Abstract

The tournament hypothesis of Brown et al. (J Finance 51(1):85–110, 1996) posits that managers of poorly performing funds actively increase portfolio risk in the second half of the year. At the same time, it is a well-established fact that stock returns and the subsequent return standard deviation are negatively related. We propose a decomposition of fund return standard deviation for the second half of the year using holdings-based measures to distinguish between risk changes that result from holding the portfolio and those that are due to managers’ trades. We extend the return gap of Kacperczyk et al. (Rev Financ Stud 21(6):2379–2416, 2008) to the return standard deviation dimension and define the volatility gap as the difference between fund return volatility and buy-and-hold portfolio volatility. Our empirical findings show that changes in the return volatilities of equity mutual funds are largely explained by shifts in buy-and-hold portfolio volatility. Thus, we find only weak evidence of tournament behavior among mutual funds.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The mutual fund tournament hypothesis posits that fund managers intentionally adjust their portfolio risk in the second half of the year. Brown et al. (1996) argue that fund managers with a poor midyear performance tend to increase their portfolio risk in the second half of the year in an attempt to move up in the ranking vis-à-vis their peers by the end of the year. This risk-shifting behavior is explained by investor responses to fund performance and by the compensation structure of fund managers. Chevalier and Ellison (1997) and Sirri and Tufano (1998) show that fund flows are asymmetric: investor outflows react less strongly to poor performance than inflows do to good performance. Furthermore, Sirri and Tufano (1998) show that fund flows mostly react to fund performance during the prior year. At the same time, managers are usually compensated based on a percentage of the assets under management (Khorana 1996). Fund flows govern total net assets, which means that it is the annual fund performance that ultimately determines manager compensation. Thus, managers of funds with a disappointing midyear performance may be inclined to increase risk to try to improve their ranking. If this strategy pays off and the funds rank well at the end of the calendar year, the managers may attract significant fund inflows and increase their salary. On the downside, outflows will be limited if the increase in risk does not result in higher realized returns.

There is also a consensus in the empirical asset pricing literature that stock returns are negatively related to the volatility of subsequent returns, a phenomenon known as asymmetric volatility (Bekaert and Wu 2000). This implies that below-average stock returns are associated with increases in return standard deviation. A number of papers discuss econometric and estimation issues that affect the tournament results; however, this paper focuses on the negative interaction between stock returns and their volatility and the role that this interaction plays in the risk shifts that are detected by tests for tournament behavior on the part of mutual fund managers. We examine the holdings data for 5,565 actively managed U.S. equity mutual funds during the 20-year period between 1991 and 2010, and we propose a decomposition of fund volatility in the second half of each of these years using holdings-based measures. Extending Kacperczyk et al. ’s (2008) definition of a return gap, we define the volatility gap as the difference between the volatility of realized fund returns and the volatility of the returns on a buy-and-hold strategy. We then use this decomposition to determine whether using returns from holding the portfolio composition constant during the second half of the year or using actual fund returns produces comparable results with respect to the tournament phenomenon. We find that the tournament test results are similar when using changes in fund return volatility or changes in buy-and-hold portfolio volatility and that volatility gap changes, which proxy for fund manager action, make only a marginal contribution to the tournament process.

Brown et al. (1996) were the first to expound the tournament theory and to find strong evidence of tournament behavior among U.S. mutual funds. Since then, studies of the phenomenon have obtained mixed results. For instance, Koski and Pontiff (1999) and Qiu (2003) support the tournament hypothesis, whereas Busse (2001), Taylor (2003), Ammann and Verhofen (2009), and Elton et al. (2010) find no evidence to support it. With these contradictory results in mind, we first test the linear relationship between the return rankings for the first half of the year and the subsequent risk shifts for our sample of mutual funds, and then we test it for individual stocks. If the tournament hypothesis holds, a stronger negative relationship would be expected for equity non-index funds than for equity index funds or individual stocks because tournament behavior involves active changes of portfolio weights. Our results for the entire sample reveal weaker relationships for funds than for stocks, whereas they are qualitatively similar for non-index and index funds. Thus, there is evidence that passively holding stocks may indicate tournament behavior in traditional return-based tests.

The second contribution of the paper is an assessment of the role played by fund managers in tournament behavior. Because the tournament phenomenon is observed among stocks, we verify whether the mutual fund tournament results are a consequence of fund manager action or the due to the negative link between the return on stocks and their volatility. We use holdings-based measures to decompose the changes in the fund return standard deviation. In particular, we decompose the changes in fund return standard deviation into buy-and-hold portfolio volatility and volatility gap changes, the first being due to volatility changes for stocks and the second due to portfolio rebalancing. Using the previous year’s December weights, we find that shifts in buy-and-hold portfolio volatility largely explain shifts in fund return volatility, with an adjusted regression \(R^{2}\) of 65.9 %. These findings are in line with the work of Busse (2001), who reaches similar conclusions using daily fund returns and factor loadings. In fact, he finds that the volatility of a constant factor-loading portfolio and the residual standard deviation for the first half of the year largely explain the changes in return standard deviations that occur between the first and second half of the year. He concludes that most changes in fund volatility are due to changes in the volatility of common stock market risk factors and that few changes result from the actions of fund managers. We cannot rule out that some managers closely monitor the passive changes in their portfolio risk and decide not to adjust their portfolio as they feel comfortable with the risk shift. For non-index funds, the coefficients from regressing the return standard deviation during the second half of the year on the difference between the buy-and-hold volatilities using June and prior year’s December weights as initial weights is positive, which indicates that some managers start to adjust their portfolio before the end of June. Yet, the adjusted \(R^{2}\) from these regressions for the full sample is very low (2.3 %).

The paper’s third contribution derives from accounting for changes in the buy-and-hold portfolio volatility when retesting the tournament hypothesis on our mutual fund sample. We find that fund performance over the first half of the year does not explain volatility gap changes, which reflect active changes in portfolio risk over and above changes caused by holding the fund portfolio during the second half of the year. The coefficient on return rankings for the first half of the year is insignificant for the entire sample, and during the two subperiods considered, which provides evidence against tournament behavior by mutual funds. When we analyze passive changes in buy-and-hold portfolio standard deviation instead of volatility gap changes, the test results are very similar to those obtained for fund return volatility: in the first subsample, the buy-and-hold standard deviation is positively and significantly related to the return rankings for the first half of the year; in the second subsample, it is negatively and significantly related to them, but has an insignificant (and negative) coefficient for the entire sample. The changes in these coefficients may explain why prior studies on tournament behavior have shown mixed results. Finally, portfolio rebalancing during the first half of the year has a statistically significant and negative impact on subsequent risk changes and thereby lends support to the tournament hypothesis. However, the effect is economically small.

Since the seminal work of Brown et al. (1996), a number of researchers have questioned the methodology of the original tournament tests. For instance, the use of total risk (return standard deviation) is criticized by Busse (2001), who suggests differentiating between systematic and idiosyncratic risks when studying the tournament phenomenon. He argues that fund managers have greater control over market beta and the unexplained component than over total portfolio variance. The same argument is made by Ammann and Verhofen (2009), who study the tournament phenomenon using systematic risk as described by the Carhart (1997) four-factor model. Some researchers analyze the impact of data frequency on tournament results. For example, Busse (2001) and Qiu (2003) advocate the robustness of results from daily as opposed to monthly data because of the absolute autocorrelation bias present in monthly returns. On the other hand, Goriaev et al. (2005) consider a relative autocorrelation bias measure and find it to be smaller in monthly than in daily returns. The debate has been revived recently by Schwarz (2012), who underlines a sorting bias in the contingency table analyses, proposing a new approach for testing the tournament effect that controls for this bias. The direction of the risk shift has received equal interest in the literature. Brown et al. (1996), Busse (2001), and Goriaev et al. (2005) argue that interim loser funds increase their risk; Taylor (2003) and Basak and Makarov (2012) defend opposing behavior that results in interim loser funds decreasing their risk in the second half of the year. Finally, Kempf and Ruenzi (2008) ascertain that the tournament phenomenon is observed at the family rather than at the fund-universe level.

Inferring the actions of fund managers indirectly from a single time series of realized returns is challenging and can lead to non-robust conclusions. Using fund holdings provides further information on managers’ trades and avoids limiting the analysis to the two-dimensional risk-return setting. Elton et al. (2010) test four hypotheses related to mutual funds: momentum trading, tax-motivated trading, window dressing, and tournament behavior. The authors highlight substantial differences in the results obtained using holding data instead of monthly return data. Chevalier and Ellison (1997) examine the flow-performance relationship and find evidence of asymmetry, where inflows are more responsive to good performance than outflows are to poor performance. Using end-of-year holdings, they compute the beta of the equity portion of the portfolio by value weighting all the individual stocks in the holdings. They find that the holdings are altered in accordance with the intentional risk-shifting argument. Huang et al. (2011) examine the consequences of risk shifting on portfolio performance and thus, to a certain extent, address the corollary of the tournament hypothesis; they find that shifting the portfolio risk upward is likely to be a value-destroying strategy. Kempf et al. (2009) study the effects of employment risk and compensation on portfolio risk shifting, finding that when employment risk is low, managers of poorly performing funds increase their risk relative to well-performing funds. The authors emphasize the usefulness of holdings for studying the tournament question, pointing out that changes in individual stock positions make it possible to capture the intended risk changes rather than the realized risk changes. They compute risk shifts as the difference between the intended risk in the second half of the year, estimated using the midyear portfolio holdings and the realized stock return standard deviation for the first half of the year as a proxy for the expected stock return volatility, and the realized risk in the first half of the year. Our paper contributes to the literature by dividing total risk changes into buy-and-hold portfolio volatility changes and volatility gap changes. We use the volatility gap to assess the changes in portfolio risk that are due to the unobserved actions of fund managers.

The remainder of the paper is structured as follows: Section 2 describes the samples of actively managed U.S. equity funds, index funds, and stocks, and Sect. 3 addresses the tournament question for these samples. Section 4 introduces the holdings-based measures of risk used to decompose fund return volatility. Section 5 explains the links between the holdings-based measures of changes in risk and fund return rankings and presents the results of the tests for tournament behavior. Section 6 contains our conclusions.

2 Data

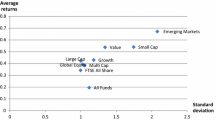

We use three main sources of data: (i) the CRSP Survivor-Bias-Free U.S. Mutual Fund Database, (ii) portfolio holdings of U.S. equity mutual funds provided by Morningstar, and (iii) the CRSP U.S. Stock Database. Monthly fund returns are retrieved from the first of these databases for the period starting in January 1991 and ending in December 2010. Data on semi-annual portfolio holdings are retrieved from the Morningstar database for January 1991–December 2002, and from the CRSP mutual fund database for January 2003–December 2010.Footnote 1 We select U.S. domestic equity funds based on style criteria stemming from five different sources: Wiesenberger, Micropal/Investment Company Data, Strategic Insights, Lipper, and the funds themselves. Hybrid funds and sector funds are excluded. We match the two databases (i) and (ii) and select only those funds whose fund identifiers in the Morningstar (data item ticker) and CRSP (Nasdaq) databases correspond. For each fund portfolio, we retain the return series of the oldest share class.

To ensure that our sample-matching procedure is correct over the 1991–2002 period, we compute the correlation between the total net assets (TNA) extracted from the Morningstar database and those extracted from the CRSP database at the portfolio level. We thus sum for each fund the TNA of all share classes in the CRSP database into a single fund portfolio. We obtain a correlation coefficient equal to 97.3 %, which supports the correctness of our merging procedure. Although we consider the entire set of fund holdings in the data-merging process, according to Elton et al. (2012), the Morningstar database only reports holdings with a weight that exceeds 0.0006 % of TNA. This has practically no effect on our results as the entire sample’s holdings weights sum to almost 1 for each fund and date. The final sample of non-index funds comprises 5,565 U.S. domestic equity mutual funds. The stock sample covers 19,177 stocks that have been held by at least one fund at some point in time during the sample period from 1991 to 2010.

In addition to our main sample, which is free from index funds, we select a sample of pure index funds based on the Lipper style classification. The fund name must include the word “index” and exclude the word “enhanced,” the category name must be equity, and the area name must include “US” and exclude “global”. Finally, we manually check the entire selected sample to ensure that the fund description, style, and name agree with an index fund categorization. The final sample comprises 570 U.S. domestic equity index funds.

3 Risk shifting in fund and stock returns

This section replicates the tests in the literature on mutual fund tournaments and extends the analysis to our equity index fund and stock samples. Brown et al. (1996) were the first to suggest the tournament hypothesis, whereby funds that perform below (above) the median performance in the first half of the year actively increase (decrease) their risk in the second half of the year. Their conjecture is motivated by fund flows being more sensitive to good than to poor performance outcomes (Chevalier and Ellison 1997; Sirri and Tufano 1998) and by investors paying more attention to performance ranks than to absolute measures of raw or risk-adjusted performance (Patel et al. 1994). In turn, to be among the tournament winners, mutual fund managers are disposed to increase their risk in the second half of the year to compensate for poor performance results in the first half of the year. Hence, the tournament hypothesis states that funds with a below-median performance in the first half of the year increase their risk in the second half of the year. This proposition implies a negative relationship between the return rankings for the first half of the year and changes in risk. Though this tournament hypothesis is enticing, it has not found unambiguous support in the empirical literature.

We use the pooled regression model of Kempf and Ruenzi (2008) to test the tournament hypothesis. This model links the change in the fund return standard deviation between the first and second half of the year to the fund return rank and return standard deviation for the first half of the year. Thus, we implicitly analyze yearly tournaments, and for mutual funds we expect investors to monitor return ranks rather than absolute raw or risk-adjusted performance.Footnote 2 The change in the return standard deviation is equal to the standard deviation of monthly returns measured between months 7 and 12 minus that over the first 6 months of the calendar year. The return rank corresponds to the ranking of the cumulative fund or stock return for the first half of the year. Ranks are normalized and expressed as fractional ranks ranging from 0 to 1, with the highest-performing funds (stocks) receiving a rank of 1. We apply the same regression model for (first) mutual funds and (then) stocks:

where \(\sigma _{[1,6],i,t} \) is either fund \(i\)’s or stock \(i\)’s monthly return standard deviation over the first six months of calendar year \(t\), \(\sigma _{[7,12],i,t} \) is the same quantity measured during the second half of the year, \(R_{[1,6],i,t} \) is the return ranking for the first half of the year of fund (stock) \(i\) in year \(t\), and \(\varepsilon _{i,t} \) is the unexplained component of the change in the return standard deviation between the first and second half of the year. In Eq. (1), a significantly negative coefficient \(\beta _1 \) would support the tournament hypothesis. We run all the panel regressions using standard errors clustered simultaneously by both fund (firm) and year, as suggested by Petersen (2009).Footnote 3

Schwarz (2012) argues that using either the contingency table approach (as, e.g., in Brown et al. 1996) or the regression approach (as, e.g., in Koski and Pontiff 1999) to test the tournament hypothesis is subject to a sorting bias. Karoui and Meier (2015) show that only the contingency table approach is systematically subject to this bias. For the regression approach, the authors maintain that the inclusion of the standard deviation for the first half of the year as an independent variable controls for much of the mean reversion in the return standard deviation.

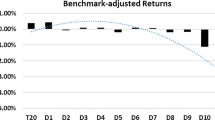

3.1 Risk shifts for equity non-index mutual funds

Table 1 shows the estimation results of Eq. (1) for our sample of actively managed U.S. domestic equity mutual funds (non-index funds), for our sample of equity index mutual funds (index funds), and for U.S. stocks. For each sample we report results for the entire sample period, and for the 1991–2000 and 2001–2010 subperiods separately. For the entire sample of non-index funds, we find a significantly negative coefficient (at the 10 % level) for the return rank variable equal to \(\beta _1 = -0.006\) with a t statistic of \(-1.92\), thereby supporting the existence of a tournament among mutual funds. The relationship, however, is economically insignificant. The return rank coefficient implies that an increase of 0.1 (i.e., one decile) in the fund return rank induces, on average, a decrease of 0.06 percentage points in the standard deviation. When we divide the sample of non-equity funds into two subperiods, the return coefficient is positive in the first period (\(\beta _1 = 0.007\)) and negative in the second period (\(\beta _1= -0.008 \)). While the sign of the return coefficient varies between the two subperiods, the t statistic is significant in both (at the 10 % and 5 % confidence levels, respectively). Our mixed results for actively managed funds are in line with the empirical studies of Busse (2001) and Qiu (2003). The positive performance coefficient found in the first subsample is consistent with the tournament models of Taylor (2003) and Basak and Makarov (2012), who argue that interim loser funds decrease their risk in the second half-year.Footnote 4 The significant intercepts and modest values for adjusted \(R^{2}\) found across all time intervals illustrate that a substantial part of the change in risk between the first and second half-years is not explained by the first half-year’s performance rank.

Mutual funds are typically sorted into different investment styles, such as aggressive growth, income, or growth and income. We use the style classification of Pastor and Stambaugh (2002) to sort funds into six style categories. When we run Eq. (1) using the rank of the fund within its respective investment style, the results remain qualitatively unchanged (see the table in the “Appendix”).

3.2 Risk shifts for equity index mutual funds

In our equity non-index fund sample, we find no strong evidence of a tournament. Because tournament behavior is supposedly restricted to actively managed funds, we test the theory in a placebo group comprising index funds. As the latter are purely passively managed, they are not expected to display the active changes in portfolio weights in response to performance as implied by tournament behavior. If index funds display results different than those of their active counterparts in the test of the tournament hypothesis, it will show that the degree of active management matters. Alternatively, finding no significant differences between the two groups would directly challenge the tournament hypothesis or the methodology used to test it.

The middle columns of Table 1 report the tournament results for index funds. For the entire sample, this category displays a negative relationship between the change in the return standard deviation and the return rank for the first half of the year. The performance coefficient equals \(\beta _1 = -0.095\), with a significant t statistic (at the 10 % level) equal to \(= -{1.95}\). Hence, an increase of 0.1 (i.e., one decile) in the fund return rank induces a decrease of 0.95 percentage points in the return standard deviation. Splitting the sample into two subperiods results in a positive and weakly significant coefficient in the first period and a negative and significant coefficient in the second period.

The index fund results are qualitatively similar to those for the non-index funds, which contradicts the idea that active portfolio management differentiates between the non-index and index funds in these tests. As for the non-index funds, we find significant intercepts for the index funds across all time intervals, but the values for adjusted \(R^{2}\) are higher.

3.3 Risk shifts for stocks

The relationship between stock returns and volatility changes is addressed in the asset pricing literature. Although the results for this relationship are contradictory in the mutual fund case, the results for stocks are quite clear: low-performance stocks see an increase in their volatility. There are two explanations for this. First, if a stock registers a low return, then the firm’s leverage increases and, consequently, the firm is perceived to be riskier (Black 1976; Christie 1982; Duffee 1995). Second, the increase in volatility places downward price pressure on the stock (Bekaert and Wu 2000; Bae et al. 2007). As volatility is persistent, one observes a negative relationship between past stock returns and volatility shifts (volatility feedback). Both explanations support the idea of asymmetric stock volatility and a negative return–volatility relationship, even though the distinction between the two arguments is difficult to demonstrate.

Although the equity literature already highlights the negative relationship between returns and risk shifts, we reexamine this relationship using the tournament model of mutual funds and incorporate the return rank as an explanatory variable. Our intuition is that the tournament results in the mutual funds sample may be affected by some stylized facts present in individual stock returns.

Table 1 shows the results from regressions of risk changes in stock returns on standard deviations and return ranks for the first half of the year. Again, we report results for the entire sample period and for the two subperiods. The results strongly support the existence of a negative relationship between the risk shifts and the return ranks for the first half of the year. For the entire sample, the coefficient of the return rank is equal to \(\beta _1 = -0.049 \), which means that an increase in the performance rank of 0.1 is accompanied by a negative additional change in the volatility equal to \(-0.49\) percentage points. The t statistic is equal to \(-5.68\), making the relationship statistically very significant. The return rank coefficients for the subperiods are also consistent and both are equal to \(-0.050\), with t statistics equal to \(-7.67\) and \(-2.75\) for the first and second subsamples, respectively.

4 Decomposition of the risk shift

The results of the previous section suggest that risk shifts of stocks are negatively related to prior returns, which could distort tests of tournament behavior among mutual funds. To uncover this contamination effect, one needs to verify whether the tournament phenomenon is due to volatility changes in the stocks or is the result of fund manager action—or a combination of both. We use fund holdings to estimate the contribution of each factor to the tournament process and to investigate the direction and magnitude of fund managers’ trades. Many studies on mutual fund tournaments rely on return-based measures only; however, there are two main advantages to using fund holdings. First, doing so provides direct observation of fund manager action and, second, it allows us to differentiate between changes in portfolio characteristics that are due to adjustments in portfolio weights and those that are due to price variations.

4.1 Variable definitions

The risk of a fund portfolio can change either due to changes in the weights of individual positions or due to changes in the volatility of the underlying assets. We develop a measure that enables us to distinguish between these two sources of changes in portfolio risk. The definition builds on the return gap introduced by Kacperczyk et al. (2008), which is defined as the difference between reported fund returns and the returns on a buy-and-hold portfolio (net of expenses). We extend their measure to the volatility dimension and decompose the standard deviation of reported fund returns into two parts: the volatility of a buy-and-hold portfolio, \(\sigma ^{\mathrm{BH}}\), and the remainder, reflecting the actions of the portfolio manager during the semester, which we call the volatility gap, VG. Reported fund returns are net of fees and, therefore, we also subtract fund management fees from the buy-and-hold portfolio returns. As we will ultimately use this volatility decomposition in Sect. 5 to analyze tournament behavior, Eqs. (2) and (3) show the decompositions for the first and second half of the year separately:

and

where \(\sigma _{[1,6],i} \) and \(\sigma _{[7,12],i} \) are, respectively, the return standard deviations of fund \(i\) over the first and second half of the year, \(\sigma _{0,[1,6],i}^{\mathrm{BH}} \) is the return standard deviation of the buy-and-hold portfolio over the first half of the year using the previous year’s December portfolio weights, and \(\sigma _{6,[7,12],i}^{\mathrm{BH}} \) is the buy-and-hold portfolio standard deviation over the second half of the year using the June portfolio weights. \(\mathrm{VG}_{[1,6],i} \) and \(\mathrm{VG}_{[7,12],i} \) denote the volatility gaps over the first and second half of the year, respectively.

The volatility gap is computed as the difference between the fund return volatility and the buy-and-hold portfolio volatility and, thus, measures the increase (positive volatility gap) or decrease (negative volatility gap) in the portfolio risk relative to a buy-and-hold strategy. A small value for the volatility gap means that the volatilities of the reported returns and of the returns of a buy-and-hold strategy are close to each other and, consequently, that the manager does little during that semester to deviate from the risk of the buy-and-hold portfolio.

Equations (2) and (3) decompose the standard deviation of fund returns into buy-and-hold portfolio volatility and volatility gap, for the first and second half of the year, respectively. Any rebalancing activity during either the first or the second part of the year will result in a difference between the actual and the buy-and-hold portfolio risks and will be captured by our measures. However, if the manager changes the portfolio weights just before midyear, and then maintains a buy-and-hold strategy in the second part of the year, Eq. (3) will not capture this risk shift. Equation (2) reflects the effects that occur in the short interval between the portfolio alteration date and the midyear point, but does not include the effects carried over to the second part of the year. To alleviate this issue, we further decompose the second half-year’s risk into three components: (i) the volatility of a buy-and-hold portfolio over the second half of the year using the previous year’s December weights, (ii) the volatility gap, which measures the incremental risk during the second half of the year, and (iii) a cross-period term that measures the increase (or decrease) in the risk of the buy-and-hold strategy over the second half of the year that is due to the manager’s activity during the first half of the year. Expanding Eq. (3), we obtain:

where \(\sigma _{[7,12],i} \), \(\sigma _{6,[7,12),i}^{\mathrm{BH}} \), and \(\mathrm{VG}_{[7,12],i} \) are defined as in Eq. (3). \(\sigma _{0,[7,12],i}^{\mathrm{BH}} \) is the buy-and-hold portfolio volatility measured between months 7 and 12 using the December weights of the previous year as the starting weights. The difference \(\sigma _{6,[7,12],i}^{\mathrm{BH}} -\sigma _{0,[7,12],i}^{\mathrm{BH}} \) assesses the impact of portfolio rebalancing over the first 6 months of the year on the risk over the second half of the year. Thus, if a portfolio manager has changed the portfolio just before midyear and then maintains a buy-and-hold strategy, the impact of such a change in the portfolio weights will be captured in the second part of the year by this cross-period term.

Table 2 displays the descriptive statistics of the return standard deviations in the first and second half of all the sample years, and their constituents, as described in Eqs. (2) and (4). For the non-index funds, the summary statistics of return standard deviations and buy-and-hold portfolio standard deviations are very similar. This result holds true for both the first and second half of the year. The mean value of the volatility gap is small (0.74 %) for the first half of the year and is only slightly larger in the second half of the year (0.79 %). Across the three second-semester portfolio risk constituents, the average value and interquartile range of the cross-period term, \(\sigma _{6,[7,12],i}^{\mathrm{BH}} -\sigma _{0,[7,12],i}^{\mathrm{BH}} \), are the smallest. For the index funds, the summary statistics for the return volatility are also close to those for the buy-and-hold volatility.

We also compute the average absolute difference between the return standard deviation and the buy-and-hold portfolio volatility for both semesters and compare these figures for the non-index and index fund groups. We expect that the buy-and-hold portfolio volatility, on average, will be closer to the fund return standard deviation for the index than for the non-index funds, thereby reflecting the lower level of rebalancing activity in those funds. For the first half of the year, we find average absolute differences equal to 0.0121 and 0.0099 for the non-index and index funds, respectively. For the second semester, these average absolute differences are only marginally different (0.0130 for non-index funds vs. 0.0120 for index funds).

4.2 Empirical evidence

Subtracting Eq. (2) from Eq. (4) gives the following expression for the change in risk between the first and second half of the year:

where \(\sigma _{[1,6],i} \), \(\sigma _{0,[ {1,6}],i}^{\mathrm{BH}} \), and \(\mathrm{VG}_{[1,6],i} \) are defined as in Eq. (2), \(\sigma _{[7,12],i} \), \(\sigma _{6,[7,12],i}^{\mathrm{BH}} \), and \(\mathrm{VG}_{[7,12],i} \) are defined as in Eq. (3), and \(\sigma _{0,[ {7,12} ],i}^{\mathrm{BH}} \) is defined as in Eq. (4). The first element of Eq. (5), \(\sigma _{0,[7,12],i}^{\mathrm{BH}} -\sigma _{0,[1,6],i}^{\mathrm{BH}} \), assesses the effect of changes in the stock volatility between the first and second halves of the year. The second element, \(\mathrm{VG}_{[7,12],i} -\mathrm{VG}_{[1,6],i}\), measures the difference between the amount of risk added by the manager in the second semester and that in the first. The third element, that is, the cross-period term, \(\sigma _{6,[7,12],i}^{\mathrm{BH}} -\sigma _{0,[7,12],i}^{\mathrm{BH}} \), captures the effect of weight changes made during the first semester on the second semester’s portfolio risk. In sum, the first element is unaffected by fund manager activity, while the last two elements are affected by their modifications of the portfolio weights.

To quantify the contribution of each of the components of Eq. (5) to the fund return volatility changes, we run the following regressions with the change in the return volatility as the dependent variable and the change in the buy-and-hold volatility, the change in the volatility gap, or the cross-period term as explanatory variables, respectively:

and

where, for a given calendar year \(t\), \(\sigma _{[1,6],i,t} \), \(\sigma _{0,[1,6],i,t}^{\mathrm{BH}} \), and \(\mathrm{VG}_{[1,6],i,t} \) are defined as in Eq. (2), \(\sigma _{[ {7,12} ],i,t} \) and \(\mathrm{VG}_{[ {7,12} ],i,t} \) are defined as in Eq. (3), \(\sigma _{6,[ {7,12} ],i,t}^{\mathrm{BH}} \) and \(\sigma _{0,[ {7,12} ],i,t}^{\mathrm{BH}} \) are defined as in Eq. (4), and \(\varepsilon _{i,t} \) in each of the three equations is the unexplained component of the change in the return standard deviation.

Table 3 shows the results, again separately for non-index and index funds. Running Eq. (6) for the non-index funds over the entire sample period, the change in the buy-and-hold volatility shows a coefficient equal to \(\beta = 0.982\), with a t statistic of 9.43. The regression’s adjusted \(R^{2}\) is 65.9 % and thus it has high explanatory power for the shifts in the return standard deviations. This finding is robust across the two subsamples. The 1991–2000 period shows an adjusted \(R^{2}\) of 61.3 %; the figure for the 2001–2010 period is 66.2 %. Panel B displays the results from running Eq. (7) with volatility gap changes as the dependent variable. In the entire sample period, the change in the volatility gap of non-index funds shows a coefficient equal to \(\beta = 1.231\), with a t statistic of 6.61. The regression’s adjusted \(R^{2}\) is 33.2 % and thus the volatility gap changes have a lower explanatory power compared to the buy-and-hold volatility component. Finally, running Eq. (8) for the non-index funds for the entire sample period, the cross-period term \(\sigma _{6,[ {7,12} ],i,t}^{\mathrm{BH}} -\sigma _{0,[ {7,12}],i,t}^{\mathrm{BH}} \) shows a coefficient equal to \(\beta = 0.368\), with a t statistic of 2.38 (Panel C). The regression’s adjusted \(R^{2}\) is 2.3 % and thus the cross-period term has limited explanatory power for the shifts in the return standard deviations.

These results, along with those presented in the previous subsection, show that fund managers may not have full control over portfolio risk through altering weights. Even if they actively rebalance their portfolios, their impact on portfolio risk over a 6-month period is limited.

Compared to the equity non-index sample, a sample made up purely of index funds should see buy-and-hold volatility shifts explaining the return standard deviation shifts to a greater extent. The results for the index funds are reported in the right-hand columns of Table 3. Panel A of Table 3 reports the regression results from Eq. (6) for the index funds and confirms our intuition. For the entire sample, the buy-and-hold portfolio risk changes largely explain the return standard deviations, with a coefficient of \(\beta = 0.970\), a t statistic of 4.79, and an adjusted \(R^{2}\) of 71.3 %. This result is very consistent across periods, with the buy-and-hold volatility always showing a very significant coefficient. Panel B of Table 3 reports the regression results from Eq. (7) for the index funds and shows that the volatility gap changes are weakly significant in explaining the return volatility changes. This is different for the second active component tested in Eq. (8), for which the results are displayed in Panel C. The coefficient of the cross-period term is not significant for any period.Footnote 5

For the entire period, a comparison between the buy-and-hold volatility regressions of the non-index and index samples shows an adjusted \(R^{2}\) equal to 65.9 % for the non-index funds and 71.3 % for the index funds. In other words, the explanatory power of the buy-and-hold volatility for the non-index funds, although smaller than that for the index funds, stays within a comparable range. For our sample of index funds, the adjusted \(R^{2}\) for the buy-and-hold volatility regression does not equal 100 % because index funds include and exclude stocks on a regular basis (especially around index reconstitution dates) and some fund holdings (such as cash and very short-term treasury bonds) may not be fully reported in our database. Overall, the comparison between the non-index and index funds in Table 3 demonstrates again that manager activity plays only a limited role in causing the return volatility to deviate from the buy-and-hold volatility for the non-index funds. All findings from the entire period hold true for each of the subperiods.

5 Tournament tests using holdings-based measures of risk

The previous section decomposes the return standard deviation into the buy-and-hold portfolio volatility, the volatility gap, and the cross-period term. In this section, we use these holdings-based quantities to retest the tournament hypothesis and discover whether any of the three return volatility constituents has a significant relationship with the first half-year’s performance. Our intuition is that the fund manager may have greater control over the active risk changes than over the total portfolio risk. Therefore, if a fund manager actively changes the portfolio risk according to Brown et al. ’s (1996) tournament hypothesis, we should observe a stronger negative relationship in terms of the volatility gap or the cross-period term than in the buy-and-hold volatility case. We study the relationship between risk changes and performance for the three constituents using the following regression models:

and

where, for a given calendar year \(t\), \(R_{[1,6],i,t} \) is defined as in Eq. (1), \(\sigma _{0,[ {1,6} ], i,t}^{\mathrm{BH}} \) and \(\mathrm{VG}_{[ {1,6} ],i,t} \) are defined as in Eq. (2), \(\mathrm{VG}_{[ {7,12} ],i,t} \) is defined as in Eq. (3), \(\sigma _{6,[ {7,12} ],i,t}^{\mathrm{BH}}\) and \(\sigma _{0,[ {7,12} ],i,t}^{\mathrm{BH}} \) are defined as in Eq. (4), and \(\varepsilon _{i,t} \) in Eqs. (9)–(11) is the unexplained component of the change in either the buy-and-hold portfolio risk, the volatility gap, or the cross-period term.

Panels A and B of Table 4 show that the changes in the buy-and-hold volatility and volatility gap differ in their reactions to the first half-year’s performance rank. Across the entire sample, the buy-and-hold risk changes show an insignificant performance rank coefficient and the volatility gap changes load insignificantly and negatively on performance rank. Fund managers do not actively increase their volatility gap when they register a poor performance; nor are the buy-and-hold portfolios subject to this phenomenon. The latter results can be compared directly to the results for Eq. (1); Panel A of Table 1 displays the return standard deviation results. The buy-and-hold risk and the return standard deviations exhibit fairly similar results, with a significantly positive performance coefficient in the first subsample and a negative and significant coefficient (at the 10 % level) in the second subsample. Thus, it appears that the results from Eq. (1), where changes in the total risk are used as the dependent variable to test tournament behavior, are driven by the changes in the buy-and-hold volatilities.Footnote 6 The actions of the fund manager, proxied by the volatility gap measure, play a very limited role in explaining the risk shifts observed for mutual fund portfolios. Finally, Panel C reports the results of the regression from Eq. (11) and supports a negative relationship between the cross-period term, \(\sigma _{6,[ {7,12} ],i,t}^{\mathrm{BH}} -\sigma _{0,[ {7,12} ],i,t}^{\mathrm{BH}} \), and the first-semester return ranks. This indicates that some of the tournament behavior may have started before the midyear and that part of the negative relationship between the return rank and change in return volatilities is due to this active component. Nonetheless, as an increase of 0.1 (i.e., one decile) in the return rank results in a decrease of 0.05 percentage points in the cross-period term, \(\sigma _{6,[ {7,12} ],i,t}^{\mathrm{BH}} -\sigma _{0,[ {7,12} ],i,t}^{\mathrm{BH}} \), the economic significance of the relationship is small.

6 Conclusion

Our paper sheds new light on the mutual fund tournament phenomenon. Using holdings-based measures, we disentangle the actions of portfolio managers from changes in the stock volatility. Specifically, we propose using the volatility gap as a way of capturing the volatility changes that exceed buy-and-hold portfolio volatility changes. Our decomposition of the return standard deviation during the second half of the year provides a better estimation of the risk-shifting behavior of fund managers. We first show that risk changes resulting from fund performance during the first half of the year are not present in equity non-index funds, but that such changes are a stylized fact when it comes to stocks. Then, we show that buy-and-hold volatility changes have a major effect on return volatility changes. These findings indicate that although fund managers actively change their portfolio weights, they may have only limited control over the portfolio volatility shift. Therefore, if the traditional regression approach appears to provide evidence in support of the tournament hypothesis, this may in fact be the result of the well-documented negative relation between stock returns and the volatility of subsequent returns. Finally, for both the volatility gap and buy-and-hold volatility, we find no evidence in support of the tournament hypothesis. Our methodology offers a new way to monitor the risk-shifting behavior of portfolio managers, and our analysis provides an alternative explanation for the mixed empirical results described in the mutual fund tournament literature.

Notes

Because the fund holdings are available in the CRSP database only from January 2003 onward, we complement this database with the Morningstar database to cover the earlier period. As Morningstar was the holdings data source for CRSP until 2008, using a combination of the two is unlikely to introduce major inconsistencies in the sample.

The Stata ado-file for two-dimensional clustering is available on Mitchell Petersen’s website at: https://doi.org/www.kellogg.northwestern.edu/faculty/petersen/htm/papers/se/se_programming.htm.

The model in Acker and Duck (2006) predicts that poorly performing funds tend to adopt extreme portfolios. These portfolios will not necessarily exhibit higher volatility. For example, when the market is expected to rise, managers may decide to bet against the market by lowering their betas.

Table 1 The change in return standard deviation and past performance In unreported results, we extend the analysis of Table 1 and assume that the fund manager pursues an equally weighted strategy and rebalances his portfolio every 6 months. We then compute the monthly returns for such a strategy and use these hypothetical returns, together with Eq. (1), to test for tournament behavior. Even when we use such a placebo strategy, the results remain qualitatively unchanged compared to those obtained with the original sample of mutual funds.

Table 4 The tournament test regression with buy-and-hold volatility, volatility gap, and cross-period term

References

Acker, D., Duck, N.W.: A tournament model of fund management. J. Bus. Financ. Account. 33(9), 1460–1483 (2006)

Ammann, M., Verhofen, M.: The impact of prior performance on the risk-taking of mutual fund managers. Ann. Financ. 5(1), 69–90 (2009)

Bae, J., Kim, C.-J., Nelson, C.R.: Why are stock returns and volatility negatively correlated? J. Empir. Financ. 14(1), 41–58 (2007)

Basak, S., Makarov, D.: Difference in interim performance and risk taking with short-sale constraints. J. Financ. Econ. 103(2), 377–392 (2012)

Bekaert, G., Wu, G.: Asymmetric volatility and risk in equity markets. Rev. Financ. Stud. 13(1), 1–42 (2000)

Black, F.: Studies of stock price volatility changes. In: Proceedings of the 1976 Meetings of the American Statistical Association, Business and Economics Statistics Section, pp. 177–181 (1976)

Brown, K.C., Harlow, W.V., Starks, L.T.: Of tournaments and temptations: an analysis of managerial incentives in the mutual fund industry. J. Financ. 51(1), 85–110 (1996)

Busse, J.: Another look at mutual fund tournaments. J. Financ. Quant. Anal. 36(1), 53–73 (2001)

Carhart, M.M.: On persistence in mutual fund performance. J. Financ. 52(2), 57–82 (1997)

Chevalier, J., Ellison, G.: Risk taking by mutual funds as a response to incentives. J. Polit. Econ. 105, 1167–1200 (1997)

Christie, A.A.: The stochastic behavior of common stock variances: value, leverage, and interest rate effects. J. Financ. Econ. 10(4), 407–432 (1982)

Duffee, G.R.: Stock returns and volatility: a firm-level analysis. J. Financ. Econ. 37(3), 399–420 (1995)

Elton, E.J., Gruber, M.J., Blake, C.R., Krasny, Y., Ozelge, S.O.: The effect of holdings data frequency on conclusions about mutual fund behavior. J. Bank. Financ. 34(5), 912–922 (2010)

Elton, E.J., Gruber, M.J., Blake, C.R.: An examination of mutual fund timing ability using monthly holdings data. Rev. Financ. 16(3), 619–645 (2012)

Goriaev, A., Nijman, T.E., Werker, B.J.M.: Yet another look at mutual fund tournaments. J. Empir. Financ. 12(1), 127–137 (2005)

Huang, J., Sialm, C., Zhang, H.: Risk shifting and mutual fund performance. Rev. Financ. Stud. 24(8), 2575–2616 (2011)

Kacperczyk, M., Sialm, C., Zheng, L.: Unobserved actions of mutual funds. Rev. Financ. Stud. 21(6), 2379–2416 (2008)

Karoui, A., Meier, I.: A note on sorting bias correction in regression-based mutual fund tournament tests. Financ. Markets Portf. Manag. 29(1) (2015)

Kempf, A., Ruenzi, S.: Tournaments in mutual-fund families. Rev. Financ. Stud. 21(2), 1013–1036 (2008)

Kempf, A., Ruenzi, S., Thiele, T.: Employment risk, compensation incentives, and managerial risk taking: evidence from the mutual fund industry. J. Financ. Econ. 92(1), 92–108 (2009)

Khorana, A.: Top management turnover, an empirical investigation of mutual fund managers. J. Financ. Econ. 40(3), 403–427 (1996)

Koski, J.L., Pontiff, J.: How are derivatives used? Evidence from the mutual fund industry. J. Financ. 54(2), 791–816 (1999)

Pastor, L., Stambaugh, R.F.: Mutual fund performance and seemingly unrelated assets. J. Financ. Econ. 63(3), 315–349 (2002)

Patel, J., Zeckhauser, R., Hendricks, D.: Investment flows and performance: evidence from mutual funds, cross-border investments, and new issues. In: Sato, R., Levich, R., Ramachandran, R. (eds.) Japan, Europe, and International Financial Markets: Analytical and Empirical Perspectives, pp. 51–71. Cambridge University Press, Cambridge (1994)

Petersen, M.A.: Estimating standard errors in finance panel data sets: comparing approaches. Rev. Financ. Stud. 22(1), 435–480 (2009)

Qiu, J.: Termination risk, multiple managers and mutual fund tournament. Eur. Financ. Rev. 7(2), 161–190 (2003)

Schwarz, C.G.: Mutual fund tournaments: the sorting bias and new evidence. Rev. Financ. Stud. 25(3), 913–936 (2012)

Sirri, E.R., Tufano, P.: Costly search and mutual fund flows. J. Financ. 53(5), 1589–1622 (1998)

Taylor, J.: Risk-taking behavior in mutual fund tournaments. J. Econ. Behav. Organ. 50(3), 373–383 (2003)

Acknowledgments

This paper has benefited from the comments of Zhi Da, Raman Kuma, Nicolas Papageorgiou, Bruno Rémillard, Xiaolu Wang, Gong Zhan, and participants at the Northern Finance Association 2010 Conference in Winnipeg and the Eastern Finance Association 2010 Meetings in Miami Beach. We thank an anonymous referee for very helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

The table below repeats the pooled regression for non-index funds shown in Table 1 using for each fund \(i\) the return rank within its respective investment style for any given calendar year \(t\), \(R_{[ {1,6} ],i,t}^{\mathrm{IS}} \). Specifically, we estimate the following specification: \(\sigma _{[ {7,12} ],i,t} -\sigma _{[ {1,6} ],i,t} =\alpha +\beta _1 R_{[ {1,6} ]i,t}^{\mathrm{IS}} +\beta _2 \sigma _{[ {1,6} ],i,t} +\varepsilon _{i,t} \). We use the investment style definitions of Pastor and Stambaugh (2002) to sort funds into six categories: small company growth, other aggressive growth, growth, income, and growth and income, and maximal capital gains (we exclude sector funds from our sample). As before, return ranks within each investment style are normalized and expressed as fractional ranks ranging from 0 to 1.

Rights and permissions

About this article

Cite this article

Karoui, A., Meier, I. Fund performance and subsequent risk: a study of mutual fund tournaments using holdings-based measures. Financ Mark Portf Manag 29, 1–20 (2015). https://doi.org/10.1007/s11408-014-0241-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-014-0241-1