Abstract

We experimentally investigate the effect of taxation of gains and losses on investment behavior. Based on the insights of economic research and psychological concepts, we expect subjects to react to taxation with behavioral and affective changes. Our main results are threefold: first, we show that taxation on gains and the possibility to deduct losses bias investment behavior, but in different directions. Since net payoffs are identical across all tax scenarios and therefore the same investment behavior is to be expected, these differences are in contrast to what a standard theory would predict. Second, we observe that different tax regulations have different effects on the affective and cognitive perception of our subjects. Third, with respect to possible connections of the affective and cognitive ratings, tax regulations, and investment decisions, we are able to show that arousal and risk perception fail to influence the decision making of participants, while there is a highly significant influence of valence perception on choice patterns.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this study, we focus on why the risky investment decisions of individuals are biased by taxation. In particular, we analyze how decision making is affected by emotional and cognitive reactions to different tax regulations. The influence of taxes on investment behavior is a factor that is long known to be highly important in various contexts. Neoclassical theory allows quantifying this influence and therefore effects on the behavior of rational subjects resulting from tax law changes can be predicted in many situations. However, reality shows that the influence of taxation cannot simply be diminished to the reduction of the amount of gains and losses, but that it seems to have additional effects that are difficult to explain with standard theory. Economists have only just begun to investigate these biasing effects, focusing mainly on the attitude towards taxes (e.g., Sausgruber and Tyran 2005, 2011; Chetty et al. 2009; Blumkin et al. 2012; Djanali and Sheehan-Connor 2012) and on the aspects influencing tax evasion decisions (for literature overviews, see Torgler 2002; Hofmann et al. 2008; Pickhardt and Prinz 2014).

One further example for an investigation focusing on tax perception issues is the experimental study by Fochmann et al. (2012). They are the first who implement a design that explicitly allows quantifying perception effects of different tax conditions independent of individual risk preferences. The authors are able to show that taxation influences the investment behavior of their subjects unexpectedly. In particular, risk-taking increases unexpectedly and in contrast to what a standard theory would predict when an imperfect loss offset is provided (see Sect. 2.1 for more details). They argue that this finding can be attributed to a biased tax perception of their subjects.

The aim of our paper is to further investigate the biased reactions investors show when confronted with taxation of their possible outcomes. To contribute to the understanding of the effect of taxes on individual decision making, it is important to understand the economic as well as the psychological perspective of the problem. In a variety of recent papers (see Sect. 2.2), for example, it is shown that decision making is affected by emotional and cognitive reactions. If taxation influences these reactions, tax policies or tax reforms can induce behavior which looks irrational from a standard economic perspective. Thus, the tax authority should have a great interest in a clearer understanding of these effects to better assess the consequences of tax law changes and to avoid unexpected behavior and unexpected tax distortions. To shed further light on this discussion, we conduct a modified version of the investment task that Fochmann et al. (2012) use and explicitly measure the affective and cognitive reactions of our subjects as well as various psychometric variables.

Our results are manifold: First, we show that taxation of gains and the possibility to deduct losses bias investment behavior, but in different directions. In particular, we are able to show that (c.p.) a loss offset provision increases the willingness to take risk whereas a tax on gains decreases risk-taking. Since we adjust the gross payoffs in such a way that the net payoffs are identical across all tax scenarios and therefore the same investment behavior is to be expected, these differences are in contrast to what a standard theory, which assumes that individuals decide only on their net payoffs, would predict. Second, we ask our participants how pleasant (valence), how exciting (arousal), and how secure (cognition) they perceive the presented tax situations and observe that different tax regulations have different effects on the affective and cognitive perception. In particular, subjects perceive the situation to be more positive, less exciting, and less risky with loss deduction and less positive, more exciting, and riskier with taxation on gains. Third, with respect to possible connections of the affective and cognitive ratings, tax regulations, and investment decisions, we are able to show that arousal and risk perception fail to influence the decision making of participants, while there is a highly significant influence of valence perception on choice patterns. Fourth, we do not find any of the other personality variables we measure to affect decision-making. This supports the view that we observe a rather general psychological effect with our experimental setting.

Our findings have both scientific and political implications. From a scientific perspective, we are able to explain decision behavior which looks irrational from a standard economic perspective using subjective ratings of valence. Therefore, our study helps to better understand why an unexpected investment behavior might occur under taxes as observed in different studies (e.g., Swenson 1989; King and Wallin 1990; Fochmann et al. 2012; Ackermann et al. 2013). From a political perspective, our paper allows us to give recommendations for tax policy makers. For example, if the legislator wants that individuals invest their money more riskily, lowering loss offset restrictions would help to induce more risk-taking behavior. In contrast, if the legislator wants to decrease the degree of risk-taking of investors, loss offset rules should be more restricted. Interestingly, although this causality between loss offset rules and risk-taking behavior is in line with the theoretical predictions (e.g., Domar and Musgrave 1994, see Sect. 2 for more details), our risk enhancing or mitigating effects do exist in addition to the theoretical expected effects and consequently amplify their impact. Furthermore, our findings suggest that the legislator should also take the affective perception of individuals into consideration to avoid unexpected behavioral responses of the taxpayers.

The remainder of the paper is organized as follows: in Sect. 2 we provide a brief review of the economic and psychological literature on this topic. In Sect. 3 we present our experimental design, sample, and procedure. The results of our study are provided in Sect. 4 and are summarized and discussed in Sect. 5. In Sect. 6, we discuss limitations of our study and possible explanations for our findings.

2 Background

2.1 Economic perspective

From an economic perspective, the effect of taxation on risk taking has been extensively covered, at least theoretically. Modern research on the topic began as early as the 1940s with the seminal work of Domar and Musgrave (1944). They show that investors increase their risk taking if they are offered the possibility of complete loss deduction, the so-called Domar–Musgrave effect. Thus, governmental involvement in both gains and losses has an enhancing effect on risk taking for risk-averse investors. While there is a wide range of theoretical contributions examining the effect of taxation on risk taking (Tobin 1958; Mossin 1968; Russell and Smith 1970; Hlouskova and Tsigaris 2012), fewer authors have tested the Domar–Musgrave effect experimentally. Examples are Swenson (1989) and King and Wallin (1990) who aimed at measuring changes in the investment behavior due to an income tax. In both studies, the authors are not able to find the risk enhancing effect of an income tax. Although the theoretical literature makes clear predictions regarding the investment behavior, the experimental results are in contrast to these predictions. So far, an explanation for these differences has not been found.

To illuminate this discussion, Fochmann et al. (2012) conducted a laboratory experiment to study the effects of limited loss deduction on the investment behavior of individuals. They use a simple investment task in which subjects choose between two lotteries in each decision situation. In different treatments the loss deduction rule is varied. However, the gross outcomes of each lottery are adapted in such a way that the net outcomes are completely identical in each treatment and compared to the outcomes in a baseline treatment without any taxation. Hence, the lottery choices should be identical in all treatments because the net payoffs remain the same. However, the authors observe a (slightly) lower willingness to take risk in the treatment with taxation of gains but without loss deduction compared to the baseline treatment. In contrast, the participants reveal an unexpected increase of their willingness to take risk in the treatments with loss deduction. This indicates that loss deduction regulations can have an unexpected and biasing effect on risk taking behavior which is in contrast to what standard theory, which assumes that individuals decide only on their net payoffs, would predict.

Nevertheless, the question remains how (at least under the assumption of a homo oeconomicus type of decision maker) the irrational behavior of investors observed by Fochmann et al. (2012) can be explained, namely which factors are influencing it. To address this question, we now give a short overview of the psychological literature that aims at explaining empirical findings of biased decision making.

2.2 Psychological perspective

As the key assumption of a rational decision maker maximizing his or her expected value (the homo oeconomicus) is widespread but often fails to hold when tested empirically, several psychological concepts aim at developing the view of decision making. The influence of initial affective reactions on decision making that do not only appear during or after cognitive evaluation was stressed early by Zajonc (1980) and described biologically through the somatic marker hypothesis (Bechara and Damasio 2005; Damasio 1994).Footnote 1 Two dual processing concepts that are especially interesting with regard to the biased reactions of the participants in the Fochmann et al. (2012) experiment are the affect heuristic (Finucane et al. 2000) and the risk-as-feelings hypothesis (Loewenstein et al. 2001). Finucane et al. (2000) postulate that decision makers use affective reactions to objects and events as clue or mental short-cut when making decisions. They suggest that positive affect is linked to a global evaluation of lower risk and higher benefit, whereas the opposite is true for negative affect.

Loewenstein et al. (2001) develop this concept further and integrate anticipated emotions as part of anticipated consequences in their model of decision making. They even go as far as stating that the affective components often are determinant for the reaction if affective and cognitive evaluation conflict. In line with the idea that emotion affects decision making, recent research has provided evidence for affective influences on decision making in the Ultimatum game (e.g., Hewig et al. 2011) and for affective influences on decision making under risk (Heilman et al. 2010). In particular, the latter authors show that negative affect increases risk aversion. More recently, Mussel et al. (2015) show that the positive affect of greed contributes to higher risk-taking. Affective reactions also influence bidding behavior in auctions (Ku et al. 2005; Adam et al. 2015) and the development of asset pricing bubbles (Andrade et al. 2015). Summers and Duxbury (2012) and Rau (2015) observe that emotional responses (such as regret and rejoice) are necessary causes for the occurrence of the disposition effect.Footnote 2 For an overview on emotions and its influence on economic behavior, see Weber and Johnson (2009).

To sum up, different psychological concepts relating to dual processing in decision making stress the role of affective reactions of decision makers. Thus, we hypothesize that investors who are confronted with the decision problem in our experiment are influenced by their affective reactions. With regard to the seemingly biased reactions of participants in Fochmann et al. (2012), it is therefore of interest to evaluate not only their choices but also their subjective evaluation of the tax situations, both affective and cognitive. The risk as feelings hypothesis (Loewenstein et al. 2001) particularly implicates that feelings may directly influence decision-making and that their influence may even primarily drive behavior as compared to more cognitive assessments of risk. Our aim is to study the underlying factors of the distorting effect of taxation on individual decision making by modifying the investment experiment conducted by Fochmann et al. (2012) and measuring the affective and cognitive perception of the investors.Footnote 3

3 Experimental design, sample and procedure

3.1 Sample

Participants were recruited from the student population of the Julius-Maximilians-University in Würzburg, Germany, by notification in several business and economics courses.Footnote 4 A total of 72 students participated in the study, exactly half of them women. 82 % of the subjects indicated to study a subject related to business and economics. On average, subjects were in their fifth semester of study (M = 4.31, SD = 2.70); their age ranged from 18 to 28 years (M = 22.1, SD = 2.25). All participants were paid between 5 and 25 € (M = 14.69, SD = 7.01) in total, depending on an initial endowment of 15 € and their decisions during the experiment (see Sect. 3.2 for further details).

3.2 Procedure

A total of nine experimental sessions were held at the CIP pool (student computer pool room) of the Faculty for Business and Economics at the University of Würzburg in November 2012. After a joint greeting and basic instructions, participants were allowed to complete the experiment at their own speed. Completion required between 36 and 107 min (M = 69.49, SD = 13.52).Footnote 5 The whole experiment was programmed using the web-based program SoSciSurvey.

Subjects were informed that they would receive an initial endowment of 15 € and that the experiment would require them to complete three parts with different tasks.Footnote 6 In the first part (lottery task), participants had to choose between lotteries. Before they had to choose in 40 decision situations in total, the lotteries and tax systems were explained using a modified version of the instructions used by Fochmann and colleagues. Comprehension was tested through several calculations.Footnote 7 The lotteries and treatments used in this part of the study are described in detail in Sect. 3.2.1.

After having chosen a lottery in every situation, participants were asked to rate the four tax treatments in general with regard to valence, arousal, and cognition. How these ratings were obtained is described in Sect. 3.2.2.

During the last part of our study, all participants were asked to fill in several questionnaires to obtain different characteristics of importance for our research question. This included the NEO-FFI (Borkenau and Ostendorf 2008) measuring the Big Five personality traits, the dynamic version of the Berlin Numeracy Test (Cokely et al. 2012), the MWT-B (Lehrl 2005) measuring intelligence, and some demographical questions including gender, age, subject of study and familiarity with taxation.

After having finished all parts of the study, one out of the 40 lotteries the participants chose in the beginning was drawn randomly and played.Footnote 8 The resulting payoff was offset against the initial endowment of 15 € and the participants received the resulting amount as payment.

3.2.1 Lottery task

In the first part of the experiment, each subject has to choose between two lotteries in several decision situations. Each lottery consists of three outcomes with equal probability (p = 1/3). Both lotteries have the following general form in each decision situation:

Both lotteries have the same expected (net) payoff (i.e., z/3), but differ with respect to variance. In particular, the lottery on the left-hand side has a higher variance than the lottery on the right-hand side because x > y. This is why the lottery on the left-hand side (right-hand side) is called high-risk lottery (low-risk lottery) in the following.

In our experiment, we use four different treatments (within-subject design) and each treatment consists of 10 decision situations.Footnote 9 Therefore, each subject is confronted with 40 decision situations in total. In each decision situation, a subject is confronted with one high-risk and one low-risk lottery (i.e., one decision situation consists of one lottery pair). The task of each participant in each decision situation is to choose one out of the two presented lotteries. All 40 lottery pairs are listed in Table 7 in Appendix 2.Footnote 10 Subjects are not able to proceed to the next decision situation without making a decision in the current situation. Furthermore, they are not allowed to go back to previous decision situations to change their previous decisions. To avoid order effects, the sequence of the 40 decision situations is randomized for each participant. In each decision situation, a participant is allowed to use the calculator provided by Windows for own calculations.

The treatments differ with respect to how gains and losses are taxed. However, we adjust the gross payoffs in such a way that the net payoffs are identical across all treatments. This means that we are able to compare a certain decision situation of one treatment with the respective decision situation of another treatment because both decision situations are identical in net terms. In the following, we specify each treatment and give an example to illustrate this net payoff equivalence.

3.2.2 Baseline treatment

Gains and losses are not taxed. Therefore, the gross and net outcomes are identical.

High-risk lottery | Low-risk lottery | |||||

|---|---|---|---|---|---|---|

Payoffs (gross = net) | 10 | 0 | −10 | 9 | 0 | −9 |

3.2.3 Taxation on gains treatment

Gains are subject to a tax with a tax rate of 35 %. This means a tax has to be paid. Losses are not taxed.

High-risk lottery | Low-risk lottery | |||||

|---|---|---|---|---|---|---|

Gross payoffs | 15.40 | 0 | −10 | 13.85 | 0 | −9 |

Tax payment | 5.40 | 0 | – | 3.85 | 0 | – |

Net payoffs | 10 | 0 | −10 | 9 | 0 | −9 |

3.2.4 Loss deduction treatment

Gains are not taxed. Losses are subject to a tax. In particular, 50 % of losses are tax deductible leading to a tax refund of 35 % of the deducted loss (i.e., tax refund is 35 % of 50 % of the actual loss).Footnote 11

High-risk lottery | Low-risk lottery | |||||

|---|---|---|---|---|---|---|

Gross payoffs | 10 | 0 | −12.10 | 9 | 0 | −10.90 |

Tax refund | – | – | 2.10 | – | – | 1.90 |

Net Payoffs | 10 | 0 | −10 | 9 | 0 | −9 |

3.2.5 Taxation on gains and losses treatment

Gains and losses are taxed (as described above).

High-risk lottery | Low-risk lottery | |||||

|---|---|---|---|---|---|---|

Gross payoffs | 15.40 | 0 | −12.10 | 13.85 | 0 | −10.90 |

Tax payment | 5.40 | 0 | – | 3.85 | 0 | – |

Tax refund | – | – | 2.10 | – | – | 1.90 |

Net payoffs | 10 | 0 | −10 | 9 | 0 | −9 |

Table 1 gives an overview over our treatments and summarizes the treatment differences.

Since we use a within-subject design and since we use the same decision situations in net terms in all our four treatments (net payoff equivalence), we are able to detect biases aside from individual risk preferences.Footnote 12 From a standard theory perspective, which assumes that an individual decides only on her net payoffs, we would expect the same choice behavior of this individual in all four treatments. However, if our different tax treatments lead to different affective reactions of our participant, differences between the treatments might occur. Therefore, we do not only look at the choice behavior, but additionally measure affective reactions in the different tax situations (see next section).

3.2.6 Ratings

This study aims at showing that the way participants perceive the applied tax system has a crucial influence on their behavior. Therefore, all participants are asked to rate the affective, emotional as well as the cognitive component after being confronted again with the respective tax scenario.Footnote 13 Following the approach of the circumplex model of affect (Russell 1980), subjects are asked to indicate the valence and arousal of the presented tax situation on a 9-point scale. The circumplex model states that affective terms group in a circle and valence and arousal show a 90°-angle. Thus these two independent dimensions (90°-angle implicates that they are uncorrelated) have been used in a large amount of emotion research to parsimoniously assess and cover the affective responses of participants. In addition, they has to indicate perceived risk on a 9-point scale as a measure of cognitive perception. In detail, participants are asked how pleasantly (valence), how excitedly (arousal), and how securely (cognition) they perceive the presented tax situation.Footnote 14 Since recent research shows that most emotions can be displayed in the two-dimensional space of the circumplex model of affect (see, for example, Yik et al. 1999), we apply this short approach to measure the affective and cognitive reactions of our subjects. The questions are as follows:

Valence: How pleasantly do you perceive the tax situation?

[1 = extremely unpleasant, 9 = extremely pleasant]

Arousal: How excited are you being confronted with the tax situation?

[1 = completely calm, 9 = extremely excited]

Cognition: How securely do you perceive the tax situation?

[1 = extremely secure, 9 = extremely unsecure]

3.3 Data analysis

Our experimental design provides us with several measures. The main variables covered are taxation on gains and loss deduction as well as valence, arousal, and cognitive perceptions. Our main goal is to show how these factors influence the decisions of the participants. Therefore, we use the absolute number of decisions for the low-risk lottery in each tax settingFootnote 15 as well as the absolute ratings (for valence, arousal, and cognition) as dependent variables. In addition, we calculate the changes in decision making and ratings within each individual when the participants face either taxation on gains or loss deduction in the following way:

where \( x \) denotes the absolute number of low-risk lottery choices or ratings in each tax condition. We get two change values for decision making, valence, arousal, and cognition ratings, respectively, and thus eight change values in total. We use these measures to examine the relation between investment decisions, taxation of gains and losses, and perception in our laboratory experiment.

The data were analyzed using ANOVA and Linear Mixed Models to identify variance components. We examined fixed factorial effects of the tax manipulations, used the ratings as covariates and included random effects of the participants as well as an intercept. For all analyses, we used SPSS 21. All of the models comprise a two way factorial design (both factors with 2 levels each). There were missing values for one participant for the valence ratings and the arousal ratings each. The mixed model analysis aimed to examine how the treatments and subjective ratings concurrently affect decision-making. In particular, the model aimed to explore whether feelings as assessed by these affective ratings are a dominant factor in explaining decision-making in the context of the treatment and the more cognitive evaluation of risk.

4 Results

4.1 Descriptive analysis

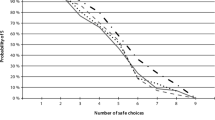

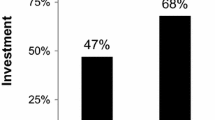

Before explicitly analyzing the predicted connections between the investigated variables, descriptive statistics and correlations are examined. As a first step, we investigate possible differences in investment behavior and ratings across treatments. Table 2 depicts the median and mean numbers of low-risk lottery choices as well as the median and mean ratings in all of the four tax situations (Figs. 1 and 2 illustrate the respective means), while Table 3 shows the median and mean changes. It is obvious that our participants reveal the same biased behavior as in Fochmann et al. (2012): compared to the baseline treatment, the low-risk lottery alternative is chosen more often in the treatment where only gains are subject to taxation and less often in the treatments with loss deduction. The change values support the impression that taxation on gains leads to an increase in decisions for the less risky investment alternative while loss deduction fosters riskier choices.

As a second step, we investigate possible connections between variables using bivariate correlations. Table 4 presents the bivariate correlations between change values and psychometric variables. It can be recognized that there are almost no connections between psychometric variables and decision making or ratings visible in the data.Footnote 16 The bivariate correlations between change values of decisions and ratings are shown in Table 5. It is observed that the changes in the number of decisions for the low-risk lottery seem to be connected with the changes in ratings in the valence dimension, at least for the change related to loss deduction. Arousal and cognition ratings, however, show no significant correlative connection to decision behavior.

4.2 Influence of taxation on decision making

To evaluate the influence of the tax conditions on decision making, we conduct a repeated-measures ANOVA with taxation on gains and loss deduction as within-subject factors and the absolute numbers of low-risk lottery choices as dependent variable.Footnote 17 The results show that the number of decisions for the low-risk lottery is significantly affected by both taxation on gains (F(1, 71) = 5.45, p = 0.022, \( \eta_{p}^{2} \) = 0.071) and loss deduction (F(1, 71) = 21.98, p < 0.001, \( \eta_{p}^{2} \) = 0.236). These changes in decision making follow the pattern of Fochmann et al. (2012) (see Fig. 1): taxation on gains leads to more risk-averse behavior, while loss deduction leads to riskier decisions. The interaction of the two taxation conditions is non-significant (F(1, 71) < 1), indicating that the two conditions are independent from each other.

Result 1: Investors are less likely to choose the low-risk lottery in the presence of loss deduction and more likely to choose the low-risk lottery in the presence of taxation on gains.

This result is also economically significant. The number of low-risk lottery choices increases by approximately 20 % in case of taxation on gains (compared to the baseline treatment). In the loss deduction treatment, the number of low-risk lottery choices decreases by approximately 27 %. If we compare both treatments, we observe that the number is almost 63 % higher in the taxation on gains than in the loss deduction treatment.

4.3 Influence of taxation on affect

Besides the fact that taxation influences the behavior of participants, it is interesting to know whether their perception is also affected. To examine this connection, we calculate several repeated measures ANOVAs with the ratings of valence, arousal, and perceived risk as dependent variables, each with taxation on gains and loss deduction as within-subject factors.Footnote 18

For valence ratings, taxation on gains (F(1, 70) = 112.17, p < 0.001, \( \eta_{p}^{2} \) = 0.616) as well as loss deduction (F(1, 70) = 36.27, p < 0.001, \( \eta_{p}^{2} \) = 0.314) have significant effects. The mean ratings (see Fig. 2) indicate that taxation on gains leads to more negative ratings, while loss deduction induces more positive ratings. The interaction effect of the two types of taxation on valence is significant (F(1, 70) = 5.31, p = 0.024, \( \eta_{p}^{2} \) = 0.071). This can be interpreted as a diminishing effect of loss deduction on the negative effect of taxation on gains and is highlighted in Fig. 3. In particular, it is observed that without loss deduction (blue line) introducing a tax on gains (“with” vs. “without”) has a (slightly) stronger negative effect on the average valence rating than with loss deduction (green line).

For arousal ratings, the picture looks similar. Again, taxation on gains and loss deduction both influence the excitement perceived. While taxation on gains tends to increase the level of perceived arousal (F(1, 70) = 16.08, p < 0.001, \( \eta_{p}^{2} \) = 0.187), loss deduction lowers it (F(1, 70) = 16.44, p < 0.001, \( \eta_{p}^{2} \) = 0.190). Furthermore, taxation on gains and losses also significantly affects the overall perceived riskiness in the same direction (F(1, 71) = 94.85, p < 0.001, \( \eta_{p}^{2} \) = 0.572 for taxation on gains and F(1, 71) = 75.11, p < 0.001, \( \eta_{p}^{2} \) = 0.514 for loss deduction). For both measures, the interaction effect turns out to be insignificant.

Result 2: Investors perceive the situation to be more positive, less exciting, and less risky with loss deduction and less positive, more exciting, and riskier with taxation on gains.

Thus, we are able to show that taxation on gains and losses does not only influence decision making, but also the affective and cognitive perception of our participants.

4.4 Connection between decisions and affect

Now that we have demonstrated that both decision behavior and affective perception are influenced by the tax treatment of gains and losses, the most interesting question remains to be answered, namely how taxation, affect, and decision making interact. To answer this question, we calculate a linear mixed model analysis. Predictors are taxation on gains and loss deduction, the ratings of valence, affect, and perceived risk. The results of this analysis are shown in Table 6.

The mixed model reveals that the only coefficient that significantly predicts the number of low-risk lottery choices is valence. For each point increase in valence there is a 0.33 decrease in the number of low risk decisions (or in other words a 0.33 increase in high risk decisions). In terms of economic significance (is the effect meaningful) the data indicate a medium sized effect. The coefficients for the tax conditions no longer significantly affect the prediction. Note, however, that this regression method can only capture the separate additional contribution of each of the variables. Thus, the fact that the two taxation conditions significantly influence the prediction of decision behavior when they are entered alone in an ANOVA (see above), but do not when they are entered together with valence indicates that they do not explain variance over and above or independent of valence ratings.

Result 3: The choice behavior changes as reaction to loss deduction and taxation on gains through the channel of valence perception.

In other words, taxation influences decision making through valence and not independent from its effects on valence. The perception of arousal and risk seem to have no significant individual impact on decision making.

5 Summary and explanations

With our experiment, we are able to show that taxation has an unexpected influence on risk-taking behavior which results in biased investment decisions. Additionally, we show that the tax treatment of gains and losses as well as affective and cognitive perception influence decision behavior. As a consequence, we are able to explain decision patterns which look irrational from a standard economic perspective using subjective ratings of affective valence.

With regard to possible connections of the affective ratings, tax conditions, and actual choices, it can be said that arousal and risk perception fail to influence the decision making of participants, while there is a highly significant influence of valence perception on choice patterns. Furthermore, our analysis shows that overall ratings do a better job at predicting the number of low-risk lottery choices than the different forms of taxation. This can be seen as strong indication for the fact that investors do not change their behavior when confronted with a different tax system, but that these changes are closely connected to their affective perception of these different tax systems. Thus, our results correspond to the concept of risk described by the risk-as-feelings hypothesis laid out above (Loewenstein et al. 2001): investors look at the tax situation, which leads them to a more negative affect in the case of taxation of gains and to a more positive affect when they find that their losses are tax deductible. This in turn influences their inclination to choose the low- or high-risk lottery alternative compared to the neutral situation without taxation of gains or losses.

Aside from our main finding, namely that valence perception influences the choice behavior of investors in our setting, we do not find any of the other personality variables we measure to affect decision-making. This supports the view that we observe a rather general psychological effect with our experimental setting.

Unfortunately, we are not able to provide a precise and testable theory that explains our findings. However, one explanation that captures all our results is that subjects focus not only on gross or on net payoffs, but that the shift from gross to net payoff triggers a (nonstandard) utility effect. That means that subjects still use the net payoffs for their decision, but the shift from gross to net payoff induce a—what we call—additional utility shift for the subjects.Footnote 19

In the baseline treatment, only net payoffs do exist and therefore such an additional utility shift cannot occur. In the taxation on gains treatment, taxation reduces the positive gross payoff (but negative payoffs are not affected). As the (positive) net payoff is lower than the gross payoff, we assume that this leads to an additional utility decrease due to the tax payment. There are at least two reasons for this additional (negative) utility shift: (1) subjects suffer (nonstandard) disutility from paying taxes (tax aversionFootnote 20) and (2) subjects perceive the reduction from gross to net payoff as a loss.Footnote 21 Since the payoff reduction is lower for the low-risk lottery (as positive payoffs are lower) than for the high-risk lottery in one decision situation, the additional decrease in utility is lower for the low-risk lottery either. Consequently, the preference for the low-risk lottery (compared to the high-risk lottery) should be higher in the taxation on gains treatment than in the baseline treatment (where no additional utility shifts occur). This is exactly what we observe in the taxation on gains treatment.

In the loss deduction treatment, taxation reduces the negative gross payoff (i.e., losses become smaller, but positive payoffs are not affected). In this case, we assume that subjects obtain an additional increase in utility due to this loss reduction (as net payoff is higher than the negative gross payoff). Again, there are at least two reasons for this additional (positive) utility shift: (1) subjects gain (nonstandard) utility from receiving a tax refund (right the opposite of tax aversion) and (2) subjects perceive the increase from gross to net payoff as a gain.Footnote 22 As the loss reduction is lower for the low-risk lottery (as negative payoffs are lower) than for the high-risk lottery, the additional increase in utility is lower for the low-risk lottery either. Consequently, the preference for the low-risk lottery (compared to the high-risk lottery) should be lower in the loss deduction than in the baseline treatment. This is exactly what we observe in the loss deduction treatment.

In the taxation on gains and losses treatment, a prediction is a bit more complicated since both effects occur simultaneously. However, a prediction can be derived if we assume—related to mental accounting—that subjects mentally separate the tax effects in case of a positive and negative payoff. Thaler (1985, 1990, 1999), Shefrin and Statman (1985), Odean (1998), and Baker et al. (2007), for example, argue that people tend to segregate different types of gambles or elements (although fungible) into separate mental accounts (here: “positive payoff domain with tax payment” and “negative payoff domain with tax refund”) and then apply prospect theoretic decision rules to each account by ignoring possible interactions. We therefore expect that the additional utility decrease due to the tax payment and the additional utility increase due to the loss reduction occur separately from each other but simultaneously. If we assume that subjects are loss averse (i.e., losses loom larger than gains) in line with Prospect Theory (Kahneman and Tversky 1979), we would expect that the additional utility increase in case of a negative payoff is greater than the additional utility decrease in case of a positive payoff.Footnote 23 As a consequence, the effect of a higher preference for the high-risk lottery due to loss deduction should be the dominating effect. Therefore, the preference for the high-risk lottery should be higher in the taxation on gains and losses treatment than in the baseline treatment. Indeed, we observe this decision pattern. Thus, this explanation would explain the different decision behavior across the treatments and could be responsible for the observed differences of the affective and cognitive reactions between the treatments. For example, the additional utility increase (decrease) in the loss deduction (taxation on gains) treatment could be a plausible explanation for the higher (lower) valence rating in this treatment compared to the baseline treatment.

We argue that tax salience or an aversion to computational complexity (which reduces utility from a lottery that has been taxed) fail to explain the differences between the treatments. As both lotteries are always taxed in the same way, level of tax salience and level of computational complexity is identical for both the low- and the high-risk lottery. Thus, from this point of view, the preference for one certain lottery should not differ between the treatments. Furthermore, gross payoff illusion (i.e., subjects focus only on gross payoffs) is not an explanation either. Consider, for example, lottery pair number 1 and 21 (see Table 7 in Appendix 2). In net terms, both lottery pairs are identical, however gross payoffs differ. In the baseline treatment without taxation, no gross payoffs do exist. In this case, the expected value is identical for both lotteries, but the low-risk lottery has a lower variance. In the loss deduction treatment, gross and net payoffs do exist. If subjects only focus on gross payoffs, the expected value of the low-risk lottery (−0.63) is higher than the expected value of the high-risk lottery (−0.70). Furthermore, the variance is still lower for the low-risk lottery. As a consequence, the preference for the low-risk lottery should increase in this treatment compared to the baseline treatment under gross payoff illusion. However, exactly the opposite result is observed. Subjects reveal a higher preference for the high-risk lottery in the loss deduction than in the baseline treatment. An overestimation of loss deduction could be an explanation for the higher preference for the high-risk lottery in the loss deduction treatment (as the perceived expected value is higher for the high- than low-risk lottery in this case). However, this cannot explain the difference between the baseline and the taxation on gains treatment where no loss offset is provided.

6 Conclusions and limitations

Our study design allows us to observe changes in the investment behavior of individuals regardless of their risk preferences and allows us to show that taxation of gains and losses irrationally influences the choices of investors through their affective perception of the tax situations. The generality of the effect we find, namely that all investors are influenced by the perception of taxation in roughly the same way regardless of their differential personality traits, allows us to give a recommendation for tax policy makers. For example, if the legislator wants that individuals invest their money more riskily, lowering loss offset restrictions would help to induce more risk-taking behavior. In contrast, if the legislator wants to decrease the degree of risk-taking of investors, loss offset rules should be more restricted. Interestingly, these risk enhancing or mitigating effects of loss offset rules do exist in addition to the theoretical expected effects and consequently amplify them.

Furthermore, our finding that the affective perception of tax regulations has an important influence on risk-taking behavior could be helpful to assess the consequences of tax law changes. Before a tax reform is introduced, the legislator has to quantify the effects of such a reform to predict how, for example, the tax revenue, investment decisions, and consumption decisions will react. Our finding suggests that the legislator should also take the affective perception of individuals into consideration to avoid unexpected behavior and unexpected tax distortions.Footnote 24 This suggestion also relates to the recommendation of the OECD (based on findings of the psychological tax literature) that so called “co-operative compliance” programs should be implemented to improve (cooperative and trust-based) relationship between taxpayer and tax authority (OECD 2008/2013). Although this tax compliance framework is not directly linked to our investment setting, it predicts that taxpayers’ perception of the whole tax system (including tax rules, treatment of tax authority, interactional fairness) has a positive influence on taxpayers’ decision behavior. Our results amplify that the tax regulations themselves have a strong effect on this perception and consequently on behavior.

However, before any reasonable policy advice can be given or before the already prevalent taxation and loss deduction rules can be properly evaluated with regard to their behavioral implications, the replication of the effect outside the laboratory would be helpful of course. In addition, a closer look at the connection between changes in decision making and affective perception with more differentiated questionnaires, for example, could lead to deeper insights into possible mechanisms. It would also be useful to add the possibility of complete loss deduction in order to see whether the tendency to choose the riskier alternative increases further when there is a possibility to deduct losses completely.

Despite these questions that remain to be answered, at this point in time we are already able to conclude that taxation of gains and losses has a non-negligible influence on the decision making of investors. Our results indicate that this influence is driven by affective reactions, especially perceived valence. Thus, our study provides an example of a case where the investigation of traditional psychological factors, such as affective reactions, is able to enhance the understanding of behavior patterns that seem irrational from a neoclassical economic perspective.

Our study has certain limitations. First, we use a laboratory experiment with students as subject. As for all experiments, our results have to be treated with caution regarding external validity. Second, we measured affective and cognitive reactions after all lottery decisions were made. As the measurement was not conducted directly in the moment of decision making, it cannot completely be excluded that the magnitude of rating measurements is effected by this approach. We conjecture that a measurement after each decision situation would lead to stronger responses as subject’s involvement is higher. As we observed differences regarding affective and cognitive perception even in our setting, the differences between the tax scenarios should then be more pronounced in the other setting. Therefore, we expect to observe stronger effects if we would measure the ratings directly in the moment of decision making which would enhance our findings. Third, unfortunately we are not able to provide a precise and with our data verifiable theory that explains why we observe that affective and cognitive perceptions are influenced by tax regulations. Thus, further research is necessary to illuminate this discussion.Footnote 25

Notes

For an example of more recent research of dual processing in neuroscience, see Brocas and Carrillo (2014).

In the finance literature, the disposition effect describes the robust behavioral anomaly that investors are reluctant to realize capital losses, whereas capital gains are sold too early (see, for example, Odean 1998).

The design modifications are as follows: First, for time reasons, subjects receive an initial endowment of 15 € in our experiment instead of “earning” this amount of money through a real effort task. Second, we do not implement the tax control treatment and capped deduction treatment for time reasons. Third, we implement a new treatment (loss deduction treatment) that completes our 2 × 2 design described below to investigate the individual effects of taxation on gains and loss deduction. Fourth, we reduce the number of decision situations per treatment from 20 to 10 for time reasons. Fifth, after the lottery task is completed, we measure subjects’ affective and cognitive perception of investment situations.

As a standard recruiting procedure was not available for us, we recruited our subjects by notification. In particular, we designed a flyer with all relevant information about the experiment and sent this to different lecturers. As the experiment was conducted at the faculty of Economics and Management, we distributed the document only to lecturers from this faculty. The lecturers were asked to present this flyer at the beginning of their courses. If a student was interested in participating, he/she was asked to send an email to the experimenter’s email address displayed at the flyer.

Although there is considerable variation in completion time across individuals, we found no systematic relationship with any of the other variables.

The instructions are presented in Appendix 1.

We confront our subjects with control questions to test their comprehension. For this purpose, a subject has to correctly calculate net payoffs for each treatment. A wrong answer is not punished and does not lead to any negative consequence. Specifically, a subject with a wrong answer is neither excluded from the experiment nor from the analyses. If an answer is not correct, the subject is given a further attempt to solve the problem correctly.

To avoid income effects and strategies to hedge the risk across all decision situations, only one out of the 40 decision situations determines pay.

In experimental economics, the term “treatment” is used to refer to a particular condition of the experiment. In our experiment, we have four different conditions (gains and losses are not subject to taxation; gains are subject to taxation, but not losses; losses are subject to taxation, but not gains; gains and losses are subject to taxation) and thus four different treatments.

In our experiment, we use the same lottery outcomes as presented in Fochmann et al. (2012). However, we reduced the number of decision situations per treatment from 20 to 10.

Although there is probably no real-life example for such a tax treatment, this combination completes the 2 × 2 design and therefore helps to investigate the individual effects of taxation on gains and loss deduction.

Indeed, the willingness to take risk and thus the decision behavior depends on the individual risk preference. However, for our research question, we are only interested in the different decision behavior of an individual across the treatments (treatment differences) and not in the exact decision behavior in one treatment. As a subject is confronted with identical lotteries in net terms in all treatments and as a subject participates in each treatment (within-subject design), decision behavior of this subject should not differ between the treatments from a standard theoretical perspective (under stable risk preferences across treatments).

The order of the tax situations to be rated is randomized for each subject.

Subjects are also asked to indicate valence, arousal, and cognition of specific lotteries. For this purpose, we confront each subject with two exemplary lottery pairs after the experiment again and ask them to rate the low-risk as well as the high-risk alternative in every tax condition. The order is randomized for each subject. We apply the same questions, but we use (in line with the instructions) “business opportunity” instead of “tax situation”. As we are only interested in how the perception of each tax regulation influences the decision behavior of our participants and not in how the perception of a specific lottery effects behavior, we will only focus on the general tax situation ratings in the following.

We decided to only report the number of low-risk lottery choices. As the number of decision situations (i.e., lottery choices) is ten in each treatment, the number of decisions for the high-risk lottery equals ten minus the number of decisions for the low-risk lottery.

Furthermore, we explicitly tested for gender differences. However, we did not observe any differences between female and male subjects with respect to the lottery choices, the ratings or the change of choices and ratings across the treatments.

As robustness tests, we further run nonparametric tests and fixed effects logistic regression to analyze the treatment differences. The test results confirm our ANOVA results and are presented in Appendix 3.

As robustness tests, we further run nonparametric tests to analyze the treatment differences. The test results confirm our ANOVA results and are presented in Appendix 3.

To ensure that the decision situations are identical in net terms in—for example—the taxation on gains treatment and baseline treatment, the (positive) gross payoffs are higher in the former than in the latter. Please notice that the increase of the gross payoff itself is not assumed to lead to an additional utility shift because we assume that subjects still use the net payoff for their decisions. Furthermore, subjects compare—within one decision situation—the low-risk and high-risk lottery under a certain tax regime and not between two tax regimes and thus are not directly confronted with the gross payoff increase.

Tax aversion refers to the idea that individuals bear an extra utility loss from paying taxes in addition to the utility loss resulting from the monetary consequences of paying taxes. See, for example, Kirchler (1998), Fennell and Fennell (2003), McCaffery and Baron (2006), Hardisty et al. (2010), Kallbekken et al. (2011), Sussman and Olivola (2011), Hundsdoerfer et al. (2013), and Blaufus and Möhlmann (2014).

This is in line with Prospect Theory (Kahneman and Tversky 1979) if the presented gross payoff is assumed to be the reference point. According to this theory, a payoff (like in this case the net payoff) below this reference point is perceived as a loss.

Again, this is in line with Prospect Theory if the presented gross payoff is assumed to be the reference point. A payoff (like in this case the net payoff) above this reference point is perceived as a gain.

In other words, subjects perceive loss deduction as a possibility to reduce negative payoffs which has stronger effects than the reduction of positive payoffs by taxation.

For example, the legislator could assess affective perception by using survey methods before the tax reform is introduced. How to measure the affective perception of different tax regulations is, however, an open question and should be answered by future research.

In addition, one further interesting research question for future research would be to analyze whether subjects with certain risk preferences react differently to the tax frame. Unfortunately, the data regarding subjects’ risk preferences or level of loss aversion is not available for us.

References

Ackermann H, Fochmann M, Mihm B (2013) Biased effects of taxes and subsidies on portfolio choices. Econ Lett 120:23–26

Adam M, Krämer J, Müller MB (2015) Auction fever! How time pressure and social competition affect bidders’ arousal and bids in retail auctions. J Retail 91:468–485

Andrade EB, Odean T, Lin S (2015) Bubbling with excitement: an experiment. Rev Financ. doi:10.1093/rof/rfv016

Baker M, Nagel S, Wurgler J (2007) The effect of dividends on consumption. Brook Papers Econ Act 1:231–276

Bechara A, Damasio A (2005) The somatic marker hypothesis: a neural theory of economic decision. Games Econ Behav 52(2):336–372

Blaufus K, Möhlmann A (2014) Security returns and tax aversion bias: behavioral responses to tax labels. J Behav Financ 15(1):56–69

Blumkin T, Ruffle B, Ganun Y (2012) Are income and consumption taxes every really equivalent? Evidence from a real-effort experiment with real goods. Eur Econ Rev 56(6):1200–1219

Borkenau P, Ostendorf F (2008) NEO-Fünf-Faktoren-Inventar nach Costa und McCrae: Manual, 2nd edn. Hogrefe, Göttingen

Brocas I, Carrillo J (2014) Dual-process theories of decision-making: a selective survey. J Econ Psychol 41:45–54

Chetty R, Looney A, Kroft K (2009) Salience and taxation: theory and evidence. Am Econ Rev 99(4):1145–1177

Cokely E, Galesic M, Schulz E, Ghazal S, Garcia-Retamero R (2012) Measuring risk literacy: the Berlin numeracy test. Judgm Decis Mak 7(1):25–47

Damasio A (1994) Descartes’ error: emotion, reason, and the human brain. Putnam, New York

Djanali I, Sheehan-Connor D (2012) Tax affinity hypothesis: do we really hate paying taxes? J Econ Psychol 33(4):758–775

Domar E, Musgrave R (1944) Proportional income taxation and risk-taking. Quart J Econ 58(3):388–422

Fennell C, Fennell L (2003) Fear and greed in tax policy: a qualitative research agenda. J Law Policy 13:75–138

Finucane M, Alhakami A, Slovic P, Johnson S (2000) The affect heuristic in judgments of risks and benefits. J Behav Decis Mak 13(1):1–17

Fochmann M, Kiesewetter D, Sadrieh A (2012) Investment behavior and the biased perception of limited loss deduction in income taxation. J Econ Behav Organ 81(1):230–242

Hardisty D, Johnson E, Weber E (2010) A dirty word or a dirty world? Attribute framing, political affiliation, and query theory. Psychol Sci 21:86–92

Heilman RM, Crişan LG, Houser D, Miclea M, Miu AC (2010) Emotion regulation and decision making under risk and uncertainty. Emotion 10(2):257

Hewig J, Kretschmer N, Trippe RH, Hecht H, Coles MGH, Holroyd CB, Miltner WHR (2011) Why humans deviate from rational choice. Psychophysiology 48(4):507–514

Hlouskova J, Tsigaris P (2012) Capital income taxation and risk taking under prospect theory. Int Tax Public Financ 19(4):554–573

Hofmann E, Hoelzl E, Kirchler E (2008) Preconditions of voluntary tax compliance: knowledge and evaluation of taxation, norms, fairness, and motivation to cooperate. Zeitschrift für Psychologie/J Psychol 216(4):209–217

Hundsdoerfer J, Sielaff C, Blaufus K, Kiesewetter D, Weimann J (2013) The influence of tax labeling and tax earmarking on the willingness to contribute—a conjoint analysis. Schmalenbach Bus Rev 65:359–377

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–291

Kallbekken S, Kroll S, Cherry T (2011) Do you not like Pigou or do you not understand him? Tax aversion and revenue recycling in the lab. J Environ Econ Manag 62:53–64

King R, Wallin D (1990) Individual risk taking and income taxes: an experimental examination. J Am Tax Assoc 12(1):26–38

Kirchler E (1998) Differential representations of taxes: analysis of free associations and judgments of five employment groups. J Socio Econ 27:117–131

Ku G, Malhotra D, Murnighan JK (2005) Towards a competitive arousal model of decision-making: a study of auction fever in live and Internet auctions. Organ Behav Hum Decis Process 96:89–103

Lehrl S (2005) Manual zum MWT-B, 5th edn. Spitta-Verlag, Balingen

Loewenstein G, Weber E, Hsee C, Welch N (2001) Risk as feelings. Psychol Bull 127(2):267–286

McCaffery E, Baron J (2006) Thinking about tax. Psychology, public policy, and law 12:106–135

Mossin J (1968) Taxation and risk-taking: an expected utility approach. Economica 35(137):74–82

Mussel P, Reiter AM, Osinsky R, Hewig J (2015) State- and trait-greed, its impact on risky decision-making and underlying neural mechanisms. Soc Neurosci 10(2):126–134

Odean T (1998) Are investors reluctant to realize their losses? J Financ 53:1775–1798

OECD (2008) Study into the role of tax intermediaries

OECD (2013) Co-operative compliance: a framework

Pickhardt M, Prinz A (2014) Behavioral dynamics of tax evasion—a survey. J Econ Psychol 40:1–19

Rau H (2015) The disposition effect in team investment decisions: experimental evidence. J Bank Financ 61:272–282

Russell J (1980) A circumplex model of affect. J Pers Soc Psychol 39(6):1161–1178

Russell W, Smith P (1970) Taxation, risk-taking, and stochastic dominance. South Econ J 36(4):425–433

Sausgruber R, Tyran J-R (2005) Testing the mill hypothesis of fiscal illusion. Public Choice 122(1–2):39–68

Sausgruber R, Tyran J-R (2011) Are we taxing ourselves? How deliberation and experience shape voting on taxes. J Public Econ 95(1):164–176

Shefrin H, Statman M (1985) The disposition to sell winners too early and ride losers too long: theory and evidence. J Financ 40:777–790

Summers B, Duxbury D (2012) Decision-dependent emotions and behavioral anomalies. Organ Behav Hum Decis Process 118:226–238

Sussman A, Olivola C (2011) Axe the tax: taxes are disliked more than equivalent costs. J Mark Res 48:S91–S101 (Special Issue 2011)

Swenson C (1989) Tax regimes and the demand for risky assets: some experimental market evidence. J Am Tax Assoc 11(1):54–76

Thaler R (1985) Mental accounting and consumer choice. Market Sci 4:199–214

Thaler R (1990) Anomalies: saving, fungibility, and mental accounts. J Econ Perspect 4(1):193–205

Thaler R (1999) Mental accounting matters. J Behav Decis Mak 12:183–206

Tobin J (1958) Liquidity preference as behavior towards risk. Rev Econ Stud 25(2):65–86

Torgler B (2002) Speaking to theorists and searching for facts: tax morale and tax compliance in experiments. J Econ Surv 16(5):657–683

Weber E, Johnson E (2009) Mindful judgment and decision making. Annu Rev Psychol 60:53–85

Yik M, Russell J, Barrett L (1999) Structure of self-reported current affect: integration and beyond. J Pers Soc Psychol 77(3):600–619

Zajonc R (1980) Feeling and thinking: preferences need no inferences. Am Psychol 35(2):151–175

Acknowledgments

This research was supported by a Schumpeter-Fellowship from Volkswagen Stiftung. The authors thank the editor Jochen Hundsdoerfer, two anonymous referees, Florian Englmaier, Maximiliane Hörl, Michael Schüßler and Lisa Spantig for insightful comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Instructions (originally written in German)

1.1 Welcome screen

Welcome! Thank you very much for your participation in this study.

The study consists of several parts:

-

First, you will be asked to put yourself into the position of an entrepreneur and choose between business opportunities. Your initial endowment here is 15 €, which you can increase or decrease depending on your decisions.

-

Then, it will be your task to rate some of the decision situations.

-

Afterwards, we will ask you to answer some general questions.

In sum, the whole study will last for about 90 min.

We ask you to work carefully on all parts of the study and to give spontaneous, honest answers to all the questions! If you have questions or problems, please raise your hand anytime.

When you are ready, please click on “proceed” to start with the first part of the study.

1.2 Instructions for the lottery task

Please read the following instructions carefully! If you have understood everything, you can test your comprehension on the next page before making your decisions.

Imagine you are an entrepreneur and have to decide which business opportunities you want to use in the future. There are two business opportunities with different payoffs available to you. Your task is to choose the option you prefer.

In the course of the study, you will be faced with 40 of these decision situations in total. They will be displayed as follows:

Each business opportunity is characterized by three payoffs which occur with a probability of 1/3 each. In case of the left option, this means that a payoff of 5 occurs with a probability of 1/3, a payoff of 0 occurs with a probability of 1/3, and a (negative) payoff of -6 occurs with a probability of 1/3.

After you have made all 40 decisions, one of these decisions will be randomly selected at the end of the experiment and offset against your initial endowment of 15 € to calculate your earnings. Hence, your outcome depends on one of your 40 decisions.

There are four different methods regarding the taxation treatment of payoffs. Potentially, positive payoffs can be subject to taxation on gains and negative payoffs can be subject to tax deduction (loss deduction). Loss deduction means that you get a refund in case that a negative payoff occurs, i.e., you actual loss is reduced. You can always see which method is applied to the current decision situation above the two business opportunities. Note that the current taxation treatment always applies to both business opportunities. For example, in the picture above, the fourth method (partial loss deduction) is depicted:

Taxation on gains yes

Loss deduction partial loss deduction

The four different taxation treatment methods are explained in the following:

-

1.

No taxation

There is no tax, i.e., all payoffs of both business opportunities are not subject to taxation, neither in the gain nor in the loss dimension. All positive and negative payoffs remain unchanged.

-

2.

No loss deduction

There is taxation on gains with a tax rate of 35 % of the payoff, but there is no loss deduction. This means that all positive payoffs are reduced by the amount of taxation, but negative payoffs are not subject to taxation and hence unchanged.

-

3.

No taxation on gains

There is no taxation on gains, but loss deduction. Hence, positive payoffs are unchanged, but half of the negative payoffs are reduced by a tax rate of 35 %.

-

4.

Partial loss deduction

There is a tax rate of 35 %. Positive payoffs are subject to taxation on gains, and half of negative payoffs are reduced by this rate.

Exemplary calculation

No taxation | No loss deduction | No taxation on gains | Partial loss deduction | ||||||

|---|---|---|---|---|---|---|---|---|---|

(1) | Payoff (gross) | 5 | −6 | 5 | −6 | 5 | −6 | 5 | −6 |

(2) | Subject to taxation | 0 | 0 | 5 | 0 | 0 | −3 | 5 | −3 |

(3) | Resulting tax = (2) × 0.35 | 0 | 0 | 1.75 | 0 | 0 | −1.05 | 1.75 | −1.05 |

Net payoff: = (1) − (3) | 5 | −6 | 3.25 | −6 | 5 | −4.95 | 3.25 | −4.95 | |

If you have understood everything, click on “proceed” to go to the next page to test your comprehension. If you have questions or problems, do not hesitate to ask the investigator!

1.3 Control questions [correct answers in red]

Please calculate the net payoffs for given gross payoffs of a business opportunity and fill them in the fields below the corresponding business opportunity. You may use a calculator if needed!

Hint: If your solution is decimal, please round to two decimal places. For example, if your solution is 15,73333, fill in 15,73 in the corresponding field!

1.4 Instructions for ratings

In the following, you will be asked to rate some of the business opportunities shown to you in the first part of the experiment. For this purpose, the corresponding business opportunity will be shown to you once again and three questions will be asked:

-

How pleasantly do you perceive the business opportunity?

[1 = extremely unpleasant, 9 = extremely pleasant]

-

How excited are you being confronted with the business opportunity?

[1 = completely calm, 9 = extremely excited]

-

How securely do you perceive the business opportunity?

[1 = extremely secure, 9 = extremely unsecure]

You will be able to rate each of these three questions on a scale with nine options.

Please look at the business opportunity briefly and then answer the three questions honestly and spontaneously, according to instinct!

When you are ready, click “proceed” to go to the first rating.

[specific lottery ratings]

Thank you for your ratings!

Now we would like to know how you rate the different taxation scenarios from the first part in general. For this purpose, the corresponding taxation scenario will be shown to you once again and again, three questions will be asked:

-

How pleasantly do you perceive the situation?

[1 = extremely unpleasant, 9 = extremely pleasant]

-

How excited are you being confronted with the situation?

[1 = completely calm, 9 = extremely excited]

-

How securely do you perceive the situation?

[1 = extremely secure, 9 = extremely unsecure]

You will be able to rate each of these three questions on a scale with nine options.

Please look at the taxation scenario briefly and then answer the three questions honestly and spontaneously, according to instinct!

When you are ready, click “proceed” to get to the first rating.

[general tax situation ratings]

Appendix 2: Lottery pairs

See Table 7.

Appendix 3: Robustness tests

As a first robustness test, we run nonparametric tests to analyze the treatment differences. In particular, we use the Wilcoxon signed-rank test for dependent samples (two-tailed) and test whether the influence of taxation on our four dependent variables decision making (i.e., number of low-risky lottery choices), valence, arousal and cognition is statistically significant. The resulting p-values for each treatment comparison are presented in Table 8.

As a second robustness test, we run a fixed effects logistic regression to analyze the influence of taxation on the low-risk lottery choices. Here we do not use the number of low-risk lottery choices of each individual per treatment as dependent variable, but the exact lottery choice in each decision situation. Thus, the dependent variable is a binary variable where 1 indicates that the subject chose the low-risk lottery and 0 that the subject chose the high-risk lottery in the respective decision situation. As independent variables, we use a dummy variable “Taxation on Gains” which takes the value of 1 if gains are subject to tax (0 otherwise), a dummy variable “Loss Deduction” which is 1 if losses are subject to tax (0 otherwise) and a dummy variable “Taxation on Gains and Losses” which is 1 if both gains and losses are subject to tax (0 otherwise). In Table 9, the results of the regression analysis are presented (regression coefficients, standard errors in parentheses).

In both robustness tests, we observe that investors are significantly less likely to choose the low-risk lottery in the presence of loss deduction and more likely to choose the low-risk lottery in the presence of taxation on gains. In the first robustness test, we observe that investors significantly perceive the decision situation to be more positive, less exciting, and less risky with loss deduction and less positive, more exciting, and riskier with taxation on gains. Thus, the results of the robustness tests confirm our previous ANOVA results.

Rights and permissions

About this article

Cite this article

Fochmann, M., Hewig, J., Kiesewetter, D. et al. Affective reactions influence investment decisions: evidence from a laboratory experiment with taxation. J Bus Econ 87, 779–808 (2017). https://doi.org/10.1007/s11573-016-0838-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11573-016-0838-0