Abstract

This study combines the resource-based view of the firms and region-based view of the strategy (i.e., a 2R-based view) to shed light on the crucial roles of firm-specific resources and region-specific heterogeneity within the context of China, a large emerging economy. The study explains the variations in internationalization levels among service multinational enterprises (MNEs). Based on a large sample analysis of Chinese service MNEs, our findings demonstrate that MNEs with good cost efficiency and few intangible resources exhibit great propensity for international expansion, thereby achieving high internationalization level. Chinese service MNEs located in a coastal region or a region with well-developed institutional environments achieve high internationalization level as well. These findings support a U-shaped relationship between the internationalization of service MNEs and their performance. Our research findings confirm our predictions from the 2R-based view, which provides valuable insight into the regional development and international strategy of MNEs from emerging economies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The international business (IB) environment has witnessed unprecedented changes in recent years, particularly with the increasingly important role played by multinational enterprises (MNEs) from emerging economies (Bello et al. 2016; Luo and Tung 2007; Park and Xiao 2017; Upadhyayula et al. 2017; Yilmaz et al. 2015). According to UNCTAD (2016), outward foreign direct investment (FDI) by these MNEs substantially increased from $68 billion in 2000 to $409 billion in 2015. In particular, China, the largest emerging economy in the world, has continually strengthened its position as one of the leading sources of outward FDI. China’s FDI outflows surpassed its inflows in 2016. Prior IB research mainly focused on the internationalization process or the relationship between internationalization and performance in manufacturing MNEs (Capar and Kotabe 2003; Meyer et al. 2015). Although FDI in the manufacturing sector accounted for only approximately 27% of global FDI stocks in 2014, that of the service sector amounted to 64% (UNCTAD 2016). Importantly, MNEs from emerging economies, especially those from China, have been playing an increasingly important role in leading global FDI outflows in the service sector. UNCTAD (2014, 2016) reported that although the service sector continues to drive global FDI flows, MNEs from emerging economies undergoing internationalization have been actively undertaking outward FDI in service sectors such as finance and real estate. Thus far, little extant research has examined the internationalization behaviors of service MNEs from emerging economies (Park et al. 2012; Stevens et al. 2015). Despite the surge in the outward FDI by MNEs from emerging economies, relatively little is known about what factors determine the extent and nature of service MNEs’ internationalization (Kundu and Lahiri 2015; Stevens et al. 2015) and whether these MNEs can improve their performance through internationalization (Capar and Kotabe 2003).

To the best of our knowledge, only a small number of studies have investigated the issue regarding the export-driven internationalization behaviors of MNEs from emerging economies or the performance implications of such behaviors (e.g., Brouthers and Xu 2002; Brouthers et al. 2005; Buck et al. 2007; Gao et al. 2010; Zhao and Zou 2002). Moreover, only a few studies are in the context of outward FDI, representing a notable gap in internationalization research.

Governments of emerging economies, including China, have been developing FDI-friendly promotion policies in the hope of promoting rapid transformation from a manufacturing-based economic structure to a service-based one. The problem is the limited understanding of what drives the internationalization of MNEs from emerging economies and whether outward FDI-based internationalization can deliver benefits to MNEs’ performance. This issue represents a serious shortcoming as service MNEs, especially those from emerging economies, have been rapidly pursuing internationalization and increasingly playing an important role in various global value chains (Williamson 2013). Thus, IB scholars need to pay much attention to unveiling the internationalization of MNEs from emerging economies because they are becoming a crucial force that drives globalization as an agent of change in the international investment landscape.

A large body of research in the IB strategy literature has been conducted on the determinants of internationalization or performance implications of such an internationalization strategy (Gimeno et al. 2005; Hitt et al. 2006b; Marano et al. 2016). Our review reveals that two conventional dominant research streams have been widely adopted to identify the factors influencing whether and to what extent MNEs from emerging economies should internationalize, that is, the eclectic paradigm (Dunning 1993) and internationalization process model (Johanson and Vahlne 1977). These theories center on how firm-specific advantages (e.g., knowledge, technology, experiential market knowledge, and learning) affect the extent of internationalization and how firms overcome liabilities of foreignness. These two different research streams share a common concept, namely, the firm-level resources and capability known as resource-based view (RBV). The notion of RBV is that heterogeneous firm-specific resources and capabilities lead to competitive advantages, thus explaining the performance differences among competitors (Barney 1991; Penrose 1959; Peteraf 1993; Wernerfelt 1984).

Institution-based thinking has also largely influenced the IB research tradition (e.g., Khanna and Palepu 2000; North 1990; Peng et al. 2008). Although insightful, RBV can be criticized for largely ignoring the local institutional contexts in which MNEs from emerging economies are embedded when attempting to understand their internationalization strategy or the performance implications of such a strategy. In practice, RBV alone may not suffice to explain the drivers of MNEs’ strategic choices or their performance differences from market rivals (Rumelt 1991), particularly for MNEs from emerging economies. In emerging economies, institutions are in a state of flux (Meyer 2004). Product, capital, and labor markets; legal systems; and other institutions are transitioning toward economic liberalization (Hoskisson et al. 2000). Emerging economies are dynamic and therefore undergoing fundamental and drastic regional economic and institutional changes (Peng et al. 2008; Wang et al. 2012). As such, local contexts are more important for IB research on MNEs from large emerging economies with heterogeneous local conditions (Chidlow et al. 2009) than conventional MNEs from advanced economies with relatively homogeneous local contexts. Such regional differences may facilitate or hinder the extent of indigenous firms’ internationalization. Perhaps one of the fundamental features of local contexts in large emerging economies is regional heterogeneity. With regard to the inward FDI toward China, the country should not be considered as a single market but as multiple sub-regional markets segmented by regional economic development and local culture (Lew and Liu 2016; Park and Xiao 2016; Zhang and Felmingham 2002). Each region in China has region-specific advantages and is managed by its own regional institutions (Lew et al. 2017). Thus, from an outward FDI perspective, regional heterogeneity also matters in the context of large emerging economies such as China.

This research attempts to enrich the understanding of whether and how heterogeneity in regional markets within an emerging economy matters in shaping the internationalization of MNEs. As such, we advocate and stress the importance of a region-based view. Specifically, we view regional heterogeneity as all the differences or variations in local conditions across subnational regions in a nation because such heterogeneity may shape firms’ internationalization behaviors differently. One possible result is firms having different heterogeneous strategies for internationalization that influence their performance. In this study, we ask the following research questions: Do firm-specific resources and regional diversity within a home market shape the internationalization strategy of MNEs from emerging economies? To what extent does the internationalization of service MNEs from emerging economies affect their performance?

To fill the research gaps in the literature, we develop an integrative framework by obtaining insights from 2Rs, that is, (1) RBV and (2) region-based view of an IB strategy. Using panel data from 2003 to 2011, this approach allows for both internal firm-specific resources and external regional heterogeneity within China in shaping the internationalization of Chinese MNEs in the service sector.

Our study extends the service MNE literature in three ways. The core of our theoretical contribution lies on the development of an integrative 2R-based view of outward FDI by explaining to what extent do firm-specific resources and regional heterogeneity influence Chinese MNEs’ internationalization. Our study also extends existing internationalization research to the international service setting by underscoring the roles of firm-specific competitive advantages and regional heterogeneity in shaping service MNEs’ internationalization and performance. Finally, prior research that explored the effect of internationalization on firms’ performance produced inconsistent findings (Capar and Kotabe 2003; Hitt et al. 2006b; Xiao et al. 2013) and focused largely on manufacturing MNEs, especially those from advanced triad economies. We find that the U-shaped relationship between internationalization and performance applies to Chinese service MNEs. This research is one of the first attempts to examine the performance implications of Chinese service MNEs’ internationalization at both the theoretical and empirical levels.

2 Theory and Hypothesis Development

In the following sections, we develop two sets of hypotheses that specify the key drivers of internationalization by service MNEs from emerging economies. Our model also defines the effect of internationalization on performance in such service MNEs, which may experience a different pattern from conventional manufacturing MNEs with respect to their performance (Borda et al. 2017). Drawing on the 2R-based view of outward FDI, the conceptual model explains to what extent do firm-specific resources and regional heterogeneity influence Chinese MNEs’ internationalization (see Fig. 1).

2.1 2Rs: RBV and Region-Based View

Internationalization (i.e., the extent of a firm’s international operations) is one of the most critical strategic decisions made by MNEs and a critical part of their growth strategies. What shapes a firm’s internationalization and whether the firm can improve its performance through internationalization are fundamental questions in IB (Buckley 2002; Peng 2004). A relatively underexplored research question is whether the advanced Western economy-centric theoretical lens and empirical evidence on MNEs’ internationalization and performance implications can be generalized to an emerging economy context. This question echoes whether research on internationalization strategies of firms originating from emerging economies requires advanced frameworks or modified theories (Barney and Zhang 2009; Sauvant et al. 2010).

We explore the drivers of the internationalization of MNEs from emerging economies by integrating insights from the RBV and region-based lens. This comprehensive conceptual approach considers internal firm-specific drivers and external local contexts across regions within a market. In our attempt to move beyond a simple path in explaining the internationalization of MNEs from emerging economies, we provide integrative mechanisms that remain largely unknown. This examination is suitable for explaining the internationalization behaviors of MNEs from emerging economies.

RBV has been one of the most influential theoretical perspectives in strategy and IB research. An extensive body of literature has emerged to empirically explore how firm-level resources and capabilities can contribute to explaining firm strategic choices and performance differences (e.g., Kraaijenbrink et al. 2010; Peng 2001; Priem and Butler 2001). A central proposition of RBV is that firms are considered bundles of resources and their strategy and performance are resource-driven (Barney 1991; Wernerfelt 1984). That is, firm-specific resources explain the strategic behaviors and performance differences among firms. Barney (1991) proffered the basic framework of RBV by arguing that not all resources hold the potential to create competitive advantages for a firm. Barney (1991) consequently identified four attributes that a firm’s resources must possess to become a source of competitive advantages, help design and implement a value-creating strategy, and create economic rent more effectively than its rivals. The resources must be valuable, rare, inimitable, and non-substitutable (VRIN), and thus only VRIN resources can result in sustained competitive advantages for the firm (Barney 1991). According to RBV, a firm’s resources include all the assets, capabilities, organizational processes, attributes, information, and knowledge the firm controls that enable and facilitate the development of its core competencies (Barney 1991; Daft 1983). In particular, assets and capabilities are broadly viewed as the two related types of resources necessary for developing a competitive advantage (Zou et al. 2003). Assets are a firm’s accumulated resource endowments (e.g., investments in the efficiency of facilities and systems, and brand equity). Capabilities are a firm’s acquired knowledge and skills organizationally embedded that enable the firm to coordinate its activities and improve the productivity of its assets. RBV emphasizes that firms with unique and distinctive resources can create competitive advantages and superior performance by substantially lowering their costs, offering substantially higher quality products, or providing a wider range of services than their rivals.

Many recent studies on the internationalization of firms have examined the influence of institutionally shaped firm behaviors, such as ownership structure and government involvement, (Khanna and Palepu 2000; Peng et al. 2008) or institutional environmental factors within the host or home market on the outward FDI entry mode choices, locations, or types of MNEs from emerging economies (Bhaumik et al. 2010; Chung et al. 2016; Cui and Jiang 2012; Wang et al. 2012; Xia et al. 2014). Scholars have focused largely on country-level influences. Location-specific institutional factors influence the ability of MNEs to exploit their firm-specific advantages in host countries, thereby affecting their internationalization abilities in these countries differently (e.g., Chan et al. 2008; Meyer et al. 2009). However, the recent study of Arregle et al. (2013) investigated the regional effects on MNEs’ international strategy. Using a sample of Japanese MNEs operating in 45 countries within eight regions, Arregle et al. (2013) determined that the degree of MNEs’ internationalization into a country is influenced by regional institutional environments. Despite Arregle et al.’s (2013) contributions in identifying the regional effects on the degree of MNEs’ internationalization, their study has two limitations. First, with its primary focus on the importance of regionalization in influencing MNEs’ internationalization decisions (i.e., the effects of institutional environments of a geographic region in which a host country is located), the study has not paid much attention to the importance of subnational heterogeneity or institutional environments within the home country. This limitation leaves gaps in the understanding of whether and how subnational regions within the home country matter in MNEs’ internationalization strategy.

Second, Arregle et al. (2013) used a sample of MNEs from Japan, an advanced home country. The findings of their study cannot be generalized to the role of regional effects in influencing the degree of internationalization of MNEs from emerging economies. Recent scholarly work in IB has paid growing attention to the importance of the behaviors and institutional surroundings of MNEs from emerging economies (Luo and Tung 2007; Meyer and Peng 2005; Peng et al. 2008; Wang et al. 2012). However, research on MNEs from emerging economies has largely ignored how within-country regional differences in a home country, specifically a large emerging economy such as China and India, explain the variations in the internationalization level of MNEs. Whether and how the internationalization strategy of MNEs is influenced by heterogeneity and diversity across regions within a home country should be explored in an emerging economy context. We seek to address these limitations theoretically and empirically by developing specific hypotheses on the effects of subnational regions in a large emerging economy on service MNEs’ degree of internationalization.

Previous research favored the strategic importance of regional heterogeneity in creating competitive advantages or explaining firm performance differences (e.g., Chan et al. 2010; Ma et al. 2013). These studies suggested that large regional differences may exist within a country due to the geographical concentration of industrial policies (Porter 1998), differences in natural factor endowments across regions (e.g., market size, human capital, and technology) (Batisse 2002; Fu 2008; Liu and Li 2006; Venables 2005), or cultural and institutional differences across regions (Chan et al. 2010; Ma et al. 2013; Zhang and Felmingham 2002). Within-country economic, political, social, and institutional environments at the subnational level, together with technology employed, may influence the transaction or transformation costs of production, and thus the performance of firms embedded in the local context (Chan et al. 2010; Cooke et al. 1997; Lew et al. 2017; Ma et al. 2013).

Enduring competitive advantages in a global economy lies increasingly in regional factors, such as knowledge, relationships, or motivation that distant rivals cannot match, and is particularly geographically clustered within the country. The reason is that these regional clusters (e.g., Silicon Valley, Hollywood, Yangtze River Delta, and Pearl River Delta) encompass an array of linked industries and other entities important to competition, such as specialized input suppliers and infrastructure providers (Porter 1998). A recent study focused on the importance of regional differences within the host market in explaining foreign subsidiary performance variations (e.g., Chan et al. 2010; Ma et al. 2013). However, these studies overlooked whether other regional aspects–regional differences within the home market–matter for the internationalization of MNEs from emerging economies and how they matter. This study emphasizes the role of regional heterogeneity within the home market side. Regional heterogeneity is one of the most important forces that can influence the internationalization of MNEs from emerging economies. Therefore, whether and how regional heterogeneity within a large emerging economy matters for the internationalization of MNEs from emerging economies is worth investigating on the basis of the ‘2Rs’, that is, resource and region.

2.2 Cost Efficiency, Intangible Assets, and Internationalization

Based on RBV, a firm’s internal resources drive its internationalization strategy, which in turn explains the performance of the firm. In the extant literature on internationalization, a firm’s resources or capabilities that are used include intangible resources (Delgado-Gomez et al. 2004; Mohr and Batsakis 2014; Nachum and Zaheer 2005), human and relational capital, or relational networks (Hitt et al. 2006a; Lew et al. 2013), and R&D intensity (Delios and Beamish 1999; Fiegenbaum et al. 1997). These prior studies demonstrated that firms with considerable resource endowment are likely to expand internationally. Drawing from the RBV, we argue that a MNE from emerging economies will be inclined to engage in internationalization if it can exploit an idiosyncratic pool of intangible resources and capabilities in the international market. Our study assesses two types of intangible resources and capabilities (i.e., cost efficiency and intangible resource) as the key drivers of internationalization for service MNEs originating from emerging economies. For a firm to compete successfully, it can offer services at a relatively lower price through cost minimization or differentiate the services to make them more attractive than those of its competitors by exploiting proprietary intangible resources. Examples of these resources are advanced technologies, brands, and managerial know-how.

Emerging-economy firms usually lack advanced resources and knowledge and over-rely on low factor costs, which may push them to focus on developing low-cost products or services when going abroad. Brouthers et al. (2000) suggested that the formulation of MNEs’ product strategies is predicted by the differences in home-country competitive advantages, such as historical factor costs, corporate climates, competitive structures, and demand conditions. In the context of China, cost efficiency and intangible resources represent important indicators of cost leadership and differentiation approaches, respectively. Brouthers and Xu (2002) determined that approximately two-thirds of Chinese exporting firms pursue low price leadership, whereas the others employ a branding approach. Brouthers et al. (2005) further revealed that when exporting to foreign markets, 48% and 29% of Chinese firms pursue cost leadership and differentiation, respectively. We expect that the likelihood of expanding internationally for emerging-economy service firms will be high when they have good cost efficiency or a high level of intangible resources.

Hypothesis 1a: Ceteris paribus, Chinese service MNEs with good cost efficiency are likely to have high internationalization level.

Hypothesis 1b: Ceteris paribus, Chinese service MNEs with high levels of intangible assets are likely to have high internationalization level.

2.3 Regional Heterogeneity and Internationalization

China has witnessed enormous economic and institutional changes across regions. The most important event of which is the reform and open-door policy (改革开放), was implemented in 1978 by the Chinese government. The reform policy refers to the internal economic structural reform and, in particular, the transformation of China’s non-market-oriented state-owned sector toward a market-based one. Opening-up refers to the opening of China’s market to foreign investors. The open-door policy aims to modernize industries and boost the economy by allowing foreign investors to start businesses in China and inviting inward FDI. China implemented a relatively cautious experimentation strategy and adopted an incremental path by ‘touching the stones to cross the river’ to find a road to reform and opening-up specific to China’s situation and reach sufficient critical mass to sustain reform and opening-up momentum. The economic transition and institutional changes, together with China’s historical, social, and cultural diversity, likely leads to a large regional variation within the country. For example, the Chinese government has incrementally opened the market to foreign investors and allowed regions to experiment with new and flexible policies, such as the initial establishment of special economic zones (SEZs) and subsequent expansion of open areas to other coastal regions. The speed and extent of the opening-up of China’s market have obviously varied across regions. SEZs and open regions allow foreign firms to enjoy market-oriented and flexible economic policies and offer various benefits to foreign investors, including those related to trade, quotas, labor regulations, tax exemptions, and duty-free importation of raw materials and technologies (Park et al. 2006; Zhu and Tan 2000). Given their favorable locations, better infrastructures, and favored policies, SEZs and coastal regions have been the largest recipients of inward FDI in China and ‘windows’ in developing the market-based economy and absorbing advanced technologies, knowledge, and managerial know-hows. These factors are necessary for Chinese firms to narrow their experience and competence gap with their powerful global rivals. The National Bureau of Statistics (NBS) reported that coastal regions account for at least 80% of the total inward FDI in China, and the inward FDI in manufacturing and services in China is highly concentrated in major coastal regions or metropolitan cities, such as Jiangsu, Zhejiang, Shanghai, and Guangdong. Gu and Lu (2011) suggested that inward investment can serve as an important impetus to outward investment by generating a positive spillover effect. Specifically, inward investments in a home country can serve as a critical learning path for local firms and thus should be weighted as an important determinant for the internationalization of firms (Gu and Lu 2011). We expect that the regional heterogeneity of opening-up in China may lead to substantial variations in the levels of spillover effects, thereby creating various ranges of learning opportunities. Moreover, it may shape different internationalization levels among Chinese service firms.

Furthermore, large differences may be observed in factor endowments and agglomeration across regions within China (Chang and Park 2005; Ma et al. 2013). Importantly, as China followed a gradual approach to reform and opening up for transforming its economy into a market-oriented one, regions in the country are heterogeneous in terms of their marketization and institutional environment changes (Fan et al. 2011; Ma et al. 2013; Walder 1995). Such changes may explain the variations in the internationalization levels among these firms. For example, local governments in coastal regions may tend to intervene less in the internationalization of firms because a market-based economy is liberalized and advanced in these regions. Moreover, regions with well-developed institutional environment may promote the internationalization of firms by supporting the effective functioning of market mechanism and facilitating market transactions of firms differently (Lu et al. 2009; Meyer et al. 2009). Therefore, firms located in a region with advanced and established institutions, such as a SEZ, Shanghai, and Guangzhou, can substantially lower the cost of searching for the information needed for internationalization due to the reduced information asymmetries in the region. Such regional market-oriented institutions may also help firms reduce their agency costs and encourage their managers to pursue a market-oriented growth strategy, such as internationalization. By contrast, regions with a low level of institutional development, such as dysfunctional financial markets or market-based rules (e.g., legal framework and financial regulations), may create difficulties for firms to secure proper financial capital needed for internationalization or make them less willing to go international for further growth. In this study, we propose that service firms in a region with advanced and well-developed institutional environments are more likely to engage in internationalization for growth than those in a region with only slightly developed institutional environments.

Hypothesis 2a: Ceteris paribus, Chinese service MNEs in coastal regions are more likely to have higher internationalization level than those in inland or rural regions.

Hypothesis 2b: Ceteris paribus, Chinese service MNEs in regions with well-developed institutional environment are more likely to have high internationalization level than those in regions with poorly or less developed institutional environment.

2.4 Performance of Service MNEs from Emerging Economies

The relationship between the internationalization of firms and their performance has been the central focus of IB strategy research (Gomes and Ramaswamy 1999; Hitt et al. 1997; Xiao et al. 2013). Although numerous studies have examined the effect of the internationalization of firms on their performance, a literature review shows that the proposed theoretical models and empirical findings generated by this research stream are inconclusive and contradictory (Capar and Kotabe 2003; Hitt et al. 2006a; Xiao et al. 2013). The results of recent studies are even inconclusive regarding the internationalization–performance relationship. Some studies reconcile theoretical arguments and confirm the existence of an S-shaped relationship between the internationalization of firms and their performance (e.g., Contractor et al. 2003; Lu and Beamish 2004; Xiao et al. 2013). However, other recent studies have found no evidence of an S-shaped relationship between the internationalization of firms and their performance. For example, Berry and Kaul’s (2016) study on US MNEs suggests no evidence of an S-shaped relationship between the internationalization of firms and their performance. Nevertheless, a stage approach to internationalization in general provides a good foundation for investigating the relationship between internationalization and performance (e.g., Contractor 2007; Contractor et al. 2003; Hennart 2007). The stage approach fundamentally assumes positive and negative MNE performance outcomes according to the degree of internationalization.

Despite the repeated calls for further research on the performance implications of the internationalization of service MNEs from emerging economies, the number of such studies is limited (Hitt et al. 2006b; Ozdemir and Upneja 2016; Xiao et al. 2013). With the increasing international expansion of MNEs from emerging economies particularly in service industries during recent years, whether the existing results on the internationalization-performance relationship can be generalized to MNEs from emerging economies or service industries remains unanswered (Hitt et al. 2006b; Xiao et al. 2013). Thus, we must examine the effect of internationalization on the performance of service MNEs from emerging economies that may experience a different pattern from conventional manufacturing MNEs with respect to their performance.

The proposition that manufacturing MNEs can improve their performance through internationalization in terms of asset/knowledge transfer and exploitation of firm-specific advantages has been widely accepted (Dunning 1993; Hymer 1976). However, this logic may not be fully applicable to service MNEs because their internationalization patterns may not always be akin to those of manufacturers (e.g., exploiting resources and lowering production costs). Capar and Kotabe (2003) summarized the key characteristics of service firms as follows: (1) service firms are likely to experience great initial costs because they may face initial internationalization barriers or legal and policy restrictions, such as a strict control over the extent of FDI, ownership restrictions, domestic preference policies, and unbalanced employment rules in service industries; (2) service firms are likely to experience great initial costs for localization owing to the large cultural and linguistic distance; (3) the inseparability between production and consumption in many service industries causes these firms to incur considerably higher investments than manufacturing firms, which are likely to increase the initial costs of internationalization and reduce their performance. With these characteristics, service firms may experience high initial expenditures associated with their early internationalization activities fundamentally rooted in institutional and cultural differences between their home and host countries. The costs of internationalizing can include initial international adaptation activities in top of premarketing, legal, training, and service localization costs.

Furthermore, services tend to be more intangible and less storable and transportable than goods. The core characteristics of intangibility and inseparability of production and consumption in service industries fundamentally distinguish service firms from manufacturers (Berthon et al. 1999; Carman and Langeard 1980; Goerzen and Makino 2007). The intangibility and inseparability between production and consumption make the firm-specific advantages of service firms relatively more location bound than those of manufacturing firms (Rugman and Verbeke 2003) and consequently may limit the international transferability of such advantages. Such features may make the initial investments of internationalizing service firms host-market specific and locally embedded and thus represent disincentives to improve performance. We expect that the relationship between internationalization and performance likely differs between service and manufacturing MNEs such that the former is more likely to experience declining performance during initial attempts at internationalization.

Previous studies (Aulakh et al. 2000; Boehe 2016; Brouthers et al. 2005; Zou and Ghauri 2010) suggested that MNEs from emerging economies are more likely to suffer from the disadvantages and liability of emergingness in their internationalization efforts than those from advanced economies. Examples of these disadvantages are lack of international experience, managerial and technological resources or capabilities, established brands, customer relationships, and other kinds of newcomer disadvantages (Aulakh et al. 2000; Boehe 2016; Brouthers et al. 2005; Zou and Ghauri 2010). Owing to such initial liabilities and newness of service MNEs from emerging economies, their initial internationalization efforts may reflect a negative relationship between internationalization and performance at inception.

Nevertheless, gradual commitment to foreign markets allows service firms to gain economic rents through economies of scale or scope (Capar and Kotabe 2003; Contractor et al. 2003), experiential learning (Hellman 1996), and increased brand power across international markets. On the basis of organizational learning perspective, the increasing international expansion may allow service MNEs from emerging economies to tap into knowledge clusters and acquire the necessary knowledge and skills applicable to developing competitive advantages through worldwide learning (Contractor et al. 2003; Xiao et al. 2013). With increased international expansion, service MNEs from emerging economies may also be capable of leveraging national differences and take advantage of market opportunities between countries (Capar and Kotabe 2003; Contractor et al. 2003). As a result, the increasing international expansion can help service MNEs from emerging economies develop and enhance their knowledge base, capabilities, and competitive advantages through incremental worldwide learning. The benefits of increased internationalization are likely to exceed the costs. The location-bound nature of the service business can cause service MNEs to take a relatively long period to explore new location-bound firm-specific advantages and reap benefits from the international markets while exploiting their homegrown transferable non-location-bound firm-specific advantages. Drawing on such a long-term view of internationalization benefits in the service industry, we expect that the need for additional investment is reduced with increased internationalization, and service MNEs from emerging economies are thus likely to enjoy improved performance by utilizing economies of scope and scale as well as specialized learning in certain markets over time.

Hypothesis 3: The internationalization of firms and their performance have a U-shaped relationship for Chinese service MNEs, with their performance declining to a certain point, beyond which high internationalization level will increase their performance.

3 Method

3.1 Research Setting

The empirical context of service firms in China provides an ideal setting for our research. China liberalized its economy for trade and investment in the late 1970s and is playing an increasingly important role in the global economy. The country has risen to become the second largest economy in the world after the USA and the largest contributor to the world growth since the global financial crisis of 2008. Many Chinese firms faced increasing international competitive pressure in the domestic market due to the market liberalization policy of the Chinese government, forcing them to accelerate their internationalization. According to the NBS of China, Chinese outward FDI rose by approximately 34.7% to $196 billion in 2016, making it the second largest investor worldwide after the USA. Zooming in on recent Chinese FDI outflows, Chinese MNEs increasingly diversify their FDI portfolios away from manufacturing industries to services. The outward FDI by Chinese service firms further surged after China’s entry into the World Trade Organization (WTO) at the end of 2001. With its WTO entry, China further liberalized the service sector and incrementally opened most of its service industries (e.g., retail/wholesale, banking, financial service, insurance, and telecommunications) to foreign investors. According to the data issued by the NBS, the outward FDI by service firms accounted for more than 70% of the total Chinese outward FDI in 2016, indicating the active engagement of these firms in exploiting global business opportunities and shaping the global economic landscape.

Moreover, regional heterogeneity and diversity exhibits substantial variation across regions in China, due to its ongoing and incremental market liberalization and economic transformation. This observation provides an ideal setting to examine regional effects among service firms, because it comprises vast regional markets, and economic opening-up and institutional reforms have created large economic and institutional differences across regions. Regarding the reform and opening-up policy, China adopted an incremental and experimental strategy over the last 40 years. For example, the economic structural reforms began in the countryside with the historic household land-contracting system in Xiaogang Village in south China’s Anhui Province. Structural economic reforms were also implemented in the cities to transform industrial and commercial firms by allowing more autonomy for firms and local governments in decision making to increase economic efficiency (Boisot and Child 1996; Li et al. 2000; Park et al. 2006; Xiao et al. 2013). Chinese internal economic structural reforms have gone through four stages thus far, namely, initial (startup) stage, implementation stage, construction of the framework of a socialist market economy, and full implementation of the socialist market economy. Prior to the opening-up of its entire economy to foreign firms, the Chinese government initially established four SEZs in the southeastern coastal areas in 1980 to attract FDI–Shenzhen, Zhuhai, Shantou, and Xiamen. Following the success of the initial opening-up, the Chinese government further expanded its open regions from the four SEZs to an additional group of 14 coastal cities in 1984, including Guangzhou, Shanghai, and Tianjin, and later Hainan Island. Since 1985, the Chinese government has expanded the open coastal regions, extending the open economic zones (e.g., Yangtze River Delta, Pearl River Delta, Xiamen-Zhangzhou-Quanzhou Triangle in the south coastal areas, Shandong Peninsula) to an open coastal belt. In 1990, the government decided to open the Pudong New Zone in Shanghai to overseas investment and opened more cities in the Yangtze River valley. Following these regional development efforts, each region/megacity experienced dynamic and diversified economic development (Mckinsey and Company 2011). As a result, these regions in China have become heterogeneous in terms of their marketization and institutional environment changes (Fan et al. 2011; Ma et al. 2013; Walder 1995). The different types of institutional development across regions are expected to significantly affect the variations in the internationalization levels among local firms. China consists of large geographic, economic, social, and institutional environmental diversity across its subnational regions, thus providing a valuable research setting to enhance the understanding of whether and how regional heterogeneity matters in shaping the internationalization of MNEs from emerging economies.

3.2 Sample and Data

We tested our hypotheses based on a sample of all types of Chinese service firms during the period of 2003–2011 that were publicly listed on the two stock exchanges in China–the Shanghai or Shenzhen Stock Exchanges. We chose 2003 as the starting year for two reasons. First, the annual financial reports for years earlier than 2003 provide less detailed information on the internationalization of firms. Second, the Chinese government initiated its ‘going-out’ policy at the beginning of the 2000s to promote Chinese outward FDI by introducing several schemes to assist Chinese firms in developing a global strategy to exploit more opportunities in the global markets.

We focused on internationalizing service MNEs and thus excluded firms in the manufacturing sector. After merging the data and eliminating firms with missing values, an unbalanced panel consisting of more than 2700 firm-year observations was assembled for analysis. We collected all information from the annual reports of listed firms for 2003–2011 except for the measurement of regional institutional indices.

In addition, to respond to the repeated calls for the use of multiple methods among IB researchers as an advantageous approach to overcome the weakness of a single-method process in drawing robust results, we conducted additional in-depth interviews (Hurmerinta-Peltomäki and Nummela 2006). We engaged in eight semi-structured, in-depth interviews with senior managers of service firms in China. The purpose of the interviews is to increase the validity of the research and enhance the understanding of the phenomena. We gained further insights into the topic, and the insights yielded during these interviews helped in interpreting our findings.

3.3 Main Variables

We used return on assets (ROA) as the measure of a firm’s performance. Following previous studies (e.g., Chang et al. 2013), we employed operating return on assets (operating ROA) to address the concern that ROA may be sensitive to financial leverage or non-operating income. Operating ROA is defined as operating income divided by the total assets. The results obtained using operating ROA are similar to those obtained using ROA, so we reported the results only for ROA.

We define internationalization as the extent of a firm’s international operations, and this measure captures the degree of the firm’s international involvement. No agreement or standard approach is found for the measurement of internationalization. We measured the degree of internationalization as the ratio of foreign sales to total sales (FSTS), which has been widely used in prior research (Capar and Kotabe 2003; Geringer et al. 1989).

We define cost efficiency as the ratio of the cost of service to total sales (c.f. Berman et al. 1999; Gao et al. 2010; Nair and Filer 2003). Thus, a small value indicates that the firm has a good operating efficiency. Consistent with previous studies (e.g., Chang et al. 2013), we used intangible asset ratio, the value of intangible assets divided by the total assets, to measure the importance of a firm’s intangible assets in shaping its internationalization.

To measure the importance of regional effects in explaining the variations in internationalization among firms, we used two approaches—regional dummies and regional institutional development—to capture regional heterogeneity. A region in China is normally defined as a province (e.g., Shandong), an autonomous region (e.g., Inner Mongolia), or a municipality directly under the central government (e.g., Beijing). According to the NBS, the top sources of Chinese outward FDI were eastern coastal regions, such as Beijing, Tianjin, Shanghai, and Guangdong, which accounted for more than 80% of the total Chinese outward FDI. In particular, Shanghai, Guangdong, Tianjin, and Beijing were the top four sources of Chinese outward FDI in 2016. Therefore, to capture the location effects, four dummy variables were used for Guangdong, Shanghai, Beijing, and Tianjin, and the east coast regions, with other northern, central, and western inland provinces, municipalities, and autonomous regions as the baseline.

In addition, we measured the regional effect using the time-variant marketization index of Chinese regions published by the National Economic Research Institute (NERI) of China to capture the variations in regional institutional development across regions (Fan et al. 2011). This index was used in prior IB research to measure the institutional development of market-oriented rules and supporting institutions at the regional level in China (e.g., Gao et al. 2010; Shi et al. 2012; Xiao and Park 2018). The NERI marketization index captures the institutional development in the 31 provinces, autonomous regions, or municipalities of China. The overall institutional development index includes five dimensions used to assess institutions in different fields: government-market relationship, non-state sector, product markets, factor markets, and market intermediaries, and legal environment. Each indicator is valued by a score between 0 and 10. A high score shows a high level of institutional development.

3.4 Control Variables

To predict firm performance, we controlled for firm size, firm age, firm leverage, ownership structure, and industry and year dummies. We measured firm size using the logarithm of the number of employees to control the potential effect of economy scale differences (Contractor et al. 2003; Hitt et al. 1997; Lu and Beamish 2004). We operationalized firm age as the number of years the firm has been in operation to control for the effect of organizational life cycle (Kim et al. 2010). We measured leverage as the ratio of total debt to total assets (Chang et al. 2013). We defined fixed assets as the value of fixed assets divided by that of total assets to control for a firm’s capital intensity. We also controlled for the ownership structure using the degree of state ownership and the degree of foreign ownership in a given firm and measured the degrees of state and foreign ownership as the respective share of stated-owned and foreign capitals in the total capital of the firm. In addition, we controlled for industry and time effects using a set of two-digit industry and year dummies.

Finally, to minimize possible endogeneity problem and take into account the lag between its drivers and the internationalization strategy, as well as between internationalization and performance gains, all time-variant independent and control variables were included in the estimations with a lag of one year. To further address the endogeneity issue, we controlled for previous ROA, which may influence the current year’s internationalization level.

4 Results

Table 1 shows the descriptive statistics and correlation matrices of the variables used in this study. To check whether multicollinearity is a potential problem when examining the relationship between internationalization and firm performance, variance inflation factor (VIF) tests were conducted, and the results do not indicate multicollinearity as a serious concern. Nonetheless, following Aiken and West’s (1991) suggestion for analyzing interaction effects, the mean-centered internationalization variable was used in creating the squared term of internationalization to minimize the potential for multicollinearity.

This study used firm-level panel data for hypothesis testing. Tobit models were used to estimate the degree of internationalization because the dependent variable (i.e., internationalization) was censored to an interval of 0–100%. The ordinary least squares method may not be appropriate because unobserved firm-level heterogeneity may be correlated with independent variables. Thus, with respect to the examination of the performance implications of service firm internationalization, we used the generalized least squares model to test the hypotheses (Wooldridge 2002). An unbalanced panel data set of internationalizing service firms in China was used to test the hypotheses. The panel data approach required a choice between fixed and random effects models. As a result, the Hausman test was conducted. The results fail to reject the assumption of random-effects models where the estimated panel errors (or unobserved individual effects) are not correlated with the independent variables in the model; hence, we used random-effects models for the analyses (Wooldridge 2002).Footnote 1

Table 2 summarizes the results of the Tobit models used for the estimation of the degree of internationalization. We tested the effects of control variables in Model (1), firm-specific cost efficiency and intangible assets ratio in Model (2), regional institutional environment in Model (3), and four regional dummies in Model (4). As shown in Model (2), cost efficiency has a negative effect on the degree of internationalization. A low value of the production cost ratio indicates a good operating efficiency. Thus, firms with improved cost efficiencies are likely to undertake internationalization and have a high internationalization level. Hence, hypothesis 1a is supported.

Moreover, our interviews with managers in internationalizing service firms confirmed these insights. We asked the managers participating in our in-depth interviews on how they can expand abroad without superior knowledge-based resources and capabilities. Two managers noted that, when internationalizing, their weak organizational knowledge bases make their successful competition with other service firms in international markets difficult. Thus, they tend to differentiate themselves from international competitors by focusing on their low-cost advantages and offering services at a low price that is attractive to local customers.

As shown in Model (2), the intangible asset ratio has a negative effect on the extent of internationalization. The results suggest that firms with more intangible resources are less likely to undertake internationalization and therefore have a lower internationalization level. Thus, hypothesis 1b is unsupported. One possible explanation for this finding is that firms with more intangible assets may find the search for additional intangible resources through international expansion unnecessary. Previous studies suggested that many Chinese firms, as latecomers, may be motivated to seek strategic assets, such as superior technology, knowledge, and management know-how, by going abroad to overcome their inherent ownership disadvantages (Awate et al. 2016; Boehe 2016; Li 2007; Luo and Tung 2007). A service firm manager that we interviewed commented,

“For us, international markets can be considered as valuable learning laboratories and channels to gain access to diverse and critical new informational and knowledge resources. We aim to overcome our latecomer disadvantages through international expansion and learn from our international competitors.”

We tested this possibility by distinguishing between capital-intensive and knowledge-based service firms, which are more driven by intangible assets. The results confirm the differences in the degree of internationalization between knowledge-based and capital-intensive service firms, such that knowledge-based firms, for example, those involved in diversified financial services, are more likely to go abroad and have an overall higher internationalization level than capital-intensive service firms.Footnote 2

Models (3) and (4), regional institutional development and regional dummies, with the exception of the dummy variable for Beijing and Tianjin, have a significant and positive effect on the degree of internationalization. Therefore, hypothesis 2a is supported. However, as shown in Model (4), the regional dummy variable of Beijing and Tianjin is not significantly associated with the degree of internationalization. Thus, hypothesis 2b is only partially supported. Our interviews also indicate that regional heterogeneity within Chinese home market plays an important role in influencing the internationalization decisions of service firms in China. An executive that we interviewed observed.

“We usually pay close attention to the specific regional context where our firm is embedded in the home country because some regions within China provide more advanced institutional environments and subnational advantages than others to encourage, support, and facilitate our internationalization strategies.”

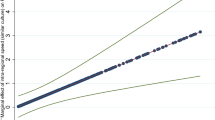

We reported the results of estimation on the effect of internationalization on firm performance in Table 3. We first showed the control variables from Model (1) and then included a linear term for internationalization and its square term in Models (2) and (3), respectively, to test the U-shaped hypothesis for the internationalization-performance relationship of service firms. As shown in Model (3) of Table 3, after controlling for the control variables, a test of the joint significance of the linear and squared terms of internationalization indicates that the internationalization variables are significant. Firm performance is negatively related to the linear term of internationalization and positively related to its squared term, indicating that a U-shaped relationship exists between internationalization and performance for service MNEs originating from China. These findings suggest that when Chinese service MNEs decide to expand internationally, they are likely to experience a performance downturn at low internationalization levels but increasing performance levels at high internationalization levels. This result provides strong support for hypothesis 3.Footnote 3 Our interviews also confirm our claim that international expansion reduces performance up to a certain point and then improves at high internationalization levels. The service firm managers we interviewed expressed their identical opinion.

“We usually experience performance decreases and suffer from weak or even absent competitive advantages when pursuing initial overseas expansion. In the meantime, we found that, increased international presence can largely improve our firm performance and quality of services. We believe that having an increased international presence offers us a valuable world-wide learning opportunity to improve and upgrade our competitive advantages.”

Not all service sectors are homogeneous and substantial differences may exist among different types of service sectors in terms of capital intensity and knowledge intensity (c.f. Contractor et al. 2003; Zhang et al. 2015). Such differences may produce slightly diverse results in terms of the effects of firm-specific resources and region-specific heterogeneity on the internationalization of Chinese service MNEs as well as the link between their performance and internationalization. As a robustness check, we tested the models by segmenting the sample into knowledge-based (e.g., financial services, legal services, and advertising) and capital-intensive service sectors (e.g., retail and wholesale trade, transportation, and construction) and checked the different effects of knowledge-based and capital-intensive service sectors as two separate groups, although this is beyond our research objectives. The results are generally robust across the two subsamples, confirming our 2R-based theorization.Footnote 4

5 Discussion and Conclusion

The global economy has witnessed a broad spectrum of service MNEs from emerging economies (UNCTAD 2016) actively engaging in internationalization as a strategic tool for their growth. Therefore, understanding the underlying forces that drive the internationalization of these MNEs and how their performance differs from that of conventional MNEs requires urgent scholarly attention. However, the literature on this prominent issue remains limited, especially in the service sector. Relatively little is known about the contributions of the internationalization of service firms from emerging economies and whether these service firms should continue to expedite their international journey. The objective of this study is to conceptualize and validate the proposed model, which includes the factors driving the internationalization of Chinse service MNEs and the performance implications of the internationalization strategy, by supplementing qualitative interview data with archival data.

5.1 Theoretical Implications

The prominence of the internationalization phenomenon of firms has captured the interest of researchers in strategic management and IB. However, the focus of prior research was limited to conventional manufacturing-based MNEs originating from advanced economies. Despite the rapid growth of outward FDI in the international service sector, which offers the greatest opportunities for firms in developing their global business, little theoretical or empirical research has been conducted on the strategic management and IB literature on exploring the factors that drive the internationalization of service firms. Therefore, little knowledge is available on whether and how firm-specific advantages or regional heterogeneity within the home market determine the extent of internationalization of service firms and how the performance of service firms will change within an observed range of internationalization in advanced economies in general and emerging economy contexts in particular. This argument may raise questions on the generalizability and applicability of previous conventional manufacturing MNE-based findings to service-based firms, especially to those service firms originating from emerging economies. Therefore, this study contributes to the internationalization literature by extending this stream of research to the international service setting and specifically underscoring the roles of firm-specific competitive advantages and regional heterogeneity in shaping the internationalization of service-based MNEs in the emerging market context of China.

To address the recurring under researched questions for service firms, we took the road less travelled by proposing a 2R-based view to theorize and move a step further by empirically testing its appropriateness in explaining the underlying drivers of internationalization for service firms in large emerging economies. This research considered a resource and regional perspective in the investigation of the internal and external factors driving the internationalization of service MNEs from emerging economies. Thus, it demonstrated that regional disparity is one of the important determinants of the internationalization and performance of MNEs. In sum, resource-based (internal) and regional institutional factors (external) significantly influence the internationalization of service MNEs from emerging economies. On the basis of the data of Chinese service MNEs from 2003 to 2011, this research tested the effects of resource- and region-based factors on the degree of internationalization, as well as the performance implications. We found partial evidence of resource and region effects on the extent of internationalization of Chinese service MNEs. We used firm-specific resources and regional heterogeneity in the conceptual framework to explain the variations in the degree of internationalization among the sample firms. However, our results reveal that only the cost leadership-based competencies that Chinese service MNEs control positively determine their degree of internationalization. By contrast, the differentiation-based intangible resources of the sample firms tend to be negatively associated with their degree of internationalization. Such seemingly contradictory findings are largely consistent with the dominant springboard view on the international expansion of MNEs from emerging economies (Luo and Tung 2007; Ramamurti 2012). The springboard perspective suggests that MNEs from emerging economies usually “use outward investments as a springboard to acquire strategic assets needed to compete more effectively against global rivals and to avoid the institutional and market constraints they face at home” (Luo and Tung 2007, p. 482).

In addition, this study extends the extant research on internationalization by proposing a region-based view and demonstrating the importance of regional effects in shaping the internationalization level among Chinese service firms. For instance, our results show that firms in coastal regions with advanced institutions are more likely to go abroad. These findings are consistent with the core argument in regional studies on economic geography (Beugelsdijk et al. 2010; Boschma and Iammarino 2009; Lew and Liu 2016), where regional local context within an economy may significantly shape the behaviors of indigenous economic actors. IB strategy researchers have generally assumed that regional contexts within the home country, such as institutional environments, are homogeneous across various regions in advanced economies. However, this assumption may not hold in large emerging economies, such as China, India, and Brazil, which consist of a large number of subnational regions with large variations in the economic and institutional environments within the home country. In this study, the idea of highlighting the value and importance of regional effects in predicting the strategic outward FDI and performance of MNEs from emerging economies may help in advancing existing knowledge about the important drivers of the internationalization strategy of latecomers in global value chains.

The results of this study, which stress the importance of regional effects, are also broadly in line with institutional thinking in IB, but we further zoomed in a nation that takes a rather narrow perspective (i.e., a region-based view). In the context of a large and diverse emerging economy, the treatment of institutions as background was rather insufficient to deepen the understanding on strategic behavior and firm performance. Thus, IB researchers can greatly benefit by making use of narrower context-based regional/provincial-level institutional environments (cf. Peng et al. 2008).

Generally, the results of this study contribute to the enhanced understanding of the special characteristics of service MNEs from emerging economies with regard to their strategic behavior in terms of internationalization. The findings enable the showcasing of benefits of an integrative approach involving a 2R-based view, capturing the internal resources and external regional heterogeneity of firms within a large emerging economy, which can help enhance the motivation of home country MNEs to go abroad or inspire these firms to take large steps toward internationalization. Hence, this study enriches the understanding of how firm-specific resources and regional differences within an emerging economy explain why and how their MNEs go abroad.

Importantly, our findings enrich the IB literature by providing one of the first attempts to theoretically and empirically examine the performance implications of internationalization in service-based MNEs, especially those originating from emerging economies. While numerous studies have examined the performance implications of internationalization, these efforts have provided conflicting results (Capar and Kotabe 2003; Hitt et al. 2006b; Xiao et al. 2013). The stream of research that explored the effect of internationalization on firm performance was largely limited to samples of manufacturing firms, especially those from advanced triad economies. Thus, the impact of internationalization on the performance of service firms is relatively under-researched. This argument raises the questions of whether service-based MNEs can benefit from internationalization and whether the relationship between internationalization and performance is different for service firms than it is for manufacturing firms, especially for those originating from large emerging economies.

Our study thus fills the gap in the prior literature on the relationship between internationalization and firm performance, which is largely limited to manufacturing firms, by extending this stream of research to service firms in an emerging economy context. We gained new insights in terms of the role of internationalization in explaining performance variations of service MNEs from emerging economies. Our findings indicate that firms originating from emerging economies generally reflect a U-shaped relationship between internationalization and performance, such that they usually face more initial costs than benefits when they begin internationalization, due to the industry- or business-specific characteristics of the service industries and the liability of emergence and newness of such MNEs. Reaping the rewards from overseas investment may take time. Thus, gaining the benefits of increased internationalization is rather gradual at a later state of internationalization than that at inception when the benefits of increased internationalization exceed the initial costs. Thus, our study provides the valuable addition of the MNE literature on the internationalization-performance relationship (e.g., Contractor 2007; Hennart 2007).

5.2 Implications for Practitioners and Policymakers

Our findings may have important implications for practitioners and policymakers in emerging economies. First, the results of this study demonstrate to managers that cost efficiency serves as a major resource determining the internationalization level of MNEs from emerging economies by helping these firms exploit labor and nature resource-based cost leadership competences. However, as suggested by previous studies (e.g., Brouthers and Xu 2002), low-price strategy, which is the most prevalent competitive approach used by Chinese firms in international markets, generally undermines their performance, because profits tend to be small under extremely fierce price-based competition. We suggest that emerging economy firm managers should be committed more to making use of internationalization as an effective approach to outsourcing advanced strategic assets, especially from advanced economies.

Second, managers in emerging economy firms should note that the negative effect of intangible resources on the degree of internationalization does not necessarily suggest that developing firm-specific intangible resources is less important for internationalizing Chinese service MNEs. These resources may be important to help them easily learn and absorb advanced technological skills and knowledge from international markets through internationalization, thereby gaining better access to global knowledge pools and strengthening their networks and learning capabilities.

Third, our findings help managers of service firms in emerging economies to understand the opportunities and risks when going abroad and show that mangers of internationalizing service MNEs from emerging economies like China should be aware of the danger of going abroad and avoid “aimless” internationalization. They should also be patient and confident enough to reap the benefits of internationalization, as they may possibly face substantial liabilities of foreignness in their initial internationalization process. Our results imply that Chinese service MNEs are able to utilize internationalization benefits to compensate for the lack of advanced technology, knowledge, and management know-how.

Finally, our study holds further critical implications for home-country central and region-level policymakers. The results demonstrate that regional heterogeneity within the home country explains the different internationalization levels across service MNEs from emerging economies. Therefore, policymakers in emerging economies, such as China, should recognize the importance of further enhancing market-oriented regional market institutional reform and development in encouraging internationalization of local firms. In particular, our findings suggest that in regions with inward FDI-friendly policies, emerging economy service firms are more likely to be able to go international. Thus, regional policymakers may need to understand the importance of region-level FDI policies in facilitating outward FDI by emerging economy firms and thus should consider the region-level FDI policies and firm internationalization simultaneously. In addition, we suggest governments of emerging economies, including the Chinese government, to reconsider their existing regional development strategy and whether they should continue to allow a group of particular regions to be concentrated in terms of the so-called preferential policies when encouraging the internationalization of local firms. The direction and scope of government policy change will eventually influence the internationalization of emerging economy firms by shaping the overall economic and institutional environments of the subnational regions of a country in which local firms are highly embedded. Thus, policymakers in the large emerging economies, such as China, should develop fine-grained policies targeted at further minimizing regional disparity and emphasizing balanced regional economic reform, opening-up, and growth instead of focusing on the generation of rapid economic development. For example, the significant attention devoted by the Chinese government in developing central and western China is a move in the right direction. Region-level policies may also need to be fine grained in terms of the regions and service industries. Consequently, additional support and incentives should be offered, given the regional heterogeneity in institutional environment across regions and, in particular, between coastal and inland regions.

5.3 Limitations and Future Research

This study has several limitations that provide opportunities for future research. First, this study was limited to Chinese firms and a single dimension of the emerging economy home context, that is, regional heterogeneity. While we believe that our 2R-based view can be applicable to a number of other large emerging economies, such as BRICS, China may represent an exceptional case in terms of firm-specific characteristics or regional heterogeneity. We thus call for more research into how firm-specific and region-specific heterogeneity affects individually or jointly the strategy of service firms originating from other emerging economies. A comparative study among emerging economies is an interesting avenue for future research. Second, the measure of the degree of internationalization used in this study was based on a single indicator only, namely, the ratio of FSTS, owing to data unavailability. Future research can use multiple or different measures to capture the degree of internationalization. Third, this study used only two measures of firm resources in this article. Future researchers should employ diverse resource measures and examine the differences in the roles and impacts of various resources related to the internationalization of service MNEs. Fourth, this study examined effects at the regional (i.e., province) level, yet regional effects might matter at other levels. Future research should examine some broad clusters within an emerging economy, such as the Yangtze and Pearl River Delta, and how these broad clusters affect firm strategic behaviors. In addition, this study only explored the home–country effect rather than the host–country aspect and thus may capture only one aspect of regional heterogeneity. Continuing this line of research by including home-country and host-country effects, as well as the differences between home country and host country, in the analysis will be interesting. Finally, this study conducted complementary interviews followed by a longitudinal data analysis, which captured a dynamic picture of how firm-specific resources and regional heterogeneity influence the internationalization of Chinese service MNEs over time. However, the findings may be limited in the context of China as regional disparity differs from one emerging economy to another. Future researchers should investigate service MNEs from other emerging economies, taking a regional institutional perspective.

Notes

We also ran fixed-effects models as a robustness check. The results for the fixed-effects models were generally consistent with the random-effects results. Detailed information on the fixed-effects models is available upon request.

Detailed empirical results are available upon request.

As a post hoc analysis, we tested and found no support for an S-shaped link between internationalization and performance for Chinese service MNEs. The results are available upon request.

The detailed empirical results for the subsamples are available upon request.

References

Aiken, L. S., & West, S. G. (1991). Multiple regression: Testing and interpreting interactions. Newbury Park: Sage Publications.

Arregle, J., Miller, T. L., Hitt, M. A., & Beamish, P. W. (2013). Do regions matter? An integrated institutional and semiglobalization perspective on the internationalization of MNEs. Strategic Management Journal, 34(8), 910–934.

Aulakh, P. S., Kotabe, M., & Teegen, H. (2000). Export strategies and performance of firms from emerging economies: Evidence from Brazil, Chile, and Mexico. Academy of Management Journal, 43(3), 342–361.

Awate, S., Larsen, M. M., & Mudambi, R. (2016). Accessing vs sourcing knowledge: A comparative study of R&D internationalization between emerging and advanced economy firms. Journal of International Business Studies, 46(1), 63–86.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Barney, J. B., & Zhang, S. (2009). The future of Chinese management research: A theory of Chinese management versus a Chinese theory of management. Management and Organization Review, 5(1), 15–28.

Batisse, C. (2002). Dynamic externalities and local growth: A panel data analysis applied to Chinese provinces. China Economic Review, 13(2–3), 231–251.

Bello, D. C., Radulovich, L. P., Javalgi, R. G., Scherer, R. F., & Taylor, J. (2016). Performance of professional service firms from emerging markets: Role of innovative services and firm capabilities. Journal of World Business, 51(3), 413–424.

Berman, S. L., Wicks, A. C., Kotha, S., & Jones, T. M. (1999). Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Academy of Management Journal, 42(5), 488–506.

Berry, H., & Kaul, A. (2016). Replicating the multinationality–performance relationship: Is there an S-curve? Strategic Management Journal, 37(11), 2275–2290.

Berthon, P., Pitt, L., Katsikeas, C. S., & Berthon, J. P. (1999). Virtual services go international: International services in the marketplace. Journal of International Marketing, 7(3), 84–105.

Beugelsdijk, S., McCann, P., & Mudambi, R. (2010). Introduction: Place, space and organization—Economic geography and the multinational enterprise. Journal of Economic Geography, 10(4), 485–493.

Bhaumik, S. K., Driffield, N., & Pal, S. (2010). Does ownership structure of emerging-market firms affect their outward FDI? The case of the Indian automotive and pharmaceutical sectors. Journal of International Business Studies, 41(3), 437–450.

Boehe, D. M. (2016). The internationalization of service firms from emerging economies: An internalization perspective. Long Range Planning, 49(5), 559–569.

Boisot, M., & Child, J. (1996). From fiefs to clans and network capitalism: Explaining China’s emerging economic order. Administrative Science Quarterly, 41(4), 600–628.

Borda, A., Geleilate, J. M. G., Newburry, W., & Kundu, S. K. (2017). Firm internationalization, business group diversification and firm performance: The case of Latin American firms. Journal of Business Research, 72, 104–113.

Boschma, R. A., & Iammarino, S. (2009). Related variety, trade linkages and regional growth in Italy. Economic Geography, 85(3), 289–311.

Brouthers, L. E., O’Donnell, E., & Hadjimarcou, J. (2005). Generic product strategies for emerging market exports into Triad nation markets: A mimetic isomorphism approach. Journal of Management Studies, 42(1), 225–245.

Brouthers, L. E., Werner, S., & Matulich, E. (2000). The influence of Triad nations’ environments on price-quality product strategies and MNC performance. Journal of International Business Studies, 31(1), 39–62.

Brouthers, L. E., & Xu, K. (2002). Product stereotypes, strategy and performance satisfaction: The case of Chinese exporters. Journal of International Business Studies, 33(4), 657–677.

Buck, T., Liu, X., Wei, Y., & Liu, X. (2007). The trade development path and export spillovers in China: A missing link? Management International Review, 47(5), 683–706.

Buckley, P. J. (2002). Is the international business research agenda running out of steam? Journal of International Business Studies, 33(2), 365–373.

Capar, N., & Kotabe, M. (2003). The relationship between international diversification and performance in service firm. Journal of International Business Studies, 34(4), 345–355.

Carman, J. M., & Langeard, E. (1980). Growth strategies for service firms. Strategic Management Journal, 1(1), 7–22.

Chan, C. M., Isobe, T., & Makino, S. (2008). Which country matters? Institutional development and foreign affiliate performance, Strategic Management Journal, 29(11), 1179–1205.

Chan, C. M., Makino, S., & Isobe, T. (2010). Does sub-national region matter? Foreign affiliate performance in the United States and China. Strategic Management Journal, 31(11), 1226–1243.

Chang, S., Chung, J., & Moon, J. J. (2013). When do wholly owned subsidiaries perform better than joint ventures? Strategic Management Journal, 34(3), 317–337.

Chang, S. J., & Park, S. (2005). Types of firms generating network externalities and MNCs’ co-location decisions. Strategic Management Journal, 26(7), 595–615.

Chidlow, A., Salciuviene, L., & Young, S. (2009). Regional determinants of inward FDI distribution in Poland. International Business Review, 18(2), 119–133.

Chung, C., Xiao, S. F., Lee, J., & Kang, J. (2016). The interplay of top-down institutional pressures and bottom-up responses of transition economy firms on FDI entry mode choices. Management International Review, 56(5), 699–732.