Abstract

Forestry professional cooperatives (FPCs) are crucial for improving the efficiency of small-scale forestry, realizing forestry modernization, and promoting the sustainable development of forestry in China. However, credit constraints restrict their development. Previous studies have examined the credit rationing issues faced by farmers and enterprises. Few researchers have investigated the financial constraints of FPCs. This paper discusses the current status of credit rationing of FPCs in China, and analyzes the influencing factors of credit rationing. Based on survey data collected in China’s Fujian Province, we found that the credit demand of most FPCs was not met, which was primarily due to the limited amount of loanable funds available. Our empirical results reveal that greater woodland area, product popularity, president's credit record, Forest Rights Guarantee and Storage Agency (FRGSA) are statistically significant factors in reducing the credit rationing of FPCs. We find that, conversely, development planning has the opposite effect. Based on our results, we propose some suggestions, such as ensuring the products have good sales channels, keeping a good credit record of the presidents and adopting forest right storage guarantees, which will help alleviate the credit constraints of FPCs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Forestry professional cooperatives (FPCs) are one of the most common commercial structures in the forestry sector in China. In many developing states, cooperatives can enhance the ability of farmers and foresters to create value-added products (Groot et al. 2019). They reinforce farmers' bargaining positions in markets and can reduce their transaction costs (Hendrikse and Veerman 2001). Refer to the Law of the People's Republic of China on CooperativesFootnote 1, we define FPC as a mutual-aid economic organization that is voluntarily created by production and business operators of similar forestry products, or by providers or users of similar forestry production and business operation services (Zheng et al. 2012). It is a new small-scale forestry management entity (He et al. 2020). In China, the formation of FPCs has been encouraged by public policies aiming to sustain small-scale peasant livelihoods. By the end of July 2019, 2.2 million farmers' cooperatives were registered. According to data from 695 farmer cooperatives surveyed by the Research Center of Agricultural, Rural, and Agricultural Development, the average revenue of farmer cooperatives in 2016 was about 2.678 million US dollars and the distribution profit reached 0.283 million US dollars (Farmers Daily 2018). Cooperatives also play a significant role in reducing agricultural risks by unifying the procurement of input as well as marketing the products (Zhang and Yuan 2009). FPCs, in particular, produce a marked effect by increasing peasants' income and enhancing welfare by improving afforestation, employment, technical level, and investment in forestry management (Huang and Zhang 2013).

Although cooperatives can improve the agricultural performance of smallholders (Ma et al. 2018), they often lack sufficient capital to achieve profits in the development process and generally face credit constraints (Li et al. 2015; Groot et al. 2019). External financing of the cooperatives is often limited by factors such as residual claim rights (Hart and Moore 1996) or non-profit maximizing behaviors (Li et al. 2015), all of which can limit their growth and competitiveness. To promote the economic development in the agriculture and forestry sectors, formal financial institutions in many countries have channeled large amounts of credit to these sectors, especially in low-income regions (Gonzalezvega 1983). However, adverse selection and moral risk caused by information asymmetry between borrowers and lenders could lead to credit rationing (Stiglitz and Weiss 1981; Swinnen and Gow 1999). Credit rationing refers to the economic phenomenon where some borrowers are unable to obtain loans when the supply and demand of creditable funds are balanced in credit markets. Potential borrowers who are denied loans would not be able to borrow even if they indicated a willingness to pay more than the market interest rate, or a willingness to put up more collateral than is demanded (Hansen et al. 2013).

In the early literature, credit rationing was regarded as quantitative rationing. For example, Stiglitz and Weiss (1981) defined credit rationing as a circumstances in which either among loan applicants who appear to be identical some receive a loan and others do not. That is, the loan application was rejected by the bank. It was not until Boucher et al. (2008) proposed that credit rationing should be divided into quantity rationing and risk rationing, and proved that they both existed in the credit market at the same time. Risk rationing refers to the practice of giving up loans for fear of losing the collateral. Since then, many scholars have studied credit rationing and refined its classification, dividing credit rationing into demand deficiency (Li et al. 2016; Meng and Wang 2017; Liang and Luo 2019), non-credit rationing (Li et al. 2016; Liang and Luo 2019), demand-based credit rationing (Li et al. 2016; Liang and Luo 2019), supply-based credit rationing (Li et al. 2016; Liang and Luo 2019), guarantee rationing (Dong et al. 2018), policy rationing (Turvey 2013), risk rationing (Meng and Wang 2017; Chiu et al. 2014), price rationing (Meng and Wang 2017; Chiu et al. 2014), and so on. No matter how credit rationing is divided, previous studies indicate that credit constraints limit the development of cooperatives, as farmers and forest owners who lack funds cannot invest in high-risk and more productive technologies, which in turn affects their agricultural profits (Guirkinger and Boucher 2008).

Scholars have analyzed how credit rationing is influenced by socio-economic factors. Common influencing factors include growth intentions (Scott et al. 2017), enterprise size (Drakos and Giannakopoulos 2011; Kundid and Ercegovac 2011), sales performance (Drakos and Giannakopoulos 2011; Kundid and Ercegovac 2011), soft information of enterprises or individuals (Smondel 2018), collateral (Kundid and Ercegovac 2011), and credit rating (Kundid and Ercegovac 2011), etc. However, the existing research results may not be fully applicable in the context of FPC credit rationing, especially in developing countries like China. First of all, previous studies mainly focused on the credit constraints on individual farmers or enterprises, and paid less attention to the constraints faced by cooperatives, including but not limited to whether joining cooperatives is beneficial to the economic development of individual farmers (Atmi et al. 2009; Ma and Abdulai 2016), or whether farmers are willing to participate in cooperative activities (Abate 2018; Zhang et al. 2019). Second, many studies consider FPCs to be the same as agricultural cooperatives, ignoring their differences in production and disposal characteristics (Luo et al. 2013). Compared with individuals and most agricultural professional cooperatives, the production cycle of forestry is longer and the capital recovery is slower. Before the end of the production cycle, the forestry industry cannot provide any products, meaning that it cannot generate income. The turnover cycle of forestry capital is longer than that of other industries, which will affect the bank's credit decisions. Third, the Chinese government allows loans in the form of joint guarantees or joint loans between cooperative members or different FPCs, which is significantly different from individuals or enterprises applying for loans alone. A joint secured loan means that in the event of a large debt, multiple borrowers will be responsible for repayment, which reduces the risk of not repaying loans. Finally, it is difficult for banks to cope with the non-performing forest right loans of FPCs. Because the cutting right of forest land is restricted by the protection policy of forest cutting in China, it is difficult for banks to obtain cash by cutting down the trees even if they have the forest right. These differences mean that financial institutions will evaluate loan applications from FPCs differently from other organizations.

Given the above account, it is important to examine the factors affecting FPCs’ credit financing. Based on survey data from Fujian Province, China, this study aims to examine the credit constraints faced by FPCs and explore the factors that influence the credit rationing affecting them. The results of this study will enable policy makers to better understand the financing constraints of FPCs and provide policy insights for improving the credit supply in China and similar countries. In 2019,the forest coverage rate of Fujian Province is 67%, covering an area of 8 million hectares, ranking it first in the country. According to the public information from the Fujian Forestry Bureau (2020), the total output value of Fujian's forestry industry in 2019 was 645 billion yuan, keeping the top three in China. Fujian Province, as a pioneer in the reform of collective forest rights system, is one of the earliest areas to establish FPCs in China, and in terms of the development of FPCs, it has always been in a leading position. In 2013, there were 1,728 FPCs in Fujian. As of 2017, there were 4,783 new commercial entities operating in Fujian Province, including FPCs and stock farms. The Fujian provincial government attaches a great importance to supporting forestry finance reforms, and carries out the reform of forestry rights mortgage loans. In 2017, forestry rights mortgage loans in Fujian Province generated more than 444 billion US dollars and the loan amounts ranked first in the country. Thus, analyzing the lending situation of FPCs in Fujian can effectively reflect the credit financing situation of FPCs in China as a whole.

The remainder of this paper is organized as follows: Sect. 2 provides information on the research methods and data; Sect. 3 presents the results; Sect. 4 discusses the findings; and Sect. 5 provides conclusions and policy implications.

Empirical Model and Data

Based on the studies of Li et al. (2016) and Liang and Luo (2019), we consider the cases of active selection and passive acceptance of credit in FPCs. We classify credit rationing into four types: demand deficiency, non-credit rationing, supply-based credit rationing, and demand-based credit rationing. Demand deficiency means the FPCs have no loan demands, while non-credit rationing means that the FPCs could get enough loans. Supply-based credit rationing means that the FPCs can only get a part of the loan amount they apply for, or they are rejected by financial institutions. Demand-based rationing means that the FPCs relinquish their initiative to apply for loans due to the reasons such as high rejection rates, high interest costs, or short loan periods. The types and degrees of credit rationing are shown in Table 1.

Methods

This study analyzes the influencing factors on FPCs with different credit rationing levels using an ordered probit model. The ordered probit model can be used to analyze ordinal variables (Winship and Mare 1984) and examine the marginal effects of each variable on the different alternatives within the ordered categories (Woods et al. 2017). This technique has been used by Woods et al. to analyze Danish farmers’ perceptions of climate change and their possible responses (Woods et al. 2017). In addition, Azra Batool et al. used this model to study women's economic empowerment in Muertan, Pakistan (Azra Batool et al. 2018). In our study, we used the ordered probit model to study the factors affecting credit rationing. The regression model is outlined below.

In Eq. (1), y* represents the latent variable of the credit allocation degree of FPCs, y represents the actual observed value of FPCs credit allocation degree, a is the constant term of the equation, β is the parameter to be estimated, X is the explanatory variable, C1 and C2 are critical points. Equation y = 0 means that FPCs are not subject to credit rationing (\({\text{y}}_{{}}^{*} \le {\text{C}}_{1}\)). Equation y = 1 means that FPCs are subject to supply-based credit rationing (\({\text{C}}_{1} < {\text{y}}_{{}}^{*} < {\text{C}}_{2}\)). Equation y = 2 means that FPCs are subject to demand-based credit rationing (\({\text{y}}_{{}}^{*} \ge {\text{C}}_{2}\)). Equation (2) is the probability formula for y to take a specific value. The degree of credit rationing can only be observed when the FPC has credit demand. At this time, the population represented by the model includes three types: non-credit rationing, supply-based credit rationing and demand-based credit rationing.

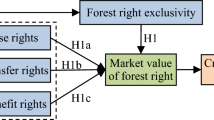

Explanatory variables used in the model

The key variables can be classified into five categories, which include development status, profitability, lending relationship, characteristics of the cooperative president, and policy environment. Table 2 lists all the variables, which are described in detail below.

Development Status

Financial institutions will examine the qualifications of FPCs applying for loans to understand its basic conditions. In this paper, demonstration level, financial statement integrity of FPCs, development planning and woodland area are selected to reflect the basic situation of the cooperative.

Demonstration level: In China, there are four demonstration levels of cooperatives, namely county, city, provincial, and national. The demonstration level of cooperatives reflects their level of development (Guo et al. 2011; Chen and Huang 2018). We divide FPCs into two categories according to whether it has the title of demonstration or not. The reason why FPCs are classified in this way is that the proportion of FPCs with national or provincial demonstration titles is low. Among the 117 samples, there are 47 FPCs at or above the county demonstration level, including only 8 provincial or national demonstration cooperatives (7%).

Financial statement integrity: Studies have shown that a high quality and comparability of financial statements can reduce the information asymmetry between borrowers and banks, thus improving the borrowers' access to debt (Fang et al. 2016; De Meyere et al. 2018). This study assumes that FPCs which are able to prepare complete financial statements in accordance with this system are more likely to obtain loans.Woodland area: Collateral can reduce the moral risk of borrowers to a certain extent and serve as an alternative to financial institutions for restricting borrowers (Rajan and Winton 1995). Forest land, as the most common tangible asset of FPCs, has high mortgage values. When the proportion of tangible assets in enterprises is high, the problem of information asymmetry tends to decrease, which makes it easier for enterprises to borrow money from banks (Mateos-Ronco and Guzman-Asuncion 2018).

Development planning: If cooperatives have plans to expand their business scale in the future, the demand for loans will be higher, and they will be more likely to apply for loans. Borrowers with clear development plans could be more likely to obtain loans, because financial institutions will know more about cooperatives before granting the loans. Therefore, we assume that FPCs with development plans are less susceptible to credit rationing.

Profitability

The profitability of agricultural companies represents their creditworthiness and investment potential (Petruk and Hryhoruk 2014). In this paper, profitability level and product popularity are chosen to represent the operational capabilities of FPCs.

Profitability level: Profitability level is the direct reflection of the borrower's solvency. For formal financial institutions, borrowers with high incomes show a lower risk of bad debts, (Guo et al. 2011; Chen and Huang 2018). This study believes that the higher the level of profitability, the easier it is for FPCs to avoid credit rationing.

Product popularity: Scholars generally believe that the greater the total value of the products sold by cooperatives, the greater market potential and better development prospects (Guo et al. 2011; Chen and Huang 2018). We believe that the more popular the FPCs’ products are, the lower their bad debt risk is and the less they will be subject to credit constraints.

Lending Relationship

We use degree of contact and distance from the bank to reflect the lending relationship between bank and FPCs.

Degree of contact: Berger and Udell (2002) believe that relationship lending technology is one of the most powerful technologies to reduce information asymmetry in small business financing. The soft information collected by banks through long-term and frequent contact with enterprises is of great value, which includes the real production information of enterprises, the abilities and behavior of owners, etc. In addition to the financial statements of the company, this information also provides them with collateral and higher credit scores (Dong et al. 2017). We used the degree of contact between banks and FPCs to reflect their relationship. We believe that the more frequent the contacts, the less credit rationing the FPCs will face.

Distance from the bank: Scholars have also noticed that the physical distance between borrowers and lenders matters. Asante-Addo et al. (2017) argue that geographical distance will affect loans. The farther the distance between the borrower and the bank is, the higher the cost of bank, including providing loans, monitoring the use of funds and recovering loans. It is our opinion that the greater the distance between the two is, the more likely the borrower will suffer from credit rationing.

Characteristics of the Cooperative President

Considering that the personal situation of business owners closely affects the development of most small and medium-sized enterprises, banks need to know the personal characteristics of the owners, such as the financial status and credit history (Ali et al. 2013). The same applies to cooperative loans. When banks lend money to cooperatives, they will also inquire about the situation of the cooperatives’ presidents (Guo et al. 2011; Chen and Huang 2018). This study measures cooperative president characteristics using the president's educational level, age, risk preference, and credit record.

Education level could influence the president’s understanding of formal credit, which in turn will affect the loan results of cooperatives. This effect may be positive or negative (Zhou et al. 2016; He et al. 2020). A highly educated president usually knows more about formal credit, which will increase the possibility of loan application. But at the same time, they are more likely to have more social capital and access to social financing instead of choosing formal financing channels (Wu et al. 2016). Risk preference also directly affects the willingness of cooperative presidents to apply for formal credit (Xu and Zhang 2012). The age of the president will also affect the bank's review of the repayment ability of cooperatives. Presidents with good credit records will reduce the credit constraints of FPCs, which will make borrowers and lenders more confident in formal credit activities. We believe that the older the president is, the better the presidents’ credit record is, the deeper the social capital accumulation will be, and the lower the credit rationing degree FPCs will face.

Policy Environment

The Forest Rights Guarantee and Storage Agency (FRGSA) is an official institution funded by the government to repay the loan for the lender and deal with the mortgaged forest rights in cases of bad debt. This institution can also provide guarantee services for FPCs applying for loans. For FPCs in rural areas, the support of the state and local governments should not be ignored. According to the Statistical Bulletin of China's National Forestry Development, nearly half of the state-owned forestry investment in 2017 was supported by the government's fiscal policy and credit policy, which have a great impact on cooperative financing (Yi et al. 2017; Sutterlüty et al. 2018). If the local government can provide stable guarantees for borrowers, the probability of loans from financial institutions will increase. Therefore, the existence of a FRGSA in the location of FPCs is a crucial factor in alleviating credit constraints.

Data Collection

In this study, a survey was conducted by means of double sampling. Non-probabilistic sampling was used in the first sampling round to determine the key survey sites. The cities of Sanming and Nanping in Fujian Province were selected due to data availability and sample representativeness. Both Sanming and Nanping are major forest areas in Fujian. Both of them have relatively large-scale forestry industries and well-developed FPCs. The forestry output value in Sanming and Nanping in 2018 accounted for 19% and 15% of the total output value in the province, ranking first and third respectivelyFootnote 2. Considering the availability of data, we selected three counties with relatively complete forestry data in each of the two cities according to the recommendation of the Municipal Forestry Bureau. In each county, we randomly selected 3–8 townships where we administered the survey questionnaire. We also selected Yongtai County in Fuzhou, and Wuping County in Longyan for investigation. Wuping County is the birthplace of the collective forest right system reform. It was here that the earliest relevant policies related to FPCs were born. Investigating the financing situation of FPCs in Wuping County will help to grasp the historical context. Yongtai County, as a key forestry county in Fujian Province, was listed as a national key ecological function area in 2017. A survey of this county will help us to understand the latest development of FPCs. In the background of China’s emphasis on green development, the financing of FPCs in these two regions is representativeFootnote 3. We administered the questionnaire in 14 towns in Sanming, 20 towns in Nanping, 6 towns in Longyan and 3 towns in Fuzhou. The sample data obtained by this sampling method is considered to be representative (Liu et al. 2014).

In the second sampling round, we used stratified random sampling to determine the specific respondents at each survey point. We obtained the list of FPCs with actual business in each region from forestry stations. In order to ensure the data reliability of FPCs to the greatest extent, We selected interviewees whose ratio of loans received by FPCs to loans not received was about 1:1.

Fieldwork, where questionnaires were administered, was conducted from January to December, 2018. The survey was developed and distributed by an investigation team composed of the authors and their colleagues. The questionnaire asked interviewees about the income and expenditure of FPCs in 2017. The questionnaire consisted of a direct interview method with the actual controllers of the FPCs, most of whom were presidents. Surveys covered the basic situation of FPCs, funding needs and financing, product and market conditions, credit status, personal and family situation, bank-cooperative relationship and expectations for credit. We received 174 questionnaires from 43 townships in 8 counties. The investigators checked the missing information and abnormal valuesFootnote 4 in each other's questionnaires, which were then confirmed by the team leader. After this comprehensive investigation, 160 valid questionnaires were obtained, with a response rate of 92%.

Results

This study find that the credit needs of most FPCs have not been met. Among the 82 FPCs that received formal credit, 39 indicate that their credit needs are not met. Only 12 FPCs (accounting for 15%) indicate that their credit needs have been fully met. We further inquire about the reasons for the unsatisfactory credit outcomes. Our results show that the primary reason is insufficient loan funds (85%), followed by high loan interest rates (62%), and the short loan terms (38%). Other FPC presidents believe that their one-year loan period could be renewed after the completion of the annual transfer, which is troublesome if the procedure and the size of loans cannot meet their needs.

A total of 35 FPCs have loan needs, but they don’t apply for loans. Their reasons are summarized in Table 3. The main factor is that they predict the loan that banks are willing to lend would be less than they want, thus losing their motivation to apply. A total of 19 FPCs select this factor, accounting for 54%. The second factor is that, as an FPC president stated, "even if you apply, you won't get it". Other reasons include troublesome and time-consuming loan procedures and excessively high loan interest rates. The remaining factors affecting FPCs’ decision include incomprehension of the terms and procedures of the loan, short loan terms, harsh and unsatisfied loan conditions, inability to pay mortgage loans, inability to obtain other sources of funds, and outstanding loans or a poor financial record.

In this survey, a total of 39 FPCs don’t receive credit. In contrast, four FPCs that don’t need loans but still apply for one, successfully obtain loans. Among the four FPCs, three FPC presidents indicate that they apply for a loan because they are encouraged by the local government to do so, and the other notes that he is persuaded by friends and relatives. The most common type of loan obtained by FPCs is a personal credit loan. That is, the president and core members of the cooperative develop FPCs’ activities through personal loans. The group that uses personal credit loans accounted for 38% of the FPCs investigated, followed by secured loans (37%). Forest right mortgage loans only accounts for 15%, ranking third. Other loan methods include factory building and real estate mortgages.

Table 4 shows the loan situation of FPCs. The average loan amount obtained is US $135,371, the average loan term is 3 years, and the average loan interest rate is 8%. Table 4 shows that the average expected value of FPC loan amounts and loan terms far exceed the actual values, and the expected loan interest rates are lower than the actual situation. In other words, the loans provided by the banks don’t meet the expectations of FPCs. They want higher loan amounts, longer loan terms, and lower interest rates.

The estimated results of the model are shown in Table 5. We use the backward elimination method to process the data. Firstly, all the variables are introduced into the regression equation, and their significances are tested. After deleting the insignificant variables, we refit the regression equation and select the equation with the smallest Akaike information criterion (AIC) (Liang and Luo 2019; Zhou and Chin 2019). Model I contains all the variables, while Model II is the equation with the smallest AIC obtained by following the stepwise backward elimination method. This study mainly discusses the results obtained through Model II. The chi-square test p values of the equation before and after deleting variables were all at the 1% significant level. Winship and Mare (1984) believe that the premise of using the ordered probit model is that the random disturbance should conform to normal distribution. Gujarati D (1996) hold the view in the Basic Econometrics book that random disturbance can be measured by the residuals of the model. So we extract the residuals of the model and use the Shapiro–Wilk test (W test) to test whether the residuals of the model have a normal distribution. The W test is used to test the normality of data between 7 and 2000 (Park 2008). The result of the test is p = 0.41 > 0.05, that is, the residual term of the model obeys the normal distribution, which means that it is appropriate to use the ordered probit model.

As shown in Table 5, woodland area, product popularity, president's credit record, FRGSA are all negatively related to the credit rationing of FPCs. This demonstrates that development status, profitability, chairman characteristics, and policy environment have an impact on the credit rationing of FPCs, while the lending relationship between banks and FPCs has no significant impact on credit rationing. It is worth noting that having a development plan increases the probability that FPCs suffered from credit rationing, which is contrary to prior expectations. This means that the higher the loan requirements of FPCs with expansion plans, the more vulnerable they are to credit rationing. Profitability level has a positive impact on credit rationing in Model I. However, it is not significant in Model II. We then performed an average marginal effect analysis and found that the profitability level does not affect credit rationing.

Tables 6 shows the average marginal effects of key variables in the model. The Marginal Effects at the Means (MEMS) of categorical variables show the difference in the predicted probabilities relative to the reference category. In the non-credit rationing case, the MEMS for “product popularity–comparatively popular” of 0.3 tells us that, for hypothetical individuals with average values on woodland area (6.29), development planning (0.84), profitability level (1.82), product popularity–very popular (0.16), president's credit record (0.38) and FRGSA (0.80), the predicted probability of avoiding credit rationing is 0.3 greater for the FPCs in “product popularity–comparatively popular” than for one who is in a state of no products. The interpretation of indicators such as development planning, product popularity–very popular, president's credit record and FRGSA is similar to the indicator above.

For the woodland area variable, MEMS means that when the other variables are held at their sample means, the probability of avoiding credit rationing increases by 6% higher for each additional woodland unit of FPCs. The probability of an FPC suffering from supply credit rationing and demand credit rationing decreased by 1% and 4% respectively. That is to say, the larger the woodland area owned by FPCs, the more likely they are to obtain credit.

Discussion

Credit Rationing for Cooperatives

The primary reason for the unsatisfied credit demand of FPCs is a lack of funds loaned, followed by a low loan application rates. This phenomenon shows that FPCs are generally confronted with quantity rationing, and the existing loanable quota cannot meet the development needs. For the sake of reducing transaction costs, FPCs are more inclined to borrow large amounts of loans from banks. However, if there is a premonition that banks will not lend, some FPCs will be discouraged and adopt other financing methods.

Agricultural credit is an important means to promote the development of agricultural and rural areas, and plays a significant role in accelerating agricultural modernization and economic development (Chandio and Jiang 2018). However, due to the long production cycle of forestry and the unstable price market, financial institutions are not as willing to grant loans to FPCs, which is directly reflected in the constraint of the amount of credit available to them. Besides, China implements forest cutting quota management, which means that cutting management is carried out according to forest growth. Nevertheless, the trees mature at different rates. The economic value of forests is affected by forest trading prices, land opportunity costs, market risks, natural disasters, and other factors that are not always in line with the tree maturity rates (Hong and Fu 2018). Trees that have not reached the growth age stipulated in the policy cannot be cut down. Even if they meet the logging standards, due to the restriction of environmental protection, the owners are often unable to obtain logging permits. These factors make it impossible to operate and produce forests according to the optimal economic rotation period. This reduces the benefit of forest management, increases the uncertainty and risk involved in forest management, restricts the liquidity of forest assets, and further reduces the enthusiasm of financial institutions for investing in FPCs.

The loan terms and loan interest rates are also important factors affecting the credit demand of FPCs. Financial institutions' funding periods for forestry projects is concentrated in the range of 1–3 years. According to our survey results, the average loan term of FPCs is 2.62 years, which shows that FPCs obtain mainly short-term loans. In general, financing friction increases aas investment horizons increase, therefore short-term investments are more popular (Qiu et al. 2018). The research conducted by Chandio and Jiang (2018) on rural wheat yield shows that agricultural credit has a significant positive impact on wheat productivity, but high interest rates limit farmers’ access to credit. The production cycle of forestry is longer than that of agriculture, and thus the period of demand for capital is longer. Other studies have shown that cooperatives have a long-term and large-scale credit demand, and borrowers asked for larger loans amounts than those typically provided by lenders (Qiu et al. 2018). We have also seen similar problems with high loan interest rates and small loan amounts for FPCs, where the actual situation does not match borrowers' expectations.

Issues such as loan quotas, maturities, and interest rates have gradually received attention from Chinese government officials, who have been exploring new financial methods of FPCs. For example, decision-makers in the city of Sanming in Fujian Province implemented the Fulin loan in 2016. The policy encourages each village to set up an FPC. This system uses FPCs instead of banks to evaluate the credit of cooperative members who need loans and to provide loan guarantees. FPCs need to establish forestry guarantee funds and the members who need loans make capital contributions with forest rights. In the case of bad debts, the disposal of non-secured forest right assets is also carried out by the FPCs. The Fulin loan system gives FPCs great autonomy in the loan process. As of September 2017, Fulin loan products in Sanming have cumulatively granted US $210 million in credits (Hong and Fu 2018). Compared with official organizations such as FRGSA, Fulin Loan, as an independent non-governmental organization, can overcome the problems of manpower shortage and limited financial allocation. In the national governance environment of village autonomy, the repayment ability of the lender will be identified by other members of FPCs living in the same village, which reduces the information asymmetry between lenders and banks. The Fulin Loan approach provides a meaningful path for FPCs to obtain formal credit under similar conditions.

Determinants of Credit Rationing

The ordered probit model results of factors affecting credit rationing for FPCs show that woodland area, product popularity, president's credit record, FRGSA is statistically significant factors that slow down the credit rationing of FPCs, while development planning exacerbates credit constraints. As effective collateral, woodland area can alleviate the credit rationing of FPCs, which is consistent with the research findings of Boot et al. (1991), Rajan and Winton (1995), and Mateos-Ronco and Guzman Asuncion (2018). Effective collateral is a powerful guarantee for obtaining bank loans. The influence of product popularity, president's credit record, and FRGSA are also confirmed, and these are consistent with the results of Guo et al. (2011), Asante-Addo et al. (2017), Chen and Huang (2018), and Beltrame et al. (2019). Improved product popularity means that FPCs will have stable income in the future, which reduces the loan risk for banks. To some extent, presidents’ credit records plays a role in credit collateral, while FRGSA, as an institution endorsed by the government, increases the bank's lending confidence.

Although some scholars have shown that larger-scale borrowers have a higher probability of obtaining the loans (Kundid and Ercegovac 2011; Mateos-Ronco and Guzman Asuncion 2018), we find that the process of expanding the scale of FPCs is not supported by financial institutions, instead, it causes credit constraints. On the one hand, FPCs with expansion plans seek to apply for higher loan amounts and are more susceptible to quantity allocation. On the other hand, FPC members develop a bad impression of financial institutions and their loan restrictions. They expect that banks would not give them loans, which reduces their likelihood to apply for loans. Among the 22 FPCs with scale expansion plans, 31% do not apply for loans. Our analysis of the average marginal effect also supports this phenomenon. The FPCs with development planning are more likely to experience demand-oriented credit rationing than supply-oriented credit rationing (the probability of the former was 36% and of the latter was 12%). This indicates that the FPCs with development planning are less likely to apply for formal credit for that the credit amounts cannot meet their actual needs. Alternatively, such FPCs might have obtained loans.

Profitability level and president’s age do not affect the credit rationing of FPCs. The probable reason for the insignificance of profitability level is that, as Guo et al. (2011) propose, the financial management of many cooperatives is not standardized. When the cooperative calculates its annual operating income, the operating income of members of the cooperative is also counted in this amount. This causes some distortion that formal financial institutions such as banks do not recognize the annual operating income data of cooperatives, and therefore do not grant credit to cooperatives based on their profitability (Chen and Huang 2018). Besides, due to the long payback period of investment in the forestry industry, the profitability level of that specific year cannot fully summarize the development potential of FPCs, which may also lead to the profitability level not having a significant impact on credit rationing. The reason why the age of the president has no significant impact on the credit rationing of FPCs may be that the presidents are a mostly middle-aged males, and the single age bracket of the presidents is not enough to affect the bank's credit rationing. In our 117 samples, the average age of the presidents is 46.5 years old, and just six individuals are under 35 years old. The age of the president does not get a forceful diversity.

The lending relationship between banks and FPCs has no significant effect on credit rationing, possibly due to insufficient communication between the lenders and the borrowers. The exchange of information between FPCs and banks may not effectively eliminate the banks' concerns about the non-performing loan ratio of FPCs.

Conclusions

This study analyzes the credit demand of FPCs in China’s Fujian Province, and uses an ordered probit model to study the factors affecting the credit rationing of FPCs. Financing difficulty is one of the main problems that restrict the development and growth of FPCs in China. Woodland area, product popularity, president's credit record, and FRGSA can help FPCs to alleviate the credit rationing. These findings are important for promoting the development of FPCs and improving the degree of forestry organization in China. They can also be applied to the operation of FPCs in other developing countries.

The results of this study inform multifaceted recommendations for alleviating the credit rationing of FPCs. It is necessary to pay attention to the sales performance of products, such as ensuring product quality, signing long-term sales contracts to stabilize downstream customer groups, and to ensure that products have good sales channels. The presidents of the FPCs should strive to maintain good credit records, which can facilitate the approval of the bank loans. The presidents should also actively participate in government-sponsored training activities and various exhibitions to enhance their ability to integrate government relations, social relationships, and resource integration capabilities. The training provided by forestry administrations for presidents would enhance their management and operational capabilities. In addition, to bring the FRGSA into full play, we suggest that the government should increase the forestry subsidy amounts, and encourage the development of state-owned enterprises and social capital. The government should also encourage forestry producers and managers to adopt forest right storage guarantees so that FPCs can participate in the formal credit market.

Although our research shows that China's FPCs are facing difficulties in financing, our analyses lack data from other major forestry provinces in China. Thus, our study lacks a horizontal comparison. We don’t conduct a long-term collection of data, which makes it uncertain whether some variables have a long-term or short-term impact on the credit rationing of FPCs. Therefore, further research is needed involving long-term data for FPCs, as well as an investigation of FPC credit financing in more regions. Additional research on the financing of FPCs would help us to better understand and promote the development of China's forestry sector.

Notes

The law is applicable to all cooperatives. As a type of cooperatives, this definition is also applicable to FPCs.

The data is sorted out according to the``2018 Fujian Province Forestry Industry Gross Output Value Completion Table'' issued by Fujian Forestry Bureau. http://lyj.fujian.gov.cn/zwgk/jhtj/tjsj/201903/t20190306_4780768.htm (Accessed 8 Aug 2021 In Chinese).

To verify the rationality of the data, we tested the impact on the models with and without data from these counties and find that the descriptive statistical analysis has little difference before and after deletion, while empirical model results are slightly different, and some variables change from insignificant to significant. We believe that the results before deletion are more accurate because the sample size is larger and the sample is more representative.

The deleted data includes but is not limited to the following cases: 1. Abnormal Value. Profitability or product sales of FPCs that are much higher than others in the same category and region which is greatly exaggerated. 2. Respondents unwilling to give the answers about FPCs’ profitability or personal information due to privacy concerns, resulting in missing data of the questionnaire.

References

Abate GT (2018) Drivers of agricultural cooperative formation and farmers’ membership and patronage decisions in Ethiopia. J Co-Op Organ Manag 6(2):53–63

Ali AS, Qtaishat T, Majdalawi MI (2013) Loan repayment performance of public agricultural credit agencies: evidence from Jordan. J Agric Sci 5(6):221–229

Asante-Addo C, Mockshell J, Zeller M et al (2017) Agricultural credit provision: what really determines farmers’ participation and credit rationing. Agric Finance Rev 77(2):239–256

Atmi E, Günen HB, Lise BB et al (2009) Factors affecting forest cooperative’s participation in forestry in Turkey. For Policy Econ 11(2):102–108

Azra Batool S, Ahmed HK, Qureshi SN (2018) Impact of demographic variables on women’s economic empowerment: an ordered probit model. J Women Aging 30(1):6–26

Beltrame F, Floreani J, Grassetti L et al (2019) Collateral, mutual guarantees and the entrepreneurial orientation of SMEs. Manag Decis 57(1):168–192

Berger AN, Udell GF (2002) Small business credit availability and relationship lending: the importance of bank organisational structure. Econ J 112(477):32–53

Boot A, Thakor A, Udell G (1991) Secured lending and default risk: equilibrium analysis, policy implications and empirical results: the journal of the royal economic society. Econ J 101(406):458–472

Boucher SR, Carter MR, Guirkinger C (2008) Risk rationing and wealth effects in credit markets: theory and implications for agricultural development. Am J Agric Econ 90:409–423

Chandio AA, Jiang Y (2018) Determinants of credit constraints: evidence from Sindh. Pakistan Emerg Mark Finance Trade 54(15):3401–3410

Chen YW, Huang HL (2018) Research on the factors influencing the availability of loans for farmers’ professional cooperatives and policy recommendations—taking fujian farmers’ professional cooperatives as an example. Fujian Forum (Humanit Soc Sci Edit) 6:178–183 ((In Chinese))

Chiu LJV, Khantachavana SV, Turvey CG (2014) Risk rationing and the demand for agricultural credit: a comparative investigation of Mexico and China. Agric Finance Rev 74(2):248–270

Farmers Daily (2018) Analysis Report on the Development of New Agricultural Operators in China in 2018 - Based on the Survey and Data of Farmers' Cooperatives. available at: https://baijiahao.baidu.com/s?id=1593157898572250653&wfr=spider&for=pc (Accessed 8 Aug 2021 In Chinese)

De Meyere M, Bauwhede HV, Van Cauwenberge P (2018) The impact of financial reporting quality on debt maturity: the case of private firms. Account Bus Res 48(7):759–781

Dong X, Cheng C, Shi X (2017) How to reduce the banks’ collateral requirements for small and micro enterprises effectively—based on the perspective of lending technology. J Guizhou Uni Finance Econ 1:33–42 ((In Chinese))

Dong XL, Feng Y, Guan YR (2018) Is loan guarantee insurance alleviating the credit ratio of farmers? Rural Econ 3:58–64 ((In Chinese))

Drakos K, Giannakopoulos N (2011) On the determinants of credit rationing: firm-level evidence from transition countries. J Int Money Finance 30(8):1773

Fang X, Li Y, Xin B et al (2016) Financial statement comparability and debt contracting: evidence from the syndicated loan market. Account Horiz 30(2):277–303

Fujian Forestry Bureau (2020) Our Province's Forestry Economy Maintained Rapid Growth in 2019. available at: http://lyj.fujian.gov.cn/zwgk/jhtj/tjjd/202003/t20200326_5223354.htm (Accessed 8 Aug 2021 In Chinese)

Gonzalezvega C (1983) Credit rationing behavior of agricultural lenders: the iron law of interest rate restrictions. Colloq Rural Finance Washington 1–29

Groot H, Bowyer J, Bratkovich S, et al (2019) The role of cooperatives in forestry. available at: http://www.dovetailinc.org/report_pdfs/2015/dovetailforcoops0715.pdf (Accessed 8 May 2019)

Guirkinger C, Boucher SR (2008) Credit constraints and productivity in peruvian agriculture. Agric Econ 39(3):295–308

Gujarati DN (2005) Basic econometrics, 4th edn. Renmin University of China Press, Beijing (In Chinese)

Guo HD, Chen M, Han SC (2011) An analysis of the attainability of farmer’s specialized cooperatives for formal credit and its determinants—based on survey to farmer’s specialized cooperatives in Zhejiang province. Chin Rural Econ 7:25–33 ((In Chinese))

Hansen MC, Potapov PV, Moore R et al (2013) High-resolution global maps of 21st-century forest cover change. Science 342(6160):850–853

Hart O, Moore J (1996) The governance of exchanges: member’s cooperatives versus outside ownership. Oxford Rev Econ Policy 12(4):53–69

He M, Huang S, Zhang Y et al (2020) From peasant to farmer: transformation of forest management in China. Small-Scale Forestry. https://doi.org/10.1007/s11842-020-09437-6

Hendrikse GWJ, Veerman CP (2001) Marketing cooperatives and financial structure: a transaction costs economics analysis. Agric Econ 26(3):205–216

Hong YZ, Fu YH (2018) Research on the accessibility factors of forestry tenure mortgage loan for farm households——taking the ”Fulin Loan” in Sanming City, Fujian province as an example. For Econ 40:31–35 ((In Chinese))

Huang S, Zhang C (2013) Study on the operation mechanism of forestry professional cooperatives: a case study of Fujian Province. Econ Syst Reform 5:92–96 ((In Chinese))

Kundid A, Ercegovac R (2011) Credit rationing in financial distress: croatia SMEs’ finance approach. Int J Law Manag 53(1):62–84

Li Z, Jacobs KL, Artz GM (2015) The cooperative capital constraint revisited. Agric Finance Rev 75(2):253–266

Li Q, Lv X, Sun G (2016) Farmers’ credit rationing: demand or supply? ——based on the analysis of the dual sample selection model. Chin Rural Econ 1:17–29 ((In Chinese))

Liang H, Luo J (2019) Research on supply-type and demand-based credit rationing and its influencing factors——Based on the experience of 3459 households in four provinces under the background of agricultural land mortgage. Econ Manag Res 40:29–40 ((In Chinese))

Liu XC, Chen LH, Yang QM (2014) Farmer’s formal credit demand and interest rate: an empirical study based on Tobit III model. Manag World 3:75–91 ((In Chinese))

Luo BL et al (2013) Reform of collective forest right system: practice and model innovation in Guangdong. China Agricultural Press, Beijing (In Chinese)

Ma W, Abdulai A (2016) Does cooperative membership improve household welfare? evidence from apple farmers in China. Food Policy 58:94–102

Ma W, Abdulai A, Goetz R (2018) Agricultural cooperatives and investment in organic soil amendments and chemical fertilizer in China. Am J Agric Econ 100(2):502–520

Mateos-Ronco A, Guzman-Asuncion S (2018) Determinants of financing decisions and management implications: evidence from Spanish agricultural cooperatives. Int Food Agribus Manag Rev 21(6):701–721

Meng Y, Wang J (2017) Credit rationing and influencing factors of Chinese rural households. J N.W Agri Univ Sci Technol (Soc Sci Edit) 17:59–66 (In Chinese)

Myoung PH (2008) Univariate analysis and normality test using SAS, Stata, and SPSS. Doctoral Dissertation, Indiana University

Petruk O, Hryhoruk I (2014) Evaluation of investment and crediting capacity of agricultural sector enterprises. Account Financ 54(4):108–114

Qiu X, Huang LY, Liu FB (2018) Analysis on the development strategy of inclusive forestry finance in the Southern collective forest region——a case study of “Fu Lin loan” in Youxi County, Fujian province. China for Econ 153:5–8 ((In Chinese))

Rajan R, Winton A (1995) Covenants and collateral as incentives to monitor. J Finance 50(4):1113–1146

Scott M, Barry O, Martie-Louise V (2017) Bank financing and credit rationing of Australian SMEs. Aust J Manag 42(1):58–85

Smondel A (2018) SMEs’ soft information and credit rationing in France. Hum Syst Manag 37(2):169–180

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Sutterlüty A, Šimunović N, Hesser F et al (2018) Influence of the geographical scope on the research foci of sustainable forest management: insights from a content analysis. For Policy Econ 90:142–150

Swinnen JFM, Gow HR (1999) Agricultural credit problems and policies during the transition to a market economy in central and eastern Europe. Food Policy 24(1):21–47

Turvey CG (2013) Policy rationing in rural credit markets. Agric Finance Rev 73(2):209–232

Winship C, Mare RD (1984) Regression models with ordinal variables. Am Sociol Rev 49(4):512–525

Woods BA, Nielsen HØ, Pedersen AB et al (2017) Farmers’ perceptions of climate change and their likely responses in danish agriculture. Land Use Policy 65:109–120

Wu Y, Song QY, Yin ZC (2016) Analysis of farmers’ access to formal credit and preference for credit channels: an explanation from the perspective of financial knowledge level and education level. Chin Rural Econ 5:43–55 ((In Chinese))

Xu CM, Zhang JJ (2012) Impact of social capital and heterogeneity risk preferences on farmers’ inter-linked credit and insurance choice. Finance Trade Econ 12:63–70 ((In Chinese))

Yi Z, Guo H, Zhong W (2017) Forestry professional cooperatives being important organizations for the sustainable management of forest. J Sichuan for Sci Technol 38:128–131 ((In Chinese))

Zhang XS, Yuan P (2009) Cooperative economy theory and practice of cooperatives in China. Capital University of Economics and Business Press, Beijing

Zhang YY, Ju GW, Zhan JT (2019) Farmers using insurance and cooperatives to manage agricultural risks: a case study of the swine industry in China. J Integr Agri 18:2910–2918 ((In Chinese))

Zheng S, Wang Z, Awokuse TO (2012) Determinants of producers’ participation in agricultural cooperatives: evidence from northern China. Appl Econ Perspect Policy 34(1):167–186

Zhou M, Chin HC (2019) Factors affecting the injury severity of out-of-control single-vehicle crashes in Singapore. Accid Anal Prev 124:104–112

Zhou L, Zhang Y, Dai G et al (2016) Access to microloans for households with forest property collateral in China. Small-Scale Forestry 15(3):291–301

Acknowledgements

The study was financially supported by the Major projects of National Social Science Foundation of China (Title: Research on improving the reform of rural collective forest right system under the background of comprehensively deepening reform / 16ZDA024). We are also grateful to anonymous reviewers for their comments on drafts of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Huang, L., Dai, Y. & Xu, Z. Credit Rationing for Forestry Professional Cooperatives: Evidence from China’s Fujian Province. Small-scale Forestry 21, 119–138 (2022). https://doi.org/10.1007/s11842-021-09490-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11842-021-09490-9