Abstract

Arguments are made that, for a typical economy, with many goods and consumers, classical tâtonnement dynamics results in a unique, globally stable equilibrium. Since global stability implies uniqueness of equilibrium, these kinds of results complete the positive general equilibrium program classically put forward in favor of the invisible hand. Such stability is demonstrated for economies with consumers having preferences drawn from the CES family, and similar results are reported when the preferences are chosen, instead, to be of the indirect addilog form.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Equilibrium analysis, like the study of most solution concepts, may be thought of as having three main positive components: existence, uniqueness, and stability. In addition, there is the normative issue of optimality of the solution, and then returning to positive economics, the possibility of comparative statics. General equilibrium theory has been quite successful on the fronts of existence and (Pareto) optimality, but much less so with uniqueness and stability. Yet stability, in particular, is essential if the equilibrium paradigm of the invisible hand is to rest on firm foundations.Footnote 1 One can simply ignore how one arrived at equilibrium, and just take it for granted that one has done so, whenever discussing a given, single equilibrium; however, as soon as you consider comparative statics, you are contemplating a new, different equilibrium, and so the question of if and how you get from the old to the new equilibrium seems inevitable and important, even if the issue is typically ignored by economists.

Now, given that uniqueness of equilibrium seems less critical than stability in order that the invisible hand be considered in effect, one could in principle relax the requirement of global stability, where one always arrives at the same equilibrium, to one of system stability, where what equilibrium one arrives at can depend on what price one starts from. For instance, this, but not global stability, is always the case when there are but two goods. This weakened criterion, though, would complicate global comparative statics, since one could not study the change in equilibrium without doing an explicitly dynamic analysis, because, while one would know solely by static analysis which new equilibria there are, one might not know which is the relevant one. In any case, it turns out that many natural conditions sufficient to assure system stability are also sufficient to assure uniqueness of equilibrium, in which case the distinction between the two stability notions disappears.Footnote 2 In this paper, at least, we will concentrate entirely on global stability and so require that there be but a single equilibrium.

One difficulty is that any disequilibrium dynamic, one operating only out of equilibrium, inevitably sits uncomfortably with the price-taking, perfectly competitive assumption, which is really only entirely satisfactory in equilibrium itself. With everyone taking the price as given, there is then no one to change the hypothetical prices. Nonetheless, it is observed that real markets do seem to find their way to equilibrium, and thus, dynamics have been suggested that mimic this apparent behavior. They fall into two general classes: tâtonnement and non-tâtonnement. However, non-tâtonnement suffers from the fact that it would now make ordinary comparative statics impossible: if prices out of equilibrium induce trade as they change, then the final equilibrium, even if achieved, will have been affected by the actual path of the dynamics. As a first pass at least, it seems more prudent to consider just tâtonnement dynamics, which only allow trade once the equilibrium is achieved, and so, maintain the legitimacy of the usual program of comparative statics.

Among possible tâtonnement dynamics, the most traditional one is the classical form:

where z(p) is mean aggregate excess demand at the vector of prices p. This dynamic encodes, in the simplest possible manner, the “law of supply and demand,” much emphasized in introductory economics classes, where prices rise when demand exceeds supply for a market out of equilibrium, whereas prices drop in the opposite case. It, of course, corresponds to the dynamics considered by Walras (1926), in first formulating general equilibrium theory.

We would conjecture that most dissatisfaction with classical tâtonnement among economists arises not from its lack of foundation in perfectly competitive behavior, since, as argued, this is true of all disequilibrium dynamics, and yet there must surely be some disequilibrium process. The dissatisfaction arises, instead, from the fact that, as is well known, and contrary to economists’ beliefs about real economies, classical tâtonnement does not inevitably take an economy to equilibrium. Here we are thinking primarily of Scarf’s (1960) celebrated counterexample, consisting of an apparently perfectly reasonable economy with three agents and three goods, where such tâtonnement results not in equilibrium, but in a limit cycle in prices. Indeed, much effort has been spent, as a result of this, and similar examples, to find alternative tâtonnement mechanisms that more consistently arrive at equilibrium.Footnote 3 But it seems that these must be regarded more as devices for an economist to compute equilibrium than as viable descriptions of the economies we observe, since the dynamics work in ways few would seriously suggest imitate the behavior of actual markets. It seems a more fruitful strategy, in support of the invisible hand, to remain with classical tâtonnement, and seek reasons why unstable behavior, possible though it may be, is unlikely to be characteristic of most actual economies.

We remark that experimental economics seems to offer some validation for the main principles of classical tâtonnement, to the point of reproducing the instability of Scarf’s famous counterexample in the appropriate circumstances (Anderson et al. (2004)). We take this, then, as a good sign, that classical tâtonnement is a reasonable description of matters, even in extreme situations, not a bad one, that limit cycles in prices can occur. We are able to regard such cycles with some equanimity because, as we argue, most actual economies are not like the hypothetical one presented in Scarf’s example.

Actual economies, it seems to us, involve a substantial number of goods and consumers, and the greater the number of these, the less likely is it that one encounters an economy, like Scarf’s example, that exhibits something other than a unique, globally stable equilibrium. That is the main thrust of our contention, and we proceed to make arguments why we believe this to be so. In addition to a large number of consumers, we will assume that they are of diverse types, and that, roughly speaking, as the number of goods increases, substitution effects remain substantial, while income effects have no tendency to become too large. We note, though, that, while we present technical supporting arguments, we currently have nothing that rises to the level of an exact proof for the general case. Lacking such an encompassing analytical result, after explaining our reasoning, further support for our contentions then takes the form of simulations, the main feature being to gradually increase the number of goods and consumers permitted, and then study the consequences. It will be seen, perhaps oddly, that it is the cases of relatively few goods or consumers which seem the most problematic for global stability, though, classically, by reason of their relative simplicity, the most attention has been focused on such economies, which, nonetheless, serve to give a somewhat distorted view of the more general situation.

We should note that, while our interests here are in the possibility of reviving the currently rather moribund project to fulfill the original general equilibrium vision of the invisible hand, a scheme dating back to at least to Walras, if not further back to Adam Smith, this, in no manner, is the only, or necessarily even the best, means of justifying perfectly competitive behavior and its consequences. Diverse alternative sorts of arguments—without prejudice to others, we mention the works of Vega-Redondo (1997), Alós-Ferrer (2005), Gintis (2007), and Lahkar (2020)—have been advanced, which, together, point to Walrasian behavior as the central organizing principle describing the outcome likely to arise from the individual interactions of the many, within a market environment.Footnote 4

2 Explicit solution of tâtonnement dynamics: the direct approach to stability

2.1 The general equilibrium setting

We will be concerned with exchange economies, where consumers are endowed with bundles of goods, \(\omega ,\) which they plan to sell on competitive markets at the current prices p, and then use the income, \(y=p\cdot \omega ,\) generated in order to demand what pleases them most.Footnote 5 Choosing what they prefer out of what they can afford is what is meant by the consumers being rational. An equilibrium of the economy is a set of good prices \(p^*\) that clear markets, so that each consumer can, in fact, obtain the bundle of goods \(x(p^*,y^*)=x(p^*,p^*\cdot \omega )\) they demand at those prices, something not possible at just any prices, given that fulfillment of demands across the economy must match with goods’ availability arising from the sale of endowments, but where demand generally varies with price. Global stability is concerned with whether one inevitably arrives at what is then necessarily the unique equilibrium, starting from any initial prices, when following the prescribed laws of motion, here being the classical tâtonnement process, already described in Eq. (1).

2.2 The selection of CES economies

Besides knowing the endowment of goods, to specify a rational consumer, one needs to know their preferences over different potential bundles of goods, so that one can determine their current demand.Footnote 6 Beyond the most classical Cobb-Douglas (\(C-D\)) preferences, typically encountered in an undergraduate microeconomics course, the next best-behaved preferences are the CES (constant elasticity of substitution) ones, typically encountered in a first-year graduate course in microeconomics. These give rise to an individual demand function of the form:Footnote 7

Like those of the \(C-D\) preferences that they subsume, CES demand functions are “globally regular,” meaning that the one functional form (2) obeys all the constraints of rationality arising with CES preferences, no matter what the inserted (positive) prices and income happen to be, a quite convenient property for what we do. This property should not be taken for granted, since the only other well-recognized family of preferences, ones, in turn, subsuming the CES family, that are also known to give rise to globally regular demand functions are the indirect addilog preferences, which we will again encounter later.Footnote 8CES preferences are, thus, especially appropriate for our purposes, given that all the simpler \(C-D\) economies (exchange economies made up of \(C-D\) consumers) are automatically globally stable, whereas what one wants, instead, are economies, like the CES ones, which, instead, permit globally instability, so that there is something to hopefully disappear in high dimensions.Footnote 9

2.2.1 The scarf counterexample

The most famous CES economies showing the capacity of this family of preferences to be unstable are undoubtedly those of Scarf, within an environment of three goods and three consumers. To appreciate how these economies work, it is easiest to follow Scarf and take a parametric limit of his family, which continues to display similar qualitative dynamic behavior. In that economy, the first consumer has an endowment of only the first good, and regards the first two goods as perfect complements (used together as are a right shoe and a left one), whereas he cares not at all about the third good. The three persons, together, have preferences and endowments that are cyclic permutations of one another in the labels, 1, 2, and 3, so for instance, the second person has an endowment of only good two (of the same absolute size as did person one), while regarding goods two and three as perfect complements, but with no regard for the first good. There is then the obvious last permutation for the third, and final, person. It is easy to show that, consequently, there is a unique equilibrium, but that no trajectory is ever attracted to it.

As stated earlier, Scarf then demonstrates, with his specified CES preferences and endowments, that tâtonnement dynamics generate a stable limit cycle, and that, as with this family’s limit in perfect complements, no trajectory ever converges to the single, completely unstable equilibrium, if not already starting from there; rather, they all converge to the limit cycle. At the time, this discovery was quite a shock to economic theorists, who had previously held out the hope that stability of tâtonnement might be an inevitable outcome when in a perfectly competitive economy composed of rational, well-behaved neoclassical individuals. We will return to other negative findings later, in our more general discussion extending beyond the CES case, when we will mention the SMD theorem, a sort of Scarf counterexample writ large, since it applies even when there are many goods and consumers, and not just three of each.

2.3 Aggregate excess demand and its properties

Before engaging in the examination of CES economies, we briefly review some of the general terminology that inevitably arises when discussing demand, where, of course, such demand is the overriding concept needed to describe an exchange economy, given that supply simply consists of the exogenously determined endowments. The excess demand, \(z^j(p,\omega ^j)=x^j(p,p\cdot \omega ^j)-\omega ^j\) of person j, as the name suggests, is the difference between his demand and his supply (his endowment), whereas aggregate excess demand, at the level of the entire economy, is simply the sum of the individual excess demands, \(z(p)=\sum _{k=1}^{m} z^k(p).\) This is, indeed, a convenient formulation of the economy as a whole, since the zeros, \(p^*\), of aggregate excess demand, where then \(z(p^*)=0,\) exactly correspond to the equilibria of the economy. Furthermore, out-of-equilibrium aggregate excess demand is also the measure of how much prices must then rise or must fall, according to the “law of supply and demand,” as prescribed by our tâtonnement process.Footnote 10

While not an essential assumption, it is generally assumed that consumers have monotone preferences, which means that they do, indeed, regard goods as good, and so, having more of the given sorts of goods is always better. This means that the consumer will invariably exhaust his budget, i.e., spend all his income, and adding this up over all consumers, one arrives at this condition in the aggregate, \(p\cdot z(p)=0,\) known as Walras’ Law. As far as the dynamics, Walras’ Law means that each aggregate excess demand vector z(p) is orthogonal (at right angles) to its generating price vector p, and so, if you consider the positive orthant of the unit sphere, \(S_+^{n-1}=\{p \epsilon \mathbb {R}_+^n |\ \Vert p\Vert =1\},\) embedded in n dimensions, then z forms what is called a vector field, living on this domain, that is a field of vectors tangent to this positive portion of the unit sphere. A vector field, it should be noted, is the geometric means of formulating dynamics over a given domain.Footnote 11 Furthermore, the same assumption of monotone preferences implies a boundary behavior that repels the trajectories of the tâtonnement vector field as they approach the edges of \(S_+^{n-1},\) which then ensures that the dynamics continue to reside in the stated domain throughout forward time.Footnote 12

Besides Walras’ Law and the boundary condition, there is one other structural property that is inherited in the aggregate from individual rationality: this is z being homogeneous of degree zero. Historically, this has been given the unfortunate name of “no money illusion” (unfortunate since no money is involved here in what is, effectively, a barter economy), but what it says is that a doubling, say, of all prices is without effect, and that only relative prices matter in such an economy of exchange. This means, in our dynamic context, that all information concerning the process in time, whatever the price, is fully captured by just the vector field on \(S_+^{n-1},\) so that, indeed, nothing is lost by normalizing one’s dynamics in the manner prescribed. When choosing to look at tâtonnement in full Euclidean n-space, one can, thus, forget about anything dealing with direction p, which, effectively, points out of the world where the dynamics may be thought to operate.

2.4 General distributional considerations for the direct approach in the CES case

When Scarf constructed his counterexample, or Chipman (2010) conducted his analysis of \(2\times 2\) CES economies, they imposed additional conditions explicitly relating the CES preferences of each consumer. However, to maintain as much generality as possible within our chosen framework, we have consciously avoided this, considering, instead, each consumer as an independent and identically distributed (i.i.d). draw from a common distribution of CES economies. Of course, the distribution has to be specified, and the narrower it is, the more the randomly selected consumers will be similar, but it is required that any such correspondence exists only at the level of the distribution.

Given that our preferences have been finitely parameterized, it is inevitable that the distribution of these parameters should be as well. For our base case, we want the distribution to be rather “uniform.” This is entirely feasible with the weights \(\alpha _i,\) and so, here, we employ a uniform distribution on the simplex; however, \(\sigma \) can take on any nonnegative value, without any apparent natural upper bound, making uniformity impossible. Thus, in our regular, base case, we employ an exponential distribution for \(\sigma \), with its decay parameter set to unity, for simplicity.Footnote 13 All exponential distributions necessarily privilege low values of the elasticity of substitution, which, as we are about to see, can only serve to increase the likelihood of an unstable economy, but it seems, nonetheless, a natural choice. For the endowment distribution, on the other hand, where endowments are also not naturally bounded from above, inspired by the homothetic character of CES preferences, we split the endowment into two parts: the first part draws a normalized endowment from the same sort of uniform distribution on the simplex as \(\alpha \) was drawn from, whereas the second part blows up or down the normalized endowment by a scalar factor, in effect determining the “income" of the individual.Footnote 14 This scalar factor is taken from a standard log normal distribution, where, the log normal form is, indeed, often used, in empirical studies, to model income distributions.Footnote 15

Despite the assumed exponential distribution of \(\sigma ,\) no cases of instability are ever observed among our finite samples, in this, our base case, whatever the dimensions. We have, therefore, not provided a tableau for this base case, similar to Table 1, since while a table with nothing but global stability illustrates well our main contention concerning the infrequency of instability, it is, in the end, a bit tedious, and certainly not instructive for considering the effects of more goods and more consumers: with no instability to begin with, it is obviously hard to detect a decrease in instability with dimension. We thus also turn to a more “narrow” distribution.

The reader may encounter lapses in recalling some of the terminology about to be used, but these concepts will have to await sec. 4.1.1 to be further detailed. There, the Slutsky decomposition plays a central role in the analysis, whereas, here, it is merely being referred to, in justifying our distributional choices. The important point, presently, is that we are following conventional microeconomic reasoning in order to design a narrow distribution having a higher proportion of unstable economies than arises in the more uniform, base case.

Recall the decomposition of the aggregate Jacobian in the homothetic case, as found in Mas-Colell et al. (1995), p. 610:

Here, \(S^j\) is, of course, the substitution matrix of the jth consumer, while \(\bar{\omega }\equiv \sum \omega ^j\) and \(\bar{x}\equiv \sum x^j.\) The first term of (7), the aggregate substitution effect, is heavily influenced by \(\sigma \) in the CES case, and is, in any event, negative semi-definite, with the last term being negative in the direction z(p). Interest focuses, then, on the second term, which represents the income effects. This correlation is not directly controlled by us, since demand x is an endogenous choice variable, but it can be strongly influenced by manipulating the correlation between \(\omega \) and \(\alpha \), given that the latter parameter describes the relative importance of each good to the consumer.

In the case of the narrow distribution, then, we triple the value of the decay parameter for the exponential distribution of \(\sigma ,\) whereas, rather than a uniform distribution of \(\alpha \) over the simplex, we look at a symmetric Dirichlet distribution with the one free parameter being .2, rather than being 1, as it was in the uniform case. The latter serves to concentrate values of \(\alpha \) nearer the corners of the simplex, so that one good’s \(\alpha \) weight tends to be larger, at the expense of the other ones, making more likely, in the case of, say, three goods, the setup of the Scarf counterexample, where each of the consumers had an endowment concentrated on one particular good, different, in Scarf’s case, from that of the other two consumers. Most dramatically, though, in consideration of what was just said about income effects in the above Jacobian, we use the same draw from the same Dirichlet distribution for the endowment as for \(\alpha ,\) thus giving these two parameters a perfect correlation. Finally, we completely eliminate any smoothing that would result from the income distribution by simply assigning a value of unity to everyone.

We note, in passing, that our earlier statement—that income effects should not be allowed to systematically dominate substitution effects as the number of goods is increased—is achieved by simply maintaining the same form for our overall parameter distribution, no matter what the number of goods is. This is as opposed, to, say, if, somewhat perversely, we were to use narrower and narrower exponential distributions for the elasticity of substitution, as the number of goods was increased.

2.5 Results on global stability by the direct approach for the CES case

2.5.1 The numerical framework

Given our interest in the invisible hand, we are primarily concerned with the prevalence of stability itself, rather than, say, the sufficient condition for it that we will develop, and so we directly test for this stability with economies drawn from our chosen distributions. Our procedure consists simply of starting with various initial price combinations, and following the trajectories associated with them, to see if they all take one to the same equilibrium. We note the obvious point that one can never conclusively prove stability by such a means, no matter the number of initial prices chosen, though you can convincingly demonstrate instability when it appears. Indeed, there could always be another attractor than the one you repeatedly locate, but which continues to go undetected, despite the number of different initial prices you have started from, due to the attractor’s small basin of attraction. We are convinced, though, that this is not happening here, at least not with any kind of frequency, and that in any case, in the spirit of discussing what is probable, though not entirely inevitable, we consider an economy that is stable for quite so many initial prices examined as being one adequate to support the principle of invisible hand, whether it is formally shown to be globally stable or not.

The initial prices generating trajectories are chosen uniformly, at random, from the price domain, except that any initial prices overly near the boundary, where excess demand explodes, are consequently rejected. The number of initial price combinations sampled is increased by stages as the dimension of the price space grows.Footnote 16 While, as noted, we can never formally claim global stability by our methods, the random selection of initial prices does allow one to make probabilistic statements about the size of the domain of attraction of the stable equilibrium, and with this one can also make probabilistic statements about the degree of stability across the economies of the chosen good and consumer dimensions, given the assumed distribution.

Each economy is passed through a sieve of four tests, in order to judge whether it is globally stable. Except after the initial test, a subsequent test is only done if the previous tests have been passed. First, a Cauchy-type criteria compares successive iterations of the numerical solution to our system of differential equations, having started from the chosen initial price vector, in order to decide if and when the trajectory of the tâtonnement dynamics has sufficiently quit moving. Then, given that the trajectories have thus individually converged, the sample mean of the trajectories’ ends ought to be a good approximation of the equilibrium that the trajectories are supposedly all approaching, and so it is required, trajectory by trajectory, that each of their ends not be too distant from this mean. A third test then verifies that this mean is, indeed, not far off from being an equilibrium, and finally, a fourth test verifies that the Jacobian of this mean approximation to the equilibrium is, in fact, a locally stable matrix (see below for a further explanation of terms used here.)

We note that there can be economies that are globally stable in the formal sense but fail to pass our convergence criteria, possibly because, despite the considerable latitude we give them, the trajectories fail to sufficiently converge to one another within the time allotted. From a practical point of view, this assignment to instability is perhaps just as well, since an economy that takes quite so long to stabilize is not one highly supportive of the invisible hand argument, even if, formally, it is globally stable.

The numerical solution of the system ordinary equations implied by the tâtonnement process, Eq. (1), was accomplished in a straightforward manner, using ODE23s of MATLAB, which employs an implicit method, designed to perform well even when the system is “stiff." The only complication was that we found that we had to take logarithmic transformations of the state variables (the prices) in order to keep the solution on its domain, despite the fact that, in principle, the built-in boundary condition should suffice for this.Footnote 17 This transformation converts the domain of the positive orthant into full Euclidean space, pushing the boundaries off to infinity. Since we have an analytical form for the Jacobian of excess demand, this is inserted into the solution process, which increases speed and accuracy relative to the case where the Jacobian must be estimated numerically. Having this analytical form is another, practical advantage of CES demand.

2.5.2 The CES base distribution

As already indicated, no instability was ever observed, whatever the dimensions, for the moderate size samples examined here. We will make further remarks on this phenomenon in sec. 4.4.1, once we have reviewed certain relevant notions coming from consumer theory and linear algebra.

2.5.3 The CES narrow distribution

An Increasing Numbers of Consumers Table 1 shows our results for the narrow distribution as the incidence of instability varies with the number of goods and the number of consumers. The most obvious outlier is the \(3\times 15\) case with one unstable economy among the 125, where you might have expected none, given the absence of instability in the dimensions immediately above and below (either that or you might have expected some instability in the \(3\times 9\) case). This reminds the reader that the results represent moderately-sized draws from binomial populations (stable versus unstable ones) and not the true population proportions themselves, and so occasional irregularities in the observed number of instabilities across dimensions, as opposed to the non-integral expected numbers, should not be so surprising. Except for this seeming outlier, the amount of instability is non-increasing in the number of consumers, given the number of goods, and, indeed, eventually disappears no matter the number of goods, indicating that all the asymptotic distributions consist of entirely stable economies. By the reasoning we develop, we would expect this with a large number of goods, but we would not necessarily expect it with few goods. Soon, though, we will see evidence that the stability condition we will introduce also always holds asymptotically, with respect to the number of consumers, no matter the number of goods.

An Increasing Numbers of Goods The behavior of instability with respect to the number of goods, given the number of consumers, is somewhat more complicated. For a larger number of consumers, where our interest lies, it is clear that the incidence of instability is eventually decreasing toward zero as the number of goods increases, whenever it is not already always zero. At the other extreme, with only two consumers, the incidence of instability is, instead, increasing with the number of goods, whereas the pattern for the case of five consumers remains unclear. As we will see, cases with a low number of consumers, most especially two, are somewhat special. With an intermediate number of consumers, even though it eventually vanishes, the incidence of instability does not always progress in a monotone fashion: for, say, nine consumers, the incidence of instability is, instead, rising and then falling as the number of goods is increased. Such behavior, though, is not at all antithetical to the arguments we develop, which will be asymptotic reasoning, and so needs only apply in high good dimensions, even with many consumers.

The one seemingly indisputable result that we observe is, fortunately, the one result of the greatest significance: with enough consumers and goods, instability is seen not to be present. This does not mean that instability is impossible to achieve in such situations, only that it becomes quite improbable.

Equal Numbers of Consumers and Goods Since we often speak just of large dimensions, to wit, a large number of both consumers and goods, we thought it would be appropriate to consider them in equal numbers, where we can then increase the two together. This case of an equal number of goods and consumers appears in the context of the SMD theorem (Mas-Colell et al. (1995)), as discussed below, since it separates the case where there are logical restrictions on aggregate demand (\(n>m\)) from the case where “anything can happen” with respect to aggregate demand (\(m\ge n\)) . This paper is more interested in what is likely to happen than in what could possibly happen, but, nonetheless, \(m=n\) seems an interesting case to examine, having the benefit of changing in but one direction, that along the diagonal. Except for a slight increase in instability going from the problematic case of two goods to the case of three goods, the results are clear: instability falls and then disappears with increased dimension.

3 Stability conditions: the indirect approach

Having seen the results for CES economies, we begin an inquiry into where the observed stability behavior in high dimensions appears to come from. We will concentrate on what happens when there are both many consumers and many goods, and since the arguments are quite general, we believe that the same results can be attained in high dimensions even when working with much more general preferences than the CES ones, so long as the distribution of preferences and endowments, governing the draws of consumers, allows for wide variations in what these consumer characteristics may be. We note, though, that our explanation will not then speak to why, above, in the CES case, we also obtained stability when there were many consumers, but not necessarily many goods. The explanation to be offered is expressed in terms of satisfaction of certain stability conditions, and so we start by a search for the presence of these stability conditions among CES economies.

3.1 The negative aggregate income effect and monotonicity as stability conditions

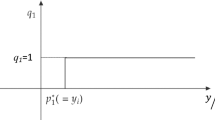

While demand is generally quite nonlinear over prices, it’s local behavior around any price combination can be adequately captured, in a linear fashion, by the Jacobian Dz(p), the square matrix of partial derivatives of excess demand with respect to price variations. Now, homogeneity of degree zero means that this Jacobian matrix can be of at most rank \(n-1,\) since it has to vanish when evaluated in direction p.Footnote 18 When the Jacobian is negative semi-definite and of maximal possible rank, and when this occurs at all prices, then the economy is said to be monotone, or that it obeys the law of demand.Footnote 19 This is an ideal state of affairs, and implies, among other things, that the economy is necessarily globally stable. One can, however, do with a good deal less than this condition and still have global stability. Keenan & Kim (2014) show that the condition of a negative aggregate income effect at all prices also suffices, where this condition only requires \(z(p)'Dz(p)z(p) <0\) for all p such that \(z(p) \ne 0.\) This is then negative definiteness solely in the single direction of aggregate demand z(p). It is the criterion on which we will focus.

We note that, while imprecise, the name negative aggregate income effect is meant to be evocative of the term “income effect” commonly used when analyzing the effect of prices on demand for an individual consumer, as reviewed in the discussion below of the Slutsky decomposition in sec 4.1.1. An analogy exists because the direction of excess demand in which we are evaluating the Jacobian in our condition is, indeed, the single dimension along which the income effect would operate were one in the case of a single individual.Footnote 20 The condition is an exact complement to the property typically known as aggregate WARP (Mas-Colell (1991)), or the law of compensated demand in the aggregate, which requires, instead, that the Jacobian acts in a negative definite fashion in all those directions orthogonal to the one of aggregate demand, the single direction with which our property is concerned. The two properties, the law of compensated aggregate demand and our negative aggregate income effect condition, characterize the law of demand for an economy, in broad conformity with Slutsky-like reasoning.

Taking, for example, the case of \(50\times 50\) economies, for both the base and narrow distributions, our negative aggregate income effect property held for all chosen price combinations among each of the 125 economies examined, where 25,000 random price vectors were sampled on each occasion. This finding alone convinces us of the main contention of this paper: large-dimensional economies almost inevitably obey our negative aggregate income effect condition, which then assures you of global stability without even the need to do an explicitly dynamic analysis. The direct dynamic simulations reported above can therefore be regarded, primarily, as just a study of stability among more modest size economies, as they transition to higher dimensions, where in so doing, stable economies get included even when they do not satisfy our property. Since they are much more rapidly computed than our explicitly dynamic simulations, and because the point they establish seems of considerable importance, we decided to run another 1875 of these \(50\times 50\) economies, again for both distributions, under the same conditions, never once observing a failure of our aggregate negative income effect condition anywhere in the examined price domain.

3.2 The negative aggregate income effect and monotonicity among CES economies

While our interest is mainly in global stability, and, in Table 1, we searched for it directly among CES economies, as indicated, we also have a certain interest in the negative aggregate income effect itself, as well as the allied, but considerably stronger, condition of monotone aggregate excess demand. Thus, we complement our direct search for global stability with a similar search for the presence, among CES economies, of these two properties, known to guarantee global stability. This is done in Table 2 for the case of the narrow distribution.Footnote 21 We note that while our search for global stability was complex, and the techniques used could be considered inconclusive, this is somewhat less the case with the negative income effect and monotone demand. They are characterized by easily checked Jacobian conditions, and while we cannot possibly check everywhere, we are able verify these properties, or not, for a much larger number of randomly chosen prices than was possible in studying stability directly. In all cases, we continue to examine 25,000 randomly chosen prices .

Table 2 has the same overall structure as Table 1, in terms of presenting results for a varying number of goods and a varying number of consumers. Each entry commences by first giving the number of economies, always out of 125, for which some prices failed to exhibit a negative aggregate income effect, while, just to the right, is the number of economies where more than .5% of the examined prices failed to meet this condition. Immediately below is the number of economies failing to always exhibit monotone demand, which, of course, must always be at least as great a number as the one immediately above it, concerned with the negative aggregate income effect. Again to the right of the figure is the number of economies where more than .5% of the examined prices failed to meet this monotonicity condition. Below all this, and slightly indented, is, first, the number of non-monotone economies where there is exactly one positive eigenvalue of the symmetrized Jacobian, and then, in cases of failure of our stability condition, the number of economies for which, at all prices, the least negative of the other nonzero eigenvalues is greater in absolute value than the unique positive eigenvalue, this being sufficient for system stability when it holds throughout, by results of Smith (1986).Footnote 22

Besides setting up the system stability condition that follows it, the case of a single positive eigenvalue is of interest, in and of itself. As we explain below more fully, in the case of a single consumer, there is only one eigenvalue of the symmetric income effect that is positive, and so there is only the one eigen direction to potentially overcome the corresponding substitution effect, and so prevent monotonicity. Consequently, particularly whenever individual demands are not as diverse as might be supposed, it would be unsurprising were the symmetric aggregate income effect to also produce only one positive eigenvalue that has a magnitude capable of dominating the substitution effect in its respective direction.Footnote 23

Turning first to the issue of most concern to us, we see, in further detail, that with sufficiently many goods and consumers, a negative aggregate income effect is always observed, which then reinforces our conclusion, coming from Table 1, that global stability is inevitable with enough goods and consumers, at least for the CES case we examine here. The similarity between the pattern, in Table 1, for stability with an increasing number of goods or an increasing number of consumers, and that of a negative aggregate income effect, shown here, suggests that the latter condition is a particularly appropriate one to consider when treating the global stability of equilibrium, especially whenever there are more than a few goods. On the other hand, while obviously lagging the previous, weaker stability condition, monotonicity is also seen to eventually become inevitable, once one arrives at a sufficiently large number of consumers, and so, if you prefer this more familiar criterion, the observed results concerning its applicability are also encouraging.

Failures of the stability condition become ever more infrequent with increases in the number of consumers, and much the same can be said for monotonicity, at least with more than a few goods. Such failures of our stability condition also diminish in frequency with increases in the number of goods, at least beyond the problematic case of two goods, whereas failures of monotonicity begin to occur less frequently only a good deal more belatedly, beyond fifteen goods. The results here, for, say, only two consumers, are probably noticeably more accurate than are the previously discussed results concerning global stability, with or without our condition, since the strict requirements imposed there, before declaring stability, means that one is liable to have exaggerated the observed instability, a possibility most likely when there are few consumers.Footnote 24

While we prepared a table showing the prevalence of the negative aggregate income effect, as well as the prevalence of monotonicity, for the more uniform distribution, being then an exact mirror of what Table 2 is for the case of the narrow distribution, we have not presented it, since it seems to us to show little of surprise, given what we have already learned from Table 2. Recall, however, that as reported earlier, in the discussion of Table 1, with this more uniform distribution, global stability prevails in all dimensions, indicating, then, that in this case, other stability conditions sufficiently substitute for the negative aggregate income effect, in those dimensions where it is sometimes absent, such that global stability is observed throughout. Of course, this is not a guaranteed phenomenon among all distributions, since, as we have seen, with the narrower CES distribution, one fails to always have global stability once one encounters fewer goods and consumers.

3.3 Summary of the CES case

We provide summary results for CES demand with the specified distribution of preferences and endowments.

-

With enough diverse consumers, it is difficult to find anything other than global stability of an economy. Surprisingly, this does not even seem to require that there also be a substantial number of goods, and, indeed, CES economies are found to consistently be monotone whenever there is a high enough number of consumers.

-

With enough goods, it is again difficult to find anything other than global stability, though this requires that the economy have more than just a few consumers. This is perhaps less appealing than the previous result, since, unlike a large number of consumers, a large number of goods is not already required in order that there be perfect competition.

-

Non-monotone economies continue to occur with a more moderate number of consumers, even with a substantial number of goods, though instability has by then disappeared. This demonstrates that, in terms of the invisible hand, monotonicity is an unnecessarily strong property.

While the conclusions above were ascertained only for our case of CES demand with given distributions, we will provide reasons to expect that the results concerning a large number of goods, with enough consumers, hold in far greater generality, whenever economies can be considered as being drawn randomly from a wide distribution of consumer characteristics. Of necessity, we worked with a particular density of such consumer characteristics, but in our first effort, this distribution was chosen to be as regular, that is unexceptional, as possible. No particular assumptions were made to encourage global stability; in fact, we made sure that low elasticities of substitution were permitted in this base case, a feature which serves to promote global instability. Then, in the case of a narrower distribution, we introduced further restrictions meant to more actively encourage such global instability. The latter case, thus, makes the continued disappearance of global instability as the number of goods and consumers increases all the more dramatic.

4 Analyzing the emergence of stability in high dimensions

4.1 Many goods but an individual consumer

4.1.1 The Slutsky decomposition

Beyond a doubt, the most famous analytical result in consumer theory is the so-called Slutsky decomposition, which states that the effects of price on demand can be divided into a “substitution effect” and an “income effect,” where, briefly, the substitution effect accounts for how a rational consumer substitutes between goods as prices change, in order to maintain a given level of satisfaction at the minimum cost, whereas the income effect arises from the consumer’s response to the changed level of satisfaction, or “real income,” resulting from the changing prices, even given nominal income, \(y=p\cdot \omega .\) Combining this last effect with the so-called endowment effect, which uses the chain rule to express how changing prices, with a fixed endowment, affect even nominal income, and hence, demand, we arrive at the Slutsky decomposition in terms of individual excess demand, as being:

Here \(S^j\) is the substitution effect matrix, while \(M^j\equiv -(a^j)(z^j)'\) is the \(n\times n\) matrix of income effects, with \(a^j\equiv D_{y} x^j(p,y)\) being the vector of the various goods’ marginal propensities to consume out of income (so that \(p\cdot a^j=1.\)) Now, the substitution effects of any rational individual behave ideally; that is, S is negative definite, except for direction p, where it vanishes due to homogeneity of degree zero, and thus the aggregate substitution effect of the economy, whose matrix is merely the sum of the individual ones, behaves in the same way. This then leaves the aggregate income effect, the sum of the individual income effects, as the only source of any possible violation of the “negative aggregate income effect,” or if it does not permits this, the only source of any possible violation of monotonicity. We now analyze this aggregate income effect by considering its individual income effect components, one at a time.

4.1.2 The income effect as a quadratic

Considering \(M^j(p)\) acting as a quadratic (and hereafter suppressing p in the notation, and, by the next paragraph, index j), it is apparent that only the component of z in the direction of \(z^j\) affects \(M^j\) when evaluating from the right, but since we are treating \(M^j\) in this fashion, one must also evaluate it from the left, and there one sees, in a completely dual fashion, that, from there, the income effect is affected only by the component of z in the direction \(a^j.\)Footnote 25 In fact, symmetrizing \(M^j,\) which has no effect on its performance as a quadratic, one sees that its natural domain is \(E_{z^j,a^j},\) the two-dimensional critical set spanned by \(z^j\) and \(a^j,\) in the sense that \(1/2(M^j+(M^j)')\), will, instead, vanish on the \((n-2)\)-dimensional space of vectors orthogonal to this E-plane. One notes that, unlike the E-plane, the latter space becomes quite large as the full dimension, n, grows.

Furthermore, if, for any individual, you look at the action of symmetrized M in the critical plane E, you will see that there is one negative eigenvalue and one positive one, each, of course, with its own eigen direction.Footnote 26 For any vector v, chosen to have length unity, for ease of discussion, we speak of \(v^+\) as its projected component onto the eigen direction of the single positive eigenvalue, \(\lambda ^+,\) at the prices under consideration. Now, there is a result (Matoušek (2002), p. 359), perhaps not altogether surprising, that says that, as n increases, \(v^+\) will become smaller than any amount one might specify, for a proportion of the vectors v in the unit sphere that increasingly approaches their entirety. The exceptions, for any n, obviously lie among the nearby vectors nearly aligning with the single eigen direction of the eigenvalue \(\lambda ^+.\) Thinking, then, in terms of mean aggregate z, the vector v we are actually interested in, there will be at most a small critical region of directions around the direction of \(\lambda ^+\) in which z could reside where the substitution effect of the one consumer, acting on full z, would not dominate his positive income effect resulting from the one-dimensional projection being spoken of.

To illustrate matters a bit more concretely, with n goods, we express the quadratic individual income effect when operating on a unit vector v, in terms of its expansion in the eigenbasis, as

Here, the \(v_i\) (or, in the last two dimensions, \(v^-\) and \(v^+\)) are the components of v in the direction of the eigenvector of \(\lambda _i,\) where, of course, the \(\lambda _1, ..., \lambda _{n-2}\) are all zeros and only the last two eigenvalues can be nonzero.Footnote 27 The next-to-last eigenvalue is the negative one and the last the positive one, where we have written the next-to-last one as \(-(-\lambda ^-),\) so as to emphasize that it is negative, and hence \(-\lambda ^-\) is positive. Note that it is only \(\lambda ^+\) that makes a positive contribution to the income effect, and hence to the total effect. The main point is that, for a typical v, when n is large, not much of v will be associated with this one positive direction, and so, any possibly positive income effect of the individual is likely to be dominated by the substitution effect \(v'Sv,\) which is negative definite in all directions (other than p), and hence, does not suffer from projections, like those of symmetrized M, that zero out most of the directions of price change.Footnote 28

4.2 The negative aggregate income effect with many goods and many diverse consumers

It could, of course, happen, that, despite everything, the mean aggregate demand vector z does lie in the small critical region for a given person j, which would be the case if the direction of z is near that of the eigen direction of \(\lambda ^{j+},\) but there are to be, one recalls, numerous consumers, with different demands, and if z lies in the critical region associated with the \(\lambda ^{j+}\) of one consumer j, it will be most unlikely to lie near those of most of the other consumers, who of course also contribute their own terms to \(z(p)'Dz(p)z(p)=\sum z(p)'D z^k(p)z(p)/m\). Thus, one can be rather confident that \(z(p)'Dz(p)z(p)\) will be negative in total, and thus that the negative aggregate income effect criterion we are seeking will be satisfied, yielding a sufficient condition for a globally stable equilibrium. This, then, is our principal argument in terms of the effect of the number of goods, given enough consumers.Footnote 29

This is not to say that can be no exceptions, and that all economies with a great enough number of goods and consumers must feature global stability of equilibrium. It is well known (Mas-Colell et al. (1995)) that, in any good dimension, with at least that many consumers, by picking the preferences and the endowments carefully, one can achieve virtually any sort of dynamics. Furthermore, one can construct that economy to be quite regular, so that neighboring economies exhibit the same disturbing dynamics. Thus, even assuming high dimensions, there could never be a result saying that global stability is generic among all attainable economies, not without invoking much more restrictive assumptions on demand than we have adopted here. The principle is, rather, that given sufficient consumers selected in a random, but diverse, manner, exceptions to global stability in any higher good dimension must occur relatively infrequently, and importantly, the proportion of such exceptions continues to further decrease as the number of goods increases, or alternatively, as the number of consumers is increased.

4.3 Distributions of consumers and the law of large numbers

The above argument depends on demand being sufficiently diverse across consumers, and given a distribution of consumers to draw from, the question arises whether this diversity occurs given a large enough sample of consumers. This would appear to depend on whether the underlying distribution of consumer characteristics, from which the economies are drawn, is sufficiently diffuse. Any such distribution will induce a population mean (excess) demand function of that distribution, but unlike the individual demands, it is not necessarily the demand of any particular individual, and so, might not obey the compensated law of demand. Nonetheless, this mean demand is the weighted combination of the individual demand functions making up the distribution, and so, if they are diverse enough, which will be the case with a diffuse enough distribution, then by exactly the kind of argument presented above for randomly chosen finite sums of individual demand, but here in a determinate sense, this mean aggregate demand will obey our condition, and so be globally stable, provided there are enough goods. Since, as the simulations below illustrate, a law of large numbers is at work, any sufficiently large draw of consumers from their distribution will generate an excess demand near this mean one, so that the former demand will then be globally stable, as well.Footnote 30

We note, as an aside, that if, on the other hand, one has a rather narrow distribution of consumer characteristics, then the above reasoning does not follow, and one might well have a mean aggregate excess demand of the distribution that corresponds to that of an unstable economy. The law of large numbers would still apply, but one would then have the reverse result that large samples from such a distribution would inevitably approach that unstable demand. For instance, in the manner of the Sonnenschein-Mantel-Debreu (SMD) theorem, discussed further below, one can decompose any unstable aggregate excess demand into a finite sum of individual excess demands, which can then be thought of as constituting an equally-weighted finite distribution with the unstable aggregate demand as its mean. Such a distribution of consumer characteristics, however, would definitely not be a diffuse one. Since the use of any such distribution is something of a thought experiment, it does not seem possible to unequivocally assert what its nature must be, but it seems to us that the more diffuse sorts considered below are more plausible than the sorts generated by the SMD theorem, and that the range of possible demands needs to always be taken to be a reasonably broad one.

4.4 Monotonicity with many goods and many diverse consumers

The arguments made previously were applied to vector v chosen to be mean aggregate demand z, since that is what was needed to obtain a negative aggregate income effect and thus global stability, but no direct use was made of the nature of z in order to conclude that the Jacobian of mean aggregate z acted negatively in its direction. Consequently, it seems that the arguments might be applicable to any v, which, if it can then be applied uniformly, then gives the condition for aggregate demand to be monotone. This, of course, yields global stability, in particular, but implies considerably more as well, in terms of, say, comparative statics.Footnote 31

Note, though, that one can interpret our argument as effectively being been that, in a typical direction, the Jacobian of mean aggregate demand acts negatively as a quadratic, but there can, of course, be atypical directions, as well, which will not affect our condition, and so global stability, so long as these atypical directions do not encompass that of aggregate demand, but which will necessarily prevent the monotonicity property, since this condition requires the negativity condition to hold in every possible direction. Furthermore, with greater numbers of goods, there are more and more directions in which the negative quadratic condition must hold if monotonicity is to prevail, and so, other things equal, more and more opportunities for it to fail, something not true of our proposed stability condition, which always operates in but one dimension. Nonetheless, given sufficiently diverse preferences, it is not surprising that, in the course of increasing dimensions, as in Table 2, not so much after the disappearance of observed failures of our stability condition, there is also an accompanying disappearance in observed instances of non-monotonicity.

We comment, in concluding our general discussion, that, in most actual situations, there do, indeed, seem to be many goods and many consumers, with the assumption of many consumers, at least, being needed, in any case, to assure the perfectly competitive assumption required by the general equilibrium framework.

4.5 Return to previous topics on CES economies

Armed with machinery stemming from the Slutsky decomposition, we can now better address certain topics on CES economies that were only briefly treated previously.

4.5.1 The base distribution

Now, recall that when we made our argument for the prevalence of global stability, it depended, in part, on the idea that when mean aggregate z(p) was close enough to the eigenvector of \(\lambda ^{j+}(p)\) such that person j’s contribution to \(z(p)'\big (\sum Dz^k(p)\big )z(p)/m\) acted toward making the latter positive, then z(p) would be far from the numerous other consumers’ similar eigenvectors, and thus the contributions of their Jacobians to the corresponding aggregate would be negative and dominant. However, when there are only, say, two consumers, one can hardly claim that the sole existing agent, other than consumer j, must be dominant, so that this argument loses most of its force. Another way of saying it is that, with a sample as low as two, the law of large numbers is not yet much in effect, and so, the sample’s mean demand could easily be unstable, even though the mean demand of the distribution is stable. It is thus quite striking that no instability was ever observed using the base distribution, even with a low number of consumers, or a low number of goods.

Regarding the results briefly reported concerning the direct solution of the tâtonnement process, when in the base case, one might wonder if instability is really so rare as it appears, especially with few goods and consumers, given that, in sec. 2, we explicitly solved the dynamics only for draws of 125 economies each time, among the various dimensional combinations examined. For the narrow distribution, at least, we saw that the \(2\times 2\) Edgeworth box is, indeed, a situation where global instability is more probable than in many other, higher-dimensional cases, given how frequently multiple equilibria occur there. Conveniently though, the \(2\times 2\) case is also the fastest case to directly solve, so we performed numerous additional draws for it, as well as for the \(3\times 3\) Scarf-like case, using the base distribution, while never once encountering an unstable economy in any of the 2000 draws for the \(2 \times 2\) case, nor in any of the same number of draws for the \(3 \times 3\) case.

Note, though, that we have only presented an argument as to why global stability should become increasingly dominant with increases in the dimension of goods and consumers, one based on negative definiteness in the direction of mean aggregate excess demand. There is, however, no converse reasoning arguing that instability must become common in low dimensions, since many additional conditions are known that yield stability, where we have less preconceptions as to how these are affected by dimension. We would say, though, that other than very special properties, like gross substitutes or diagonal dominance, the most important condition in economics is surely aggregate WARP.Footnote 32 Now, unlike our condition in one direction, WARP depends on negative definiteness in all the orthogonal directions other than this single one of aggregate demand. Thus, it seems that, at least relative to our stability condition, WARP, and hence the global stability it engenders, ought to become more difficult to achieve as the numbers of goods increases, with a given number of consumers. This is because, with WARP, negative definiteness is then being required to hold for an increasing number of dimensions concerned (\(n-2\) of the \(n-1\) in all, in the tangent space to \(S_+^{n-1}\) at prices p), rather than always just a single dimension, as with our property. All this, then, amounts to employing the same logic that we have already taken advantage of in high dimensions, with respect to our property, but now applied to WARP, in the complementary sense. Then, however, when, the number of goods is, instead, low, WARP becomes much easier to achieve, and it might very well be that aggregate WARP substantially contributes to explaining the scarcity of instability that is still found with few goods.Footnote 33

4.5.2 Two goods

We also reconsider the case of two goods, particularly in relation to Table 2. Having but two goods is rather special, since then, for instance, the symmetrized aggregate Jacobian has but a single nonzero eigenvalue, which then makes the conditions for a negative aggregate income effect and for monotonicity of aggregate demand one and the same. Having but a single nonzero eigenvalue is also characteristic of any individual’s quadratic income effect, where, then, it is only in certain circumstances that this eigenvalue will be positive, and, so, potentially induce failure of our stability condition. On the other hand, we have seen that, beginning with three goods, an individual will invariably have a positive eigenvalue in his symmetrized income matrix, and thus, as a result, there is a potential failure of the stability condition in all circumstances, depending on prices. It is perhaps, then, not surprising that, at least for a modest number of consumers, failures of the stability condition increase in number when going from two goods to three, a phenomenon at odds with the later tendency to have less such failures with yet more goods.

While few goods or few consumers remain a secondary issue for us, the behavior there has, nonetheless, been worth remarking, if just to see the contrast with the case of greater concern to us, that of a large number of goods and consumers. Not for the first time, nor for last, we reach the conclusion that having few goods or few consumers (in particular, just two) can often yield results not indicative of what is happening in the situation of a larger number of goods and consumers.

5 The role of diffuse distributions in stability

5.1 The SMD Theorem

Sonnenschein (1972) initiated, and then Mantel and Debreu completed (see Mas-Colell et al. (1995)), an analysis, in n-good economies, of arbitrary aggregate demands—that is, any of those satisfying the conditions mentioned in sec. 2.3—which showed, roughly, that any one of these economies can be expressed as the aggregate (sum) of the demands of n neoclassical, rational consumers. This means that rationality of consumers, at the level of the economy, has no implications beyond the properties previously discussed. Thus, when translating such economies into vector fields living entirely on \(S_+^{n-1}\), as done in sec. 2.3, any such vector field can arise. Since mathematicians have shown that these sorts of vector fields, in dimensions higher than three (i.e., with more than four goods), include robust examples having dynamics far more complex than the mere limit cycles that Scarf observed, this means that viable economies exist in higher good dimensions capable of recreating this same complex behavior via their tâtonnement dynamics. One might say that, with this discovery by economists, chaos ensued.

5.2 The SMD Theorem versus the law of large numbers

As a result of the SMD theorem (previously known as the Sonnenschein conjecture), economic theorists are now liable to dismiss, out of hand, the sort of results proposed here. However, at the risk of exaggeration, this is not unlike if one were to dismiss the law of large numbers, for independent tosses of a fair coin, by observing that one can easily construct an example consisting of nothing but a long succession of heads, where, then, for such a selection, the proportion of observed heads would be exactly 1, not at all close to the population proportion 1/2 that the law of large numbers predicts the sample proportion should approach. While this could indeed occur, in reality, such a draw is most unlikely to ever be seen, at least not when conducting a large number of independent draws from a binomial distribution. It appears to us that the moral must be that one needs to focus one’s attention more on what is likely, and less on what is merely feasible. Similarly, in our situation, we find modeling an economy by independent draws from a wide distribution of characteristics, and then observing the result, to be a more reasonable way of describing the likelihood of equilibrium being stable than by conducting a search for possible unstable economies, and then abandoning the topic once they have been discovered. Expecting to have stability, no matter the circumstances, is asking rather too much of tâtonnement, or, indeed, any plausible dynamic.

The answer to where the stability we find comes from is that it comes from the wide distribution we permit in consumer characteristics. One would not even need to look at explicit draws from the distribution: one could just look directly at the mean demand of the population from which the draws come, and that mean population demand is predicted to be stable. The draws are just a device we need to do simulations, and to reflect the prosaic observation that, in reality, there can be but a finite number of consumers, even if we are uncertain as to which consumers they are. A corollary of this insight—that stability lies in the wide distribution of possible consumers and the large number of consumers and goods—is the observation that no structural properties of individual or aggregate demand seem to be required for the argument to go through, beyond those implied by the rationality of the consumers and the setting of perfect competition. This is in contrast to traditional stability analysis, which just imposes, say, the gross substitutes property on aggregate demand, usually without much justification. The ad hoc character of such assumptions has probably contributed considerably to traditional stability analysis having been discredited.

To further see the lack of conflict between the SMD result and our present analysis, consider that if the distribution of consumer types is truly a wide one, and so has a large support, the latter is liable to contain the n individual demands needed in the SMD construction of some particular unstable economy involving n goods.Footnote 34 However, even though an unstable economy would indeed result from that particular draw of n consumers, such instability is most unlikely to continue occurring in economies with yet larger number of consumers, since the sample mean demand will inexorably approach the mean demand of the population, and we have argued that this demand will be a stable one.Footnote 35

5.3 The overabundance of observed stability

We cannot explain everything observed in our CES case, but, fortunately, what we cannot explain is mostly the welcome fact that a negative aggregate income effect, and, indeed, the stronger monotonicity property, seem to occur whenever there are many consumers, even when there are only a few goods. Of course, with many consumers, the sampled economy should approach that of the distribution, whatever the number of goods might be, but we currently lack a compelling reason why that mean economy of the distribution need, itself, be stable when there are but a few goods. This overabundance of stability might point to a general principle, or it might simply be an artifact of the CES environment examined; lacking an adequate explanation, we must remain agnostic as to the generality of the observed phenomenon. However, as to the CES economies being such a singular case, see the discussion of indirect addilog preferences, presented below.

We comment, in closing our general discussion, that even if one rejects classical tâtonnement as the appropriate dynamic, or, indeed, even if one rejects all disequilibrium analysis, the results of this paper should remain interesting, in that they show the ubiquity in high dimensions of the uniqueness of equilibrium.

6 Indirect addilog preferences: normal goods versus inferior goods

6.1 An aside on normal goods

While the previous dimensional arguments do not depend on whether goods are normal or inferior, the assumption of normal goods, characteristic of CES preferences, will, other things equal, contribute toward the individual income effect being negative, with obvious consequences for satisfaction, in the large, of our negative aggregate income effect condition. Indeed, if you look at the formula for the quadratic action of the income matrix \(M^j\) (see footnote 26), much depends on its trace, \(tr(M^j)\equiv -z^j(p)\cdot a^j(p)=-\sum _i a_i^j(p)z_i^j(p).\) While this can be of either sign, the normal good assumption keeps it from being too positive, since the only terms that can then be of that sign correspond to negative excess demands, \(z^j_i<0\), which are, however, limited to be of size at most \(-\omega _i^j,\) given that you cannot sell more than your endowment. This is as opposed to an inferior good, which could, in principle, have an arbitrarily large positive excess demand, thus making an arbitrarily large positive contribution to the trace. Furthermore, with normal goods, the other factors, \(a_i^j(p),\) of the trace cannot be that large, either, among those goods in excess supply, since \(\sum _i p_ia_i^j(p)=1,\) by the budget constraint, and so, the only way for \(a^j_i(p)\) to be exceedingly large is for \(p_i\) to be exceedingly small, in which case, the good will be excess demand, not excess supply.

However, while inferior rather than normal goods may, indeed, impede the progress toward increased global stability with rising good and consumer dimensions, they shouldn’t prevent the ultimate achievement of such stability. This is because the dimensional argument works by increasingly reducing the magnitude of the income effect, as one moves to higher and higher good dimensions, and, in the end, such an argument should be indifferent to the sign of income effects.

6.2 The indirect approach for indirect addilog preferences

In addition to looking at CES preferences, we decided to also look at economies composed of consumers with the previously mentioned indirect addilog preferences, a yet wider class than the CES ones. Compared to CES demand, Eq. (2), these preferences give rise to demand the form:Footnote 36

Given our experience with CES preferences, we thought it sufficient to only examine cases with a large number (200) of consumers, where, consequently, any draw should provide an adequate approximation of the aggregate demand of its underlying distribution of consumer characteristics. Now, the immediate reason for examining the indirect addilog case was to see if the presence of inferior goods can prevent stability in high dimensions, given that, unlike CES preferences, indirect addilog ones need not be homothetic, and do permit inferior goods. We thus went out of our way to consider cases that promoted the appearance of inferior goods. Despite our efforts, we, once again, did not discover a single case, with our high number of consumers, where the negative aggregate income effect did not hold; indeed, once more, monotonicity always held, as well. We, thus, do not present a table showing these rather repetitive outcomes. The results fit well, though, with our intuition that while inferior goods might impede stability in low dimensions, they should not prevent its attainment in high ones.Footnote 37

6.3 Coda

Of course, what wants, in the end, are not just convincing simulations for an ever larger number of cases examined, but a rigorous proof that the mean demands of distributions of consumers will be stable, across a significant class of such distributions, when in high good dimensions. Beyond the rather geometric arguments employed here, one will presumably need formal probabilistic arguments, in the fashion of the law of large numbers. Spurred, in part, by advances in computing power and the needs of big data, mathematicians have lately made considerable advances in treating probability in high dimensions. The recent textbook by Vershynin (2018) provides an accessible introduction to these topics. However, before we can expect the profession to provide the looked-for arguments, economic theorists will need to be persuaded that such results surely exist, and that, for these purposes, the SMD theorem is largely irrelevant, speaking, as it does, to what is unlikely to actually occur when distributions of consumer types are well-behaved. Providing evidence for this has been the object of this paper.

7 Conclusion

Technical arguments are made supporting the thesis that, with many goods and many consumers, it is nearly inevitable that the classical tâtonnement mechanism will lead an economy to the unique, globally stable equilibrium. The importance of this conjecture lies in the fact that, without such assurances, the invisible hand argument would be seriously compromised, since an equilibrium not attained, Pareto optimal though it would be, is only of academic interest. While classical tâtonnement is not the only plausible market mechanism supporting equilibrium theory, it has, for reasons of its straightforwardness and reasonableness, traditionally been the disequilibrium dynamic of choice in doing economic reasoning, and establishing stability with respect to it seems of some importance for the general equilibrium program.

The earliest results of formal general equilibrium theory demonstrated existence and Pareto optimality of equilibrium for each and every economy obeying seemingly mild conditions. Then, after the reintroduction of regularity into general equilibrium theory (Debreu (1970)), one obtained further positive results that did not always hold, but held only “almost always,” this in a precise sense: an example would be the generic finiteness (determinacy) of the number of equilibria. Now, we are suggesting relaxing matters yet further, not to just what is generically true, but to what is only true with high probability, when in large enough dimensions. At least for us, the invisible hand is more a general tenet than an iron-clad truth admitting no exceptions, and the usefulness of tâtonnement in supporting its principles permits the finding that, under that dynamic, one remains only highly confident of arriving at equilibrium.

Notes

The failure to obtain stability results, in particular, is a major theme in the historical survey of general equilibrium theory by Ingrao and Israel (1990), with little having seemingly changed since.

We are thinking of, for instance, the well-known gross substitutes property that assures system stability, and where, with a mild non-degeneracy condition, one then gets uniqueness of equilibrium, and, so, global stability as well (Mas-Colell et al. (1995)).

See, for instance, the discussions in Herings (2012).

We note that, with the notable exception of Gintis (2007), these works primarily concentrate on firms and production, and, in any case, cannot be said to be fully in the general equilibrium tradition, with its emphasis on the role of consumer demand and the endogenous determination of prices. They are, instead, for the most part, in the partial equilibrium tradition of Cournot. This is not at all to say, though, that the principles they expound could not be extended to a complete general equilibrium setting.

We are, more or less, forced to use vector notation for our symbols, lest one descend into a thicket of indices, given that we will have both m consumers and n goods to account for. For instance, the inner, or dot, product \(y=p\cdot \omega ,\) in component notation, is \(\sum _{i=1}^n p_i\omega _i,\) with scalar y being the value of the bundle \(\omega \) at prices p.

Preferences are an ordering of commodity bundles x by which are preferred, that is liked more by the consumer.

The parameters \(\alpha _i\) are, of course, weights on the n individual goods, whereas the unique elasticity of substitution parameter \(\sigma \) combines with these to determine the degree of substitution between the various goods. Together with preferences, consumer \(j'\)s demand is then fully characterized by the already spoken of value of his endowment, \(\omega ^j.\)

The specialness of the global regularity of CES preferences is then a matter of their convenience for analytical and numerical calculations, rather than their having some crucial theoretical property giving rise to our results; many other possible families of preferences should result in similar stability behavior when in the aggregate; it is only that they do not possess a convenient closed form to express the individual demands, whatever the circumstances.

There is the further point that CES preferences have a finite parameterization, so that distributions of these parameters can be easily formulated, permitting draws of individual demand functions to be performed with ease, something not so straightforward in the infinite dimensions of all rationalizable demand functions.

Note, though, that, in practice, we actually work with mean aggregate demand, rather than absolute aggregate demand, in order to facilitate comparison across economies possibly having radically different numbers of consumers Here, mean excess demand simply divides aggregate excess demand by the number of consumers, m.

\(\mathbb {R}_+^{n}\) stands for the elements in Euclidean n-space having all nonnegative components, and \(\Vert \Vert \) is the Euclidean norm on this space, measuring the size of a vector, according to Pythagoras’ Theorem. The \(\epsilon ,\) of course, denotes set membership, and, here, with the curly brackets and the “such that" symbol, |, we are defining the set \(S_+^{n-1}.\)