Abstract

In this study, we integrate resource dependence theory and agency theory to argue that state ownership has a dual (inducement and constraint) effect on emerging market firms’ export performance. Building on this inducement-constraint framework, we hypothesize a non-linear relationship between state ownership and export performance of emerging market firms that is further moderated by the varying levels of home country government effectiveness. Using cross-sectional data of 4,239 firms from 16 emerging economies, as well as panel data of more than 10,000 Chinese exporting firms, we find supporting evidence for these hypotheses. The theoretical development and empirical findings of this study highlight the complex and dynamic relationship between state ownership, government effectiveness, and export performance among firms from emerging economies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The share of emerging economies in world trade has risen significantly during the past 15 years (Benkovskis and Wörz 2013). In these emerging economies, state-owned enterprises (SOEs) represent a ubiquitous organizational form and play a critical role in exporting activities (Aulakh et al. 2000; Siegel 2007). For example, by the end of 2012, more than 278,479 SOEs in China contributed $22.6 billion monthly to the nation’s exports, accounting for 11.8 % of total exports (http://www.customs.gov.cn/publish/portal0/tab400/). Moreover, national export promotion policies, such as direct subsidies to SOEs from central and local governments, tax and tariff relief, bank loans, government contracts with payments well above costs, privileged use and retention of foreign exchange earned from exports, and services that facilitate transportation and contacting foreign customers, all assist SOEs in exporting. Given the increasing share of emerging economies in world trade, and the tremendous contributions of SOEs to these economies’ exporting activities, addressing the issue of state-owned exporters is both timely and essential.

The importance of state-owned exporters has attracted unprecedented research interest from strategy and international business scholars. In a nearly exhaustive literature search on this topic, we discovered most of the relevant studies in the context of emerging economies as reflected in Table 1. However, previous studies on the relationship between state ownership and exporting have shown mixed findings. For example, in their study of the relationship between state ownership and export propensity of firms in Russia, Ukraine, and Belarus, Buck et al. (2000) find a positive but non-significant effect of state ownership on export propensity. In contrast, Cuervo-Cazurra and Dau (2009) find, in the context of Latin America, that domestic SOEs were comparatively less likely than domestic private and foreign-invested firms to engage in export activities. They suggest that reduction of state interference through structural reform negatively influences foreign sales of domestic SOEs. These inconclusive findings suggest a plausible non-linear relationship between state ownership and exporting. However, no effort has been made to reconcile these contradictory findings.

Although recent studies emphasize the institutional environment of exporting firms as extending from the operating environment, their lack of consideration of the influence of government effectiveness in an SOE’s home environment is a consistent limitation of this work. The level of government effectiveness varies among emerging economies and differentiates these economies from their developed counterparts (Mahmood and Rufin 2005). Because government effectiveness in emerging economies significantly shapes the strategies and performance of both domestic and foreign-invested firms, studies that omit this factor when examining the drivers of export behavior and performance are seriously limiting their understanding of exporting (Gao et al. 2010). Unfortunately, existing studies have paid little attention to the role of government effectiveness of home countries. Meyer (2004) calls for further research on this important contingency in the strategy-performance linkage of emerging market firms (EMFs).

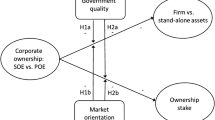

To reconcile these research gaps, we integrate resource dependence theory (Pfeffer 1981; Pfeffer and Salancik 2003) and agency theory (La Porta et al. 2002; Shleifer and Vishny 1994, 1997) to show the dual (inducing and constraining) effects of state ownership on export performance in the context of emerging economies. We use resource dependence theory to argue that governments possess the resources SOEs need to pursue export activities, which potentially creates a dependence of SOEs on the government to support their business activities. However, excessive reliance on government resources exposes firms to agency problems, compromising economic efficiency. Thus, we use agency theory to argue that state ownership essentially represents a political relationship between a firm and the political organization that owns the firm. In this type of principal-agent relationship, governments and politicians as key owners can coerce managers to act in line with their non-economic objectives. As such, managers are likely to conform to this pressure given that their welfare depends on future favors and resources provided by the principal. Because the principals of SOEs are political owners with non-economic objectives, their preferences and interests likely diverge from those of managers. Thus, the integration of the two theories enables us to propose an inducement-constraint framework through which we can show how the interplay of these processes can more fully explain the complex relationships among SOEs, government effectiveness, and export performance in emerging economies.

Our theoretical departure lies in the development of inducement and constraint processes that capture the dual aspects of state ownership. This feature enables us to distinguish and integrate both the positive and negative effects of state ownership and reconcile the inconsistent findings of existing research in a non-linear model. We examine these theoretical arguments in the context of firms in emerging market economies (EMFs), for which governments in general still control critical resources, and financial markets are under-developed (Khanna and Palepu 1997; Ramamurti 2000). EMFs with a certain level of state ownership are in a better position than other firms to generate proportionally increased foreign sales by capitalizing on the state as a resource provider. However, this government resource-induced export benefit is likely to be offset by the costs resulting from the excessive control of the state through its politically appointed managers. These managers’ non-economic objectives prevail over efficiency for export competitiveness, thus leading to a decline of foreign sales. Therefore, the role of state ownership in helping EMFs to export is subject to the varying degrees of government effectiveness across emerging countries. The historical account shows that while, overall, the institutional infrastructure of emerging economies is not well developed (Khanna and Palepu 1997), considerable variation exists in the level of government effectiveness in exporting activities. Thus, the interaction between government effectiveness and state ownership offers a unique opportunity to investigate EMFs’ export actions.

This study contributes to the literature in several ways. First, we extend the research on the relationship between state ownership and exporting by integrating resource dependence theory and agency theory to advance an inducement-constraint framework in explaining the dual effects of state ownership on export performance. The juxtaposition of inducement and constraint mechanisms provides a more comprehensive picture of the role of state ownership on firms’ export behaviors. Second, this study enriches the literature on organizational processes and dynamics by specifying the institutional conditions of the double-edged mechanism of state ownership in shaping firm behavior and strategic choices. We empirically demonstrate that the effect of state ownership on firm export performance varies with the level of government effectiveness across emerging economies.

2 Theoretical Framework

2.1 State Ownership and Export

State ownership, which epitomizes the formal inter-organizational relationship between a firm and the government, refers to the percentage of government ownership in a firm (Boisot and Child 1988). From a comprehensive view of the literature, we present a summary of the empirical and conceptual studies on export performance in emerging economies, many of which pertain to SOEs’ exporting activities. As Table 1 details, most of these studies analyze the leadership strategies, locations, branding, guanxi, entrepreneurial characteristics, and marketing capabilities of EMFs (Aulakh et al. 2000; Filatotchev et al. 2001; Zhou et al. 2007). Some studies stress how low cost strategies and outside control influence EMFs’ competitiveness in international markets (Dominguez and Sequeira 1993). Others focus on the operating environments as part of a firm’s organizational environment in its home country (Buck et al. 2000; Cuervo-Cazurra and Dau 2009). Despite the large number of export determinant studies (see Table 1; for a literature review, see also Katsikeas et al. 2000), limited efforts have been devoted to exploring the determinants of state ownership in SOEs’ exporting (O’Neill et al. 2004). That is, no study has explored the complex relationship between state ownership and the export performance of EMFs. This research gap is alarming because state ownership, as an important and parsimonious variable, allows organization and management scholars to explore the institutional characteristics of emerging economies (Filatotchev et al. 2003). Thus, studying the complex roles of state ownership in SOEs’ export activities in emerging economies can yield important insights.

2.2 Resource Dependence Theory and State Ownership

Resource dependence theory suggests that organizations that depend on external entities for critical resources are more susceptible to the control and influence of these external entities than other firms are (Pfeffer 1981; Pfeffer and Salancik 2003). Building on this theory, we conceptualize state ownership as a source of political resources that enables SOEs to access preferential government treatment and policy support for exporting. In turn, this resource need of SOEs potentially creates dependence on the government to support their business activities.

Resource dependence theory also suggests that state ownership that can be conceived as political capital linking firms to political systems (Talmud and Mesch 1997) that, in turn, afford firms more legitimacy and legality to seek support and resources from the government (Siegel 2007). Governments in emerging economies remain a key resource provider for firms (Schipke 2001) and continue exercising distributive power over resources through tax policies, land exploitation laws, and labor market regulations (Tan and Tan 2005); therefore, a relationship with the government through state ownership can benefit firms’ export activities.

Resource dependent theory addresses the inducement mechanism associated with political resources conferred by state ownership that enable an EMF to receive preferential government treatment and policy support. It does not, however, account for managerial constraints imposed by state ownership. To the extent that the ownership of firms connotes the administrative responsibilities and acts as a barometer of states’ willingness to share authority with others (Doh et al. 2004), an increase in state ownership of firms implies increased state interference in business decision making. In this way, agency theory provides an important contribution by suggesting that excessive reliance on government resources exposes firms to agency problems and compromises economic efficiency.

2.3 Agency Theory and State Ownership

Agency theory has long recognized that owners and managers have contradictory risk preferences, leading to managerial decisions that depart from owners’ preferences (Jensen and Meckling 1976). Building on agency theory, we argue that state ownership represents a political relationship between a firm and the political organization that owns the firm. In this type of relationship, the government and its politicians, as key owners, can coerce managers to act in line with their non-economic objectives. As such, their preferences and interests likely diverge from managers’. Thus, government interference with increasing state ownership constrains managerial decision making (Huang and Xu 1998), generates inefficiency, and imposes agency problems (Dinc 2005; Khwaja and Mian 2005; La Porta et al. 2002).

Drawing on agency theory (Jensen and Meckling 1976; Shleifer and Vishny 1994), we propose that, in addition to profitability, increasing state ownership allows governments to achieve many non-economic objectives (e.g., maximizing its own interests, securing political support) that interfere with firms’ economic objectives. Government guarantees to bail out loss-making SOEs and soft budget constraints also tend to weaken managers’ incentives to improve the operational efficiency of their firms, further undermining the competitive base of firms’ exporting potential (Kornai et al. 2003). These arguments suggest that increasing state ownership reduces the operational efficiency of firms (Kornai et al. 2003; Svensson 2003).

Agency theory addresses the constraint mechanism associated with government interferences invited by state ownership that limits managerial decision making (Huang and Xu 1998; Kornai et al. 2003), generates inefficiency, and imposes agency problems (Dinc 2005; Khwaja and Mian 2005; La Porta et al. 2002). However, agency theory downplays the inducement mechanism arising from EMFs’ external dependence on policy support and financial resources.

Building on the juxtaposition of resource dependence theory and agency theory, we propose a dual (inducement and constraint) effect of state ownership on export behavior. The inducement mechanism suggests that state ownership provides EMFs with benefits that can enhance their export performance. Conversely, the constraint mechanism suggests that excessive state ownership leads to divergent interests between government and EMFs, managerial indiscretion, and complacency. Therefore, the effects of state ownership on export performance depend on the interplay of inducement and constraint processes, which varies with the level of state ownership. We examine the two arguments in the context of SOE exporting to elucidate the nuanced relationship between state ownership and export behavior.

2.4 Dual Effects of State Ownership on SOE Exporting

In SOEs’ export activities, state ownership is associated with both inducement and constraint effects. On the one hand, state ownership provides EMFs with benefits such as policy support (e.g., trade programs, licensing), access to financial resources, and perceived legitimacy, which can enhance their export performance. On the other hand, it imposes constraints on effective exporting through divergent interests, managerial discretion, and complacency.

2.4.1 Inducement Effect of State Ownership

State ownership in emerging economies can positively affect export behavior by providing three benefits: policy support, access to financial resources, and perceived legitimacy. First, governments in emerging economies are often heavily involved in economic development, setting the regulatory policies and controlling the critical resources that shape firms’ competitive environments (Mahmood and Rufin 2005; Siegel 2007). Governments can impose economic, industry-specific regulations on firms with regard to prices, output, and licensing, as well as social regulations that transcend industries, such as environmental, occupational safety, and labor laws (Chen and Wu 2011; Li et al. 2010). Pistor et al. (2000) suggest that in most emerging economies, governments maintain some influence over firms by leveraging subsidies, regulatory favors, and tax arrears. Accordingly, ownership-based political connections with governments can provide firms with access to policy support (Hillman et al. 1999; Siegel 2007). For example, Luo and Tung (2007) suggest that SOEs are in a more advantageous position than private firms because they enjoy the privileges of participating in government-sponsored export programs and obtain trade licenses and export market information from related agencies. Prior studies have shown that export promotion policies positively contribute to the increase in the exportation of wood products (Tesfom and Clemens 2008).

Second, to overcome the constraints and uncertainties associated with export activities, firms need access to certain key resources that governments of emerging economies typically control (Pfeffer 1981). State ownership is particularly instrumental in the context of emerging markets when both the financial markets and institutional environment are under-developed (Khanna and Palepu 1997; Ramamurti 2000). The emerging economies lack market-supporting institutions (Khanna and Palepu 1997; Sheth 2011). While institutional environments vary among emerging economies (Ramamurti 2012), the under-development of institutions and financial markets is a hallmark of developing and transitional economies (Alston et al. 1996; North 1990). The political resources provided by state ownership give SOEs access to financial resources that can be used for their export activities. In other words, because SOEs act as government agents to implement the social goals of providing employment and social services, managers opportunistically take advantage of the situation by bargaining for more resources and low-output goals, as well as by concealing and hoarding resources (Walder 1995). At the same time, they are also entitled to plenty of resources and other non-financial support from the government (Ju and Zhao 2009). Government subsidies can also help EMFs lower their costs of borrowing (Wu 2011), thus strengthening their competitive position in international markets. However, because of their disadvantageous position in international markets (e.g., limited technology and marketing capabilities, lack of brand development), EMFs must accept risk-bearing payments, such as payments after sale that their importers pass on to them (Aulakh et al. 2000). Such forms of international payment not only involve high levels of risk and uncertainty, but also limit the pool of financial resources available to EMFs. In these instances, SOEs can easily turn to state-owned banks for alternative international settlements (e.g., letters of credit) to alleviate the risk embedded in international settlements (Luo and Tung 2007).

Third, the political resources derived from state ownership can also enhance the reputations and legitimacy of EMFs. In the context of emerging markets, where there is insufficient information about the financial position and credibility of firms, SOEs are likely to be perceived as credible and trustworthy. This, in turn, increases the likelihood that their products will be accepted by foreign customers who have relatively little information on sellers (Li et al. 2010). As Styles et al. (2008) note, the reputation of exporters plays a critical role in an exporting context, and an exporter known as unreliable will not generate high levels of contractual revenues.

Successful export endeavors for EMFs rely on efficient operation, their ability to develop competitive strategies (Aulakh et al. 2000), and managerial independence in strategic decision making (Filatotchev et al. 2001, 2008). Nonetheless, the state ownership of firms is likely to evoke hazards of state interferences that can avert these positive effects, resulting in diminishing foreign sales.

2.4.2 Constraint Effect of State Ownership

When an EMF is reliant on state ownership for conducting export activities, the positive effects of state ownership on export sales are likely to be eroded by the inevitably high costs resulting from three sources: divergent interests, managerial discretion, and complacency. First, the government, as the principal owner, has the legitimate authority to divert resources from export activities, and as a political agent, can use these resources to pursue political and social objectives. Studies on rent seeking (e.g., Khwaja and Mian 2005; La Porta et al. 2002) argue that reliance on state ownership allows politicians to pursue their own interests, such as securing votes and political contributions, at the expense of the profitability and efficiency of politically connected firms. In emerging markets, politicians may pressure SOEs to hire or retain extra employees, pay higher wages, or develop products preferred by the government, even though the firms may not be capable of doing so efficiently (Wu 2011). Such divergent interests between managers and the bureaucrats overseeing SOEs will eventually decrease firm value (Shleifer and Vishny 1994, 1997), further jeopardizing the ability of the firms to export.

Second, state ownership of EMFs constrains managerial discretion, resulting in the inefficient management of export activities. Managerial discretion gives managers the “ability to respond to various demands from dynamic competitive environments” (Sanchez 1995, p. 138). A high degree of decision-making autonomy and flexibility enables managers to make timely strategic actions to improve their firms’ competitive position in promoting overseas outputs (Aulakh et al. 2000). However, the autonomy of managerial decision making hinges on the firm’s ownership structure (Uhlenbruck et al. 2003). The retention of a high percentage of state ownership in a firm allows government bureaucrats, who are politically appointed and tend to lack relevant market experience, to intervene in management decisions (Garg and Handa 1991). Thus, excessive bureaucratic control can hamper an incumbent manager’s ability to exercise managerial discretion in accordance with foreign market demand. Previous studies have shown that excessive reliance on state ownership invites intense government intervention, which can increase the costs for firms as a result of inefficiency and managerial indiscretion (Dinc 2005; Khwaja and Mian 2005; La Porta et al. 2002; Sapienza 2004; Shleifer 1998; Shleifer and Vishny 1994; Svensson 2003). Boisot and Child (1988) suggest that the direct involvement of government officials in Chinese SOEs’ daily operations leads these officials to make inefficient decisions, not only to gain political contributions and votes, but to increase personal income such as through bribery. These decisions are often made at the expense of the profitability or efficiency of the SOEs.

Third, reliance on state ownership for political support (e.g., state protection from market-driven competition) breeds complacency and risk-averse behavior among managers of EMFs. Krueger (1974) and Mahmood and Rufin (2005) note that when governments play a key role in the allocation of resources, firms devote relatively more resources to lobbying government officials to create entry barriers to deter potential new entrants. With the creation of entry barriers, firms become complacent and lose the incentive and competitive motivation to take risks in international markets. Prior studies have shown that managers of wholly owned state enterprises tend to have little interest in restructuring, investing abroad, or introducing radical strategic changes (Cuervo and Villalonga 2000; Zhara et al. 2000). Firms with a majority state ownership and wholly owned state enterprises are comparatively less tolerant of the uncertainties in foreign markets and therefore are less likely to implement aggressive foreign entry strategies (Garcia-Canal and Guillen 2008). Prolonged import protection and export promotion through monopolistic, state-owned foreign trade have made companies ill-equipped, both to meet overseas threats as well as for internationalization (Filatotchev et al. 2001).

The theoretical arguments of the inducement and constraint effects on SOEs’ export activities suggest an integrated framework for their interaction. As such, we propose a non-linear relationship between state ownership and the export performance of EMFs. We further propose that this non-linear relationship varies with the level of government effectiveness across countries. We formalize these arguments in hypotheses and empirically test them using the cross-sectional data of 4,239 firms from 16 emerging economies, as well as panel data of more than 10,000 Chinese exporting firms.

3 Hypotheses

3.1 Non-linear Relationship Between State Ownership and Export Performance

A firm’s observed export behavior reflects the joint effect of the inducements and constraints of its state ownership. Low levels of state ownership restrict a firm’s access to key resources controlled by the government. In many emerging economies, the government allocates critical resources in accordance with the closeness of the political connections represented by the percentage of state ownership. Accordingly, the government allocates more resources to firms with higher percentages of state ownership and less to those with minimal or no state ownership. For example, Chinese provincial governments control, safeguard, and provide SOEs with unlimited political support and funding; however, enterprises without sufficient state ownership are driven into market competition by governments with little concern for their chances of survival. As a result, low levels of state ownership represent a ceiling on the extent to which EMFs can gain policy support and funding from the government to boost their exports. Similarly, such firms receive relatively few legitimacy benefits, as minimal state ownership is less likely to have an effect on legitimacy in the eyes of the government and consumers. On the other hand, limited state ownership effectively restricts the costs resulting from management fees and rent-seeking behaviors of politicians. Thus, at low levels of state ownership, low benefits and low costs cancel each other out, resulting in a weak effect of state ownership on firm export behavior (Bai et al. 2006).

EMFs at intermediate levels of state ownership receive guarantees of the government resources necessary to withstand the risks of trading in international markets (Luo and Tung 2007). The increased level of state ownership also provides them the opportunity to participate in policy-making processes, which helps them to more readily access government policy initiatives and better integrate any anticipated regulatory changes into their export plans. In addition, the enhanced political legitimacy resulting from state ownership enables them to borrow more from state-owned banks to fund their export activities. At the same time, firm managers enjoy sufficient autonomy to make decisions in accordance with market changes and requirements (Lu et al. 2009). In other words, at intermediate levels, the increase in the negative effect of state ownership is limited, and thus the benefits outweigh the costs, leading to a net positive effect of state ownership on export behavior.

At high levels of state ownership, the costs of state ownership increase at an accelerated rate because the EMFs must tolerate political interference and rent-seeking from politicians. A high level of state ownership grants government officials the legitimacy to interfere in decision making and to seek personal benefits using firm resources. The higher the level of state ownership is, the more prevalent government intervention becomes; the higher the cost of rent seeking, the lesser the degree of managerial discretion. Furthermore, when state ownership is high, its marginal benefits diminish because the resources and policy support EMFs can acquire from the government through state ownership are limited. Thus, at high levels, the costs outweigh the benefits, resulting in a net negative effect on firm export behavior. Taking these arguments together, we expect a non-linear relationship between the level of state ownership and the export performance of EMFs, as follows:

Hypothesis 1: There is a curve-linear relationship between EMFs’ export intensity and the levels of state ownership in that: the export intensity is lower for both low- and high levels of state ownership than the moderate state ownership.

3.2 Moderating Role of Government Effectiveness

We further argue that the non-linear relationship between the level of state ownership and export performance varies across the institutional environments of different emerging economies. Previous studies suggest that the relationship between the ownership structure and export performance of EMFs depends on the institutional environment (Lu et al. 2009). Gao et al. (2010) argue that EMFs’ political dependence on the government to secure resources can be reduced as the institutional environment develops. Among different institutional factors, government effectiveness is essential in shaping the development of the institutional environment (Mahmood and Rufin 2005). Government effectiveness reflects the quality and competence of a nation’s governance (Kaufmann et al. 2004).

We argue that, relative to a less effective government, a highly effective government attenuates the benefits and suppresses the costs of state ownership on the export performance of EMFs. That is, more effective governments are likely to opt for market mechanisms and subject firms to market discipline, thereby decreasing the need for and the importance of the political influence of government agencies in business transactions. Moreover, an effective government that epitomizes quality governance will treat social entities equally, regardless of their relationship with the government. Conversely, the lack of impartiality in less effective governments may discriminate against firms with minimal or no state ownership by restricting their access to important resources. For example, as a result of social and political discrimination, private firms in China are less likely to obtain bank loans than SOEs (Li et al. 2008). Effective governments that display impartial authority will potentially equalize resource opportunities (e.g., export permits, policy support) for all firms for reasons of economic efficiency and effectiveness, rather than the political legitimacy of firms. Thus, in the same vein, effective governments will also make foreign market information equally available to exporting firms to facilitate their export activities.

In such a situation, the benefits in terms of policy support and financial resources that EMFs can obtain from state ownership may decline with increased government effectiveness. Firms with low levels of state ownership will have equal opportunities to acquire critical resources and policy support from the government. Furthermore, the benefits of policy support enjoyed by firms with high levels of state ownership will diminish because efficient governments will make all relevant information equally available in order to facilitate economic exchange. Therefore, both the positive and negative effects of state ownership on the export performance of EMFs will be attenuated.

Highly effective governments will also work to suppress the constraining effects associated with high levels state ownership. For example, the administrative body will enforce laws and regulations as a means of minimizing state intervention in managerial decision making (Peng 2003). As Rothstein and Teorell (2008) note, effective governments prevent the abuse or misuse of authority. In this case, the costs of state ownership will be lessened because the lack of political interference not only reduces the chances of rent-seeking behavior on the part of government officials, but also alleviates pressure for firms to achieve non-economic objectives. Consequently, managers of SOEs will be motivated to improve efficiency because they have more authority in, and take full responsibility for, managerial decisions related to international expansion. Therefore, the constraining effects of high levels of state ownership will be suppressed with more effective governments. Taken together, we argue that the effects of state ownership on export performance depend on the quality of government. In other words, the efficient operation of government institutions, as characterized by a low degree of intervention and bureaucracy and a high degree of impartiality, offsets the positive and negative effects of state ownership on the export performance of EMFs. Combining these arguments, we posit the following.

Hypothesis 2: Government effectiveness of the home country moderates the non-linear relationship between state ownership and the export intensity of EMFs, such that highly effective governments (a) neutralize the positive effect of low levels of state ownership and (b) weaken the negative effect of high levels of state ownership.

4 Data and Methodology

4.1 Data

Our empirical analyses are based on the World Bank Productivity and Investment Climate Survey (PICS) conducted in 16 emerging economies, including Brazil, Russia, India, China, Bulgaria, Czech Republic, Egypt, Hungary, Poland, South Africa, Thailand, Turkey, Indonesia, Morocco, Pakistan, and Peru.Footnote 1 Such a variety of sampled countries is highly suitable to our international study of different levels of institutional environments. The PICS has been conducted since 2000. It focuses on the micro-economic and structural dimensions of nations’ product markets, financial and non-financial markets, and service infrastructure, including the strength of an economy’s legal, regulatory, and institutional framework, enabling a country’s business environment to be assessed in an internationally comparable manner. The surveys in the PICS use standardized survey instruments and a uniform sampling methodology to minimize measurement error and to yield data comparable across the world’s economies. The methodology generates a representative sample of the entire non-agricultural private economy, including multiple manufacturing industries. The sampling also ensures large enough sample sizes to conduct statistically robust analyses for selected industries, with levels of precision at a minimum of 7.5 % for 90 % confidence intervals, of estimates of population proportion (percentages) at the industry level as well as estimates of the mean of log of sales at the industry level. To maintain comparability across countries, the same manufacturing industries are selected (e.g., food products and beverages, wearing apparel, and fur).Footnote 2

The PICS reports detailed firm-specific information on employment, firm age, industry, ownership, legal status, and number of establishments. The survey consists of two sections. The first section, designed to be administered to firm managers or owners, involves the firm’s investment and management strategies. This section contains information about the characteristics of the business and the investment climate in which it operates, including general information about the firm, sales and supplies, investment climate constraints, infrastructure and services, finance, labor relations, business–government relations, conflict resolutions/legal environment, crime, capacity, innovation, and learning. The second section, designed to be administered to members of the accounting department and the human resources manager, solicits information on production costs, investment flows, the balance sheet, and workforce statistics.

The sampling method used by the World Bank in the survey is a stratified sampling that takes into account of the possible bias given the varying size of the individual national economies and the number of firms in each economy. Such stratified random sampling method ensures the representativeness of each country and avoid over (or under) representation of any single country (Wu 2013). Since our study sample is from this sampling frame, the samples from each country should be representative and pose no substantial bias. Moreover, we randomly split the sample into two groups by the dependent variable, and use the same methods to compare the model results from one sample with the results from the other (Efron 1983). The results from two subsamples are qualitatively similar. The survey is administered through face-to-face interviews with managing directors, accountants, human resource managers, and other relevant company staff. The surveyed sample contains about 9,000 firm-year observations. After dropping the missing value, we have about 4,000 firm-observations. This may potentially raise the concern of selection bias or omission bias. To alleviate this concern, we run a t test between the sampled firms included in this study and those firms that have been excluded in the study in terms of firm age, employee numbers and ownership. The results of the t test show no significant differences. We thereby conclude that there is no selection bias in this study.

4.2 Measures

4.2.1 Dependent Variable

Export intensity is measured by the ratio of export sales to total sales and has been used extensively in previous studies as an indicator of export performance (Griffin and Page 1993; Hultman et al. 2011; Large et al. 2008; Majocchi et al. 2005; Shoham 1998; Zhao and Zou 2002).Footnote 3 Prior studies suggest that the ratio of export sales to total sales is a suitable measure of export performance. As Katsikeas et al. (2000) note, export sales intensity is the most common measure of export performance. Among the 61 studies they reviewed, 57 (93.44 %) adopted export sales intensity to measure export performance. Following prior literature, we measure the export performance of a firm using the ratio of its export sales to its total sales in the next year.

4.2.2 Independent and Moderating Variables

Consistent with our conceptual development and prior studies on state ownership (e.g., Bai et al. 2006; Boisot and Child 1988), we measure the level of state ownership of an EMF using the percentage of government ownership. We compute the percentage of state owned enterprises for each of the sampled countries and report them in “Appendix” (see the column “Percent of SOE” in Table 1). As predicted, the percentage of state owned enterprises in some emerging countries, like China, is higher than that of other emerging countries, such as India.

Following prior studies (Chan et al. 2008, 2010), we collect the information on government effectiveness from the International Country Risk Guide 2008–2012 and use the five-year growth rate to capture the changes/evolution of government effectiveness over time. This guide rates countries according to 12 items (0 = the country with the lowest effectiveness, 12 = the country with the highest effectiveness). We calculate a government effectiveness index for each country by dividing each value of the 12 items identified by the highest value of the respective item to convert the original value to a ratio. We then sum and average the value of the 12 ratios to obtain one composite value that constitutes the government effectiveness index for each country.

4.2.3 Control Variables

We control for several variables that may influence a firm’s export strategy. First, we include firms that have no state ownership as a control group. We create a dummy variable, which takes the value of 1 if a firm has no state ownership and 0 if otherwise. Second, prior studies have shown that large firms perform better than smaller firms in international markets because they have adequate resources to conduct export activities (e.g., Christensen et al. 1987). According to the World Bank definition of firm size, firms with more than 100 employees are considered large firms. Accordingly, we create a firm size dummy variable, which equals 1 if a firm has more than 100 and 0 if otherwise. Third, Gao et al. (2010) show that firms with foreign ownership have a greater propensity to engage in export activities. Thus, we control for a firm’s foreign ownership by including the total percentage owned by foreign investors. Fourth, we control for a firm’s research-and-development (R&D) intensity, which we measure by the ratio of R&D expenditure to total sale revenues. Fifth, because the sample covers 16 emerging economies, we create 15 country dummy variables and use Brazil as the base group. Finally, given that the sample includes firms from multiple industries, we generate industry dummy variables to control for industry effects.

4.3 Statistical Modeling

The basic structure of the multivariate statistical model is as follows:

Given that the export performance measure has a lower bound of zero, the left-censored data violates the linearity assumption of ordinary least squares (OLS). Tobit models correct the dependent variable with limiting values, making it possible to estimate the relationship between export performance and other explanatory variables. Thus, we estimate the models using Tobit specifications along with the maximum likelihood (ML) method. We lag all the explanatory variables 1 year. An alternative method for the dependent variable with limiting values is to correct the OLS estimates for bias. Greene (1981) shows that a method-of-moments procedure can be used to correct the OLS bias. In the robustness check, we therefore employ this procedure to correct the OLS bias and obtain consistent results.

5 Results

5.1 Results of Emerging Economies

Table 2 presents the mean and standard deviation of each variable and the correlation matrix among the variables, where the magnitude of the correlations between the independent variables is in the range of low to medium. Before model estimation, we ran a variance inflation factors (VIF) test. The VIF values were considerably lower than the threshold value of 10 (Neter et al. 1983), suggesting that multicollinearity is not a problem in the data used in this study.

Table 3 reports the results of the relationships among state ownership, government effectiveness, and export intensity. Model 1 is the baseline model with controls only. Model 2 adds the main effect of state ownership, its squared term (state ownership)2, and the cubic term (state ownership)3. Model 3 adds the effects of government effectiveness. Finally, Model 4 is the full model, including its own interaction term of government effectiveness and state ownership, the interaction terms of government effectiveness and (state ownership)2, and government effectiveness and (state ownership)3. To reduce the potential problem of multicollinearity, we mean-center the predictor and moderator variables before creating the interaction terms (Aiken and West 1991).

Hypothesis 1 predicts that state ownership will have a non-linear relationship to firm export intensity, which varies for different ownership levels. As Model 4 of Table 3 shows, the coefficient of state ownership is negative and significant (β = −2.299, p < 0.01), the coefficient of (state ownership)2 is positive and significant (β = 32.926, p < 0.05), and the coefficient of (state ownership)3 is negative and significant (β = −0.198, p < 0.05). These results suggest that state ownership initially has a negative impact on export intensity, then has a positive impact on export intensity at a medium level of state ownership, and finally has a negative impact on export intensity at a high level of state ownership, meaning that Hypothesis 1 is supported.

Hypothesis 2 proposes that government effectiveness as a national institutional factor moderates the non-linear relationship between state ownership and export intensity. Model 4 shows that the coefficient of the interaction term between state ownership and government effectiveness is positive and significant (β = 0.052, p < 0.001), the coefficient of the interaction term between (state ownership)2 and government effectiveness is negative and significant (β = −0.403, p < 0.001), and the coefficient of the interaction term between (state ownership)3 and government effectiveness is negative and non-significant (β = −0.001, n.s.). We plot these relationships in Fig. 1, separating government effectiveness into low and high levels on the basis of one standard deviation above and below the mean. As the figure shows, both lines have curvilinear relationships to export intensity, but the solid line (high level of government effectiveness) is smoother, suggesting that high levels of government effectiveness neutralize the positive effect of low levels of state ownership and weaken the negative effect of high levels of state ownership. Thus, Hypothesis 2 is also supported.

5.2 Results of Panel Data (2000–2006)

A possible concern is that the proposed relationships may not hold over time, because emerging markets are continuously evolving and government effectiveness in these markets changes over time. To address this concern, we constructed panel data of Chinese EMFs and performed new analyses. We obtained the panel data for Chinese firms’ export data from the General Administration of Customs of the People’s Republic of China,Footnote 4 which records monthly exporting activities by Chinese firms. We converted monthly data to yearly data to merge with China Census data, which provides detailed information about a firm’s ownership by different owners, such as governments, foreign investors, and domestic private investors. The China Export Panel data covered more than 10,000 Chinese firms during the 2000–2006 period. After deleting missing observations, the final data set included 172,084 firm-year observations. We obtained the measure of government effectiveness from the general market condition index developed by National Economic Research Institute of the State Council. This index has been used extensively in previous economic and finance studies (e.g., Gao et al. 2010). We used the overall indexFootnote 5 to reflect variations of government effectiveness across regions.

Table 4 provides means, standard deviations, and correlations. The VIF values for each predictor variable were below 2.83, suggesting that multicollinearity was not a problem in the regression analysis. To eliminate multicollinearity between the main effect and interaction effects in the model, we mean-centered the independent variables before estimating the interaction effects. Table 5 reports the results of the regression analysis. In general, the results in Table 5 are consistent with those in Table 3. For example, in Model 4 of Table 5, the coefficient of state ownership is negative and significant (β = −18.516, p < 0.001), the coefficient of (state ownership)2 is positive and significant (β = 50.457, p < 0.001), and the coefficient of (state ownership)3 is negative and significant (β = −33.4689, p < 0.001). These results provide additional support for Hypothesis 1. Moreover, the coefficient of the interaction term between state ownership and government effectiveness is positive and significant (β = 2.721, p < 0.001), the coefficient of the interaction term between (state ownership)2 and government effectiveness is negative and significant (β = −7.727, p < 0.001), and the coefficient of the interaction term between (state ownership)3 and government effectiveness is negative and significant (β = 5.246, p < 0.001). Thus, Hypothesis 2 also receives additional support.

5.3 Robustness Test

We tested the sensitivity of the results in several ways. First, we re-constructed the measure of government effectiveness using government efficiency data collected from the World Bank in 2012 and re-estimated all the models using this alternative measure. The results are highly consistent with those reported using the measure constructed from the International Country Risk Guide 2008–2012. Second, we employed the absolute value of exporting as an alternative measure of export performance; again, the results are highly consistent with those which used export intensity. Finally, as previously discussed, we fit the Tobit models using the ML method and re-estimated the models using the method-of-moments procedures with “corrected” OLS. These results are also consistent with those using the Tobit models with the ML method reported in Table 3.

6 Discussion and Conclusion

6.1 Theoretical Contributions

In this study, we draw on insights from resource dependence and agency theories to propose the inducement and constraint perspectives, which capture both the positive and negative effects of state ownership of firms from emerging economies. Using a sample of 4,239 firms from 16 emerging economies, the findings provide support for a three-level model of state ownership and export intensity. That is, EMFs are likely to be induced to leverage the political resources embodied in state ownership to expand export sales. However, this export benefit begins to decline at the inflection point, at which high levels of state ownership allow the government to legitimately intervene in business management (e.g., appointing bureaucrats to top management positions, re-allocating and re-directing resources to meet multiple policy objectives), consequentially diluting management’s focus on export activities. The findings also show that government effectiveness as a national institutional factor significantly moderates the non-linear relationship between state ownership and the export intensity of EMFs. As delineated in the previous section, we make two contributions in this study.

First, the finding of a non-linear relationship between state ownership and export intensity adds a dual perspective of state ownership to the existing organizational research by providing an objective and more complete explanation of the effects of state ownership. As Table 1 illustrates, the study of firm strategy and performance in emerging economies has recently gained prominence. The findings of previous research suggest that agency problems are more complex for EMFs than for other multinational corporations (Xu and Meyer 2013). As such, the relationship between state ownership and firm performance is more complex than typically assumed. Our study adds to this research field by conceptually proposing and empirically showing a non-linear relationship between state ownership and export performance that demonstrates the moderating effect of government effectiveness on this relationship. Therefore, we suggest that the effects of state ownership on export intensity should be examined in an eclectic manner by taking into account both the negative and positive impacts of state ownership. In this way, our inducement and constraint arguments offer theoretical conjectures that can help resolve the seemingly conflicting views of state ownership and the inconsistency of empirical results in the literature, further enhancing the understanding of the role of state ownership in organizational activities.

Second, this study contributes to organizational and political research by specifically integrating and empirically testing the role of the institutional environment in the ownership-performance relationship. The institution-based view suggests that institutional contexts affect the ability of EMFs to enhance their competitiveness and performance in foreign markets (Peng 2003). Wright et al. (2005) propose that in the context of the heterogeneous institutional landscape in emerging economies, a single theoretical perspective may not be sufficient to explain the strategic decisions firms make. However, prior research has pushed institutions to the “background” or entirely ignored their importance (e.g., Hoskisson et al. 2000; Peng 2003). By accounting for the interplay between state ownership and government effectiveness as a specific institutional factor in the home country, this study helps clarify the debate on the importance of institution-based views of international business. This study complements the work of Meyer (2004) and Peng (2003) by documenting that the proposed non-linear relationship between state ownership and the export intensity of EMFs is also contingent on the institutional environment.

6.2 Managerial Implications

The results of this study also have important implications for managers and public policy makers in emerging markets. For managers, the findings highlight the benefits and costs of state ownership for the export intensity of EMFs. For example, when firms obtain valuable resources from the government for their exports and other related business, they need to be aware of the administrative constraints and other impediments the government may impose and affect the consequent managerial inefficiency. The findings suggest that the “right” level of state ownership is important in an emerging market context to minimize the cost of acquiring critical resources from the government. Equally importantly, managers need to take a dynamic view of state ownership. Although a certain level of state ownership benefits the firm’s exports through the provision of political resources, high levels of state ownership can eventually lead to a decline of export intensity. Thus, it is imperative for managers to devote attention to balancing the resources needed from the government and the associated costs and risks resulting from excessive demand by the government for non-economic goals.

For public policy makers in emerging economies, the findings show that the institutional environment can moderate the effects of state ownership on the export intensity of firms. Improving the institutional environment can reduce transaction costs and suppress the negative effects of state ownership on export intensity. As such, governments in emerging economies should endeavor to improve their institutional environments, particularly with regard to improving government effectiveness (e.g., less intervention, less bureaucratic control, greater impartiality), which is conducive to increased export activities, internationalization, and an enhanced competitive advantage in the global marketplace. Another implication of the findings is that in managing the relationship with the SOEs, policy makers in emerging economies should avoid over-investing and intervening in the management and decision making of firms. Rather, they should adopt measures geared to increasing the efficiency of SOEs and ensuring that they function in line with market forces.

6.3 Limitations and Future Directions

This study has some limitations that, in turn, suggest avenues for further research. First, given that the data we use are cross-sectional, it is possible that, rather than resulting from state ownership, better export intensity may provide more resources for EMFs to build political connections with the government. Although we took steps to address the potential issue of reverse causality (a 1-year lag), a longer period of time may be necessary to fully rule out this concern. Further research using longitudinal data could confirm the direction of causality, as well as the relationships revealed in this study. Second, more theoretical advancement can be made if various resource combinations are incorporated in future studies. As Barney et al. (2001) note, the resource-based view (RBV) has rarely been applied in the export context. Integration of RBV theory may help researchers in this area obtain more insights into whether the development and utilization of resources by SOEs reduces their excessive reliance on the government, thus ameliorating the agency problem. Third, lacking export destination data, our study does not explain whether the institutional environments in the export destination markets also play important roles. The idiosyncratic nature of the institutional landscape in overseas markets requires specialized marketing knowledge. For example, SOEs’ export sales are potentially more receptive to comparable emerging economies with proximate institutional norms and practices. Research that incorporates the institutional dimension of destination markets could further our knowledge in this area. In addition, although our findings based on international analysis generally support the propositions, our findings are bounded by a limited condition of government effectiveness. The hypothesized moderating relationships need to be explored in future research that incorporates a broader set of country-specific institutional variables, which may generate more insights. Lastly, we could have incorporated more control variables, such as export credit and export orientation, that directly affect export intensity. Nonetheless, the nature of the secondary data used in this study prevents us from doing so to isolate the potential confounding effects. Further research should consider including more variables as suggested in the export determinant literature for either controlling purposes or for theoretically examining their interactions with state ownership. We hope that the study’s findings will contribute to a better understanding of how organizational ownership and institutional environments work together to shape EMFs’ strategic choices in overcoming the costs of internal structure and external environments in order to reap the benefits of internationalization.

Notes

Specifically, the survey conducted in Brazil in 2003; Bulgaria in 2005; China in 2005; Czech Republic in 2005; Egypt in 2004; Hungary in 2005; India in 2002; Indonesia in 2003; Morocco in 2000; Pakistan in 2002; Peru in 2002; Poland in 2005; Russia in 2005; South Africa in 2003; Thailand in 2004; Turkey in 2005.

A 7.5 % precision of an estimate at a 90 % confidence interval means that we can guarantee that the population parameter is within the 7.5 % range of the observed sample estimate, except in 10 % of the cases.

Although we adopt the most frequently used measure (i.e., export intensity), we acknowledge that export performance can be a multi-dimensional construct (see Sapienza et al. 2006).

The overall index consists of five sub-indices: government-market relationship, development of the non-state economic sector, development of the product market, development of the factor market, and development of intermediate institutions and the legal environment.

References

Aiken, L. S., & West, S. G. (1991). Multiple regression: testing and interpreting interactions. Newbury Park: Sage.

Alston, L. J., Eggertsson, T., & North, D. (1996). Empirical studies in institutional change. Cambridge: Cambridge University Press.

Aulakh, P. S., Kotabe, M., & Teegen, H. (2000). Export strategies and performance of firms from emerging economies: evidence from Brazil, Chile, and Mexico. Academy of Management Journal, 43(3), 342–361.

Bai, C. E., Lu, J., & Tao, Z. (2006). The multitask theory of state enterprise reform: empirical evidence from China? American Economic Review, 96(2), 353–357.

Barney, J., Wright, M., & Ketchen, D. J. (2001). The resource-based view of the firm: ten years after 1991. Journal of Management, 27(6), 625–641.

Benkovskis, K., & Wörz, J. (2013). Non-price competitiveness of exports from emerging countries. Working paper series #1612. European Central Bank (November).

Boisot, M., & Child, J. (1988). The iron law of fiefs: bureaucratic failure and the problem of governance in the Chinese economic reforms. Administrative Science Quarterly, 33(4), 507–527.

Brouthers, L. E., & Nakos, G. (2005). The role of systematic international market selection on small firms’ export performance. Journal of Small Business Management, 43(4), 363–381.

Brouthers, L. E., & Xu, K. F. (2002). Product stereotypes, strategy and performance satisfaction: the case of Chinese exporters. Journal of International Business Studies, 33(4), 657–677.

Buck, T., Filatotchev, I., Demina, N., & Wright, M. (2000). Exporting activity in transitional economies: an enterprise-level study. Journal of Development Studies, 37(2), 44–66.

Chan, C. M., Isobe, T., & Makino, S. (2008). Which country matters? institutional development and foreign affiliate performance. Strategic Management Journal, 29(11), 1179–1205.

Chan, C. M., Makino, S., & Isobe, T. (2010). Does subnational region matter? foreign affiliate performance in the United States and China. Strategic Management Journal, 31(11), 1226–1243.

Chen, X., & Wu, J. (2011). Do different guanxi types affect capability building differently? a contingency view. Industrial Marketing Management, 40(4), 581–592.

Christensen, C. H., Da Rocha, A., & Gertner, R. K. (1987). An empirical investigation of the factors influencing exporting success of Brazilian firms. Journal of International Business Studies, 18(3), 61–77.

Cuervo, A., & Villalonga, B. (2000). Explaining the variance in the performance effects of privatization. Academy of Management Review, 25(3), 581–590.

Cuervo-Cazurra, A., & Dau, L. A. (2009). Promarket reforms and firm profitability in developing countries. Academy of Management Journal, 52(6), 1348–1368.

Dinc, I. S. (2005). Politicians and banks: political influences on government-owned banks in emerging markets. Journal of Financial Economics, 77(2), 453–479.

Doh, J. P., Teegan, H., & Mudambi, R. (2004). Balancing private and state ownership in emerging markets telecommunications infrastructure: country, industry, and firm influences. Journal of International Business Studies, 35(3), 233–250.

Dominguez, L. V., & Sequeira, C. G. (1993). Determinants of LDC exporters’ performance: a cross-national study. Journal of International Business Studies, 24(1), 19–40.

Efron, B. (1983). Estimating the error rate of a prediction rule: improvement on cross-validation. Journal of the American Statistical Association, 78(382), 316–331.

Filatotchev, I., Demina, N., Wright, M., & Buck, T. (2001). Strategic choices, export orientation and corporate governance in privatized firms in Russia, Ukraine and Belarus: theory and empirical evidence. Journal of International Business Studies, 32(4), 853–871.

Filatotchev, I., Liu, X., Buck, T., & Wright, M. (2009). The export orientation and export performance of high-technology SMEs in emerging markets: the effects of knowledge transfer by returnee entrepreneurs. Journal of International Business Studies, 40(6), 1005–1021.

Filatotchev, I., Stephan, J., & Jindra, B. (2008). Ownership structure, strategic controls and export intensity of foreign-invested firms in transition economies. Journal of International Business Studies, 39(7), 1133–1148.

Filatotchev, I., Wright, M., Ullenbruck, K., Tihanyi, L., & Hoskisson, R. (2003). Governance, organizational capabilities, and restructuring in transition economies. Journal of World Business, 38(4), 331–347.

Gao, G. Y., Murray, J. Y., Kotabe, M., & Lu, J. (2010). A “strategy tripod” perspective on export behaviors: evidence from domestic and foreign firms based in an emerging economy. Journal of International Business Studies, 41(3), 377–396.

Garcia-Canal, E., & Guillen, M. F. (2008). Risk and the strategy of foreign location choice in regulated industries. Strategic Management Journal, 29(10), 1097–1115.

Garg, S., & Handa, S. (1991). Privatization of public enterprises in India. Jaipur: Arihant Publishers.

Greene, W. H. (1981). On the asymptotic bias of the ordinary least squares estimator of the Tobit model. Econometrica, 49(2), 505–513.

Griffin, A., & Page, A. L. (1993). An interim report on measuring product development success and failure. Journal of Product Innovation Management, 10(4), 291–308.

Hillman, A. J., Zardkoohi, A., & Bierman, L. (1999). Corporate political strategies and firm performance: indications of firm-specific benefits from personal service in the US government. Strategic Management Journal, 20(1), 67–81.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. (2000). Strategy in emerging economies. Academy of Management Journal, 43(3), 249–267.

Huang, H., & Xu, C. (1998). Soft budget constraint and the optimal choices of research and development projects financing. Journal of Comparative Economics, 26(1), 62–79.

Hultman, M., Katsikeas, C. S., & Robson, M. J. (2011). Export promotion strategy and performance: the role of international experience. Journal of International Marketing, 19(4), 17–39.

Jensen, M. C., & Meckling, W. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Ju, M., & Zhao, H. (2009). Behind organizational slack and firm performance in China: the moderating roles of ownership and competitive intensity. Asia Pacific Journal of Management, 26(4), 701–717.

Ju, M., Zhao, H., & Wang, T. (2014). The boundary conditions of export relational governance: a strategy tripod perspective. Journal of International Marketing, 22(2), 89–106.

Katsikeas, C. S., Leonidou, L. C., & Morgan, N. A. (2000). Firm-level export performance assessment: review, evaluation, and development. Journal of the Academy of Marketing Science, 28(4), 493–511.

Kaufmann, H., Kraay, A., & Mastruzzi, M. (2004). Governance matters III: governance indicators for 1996, 1998, 2000, and 2002. World Bank Economic Review, 18(2), 253–287.

Kaynak, E., & Kuan, W. K. (1993). Environment, strategy, structure, and performance in the context of export activity: an empirical study of Taiwanese manufacturing firms. Journal of Business Research, 27(1), 33–49.

Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4), 41–54.

Khwaja, A. I., & Mian, A. (2005). Unchecked intermediaries: price manipulation in an emerging stock market. Journal of Financial Economics, 78(1), 203–241.

Kornai, J., Maskin, E., & Roland, G. (2003). Understanding the soft budget constraint. Journal of Economic Literature, 41(4), 1095–1136.

Krueger, A. O. (1974). The political economy of the rent-seeking society. American Economic Review, 64(3), 291–303.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (2002). Investor protection and corporate valuation. Journal of Finance, 57(3), 1147–1170.

Large, L. F., Jap, S. D., & Griffith, D. A. (2008). The role of past performance in export ventures: a short-term reactive approach. Journal of International Business Studies, 39(2), 304–325.

Li, H. B., Meng, L., Wang, Q., & Zhou, L. (2008). Political connections, financing and firm performance: evidence from Chinese private firms. Journal of Development Economics, 87(2), 283–299.

Li, J., Wu, J., & Zajac, E. (2010). What we get and what we give up: political ties as a double-edged resource for enhancing firm innovativeness. Chicago: Paper presented at the Academy of Management.

Lu, J., Xu, B., & Liu, X. (2009). The effects of corporate governance and institutional environments on export behavior in emerging economies. Management International Review, 49(4), 455–478.

Luo, Y. D., & Tung, R. L. (2007). International expansion of emerging market enterprises: a springboard perspective. Journal of International Business Studies, 38(4), 481–498.

Mahmood, I. P., & Rufin, C. (2005). Government’s dilemma: the role of government in imitation and innovation. Academy of Management Review, 30(2), 338–360.

Majocchi, A., Bacchiocchi, E., & Mayrhofer, U. (2005). Firm size, business experience and export intensity in SMEs: a longitudinal approach to complex relationships. International Business Review, 14(6), 719–738.

Meyer, K. E. (2004). Perspectives on multinational enterprises in emerging economies. Journal of International Business Studies, 35(4), 259–276.

Neter, J., Wasserman, W., & Kutner, M. H. (1983). Applied regression models. Homewood: Richard D. Irwin.

North, D. C. (1990). Institutions, institutional change, and economic performance. Cambridge: Cambridge University Press.

O’Neill, H., Rondinelli, D. A., & Wattanakul, T. (2004). Ownership and its impact on coping with financial crisis: differences in state-, mixed-, and privately-owned enterprises in Thailand. Asia Pacific Journal of Management, 22(1–2), 49–74.

Peng, M. W. (2003). Institutional transitions and strategic choices. Academy of Management Review, 28(2), 275–296.

Pfeffer, J. (1981). Power in organizations. Marshfield: Pitman.

Pfeffer, J., & Salancik, G. R. (2003). The external control of organizations. Stanford: Stanford University Press.

Pistor, K., Raiser, M., & Gelfer, S. (2000). Law and finance in transition economies. Economics of Transition, 8(2), 325–368.

Ramamurti, R. (2000). A multilevel model of privatization in emerging economies. Academy of Management Review, 25(3), 525–550.

Ramamurti, R. (2012). What is really different about emerging market multinationals? Global Strategic Management, 2(1), 41–47.

Rothstein, B., & Teorell, J. (2008). What is quality of government? a theory of impartial government institutions. Governance, 21(2), 165–190.

Sanchez, R. (1995). Strategic flexibility in product competition. Strategic Management Journal, 16(S1), 135–159.

Sapienza, P. (2004). The effects of government ownership on bank lending. Journal of Financial Economics, 72(2), 357–384.

Sapienza, H. J., Autio, E., George, G., & Zahra, S. A. (2006). A capabilities perspective on the effects of early internationalization on firm survival and growth. Academy of Management Review, 31(4), 914–933.

Schipke, A. (2001). Why do government divest? the macroeconomics of privatization. New York: Springer.

Sheth, J. N. (2011). Impact of emerging markets on marketing: rethinking existing perspectives and practices. Journal of Marketing, 75(4), 166–182.

Shleifer, A. (1998). State versus private ownership. Journal of Economic Perspectives, 12(4), 133–150.

Shleifer, A., & Vishny, R. W. (1994). Politicians and firms. Quarterly Journal of Economics, 109(4), 995–1025.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. Journal of Finance, 52(2), 737–783.

Shoham, A. (1998). Export performance: a conceptualization and empirical assessment. Journal of International Marketing, 6(3), 59–81.

Siegel, J. (2007). Contingent political capital and international alliances: evidence from South Korea. Administrative Science Quarterly, 52(4), 621–666.

Styles, C., Patterson, P. G., & Ahmed, F. (2008). A relational model of export performance. Journal of International Business Studies, 39(5), 880–900.

Svensson, J. (2003). Who must pay bribes and how much? evidence from a cross section of firms. Quarterly Journal of Economics, 118(1), 207–230.

Talmud, I., & Mesch, G. S. (1997). Market embeddedness and corporate instability: the ecology of inter-industrial networks. Social Science Research, 26(4), 419–441.

Tan, J., & Tan, D. (2005). Environment–strategy coevolution and coalignment: a staged model of Chinese SOEs under transition. Strategic Management Journal, 26(2), 141–157.

Tesfom, G., & Clemens, L. (2008). Evaluating the effectiveness of export support services in developing countries: a customer (user) perspective. International Journal of Emerging Markets, 3(4), 364–377.

Uhlenbruck, K., Meyer, K., & Hitt, M. A. (2003). Organizational transformation in transition economies: resource-based and organizational learning perspectives. Journal of Management Studies, 40(2), 257–282.

Walder, A. G. (1995). Local governments as industrial firms: an organizational analysis of China’s transitional economy. American Journal of Sociology, 101(2), 263–301.

Wright, M., Filatotchev, I., Hoskisson, R. E., & Peng, M. (2005). Strategy research in emerging economies: challenging the conventional wisdom. Journal of Management Studies, 42(1), 1–33.

Wu, J. (2011). Asymmetric roles of business ties and political ties in product innovation. Journal of Business Research, 64(11), 1151–1156.

Wu, J. (2013). Marketing capabilities, institutional development, and the performance of emerging market firms: a multinational study. International Journal of Research in Marketing, 30(1), 36–45.

Xu, D., & Meyer, K. E. (2013). Linking theory and context: “strategy research in emerging economies” after Wright et al. (2005). Journal of Management Studies, 50(7), 1322–1346.

Zhao, H. X., & Zou, S. M. (2002). The impact of industry concentration and firm location on export propensity and intensity: an empirical analysis of Chinese manufacturing firms. Journal of International Marketing, 10(1), 52–71.

Zhara, S. A., Ireland, R. D., Gutierrez, I., & Hitt, M. A. (2000). Privatization and entrepreneurial transformation: emerging issues and a future research agenda. Academy of Management Review, 25(3), 509–524.

Zhou, L., Wu, W.-P., & Luo, X. (2007). Internationalization and the performance of born-global SMEs: the mediating role of social networks. Journal of International Business Studies, 38(4), 673–690.

Zou, S. M., Fang, E., & Zhao, S. M. (2003). The effect of export marketing capabilities on export performance: an investigation of Chinese exporters. Journal of International Marketing, 11(4), 32–55.

Acknowledgments

The first author would like to acknowledge the financial support provided by Chinese Social Science Fund (#14BGL029) and Planning Fund of the Ministry of Education of China (#12YJA790147) for this research.

Author information

Authors and Affiliations

Corresponding author

Appendix: The percentage of state owned enterprises contained by sampled countries

Appendix: The percentage of state owned enterprises contained by sampled countries

Country | Year | No. of SOEs in study sample | Percent of SOEs |

|---|---|---|---|

Brazil | 2003 | 50 | 18.05 |

Bulgaria | 2005 | 94 | 17.84 |

China | 2005 | 602 | 55.08 |

Czech Republic | 2005 | 48 | 21.05 |

Egypt | 2004 | 85 | 8.70 |

Hungary | 2005 | 56 | 17.95 |

India | 2002 | 93 | 9.28 |

Indonesia | 2003 | 25 | 6.00 |

Morocco | 2000 | 19 | 2.21 |

Pakistan | 2002 | 27 | 3.51 |

Peru | 2002 | 18 | 4.84 |

Poland | 2005 | 33 | 14.47 |

Russia | 2005 | 36 | 9.97 |

South Africa | 2003 | 11 | 2.21 |

Thailand | 2004 | 53 | 5.58 |

Turkey | 2005 | 43 | 11.00 |

Total | 1,293 | 100 |

Rights and permissions

About this article

Cite this article

Wu, J., Zhao, H. The Dual Effects of State Ownership on Export Activities of Emerging Market Firms: An Inducement–Constraint Perspective. Manag Int Rev 55, 421–451 (2015). https://doi.org/10.1007/s11575-014-0231-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-014-0231-6