Abstract

Purpose of Review

High insulin prices and cost-related insulin underuse are increasingly common and vexing problems for healthcare providers. This review highlights several factors that contribute to high prices and limited generic competition in the US insulin market.

Recent Findings

An opaque and complex pricing and reimbursement system for insulin, allegations of collusive practices by insulin manufacturers, and a lack of generic competition drive and sustain high insulin prices. When combined with increasing insurance deductibles and cost sharing, these factors contribute to cost-related insulin underuse and are associated with adverse clinical outcomes.

Summary

Healthcare providers facing patients with type 2 diabetes who struggle to afford insulin should consider initiating or switching from analogue to human insulin as one way to help address the challenges of access and affordability. However, it is also important to support initiatives to advocate for affordable pricing for insulin for patients who can benefit from the flexibility offered by many of the newer insulin preparations.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

A large number of stakeholders have become interested in rising insulin prices in the USA. Large public and commercial payers of prescription drugs are interested because high and increasing insulin prices drive up overall healthcare spending. Patients, their families, and their healthcare providers are interested because of concerns related to insulin rationing and the associations between high insulin prices and worsened clinical outcomes, such as poor glycemic control, risk of diabetic ketoacidosis, and death [1]. Cost-related insulin underuse is becoming an increasingly common phenomenon: contemporary surveys estimate that roughly one in four Americans with diabetes use less insulin than prescribed because of high costs [2•, 3].

Several features characterize the US insulin market today and have combined to form a “perfect storm” of unaffordability. First, the list price of insulin has increased dramatically over the past 15 years [4,5,6,7]. The mean price per ml of insulin rose over 300% between 2002 and 2013 [8]. Second, individual insulin manufacturers tend to follow the pricing practices of their direct competitors, contributing to an environment where prices have increased in lockstep for similar types of insulin [9]. Third, cost-sharing practices for higher cost prescription drugs have become a more prominent feature of the health insurance market in recent years, with a corresponding rise in the number of patients with diabetes who pay either high deductibles or high copays (or both) for their insulin [10].

Since 2018, both the US House of Representatives and the Senate have held subcommittee hearings on the topic of the rising cost of insulin, where representatives from each of the three major insulin manufacturers (Novo Nordisk, Sanofi, Eli Lilly), pharmacy benefits managers (e.g., Express Scripts, CVS Caremark, OptumRx), scientists and patients/family members provided sworn testimony. A large number of federal bills, state proposals, and regulatory reforms have been proposed to deal with this vexing problem. These run the gamut from proposed legislation to completely restructure the healthcare system in the USA (e.g., Medicare-for-All) to targeted state-level laws aimed at increasing insulin price transparency (e.g., Nevada’s drug price transparency legislation for glucose-lowering drugs; Colorado’s initiative to place a ceiling on out-of-pocket costs for insulin) [11]. An array of voluntary pharmaceutical manufacturer and insurer programs to address insulin affordability has also been proposed. The myriad of bills and programs is a recognition of how important the issue of insulin affordability is to patients, their family members, and frontline healthcare providers.

The objectives of this review article are to (1) describe the factors that led to the current state of high insulin prices and (2) provide practical advice for clinicians who would like to help individual patients who report difficulty paying for insulin (with a special focus on the evidence supporting human insulin use in patients with type 2 diabetes).

How Did We Get into the Current Situation of High Insulin Prices to Begin with?

Three factors help to explain the current state of high insulin prices: (1) an opaque and complex reimbursement system for prescription insulin, (2) allegations of price-fixing or collusion on the part of the so-called “Big 3” insulin manufacturers and PBMs, and (3) lack of generic competition. While all of these factors probably have some role to play in driving up insulin prices over the past 10–15 years, fundamentally, it is a lack of robust generic competition that has allowed high insulin prices to persist today [12, 13].

An Opaque and Complex Pharmaceutical Pricing System

When representatives from any one of the large insulin manufacturers are queried about the high cost of insulin, they blame high prices on other players in a complex drug payment and reimbursement system [14]. For example, manufacturers frequently describe being forced to increase list prices in a highly competitive market where large, powerful, middlemen (and women) called pharmacy benefits managers, and the commercial and employer sponsored health plans they represent, seek increasingly higher rebates in exchange for preferred formulary placement [15, 16]. In some cases, these rebates are claimed to be as high as 68% of gross sales. Since rebates are often used by health plans to reduce overall premiums (rather than reduce cost sharing), manufacturers argue that the current system is perverse in that it allows those with chronic health issues (i.e., patients using insulin) to subsidize the healthy. It is also worth noting that product-specific rebate data are proprietary, and therefore data on net insulin prices have not generally been available for independent verification by policymakers or researchers.

There are several reasons why these arguments are not sufficient to explain the root causes of the larger, more systemic problem of high insulin prices. First, the PBM and rebate system operates in the same manner for all brand name drugs, not just insulin. Therefore, the mere existence of this added layer of opacity and complexity does not solely explain the unique trends seen in list price increases for insulin over the past 15 years. Second, even if manufacturers are correct that net insulin prices may have been stagnated or decreased in recent years, high list prices will continue to negatively affect the millions of Americans with high deductible plans, who are uninsured or who face gaps in coverage.

Nevertheless, manufacturers argue that the solution to high insulin prices is not to target high list prices themselves (or to increase generic competition) but rather to regulate how rebates can be used by PBMs or health plans in the commercial prescription drug market and to instead pass on savings from rebates to patients at the point of sale. For example, one US Department of Health and Human Services proposal sought to reduce high out-of-pocket costs for prescription drugs for seniors covered under the Medicare Part D program by eliminating the use of rebates in that program. However, the proposed rule was withdrawn less than 6 months after it was first introduced, primarily due to concerns that it would increase Medicare spending by $177 billion over the next 10 years and increase premiums for all beneficiaries, even if lowering cost sharing for some [17, 18].

In response to these criticisms, some payers have announced voluntary caps in out-of-pocket spending for insulin for some patients [19]. For example, Cigna and its pharmacy benefit manager Express Scripts launched a program in 2019 where members in its commercial plans would pay a maximum of $25 for a 30-day supply of insulin. While laudable, timely, and potentially life-saving for certain patients, the ability of these voluntary/piecemeal programs to address the overall problem of high insulin prices is limited because they are typically restricted to patients with certain types of commercial health insurance and typically exclude patients covered under Medicare or Medicaid plans, as well as those who are uninsured.

The most recent response by manufacturers to address these pricing concerns is the release of “authorized generic” insulins. Authorized generics are the same exact drugs as the branded versions but relabeled as a different drug and offered at lower list prices to circumvent the need to pay rebates. With lower list prices, the authorized generics have the potential to lower costs to both insured and uninsured patients at the point of sale. In March 2019, Lilly offered an authorized generic for lispro insulin (Humalog), and Novo Nordisk announced that it would follow suit beginning in 2020 for insulin aspart (NovoLog) [20]. Lilly’s authorized generic will retail for $137.50 per vial, equivalent to the list price for brand name Humalog vials in 2011 [21]. These piecemeal measures are all intended to help address the problems of unaffordable insulin in that they will likely improve the situation for some patients while not drastically changing the existing prescription drug reimbursement system, which relies heavily on PBMs and rebates.

Allegations of Price-Fixing by the “Big 3”

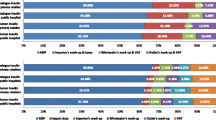

Insulin manufacturers are not unique in driving up list prices for their products. In many niche markets where there is limited competition, increasing unit prices (without any change in volume of sales) is a common method to generate short-term profits. However, price spikes in insulin differ from those seen in medicines that are used to treat rare cancers or infectious diseases. First, insulin is one of the most commonly used prescription medicines in the country. In 2017, ~ 1.1 million Medicare Part D beneficiaries filled a prescription for just one brand of long-acting insulin pen (glargine; Lantus SoloStar) [22]. Second, several manufacturers market dozens of insulin products. Theoretically, this should apply some downward pricing pressure. Unfortunately, for any single type of insulin, there may only be one or two direct competitors. For example, as shown in Fig. 1, list prices for the two most commonly used rapid-acting insulins on the market, aspart (NovoLog) and lispro (Humalog) rose in lockstep between May 2001 and July 2018. A similar trend can be seen with the commonly prescribed long-acting insulin analogues detemir (Levemir) and glargine (Lantus) [9].

Changes in the list price* of aspart (NovoLog) and lispro (Humalog) vials from 2001 to 2018

*List prices were obtained using Average Wholesale Prices from the RED BOOK online (Truven Health Analytics). [21]

This type of tit-for-tat price increases has been called “shadow pricing” and has been the subject of considerable scrutiny. For example, total Medicare Part D spending on insulin increased 840% between 2007 and 2017, from $1.4 billion to $13.3 billion (excluding rebates) [23]. At the same time, the average Part D enrollees’ out-of-pocket spending doubled, from $324 to $588, despite a gradual narrowing of the coverage gap (donut hole). [24]

A class-action lawsuit filed in 2017 on behalf of dozens of plaintiffs against the three major insulin manufacturers alleged conspiracy with pharmacy benefits managers to raise the list price of insulin far above the cost of production [25]. Although the conspiracy lawsuit was dismissed in early 2019 by a New Jersey federal judge, the opinion suggested that pricing practices by the insulin manufacturers may run afoul of state consumer protection laws. Furthermore, all three manufacturers received recent subpoenas from the New York Attorney General’s office requesting documents concerning insulin pricing, discounts, and sales practices.

While potentially fraudulent or collusive practices may explain how insulin prices have increased to their current extent, they do not explain why. To answer that question, we turn to the topic of competition the US insulin market.

Lack of Robust Generic Competition in the US Insulin Market

Prior empiric research suggests that three or more manufacturers competing for the same drug product or in the same therapeutic class are often needed to substantially reduce prices [26]. While some evidence suggests that the market entry of two recently approved follow-on insulin analogues (Basaglar (glargine) and Admelog (lispro)) may be slowing down reimbursement increases for insulin in the Medicaid program [27], estimated savings have still not reached the level one that would normally expect with robust competition. This is because three insulin manufacturers still control 100% of the US insulin supply, despite the fact that we are approaching the 100-year anniversary of the first clinical use of pancreatic extract in type 1 diabetes. What are some of the remaining barriers to truly robust generic competition?

Intellectual Property Protections

A free and vibrant market tends to constrain prices. However, in the USA, government-granted monopolies in the form of patents (or other non-patent exclusivities) are combined with a pricing system that places few limits on drug manufacturers. Manufacturers are free and, in most cases, are encouraged by shareholders, to set the starting price (aka list price) at whatever they believe the market will bear. There are no regulations per se that prevent a manufacturer from increasing the price of a highly utilized insulin product by double digits multiple times during a single year. In fact, these latter pricing practices had become so common and scrutinized in the insulin market that Novo Nordisk, in a gesture of corporate responsibility, announced in 2017 that it would limit annual price increases on its insulin products to 10% or less [28].

While patent barriers are a substantial barrier to generic competition in other classes of drugs (e.g., adalimumab (Humira; AbbVie)) [29], such barriers are not quite as problematic in the insulin market. In prior empiric research, we found that many of the most commonly prescribed insulins were only protected by follow-on patents claiming innovation with respect to methods of delivery (i.e., innovations in prefilled pen designs or components) rather than the active ingredient itself (i.e., the chemical structure of the insulin analogue) [30, 31]. These weaker secondary patents tend to be easier to overcome during patent litigation between brand name and generic manufacturers. Therefore, while these patent “evergreening” practices are likely playing in role in limiting competition [32], they are not the sole cause.

Regulatory Complexity with Respect to Interchangeable Insulin and Other Market Concerns

Two other factors primarily drive a lack of competition in the insulin market. First, the regulatory environment for the approval of generic insulin is just starting to be established in the USA. One of the lesser known laws that passed with the Affordable Care Act was the Biologics and Price Competition and Innovation Act (BPCIA) of 2009. This legislation codified a new regulatory pathway at FDA for biologic medicines and follow-on biologic medicines (aka biosimilars). After a 10-year grace period, ending in March 2020, all previously approved brand name insulins (and other less commonly used protein-based medicines such as somatotropin) would be deemed biologic medicines. Therefore, potential generic manufacturers seeking to make copies of these originally approved insulin molecules would be forced to apply under a pathway at FDA intended for biosimilar medicines. While some large generic manufacturers have the legal, regulatory, and technical capacity to produce biosimilar insulin, we remain cautiously guarded with respect to the ability of biosimilar insulins to substantially reduce overall insulin spending in the near term.

Historically, biosimilar insulins may only be priced 15% below the list price of the originator insulin. Furthermore, we believe that without dramatic changes at FDA or with respect to existing statues, many of the biosimilar insulins that will likely be approved in 2020 (e.g., Mylan/Biocon’s glargine) will not receive a designation of interchangeability by the FDA. The evidentiary standards for demonstrating interchangeability are (1) evolving (draft guidance was only recently finalized in May 2019) and (2) quite high manufacturers will likely need to conduct clinical switching studies in addition to standard preclinical studies demonstrating bioequivalence. These switching studies (unique to the USA) will add both cost and risk to any potential generic insulin manufacturer seeking FDA approval.

In the absent of other regulatory or legislative changes, interchangeability will be critically important in addressing the problem of high insulin prices in the USA, because state pharmacy substitution laws generally will only allow a lower-cost biosimilar insulin to be swapped out in place of a higher-cost brand name insulin when the FDA has approved them as interchangeable. Historically, state generic substitution laws were highly effective in reducing spending on brand name small-molecule drugs after loss of market exclusivity. These systems led to extremely high rates of generic drug utilization, often without any need for commercial detailing or marketing by the part of generic manufacturers. For example, mandatory generic substation of generic simvastatin and atorvastatin after loss of exclusivity of their respective brand name counterparts led to dramatic increases in the utilization of generic statins in the USA [33, 34]. Unfortunately, this is not the case for insulins today, where many brand name therapeutic substitutes exist; however, none of these products can be automatically substituted at the pharmacy without explicit action or consent on the part of the prescriber. In fact, none of the 20 or so approved biosimilar medicines to date have been designated as interchangeable.

In addition to regulatory concerns, potential generic insulin manufacturers may be concerned about market-based barriers to commercial success. For example, some generic manufacturers may be reluctant to enter the market for insulin because of concerns about patients and provider loyalty to existing brand name insulin manufacturers. Even very large generic manufacturers (Teva, Mylan, Sandoz) may worry that patients will continue to prefer insulin from the well-known “Big 3” rather than from a novel insulin manufacturer. These barriers may be especially pronounced in cases where patients may have to adjust to using a new pen or delivery device [35]. Alternatively, some of these large manufacturers may simply be more strategically focused on other disease areas (oncology), rather than in diabetes, because they believe that they can make more money producing high priced, original biologic medicines (or biosimilars) rather than biosimilar insulin. In addition, with the continued presence of rebates in the pharmaceutical reimbursement system, insurers and PBMs will continue to favor branded products with higher rebates. These market-based concerns may also contribute to an extremely limited generics market for insulin.

How Clinicians Can Help Individual Patients

In the prior section, we described how three factors contribute to maintaining the high list prices for insulin in the US market today, with a focus on regulatory and market-based threats to generic competition. Next, we will turn to how providers may be able to help individual patients who may be struggling with affording their insulin prescriptions.

In general, there are two options for prescribers when encountering patients with “good” insurance (defined broadly as a commercial health insurance plan with low deductibles and copays or Medicaid) who report difficulty accessing a specific insulin analogue. First, if one type of insulin is not covered (e.g., not on formulary), the prescriber should consider whether the patient could take the same product, perhaps as a different formulation or manufactured by a different company. For example, a patient’s insurance may not cover Lantus SoloStar pens (Sanofi) but may cover (A) glargine in vial form (Sanofi) or (B) the follow-on biologic glargine (Basaglar; Lilly/Boehringer Ingelheim). Alternatively, the provider could prescribe an alternate evidence-based product in place of the one that is not well covered. For example, a patient’s prescription drug plan may not cover the ultra-long-acting insulin analogue degludec (Tresiba) for a newly diagnosed patient with type 1 diabetes but may cover glargine (either Basaglar or Lantus). Please note that not all insulins are easily or directly changeable on a unit-per-unit basis, in part due to differences in pharmacokinetics and timing intervals. For example, when changing from degludec to detemir or glargine for many patients with type 1 diabetes, the provider should consider whether dosing would need to change from once to twice per day.

Affordability solutions grounded in therapeutic switching pose real-world challenges to providers because most clinicians do not have currently have access to details of a patient’s drug benefit design at the point of prescribing. Most clinicians are well aware of how frustrating it can be to for a patient to show up at a retail pharmacy, only to be told that the prescription was denied by their third party payer (i.e., insurer). Hopefully these experiences will become less common as more health systems begin linking electronic prescribing with electronic Real-Time Benefit Tools, as will be mandatory for all Medicare Part D plans by January 1, 2021. These tools draw information from each patient’s unique drug benefit and will have the capacity to help clinicians (at the point of prescribing) forecast actual out-of-pocket costs for an individual prescription before the script is even electronically sent to the pharmacy.

Unfortunately the two strategies described above will not help uninsured patients or those covered under high deductible health plans. For these patients, even covered insulins (i.e., insulin products on a drug formulary) may be unaffordable during the first few months of the year. During the deductible phases many plans, patients must often pay the list price at the pharmacy counter until the negotiated price becomes available.

For uninsured patients, or for patients covered by high-deductible plans, three options are available. First, some patients may benefit from manufacturer-sponsored coupons, discounts, or free-drug programs. For example, Sanofi recently expanded its Insulins Valyou Savings Program, allowing patients to pay $99 per month for up to ten vials and/or pens per insulin fill. Starting in 2020, Novo Nordisk will introduce a $99 Cash Card program, allowing patients the ability to purchase up to three vials or two packs of analogue pens. It is important to read the fine print of these programs because eligibility requirements may vary dramatically. For example, these discount programs exclude patients covered under any federal, state, or military health insurance plans (e.g., Medicare Part D, Medicaid, TRICARE). Another confusing aspect of these programs is that they are often offered in addition to preexisting free drug programs (aka manufacturer sponsored patient assistance programs). Free drug programs may be even more onerous than the recently announced discount programs in that they typically require patients to submit documentation that they meet certain income requirements. Second, some patients could consider driving to Canada or Mexico to purchase lower-cost brand name insulin produced by the “Big 3” [36]. Although the potential cost savings may be dramatic (up to 1/10th the price for the equivalent FDA approved insulin product), this option is not ideal because it may be time-consuming for patients to travel long distances and because the FDA may consider importation of insulin, even for personal use, to be illegal, with potential safety risks.

The third, and likely best, option is to use human insulin (e.g., neutral protamine Hagedorn (NPH), premixed human 70/30, and regular) in place of more expensive analogue insulins. These products are often the lowest commercially priced insulins manufactured by one of the “Big 3” available in the US market and can be purchased in large retailers such as Walmart, in most cases without a prescription, for as little as $25 a vial [37]. It is important to be aware of how to safely prescribe these insulins as initial therapy or as a modification of an existing insulin regimen in order to create a schedule that is acceptable to the patient and that minimizes the risk of hyper- and hypoglycemia.

Evidence Comparing Analogue Vs Human Insulin in Type 2 Diabetes

Many of the randomized trials comparing basal insulin analogue against human insulins were conducted in the early 2000s [38,39,40,41]. For example, in the glargine treat-to-target trial, 756 overweight men and women with type 2 diabetes and a baseline HbA1c > 7.5% on one or two oral agents were randomized to either the long-acting insulin analogue, glargine, or intermediate human insulin, NPH. Mean fasting glucose, HbA1c at 24 weeks, was similar between glargine and NPH; however, there was a higher incidence of nocturnal hypoglycemia [39]. In a Cochrane review comparing eight trials (six of glargine vs NPH and two of detemir vs NPH), patients randomized to glargine or detemir had statistically lower rates of symptomatic or nocturnal hypoglycemia; however, the authors concluded that the overall clinical benefit was only minor and likely not worth the increased costs [42]. It is important to note that these treat-to-target trials mandated increases in insulin dosing according to study protocol for fasting glucose levels above a pre-specified target for fasting glucose of > 100 mg/dl in some studies. This is not a common clinical practice where less aggressive dose escalation strategies are used with higher glycemic targets. It is highly likely that the more intensive dose escalation strategies in these trials contributed to the observed increases in hypoglycemia with NPH insulin, which has different pharmacokinetic properties when compared to glargine or detemir (or degludec insulin). This is supported by an observational study using administrative data from the Veterans Health Administration and Medicare between 2000 and 2010 and found that analogue insulin was not associated with mortality benefits or benefits with respect to ambulatory care-sensitive condition hospitalizations [43].

Given the still substantial price differences between human insulin NPH (and premixed 70/30) and long-acting insulin analogues such as glargine and detemir, it may be prudent to consider human insulin as an option for a patient with type 2 diabetes, especially if he or she reports difficulty affording analogue insulin. The following sections provide practical suggestions for initiating human insulin in two types of patients: (1) insulin-naïve (new initiation) and (2) patients already taking basal analogues (insulin switching).

How to Initiate Human Insulin Among Patients with Insulin-Naïve Type 2 Diabetes

Decades of clinical experience support initiation of human insulin in patients with type 2 diabetes. As suggested in the American Diabetes Association Standards of Medical Care in Diabetes, initiating human insulin is the same as initiating analogue insulin [44]. Prescribers may elect to use weight-based dosing (0.1 to 0.2 international units per kilogram) and titrate based on evidence-based algorithms such as treat-to-target, albeit with less aggressive and more individualized glycemic targets [39]. The evidence supporting human insulin initiation comes primarily from real-world observational studies. For example, in a recently published study of 25,489 older adults with type 2 diabetes receiving care in an integrated healthcare delivery system, insulin-naïve patients initiating NPH did not experience more frequent episodes of hypoglycemia-related emergency department visits or hospitalizations than those who initiated analogue insulin (detemir or glargine) [45••]. Importantly, those initiating a long-acting insulin analogue (a minority of subjects in the study cohort) did not achieve better glycemic control compared to those initiating NPH. Limitations of this study were threefold: (1)it was based on claims data and thus could not examine differences in nocturnal or non-severe (i.e., self-reported) hypoglycemic events and (2) was conducted in an integrated health system that strongly prefers human insulin, potentially limiting generalizability, and (3) patients with type 1 diabetes were not included, limiting the ability to make any generalizations regarding the comparable safety of human vs analogue insulin in this population.

How to Switch from Analogue to Human Insulin

Some patients may already be taking a long-acting insulin analogue. For these patients, affordability concerns may prompt a provider to consider switching from the more expensive insulin analogue to a less expensive human insulin. Like the initiation example above, evidence supporting the safety and efficacy of switching from an insulin regimen that combines a long-acting insulin analogue with prandial rapid-acting analogues to a regimen using either premixed human 70/30 or a combination of NPH with regular insulin comes from a large observational study conducted in over 14,000 older adults with type 2 diabetes [46••]. In this study, Medicare beneficiaries receiving care at CareMore (a subsidiary of Anthem) with type 2 diabetes who used > 50 units of insulin per day, the majority using both a long-acting analogue and multiple doses of rapid-acting insulin per day, were switched to a regimen relying on less expensive human insulin. The switch was started in the following manner: first, each patient’s total daily insulin dose was calculated. For example, a patient using 35 units of insulin glargine at night and 35 total units of mealtime rapid-acting insulin during the day has a total daily insulin requirement of 70 units. In this example, 80% of that dose or 56 units (0.8 × 70) were split into two unequal doses of premixed insulin 70/30. Two-thirds of 56 units or 37 units were administered in the morning before breakfast, and the remaining one-third or 19 units were administered before dinner. Thereafter, the new human insulin doses were titrated up based on fasting sugars over the next several days.

This approach to switching was associated with only a modest and likely clinically insignificant, HbA1c increase of 0.14% across the entire cohort. Importantly, there were no associations between this switching intervention and serious hypoglycemic or hyperglycemic events. Furthermore, the intervention was associated with a substantial savings to the health plan and reduced the risk of members reaching the Part D coverage gap (aka donut hole). Limitations in the study were similar to the observational study examining NPH insulin initiation in the Kaiser observational study, namely, that study investigators were not able to examine changes related to nocturnal or less serious hypoglycemic events. Despite the observed safety of this transition, it is important to note a twice daily regimen of 70/30 insulin administered before breakfast, and dinner works best among patients who have fairly reasonable meal times with a time separation between breakfast and dinner of approximately 12 h. Patients who work rotating shifts or are unsure of meal times may still be able to use NPH in combination with regular insulin, but the regimen needs to be tailored to individual needs.

Conclusions

The high price of insulin affects the optimal clinical care of many patients with diabetes mellitus. Cost-related insulin underuse is common. A number of factors including an opaque reimbursement system for insulin, allegations of collusive pricing practices on the part of the large insulin manufacturers, and a lack of robust generic competition help to explain how and why prices remain high today. While many proposals and programs exist to help address the problem of unaffordable insulin, providers should also consider prescribing human insulin as a viable therapeutic option for many patients with type 2 diabetes.

References

Papers of particular interest, published recently, have been highlighted as: • Of importance •• Of major importance

Beran D, Hirsch IB, Yudkin JS. Why are we failing to address the issue of access to insulin? A national and global perspective. Diabetes Care. 2018;41(6):1125–31.

• Herkert D, Vijayakumar P, Luo J, Schwartz JI, Rabin TL, DeFilippo E, et al. Cost-related insulin underuse among patients with diabetes. JAMA Intern Med. 2019;179(1):112–4 Findings from this study suggest that 1 in 4 adults may experience cost-related insulin underuse. Furthermore, cost-related insulin underuse is associated with higher risk of poor glycemic control (HbA1c>9%).

Conner F, Pfiester E, Elliott J, Slama-Chaudhry A. Unaffordable insulin: patients pay the price. Lancet Diabetes Endocrinol. 2019;7(10):748.

Riddle MC, Herman WH. The cost of diabetes care—an elephant in the room. Diabetes Care. 2018;41(5):929–32.

Luo J, Avorn J, Kesselheim AS. Trends in Medicaid reimbursements for insulin from 1991 through 2014. JAMA Intern Med. 2015;175(10):1681–7.

Lipska KJ, Ross JS, Van Houten HK, Beran D, Yudkin JS, Shah ND. Use and out-of-pocket costs of insulin for type 2 diabetes mellitus from 2000 through 2010. Jama. 2014;311(22):2331–3.

Biniek JF, Johnson W. Spending on individuals with type 1 diabetes and the role of rapidly increasing insulin prices: health care cost institute; 2019.

Hua X, Carvalho N, Tew M, Huang ES, Herman WH, Clarke P. Expenditures and prices of antihyperglycemic medications in the United States: 2002-2013. Jama. 2016;315(13):1400–2.

Langreth R. Hot drugs show sharp price hikes in shadow market. Bloomberg Business 2015.

Wharam JF, Zhang F, Eggleston EM, Lu CY, Soumerai SB, Ross-Degnan D. Effect of high-deductible insurance on high-acuity outcomes in diabetes: a natural experiment for translation in diabetes (NEXT-D) study. Diabetes Care. 2018;41(5):940–8.

Sarpatwari A, Avorn J, Kesselheim AS. State initiatives to control medication costs—can transparency legislation help? N Engl J Med. 2016;374(24):2301–4.

Kesselheim AS, Avorn J, Sarpatwari A. The high cost of prescription drugs in the United States: origins and prospects for reform. Jama. 2016;316(8):858–71.

Luo J, Kesselheim AS, Greene J, Lipska KJ. Strategies to improve the affordability of insulin in the USA. Lancet Diabetes Endocrinol. 2017;5(3):158–9.

Stanley T. Life, death and insulin. The Washington Post Magazine 2019.

Bryant J. Inaccurate reporting of insulin reimbursement. JAMA Intern Med. 2016;176(3):408-.

Bluth R. The blame game: everyone and no one is raising insulin prices. Kaiser Health News 2019

Congressional Budget Office. Incorporating the effects of the proposed rule on safe harbors for pharmaceutical rebates in CBO’s budget projections—Supplemental Material for Updated Budget Projections: 2019 to 2029 Washington, D.C.2019.

Gellad WF, Ennis M, Kuza CC. A new safe harbor-turning drug rebates into discounts in Medicare part D. N Engl J Med. 2019;380(18):1688–90.

Cefalu WT, Dawes DE, Gavlak G, Goldman D, Herman WH, Van Nuys K, et al. Insulin access and affordability working group: conclusions and recommendations. Diabetes Care. 2018;41(6):1299–311.

Sable-Smith B. How much difference will Eli Lilly’s half-Price insulin make? Kaiser health news. 2019.

RED BOOK Online [Internet]. 2019 [cited October 14, 2019]. Available from: https://www.micromedexsolutions.com/micromedex2/4.34.0/WebHelp/RED_BOOK/Introduction_to_REDB_BOOK_Online.htm.

Centers for Medicaid & Medicare Services. Medicare Part D Drug Spending Dashboard & Data 2019 [updated March 14, 2019. Available from: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Information-on-Prescription-Drugs/MedicarePartD.html.

Cubanski J, Neuman T, True S, Damico A. How Much Does Medicare Spend on SInsulin. Kaiser Family Foundation; 2019.

Borelli MC, Bujanda M, Maier K. The affordable care act insurance reforms: where are we now, and What’s next? Clin Diabetes. 2016;34(1):58–64.

Thomas K. Drug makers accused of fixing prices on insulin. New York Times 2017.

Dave CV, Hartzema A, Kesselheim AS. Prices of generic drugs associated with numbers of manufacturers. N Engl J Med. 2017;377(26):2597–8.

Hernandez I, Good CB, Shrank WH, Gellad WF. Trends in Medicaid prices, market share, and spending on long-acting Insulins, 2006-2018. Jama. 2019;321(16):1627–9.

Kuchler H. Sanofi and Novo Nordisk press ahead with US insulin prices rises. Financial Times 2019.

Price WN, Rai AK. How logically impossible patents block biosimilars. Nat Biotechnol. 2019;37(8):862–3.

Luo J, Kesselheim AS. Evolution of insulin patents and market exclusivities in the USA. Lancet Diabetes Endocrinol. 2015;3(11):835–7.

Mayor S. Insulin has never become a cheap generic drug in the US because of companies’ small changes to “evergreen” the patent. British Medical Journal Publishing Group; 2015.

Greene JA, Riggs KR. Why is there no generic insulin? Historical origins of a modern problem. N Engl J Med. 2015;372(12):1171–5.

Shrank WH, Choudhry NK, Agnew-Blais J, Federman AD, Liberman JN, Liu J, et al. State generic substitution laws can lower drug outlays under Medicaid. Health Aff. 2010;29(7):1383–90.

Luo J, Seeger JD, Donneyong M, Gagne JJ, Avorn J, Kesselheim AS. Effect of generic competition on atorvastatin prescribing and patients’ out-of-pocket spending. JAMA Intern Med. 2016;176(9):1317–23.

White J, Goldman J. Biosimilar and follow-on insulin: the ins, outs, and interchangeability. J Pharm Technol. 2019;35(1):25–35.

Fralick M, Avorn J, Kesselheim AS. The price of crossing the border for medications. N Engl J Med. 2017;377(4):311–3.

Lipska KJ, Hirsch IB, Riddle MC. Human insulin for type 2 diabetes: an effective, less-expensive option. Jama. 2017;318(1):23–4.

Yki-Järvinen H, Dressler A, Ziemen M. Group HsS. Less nocturnal hypoglycemia and better post-dinner glucose control with bedtime insulin glargine compared with bedtime NPH insulin during insulin combination therapy in type 2 diabetes. HOE 901/3002 study group. Diabetes Care. 2000;23(8):1130–6.

Riddle MC, Rosenstock J, Gerich J. The treat-to-target trial: randomized addition of glargine or human NPH insulin to oral therapy of type 2 diabetic patients. Diabetes Care. 2003;26(11):3080–6.

Hirsch IB. Insulin analogues. N Engl J Med. 2005;352(2):174–83.

Hermansen K, Davies M, Derezinski T, Ravn GM, Clauson P, Home P. A 26-week, randomized, parallel, treat-to-target trial comparing insulin detemir with NPH insulin as add-on therapy to oral glucose-lowering drugs in insulin-naive people with type 2 diabetes. Diabetes Care. 2006;29(6):1269–74.

Horvath K, Jeitler K, Berghold A, Ebrahim SH, Gratzer TW, Plank J, et al. Long-acting insulin analogues versus NPH insulin (human isophane insulin) for type 2 diabetes mellitus. Cochrane Database Syst Rev. 2007;2.

Prentice JC, Conlin PR, Gellad WF, Edelman D, Lee TA, Pizer SD. Long-term outcomes of analogue insulin compared with NPH for patients with type 2 diabetes mellitus. Am J Manag Care. 2015;21(3):e235–43.

American Diabetes Association. 9. Pharmacologic approaches to glycemic treatment: standards of medical care in diabetes—2019. Diabetes Care. 2019;42(Supplement 1):S90-S102.

•• Lipska KJ, Parker MM, Moffet HH, Huang ES, Karter AJ. Association of initiation of basal insulin analogs vs neutral protamine Hagedorn insulin with hypoglycemia-related emergency department visits or hospital admissions and with glycemic control in patients with type 2 diabetes. JAMA. 2018;320(1):53–62 Findings from this study suggest that initiating insulin with NPH in patients with type 2 diabetes may be as effective as a long-acting insulin analogue.

•• Luo J, Khan NF, Manetti T, Rose J, Kaloghlian A, Gadhe B, et al. Implementation of a health plan program for switching from analogue to human insulin and glycemic control among Medicare beneficiaries with type 2 diabetes. JAMA. 2019;321(4):374–84 Findings from this study suggest that a health plan intervention switching older adults with type 2 diabetes from human to analogue insulin was not associated with an increased risk of hypoglycemia or glycemic control.

Acknowledgments

The authors would like to thank Dr. Mary Korytkowski, who provided comments on an earlier version of this manuscript.

Funding

Research reported in this publication was supported by the National Center For Advancing Translational Sciences of the National Institutes of Health under Award Number KL2TR001856. The content is solely the responsibility of the authors and does not necessarily represent the official views of the National Institutes of Health or the Department of Veterans Affairs.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

Jing Luo consults for Alosa Health and has received grant and travel support from Health Action International.

Walid F. Gellad declares that he has no conflicts of interest.

Human and Animal Rights and Informed Consent

This article does not contain any studies with human or animal subjects performed by any of the authors.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the Topical Collection on Economics and Policy in Diabetes

Rights and permissions

About this article

Cite this article

Luo, J., Gellad, W.F. Origins of the Crisis in Insulin Affordability and Practical Advice for Clinicians on Using Human Insulin. Curr Diab Rep 20, 2 (2020). https://doi.org/10.1007/s11892-020-1286-3

Published:

DOI: https://doi.org/10.1007/s11892-020-1286-3