund et al. 2012; Levine et al., 1995). Drivers are factors that accelerate the uptake of energy efficiency measures, while barriers are all factors that impede the adoption of cost-effective energy-saving measures (Fleiter et al. 2011). Nevertheless, Sutherland (1991, 1996) argued that the energy-saving potential is only profitable from a superficial point of view and that many barriers can be traced back to rational economic behavior, e.g., transaction costs and other factors. Yet, many of the barriers can be addressed or even mitigated by policies.

Different taxonomies of drivers and barriers have been developed, although most refer back to the taxonomy of Sorrell et al. (2000) (Brunke et al. 2014; Sorrell et al. 2000). They derived a taxonomy of barriers combining findings from orthodox economics, transaction cost economics, and behavioral economics. The six classes of barriers are: risk, imperfect information, hidden costs, access to capital, split incentives, and bounded rationality. According to Cagno et al. (2013), the taxonomy of Sorrell et al. lacks accuracy and is incomplete. They suggest a novel, more sophisticated taxonomy, which distinguishes the origin of the barrier, i.e., either internal or external with respect to the firm. They also classify the actor or area affected by the barrier (e.g., market, government/politics, behavioral, economic), arriving at a taxonomy encompassing 33 barriers.

This analysis bases the drivers and barriers on the taxonomy of Sorrell et al. (2000) complemented by the findings of Cagno et al. (2013) and Brunke et al. (2014) (Table 1). Since original drivers can become barriers, drivers and barriers may overlap. Hence, this study unifies drivers and barriers as diffusion factors.

Economics are self-evidently a key driver or barrier towards the diffusion of EET. Depending on the scope of the studies, economics of an EET are considered as a driver or not. Especially newer studies seem to focus on cost-effective EET (e.g., Okazaki and Yamaguchi 2011; Thollander et al. 2007; Thollander and Ottosson 2008; Trianni et al. 2013). In contrast, Harris et al. (2000) highlight low rates of return and long payback periods as key barriers. Other studies address economics from different perspectives. Fleiter et al. (2012b) name high investment costs and non-profitability as key barriers to the diffusion of EETs in small- and medium-sized enterprises (SMEs) in Germany. Sardianou (2008) finds bureaucratic procedures for financial support too difficult, i.e., the measure does not meet the companies’ economic requirements without governmental support.

The role of policy-induced energy price components on the economics of energy-efficient technologies has rarely been quantified. Rosenberg et al. (2011) studied the impact of tax exemptions and levy reductions on the German industry of four energy policies (i.e., the Environmental Tax Reform, the Combined Heat and Power Act, the EU Emission Trading Scheme, and the Renewable Energy Act). They found that these exemptions and reductions of energy prices in Germany reduce the incentive for manufacturing industries to invest in energy efficiency measures. Furthermore, they conclude that polices and their exemptions create significant differences in energy costs among companies, especially in large-scale and electricity-intensive industries.

In the taxonomy of barriers by Sorrell et al. (2000), imperfect information is recognized as a key barrier towards the diffusion of EETs. For instance, energy audits aim to overcome these information-related barriers. Imperfect information is a barrier in SMEs, which do not employ an energy manager. Large and energy-intensive companies—like steel mills—are assumed to have access to relevant information on key energy-efficient technologies.

In 1998, Germany liberalized its electricity market thereby accomplishing a European directive. Market liberalization intended to benefit customers (Lise and Kruseman, 2008). However, Newbery (2001, 2002) argues that benefits can be offset if regulation is insufficient. Pollitt (2012) found that generally electricity prices did not decrease demonstrably through market liberalization, contrary to expectations. Instead, electricity prices increased due to rising commodity prices, unwinding subsidies, and reduced rates of technological progress, in part due to rising environmental concerns around power generation. In Germany, industrial electricity prices dropped after liberalization from March 1998 till March 2000 (Ziesing et al. 2001). Thollander et al. (2005) assumed that industrial electricity prices will rise in Sweden due to market liberalization.

Environmental protection agencies permit the erection of large industrial plants thereby controlling environmental requirements. They control the environmental impact of the plants. In Germany, this kind of policy intervention is backed up by a strong law, i.e., the Federal Control of Pollution Act that implemented the European Industrial Emissions Directive (2010/75/EU).Footnote 1 The Federal Control of Pollution Act includes a paragraph on the efficient use of energy for plants (BImSchG §5/4) (BMJV 2014a). So far, no studies have investigated the impact of this law on energy efficiency developments in the German industry.

Access to capital is regarded as a major barrier. Thollander et al. (2007) evaluated a Swedish energy efficiency program for SMEs, and found that after a low priority for energy issues, access to capital is a major barrier towards energy efficiency improvement. Trianni and Cagno (2012) investigated 128 non-energy-intensive small- and medium-sized enterprises in northern Italy, and identified access to capital as the most important barrier towards energy efficiency.

Another pillar of Sorrell’s taxonomy is risk (Sorrell et al. 2000), distinguishing external risks, business risks, and technical risks Brunke et al. (2014). Brunke et al. (2014) emphasize technical risks like production failures and production interruptions as a key barrier.

In summary, there is a wide range of studies on drivers, barriers, and policy for the diffusion of EETs. Still, the factors affecting diffusion on the level of firms and plants have received little attention. Little is known about the decision-making process at site and company level, as well as site-specific constraints towards the uptake of EETs.

Research aim

This paper aims to shed some light on the reasons why key energy-efficient technologies diffused discontinuously as shown in Arens and Worrell (2014) in the German steel industry, seemingly opposed to the diffusion theory (e.g., Rogers 2003). This study focuses on currently running sites. The studied period also covers the time before German reunification. However, only one site on the territory of the former German Democratic Republic is part of this study (i.e., Eisenhüttenstadt). Its analysis considers these historical facts. The selected technologies are applied major energy-efficient technologies with a remaining diffusion potential (see Arens and Worrell 2014). It aims to find explanations for the observed diffusion patterns, and why some plants still have not implemented these—at least to competitors—cost-effective technologies. The analysis gives insights on the decision-making process of firms helping to understand how policies can act on them. National trends (Arens and Worrell 2014) are broke down to that of individual firms and plants focusing on key energy-efficient technologies for primary steelmaking that are currently applied and have a further diffusion potential (Arens and Worrell 2014), i.e., top-pressure recovery turbine (TRT), basic oxygen furnace gas recovery (BOFGR), and pulverized coal injection (PCI). These technologies are either applied to the blast furnace or the basic oxygen furnace. A detailed description of steelmaking processes can be found in, e.g., Arens et al. (2012).

Section 2 describes the methodology. Section 3 investigates the diffusion of the selected technologies both on the national and on the site level. Section 4 studies the impact of drivers and barriers on the diffusion of the selected technologies, followed by the conclusions.

Methodology

The analysis is based on five steps (Table 2).

First, data obtained from reference lists by plant manufacturers is analyzed and cross-checked with reports by the Steel Institute VDEh (2005-2010) and interviews (step 1). The findings are shown in a timeline in which year a certain EET was implemented in Germany.

Then, a timeline of all current German integrated steel sites is established including the start-up of blast furnaces (BF) and basic oxygen furnaces (BOF) as well as the year of implementation of the selected EET since 1980 (Steelinstitue VDEh 2013) (step 2). Data is cross-checked with other sources and interviews. Also, it is indicated in which year an EET was available on the market but was yet not implemented to a certain plant, showing whether individual sites behave similarly or not.

In order to compare the behavior of single sites or companies, the average number of years are calculated which passed till an EET was implemented (Eq. (1)) (step 3).

The development of the energy prices for the German industry from the late 1960s until today is tracked, acknowledging that time series over such a long time include uncertainties (step 4). We chose the development of energy prices on the industrial level due to the lack of more specific energy prices for individual industrial branches (e.g., Eurostat: Electricity prices for industrial consumers). The analysis of the energy prices starts about 10 years earlier than the commercialisation of the selected EET to review the firms’ decision-making process. Furthermore, we include the impact of two major policy-induced energy price components on the payback period of the selected EET, i.e., the European Emission Trading Scheme (ETS) and the German Renewable Act (EEG).

Energy prices are collected from several federal, international, and non-profit organizations (Appendix, Table 8). Following the German Energy Tax Act (BMJV 2014b) that exempts iron and steelmaking, the impact of taxes for solid fuels is neglected. Neither transportation costs for coal, coke, and coking coal are considered.

The prices are deflated using a BIP-Deflator for the year 2005 (Destatis 2013, Worldbank 2016; own calculations). Then, prices are converted to Euro2005/MWh using conversion factors (Appendix, Table 8).

The period from the late 1980s till early 2000 is characterized by relatively low energy prices (Fig. 1).

Development of selected energy prices in the German industry between 1970 and 2014 in Euro2005/MWh, excluding developments in the former German Democratic Republic (1949–1990). Sources are given in Table 8

The first phase of the European Emission Trading Scheme (ETS) started in 2005 (VDKI 2004–2015). Under the ETS selected sectors, including iron- and steelmaking companies, receive free allowances up to the benchmark (BMU 2006), Furthermore, within the third trading period (2013–2020), a compensation for an increasing electricity price due to ETS is introduced for selected sectors, including iron and steelmaking (DEHSt 2015). In our analysis, we refer to the costs of ETS without any free allowances, or compensations, to evaluate the companies’ decision-making processes, as these represent opportunity costs if any allowances can be sold. The impact of the ETS has decreased since the economic crisis in 2008/2009 (Fig. 2). The net results of both are summarized in Table 3 excluding free allowances and compensation.

Development of the price of CO2 emissions under the EU-ETS (2004–2014) (VDKI 2004–2015)

Germany charges a levy for the support of renewable energies empowered by the German Renewable Act (Erneuerbare-Energien-Gesetz; EEG) (BMJV 2014c) since 2003. The levy was 0.41 eurocent/kWh of electricity in 2003, and has since evolved to one of the key electricity price components (2013: 5.23 eurocent/kWh; 2014: 6.24; 2015: 6.17; Fig. 3). Reductions are given to companies with a high ratio of electricity costs to gross value added (Rosenberg et al. 2011) and that face international competition (Besondere Ausgleichsregelung, BesAR) (BMJV 2014c). While electric steel mills are mostly privileged, integrated steel mills in general do not fulfill the requirements for privileging (BAFA 2014). Nevertheless, the overall impact of the EEG on integrated steel mills is rather low, since they produce the majority of the consumed electricity in on-site power plants fed with top gases, which are excluded from the levy.

Development of the levy for the support of renewable energies in Germany under the EEG (2003–2014) (BMWi 2016)

While the impact of the EEG on the energy prices increased since its introduction, the impact of the ETS lowered (Table 3).

Payback periods are calculated showing the impact of the selected policy-induced energy prices (EEG, ETS) (Table 4). Since BOFGR and PCI save natural gas and coke, respectively, the economics of these technologies are not affected by the EEG. The economics of TRT are subject to both, ETS and EEG.

Since this study is mainly ex post, past firms’ assumptions on future energy prices can hardly be derived from the present. However, a limited number of interviewees stated that companies expected increasing electricity prices. Nevertheless, it hardly can be determined (a) in which period they expected increasing electricity prices, (b) for which period they expected increasing prices, or (c) by which amount they expected prices to increase. Hence, this analysis does not consider firms’ assumptions on future developments of energy prices.

Investment, operation, and maintenance costs are kept ceteris paribus. All costs are converted to Euro2005. Interest rates are not included. The calculations of the payback periods are explained in detail in 0.

The uptake of the selected energy-efficient technologies (EETs) in the German iron and steel industry has been rather quick during the 1980s but slow in the 1990s (Arens and Worrell 2014). Since the mid-2000s, these technologies are again being implemented, but some plants still possess a potential to adopt these technologies (Table 5). In step 5, we try to understand the drivers for the recent uptake and the barriers on a plant-specific level. We analyzed those cases in detail which either have implemented an EET recently, i.e., since 2009, or which still could implemented one. In total, these are 10 cases (Table 5).

Next to literature research in step 5, also, interviews with stakeholders are conducted, e.g., staff at the companies, plant manufacturers, and governmental institutions. Confidentiality to all interviewees was assured. Interviewees were typically contacted by phone. Sometimes, the interview was held directly. In other cases, the interviewees requested advanced information via e-mail. Then, either the interview was held on a later appointment, or the interview was passed on to a more appropriate person. In total, about 40 persons were consulted.

Case-specific interview guidelines were prepared based on Gläser and Laudel (2010). After a short introduction, open questions were asked. In case of a recent implementation of an EET two main questions were raised: Why have the EET been implemented recently? Why have the EET not been implemented earlier? In the case that the plant has not implemented the technology yet, the basic question was: Why has the EET not been implemented yet? Depending on the answers, more detailed queries were raised, checking the impact of possible drivers and barriers as mentioned in Table 1. Additionally, site-specific issues were raised such as the financial situation of the firm, earlier adoption of the same technology or other EETs, other investments, plants at the site, site-specific production processes, and commitment of the management.

Notes were taken manually. The notes were transcribed subsequently. If necessary, follow-up questions were raised via e-mail or by an additional phone call. The content of the interviews was analyzed qualitatively according to Gläser and Laudel (2010). The interviews were scanned for relevant information that helps to shed light on why after a period of nearly no uptake, recently EETs were implemented again as well as why some plants still have not agreed on investing in these technologies. Thus, the decision whether information is relevant or not is based on the factors described in Table 1. But relevant information is also considered even if it does not apply to the structure of those factors. The relevant information is extracted from the interviews and is allocated by factor. The extracted information is analyzed and interpreted.

Diffusion of energy-efficient technologies

Technology description

TRTs are driven by the high-pressure top gas from blast furnaces generating electricity. TRT is a proven technology with little risk involved for installation and operation. TRT can only be installed at blast furnaces with high top pressure. Today, there are only three high-pressure and two low-pressure blast furnaces with little production capacity in Germany without TRT (Arens and Worrell 2014). In Germany, TRT was first introduced in about 1978 (Arens and Worrell 2014).

BOFGR is an add-on technology which collects the BOF gas (BOFG). The heating value of BOFG varies depending on the hot metal ratio in the BOF. Also, the recoverable amount of converter gas varies (Brauer 1996). In Germany, BOFGR was first introduced in 1982 (Arens and Worrell 2014).

Pulverized coal injection (PCI) partly replaces coke consumption in the blast furnace. One kilogram of coal can replace about 0.8 kg of coke.Footnote 2 It does not reduce energy consumption in the blast furnace itself but reduces energy consumption for coke making. Since coke is a structural element needed to carry the weight in the blast furnace, a minimum coke rate is needed. The amount of coal injected into the blast furnace depends on a set of factors such as coke properties, desired hot metal quality, or type and the condition of the coal (Remus et al. 2013). In 2010, the highest PCI rate in Germany achieved in a single blast furnace was 177 kg/thm while the national average was 138 kg coal/thm (Steelinstitute VDEh 2005-2010). Blast furnaces can be retrofitted with PCI. This technology is widely applied nowadays. It was first introduced in Germany in 1986 (Arens and Worrell 2014).

Diffusion on the national level

The selected EETs diffused quickly in the initial phase after their introduction to Germany (Table 6). During the first 10 years (7 years for BOFGR), the EETs were implemented at a new site at least every 2 years. This was followed by a period in which none of the selected EETs were installed (1994–2003). From 1998 to 2008, no BOFGR has been adopted. Only in 2009 one site was equipped with BOFGR. Since then, again no company has invested in BOFGR. A similar observation is made with TRT and PCI. Between 1994 and 2012, i.e., for 18 years, no TRT was installed in Germany. Since then, two TRTs have been implemented and a third blast furnace will be equipped with TRT. Its start-up is expected for mid-2015 (Siemens 2013). PCI was not installed in Germany between 1994 and 2003. A period of 5 years followed in which five sites invested in PCI. In 2014, the last site adopted PCI.

This analysis shows phases with high and low diffusion of the selected EET; hence, it can be assumed that there are national level drivers and barriers that shape the diffusion of EET in the German steel industry.

Diffusion on the site and company level

Sites and companies seem to vary a lot in their attitude towards the uptake of the selected technologies (Table 7). While some sites implemented the selected technologies shortly after they had been introduced (Schwelgern/Beeckerwerth, Hamborn/Bruckhausen), other sites adopted these technologies only many years later, if at all. Interestingly, some sites implemented an EET at one furnace, but equipped a second furnace only many years later with the same—but proven—technology (TRT at Salzgitter), or did not install it at a second furnace (TRT at Bremen). In some cases, a site took up an EET quickly, but it is very slow to adopt a different technology (Rogesa/Dillingen, Eisenhüttenstadt). Some sites seem to be very slow in adopting the selected EET (HKM).

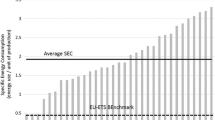

The average years which passed before a site/company adopted an EET cover a broad range (Fig. 4). The value differs from 1.6 years (Schwelgern/Beeckerwerth) to (more than) 34 years (Ruhrort). The distribution has a linear to parabolic shape.

According to our analysis, the quickest site is Schwelgern/Beeckerwerth by ThyssenKrupp Steel that is located in a densely populated area. On average, only 1.6 years passed before one of the selected EET was implemented at this site. Hamborn/Bruckhausen also belongs to ThyssenKrupp Steel Europe. This site also quickly adopted the selected EETs. In 2007, they built a new blast furnace that they directly equipped with PCI. Interestingly, TRT was not directly implemented in the newly built blast furnace, but only in 2013. Eight out of the first nine implementations of PCI took place at sites belonging to firms that are considered as predecessors of the current ThyssenKrupp group. The same accounts for BOFGR.

The second quickest site (i.e., Völklingen) and the slowest site (i.e., Ruhrort) only produce steel, not hot metal. Völklingen implemented BOFGR in 1986 when the site was just closing its blast furnaces. The blast furnace gas was replaced by BOFG (Marion 2009). Ruhrort was one of the first sites implementing a waste heat boiler in its BOF in Germany. In 1994, the blast furnaces were shut down (ArcelorMittal 2014a). The site has not implemented BOFGR yet.

The site that was the second most slowly in implementing the selected EETs is HKM, which is also situated in the same densely populated area as ThyssenKrupp and Ruhrort. This site does not possess rolling mills (i.e., large electricity consumer within integrated steel mills), which might be a site-specific constraint to implementing EETs. HKM does not (yet) use TRT and BOFGR and implemented PCI (only) in about 2007.

The third slowest site is ArcelorMittal Bremen, which implemented TRT at one blast furnace in 1990, PCI in 2004 and 2006, and BOFGR only in 2009. A second high-pressure blast furnace does not possess TRT yet.

In the middle range, there are the sites of Dillingen/Rogesa, Eisenhüttenstadt, and Salzgitter. The first two sites implemented BOFGR quickly, while BOFGR is still not applied at Dillingen. Additionally, Salzgitter was one of the first companies to install TRT at one blast furnace though it equipped its second blast furnace with TRT a remarkable 30 years later (i.e., 2012). Dillingen/Rogesa adopted PCI and TRT early. The implementation of TRT at Eisenhüttenstadt (formerly located in the German Democratic Republic, GDR) and PCI at Salzgitter can be considered to have happened rather slowly.

The findings suggest that the adoption of EET depends to some extent on the companies’ attitude towards new technologies and energy efficiency. ThyssenKrupp was initially very quick to implement the selected technologies, though the recent implementation of TRT at Hamborn 8 might not be considered as quick. It is also notable that the three sites belonging to ArcelorMittal are among the five slowest sites according to this analysis. Nevertheless, we cannot find proof that the management practices towards innovation and energy efficiency is responsible for the observations. Barriers such as economics and access to capital could explain the behavior as well.

This analysis only provides partial insights into a section of the German steel industry. The results indicate that there are site- or company-specific factors driving the diffusion of EET besides national level drivers and barriers.

Findings on drivers and barriers

Economics

Economics are a key driver for the diffusion of EETs. The diffusion of the selected EETs rarely happened at payback periods above 3 years (Figs. 5, 6, and 7). Moreover, the low energy prices in the late 1980s until the mid 2000s seem to have stopped the diffusion of the EETs in that period. It seems that the strong increase in energy prices from 2000 onwards helped to further diffuse the technologies.

Even without considering free allocations, EU ETS affect fairly the economics of the selected technologies. Only for the period of 2005–2008, ETS reduced the payback period of the selected EETs by about 10–14 %. The biggest impact was on TRT when the ETS reduced the payback period by 17 % in 2005. Since 2009, the impact of the EU-ETS on the reduction of the payback period has been far below 10 % for all selected technologies. Although the current impact of EU-ETS is limited, the interviewees acknowledged the importance of how EU-ETS might develop.

The analysis indicates that the levy for the support of renewable energies (EEG) shaped the economics of TRT (Fig. 5). It is assumed that integrated steel mills pay an electricity price which equals the average electricity price of the German industry. Integrated steel mills in general are not excluded from EEG. Hence, the average electricity price of the German industry provides a good estimation of the electricity price of integrated steel mills. The payback period of an investment in TRT in 2012 would nearly double from 2.0 years with EEG to 3.4 years without EEG.

According to these findings, economics seem to play a key role in the diffusion of EETs. However, economics alone cannot explain why some companies do not invest in an EET while other companies do.

Access to capital

Access to capital is also a key barrier, mentioned both in literature (e.g., Thollander et al. 2007; Rohdin and Thollander. 2006; Trianni and Cagno 2012; Apeaning and Thollander 2013) and by the interviewees. Good and bad economic prospects on the national or global level and as for the company determine how easily or not a company can access capital. The firm has to decide which investments are more important to secure the companies’ competiveness. For example, several interviewees stated that limited access to capital is a strong reason why blast furnace No. 3 of Bremen is not yet equipped with TRT. The site of Bremen was insolvent in 1993. In recent years, they have made several investments (ArcelorMittal 2014b). Additionally, the owner company of the site of Bremen, i.e., ArcelorMittal, has currently bad financial ratings (Reuters 2012) and has therefore more limited access to capital. Finally, blast furnace No. 3 is the smallest high-pressure blast furnace in Germany. The smaller the blast furnace is, the smaller the TRT, and the investment may be less economically viable. While access to capital seems to be a barrier for the implementation of TRT at Bremen 3, it seems to be a driver for the investment in BOFGR at Bremen in 2009. Until then, the released BOFG was flared. The BOFGR only met the firms’ economic requirements in the early 1980s and from the mid-2000s onwards (Fig. 6). Once a firm missed the first window of opportunity, it was unlikely to invest in BOFGR between the mid-1980s and mid-2000s. The BOF at Bremen is the last one in a German integrated steel mill which was equipped with BOFGR.

The blast furnace 5A of Eisenhüttenstadt will be equipped with TRT in 2015, which can be considered as late. Eisenhüttenstadt is located in the territory of the former German Democratic Republic, and reunified in 1991. From 1990 onwards, the site was run by EKO Stahl AG, and was acquired by Arcelor in 2002. Interviewees claim that the site of Eisenhüttenstadt has evolved into one of the most competitive sites of the ArcelorMittal Group in Germany or even Europe, which may explain the current investment in the TRT. Furthermore, the local energy supplier co-financed the investment (Siemens 2013). ArcelorMittal is actively looking for investors in TRT at their sites (ArcelorMittal 2012).

Lack of information and technological risk

Lack of information does not seem to be a barrier to the diffusion of the selected technologies. Without exception, all interviewees knew the technologies and reported that the company every once in a while estimates the economics.

Only in two cases technological risk was mentioned as a strong barrier to the diffusion of the selected EET. An interviewee of ArcelorMittal Ruhrort stressed the danger of carbon monoxide which is part of BOFG and its leakage. He put forward that at another site two workers had died of carbon monoxide. The interviewee is responsible for security, and therefore does not promote the implementation of BOFGR. Second, an interviewee of HKM stressed the risk of retrofitting TRT to the blast furnaces at the site. According to our finding, risks are considered when analyzing the economics, but in none of the cases risks surpassed good economics in decision making.

Liberalized electricity market

Salzgitter was one of the first companies to implement TRT in Germany (1982). It runs another high-pressure blast furnace which was equipped with TRT only in 2012, i.e., 30 years later. When Salzgitter B was erected in 1994, it was not equipped with TRT, while the same year the new blast furnace Schwelgern 2 (1993) of ThyssenKrupp was. One member of the company said that during times of state-controlled electricity markets, Salzgitter held a contract with the electricity supplier in which it agreed to refrain to build a TRT to retain a high level of purchased power. In return, low electricity prices were assured. After liberalizing the German electricity market in 1998, the firm assessed the economics, and the recent increase in power prices led to the erection of a TRT at Salzgitter B in 2012.

Policy intervention

Germany is a federal state which shares responsibilities between the governmental and the federal level. Permissions for the construction of new industrial plants are allocated to the responsibility of the Länder which might even empower hierarchic lower institutions with the permission process. The case of TRT at Hamborn 8 seems to have been impacted by policy intervention. Several members of ThyssenKrupp claim that the blast furnace would not have been equipped with TRT if the company had not faced pressure from the local government. The local government officer in charge stated that his institution applies a law that requires large industrial plants to be run energy efficiently (BImSchG §5/4; BMJV 2014a). He stated that companies have to illustrate the energy efficiency of the plant, while the local government itself collects information on energy-efficient technologies. The local government might find more options to increase energy efficiency than the company plans to include. The local government generally approves the application with additional requirements, e.g., the implementation of energy-efficient technologies which are (a) appropriate, (b) necessary, and (c) adequate to use energy efficiently. Energy-efficient technologies (e.g., TRT) are self-evidently appropriate to save energy, are necessary since the law asks to use energy efficiently, and are adequate if they are economically viable. The last is given when competitive companies in reasonable economic conditions are already applying this technology. Though there are some indications that environmental permitting agencies such as the local government of Duisburg may play a role in the diffusion of energy-efficient technologies, we did not find any further proof that this happened in other regions of Germany (Länder) as well. Few plant suppliers mentioned policy intervention for the case of TRT at Salzgitter B. However, the respective governmental institutions strongly deny any influence.

In summary, we found some indication for policy intervention on the diffusion of energy-efficient technologies in the German steel industry, though only in a single case and with differing views from the regulator and company side. It seems that different environmental permitting agencies have different approaches towards the implementation of energy-efficient technologies.

Site-specific constraints

Site-specific factors have been described to some extent by Sutherland (1991) and Sutherland (1996), though not by Sorrell et al. (2000), Cagno et al. (2013), and Brunke et al. (2014). In this analysis, four out of five cases that have not implemented a selected EET yet (Table 5) put forward site-specific constraints as a key barrier. The four cases belong to three sites. The cases are TRT and BOFGR at HKM as well as BOFGR at Ruhrort and Dillingen. All three sites are not complete integrated steelworks. One site has no rolling capacity (HKM), a second only a rolling capacity of about 50 % of its hot metal production (Dillingen), and the third has steelmaking and rolling but no iron production (Ruhrort).

The implementation of TRT at HKM seems to be restrained by site-specific constraint that HKM has no rolling and thus a lower electricity demand than integrated steelworks including rolling. Rolling is one of the key electricity and fuel consumers in an integrated steel plant. If an integrated steel plant does not possess rolling mills (e.g., HKM), its electricity and gas demand is lower. If it then was to produce electricity with TRT or recover BOFG, the company would either have to sell the energy or to find other on-site uses. Additionally, currently, market power prices are low in Germany while consumer prices are high, particularly due to the EEG reallocation charge. Since HKM does not have any further electricity demand, the price of electricity produced with TRT at HKM would have to compete with power plants. As an interviewee stated, the company consistently evaluates the economic viability of TRT at its blast furnaces. So far, the implementation would not meet the companies’ economic requirements. The implementation of TRT at HKM is foreseen when the blast furnaces are re-built.

The recovery of BOFG at Dillingen seems to be held back by the site-specific constrain that its blast furnace capacity is about twice as big as its rolling capacity. Hence, the amount of blast furnace gas covers already to a large extent the energy demand for rolling. The economics of BOFG recovery seems to depend largely on whether a company can reduce its natural gas consumption or not.

The site of Ruhrort seems to abstain from implementing BOFGR since this site does not possess ironmaking facilities, but only two BOFs and rolling. It was one of the first BOFs in Germany that was equipped with a waste heat boiler, so the BOFG is burned to boil water. The steam is used for both on-site purposes such as vacuum-degassing and is sold to another steel plant. The pipes for the transport of the steam to the other steelwork were renewed in 2004 at times of comparably low energy prices. The interviewee stated that the company considers BOFGR once in a while but that so far it has not turned out to meet the firms’ economic requirements. Since the site has recovered parts of the off-gas energy, invested in the pipes, and has a contract with the other company, possible additional proceeds by BOFGR would not compensate for the opportunity costs.

Conclusions

Policy can shape the uptake of EET but so far its impact is limited. The strong increase of the levy for the support of renewable energies (EEG) seems to have led to a further diffusion of one TRT since about 2012. Furthermore, we found indications that one TRT has been erected partly due to the application of an existing law on energy efficiency in industry by a local government. The introduction of the CO2-Emission Trading System in 2005 has had only marginal effects on the diffusion of the selected EET.

Economics matter. The results indicate that investment rarely happened at payback periods exceeding about 3 years. Increasing coke prices led to the strong uptake of PCI from 2004 onwards. A better economic outlook of a company also strengthens the uptake of EET.

Site-specific constraints seem to be the key barrier to a further diffusion of the selected EET in Germany since they impact the economics of an EET. A second strong barrier seems to be access to capital, i.e., the economic situation of the company. In one case, the formerly state-regulated electricity market seemed to have hindered the implementation of a TRT.

Risks and lack of information were not identified as barriers to the diffusion of the selected EET.

Our analysis shows that there are still few plants that could implement the selected EET in Germany, but that mainly site-specific constraints lower the economics of the technologies. Lessons learnt from this paper might be applied to other market economies with a similar share of primary to secondary steel production. The selected technologies were introduced about 30 years ago, so the remaining diffusion potential should be limited in most countries.

A significant increase in the price of CO2 within the EU-ETS (in the case of Germany) or the introduction of a strong emission trading system in other countries would most likely lead to a further diffusion of the selected technologies. However, the energy efficiency potential seems to be limited. Reducing CO2 emissions in the steel industry requires new technologies (e.g., strip casting, breakthrough technologies) or carbon capture and storage.

It should be elaborated to which extend the CO2 emissions in the steel industries of selected countries could be reduced considering different technological pathways. This would also help to design future policy including targets within emission trading systems.

BImSchG, Federal Emissions Protection Law (Bundesimmisionsschutzgestz); BF, blast furnace; BOF, basic oxygen furnace; BOFGR, basic oxygen furnace gas recovery; CO2, carbon dioxide; ETS, European Emission Trading Scheme; EEG, German Renewable Energies Act (Erneuerbaren-Energien-Gesetz); EET, energy-efficient technology; HKM, Hüttenwerke Krupp-Mannesmann, a German steel company; PCI, pulverized coal injection; TRT, top-pressure recovery turbine.

Notes

On November 24, 2010, the European Parliament and the European Council issued the Industrial Emission Directive (2010/75/EU) which came into force on January 11, 2011. In May 2013, the directive was implemented into German law. The implementation of the new requirements occurred in accordance with the Federal Control of Pollution Act (BImSchG) as well as with the directive on the approval procedure (9. BImSchV) (BMU 2013).

Personal communication. Lüngen, HB. VDEh. Heidelberg/Düsseldorf; 26.7.2013.

References

Apeaning, R. W., & Thollander, P. (2013). Barriers to and driving forces for industrial energy efficiency improvements in African industries—a case study of Ghana’s largest industrial area. Journal of Cleaner Production, 53(0), 204–213.

ArcelorMittal. (2012). Leading from the top. The reuse of high pressure flue gas from the top of the blast furnace is reducing Arcelormittal’s carbon footprint—and our energy bill! http://flateurope.arcelormittal.com/flatarchivenews/nov/947. Accessed 20 Oct 2015.

ArcelorMittal. (2014a). The company history—site Ruhrort. http://duisburg.arcelormittal.com/amdu_geschichte.html. Accessed 20 Oct 2015.

ArcelorMittal. (2014b). The company history—site Bremen. http://bremen.arcelormittal.com/694.html. Accessed 20 Oct 2015.

Arens, M., & Worrell, E. (2014). Diffusion of energy efficient technologies in the German steel industry and their impact on energy consumption. Energy, 73(0), 968–977.

Arens, M., Worrell, E., & Schleich, J. (2012). Energy intensity development of the German iron and steel industry between 1991 and 2007. Energy, 45(1), 786–797.

Backlund, S., Thollander, P., Palm, J., & Ottosson, M. (2012). Extending the energy efficiency gap. Energy Policy, 51(0), 392–396.

Brauer, H. (Ed.) (1996). Produktions- und produktintegrierter Umweltschutz. In: Handbuch des Umweltschutzes und der Umweltschutztechnik (in German). Vol. 2. Berlin, Heidelberg: Springer.

Brunke, J.-C., Johansson, M., & Thollander, P. (2014). Empirical investigation of barriers and drivers to the adoption of energy conservation measures, energy management practices and energy services in the Swedish iron and steel industry. Journal of Cleaner Production, 84(0), 509–525.

Bundesamt für Wirtschaft und Ausfuhrkontrollen (BAFA). (2016). Drittlandssteinkohlepreise frei Deutsche Grenze (in German). Eschborn. http://www.bafa.de/bafa/de/energie/steinkohle/drittlandskohlepreis/. Accessed 03 Jun 2016.

Bundesamt für Wirtschaft und Ausfuhrkontrollen (BAFA). (2014). Durch die Besondere Ausgleichsregelung in 2014 begünstigte Abnahmestellen (in German). http://www.bafa.de/bafa/de/energie/besondere_ausgleichsregelung_eeg/publikationen/statistische_auswertungen/besar_2014.xls. Accessed 20 Oct 2015.

Bundesministerium für Justiz und Verbraucherschutz (BMJV). (2014a). Gesetz zum Schutz vor schädlichen Umwelteinwirkungen durch Luftverunreinigungen, Geräusche, Erschütterungen und ähnliche Vorgänge (in German). http://www.gesetze-im-internet.de/bimschg/. Accessed 20 Oct 2015.

Bundesministerium für Justiz und Verbraucherschutz (BMJV). (2014b). Energiesteuergesetz (in German). http://www.gesetze-im-internet.de/energiestg/. Accessed 20 Oct 2015.

Bundesministerium für Justiz und Verbraucherschutz (BMJV). (2014c). Gesetz für den Ausbau Erneuerbarer Energien (in German). http://www.gesetze-im-internet.de/eeg_2014/. Accessed 20 Oct 2015.

Bundesministerium für Umwelt, Naturschutz und Reaktorsicherheit (BMU). (2006). Nationaler Allokationsplan 2008–2012 für die Bundesrepublik Deutschland (in German). http://ec.europa.eu/clima/policies/ets/pre2013/nap/docs/nap_germany_final_en.pdf. Accessed 20 Oct 2015.

Bundesministerium für Wirtschaft und Energie (BMWi). (2016). Gesamtausgabe der Energiedaten – Datensammlung des BMWi. Letzte Akutalisierung 19.05.2015. http://www.bmwi.de/DE/Themen/Energie/Energiedaten-und-analysen/Energiedaten/gesamtausgabe. Accessed 03 Jun 2016.

Cagno, E., Worrell, E., Trianni, A., & Pugliese, G. (2013). A novel approach for barriers to industrial energy efficiency. Renewable and Sustainable Energy Reviews, 19(0), 290–308.

Deutsche Emissionshandelsstelle (DEHSt). (2015). Strompreiskompensation – Hintergrund (in German). http://www.dehst.de/SPK/DE/Strompreiskompensation/Hintergrund/Hintergrund_node.html;jsessionid = A37B66FA0611E0CC5A8C7634D2F38A84.2_cid331. Accessed 20 Oct 2015.

Fleiter, T., Hirzel, S., & Worrell, E. (2012a). The characteristics of energy-efficiency measures—a neglected dimension. Energy Policy, 51(0), 502–513.

Fleiter, T., Schleich, J., & Ravivanpong, P. (2012b). Adoption of energy-efficiency measures in SMEs—an empirical analysis based on energy audit data from Germany. Energy Policy, 51(0), 863–875.

Fleiter, T., Worrell, E., & Eichhammer, W. (2011). Barriers to energy efficiency in industrial bottom-up energy demand models—a review. Renewable and Sustainable Energy Reviews, 15(6), 3099–3111.

Gläser, J., & Laudel, G. (2010). Experteninterviews und qualitative Inhaltsanalyse als Instrumente rekonstruierender Untersuchungen (in German) (4th ed.). Wiesbaden: VS Verlag für Sozialwissenschaften.

Harris, J., Anderson, J., & Shafron, W. (2000). Investment in energy efficiency: a survey of Australian firms. Energy Policy, 28(12), 867–876.

Hirst, E., & Brown, M. A. (1990). Closing the efficiency gap: barriers to the efficient use of energy. Resources, Conservation and Recycling, 267–281.

International Energy Agency (IEA). (2016). Energy statistics of OECD countries. Paris.

Levine, M. D., Koomey, J. G., McMahon, J. E., & Sanstad, A. H. (1995). Energy efficiency policy and market failures. Annual Review of Energy and the Environment, 535–555.

Lise, W., & Kruseman, G. (2008). Long-term price and environmental effects in a liberalised electricity market. Energy Economics, 30(2), 230–248.

Marion, M. (2009). Development of the production and use of converter gas at Saarstahl AG. Stahl und Eisen, 7, 61–67.

Newbery, D. M. (2001). Economic reform in Europe: integrating and liberalizing the market for services. Utilities Policy, 10, 85–97.

Newbery, D. M. (2002). European deregulation, problems of liberalising the electricity industry. European Economic Review, 46, 919–927.

Okazaki, T., & Yamaguchi, M. (2011). Accelerating the transfer and diffusion of energy saving technologies steel sector experience—lessons learned. Energy Policy, 39(3), 1296–1304.

Pollitt, M. G. (2012). The role of policy in energy transitions: lessons from the energy liberalisation era. Energy Policy, 50(0), 128–137.

Remus, R., Monsonet, M. A. A., Roudier, S., & Sancho, L. D. (2013). Best Available Techniques (BAT) reference document for iron and steel production—industrial emissions directive 2010/75/EU (Integrated Pollution Prevention and Control). Luxembourg: Publications Office of the European Union. http://eippcb.jrc.ec.europa.eu/reference/BREF/IS_Adopted_03_2012.pdf. Accessed 20 Oct 2015.

Reuters. (2012). S&P cuts ArcelorMittal to ‘BB+’. http://www.reuters.com/article/2012/08/02/idUSWNA253620120802. Accessed 20 Oct 2015.

Rogers, E. (2003). Diffusion of innovations (5th ed.). New York: Free Press.

Rohdin, P., & Thollander, P. (2006). Barriers to and driving forces for energy efficiency in the non-energy intensive manufacturing industry in Sweden. Energy, 31(12), 1836–1844.

Rosenberg, A., Schopp, A., Neuhoff, K., & Vasa, A. (2011). Impact of reductions and exemptions in energy taxes and levies on German industry. CPI Brief. http://www.diw.de/sixcms/detail.php?id = diw_01.c.457174.de. Accessed 20 Oct 2015.

Sardianou, E. (2008). Barriers to industrial energy efficiency investments in Greece. Journal of Cleaner Production, 16(13), 1416–1423.

Schott, R., Malek, C., & Schott, H.-K. (2012). Effizienzsteigerung des Reduktionsmitteleinsatzes im Hochofen zur CO2-Minderung und Kostenersparnis (in German). Chemie Ingenieur Technik 84(7), 1076–1084.

Siemens. (2013). Entspannungsturbine von Siemens – VEO in Eisenhüttenstadt gewinnt Strom aus Gichtgas (in German). https://www.stahleisen.de/Content/News/AktuelleNews/Newsentry/tabid/360/sni%5B847%5D/16263/language/en-US/Default.aspx. Accessed 20 Oct 2015.

Sorrell, S., Schleich, J., Scott, S., O’Malley, E., Trace, F., Boede, U. et al. (2000). Reducing barriers to energy efficiency in public and private organizations. Brighton, UK.

Statistisches Bundesamt (Destatis). (2013). BIP-Deflator. Wiesbaden.

Statistisches Bundesamt (Destatis). (2016). Preise – Daten zur Energiepreisentwicklung. Lange Reihen von Januar 2000 bis April 2016. Wiesbaden. https://www.destatis.de/DE/Publikationen/Thematisch/Preise/Energiepreise/EnergiepreisentwicklungPDF_5619001.pdf?__blob = publicationFile. Accessed 03 Jun 2016.

Steelinstitute VDEh. (2005–2010). CO 2 -Monitoring-Fortschrittsberichte der Stahlindustrie (in German). Düsseldorf.

Steelinstitute VDEh. (2013). Plantfacts database. Düsseldorf.

Sutherland, R. J. (1991). Market barriers to energy-efficiency investments. The Energy Journal, 12(3), 15–34.

Sutherland, R. J. (1996). The economics of energy conservation policy. Energy Policy, 24(4), 361–370.

Thollander, P., Danestig, M., & Rohdin, P. (2007). Energy policies for increased industrial energy efficiency: evaluation of a local energy programme for manufacturing SMEs. Energy Policy, 35(11), 5774–5783.

Thollander, P., Karlsson, M., Søderstrøm, M., Creutz, D. (2005). Reducing industrial energy costs through energy-efficiency measures in a liberalized European electricity market: case study of a Swedish iron foundry. Applied Energy 81(2), 115–126.

Thollander, P., & Ottosson, M. (2008). An energy efficient Swedish pulp and paper industry: exploring barriers to and driving forces for cost-effective energy efficiency investments. Energy Efficiency 1(1), 21–34.

Trianni, A., & Cagno, E. (2012). Dealing with barriers to energy efficiency and SMEs: some empirical evidences. Energy, 37(1), 494–504.

Trianni, A., Cagno, E., & Worrell, E. (2013). Innovation and adoption of energy efficient technologies: an exploratory analysis of Italian primary metal manufacturing SMEs. Energy Policy, 61(0), 430–440.

Umweltbundesamt (UBA). (2013). Entwicklung der spezifischen Kohlendioxid-Emissionen des deutschen Strommix in den Jahren 1990 bis 2012. Dessau-Roßlau. https://www.umweltbundesamt.de/sites/default/files/medien/461/publikationen/climate_change_07_2013_icha_co2emissionen_des_dt_strommixes_webfassung_barrierefrei.pdf. Accessed 03 Jun 2016.

Verein der Kohlenimporteure (VDKI). (2004–2015). Jahresberichte 2004–2015 (in German). Hamburg. http://www.kohlenimporteure.de/archiv-jahresberichte.html. Accessed 03 Jun 2016.

Worldbank. (2016). GDP-Deflator. http://data.worldbank.org/indicator/NY.GDP.DEFL.KD.ZG. Accessed 03 Jun 2016.

Ziesing, H.-J., Enßlin, C., & Langniß, O. (2001). Stand der Liberalisierung der Energiewirtschaft in Deutschland – Auswirkungen auf den Strom aus Erneuerbaren Energiequellen. FVS Themen, 144–150.

Acknowledgments

The authors would like to thank Tobias Fleiter for his valuable remarks. Also, we appreciate the good collaboration with the Steelinstitue VDEh especially with H.-B. Lüngen, M. Sprecher, and R. Hömann.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Data sources for the construction of the timeline of energy prices for the German industry

Calculation of payback periods

The payback periods are calculated according to Eq. (2).

where

PB: payback period

I: investment

P: annual return due to technology i

C: annual O&M cost

i: technology

t: case (Table 4)

k: year

The proceeds for TRT are assumed to equal the market value of generated electricity. This assumes that the company purchases electricity from the public grid and that by applying TRT the company can reduce its electricity consumption from the public grid. Later, we will see that not all steel companies in Germany fulfill this assumption and that TRT in some cases does not compete with the electricity price from the public grid but with the price for on-site electricity generation. Hence, the electricity prices for cases (b) and (c) are (Eq. (3)–(4)):

where

PC: price

EL: electricity

SE: specific emissions

CO2: carbon dioxide

EEG: levy for the support of renewable energies

k: year

a, b: case (Table 4).

For BOFGR, we assume that the recovered BOFG reduces the consumption of natural gas and that in case of EU-ETS costs for the CO2 emissions of that amount of natural gas are saved.

Estimating the economic benefits of PCI, we follow the approach of Schott et al. (2012). Coke is partly replaced by coal in the blast furnace. Differences between the coke and coal price lead to economic benefits. CO2 emission reductions are calculated by accounting coal consumption both in coke ovens and blast furnaces. We assume that 1 t of coke is produced from 1.3 t of coal (Schott et al. 2012). Table 9 lists further assumptions.

The calculations of the proceeds of the respective technologies are given below (Eq. (5)–9).

where

P i: annual return due to technology i

SP: specific production

SR: specific recovery

SE: specific emissions

SC: specific consumption

PC: price

CP: capacity

Q: factor (input to coke oven: coke/coal = 1.6 (Schott et al. 2012)

BF: blast furnace

BOF: basic oxygen furnace

BOFG: basic oxygen furnace gas

CK: coke

CL: coal

CO2: carbon dioxide

EL: electricity

NG: natural gas

OP: without PCI

WP: with PCI

k: year

t: case a, b, or c (Table 4)

a, b, c: cases (Table 4)

Rights and permissions

About this article

Cite this article

Arens, M., Worrell, E. & Eichhammer, W. Drivers and barriers to the diffusion of energy-efficient technologies—a plant-level analysis of the German steel industry. Energy Efficiency 10, 441–457 (2017). https://doi.org/10.1007/s12053-016-9465-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-016-9465-4