Abstract

Little is known about how take-up of private health insurance coverage differs between those with and without mental disorders. This study seeks to fill this gap by using data from the 2004–2008 Medical Expenditure Panel Survey to examine differences in offers and take-up of employer-sponsored insurance (ESI) among adults aged 27–54. Little evidence that mental disorders are associated with take-up of offers of ESI coverage was found. This suggests that take-up rates in the Affordable Care Act (ACA) marketplaces by those with and without mental disorders may be similar. The ACA is especially important to Americans with mental disorders, many of whom lack access to ESI coverage to pay for mental health treatment either through their own job or through a spouse’s job.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The Affordable Care Act (ACA) has the potential to substantially increase insurance coverage for the large number of Americans with severe mental disorders. Garfield et al. estimated that approximately 3.7 million Americans with severe mental disorders, including depression, ultimately could gain coverage under the ACA—2.0 million under the Medicaid expansion provisions if fully implemented and 1.7 million under the private insurance provisions.1 The ACA coverage provisions are especially important to people with mental disorders because they have lower incomes on average, greater health needs, and are more likely to be uninsured, in large part because of more limited access to private employer-sponsored insurance (ESI) coverage compared to Americans without mental disorders.1 – 3 This lack of coverage contributes to substantial unmet needs among people with mental disorders.3 – 7

The potential for the ACA to help people with mental disorders depends on the extent to which they take advantage of the ACA coverage expansions. However, little is known about how take-up of insurance differs in the general population between those with and without mental disorders. The much higher expected expenditures on both mental health and nonmental health services would suggest higher take-up rates among those with mental disorders (in other words, adverse selection).2 On the other hand, those with mental disorders may have greater difficulty navigating complex public program rules or face other barriers in private health insurance markets.

This study seeks to study access to and take-up of pre-ACA private health insurance options and assess their implications for the ACA marketplaces, one of the two major ACA coverage expansions. Past experience under Medicaid expansions and other changes in Medicaid eligibility may provide some guide to take-up under the ACA Medicaid expansions but is the subject of a separate study. Ideally, one would like to analyze the differential take-up of coverage by those with and without mental health problems in close analogs to the ACA marketplaces. However, data to directly analyze the ACA marketplaces will not be available for some time. Unfortunately, there is also insufficient data (primarily due to insufficient sample available for Massachusetts in national surveys) to fully study differential take-up of coverage available through the Massachusetts Connector, a precursor to the ACA. The historical market for individually purchased insured plans is likely a poor guide to take-up in the ACA marketplaces, and it is difficult to develop and observe meaningful measures of offers in the individual market. Instead, this study seeks to better understand take-up of private health insurance coverage for those with and without mental disorders in the market for private ESI coverage, the primary source of insurance for the prime working age population.

Specifically, this study used data from the 2004–2008 MEPS to examine differences in offers and take-up of ESI coverage among adults aged 27–54 by mental health status. Older adults were excluded because retirement decisions (both for workers and their spouses) are increasingly tied to health and health insurance coverage—those who continue to work are a selected group that may not generalize to other adults. Younger adults also do not generalize well to other adults because they are still completing schooling and sorting themselves into career paths. Moreover, younger adults differ from prime age working adults through ACA provisions that went into effect in 2010 expanding access to private insurance coverage as dependents on their parent’s policies up to the age of 26. Thus, the focus here is on adults of prime-working age—separate analyses of young adults and older workers are beyond the scope of this study, but of policy interest. Probit regression models were used to examine key correlates of take-up of employer offers of insurance coverage, including educational background, race/ethnicity, family composition, geography, physical health status, and most importantly, mental health status. It is important to emphasize that these analyses are descriptive in nature and direct causal inferences cannot be made.

Data and Methods

Data

The data were drawn from the 2004–2008 Medical Expenditure Panel Survey (MEPS), a large nationally representative household survey conducted annually in the USA since 1996 by the Agency for Healthcare Research and Quality. The MEPS contains a rich array of information on each household member’s health care use and expenditures, health insurance coverage, employment and income, health status and health conditions, and other sociodemographic characteristics. The MEPS is widely used to model the demand for insurance and health care and to plan and evaluate health policy reforms and changes.

The MEPS utilizes an overlapping panel design to represent the civilian noninstitutionalized population in each calendar year. Households are interviewed in-person for five rounds covering two full calendar years. The average recall period for these five rounds is approximately 5 months. Generally, one person responds for all members of the household. In-person interviews are supplemented with an adult self-administered health questionnaire (MEPS Adult SAQ) asked of every adult to assess health status and experiences of care that might not be captured reliably by proxy.

Because the main measures of mental disorder were drawn from the adult SAQ and because it is administered during rounds 2/4 of each year (round 2 for the new panel and round 4 for the old panel comprising each MEPS calendar year), the contemporaneous round 2/4 versions of all other variables including employment and health insurance status were used.

Mental health status

Two well-validated measures of mental health status contained in the MEPS Adult SAQ were used to identify the population likely to have a mental disorder: the two-item Patient Health Questionnaire (PHQ-2) depression screener and the K6 scale of nonspecific serious psychological distress. The PHQ-2 asks “Over the last 2 weeks, how often have you been bothered by any of the following problems?” “feeling down, depressed, or hopeless,” and “little interest or pleasure in doing things.” Responses ranged from “not at all” (0) to “nearly every day” (3). A score of 3 or higher indicates the need for more comprehensive depression screening. The PHQ-2 is a sensitive (93%) and specific (75%) indicator for any depressive disorder.8 The K6 scale is predictive of severe mental illness, defined as any individual with a DSM-IV diagnosis and severe impairment, with a score of 13 suggested as a cut-point.9 A person was considered to have a probable mental disorder if he or she scored greater than 2 on the PHQ-2 depression symptom checklist (indicating probable depressive disorder) or scored 13 or greater on the K6 scale.

Sample

Several restrictions on the 2004–2008 MEPS sample were imposed. First, the population of interest was limited to those between the ages of 27 and 54. Younger adults were excluded because they are still completing schooling and sorting themselves into career paths. Those younger adults in the labor force are a select group that might not generalize to other adults. The ACA also greatly expanded the coverage options of adults up to the age of 26 as dependents on their parent’s health insurance policies. This provision complicates the inferences that may be drawn from the experiences of pre-ACA young adults to post-ACA young adults. Older adults aged 55 and older were excluded because those that continue working are increasingly a selected group in terms of their health and health insurance coverage choices that might not generalize to other adults. Like young adults, the experience of older workers is certainly important from a policy perspective but beyond the scope of the present analyses. Children were also excluded here because of the lack of indicators for mental disorder contained in the MEPS.

Second, the analysis was limited to those persons with family incomes above the 138% of modified adjusted gross income threshold (133% of poverty + 5% automatic disregard) believing this population to be the most relevant to potential take-up of private insurance in the health insurance exchanges. Adults who either did not complete the Adult SAQ (1760 observations for women and 1785 for men) or did not complete both the PHQ2 and K6 scales contained on the SAQ (219 observations for women and 191 for men) were further excluded. The MEPS sample weight specific to the Adult SAQ were used to account for SAQ nonresponse.

Because the epidemiology of mental disorders differs greatly between men and women (for example, women have much higher rates of depression) as do labor market decisions, all analyses were stratified by sex. Final sample sizes used in the analyses were 19,760 observations for women and 18,657 observations for men.

Outcomes

The three key outcome variables were, respectively, employment at the time of the round 2/4 interview, an offer of health insurance coverage from a person’s current main job, and whether the person accepted the offer of insurance (that is, take-up) from the current main job. Following Cooper and Schone, a measure of whether a person had access to ESI coverage either from their own job or their spouse’s current main job was also used.10 Similarly, a measure of family level take-up of insurance if either or both spouses took up the offer of health insurance coverage was used.

Covariates

In addition to the indicator for probable mental disorder, several other indicators for health and mental health status that might factor into individual and family decisions about employment and health insurance choices were included. The first is derived from the standard one-item perceived health status question asked in each of the five rounds of MEPS. Respondents are asked relative to persons their age, whether each member of the household is in excellent, very good, good, fair, or poor health. Poor and fair responses were combined into a single binary indicator (ever poor or fair vs good/very good/excellent). A mental health analog of the perceived physical health status item was also included. Perceived mental status captures aspects of an individual’s perceptions of need for treatment and thus may drive choices about employment and insurance.11 Finally, a simple count of a set of 11 chronic conditions that are ascertained in each MEPS panel was included. Respondents were asked if the doctor ever told the person they had diabetes, arthritis, asthma, emphysema, stroke, high blood pressure, high cholesterol, coronary heart disease, heart attack (myocardial infarction), angina, and other heart disease.

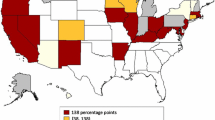

A number of sociodemographic characteristics expected to be related to employment and health insurance choices were included. The standard representation of race/ethnicity dividing the population into mutually exclusive groups was included as follows: non-Hispanic whites (the omitted group), Hispanic ethnicity, non-Hispanic blacks, and others including those of Asian and mixed race ancestry. Education was represented by a series of binary indicators corresponding to degrees obtained: less than high school diploma (omitted), high school diploma or equivalent, some college, bachelors, and advanced degree (masters, MD, JD, PhD). Indicators for each of the four Census Regions in the USA (Northeast, Midwest, South, and West) and whether the person resided in a Census Bureau defined Metropolitan Statistical Area, a measure of whether the person lives in an urban or rural area, were also included.

Marriage is clearly a key pathway by which individuals may obtain employer-sponsored health insurance coverage through their spouses. In some analyses, analyses were stratified by single versus married to better account for this key pathway. Counts of the number of household members between the ages of 0–5, 6–17, 18–64, and 65 and older, which may factor into labor market decisions and choices about health insurance coverage, were also included.

Analyses

A series of bivariate descriptive analyses were first performed separately for men and women comparing those with and without mental disorders along a number of sociodemographic, health insurance coverage, and employment characteristics. Next, employment, offer rates (conditional on employment), and take-up rates (conditional on offers) were examined. Using a logarithmic decomposition method, the relative contributions of each (employment, offer, and take-up) to overall ESI coverage rates was obtained. Again, these descriptive means of employment, offers, and take-up rates are stratified by those with and without mental disorders and by sex. These were further stratified by marital status and, among married adults, whether a spouse had offers of health insurance coverage.

Descriptive probit equations on the main outcome of interest, the probability an individual takes up an employer offer of health insurance coverage, were then estimated separately for men and women. These regressions were estimated on the full sample of men and women, respectively, aged 27–54 with offers of employment-related coverage. Adults who were self-employed or reported an establishment size of 1 were excluded because of concerns that individuals were “offering” themselves insurance, thus carrying a different meaning than for others (in addition to some measurement issues). The regressions included the following individual characteristics: age, race/ethnicity, education, marital status and household composition, MSA status (urban/rural), Census region, trend, perceived poor/fair physical health, chronic conditions, and the key indicator of probable mental disorder. To those individual characteristics, a comparable set of physical and mental health measures if a spouse was present and indicators for whether any child or adolescent in the family had poor or fair mental or physical health were added. In both cases, it is expected that a person will be more likely to take up coverage if there is a family member in poor physical or mental health. Whether a spouse had an offer of coverage, which likely would reduce the need to take up one’s own offer, was also included for married men and women.

The central concern with this study’s approach analyzing take-up is selection. Individuals may seek out and take-up offers of health insurance coverage either for themselves if they are in poor mental health, or on behalf of a family member. On the other hand, persons with mental disorders may be less able to work or employers may seek to screen out job applicants with mental disorders because of concerns about productivity and high medical costs. Attempts to correct for selection by jointly estimating a Heckman selection model with the first probit equation describing the probability an individual receives an offer of coverage and the second probit equation describing the probability an individual takes up an offer were unsuccessful. It is well known that, while technically identified, Heckman selection models are unreliable in the absence of first-stage exclusion restrictions. From a conceptual standpoint, it is nearly impossible to find suitable individual or family-level characteristics that are strongly related to whether an individual has an offer of coverage but not take-up. A number of potential area and market-level exclusion restrictions (for example, state-level offer rates and premiums by firm size and industry) were considered, but these performed poorly in predicting individual offers after controlling for individual and family characteristics. Thus, the strategy remains to rely on observable individual characteristics and family characteristics, such as the measures of mental health status, to control for selection in the take-up regressions recognizing that selection on unobservable characteristics may still be present.

Related to this concern about selection is the treatment of some potentially useful explanatory characteristics related to the take-up of employers’ offers of insurance coverage. Generosity of coverage and out-of-pocket premiums are key inputs into individual and family decisions about accepting employer’s offers of insurance. While generosity of coverage and out-of-pocket premiums are not directly observed in the data, proxies such as industry and occupation, firm size (2–24, 25–99,100–499, 500 plus), whether the person belongs to a union or not, and wages could be included in the descriptive models. The main results do not change when these proxies (which are strongly correlated with take-up) were included. Ultimately, following standard practice, these potentially endogenous (to employment choices and generosity) proxies were excluded. One could argue that spousal offers of coverage should also be dropped because of similar concerns that it is endogenous to joint decision-making about insurance plan and employment choices. However, dropping this variable drastically alters the magnitude of the marital status effect—in effect, marital status soaks up the effect of spousal offers of coverage, if omitted, in addition to its direct effect of marital status on the likelihood of take-up—without changing the main results. Because of these concerns, separate models for single and married men and women were also estimated. The main conclusions did not change in these separate models and thus are omitted here for the sake of parsimony.

Finally, four measures of attitudes and preferences toward insurance and health care available in the MEPS Adult SAQ were considered but ultimately excluded: “I’m healthy enough that I really don’t need health insurance,” “Health insurance is not worth the money it costs,” “I’m more likely to take risks than the average person,” and “I can overcome illness without help from a medically trained person.” These might be correlated with individual choices about taking up offers of health insurance coverage, but these are also potentially endogenous. For example, a person’s perceptions about whether “health insurance is not worth the money it costs” may be endogenous to their choices about employment and thus generosity and out-of-pockets costs under their employer’s offers. Again, the main conclusions were not sensitive to whether or not these attitudinal items were included.

All analyses were performed using the Stata 12.1/MP4 statistical package. Taylor series linearization methods were used to correct all standard errors and statistical tests for the stratified and clustered design of the MEPS. This method also corrects for the correlation across individuals and families.12

Results

Bivariate analyses

Table 1 shows means of socioeconomic characteristics of adults aged 27–54 stratified by sex and whether the person had a probable mental disorder. Educational attainment is substantially lower for those with a mental disorder among both men and women. For example, 16% of women without a mental disorder had a graduate degree compared to 7% with a degree. Family income too was substantially lower for both men and women with mental disorders. Women and, especially, men with mental disorders were less likely to be married, reducing the likelihood that they obtained insurance through their spouse’s employer. Mental disorders were also strongly correlated with physical health problems. For example, men and women with a mental disorder were four times more likely to report that they were in fair or poor physical health. Together, these sociodemographic characteristics suggest greater need for health care and health insurance but fewer resources to obtain them among those with mental disorders.

Table 2 describes pre-ACA insurance coverage in the MEPS sample, again stratified by sex and likely presence of a mental disorder. Both women and men with mental disorders were less likely to be insured than their healthier counterparts. For example, 18% of men without a disorder lacked insurance compared to 27% with a mental disorder. Men and especially women with mental disorders rely more on public insurance sources (Medicare, Medicaid, and other state programs) for their coverage. For example, only 4% of women without a disorder had public coverage compared to 12% with a disorder. Rates of private coverage were correspondingly lower in populations with mental disorders—about 12 percentage points less in both men and women. For all groups covered by private plans, employer or union plans were the primary source of insurance coverage. Access to and take-up of these employment-related sources of coverage was the focus of the remaining analyses.

As seen in Table 3, both women (12 percentage points less) and men (14 percentage points less) with mental disorders were substantially less likely to be working than their healthier counterparts. This is consistent with the prior literature demonstrating negative labor market effects of mental disorders.13 – 20 For the full sample, offer rates were slightly lower among women with disorders (72 compared to 75% without disorder, p = 0.097) and men with mental disorders (72 vs 76%, p = 0.02). In contrast, there were no statistically significant differences in take-up rates between those with and without mental disorders in either men or women. Decomposing the overall differences in ESI coverage between those with and without a disorder, lower employment rates among those with mental illnesses explained 82% of the differences in women and 66% in men (not shown). Differences in offer rates explained most of the remaining differences in employment-related coverage while differences in take-up rates explain little.

Table 3 also stratifies adults 27–54 by their marital status to further examine variations in employment, offer, and take-up rates. Among single adult women, the same basic pattern as the sample as a whole was seen, with the exception that take-up rates were marginally different between those with and without a mental disorder (89 vs 92%, p = 0.062). Among married adults aged 27–54, again, differences in employment explained most of the differences in actual private insurance coverage. Take-up rates were the same overall for married women with and without a mental disorder (66%) while they were marginally different (p = 0.096) for married men with (79%) and without a mental disorder (83%). Not surprisingly, take-up rates varied considerably by whether a spouse also had an offer of employment-related coverage. For example, for men without a mental disorder, 75% accepted their own employer’s offer when their spouse also accepted an offer, while the acceptance rate was 92% when their wives did not have offers of their own. Among this latter group where spouses did not have offers, there are some differences in take-up rates between those with and without disorders—81 versus 87% for women (p = 0.088) and 85 versus 92% for men (p = 0.024). Finally, offers and take-up rates through a spouse for those without their own offers of health insurance coverage through an employer were also examined (not shown). Among married women without a mental disorder and no offer of their own 73% had a spouse with an offer of coverage compared to 68% with a disorder (p = 0.037). Take-up rates by their spouses were lower among those with a disorder (88 vs 93%, p = 0.030). Spousal coverage was a less significant potential source of coverage among married men without their own coverage, with only about half of their wives having offers through their employers.

Table 4 combines offers from one’s own employer with a spouse’s offer to look at overall access to employer-sponsored health insurance coverage.10 Among married adults (both women and men), 88% of those without a mental disorder had access to an offer of coverage from either their own or their husband’s coverage compared to 82% with a disorder (p < 0.001). Take-up of an offer from either spouse was 94% among married adults without a disorder and slightly lower (90%) among married adults with a disorder (p = 0.002).

Regression analyses

Table 5 reports the main regressions results among adults aged 27–54 with offers from their own employer (similar descriptive probit regressions, not shown, confirmed the same patterns of employment and offer rates among those with and without mental disorders found in the bivariate results reported in Tables 3 and 5). Persons who were self-employed or their reported firm size of 1 were excluded because “offers” have a different meaning in this context. To aid in interpretation, the table presents average marginal effects instead of probit coefficient estimates. Controlling for other personal characteristics, mental health status was uncorrelated with take-up of insurance offers for either women or men. The same held true when take-up was estimated separately for single women, married women, single men, and married men (results not shown). A person’s own physical health indicators were uncorrelated with take-up with the exception of a small negative effect on take-up of better physical health on the SF-12 physical health summary scale among women. Poor mental health of a child was also uncorrelated with take-up. Poor/fair physical health of a child was marginally statistically significant as a predictor of take-up among men (p = 0.051), but the magnitude of the marginal effect was fairly small (4.3 percentage points more likely). Poor/fair physical health of a spouse was not associated with take-up for either married men or women. However, presence of a mental disorder in a spouse was associated with a 6 percentage point increase in the probability of take-up among women (p = 0.051), but the same was not true for men where there was no discernible effect. A spouse’s offer of coverage was associated with strikingly lower probability of take-up—in women by 24 percentage points and in men, by 17 percentage points. Education was also a strong predictor of take-up in both women and men.

Discussion

This study found little evidence that take-up of offers of ESI coverage differed markedly between those with and without mental disorders. Differences were generally small in magnitude and rarely statistically significant. This suggests that assumptions about take-up of health insurance coverage in the ACA marketplaces used for the general population may also apply to eligible populations with mental disorders. Previous projections of the impact of health reform on coverage had no choice but to assume take-up rates were the same for those with and without mental disorders, lacking an empirical basis one way or another.

By far, the biggest explanation for the much lower rates of ESI coverage among those with mental disorders compared to their healthier counterparts was that they were simply less likely to be employed in the first place. In addition, among those employed, those with mental disorders were somewhat less likely to be offered coverage by their employer. Compounding these problems, women and, especially, men with mental disorders were less likely to be married diminishing the prospects of coverage through a spouse. Further, married women with a mental disorder were less likely to have a husband who had access to coverage through their job. Thus, the ACA marketplaces are particularly important to the large number of Americans with mental disorders who lack access to ESI coverage.

Limitations

There are several issues that confound interpretation of the results. First and foremost, the analyses did not control for the simultaneity and reverse causality biases inherent in examining the effects of mental health disorders on employment-related outcomes (employment, offers, and take-up). For example, job loss may lead to or exacerbate symptoms of depression and anxiety. Similarly, past take-up of insurance may lead to improved mental health through increased access to treatment. Heckman selection models can be used to control for unobserved heterogeneity but suitable exclusion restrictions that strongly predicted employer offers were lacking. Therefore, causal claims concerning the effect of mental disorders on take-up of insurance coverage cannot be made.

Second, while well-validated measures of mental health status were used in this study, these short scales are by their nature imperfect and not as sensitive to severity of disorders as longer diagnostic instruments. Alternative ways of specifying the PHQ-2 and K6 measures in the regression models were tested (for example, including them as continuous measures rather than cut-points), and the results were not sensitive. However, the analyses were still limited to these two particular scales available in the MEPS and thus subject to measurement error in the identification of the population with and with mental disorders.

Third, and perhaps most importantly from a policy perspective, the experience of individuals that offered health insurance coverage through their employers may differ in fundamental ways from the ACA marketplaces. For example, the marketplaces require positive action from enrollees to sign up (that is, take-up coverage) which require significantly more effort than simply accepting or declining an employer offer of coverage. Premiums paid for ESI coverage are tax advantaged (pre-tax dollars) and employee contribution to total premiums often small—in 2013, employees paid an average of 21% for single plans and 27% for family plans.21 , 22 ESI coverage may also be more generous than many ACA marketplace plans. As a result, even with substantial subsidies for much of the population (and small shared responsibility payments), take-up rates in the ACA marketplaces will likely be lower than take-up rates reported for pre-ACA employer offers.

Finally, it is unlikely that the pre-ACA experience of take-up of employer offers generalizes to the ACA Medicaid expansions at all. The populations newly eligible for Medicaid coverage differ even more markedly from those with pre-ACA offers of ESI than those eligible for the ACA marketplaces in terms of income and health needs. Past Medicaid expansions and other changes in income eligibility requirements likely provide a much closer analog to the ACA Medicaid coverage expansions and are the subject of a separate study.

Implications for Behavioral Health

Americans with mental disorders are substantially less likely to have access to ESI coverage. Thus, the ACA marketplace expansions are particularly important to people with mental disorders above 138% of the poverty line (or 100% in the cases of states who so far have opted out of the ACA Medicaid expansion). Despite limitations, the experience of take-up of pre-ACA employment offers may still shed light on differences in enrollment rates in the ACA marketplaces. This experience suggests that enrollment rates may be similar among those with mental disorders compared to the rest of the marketplace eligible population. However, as data becomes available, it will be important to track actual enrollment by people with mental disorders in the new ACA marketplaces. If enrollment by people with mental disorders lags the rest of the population, more targeted outreach efforts may be required.

References

Garfield R, Zuvekas SH, Lave J, et al. The impact of national health reform on adults with mental disorders. American Journal of Psychiatry 2011;168(5): 486-494.

Zuvekas SH, Selden TM. Mental Health and Family Out-of-Pocket Expenditure Burdens. Medical Care Research and Review 2010;67(2): 194-212.

Roy-Byrne PP, Joesch JM, Wang PS, et al. Low socioeconomic status and mental health care use among respondents with anxiety and depression in the NCS-R. Psychiatric Services 2009; 60(9):1190–1197.

Kessler RC, Demler O, Frank RG, et al. Prevalence and treatment of mental disorders, 1990 to 2003. New England Journal of Medicine 2005;352(24):2515–2523.

McAlpine DD, Mechanic D. Utilization of specialty mental health care among persons with severe mental illness: the roles of demographics, need, insurance, and risk. Health Services Research 2000; 35 (1 Pt 2):277–292.

Zuvekas SH. Health insurance, health reform, and outpatient mental health treatment: who benefits? Inquiry 1999; 36(2):127–146.

Landerman LR, Burns BJ, Swartz MS, et al. The relationship between insurance coverage and psychiatric disorder in predicting use of mental health services. American Journal of Psychiatry 1994; 151(12):1785–1790.

Kroenke K, Spitzer RL, Williams JBW. The Patient Health Questionnaire-2: validity of a two-item depression screener. Medical Care2003; 41(11): 1284-92.

Kessler RC, Barker PR, Colpe LJ, et al. Screening for serious mental illness in the general population. Archives of General Psychiatry2003;60(2): 184-89.

Cooper P, Schone B. More offers, fewer takers for employment-based health insurance: 1987 and 1996. Health Affairs 1997;16(6):142-9.

Zuvekas SH, Fleishman JA. Self-rated mental health and racial/ethnic disparities in mental health service use. Medical Care2008;46(9): 915-23.

Wolter KM. Introduction to Variance Estimation. New York: Springer-Verlag, 1985, pp. 111-121.

Chatterji P, Alegria M., Takeuchi D. Psychiatric disorders and labor market outcomes: Evidence from the national comorbidity survey-replication. Journal of Health Economics2011; 30(5): 858-868.

Ojeda VD, Frank RG, McGuire TG, et al. 2010. Mental illness, nativity, gender and labor supply. Health Economics 19(4): 396-421.

Cseh A. The effects of depressive symptoms on earnings. Southern Economic Journal2008; 75(2): 383-409.

Alexandre PK, French MT. Labor supply of poor residents in metropolitan Miami, Florida: The role of depression and the co-morbid effects of substance use. Journal of Mental Health Policy and Economics2001;4 (4): 161-173.

Lim D, Sanderson K., Andrews G. Lost productivity among full-time workers with mental disorders. Journal of Mental Health Policy and Economics2000;3(3): 139-146.

Kessler RC, Barber C, Birnbaum HG, et al. Depression in the workplace: Effects on short-term disability. Health Affairs1999;18 (5): 163-71.

Ettner SL, Frank RG, Kessler RC. The impact of psychiatric disorders on labor market outcomes. Industrial and Labor Relations Review1997;51(1): 64-81.

Kessler RC, Frank RG. The impact of psychiatric disorders on work loss days. Psychological Medicine1997;27(4): 861-73.

Agency for Healthcare Research and Quality. Percent of total premiums contributed by employees enrolled in single coverage at private-sector establishments that offer health insurance by firm size and selected characteristics: United States, 2013. (Table I.C.3). Medical Expenditure Panel Survey Insurance Component Tables. Generated using MEPSnet/Insurance Component. Available online at http://meps.ahrq.gov/mepsweb/data_stats/meps_query.jsp. Accessed November 10, 2014.

Agency for Healthcare Research and Quality. Percent of total premiums contributed by employees enrolled in family coverage at private-sector establishments that offer health insurance by firm size and selected characteristics: United States, 2013. (Table I.D.3). Medical Expenditure Panel Survey Insurance Component Tables. Generated using MEPSnet/IC. Available online at http://meps.ahrq.gov/mepsweb/data_stats/meps_query.jsp. Accessed November 10, 2014.

Acknowledgments

A previous draft of this paper was presented at the American Society of Health Economists Research Meeting in Minneapolis, MN, June 2012. The author would like to thank Alexander Cowell for his many thoughtful comments and suggestions. The author also wishes to thank Steve Hill, Jessica Vistnes, and Tom Selden for key MEPS variables used in these analyses and their excellent advice. The views expressed in this paper are those of the author, and no official endorsement by the Agency for Healthcare Research and Quality, or the Department of Health and Human Services is intended or should be inferred.

Conflict of Interest

The authors declared no conflicts of interest with respect to the authorship and/or publication of this article.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zuvekas, S.H. The Take-Up of Employer-Sponsored Insurance Among Americans with Mental Disorders: Implications for Health Care Reform. J Behav Health Serv Res 42, 279–291 (2015). https://doi.org/10.1007/s11414-015-9459-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11414-015-9459-6