Abstract

In this paper, we use an agent-based simulation combined with innovative calibration techniques to model the European banking system as accurately as possible. Our novel contribution to the recent literature involves adding bank heterogeneity to the model. To estimate the levels of shock propagation in large-scale events, such as the default of multiple banks, as well as smaller events, such as the defaults of an individual bank, we provide granular modeling of bank behavior. We extend the existing network approach by adding the ability to model banks of various sizes and the detailed connections of 286 individual banks across 9 European countries. Our main results show how the failure of a large Italian bank or of a medium-sized German bank might create a cascade of problems for the entire European banking sector. Our results reveal that Italian banks make a much larger contribution to systemic risk than German or French banks. We believe that computational experiments in this model provide valuable insights into systemic risk within the European banking system for policy makers when estimating the systemic effects of individual bank defaults. From a regulatory perspective, we recommend the introduction of a tighter limit for all types of inter-bank exposures than the recent limit of 25% of Tier 1 capital. Moreover, we propose an increase in the risk-weights for exposures to large banks in Germany, France, Italy, and Spain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Trends in increasing operational complexity, globalization, and organizational interdependencies have been observed in contemporary financial systems. Modern markets bring together a diverse group of stakeholders that form a rich network of interdependencies through a wide set of possible actions, such as cross-ownership. The broad use of financial products, such as collateralized debt obligations and exotic derivatives, further complicates the balance sheets and risk profiles of their users and adds to the overall organizational interconnectedness. During the past decades, international integration and changing regulations have added even more interconnectedness and have introduced concentrations of risk to the global financial system. In such an environment, systemic risk emerges as a key issue because the failure of an individual bank may impose significant costs on the entire system.

As dramatically demonstrated during the global financial crisis of 2007–2009, the relevance of systemic risk was significantly underestimated. Before the crisis, financial regulators and central banks were mostly focused on ensuring the liquidity of individual banks, and the risk of contagion was, in general, considered to be low (Furfine 2003). However, the collapse of the Lehman Brothers and the need for bailout funds for American International Group (AIG) indicated that feedback elements in interconnected networks have the potential to amplify shocks to financial systems. These highly undesirable effects of systemic risk, interconnectedness, and shock propagation have drawn significant research interest from academic researchers (Bruha and Kocenda 2018; Black et al. 2016; Allen and Carletti 2013; Gai and Kapadia 2010; Haas and Horen 2012; Kvapilikova and Teply 2017; Upper 2011), international organizations and stability regulators (BCBS 2009; Borio 2011; Chui et al. 2010; Demekas 2015; Morrison et al. 2017), and policy makers (U.S. Congress 2010).

The regulatory bodies responded to the crisis as well, such as by updating the Basel II recommendations; the revised version, Basel III, attempts to add robustness to the system by including mechanisms for increasing the resilience of banks to transient shocks (Basel Committee 2013). Additionally, the European Banking Authority (EBA) has performed stress tests of the EU banking sector (Basel Committee 2010). Despite the soft assumptions used in these tests, these results and the overall Basel III framework were subject to criticism (Sutorova and Teply 2014).

The first network model-based research of systemic stability was performed by Allen and Gale (2000), who investigated the liquidity shock contagion. Another early study was carried out by Freixas et al. (2000), who analyzed banks with systemic importance and provided recommendations for central banks’ interventions. Cifuentes et al. (2005) and Shin (2008) added a market liquidity contagion channel to decrease the price of illiquid assets. Other studies analyzed systemic stability by simulation experiments on random networks under varying conditions, such as connectedness and exposure (Nier et al. 2007; Gai and Kapadia 2010; Georg 2013), risk diversification, innovation, and leverage (Devereux and Yetman 2010; Battiston et al. 2012; Caccioli et al. 2014; Corsi et al. 2013; van Wincop 2013). Löffler and Raupach (2016) examined the possible pitfalls in the use of return-based measures of systemic risk contributions. Regulatory requirements are investigated in Klinger and Teply (2014a) and Chan-Lau (2014), who studied the influence of capital buffers, bank solvency, and interconnectedness on system stability, as well as measures to contain the contagion during a crisis. Klinger and Teply (2016) added state aid to banks as a means of mitigating systemic crises.

However, these works are theoretical rather than empirical, with exceptions such as Upper and Worms (2004), who focused on the German interbank market, or Van Lelyveld and Liedorp (2006), who analyzed the Dutch market. More recently, several realistic models of the global bank market were devised (Hale et al. 2011; Hale 2012; Montagna and Kok 2013; Gross and Kok 2013; Minoiu and Reyes 2013). Additionally, Nirei et al. (2015) calibrated the loan syndication networks model to broad market data. The limited empirical literature on systemic risk modeling is understandable because the simulation of the network structures is computationally very costly (Halaj and Kok 2013).

Several studies concentrate on real-world interbank exposure modeling. For example, Boss et al. (2004), Upper and Worms (2004), Wells (2004), van Lelyveld and Liedorp (2006), and Muller (2006) analyzed the banking systems of Austria, Germany, the United Kingdom, the Netherlands, and Switzerland, respectively. Recently, Halaj and Kok (2013) attempted to approximate a network of banks that reported during the 2010 and 2011 EBA stress tests (EBA 2011). Finally, Craig and von Peter (2014) investigated the tiered structure of the real-world German banking network. However, most researchers face the problem of virtually non-existent reliable data on individual interbank exposures. This work combines theory and empirics in the model to calibrate it to the real-world data of the European banking network.

Our approach builds on the probabilistic network model proposed by Gai et al. (2011) and the simulation models by Nier et al. (2007) and Klinger and Teply (2014a, b). We devise a realistic model of the European banking system based on the available data on interconnections among the banks. In this way, we would like to help bridge the aforementioned gap between theoretical insights and practical research based on current real-world data. We simulate the behavior of the European banking system when impacted by an adverse shock event, such as a bank default. Unlike in Klinger and Teply (2014a), who represented the banking system of each country, we take into account the multitude of banks in each country. We add further detail to the simulation as well by introducing the ability to model banks of various sizes. Banking networks within individual countries are modeled using real data, including market concentration, competition, and the relative power of large versus small banks, to represent the financial structures across countries as faithfully as possible. Put differently, the value-added of our research is the addition of bank heterogeneity to the modeling.

The main goal of this research is to shed light on the real interconnectedness between nine Eurozone banking sectors and to estimate the levels of shock propagation in large-scale events, such as defaults of multiple banks, and in smaller events, such as the default of an individual bank. Our hope is that these findings might contribute useful information to EU policy makers, including the European Central Bank (ECB), when estimating the systemic effects of bank defaults.

This remainder of this paper is organized as follows. Section 2 describes the network model, and agent-based shock modeling is covered in Sect. 3. System calibration to real data is reviewed in Sect. 4, and Sect. 5 presents the results. Section 5 concludes the paper and makes final remarks .

2 The model

Our model of the European banking system is designed to evaluate the systemic risk of various inter-banking connection patterns. Our approach consists of (1) the network structure and (2) policies for shock modeling. The network model is a general representation that can be used to simulate an arbitrary banking system and is therefore a highly flexible framework for computational experiments with hypothetical scenarios; it is also used to model current real-world banking networks (through the Monte-Carlo method). Nevertheless, the network model is a static data structure to which a dynamic component is added through means of agents representing individual banks. As precise descriptions of bank behavior are added, interdependent banks can interact in a simulation.Footnote 1

Given the definition of the initial connections network and the rules of dynamic behavior, it is possible to simulate the system’s behavior when hit by an adverse shock. The network model is described in Sect. 2.1, and the behavior specification for agents is given in Sect. 2.2.

2.1 Bank network modeling

The banking network \( {\text{G }} = \left( {{\text{V}}, {\text{C}}} \right) \) is a directed weighted network consisting of a set of nodes V and a set of connections C. Each bank corresponds to a single node from set V. Two nodes j and k are connected if and only if debt exposure exists between the banks corresponding to these nodes. If there is a connection between j and k, the set E contains the ordered pair (j, k). All connections in the network are directed, meaning that debt exposure from j to k does not imply the opposite. Furthermore, each connection is weighted, meaning that a debt value is associated with each connection. Each node is associated with (1) balance sheet information and (2) debt exposure data for the bank.

For each pair of banks (j, k), the debt exposure of j to k, denoted \( w_{jk}^{IN} = w_{kj}^{OUT} \), is defined as bank k given quantity w to bank j. Note the symmetry of the debt, denoted with the superscript “out” and the exposure, denoted with the superscript “in.” Combined, all debt data form the debt structure in the system. The balance sheet data associated with each node contains bank assets and liabilities. During the simulation, the balance sheet is updated to reflect the current bank balance. An example bank sheet is given in Table 1. At the moment of network initialization, the total asset value for bank i is defined as a sum of interbank assets (ij), sovereign debt (sj), and external assets (ej):

The value of the bank’s interbank assets is the sum of all loans in the network and, for individual bank i, equals the sum of the exposures toward other banks in the system:

where N(j) is the set of nodes connected to node j.

Sovereign debt, denoted as sj, is defined as the sum of a bank’s exposure to the local sovereigns. Finally, external assets, denoted as ej for a bank, is the sum of a bank’s exposure outside the banking network, such as households, foreign sovereigns, and non-national financial institutions. The sum of all external assets in the network, denoted as E, is the sum of the external assets of all individual banks.

The value of liabilities for bank j, denoted as lj, is defined as the sum of interbank liabilities (\( b_{j} \)), external liabilities (\( d_{j} \)), and the capital reserve:

Interbank liabilities are the sum of all loans in the network and, for an individual bank, i is the sum of the debt to other banks in the system:

where N(j) is the set of nodes connected to node j.

External liabilities are defined as the sum of bank exposures related to the outside the network, such as loans to households, foreign sovereigns, and non-national financial institutions. The value of capital reserve represents the security buffer for covering potential losses (Table 1).

2.2 Agent-based contagion simulation

To investigate the interactions among the network of banks, bank behavior is modeled by rules of agent behavior under various possible conditions. We focus on the actions of banks under stress and develop behavior rules for events related to the propagation of systemic shock: when to default and when to perform asset fire sales. The simulation starts by deducting a share of external assets from the balance sheet of a selected bank or a group of banks. A balance sheet shock originating from that bank follows throughout the entire system. Similarly, at the beginning of each next simulation iteration, every bank may receive a total asset-side shock of Δ = δ + PriceShock, whose individual components are subsequently described in detail. The stress propagates through the network, triggering actions of distressed banks, and the simulation continues until the initial shock is completely dissolved and stops being further transmitted onto other agents (Fig. 1).

If banks affected by the primary shock do not possess sufficient capital buffers, a process of cascading contagion might unfold as manifested by further transmission of the shock to other banks in each iteration. Each iteration is assumed to last for an unspecified period. In reality, this period depends on the maturity structure of the debt and the regulation on the procedure for writing off bad debts. Every shock is reflected in the balance sheets of banks that were affected. As they lose a certain part of their assets in the simulation, banks write off an equal value of liabilities to balance the assets and liabilities. Banks first attempt to absorb the shock using owners’ equity; however, if the capital buffers are not large enough, they default on the claims of other creditors.

The shock that the j-th bank receives is a total shock received from all exposures and translates into a gap between its assets and liabilities. When bank j suffers a shock of size \( \Delta _{j,t} = l_{j,t} - a_{j,t} \) during iteration t of the simulation, its external behavior depends on the size of the shock relative to its balance sheet structure. The behavior of the bank is defined as follows.

- (a)

The bank attempts to absorb the shock using its capital reserve. If \( c_{j,t} \ge\Delta _{j,t} \), the bank is able to cover the losses using its own funds, and the capital covers the cost. The bank does not propagate the shock further to other banks in the system.

- (b)

If \( c_{j,t} <\Delta _{j,t} \), the bank cannot cover the losses using its own reserve and defaults.Footnote 2 The residual shock overflows to interbank liabilities \( b_{j} \). In this case, its value up to the value of interbank liabilities \( b_{j} \) is uniformly divided into the losses of all creditor banks. In the case of \( m \) creditor banks, in the next simulation iteration, each creditor \( k \) will receive a shock \( \delta_{jk,t + 1} \) from bank \( j\):

As the bank defaults, it is removed from the network and does not participate in the system in subsequent iterations. Furthermore, each creditor bank evaluates the received shock in the next iteration.

Additionally, it holds that:

- i.

If \( b_{j,t} \ge\Delta _{j,t} - c_{j,t} \), then the shock is absorbed by the bank’s capital and interbank liabilities.

- ii.

If \( b_{j,t} <\Delta _{j,t} - c_{j,t,} \), then the shock overflows to external liabilities, meaning that the residual loss is covered by the depositors.

Two types of liquidity issues can affect a stressed financial system: (1) market illiquidity and (2) funding illiquidity. Market illiquidity, first described by Kyle (1985), is a situation in which selling assets negatively impacts their prices. Funding illiquidity is the inability to meet the due obligations. During the recent financial turmoil, both issues were evident because an unexpected gap in short-term bank financing caused funding illiquidity on the liability side and the resulting fire sale of assets promoted a further rapid decline in asset prices. To enable realistic simulations of the system, both illiquidity types are accounted for in our model.

Following Gai et al. (2011), we assume that banks in default must liquidate all of their assets before they can be removed from the network. The sovereign debt is entirely liquidated because it is assumed to be more liquid. However, the low market depth might limit the capacity to absorb external and interbank assets and, under these conditions, it will not be possible to sell them for the prices on the bank’s balance sheet. Based on Cifuentes et al. (2005), we calculate the discounted external asset price at iteration t, denoted as \( P\left( \varvec{x} \right)_{t} \), which is calculated using an inverse demand function:

where \( \alpha \) represents the market’s illiquidity (the speed at which the asset price declines), \( \left| V \right| \) is the number of banks (nodes) in the network, \( E_{t} \) is the total value of the external assets in the system, and \( x_{j,t} \) is the initial value of the external and interbank assets being sold by bank j during iteration t. The additional loss caused by the asset sales are added to the initial shock on the i-th bank in the current iteration and are transmitted accordingly.

Using the mark-to-market accounting procedure, at the end of each iteration, the external assets of each bank are revaluated such that the value during iteration j + 1 is defined as:

Therefore, the value of the price shock for all banks in iteration t + 1 is the result of the losses from these price adjustments:

Furthermore, as the failing bank liquidates all of its assets, it may withdraw a certain part of short-term credit claims on other banks. For this reason, the debtors of the failing bank may receive an additional funding liquidity shock. This shock is evaluated using the previously described rules as a decrease in liabilities and may require them to sell a part of their assets to balance out the funding gap (Chan-Lau 2010). More formally, if bank j defaults, the related part of the interbank liabilities \( b_{kj} = i_{jk} \) of its debtor \( k \) is erased from debtor \( k \)’s total liabilities such that

As a result, the k-th bank is forced to fire-sale external assets equal to the value of the funding shock. This amount of external assets is added to the total amount that banks in the current iteration offer on the market for sale, and the k-th bank receives for it the amount of \( P\left( \varvec{x} \right)_{t} b_{kj,t} \), which is the price of the assets under the current market valuation. The value of the loss \( b_{kj,t} - P\left( \varvec{x} \right)_{t} b_{kj,t} \) is added to the k-th bank’s credit shock.

3 System calibration

The focus of this research is to provide insight into the real-world banking network in Europe and to contribute to the ongoing debates on banking sector stability and systemic risk. Although the described simulation approach is applicable to arbitrary banking networks and behavior, the key goal of the study is to find realistic data and calibrate the devised model to represent the real-world environment with a high degree of accuracy and realism. Table 2 displays the input parameters of the model and presents the initial conditions of our modeling.

We include the following countries in our simulations: Austria, Belgium, France, Germany, Ireland, Italy, The Netherlands, Portugal, and Spain. However, as documented by many authors, such as Mistrulli (2011), full data on mutual exposures of real-world banks are not available. Therefore, we resort to proxy data inferred from available sources to build the interbank network approximation that is as close to the real-world as was possible. The banks in our system are approximated based on their home country parameters, such as the total asset amount and the structure of the banking sector (EBA 2011), the number of banks, and the market concentration in the given country (ECB 2014). The structure of the interbank network is approximated from high-level aggregate data on banking systems according to the positions reported to the Bank of International Settlements (BCBS 2009, 2013b).

The calibration consists of (1) bank market structure estimations in each country and (2) interbank debt structure estimations. Unlike the previous work in Klinger and Teply (2014a, b), in which banking systems for each country were highly simplified and represented as a single node, we wanted to add more detail to the study and model individual banks in each country. For this reason, we developed a set of tools to use the incomplete data on bank interdependencies to estimate both the market structure in the countries we simulate and the connections among the banks (both locally and internationally).

3.1 Bank size estimation

Because the banks in the countries of our model are different, the homogeneity assumption of Klinger and Teply (2014a) is relaxed. In this work, we provide more detail in the model and consider bank size. We introduce three bank sizes: small, medium, and large. To determine the number of banks and the relative asset share in each category, we investigate the structure of the real-world banking networks: the aggregate balance sheet data and the market concentration in each country of the model. We created representative balance sheets for each bank type—large, medium-sized, and small banks (Table 3) . The size definitions are based on the asset size criterion, and the representative balance sheet for each size is derived by analyzing the patterns in the balance sheets of real-world banks (Gambacorta and van Rixtel 2013; ECB 2015).

The relative asset share per category is obtained by analyzing the market structure in each country. We classify the bank markets into three categories of low, medium, and highly concentrated, and use the Herfindahl index (HI) to determine categories for each market. The HI values are between 0 and 10,000. Values below 500 indicate low market concentration, values between 500 and 1100 indicate medium concentration, and values higher than 1100 correspond to high concentration (Hake 2012). Based on the real-world data for the banks in the model (BCBS 2009, 2013b), we define prototype country market shares depending on the market concentration. For markets with low concentration, small banks have a 45% market share, medium-sized banks have a 15% market share, and large banks have a 40% market share. For moderately concentrated markets, small banks have a 15% market share, medium-sized banks have a 25% market share, and large banks have a 60% market share. Finally, the highly concentrated market prototype has a small bank market share of 10%, a medium-sized bank market share of 20%, and a large bank market share of 70%. The resulting estimates of the shares are described in detail in Table 4.

We calculated the estimated structure of each national banking sector based on the available data from the ECB (BCBS 2009, 2013b). For example, Table presents an aggregated balance sheet of the German banking sector with total assets of EUR 7.6 trillion as of December 31, 2013. The banking sector balance sheet for each country and bank type (Table 2) can be used to simply calculate the aggregate balance sheets for large, medium-sized, and small banks in each country. Table 6 shows the illustrative balance sheets of a large, medium-sized, and small bank in Germany. The assets of each size group are calculated based on the total assets of the country and the estimated shares of each size group (Table 3). The assets are further divided into assets of each bank depending on the bank number in each size group. The individual banks’ balance sheets are calculated based on the balance sheet prototypes (Fig. 2). The total number of banks in the network is 286. We do not present balance sheets for all banking sectors because of space constraints in this paper.

3.2 Interbank debt structure estimation

To estimate the structures of the dependencies that connect the banks in a network, we explore the interbank exposure datasets from the BIS International Financial Statistics (BCBS 2013b). In these datasets, the central banks compile national aggregate data for banks in their jurisdictions. The interbank exposure matrix is inferred from the consolidated statistics of foreign claims on an immediate borrower basis. The aforementioned data provide insights into the exposures of domestically owned parent banks at the highest consolidation level. Therefore, they include external exposures of own foreign offices and exclude all internal inter-office positions in the consolidation group (BCBS 2009).

Nevertheless, to the best of our knowledge, there exist no publicly available data on pure bank-to-bank exposures between the banking sectors in the individual countries. Therefore, a certain level of approximation is inevitable. We ground our estimates in the BIS total claims dataset that contains information about total exposures among pairs of countries from our model. However, because it is not possible to directly obtain pure bank-to-bank exposures between the individual countries’ banking sectors, some level of approximation is inevitable. To estimate the bank-to-bank exposures from the reporting banking sectors’ pool of total claims, we employ another dataset of BIS statistics—the total claims on each country’s banking sector by all reporting sectors grouped by type of debtor institution (i.e., whether it is a bank in the public sector or a non-bank in the private sector).

By combining the two datasets and calculating the banking sector percentage in the known total exposure, it is possible to obtain proxy variables for pairs of banking sectors in the model being calibrated. We apply a similar approach to Klinger and Teply (2014b). The interbank exposures for individual banks are calculated by distributing the exposures of the sector interdependencies proportionally to the individual bank exposures, as defined in the large/medium/small structures. In other words, the exposure of the country is divided into its banks according to the size of the different types of assets on their balance sheets. For example, an aggregated balance sheet of the German banking sector reported a 27.0% interbank-to-total assets ratio (Table 5). First, this share was recalculated for other banking sectors using country-to-country exposures based on the BIS data. Second, country exposures were distributed to the banking sector of a particular country regarding its market characteristics (Table 4). Finally, the exposure was divided by small/mid-size banks in the country. When the network is created, it can be plotted as shown in Fig. 3. For instance, in the right-hand part (in the center of the network), we see the “core” sectors (highly interlinked nodes such in Germany, France, Italy, and Spain) and around them are more “peripheral” banking systems.

Interbank network of the selected countries as of December 31, 2011. Note: Abbreviations: Austria (AUT), Belgium (BEL), France (FRA), Germany (GER), Ireland (IRE), Italy (ITA), Netherlands (NET), Portugal (POR), and Spain (SPA). For instance, GER_mid_12 indicates German medium-sized bank no. 12.

4 Results and policy recommendations

4.1 Results of simulations

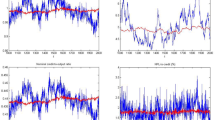

We run a number of computational experiments based on the developed model, which can be divided into six main groups (Table 7). First, the behavior of the system was tested under various conditions; we wanted to investigate the influence of the shock size and market illiquidity factor \( \alpha \). For example, if \( \alpha = 1 \), then 10% of external assets sold by the defaulting banks impose a 10% price shock on the external assets on the balance sheets of other banks. In a perfectly liquid market, this parameter equals zero. With our analysis, we focus on the range \( \alpha \in [0,2] \) as increasing the parameter even further, leading too often to a total collapse of the system. The range used is in line with Nier et al. (2007), who uses a range of \( \alpha \in [0,3] \). In subsequent examples, we focus on values for which there are interesting breakpoints for different countries (partially illustrated in Fig. 11).

Second, a series of computational experiments was performed to investigate different combinations of these parameters to assess their mutual influence on systemic risk. Additionally, the effects of failures originating from different countries were analyzed. This way, unique local market features can be considered. The results have shown that the system’s behavior is significantly influenced by the investigated parameters. Third, the interpretation of the parameters might provide insights into the influence of interconnectedness and size on the systemic stability in the present banking system. Figure 4 presents a detailed timeline of the simulation events under various settings when starting with a shock in different countries. It is clear that shocking medium-sized Austrian banks does not cause much distress in the entire system, which highlights the robustness and low systemic risk of the Austrian sector. Although 16 Austrian banks fail and cause damage to the system, the contagion does not spread further, and the banks outside of Austria remain stable. In other examples, we present setups that have caused a total banking system collapse that resulted in all 286 banks in the network to shut down. Such cases are large shocks to medium German banks in a relatively liquid market and moderate shocks to small Italian and large Spanish banks under higher illiquidity.

The issue of interconnectedness is widely studied and especially interesting to investigate using the model devised in our work. We confirm that the notion of “too connected to fail” and measures such as node degree and feedback centrality provide valuable metrics for estimating systemic risk. Imposing a shock—a share of external assets is deducted from a random bank’s balance sheet—on highly interconnected banks is highly risky for the entire system because they propagate the shock to a large number of other banks. A good example of this is the computational experiment of shocking the large French banks.

Fourth, Figs. 5, 6, 7, 8, 9 and 10 show the results of the computational experiments in which a group of banks from a certain country receives the shock. On the x-axis, the banking sectors in each country are placed in the same order across all charts. The y-axis displays the intensity of a shock as part of the bank’s assets. The value of the losses and the number of failing banks are represented as heat maps, with the lowest value and the best possible outcome corresponding to white. The highest losses and the highest number of failing banks are the worst possible outcomes and are drawn in black. It is clear that even with low illiquidity levels, shocks larger than 0.4 have the potential to lead to a total collapse of the entire system. Given a moderate illiquidity level, this effect happens regardless of the shock size, and even the lowest tested shock size (0.2) causes all of the capital to be wiped out of the system. From the point of view of the depositor loss, this scenario is nevertheless relatively mild compared with shocks to other large banking systems. This can be explained by the fact that the collapse happens very quickly given the high level of interconnectedness. However, the asset losses are not large because the liquidity channel is not as intense in this case.

With alpha equal to 0.4 and 40% of external assets liquidated, the large French banks are unable to absorb the shock and fail in the first lap. In the second lap, the shock is transferred to all other French banks. This is the result of the fact that the interbank connections are the strongest among banks in the same country and, in this case, the shock propagates almost entirely by the interbank transmission channel. In subsequent rounds, both channels are active and cause the Dutch banks to fail in the third lap, Belgian in the fourth, and all others except Austrian in the fifth. The Austrian banking system, which is the most resilient because of its high capital buffers, fails last—in the sixth lap.Footnote 3 In this scenario, the simulation ends with all of the banks in the system closing. This is clearly evident in the case in which alpha is equal to 1 as well, as shown in Figs. 5 and Fig. 9.

Turmoil is produced when small German banks are affected by a shock. In this case, the liquidity channel is comparatively stronger, as seen in Fig. 6. Although the system does not fail completely for \( \alpha = 0.2 \), it is enough to result in \( \alpha = 0.4 \) and to create an impact of 40% of the assets for the entire system to collapse. Counterintuitively, with \( \alpha = 0.4 \), the system is more stable when stronger shocks are imposed on small German banks. In this case, only the German banking system shuts down while the remaining of the European system is able to handle the crisis. The results are similar when a simulated shock of higher intensity causes fewer banks to fail, and a lower capital loss is evident for the small Italian, Spanish, and French banks (Fig. 6). This is explained by the fact that small banks have fewer external assets to fire-sale and, therefore, less of an influence on the entire system. Conversely, in cases of high illiquidity, the entire system can quickly collapse when similar disturbances are imposed on banks with significant external assets. As some of the external assets of the initial group are eliminated, if the losses are large enough, the failing banks are forced to sell the rest of these assets. Because the price of the overall external assets depends on the amount of assets sold in each simulation round, intense selling has the potential to decrease asset value and, therefore, produce indirect pricing shocks on all banks in the system. Therefore, it might be better if failing banks quickly default from large shocks than continue to fail for a considerable time. If the bank defaults immediately, aside from the first level of immediate losses, the system recovers because system-wide shocks transmitted by the liquidity channel do not appear. This is because the assets immediately written off as part of the initial shock do not have to be sold in the market. However, indeed, these create significant depositor losses that, in reality, must be covered up by state support or deposit insurance. The subsequent effect on financial stability when state support channels are accounted for and the transfer of risk between public support measures and the financial system are discussed in detail in Klinger and Teply (2016).

Fifth, among the national banking systems, we have identified that large Italian and Spanish banks add the highest risk to the system’s stability. Figures 4 and 9 show that hitting a small portion of the external assets of large Spanish banks results in a total systemic collapse when the market is not deep enough to absorb the flood of assets being liquidated in fire sales. Additionally, a less liquid system requires fewer asset sales to collapse the system. In these cases, when all of the banks fail, the entire capital pool of the banking system is eliminated. Depositor losses are not as severe as in cases of larger shocks that propagate mainly through the interbank network.

With alpha equal to one and 20% of external assets liquidated, large Spanish banks cannot absorb the shock and fail in the first simulation round. In the second round, the shock is transferred to all Dutch banks, which do not hold sufficient capital reserves to withstand even the lesser shocks initiated by the Spanish banks fire-selling their assets. In the following rounds, the Belgian, Portuguese, German, and French banking systems are failing, which finally leads to the failure of the rest of the system. Because the chain reaction of decreasing asset prices is very strong, even robust banking systems such as in Austria cannot withstand a crisis. It is interesting to point out that medium and small Spanish banks failed only in the last round, providing additional evidence that this shock does not progress through the interbank network but externally via the liquidity channel. Increasing the shock intensity lowers the total losses in the entire system (Figs. 5 and 9). The progress is very similar to the case of shocking small Italian banks when wiping off 20% of their external assets and alpha set to 1.2.

Sixth, total capital losses further show a noticeable influence of illiquidity on the entire system. As shown in Fig. 11, because the market is shallower, capital losses increase regardless of the country. For some of those countries, the dependence is linear because there are no propagations—aside from the initial shock in a group of banks. The losses result from the fire-sale price adjustment on all books. For some of them, the shock is propagated further and with a high enough alpha, a total systemic collapse may easily happen. As seen in the following figures, this holds for large and small banks.

4.2 Policy recommendations

Our research has resulted in three key policy recommendations for making the EU banking network more robust. First, we recommend introducing a tighter limit for all types of inter-bank exposures than the recent upper limit of 25% of a bank’s eligible capital (BCBS 2014). As a result, the system will be more resilient because banks will have more capital to cover losses. Therefore, we agree with a proposal for a tighter credit exposure limit of 15% between Global Systemically Important Banks (G-SIBs), as suggested by BCBS (2013a). Of all 30 G-SIBs, 13 are in the European Union (including UK banks), which makes the tighter limit more relevant. Second, we propose increasing the risk weights for exposures of large banks in Italy and Spain to reflect the higher systemic risk of these banks (a higher risk weight implies a higher capital requirement, which should increase bank stability). Last but not least, our results show the importance of emergency liquidity funding for banks during a period of financial distress. Thus, we agree with the policy of additional liquidity support from central banks, such as the Emergency Liquidity Assistance announced by the European Central Bank in 2017 (ECB 2017).

4.3 Limitations of the results and further research opportunities

Our novel contribution to the recent literature is to add bank heterogeneity to the agent-based model because we consider three different bank sizes. Our model focuses only on the banking sector and, therefore, its results are limited because they do not capture a feedback loop between failing banks and state budgets, as discussed by Estrella and Schich (2011), Pisani-Ferry (2012), and Klinger and Teply (2016). However, we focused in such a manner for simplicity and to capture the effects of different bank types on the network rather than on state budgets.

The proposed agent-based modeling has shown itself to be a highly flexible methodology because of its ability to simulate both realistic and hypothetical cases. It also provides a means for the research of complex interactions that are difficult to solve analytically. Regarding further refinements to the study, we suggest another research direction on the lack of reliable data on interbank relations. Instead of relying on indirect proxy datasets, finding more direct and more precise data could significantly improve the level of detail and the accuracy of the results. Moreover, the model still relies on several simplifications. First, the simulations of a liquidity hoarding channel assume a very short period. In addition, liquidating a bank or its loan portfolios can take up to several years (in addition to writing off the losses). However, in such a time frame, banks could already make new profits and rebuild their capital positions. In general, all three channels are unlikely to contribute simultaneously to the contagion. Second, the assumption of an integrated asset market and one asset price level across Europe is a simplification. The study of integration across the liquidity channel deserves a deeper investigation as another area of research. Last but not least, the model might be expanded to include the bank-sovereign nexus and its impact on state budgets.

The system’s behavior also proves stable with small changes in the calibration figures (e.g., bank and shock sizes). In this paper, several Monte-Carlo simulations were run to test the dependence of the results on key input parameters to make our results more robust (see also Table 1 for all input parameters of the model). We focused on testing the interbank exposures (parameter interbank asset ratio) and shock sizes (parameters shockrandom and shockothers). Further simulations on similar systems are provided in Nier et al. (2007) or Klinger and Teply (2014a). We believe that detailed Monte-Carlo simulations of the three input parameters are sufficient for robust results. Detailed simulations of all parameters are beyond the scope of this paper but are a logical follow-up for further research.

5 Conclusions

In this paper, we use the unique approach of an agent-based simulation to assess systemic risk in the present-day European banking system. The bank interdependencies are expressed using balance sheets and modeled as an interconnected network. This model allows simulations of bank behavior when impacted by adverse shocks of various sizes and under several different market conditions. Furthermore, the model is methodologically extended to include banks of assorted sizes. In our simulations, banks can operate in a diverse range of interdependent relationships and market conditions. Two parameters are key factors that influence bank behavior: market illiquidity \( \alpha \) and the size of the initial shock. In this study, we use the most realistic data available to us to calibrate the model to the real-world bank network and provide insights into the specifics of banking markets in each country. In total, we simulate the behavior of 286 banks from 9 countries: Austria, Belgium, France, Germany, Ireland, Italy, the Netherlands, Portugal, and Spain. All banks are divided into three categories: small, medium-sized, and large.

We run a simulation of a shock hitting a set of banks in the network to study how this shock propagates and how the entire system responds to such disturbances. Various insights can be gained through the investigation of the ways in which banking systems in different countries respond to a crisis and how they are connected to other banks in the overall system. In France, it appears that the key factor that contributes to the systemic risk is bank size, whereas liquidity does not matter as much. The failure of large French banks indeed poses a significant risk to the entire system because even mild shocks to large banks in France have the potential to lead to a system-wide collapse regardless of the \( \alpha \) factor. The system is much more resilient to shocks in small and medium-sized banks because a system-wide collapse happens only in cases of large shocks to medium-sized banks under high illiquidity. Similar results were observed in computational experiments involving German banks. However, the German bank network seems more susceptible to variations in liquidity. This effect is especially prominent for small banks, of which no more than 44 banks fail in the case of \( \alpha = 0 \), and the system collapse is complete for \( \alpha = 2 \) regardless of the shock intensity. In Germany, size matters as well but not nearly as much as in France.

Interesting results are produced when performing simulations of shocks in the Italian banking sector. Especially, Italian banks seem to have a much higher contribution to systemic risk than German and French banks. Despite the fact that the Italian banking sector is smaller than those in Germany and France, the effects of bank collapses in Italy are comparable to those in Germany and France. We believe that these results are another contribution to the recent guidelines for decision makers to handle Italian banks with caution. From a regulatory perspective, we recommend the introduction of a tighter limit for all types of inter-bank exposures than the recent limit of 25% of Tier 1 capital. Moreover, we propose an increase in the risk-weights for exposures to large banks in Germany, France, Italy, and Spain.

Notes

The model as described in this paper allows banks to operate with capital close to zero. However, in reality, supervisors claim that they would revoke the license much earlier, such as at a 4.5% capital-to-asset ratio. However, given a major systemic shock, regulators cannot easily afford to immediately close down banks and the regulatory behaviour is subject to dynamic inconsistency. The rationale is discussed in greater detail in Klinger and Teply (2014a).

We should note that the Austrian banking system has not been reporting strong capital positions in the last years, although it is improving recently. However, the system’s weak capital position was primarily the result of the poor performance of the sector’s subsidiaries in Central and Eastern Europe (including higher credit risk in Ukraine and bank taxes in Hungary) rather than from losses stemming from the interbank market.

References

Allen F, Carletti E (2013) What is systemic risk? J Money Credit Bank 45:121–127

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Battiston S, Gatti D, Gallegati M, Greenwald B, Stiglitz JE (2012) Liaisons dangereuses: increasing connectivity, risk sharing, and systemic risk. J Econ Dyn Control 36:1121–1141. https://doi.org/10.1016/j.jedc.2012.04.001

BCBS (2009) Guide to the international financial statistics. Basel Committee on Banking Supervision http://www.bis.org/statistics/intfinstatsguide.pdf. Accessed 1 May 2017

BCBS (2013a) Supervisory framework for measuring and controlling large exposures. Consultative document. Basel Committee on Banking Supervision. http://www.bis.org/publ/bcbs246.pdf. Accessed 11 Jan 2018

BCBS (2013b) Consolidated banking statistics. Basel Committee on Banking Supervision (BCBS) http://www.bis.org/statistics/consstats.htm. Accessed 1 May 2017

BCBS (2014) Supervisory framework for measuring and controlling large exposures. http://www.bis.org/publ/bcbs283.pdf. Accessed 11 Jan 2018

Black L, Correa R, Huang X, Zhou H (2016) The systemic risk of European banks during the financial and sovereign debt crisis. J Bank Finance 63:10–125. https://doi.org/10.1016/j.jbankfin.2015.09.007

Borio C (2011) Rediscovering the macroeconomic roots of financial stability policy: journey, challenges and a way forward. BIS working papers

Bruha J, Kocenda E (2018) Financial stability in Europe: banking and sovereign risk. J Financ Stab 36:305–321

Caccioli F, Shrestha M, Moore C, Farmer JD (2014) Stability analysis of financial contagion due to overlapping portfolios. J Bank Finance 46:233–245. https://doi.org/10.1016/j.jbankfin.2014.05.021

Chan-Lau JA (2010) Regulatory capital charges for too-connected-to-fail institutions : a practical proposal. Financ MarkInst Instrum 19:355–379. https://doi.org/10.1111/j.1468-0416.2010.00161.x

Chan-Lau JA (2014) Regulatory requirements and their implications for bank solvency, liquidity and interconnectedness risks: insights from agent-based model simulations. https://doi.org/10.2139/ssrn.2537124

Chui M, Domanski D, Kugler P, Shek J (2010) The collapse of international bank finance during the crisis: evidence from syndicated loan markets. BIS Quart Rev 3:39–49

Cifuentes R, Ferrucci G, Shin HS (2005) Liquidity risk and contagion. J Eur Econ Assoc 3:556–566. https://doi.org/10.1162/jeea.2005.3.2-3.556

Corsi F, Marmi S, Lillo F (2013) When micro prudence increases macro risk: the destabilizing effects of financial innovation, leverage, and diversification mimeo. http://ssrn.com/abstract=2278298. Accessed 1 May 2017

Craig B, von Peter G (2014) Interbank tiering and money center banks. J Financ Intermed 23:322–347. https://doi.org/10.1016/j.jfi.2014.02.003

Demekas, DG (2015) Designing effective macroprudential stress tests: progress so far and the way forward. IMF working paper. WP/15/146

Devereux MB, Yetman J (2010) Leverage constraints and the international transmission of shocks. J MoneyCredit Bank 42:71–105. https://doi.org/10.1111/j.1538-4616.2010.00330.x

EBA tests (2009, 2010, 2011, 2014 and 2016) http://www.eba.europa.eu/risk-analysis-and-data/eu-wide-stress-testing/2014. Accessed 1 May 2017

ECB (2015) Statistics. European Central Bank. https://www.ecb.europa.eu/press/pr/date/2015/html/pr150701.en.html. Accessed 1 May 2017

ECB (2017) Agreement on emergency liquidity assistance. European Central Bank. https://www.ecb.europa.eu/pub/pdf/other/Agreement_on_emergency_liquidity_assistance_20170517.en.pdf. Accessed 1 Apr 2018

Estrella A, Schich S (2011) Sovereign and banking sector debt: interconnections through guarantees. OECD J Financ Mark Trends 2011(2):21–45

Freixas X, Parigi BM, Rochet JC (2000) Systemic risk, interbank relations, and liquidity provision by the central bank. J Money Credit Bank 32:611–638. https://doi.org/10.2307/2601198

Furfine CH (2003) Interbank exposures: quantifying the risk of contagion. J Money Credit Bank 35:111–128. https://doi.org/10.1353/mcb.2003.0004

Gai P, Kapadia S (2010) Contagion in financial networks. In: Proceedings of the Royal Society of London A: mathematical, physical and engineering sciences, pp 1–23. https://doi.org/10.1098/rspa.2009.0410

Gai P, Haldane A, Kapadia S (2011) Complexity, concentration and contagion. J Monet Econ 58:453–470. https://doi.org/10.1016/j.jmoneco.2011.05.005

Gambacorta L, van Rixtel A, (2013) Structural bank regulation initiatives: approaches and implications.BIS working papers, no 412, Monetary and Economic Department

Georg CP (2013) The effect of interbank network structure on contagion and common shocks. J Bank Finance 37:2216–2228. https://doi.org/10.1016/j.jbankfin.2013.02.032

Gross M, Kok C (2013) Measuring contagion potential among sovereigns and banks using a mixed-cross-section GVAR. ECB working paper no. 1570, European Central Bank

Haas RD, Horen NV (2012) International shock transmission after the Lehman Brothers collapse: evidence from syndicated lending. Am Econ Rev 102:231–237. https://doi.org/10.1257/aer.102.3.231

Hake M (2012) Banking sector concentration and firm indebtedness: evidence from central and eastern Europe. Focus Eur Econ Integr 3:48–68

Halaj G, Kok C (2013) Assessing interbank contagion using simulated networks. ECB working paper no. 1506, European Central Bank

Hale G (2012) Bank relationships, business cycles, and financial crises. J Int Econ 88:312–325. https://doi.org/10.1016/j.jinteco.2012.01.011

Hale G, Candelaria C, Caballero J, Borisov S (2011) Global banking network and international capital flows. Mimeo, Federal Reserve Bank of San Francisco

Klinger T, Teply P (2014a) Systemic risk of the global banking system-an agent-based network model approach. Prague Econ Pap 23:24–41. https://doi.org/10.18267/j.pep.471

Klinger T, Teply P (2014b) Modelling interconnections in the global financial system in the light of systemic risk. Econ Stud Anal/Acta VSFS 8:64–88

Klinger T, Teply P (2016) The nexus between systemic risk and sovereign crises. Czech J Finance/Finance Uver 66:50–69

Kyle AS (1985) Continuous auctions and insider trading. Econom J Econom Soc 53:1315–1335. https://doi.org/10.2307/1913210

Kvapilikova I, Teply P (2017) Measuring systemic risk of the US banking sector in time-frequency domain. N Am J Econ Finance 42:461–472. https://doi.org/10.1016/j.najef.2017.08.007

Löffler G, Raupach P (2016) Pitfalls in the use of systemic risk measures. J Financ Quant Anal 53:269–298

Minoiu C, Reyes JA (2013) A network analysis of global banking: 1978–2010. J Financ Stab 9:168–184. https://doi.org/10.1016/j.jfs.2013.03.001

Mistrulli PE (2011) Assessing financial contagion in the interbank market: maximum entropy versus observed interbank lending patterns. J Bank Finance 35:1114–1127. https://doi.org/10.1016/j.jbankfin.2010.09.018

Montagna M, Kok C, (2013) Multi-layered interbank model for assessing systemic risk. Kiel working papers no. 1873, Kiel Institute for the World Economy

Morrison A, Michalis V, Mungo W, Zikes F (2017) Identifying Contagion in a Banking Network. Finance and economics discussion series 2017–082. Board of Governors of the Federal Reserve System (US)

Muller J (2006) Interbank credit lines as a channel of contagion. J Financ Serv Res 29(1):37–60. https://doi.org/10.1007/s10693-005-5107-2

Nier E, Yang J, Yorulmazer T, Alentorn A (2007) Network models and financial stability. J Econ Dyn Control 31:2033–2060. https://doi.org/10.1016/j.jedc.2007.01.014

Nirei M, Caballero J, Sushko V (2015) Bank capital shock propagation via syndicated interconnectedness, Basel Committee on Banking Supervision working paper, No. 484. Bank for International Settlements

Pisani-Ferry J (2012): The euro crisis and the new impossible trinity. Bruegel policy contribution, no. 2012/01 (January)

Shin HS (2008) Risk and liquidity in a system context. J Financ Intermed 17:315–329. https://doi.org/10.1016/j.jfi.2008.02.003

Sutorova B, Teply P (2014) The level of capital and the value of EU banks under BASEL III. Prague Econ Pap 23:143–161. https://doi.org/10.18267/j.pep.477

U.S. Congress (2010) Dodd–Frank Wall Street reform and consumer protection act. Public Document H.R. 4173

Upper C (2011) Simulation methods to assess the danger of contagion in interbank markets. J Financ Stab 7:111–125. https://doi.org/10.1016/j.jfs.2010.12.001

Upper C, Worms A (2004) Estimating bilateral exposures in the German interbank market: is there a danger of contagion? Eur Econ Rev 48:827–849. https://doi.org/10.1016/j.euroecorev.2003.12.009

van Lelyveld I, Liedorp F (2006) Interbank contagion in the dutch banking sector: a sensitivity analysis. Int J Cent Bank 2:99–133

van Wincop E (2013) International contagion through leveraged financial institutions. Am Econ J Macroecon 5:152–189

Wells S (2004) Financial interlinkages in the United Kingdom’s interbank market and the risk of contagion, Bank of England working article no. 230

Acknowledgements

This research was supported by the Czech Science Foundation (Project No. GA 17-02509S) and University of Economics in Prague (Project No. VŠE IP100040). We also thank to anonymous referees for their valuable comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Teply, P., Klinger, T. Agent-based modeling of systemic risk in the European banking sector. J Econ Interact Coord 14, 811–833 (2019). https://doi.org/10.1007/s11403-018-0226-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-018-0226-7